Promoting the Diffusion of New Energy Vehicles under Dual Credit Policy: Asymmetric Competition and Cooperation in Complex Network

Abstract

:1. Introduction

2. Literature Review

2.1. Research on Incentive Policy

2.2. Research on Interactive Relationship among Multiple Agents

3. Methodology and Modeling

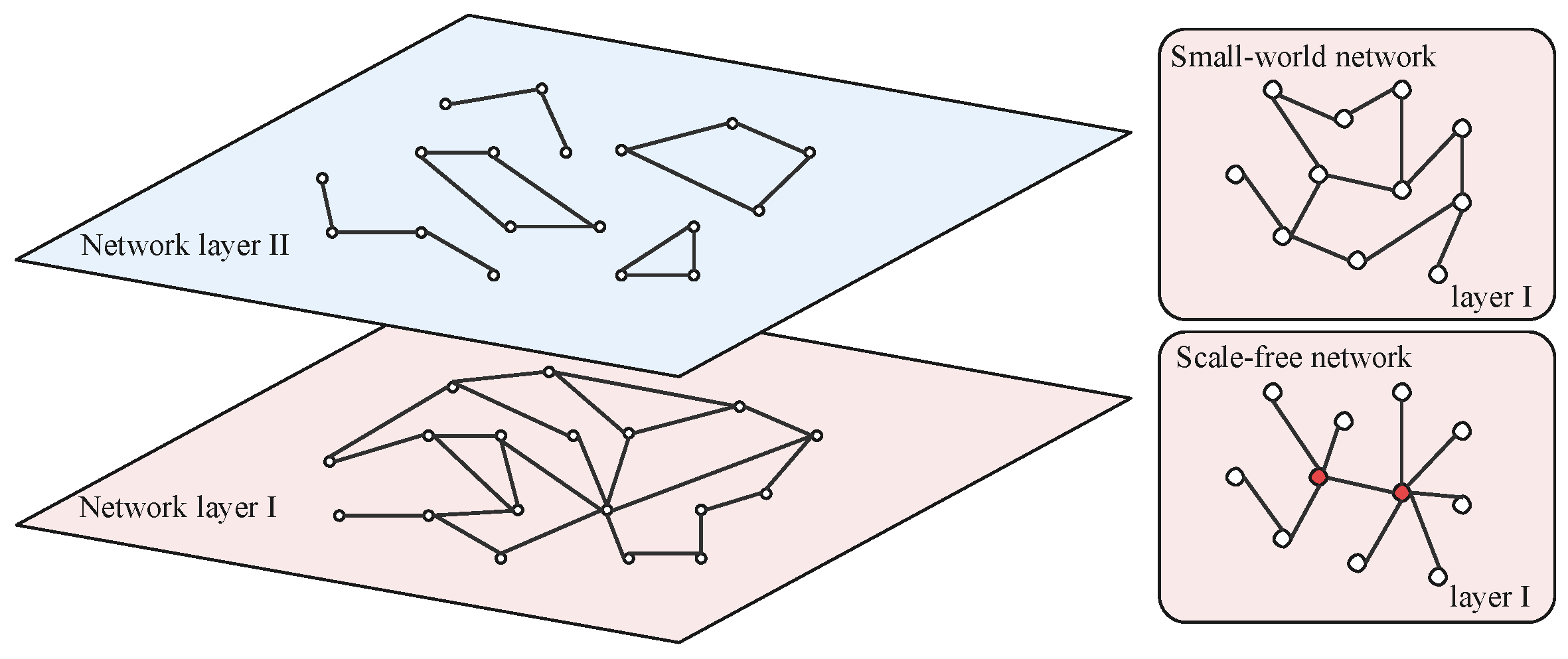

3.1. Interaction Structure on Complex Network

3.2. Manufacturer’s Behavior Analysis

3.2.1. Model Assumptions

- A three-stage model is established based on the manufacturer’s behavior, including market competition, credit cooperation, and strategy updating. At the stage of market competition, N vehicle manufacturers make their optimal pricing decision in the competitive environment of network layer I according to the multi-agent Bertrand game model, obtaining their market profits and initial CAFC credits. At the stage of credit cooperation, according to the affiliated structure of network layer II, final CAFC credit of each vehicle manufacturer are calculated, so they incur extra expenditure of credit compliance. At the stage of strategy updating, the total revenue of each vehicle manufacturer is obtained by synthesizing their market profits and expenditure of credit compliance, and the production strategy is updated based on related updating rule;

