Opportunities and Limitations of Hydrogen Energy in Poland against the Background of the European Union Energy Policy

Abstract

:1. Introduction

- Sixty-seven percent of surveyed experts believed that the legal legislation was insufficient for the development of the hydrogen economy;

- Three-quarters of the experts gave a poor assessment of the potential of infrastructure, raw materials, and resources for the implementation of the hydrogen economy;

- Funds allocated to hydrogen R&D in Poland were 40 times lower than the EU leaders (Germany, France);

- The share of funds allocated to hydrogen R&D in total national R&D expenditures was only 2 percent;

- Low research activity—only 83 scientific publications on hydrogen as a fuel (2019).

2. Strategies for Developing the Hydrogen Ecosystem

2.1. The Legal, Economic, and Organisational Aspects of Developing the Hydrogen Economy in the European Union

- Hydrogen production;

- Transmission and distribution;

- Application in industry, transport, energy systems, and buildings.

2.2. Objectives of the Polish Hydrogen Strategy vs. the EU Climate and Energy Targets

- Strategy for Responsible Development until 2020 (with an outlook to 2030) [30];

- The Act on electromobility and alternative fuels [31];

- The Energy Policy of Poland until 2040 (PEP2040) [32];

- Poland’s National Energy and Climate Plan for the years 2021–2030 (NECP2030), developed in fulfilment of the obligation set out in Regulation (EU) 2018/1999 of the European Parliament and of the Council of 11 December 2018 on the Governance of the Energy Union and Climate Action submitted to the European Commission on 30 December 2019.

- A 7% reduction in greenhouse gas emissions from sectors not covered by the EU ETS compared with 2005 levels;

- A 21–23% share of RES in gross final energy consumption (taking into account the percentage share of RES in transport and the annual increase of the share of RES in heating and cooling by 1.1 percentage points on average per year), provided that Poland is granted additional EU funds, including those earmarked for a just transition;

- A 32% share of RES in electricity production;

- Increase in energy efficiency of 23% in comparison with the PRIMES 2007 projections;

- Reduction of coal share in electricity production to 56–60%.

- The deployment of hydrogen technologies in the energy sector;

- The use of hydrogen as an alternative fuel in transport, which will enable the transition to a low-carbon transport sector;

- Supporting the decarbonisation of industry—the use of low-carbon hydrogen will significantly reduce greenhouse gas emissions, especially in sectors that are difficult to electrify;

- Launching hydrogen production in new installations—providing conditions for launching installations to produce hydrogen exclusively from low- and zero-emission sources (governmental incentives will provide support for innovative activities that will enable Polish entrepreneurs to benefit from the EU aid and international financial institutions for hydrogen development);

- Ensuring efficient and safe hydrogen transmission, distribution, and storage;

- Creating an appropriate and standardised legal framework, which would enable, among other things, a gradual increase in the use of renewable energy for hydrogen electrolysis; elimination of barriers to hydrogen market development.

- Launching a P2G installation of at least 1 MW class;

- Implementation of 100 to 250 new zero-emission hydrogen buses;

- Launching at least 32 new hydrogen filling and bunkering stations at pressures of 350 and 700 bars;

- Launching an installation for producing hydrogen from low-emission sources, processes, and technologies with the capability at least of 50 MW.

- Cogeneration and polygeneration installations (e.g., combined heat and power plants) with a capacity of up to 50 MWt, where hydrogen will be the primary fuel; 800 to 1000 new hydrogen buses (including those manufactured in Poland);

- At least five hydrogen valleys, which will be centres of excellence in the process of implementing a hydrogen economy;

- Not less than 2 GW of installed production capacity (including electrolysers) for producing hydrogen and its derivatives from low-emission sources, processes, and technologies.

- To develop hydrogen purification plants compliant with the EU standards in force;

- To implement hydrogen trains/locomotives to replace their diesel counterparts on routes not intended for electrification;

- To launch pilot programmes for applying hydrogen and its derivatives in urban, heavy-road, maritime, river, air, and intermodal transport;

- To carry out activities to obtain and use low-carbon hydrogen for petrochemical, chemical, and fertiliser production processes based on green industrial energy;

- To launch technological pilot projects for sectors where climate neutrality is difficult to achieve (steel, refining, chemicals);

- To develop hydrogen transmission and distribution networks based on an analysis of the optimal form of transmission;

- To produce a feasibility study of a north–south hydrogen pipeline (the Hydrogen Highway);

- To implement rail, road, and intermodal hydrogen transport.

- Further development of hydrogen refuelling and bunkering infrastructure;

- Gradual replacement of diesel trains and locomotives by their hydrogen equivalents;

- Development of hydrogen use in heavy-wheel, rail, sea, river, air, and intermodal transport;

- Commissioning of vessels with hydrogen-based propulsion systems;

- Adaptation of selected sections of the gas network for the transmission and distribution of hydrogen mixed with gas;

- Introduction of synthetic natural gas (SNG) produced in power-to-gas (P2G) systems into gas networks, as well as the construction of pipelines for the transmission and distribution of hydrogen;

- R&D on lightweight tanks for hydrogen production and development of large-scale salt caverns for hydrogen storage.

