What Is the Temporal Path of the GDP Elasticity of Energy Consumption in OECD Countries? An Assessment of Previous Findings and New Evidence

Abstract

:1. Introduction

1.1. Why the GDP Elasticity of Energy Consumption Might Change

1.1.1. Why the GDP Elasticity Might Have a One-Time Drop

1.1.2. Why the GDP Elasticity Might Decline Continuously

2. Previous Work on the Temporal Path of the GDP Elasticity of Energy Consumption

3. Materials and Methods for New Evidence on the Temporal Path of the GDP Elasticity of Energy Consumption

3.1. Data and Models

3.2. Methods

3.2.1. Methods for Determining Pre- and Post-Crises Elasticities

3.2.2. Methods for Determining the Temporal Stability of Elasticities

4. Results and Discussion

4.1. Results and Discussion of the Pre- and Post-Crises Elasticities

4.2. Results and Discussion of the Temporal Stability of Elasticities

5. Conclusions

Supplementary Materials

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Dargay, J.M. The irreversible effects of high oil prices: Empirical evidence for the demand for motor fuels in France, Germany and the UK. In Energy Demand: Evidence and Expectations; Hawdon, D., Ed.; Surrey University Press: Guildford, UK, 1992; pp. 165–182. [Google Scholar]

- Walker, I.O.; Wirl, F. Irreversible price-induced efficiency improvements: Theory and empirical application to road transportation. Energy J. 1993, 14, 183–205. [Google Scholar] [CrossRef]

- Dargay, J.M.; Gately, D. The imperfect price-reversibility of non-transport oil demand in the OECD. Energy Econ. 1995, 17, 59–71. [Google Scholar] [CrossRef]

- Dargay, J.M.; Gately, D. The demand for transportation fuels: Imperfect price reversibility? Transp. Res. B 1997, 31, 71–82. [Google Scholar] [CrossRef]

- Gately, D.; Huntington, H.G. The asymmetric effects of changes in price and income on energy and oil demand. Energy J. 2002, 23, 19–55. [Google Scholar] [CrossRef]

- Ryan, D.; Plourde, A. Smaller and smaller? The price responsiveness of non-transport oil demand. Q. Rev. Econ. Financ. 2002, 42, 285–317. [Google Scholar] [CrossRef]

- Huntington, H.G. Oil demand and technical progress . Appl. Econ. Lett. 2010, 17, 1747–1751. [Google Scholar] [CrossRef]

- Goldemberg, J. Leapfrog energy technologies. Energy Policy 1998, 2, 729–741. [Google Scholar]

- Van Benthem, A. Energy leapfrogging. J. Assoc. Environ. Resour. Econ. 2015, 2, 93–132. [Google Scholar] [CrossRef]

- Liddle, B.; Huntington, H. There’s Technology Improvement, but is there Economy-wide Energy Leap-Frogging? A Country Panel Analysis. World Dev. 2021, 140, 105259. [Google Scholar] [CrossRef]

- Galli, R. The relationship between energy and income levels: Forecasting long term energy demand in Asian emerging countries. Energy J. 1998, 19, 85–105. [Google Scholar] [CrossRef]

- Medlock, K.; Soligo, R. Economic development and end-use energy demand. Energy J. 2001, 22, 77–105. [Google Scholar] [CrossRef]

- Csereklyei, Z.; Rubio Varas, M.; Stern, D. Energy and economic growth: The stylized facts. Energy J. 2016, 37, 223–255. [Google Scholar] [CrossRef]

- Liddle, B.; Huntington, H. Revisiting the income elasticity of energy consumption: A heterogeneous, common factor, dynamic OECD & non-OECD country panel analysis. Energy J. 2020, 41, 207–229. [Google Scholar] [CrossRef]

- Liddle, B.; Smyth, R.; Zhang, X. Time-varying income and price elasticities for energy demand: Evidence from a middle-income panel. Energy Econ. 2020, 86, 104681. [Google Scholar] [CrossRef]

- Gao, J.; Peng, B.; Smyth, R. On income and price elasticities for energy demand: A panel data study. Energy Econ. 2021, 96, 105168. [Google Scholar] [CrossRef]

