3. Literature Review of M&A

A review of the literature on mergers and acquisitions should begin by stating that it is rich and varied. Many authors have attempted to answer the question not only of what M&A is and what is its role in shaping a modern and, at the same time, reactive strategic management system, but also to what extent it determines managerial decisions and, finally, in which direction companies are heading in order to secure their advantage in a turbulent and uncertain competitive environment. At this point, it is worth noting that M&A currently plays a crucial role in the process of capital consolidation, as the primary form of external financing, mainly within large companies, including energy companies [

2].

The development of energy companies, by assumption generating large operating costs and therefore requiring abundant financial resources, forces investors to look for appropriate solutions of a long-term nature, enabling them not only to obtain financing for the payment of current liabilities but also for long-term development. Among the mechanisms of long-term financing, the literature of economics and management sciences places merger and acquisition transactions on a key position, due to their ability to reorganize the organizational structure and resources and management efficiency [

3]. This is particularly evident in the era of increasing globalization, which affects the integration of markets, information flow and concentration of capital [

4].

A merger involves the establishment of a new capital company, in place of the previously separately functioning (usually competing) entities, in a procedure involving the transfer of the assets of all the merging companies, in exchange for shares (stocks) in the newly formed entity [

5]. Thus, the shares (stocks) in the previously existing entities are cancelled. The whole transaction is based on a contract concluded between the interested parties. As a result, the newly formed company is endowed not only with a legal standing (e.g., to incur liabilities), but also with the initial capital, which is the equivalent of the total assets of all participating companies. As a result, the merging entities lose their legal personality (in fact: they cease to exist), which, from a legal point of view, results in their deletion from the National Court Register, without conducting separate liquidation proceedings (cf. art. 493 The Polish Code of Commercial Companies). In their place, on the day of making an entry in the register appropriate for the registered office of the incorporated company, a new entity is created [

6].

Merger, of necessity, leads to a situation of reduction in the number of players in the market. This reduction can take place in two ways. The first of them, called consolidation (merger sensu stricto), leads to a situation where at least two entities are merged in such a way that both of them lose their property separation but also their legal subjectivity in favour of a new entity [

7].

The second way, called incorporation (merger sensu largo), involves the transfer of all assets from the acquired company to the acquiring company in exchange for shares (stocks), which the acquiring company then issues to the shareholders of the acquired company. In the process of incorporation, the acquired company generally ceases to exist [

8]. In the acquiring company, basically (there is a case when the acquiring company holds shares of the acquired company, in which case there is either no issue or even a decrease in the issue), there is a capital increase in the net asset value of the acquiring entity.

Acquisition is the process of transferring control between entities, which in practice usually manifests itself in the direct acquisition of such a number of shares (stocks) of a given company that allows itself to be controlled [

9]. Obviously, this is not the only form of acquisition, which may also occur through the purchase of assets, obtaining a power of attorney, privatization of an enterprise, a joint venture or also a lease with the right to exercise voting rights at the general meeting [

10]. In each case, however, with the exception of the purchase of property (assets), there is a transfer of control understood both as control over the economic activity of the acquiring company and control over the company itself, thanks to obtaining a majority position [

11]. In the case of asset acquisitions, on the other hand, there is only an acquisition of control over the business to the extent of the assets acquired. There is no acquisition of control over the ownership of the target company. The sold assets are converted into cash, which the existing shareholders (stockholders) can use for specific investment purposes [

12].

As part of the acquisition, the existing shareholders (stockholders) lose their independence in favour of capital control of the acquiring company. At the same time, it does not mean that the entity loses its legal personality. It also happens that the takeover precedes the actual “absorption” of the enterprise (it is, as it were, an initiating phase for it) to a closer merger process, which is incorporation [

13]. The acquisition may involve both the entire enterprise and its separated part or even selected assets (e.g., individual production lines).

What distinguishes an acquisition from an incorporation is that an incorporation (or more broadly: a merger) is more often a voluntary and uncoerced creation of a new entity (as there are cases of “unfriendly” acquisitions). Whereas a merger leads to the termination of the legal personality of at least one of the participating entities, an acquisition does not preclude the preservation of that personality, so that the acquired company may continue to operate (but under different management) [

14].

Finally, a merger is generally dealt with given the relatively similar economic strength of the entities, whereas an acquisition most often (although the reverse also happens) involves the acquisition of a smaller and weaker (economically) entity by a larger and stronger one. Naturally, given the complexity of business processes occurring in the modern world, the proposed division is in fact conventional [

15]. It is often difficult to determine whether a transaction was entered into voluntarily or under duress. As an example, consider the case of a proxy contest between groups of minority shareholders, in which if either group gains adequate representation, it can gain control [

16]. Still another case is the so-called won takeover, in which the initial resistance of the target company’s management, in the course of negotiations and mutual business concessions, is overcome and the takeover transaction is concluded [

17].

It is worth mentioning that the indicated methods of mergers are not interchangeable with each other (neither merger versus acquisition, nor acquisition versus merger)—they are separate models of strategic management, the implementation of which requires a thorough risk analysis and efficiency assessment so that they meet the hopes of the management of the participating enterprises [

18]. However, both methods have been basic forms of external development of enterprises for more than 100 years.

Moreover, due to the fact that these processes are mainly considered in the long-term perspective, their economic usefulness (profitability) should be assessed, taking into account an appropriate time horizon and the amount of work involved in carrying them out, as a thoroughly thought-out transaction is largely the basis for its success [

19].

The authors researching M&A transactions also include Walsh (1989), Catwright and Cooper (1993), Homberg and Osterloh (2010), Philips and Zhdanov (2013), Korpus (2014), Wójcik (2014), Helin, Zorde, Bernaziuk, Kowalski (2019) and Mariański (2021) [

13,

20,

21,

22,

23,

24,

25,

26].

Mergers and acquisitions can be horizontal or vertical but also conglomerate (unrelated diversification) or concentric (related diversification) [

27]. In the first case, there is a merger of companies from the same economic chain, most often to achieve economies of scale as a result of reduced competition or the need to increase market share [

28]. The second case concerns vertical mergers, in which the merging firms do not come from the same economic chain but conduct similar (sometimes complementary) business activities to each other. In this case, it is usually a matter of controlling the entire production process, hence the distinction between vertical upward acquisitions, where the merger takes place with an existing customer, and vertical downward acquisitions, where the merger takes place with an existing supplier. The third case concerns a conglomerate merger that brings together entities with a diversified business profile, and thus with a different product range or providing different services than the acquiring or merging company. This type of merger is aimed at diversifying business risk, increasing credit potential, and creating a multi-industry conglomerate with a diversified business profile. The last way—concentric mergers refer to the merging of companies related in terms of market, as well as technically or geographically related companies, offering similar products or providing similar services. The benefit for companies here is the ability to maximize profits from these activities and diversify potential operational risks [

29].

From the perspective of this study focused on the acquisitions made by PKN Orlen in recent years (the period 2018–2022 is the subject of consideration), this type of merger will find its greatest practical application, as the corporation has engaged in M&A transactions with other companies with the same business profile, competitively engaged in the same activity and focused on the acquisition and distribution of electricity and fossil fuels, i.e., Energa Group, Lotos Group and PGNiG Group.

4. Significance of Polish Energy Security in the Context of the Challenges of the 21st Century

One of the crucial challenges of the first half of the 21st century is the need to maintain a stable and uninterrupted source of energy supply. The main object of the state energy policy is to ensure a proper fuel and energy balance and an adequate level of production capacity [

30]. The climate and energy policy pursued for many years (aiming to reduce fossil fuels (the Paris Agreement in 2015 and COP26 concluded in Glasgow in 2021)), the coronavirus pandemic and the Russian-Ukrainian war enforce the rapid need for the European Union to become independent from Russian natural gas supplies and for the suspension of the certification of the Nord Stream 2 pipeline. Furthermore, the search for alternative sources of gas supplies from the U.S. and Qatar forces many countries to revise the direction of energy supply, which directly affects the maintenance of an optimal level of state security.

The common denominator linking all these factors is therefore the word “security”. Generally speaking, security means freedom from danger, uncertainty and fear (negative approach) and a sense of certainty, peace and independence (positive approach). A slightly more precise definition is provided by the UNESCO Dictionary of the Social Sciences, which defines security as actually identical to certainty (safety) and means the absence of physical threat (danger) or protection from it. These are, therefore, the circumstances that are not related to fear or a state of danger [

31]. The definition proposed by UNESCO has, in a sense, a general dimension, so the concept of “security” is rather interdisciplinary and utilitarian, conditioned by the subject of a specific diagnosis or case, becoming the basis for research of many scientific disciplines. However, regardless of the field in the context of which it is considered, it concerns such values as survival, integrity, independence and development. It has both subjective features—dependent on the social conviction of the absence of fear—and objective features—the ability to defend oneself, complemented by the aspect of maintaining a state of balance between threats (their nature and intensity) and the ability to counter them [

32].

