1. Introduction

Energy is crucial to a country’s economy and people’s livelihoods since it is the material underpinning for human survival and development [

1]. The majority of people have realized that excessive energy consumption and pollution from the production and use of chemical products will cause an environmental crisis, despite the rapid expansion of the renewable energy industry.

The need to strike a balance between energy corporations’ long-term expansion and environmental protection has become a pressing concern [

2].

According to Ren et al. (2018), the environmental regulations discussed in this paper are related to those mandatory regulations issued by the government [

3]. Environmental regulation (

ER) is one of the policies initiated by the government to control and protect environmental resources [

4]. Environmental regulation’s role has received a lot of academic attention. Telle and Larsson (2007) suggested that

ER does not reduce industrial productivity [

5], but Xie et al. (2017) argued that environmental regulation can boost enterprises’ industrial production competitiveness [

6]. Wang, Y. et al. (2022) consider the diversity of the regulatory role of environmental regulations on the energy sector [

7].

ERs have a favorable impact on sustainable growth up to a certain amount, but beyond that point, environmental regulation is detrimental to sustainable growth. Later, it was further suggested that environmental regulation has a facilitating effect on firms’ performance and sustainable growth [

8]. In addition,

ERs have a facilitating and then inhibiting effect on the green economy [

9]. Further, a combination of policy subsidies and carbon taxes is an effective way to develop low-carbon environmental protection.

Sustainability is the ability to improve living standards within ecological tolerances. Elkington (1994) proposed the concept of a sustainability floor based on social, economic, and environmental perspectives, which is now widely recognized by the academic community [

10]. Das et al. (2020) argue that the concept of achieving growth without compromising the prospects of the next generation is increasingly becoming a core concept in business philosophy [

11]. Salzmann et al. (2005) and Engert et al. (2016) argue that the regulatory effect of

ERs on the sustainability of a business or economy varies in effect in different situations [

12,

13]. There are three main relationships between

ERs and

SG: first, environmental regulation has a positive contribution to sustainable growth [

14]; second, Curtis and Lee (2019) argue that environmental regulation has a reverse inhibitory effect on sustainable growth [

15]. Third, Curtis and Lee (2019) argue that the link between environmental regulation and sustainable growth is considered to be a “hump-shaped” relationship that varies over time [

15].

Without resources, no business can expand sustainably, and resource endowment is the most important aspect in promoting long-term success. Zhai and An (2020) discovered that human capital, financial capabilities, technical innovation, and government conduct have a significant positive impact on

SG, based on survey data from 500 Chinese manufacturing enterprises in 2017 [

16]. The factors of education, expertise, and the availability of local entrepreneurial capital, fluctuate along the stages of the entrepreneurial process [

17]. It has been argued that resource endowment has a long-term positive effect; specifically, the opportunity cost since resource endowment has the impact of inhibition in the early stage, and when it waits for the later order, resource endowment starts to show its positive effect, thus favoring long-term growth. Wang, S et al. (2022) argue that countries and regions that are rich in natural resources tend to have poorer green economic growth [

18]. Government subsidies are the main driver for the long-term growth of renewable energy firms (Yang et al., 2019) [

19], and they have been an important policy tool to nurture and promote the renewable energy industry in China (Song et al., 2020) [

20]. Peng and Liu (2018) argue that government subsidies have a moderating effect on firm development, with negative and then positive effects developing over time [

4]. When businesses receive government subsidies, it signifies that the government has accepted their legal status, which allows them to obtain more resources [

21]. According to Lu et al. (2020), finance and subsidy impacts can raise the export size, impacting the long-term viability of firms’ export expansion, and social capital plays an important role in fostering long-term growth, since high social capital firms are subjected to more lenient non-price lending requirements, resulting in lower bond interest rates [

22].

With its large population and vast land area, China needs to import and use large amounts of energy in its development. The energy structure of China is dominated by traditional energy sources of fossil fuels, and the massive use of fossil fuels will certainly lead to a slew of significant environmental issues, including energy scarcity and pollution. Wu, L. et al. (2021) point out that energy endowment is a major factor in the growth of carbon emissions [

23]. People’s tolerance for environmental pollution decreases as their money and living standards rise, and the strength of environmental regulation steadily rises, opening up prospects for renewable energy development. Wang, Q et al.’s (2022) research found that renewable energy gives a significant boost to the economy [

24]. Renewable energy is crucial for modifying the energy structure, lowering greenhouse gas emissions, and fostering long-term growth. Renewable energy businesses have grown quickly in recent years as high-tech industries throughout the world. Increased R&D expenditure is required to strengthen technical innovation and promote long-term growth in order to expand quickly and profitably. Furthermore, a major portion of China’s renewable energy businesses are state-owned companies (SOEs), which have greater resources than private businesses. As a result, the research object for this study is renewable energy enterprises.

