Civic Energy in an Orchard Farm–Prosumer and Energy Cooperative—A New Approach to Electricity Generation

Abstract

1. Introduction

2. Background Review of Energy Cooperatives and Literature Review

2.1. The Importance of Cooperatives around the World

2.2. Prosumers and Energy Cooperatives in Poland

3. Materials and Methods

- Four models;

- Two billing scenarios with a different approach to electricity purchase prices.

- A prosumer settling accounts with the seller in the net-metering system, the so-called old prosumer;

- A prosumer settling accounts with the seller in the net-billing system, the so-called new prosumer;

- Energy cooperatives;

- Comparative in the absence of energy production for their own needs (no RES installations).

- -

- Eb(t)—Total amount of energy balanced in hour (t), expressed in kWh, billed in a given billing period;

- -

- (+)—Positive value means the amount of electricity consumed in a given hour (t) from the electricity distribution network;

- -

- (−) —A negative value indicates the amount of electricity introduced at a given hour (t) to this network;

- -

- Ep(t)—The sum of all phases of the amount of electricity consumed in an hour (t) from the power distribution network, expressed in kWh;

- -

- Ew(t)—The sum of all phases of the amount of electricity introduced in hour (t) to the power distribution network, expressed in kWh.

- -

- Er(o)—The amount of energy billed as fed into the grid or taken from the electricity distribution grid in a given billing period, expressed in kWh;

- -

- Ebp—The sum of the amount of summarily balanced energy from all hours (t) of the billing period for which the result of the summary balancing is positive, marked with the symbol Eb (t) in Formula (1), expressed in kWh;

- -

- Ebw—The sum of the amount of summarily balanced energy from all hours (t) of the billing period for which the result of the summary balancing is negative, marked with the symbol Eb (t) in Formula (1), expressed in kWh;

- -

- Er(o−1)—The amount of electricity not used by the prosumer in previous billing periods, settled in the current billing period for which the billing value is negative, expressed in kWh;

- -

- Wi—Quantitative ratio, equal to 0.7 for installations, with a total power greater than 10 kW.

- To the seller, fees for its settlement;

- Charges for the distribution service, the amount of which depended on the amount of electricity consumed.

- RES fees;

- Power fee;

- The cogeneration fee.

