Regional Specialization, Competitive Pressure, and Cooperation: The Cocktail for Innovation

Abstract

1. Introduction

2. Literature Review

2.1. Industrial Clustering and Innovation

2.2. Business Associations and Interorganizational Cooperation

2.3. Industrial Clustering, Cooperation and Innovation

3. Methodology

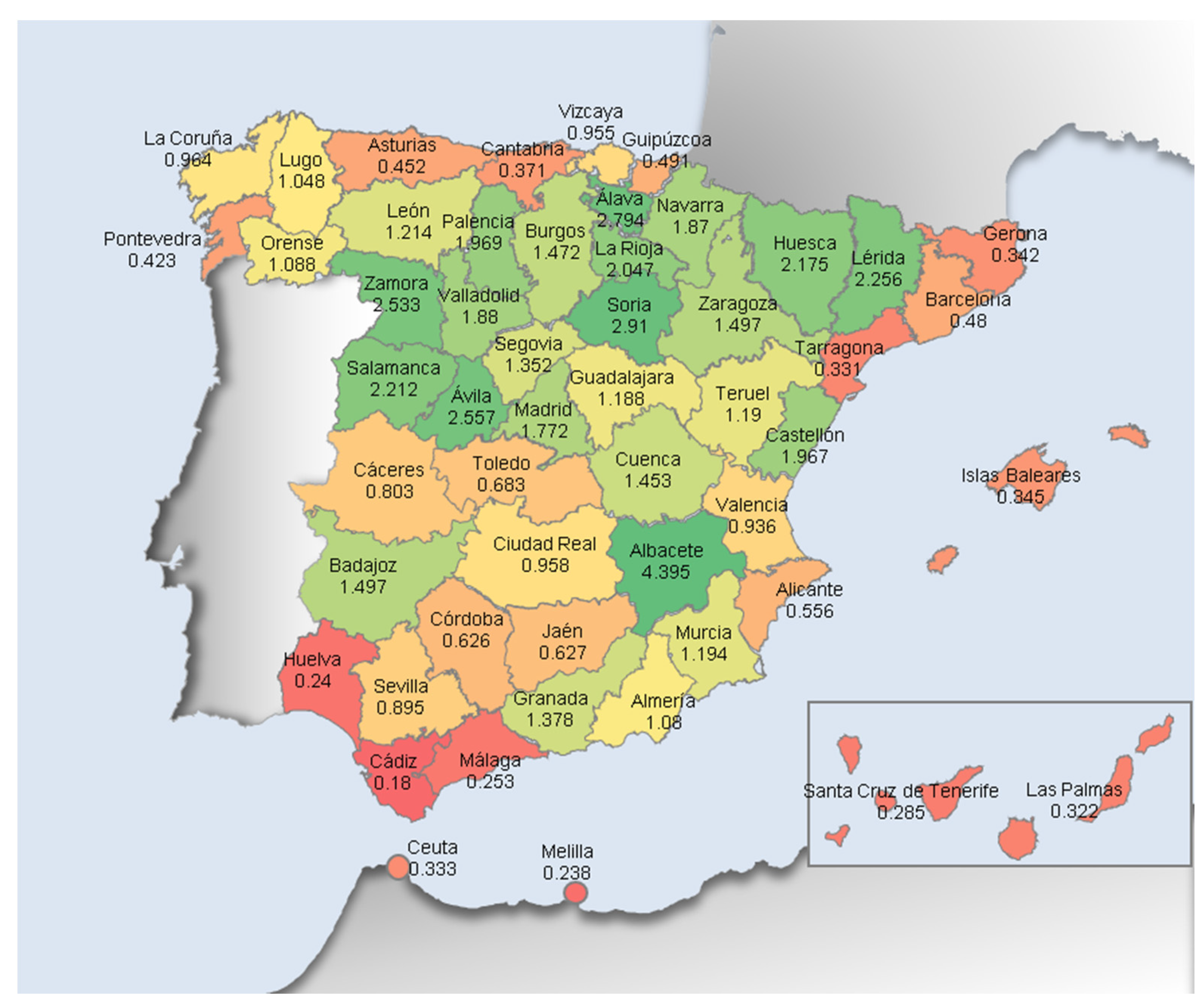

3.1. Population and Sample

3.2. Data Collection and Measurement of Variables

3.3. Analysis Technique

4. Data Analysis and Results

4.1. Data Analysis and Results

4.2. Model Evaluation

4.2.1. Evaluation of the Formative and Reflective Measurement Models

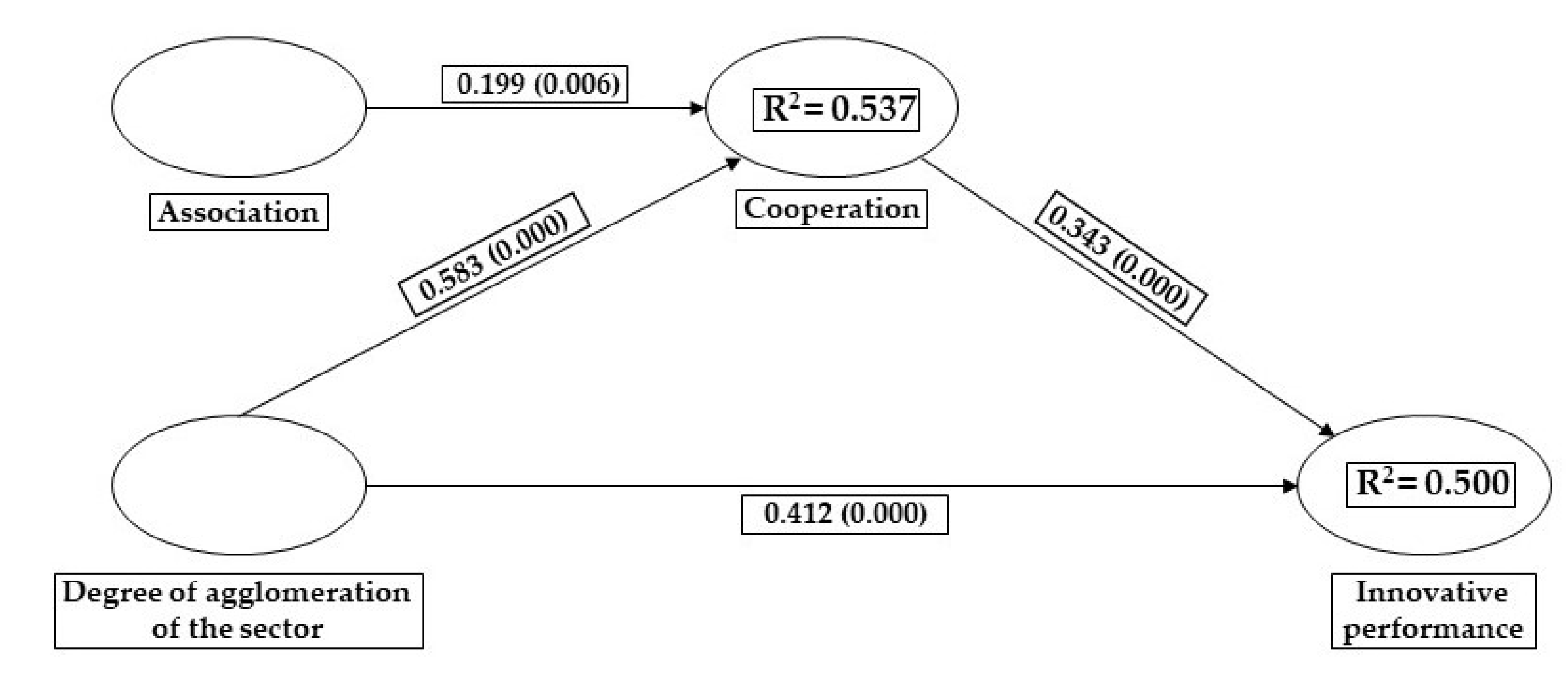

4.2.2. Evaluation of the Structural Model

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Concept | Items | Definition | Measurement |

| Cooperation | Coop1 | Degree to which your company cooperates with its customers. | Likert scale (−3 = Far inferior relative to my competitors; +3 = Far superior relative to my competitors). |

| Coop2 | Extent to which your company cooperates with its suppliers. | ||

| Coop3 | Degree to which your company cooperates with its competitors. | ||

| Coop4 | Extent to which your company cooperates with universities. | ||

| Coop5 | Extent to which your company cooperates with technology centers. | ||

| Coop6 | Extent to which your company cooperates with other types of institutions. | ||

| Association | Asoc1 | Yes, and actively participates. | Single election. |

| Asoc2 | Yes, but it does NOT actively participate. | ||

| Asoc3 | No. | ||

| Innovative performance | DI1 | Degree of novelty of our new products. | Likert scale (−3 = Far inferior relative to my competitors; +3 = Far superior relative to my competitors). |

