Ultra-Cheap Renewable Energy as an Enabling Technology for Deep Industrial Decarbonization via Capture and Utilization of Process CO2 Emissions

Abstract

:1. Introduction

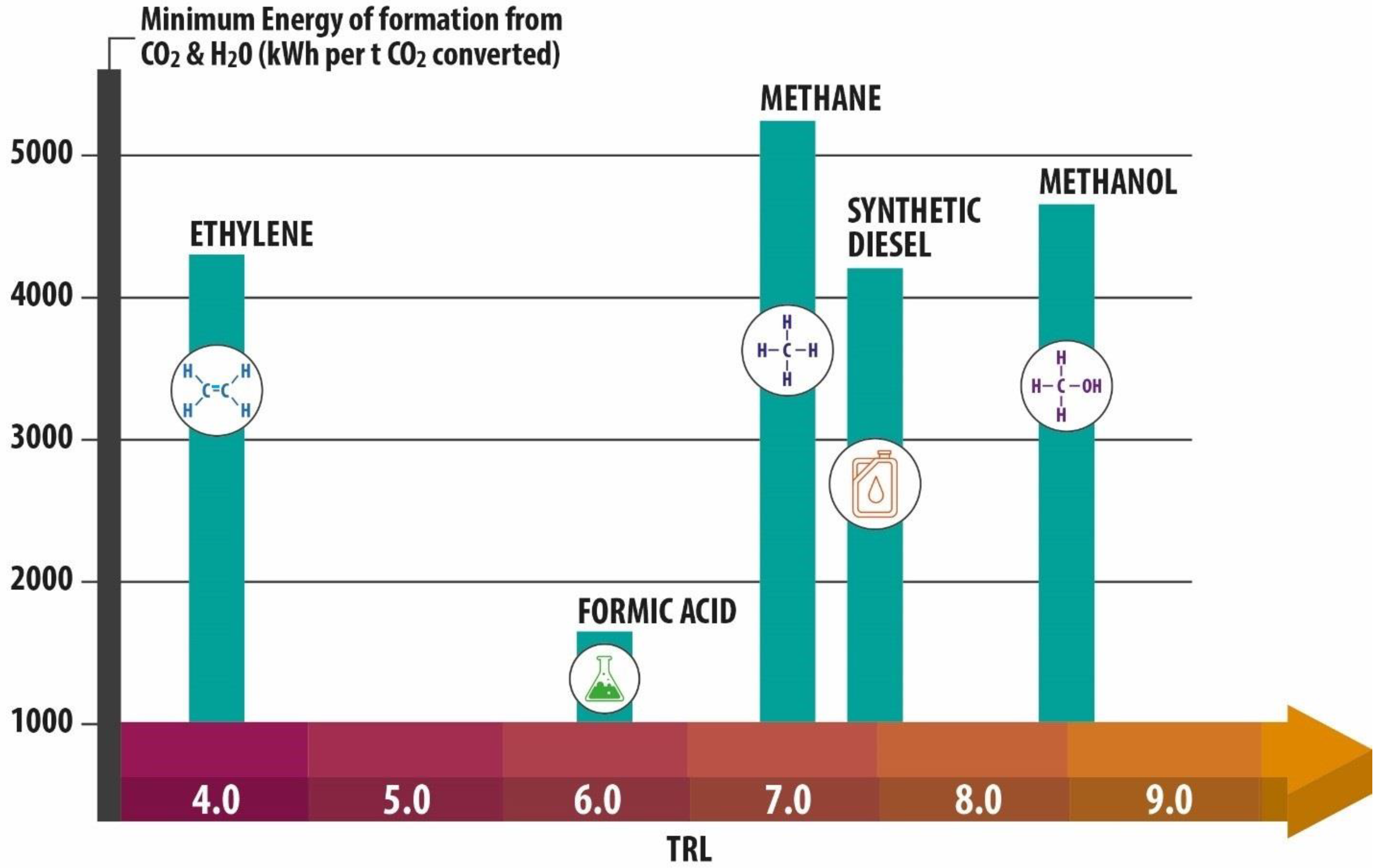

2. Capture and Industrial Utilization Pathways for Industrial CO2

| Chemical | Production Year | Mt of Product/Year | Ton CO2 Required/Ton of Product | CO2 Utilization Potential Mt CO2/Year |

