Development of Roadmap for Photovoltaic Solar Technologies and Market in Poland

Abstract

:1. Introduction

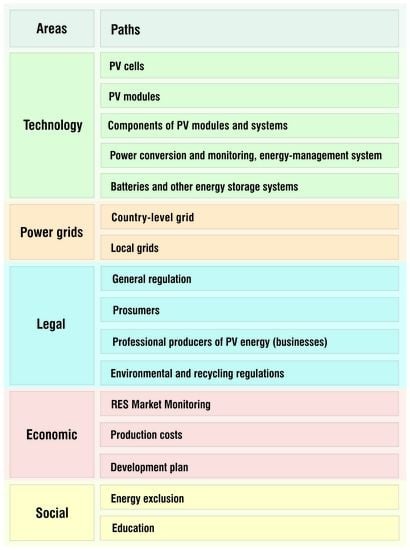

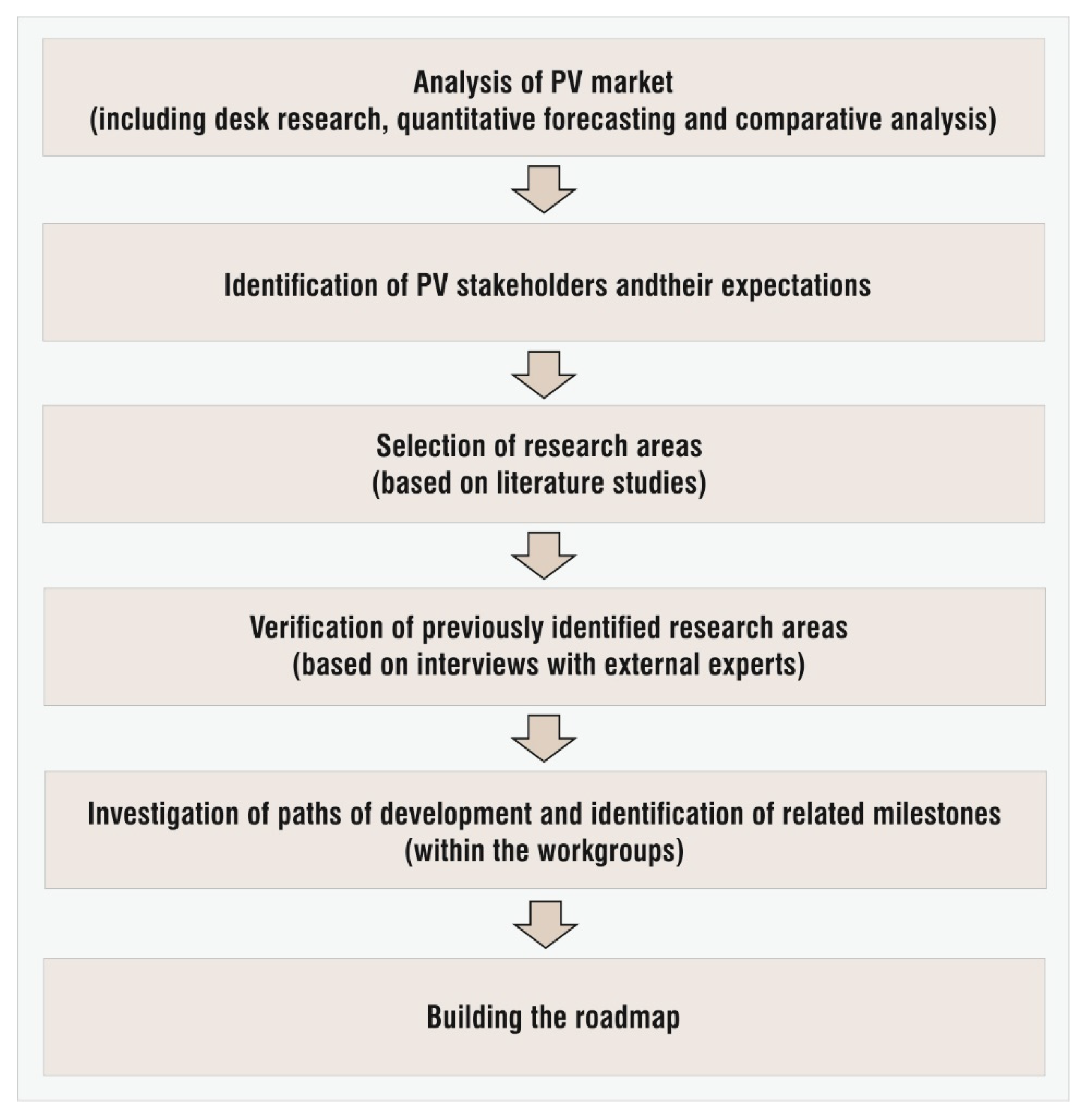