| DI2 | Use of the latest technological innovations in the new products developed by my company. | ||

| DI3 | Speed of new product development. | ||

| DI4 | Number of new products introduced by my company in the market. | ||

| DI5 | Number of our new products that are new to the market (they are the first to be launched on the market). | ||

| DI6 | Level of technological competitiveness of my company. | ||

| DI7 | Speed with which the latest technological innovations are adopted in our processes. | ||

| DI8 | Degree to which the technology used in our processes is up to date or new. | ||

| DI9 | Pace of updating our processes, techniques, and technologies. | ||

| DI10 | In my company, the development of new distribution channels for products and services is an ongoing process. | Likert scale (−3 = Strongly disagree; +3 = Strongly agree). | |

| DI11 | In my company, customer suggestions or complaints are handled with urgency and attention. | ||

| DI12 | My company develops better marketing innovations than its competitors. | ||

| DI13 | My company constantly emphasizes and introduces management innovations. | ||

| Size | TM | Company size. | Number of employees as of 31 December 2020 |

| Age | ANT | Seniority of the company. | Years elapsed between the date of incorporation and fiscal year 2020 |

References

- Kijkasiwat, P.; Phuensane, P. Innovation and firm performance: The moderating and mediating roles of firm size and small and medium enterprise finance. J. Risk Financ. Manag. 2020, 13, 97. [Google Scholar] [CrossRef]

- Lee, D.S. Towards urban resilience through inter-city networks of co-invention: A case study of US cities. Sustainability 2018, 10, 289. [Google Scholar] [CrossRef]

- Gherghina, Ș.C.; Botezatu, M.A.; Hosszu, A.; Simionescu, L.N. Small and Medium-Sized Enterprises (SMEs): The Engine of Economic Growth through Investments and Innovation. Sustainability 2020, 12, 347. [Google Scholar] [CrossRef]

- Lee, R.; Lee, J.H.; Garrett, T.C. Synergy effects of innovation on firm performance. J. Bus. Res. 2019, 99, 507–515. [Google Scholar] [CrossRef]

- Ramadani, V.; Hisrich, R.D.; Abazi-Alili, H.; Dana, L.P.; Panthi, L.; Abazi-Bexheti, L. Product innovation and firm performance in transition economies: A multi-stage estimation approach. Technol. Forecast. Soc. Chang. 2019, 140, 271–280. [Google Scholar] [CrossRef]

- Lin, W.L.; Yip, N.; Ho, J.A.; Sambasivan, M. The adoption of technological innovations in a B2B context and its impact on firm performance: An ethical leadership perspective. Ind. Mark. Manag. 2020, 89, 61–71. [Google Scholar] [CrossRef]

- Klerkx, L.; Proctor, A. Beyond fragmentation and disconnect: Networks for knowledge exchange in the English land management advisory system. Land Use policy 2013, 30, 13–24. [Google Scholar] [CrossRef]

- Pyburn, R.; Woodhill, J. Dynamics of Rural Innovation—A Primer for Emerging Professionals, 1st ed.; LM Publishers: Arnhem, The Netherlands, 2014. [Google Scholar]

- Alexy, O.; George, G.; Salter, A.J. Cui bono? The selective revealing of knowledge and its implications for innovative activity. Acad. Manag. Rev. 2013, 38, 270–291. [Google Scholar] [CrossRef]

- Tranekjer, T.L.; Knudsen, M.P. The (unknown) providers to other firms’ new product development: What’s in it for them? J. Prod. Innov. Manag. 2012, 29, 986–999. [Google Scholar] [CrossRef]

- Wang, C.; Hu, Q. Knowledge sharing in supply chain networks: Effects of collaborative innovation activities and capability on innovation performance. Technovation 2020, 94, 102010. [Google Scholar] [CrossRef]

- Kim, N.; Shim, C. Social capital, knowledge sharing and innovation of small-and medium-sized enterprises in a tourism cluster. Int. J. Contemp. Hosp. Manag. 2018, 30, 2417–2437. [Google Scholar] [CrossRef]

- Le, P.B.; Lei, H. The effects of innovation speed and quality on differentiation and low-cost competitive advantage. Chin. Manag. Stud. 2018, 12, 305–322. [Google Scholar] [CrossRef]

- Chen, C.J.; Hsiao, Y.C.; Chu, M.A. Transfer mechanisms and knowledge transfer: The cooperative competency perspective. J. Bus. Res. 2014, 67, 2531–2541. [Google Scholar] [CrossRef]

