A Sequential Multi-Staged Approach for Developing Digital One-Stop Shops to Support Energy Renovations of Residential Buildings

Abstract

:1. Introduction

2. Literature Review: Building Renovation One-Stop Shops

3. Materials and Methods

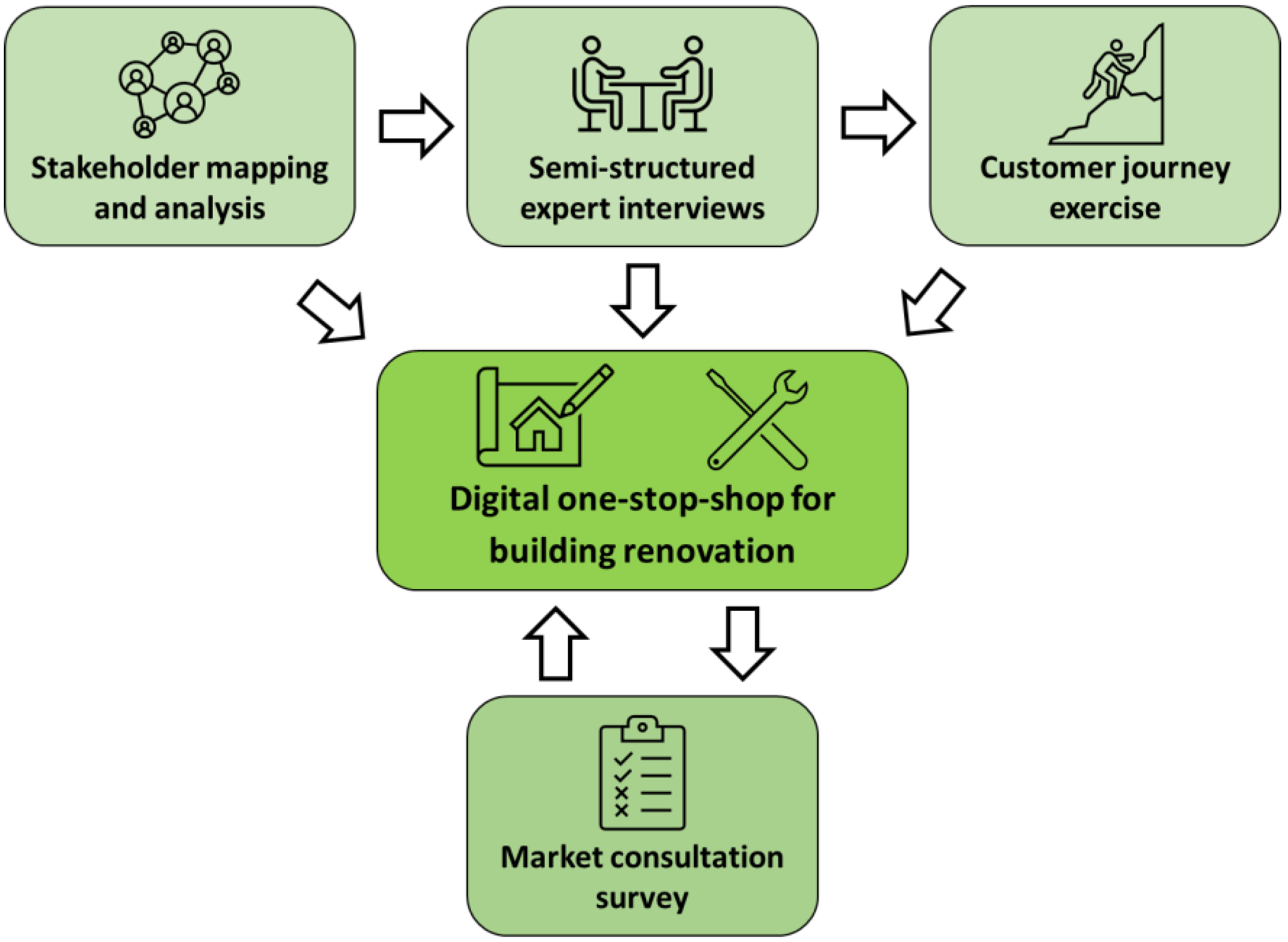

3.1. Methodological Approach

3.2. Case-Study Portugal

3.3. Stakeholder Mapping and Analysis

3.4. Semi-Structured Expert Interviews

3.5. Customer Journey

3.6. Digital One-Stop Shop for Residential Building Renovations

3.7. Market Consultation Survey

4. Results

4.1. Overview

4.2. Stakeholder Mapping and Analysis

4.3. Semi-Structured Expert Interviews

4.4. Customer Journey

4.5. Digital One-Stop Shop for Residential Buildings Renovation

4.6. Market Consultation Survey

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Interview Script Used for the Semi-Structured Expert Interviews

- Portuguese buildings characterization:

- What are the most pressing pathologies and needs of residential buildings in Portugal?

- What kind of construction and materials are more common in old residential buildings in Lisbon (constructed before 1919/1945)? What pathologies are typically present and require intervention? Other common characteristics (area, number, divisions, owner/tenant, among others)?

- What type of energy consumption is typically found in old residential buildings in Lisbon (e.g., electricity, natural gas, biomass)? What type of energy-consuming equipment exists?

- Portuguese renovation market evolution:

- 4.