|---|---|---|---|---|

| Urea | 2019 [31] | 180.9 | 0.735 | 132.9 |

| Methanol | 2020 [32] | 83.8 | 1.373 | 115 |

| Methane | 2017 | 1100–1500 | 2.75 | 3000–4000 |

| Calcium carbonate | 2020 [33] | 90 | 0.439 | 39.51 |

| Ethanol | 2018 | 80 | 1.911 | 152.8 |

| Sodium carbonate | 2018 | 62 | 0.415 | 25.73 |

| Dimethyl ether | 2020 [34] | 9 | 1.911 | 17.2 |

3. Carbon Capture and Utilization with Low-Cost Renewable Energy

3.1. Carbon Capture and Utilization

3.2. Determining Renewable Energy Cost

3.3. Levelized Cost of CO2 Capture and Methanol

4. Results and Discussion

4.1. Declining Cost of Renewable Methanol

4.2. Energy and Hydrogen Costs in the Circular Carbon Economy

4.3. Effect of Electrolyzer Efficiency, Cost and Stack Life, and Electrolyzer on Cost of Methanol Production

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Apostoleris, H.; Sgouridis, S.; Stefancich, M.; Chiesa, M. Utility solar prices will continue to drop all over the world even without subsidies. Nat. Energy 2019, 4, 833. [Google Scholar] [CrossRef] [Green Version]

- Climate Watch Historical GHG Emissions. 2021. Available online: https://www.climatewatchdata.org/ghg-emissions?breakBy=sector&end_year=2018&gases=co2§ors=industrial-processes%2Ctotal-including-lucf%2Cmanufacturing-construction%2Ctotal-excluding-lucf&source=CAIT&start_year=1990 (accessed on 27 March 2021).

- Industrial Process Emissions. Available online: https://www.wri.org/resources/data-visualizations/world-greenhouse-gas-emissions-2016 (accessed on 27 March 2021).

- Sgouridis, S.; Carbajales-Dale, M.; Csala, D.; Chiesa, M.; Bardi, U. Comparative net energy analysis of renewable electricity and carbon capture and storage. Nat. Energy 2019, 4, 456. [Google Scholar] [CrossRef] [Green Version]

- Gardarsdottir, S.O.; De Lena, E.; Romano, M.; Roussanaly, S.; Voldsund, M.; Perez-Calvo, J.-F.; Berstad, D.; Fu, C.; Anantharaman, R.; Sutter, D. Comparison of technologies for CO2 capture from cement production Part 2: Cost analysis. Energies 2019, 12, 542. [Google Scholar] [CrossRef] [Green Version]

- Roussanaly, S.; Fu, C.; Voldsund, M.; Anantharaman, R.; Spinelli, M.; Romano, M. Techno-economic Analysis of MEA CO2 Capture from a Cement Kiln–Impact of Steam Supply Scenario. Energy Procedia 2017, 114, 6229. [Google Scholar] [CrossRef] [Green Version]

- Krahé, M.; Heidug, W.; Ward, J.; Smale, R. From demonstration to deployment: An economic analysis of support policies for carbon capture and storage. Energy Policy 2013, 60, 753. [Google Scholar] [CrossRef]

- A Proposal to Scale Up Global Carbon Pricing. Available online: https://blogs.imf.org/2021/06/18/a-proposal-to-scale-up-global-carbon-pricing/ (accessed on 20 June 2021).

- Sgouridis, S.; Csala, D.; Bardi, U. The sower’s way: Quantifying the narrowing net-energy pathways to a global energy transition. Environ. Res. Lett. 2016, 11, 94009. [Google Scholar] [CrossRef] [Green Version]

- Aresta, M.; Dibenedetto, A.; Quaranta, E. State of the art and perspectives in catalytic processes for CO2 conversion into chemicals and fuels: The distinctive contribution of chemical catalysis and biotechnology. J. Catal. 2016, 343, 2–45. [Google Scholar] [CrossRef]

- Maynard, N.J.; Subramanian, V.R.K.; Hua, C.-Y.; Lo, S.-F. Industrial Symbiosis in Taiwan: Case Study on Linhai Industrial Park. Sustainability 2020, 12, 4564. [Google Scholar] [CrossRef]

- Arasto, A.; Tsupari, E.; Karki, J.; Pisila, E.; Sorsamaki, L. Post-combustion capture of CO2 at an integrated steel mill-Part I: Technical concept analysis. Int. J. Greenh. Gas Control 2013, 16, 271. [Google Scholar] [CrossRef]

- IEA. IEA Tracking Report-Cement; IEA: Paris, France, 2020.