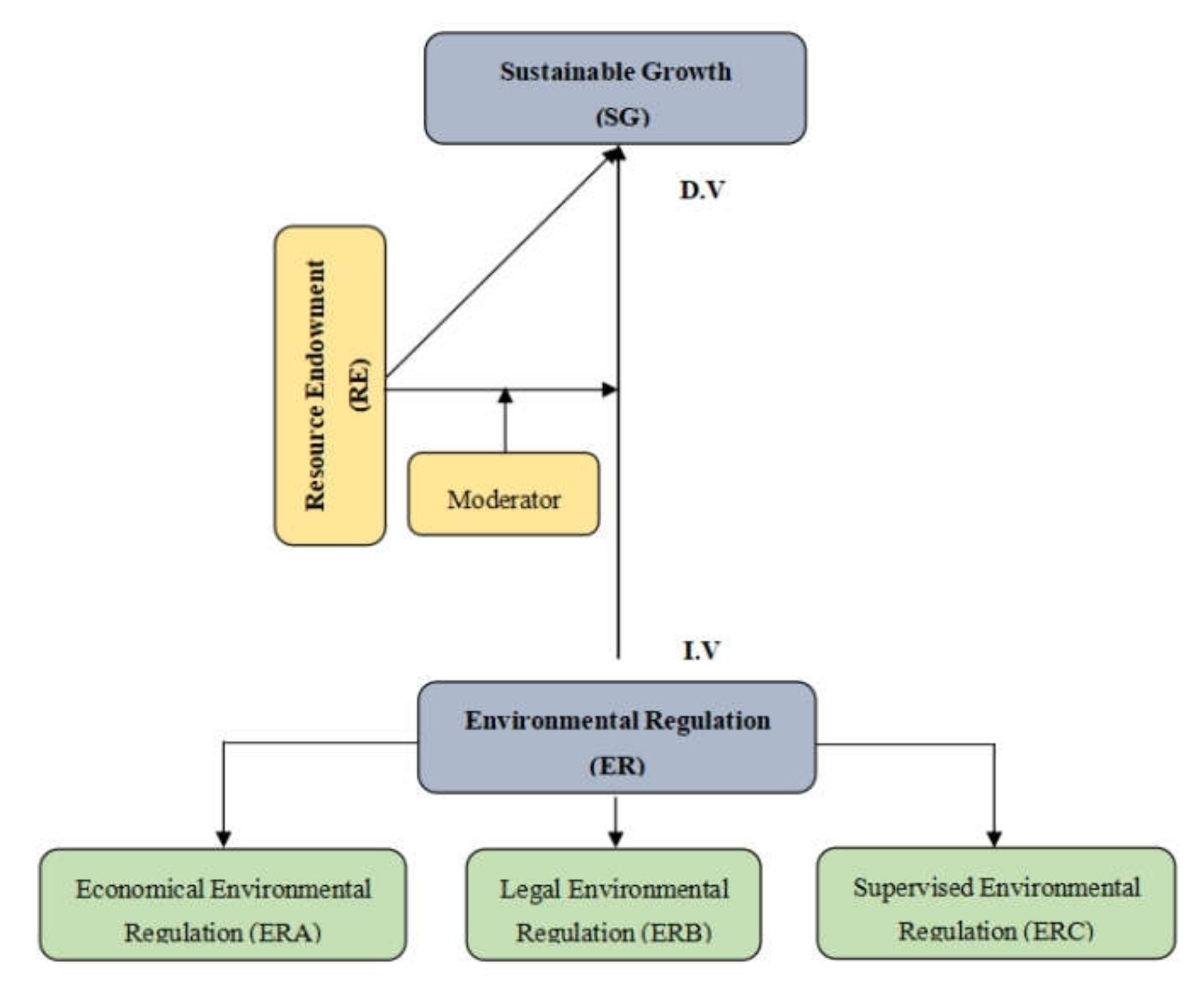

Do environmental regulations inhibit or promote sustainable company growth? How do different types of environmental regulatory regimes affect the sustainable growth of firms? With the increasing emphasis on resource endowment by firms, how does environmental regulation affect resource endowment and further contribute to firms’ sustainable growth? To address these questions, this paper will provide insights into the impact of environmental regulation and resource endowment on firms’ sustainable growth from the perspective of Chinese renewable energy firms and provide constructive suggestions for the government to develop more accurate environmental and energy policies.

