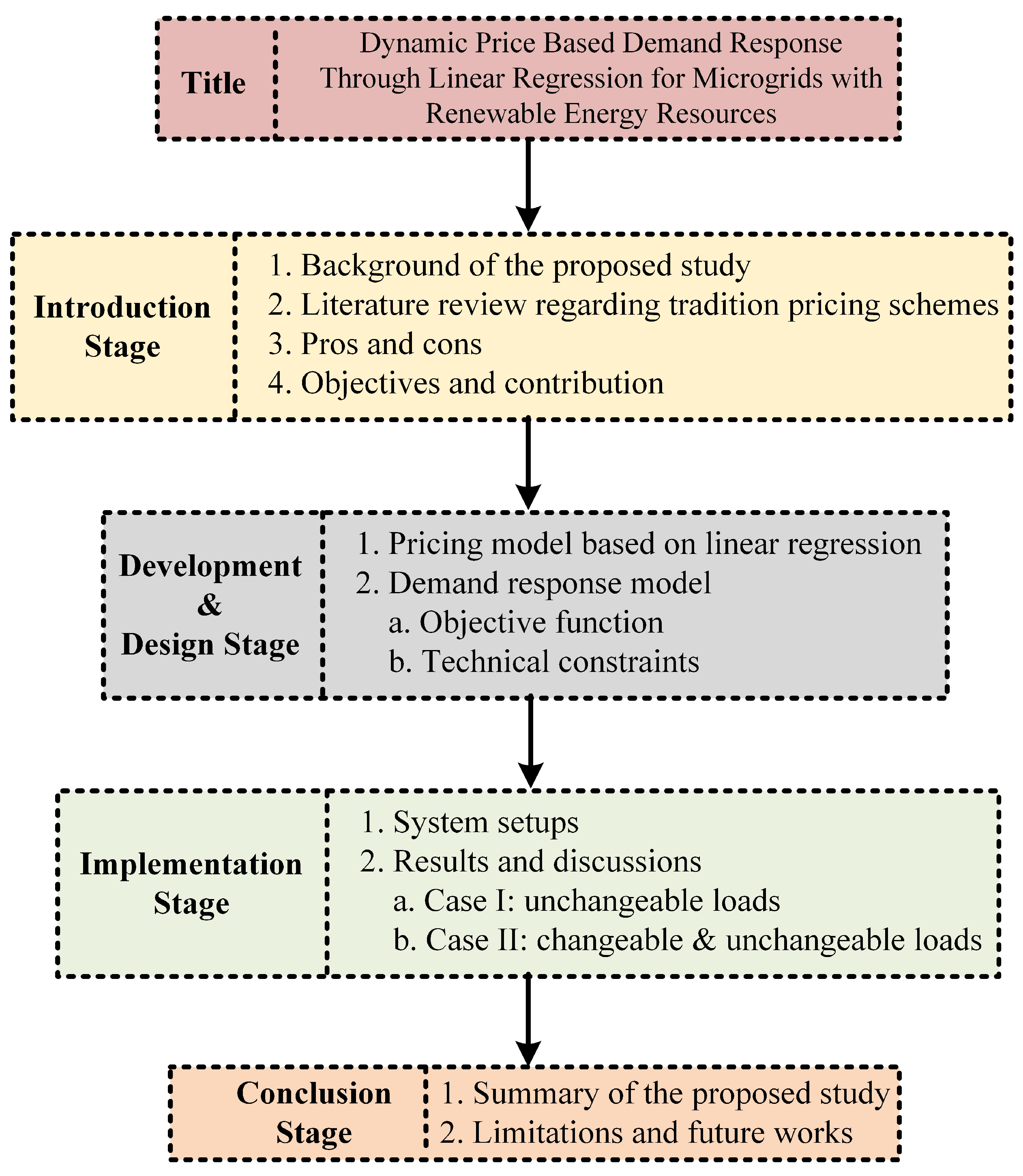

Dynamic Price-Based Demand Response through Linear Regression for Microgrids with Renewable Energy Resources

