Operation Optimization of an Integrated Energy Service Provider with Ancillary Service Provision

Abstract

:1. Introduction

- (1)

- The operation mode of an IESP to provide ancillary services is studied. On this basis, the equipment model managed by the IESP is established, including energy coupling devices and energy storage devices.

- (2)

- The ancillary service provision of the IESP is considered and the optimal operation strategy is determined. The optimization goal is to maximize the total operation profits of the IESP, and the corresponding optimal frequency regulation and spare ancillary service capacity that the IESP can provide is obtained.

- (3)

- The changes in equipment scheduling before and after the ancillary service provision are compared and analyzed, providing useful guidance for the IESP’s subsequent participation in the ancillary service market.

2. Modeling of IESP’s Operation

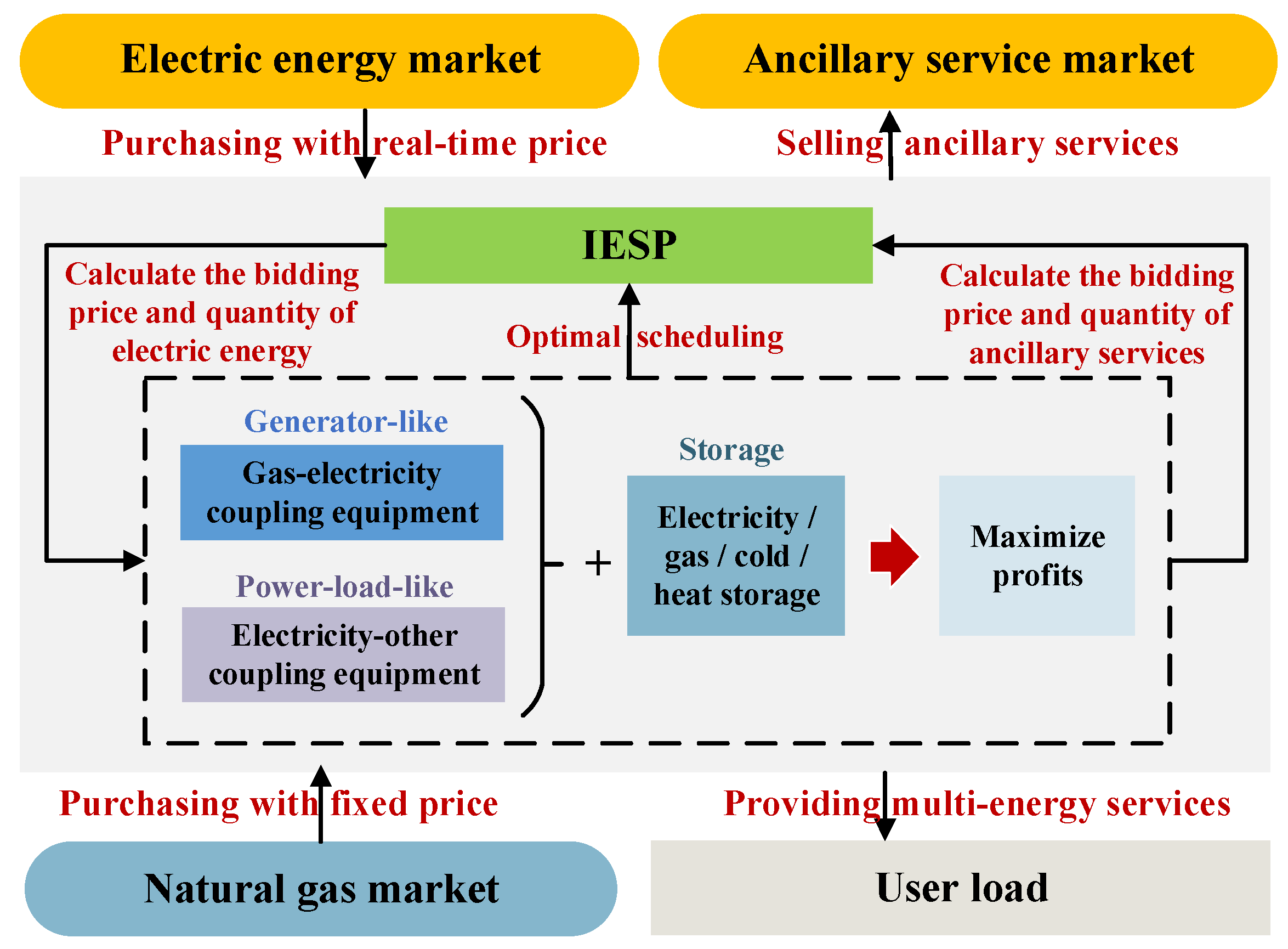

2.1. Operation Mode of IESP

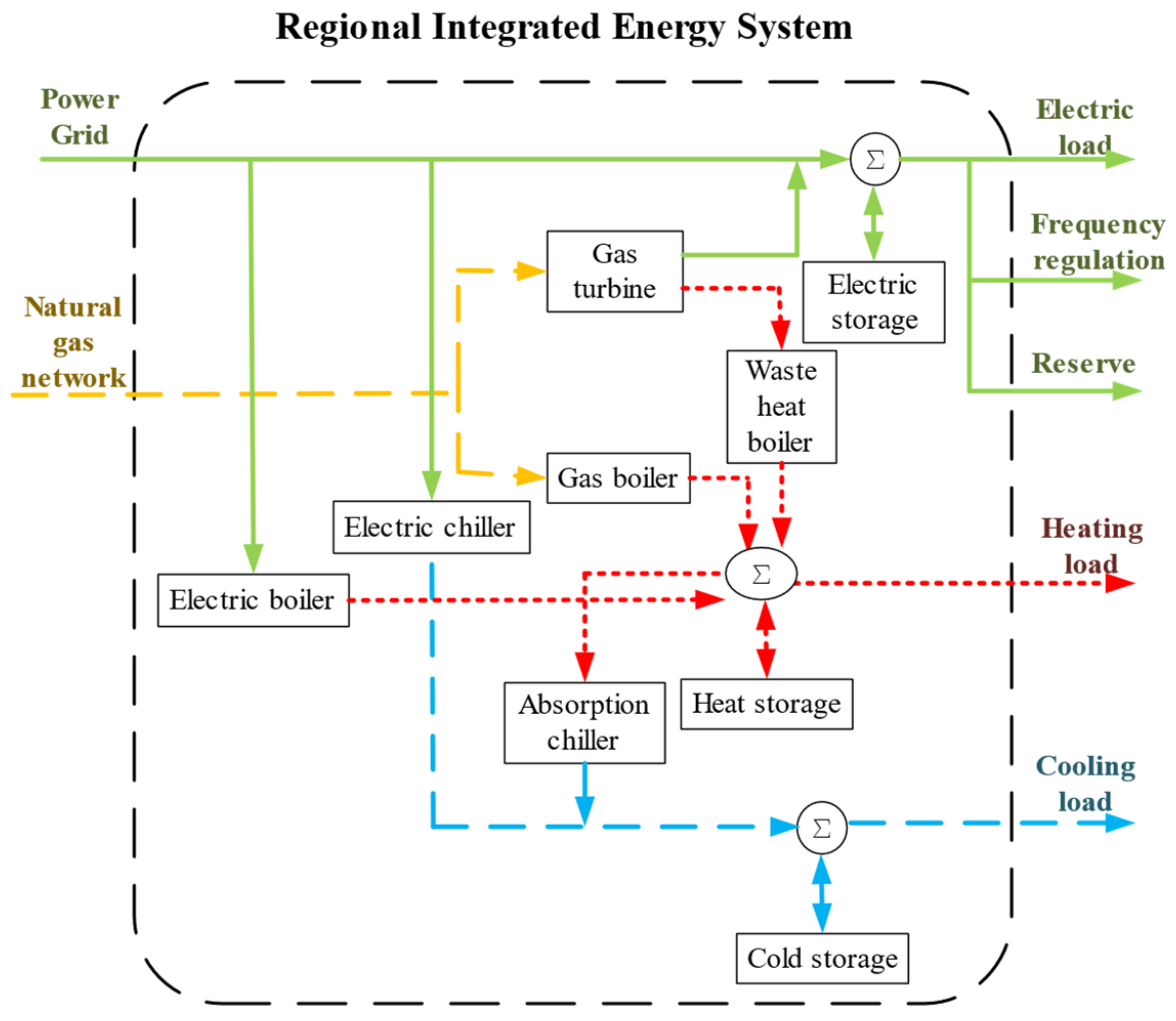

2.2. Modeling of Equipment in the IESP

2.2.1. Energy Coupling Devices

- Energy coupling constraints.