- Wang, R.H.; Lv, Y.B.; Duan, M. Evolutionary game of inter-firm knowledge sharing in innovation cluster. Evol. Syst. 2017, 8, 121–133. [Google Scholar] [CrossRef]

- Porter, M.E. The Competitive Advantage of Nations, 1st ed.; The Free Press: New York, NY, USA, 1990. [Google Scholar]

- Dalziel, M. The impact of industry associations: Evidence from Statistics Canada data. Innovation 2006, 8, 296–306. [Google Scholar] [CrossRef]

- Howells, J. Intermediation and the role of intermediaries in innovation. Res. Policy 2006, 35, 715–728. [Google Scholar] [CrossRef]

- Mejía-Villa, A.; Tanco, J.A.A.; San Martín, E.S. Analysis of the Absorptive Capacity Process in Business Associations as Innovation Intermediaries; Workingpaper; University of Navarra: Navarra, Spain, 2017. [Google Scholar]

- De Groot, H.L.; Poot, J.; Smit, M.J. Agglomeration externalities, innovation and regional growth: Theoretical perspectives and meta-analysis. In Handbook of Regional Growth and Development Theories, 1st ed.; Capello, R., Nijkamp, P., Eds.; Edward Elgar: Cheltenham, UK, 2009; pp. 256–281. [Google Scholar] [CrossRef]

- Baldwin, C.; Von Hippel, E. Modeling a paradigm shift: From producer innovation to user and open collaborative innovation. Organ. Sci. 2011, 22, 1399–1417. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Parra-Requena, G.; Molina-morales, F.X.; García-Villaverde, P.M. The mediating effect of cognitive social capital on knowledge acquisition in clustered firms. Growth Chang. 2010, 41, 59–84. [Google Scholar] [CrossRef]

- Mejía-Villa, A.; Recalde, M.; Alfaro, J.A.; Gutierrez, E. Business associations as collaborative innovation communities: Development of a theoretical model. In Proceedings of the 23rd Innovation and Product Development Management Conference (IPDMC), Glasgow, UK, 12–14 June 2016; European Institute for Advanced Studies in Management (EIASM): Brussel, Belgium, 2016. [Google Scholar]

- Li, D.; Wei, Y.D.; Miao, C.; Wu, Y.; Xiao, W. Innovation, Network Capabilities, and Sustainable Development of Regional Economies in China. Sustainability 2019, 11, 4770. [Google Scholar] [CrossRef]

- Delgado, M.; Porter, M.E.; Stern, S. Clusters and entrepreneurship. J. Econ. Geogr. 2010, 10, 495–518. [Google Scholar] [CrossRef]

- Resbeut, M.; Gugler, P.; Charoen, D. Spatial agglomeration and specialization in emerging markets: Economic efficiency of clusters in Thai industries. Compet. Rev. Int. Bus. J. 2019, 29, 236–252. [Google Scholar] [CrossRef]

- Porter, M.E. Clusters and the new economics of competition. Harv. Bus. Rev. 1998, 76, 77–90. [Google Scholar]

- Asheim, B.T.; Isaksen, A. Regional innovation systems: The integration of local ‘sticky’and global ‘ubiquitous’ knowledge. J. Technol. Transf. 2002, 27, 77–86. [Google Scholar] [CrossRef]

- McCann, P.; Ortega-Argilés, R. Smart specialization, regional growth and applications to European Union cohesion policy. Reg. Stud. 2015, 49, 1291–1302. [Google Scholar] [CrossRef]

- Nonaka, I.; Konno, N. The concept of “ba”: Building a foundation for knowledge creation. Calif. Manag. Rev. 1998, 40, 40–54. [Google Scholar] [CrossRef]

- Chesbrough, H. Open Business Models: How to Thrive in the New Innovation Landscape, 1st ed.; Harvard Business Press: Boston, MA, USA, 2006. [Google Scholar]

- Becerra, M.; Lunnan, R.; Huemer, L. Trustworthiness, risk, and the transfer of tacit and explicit knowledge between alliance partners. J. Manag. Stud. 2008, 45, 691–713. [Google Scholar] [CrossRef]

- García-Peñalvo, F.J.; Colomo-Palacios, R.; Lytras, M.D. Informal learning in work environments: Training with the Social Web in the workplace. Behav. Inform. Technol. 2012, 31, 753–755. [Google Scholar] [CrossRef]

- Zheng, W. A social capital perspective of innovation from individuals to nations: Where is empirical literature directing us? Int. J. Manag. Rev. 2010, 12, 151–183. [Google Scholar] [CrossRef]