In the economic aspect, energy security is treated as a public good for which the state authorities are responsible. They have the ability to regulate issues related to the production, distribution and supply of energy to various consumers in the country. Some of these tasks can be performed by the private sector; nevertheless, the implementation of energy policy objectives, which guarantees the security of energy supply, is ensured by the state [

33].

From the perspective of sustainable state management today, one of the basic pillars of security is energy security. In Poland, since the enactment of the Energy Law in April 1997, the key areas of energy management in the country have focused on the demonopolization of the energy sector, including its division into sectors and subsectors of energy generation (power plants), transmission, distribution and trade, the liberalization of the market (which has allowed for the coexistence of individual energy companies on a commercial basis) and comprehensive privatization of the energy sector, involving firstly the transformation of state-owned enterprises into sole shareholder companies of the State Treasury and then the sale of shares (stocks) to domestic or foreign investors.

According to art. 3 item. 16 of the Polish Energy Law, energy security is such a state of the economy which enables one to cover the perspective demand for fuel and energy in a technically and economically justified manner, while meeting environmental protection requirements. Although the statutory definition is contested in the literature due to the vague (and sometimes even contradictory from a practical point of view) notions of “in an economically justified manner” and “while meeting environmental protection requirements” contained therein, as well as the issue of determining the primacy of the energy security of the general public over the financial security of energy companies or meeting basic ecological—environmental needs [

34], in a certain general manner, it outlines this complex issue. Energy security is recognized as a crucial system that secures the uninterrupted flow and access date to energy sources (and thus is the basic link of the country’s critical infrastructure), and this in turn contributes to ensuring sustainable and uninterrupted development of the country [

33]. It is a part of the system of national security, because reliable, constant access date to energy sources, which at the same time is possible to obtain, at a cost that can be borne by society, is a relevant element of any modern economy. The adoption of such an assumption should lead to the construction of the system in such a way that the production capacity is adapted to the expectations of end users [

35]. The importance of energy security takes on additional special significance in the third decade of the 21st century due to the ever-increasing demand for energy, energy resources and fuels, with the need to reduce them in favour of renewable sources.

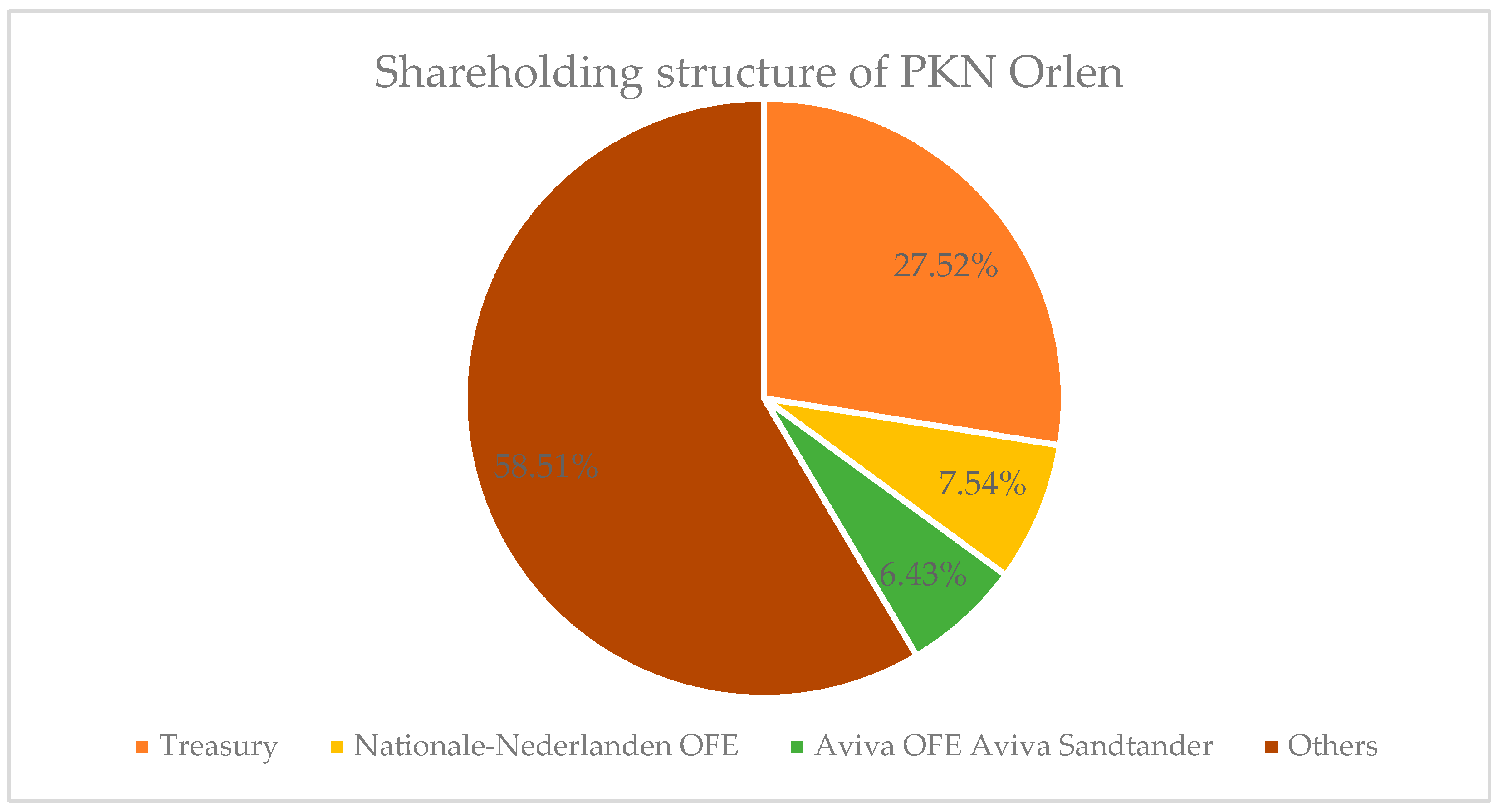

Due to their vital, state-owned nature, the largest Polish energy companies have a majority or significant level of participation of the State Treasury in their shareholding structure. Entities in which the State Treasury holds more than 50% of shares include: PGE (57.39%), Tauron Polska Energia (54.49%) and Enea (51.5%). The exception is Energa, whose majority shareholder is PKN Orlen. In turn, the State Treasury holds over 27% of shares in PKN Orlen. Such capital ties are definitely conducive to the creation of a multi-energy concern, as they are in line with current global trends. An example is the state-controlled Italian concern ENI, which is one of the leaders of the integrated oil and gas production system in the world.

Consolidation processes in the energy sector are not only associated with Polish PKN Orlen and Italian ENI, but, taking into account data from recent years, also Hungarian MOL, Norwegian Statoil (Circle K), Spanish Repsol, Portugese GalpEnergia, Austrian OMV or French Total [

36].

According to the Energy Regulatory Office (URE, Poland), the largest energy producers in Poland had more than half of the installed capacity and accounted for nearly two-thirds of the domestic electricity production [

37]. On this basis, it can be concluded that the energy sector in Poland is characterized by a high degree of concentration.