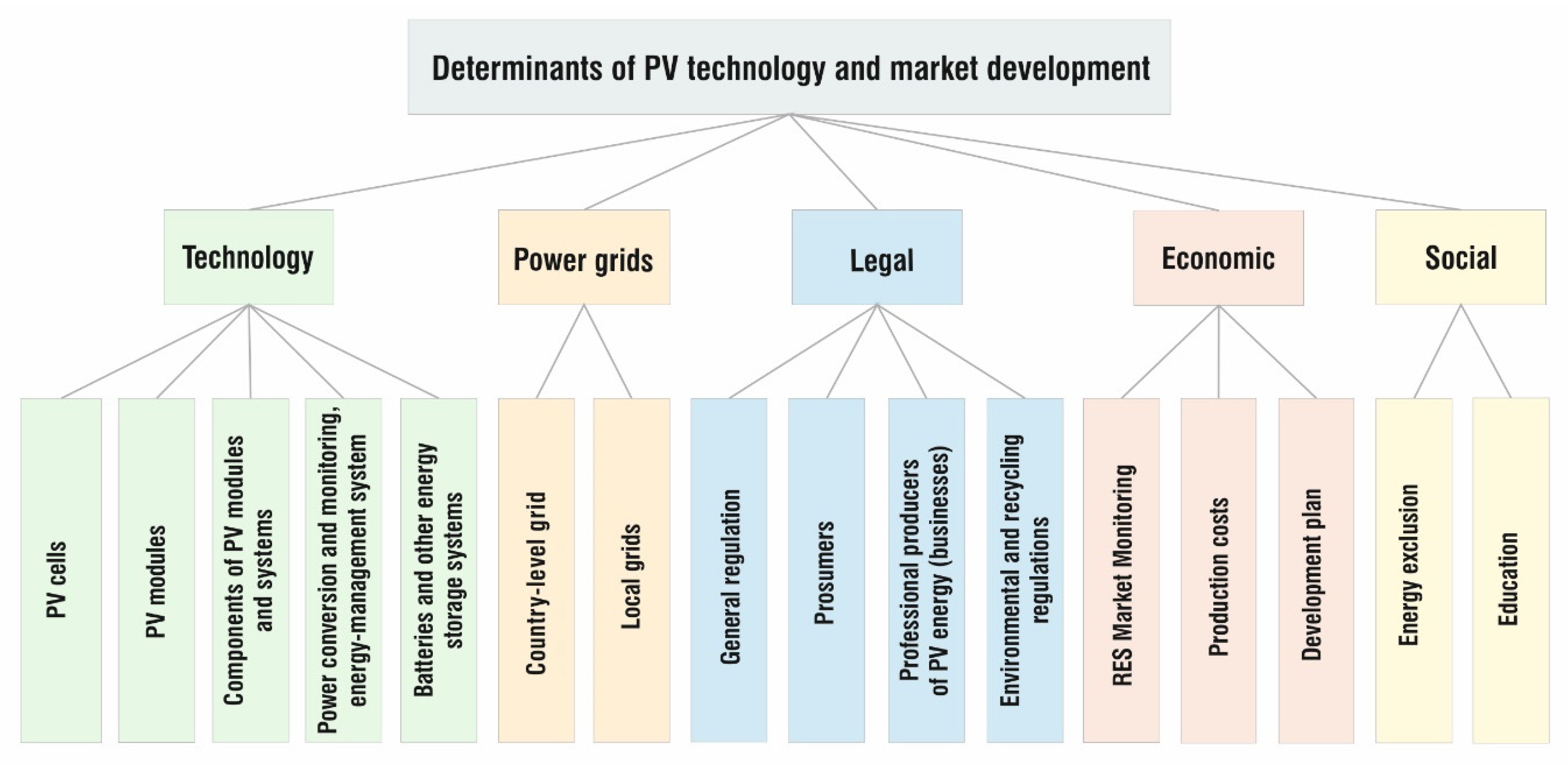

2. Materials and Methods

- -

- Technology;

- -

- Power grids;

- -

- Law;

- -

- Economic conditions;

- -

- Social conditions.

