1. Introduction

Energy efficiency (EE) offers opportunities to reduce carbon emissions and lower the overall investment requirements of decarbonization targets [

1]. Provided that the transition toward renewables, EE and technological advancement are critical factors in decarbonization [

2], EE has been indicated as a pathway to improving the economic competitiveness and sustainability of the economy [

3]. In the context of the clean energy transition, the emphasis on EE also offers opportunities to create jobs while supporting economic growth and industrial production [

4]; with demand-side action, it plays a significant role when global energy prices are high and volatile, which harms households, industries, and entire economies [

5]. Market-based instruments offer policymakers the potential to access more cost-effective efficiency gains [

6].

According to Regulation (EU) 2018/1999, European countries must develop a 10-year national energy and climate plan (NECP) for 2021–2030 that outlines how they expect to meet the 2030 targets for EE, renewable energy, and greenhouse gas emissions. The amended Energy Efficiency Directive 2018/2002 (EED) entered into force in 2018 and updated specific provisions from the previous directive while introducing new elements, such as a headline EU EE target for 2030 of at least 32.5%. Many policy tools can be used to contribute to reaching these targets, and EU member states can use Energy Efficiency Obligation Schemes (EEOS) given that they have been asked to introduce EEOS to contribute to meeting the energy-saving objectives [

7]. Member states can also rely on alternative policy measures; see [

8] for a discussion of the national contributions to the EU 2020 target. White certificates fall within the category of EEOS and are used as a policy measure to reach EE targets; some of the first schemes (i.e., those of the UK, Italy, France, and Denmark) have thus far yielded positive results [

9]. A recent study presents a critical review of Europe’s experience with white certificate obligations [

10] and proves that EEOS are essential tools for achieving EE and the decarbonization of production systems [

11].

Following the increase in EE targets [

12], it is crucial to rethink the role that policy instruments such as EEOS can play in the energy transition, even if the present levels of energy savings are insufficient to achieve the European EE targets [

13]. Therefore, complementary instruments are needed to improve their effectiveness [

14] along with other policy measures such as regulations at the technical level [

15]. It follows that some European countries have introduced market-based policy portfolios based on the quantified energy savings obligations of energy distributors or suppliers, often jointly with the certification of energy savings [

16] and the possibility of negotiating certificates.

This paper focuses on Italy’s white certificate scheme because it is among the longest-lived and has achieved notable results. Although there are other white certificate schemes, the Italian scheme is the most remarkable in terms of quantities traded [

17]. The previous literature also analyses other proposals and frameworks. For example, there is an attempt to assess the applicability of energy saving obligations and white certificates in the Emirate of Abu Dhabi [

18] as well as in Turkey, which aims to reduce its energy intensity by planning financial mechanisms and white certificates to improve its EE [

19].

The Italian scheme’s structure and regulatory approach have been considered among the best worldwide. For example, in Directive 32/2006, the European Commission included white certificates as one of the tools that member states may use to achieve EE goals. In addition, the Italian scheme was introduced in January 2005 to implement the EU Directive on liberalizing the electricity and natural gas markets [

20].

EE policy should be designed to ensure optimal economic, social and environmental goals, and among EE policies, the so-called white certificate scheme plays a relevant role. There are gaps to be filled both in terms of the time horizon and the policy implications, which are particularly important in this historical period due to the instability of energy commodity prices, the climate crisis, and the energy strategies that are both already in place and being developed at the global level. Although EE is essential to decarbonization, it is still rarely analyzed from the point of view of the results and perspectives of white certificates (i.e., one of the leading market instruments used to promote it). This article contributes to this line of research. It is also relevant because the interaction between carbon pricing and EE policies is becoming increasingly important.

The effects can be positive if the energy policy is well designed. We contribute to the literature on EE policies by providing insights into the lessons that can be learned from Italy’s white certificate scheme and outlining the strategic implications of the latest update to the scheme. We address the strategic implications of the latest update to the scheme, which introduced a reverse auction mechanism in the discussion section, given that there are no historical data at the time of this writing.

This study is particularly valuable because of its analysis of the potential implications of the scheme’s latest update, which occurred in 2021, as well as its prospects for the future. To fine-tune our analysis, the developmental prospects are limited to a critical novelty—that is, an auction-based mechanism aimed at complementing the white certificate scheme. Our analysis is based on market prices and tariff reimbursements from the first year of the white certificate scheme until the present. Notably, a recent study finds that price equilibria result from interactions between market forces and public intervention [

21]. This information is complemented by an extensive review of the literature, and the role of EE in industrial processes [

22], products [

23], and EE development projects [

24] are also highlighted. Starting from these considerations, we present a detailed analysis of Italy’s latest ministerial decree on EE to predict its implications for the development of the market. Our analysis covers the functioning of the auction mechanism as well as other innovations introduced by the decree, such as the stability mechanism, which could have tangible benefits for the white certificate market and economic implications for all related activities (ranging from technological innovations to job creation) and the achievement of EE and the decarbonization targets.

3. Background

We take a European perspective on energy consumption and consider the cumulative energy savings foreseen by EU countries, as depicted in

Table 1. Over the years, primary energy consumption has fluctuated as energy needs have been influenced by economic development as well as changes to the industrial structure and how EE is measured [

25]. In 2020, the critical factor affecting consumption was the enactment of restrictions related to the COVID-19 pandemic [

26], which led to a sharp drop in primary energy consumption in the EU-27 [

27].