- Kiseleva, O.N.; Sysoeva, O.V.; Vasina, A.V.; Sysoev, V.V. Updating the Open Innovation Concept Based on Ecosystem Approach: Regional Aspects. J. Open Innov. Technol. Mark. Complex. 2022, 8, 103. [Google Scholar] [CrossRef]

- Sun, M.; Zhang, X.; Zhang, X. The Impact of a Multilevel Innovation Network and Government Support on Innovation Performance—An Empirical Study of the Chengdu–Chongqing City Cluster. Sustainability 2022, 14, 7334. [Google Scholar] [CrossRef]

- Krenz, P.; Basmer, S.; Buxbaum-Conradi, S.; Redlich, T.; Wulfsberg, J.P. Knowledge management in value creation networks: Establishing a new business model through the role of a knowledge-intermediary. Procedia CIRP 2014, 16, 38–43. [Google Scholar] [CrossRef]

- De Silva, M.; Howells, J.; Meyer, M. Innovation intermediaries and collaboration: Knowledge-based practices and internal value creation. Res. Policy 2018, 47, 70–87. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Hülsbeck, M.; Lehmann, E.E. Regional competitiveness, university spillovers, and entrepreneurial activity. Small Bus. Econ. 2012, 39, 587–601. [Google Scholar] [CrossRef]

- Icart, I.B.; Suρι, A.V. The Government of the Human Factor; Delta Publicaciones: Madrid, Spain, 2007. [Google Scholar]

- Oliva, F.; Couto, M.; Santos, R.; Bresciani, S. The integration between knowledge management and dynamic capabilities in agile organizations. Manag. Decis. 2019, 57, 1960–1979. [Google Scholar] [CrossRef]

- Matthyssens, P.; Pauwels, P.; Vandenbempt, K. Strategic flexibility, rigidity and barriers to the development of absorptive capacity in business markets: Themes and research perspectives. Ind. Mark. Manag. 2005, 34, 547–554. [Google Scholar] [CrossRef]

- Kekezi, O.; Klaesson, J. Agglomeration and innovation of knowledge intensive business services. Ind. Innov. 2020, 27, 538–561. [Google Scholar] [CrossRef]

- Boschma, R. Role of proximity in interaction and performance: Conceptual and empirical challenges. Reg. Stud. 2005, 39, 41–45. [Google Scholar] [CrossRef]

- Rodríguez-Rodríguez, G.; Ballesteros, H.M.; Martínez-Cabrera, H.; Vilela, R.; Pennino, M.G.; Bellido, J.M. On the Role of Perception: Understanding Stakeholders’ Collaboration in Natural Resources Management through the Evolutionary Theory of Innovation. Sustainability 2021, 13, 3564. [Google Scholar] [CrossRef]

- Omobhude, C.; Chen, S.-H. The Roles and Measurements of Proximity in Sustained Technology Development: A Literature Review. Sustainability 2019, 11, 224. [Google Scholar] [CrossRef]

- Alguezaui, S.; Filieri, R. Investigating the role of social capital in innovation: Sparse versus dense network. J. Knowl. Manag. 2010, 14, 891–909. [Google Scholar] [CrossRef]

- Waples, E.P.; Friedrich, T.L. Managing creative performance: Important strategies for leaders of creative efforts. Adv. Deve. Hum. Resour. 2011, 13, 366–385. [Google Scholar] [CrossRef]

- Parra-Requena, G.; Ruiz-Ortega, M.J.; Garcia-Villaverde, P.M. Social capital and effective innovation in industrial districts: Dual effect of absorptive capacity. Ind. Innov. 2013, 20, 157–179. [Google Scholar] [CrossRef]

- Juhász, S.; Lengyel, B. Creation and persistence of ties in cluster knowledge networks. J. Econ. Geogr. 2018, 18, 1203–1226. [Google Scholar] [CrossRef]

- Wang, B.; Sun, A.; Zheng, Q.; Wu, D. Spatial-temporal characteristics of green development cooperation network among belt and road initiative regions and countries. Sustainability 2021, 13, 11216. [Google Scholar] [CrossRef]

- Argote, L.; Ren, Y. Transactive memory systems: A microfoundation of dynamic capabilities. J. Manag. Stud. 2012, 49, 1375–1382. [Google Scholar] [CrossRef]

- Martín de Castro, G. Knowledge management and innovation in knowledge-based and high-tech industrial markets: The role of openness and absorptive capacity. Ind. Mark. Manag. 2015, 47, 143–146. [Google Scholar] [CrossRef]