3. Results

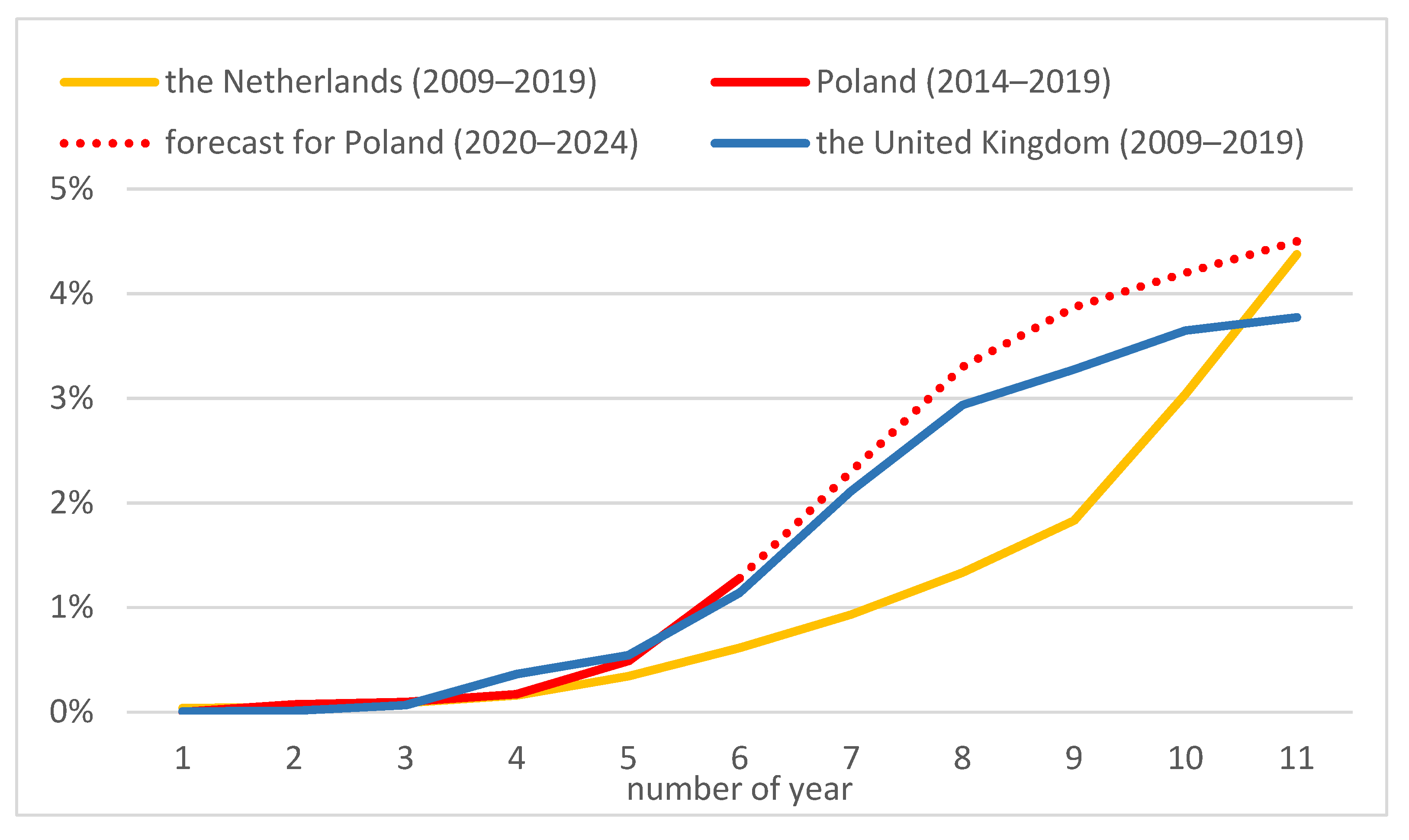

3.1. Development of the Photovoltaic Market in Poland

3.2. PV Technology Development Roadmap in Poland

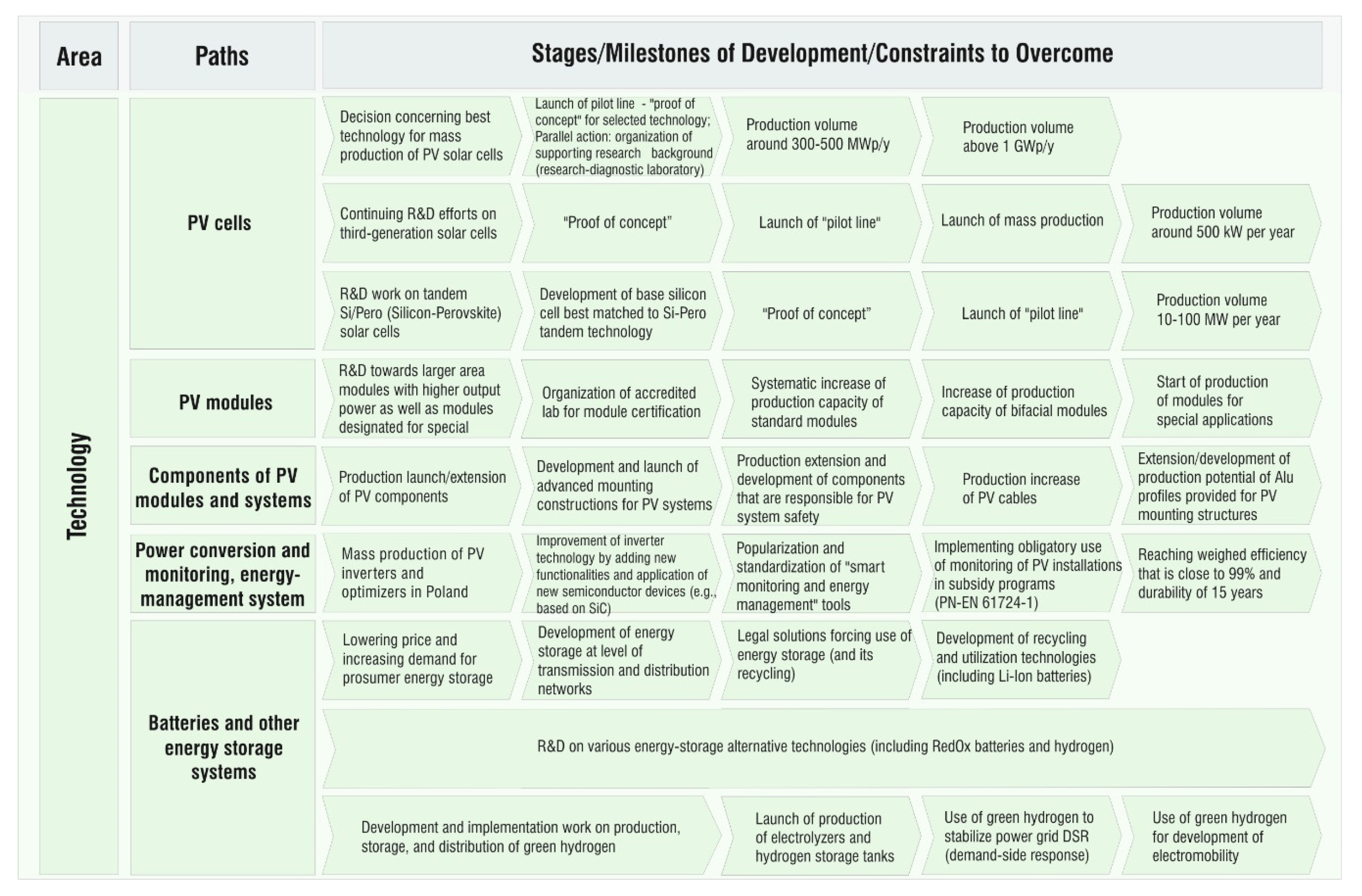

3.2.1. Technology

- -

- PV cells;

- -

- PV modules;

- -

- Components of PV modules and systems;

- -

- Power conversion and monitoring and energy-management systems;

- -

- Batteries and other energy storage systems.

- -

- Adoption of either of advanced cell technologies, i.e., PERC+, HJT or TopCON;

- -

- Highly automated smart fab;

- -

- Efficiency: 22% at first step, 24–25% goal;

- -

- Wafers: single crystalline (preferably n-type), size: M6 first step, M10 final, occasionally M12;

- -

- Wafer thickness: <140 μm;

- -

- Degradation free;

- -

- Advanced metallization schemes and technique (MBB and other techniques).

- -

- Optimized Si bottom cell for high efficiency tandem Perovskite-Silicon cell;

- -

- Polysilicon, crystallization, and wafering.