- Fouquau, J.; Destais, G.; Hurlin, C. Energy demand models: A threshold panel specification of the ‘Kuznets curve’. Appl. Econ. Lett. 2009, 16, 1241–1244. [Google Scholar] [CrossRef]

- Pablo-Romero, M.; Sanchez-Braza, A. Residential Energy Environmental Kuznets Curve in the EU-28. Energy 2017, 125, 44–54. [Google Scholar] [CrossRef]

- Brookes, L.G. More on the output elasticity of energy consumption. J. Ind. Econ. 1972, 21, 83–92. [Google Scholar] [CrossRef]

- Chang, Y.; Choi, Y.; Kim, C.; Miller, J.; Park, J. Disentangling temporal patterns in elasticities: A functional coefficient panel analysis of electricity demand. Energy Econ. 2016, 60, 232–243. [Google Scholar] [CrossRef]

- Bai, J. Panel data models with interactive fixed effects. Econometrica 2009, 77, 1229–1279. [Google Scholar] [CrossRef]

- Pesaran, M.H. Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 2006, 74, 967–1012. [Google Scholar] [CrossRef]

- Chang, Y.; Choi, Y.; Kim, C.; Miller, I.; Park, J. Forecasting regional long-run energy demand: A functional coefficient panel approach. Energy Econ. 2021, 96, 105117. [Google Scholar] [CrossRef]

- Adams, F.G.; Miovic, P. On relative fuel efficiency and the output elasticity of energy consumption in Western Europe. J. Ind. Econ. 1968, 17, 41–56. [Google Scholar] [CrossRef]

- Hamilton, L. How robust is robust regression? Stata Tech. Bull. 1991, 2, 21–26. [Google Scholar]

- Pesaran, M.H.T. Yamagata. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Chudik, A.; Pesaran, M. Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressions. J. Econom. 2015, 188, 393–420. [Google Scholar] [CrossRef]

- Nickell, S. Biases in dynamic models with fixed effects. Econometrica 1981, 49, 1417–1426. [Google Scholar] [CrossRef]

- Beck, N.; Katz, J. Modeling dynamics in time-series—cross-section political economy data. Annu. Rev. Polit. Sci. 2011, 14, 331–352. [Google Scholar] [CrossRef]

- Judson, R.; Owen, A. Estimating dynamic panel data models: A guide for macroeconomists. Econ. Lett. 1999, 65, 9–15. [Google Scholar] [CrossRef]

- Westerlund, J.; Perova, Y.; Norkute, M. CCE in fixed-T panels. J. Appl. Econom. 2019, 34, 746–761. [Google Scholar] [CrossRef]

- Pesaran, H.; Shin, Y.; Smith, R. Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Stern, D. How large is the economy-wide rebound effect? Energy Policy 2020, 147, 111870. [Google Scholar] [CrossRef]

- Brockway, P.; Sorrell, S.; Semieniuk, G.; Kuperus Heun, M.; Court, V. Energy efficiency and economy-wide rebound effects: A review of the evidence and its implications. Renew. Sustain. Energy Rev. 2021, 141, 110781. [Google Scholar] [CrossRef]

| Variable | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| 1960–2019, 22 countries | ||||

| GDP pc | 30,068 | 13,434 | 5543 | 91,333 |

| TFC pc | 3.0 | 1.5 | 0.2 | 8.8 |

| Energy price index | 80.7 | 19.0 | 32.0 | 133.1 |

| 1986–2019, 28 countries | ||||

| GDP pc | 34,240 | 13,081 | 8188 | 91,333 |

| TFC pc | 3.0 | 1.4 | 0.9 | 8.8 |

| Energy price index | 86.2 | 16.0 | 38.2 | 125.0 |

| Estimator | Homogeneous | MG/Heterogeneous | ||||

|---|---|---|---|---|---|---|

| CCEP | FE-2W | CCE | DCCE | |||

| Model | Static | Partial Adjustment | Static | Partial Adjustment | Static | Partial Adjustment |