4. Results

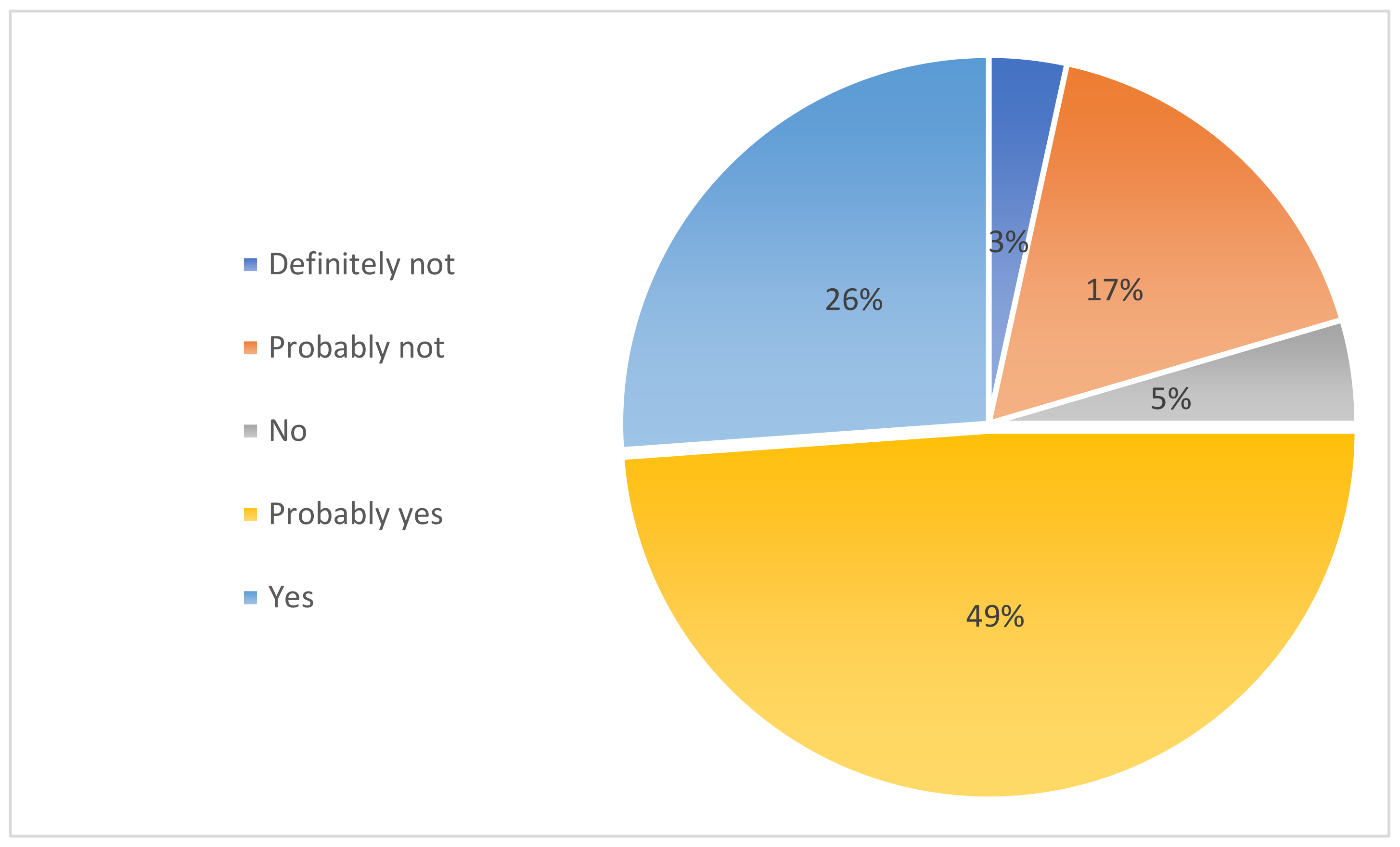

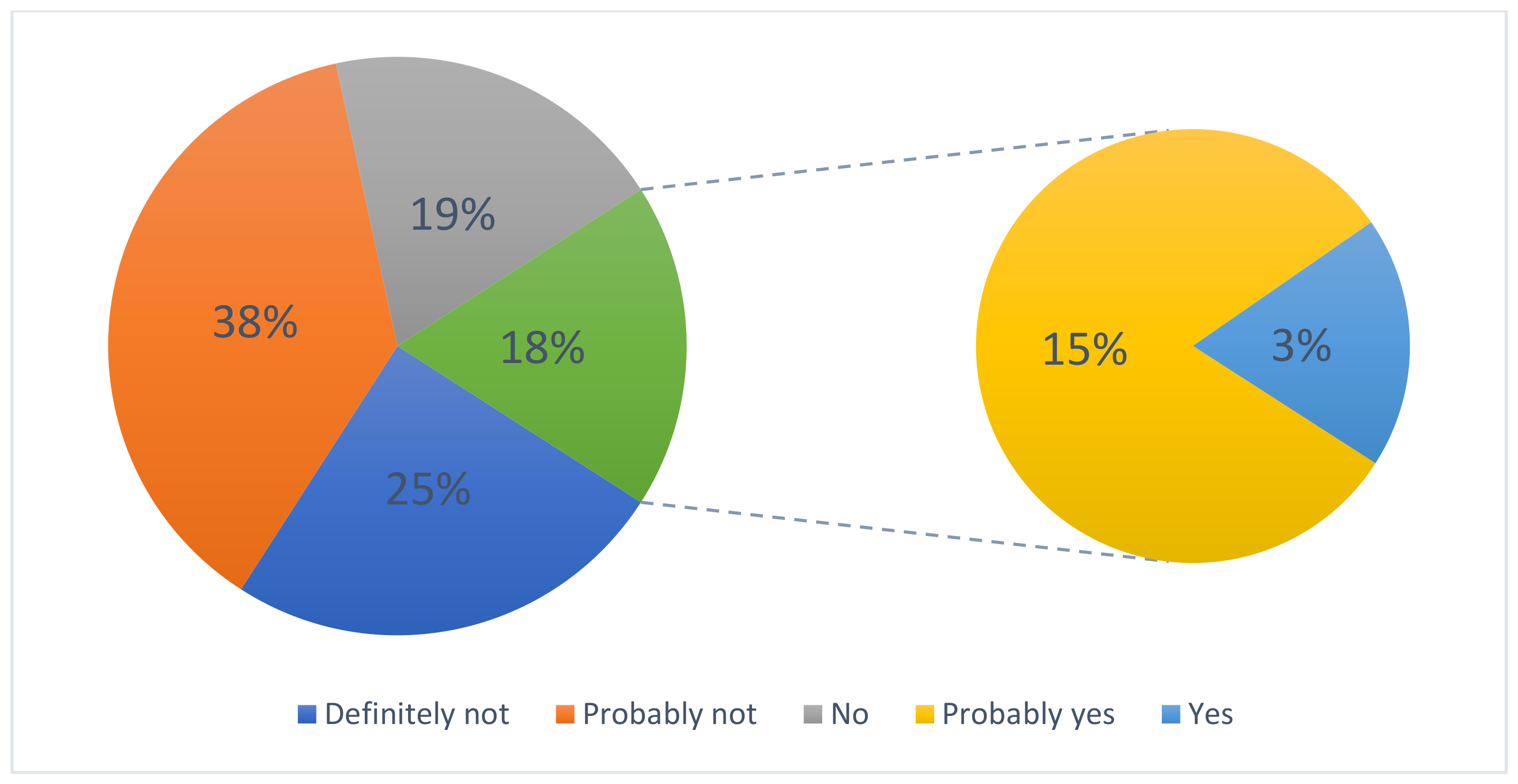

4.1. The Willingness of Fruit Growers to Cooperate

- Are you currently a part of a producer group?

- Please indicate at least three reasons why you are not a part of a group production.

- Would you become a member of a cooperative if membership provided benefits to the farm in the form of cost reduction or other economic or social benefits?

- Do you think fruit growers can cooperate with each other?

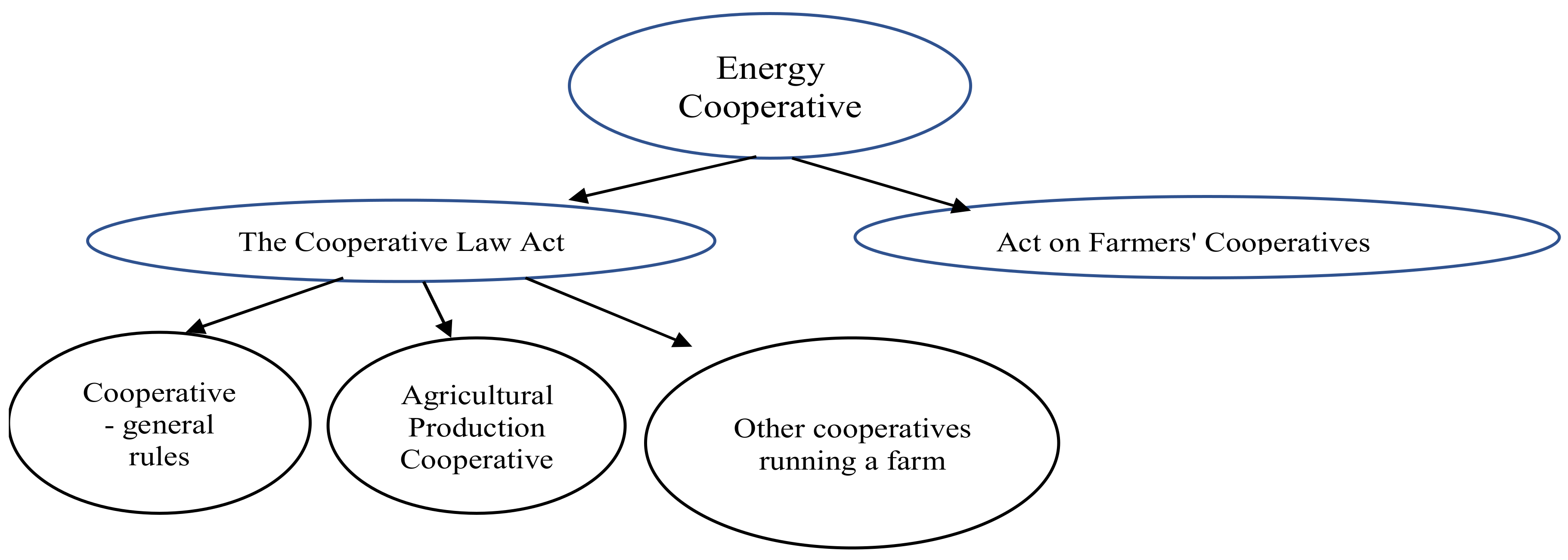

4.2. Formal Conditions for the Functioning of a Cooperative in Poland

4.2.1. Types of Cooperatives

4.2.2. Founders and Members of the Cooperative

- Ten natural persons;