- -

- Output power: 230–500 Wp, depending on cells type and module size;

- -

- Number of cells: mostly 60, 72, or occasionally doubled for half-cut;

- -

- Module format (cells being imported): mostly standard monofacial glass/foil configuration; occasionally half-cut, shingled or special designs for BIPV.

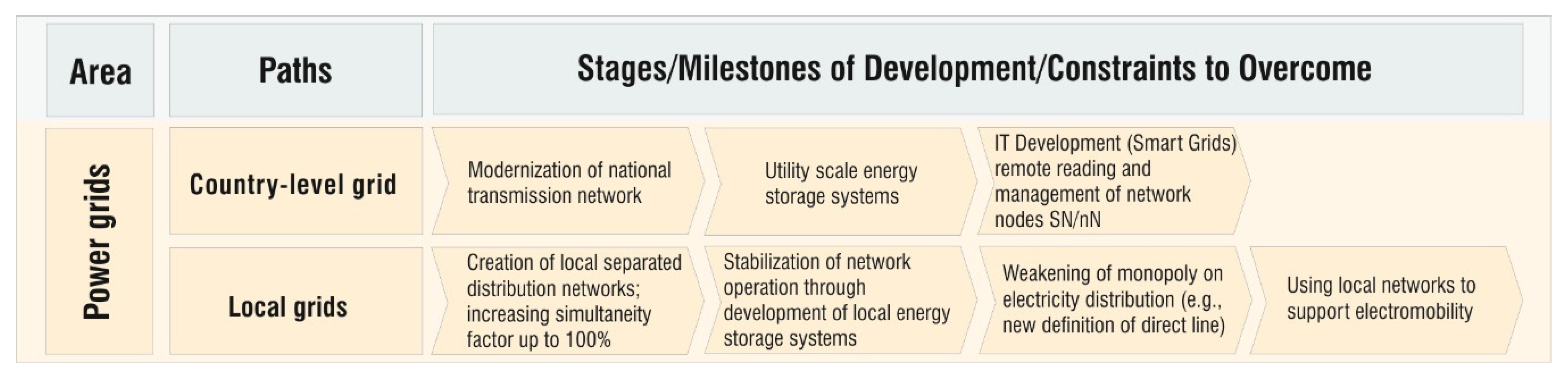

3.2.2. Power Grids

- -

- Country;

- -

- Local.

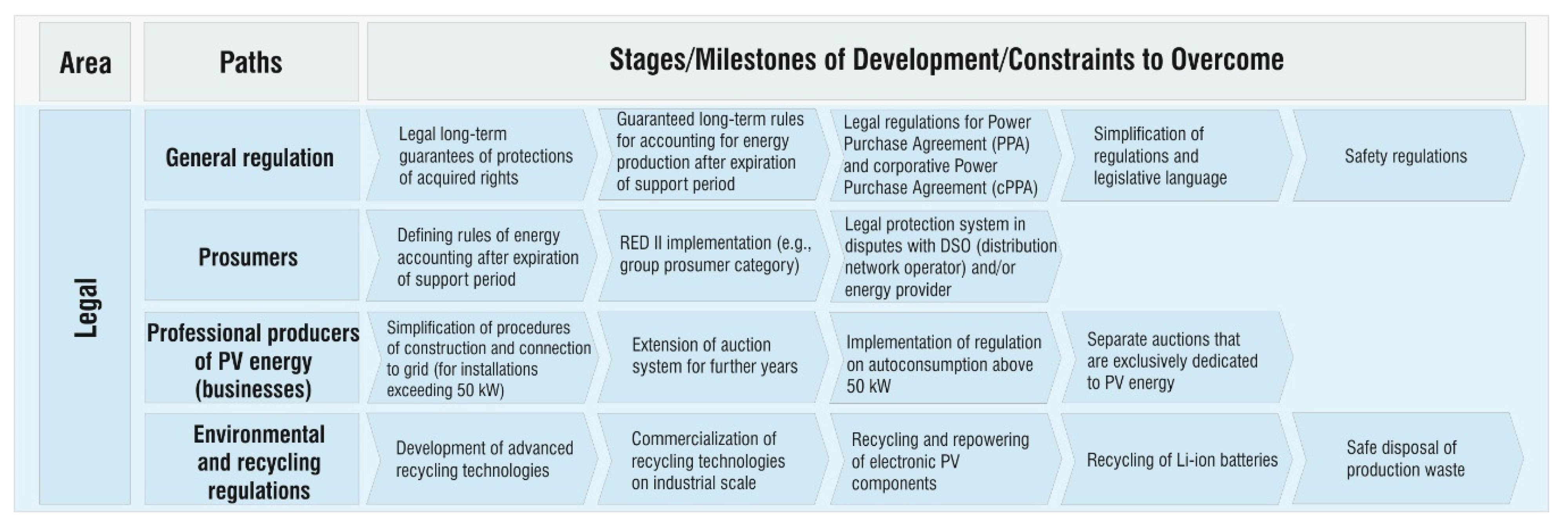

3.2.3. Law

- -

- General regulations;

- -

- Prosumers;

- -

- Professional producers of PV energy (businesses);

- -

- Environmental regulations and recycling of modules and batteries.