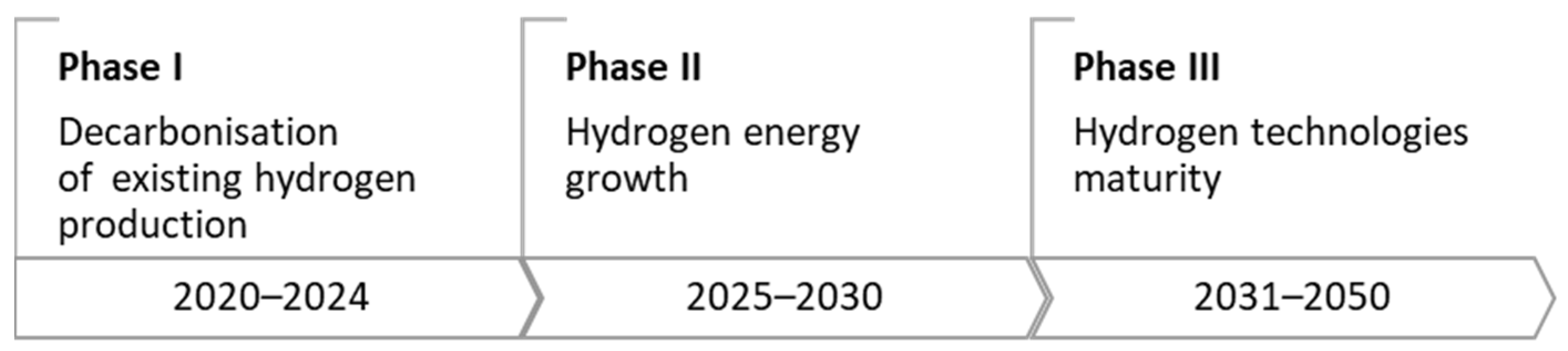

- The first phase of planned activities in Poland closes in 2025, while in the regulations of the EU it lasts one year shorter (until 2024), which necessarily indicates a greater intensity of activities at the very beginning of the implementation of the hydrogen strategy.

- The EU strategy is strongly focused on obtaining zero-emission hydrogen as an energy source, whereas projects to obtain low-emission hydrogen for energy purposes predominate in the PHS.

- The EU Hydrogen Strategy contains precisely outlined goals in terms of the construction of a technical base (the power of installed electrolysers) and the volume of renewable hydrogen production (in a million tonnes), which is not the case with the PHS; instead, the latter contains only quite enigmatically formulated quantitative goals concerning developing a technical base for hydrogen production, assuming, for example, that the capacity of installations for producing low-emission hydrogen, including electrolysers, should be at the level of 2 GW.

2.3. Changes Announced in Polish Energy Strategy

- Increased share of renewable energies in final energy consumption (over the current level of 23 percent in 2030);

- Modernisation of small power plants (200 MW) with coal and iron to extend their service life;

- Development of the nuclear power industry.

3. Implementation Status of the Polish Hydrogen Strategy

3.1. Construction of Hydrogen Management Infrastructure

3.2. Financial Aspects of the Implementation of the PHS

- The need to meet the demand for energy by using cheaper (but more harmful to the environment) sources of its acquisition;

- Still relatively low level of advancement of hydrogen technologies, which limits the possibilities of investing in their implementation;

- Lack of a comprehensive and precise plan to build a hydrogen ecosystem in Poland (PHS does not fill this gap sufficiently).

- The steady decline in the price of hydrogen fuel will make the cost of operating fuel cell buses equal to the cost of operating electric buses around 2025;

- The largest Polish fuel and energy company PKN Orlen S.A. is interested in increasing hydrogen fuel sales.

- Programmes supporting conceptual work, research, and development in the field of hydrogen technologies (two in total);

- Programmes supporting entrepreneurs, business environment institutions, research and development units, and public administration institutions carrying out innovative projects related to hydrogen technologies and implementing works in the field of production technology, transport, storage, and use of emission-free hydrogen (four in total);

- EU Programmes dedicated in their entirety or including components aimed at developing the hydrogen ecosystem in EU countries (a total of six).

- The National Centre for Research and Development Hydrogen Technology Support Program (PLN 1 billion) and the National Fund for Environmental Protection and Water Management (NFEPWM, PLN 600 million);

- Green Public Transport (PLN 320 million);

- Support for electric vehicle charging and refuelling infrastructure (ca. PLN 100 million);

- The NFEPWM Hydrogen Economy—no financial data available yet.

- The Important Projects of Common European Interest (IPCEI);

- The Instrument for Recovery and Resilience (Reconstruction Fund);

- The Fair Transition Mechanism, Cohesion Policy Funds, and the Connecting Europe Facility (CEF).