- Three legal persons;

- Five natural persons in agricultural production cooperatives;

- Five natural persons and legal persons running a farm within the meaning of the provisions on agricultural tax or conducting agricultural activity in the field of special departments of agricultural production solely for the purpose of organizing themselves into groups of agricultural producers or in preliminary recognized groups of fruit and vegetables producers and recognized fruit producer organizations and vegetables (Article 6 § 2 and § 2a of the Cooperative Law Act).

4.2.3. The Object of Activity of an Energy Cooperative

- Production planning carried out by farmers and adapting it to market conditions;

- Concentration of supply and organizing the sale of products produced by farmers;

- Concentration of demand and organizing the acquisition of the means of production necessary for farmers.

4.2.4. Types of Cooperative Capitals

4.2.5. An Energy Cooperative Is a Prosumer

4.2.6. Balancing the Electricity Demand of an Energy Cooperative and Its Members

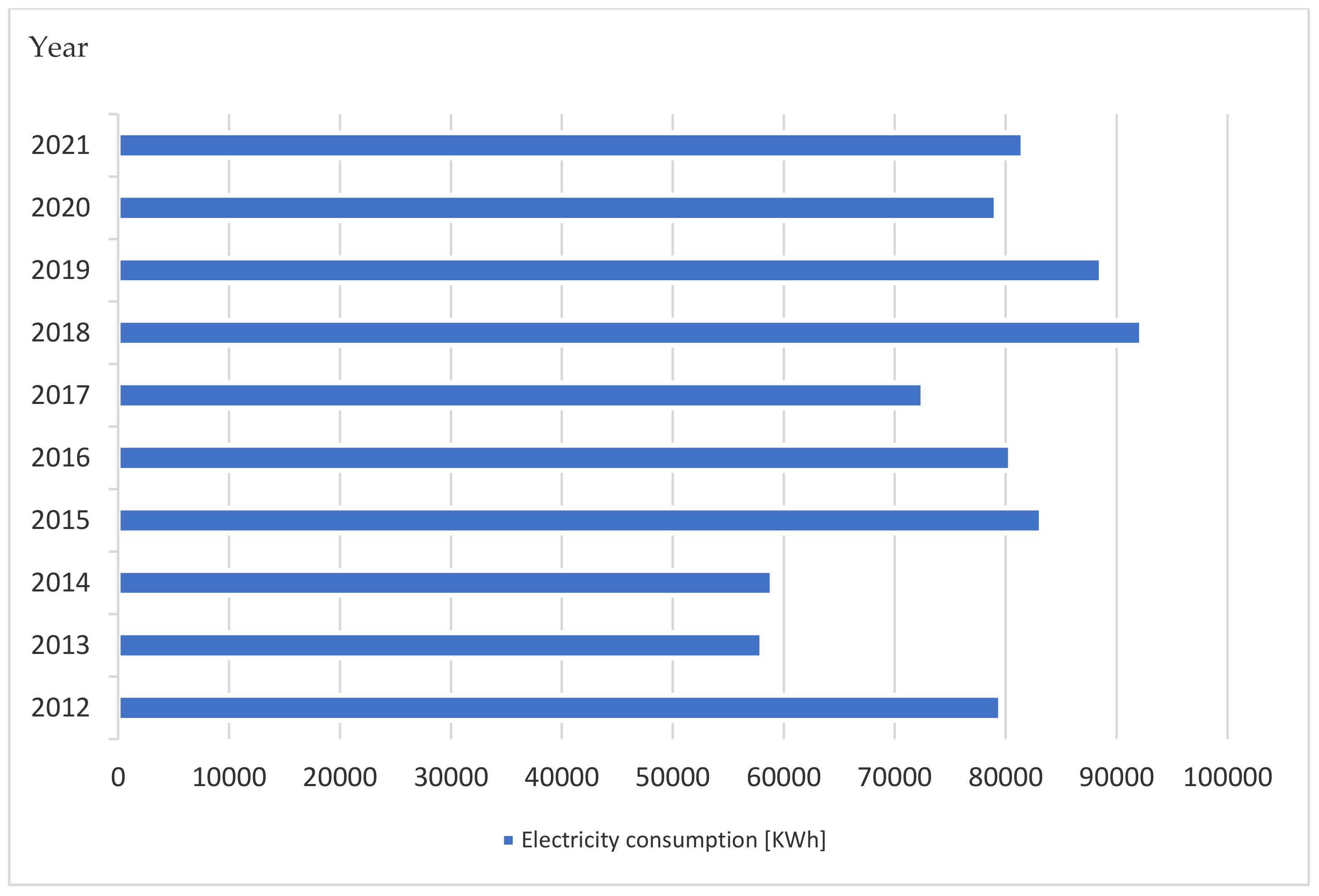

4.3. Electricity Generation in Micro-Installations from RES and the Support Mechanism

- (a)

- According to the current accounting rules in a quantitative ratio of 1 to 0.7;

- (b)

- According to the new settlement rules, in force from July 2022;

- (c)

- Being a cooperative.

5. Conclusions

- (a)

- A prosumer settling in the net-metering system, if they were prosumers before 1 July 2022;

- (b)

- A prosumer who settles in the net-billing system, if they start generating electricity after 1 July 2022, or if they have already generated electricity and wish to change the rules of accounting;

- (c)

- A member of an energy cooperative.

- The need to analyze electricity production in a micro-installation, because it cannot be the subject of the principial economic activity of a grower—there are no conditions determining what measure to measure the activity by, for example, by the amount of revenues or some other measure;

- The multitude of types of cooperatives—it is possible to establish four types: cooperatives on general terms; agricultural production cooperatives; farmers’ cooperatives; other cooperatives, which may be granted the status of an energy cooperative;

- Numerous conditions to be met when choosing the legal form for an energy cooperative require maintaining an appropriate number of founders and members per the regulations; additionally, the subject of activity of an energy cooperative being a prosumer is not arbitrary;

- Meeting the condition of ensuring that members of the cooperative have 70% of the electricity demand—orchard production and the volume of the electricity demand are not predictable.