- 2.

- Equipment power constraints.

2.2.2. Energy Storage Devices

- Energy storage state constraints.

- 2.

- Charging and discharging constraints.

- 3.

- Power and capacity constraints.

3. Optimal Market Strategy for IESP

3.1. Objective Function

3.1.1. IESP Income

- Energy supply income.

- 2.

- Frequency regulation service income.

- 3.

- Reserve service income.

3.1.2. IESP Cost

- Electricity purchase cost.

- 2.

- Gas purchase cost.

- 3.

- Maintenance cost.

3.2. Constraints

3.2.1. Constraints of Energy Conservation

3.2.2. Constraints of Line Capacity

3.2.3. Constraints of Frequency Regulation Service

3.2.4. Constraints of Reserve Service

3.3. Optimal Operation Procedure of IESP

- (1)

- Obtain the IESP optimal operation schedule without providing ancillary services, and attain the power purchase plan.

- (2)

- Maintain the original power purchase plan of the IESP and calculate the available maximal reserve capacity.

- (3)

- Attain the IESP optimal operation scheme with ancillary service provision, with the maximum reserve service constraint respected.

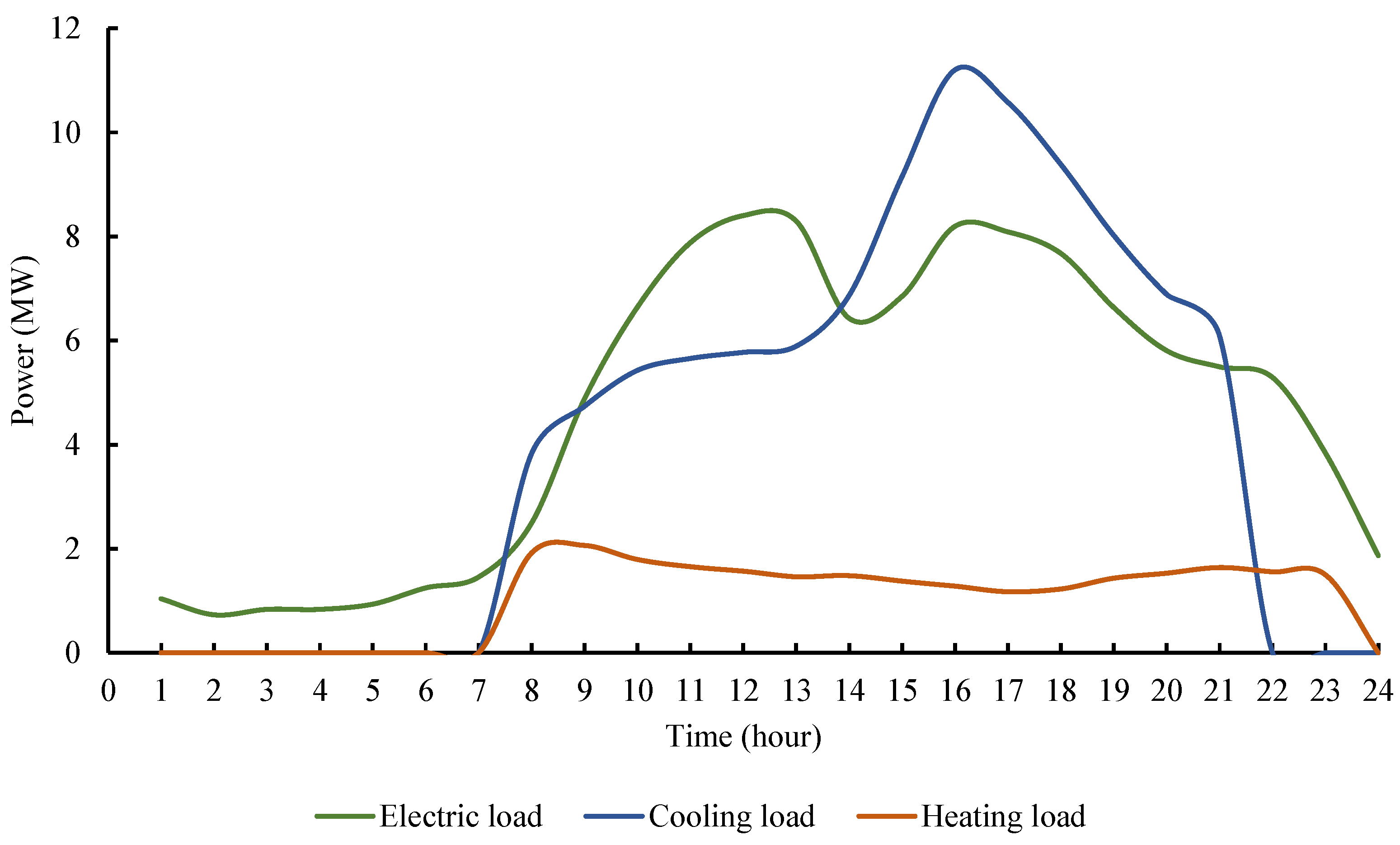

4. Numerical Example and Results

4.1. Numerical Example

- (1)