- Naims, H. Economics of carbon dioxide capture and utilization—A supply and demand perspective. Environ. Sci. Pollut. Res. 2016, 23, 22226. [Google Scholar] [CrossRef] [Green Version]

- Bains, P.; Psarras, P.; Wilcox, J. CO2 capture from the industry sector. Prog. Energy Combust. Sci. 2017, 63, 146. [Google Scholar] [CrossRef]

- IEA. The Future of Hydrogen; IEA: Paris, France, 2019.

- Wilcox, J. Carbon Capture; Springer Science+Business Media, LLC: New York, USA, 2012. [Google Scholar]

- Van der Hoeven, M. CO2 emissions from fuel combustion-highlights 2014. In International Energy Agency; IEA: Paris, Franch, 2014. [Google Scholar]

- Andrew, R.M. Global CO2 emissions from cement production, 1928–2018. Earth Syst. Sci. Data 2019, 11, 1675. [Google Scholar] [CrossRef] [Green Version]

- Fischedick, L.P.; Roy, M.J.; Abdel-Aziz, A.; Acquaye, A.; Allwood, J.M.; Ceron, J.-P.; Geng, Y.; Kheshgi, H.; Lanza, A.; Perczyk, D.; et al. Sheinbaum, Contri Bution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Edenhofer, C., Santalla, E., Pichs-Madruga, B.K.O.R., Sokona, Y., Farahani, E., Kadner, S., Seyboth, K., Adler, A., Baum, I., Brunner, S., Eickemeier, P., Savolainen, K.T.J., Schlömer, S., von Stechow, C., Zwickel, T., Minx, J.C., Eds.; IPCC, 2014.

- Xu, Y.; Isom, L.; Hanna, M.A. Adding value to carbon dioxide from ethanol fermentations. Bioresour. Technol. 2010, 101, 3311. [Google Scholar] [CrossRef] [PubMed]

- World Ethanol Production Data. Available online: https://afdc.energy.gov/data/10331 (accessed on 12 April 2021).

- Van Straelen, J.; Geuzebroek, F.; Goodchild, N.; Protopapas, G.; Mahony, L. CO2 capture for refineries, a practical approach. Int. J. Greenh. Gas Control 2010, 4, 316. [Google Scholar] [CrossRef]

- IEA. IEA Tracking Report-Hydrogen; IEA: Paris, France, 2020.

- Sanchez, D.L.; Johnson, N.; McCoy, S.T.; Turner, P.A.; Mach, K.J. Near-term deployment of carbon capture and sequestration from biorefineries in the United States. Proc. Natl. Acad. Sci. USA 2018, 115, 4875. [Google Scholar] [CrossRef] [Green Version]

- Husebye, J.; Brunsvold, A.L.; Roussanaly, S.; Zhang, X. Techno Economic Evaluation of Amine based CO2 Capture: Impact of CO2 Concentration and Steam Supply. Energy Procedia 2012, 23, 381. [Google Scholar] [CrossRef] [Green Version]

- Berghout, N.; McCulloch, S. Putting CO2 to Use; International Energy Agency (IEA), 2019. [Google Scholar]

- Quadrelli, E.A.; Centi, G.; Duplan, J.-L.; Perathoner, S. Carbon Dioxide Recycling: Emerging Large-Scale Technologies with Industrial Potential. ChemSusChem 2011, 4, 1194. [Google Scholar] [CrossRef]

- Hepburn, C.; Adlen, E.; Beddington, J.; Carter, E.A.; Fuss, S.; Mac Dowell, N.; Minx, J.C.; Smith, P.; Williams, C.K. The technological and economic prospects for CO2 utilization and removal. Nature 2019, 575, 87. [Google Scholar] [CrossRef] [Green Version]

- Chauvy, R.; Meunier, N.; Thomas, D.; De Weireld, G. Selecting emerging CO2 utilization products for short- to mid-term deployment. Appl. Energy 2019, 236, 662. [Google Scholar] [CrossRef]

- Urea Market, Supplier, Risk and Competitive Intelligence. Available online: https://www.beroeinc.com/category-intelligence/urea-market/ (accessed on 25 October 2021).

- Methanol Market-Growth, Trends, and Forecast (2021–2026). Available online: https://www.mordorintelligence.com/industry-reports/methanol-market (accessed on 25 October 2021).

- Calcium Carbonate Market-Growth, Trends, COVID-19 Impact, and Forecasts (2021–2026). Available online: https://www.mordorintelligence.com/industry-reports/calcium-carbonate-market (accessed on 19 February 2021).