- Clauss, T.; Kesting, T. How businesses should govern knowledge-intensive collaborations with universities: An empirical investigation of university professors. Ind. Mark. Manag. 2017, 62, 185–198. [Google Scholar] [CrossRef]

- Formichella, M. The evolution of the concept of innovation and its relationship with development. INTA 2005, 1, 1–46. [Google Scholar]

- McEvily, B.; Marcus, A. Embedded ties and the acquisition of competitive capabilities. Strateg. Manag. J. 2005, 26, 1033–1055. [Google Scholar] [CrossRef]

- Liu, N.; Wang, J.; Song, Y. Organization Mechanisms and Spatial Characteristics of Urban Collaborative Innovation Networks: A Case Study in Hangzhou, China. Sustainability 2019, 11, 5988. [Google Scholar] [CrossRef]

- Vivas, C.; Gil, A.B. Impact on firms of the use of knowledge external sources: A systematic review of the literature. J. Econ. Surv. 2015, 29, 943–964. [Google Scholar] [CrossRef]

- Fujita, M.; Krugman, P.R.; Venables, A. The Spatial Economy: Cities, Regions, and International Trade; MIT Press: Cambridge, MA, USA, 1999. [Google Scholar] [CrossRef]

- De Groot, H.L.; Poot, J.; Smit, M.J. Which agglomeration externalities matter most and why. J. Econ. Surv. 2016, 30, 756–782. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: Thousand Oaks, CA, USA, 2016. [Google Scholar] [CrossRef]

- Prajogo, D.I.; Ahmed, P.K. Relationships between innovation stimulus, innovation capacity, and innovation performance. RandD Manag. 2006, 36, 499–515. [Google Scholar] [CrossRef]

- Škerlavaj, M.; Song, J.H.; Lee, Y. Organizational learning culture, innovative culture and innovations in South Korean firms. Expert Syst. Appl. 2010, 37, 6390–6403. [Google Scholar] [CrossRef]

- McCann, B.T.; Folta, T.B. Location matters: Where we have been and where we might go in agglomeration research. J. Manag. 2008, 34, 532–565. [Google Scholar] [CrossRef]

- Kukalis, S. Agglomeration economies and firm performance: The case of industry clusters. J. Manag. 2010, 36, 453–481. [Google Scholar] [CrossRef]

- Díez-Vial, I. Geographical cluster and performance: The case of Iberian ham. Food Policy 2011, 36, 517–525. [Google Scholar] [CrossRef]

- Boix, R.; Trullén, J. Industrial districts, innovation and I-district effect: Territory or industrial specialization? Eur. Plan. Stud. 2010, 18, 1707–1729. [Google Scholar] [CrossRef]

- Marco-Lajara, B.; Claver-Cortés, E.; Úbeda-García, M.; Zaragoza-Sáez, P.D.C. Hotel performance and agglomeration of tourist districts. Reg. Stud. 2016, 50, 1016–1035. [Google Scholar] [CrossRef]

- Díaz-Díaz, N.L.; de Saá Pérez, P. The interaction between external and internal knowledge sources: An open innovation view. J. Knowl. Manag. 2014, 18, 430–446. [Google Scholar] [CrossRef]

- Marco-Lajara, B. The Cooperation between Companies in the Industrial Fabric of the Province of Alicante: An Analysis Based on the Model of Strategic Management. Ph.D. Dissertation, University of Alicante, Alicante, Spain, 2000. [Google Scholar]

- Aguilar-Olavés, G.; Herrera, L.; Clemenza, C. Absorptive capacity: Theoretical and empirical approaches for the service sector. Rev. Venez. Gerenc. 2014, 19, 499–518. [Google Scholar] [CrossRef][Green Version]

- González, C.H.; Hurtado, A.A. Influence of absorption capacity on innovation: An empirical analysis in Colombian SMES. Estudios Gerenc. 2014, 30, 277–286. [Google Scholar]

- Claver-Cortés, E.; Marco-Lajara, B.; Manresa-Marhuenda, E. Location in science-technology parks, dynamic capabilities and business innovation. Ind. Econ. 2015, 397, 59–71. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Pieper, T.M.; Ringle, C.M. The use of partial least squares structural equation modeling in strategic management research: A review of past practices and recommendations for future applications. Long Range Plan. 2012, 45, 320–340. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS 3. Bönningstedt: SmartPLS. 2015. Available online: http://www.smartpls.com (accessed on 1 January 2021).