Abstract

:1. Introduction

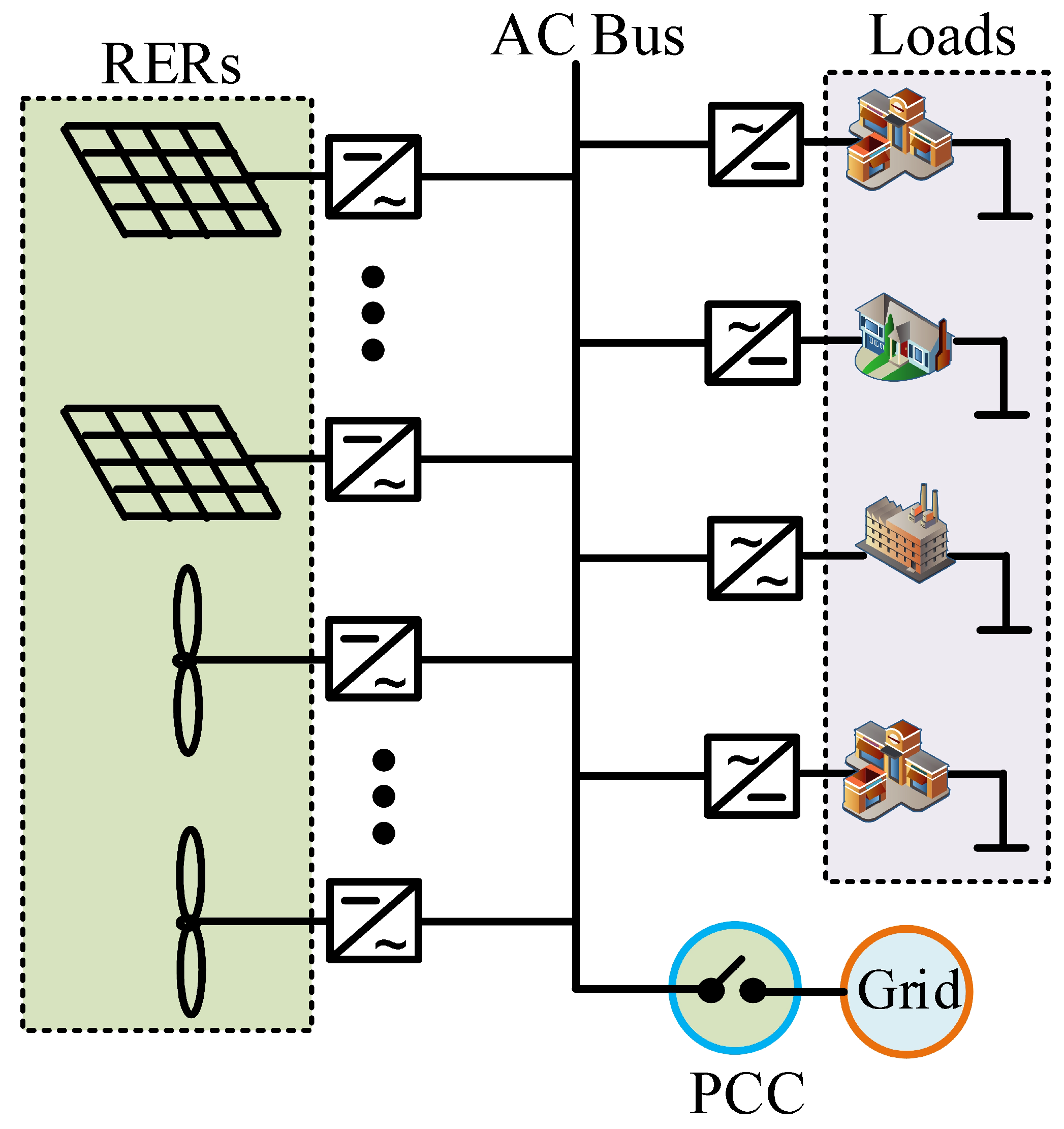

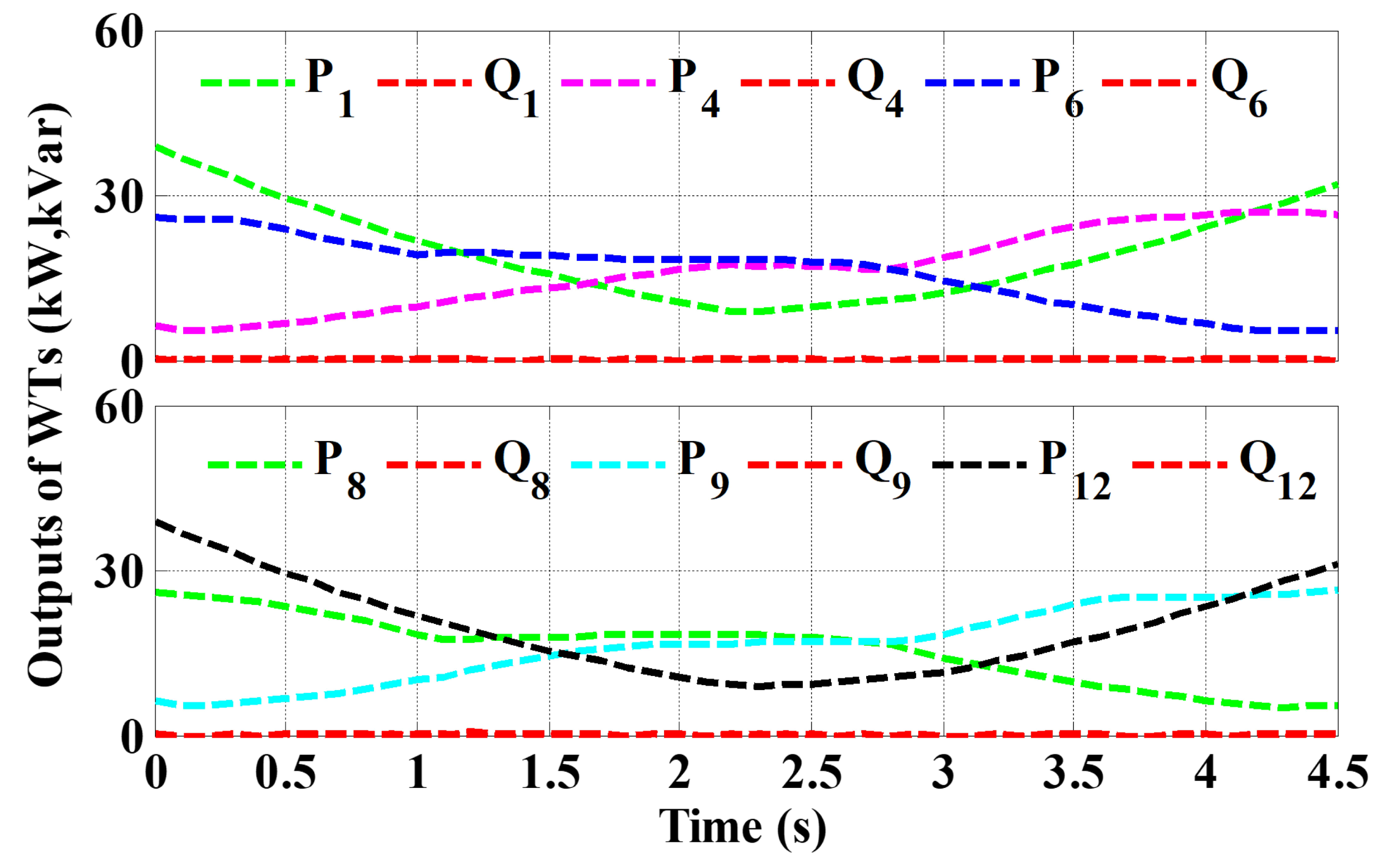

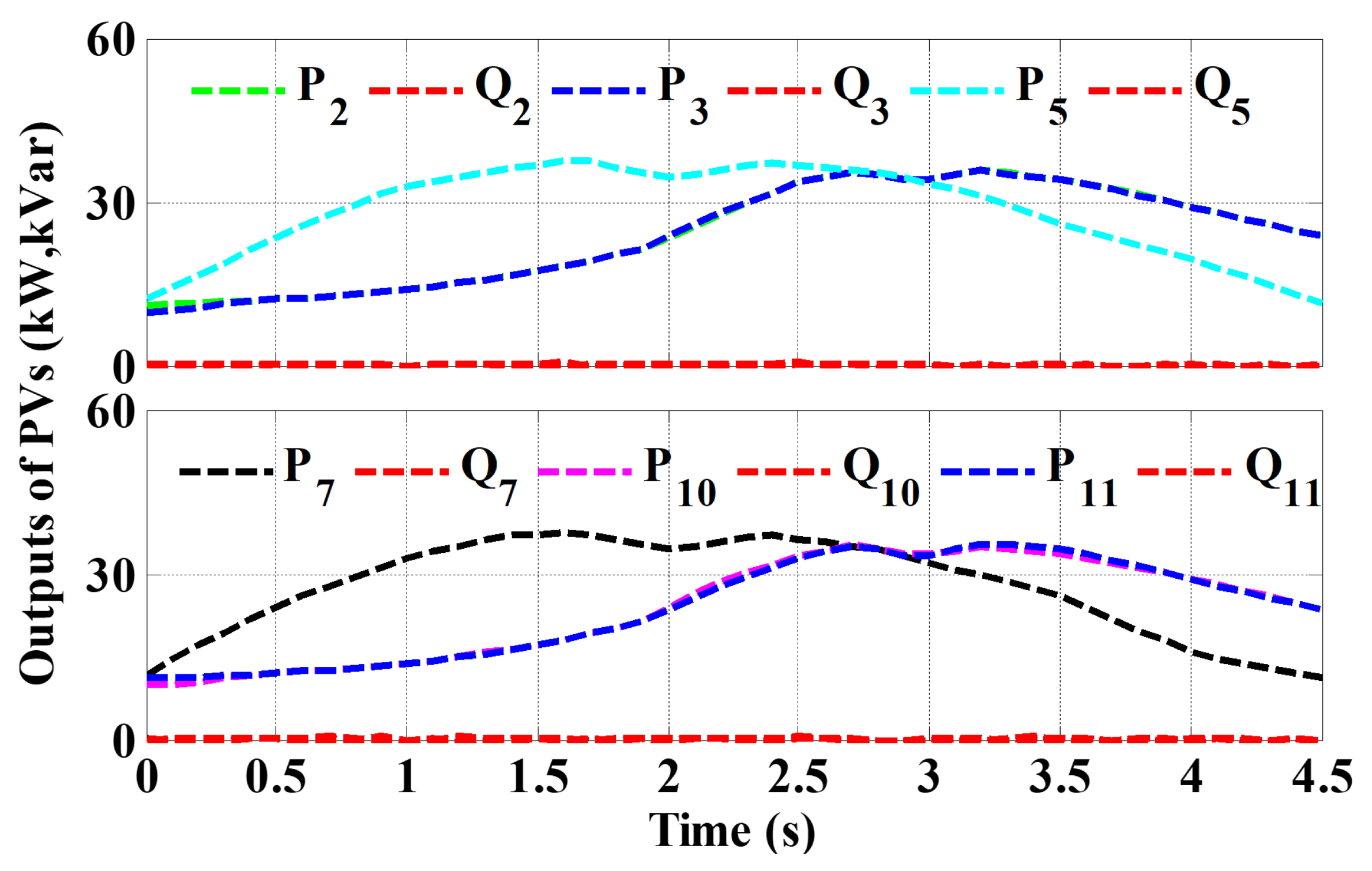

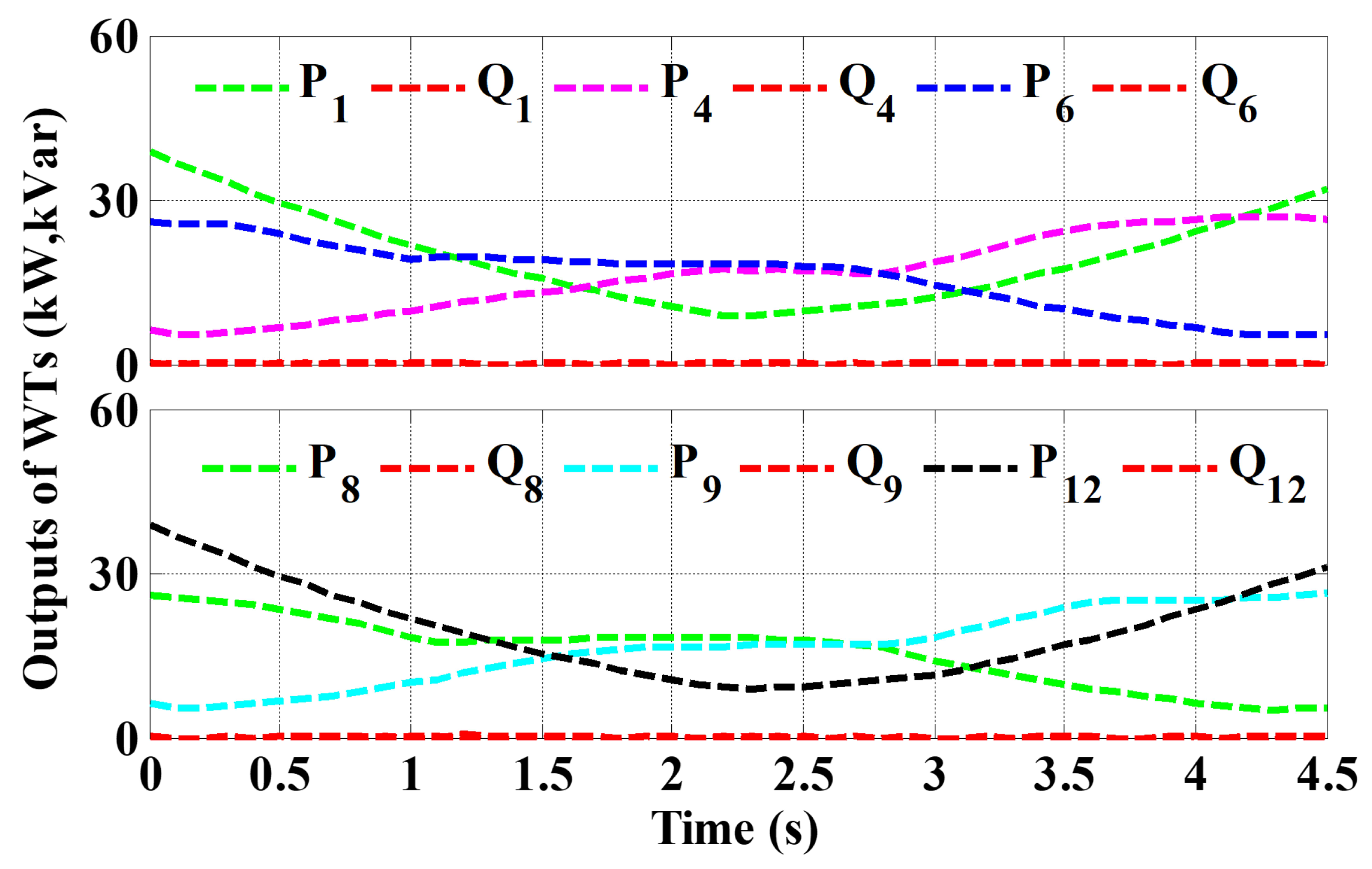

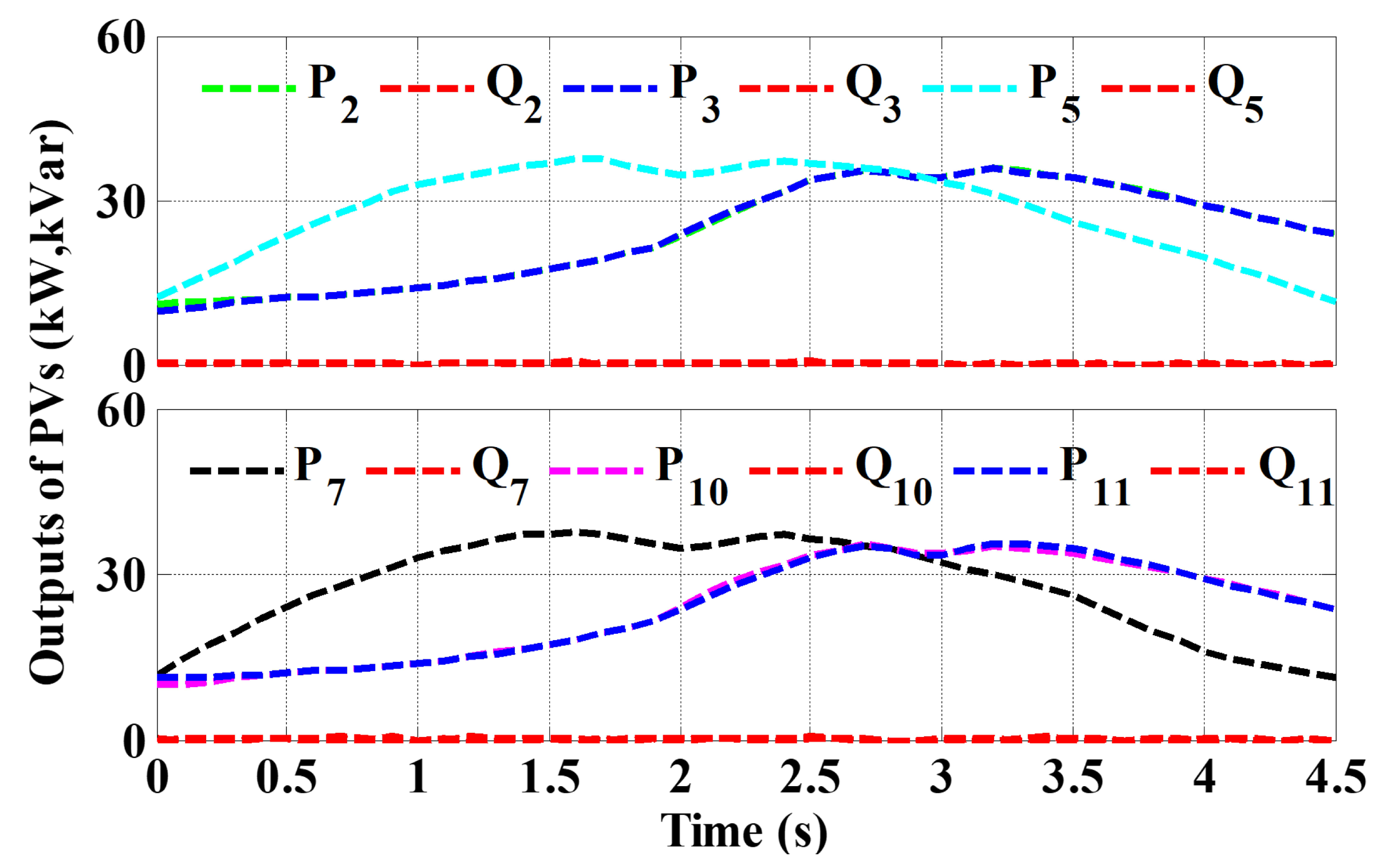

- The MG including photovoltaics (PVs) and wind turbines (WTs) is modeled in MATLAB/Simulink for two types of load customers (changeable and unchangeable).

- The dynamic electricity pricing scheme is designed based on linear regression.

- The optimization of the DR problem is solved through the particle swarm optimization (PSO) technique.

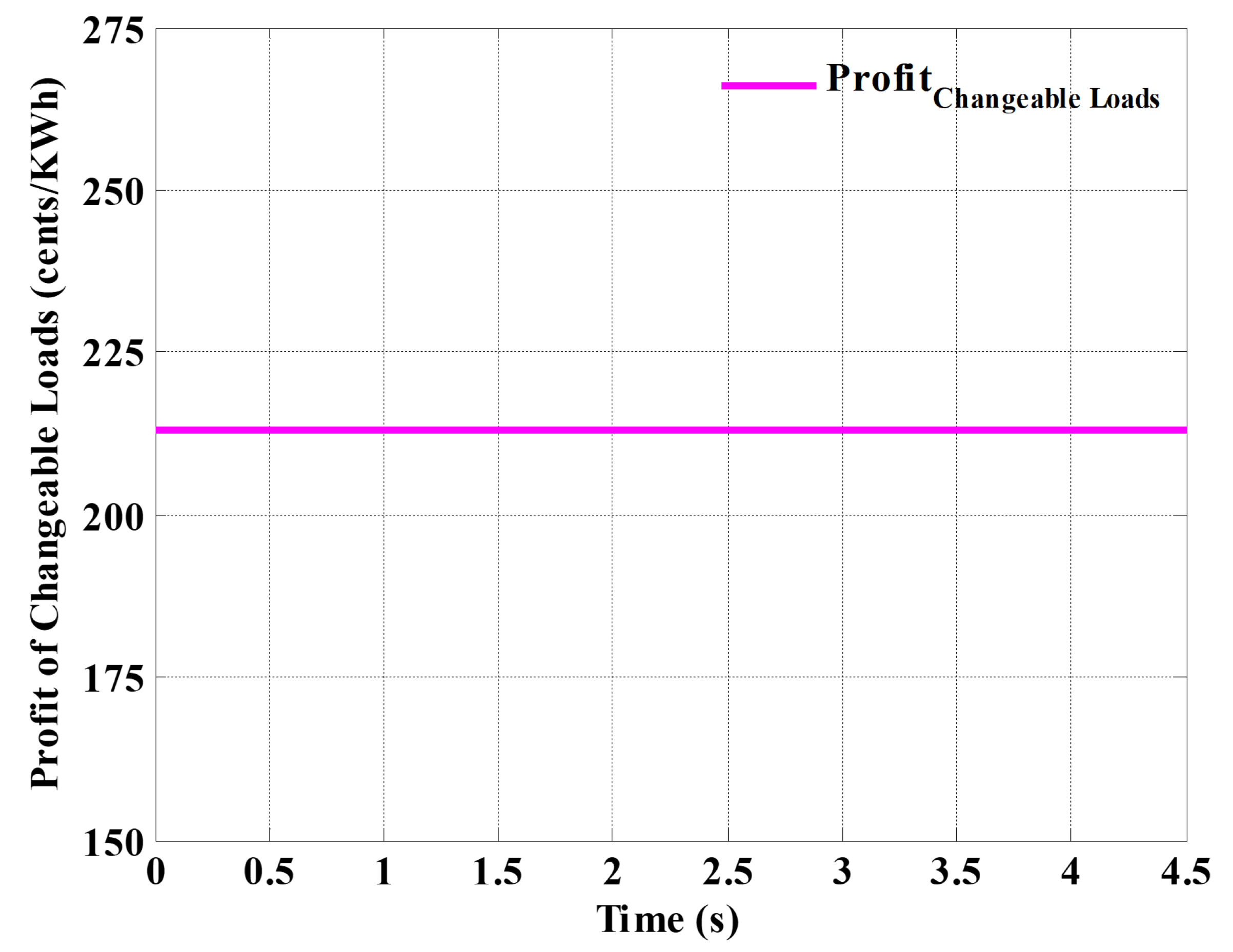

- The profit is enhanced for changeable and unchangeable load customers.

- The proposed scheme is favorable for small-scale changeable loads.

- The proposed scheme has plug and play feature for a real world market.

2. Dynamic Pricing Model

3. Demand Response Model

3.1. Objective Function

- Non-decreasing utility function should be used because it can fulfill the maximum desires of consumers.

- The usage of first unit of electricity (accounted as satisfaction level/utility of consumers) should exceed the utility until the nth unit. At this moment, the user’s utility increased smoothly.

- The zero-power utilization should result in zero utility.