- DimethylEther Annual Production. Available online: https://aboutdme.org/FAQ (accessed on 19 February 2021).

- Bennett, S.J.; Schroeder, D.J.; McCoy, S. Towards a Framework for Discussing and Assessing CO2 Utilisation in a Climate Context. Energy Procedia 2014, 63, 7976. [Google Scholar] [CrossRef] [Green Version]

- Jarvis, S.M.; Samsatli, S. Technologies and infrastructures underpinning future CO2 value chains: A comprehensive review and comparative analysis. Sustain. Energy Rev. 2018, 85, 46. [Google Scholar] [CrossRef]

- Laribi, S.; Dubois, L.; De Weireld, G.; Thomas, D. Study of the post-combustion CO2 capture process by absorption-regeneration using amine solvents applied to cement plant flue gases with high CO2 contents. Int. J. Greenh. Gas Control 2019, 90, 102799. [Google Scholar] [CrossRef]

- Mokhtar, M.; Ali, M.T.; Khalilpour, R.; Abbas, A.; Shah, N.; Alhajaj, A.; Armstrong, P.; Chiesa, M.; Sgouridis, S. Solar-assisted Post-combustion Carbon Capture feasibility study. Appl. Energy 2012, 92, 668. [Google Scholar] [CrossRef]

- Pérez-Fortes, M.; Bocin-Dumitriu, A.; Tzimas, E. CO2 Utilization Pathways: Techno-Economic Assessment and Market Opportunities. Energy Procedia 2014, 63, 7968. [Google Scholar] [CrossRef]

- Anwar, M.; Fayyaz, A.; Sohail, N.; Khokhar, M.; Baqar, M.; Yasar, A.; Rasool, K.; Nazir, A.; Raja, M.; Rehan, M.; et al. CO2 utilization: Turning greenhouse gas into fuels and valuable products. J. Environ. Manag. 2020, 260. [Google Scholar] [CrossRef]

- Shih, C.F.; Zhang, T.; Li, J.; Bai, C. Powering the Future with Liquid Sunshine. Joule 2018, 2, 1925. [Google Scholar] [CrossRef] [Green Version]

- Van-Dal, E.S.; Bouallou, C. Design and simulation of a methanol production plant from CO2 hydrogenation. J. Clean. Prod. 2013, 57, 38. [Google Scholar] [CrossRef]

- Pérez-Fortes, M.; Schöneberger, J.C.; Boulamanti, A.; Tzimas, E. Methanol synthesis using captured CO2 as raw material: Techno-economic and environmental assessment. Appl. Energy 2016, 161, 718. [Google Scholar] [CrossRef]

- Shaner, M.R.; Atwater, H.A.; Lewis, N.S.; McFarland, E.W. A comparative technoeconomic analysis of renewable hydrogen production using solar energy. Energy Environ. Sci. 2016, 9, 2354–2371. [Google Scholar] [CrossRef] [Green Version]

- Proost, J. Critical assessment of the production scale required for fossil parity of green electrolytic hydrogen. Int. J. Hydrogen Energy 2020, 45, 17067–17075. [Google Scholar] [CrossRef]

- Gandhi, K.; Apostoleris, H.; Sgouridis, S. Catching the hydrogen train: Economics-driven green hydrogen adoption potential in the United Arab Emirates. Int. J. Hydrogen Energy 2022, 47, 22285. [Google Scholar] [CrossRef]

- Apostoleris, H.; Sgouridis, S.; Stefancich, M.; Chiesa, M. Evaluating the factors that led to low-priced solar electricity projects in the Middle East. Nat. Energy 2018, 3, 1109. [Google Scholar] [CrossRef]

- Apostoleris, H.; Al Ghaferi, A.; Chiesa, M. What is going on with Middle Eastern solar prices, and what does it mean for the rest of us? Prog. Photovolt. Res. Appl. 2021, 29, 638. [Google Scholar] [CrossRef]

- Widyolar, B.K.; Jiang, L.; Ferry, J.; Brinkley, J.; Bhusal, Y.; Winston, R. Nonimaging Optics: Efficient Design for Illumination and Solar Concentration XVI; Winston, R., Yablonovitch, E., Eds.; SPIE: San Diego, CA, USA, 2019; Volume 11120, p. 67. [Google Scholar] [CrossRef]

- NREL-Current Central Hydrogen Production from Polymer Electrolyte Membrane (PEM) Electrolysis (2019) Version 3.2018. Available online: https://www.nrel.gov/hydrogen/h2a-production-models.html (accessed on 29 March 2021).