Primary energy consumption measures the total energy demand of a country. It covers consumption of the energy sector itself, losses during transformation and distribution of energy, and the final consumption by end users. Under the EED, EU countries are required to state how they intend to reach efficiency targets. Specifically, they must achieve cumulative final energy savings of at least 0.8% annually; that said, monitoring EE achievement involves a detailed assessment [

30], given the remarkable amounts of data that are now generated at an unprecedented rate [

31]. While EEOS require energy companies to achieve energy savings targets to boost the efficiency of energy services, EU countries can also opt for different measures.

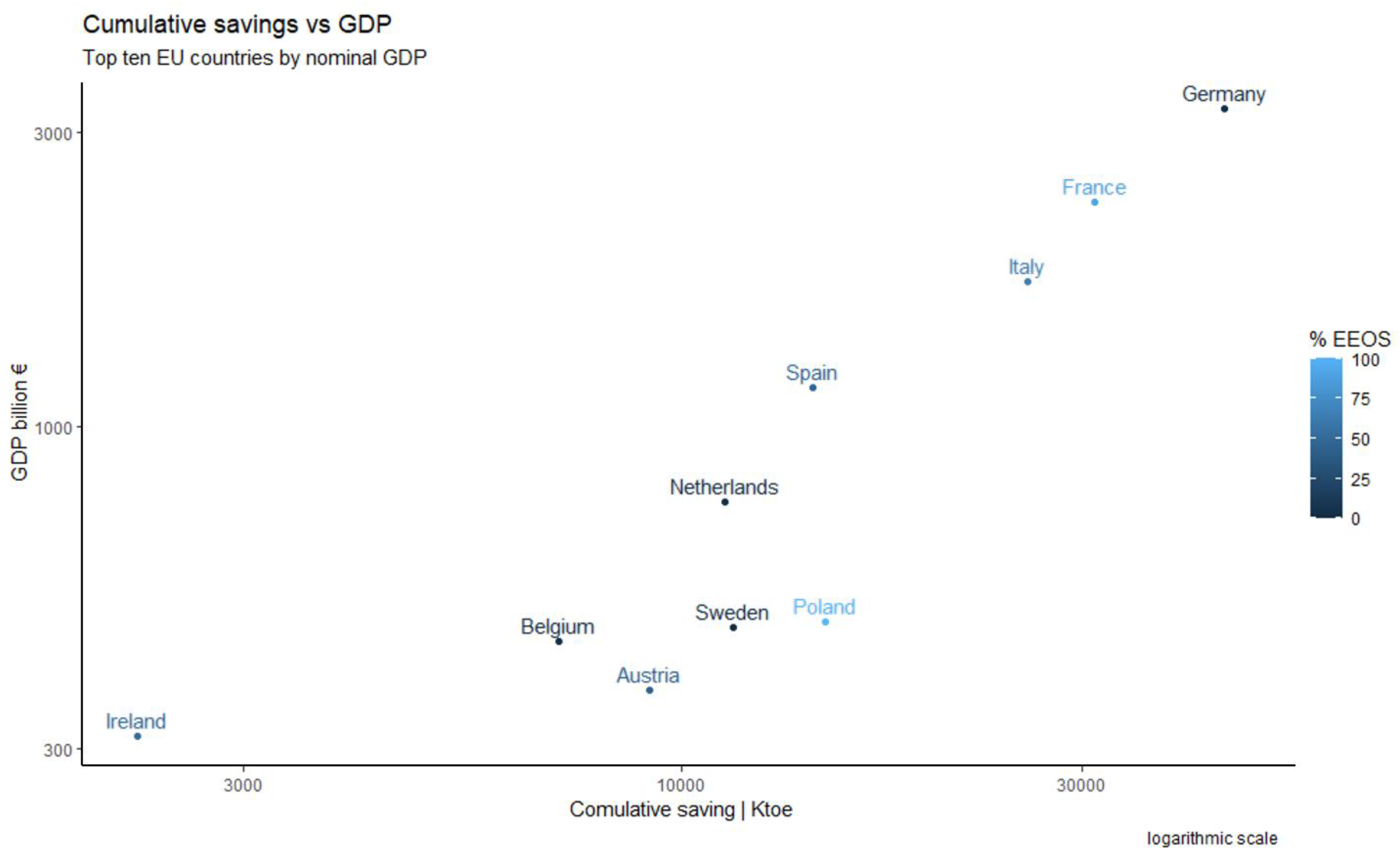

Figure 1 presents a breakdown of cumulative savings proposed by key EU countries for the 2014–2020 period.

Some conclusions can be drawn from the information in

Figure 1, particularly regarding the overall savings. Regarding the approach for energy performance, at the country level, there are more approaches [

32], so member countries plan to contribute to EE objectives through a combination of heterogeneous policy tools [

33]; see [

34] for a system dynamics approach to analyze the role of EE policies.

The Italian white certificate scheme was first introduced as an innovative approach aimed at combining a command and control policy with a market-oriented instrument and started in 2005. Distribution system operators of gas and electricity were obliged to achieve a rate of energy savings not lower than the target defined within the scheme.

Table 2 lists targets that have been constantly updated.