- How has the building renovation market evolved in Portugal over the last few decades?

- 5.

- What are the main drivers and barriers from the perspective of the various players involved in the different stages of the energy renovation process of a residential building?

- 6.

- What is the average quality of renovation works of buildings in Portugal, taking into account energy performance improvement?

- 7.

- Why is the rate of building renovation in Portugal so low compared with the European average and the figures predicted in the European Green Deal and the European Renovation Wave?

- 8.

- How has the market for the renovation of historic areas of Lisbon/Portugal been evolving? What are the main drivers? What needs to be addressed to increase the number and quality of projects, without requiring the residents to leave?

- 9.

- How to leverage the residential building renovation market in Portugal taking into consideration the decarbonization of the sector by 2050?

- Technical measures for the energy renovation of residential buildings:

- 10.

- Which energy efficiency and comfort measures must be prioritized in Portuguese buildings? Which of them are most frequently applied? Which could be applied, but are not? Why?

- 11.

- What type of measures provide an improvement in thermic performance of buildings in both winter and summer?

- 12.

- What type of energy efficiency and comfort solutions are most appropriate for old buildings? Which of them are most frequently applied? Which of them could bring benefits, but are not applied? Why?

- 13.

- How is the integration of renewables (mainly solar photovoltaic) evolving in the renovation of residential buildings? And in old residential buildings with historic value?

- 14.

- What type of innovative, technical solutions are being developed to improve the energetic and thermic comfort performance, with short/medium term impact on the market?

- 15.

- How much importance do you give to local knowledge and techniques in the renovation of buildings? And to the existence of qualified entities in a context of proximity to the community?

- 16.

- How important is it to use locally sourced materials, from the perspective of sustainability, circular economy, and thermic performance improvement?

- Policies and regulations for the renovation of residential buildings:

- 17.

- What is your perspective on the evolution of policies and regulations, in Lisbon and Portugal, which establish the norms for the renovation of buildings? What are their pros and cons when considering a continued and sustainable energy renovation?

- 18.

- What policies and regulations, in Lisbon and Portugal, are specific to the renovation of old and historic residential buildings?

- 19.

- What are the main barriers to the renovation of historic buildings?

- 20.

- Which regulations/measures/processes could be adopted to streamline and expedite the renovation process of a building?

- Financing instruments for the renovation of residential buildings:

- 21.

- Do you think that financial support instruments for the renovation of buildings in Portugal have been effective? If not, why not?

- 22.

- What are the factors that determine the success of this kind of support? What importance do you give to personal and personalized contact for the adoption of financial support?

- 23.

- How important are digital platforms to involve people in building renovation and to increasing the rate of adoption of financial instruments by the population. What information do you consider should be on these sites?

- 24.

- What financial (or other) barriers are still present in renovation projects for the various participants?

- 25.

- What financial (or other) mechanisms could be implemented in order to accelerate the renovation and regeneration of historic areas? And what about the renovation of residential buildings in general to increase the current rate (from 1% to 3.5%)?

- 26.

- How should the renovation of buildings, where people on low wages live and who have no ability to invest, be promoted? How could a financial instrument be specifically directed to these people?

- 27.

- How could traditional commerce and services, often situated on the ground floor of residential buildings, be involved in the rehabilitation process? What instruments should be directed to these small and medium sized companies?

- Citizen engagement and district-scale approaches:

- 28.

- Which stakeholders should be involved in the renovation of buildings in Portugal?

- 29.

- What type of approach is necessary to involve citizens, companies, and authorities in the renovation of buildings?

- 30.

- What possible advantages and disadvantages are there in the adoption of an approach to renovation on a neighborhood or district scale, compared with the traditional approach at the single building scale? What role should the different stakeholders take on in both situations?

- 31.

- What examples are there in Portugal (and other countries) that might be relevant to the boosting of the renovation of residential buildings?

- 32.

- Can you recommend another entity or person to interview with respect to this matter?

Appendix B. Structure of the Market Consultation Survey

- 1.

- Age

- 18–24

- 25–39

- 40–59

- 60–70

- >70

- Does not answer

- 2.

- Education level

- 4-years

- 9-years

- 12-years

- Bachelor’s

- Master’s

- Ph.D.

- Does not answer

- Other

- 3.

- Do you work in the energy, construction, or housing sector?

- Yes

- No

- Does not answer

- 4.

- Municipality

- 5.

- Year of construction of the building

- before 1919

- 1919–1945

- 1946–1960

- 1961–1980

- 1981–1990

- 1991–2004

- 2005–2015

- after 2015

- Does not answer

- 6.

- Building typology

- Single-family house (isolated)

- Single-family house (in band/geminated)

- Apartment in a multi-family building with 2 floors or less

- Apartment in a multi-family building with 3 or 4 floors

- Apartment in a multi-family building with 5 floors or more

- Does not answer

- Other

- 7.

- Do you own or rent your dwelling?

- Owner

- Family member of the owner (no rent or symbolic rent)

- Long-term tenant

- Short-term tenant

- Does not answer

- Other

- 8.

- Are you a landlord?

- Yes

- No

- Does not answer

- 8.1.

- If “yes” on question 8, do you worry about the energy performance of the houses you rent?

- Yes

- No

- Does not answer

- 8.1.1.

- If “yes” on question 8.1, why do you worry about the energy performance of the houses you rent (select all options that apply)?