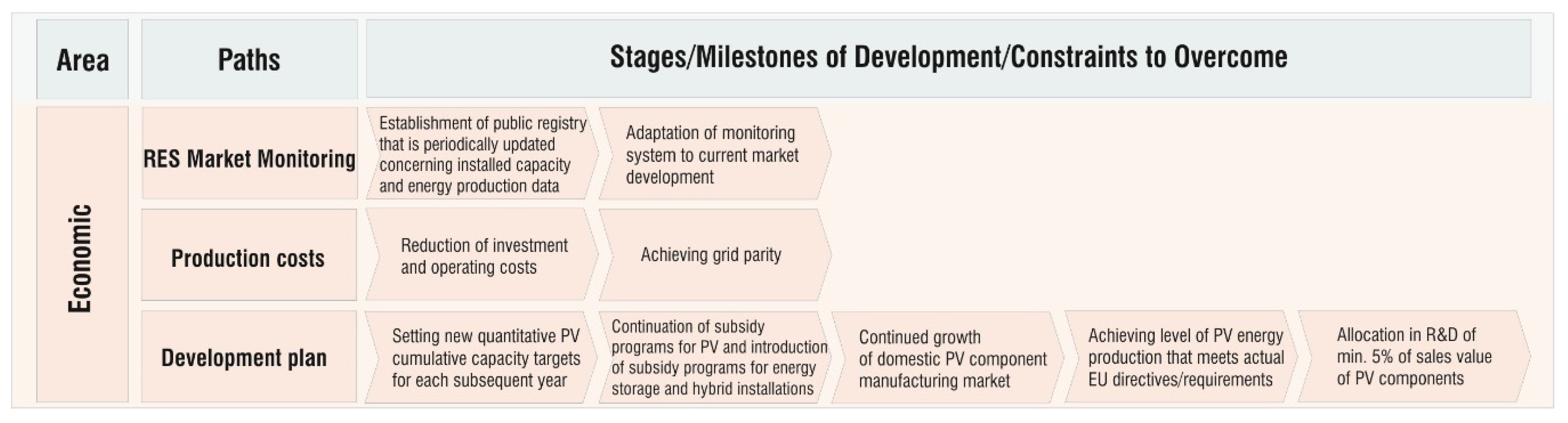

3.2.4. Economic Conditions

- -

- Capital investments;

- -

- RES market monitoring;

- -

- Production costs;

- -

- Market development planning.

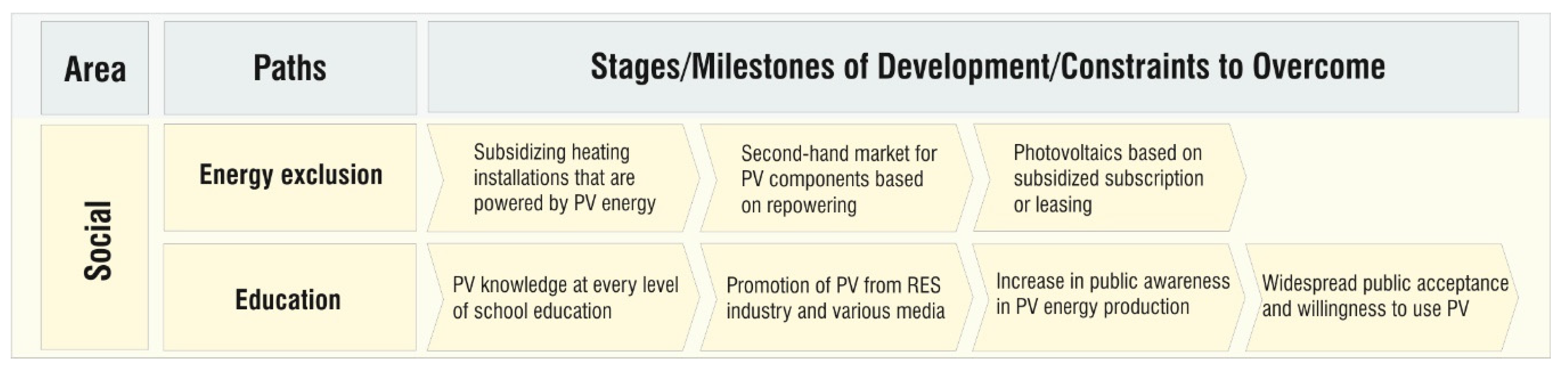

3.2.5. Social Conditions

- -

- Energy exclusion;

- -

- Education.

4. Discussion

5. Research Limitations and Future Prospects

- -

- Support and direct the development of renewable energies—the aim is to enable, through the use of support mechanisms, a stable increase in the number of PV installations to obtain the potential of min. 15 GW in 2030. The development of PV systems must be oriented in such a way as to enable their connection to the grid and integration with the energy system. In addition, the product-based nature of photovoltaics—for example the provision of grid services—should be further developed through a system of appropriate incentives and thus integrated into the energy market;

- -

- Strive for the integration of photovoltaics and other types of renewable energy into the energy system—the development of photovoltaics and other types of renewable energy is transforming the energy system from the centralized one that still exists to the decentralized one. So far, the network is being built for a centralized system. The growing number of connections of new renewable energy producers with variable production dynamics, who do not operate within the central system, poses new challenges that require adaptation of the distribution system;

- -

- Develop and make available the necessary technology—to achieve rapid progress in activities indicated above, and to reduce conversion costs. This, in turn, requires research and technological development to be undertaken.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- European Commission. New Circular Economy Action Plan For a Cleaner and More Competitive Europe (COM no. 98, 2020); European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. The European Green Deal (COM no. 640, 2019); European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Fragkiadakis, K.; Fragkos, P.; Paroussos, L. Low-Carbon R&D Can Boost EU Growth and Competitiveness. Energies 2020, 13, 5236. [Google Scholar]

- Gródek-Szostak, Z.; Suder, M.; Kusa, R.; Szeląg-Sikora, A.; Duda, J.; Niemiec, M. Renewable Energy Promotion Instruments Used by Innovation Brokers in a Technology Transfer Network. Case Study of the Enterprise Europe Network. Energies 2020, 13, 5752. [Google Scholar] [CrossRef]

- Tvaronavičienė, M.; Lisin, E.; Kindra, V. Power Market Formation for Clean Energy Production as the Prerequisite for the Country’s Energy Security. Energies 2020, 13, 4930. [Google Scholar] [CrossRef]

- Newbery, D.M. Towards a green energy economy? The EU Energy Union’s transition to a low-carbon zero subsidy electricity system–Lessons from the UK’s Electricity Market Reform. Appl. Energy 2020, 179, 1321–1330. [Google Scholar]

- European Environment Agency. Share of Energy Consumption from Renewable Sources in Europe. 2021. Available online: https://www.eea.europa.eu/data-and-maps/indicators/renewable-gross-final-energy-consumption-6/assessment (accessed on 11 September 2021).