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Castillo Apraiz, J.; Cepeda Carrión, G.; Roldán, J.L. Manual de Partial Least Squares Structural Equation Modeling (Pls-Sem), 1st ed.; OmniaScience Scholar: Madrid, Spain, 2019. [Google Scholar] [CrossRef]

- Roldán, J.L.; Cepeda, G. Variance-Based Structural Equation Models: Partial Least Squares (PLS) for Researchers in Social Sciences, 1st ed.; University of Seville: Seville, Spain, 2019. [Google Scholar]

- Martínez, M.A.; Fierro, E.M. Application of the PLS-SEM technique in knowledge management: A practical technical approach. RIDE. Ibero-Am. J. Educ. Res. Dev. 2018, 8, 130–164. [Google Scholar] [CrossRef]

- Henseler, J. Partial least squares path modeling: Quo vadis? Q. Quant. 2018, 52, 1–8. [Google Scholar] [CrossRef]

- Henseler, J.; Hubona, G.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. Ind. Manag. Data 2016, 116, 2–20. [Google Scholar] [CrossRef]

- Edwards, J.R. Multidimensional Constructs in Organizational Behavior Research: An Integrative Analytical Framework. Organ. Res. Methods 2001, 4, 144–192. [Google Scholar] [CrossRef]

- Van Riel, A.C.; Henseler, J.; Kemény, I.; Sasovova, Z. Estimating hierarchical constructs using consistent partial least squares. Ind. Manag. Data Syst. 2017, 117, 459–477. [Google Scholar] [CrossRef]

- Sarstedt, M.; Hair, J.F.; Ringle, C.M.; Thiele, K.O.; Gudergan, S.P. Estimation issues with PLS and CBSEM: Where the bias lies! J. Bus. Res. 2016, 69, 3998–4010. [Google Scholar] [CrossRef]

- Ringle, C.M.; Sarstedt, M.; Straub, D.W. Editor’s comments: A critical look at the use of PLS-SEM in “MIS Quarterly”. MIS Q. 2012, 36, 3–14. [Google Scholar] [CrossRef]

- Hu, L.T.; Bentler, P.M. Fit indices in covariance structure modeling: Sensitivity to underparameterized model misspecification. Psychol. Methods 1998, 3, 424. [Google Scholar] [CrossRef]

- Sarstedt, M.; Wilczynski, P.; Melewar, T.C. Measuring reputation in global markets—A comparison of reputation measures’ convergent and criterion validities. J. World Bus. 2013, 48, 329–339. [Google Scholar] [CrossRef]

- Chin, W.W. The partial least squares approach to structural equation modeling. Modern Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Hair, J.F.; Babin, B.J.; Anderson, R.E.; Black, W.C. Multivariate Data Analysis, 8th ed.; Cengage Learning: Hampshire, UK, 2019. [Google Scholar]

- Dijkstra, T.K.; Henseler, J. Consistent partial least squares path modeling. MIS Q. 2015, 39, 297–316. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Kline, R.B. Convergence of structural equation modeling and multilevel modeling. In The SAGE Handbook of Innovation in Social Research Methods, 1st ed.; Malcolm, W., Vogt, W.P., Eds.; SAGE Publications: Thousand Oaks, CA, USA, 2011; pp. 562–589. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Erlbaum: Hillsdale, NJ, USA, 1988. [Google Scholar]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Lazzarotti, V.; Bengtsson, L.; Manzini, R.; Pellegrini, L.; Rippa, P. Openness and innovation performance. Eur. J. Innov. Manag. 2017, 20, 463–492. [Google Scholar] [CrossRef]

- Prashant, K.; Harbir, S. Managing strategic alliances: What do we know now, and where do we go from here? Acad. Manag. Perspect. 2009, 23, 45–62. [Google Scholar] [CrossRef]

- Howell, A. Agglomeration, absorptive capacity and knowledge governance: Implications for public-private firm innovation in China. Reg. Stud. 2020, 54, 1069–1083. [Google Scholar] [CrossRef]