- To increase the value of the rent

- To make renting easier

- To reduce energy costs

- To increase thermal and acoustic comfort

- To address worries about sustainability

- To fulfill legal concerns

- Other

- 8.1.2.

- If “no” on question 8.1, why do you not worry about the energy performance of the houses you rent (select all options that apply)?

- It is not possible to improve energy performance of the house

- I do not know if the measures will bring benefits

- I have other priorities

- It is not possible to conduct renovation works

- I do not pay the energy bill

- Other

- 9.

- Have you conducted renovation works in your home with the goal to improve energy performance?

- Yes

- I conducted renovation works but not acted on energy performance

- No

- Does not answer

- 9.1.

- If “yes” on question 9, what drivers led to the renovation works with the goal to improve the energy performance of your house (select all options that apply)?

- I had to renovate the house anyway

- To increase the house’s market value

- To reduce energy costs

- To improve thermal and acoustic comfort

- To improve the environmental sustainability of the house

- To fulfill legal requirements

- To produce my own renewable energy

- Other

- 9.2.

- If the answer on question 9 was “I conducted renovation works but not acted on energy performance”, what were the barriers to improve the energy performance of your house during the renovation works?

- I do not know what measures are appropriate to my house

- It is not possible to improve the energy performance of the house

- I do not know if the measures will bring benefits

- I had other priorities

- I had a limited budget

- I cannot implement measures in my house

- I do not pay the energy bills

- Other

- 10.

- Are you planning to perform renovation works (even if simple) at some point in the next 10 years?

- Yes

- No

- Does not answer

- 10.1.

- If “yes” on question 10, are energy efficiency measures and renewable energy systems among your priorities for renovation works?

- Yes

- No

- Does not answer

- 10.1.1.

- If “yes” on question 10.1, what are the drivers to implement these solutions?

- To increase the house’s market value

- To reduce energy costs

- To improve thermal and acoustic comfort

- To improve the environmental sustainability of the house

- To fulfill legal requirements

- To produce my own renewable energy

- Other

- 10.1.2.

- If “no” on question 10.1, what are the barriers to implementing these solutions?

- I do not know what measures are appropriate to my house

- It is not possible to improve the energy performance of the house

- I do not know if the measures will bring benefits

- I have other priorities

- I have a limited budget

- I cannot implement measures in my house

- Other

- 11.

- Do you know any financing schemes that support the improvement of energy performance in the residential sector?

- Yes

- No

- Does not answer

- 11.1.

- If “yes” on question 11, which one?

- 12.

- If a digital platform with all the needed information—such as technical measures, financing schemes and regulations—to improve energy performance was available would you be interested in using it?

- Yes

- No

- Does not answer

- 13.

- How would you like to receive information about this platform (select all options that apply)?

- E-mail

- Social networks (Facebook, Instagram, Twitter, LinkedIN)

- Written press

- Radio

- Television

- With your energy bill

- 14.

- What would be the preferential way of using the platform?

- Computer

- Tablet

- Smartphone

- 15.

- Do you consider the visual aspects of the Green Menu (3D model, animations, and pictures) attractive when compared with other platforms?

- Yes, but I do not know others

- Yes, even when compared with others

- No

- Does not answer

- 15.1.

- Can you suggest any improvements?

- 16.

- The Green Menu combines in the same platform technical information, financing, and regulations. Do you think that this is a useful feature that can facilitate the process of renovation your dwelling?

- Yes

- No

- Does not answer

- 16.1.

- Can you suggest any improvements?

- 17.

- Is the information on the technical measures well organized, clear, and accessible?

- Yes

- No

- Does not answer

- 17.1.

- Can you suggest any improvements?

- 18.

- Is the information on the financing schemes well organized, clear, and accessible?

- Yes

- No

- Does not answer

- 18.1.

- Can you suggest any improvements?

- 19.

- Do you consider useful for the financing schemes to be directly linked to the corresponding technical measures?

- Yes

- No

- Does not answer

- 19.1.

- Can you suggest any improvements?

- 20.

- Is the information on the regulations and licensing processes well organized, clear, and accessible?

- Yes

- No

- Does not answer

- 20.1.

- Do you consider useful for the regulations and licensing processes to be directly linked to the corresponding technical measures?

- Yes

- No

- Does not answer

- 20.2.

- Can you suggest any improvements?

- 21.

- The Green Menu already includes a short list of key stakeholders to contact to perform energy renovation of the house. Do you consider this information useful?

- Yes

- Yes, but more information is needed

- No

- Does not answer

- 21.1.

- Can you suggest any improvements?