- The positive CAFC credits transferred are assumed free because they are cooperators, so FV manufacturers are willing to seek for help from their affiliated manufacturers at first. For the part that cannot be eliminated through credit transfer, purchasing NEV credits in the market is the only way to meet the requirement of dual credit policy. Meanwhile, the positive CAFC credits cannot be traded, thus generating no profit for manufacturers. The fuel consumption level of manufacturers is assumed to remain stable, that is, the positive or negative of year-end CAFC credit generated will not change. The CAFC credits carried forward from previous years do not require the elimination of negative CAFC credits generated this year. Therefore, the carry-forward of positive CAFC credits from previous years is not considered in this study.

3.2.2. Model Analysis

- 1.

- Competitive analysis

- 2.

- Cooperative analysis

- (1)

- Cooperation based on affiliated rate

- (2)

- Cooperation based on sales profit

3.2.3. Asymmetric Competition and Cooperation Analysis

4. Numerical Simulation

4.1. Parameter Initialization Settings

4.2. Results and Discussion

4.2.1. Impact of Different Incentive Policies and Cooperative Strategies

- 1.

- Cooperation based on affiliated rate

- 2.

- Cooperation based on sale profit

4.2.2. Impact of Different Cooperative Strategies and Learning Strategies

4.2.3. Impact of Different NEV Credits Trading Price

5. Conclusions

- The effectiveness of the dual credit policy is always better than that of the subsidy mechanism. However, the consideration of credit cooperation is not always outstanding for the diffusion of NEVs, which mainly depends on the credit cooperative strategy within affiliated groups. Only under the cooperative strategy that assists weak manufacturers first can the diffusion of NEVs be maximized;

- To enhance the diffusion of NEVs, the optimal competitive structure for the vehicle industry is small world network. The optimal credit cooperative strategy for affiliated groups is distributing by sale profit, and the optimal learning strategy for vehicle manufacturers is learning from competitors. Therefore, the optimal composition is distributing by sale profit and learning from competitors in small world competitive structure. Additionally, in the competitive structure of small world, learning strategy is the focus of manufacturers to maximize the NEV diffusivity. Moreover, in the monopoly competitive structure, learning from competitors and distributing by sale profit should be implemented simultaneously to ensure high NEV diffusivity;

- The higher the NEV credit’s trading price, the higher the NEV’s equilibrium diffusivity. The credit cooperative strategy greatly influences the effectiveness of NEV credit’s trading price. When the strategy of distributing by sale profit is implemented, the diffusion of NEVs under different NEV credit’s trading price becomes more stable and higher, which is beneficial to reduce the risk caused by the instability of NEV credit’s trading market. The competitive structure of small world is more conductive to the effectiveness of NEV credit’s trading price, where the NEV diffusivity becomes higher than in the monopoly competitive structure.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Introduction to Dual Credit Policy

| Vehicle Type | Pure Electric Cruising Range (R/km) | ||

|---|---|---|---|

| Pure electric vehicle | R ≥ 300 | R ≥ 400 | R ≥ 50 |

| 1.3 | 1.8 | / | |

| Plug-in hybrid vehicle | / | 0.68 | |

| A0 | A | B | C | Remarks | ||

|---|---|---|---|---|---|---|

| Yaris X | Excelle XT | Santana | BMW 3L | Avalon Hybrid | Audi A6L | The auto models selected mainly come from Anluqin price monitoring system. |