| Pre−energy crises, 1960–1973 | ||||||

| GDP | 0.74 *** | 0.98 ** | 1.06 *** | 1.16 *** | ||

| [0.28 1.19] | [0.15 1.80] | [0.62 1.49] | [0.52 1.80] | |||

| Price | −0.076 | −0.27 | −0.25 * | −0.21 | ||

| [−0.24 0.083] | [−0.71 0.16] | [−0.51 0.015] | [−0.57 0.14] | |||

| Post−energy crises, 1986–2019 | ||||||

| GDP | 0.32 *** | 0.35 **** | 0.26 *** | 0.29 *** | 0.41 **** | 0.52 *** |

| [0.14 0.49] | [0.17 0.53] | [0.12 0.41] | [0.11 0.48] | [0.22 0.61] | [0.22 0.82] | |

| Price | −0.17 *** | −0.21 *** | −0.42 *** | −0.29 *** | −0.10 *** | −0.14 *** |

| [−0.30 −0.043] | [−0.36 −0.055] | [−0.67 −0.16] | [−0.45 −0.12] | [−0.17 −0.032] | [−0.24 −0.036] | |

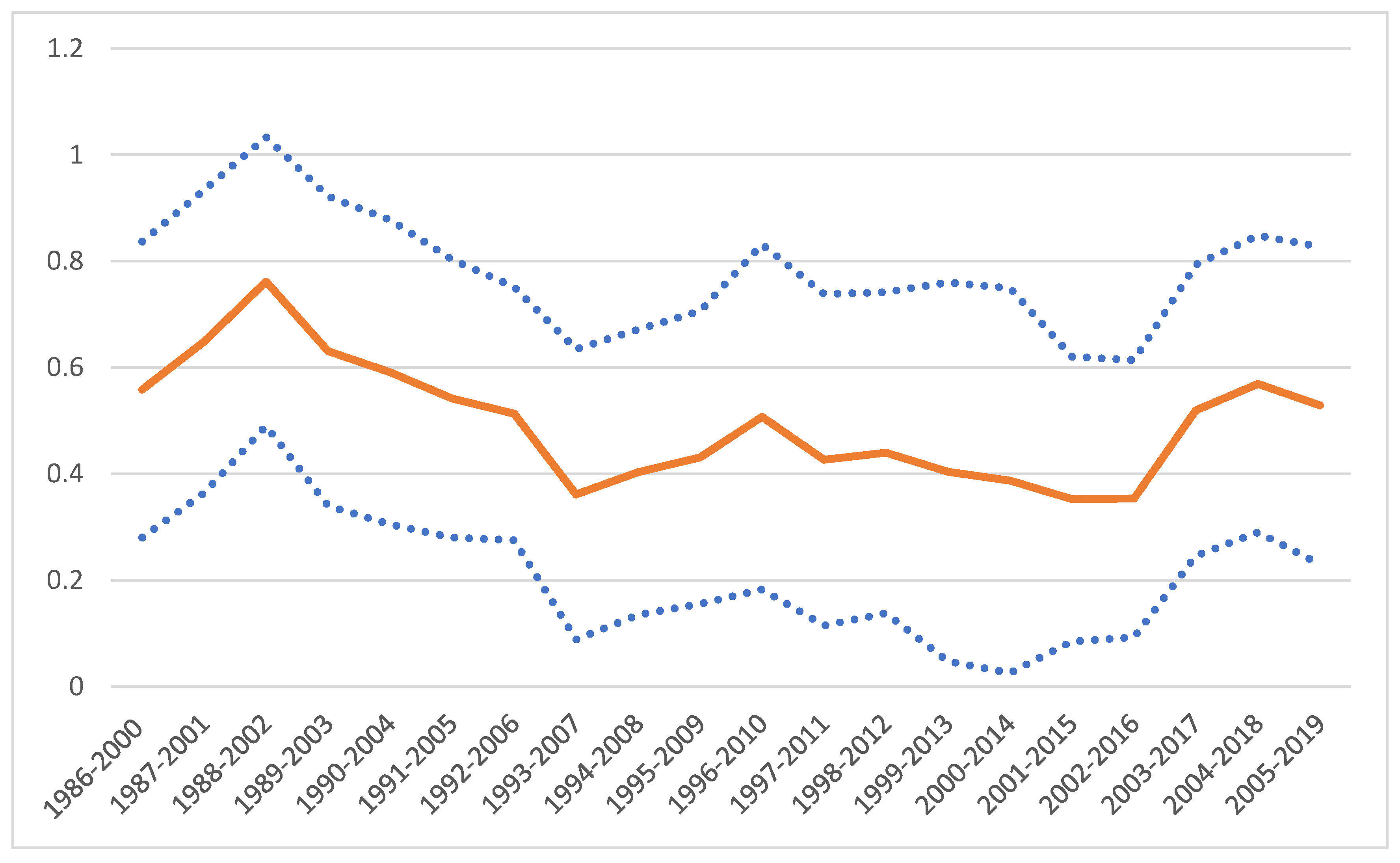

| Span | GDP | Price |

|---|---|---|

| 1986–2000 | 0.56 **** | −0.06 |

| [0.28 0.84] | [−0.23 0.12] | |

| 1987–2001 | 0.65 **** | −0.1 |

| [0.36 0.93] | [−0.26 0.06] | |

| 1988–2002 | 0.76 **** | −0.1 |

| [0.49 1.03] | [−0.23 0.04] | |

| 1989–2003 | 0.63 **** | −0.02 |

| [0.34 0.92] | [−0.14 0.10] | |

| 1990–2004 | 0.59 **** | −0.03 |

| [0.30 0.88] | [−0.13 0.08] | |

| 1991–2005 | 0.54 **** | −0.09 * |

| [0.28 0.80] | [−0.20 0.02] | |

| 1992–2006 | 0.51 **** | −0.15 *** |

| [0.28 0.75] | [−0.24 −0.05] | |

| 1993–2007 | 0.36 ** | −0.19 **** |

| [0.09 0.63] | [−0.28 −0.11] | |

| 1994–2008 | 0.40 *** | −0.16 *** |

| [0.13 0.67] | [−0.27 −0.04] | |

| 1995–2009 | 0.43 *** | −0.19 *** |

| [0.16 0.71] | [−0.30 −0.07] | |

| 1996–2010 | 0.51 *** | −0.16*** |

| [0.18 0.83] | [−0.26 −0.05] | |

| 1997–2011 | 0.43 *** | −0.15 ** |