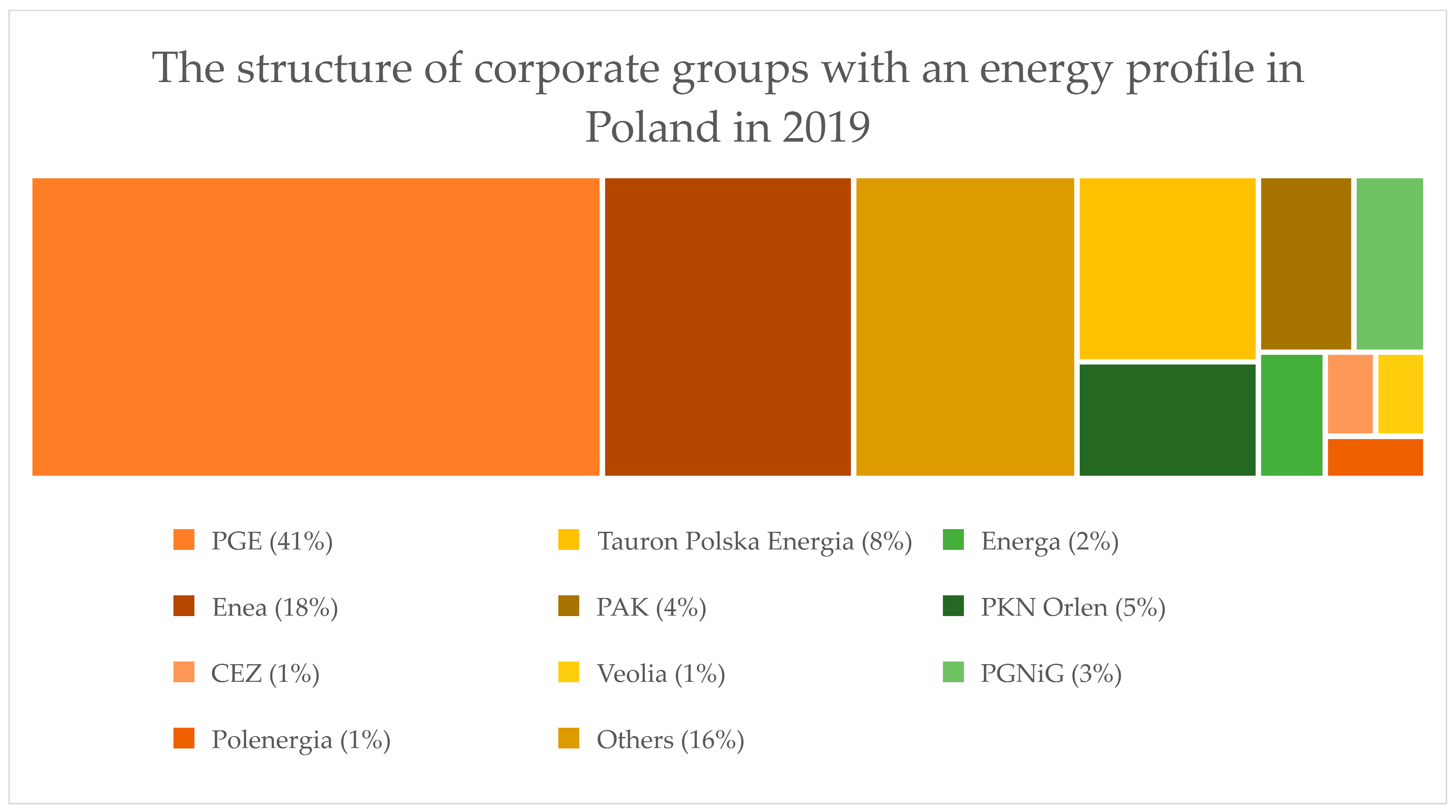

The largest entities in the energy market include: PGE (41%), Enea SA (18%), Tauron Polska Energia SA (8%) and Orlen Group (5%). A detailed analysis of the structure of this group in the volume of electricity fed into the grid in 2019 is illustrated in

Figure 1.

Energy security of a country is conditioned by the existence of many different factors. The most important are undoubtedly those of economic, political and technological nature connected with the process of acquisition and distribution of energy resources (including natural gas). In such an approach to the discussed issues, the assessment of international relations in Europe and in the world in terms of having an energy surplus (buffer) or even energy self-sufficiency comes to the forefront of considerations on the development of the energy sector in the 2020s. The particular character of this phenomenon can be seen in the changes that took place at the beginning of the 21st century. The U.S. ceased to be only an importer, but also thanks to the construction of the Świnoujście gas port and the increased share of liquefied natural gas supplies by sea (LNG), it became a key exporter for Poland [

39]. Apart from the U.S., Poland also benefits from supplies from Qatar. It is enough to mention that in 2020 only, PGNiG imported to Poland about 3.76 billion m

3 of liquefied natural gas, which in the perspective of 2019 means an increase by nearly 10% and corresponds to more than 25% of the volume of natural gas imports in general forms of distribution. The structure of electricity production in 2019–2021 is presented in

Table 1, respectively.

As can be seen from

Table 1, the largest share in the structure of electricity production in the analysed time frame is occupied by hard coal and lignite, whose share is slowly but steadily decreasing—from 52.30% in 2019 to 49.70% in 2021 for hard coal and from 25.90% in 2019 to 25.70% in 2021 for lignite. At the same time, we can see a slight increase in the share of photovoltaic power plants from 0.5% in 2019 to 2.90% in 2021. It seems that with time this trend will not only continue but will also intensify. In part, this will be due to new pro-ecological solutions, implementation of EU regulations, promotion of support programs for renewable energy sources or simply individual preferences of users.

According to the calculations of the Ministry of Energy, the forecast demand for electricity and net maximum capacity is increasing. Current estimates indicate that domestic demand for electricity will reach 200 TWh by 2030 and 230 TWh by 2040. At the same time, an increase in demand for peak capacity is indicated, which in 2025 will be approximately 27,963 TWh, whereas in 2040 it will rise by nearly 10,000 TWh to 34,535 TWh. Data on the structure of electricity production in Poland indicate that 161.1 TWh were produced in 2021, of which 136.5 TWh came from conventional power and 24.6 TWh from renewable energy sources [

41].

Table 2 shows the range of renewable generation capacity and net peak annual capacity demand in Poland over the 2020–2040 timeframe.

According to calculations, domestic electricity demand will be 181 TWh in 2030 (representing an increase of approximately 13.26% relative to 2020) and 204 TWh in 2040 (representing an increase of approximately 27.70% relative to 2020). At the same time, peak capacity demand will be around 28 GW in 2030 and over 31 in 2040 (an increase of approximately 13.06% and 27.75%, respectively, relative to 2020).

Table 3 presents the renewable energy generation capacity in Poland.

According to the data presented in

Table 3, there was a significant share of wind energy (6790.7 MW) and photovoltaic energy (5970.8 MW) among renewable energy sources in Poland. The share of other sources is noticeably lower, which does not mean that it is negligible because it still contributes to increasing the share of renewable energy in the overall energy production structure in Poland.

Figure 2 presents the structure of electricity production in Poland in 2019–2021.

The analysis of the above graph shows that Poland is still not sufficiently independent from fossil fuels, mainly with regard to hard coal and lignite. Electricity production is still based mostly (over 70%) on these raw materials. According to the analyses of the National Energy and Climate Plan for 2021–2030, Poland is in 7th place among the European Union countries with the highest percentage of delay in implementation of coal transformation programs. Of necessity, this state of affairs leads to negative consequences, not only environmental but also financial, because Poland, as a member of the European community, is obliged to respect the EU community regulations. Hence, among the targets set in this medium-term perspective are a 7% reduction in greenhouse gas emissions from sectors not covered by the European Emissions Trading Scheme (EU ETS) compared to 2005 levels, a 21–23% share of renewable energy sources in gross final energy consumption, a 14% increase in transport, a 32% increase in energy technology and a 28.4% increase in heating and cooling from renewable energy sources and a reduction of about 60% of the share of coal in electricity production (question no. 2).

This direction of development of the energy sector seems to be fully justified. In Europe (which is also presented in

Figure 1), there is still quite a big dependence on gas supplies (mainly from Russia), and it uses its dominant position for instrumental realization of political goals. One such political-economic dependency is the promotion of the construction by an international consortium consisting of Russian Gazprom, German BASF-Wintershall and Uniper, French Engie, Austrian OMV and the British-Dutch Royal Dutch Shell of the Nord Stream II gas pipeline from Russia to Germany, bypassing Ukraine and Poland, whose certification was halted as a result of Russia’s aggression against Ukraine in 2022. It is therefore not surprising to conclude that currently all countries, and not only Poland or other countries from the region of Central and Eastern Europe, oppose its launch. The goals that the Russian Federation uses to varying degrees and extents touch not only on economic but above all on political issues. This problem seems to be particularly noticeable at the moment and especially true since 2014, which is when Russia annexed Ukrainian Crimea, and certainly since 2022, which is when the Russian Federation declared war on Ukraine on 24 February 2022.

In the face of these challenges, alternative programs are gaining particular significance. One of them is the infrastructural project Baltic Pipe, i.e., the construction of a new gas pipeline implemented through the territories of Norway, Denmark and Poland with a declared gas capacity of 10 billion m

3 tons per year, which is scheduled to be put into operation in the last quarter of 2022 (1 October 2022 to be precise) [

45]. The project extends from the North Sea, from the connection with the Europipe II pipeline, to Poland and then to the neighbouring countries in Central and Eastern Europe. The Baltic Pipe project is implemented in close cooperation between the transmission system operators—Polish Gaz-System and Danish Energinet and consists of a gas pipeline located on the seabed of the North Sea and the Baltic Sea and through the expansion of the Danish and Polish transmission systems and compressor stations in Denmark.

Therefore, taking the whole issue into account, there is no doubt that energy security is influenced not only by economic and technological factors, related to the price and ways (and therefore costs) of obtaining raw materials, but also by political dependence, on the one hand on the Russian dictate, and on the other on the appropriate and balanced policy aimed at building long-term international and intercontinental alliances supported by adequate strategic planning and setting the framework for energy policy for many years ahead. From an external perspective, this is conducted in cooperation with the European Union but also the Visegrad Group and the OECD. Finally, it should be mentioned that the internal perspective will include various types of long-term government plans or policies (e.g., “Energy Policy of Poland until 2040”) implemented to comply not only with EU regulations but also to reduce the negative environmental impact of using non-renewable sources.

5. Motives for Mergers and Acquisitions in the Energy Sector

All business transactions, especially those that are long-term and costly in nature, such as mergers and acquisitions, require a prior profitability analysis [

46]. This analysis can be based both on the assessment of financial, legal, and organizational risks (e.g., as part of due diligence) but also by delineating the overall directional framework and motives of stakeholders interested in this form of external financing. This is essential due to the fact that an improperly executed transaction may lead to a decrease rather than an increase in the value of the company [

47].