| Vios | Sylphy Classic | Ralink | Magotan | Lacrosse | BMW 5L | |

| Polo HB | Bora | Roewe i5 | Honda Accord | Inspire Fuel version | Benz EL | |

| Fit HB | Corolla | Monza | Audi A4L | Mazda 6 Atenza | Volvo S90 | |

| Yuena | Lavida | Mazda 3 Axela NB | Camry | Raeton CC | Cadillac CT6 | The selection criteria for all levels are that the total sales volume of the car in the last quarter accounted for more than 90% of the total sales volume of the market segment. |

| Yaris | Emgrand EC7 NB | Mercedes AL | Altims | Volvo S60 | ||

| Vios FS | Sagitar | Lingke 03 | Benz CL | Mondeo | ||

| Yaris L | Civic | Golf | Regal | |||

| Yuexiang | Eado Plus | Binrui | Passat | |||

| Tiida | Corolla Hybrid | Avalon | ||||

| Jetta VA3 | Ralink Hybrid | Cadillac CT5 | ||||

| Celesta | Audi A3 Limousine | Hong Qi H5 | ||||

| Lamando | BMW 1 NB | Malibu XL | ||||

| A0 | A | B | C | ||

|---|---|---|---|---|---|

| Gac Toyota | Shanghai GM Buick | SAIC-GM Chevrolet | Brilliance BMW | Saic Volkswagen | Brilliance BMW |

| Faw Toyota | Dongfeng Nissan | Changan Mazda | Benz | SAIC-GM Chevrolet | Benz |

| Saic Volkswagen | Faw Volkswagen | LYNK&CO | Faw Volkswagen | Faw Toyota | FAW-Volkswagen Audi |

| Guangqi Honda | Faw Toyota | FAW-Volkswagen Jetta | Guangqi Honda | Faw Mazda | Cadillac |

| Beijing Hyundai | Saic Volkswagen | Beijing Hyundai | FAW-Volkswagen Audi | Changan automobile | Volvo |

| Changan automobile | Geely automobile | FAW-Volkswagen Audi | Cadillac | Changan Ford | |

| Dongfeng Honda | Brilliance BMW | Volvo | |||

| Changan automobile | Benz | Faw hongqi | |||

| Gac Toyota | Saic Motor | Shanghai GM Buick | |||

References

- Wang, X.; Li, C.; Shang, J.; Yang, C.; Zhang, B.; Ke, X. Strategic Choices of China’s New Energy Vehicle Industry: An Analysis Based on ANP and SWOT. Energies 2017, 10, 537. [Google Scholar] [CrossRef] [Green Version]

- MEE (Ministry of Ecology and Environment of the People’s Republic of China). China Mobile Source Environmental Management Annual Report. 2020. Available online: http://www.mee.gov.cn/xxgk2018/xxgk/xxgk15/202008/t20200810_793252.html (accessed on 10 August 2020).

- Goel, P.; Sharma, N.; Mathiyazhagan, K.; Vimal, K. Government is trying but consumers are not buying: A barrier analysis for electric vehicle sales in India. Sustain. Prod. Consum. 2021, 28, 71–90. [Google Scholar] [CrossRef]

- Xu, B.; Sharif, A.; Shahbaz, M.; Dong, K. Have electric vehicles effectively addressed CO2 emissions? Analysis of eight leading countries using quantile-on-quantile regression approach. Sustain. Prod. Consum. 2021, 27, 1205–1214. [Google Scholar] [CrossRef]

- Wu, Y.A.; Ng, A.W.; Yu, Z.; Huang, J.; Meng, K.; Dong, Z. A review of evolutionary policy incentives for sustainable development of electric vehicles in China: Strategic implications. Energy Policy 2020, 148, 111983. [Google Scholar] [CrossRef]

- Kong, D.; Xia, Q.; Xue, Y.; Zhao, X. Effects of multi policies on electric vehicle diffusion under subsidy policy abolishment in China: A multi-actor perspective. Appl. Energy 2020, 266, 114887. [Google Scholar] [CrossRef]