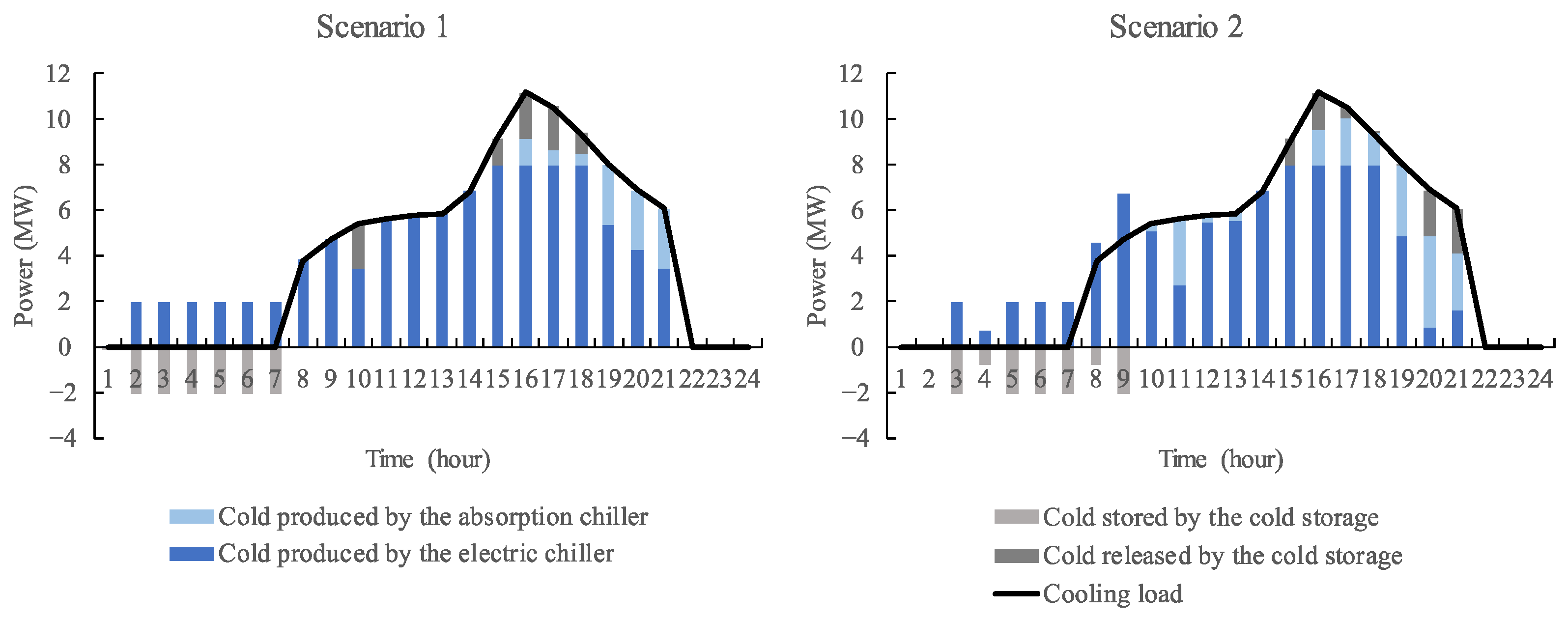

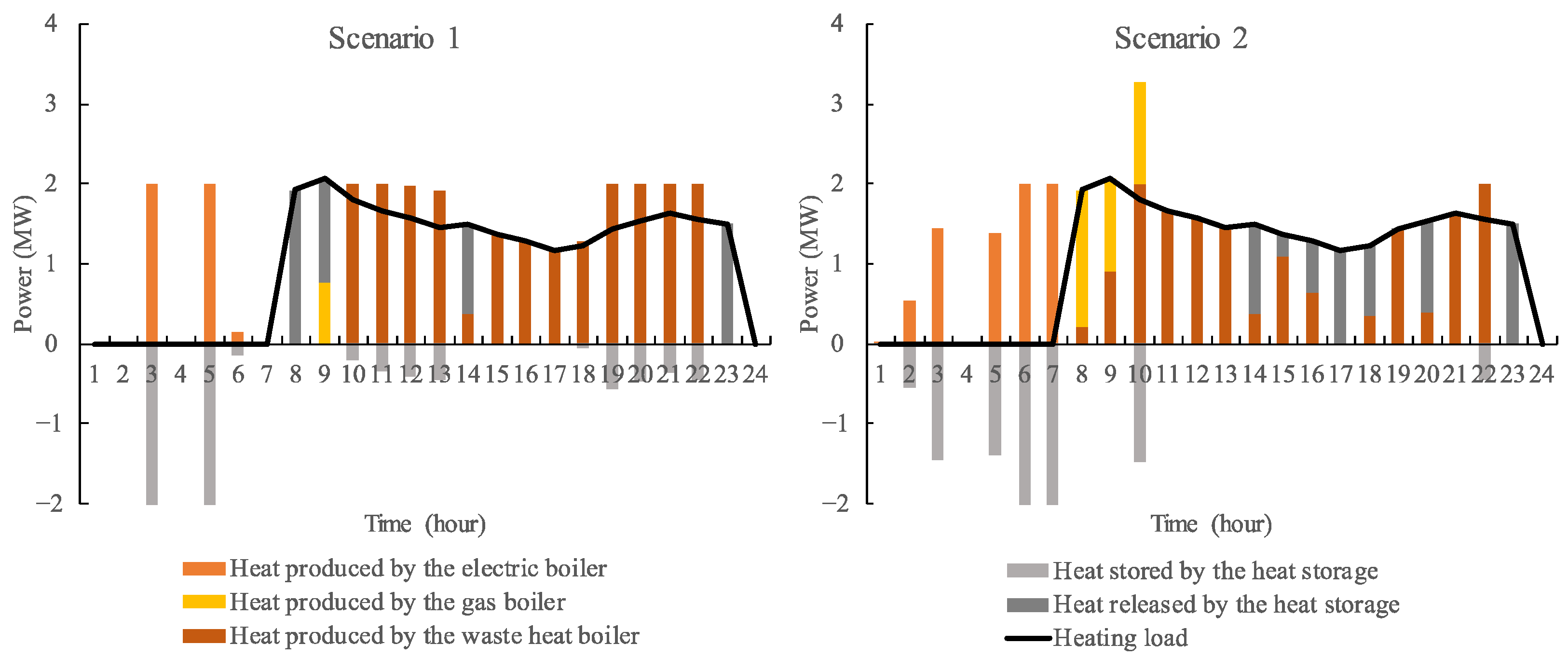

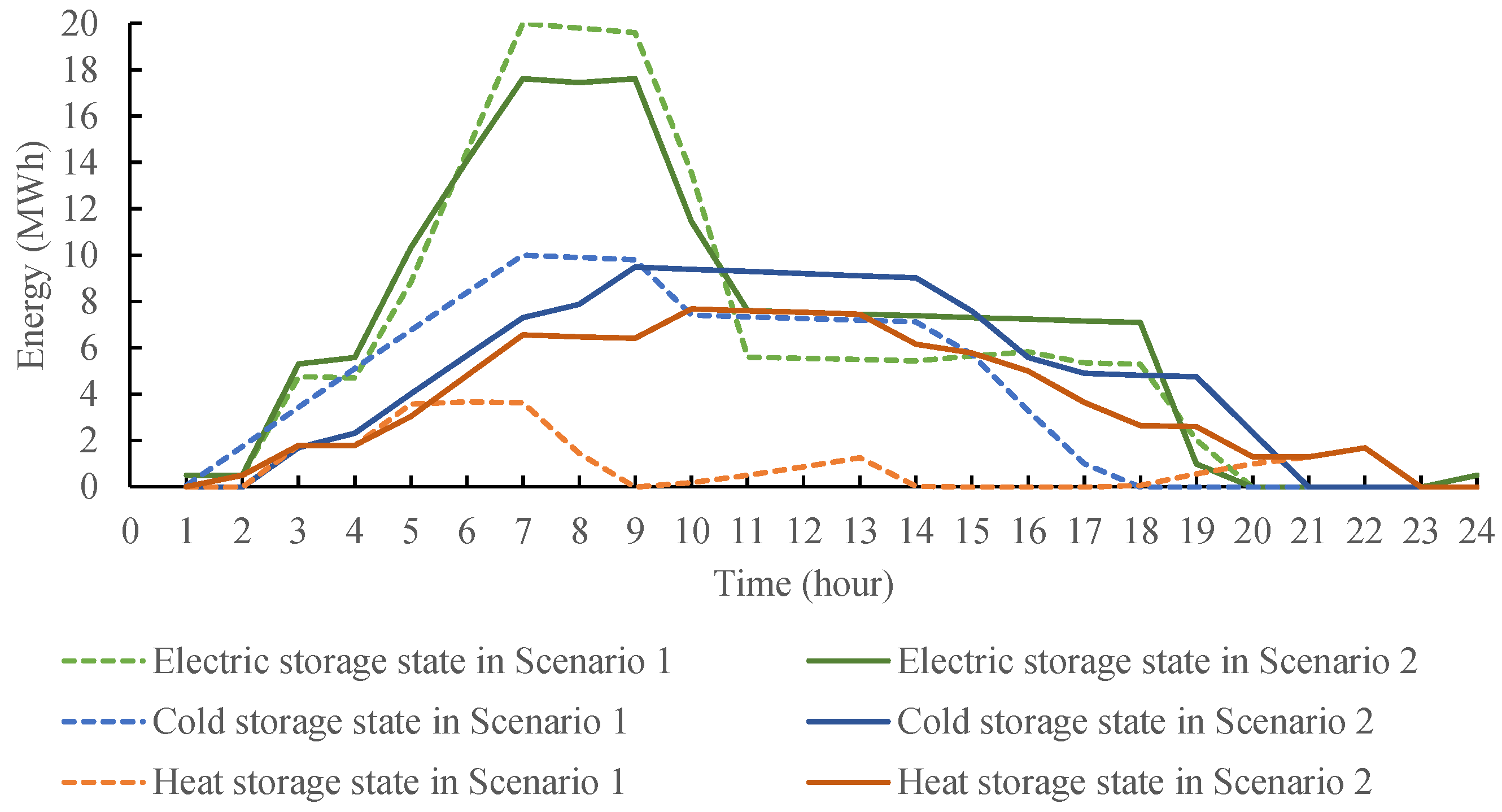

- Scenario 1: IESP optimal operation without ancillary service provision.

- (2)

- Scenario 2: IESP optimal operation with ancillary service provision.

4.2. Simulation Results

4.2.1. Operation Results

4.2.2. Economic Results

5. Conclusions

- (1)

- In terms of operation, when the IESP provides ancillary services, it increases the consumption of natural gas and the use of related energy coupling devices, increases the use of heat and cold storage units, and reduces the use of the electric storage unit to improve its capability of providing ancillary services.

- (2)

- In terms of economic benefits, when the IESP provides ancillary services, the income from ancillary services is higher than the cost from the increase in natural gas consumption, with other income and costs basically unchanged. Hence, the profit of the IESP operation in a typical day is increased.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, Y.; Wang, Y.; Huang, Y.; Yu, H.; Du, R.; Zhang, F.; Zhang, F.; Zhu, J. Optimal Scheduling of the Regional Integrated Energy System Considering Economy and Environment. IEEE Trans. Sustain. Energy 2019, 10, 1939–1949. [Google Scholar] [CrossRef]