4. The SWOT/TOWS Analysis of the Hydrogen Economy in Poland

- maxi-maxi (S/O)—strengths and opportunities prevail, corresponding to a strategy of strong expansion and diversified development; it is the strategy with the greatest potential for success.

- mini-maxi (W/O)—weaknesses prevail, but it is favoured by the system of external conditions (opportunities). The strategy is to exploit the favourable external environment while reducing or improving the weaknesses—the negative internal factors.

- maxi-mini (S/T)—strengths and threats prevail, the source of barriers to development is the unfavourable pattern of external conditions. The strategy is to use strengths, assets, and internal potential to counter the threats present in the environment.

- mini-mini (W/T)—predominance of weaknesses (low internal potential) and threats (unfavourable external conditions). The strategy boils down to a struggle for survival and the resolution of crises; it is the least favourable strategy.

- In the SWOT analysis:

- Does a particular strength make it possible to exploit an opportunity?

- Will a particular strength help to mitigate a given threat?

- Does a specific weakness limit the possibilities of using a given opportunity?

- Does a specific weakness increase the risk associated with a given threat?

- In the TOWS analysis:

- Does the opportunity reinforce a given strength?

- Does the threat undermine the strength?

- Does the opportunity make it possible to overcome the weaknesses?

- Does the threat compound the weaknesses?

5. Discussion

- If Poland fails to implement the Fit for 55 findings, this will set a dangerous precedent, contesting one of the most important EU goals that the Community has been consistently pursuing for several decades, which could expose Poland to severe repercussions from the Community;

- By withdrawing from the EU ETS, Poland would reject the EU’s key instrument to pressure member states to move away from high-carbon energy sources, which would result in the EU significantly limiting funds flowing to Poland for energy restructuring (e.g., the Modernisation Fund). In addition, the EU could argue that Poland is not sufficiently engaged in implementing the EU energy targets.

6. Conclusions

- The war in Ukraine, which has caused changes in the supply of energy resources and their prices on a European and global scale that were difficult to predict in advance;

- The escalation of the dispute between Poland and the European Union over the rule of law is reflected in financial penalties imposed by the Union on Poland and the suspension of EU funding under the Instrument for Reconstruction and Enhanced Resilience (Reconstruction Fund) for Poland;

- The development of inflationary processes in Poland (annual price growth rate of 15.6% for June 2022) makes it very difficult to plan expenditure and effects in the power sector in a longer time horizon (up to 2030).

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

| O1 | O2 | O3 | O4 | T1 | T2 | T3 | T4 | |

|---|---|---|---|---|---|---|---|---|

| S1 | 1 | 1 | 1 | 1 | 0 | 1 | 0 | 0 |

| S2 | 1 | 1 | 1 | 1 | 0 | 1 | 0 | 1 |

| S3 | 1 | 1 | 1 | 1 | 0 | 1 | 1 | 1 |

| S4 | 0 | 1 | 1 | 0 | 0 | 0 | 1 | 1 |

| W1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| W2 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| W3 | 0 | 1 | 1 | 0 | 1 | 1 | 1 | 1 |

| W4 | 0 | 1 | 1 | 0 | 1 | 1 | 1 | 1 |

| W5 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 |

| S1 | S2 | S3 | S4 | W1 | W2 | W3 | W4 | W5 | |

|---|---|---|---|---|---|---|---|---|---|

| O1 | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 |

| O2 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 0 |

| O3 | 0 | 1 | 1 | 1 | 0 | 1 | 0 | 0 | 0 |

| O4 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 1 |

| T1 | 1 | 1 | 1 | 0 | 1 | 0 | 0 | 0 | 0 |

| T2 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| T3 | 1 | 1 | 0 | 1 | 0 | 1 | 0 | 1 | 0 |

| T4 | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 |

| Results of SWOT | Results of TOWS | Summary of SWOT/TOWS | ||||

|---|---|---|---|---|---|---|

| Combination (Strategy) | Sum of Interactions | Weighted Sum of Interactions | Sum of Interactions | Weighted Sum of Interactions | Sum of Interactions | Weighted Sum of Interactions |

| S/O | 14 | 6.8 | 14 | 7.1 | 28 | 13.9 |

| S/T | 8 | 3.15 | 8 | 4.5 | 16 | 7.65 |

| W/O | 14 | 6.2 | 9 | 3.85 | 23 | 10.05 |

| W/T | 16 | 7 | 4 | 1.8 | 20 | 8.8 |

References and Notes

- Communication from the Commission to The European Parliament; The European Council; The Council; The European Economic and Social Committee and The Committee of The Regions and The European Investment Bank. A Clean Planet for All A European Strategic Long-Term Vision for a Prosperous, Modern, Competitive and Climate Neutral Economy. COM/2018/773 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52018DC0773&qid=1646822363604 (accessed on 5 June 2022).