- Bishop, J.D.; Martin, N.P.; Boies, A.M. Quantifying the role of vehicle size, powertrain technology, activity and consumer behaviour on new UK passenger vehicle fleet energy use and emissions under different policy objectives. Appl. Energy 2016, 180, 196–212. [Google Scholar] [CrossRef] [Green Version]

- Das, P.K.; Bhat, M.Y. Global electric vehicle adoption: Implementation and policy implications for India. Environ. Sci. Pollut. Res. 2022, 29, 40612–40622. [Google Scholar] [CrossRef]

- MIIT. The Passenger Cars Corporate Average Fuel Consumption and New Energy Vehicle Credit Regulation. 2017. Available online: https://www.miit.gov.cn/jgsj/zbys/qcgy/art/2020/art_f09be90b302f4875928ac1c05a5c3bbc.html (accessed on 28 September 2017).

- Anand, K.S.; Giraud-Carrier, F.C. Pollution Regulation of Competitive Markets. Manag. Sci. 2020, 66, 4193–4206. [Google Scholar] [CrossRef]

- Li, K.; Ji, L.; Zhang, C.; Li, H. Fully distributed event-triggered pinning group consensus control for heterogeneous multi-agent systems with cooperative-competitive interaction strength. Neurocomputing 2021, 464, 273–281. [Google Scholar] [CrossRef]

- Bian, J.; Zhao, X. Tax or subsidy? An analysis of environmental policies in supply chains with retail competition. Eur. J. Oper. Res. 2019, 283, 901–914. [Google Scholar] [CrossRef]

- MIIT. Decision on Amending. 2020. Available online: https://www.miit.gov.cn/jgsj/zfs/bmgz/art/2020/art_bb9aff09c02d44cf87dfce83fc5df7d5.html (accessed on 29 June 2020).

- Wang, S.; Li, J.; Zhao, D. The impact of policy measures on consumer intention to adopt electric vehicles: Evidence from China. Transp. Res. Part A: Policy Pract. 2017, 105, 14–26. [Google Scholar] [CrossRef]

- Chen, K.; Zhao, F.; Hao, H.; Liu, Z. Synergistic Impacts of China’s Subsidy Policy and New Energy Vehicle Credit Regulation on the Technological Development of Battery Electric Vehicles. Energies 2018, 11, 3193. [Google Scholar] [CrossRef] [Green Version]

- Shao, L.; Yang, J.; Zhang, M. Subsidy scheme or price discount scheme? Mass adoption of electric vehicles under different market structures. Eur. J. Oper. Res. 2017, 262, 1181–1195. [Google Scholar] [CrossRef]

- Zhang, X.; Bai, X. Incentive policies from 2006 to 2016 and new energy vehicle adoption in 2010–2020 in China. Renew. Sustain. Energy Rev. 2017, 70, 24–43. [Google Scholar] [CrossRef]

- Ou, S.; Lin, Z.; Qi, L.; Li, J.; He, X.; Przesmitzki, S. The dual-credit policy: Quantifying the policy impact on plug-in electric vehicle sales and industry profits in China. Energy Policy 2018, 121, 597–610. [Google Scholar] [CrossRef]

- Hsieh, I.-Y.L.; Pan, M.S.; Green, W.H. Transition to electric vehicles in China: Implications for private motorization rate and battery market. Energy Policy 2020, 144, 111654. [Google Scholar] [CrossRef]

- Lou, G.; Ma, H.; Fan, T.; Chan, H.K. Impact of the dual-credit policy on improvements in fuel economy and the production of internal combustion engine vehicles. Resour. Conserv. Recycl. 2020, 156, 104712. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Q.; Tang, Y.; Mclellan, B.; Ye, H.; Shimoda, H.; Ishihara, K. Dynamic optimization management of the dual-credit policy for passenger vehicles. J. Clean. Prod. 2019, 249, 119384. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Q.; Li, H.; Tang, Y.; Liu, B. The impact of dual-credit scheme on the development of the new energy vehicle industry. Energy Procedia 2019, 158, 4311–4317. [Google Scholar] [CrossRef]