Funding

Data Availability Statement

Conflicts of Interest

References and Note

- Rutkowska-Tomaszewska, E.; Łakomiak, A.; Stanisławska, M. The Economic Effect of the Pandemic in the Energy Sector on the Example of Listed Energy Companies. Energies 2022, 15, 158. [Google Scholar] [CrossRef]

- Energy Union Package. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee, the Committee of the Regions and the European Investment bank, A Framework Strategy for a Resilient Energy Union with a Forward-Looking Climate Change Policy. COM (2015) 80 final, Brussels. 25 February 2015. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:1bd46c90-bdd4-11e4-bbe1- (accessed on 28 December 2021).

- Šahović, N.; Pereira da Silva, P. Community Renewable Energy—Research Perspectives. Energy Procedia 2016, 106, 46–58. [Google Scholar] [CrossRef]

- Ceglia, F.; Marrasso, E.; Roselli, C.; Sasso, M. Small Renewable Energy Community: The Role of Energy and Environmental Indicators for Power Grid. Sustainability 2021, 13, 2137. [Google Scholar] [CrossRef]

- European Parliament. Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from Renewable Sources (Recast); RED II; European Parliament: Brussels, Belgium, 2018. [Google Scholar]

- European Parliament. Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27/EU (Recast); European Parliament: Brussels, Belgium, 2019. [Google Scholar]

- European Parliament. Regulation (EU) 2019/943 of the European Parliament and of the Council of June 2019 on the Internal Market for Electricity (Recast); European Parliament: Brussels, Belgium, 2019. [Google Scholar]

- Energy Communities under the Clean Energy Package Transposition Guidance; REScoop.eu. Available online: https://www.rescoop.eu/news-and-events/press/energy-communities-under-the-clean-energy-package (accessed on 28 December 2021).

- Ceglia, F.; Esposito, P.; Faraudello, A.; Marrasso, E.; Rossi, P.; Sasso, M. An energy, environmental, management and economic analysis of energy efficient system towards renewable energy community: The case study of multi-purpose energy community. J. Clean. Prod. 2022, 369, 133269. [Google Scholar] [CrossRef]

- Horstink, L.; Wittmayer, J.M.; Ng, K.; Luz, G.P.; Marín-González, E.; Gährs, S.; Campos, I.; Holstenkamp, L.; Oxenaar, S.; Brown, D. Collective Renewable Energy Prosumers and the Promises of the Energy Union: Taking Stock. Energies 2020, 13, 421. [Google Scholar] [CrossRef]

- Błażejowska, M.; Gostomczyk, W. Conditions for the Creation and State of Development of Cooperatives and Energy Clusters in Poland Compared with Germany. Zeszyty Naukowe Szkoły Głównej Gospodarstwa Wiejskiego w Warszawie-Problemy Rolnictwa Światowego 2018, 18, 20–32. [Google Scholar] [CrossRef]

- Caramizaru, A.; Uihlein, A. Energy Communities: An Overview of Energy and Social Innovation; EUR 30083 EN; Publications Office of the European Union: Luxembourg, 2020; ISBN 978-92-76-10713-2. [Google Scholar] [CrossRef]

- Schwanitz, V.J.; Wierling, A.; Zeiss, J.P.; von Beck, C.; Koren, I.K.; Marcroft, T.; Müller, L.; Getabecha, M.; Dufner, S. The Contribution of Collective Prosumers to the Energy Transition in Europe—Preliminary Estimates at European and Country-Level from the COMETS Inventory, Western Norway University of Applied Sciences, August 21; 2021, p. 1. Available online: https://osf.io/preprints/socarxiv/2ymuh/ (accessed on 28 December 2021).

- Report from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, State of the Energy Union 2021—Contributing to the European Green Deal and the Union’s recovery, Brussels, 26 October 2021. COM (2021) 950 final, p. 24. Available online: https://ec.europa.eu/energy/sites/default/files/state_of_the_energy_union_report_2021.pdf (accessed on 28 June 2022).

- Suchoń, A. Cooperatives in The Process of Developing the Multifunctionality of Rural Areas in Poland—Selected Legal Issues. Int. J. Coop. Law 2020, 3, 10–30. [Google Scholar]

- Marzec, T. Legal perspectives for the development of energy cooperatives in Poland. Internet Antimonop. Regul. Q. 2021, 24. [Google Scholar] [CrossRef]

- Łakomiak, A. Accounting and Taxation Issues in Branch of Horticultural Producer Groups. Research work of the Wrocław University of Economics, Wrocław University of Economics. 2014. Available online: https://www.dbc.wroc.pl/dlibra/docmetadata?id=27244&from=publication (accessed on 18 June 2022).

- Gilcrease, W.; Arrobbio, O.; Sciullo, A. Energy Cooperatives in EU and United States: History, Regulations, and Challenges; Filho, W.L., Azul, A., Brandli, L., Lange Salvia, A., Wall, T., Eds.; Springer: Berlin/Heidelberg, Germany, 2020. [Google Scholar] [CrossRef]

- Jørgensen, U.; Elle, M.; Lauritsen, D.; Leonardsen, Ø.; Viksø, A.; Flemming Gerhardt Nielsen, F.G.; Kepny-Rasmussen, J. Handbook for Energy Communities, 1st ed.; Energiforum Sydhavn: Glostrup, Denmark, 2020; Available online: https://eboconsult.dk/wp-content/uploads/2020/12/Handbook-for-Energy-Communities-web-version-Vissing-SoB-8-August-2020-ver-1.pdf (accessed on 18 June 2022)ISBN 978-87-93053-06-9.

- Szyrski, M. Local Energy. Administrative and Legal Study; Scientific Publishing House of the Cardinal Stefan Wyszyński University: Warsaw, Poland, 2019; ISBN 978-83-8090-557-3. [Google Scholar]

- Wissenschaftlicher Dienst des Bundestages. Zur Geschichte und aktuellen Situation von Genossenschaften. Ausarbeitung. Pozyskano z. 2018. Available online: https://www.bundestag.de/resource/blob/551654/645df4e523cdb75608768f872637fcd8/wd-1-001-18-pdf-data.pdf (accessed on 18 June 2022).