- European Parliament. Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32009L0028&from=EN (accessed on 11 November 2021).

- Tomaszewski, K. The Polish road to the new European Green Deal—Challenges and threats to the national energy policy. Polityka Energetyczna 2020, 2, 5–18. [Google Scholar] [CrossRef]

- NIK 2019. Supreme Audit Office. Investments in Electricity Generative Power in the Years 2012–2018 (Inwestycje w Moce Wytwórcze Energii Elektrycznej w Latach 2012–2018). Sign. No 26/2019/P/18/018/ KGP. Available online: https://www.nik.gov.pl/plik/id,21644,vp,24294.pdf (accessed on 17 April 2020). (In Polish)

- Ministry of Climate and Environment. Energy Policy of Poland until 2040; Ministry of Climate and Environment: Warsaw, Poland, 2021.

- Olczak, P.; Olek, M.; Kryzia, D. The ecological impact of using photothermal and photovoltaic installations for DHW preparation. Polityka Energetyczna 2020, 23, 65–74. [Google Scholar] [CrossRef]

- Sobri, S.; Koohi-Kamali, S.; Rahim, N.A. Solar photovoltaic generation forecasting methods: A review. Energy Convers. Manag. 2020, 156, 459–497. [Google Scholar] [CrossRef]

- International Energy Agency. Snapshot of Global PV Markets 2020, Report IEA-PVPS T1-37; International Energy Agency: Rheine, Germany, 2020. [Google Scholar]

- Zdyb, A.; Gulkowski, S. Performance assessment of four different photovoltaic technologies in Poland. Energies 2020, 13, 196. [Google Scholar] [CrossRef] [Green Version]

- Institute of Renewable Energy. Report—Photovoltaic Market in Poland; Institute of Renewable Energy: Warsaw, Poland, 2021; pp. 1–65. [Google Scholar]

- Piwowar, A.; Dzikuć, M. Development of renewable energy sources in the context of threats resulting from low-altitude emissions in rural areas in Poland: A review. Energies 2019, 12, 3558. [Google Scholar] [CrossRef] [Green Version]

- Kober, T.; Schiffer, H.-W.; Densing, M.; Panos, E. Global energy perspectives to 2060—WEC’s World Energy Scenarios 2019. Energy Strategy Rev. 2020, 31, 100523. [Google Scholar] [CrossRef]

- Knutel, B.; Pierzyńska, A.; Dębowski, M.; Bukowski, P.; Dyjakon, A. Assessment of Energy Storage from Photovoltaic Installations in Poland Using Batteries or Hydrogen. Energies 2020, 13, 4023. [Google Scholar] [CrossRef]

- Standar, A.; Kozera, A.; Satoła, Ł. The Importance of Local Investments Co-Financed by the European Union in the Field of Renewable Energy Sources in Rural Areas of Poland. Energies 2020, 14, 450. [Google Scholar] [CrossRef]

- Instytut Energetyki Odnawialnej (IEO). Rynek Fotowoltaiki w Polsce 2021 (PV Market in Poland 2021); Instytut Energetyki Odnawialnej (IEO): Warsaw, Poland, 2021; Available online: https://ieo.pl/pl/aktualnosci/1538-rynek-fotowoltaiki-w-polsce-2021. (accessed on 16 September 2021).

- Olczak, P.; Kryzia, D.; Matuszewska, D.; Kuta, M. “My Electricity” Program Effectiveness Supporting the Development of PV Installation in Poland. Energies 2021, 14, 231. [Google Scholar] [CrossRef]

- Lew, G.; Sadowska, B.; Chudy-Laskowska, K.; Zimon, G.; Wójcik-Jurkiewicz, M. Influence of Photovoltaic Development on Decarbonization of Power Generation—Example of Poland. Energies 2021, 14, 7819. [Google Scholar] [CrossRef]

- Smol, M. Inventory and Comparison of Performance Indicators in Circular Economy Roadmaps of the European Countries. Circ. Econ. Sustain. 2021, 1–28. [Google Scholar] [CrossRef]

- Kostoff, R.N.; Schaller, R.R. Science and technology roadmaps. IEEE Trans. Eng. Manag. 2001, 48, 132–143. [Google Scholar] [CrossRef] [Green Version]

- Phaal, R.; Farrukh, C.J.P.; Probert, D.R. Technology roadmapping—A planning framework for evolution and revolution. Technol. Forecast. Soc. Chang. 2004, 71, 5–26. [Google Scholar] [CrossRef]

- Willyard, C.H.; McClees, C.W. Motorola’s technology roadmap process. Res. Manag. 1987, 30, 13–19. [Google Scholar] [CrossRef]

- Kerr, C.; Phaal, R. Technology roadmapping: Industrial roots, forgotten history and unknown Origins. Technol. Forecast. Soc. Chang. 2020, 155, 119967. [Google Scholar] [CrossRef]

- Park, H.; Phaal, R.; Ho, J.Y.; O’Sullivan, E. Twenty years of technology and strategic roadmapping research: A school of thought perspective. Technol. Forecast. Soc. Chang. 2020, 154, 119965. [Google Scholar] [CrossRef]

- Albright, R.E. A Unifying Architecture for Roadmaps Frames a Value Scorecard. In Proceedings of the IEEE International Engineering Management Conference, Albany, NY, USA, 2–4 November 2003; pp. 383–386. [Google Scholar]

- Geum, Y.; Lee, H.; Lee, Y.; Park, Y. Development of data-driven technology roadmap considering dependency: An ARM-based technology roadmapping. Technol. Forecast. Soc. Chang. 2015, 91, 264–279. [Google Scholar] [CrossRef]

- Vatananan, R.S.; Gerdsri, N. The current state of technology roadmapping (TRM) research and practice. Int. J. Innov. Technol. Manag. 2012, 9, 1250032. [Google Scholar] [CrossRef]