Through capital concentration in the energy sector, so closely related to security and management of critical infrastructure, the state and energy companies pursue a strategy of ensuring energy security [

48]. The practical and at the same time measurable effect of this process are mergers and acquisitions, which allow for the increase in the share of the State Treasury in energy companies, and thus also for the control of this part of the economy, regardless of the influence of private entities.

The M&A literature distinguishes different categories of motives classified from the subjective perspective, depending on the starting position of the investor (buyer, seller) and from the objective perspective (i.e., from the point of view of the answer to the question: what is the substantive rationale for the merger?), which can be classified into: strategic, financial, operational and managerial motives [

49]. A catalogue of exemplary motives that may constitute the basis for decision making in mergers and acquisitions on the example of a multi-energy concern PKN Orlen has been highlighted in

Table 4.

One of the most important reasons for mergers and acquisitions is the opportunity for companies to achieve positive synergies. Synergy is the phenomenon of two or more entities working together in such a way that together they can achieve a greater benefit than if the entities performed the activity separately. In the literature, it is often figuratively assumed that the synergy effect corresponds to the inequality 2 + 2 > 4. Interdependence understood in this way means the positive synergy effect that arises from a successful merger transaction. The resulting added value, if it exceeds the acquisition costs, generates an increase in market value for the acquiring company [

7]. A similar goal can be found in energy companies, which due to the high operating costs (e.g., associated with the maintenance of infrastructure, research and development funds or even the need to comply with increasingly stringent European standards for quality standards) are often forced to seek (still expensive) forms of external financing, which in the long term contribute to improved efficiency of management, diversification and, consequently, financial condition (question no. 3).

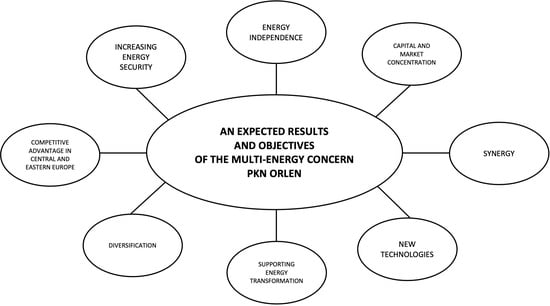

Figure 3 presents a catalogue of the most important motivations driving both financial and strategic investors to pursue mergers and acquisitions.

Analysing

Figure 3, it can be observed that in many aspects, financial as well as strategic investors express a similar position and evaluation. Among the most popular motives for M&A are: the potential for growth, the possibility of achieving the expected return on investment, cost savings or considerable efficiency improvements as well as achieving synergy effect. At the same time, both groups of investors are less interested in factors related to the expected risk discount or additional offers from other investors or market pressure or other internal factors on the side of the buyer [

14].

It should be added that in making M&A decisions, each company should make an appropriate needs analysis for determining the direction and purpose of the transaction to be carried out [

51]. In energy companies, undoubtedly important for the cost balance are technical issues, related to technological advance, supply chain management or ways of energy transmission to end users, maintenance of control and transmission equipment and also issues of implementation of modern energy security solutions, such as expensive CO

2 sequestration technology.

6. Major M&A Transactions in Poland in the Energy Sector in 2018–2022 Based on the Example of PKN Orlen Transactions

Beginning a detailed consideration of the structure of the energy sector in Poland, it is necessary to mention four basic entities, the so-called “big four”—Polska Grupa Energetyczna, Tauron, Energa and Enea [

52]. The vast majority of their generating capacity is based on coal. However, a trend of increasing resources in investments in low- and zero-emission sources can be observed for several years. Until recently, their total share in the national electricity generation system was about 70%, and their revenues in 2019 exceeded 83 billion PLN and were 23% higher than in 2018 [

53]. The activity of these companies is focused on business segments related to energy generation and transmission, distribution and retail sales. It is worth mentioning that according to the calculations, energy companies are among the top Polish brands with the highest estimated value.

Table 5 presents a list of the ten most valuable (with the highest estimated value in billion PLN) Polish brands in 2021.

According to the data presented in

Table 5, of the ten most valuable brands in Poland in 2021, as many as half were related to the energy sector. The list also included KGHM, whose main business is the mining industry, related to the energy sector. However, the most valuable Polish brand in the analysed year was PKN Orlen, whose estimated brand value in that year amounted to about PLN 9.87 billion.

PKN Orlen is a leading, international Polish energy company, which has been developing intensively in recent years, as evidenced by the merger and acquisition processes conducted by the company. This applies both to the transaction concluded between PKN Orlen, Lotos Group and PGNiG but also the earlier acquisition of one of the largest electricity distributors in Poland—Energa.

Energa is a capital group established in 2006. It produces and sells electricity, but its portfolio also includes trading in thermal energy and natural gas. Energa SA is both a leading energy company and one of the largest electricity suppliers in Poland. Currently, after PKN ORLEN S.A. took over 80.01% shares in its share capital, the group’s core business is focused on generation, distribution and trade in electricity and heat energy. From the perspective of building a modern multi-energy concern focused on increasing its share in renewable energy production in a long-term perspective, Energa has the largest share of RES in energy production among all Polish energy groups (over 40%). The generation capacity includes a system power plant in Ostrołęka, 2 heat and power plants, 47 hydroelectric power plants, a pumped hydroelectric energy storage in Żydów and 5 wind farms and 2 photovoltaic farms. Energa’s distribution network currently covers about a quarter of the country [

44].

Figure 4 presents the electricity market after the Energa acquisition by Orlen.

Figure 4 proves that the merger of PKN and Orlen Group affected both the sales of electricity to end users and the level of power generation. Therefore, it should be assumed that the merger between these companies strengthened the whole energy concern, which should be regarded as a positive result of the capital concentration, as its main objective is to gain competitive advantage through diversification of revenue sources, which not only allows building additional value for customers but above all serves to create an appropriate level of the company’s resistance to market fluctuations, including threats arising from economic uncertainty of events on European and global markets.

PKN Orlen’s power generation segment has seen a significant increase in critical financial parameters in the 2019–2021 period.

Table 6 presents their most important summary.

As shown above, PKN Orlen’s sales, external sales and inter-segment sales, operating expenses and other operating income and expenses have increased sharply over the period 2019–2021. EBITDA increased from PLN 1563 million in 2019 to PLN 3674 million in 2021. There was also an increase in fixed assets from PLN 318 million in 2019 to PLN 2640 million in 2021. Undoubtedly, these figures were influenced by PKN Orlen’s acquisition of the energy company Energa (profit from the bargain purchase of 80% of Energa Group shares amounted to PLN 4062 million). The presented financial data demonstrate the effectiveness of the merger procedure, reinforced by the expected business synergies in the key segments, i.e., energy and petrochemicals, as well as in production, distribution and retail sales.

The Lotos Group and the PGNiG Group are groups of energy sector entities comprising in their organisational structures production, trade and service companies operating in the field of exploration, production and processing of crude oil and distribution of petroleum products, mainly fuels, oils and paraffins. Both capital groups play a key role in the Polish energy market, being directly responsible for maintaining the country’s energy security.

PGNiG ensures diversification of supplies through production from domestic fields and imports from external sources, while being the largest importer and supplier of gas in Poland, which is supplied via the extensive network of the transmission system and the LNG terminal in Świnoujście. Through distribution networks, gas is distributed to end customers. The national gas system is supplemented by gas storage facilities, which are used to cover seasonal and daily shortages of gaseous fuel. Part of the Lotos Group structure is one of the largest crude oil refineries in terms of processing (approximately 10.5 million tonnes per year), located in Gdansk [

57].

The acquisition of Energa by PKN Orlen is part of a multi-stage, multi-year strategy to build a multi-energy company which will help build national energy security. It is worth remembering that despite the fact that the transaction itself was finalised in a short period of time, both companies face many organisational and integration tasks, the implementation of which additionally requires a thorough economic and legal analysis. Nevertheless, this combination has a direct impact on increasing investment potential, e.g., through investments in renewable energy sources. Energa is the owner of many onshore wind farms, water farms and photovoltaic farms) or electro-mobility. From a purely economic point of view, the merger enables PKN Orlen to utilize its production surpluses, which will allow it to reduce operating costs associated with energy trading. On the other hand, integration of the customer base of the two companies will expand the potential for selling additional products and services, especially in the retail segment, which will also help create additional value for customers and shareholders.

Another significant M&A transaction on the Polish energy market in recent years is the continued merger of PKN Orlen, the state-owned fuel market giant, with Lotos and PGNiG. This process began in 2018 with the signing of a letter of intent with the State Treasury holding 53.19% in Lotos at the General Meeting of Shareholders. In July 2020, the European Commission gave conditional approval for the acquisition of Lotos Group (after fulfilling criteria arising from the implementation of so-called remedies, before the formal merger process), whereas in August this year PKN Orlen signed an agreement with the State Treasury and Lotos Group to implement the acquisition, and consequently to take control over it. In May 2021, PKN Orlen, Lotos Group and the Ministry of State Assets signed another agreement on the structure of the concern, the formula of which is based on the participation of three companies: PKN Orlen, Lotos and PGNiG. In order to implement the European Commission’s demands, in January 2022, PKN Orlen’s management board decided to conditionally sell 417 Lotos petrol stations to the Hungarian company MOL and 30% of shares in the Gdańsk refinery to Saudi Aramco [

58].