- Communication from the Commission to the European Parliament; the European Council; the Council; the European Economic and Social Committee and the Committee of the Regions the European Green Deal COM/2019/640 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM:2019:640:FIN (accessed on 5 June 2022).

- Drożdż, W.; Elżanowski, F.; Dowejko, J.; Brożyński, B. Hydrogen Technology on the Polish Electromobility Market. Legal, Economic, and Social Aspects. Energies 2021, 14, 2357. [Google Scholar] [CrossRef]

- Bielański, A. Podstawy Chemii Nieorganicznej, 6th ed.; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2012; Volume I. [Google Scholar]

- Hydrogen (H)—Chemical Properties, Health and Environmental Effects. Available online: https://www.lenntech.com/periodic/elements/h.htm (accessed on 5 June 2022).

- The European Network of Excellence “Safety of Hydrogen as an Energy Carrier” (NoE HySafe). BRHS, Biennial Report on Hydrogen Safety. Available online: http://www.hysafe.org/download/997/BRHS_Ch1_Fundamentals-version%201_0_1.pdf (accessed on 10 March 2022).

- Kaplan, R.; Kopacz, M. Economic Conditions for Developing Hydrogen Production Based on Coal Gasification with Carbon Capture and Storage in Poland. Energies 2020, 13, 5074. [Google Scholar] [CrossRef]

- In Focus: Hydrogen—Driving the Green Revolution. Available online: https://ec.europa.eu/info/news/focus-hydrogen-driving-green-revolution-2021-abr-14_en (accessed on 12 June 2022).

- Energy Market Information Centre CIRE Hydrogen Market Could nearly Triple. Available online: https://www.cire.pl/artykuly/serwis-informacyjny-cire-24/187551-rynek-wodoru-moze-wzrosnac-niemal-trzykrotnie (accessed on 12 June 2022).

- Communication from The Commission to The European Parliament; The European Council; The Council; The European Economic and Social Committee and The Committee of The Regions. A Hydrogen Strategy for a Climate-Neutral Europe. COM(2020) 301 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020DC0301 (accessed on 5 June 2022).

- A European Strategy for Hydrogen. Procedure File: 2020/2242(INI)|Legislative Observatory|European Parliament. Available online: https://oeil.secure.europarl.europa.eu/oeil/popups/ficheprocedure.do?lang=en&reference=2020/2242(INI) (accessed on 5 June 2022).

- Koneczna, R.; Cader, J. Hydrogen in the Strategies of the European Union Member States. Gospod. Surowcami Miner. Miner. Resour. Manag. 2021, 37, 53–74. [Google Scholar] [CrossRef]

- Maj, M.; Szpor, A. The Hydrogen Economy in Poland. Observations Based on the Technological Innovation System Research Framework; Policy Paper; Polski Instytut Ekonomiczny: Warszawa, Poland, 2020. [Google Scholar]

- Resolution No. 149 of the Council of Ministers of 2 November 2021 on the Adoption of the “Polish Hydrogen Strategy until 2030 with a Perspective until 2040”. Official Gazette of the Republic of Poland “Monitor Polski” of 2021, Item 1138. Available online: https://www.dziennikustaw.gov.pl/MP/2021/1138 (accessed on 5 June 2022).

- Dragan, D. Internet Antimonopoly and Regulatory Quarterly, No 2(10). 2021. Available online: https://ikar.wz.uw.edu.pl/archiwum/33-2021/129-numer-2-10-seria-regulacyjna.html (accessed on 17 July 2022).

- Communication from The Commission to The European Parliament; The European Council; The Council; The European Economic and Social Committee and The Committee of The Regions. REPowerEU Plan. COM(2022) 230 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2022%3A230%3AFIN&qid=1653033742483 (accessed on 13 June 2022).

- European Clean Hydrogen Alliance. Available online: https://www.ech2a.eu (accessed on 13 June 2022).

- Recovery and Resilience Facility. Available online: https://ec.europa.eu/info/business-economy-euro/recovery-coronavirus/recovery-and-resilience-facility_en (accessed on 13 June 2022).

- Hydrogen Europe. Available online: https://hydrogeneurope.eu/ (accessed on 13 June 2022).

- Roundtables of the European Clean Hydrogen Alliance. Available online: https://ec.europa.eu/growth/industry/strategy/industrial-alliances/european-clean-hydrogen-alliance/roundtables-european-clean-hydrogen-alliance_en (accessed on 13 June 2022).

- Project Pipeline. Available online: https://ec.europa.eu/growth/industry/strategy/industrial-alliances/european-clean-hydrogen-alliance/project-pipeline_en (accessed on 13 June 2022).

- Hydrogen Council. Available online: https://hydrogencouncil.com/en/ (accessed on 13 June 2022).

- Policy Toolbox for Low Carbon and Renewable Hydrogen—Hydrogen Council. Available online: https://hydrogencouncil.com/en/policy-toolbox-for-low-carbon-and-renewable-hydrogen/ (accessed on 10 June 2022).