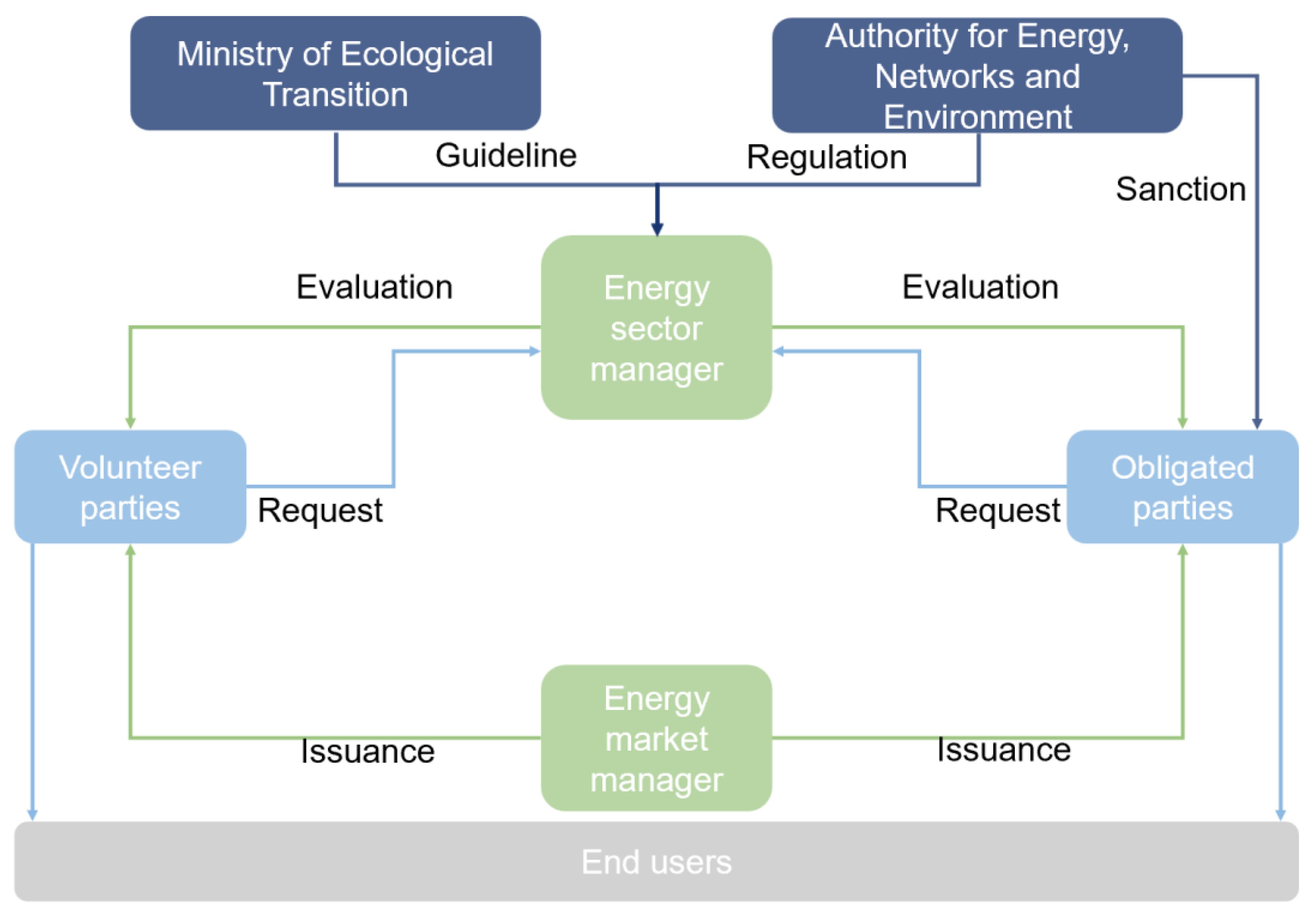

The Energy Services Manager (GSE) manages, assesses, and certifies the savings attributable to EE projects. The certificates are actually issued by the Energy Market Operator (GME) and subject to the approval of the GSE.