In March 2022, the Polish Office of Competition and Consumer Protection (Urząd Ochrony Konkurencji i Konsumentów) issued a positive decision regarding the merger of PGNiG and PKN Orlen under the condition of the implementation of a remedy in the form of a commitment to divest control over the subsidiary Gas Storage Poland (GSP) to an independent investor within 12 months from the merger date. At the same time, PGNiG and PKN Orlen undertook to conclude, for a period of at least 10 years, an agreement entrusting GSP or its legal successor with the duties of a gas fuel storage system operator owned by the entity created as a result of the merger between PGNiG and PKN Orlen [

59].

Figure 5 indicates the shareholder structure of PKN Orlen in 2022.

This merger is one of the largest undertakings to have been carried out in Central and Eastern Europe in recent years. At the same time, the transaction reflects the need to build a multi-level, multi-energy company. Its role is not limited solely to build a stable energy base for Poland but also for the neighbouring countries, i.e., the Baltic states—Lithuania, Latvia and Estonia—as well as the Czech Republic and Slovakia and in terms of its scope, the establishment of the concern will contribute to the creation of an international energy entity capable of operating in the fuel, mining and electricity sectors.

In order to present economic information from the period before the finalization of the merger transaction with Lotos Group, it is reasonable to analyse the consolidated financial statements of PKN Orlen Group.

Table 7 presents a summary of the most important economic parameters of PKN Orlen in 2018–2021 in PLN.

As can be seen from the data presented in

Table 7, in the years under review, PKN Orlen recorded net sales revenues in excess of PLN 100 billion (except in 2020 when PLN 86 billion was recorded). At the same time, in 2021 there was a significant increase in the most significant economic parameters of the company, starting from PLN 131 billion of net sales revenues, through a clear increase in operating profits and gross profit exceeding PLN 12 billion. At the same time, the level of EBITDA, i.e., the profit generated by PKN Orlen, excluding depreciation, interest on interest-bearing liabilities and income tax, amounted to over PLN 18 billion, which means an almost twofold increase in the value of this parameter in relation to the recognition resulting from previous years. From a stakeholder perspective, the company recorded a net profit in each of the years, with the highest value recorded in 2021. This represents a marked improvement over the previous year (mainly marked by economic uncertainty caused by the coronavirus pandemic), which directly affects the financial health of the entire company.

The merger of PKN Orlen with Lotos Group, which does not have an extensive petrochemical business, is a sign of diversification of revenue sources and, from the perspective of the volatile geopolitical environment, seems fully justified because it provides an opportunity for the long-term operation of the entire entity in the market. Such decision seems to be dictated also by economic factors. The U.S. is becoming an increasingly powerful exporter of oil and natural gas, the European Union is introducing increasingly restrictive climate and environmental regulations and a potential reduction in margins, given the high level of volatility, may lead to a risk of loss of liquidity and ultimately bankruptcy. From this point of view, consolidation of the sector to create a multi-energy conglomerate reduces this risk.

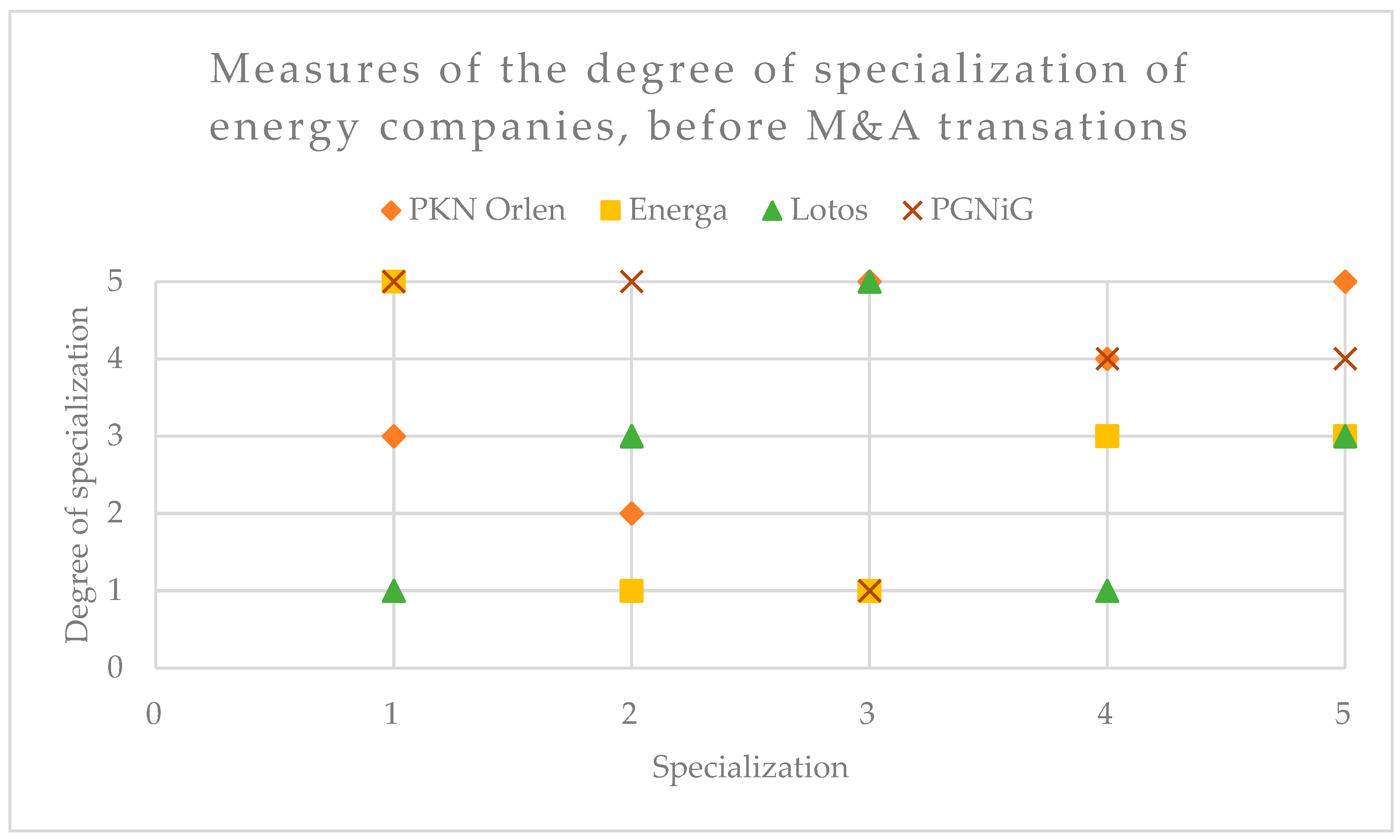

An assessment of the capital concentration of the multi-energy concern PKN Orlen can be made by taking into account the main areas of activity of the individual companies to be included in it. This is an assessment of the asset portfolio (after taking into account all completed and planned acquisitions). The analysis should begin with a statement that each of the merged companies specializes in its own energy segments, which, taking into account the activity of the main entity within the multi-energy concern, i.e., PKN Orlen, may contribute to its diversification and integration, which is also an important premise for the merger.

In order to standardize the results of the measurement, a scale from 1 to 5 was applied, which indicates the degree of professionalization of the company in a given energy segment. The higher the degree, the greater the degree of specialization of a given energy company, and the greater the ability to split (after merger) the organizational and technical structure of a multi-energy concern. The individual degrees were assigned on the basis of the assessment of the scope of activity and professionalization of the energy segments of the surveyed companies, both taking into account the descriptions declared in periodic reports and financial statements, in recent years.

Table 8 presents a summary of the degree of diversification and specialisation of the multi-energy concern PKN Orlen.

Taking into account the highest (specialisation) values of individual companies that are part of the merger procedure, one should note a significant strengthening of the multi-energy concern. Each company specialises in a particular segment of the energy business (some of them intersect and all of them complement each other)—Energa and PGNiG in electricity distribution, PGNiG in crude oil extraction and distribution, PKN Orlen (before the merger) in refining and petrochemicals (also Lotos) and in retail sales. Due to the conditions of the Polish energy sector, only recently have the surveyed companies also focused on the intensive development of renewable energy, e.g., Energa. The distribution of specialisations of the surveyed companies, taking into account the adopted scale, is illustrated in

Figure 6.