- Pfeifer, A.; Dobravec, V.; Pavlinek, L.; Krajacic, G.; Duic, N. Integration of Renewable Energy and Demand Response Technologies in Interconnected Energy Systems. Energy 2018, 161, 447–455. [Google Scholar] [CrossRef]

- Lei, Y.; Wang, D.; Jia, H.; Chen, J.; Li, J.; Song, Y.; Li, J. Multi-Objective Stochastic Expansion Planning Based on Multi-Dimensional Correlation Scenario Generation Method for Regional Integrated Energy System Integrated Renewable Energy. Appl. Energy 2020, 276, 115395. [Google Scholar] [CrossRef]

- Miao, B.; Lin, J.; Li, H.; Liu, C.; Li, B.; Zhu, X.; Yang, J. Day-Ahead Energy Trading Strategy of Regional Integrated Energy System Considering Energy Cascade Utilization. IEEE Access 2020, 8, 138021–138035. [Google Scholar] [CrossRef]

- Ge, S.; Li, J.; He, X.; Liu, H. Joint Energy Market Design for Local Integrated Energy System Service Procurement Considering Demand Flexibility. Appl. Energy 2021, 297, 117060. [Google Scholar] [CrossRef]

- Liu, W.; Wen, F.; Dong, Z.; Palu, I. Development of Robust Participation Strategies for an Aggregator of Electric Vehicles in Multiple Types of Electricity Markets. Energy Convers. Econ. 2020, 1, 104–123. [Google Scholar] [CrossRef]

- Yan, M.; He, Y.; Shahidehpour, M.; Ai, X.; Li, Z.; Wen, J. Coordinated Regional-District Operation of Integrated Energy Systems for Resilience Enhancement in Natural Disasters. IEEE Trans. Smart Grid 2019, 10, 4881–4892. [Google Scholar] [CrossRef]

- Li, F.; Lu, S.; Cao, C.; Feng, J. Operation Optimization of Regional Integrated Energy System Considering the Responsibility of Renewable Energy Consumption and Carbon Emission Trading. Electronics 2021, 10, 2677. [Google Scholar] [CrossRef]

- Cao, Y.; Mu, Y.; Jia, H.; Qi, Y.; Wang, C. Multi-Scene Upgrade and Renovation Method of Existing Park-Level Integrated Energy System Based on Comprehensive Analysis. Energy Convers. Econ. 2020, 1, 184–197. [Google Scholar] [CrossRef]

- Yan, R.; Wang, J.; Zhu, S.; Liu, Y.; Cheng, Y.; Ma, Z. Novel Planning Methodology for Energy Stations and Networks in Regional Integrated Energy Systems. Energy Convers. Manag. 2020, 205, 112441. [Google Scholar] [CrossRef]

- Yang, Z.; Ni, M.; Liu, H. Pricing Strategy of Multi-Energy Provider Considering Integrated Demand Response. IEEE Access 2020, 8, 149041–149051. [Google Scholar] [CrossRef]

- Dou, X.; Wang, J.; Hu, Q.; Li, Y. Bi-Level Bidding and Multi-Energy Retail Packages for Integrated Energy Service Providers Considering Multi-Energy Demand Elasticity. CSEE J. Power Energy Syst. 2020, 1–14. [Google Scholar] [CrossRef]

- Hou, L.; Chen, B.; Wang, Y.; Miao, A.; Su, K.; Zhang, Z. Optimal Decision of Electricity Transaction for Integrated Energy Service Providers under Renewable Portfolio Standards. In Proceedings of the 2019 IEEE Sustainable Power and Energy Conference (iSPEC), Beijing, China, 21–23 November 2019; pp. 1060–1065. [Google Scholar]

- Guo, L.; Wang, L.; Wei, W.; Wu, J. Day Ahead Economic Dispatch of District Integrated Energy Service Providers under Energy Market. In Proceedings of the 2019 IEEE 3rd International Electrical and Energy Conference (CIEEC), Beijing, China, 7–9 September 2019; pp. 1878–1883. [Google Scholar]

- Ma, H.; Wang, B.; Gao, W.; Liu, D.; Sun, Y.; Liu, Z. Optimal Scheduling of an Regional Integrated Energy System with Energy Storage Systems for Service Regulation. Energies 2018, 11, 195. [Google Scholar] [CrossRef] [Green Version]