4. Italy’s White Certificate Scheme

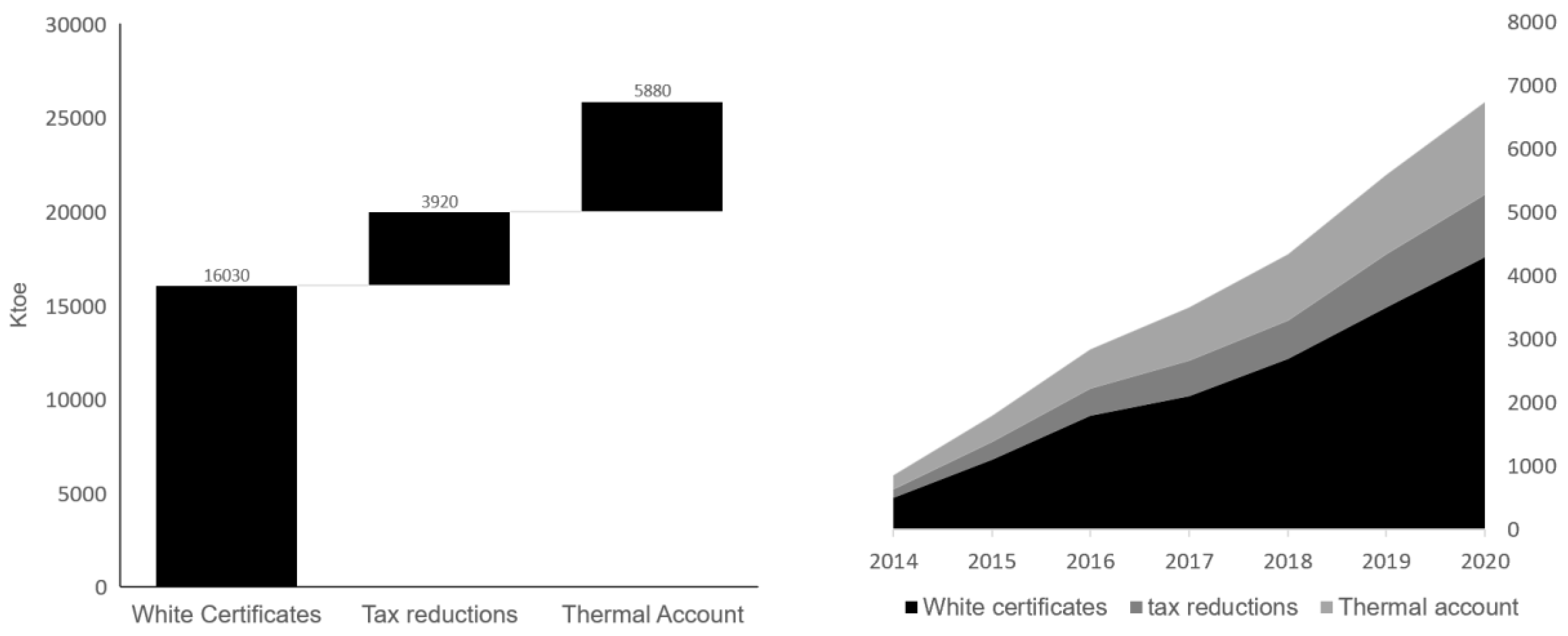

In its strategy to achieve its EED Article 7 final energy saving targets, Italy has adopted three primary mechanisms: white certificates, tax reductions (especially for buildings), and the so-called thermal account, which promotes the uptake of renewable thermal energy sources [

35].

Figure 2 summarizes the savings targets assigned to each scheme. The proposed schemes generated cumulative savings of 25.83 toe between 2014 and 2020, approximately 62% of which came from white certificates [

36].

In addition to promoting renewable sources through incentives, the efficient management of energy resources is of primary importance for carbon-mitigating energy policies [

37], including energy plant repowering and upgrading projects [

38]. In this context, the white certificate scheme is the main tool for achieving increased industrial EE [

39] and reduced energy consumption [

40], as suggested by the evidence reported from an analysis the Italian white certificate scheme [

41]. Electricity and natural gas distributors with at least 50,000 customers must produce a specified number of white certificates per year [

42]. White certificates are issued according to the energy savings generated by interventions carried out by obligated distributors and, more commonly, by volunteer parties (i.e., companies that are not obligated to issue white certificates but are eligible to participate in the scheme). Volunteer parties can sell white certificates to obligated entities through a market managed by the energy market manager. Obligated distributors, on the other hand, are reimbursed based on white certificates transmitted to the GSE because they cannot pass the incurred costs on to end users.

Figure 3 illustrates the key roles in the Italian white certificate scheme.

The white certificate scheme is characterized by annually increasing energy savings targets, flexibility due to the inclusion of volunteer parties, the opportunity to include all sectors and multiple EE measures, and the promotion of energy services companies. The exchange of white certificates occurs on a trading platform.

Given that Italy’s white certificate scheme is among the longest-running in the world, it is worthwhile to review how it has been refined over time. In particular, in 2018, rising prices prompted the Ministry of Economic Development to intervene by implementing rules designed to lower the price of white certificates and avoid excessive growth in the scheme’s costs. It is helpful to analyze the elements that have positively and negatively influence the scheme [

42]. Italy was among the first countries in the world to apply this market tool to promote end-use EE [

9], and, following its introduction, the structure of the scheme and its regulations have been the subject of analysis by the European Commission, the International Energy Agency, and a growing number of countries worldwide. For example, with Directive 32/2006, the European Commission indicated white certificates as one of the tools that member states can use to lower energy consumption.