- Lu, H.P.; Chen, C.-S.; Yu, H. Technology roadmap for building a smart city: An exploring study on methodology. Future Gener. Comput. Syst. 2019, 97, 727–742. [Google Scholar] [CrossRef]

- Cresto Aleina, S.; Viola, N.; Fusaro, R.; Longo, J.; Saccoccia, G. Basis for a methodology for roadmaps generation for hypersonic and re-entry space transportation systems. Technol. Forecast. Soc. Chang. 2018, 128, 208–225. [Google Scholar] [CrossRef]

- Duda, J.; Kusa, R.; Rumin, R.; Suder, M.; Feliks, J. Identifying the determinants of vacuum tube high-speed train development with technology roadmapping—A study from Poland. Eur. Plan. Stud. 2021. [Google Scholar] [CrossRef]

- Yadav, P.; Malakar, Y.; Davies, P.J. Multi-scalar energy transitions in rural households: Distributed photovoltaics as a circuit breaker to the energy poverty cycle in India. Energy Res. Soc. Sci. 2019, 48, 1–12. [Google Scholar] [CrossRef]

- Li, W.; Ling, Y.; Liu, X.; Hao, Y. Performance analysis of a photovoltaic-thermochemical hybrid system prototype. Appl. Energy 2017, 204, 939–947. [Google Scholar] [CrossRef]

- Tariq, A.; Badir, Y.F.; Tariq, W.; Bhutta, U.S. Drivers and consequences of green product and process innovation: A systematic review, conceptual framework, and future outlook. Technol. Soc. 2017, 51, 8–23. [Google Scholar] [CrossRef]

- Hepbasli, A.; Alsuhaibani, Z. A key review on present status and future directions of solar energy studies and applications in Saudi Arabia. Renew. Sustain. Energy Rev. 2011, 15, 5021–5050. [Google Scholar] [CrossRef]

- Castillo, C.P.; e Silva, F.B.; Lavalle, C. An assessment of the regional potential for solar power generation in EU-28. Energy Policy 2016, 88, 86–99. [Google Scholar] [CrossRef]

- Cressie, N.; Wikle, C.K. Statistics for Spatio-Temporal Data; John Wiley & Sons: Hoboken, NJ, USA, 2011. [Google Scholar]

- Wikle, C.K. Modern perspectives on statistics for spatio-temporal data. Wiley Interdiscip. Rev. Comput. Stat. 2015, 7, 86–98. [Google Scholar] [CrossRef]

- The International Renewable Energy Agency (IRENA). 2021. Available online: https://www.irena.org/Statistics (accessed on 9 August 2021).

- European Statistical Office (Eurostat). 2021. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 9 August 2021).

- Agencja Rynku Energii (ARE S.A.). Statistical Information about Electricity Bulletin. 2021. Available online: https://www.are.waw.pl/wydawnictwa (accessed on 18 October 2021). (In Polish).

- Department for Business, Energy & Industrial Strategy, Solar Photovoltaics Deployment in the UK. 2021. Available online: https://www.gov.uk/government/statistics/solar-photovoltaics-deployment (accessed on 14 November 2021).

- Statistics Netherlands (CBS). Renewable Electricity; Production and Capacity. 2021. Available online: https://www.cbs.nl/en-gb/figures/detail/82610ENG?q=photovoltaics (accessed on 15 November 2021).

- Urząd Regulacji Energetyki (URE). Informacja Prezesa Urzędu Regulacji Energetyki Nr 38/2021 w sprawie ogłoszenia wyników Aukcji Zwykłej Nr AZ/8/2021. 2021. Available online: https://www.ure.gov.pl/pl/oze/aukcje-oze/ogloszenia-i-wyniki-auk/9586,Informacja-nr-382021.html (accessed on 16 November 2021). (In Polish)

- International Renewable Energy Agency. Rise of Renewables in Cities: Energy Solutions for the Urban Future; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2021; ISBN 978-92-9260-271-0. [Google Scholar]

- Ibn-Mohammed, T.; Koh, S.C.L.; Reaney, I.M.; Acquaye, A.; Schileo, G.; Mustapha, K.B.; Greenough, R. Perovskite solar cells: An integrated hybrid lifecycle assessment and review in comparison with other photovoltaic technologies. Renew. Sustain. Energy Rev. 2017, 80, 1321–1344. [Google Scholar] [CrossRef]

- Carreño-Ortega, A.; Galdeano-Gómez, E.; Pérez-Mesa, J.C.; Galera-Quiles, M.D.C. Policy and environmental implications of photovoltaic systems in farming in southeast Spain: Can greenhouses reduce the greenhouse effect? Energies 2017, 10, 761. [Google Scholar] [CrossRef] [Green Version]

- International Renewable Energy Agency & International Labour Organization. Renewable Energy and Jobs—Annual Review; International Renewable Energy Agency & International Labour Organization: Abu Dhabi, United Arab Emirates, 2021; ISBN 978-92-9260-364-9. [Google Scholar]

- Lilliestam, J.; Melliger, M.; Ollier, L.; Schmidt, T.S.; Steffen, B. Understanding and accounting for the effect of exchange rate fluctuations on global learning rates. Nat. Energy 2020, 5, 71–78. [Google Scholar]

- Green, M.A.; Dunlop, E.D.; Hohl-Ebinger, J.; Yoshita, M.; Kopidakis, N.; Hao, X. Solar Cell Efficiency Tables (Version 58). Prog. Photovolt. Res. Appl. 2021, 29, 657–667. [Google Scholar] [CrossRef]

- International Technology Roadmap for Photovoltaic (ITRPV) (12th Edition). 2021. Available online: https://itrpv.vdma.org/viewer/-/v2article/render/73707020 (accessed on 16 November 2021).