- Najafi-Tavani, S.; Najafi-Tavani, Z.; Naudé, P.; Oghazi, P.; Zeynaloo, E. How collaborative innovation networks affect new product performance: Product innovation capability, process innovation capability, and absorptive capacity. Ind. Mark. Manag. 2018, 73, 193–205. [Google Scholar] [CrossRef]

| Coefficient | Degree of Agglomeration of the Region | Number of Firms of the Sample | Percentage of the Sample |

|---|---|---|---|

| Employees | Higher than the national average | 114 companies | 57.87% |

| Lower than the national average | 83 companies | 42.13% | |

| Companies | Higher than the national average | 112 companies | 56.85% |

| Lower than the national average | 85 companies | 43.15% |

| Coefficient | Degree of Agglomeration of the Region | Percentage of the Population | Percentage of the Sample |

|---|---|---|---|

| Employees | Higher than the national average | 66.09% | 57.87% |

| Lower than the national average | 33.91% | 42.13% | |

| Companies | Higher than the national average | 66.62% | 56.85% |

| Lower than the national average | 33.38% | 43.15% |

| Mean | Min | Max | S.D. | |

|---|---|---|---|---|

| Cooperation | 4.396 | 1 | 7 | 1.726 |

| Association | 1.868 | 1 | 3 | 0.776 |

| I.P. | 4.809 | 1 | 7 | 1.590 |

| D.A.S. | 1.086 | 0.059 | 4.743 | 0.928 |

| Variables | Cronbach’s Alpha | Rho_A | Composite Reliability | Average Variance Extracted |

|---|---|---|---|---|

| Association | 1 indicator | 1 indicator | 1 indicator | 1 indicator |

| Cooperation | 0.885 | 0.885 | 0.913 | 0.638 |

| I.P. | 0.847 | 0.851 | 0.897 | 0.686 |

| External Loads (λ) | ||||

| Cooperation | Innovative Performance | |||

| COOP customers | 0.859 | |||

| COOP competitors | 0.787 | |||

| COOP Tech. centers | 0.713 | |||

| COOP others | 0.756 | |||

| COOP suppliers | 0.828 | |||

| COOP universities | 0.841 | |||

| I.P. management | 0.810 | |||

| I.P. marketing | 0.786 | |||

| I.P. process | 0.857 | |||

| I.P. product | 0.858 | |||

| Heterotrait–Monotrait Ratio (HTMT) | |||

|---|---|---|---|

| Association | Cooperation | I.P. | |

| Association | |||

| Cooperation | 0.631 | ||

| I.P. | 0.522 | 0.744 | |

| Structural Path | Coef. (β) | S.D. | p-Values | t0.005. 4999 | 99% C.I. | Results |

|---|---|---|---|---|---|---|

| D.A.S. -> Cooperation | 0.583 ** | 0.066 | 0.000 | 8.808 | [0.426–0.739] | |

| D.A.S. -> I.P. | 0.412 ** | 0.081 | 0.000 | 4.991 | [0.211–0.596] | H1 (+) ✓ |

| Association -> Cooperation | 0.199 ** | 0.076 | 0.006 | 2.640 | [0.017–0.363] | H2 (+) ✓ |

| Cooperation -> I.P. | 0.343 ** | 0.094 | 0.000 | 3.646 | [0.124–0.558] |

| Total Effect of D.A.S. on I.P. | Direct Effect of D.A.S. on I.P. | Indirect Effect of D.A.S. on I.P. | Results | ||||

|---|---|---|---|---|---|---|---|

| Coef. (β) | t0.005, 4999 | Coef. (β) | t0.005, 4999 | Estimate | t0.005, 4999 | C.I. 99% | |

| 0.612 ** | 14.241 | 0.412 ** | 4.991 | 0.200 | 3.028 | [0.067–0.371] | H3 (+) ✓ |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Marco-Lajara, B.; Sánchez-García, E.; Martínez-Falcó, J.; Poveda-Pareja, E. Regional Specialization, Competitive Pressure, and Cooperation: The Cocktail for Innovation. Energies 2022, 15, 5346. https://doi.org/10.3390/en15155346

Marco-Lajara B, Sánchez-García E, Martínez-Falcó J, Poveda-Pareja E. Regional Specialization, Competitive Pressure, and Cooperation: The Cocktail for Innovation. Energies. 2022; 15(15):5346. https://doi.org/10.3390/en15155346

Chicago/Turabian StyleMarco-Lajara, Bartolomé, Eduardo Sánchez-García, Javier Martínez-Falcó, and Esther Poveda-Pareja. 2022. "Regional Specialization, Competitive Pressure, and Cooperation: The Cocktail for Innovation" Energies 15, no. 15: 5346. https://doi.org/10.3390/en15155346

APA StyleMarco-Lajara, B., Sánchez-García, E., Martínez-Falcó, J., & Poveda-Pareja, E. (2022). Regional Specialization, Competitive Pressure, and Cooperation: The Cocktail for Innovation. Energies, 15(15), 5346. https://doi.org/10.3390/en15155346