- Hu, Y.; Wang, Z.; Li, X. Impact of policies on electric vehicle diffusion: An evolutionary game of small world network analysis. J. Clean. Prod. 2020, 265, 121703. [Google Scholar] [CrossRef]

- Yang, R.; Tang, W.; Zhang, J. Technology improvement strategy for green products under competition: The role of government subsidy. Eur. J. Oper. Res. 2021, 289, 553–568. [Google Scholar] [CrossRef]

- Watts, D.J.; Dodds, P.S.; Newman, M.E.J. Identity and Search in Social Networks. Science 2002, 296, 1302–1305. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Barabási, A.-L.; Albert, R. Emergence of Scaling in Random Networks. Science 1999, 286, 509–512. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Adler, N.; Brudner, A.; Proost, S. A review of transport market modeling using game-theoretic principles. Eur. J. Oper. Res. 2020, 291, 808–829. [Google Scholar] [CrossRef]

- Taylor, P.D.; Jonker, L.B. Evolutionary stable strategies and game dynamics. Math. Biosci. 1978, 40, 145–156. [Google Scholar] [CrossRef]

- Bass, F.M. A New Product Growth for Model Consumer Durables. Manag. Sci. 1969, 15, 215–227. [Google Scholar] [CrossRef]

- MIIT. Table of Accounting for Average Fuel Consumption and New Energy Vehicle Credits of Chinese Passenger Car Manufacturers. 2019. Available online: https://ythxxfb.miit.gov.cn/ythzxfwpt/hlwmh/zcwj/xzxk/clsczr/art/2020/art_a14a402f2b5b4ac6addad2998f845fd0.html (accessed on 2 July 2020).

- Jiao, Y.; Yu, L.; Wang, J.; Wu, D.; Tang, Y. Diffusion of new energy vehicles under incentive policies of China: Moderating role of market characteristic. J. Clean. Prod. 2022, 353, 131660. [Google Scholar] [CrossRef]

- MIIT. Notice of Further Improving the Financial Subsidy for the Promotion of NEV. 2021. Available online: https://www.miit.gov.cn/xwdt/gxdt/sjdt/art/2021/art_a42ae2cf64d34e0a9c4bf97a37b71c64.html (accessed on 1 January 2021).

- Li, J.; Ku, Y.; Yu, Y.; Liu, C.; Zhou, Y. Optimizing production of new energy vehicles with across-chain cooperation under China’s dual credit policy. Energy 2020, 194, 116832. [Google Scholar] [CrossRef]

- CATARC. Blue Book of Power Battery; Social Science Academic Press: Beijing, China, 2018. (In Chinese) [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, L.; Jiang, X.; He, Y.; Jiao, Y. Promoting the Diffusion of New Energy Vehicles under Dual Credit Policy: Asymmetric Competition and Cooperation in Complex Network. Energies 2022, 15, 5361. https://doi.org/10.3390/en15155361

Yu L, Jiang X, He Y, Jiao Y. Promoting the Diffusion of New Energy Vehicles under Dual Credit Policy: Asymmetric Competition and Cooperation in Complex Network. Energies. 2022; 15(15):5361. https://doi.org/10.3390/en15155361

Chicago/Turabian StyleYu, Liukai, Xuehai Jiang, Yujie He, and Yangyang Jiao. 2022. "Promoting the Diffusion of New Energy Vehicles under Dual Credit Policy: Asymmetric Competition and Cooperation in Complex Network" Energies 15, no. 15: 5361. https://doi.org/10.3390/en15155361

APA StyleYu, L., Jiang, X., He, Y., & Jiao, Y. (2022). Promoting the Diffusion of New Energy Vehicles under Dual Credit Policy: Asymmetric Competition and Cooperation in Complex Network. Energies, 15(15), 5361. https://doi.org/10.3390/en15155361