- Database—Eurostat. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 14 June 2022).

- Statistics Poland—Local Data Bank. Available online: https://bdl.stat.gov.pl/bdl/dane/podgrup/temat (accessed on 16 June 2022).

- Poland. 2022 National Inventory Report (NIR)|UNFCCC. Available online: https://unfccc.int/documents/461818 (accessed on 16 June 2022).

- Statistics|Eurostat: Greenhouse Gas Emissions Intensity of Energy Consumption. Available online: https://ec.europa.eu/eurostat/databrowser/view/sdg_13_20/default/table?lang=en (accessed on 16 June 2022).

- Proposal for a Regulation of The European Parliament and of The Council Establishing a Social Climate Fund COM/2021/568 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52021PC0568 (accessed on 16 June 2022).

- Directorate-General for Climate Action Modernisation Fund. Available online: https://ec.europa.eu/clima/eu-action/funding-climate-action/modernisation-fund_en (accessed on 16 June 2022).

- Strategy for Responsible Development until 2020 (with an Outlook to 2030), Resolution No. 8 of the Council of Ministers of February 14, 2017, Official Journal of the Republic of Poland (Monitor Polski) Item 260. 2017. Available online: https://www.infor.pl/akt-prawny/MPO.2017.044.0000260,uchwala-nr-8-rady-ministrow-w-sprawie-przyjecia-strategii-na-rzecz-odpowiedzialnego-rozwoju-do-roku-2020-z-perspektywa-do-2030-r.html (accessed on 15 March 2022).

- The Act of 11 January 2018 on Electromobility and Alternative Fuels, with Later Amendments (Consolidated Text, Journal of Laws of 2020, Item 908).

- Ministry of Climate and Environment. The Energy Policy of Poland until 2040 (PEP2040). In Official Journal of the Republic of Poland (Monitor Polski, Item 264); 2 March 2021. Available online: https://www.gov.pl/web/climate/energy-policy-of-poland-until-2040-epp2040 (accessed on 15 March 2022).

- National Energy and Climate Plan for the Years 2021–2030—Ministerstwo Klimatu i Środowiska—Portal Gov.pl. Available online: https://www.gov.pl/web/klimat/national-energy-and-climate-plan-for-the-years-2021-2030 (accessed on 4 October 2021).

- Regulation (EU) 2021/1119 of the European Parliament and of the Council of 30 June 2021 Establishing the Framework for Achieving Climate Neutrality and Amending Regulations (EC) No 401/2009 and (EU) 2018/1999 (‘European Climate Law’). Available online: http://data.europa.eu/eli/reg/2021/1119/oj/eng (accessed on 16 June 2022).

- Assumptions to Update Poland’s Energy Policy until 2040 (PEP2040)—Strengthening Energy Security and Independence—Prime Minister’s Office—Gov.pl Portal. Available online: https://www.gov.pl/web/premier/zalozenia-do-aktualizacji-polityki-energetycznej-polski-do-2040-r-pep2040--wzmocnienie-bezpieczenstwa-i-niezaleznosci-energetycznej (accessed on 17 June 2022).

- Energy Market Information Centre CIRE How Will We Fuel the Hydrogen Economy? All You Need to Know about the Polish Hydrogen Strategy—Problem Materials. Available online: https://www.cire.pl/artykuly/materialy-problemowe/179840-jak-napedzimy-gospodarke-wodorem-wszystko,-co-musisz-wiedziec-o-polskiej-strategii-wodorowej (accessed on 17 June 2022).

- Hydrogen Valleys in Poland—Portal Wodorowy. Available online: https://h2poland.eu/en/categories/hydrogen-valleys/public-perception/doliny-wodorowe-w-polsce/ (accessed on 18 June 2022).

- Industrial Development Agency JSC. Available online: https://arp.pl/en/ (accessed on 18 June 2022).

- Energy Market Information Centre CIRE Orlen Will Open Poland’s First Hydrogen Refuelling Station in Kraków. Available online: https://www.cire.pl/artykuly/serwis-informacyjny-cire-24/orlen-w-najblizszych-tygodniach-chcemy-otworzyc-pierwsza-stacje-tankowania-wodorem-w-polsce (accessed on 18 June 2022).

- Portal World of RES Solaris the Largest Manufacturer of Zero-Emission Buses in Europe! Polish Company Is the Leader. Available online: https://swiatoze.pl/solaris-najwiekszym-producentem-autobusow-bezemisyjnych-w-europie-polska-firma-liderem/ (accessed on 18 June 2022).