References

- Eurostat. Energy Data—2020 Edition; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar] [CrossRef]

- Roscini, A.V.; Rapf, O.; Kockat, J. On the Way to a Climate-Neutral Europe: Contributions from the Building Sector to a Strengthened 2030 Climate Target; Buildings Performance Institute Europe (BPIE): Brussels, Belgium, 2020. [Google Scholar]

- European Commission. A Renovation Wave for Europe—Greening our Buildings, Creating Jobs, Improving Lives; 14.10.2020, COM(2020) 662 Final; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Bouzarovski, S. Energy Poverty: (Dis)Assembling Europe’s Infrastructural Divide; Palgrave Macmillan: Cham, Switzerland, 2018; ISBN 978-3-319-69298-2. [Google Scholar] [CrossRef] [Green Version]

- Shnapp, S.; Paci, D.; Bertoldi, P. Untapping Multiple Benefits: Hidden Values in Environmental and Building Policies; Joint Research Centre Technical Report (JRC120683), EUR 30280 EN; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar] [CrossRef]

- Reuter, M.; Patel, M.K.; Eichhammer, W.; Lapillonne, B.; Pollier, K. A comprehensive indicator set for measuring multiple benefits of energy efficiency. Energy Policy 2020, 139, 111284. [Google Scholar] [CrossRef]

- Di Foggia, G. Energy efficiency measures in buildings for achieving sustainable development goals. Heliyon 2018, 4, e00953. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Bean, F.; Volt, J.; Dorizas, V.; Bourdakis, E.; Staniaszek, D.; Roscetti, A.; Pagliano, L. Future-Proof Buildings for all Europeans: A Guide to Implement the Energy Performance of Buildings Directive (2018/844); Buildings Performance Institute Europe (BPIE): Brussels, Belgium, 2019. [Google Scholar]

- Cheshmehzangi, A. COVID-19 and Household Energy Implications: What are the Main Impacts on Energy Use? Heliyon 2020, 6, e05202. [Google Scholar] [CrossRef] [PubMed]

- Eurostat. Share of Total Population Living in a Dwelling with a Leaking Roof, Damp Walls, Floors or Foundation, or rot in Window Frames of Floor—EU-SILC Survey; Publications Office of the European Union: Luxembourg, 2022. [Google Scholar]

- Eurostat. Conventional Dwellings by Occupancy Status, Type of Building and NUTS 3 Region; Publications Office of the European Union: Luxembourg, 2021. [Google Scholar]

- Economidou, M.; Todeschi, V.; Bertoldi, P.; D’Agostino, D.; Zangheri, P.; Castellazzi, L. Review of 50 years of EU energy efficiency policies for buildings. Energy Build. 2020, 225, 110322. [Google Scholar] [CrossRef]

- Galvin, R.; Sunikka-Blank, M. The UK homeowner-retrofitter as an innovator in a socio-technical system. Energy Policy 2014, 74, 655–662. [Google Scholar] [CrossRef]

- Barbiero, T.; Grillenzoni, C. A statistical analysis of the energy effectiveness of building refurbishment. Renew. Sustain. Energy Rev. 2019, 114, 109297. [Google Scholar] [CrossRef]

- Streimikiene, D.; Balezentis, T. Willingness to Pay for Renovation of Multi-Flat Buildings and to Share the Costs of Renovation. Energies 2020, 13, 2721. [Google Scholar] [CrossRef]

- Bertoldi, P.; Boza-Kiss, B.; Della Valle, N.; Economidou, M. The role of one-stop shops in energy renovation—A comparative analysis of OSSs cases in Europe. Energy Build. 2021, 250, 111273. [Google Scholar] [CrossRef]

- Pillai, A.; Reaños, M.T.; Curtis, J. An examination of energy efficiency retrofit scheme applications by low-income households in Ireland. Heliyon 2021, 7, e08205. [Google Scholar] [CrossRef]

- Labanca, N.; Suerkemper, F.; Bertoldi, P.; Irrek, W.; Duplessis, B. Energy efficiency services for residential buildings: Market situation and existing potentials in the European Union. J. Clean. Prod. 2015, 109, 284–295. [Google Scholar] [CrossRef]

- Murto, P.; Jalas, M.; Juntunen, J.; Hyysalo, S. Devices and strategies: An analysis of managing complexity in energy retrofit projects. Renew. Sustain. Energy Rev. 2019, 114, 109294. [Google Scholar] [CrossRef]

- De Wilde, M.; Spaargaren, G. Designing trust: How strategic intermediaries choreograph homeowners’ low-carbon retrofit experience. Build. Res. Inf. 2019, 47, 362–374. [Google Scholar] [CrossRef] [Green Version]

- Gonzalez-Caceres, A.; Lassen, A.K.; Nielsen, T.R. Barriers and challenges of the recommendation list of measures under the EPBD scheme: A critical review. Energy Build. 2020, 223, 110065. [Google Scholar] [CrossRef]

- Mlecnik, E.; Straub, A.; Haavik, T. Collaborative business model development for home energy renovations. Energy Effic. 2018, 12, 123–138. [Google Scholar] [CrossRef] [Green Version]

- Mahapatra, K.; Mainali, B.; Pardalis, G. Homeowners’ attitude towards one-stop-shop business concept for energy renovation of detached houses in Kronoberg, Sweden. Energy Procedia 2019, 158, 3702–3708. [Google Scholar] [CrossRef]

- Ambrose, A.; Baker, W.; Batty, E.; Hawkins, A. Reaching the ‘Hardest to Reach’ with Energy Advice: Final Report; Sheffield Hallam University: Sheffield, UK, 2019. [Google Scholar] [CrossRef]

- Gram-Hanssen, K. Retrofitting owner-occupied housing: Remember the people. Build. Res. Inf. 2014, 42, 393–397. [Google Scholar] [CrossRef]

- Wise, F.; Jones, D.; Moncaster, A. Reducing carbon from heritage buildings: The importance of residents’ views, values and behaviours. J. Arch. Conserv. 2021, 27, 117–146. [Google Scholar] [CrossRef]