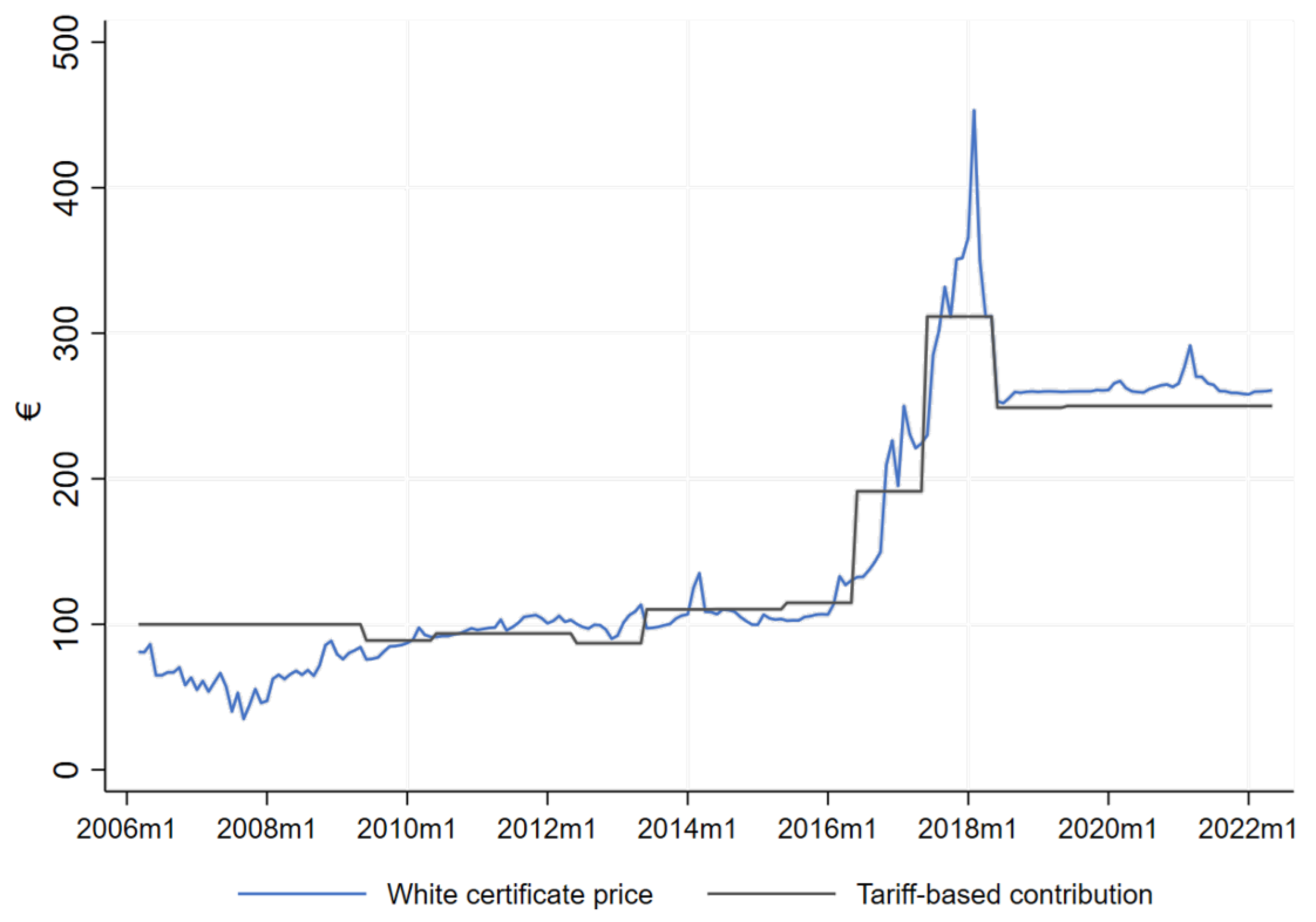

Figure 4 shows how the white certificate market has evolved along with the tariff contribution. As an alternative to their energy-saving interventions, obligated parties, with the collaboration of third parties, can purchase white certificates attesting to the attainment of savings by other obligated and voluntary parties. It is worth noting that voluntary markets have been identified as drivers of the scheme’s success along with efficiency resource standards [

44]. The purchase and sale of white certificates occur through bilateral contracts or an exchange managed by GME. Each year, the Authority for Energy, Networks, and Environment determines a tariff contribution to be paid to obligated parties to satisfy their obligations. This tariff contribution is financed through a small levy from the electricity and gas distribution tariffs, which are established by the authority to ensure that the overall burden on consumers’ energy bills remains considerably lower than the overall economic benefit derived from the implementation of the scheme. The contribution therefore aids in the implementation of interventions among end consumers by reducing their costs. A recent study focuses on adopting white certificates on the economic performance of companies [

45] and finds a positive impact of white certificates on firm performance, as confirmed by previous literature [

46].

4.1. Phases

The scheme’s first phase (2005–2007) was characterized by sustainable performance in the supply and pricing of white certificates. However, it is necessary to clarify under which conditions white certificates outperform other instruments [

48]. White certificates were issued to generate additional savings through three different procedures: standard projects characterized by estimated savings, in which savings were calculated based on installed units; analytical projects characterized by measured savings; and consumptive projects, which were limited in number mainly due to the complexity of the approach compared to previous incentive schemes.

The second phase (2008–2010) was characterized by increases in energy savings targets and the number of obligated entities, the introduction of a factor designed to automatically increase targets each year if available white certificates exceeded the updated annual targets by more than 5%, a modified flexibility clause that increased the minimum number of certificates, and the possibility for companies with an energy manager to become volunteer parties in the scheme. The changes generated beneficial effects, including an increase in the market price of white certificates [

39]. In addition, the energy savings generated in 2008 and 2009 increased significantly from those in 2007. Despite these encouraging developments, the growth of energy savings stalled in 2010 due to the reduction in savings generated by new projects submitted that year and the conclusion of projects submitted in 2005–2006, with five years being the standard duration of white certificates.

In the third phase (2011–2012), the relevant authority sought to make the scheme more attractive by introducing the so-called tau coefficient, which adds the future savings relating to the period between the validity of the white certificate and the end of the useful life of the project, to the annual savings recognized for each project [

49]. As a result, on average, projects were awarded three times as many white certificates over the five-year term as had been previously granted. The result has been the long-coveted growth in interest in the mechanism, which has been accompanied by adverse effects resulting from the decoupling of white certificates from the savings they generate, thus making it more challenging to evaluate their performance. The tau coefficient made interventions related to standard projects more attractive and generated excess economic returns for some projects. Its introduction brought the supply of certificates back in line with the targets and halted the increase in targets, thus reducing in prices in 2012. However, it did not positively affect energy savings.

The fourth phase (2013–2016) introduced innovations to make the scheme more efficient as well as new targets to consider the tau coefficient and the inability to submit projects after their implementation. There was a shortage of white certificates, as reflected in the decision to allow the eligibility of projects yet to be implemented and the GSE’s decision to limit the effect of the tau coefficient on industrial projects. These decisions resulted in a decline in the number of certificates issued in 2014 and 2015, which only partially recovered in 2016 with the increase in standardized projects.