- Li, C.; Li, P.; Yu, H.; Li, H.; Zhao, J.; Li, S.; Wang, C. Optimal Planning of Community Integrated Energy Station Considering Frequency Regulation Service. J. Mod. Power Syst. Clean Energy 2021, 9, 264–273. [Google Scholar] [CrossRef]

- Zhou, Y.; Wei, Z.; Sun, G.; Cheung, K.W.; Zang, H.; Chen, S. A Robust Optimization Approach for Integrated Community Energy System in Energy and Ancillary Service Markets. Energy 2018, 148, 1–15. [Google Scholar] [CrossRef]

| Equipment | Installed Capacity | Efficiency | Maintenance Price |

|---|---|---|---|

| Gas turbine | 10 MW | 0.427 (gas-electricity) 0.458 (waste heat) | 9.46 USD/MWh |

| Absorption chiller | 8 MW | 0.8 | 1.26 USD/MWh |

| Waste heat boiler | 2 MW | 0.9 | 0.47 USD/MWh |

| Gas boiler | 2 MW | 0.93 | 0.63 USD/MWh |

| Electric boiler | 2 MW | 0.95 | 0.79 USD/MWh |

| Electric chiller | 8 MW | 3.5 | 0.80 USD/MWh |

| Electric storage | 10 MW, 20 MWh | 0.01 | 11.04 USD/MWh |

| Cold storage | 2 MW, 10 MWh | 0.01 | 0.78 USD/MWh |

| Heat storage | 2 MW, 10 MWh | 0.01 | 1.25 USD/MWh |

| Parameter | Value |

|---|---|

| Capacity price for reserve ancillary services | 250 USD/MW |

| Actual start time of reserve ancillary services | 18:00 |

| Actual end time of reserve ancillary service | 19:00 |

| Capacity price for frequency ancillary services | 100 USD/MW |

| Mileage price for frequency ancillary services | 15 USD/MW |

| Mileage factor for frequency ancillary services | 10 |

| Parameter | Value |

|---|---|

| Price of heating service | 80 USD/MWh |

| Price of cooling service | 80 USD/MWh |

| Price of purchasing natural gas | 70 USD/MWh |

| Maximum power purchased from the natural gas network | 12 MW |

| Maximum power purchased from the external power grid | 8 MW |

| Items (In USD) | Scenario 1 | Scenario 2 |

|---|---|---|

| Total income | 21,452.31 | 22,756.79 |

| Electricity income | 11,523.88 | 11,523.88 |

| Cooling income | 7957.66 | 7957.66 |

| Heating income | 1970.78 | 1970.78 |

| Frequency ancillary service income | 0 | 596.20 |

| Reserve ancillary services income | 0 | 708.27 |

| Total cost | 14,690.90 | 14,917.25 |

| Electricity purchase cost | 8147.80 | 7524.52 |

| Gas purchase cost | 5642.56 | 6504.81 |

| Maintenance cost | 900.54 | 887.92 |

| Total profit | 6761.41 | 7839.53 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lai, X.; Xie, Z.; Xu, D.; Ying, S.; Zeng, Y.; Jiang, C.; Wang, F.; Wen, F.; Palu, I. Operation Optimization of an Integrated Energy Service Provider with Ancillary Service Provision. Energies 2022, 15, 4376. https://doi.org/10.3390/en15124376

Lai X, Xie Z, Xu D, Ying S, Zeng Y, Jiang C, Wang F, Wen F, Palu I. Operation Optimization of an Integrated Energy Service Provider with Ancillary Service Provision. Energies. 2022; 15(12):4376. https://doi.org/10.3390/en15124376

Chicago/Turabian StyleLai, Xinyi, Zhihan Xie, Danlu Xu, Shuyang Ying, Yiming Zeng, Chenwei Jiang, Fei Wang, Fushuan Wen, and Ivo Palu. 2022. "Operation Optimization of an Integrated Energy Service Provider with Ancillary Service Provision" Energies 15, no. 12: 4376. https://doi.org/10.3390/en15124376

APA StyleLai, X., Xie, Z., Xu, D., Ying, S., Zeng, Y., Jiang, C., Wang, F., Wen, F., & Palu, I. (2022). Operation Optimization of an Integrated Energy Service Provider with Ancillary Service Provision. Energies, 15(12), 4376. https://doi.org/10.3390/en15124376