- European Commission. Commission Staff Working Document: Preliminary Analysis of the Long-Term Renovation Strategies of 13 Member States; 25.3.2021, SWD(2021) 69 Final; European Commission: Brussels, Belgium, 2021. [Google Scholar]

- Mahapatra, K.; Gustavsson, L.; Haavik, T.; Aabrekk, S.; Svendsen, S.; Vanhoutteghem, L.; Paiho, S.; Ala-Juusela, M. Business models for full service energy renovation of single-family houses in Nordic countries. Appl. Energy 2013, 112, 1558–1565. [Google Scholar] [CrossRef]

- Peltomaa, J.; Mela, H.; Hildén, M. Housing managers as middle actors implementing sustainable housing policies in Finland. Build. Res. Inf. 2020, 48, 53–66. [Google Scholar] [CrossRef]

- Owen, A.; Mitchell, G.; Gouldson, A. Unseen influence—The role of low carbon retrofit advisers and installers in the adoption and use of domestic energy technology. Energy Policy 2014, 73, 169–179. [Google Scholar] [CrossRef]

- Maby, C.; Gwilliam, J. Integrating energy efficiency into private home repair, maintenance and improvement practice in England and Wales. Build. Res. Inf. 2021, 50, 424–437. [Google Scholar] [CrossRef]

- Boza-Kiss, B.; Bertoldi, P. One-Stop-Shops for Energy Renovations of Buildings; Joint Research Centre Science for Policy Report (JRC113301); European Commission: Ispra, Italy, 2018. [Google Scholar]

- Brown, D. Business models for residential retrofit in the UK: A critical assessment of five key archetypes. Energy Effic. 2018, 11, 1497–1517. [Google Scholar] [CrossRef] [Green Version]

- Rotmann, S.; Mundaca, L.; Castaño-Rosa, R.; O’Sullivan, K.; Ambrose, A.; Butler, D.; Marchand, R.; Chester, M.; Karlin, B.; Chambers, J.; et al. Hard-to-Reach Energy Users: A critical Review of Audience Characteristics and Target Behaviours; User-Centred Energy Systems TCP—HTR Annex: Wellington, New Zealand, 2021; 250p. [Google Scholar]

- Volt, J.; McGinley, O.; Moran, P.; Fabbri, M.; Steuwer, S. Underpinning the Role of One-Stop Shops in the EU Renovation Wave: First Lessons Learned from the Turnkey Retrofit Replication; TURNKEY Solution for Home RETROFITting Project; European Commission: Brussels, Belgium, 2021. [Google Scholar]

- Bjørneboe, M.G.; Svendsen, S.; Heller, A. Using a One-Stop-Shop Concept to Guide Decisions When Single-Family Houses Are Renovated. J. Arch. Eng. 2017, 23, 05017001. [Google Scholar] [CrossRef] [Green Version]

- Bertoldi, P.; Economidou, M.; Palermo, V.; Boza-Kiss, B.; Todeschi, V. How to finance energy renovation of residential buildings: Review of current and emerging financing instruments in the EU. Wiley Interdiscip. Rev. Energy Environ. 2020, 10, e384. [Google Scholar] [CrossRef]

- Mainali, B.; Mahapatra, K.; Pardalis, G. Strategies for deep renovation market of detached houses. Renew. Sustain. Energy Rev. 2021, 138, 110659. [Google Scholar] [CrossRef]

- Cicmanova, J.; Eisermann, M.; Maraquin, T. How to Set Up a One-Stop-Shop for Integrated Home Energy Renovation? A Step-by-Step Guide for Local Authorities and Other Actors; INNOVATE Project; Energy Cities: Besancon, France, 2020. [Google Scholar]

- Kwon, M.; Mlecnik, E. Modular Web Portal Approach for Stimulating Home Renovation: Lessons from Local Authority Developments. Energies 2021, 14, 1270. [Google Scholar] [CrossRef]

- Croci, E.; Molteni, T.; Penati, T. Mapping of Existing One-Stop-Shop Initiatives in EU and Beyond and Underlying Business Models for Integrated Home Energy Renovation Services; Bocconi University (UB); Padova FIT Expanded Project; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Volt, J.; Zuhaib, S.; Steuwer, S. Benchmarking of Promising Experiences of Integrated Renovation Services in Europe; TURNKEY Solution for Home RETROFITting Project; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Tingey, M.; Webb, J.; Van der Horst, D. Housing retrofit: Six types of local authority energy service models. Build. Cities 2021, 2, 518–532. [Google Scholar] [CrossRef]

- Pardalis, G.; Mainali, B.; Mahapatra, K. One-stop-shops as an innovation, and construction SMEs: A Swedish perspective. Energy Procedia 2019, 158, 2737–2743. [Google Scholar] [CrossRef]

- Maraquin, T.; Eisermann, M. The Accelerator for Renovation One-Stop-Shops: Final Publishable Report about the Why, How and What of This European Experimentation; INNOVATE Project; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Pardalis, G.; Mahapatra, K.; Mainali, B. Swedish construction MSEs: Simply renovators or renovation service innovators? Build. Res. Inf. 2020, 48, 67–83. [Google Scholar] [CrossRef]

- Gram-Hanssen, K.; Jensen, J.O.; Friis, F. Local strategies to promote energy retrofitting of single-family houses. Energy Effic. 2018, 11, 1955–1970. [Google Scholar] [CrossRef]

- DGEG. Balanço Energético 2019 Provisório [“Preliminary Energy Balance 2019”]; Version of 02/11/2020; Portuguese Energy and Geology Directorate: Lisbon, Portugal, 2020.