- Zahlen und Fakten. 2022. Der Genossenschaften in Deutschland. Facts and Figures of the Cooperatives in Germany. Available online: https://www.dgrv.de/der-verband/ (accessed on 2 May 2021).

- Thierjung, E.-M. (Civic) Energy Cooperatives in Germany. Internetowy Kwartalnik Antymonopolowy i Regulacyjny 2021, nr 2(10). Available online: www.ikar.wz.uw.edu.pl (accessed on 18 June 2022).

- Poppen, S. Energiegenossenschaften und deren Mitglieder: Erste Ergebnisse einer empirischen Untersuchung. Arbeitspapiere des Instituts für Genossenschaftswesen der Westfälischen WilhelmsUniversität Münster; Westfälische Wilhelms-Universität Münster, Institut für Genossenschaftswesen (IfG): Münster, Germany, 2015; Available online: https://www.econstor.eu/bitstream/10419/123711/1/841415013.pdf (accessed on 18 June 2022).

- Debor, S. The Socio-Economic Power of Renewable Energy Production Cooperatives in Germany: Results of an Empirical Assessment; Wuppertal Papers: Wuppertal, Germany, 2014; Volume 187, Available online: https://www.econstor.eu/handle/10419/97178 (accessed on 18 May 2022).

- Kluth, W. Governance-Konzept der Genossenschaft; Zeitschrift für Rechtspolitik (ZRP): Bad Feilnbach, Germany, 2017; pp. 108–111. [Google Scholar]

- Althanns, A. Genossenschaftliche Modelle bei der Realisierung von Anlagen der erneuerbaren Energien. Zeitschrift für Deutsches und Internationales Bau-und Vergaberecht–Beilage 2012, 35, 37. [Google Scholar]

- Pfister, T.; Wallraf, C.; Sieverding, U.I. Nahwärmegenossenschaften, Chancen und Risiken aus Verbrauchersicht; Verbraucherzentrale NRW: Düsseldorf, Germany, 2015; p. 3. [Google Scholar]

- Act Erneuerbare-Energien-Gesetz, 21 July 2014, BGBl. I p. 1066, Last Amended by Art. 1 of the Act of 21 December 2020, BGBl. I p. 3138. Available online: https://dejure.org/BGBl/2014/BGBl._I_S._1066 (accessed on 18 May 2022).

- De Christo, T.M.; Perron, S.; Fardin, J.F.; Simonetti, D.S.L.; de Alvarez, C.E. Demand-side energy management by cooperative combination of plans: A multi-objective method applicable to isolated communities. Appl. Energy 2019, 240, 453–472. [Google Scholar] [CrossRef]

- International Labor Office; Cooperatives Unit (ENT/COOP). Providing Clean Energy and Energy Access through Cooperatives; Green Jobs Program; ILO: Geneva, Switzerland, 2013; ISBN 978-92-2-127528-2. [Google Scholar]

- Electric Co-op Facts & Figures—America’s Electric Cooperatives, NRECANews, April 2022, Accessed on Electric Co-op—America’s Electric Cooperatives. National Rural Electric Cooperative Association NRECA America’s Electric Cooperatives. Available online: https://www.electric.coop/wp-content/uploads/2021/10/2022_NCS4918_Coop_FactsAndFigures_6.03.22a.pdf (accessed on 18 May 2022).

- Community Energy State of the Sector Report 2021. Available online: https://communityenergyengland.org/files/document/626/1655376945_CommunityEnergyStateoftheSectorUKReport2022.pdf (accessed on 18 May 2022).

- Minuto, F.D.; Lazzeroni, P.; Borchiellini, R.; Olivero, R.; Bottaccioli, L.; Lanzini, A. Modeling technology retrofit scenarios for the conversion of condominium into an energy community: An Italian case study. J. Clean. Prod. 2021, 282, 124536. [Google Scholar] [CrossRef]

- Energy Communities in the Lignite Regions of Greece, The Green Tank 2021. Available online: https://thegreentank.gr/wp-content/uploads/2021/11/20211122_Brief_EnCom_EN.pdf (accessed on 20 June 2020).

- Douvitsa, I. The New Law on Energy Communities in Greece. Coop. E Econ. Soc. 2019, 40, 31–58. [Google Scholar] [CrossRef]

- Wróbel, J.; Sołtysik, M.; Rogus, R. Selected elements of the Neighborly Exchange of Energy—Profitability evaluation of the functional model. Polityka Energetyczna Energy Policy J. 2019, 22, 53–64. [Google Scholar] [CrossRef]

- Suchoń, A. On the legal issues of establishing and running a business by cooperative groups of agricultural producers. Przegląd Prawa Rolnego 2012, 2, 221. Available online: https://repozytorium.amu.edu.pl/bitstream/10593/5955/1/221-242%20SUCHOŃ.pdf (accessed on 20 June 2020).

- Mucha-Kuś, K.; Sołtysik, M.; Zamasz, K.; Szczepańska-Woszczyna, K. Coopetitive Nature of Energy Communities-The Energy Transition Context. Energies 2021, 14, 931. [Google Scholar] [CrossRef]

- Institute for Renewable Energy. The Photovoltaic Market in Poland; Institute for Renewable Energy: Warsaw, Poland, 2022; p. 31. [Google Scholar]

- Ustawa z Dnia 20 lutego 2015 r. o Odnawialnych źródłach Energii (Act of February 20, 2015, on Renewable Energy Sources—Uniform Text) (Dz. U. z 2022 poz. 1378. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20150000478/U/D20150478Lj.pdf (accessed on 31 July 2022).

- Ustawa z Dnia 29 Października 2021 r. o Zmianie ustawy o Odnawialnych źródłach Energii Oraz Niektórych Innych Ustaw (Act of October 29, 2021, Amending the Act on Renewable Energy Sources and Certain other Acts) (Dz. U. z 2021 r. poz. 2376. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20210002376/U/D20212376Lj.pdf (accessed on 1 July 2022).