- Zhou, Y.; Cao, S.; Hensen, J.L.M.; Hasan, A. Heuristic battery-protective strategy for energy management of an interactive renewables–buildings–vehicles energy sharing network with high energy. Energy Convers. Manag. 2020, 214, 112281. [Google Scholar] [CrossRef]

- He, Y.; Zhou, Y.; Yuan, J.; Liu, Z.; Wang, Z.; Zhang, G. Transformation towards a carbon-neutral residential community with hydrogen economy and advanced energy management strategies. Energy Convers. Manag. 2021, 249, 114834. [Google Scholar] [CrossRef]

- Liu, J.; Yang, H.; Zhou, Y. Peer-to-peer energy trading of zero-energy communities with hybrid renewable energy systems integrating hydrogen vehicle storage. Appl. Energy 2021, 298, 117206. [Google Scholar] [CrossRef]

| Year | Cumulative Capacity | Cumulative Count | Average Power | |||

|---|---|---|---|---|---|---|

| [GWp] | y/y [%] | [Thousand pcs.] | y/y Increment [%] | [kWp] | y/y Increment [%] | |

| 2009 | 0.015 | - | No data | - | - | - |

| 2010 | 0.096 | 554.1 | 29.9 | - | 3.2 | |

| 2011 | 0.997 | 943.5 | 235.8 | 687.9 | 4.2 | 32.4 |

| 2012 | 1.769 | 77.5 | 404.0 | 71.3 | 4.4 | 3.6 |

| 2013 | 2.888 | 63.2 | 509.9 | 26.2 | 5.7 | 29.3 |

| 2014 | 5.470 | 89.4 | 651.7 | 27.8 | 8.4 | 48.2 |

| 2015 | 9.645 | 76.3 | 840.9 | 29.0 | 11.5 | 36.7 |

| 2016 | 11.798 | 22.3 | 901.5 | 7.2 | 13.1 | 14.1 |

| 2017 | 12.690 | 7.6 | 937.5 | 4.0 | 13.5 | 3.4 |

| 2018 | 12.989 | 2.4 | 976.2 | 4.1 | 13.3 | −1.7 |

| 2019 | 13.263 | 2.1 | 1025.0 | 5.0 | 12.9 | −2.8 |

| 2020 | 13.435 | 1.3 | 1060.5 | 3.5 | 12.7 | −2.1 |

| Q3 2021 | 13.587 | 1.1 | 1103.9 | 4.1 | 12.3 | −2.8 |

| Year | Cumulative Capacity | Year | Cumulative Capacity | ||

|---|---|---|---|---|---|

| [MWp] | y/y [%] | [MWp] | y/y [%] | ||

| 2001 | 21 | - | 2011 | 149 | 65.6 |

| 2002 | 26 | 23.8 | 2012 | 287 | 92.6 |

| 2003 | 46 | 76.9 | 2013 | 650 | 126.5 |

| 2004 | 50 | 8.7 | 2014 | 1007 | 54.9 |

| 2005 | 51 | 2.0 | 2015 | 1526 | 51.5 |

| 2006 | 53 | 3.9 | 2016 | 2135 | 39.9 |

| 2007 | 54 | 1.9 | 2017 | 2911 | 36.3 |

| 2008 | 59 | 9.3 | 2018 | 4608 | 58.3 |

| 2009 | 69 | 16.9 | 2019 | 7226 | 56.8 |

| 2010 | 90 | 30.4 | 2020 | 10,950 | 51.5 |

| Year | Cumulative Capacity | Cumulative Count | Average Power | |||

|---|---|---|---|---|---|---|

| [MWp] | y/y [%] | [Thousand pcs.] | y/y Increment [%] | [kWp] | y/y Increment [%] | |

| 2011 | 1.11 | - | No data | - | - | - |

| 2012 | 1.30 | 17.1 | No data | - | - | - |

| 2013 | 2.39 | 84.1 | No data | - | - | - |

| 2014 | 27.15 | 1034.6 | No data | - | - | - |

| 2015 | 107.78 | 297.0 | No data | - | - | - |

| 2016 | 187.25 | 73.7 | No data | - | - | - |

| 2017 | 287.25 | 53.4 | 26.160 | - | 11.0 | - |

| 2018 | 565.56 | 96.9 | 52.131 | 99.3 | 10.8 | −1.2 |

| 2019 | 1550.85 | 174.2 | 146.389 | 180.8 | 10.6 | −2.3 |

| 2020 | 3969.76 | 156.0 | 449.348 | 207.0 | 8.8 | −16.6 |

| Q3 2021 | 6304.20 | 58.8 | 701.025 | 56.0 | 9.0 | 1.8 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Duda, J.; Kusa, R.; Pietruszko, S.; Smol, M.; Suder, M.; Teneta, J.; Wójtowicz, T.; Żdanowicz, T. Development of Roadmap for Photovoltaic Solar Technologies and Market in Poland. Energies 2022, 15, 174. https://doi.org/10.3390/en15010174

Duda J, Kusa R, Pietruszko S, Smol M, Suder M, Teneta J, Wójtowicz T, Żdanowicz T. Development of Roadmap for Photovoltaic Solar Technologies and Market in Poland. Energies. 2022; 15(1):174. https://doi.org/10.3390/en15010174

Chicago/Turabian StyleDuda, Joanna, Rafał Kusa, Stanisław Pietruszko, Marzena Smol, Marcin Suder, Janusz Teneta, Tomasz Wójtowicz, and Tadeusz Żdanowicz. 2022. "Development of Roadmap for Photovoltaic Solar Technologies and Market in Poland" Energies 15, no. 1: 174. https://doi.org/10.3390/en15010174

APA StyleDuda, J., Kusa, R., Pietruszko, S., Smol, M., Suder, M., Teneta, J., Wójtowicz, T., & Żdanowicz, T. (2022). Development of Roadmap for Photovoltaic Solar Technologies and Market in Poland. Energies, 15(1), 174. https://doi.org/10.3390/en15010174