- Gouveia, J.P.; Palma, P. Harvesting big data from residential building energy performance certificates: Retrofitting and climate change mitigation insights at a regional scale. Environ. Res. Lett. 2019, 14, 095007. [Google Scholar] [CrossRef]

- Eurostat. Cooling and Heating Degree Days by Country—Annual Data; Publications Office of the European Union: Luxembourg, 2022. [Google Scholar]

- Eurostat. Inability to Keep Home Adequately Warm—EU-SILC Survey; Publications Office of the European Union: Luxembourg, 2022. [Google Scholar]

- Eurostat. Share of Population Living in a Dwelling Not Comfortably Cool during Summer Time by Income Quintile and Degree of Urbanisation; Publications Office of the European Union: Luxembourg, 2021. [Google Scholar]

- Portuguese Energy Observatory. Certificação Energética de Edifícios—Principais Números: Habitação [“Energy Certification of Buildings—Key Figures: Housing”]. 2021. Available online: https://www.observatoriodaenergia.pt (accessed on 16 February 2021).

- Palma, P.; Gouveia, J.P.; Simoes, S.G. Mapping the energy performance gap of dwelling stock at high-resolution scale: Implications for thermal comfort in Portuguese households. Energy Build. 2019, 190, 246–261. [Google Scholar] [CrossRef]

- Horta, A.; Gouveia, J.P.; Schmidt, L.; Sousa, J.C.; Palma, P.; Simões, S. Energy poverty in Portugal: Combining vulnerability mapping with household interviews. Energy Build. 2019, 203, 109423. [Google Scholar] [CrossRef] [Green Version]

- Antepara, I.; Papada, L.; Gouveia, J.P.; Katsoulakos, N.; Kaliampakos, D. Improving Energy Poverty Measurement in Southern European Regions through Equivalization of Modeled Energy Costs. Sustainability 2020, 12, 5721. [Google Scholar] [CrossRef]

- Melo, J.J.; Fernandes, F.; Sousa, M.J.F.; Galvão, A.; Grilo, J.; Pereira, A.M. Estratégia Energética Alternativa: Princípios e Identificação de Medidas [“Alternative Energy Strategy: Principles and Identification of Measures”]; NOVA School of Science and Technology of the NOVA University of Lisbon: Lisbon, Portugal, 2019; ISBN 978-972-8893-82-8. [Google Scholar]

- Silva, S.M.; Mateus, R.; Marques, L.; Ramos, M.; Almeida, M. Contribution of the solar systems to the nZEB and ZEB design concept in Portugal—Energy, economics and environmental life cycle analysis. Sol. Energy Mater. Sol. Cells 2016, 156, 59–74. [Google Scholar] [CrossRef] [Green Version]

- Monzón-Chavarrías, M.; López-Mesa, B.; Resende, J.; Corvacho, H. The nZEB concept and its requirements for residential buildings renovation in Southern Europe: The case of multi-family buildings from 1961 to 1980 in Portugal and Spain. J. Build. Eng. 2020, 34, 101918. [Google Scholar] [CrossRef]

- Gouveia, J.P.; Palma, P.; Simoes, S.G. Energy poverty vulnerability index: A multidimensional tool to identify hotspots for local action. Energy Rep. 2019, 5, 187–201. [Google Scholar] [CrossRef]

- OPENEXP. European Energy Poverty Index (EEPI): Assessing Member States Progress in Alleviating the Domestic and Transport Energy Poverty Nexus. 2019. Available online: https://www.openexp.eu/european-energy-poverty-index-eepi (accessed on 28 May 2021).

- Portuguese Government. Estratégia de Longo Prazo para o Combate à Pobreza Energética 2021–2050 [“Long-Term Strategy for Energy Poverty Mitigation 2021–2050”]; Document for Public Consultation; Ministry of Environment and Climate Action: Lisbon, Portugal, 2021.

- Portuguese Government. Resolução do Conselho de Ministros n.º 8-A/2021—Aprova a Estratégia de Longo Prazo para a Renovação dos Edifícios [“Resolution of the Council of Ministers no. 8-A/2021—Approving the Long-Term Strategy for Building Renovation”]; Diário da República, 1.ª Série, 23; Ministry of Environment and Climate Action: Lisbon, Portugal, 2021.

- European Commission. Comprehensive Study of Building Energy Renovation Activities and the Uptake of Nearly Zero-Energy Buildings in the EU; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- INE. Construção e Habitação [“Construction and Housing Statistics”]. Portugal Statistics. 2020. Available online: www.ine.pt (accessed on 15 August 2021).