- Minister of Climate and Environment. Regulation of the Minister of Climate and Environment of 23 March 2022 on the registration, balancing and sharing of measurement data and billing of energy cooperatives. J. Laws 2022, 703. [Google Scholar]

- Sołtysik, M.; Kozakiewicz, M.; Jasiński, J. Profitability of Prosumers According to Various Business Models-An Analysis in the Light of the COVID-19 Effect. Energies 2021, 14, 8488. [Google Scholar] [CrossRef]

- Jasinski, J.; Kozakiewicz, M.; Sołtysik, M. Determinants of Energy Cooperatives’ Development in Rural Areas-Evidence from Poland. Energies 2021, 14, 319. [Google Scholar] [CrossRef]

- Wrocławski, M. The energy cooperative in an energy cluster—A case study. Energetyka Rozproszona Zesz. 2022, 7, 77–83. [Google Scholar] [CrossRef]

- Wójcicki, R. The community microgrid as a virtual power plant on multifamily residential areas. Napędy i Sterowania, “Druk-Art SC”. Drives Control. 2018, 2, 57. [Google Scholar]

- Popczyk, J.; Bodzek, K. Directions of Technological and System Revitalization of Power Grids in the RES Electricity Monolithic and Useful Energy Markets; Public Platform of EnegyTransformation (PPET). 2017. Available online: https://ppte2050.pl/platforman/bzppte/static/uploads/Kierunki%20rewitalizacji%20technologiczno-systemowej%20sieci%20...%20na%20mono%20rynku%20...%20Popczyk%20J.,%20Bodzek%20K..pdf (accessed on 1 July 2022).

- Łakomiak, A.; Zhichkin, K.A. Economic aspects of fruit production: A case study in Poland. BIO Web Conf. 2020, 17, 236. [Google Scholar] [CrossRef]

- Statistics Poland. In Statistical Yearbook of Agriculture; Statistics Poland: Warsaw, Poland, 2021. Available online: https://stat.gov.pl/en/topics/statistical-yearbooks/statistical-yearbooks/statistical-yearbook-of-agriculture-2020,6,15.html# (accessed on 2 January 2022).

- Tariff For Electricity Tauron Sprzedaż Spółka z o.o. Based in Kraków for Customers Settled on the Basis of Tariff Groups A, B, C, O, R Approved by Resolution No. 157/IV/2018 of the Management Board of Tauron Sprzedaż sp.z o.o. of 3 July 2018, Effective from 1 September 2018. Uniform Text as of 1 September 2022. The Changes Introduced by Resolution No. 86/V/2022 of the Management Board of TAURON Sprzedaż sp. z o. o. of 10 May 2022 Are Valid from 1 July 2022 and Concern Point 7. Available online: https://www.tauron.pl/dla-firm/prad/taryfa-sprzedawcy (accessed on 26 July 2022).

- Tariff for Electricity Tauron Sprzedaż Spółka z o.o. based in Kraków FOR CUSTOMERS settled on the basis of tariff groups A, B, C, O, R Approved by Resolution No. 157/IV/2018 of the Management Board of Tauron Sprzedaż sp.z o.o. of 3 July 2018, Effective from 1 September 2018. Uniform Text as of 1 September 2022. The Changes Introduced by Resolution No. 118/V/2022 of the Management Board of TAURON Sprzedaż sp. z o. o. of 12 July 2022, Are Effective from 1 September 2022. and Concern Point 7. Available online: https://www.tauron.pl/dla-firm/prad/taryfa-sprzedawcy (accessed on 26 July 2022).

- Excerpt from the Tariff for Electricity for Electricity Distribution of TAURON Dystrybucja, S.A. for 2022 Concerning Settlements with Customers Classified as C1x, O1x, R Tariff Groups, Supplied from a Network with a Rated Voltage of not More than 1 kV. Available online: https://www.tauron.pl/dla-firm/prad/taryfa-sprzedawcy (accessed on 26 July 2022).

- Słomski, D. Two Elements Will Determine Electricity Prices. Experts Recalculated Various Options Compilation. Available online: https://businessinsider.com.pl/biznes/ceny-pradu-ile-wyniosa-w-zaleznosci-od-cen-wegla-i-praw-do-emisji-co2/j9tvfm9 (accessed on 26 July 2022).

- The Agency for Restructuring and Modernization of Agriculture. 2020.

- Ustawa Z Dnia 16 Września 1982 r. Prawo Spółdzielcze (Act of September 16, 1982—Cooperative Law) (Dz. U. z 2021 r. poz. 648; J. Laws 2021, 648). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU19820300210/U/D19820210Lj.pdf (accessed on 26 July 2022).

- Ustawa Z Dnia 4 Października 2018 r. o Spółdzielniach Rolników (Act of 4 October 2018 on Farmers Cooperatives) (Dz. U. z 2018 r. poz. 2073; J. Laws 2018, 2073). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20180002073/T/D20182073L.pdf (accessed on 26 July 2022).

- Rozporządzenie Ministra Rolnictwa i Rozwoju Wsi z dnia 28 marca 2019 r. W Sprawie Wykazu Produktów Lub Grup Produktów, Ze Względu na Które Mogą Być Zakładane Spółdzielnie Rolników (Regulation of the Minister of Agriculture and Rural Development of 28 March 2019 (Dz. U. z 2019 poz. 635; J. Laws 2019, 635). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20190000635/O/D20190635.pdf (accessed on 26 July 2022).

| Prosumer Net-Metering | Prosumer Net-Billing | Energy Cooperative Net-Metering | Comparative Model Without Electricity Generation | ||

| Price Scenarios | (1) | 2021 | |||

| (2) | 2022 | ||||

| model | no RES installation comparative model | Prosumer net-metering model | Prosumer net-biling model | Energy cooperative member model | ||||

| scenario | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 2 |

| energy consumpion (demand) reference data | 2021 actual energy purchase + RES production actual | |||||||

| energy production | Y2021 RES production actual | |||||||

| energy purchase prices refereences | 2021 actual | 2022 actual + changes applicable | 2021 actual | 2022 actual + changes applicable | 2021 actual | 2022 actual + changes applicable | 2021 actual | 2022 actual + changes applicable |

| energy sale prices refereences | 2022 WAP D-AM actual | 2022 WAP D-AM actual + forecasted | ||||||

| Funds | Cooperative | Agricultural Production Cooperative | Farmers’ Cooperative |

|---|---|---|---|

| Share capital | Payments of members’ shares Write-offs for shares from the balance sheet surplus Other sources specified in separate regulations | Payments of members’ shares Write-offs for members’ shares from the distribution of general income Other sources specified in separate regulations | Payments of membership shares |