| [0.11 0.74] | [−0.28 −0.02] | |

| 1998–2012 | 0.44 *** | −0.13 * |

| [0.14 0.74] | [−0.27 0.00] | |

| 1999–2013 | 0.40 ** | −0.14 ** |

| [0.05 0.76] | [−0.27 −0.01] | |

| 2000–2014 | 0.39 ** | −0.13 ** |

| [0.03 0.75] | [−0.24 −0.02] | |

| 2001–2015 | 0.35 ** | −0.12 ** |

| [0.08 0.62] | [−0.22 −0.02] | |

| 2002–2016 | 0.35 *** | −0.07 * |

| [0.09 0.61] | [−0.16 0.01] | |

| 2003–2017 | 0.52 **** | −0.06 |

| [0.25 0.79] | [−0.14 0.02] | |

| 2004–2018 | 0.57 **** | −0.06 |

| [0.29 0.85] | [−0.15 0.04] | |

| 2005–2019 | 0.53 *** | −0.06 |

| [0.23 0.83] | [−0.16 0.04] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liddle, B. What Is the Temporal Path of the GDP Elasticity of Energy Consumption in OECD Countries? An Assessment of Previous Findings and New Evidence. Energies 2022, 15, 3802. https://doi.org/10.3390/en15103802

Liddle B. What Is the Temporal Path of the GDP Elasticity of Energy Consumption in OECD Countries? An Assessment of Previous Findings and New Evidence. Energies. 2022; 15(10):3802. https://doi.org/10.3390/en15103802

Chicago/Turabian StyleLiddle, Brantley. 2022. "What Is the Temporal Path of the GDP Elasticity of Energy Consumption in OECD Countries? An Assessment of Previous Findings and New Evidence" Energies 15, no. 10: 3802. https://doi.org/10.3390/en15103802

APA StyleLiddle, B. (2022). What Is the Temporal Path of the GDP Elasticity of Energy Consumption in OECD Countries? An Assessment of Previous Findings and New Evidence. Energies, 15(10), 3802. https://doi.org/10.3390/en15103802