- Weihrich, H. The TOWS Matrix—A Tool for Situational Analysis. Long Range Plan. 1982, 15, 54–66. [Google Scholar] [CrossRef]

- Obłój, K. Strategia Organizacji (Strategy of the Organisation); PWN: Warszawa, Poland, 2002. [Google Scholar]

- Czyżak, P.; Hetmański, M. 2030: Analysis of the Border Coal Phase-Out Year in the Energy Sector in Europe and Poland; Instrat Policy Paper; Instrat Foundation: Warszawa, Poland, 2020. [Google Scholar]

- Special Reports of Bank Pekao, S.A. Impact of Fit for 55 on the Polish Economy. Available online: https://www.pekao.com.pl/analizy-makroekonomiczne/raporty-specjalne.html (accessed on 17 June 2022).

- Statistics|Eurostat: Gross Fixed Capital Formation. Available online: https://ec.europa.eu/eurostat/databrowser/view/nama_10_an6/default/table?lang=en (accessed on 14 June 2022).

- European Energy Exchange AG Emission Spot Primary Market Auction Report. 2022. Available online: https://www.eex.com/en/market-data/environmental-markets/eua-primary-auction-spot-download (accessed on 17 June 2022).

| Hydrogen Valley | Date of Establishment | Statutory Objectives |

|---|---|---|

| Pomeranian | 1 October 2019 | Building a hydrogen ecosystem in the Pomeranian region, implementing projects related to land and sea transport (buses, trains, and ships powered by hydrogen) and connecting the ports of Tri-City and Hel. Developing ‘power-to-gas’ projects in the Pomeranian region. Raising hydrogen awareness among the inhabitants of the voivodeship. |

| Sub-Carpathian | 18 May 2021 | The estimated potential of the programme is at least 20,000 tons of hydrogen per year and a 15% share of hydrogen as a fuel in the transport energy mix of the Pomeranian region by 2030. |

| Greater Poland | 5 July 2021 | Producing fuel cells, hydrogen buses, and work on hydrogen as a fuel to power aircraft. |

| Silesian-Lesser Poland | 31 January 2022 | Cross-sectoral cooperation for the dissemination of hydrogen solutions and the production of green hydrogen. |

| Lower Silesian | 25 February 2022 | Supporting the development of hydrogen economy, building the Silesian-Lesser Poland hydrogen industry based on the production of hydrogen in the electrolysis process with the use of energy produced from RES installations and its use in the energy sector, including heat, transport and infrastructure, and industry. |

| Mazovian | 8 April 2022 | Creating economic networks with suppliers, subcontractors, and collaborators, especially between universities, research institutes, start-ups, clusters, implementation companies, local government units, and large state-treasury companies. |

| No. | Internal Factors (S—Strengths) | Weight | No. | Internal Factors (W—Weaknesses) | Weight |

|---|---|---|---|---|---|

| S1 | Assigning hydrogen, in particular zero-emission, a special role in storage and RES energy management (PEP2040 update). | 0.5 | W1 | Poland’s low investment capacity compared with that of leading European Union countries, limiting the possible scale of investment in hydrogen power development; inadequate R&D funding. | 0.3 |