- Zangheri, P.; Castellazzi, L.; D’Agostino, D.; Economidou, M.; Ruggieri, G.; Tsemekidi-Tzeiranaki, S.; Maduta, C.; Bertoldi, P. Progress of the Member States in Implementing the Energy Performance of Building Directive; Joint Research Centre Science for Policy Report (JRC122347), EUR30469 EN; Publications Office of the European Union: Luxembourg, 2021. [Google Scholar] [CrossRef]

- Palma, P.; Gouveia, J.P.; Barbosa, R. How much will it cost? An Energy Renovation Analysis for the Portuguese Dwelling Stock. Sustain. Cities Soc. 2022, 78, 103607. [Google Scholar] [CrossRef]

- Sequeira, M.M.; Gouveia, J.P.; Palma, P. Case Study Analysis—Portugal; HTR Task Users TCP: Lisbon, Portugal, 2021; 38p. [Google Scholar] [CrossRef]

- Project Management Institute. A Guide to the Project Management Body of Knowledge (PMBOK® Guide), 5th ed.; Project Management Institute, Inc.: Newtown Square, PA, USA, 2013; ISBN 978-1-935589-67-9. [Google Scholar]

- Ginige, K.; Amaratunga, D.; Haigh, R. Mapping stakeholders associated with societal challenges: A Methodological Framework. Procedia Eng. 2018, 212, 1195–1202. [Google Scholar] [CrossRef]

- Muhr, L.; Clanzett, S.; Hildebrand, J. Stakeholder Analysis Report: General and Country Specific Stakeholder Maps; Version 1; IZES gGmbH—Institut für Zukunftsenergie und Stoffstromsysteme, ePanacea Project; ePanacea: Sarriguren, Spain, 2020. [Google Scholar]

- Portuguese Government. Roteiro para a Neutralidade Carbónica 2050 (RNC2050): Estratégia de Longo Prazo para a Neutralidade Carbónica da Economia Portuguesa Em 2050 [“Carbon Neutrality Roadmap 2050 (RNC2050): Long-Term Strategy for a Carbon Neutral Portuguese Economy in 2050”]. R262/2019. 2019. Available online: https://descarbonizar2050.apambiente.pt/ (accessed on 19 May 2021).

- Gouveia, J.P.; Seixas, J.; Palma, P.; Duarte, H.; Luz, H.; Cavadini, G.B. Positive Energy District: A Model for Historic Districts to Address Energy Poverty. Front. Sustain. Cities 2021, 3, 648473. [Google Scholar] [CrossRef]

- Döringer, S. ‘The problem-centred expert interview’. Combining qualitative interviewing approaches for investigating implicit expert knowledge. Int. J. Soc. Res. Methodol. 2021, 24, 265–278. [Google Scholar] [CrossRef]

- Berawi, M.A.; Miraj, P.; Windrayani, R.; Berawi, A.R.B. Stakeholders’ perspectives on green building rating: A case study in Indonesia. Heliyon 2019, 5, e01328. [Google Scholar] [CrossRef] [Green Version]

- Becker, L.; Jaakkola, E.; Halinen, A. Toward a goal-oriented view of customer journeys. J. Serv. Manag. 2020, 31, 767–790. [Google Scholar] [CrossRef]

- De Santoli, L. Guidelines on energy efficiency of cultural heritage. Energy Build. 2016, 86, 534–540. [Google Scholar] [CrossRef]

- Sunikka-Blank, M.; Galvin, R. Irrational homeowners? How aesthetics and heritage values influence thermal retrofit decisions in the United Kingdom. Energy Res. Soc. Sci. 2016, 11, 97–108. [Google Scholar] [CrossRef] [Green Version]

- Caro, R.; Sendra, J.J. Are the dwellings of historic Mediterranean cities cold in winter? A field assessment on their indoor environment and energy performance. Energy Build. 2020, 230, 110567. [Google Scholar] [CrossRef]

- Mazzola, E.; Mora, T.D.; Peron, F.; Romagnoni, P. An Integrated Energy and Environmental Audit Process for Historic Buildings. Energies 2019, 12, 3940. [Google Scholar] [CrossRef] [Green Version]

- Sequeira, M.; de Melo, J.J. Energy saving potential in the small business service sector: Case study Telheiras neighborhood, Portugal. Energy Effic. 2020, 13, 551–569. [Google Scholar] [CrossRef]

- Salvia, M.; Simoes, S.G.; Herrando, M.; Čavar, M.; Cosmi, C.; Pietrapertosa, F.; Gouveia, J.P.; Fueyo, N.; Gómez, A.; Papadopoulou, K.; et al. Improving policy making and strategic planning competencies of public authorities in the energy management of municipal public buildings: The PrioritEE toolbox and its application in five mediterranean areas. Renew. Sustain. Energy Rev. 2021, 135, 110106. [Google Scholar] [CrossRef]

- CENSE FCT-NOVA; De Groene Grachten. Menu Renovação Verde. December 2020. CENSE—Center for Environmental and Sustainability Research, FCT-NOVA—NOVA School of Science and Technology, NOVA University of Lisbon, De Groene Grachten. 2020. Available online: https://www.menurenovacaoverde.pt (accessed on 27 December 2021).