3.2. Technical Constraints

4. System Setups

5. Results and Discussions

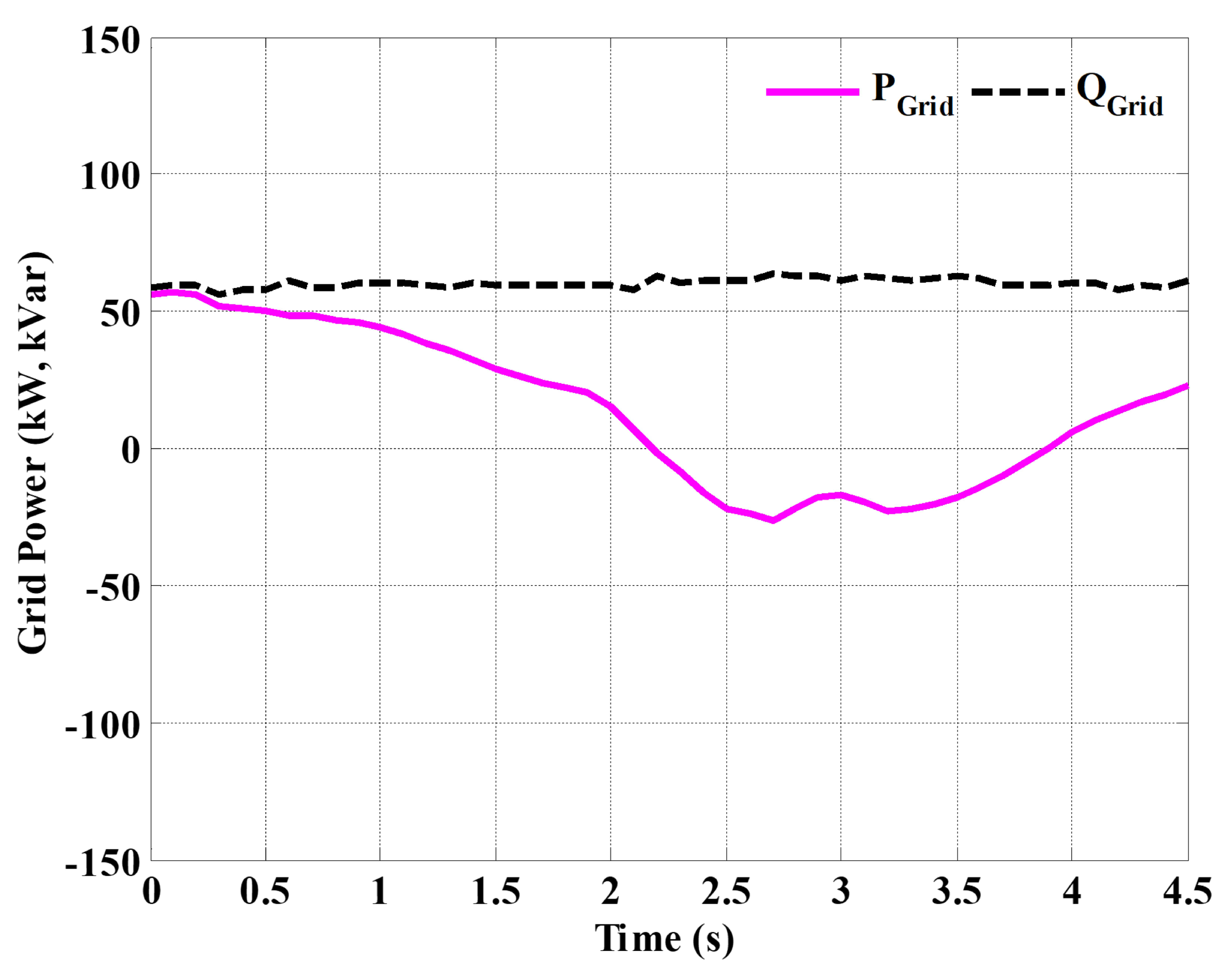

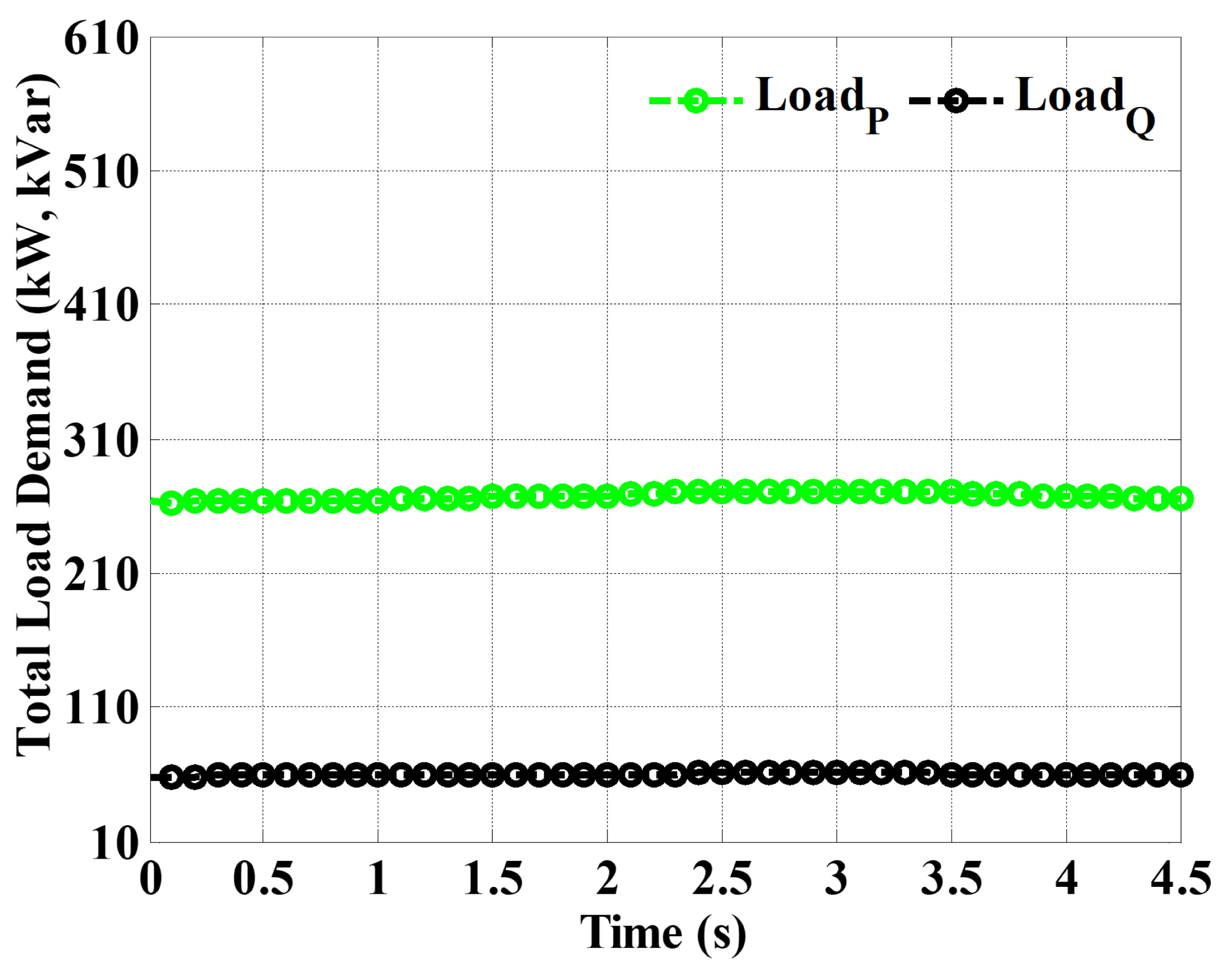

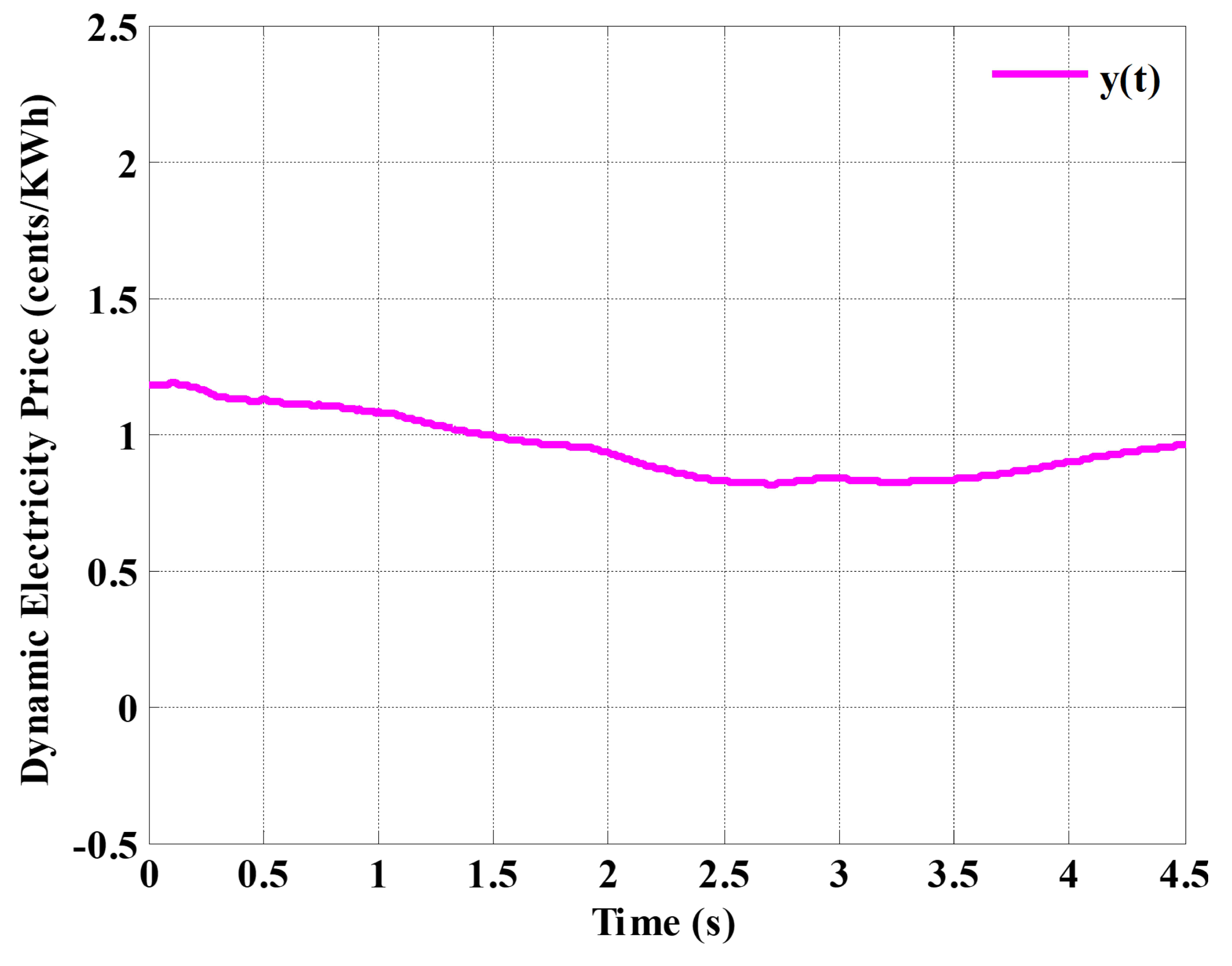

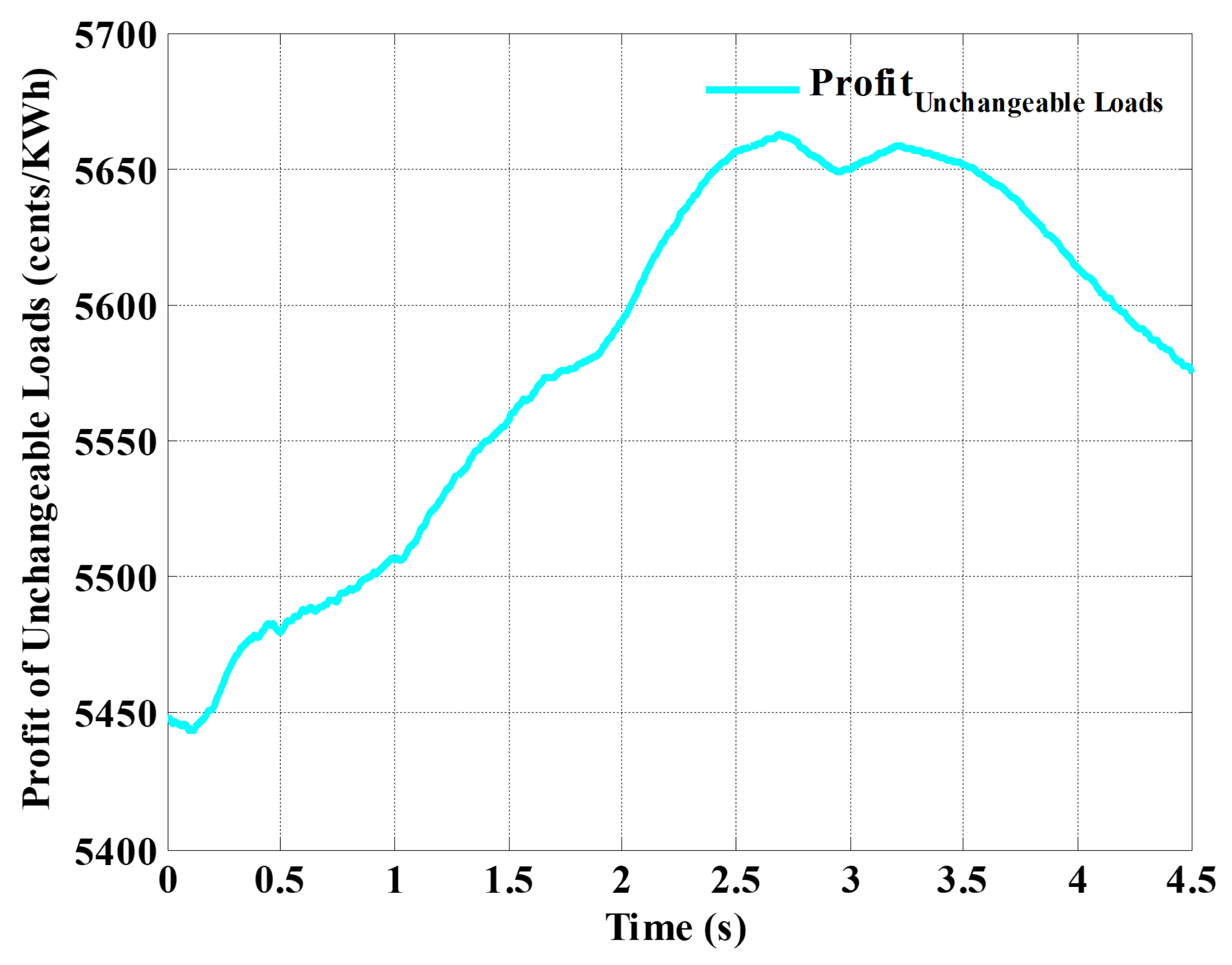

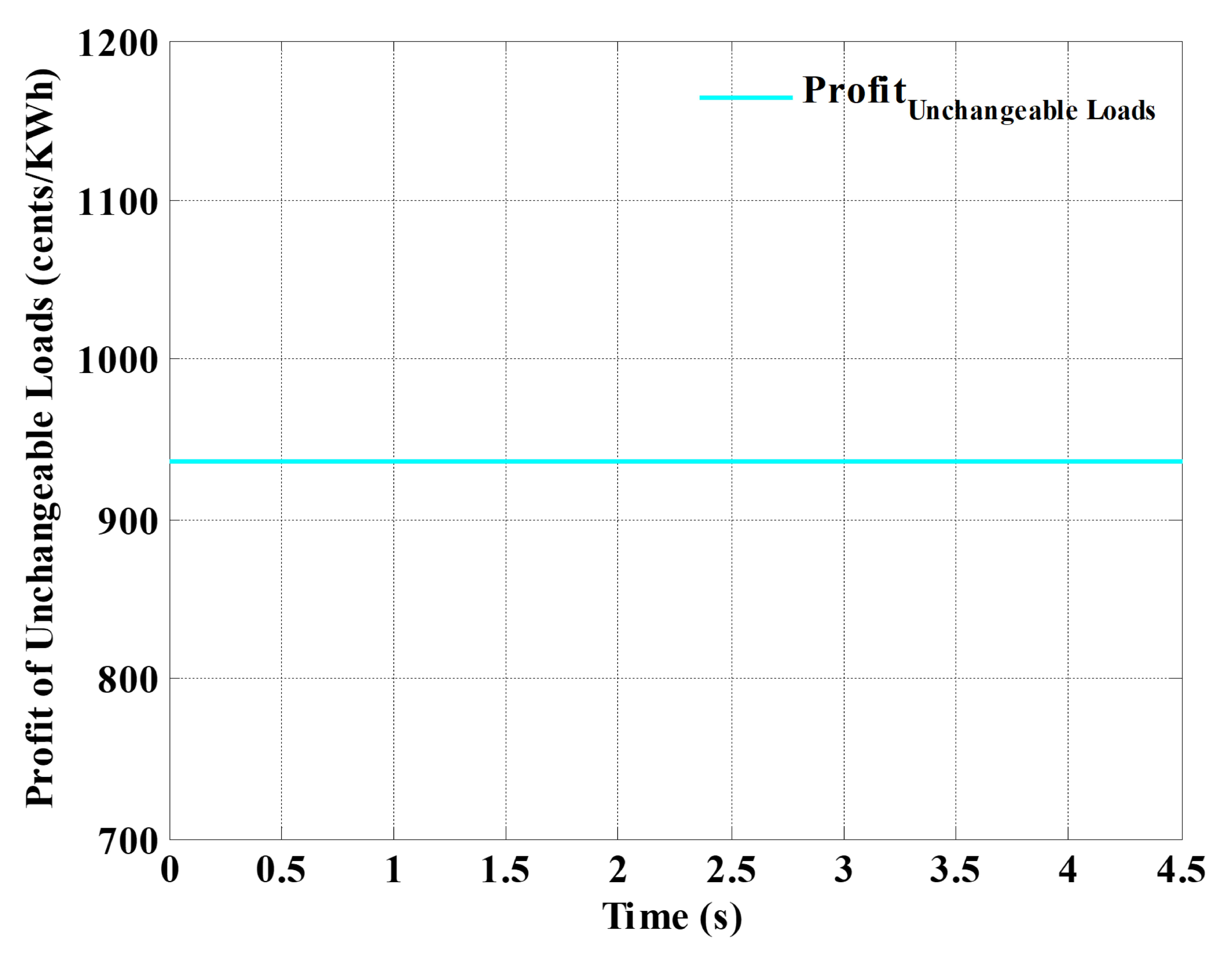

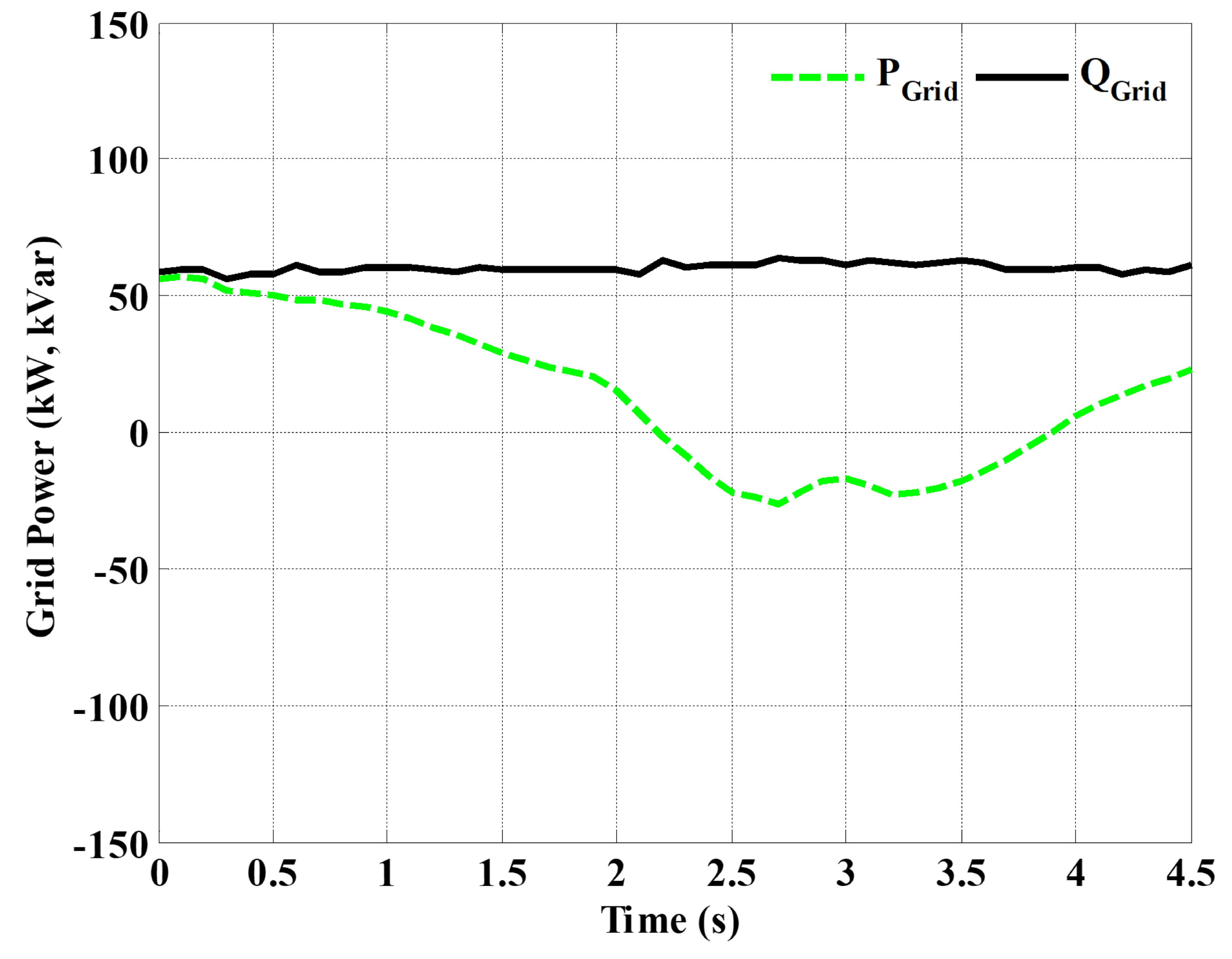

5.1. Case I: Comparison of Dynamic and Fixed Electricity Pricing Schemes for Unchangeable Loads

5.1.1. Dynamic Electricity Pricing Scheme

5.1.2. Fixed Electricity Pricing Scheme

5.2. Case II: Comparison of Dynamic and Fixed Electricity Pricing Schemes-Based DR for Changeable and Unchangeable Loads

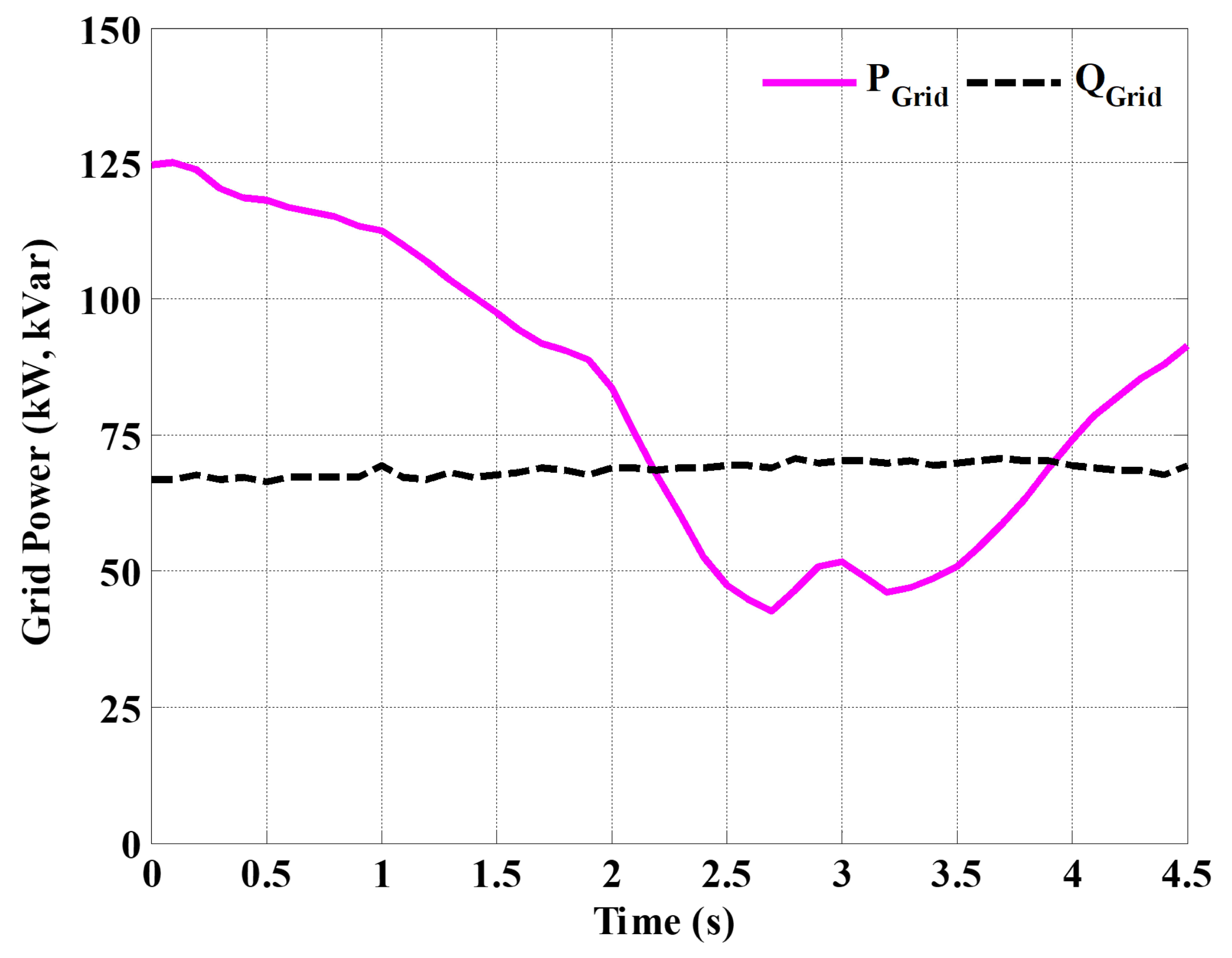

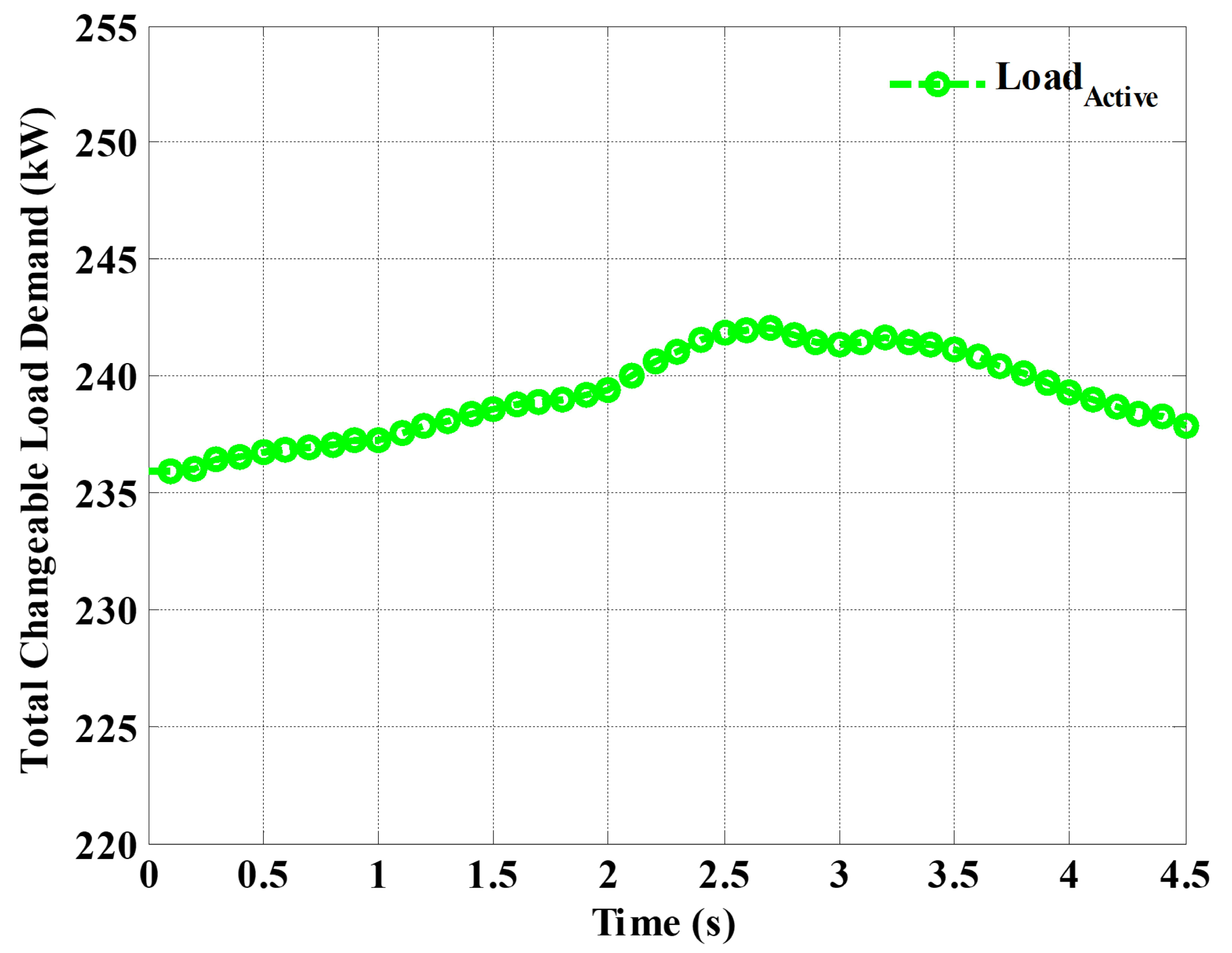

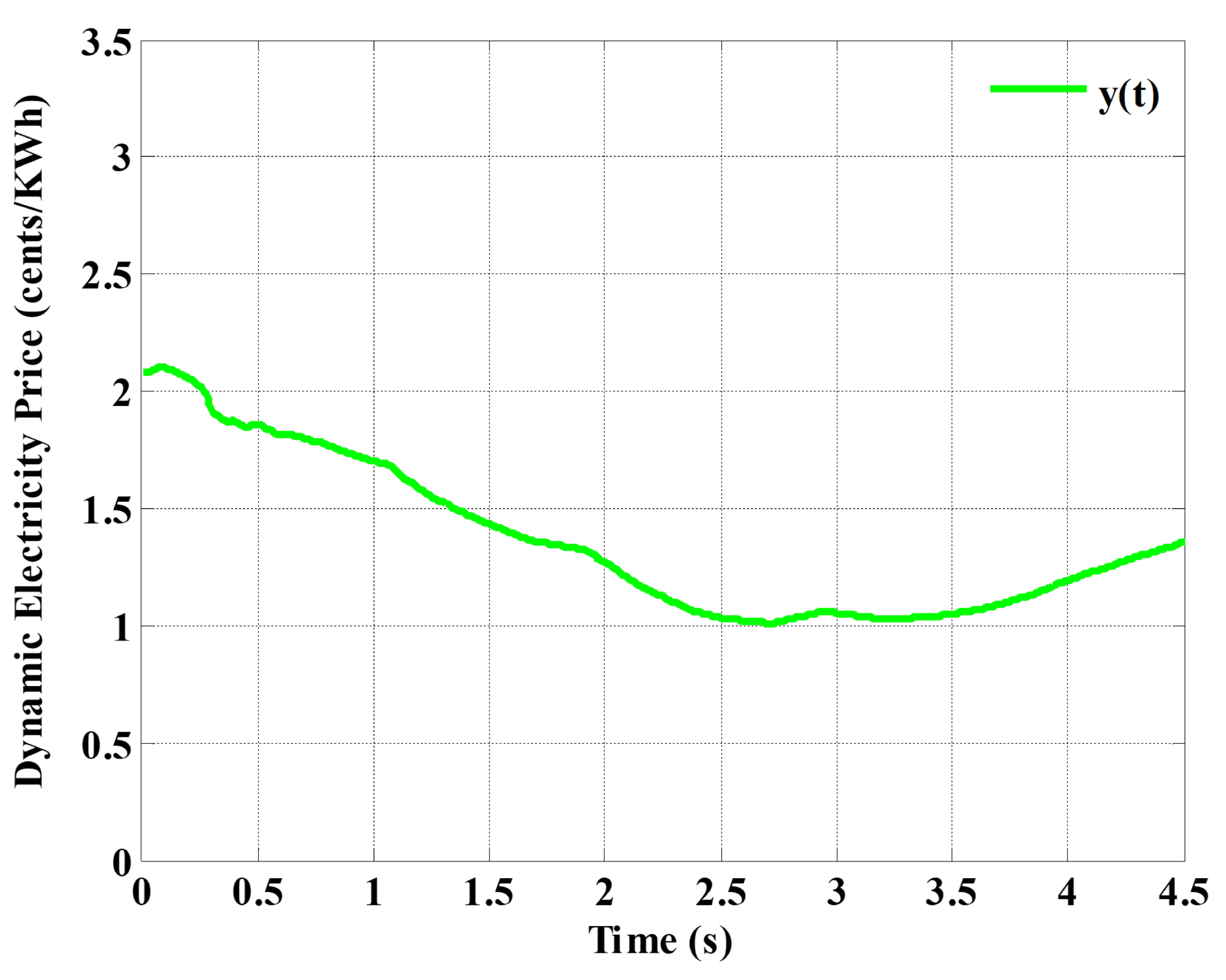

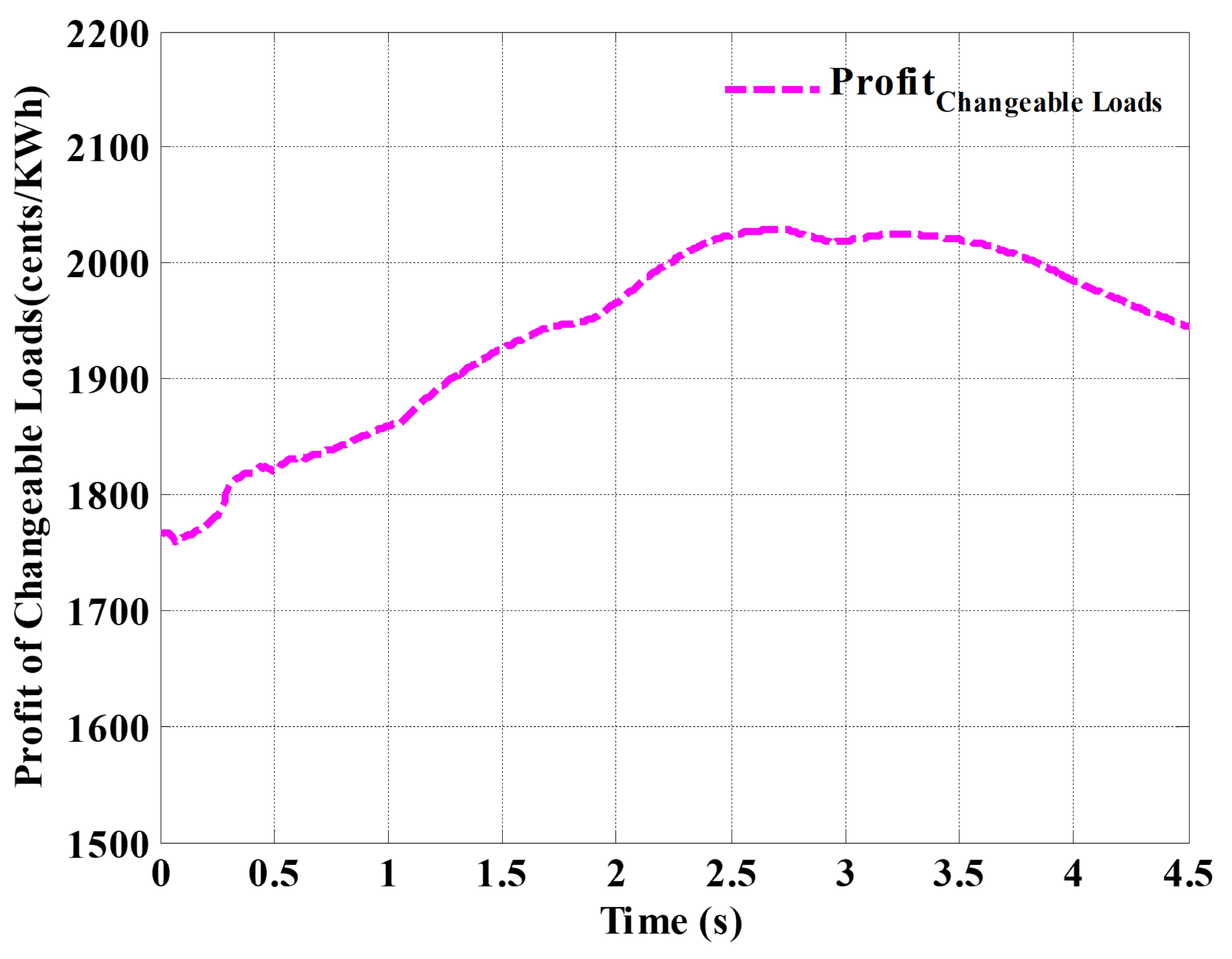

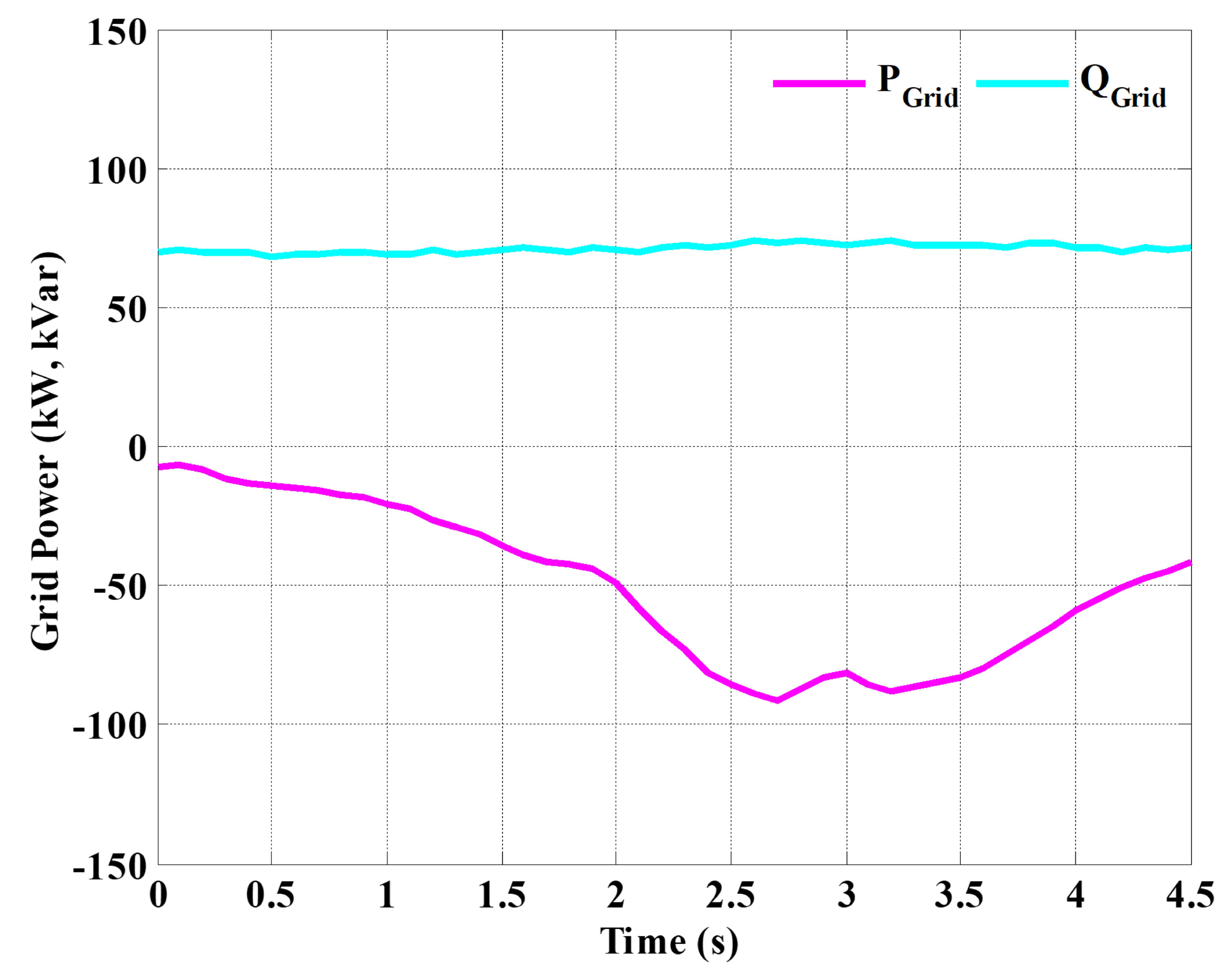

5.2.1. Dynamic Electricity Pricing Scheme

5.2.2. Fixed Electricity Pricing Scheme

6. Conclusions