- Methanol Price. Available online: https://www.methanol.org/methanol-price-supply-demand/ (accessed on 9 June 2021).

- Blumberg, T.; Tsatsaronis, G.; Morosuk, T. On the economics of methanol production from natural gas. Fuel 2019, 256, 115824. [Google Scholar] [CrossRef]

- Boulamanti, A.; Moya, J.A. Production costs of the chemical industry in the EU and other countries: Ammonia, methanol and light olefins. Renew. Sustain. Energy Rev. 2017, 68, 1205. [Google Scholar] [CrossRef]

- Blumberg, T.; Morosuk, T.; Tsatsaronis, G. A Comparative Exergoeconomic Evaluation of the Synthesis Routes for Methanol Production from Natural Gas. Appl. Sci. 2017, 7, 1213. [Google Scholar] [CrossRef] [Green Version]

- Kourkoumpas, D.; Papadimou, E.; Atsonios, K.; Karellas, S.; Grammelis, P.; Kakaras, E. Implementation of the Power to Methanol concept by using CO2 from lignite power plants: Techno-economic investigation. Int. J. Hydrogen Energy 2016, 41, 16674. [Google Scholar] [CrossRef]

- Saudi Arabia’s Second PV Tender Draws World Record Low Bid of $0.0104/kWh. Available online: https://www.pv-magazine.com/2021/04/08/saudi-arabias-second-pv-tender-draws-world-record-low-bid-of-0104-kwh/ (accessed on 19 April 2021).

- Carbon Recycling International. Available online: https://www.carbonrecycling.is/projects#project-goplant (accessed on 15 October 2020).

- Carbon Pricing. Available online: https://carbonpricingdashboard.worldbank.org/map_data (accessed on 30 March 2021).

- Norway Carbon Tax. Available online: https://bellona.org/news/ccs/2021-02-norway-proposes-e200-per-ton-co2-tax-by-2030 (accessed on 9 June 2021).

| IRR % | Clinker Production t/h | Capacity Factor | CO2 Captured (kg/ton of Clinker) | Economic Life Years |

|---|---|---|---|---|

| 8 | 120.65 | 0.9 | 761 | 25 |

| Total Plant Cost—Carbon Capture System—Capex (M USD) | 91.8 | |||

| Opex (M USD/year) | 41.5 | |||

| Variable Opex | Elect. consumption (kWhel/kg CO2 removed) | 0.144 | Electric cost (USD/MWh) | 70 |

| Therm. consumption (kWhth/kg CO2 removed) | 1.05 | Heat cost (USD/MWh) | 30 | |

| MEA make up (kg/kg CO2) | 0.001 | MEA solvent USD/t | 1740 | |

| NaOH solution for desulfurization (kg/kg CO2) | 0.001 | NaOH sol. USD/t desulfurization | 444 | |

| Process water make up (kg/kg CO2) | 0.473 | Process water cost USD/m3 | 8 | |

| Cooling water makeup (m3/year) | 1,670,995 | Cooling water cost USD/m3 | 0.468 | |

| Additional ammonia solution for NOx removal (kg/kg CO2) | 0.0002 | Ammonia solvent USD/t | 487.2 | |

| Fixed Opex | Annual labor + maintenance cost for carbon capture (M USD) | 4.45 | ||

| Annual insurance and location taxes (M USD) (the annual insurance and location taxes, including overhead and miscellaneous regulatory fees are set to 2% of Capex) | 1.83 | |||

| Fixed OPEX—Labor Charges | Total Plant Cost—Carbon Capture System—Capex (USD) | M USD | 91.8 | |

| Maintenance cost | (% of TPC) | 2.50% | ||

| Maintenance cost | M USD/year | 2.30 | ||

| Number of persons | Persons | 20 | ||

| Cost of labor | k USD/year per person | 72.48 | ||

| Operating labor | M USD/year | 1.44 | ||

| Maintenance labor | (% of Maintenance Cost) | 40% | ||

| Maintenance labor | M USD/year | 0.92 | ||

| Administrative and support labor | (% Oper. and maint labor) cost) | 30% | ||

| Administrative and support labor | M USD/year | 0.71 | ||

| Labor cost (operating labor + administrative labor) | M USD/year | 2.16 | ||

| Total cost = labor cost + maintenance cost | M USD/year | 4.45 | ||

| Annual Production kt MEOH/Year | Capacity Factor | Levelized Cost of Methanol (LCOM) (USD/Ton CH3OH Produced) | ||