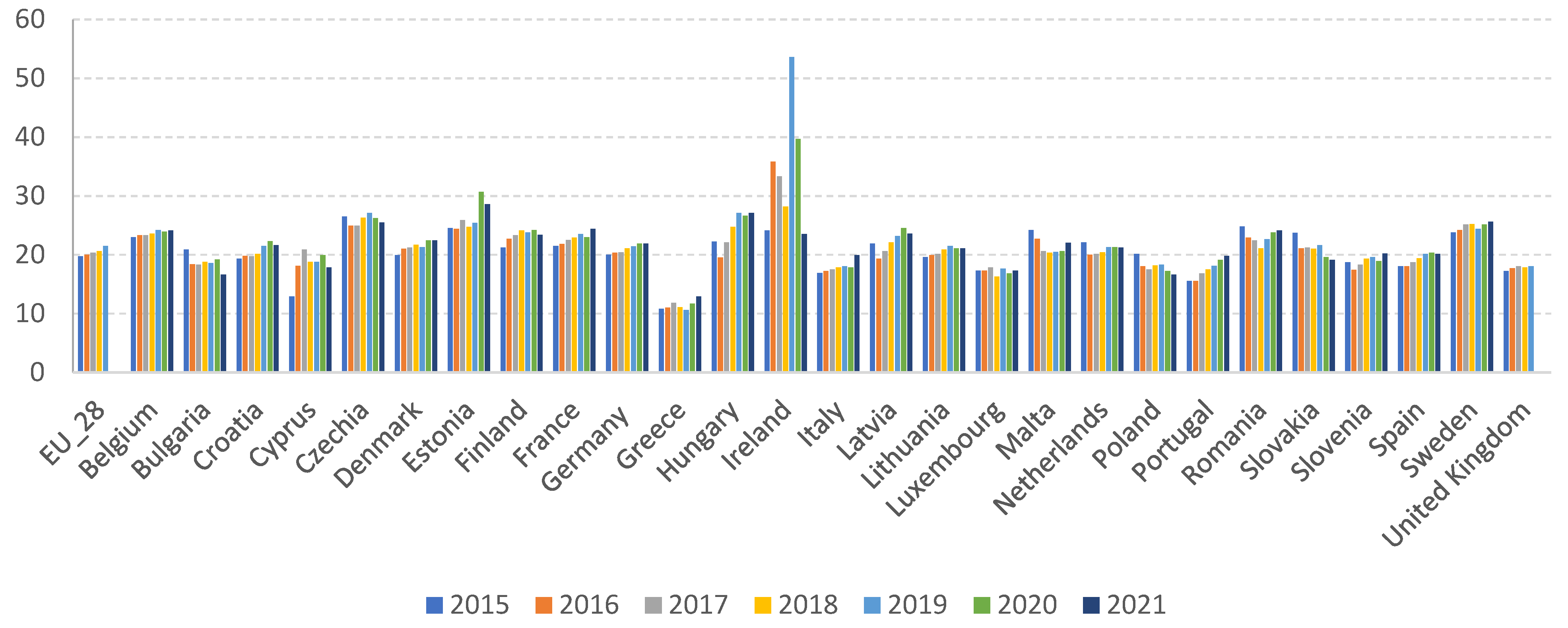

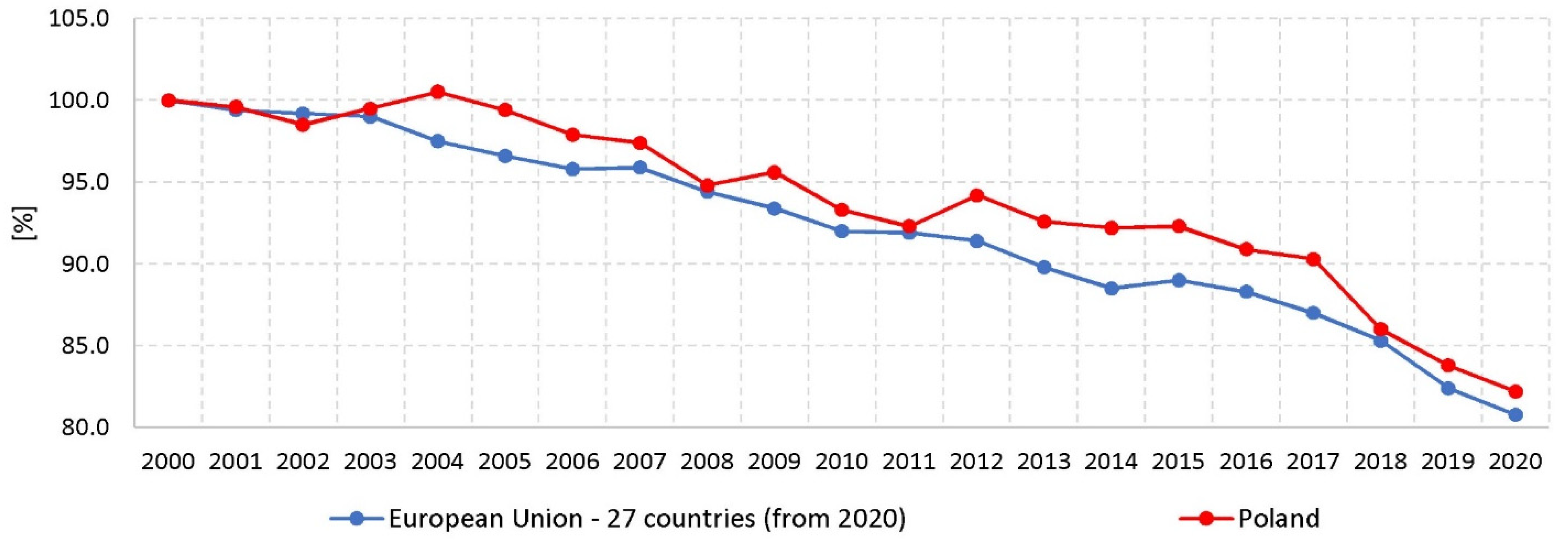

| S2 | Growing hydrogen generation capacity. There will be six hydrogen valleys, which will be the main centres for obtaining hydrogen for energy purposes and parts of the European Hydrogen Ecosystem. | 0.1 | W2 | High greenhouse gas emission intensity of energy consumption. | 0.1 |

| S3 | Intensified efforts to develop offshore wind farms and pumped storage hydroelectric power plants that will enable increased production of zero-emission hydrogen. | 0.15 | W3 | Very low production of hydrogen obtained by electrolysis of water, carried out using wind and solar energy. In 2020, nearly 95 percent of hydrogen in Poland was produced from fossil fuels. | 0.25 |

| S4 | No financial problems with the timely implementation of the PHS in the part concerning the implementation of hydrogen technologies in public transport (hydrogen buses) and refuelling infrastructure. | 0.25 | W4 | Lack of price competitiveness in Poland of low-emission hydrogen (even produced in modern electrolysers) with hydrogen obtained from fossil sources due to the high cost of energy needed for its production. | 0.1 |