- To overcome the uncertainty of RERs in MG, a battery storage system (BSS) can be added into the system model. By adding BSS, the DR will be a multiobjective optimization problem and a predictive dynamic electricity pricing model can be simulated by using stochastic techniques.

- The regression analysis has transformed the problem of DR, a mathematical optimization problem, into a convex optimization problem. This will open up ways of modeling through hybrid optimization techniques to significantly improve the efficiency of an MG through DR.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| MG | Microgrid |

| MGs | Microgrids |

| SG | Smartgrid |

| RERs | Renewable energy resources |

| RER | Renewable energy resource |

| DR | Demand response |

| DSM | Demand side management |

| PSO | Particle swarm optimization |

| RTP | Real-time pricing |

| CPP | Critical peak pricing |

| TOU | Time of use |

| ESP | Energy service provider |

| MILP | Mixed-integer linear programming |

| ESS | Energy storage system |

| LSE | Load serving entity |

| WTs | Wind turbines |

| PVs | Photo voltaic |

| DPE | Demand–price elasticity |

References

- Wang, Y.; Huang, Y.; Wang, Y.; Zeng, M.; Li, F.; Wang, Y.; Zhang, Y. Energy management of smart micro-grid with response loads and distributed generation considering demand response. J. Clean. Prod. 2018, 197, 1069–1083. [Google Scholar] [CrossRef]

- Ourahou, M.; Ayrir, W.; Hassouni, B.E.; Haddi, A. Review on smart grid control and reliability in presence of renewable energies: Challenges and prospects. Math. Comput. Simul. 2020, 167, 19–31. [Google Scholar] [CrossRef]

- Hassan, M.A.S.; Chen, M.; Li, Q.; Mehmood, M.A.; Cheng, T.; Li, B. Microgrid control and protection state of the art: A comprehensive overview. J. Electr. Syst. 2018, 14, 148–164. [Google Scholar]

- Tabar, V.S.; Jirdehi, M.A.; Hemmati, R. Sustainable planning of hybrid microgrid towards minimizing environmental pollution, operational cost and frequency fluctuations. J. Clean. Prod. 2018, 203, 1187–1200. [Google Scholar] [CrossRef]

- Jordehi, A.R. Optimisation of demand response in electric power systems, a review. Renew. Sustain. Energy Rev. 2019, 103, 308–319. [Google Scholar] [CrossRef]

- Huang, W.; Zhang, N.; Kang, C.; Li, M.; Huo, M. From demand response to integrated demand response: Review and prospect of research and application. Prot. Control Mod. Power Syst. 2019, 4, 12. [Google Scholar] [CrossRef] [Green Version]

- Lu, R.; Hong, S.H.; Zhang, X. A dynamic pricing demand response algorithm for smart grid: Reinforcement learning approach. Appl. Energy 2018, 220, 220–230. [Google Scholar] [CrossRef]

- Annala, S.; Lukkarinen, J.; Primmer, E.; Honkapuro, S.; Ollikka, K.; Sunila, K.; Ahonen, T. Regulation as an enabler of demand response in electricity markets and power systems. J. Clean. Prod. 2018, 195, 1139–1148. [Google Scholar] [CrossRef]

- Vardakas, J.S.; Zorba, N.; Verikoukis, C.V. A survey on demand response programs in smart grids: Pricing methods and optimization algorithms. IEEE Commun. Surv. Tutor. 2014, 17, 152–178. [Google Scholar] [CrossRef]

- Qdr, Q. Benefits of Demand Response in Electricity Markets and Recommendations for Achieving Them; Technical Report; US Department Energy: Washington, DC, USA, 2006.