As can be deduced from the analysis of

Figure 6, the distribution of specialization of the studied energy companies is non-standard. This is due to the adoption of the thesis that each of the enterprises included in the multi-energy concern has its own range of specialization (electricity distribution, oil and gas extraction and distribution, refining and petrochemicals, renewable energy and retail sales). Some of these specialisations overlap between the companies, e.g., in the area of electricity distribution, the highest value is achieved by Energa and PGNiG. It can be seen that the combination of the specialization of individual companies will provide a strong diversification and integration base for the multi-energy concern (one concern will combine the specializations of individual energy companies that are part of it). Such a solution results from the idea of capital concentration, which in turn leads to the creation of a diversified entity capable of competing on the international (mainly European) market.

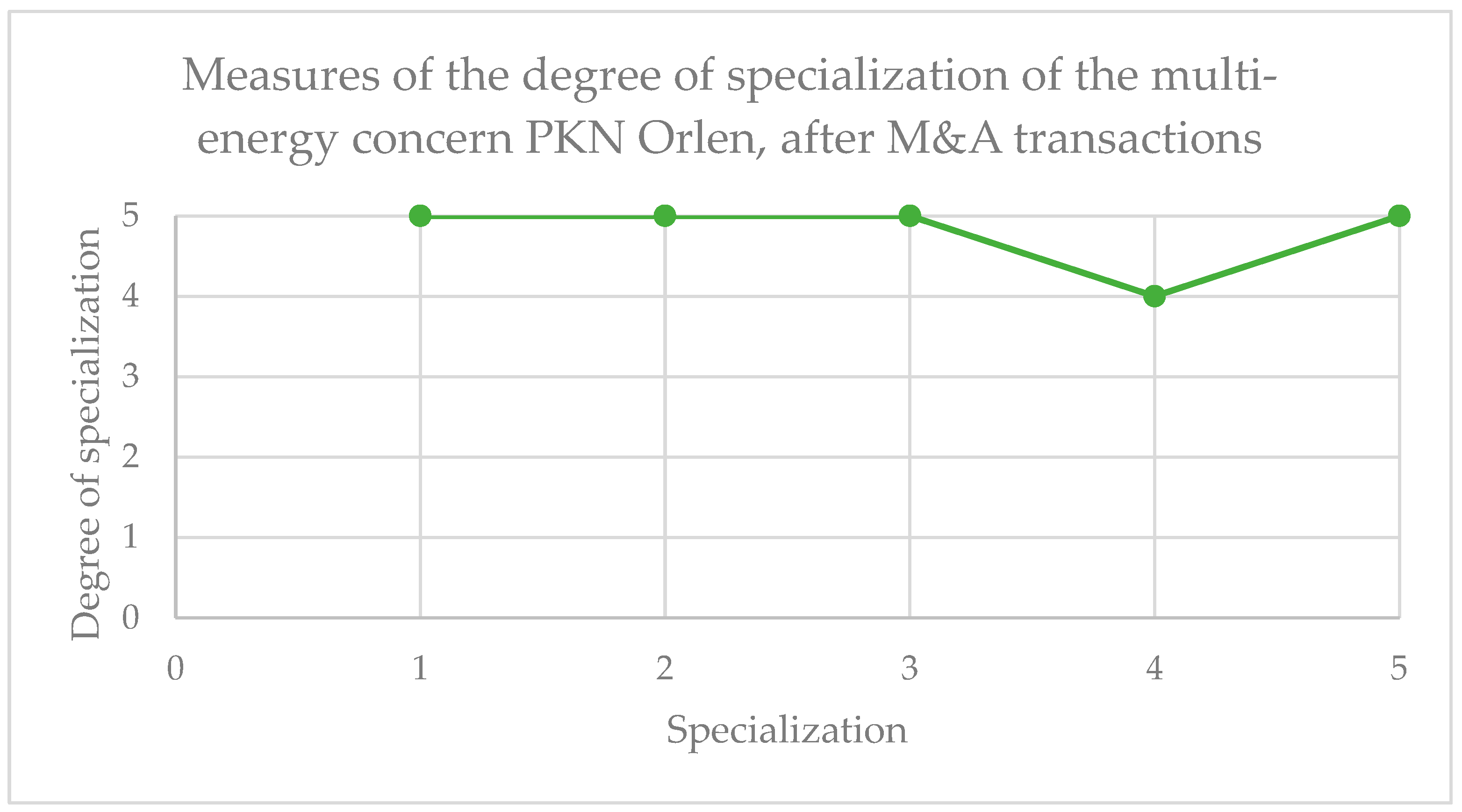

Figure 7 shows the distribution of the value of the multi-energy concern (after all mergers), taking into account the highest values of the companies’ specialisations—PKN Orlen, Energa, Lotos and PGNiG.

An analysis of

Figure 7 shows that the cumulation of the specialisation of Energa, Lotos and PGNiG by PKN Orlen will contribute to the diversification of the activities of the multi-energy conglomerate, and thus to the diversification of energy generation and distribution sources. A comparison of

Figure 6 and

Figure 7 shows that the measure of the degree of specialisation of the entire multi-energy conglomerate has increased relative to the individual companies (pre-merger). This is a positive outcome of the merger process, which has directly resulted in the creation of positive synergy effect by strengthening national energy security and better coordination of investment programmes.

It also results in improved efficiency of the logistics system, purchasing savings due to both better negotiating position and increased purchasing volume, which should translate into lower unit expenditures or finally lead to cost reductions through the use of shared infrastructure and operating inventory. Additionally, future investments in the area of renewable energy sources may help to become independent from fossil fuels and constitute a business alternative to them. These include investments in, among other things, the acquisition and distribution of alternative fuels associated with electromobility.

Energa has declared it will achieve by 2030 about 1.1 GWe of installed capacity in onshore renewable energy sources and that it will participate in offshore wind projects of about 1.3 GWe and in the implementation of investments in gas installations of about 1.3 GWe, to reduce CO

2 emissions/MWh by 33% compared to 2019 and to increase the share of remote reading meters installed to 100% in 2026 [

61].

Summing up, it should be emphasized that the consolidations carried out by the PKN Orlen Group in recent years clearly indicate the rationale for creating a diversified multi-energy concern. Diversification of operations (e.g., related to electromobility, renewable energy sources or offshore wind farms) and, consequently, of revenue sources improves the company’s financial standing. It makes it independent from market fluctuations and changes in the macroeconomic competitive environment. However, one should also bear in mind the organizational and technical issues, because on the one hand, the creation of such a large entity bringing together the largest players in the energy sector may raise concerns about the dominance of this company in the market for processing and distribution of energy resources, and on the other hand, there may be difficulties in effective management of the entire company, also in terms of potentially expected profitability.

7. Directions of Change and Prospects for the Development of the Energy Industry in the First Half of the 21st Century

According to calculations presented in the government document Energy Policy of Poland until 2040 [

62], the energy transformation will require significant investment outlays, the scale of which will amount to approximately 1.6 trillion PLN in less than 20 years. Current global trends encourage countries to move away from fossil fuels as the primary source of electricity. This problem assumes additional importance in Poland, where electricity production as indicated is still based largely on coal. According to calculations, the share of coal in electricity production by 2040 is projected to be 28% under the scenario of balanced increase in prices of carbon credits or 11% under the scenario of high prices of carbon credits [

63].

PEP2040 contains a synthesis of three pillars—fair transformation, zero-emission energy system and good air quality—on the basis of which directional (specific) objectives of future energy behaviour have been set. These goals highlighted in the document include the optimal use of own energy resources through the transformation of own coal regions (hard coal and lignite) and in-depth research and development activities aimed at finding innovations to reduce the environmental burden of fossil fuels, development of the power generation and grid infrastructure in such a way as to ensure that, with the decreasing impact of fossil fuels and greater renewable energy sources, it will be possible to meet the demand for power with one’s own resources [

64]. The strategic objectives resulting from PEP2040 also include diversification of natural gas and crude oil supplies and expansion of network infrastructure through import capacities and the launch of Baltic Pipe and the second line of the Pomeranian Pipeline as well as other storage facilities, liberalisation of the electricity market through the implementation of an action plan to increase cross-border electricity transmission capacity, use of bio-components and alternative fuels (LNG, CNG, hydrogen, biomethane and synthetic fuels) and electromobility.

Nuclear power is also increasingly being discussed in the public space. It is also one of the pillars of PEP2040. Although this topic seems to have both its supporters and opponents (due to the high costs of construction and operation (including waste disposal), concerns and public resistance related to potential environmental contamination and incompatibility with renewable energy sources), it is a serious alternative and an important source of support for maintaining national energy security in the future. According to forecasts, in 2033 the first nuclear unit with a capacity of about 1–1.6 GW will be put into operation, and within the next 10 years, another 5 units will be put into operation. Therefore, there is no doubt that the direction of future energy security efforts of many countries will be based on nuclear energy (explained more extensively: [

65]).