| W5 | No infrastructure (gas pipelines) dedicated solely to the transport of hydrogen. | 0.25 | |||

| - | External factors (O—Opportunities) | - | - | External factors (T—Threats) | - |

| O1 | Establishment of an open, competitive, cross-border hydrogen market in Europe around 2030, ensuring its efficient allocation to key groups of recipients. | 0.4 | T1 | Lengthy negotiations related to the adoption of the Fit for 55 package. | 0.4 |

| O2 | A rapid improvement in the price competitiveness of hydrogen obtained in electrolysers powered by offshore wind farms vis-à-vis hydrogen obtained from fossil sources due to strong price increases for all fossil energy feedstocks, including coal. | 0.2 | T2 | Significant reductions in the supply of fossil energy resources and price increases on world markets. | 0.2 |

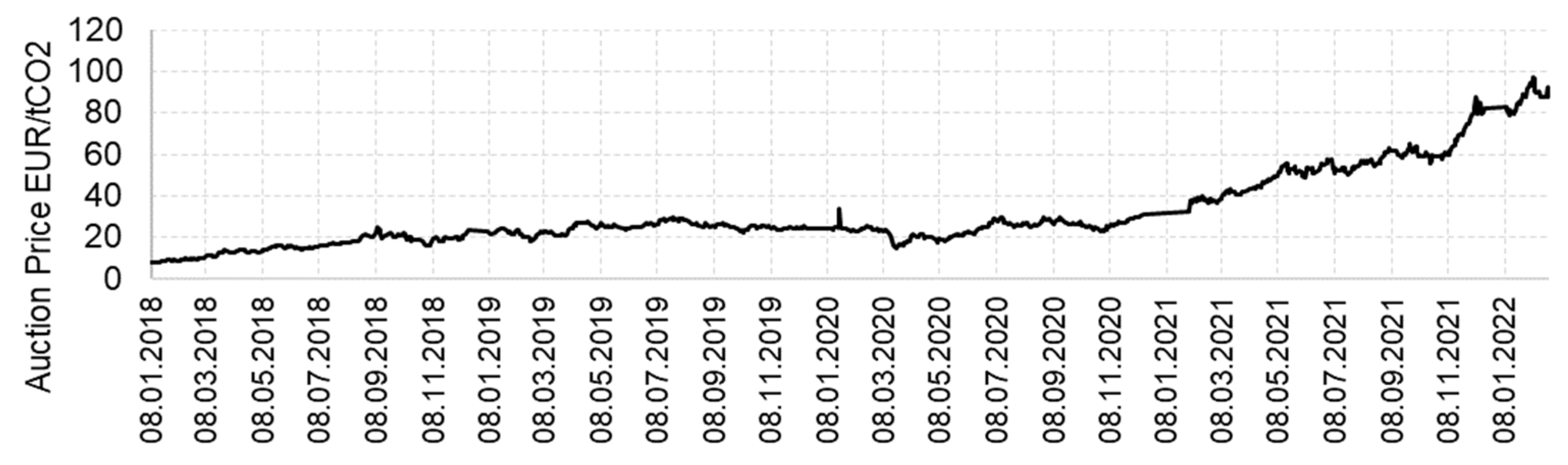

| O3 | Continuous decline in hydrogen fuel prices, bringing fuel cell bus operating costs in line with the operating costs of electric buses around 2025. | 0.1 | T3 | Increased costs and deterioration in the cost-effectiveness of low-emission hydrogen production associated with the systematic increase in the EU ETS price. | 0.3 |

| O4 | Financial support from the EU for the implementation of the PHS objectives. | 0.3 | T4 | The need for very high energy production costs in the event of further expansion and price increases of the EU ETS. | 0.1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bednarczyk, J.L.; Brzozowska-Rup, K.; Luściński, S. Opportunities and Limitations of Hydrogen Energy in Poland against the Background of the European Union Energy Policy. Energies 2022, 15, 5503. https://doi.org/10.3390/en15155503

Bednarczyk JL, Brzozowska-Rup K, Luściński S. Opportunities and Limitations of Hydrogen Energy in Poland against the Background of the European Union Energy Policy. Energies. 2022; 15(15):5503. https://doi.org/10.3390/en15155503

Chicago/Turabian StyleBednarczyk, Jan L., Katarzyna Brzozowska-Rup, and Sławomir Luściński. 2022. "Opportunities and Limitations of Hydrogen Energy in Poland against the Background of the European Union Energy Policy" Energies 15, no. 15: 5503. https://doi.org/10.3390/en15155503

APA StyleBednarczyk, J. L., Brzozowska-Rup, K., & Luściński, S. (2022). Opportunities and Limitations of Hydrogen Energy in Poland against the Background of the European Union Energy Policy. Energies, 15(15), 5503. https://doi.org/10.3390/en15155503