|---|---|---|---|---|

| 440 | 0.9 | 1173 | ||

| H2 Required (tons/day) | CO2 Required (tons/day) | WACC/IRR | ||

| 239.89 | 1760 | 0.08 | ||

| Capex (M USD) | 264 | |||

| Opex (M USD/year) | 491.49 | |||

| Variable Opex | Electricity consumption (MWh/tMeOH) | 0.169 | Electricity cost (USD/MWh) | 70 |

| Heating requirement (MWh/t MeOH) | 0.439 | Heat cost (USD/MWh) | 30 | |

| Water consumption (t H2O/t MeOH) | 26.39 | Water cost (USD/ton) | 0.03 | |

| Catalyst consumption per year (kg) | 44,500 | Catalyst cost (USD/kg) | 95.24 | |

| Consumption CO2 (t/t MeOH) | 1.46 | CO2 (USD/ton) | 69.3 | |

| Consumption H2 (t/t MeOH) | 0.199 | Hydrogen cost (USD/ton) | 4776 | |

| Fixed Opex | Fixed annual cost (labor, etc.) (M USD) | 13.2 | ||

| Case | IRR | Pel (USD/MWh) | Ph (USD/MWh) | Scenario |

|---|---|---|---|---|

| 1 | 8 | 70 | 30 | Baseline |

| 2 | 8 | 52 | 18 | |

| 3 | 4 | 52 | 18 | Current |

| 4 | 4 | 30 | 10 | |

| 5 | 4 | 15 | 5 | Future |

| Average production rate | kg H2/day | 250,000 |

| Hours per stack life | h/life | 55,188 |

| Total system input power (peak) | MW | 653.281 |

| Total system cost | M SD | 272.8 |

| Discount rate | % | 4 |

| Operating capacity factor | % | 0.9 |

| Total system electrical usage | kWh/kg H2 | 55.5 |

| System efficiency | % | 60 |

| Total system cost | USD/kW | 460 |

| Case | CO2 Capture (USD/Ton) | H2 Cost (USD/Ton) | CH3OH Cost (USD/Ton) | Parameters (%, USD/MWh, USD/MWh) |

|---|---|---|---|---|

| 1 | 69.29 | 4776.16 | 1173.25 | r = 8, Pel = 70 Ph = 30 |

| 2 | 54.10 | 3743.08 | 937.17 | r = 8, Pel = 52 Ph = 18 |

| 3 | 50.33 | 3541.92 | 873.85 | r = 4, Pel = 52 Ph = 18 |

| 4 | 38.77 | 2295.38 | 601.67 | r = 4, Pel = 30 Ph = 10 |

| 5 | 31.36 | 1445.46 | 416.99 | r = 4, Pel = 15 Ph = 5 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Afif, M.B.; Afif, A.B.; Apostoleris, H.; Gandhi, K.; Dadlani, A.; Ghaferi, A.A.; Torgersen, J.; Chiesa, M. Ultra-Cheap Renewable Energy as an Enabling Technology for Deep Industrial Decarbonization via Capture and Utilization of Process CO2 Emissions. Energies 2022, 15, 5181. https://doi.org/10.3390/en15145181

Afif MB, Afif AB, Apostoleris H, Gandhi K, Dadlani A, Ghaferi AA, Torgersen J, Chiesa M. Ultra-Cheap Renewable Energy as an Enabling Technology for Deep Industrial Decarbonization via Capture and Utilization of Process CO2 Emissions. Energies. 2022; 15(14):5181. https://doi.org/10.3390/en15145181

Chicago/Turabian StyleAfif, Mohammed Bin, Abdulla Bin Afif, Harry Apostoleris, Krishiv Gandhi, Anup Dadlani, Amal Al Ghaferi, Jan Torgersen, and Matteo Chiesa. 2022. "Ultra-Cheap Renewable Energy as an Enabling Technology for Deep Industrial Decarbonization via Capture and Utilization of Process CO2 Emissions" Energies 15, no. 14: 5181. https://doi.org/10.3390/en15145181

APA StyleAfif, M. B., Afif, A. B., Apostoleris, H., Gandhi, K., Dadlani, A., Ghaferi, A. A., Torgersen, J., & Chiesa, M. (2022). Ultra-Cheap Renewable Energy as an Enabling Technology for Deep Industrial Decarbonization via Capture and Utilization of Process CO2 Emissions. Energies, 15(14), 5181. https://doi.org/10.3390/en15145181