- Ebrahimigharehbaghi, S.; Qian, Q.K.; Meijer, F.M.; Visscher, H.J. Unravelling Dutch homeowners’ behaviour towards energy efficiency renovations: What drives and hinders their decision-making? Energy Policy 2019, 129, 546–561. [Google Scholar] [CrossRef]

- Pardalis, G.; Mahapatra, K.; Mainali, B.; Bravo, G. Future Energy-Related House Renovations in Sweden: One-Stop-Shop as a Shortcut to the Decision-Making Journey. In Emerging Research in Sustainable Energy and Buildings for a Low-Carbon Future; Advances in Sustainability Science and Technology; Howlett, R.J., Littlewood, J.R., Jain, L.C., Eds.; Springer: Singapore, 2021. [Google Scholar] [CrossRef]

- Causse, E.; Figueira, M.; Gutiérrez, B.; Panagiotopoulou, I. UIPI Survey Final Report: European Property Owners’ Readiness and Capacity to Renovate; International Union of Property Owners: Brussels, Belgium, 2021. [Google Scholar]

- Abreu, M.I.; de Oliveira, R.A.; Lopes, J. Younger vs. older homeowners in building energy-related renovations: Learning from the Portuguese case. Energy Rep. 2020, 6, 159–164. [Google Scholar] [CrossRef]

- Senior, C.; Salaj, A.; Vukmirovic, M.; Jowkar, M.; Kristl, Ž. The Spirit of Time—The Art of Self-Renovation to Improve Indoor Environment in Cultural Heritage Buildings. Energies 2021, 14, 4056. [Google Scholar] [CrossRef]

- Hall, S.; Anable, J.; Hardy, J.; Workman, M.; Mazur, C.; Matthews, Y. Matching consumer segments to innovative utility business models. Nat. Energy 2021, 6, 349–361. [Google Scholar] [CrossRef]

- Pardalis, G.; Mahapatra, K.; Bravo, G.; Mainali, B. Swedish House Owners’ Intentions towards Renovations: Is there a Market for One-Stop-Shop? Buildings 2019, 9, 164. [Google Scholar] [CrossRef] [Green Version]

- Bartiaux, F.; Schmidt, L.; Horta, A.; Correia, A. Social diffusion of energy-related practices and representations: Patterns and policies in Portugal and Belgium. Energy Policy 2016, 88, 413–421. [Google Scholar] [CrossRef]

- Domínguez-Amarillo, S.; Fernández-Agüera, J.; Peacock, A.; Acosta, I. Energy related practices in Mediterranean low-income housing. Build. Res. Inf. 2020, 48, 34–52. [Google Scholar] [CrossRef]

- Kivimaa, P.; Martiskainen, M. Innovation, low energy buildings and intermediaries in Europe: Systematic case study review. Energy Effic. 2018, 11, 31–51. [Google Scholar] [CrossRef] [Green Version]

- Pardo-Bosch, F.; Cervera, C.; Ysa, T. Key aspects of building retrofitting: Strategizing sustainable cities. J. Environ. Manag. 2019, 248, 109247. [Google Scholar] [CrossRef]

- Kerr, N.; Winskel, M. Household investment in home energy retrofit: A review of the evidence on effective public policy design for privately owned homes. Renew. Sustain. Energy Rev. 2020, 123, 109778. [Google Scholar] [CrossRef]

- Pardalis, G.; Mahapatra, K.; Mainali, B. A triple-layered one-stop-shop business model canvas for sustainable house renovations. IOP Conf. Ser. Earth Environ. Sci. 2020, 588, 022060. [Google Scholar] [CrossRef]

| Topic | Key Insights |

|---|---|

| Portuguese building stock |

|

| Renovation market evolution |

|

| Technical measures |

|

| Policies and regulations |

|

| Financing instruments |

|

| Citizen engagement |

|

| Theme | Category | Number of Measures |

|---|---|---|

| Orientation: Quick wins | Energy use | 12 |

| Water use | 4 | |

| Orientation: Insulation and ventilation | Seams and gaps | 6 |

| Roof insulation | 6 * | |

| Floor insulation | 5 | |

| Wall insulation | 8 * | |

| Windows | 9 | |

| Ventilation | 5 | |

| Orientation: Electricity generation and end-use appliances | Electricity generation | 10 * |

| Monitoring, storage, and electric vehicle charging | 4 | |

| Lighting | 5 * | |

| Cooking | 4 | |

| Other electrical equipment | 6 * | |

| Orientation: Climatization and water heating | Space heating | 9 * |

| Heat distribution | 8 | |

| Water heating | 13 * | |

| Space cooling | 6 * | |

| Orientation: Water and greenery | Green roofs and façades | 3 |

| Water use | 7 | |

| Advise | - | - |

| Financing | - | 12 financing schemes |

| Implementation | - | - |

| Inspiration/News | - | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sequeira, M.M.; Gouveia, J.P. A Sequential Multi-Staged Approach for Developing Digital One-Stop Shops to Support Energy Renovations of Residential Buildings. Energies 2022, 15, 5389. https://doi.org/10.3390/en15155389

Sequeira MM, Gouveia JP. A Sequential Multi-Staged Approach for Developing Digital One-Stop Shops to Support Energy Renovations of Residential Buildings. Energies. 2022; 15(15):5389. https://doi.org/10.3390/en15155389

Chicago/Turabian StyleSequeira, Miguel Macias, and João Pedro Gouveia. 2022. "A Sequential Multi-Staged Approach for Developing Digital One-Stop Shops to Support Energy Renovations of Residential Buildings" Energies 15, no. 15: 5389. https://doi.org/10.3390/en15155389

APA StyleSequeira, M. M., & Gouveia, J. P. (2022). A Sequential Multi-Staged Approach for Developing Digital One-Stop Shops to Support Energy Renovations of Residential Buildings. Energies, 15(15), 5389. https://doi.org/10.3390/en15155389