The fifth phase introduced targets, a baseline, additionality, evaluation and measurement procedures, verification, and control. Regarding the calculation of energy savings, the decree modified standard designs and eliminated analytical ones. Thus, the two currently existing methods are standard designs with sample measurement, which are used when homogeneous interventions fall within similar contexts and operating conditions, and monitoring plan designs, which remain primarily unchanged but include additional requirements for the identification of the consumption baseline. In addition, the decree eliminated the tau coefficient to solve the aforementioned problem and increased the duration of white certificates for most projects. With the ministerial decree of 11 January 2017, the GSE also introduced changes to the control activity by making it possible to review the recognized certificates even after the investment is made. This has led to uncertainty in the development of new projects and a significant contraction in the availability of certificates, and in the following years increased the price of certificates, as shown in

Figure 4.

It can be seen from the data from this period that the design of the white certificate market was unstable. The supply became inelastic because approximately 18 months would pass between the implementation of a project and the issuance of the corresponding certificate. At the same time, existing standardized designs allowed for quick action. Moreover, the criterion for determining the tariff subsidy resulted in distributors purchasing certificates in every market session to ensure that their weighted purchase cost would be in line with weighted average prices. In a fluid market system, this would not cause any inconvenience. Nevertheless, the current situation has resulted in high systemic costs.

The sixth phase (2018–2021) followed a ministerial decree dated 10 May 2018 and introduced another phase in the evolution of supply and demand. On the supply side, the aim was to increase the number of available certificates by abolishing additionality for projects related to the improvement of existing facilities, introducing new eligible projects, and clarifying the conditions for the coexistence of white certificates with related EE measures. The elimination of additionality for improvements to existing facilities was an attempt to overcome one of the main problems related to consumptive projects, particularly in the industrial sector.

The final phase (i.e., the ongoing period), which followed a ministerial decree issued on 21 May 2021, plans to revive the white certificate scheme and regulate new EE obligations until 2024. The decree contains numerous new features in addition to new energy savings targets. For example, it allows temporary business groups and associations to participate in the white certificate scheme. It also allows cumulation with tax credits for projects submitted after 2020 by receiving half of the white certificates. Regarding the types of EE interventions eligible for the scheme, the decree expanded the types and technologies eligible for white certificates and classified them by industrial sector and level of energy savings. Finally, the changes aimed at the functioning of the market were significant and included the introduction of flexibility tools that balance supply and demand on an annual basis as well as mechanisms capable of identifying innovative capital-intensive technologies that require more substantial incentives. In particular, the decree introduces a new incentive system that generates savings through downward auctions that can be accessed by entities wishing to implement EE projects. The auction mechanism is an important innovation that deserves to be analyzed in detail, as it can be used as an example by policymakers in other countries intending to develop a similar white certificate mechanism.

4.2. Some Evidence on Types of Interventions

In this section, we report on evidence from a survey that explored the technological upgrading and EE potential that white certificates could bring to Italian industry. The study was based on an assessment of 1068 interventions in the following sectors: steel, food, glass, paper, ceramics, chemicals, and cement [

50].

Table 3 presents the relevant descriptive statistics.

These sectors are collectively responsible for approximately 66 percent of final energy consumption. The impact of EE interventions was determined in terms of energy savings associated with the various auxiliary phases and services of the processes by starting with an in-depth analysis and reworking of all the elements provided in the available documentation. These savings are related to EE interventions with requirements that exceed the targets achieved by the continued technological development of production processes, as required by the standard. Similarly, the degree of effectiveness of the interventions was evaluated for the various sectors and expressed in average energy savings per intervention, average investment cost, and average investment cost per toe saved.

To identify groups of interventions as homogeneously as possible while being aware of the specificity of industrial activities, it was necessary to consider certain critical factors that may influence their implementation on a macro scale. Because similar processes may require different equipment and have economic limits given that the propensity to apply EE interventions depends on several financial conditions and technological limits, geographical aspects stipulate that certain types of production depend on the particular industrial district and local geopolitical context. As such, additivity cannot be performed on some EE interventions on the same facility and degree of repeatability because those interventions can be replicated in the same plant at regular intervals. According to RSE evaluations, the white certificate mechanism could enable the industrial sector to reduce its consumption by approximately 1.7 Mtoe by 2030, amounting to total cumulative savings over the 2022–2030 period of approximately 9.2 Mtoe. It is also possible to differentiate potential savings based on the payback period of achievable EE interventions. As seen from

Table 4, 55% of the total savings could be achieved by interventions with a payback period of less than 5 years. In contrast, the most demanding measures involving significant investments by the company and a payback period longer than ten years would achieve 16% of the total savings.