The following are the main contributions: First, this is the first article that divides environmental regulation into three levels, including economic environmental regulation, legal environmental regulation, and supervisory environmental regulation. Second, for the first time, the impact of environmental regulation on the sustainable development of renewable energy firms is studied and specifically analyzed from the perspective of micro data of firms. Third, this paper is the first to study the relationship between environmental regulation and sustainable growth using resource endowment as a moderating variable. Fourth, this paper analyzes the ownership structure heterogeneity of the impact of resource endowment on sustainable growth, which helps to provide targeted policy recommendations for improving the sustainable growth of renewable energy firms with different ownership structures. Fifth, considering the accuracy and comprehensiveness of variable calculation, this paper uses a weighted algorithm to calculate environmental regulations and principal component analysis to calculate resource endowments.

5. Conclusions and Policy Recommendations

This paper studied the relationships between environmental regulation, resource endowment, and sustainable growth by using a fixed-effects model and system GMM method, and the research sample is the panel data of new energy enterprises from 2010 to 2019. This paper focuses on the impact of environmental regulation on the sustainable growth of Chinese renewable energy enterprises, and introduced resource endowment to examine its moderating effects. After empirical analysis, we obtained the following conclusions: economical environmental regulations, legal environmental regulations, and supervised environmental regulations are positively associated with sustainable growth. Compared with legal environmental regulations and supervised environmental regulations, economic environmental regulations have the greatest impact on sustainable growth. The resource endowment is positively associated with sustainable growth, especially for non-state-owned renewable energy enterprises, and resource endowment plays a moderating role between environmental regulations and sustainable growth. Furthermore, resource endowment has the greatest moderating effect on the relationship between economical environmental regulations and sustainable growth. According to the above conclusion, we propose the following suggestions.

The first one is based on the effectiveness of economic environment regulations. Economic environmental regulations intuitively discourage the consumption of traditional energy sources and promote the development of renewable energy from an economic perspective. Governments can implement flexible and effective economic policies that take into account local conditions, such as increasing taxes on traditional energy sources while providing policy subsidies and tax incentives for renewable energy. By reducing the financial pressure on renewable energy companies, new energy innovations can be promoted to achieve sustainable growth.

Secondly, based on the effectiveness of legal environmental regulations. The use of traditional energy sources inevitably leads to the consumption of environmental resources and environmental pollution. For government policies, on the one hand, through the establishment of a sound legal environmental regulation system, the use of traditional energy sources and the treatment and discharge of pollution can be regulated in order to curb the consumption of natural resources and mitigate environmental pollution. On the other hand, legal environmental regulations are also conducive to the management of renewable energies, as they regulate the research and development and production of renewable energies and promote the sustainable growth of new energy enterprises.

Thirdly, based on the effectiveness of supervisory environmental regulations. Strict and effective regulation, based on sound laws and regulations, can ensure that legal provisions are implemented. For example, strict monitoring of energy consumption and the treatment and discharge of pollutants by energy companies can effectively force traditional energy companies to transform and promote technological progress in the field of new energy. Thus, strengthening supervisory environmental regulation is beneficial to the sustainable growth of renewable energy companies.

Fourth, based on the effectiveness of resource endowment. Environmental endowments are inherently conducive to sustainable growth, so governments should actively guide energy companies to develop and build local resources with local characteristics, and sufficient environmental resources to ensure sustainable growth. However, given the ‘resource curse’ effect, local energy development should not be overly dependent on the benefits of environmental endowments and should focus on the long-term benefits of renewable energy. In addition, as resource endowments have a negative impact on the influence of environmental regulations, as resource endowments increase, the role of environmental regulation in sustainable growth decreases. Therefore, government departments should be fully aware of the contradictions between resource endowments and environmental regulation, and the link between resource endowment and environmental regulation should be better coordinated. For example, for traditional energy sources, environmental regulations should be strengthened to avoid the “resource curse” brought about by overly strong resource endowments, while for renewable energy enterprises, resource endowments can be moderately strengthened through the creation of a favorable financing environment and research environment to promote sustainable growth. Whether starting from an environmental regulatory perspective or a resource endowment perspective, the final goal is to curb traditional energy sources and promote renewable energy development so as to achieve sustainable growth. The government should be fully aware that technological development is the basic driver of sustainable growth, reasonably integrating the local environmental and social resources, enhancing resource-use efficiency, and encouraging scientific and technological research and development so as to achieve sustainable growth.