Another important element in the PEP2040 plan is the development of renewable energy sources. Poland has declared it will achieve at least 23% share of RES in gross final energy consumption in 2030, due to increasing access date and development of photovoltaics, biomass, biogas, geothermal energy and offshore wind farms in district heating and heat pumps in individual heating. It should be noted that, increasingly, building investors in architectural designs assume the use of passive building tools, which, through the use of natural sunlight and with the support of a low-temperature underfloor heating system, heat pump and an appropriate level of thermo-modernization, allows for the achievement of a negative energy balance [

66]. Obviously, this solution can also be achieved in existing buildings, although this requires additional costs connected with modernization or remodelling of the already existing heating and electrical installation.

In the opinion of the authors of this article, however, such a direction of development of alternative energy sources, which has a direct positive impact on reducing the load on the power mains, seems to be a reasonable optimum in the coming years. On the one hand, the building (most often a single-family house) will consume less energy thanks to maintaining an appropriate level of heat transfer coefficient, and on the other hand, the potentially obtained surplus may be stored in the installation itself, e.g., thanks to the support of domestic battery energy storage or transmission to the power grid. Such a system leads to energy self-sufficiency in three ways, depending on the degree of dependence on the power grid. The first way enables the abandonment of support from the power grid. All of the energy produced will be obtained from the household’s own micro-installation, with any potential surplus accumulated in a home energy store, in a kind of closed system (

off grid). The second does not imply leaving the grid connection, but when it stays in, it is limited to transferring the surplus to the grid (on grid). The third one can cooperate with the grid as well as provide energy [

67]. In this case, the users transferring the surplus become prosumers. This status allows them to take the bulk of the surplus surrendered (about 70–80%) back as needed.

The increasing role of RES is noticeable in practice. On 14 March 2022, an hourly electricity production record was broken (between 12 pm. and 1 pm.), as the panels generated 4.5 GWh of electricity during that hour (equivalent to 20.3% of the energy produced in Poland at that time). It should be added that these are March figures, which probably do not fully reflect the annual perspective. This compares to a record of 3.4 GWh in 2021 and 1.7 GWh in 2020. Daily production was 31.07 GWh (and was slightly lower than the 7 June 2021 record of 31.5 GWh) [

68]. This is undoubtedly influenced by the increasing number of solar PV installations as a strong component of individual heating systems.

The second key element of Poland’s energy transformation by the middle of the 21st century will be the comprehensive development of district heating, with a view to creating or improving an energy-efficient district heating system (by 2030 about 85% of all heating and cooling systems are to meet specific efficiency criteria). An increase in energy efficiency is to be created by specific groups of entities in different scope and mode. It is worth mentioning here that one of the tools for combating the problem of inefficiency is the universal access date to thermo-modernisation of residential buildings and providing access date to ecological heat sources, which in the perspective of 2030 is to contribute to the reduction in energy poverty among households by about 30%, to the maximum level of 6%, and achieving zero emission in public transport in cities with a population over 100,000 by 2030.

It is also worth mentioning that the construction of ecological and renewable domestic energy sources is positively influenced by government-supported social programs (e.g., the “Clean Air” program), which offer preferential financing conditions and allow less affluent citizens to replace their energy sources. In particular, it concerns replacing coal-fired furnaces with gas-fired ones, replacing window frames or thermo-modernisation of the whole building. This direction also has additional economic justification [

69]. For several years, a trend of increasing prices of carbon credits has been noticeable. Although still at the beginning of 2018 the prices of carbon credits were around 8 EUR/EUA, already in April 2021 they reached 44.28 EUR/EUA. In just three years, this represents a fivefold increase. This state of affairs, by necessity, causes the profitability of energy production from coal assets to deteriorate, while forcing the acceleration of the transformation of the energy system to a low-carbon one [

70].

Apart from the increase in carbon credits, a gradual trend of increasing energy prices in Poland is also noticeable. This is dictated, on the one hand, by the monopolisation of the energy market (also with the participation of PKN Orlen), while at the same time there are attempts to “artificially” interfere with the system of fees, e.g., through compensation or the possibility of spreading increases in gas prices to households.

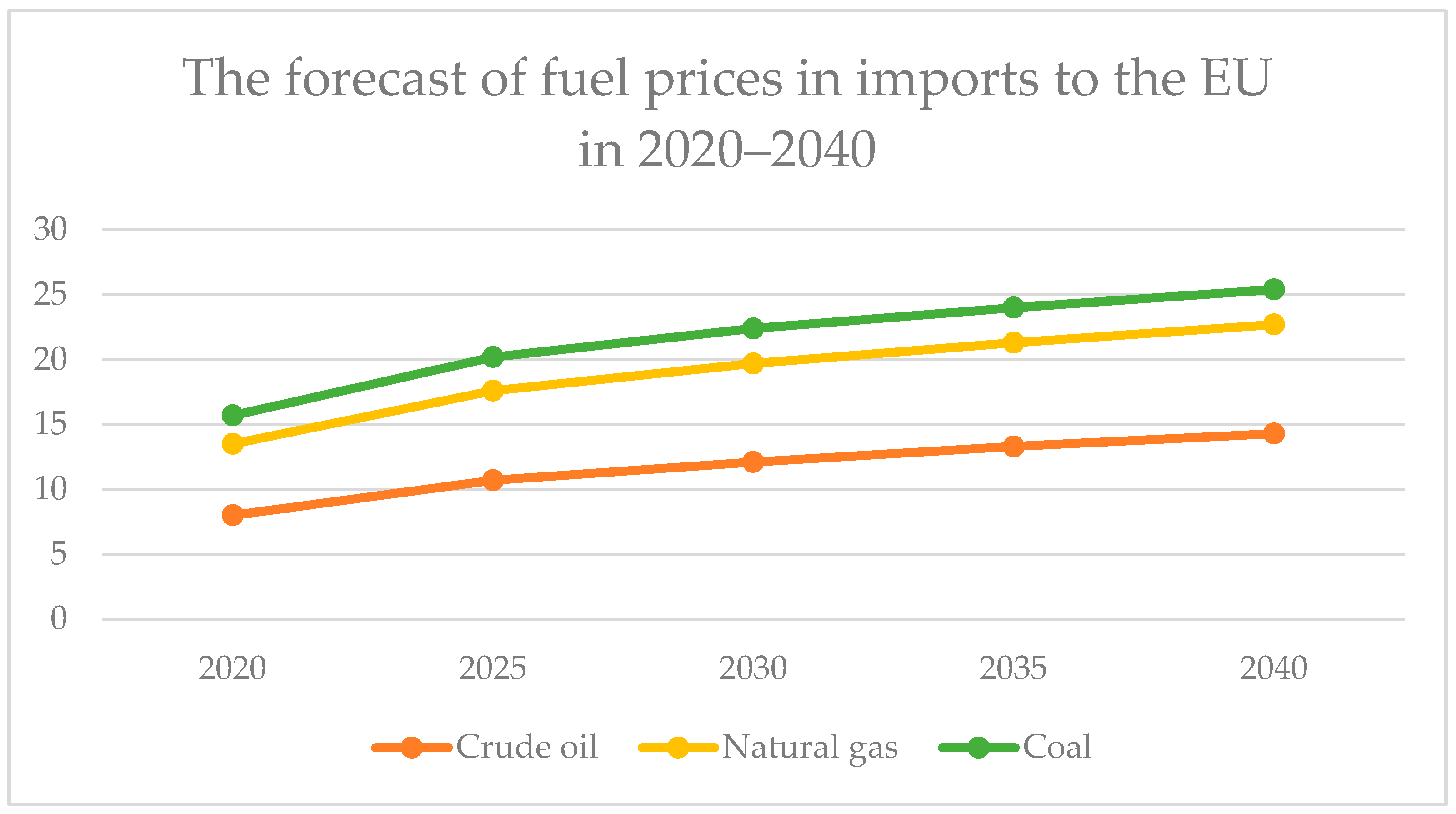

Figure 8 presents the forecast of fuel prices in imports to the EU in 2020–2040 (EUR’2016/GJ).

According to the calculations presented in

Figure 8, over the next nearly twenty years the prices of all raw materials, both crude oil, natural gas and hard coal, will increase. The biggest price increase will be observed for crude oil (by around 79% until 2040) and the smallest for hard coal (by around 23%).

The short-term potential causes of this phenomenon include, firstly, the ongoing coronavirus pandemic, during which demand for electricity and gas has increased significantly, and secondly, the Russian-Ukrainian war, the consequences of which, including those of the unprecedented economic sanctions imposed by the USA and the European Union, are difficult to assess with any certainty, and which directly interfere with the global market on account of the many connections with the Russian economy. Thirdly, in 2021, a power fee was introduced, charged to final energy consumers to finance new or existing generation units by energy companies, which also generates additional costs distributed in energy prices. Fourthly, as has already been emphasized in this article, the progressing global process of shifting from traditional fuels to renewable ones forces a costly reorganisation of the energy system. According to government calculations, investments in the energy sector in 2020–2040 will amount to about 400 billion PLN [

71]. They are primarily aimed at reducing the use of non-renewable resources (mainly coal), on which Poland is currently highly dependent [

72].