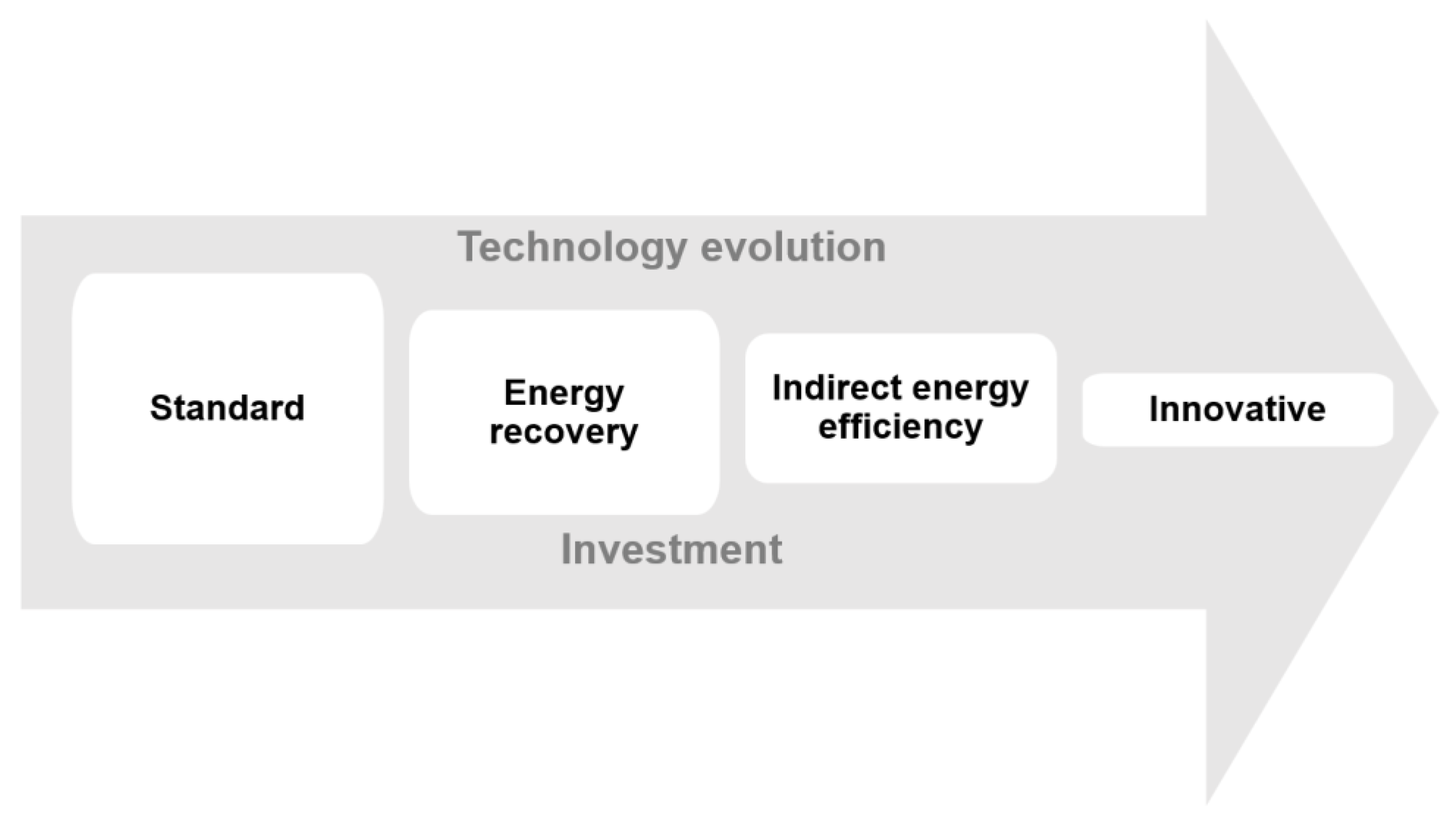

Our analysis of EE interventions under the white certificates mechanism allowed for an overall view of the choices made by companies. Thus, a hierarchy of the different types of actions chosen by companies was defined and classified according to their increasing specificity and complexity, as shown in

Figure 5.

Most of the cases analyzed fall into the category of standard interventions (e.g., inverters, electric motors, air compressors, and boilers). These investments are typical EE interventions that anticipate the technical changes that will become market standard due to technological evolution. The second type of intervention refers to energy recovery. Such interventions are not technologically innovative but capable of giving the process greater EE. Again, the normal technological evolution of industrial equipment is moving in this direction. Indeed, new production lines are equipped with preinstalled heat recovery or other technological systems that reduce waste and heat loss. At the third level, in terms of frequency, interventions that can be considered indirect consist of those that replace or revamp production lines and computerized management and control systems. Finally, interventions can be defined as innovative, albeit in smaller numbers but of higher quality, as they are not only the result of normal technological evolution but also the result of specific projects aimed at improving the overall process efficiency. This requires specific skills and strong motivation of the company to invest on this front [

51]. Therefore, we determine that the main driver of the development of EE in Italian industry is technological evolution.

5. Discussion

White certificates have been adopted in various European countries, and although the key objective, namely, the national adoption of an energy saving obligation, was similar, various countries have pursued different methods for achieving the objectives. However, there is a peculiarity concerning the commodity identified for the calculation of savings: in Italy, France and the UK, it is primary energy, final energy and the amount of CO

2 avoided. The choice of primary or final energy affects the balance between electricity and gas savings. Regarding the obligated parties, in the UK and France, they are the suppliers of gas, electricity and heat, while in Italy, they are the distributors of electricity and gas [

16]. In Italy, the existence of energy services companies has made it possible to expand the scope of projects in the medium term.

The obligation on the part of energy suppliers has meant that they carry out efficient projects either alone or in partnerships, while in Italy, the presence of energy services companies and the organization of a trading platform has favored the development of a market that makes white certificates a preferable solution, in terms of costs, to other instruments. Another feature is white certificates’ scope of application in various countries. In the UK, certification of interventions are made in the residential sector, while in France, the scheme is open to any plant, except those falling under the ETS [

10]. In Italy, the mechanism has evolved from simple interventions promoted through standardized forms to complex interventions carried out in the industrial sector, which to date has covered 80% of all white certificates produced [

3].

5.1. Functioning of the Mechanism

To provide comparable information, a unified framework is used to estimate the costs and benefits of the schemes [

52] by a recent study. For example, stricter rules on additionality and the large amount of data required for projects have limited the number of eligible projects and the savings that can be generated, with a rationale that is not always linked to the established objectives. In addition, the high number of rejected proposals in recent years indicates that the rules are unclear and thus require further preliminary discussion as well as more training and support for operators.