| Resource capital | (a) Payment of the entry fee (b) Part of the balance sheet surplus, at least 5% of the balance sheet surplus up to the number of obligatory shares contributed (c) Other sources specified in separate regulations | (a) Payment of the entry fee (b) Part of the general income—at least 3% of the general income, if it does not reach the amount of the obligatory shares contributed, property values received free of charge (c) Other sources specified in separate regulations (d) Reduced by losses on liquidation of fixed assets and random losses | (a) Entry fees (b) 10% of the balance sheet surplus |

| Mutual capital | At least 3% of the balance sheet surplus | ||

| Net profit (balance sheet loss) | Balance sheet surplus | General income | Balance sheet surplus |

| Other own funds | |||

| Months | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| I | II | III | IV | V | VI | VII | VIII | X | X | XI | XII | Total | |

| Production | 353 | 852 | 2018 | 2842 | 3859 | 4896 | 4162 | 3195 | 2631 | 1865 | 645 | 264 | 27,582 |

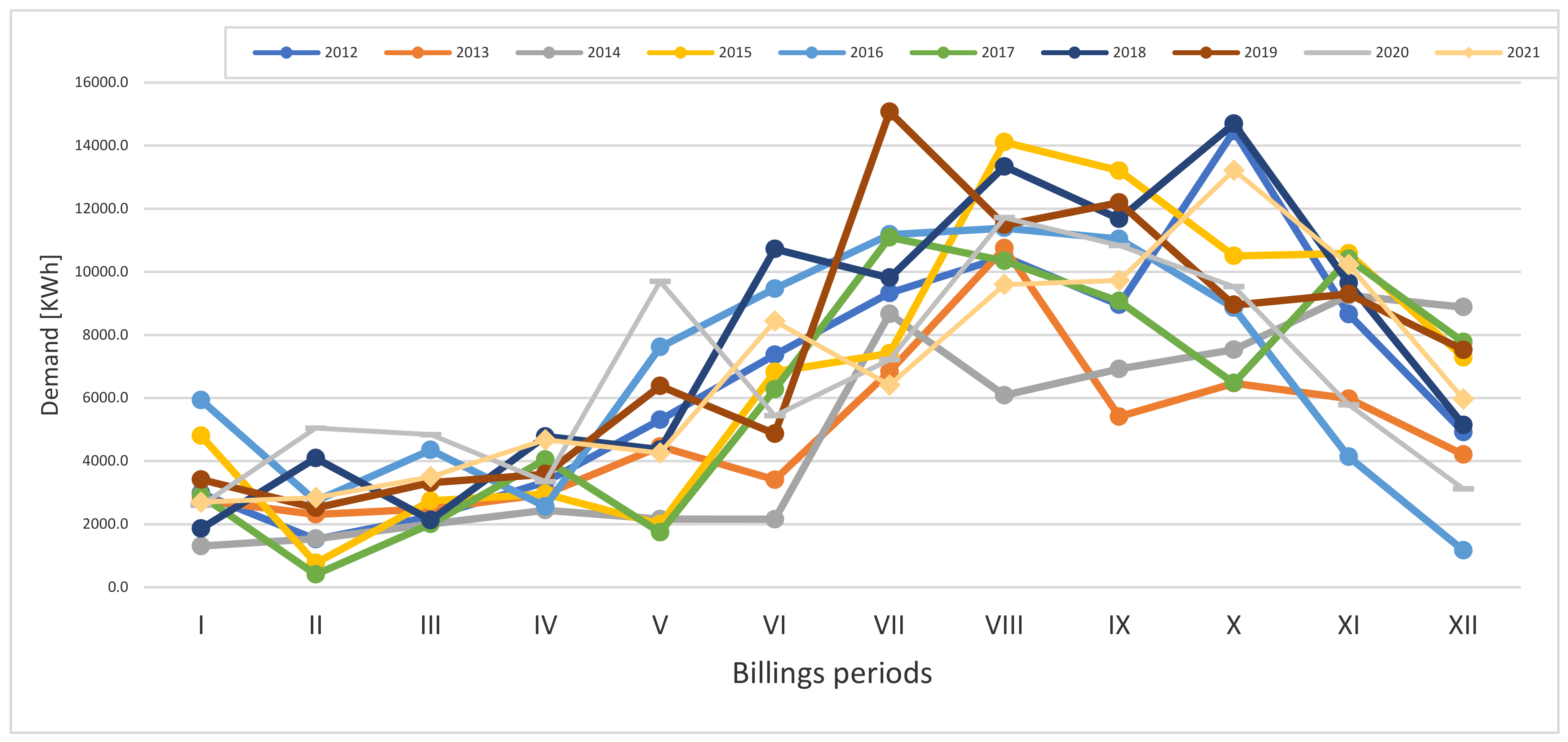

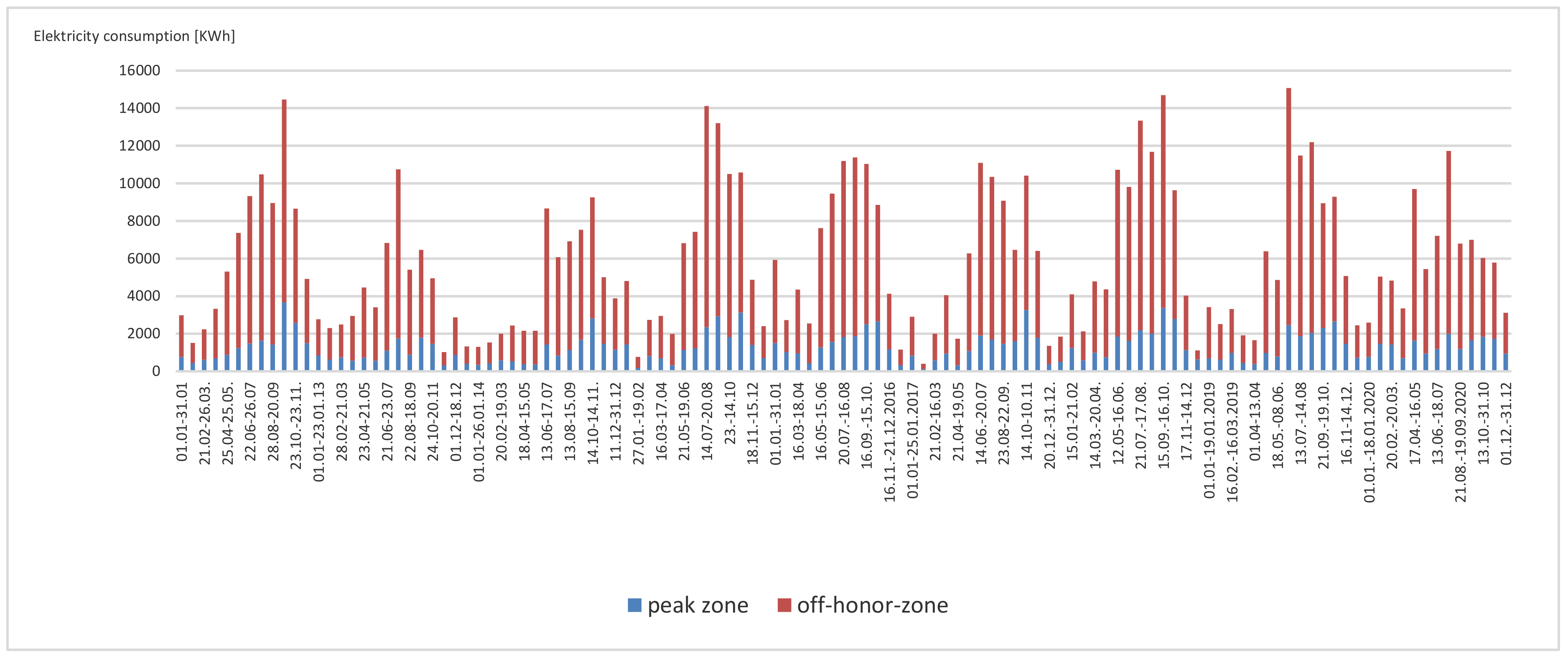

| Consumption | 2696 | 2843 | 3505 | 4673 | 4258 | 8438 | 6407 | 9599 | 9729 | 13,223 | 10,230 | 5966 | 81,567 |

| Months | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| I | II | III | IV | V | VI | VII | VIII | X | X | XI | XII | Total | |

| Energy fed into the grid | 62 | 297 | 852 | 1293 | 1937 | 1316 | 1484 | 670 | 477 | 69 | 14 | 17 | 8488 |

| Energy picked up from the grid (0.7) * | 43 | 208 | 596 | 905 | 1356 | 921 | 1039 | 469 | 334 | 48 | 10 | 12 | 5942 |

| Energy picked up from the grid (0.6) ** | 37 | 178 | 511 | 776 | 1162 | 790 | 890 | 402 | 286 | 41 | 8 | 10 | 5093 |

| No RES Installation Approach | Prosumer Net-Metering Model | Prosumer Net-Billing Model | Energy Cooperative Member Model | |

|---|---|---|---|---|

| Energy consumption/demand | 81,567 | 81,567 | 81,567 | 81,567 |

| RES energy production | - | 27,582 | 27,582 | 27,582 |

| RES energy temporarily fed into the electricity grid | - | 8488 | - | 8488 |

| RES energy (for deposit) | - | 8488 | ||

| RES energy picked up | - | 5942 | - | 5093 |

| Energy remained to be purchased under overall contract conditions | 81,567 | 56,531 | 62,473 | 57,380 |

| No RES Installation Approach | Prosumer Net-Metering Model | Prosumer Net-Billing Model | Energy Cooperative Member Model | |