- Iwayemi, A.; Yi, P.; Dong, X.; Zhou, C. Knowing when to act: An optimal stopping method for smart grid demand response. IEEE Netw. 2011, 25, 44–49. [Google Scholar] [CrossRef]

- Dong, Q.; Yu, L.; Song, W.Z.; Tong, L.; Tang, S. Distributed demand and response algorithm for optimizing social-welfare in smart grid. In Proceedings of the 2012 IEEE 26th International Parallel and Distributed Processing Symposium, Shanghai, China, 21–25 May 2012; pp. 1228–1239. [Google Scholar]

- Alagoz, B.; Kaygusuz, A.; Karabiber, A. A user-mode distributed energy management architecture for smart grid applications. Energy 2012, 44, 167–177. [Google Scholar] [CrossRef]

- Xu, F.Y.; Lai, L.L. Novel active time-based demand response for industrial consumers in smart grid. IEEE Trans. Ind. Inform. 2015, 11, 1564–1573. [Google Scholar] [CrossRef]

- Cui, H.; Zhou, K. Industrial power load scheduling considering demand response. J. Clean. Prod. 2018, 204, 447–460. [Google Scholar] [CrossRef]

- Brem, A.; Adrita, M.M.; O’Sullivan, D.T.; Bruton, K. Industrial smart and micro grid systems—A systematic mapping study. J. Clean. Prod. 2020, 244, 118828. [Google Scholar] [CrossRef]

- Chen, Z.; Wu, L.; Fu, Y. Real-time price-based demand response management for residential appliances via stochastic optimization and robust optimization. IEEE Trans. Smart Grid 2012, 3, 1822–1831. [Google Scholar] [CrossRef]

- Mitra, K.; Dutta, G. A two-part dynamic pricing policy for household electricity consumption scheduling with minimized expenditure. Int. J. Electr. Power Energy Syst. 2018, 100, 29–41. [Google Scholar] [CrossRef]

- Wang, Y.; Lin, H.; Liu, Y.; Sun, Q.; Wennersten, R. Management of household electricity consumption under price-based demand response scheme. J. Clean. Prod. 2018, 204, 926–938. [Google Scholar] [CrossRef]

- Barhagh, S.S.; Abapour, M.; Mohammadi-Ivatloo, B. Optimal scheduling of electric vehicles and photovoltaic systems in residential complexes under real-time pricing mechanism. J. Clean. Prod. 2020, 246, 119041. [Google Scholar] [CrossRef]

- Yi, P.; Dong, X.; Iwayemi, A.; Zhou, C.; Li, S. Real-time opportunistic scheduling for residential demand response. IEEE Trans. Smart Grid 2013, 4, 227–234. [Google Scholar] [CrossRef]

- Altayeva, A.; Omarov, B.; Im Cho, Y. Multi-objective optimization for smart building energy and comfort management as a case study of smart city platform. In Proceedings of the 2017 IEEE 19th International Conference on High Performance Computing and Communications, IEEE 15th International Conference on Smart City, IEEE 3rd International Conference on Data Science and Systems (HPCC/SmartCity/DSS), Bangkok, Thailand, 18–20 December 2017; pp. 627–628. [Google Scholar]

- Jafari, A.; Khalili, T.; Ganjehlou, H.G.; Bidram, A. Optimal integration of renewable energy sources, diesel generators, and demand response program from pollution, financial, and reliability viewpoints: A multi-objective approach. J. Clean. Prod. 2020, 247, 119100. [Google Scholar] [CrossRef]

- Chamandoust, H.; Derakhshan, G.; Hakimi, S.M.; Bahramara, S. Tri-objective optimal scheduling of smart energy hub system with schedulable loads. J. Clean. Prod. 2019, 236, 117584. [Google Scholar] [CrossRef]

- Mahboubi-Moghaddam, E.; Nayeripour, M.; Aghaei, J.; Khodaei, A.; Waffenschmidt, E. Interactive robust model for energy service providers integrating demand response programs in wholesale markets. IEEE Trans. Smart Grid 2016, 9, 2681–2690. [Google Scholar] [CrossRef]

- Asimakopoulou, G.E.; Dimeas, A.L.; Hatziargyriou, N.D. Leader-follower strategies for energy management of multi-microgrids. IEEE Trans. Smart Grid 2013, 4, 1909–1916. [Google Scholar] [CrossRef]

- Parvania, M.; Fotuhi-Firuzabad, M.; Shahidehpour, M. Optimal demand response aggregation in wholesale electricity markets. IEEE Trans. Smart Grid 2013, 4, 1957–1965. [Google Scholar] [CrossRef]

- Nguyen, D.T.; Le, L.B. Risk-constrained profit maximization for microgrid aggregators with demand response. IEEE Trans. Smart Grid 2014, 6, 135–146. [Google Scholar] [CrossRef]

- Nguyen, D.T.; Nguyen, H.T.; Le, L.B. Dynamic pricing design for demand response integration in power distribution networks. IEEE Trans. Power Syst. 2016, 31, 3457–3472. [Google Scholar] [CrossRef]

- Kabir, A.; Gilani, S.M.; Rehmanc, G.; Sabath H, S.; Popp, J.; Hassan, M.A.S.; Oláh, J. Energy-aware caching and collaboration for green communication systems. Acta Montan. Slovaca 2021, 26, 47–59. [Google Scholar]

- Nguyen, D.T.; Le, L.B. Optimal bidding strategy for microgrids considering renewable energy and building thermal dynamics. IEEE Trans. Smart Grid 2014, 5, 1608–1620. [Google Scholar] [CrossRef]

- Conejo, A.J.; Morales, J.M.; Baringo, L. Real-time demand response model. IEEE Trans. Smart Grid 2010, 1, 236–242. [Google Scholar] [CrossRef]

- Anvari-Moghaddam, A.; Monsef, H.; Rahimi-Kian, A. Optimal smart home energy management considering energy saving and a comfortable lifestyle. IEEE Trans. Smart Grid 2014, 6, 324–332. [Google Scholar] [CrossRef]

- Brahman, F.; Honarmand, M.; Jadid, S. Optimal electrical and thermal energy management of a residential energy hub, integrating demand response and energy storage system. Energy Build. 2015, 90, 65–75. [Google Scholar] [CrossRef]

- Mariyakhan, K.; Mohamued, E.A.; Asif Khan, M.; Popp, J.; Oláh, J. Does the level of absorptive capacity matter for carbon intensity? Evidence from the USA and China. Energies 2020, 13, 407. [Google Scholar] [CrossRef] [Green Version]

- Parrish, B.; Gross, R.; Heptonstall, P. On demand: Can demand response live up to expectations in managing electricity systems? Energy Res. Soc. Sci. 2019, 51, 107–118. [Google Scholar] [CrossRef]

- Hassan, M.A.S.; Chen, M.; Lin, H.; Ahmed, M.H.; Khan, M.Z.; Chughtai, G.R. Optimization modeling for dynamic price based demand response in microgrids. J. Clean. Prod. 2019, 222, 231–241. [Google Scholar] [CrossRef]

- Johannesen, N.J.; Kolhe, M.; Goodwin, M. Relative evaluation of regression tools for urban area electrical energy demand forecasting. J. Clean. Prod. 2019, 218, 555–564. [Google Scholar] [CrossRef]

- Samadi, P.; Mohsenian-Rad, H.; Schober, R.; Wong, V.W. Advanced demand side management for the future smart grid using mechanism design. IEEE Trans. Smart Grid 2012, 3, 1170–1180. [Google Scholar] [CrossRef]

- Asr, N.R.; Zhang, Z.; Chow, M.Y. Consensus-based distributed energy management with real-time pricing. In Proceedings of the 2013 IEEE Power & Energy Society General Meeting, Vancouver, BC, Canada, 21–25 July 2013; pp. 1–5. [Google Scholar]

- Jiang, T.; Cao, Y.; Yu, L.; Wang, Z. Load shaping strategy based on energy storage and dynamic pricing in smart grid. IEEE Trans. Smart Grid 2014, 5, 2868–2876. [Google Scholar] [CrossRef]

- Asgher, U.; Babar Rasheed, M.; Al-Sumaiti, A.S.; Ur-Rahman, A.; Ali, I.; Alzaidi, A.; Alamri, A. Smart energy optimization using heuristic algorithm in smart grid with integration of solar energy sources. Energies 2018, 11, 3494. [Google Scholar] [CrossRef] [Green Version]

| Sources | Load | Type of Load | Control | Capacities | Max. Demand |

|---|---|---|---|---|---|

| DG | Load | Unchangeable | MPPT | 45 kW, 0 kVar | 40 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 45 kW, 0 kVar | 35 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 55 kW, 0 kVar | 40 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 60 kW, 0 kVar | 30 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 55 kW, 0 kVar | 25 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 45 kW, 0 kVar | 13 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 55 kW, 0 kVar | 18 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 40 kW, 0 kVar | 14 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 35 kW, 0 kVar | 10 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 60 kW, 0 kVar | 14 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 55 kW, 0 kVar | 15 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 45 kW, 0 kVar | 15 kW, 5 kVar |

| Sources | Load | Type of Load | Control | Capacities | Max. Demand |

|---|---|---|---|---|---|

| DG | Load | Changeable | MPPT | 45 kW, 0 kVar | 0–62 kW, 7 kVar |

| DG | Load | Changeable | MPPT | 45 kW, 0 kVar | 0–64 kW, 7 kVar |

| DG | Load | Changeable | MPPT | 55 kW, 0 kVar | 0–72 kW, 7 kVar |

| DG | Load | Changeable | MPPT | 60 kW, 0 kVar | 0–58 kW, 7 kVar |

| DG | Load | Changeable | MPPT | 55 kW, 0 kVar | 0–64 kW, 7 kVar |

| DG | Load | Unchangeable | MPPT | 45 kW, 0 kVar | 13 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 55 kW, 0 kVar | 18 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 40 kW, 0 kVar | 14 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 35 kW, 0 kVar | 10 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 60 kW, 0 kVar | 14 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 55 kW, 0 kVar | 15 kW, 5 kVar |

| DG | Load | Unchangeable | MPPT | 45 kW, 0 kVar | 15 kW, 5 kVar |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hassan, M.A.S.; Assad, U.; Farooq, U.; Kabir, A.; Khan, M.Z.; Bukhari, S.S.H.; Jaffri, Z.u.A.; Oláh, J.; Popp, J. Dynamic Price-Based Demand Response through Linear Regression for Microgrids with Renewable Energy Resources. Energies 2022, 15, 1385. https://doi.org/10.3390/en15041385

Hassan MAS, Assad U, Farooq U, Kabir A, Khan MZ, Bukhari SSH, Jaffri ZuA, Oláh J, Popp J. Dynamic Price-Based Demand Response through Linear Regression for Microgrids with Renewable Energy Resources. Energies. 2022; 15(4):1385. https://doi.org/10.3390/en15041385

Chicago/Turabian StyleHassan, Muhammad Arshad Shehzad, Ussama Assad, Umar Farooq, Asif Kabir, Muhammad Zeeshan Khan, S. Sabahat H. Bukhari, Zain ul Abidin Jaffri, Judit Oláh, and József Popp. 2022. "Dynamic Price-Based Demand Response through Linear Regression for Microgrids with Renewable Energy Resources" Energies 15, no. 4: 1385. https://doi.org/10.3390/en15041385

APA StyleHassan, M. A. S., Assad, U., Farooq, U., Kabir, A., Khan, M. Z., Bukhari, S. S. H., Jaffri, Z. u. A., Oláh, J., & Popp, J. (2022). Dynamic Price-Based Demand Response through Linear Regression for Microgrids with Renewable Energy Resources. Energies, 15(4), 1385. https://doi.org/10.3390/en15041385