From early 2006 to 2007, there was a reduction in value related to the rapid deployment of emerging technologies and interventions. In the following few years, due to the increase in targets and the difficulty the market experienced in proposing projects in sufficient numbers, the price increased, as

Figure 4 shows. Less variability was observed until mid-2016, given the balance between supply and demand. Subsequently, the market trend was characterized by price volatility. The introduction of a cap on the tariff contribution in 2018 led to a relatively constant price.

From mid-2008 to mid-2014, there was a marked price rise. In early March 2014, there was a price spike that remained an isolated case, presumably because its speculative intent did not produce the hoped-for results or because conditions to induce distributors to buy on similar terms did not arise thereafter.

Figure 4 depicts the price trend of white certificates to allow for a more detailed look at their evolution.

The Ministerial Decree of 21 May 2021 introduced an auction mechanism to grant incentives for interventions that can bring additional energy savings to the white certificate scheme to achieve the EE targets set by the NECP. The annual incentive is equal to the product of the economic value awarded at auction and the additional energy savings achieved.

5.2. Implications for Auction Mechanism Design and Policy

The auction is mechanism is intended to achieve additional results compared to the current mechanism. Therefore, it cannot be understood as an alternative to white certificates. The auction mechanism can be an opportunity to enhance synergies between the two mechanisms and structurally address the procedural issues.

The reference period for auctions should be set to have a sufficient frequency. The appropriateness of defining shorter timeframes for auction sessions should be evaluated according to the type of projects eligible to participate. For each year, the potential savings can be consistent with what is provided in the NECP. Participation in the auction should not inhibit the proposing entity’s ability to access the white certificate scheme. Having already submitted a project for access to white certificates should not result in exclusion from auctions. Auctions should be reserved for technologies, types of projects, and areas of intervention that, due to their level of innovation, complexity, standardization of savings, or positive externalities, need an incentive over a predefined time horizon to ensure their economic sustainability.

The value placed on the auction base shall equal the economic value of the toe saved. The auction should be carried out through a series of percentage reduction bids that determine the value assigned to the auction base. There are two views on how obligated entities should achieve their targets and savings through the auctions: one envisions keeping auctions and white certificates separate, and the other proposes using the savings produced by auctions to provide liquidity to the white certificate market. A possible compromise would be to issue several white certificates to successful bidders and provide remuneration akin to tradeable carbon credits, which would allow for the activation of a stability mechanism. Finally, the dynamic that could potentially be triggered would be as follows: the increased liquidity in the stock market resulting from the contribution from auctions would allow for the toe of submitted projects to be assessed annually, and if the supply is greater than or at least equal to the demand, the ordinary release of the white certificates generated from auctions into the market would be blocked.

5.3. Pieces of Evidence

The evidence relating to the type of interventions shows that the most common interventions concern inverters, electric motors, air compressors, and self-regenerative burners, which are relatively small interventions characterized by low investment costs and a low impact on operating costs. These interventions generate small additional energy savings compared to typical market technologies. It can be argued that they substantially precede technologies destined to become the market standard in the near future. The typical EE interventions are primarily represented by those that involve heat recovery and the reduction of energy dispersion. Compared to previous interventions, these interventions require particular attention to the consumption of the processes. Additionally, in such cases, they are interventions with low investment costs and operating costs. An important contribution to the decarbonization of industry is due to the third category of interventions, which are defined as indirect interventions—that is, interventions that revamp and replace production lines with more technologically advanced and energy efficient lines. These combine improvements to the quantity and quality of the products with a significant reduction in energy consumption. Therefore, these interventions indirectly increase the EE associated with companies’ production processes. Finally, a fourth type of intervention defined as “innovative interventions” emerges from the empirical evidence, which are few in number but more advanced in terms of technological solutions for achieving EE and which are, unlike the three previous categories, not the result of normal technological evolution but rather from the strategy, determination, and innovative capacity of companies. These are interventions that, in some cases, are part of ESG strategies aimed at achieving certain objectives to reduce the environmental impact of industry.

6. Conclusions

Based on the common knowledge that EE has become particularly important, as it offers opportunities to reduce carbon emissions and meet decarbonization targets and that many policy tools can contribute to reaching these targets, we focus on a prominent market-based mechanism falling within the category of efficiency obligation schemes. Specifically, we focus on a remarkable market-based instrument known as white certificates, given that it is important to rethink the role that white certificates can play in the energy transition. Considering that many countries worldwide have introduced or are considering introducing white certificate schemes, we have analyzed the Italian case, since it is one of the principal points of reference at the international level, among the longest-lived, and has achieved notable results. Considering the depth of literature available on its functioning, we offer novel insights by providing evidence from an empirical survey and analyzing the last update to the scheme, which introduced critical innovations. Specifically, we review lessons learned from the Italian case and the implications of the latest update to the scheme, which narrows our analysis to a critical particularity: an auction-based mechanism aimed at complementing the white certificate scheme. In doing so, we extend the understanding of the Italian white certificate scheme by adding empirical evidence to the literature that describes the current period as well as prospects for the future. Similarly, we discuss the strategic implications of the latest update to the scheme, which introduced a reverse auction mechanism. Such insights can serve policymakers in setting up or fine-tuning similar schemes in countries with little or no related experience. In addition, we focus on the innovative potential of the last update to the scheme, which could improve the healthy functioning of white certificates in an increasingly complex energy market landscape. Although the contribution of EE to the decarbonization path is essential, it is still rarely analyzed from the perspective of the results of the white certificate scheme, which is one of the leading market instruments used to promote it.