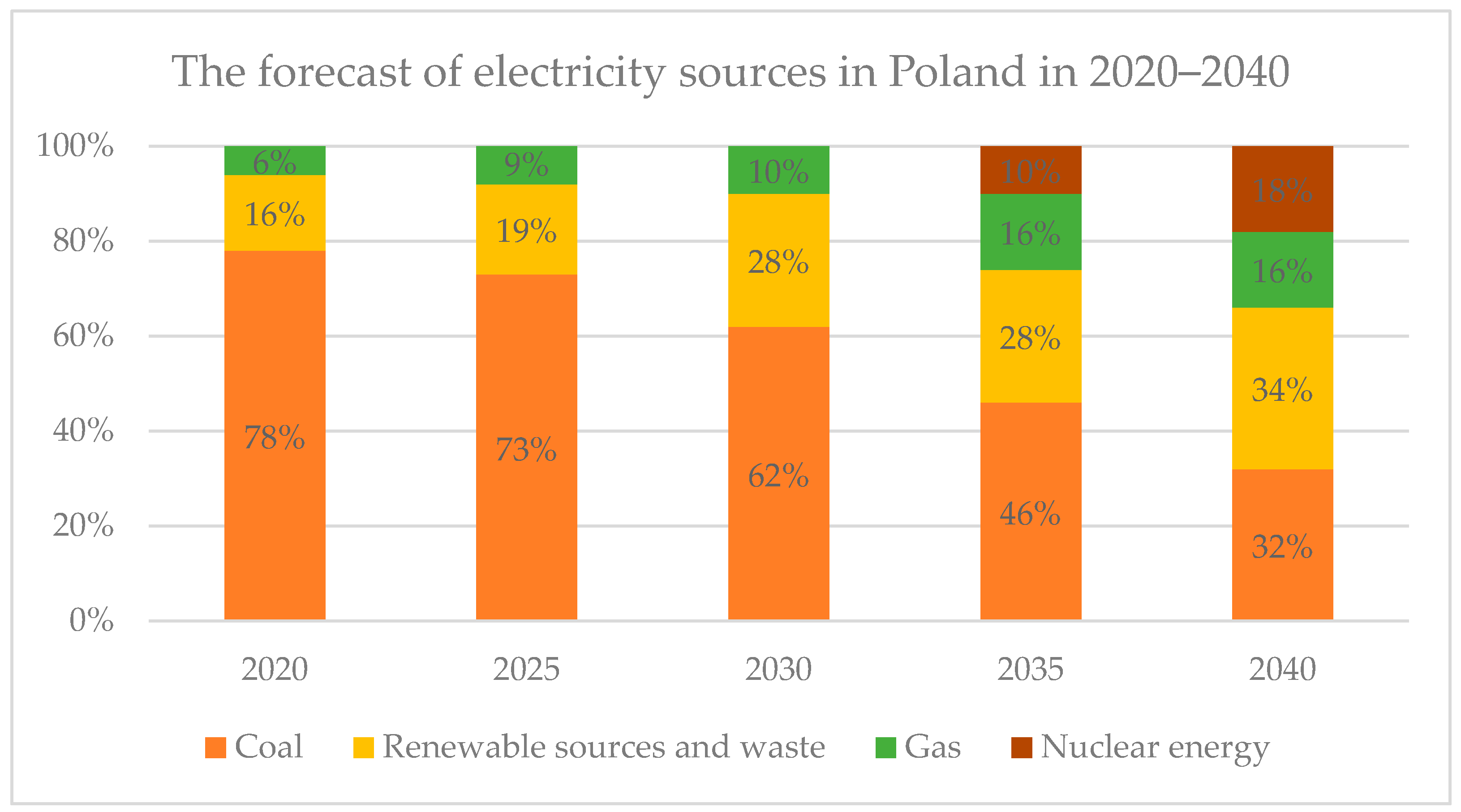

Figure 9 presents a potential forecast of changes (developed by the Polish government in 2018) of electricity generation sources by 2040 in Poland.

As shown in

Figure 9, by 2040 the level of Polish energy system dependence on coal is to be significantly reduced (from 78% in 2020 to 32% in 2040), with a simultaneous clear increase in the importance of renewable energy sources and waste (from 16% in 2020 to 34% in 2040), and slightly on gas (to 16% in 2040) and nuclear energy in 2035–2040 (about 18% in 2040).

In this sense, the investment decision to take over Energa in 2020 with its portfolio of 46 hydro power plants, 5 wind farms and 2 photovoltaic farms with a total capacity of 590 MW seems justified. This decision also fits into the strategic framework based on future investments in renewable energy sources, especially in construction of further offshore wind farms on the Baltic Sea (thanks to its natural conditions, including low salinity, strong winds and relatively shallow depth). To this end, in 2022, the company has applied for seven licenses for the construction of offshore wind farms in the Baltic Sea. In total, PKN Orlen plans to launch 21 offshore wind farms, with a total capacity of 7 GW, as part of the three license application phases. Ultimately, in a long-term perspective, by 2050, the company would like to reach a power level of ca. 93 GW [

74] (question no. 4).

8. Conclusions

The energy sector, like the whole economy, is exposed to constant changes resulting from the unpredictability of events and turbulent economic environment. Energy companies must be able to find themselves in this difficult reality [

75]. One of the solutions, which at the same time are aimed at long-term implementation of the development strategy, are merger and acquisition transactions [

76]. On the one hand, they allow for structural modification of the company’s management system, and on the other hand, thanks to the concentration of capital, they make it possible to achieve the expected long-term goals.

Summing up the discussion, it should be emphasized that on the Polish market of energy companies, the largest role is played by companies that are associated with corporate groups, such as Polska Grupa Energetyczna (PGE), Tauron Polska Energia, Enea and PKN Orlen which after the merger with Energa in 2020, but also in connection with merger transactions with Lotos and PGNiG, as significant entities of the exploration, production and trade sector in the energy industry, joined the group of the most powerful energy and fuel companies in Central and Eastern Europe. In recent years, PKN Orlen has clearly been shaping its policy towards building a multi-energy company capable not only of competing with European and world leaders but also contributing to strengthening the national energy security system by diversifying its energy sources, e.g., with foreign partners, such as the Saudi petrochemical company Saudi Aramco [

77].

The development of energy technology (mainly including renewable energy technology) in the long term becomes an important link in the geopolitical independence of countries and societies. This need is particularly evident in the early 2020s—the implementation of EU (e.g., the “Fit for 55” project) and national (e.g., Poland’s Energy Policy until 2040) climate policies, the need to reduce greenhouse gas emissions, the global community’s concern for the world’s climate, weather anomalies but also financial and non-financial criteria for evaluating the energy sector—when the construction of a multi-energy concern by PKN Orlen, are forcing these changes.

Table 9 contains a catalogue of 10 example solutions in the energy sector in Poland, taking into account the indicated factors and determinants.

This system, due to its complexity and economic and geopolitical importance, is a crucial link in the development of the economies of many countries. This is particularly important from the point of view of post-industrial countries (including Poland), where electricity provides services necessary for the processes of production, communication and trade in goods. An indispensable element of Poland’s ability to gain a competitive advantage in Europe is the concern for ensuring an appropriate level of energy security, understood as a guarantee of resistance to any adverse and unpredictable events that may threaten the physical integrity of electricity flows. This is both from a collective perspective, e.g., through the multi-energy concern PKN Orlen but also from individual one-household renewable energy sources. Nonetheless, the conducted research directionally points to an increase in the importance of the Polish energy sector as a result of the construction of the multi-energy concern PKN Orlen. This process is still not over. It must be stressed that only future studies and analyses, in particular after completion of all consolidation processes, taking into account geopolitical conditions and financial standing of the group, will allow for the estimation of the actual economic effectiveness of the whole transaction. They will also make it possible to assess the implementation of the main premise behind the merger within the group, which is to ensure national energy security. Therefore, one must evaluate the usefulness of this concentration of capital (question no. 1).

One of these disadvantages may be limited availability of energy, making it impossible to generate or purchase energy at reasonable and acceptable prices. The level of demand for energy has been increasing for many years, which should encourage governments to ensure an adequate system of diversification of electricity sources, so that it is supplied from as many sources as possible (preferably renewable) and thus provides adequate flexibility in meeting the collective needs of society [

78].

The targets set by government programs and EU and national climate policies aim to significantly reduce the use of ever-shrinking fossil fuel resources [

79]. Over the next 20 years, Poland is expected to undergo an energy transition in which the essence of the discourse is a shift away from coal and lignite and partially also natural gas, whose combined current share exceeds 80% in electricity, towards renewable energy from solar, wind and tidal (at about 34% in 2040), supported by nuclear power solutions (at a share of about 16% in 2040). This will make it possible to achieve not only energy independence from foreign suppliers, reducing the need to import gas from Russia or the United States, but it will also positively affect the long-term construction of the energy security system, which from the perspective of the state’s interest seems to be of paramount importance [

80]. Such a direction seems to be fully justified not only for environmental reasons but also taking into account the current economic and technological trends focused on the development of the renewable energy sources industry.