|---|---|---|---|---|

| Scenario 1 | ||||

| Purchase of energy | 33,192 | 23,761 | 25,895 | 24,066 |

| Distribution services | 25,316 | 21,928 | 22,728 | 22,042 |

| Prosumer deposit * | - | (2833) | - | |

| Scenario 2 | ||||

| Purchase of energy | 134,560 | 98,947 | 106,572 | 100,036 |

| Distribution services | 27,262 | 23,637 | 24,348 | 23,614 |

| Prosumer deposit * | (6168) | - | ||

| No RES Installation Approach | Prosumer Net-Metering Model | Prosumer Net-Billing Model | Energy Cooperative Member Model | |

|---|---|---|---|---|

| Scenario 1 | ||||

| net value in pln | ||||

| Energy purchased under overall contract conditions including distribution fees | 58,508 | 45,689 | 48,623 | 46,108 |

| Energy sold (collected on prosumer account) | (2833) | |||

| Energy costs overall | 58,508 | 45,689 | 45,790 | 46,108 |

| in % | ||||

| Savings on each model | ||||

| No RES installation | 21.91% | 21.74% | 21.19% | |

| Prosumer net-metering model | 0.22% | 0.92% | ||

| Prosumer net-billing model | 0.69% | |||

| Energy cooperative member model | ||||

| Scenario 2 | ||||

| net value in pln | ||||

| Energy purchased under overall contract conditions including distribution fees | 161,822 | 122,584 | 130,920 | 123,650 |

| Energy sold (collected on prosumer account) | (6168) | |||

| Energy costs overall | 161,822 | 122,584 | 124,752 | 123,650 |

| in % | ||||

| Savings on each model | ||||

| No RES installation | 24.25% | 22.91% | 23.59% | |

| Prosumer net-metering model | 1.77% | 0.87% | ||

| Prosumer net-billing model | −0.88% | |||

| Energy cooperative member model | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Łakomiak, A. Civic Energy in an Orchard Farm–Prosumer and Energy Cooperative—A New Approach to Electricity Generation. Energies 2022, 15, 6918. https://doi.org/10.3390/en15196918

Łakomiak A. Civic Energy in an Orchard Farm–Prosumer and Energy Cooperative—A New Approach to Electricity Generation. Energies. 2022; 15(19):6918. https://doi.org/10.3390/en15196918

Chicago/Turabian StyleŁakomiak, Aleksandra. 2022. "Civic Energy in an Orchard Farm–Prosumer and Energy Cooperative—A New Approach to Electricity Generation" Energies 15, no. 19: 6918. https://doi.org/10.3390/en15196918

APA StyleŁakomiak, A. (2022). Civic Energy in an Orchard Farm–Prosumer and Energy Cooperative—A New Approach to Electricity Generation. Energies, 15(19), 6918. https://doi.org/10.3390/en15196918