Main Trends and Criteria Adopted in Economic Feasibility Studies of Offshore Wind Energy: A Systematic Literature Review

Abstract

:1. Introduction

2. Methodology

- i.

- Topic: (“wind offshore” OR “offshore wind” OR “offshore-wind” OR “wind-offshore”);

- ii.

- Paper title: (“wind offshore” OR “offshore wind” OR “offshore-wind” OR “wind-offshore”);

- iii.

- Paper title: (“wind offshore” OR “offshore wind” OR “offshore-wind” OR “wind-offshore”) AND Topic: (“economic* feasibility” OR “economic* viability” OR “economic* analysis” OR “economic* assessment” OR “economic* evaluation” OR “financial feasibility” OR “financial assess*” OR “financial viability” OR “financial analysis” OR “financial evaluation*” OR “techno–economic” OR “investment*”).

- (a)

- All studies that are not scientific and/or review articles.

- (b)

- Articles that are not related to energy generation.

- (c)

- Articles that do not address methods, economic and financial analysis models, and tools related to risk or uncertainty or at least mention some financial indicator.

3. Results and Discussions

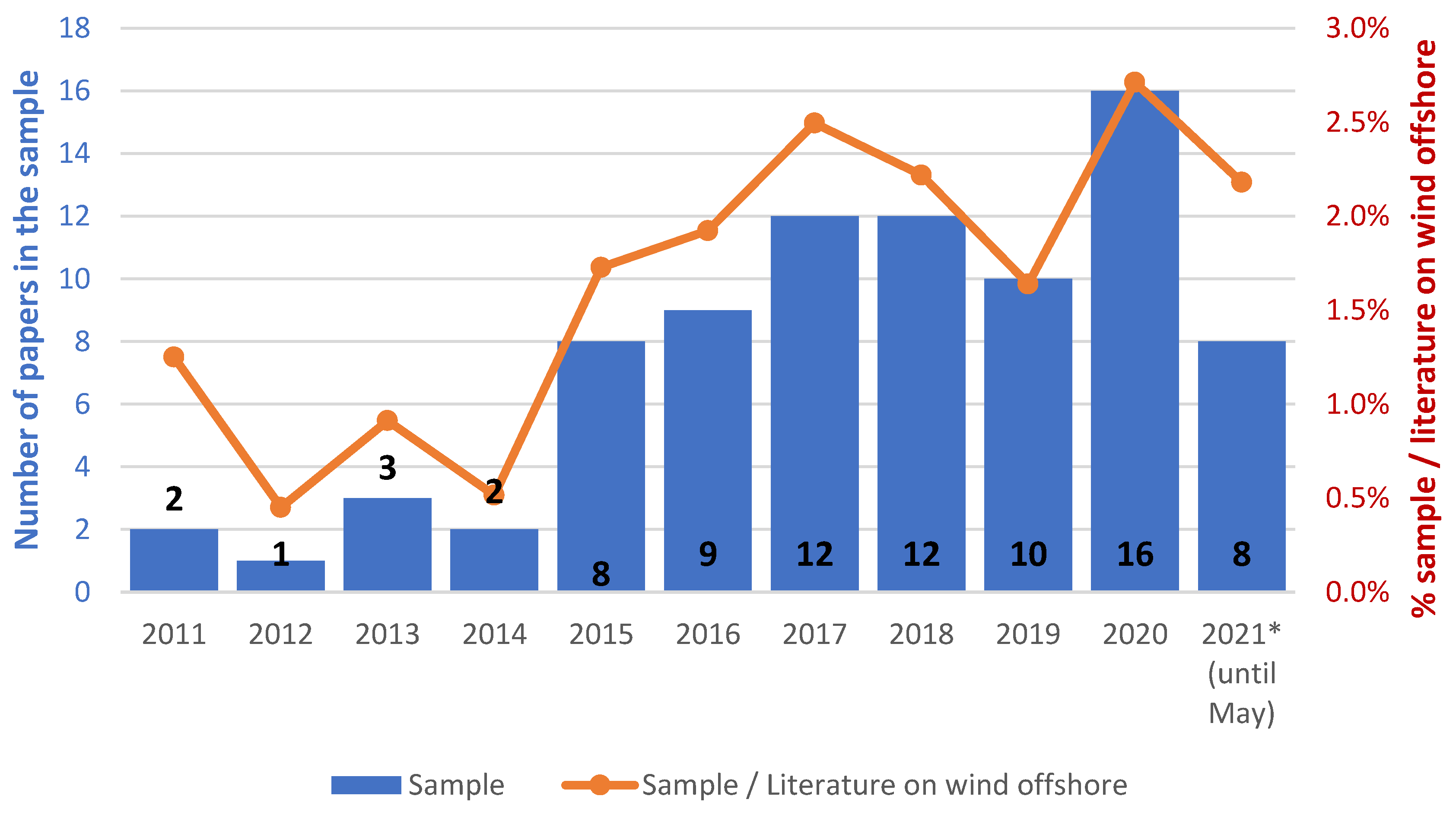

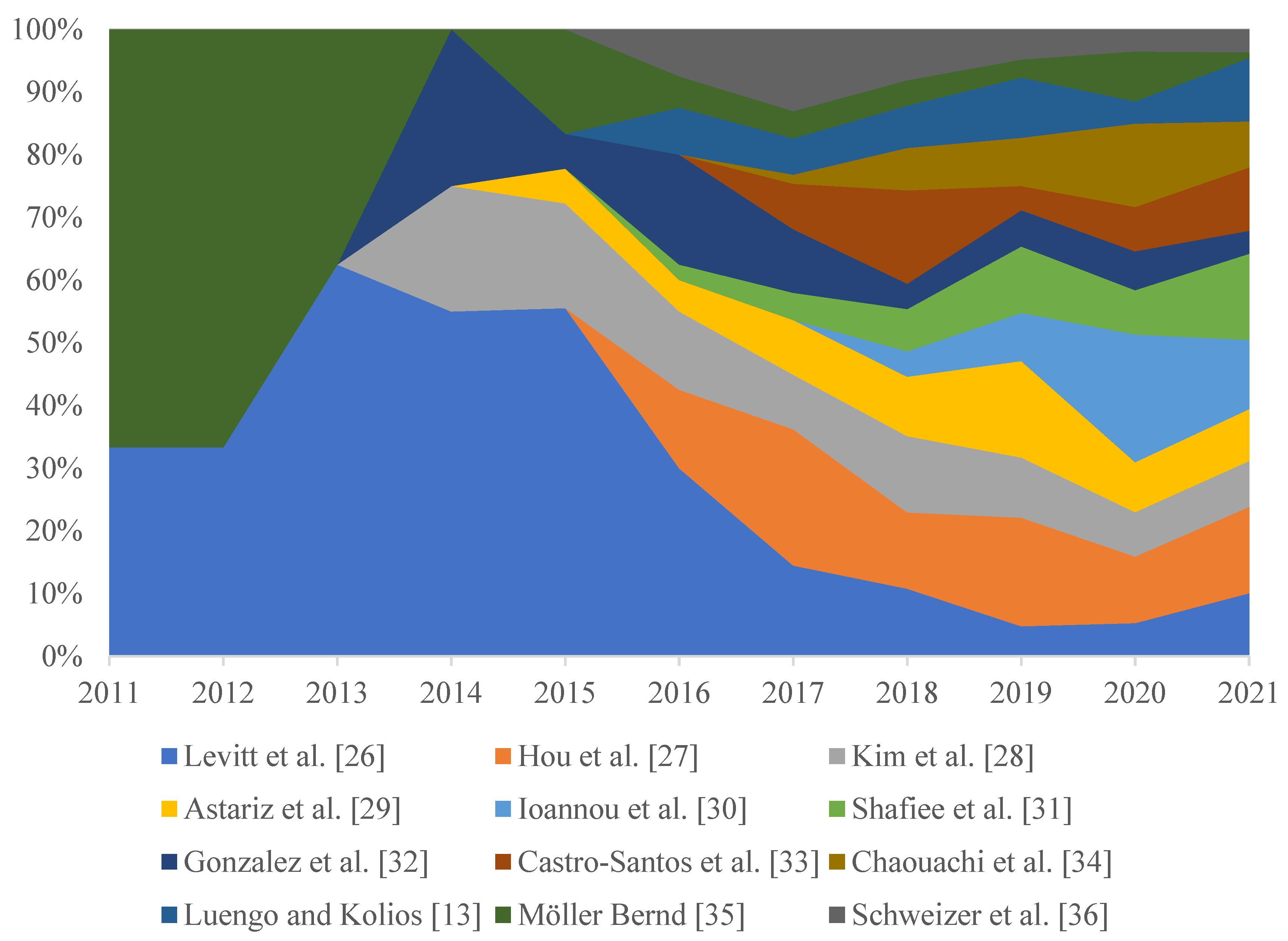

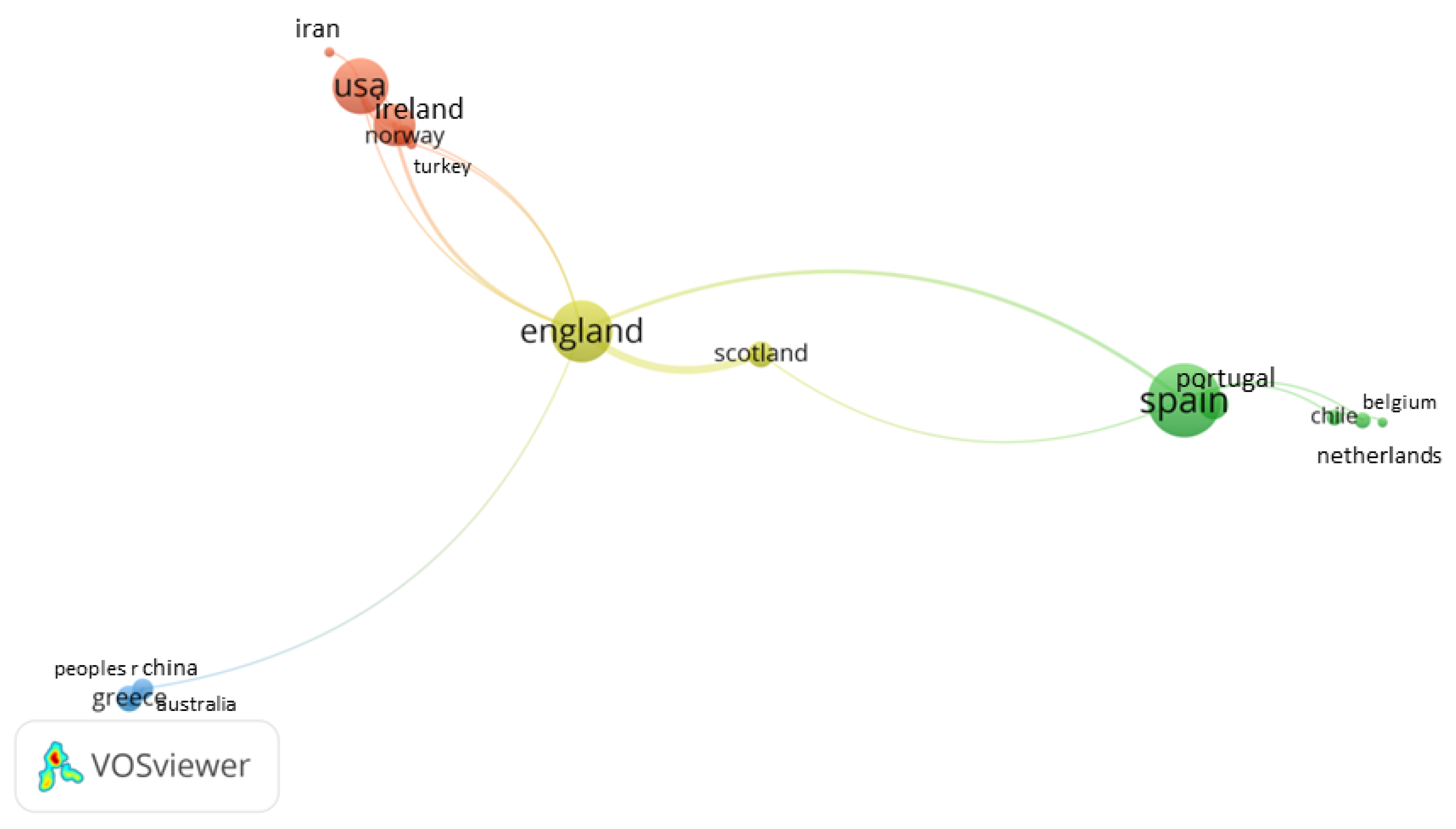

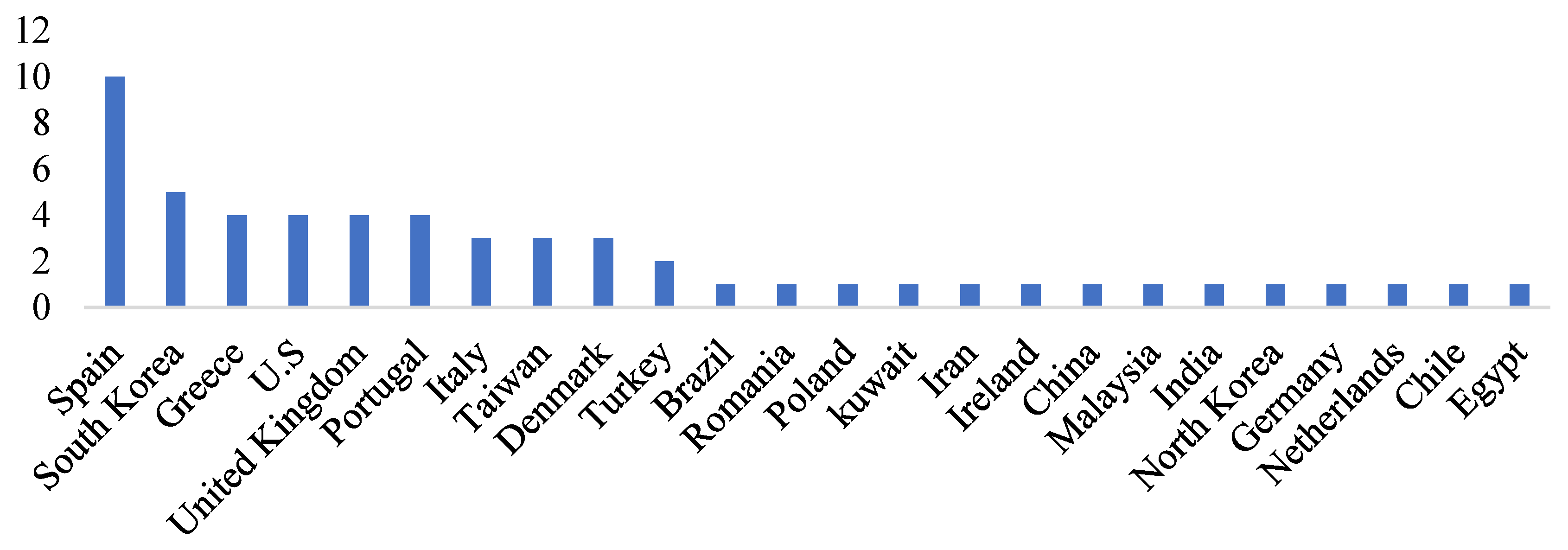

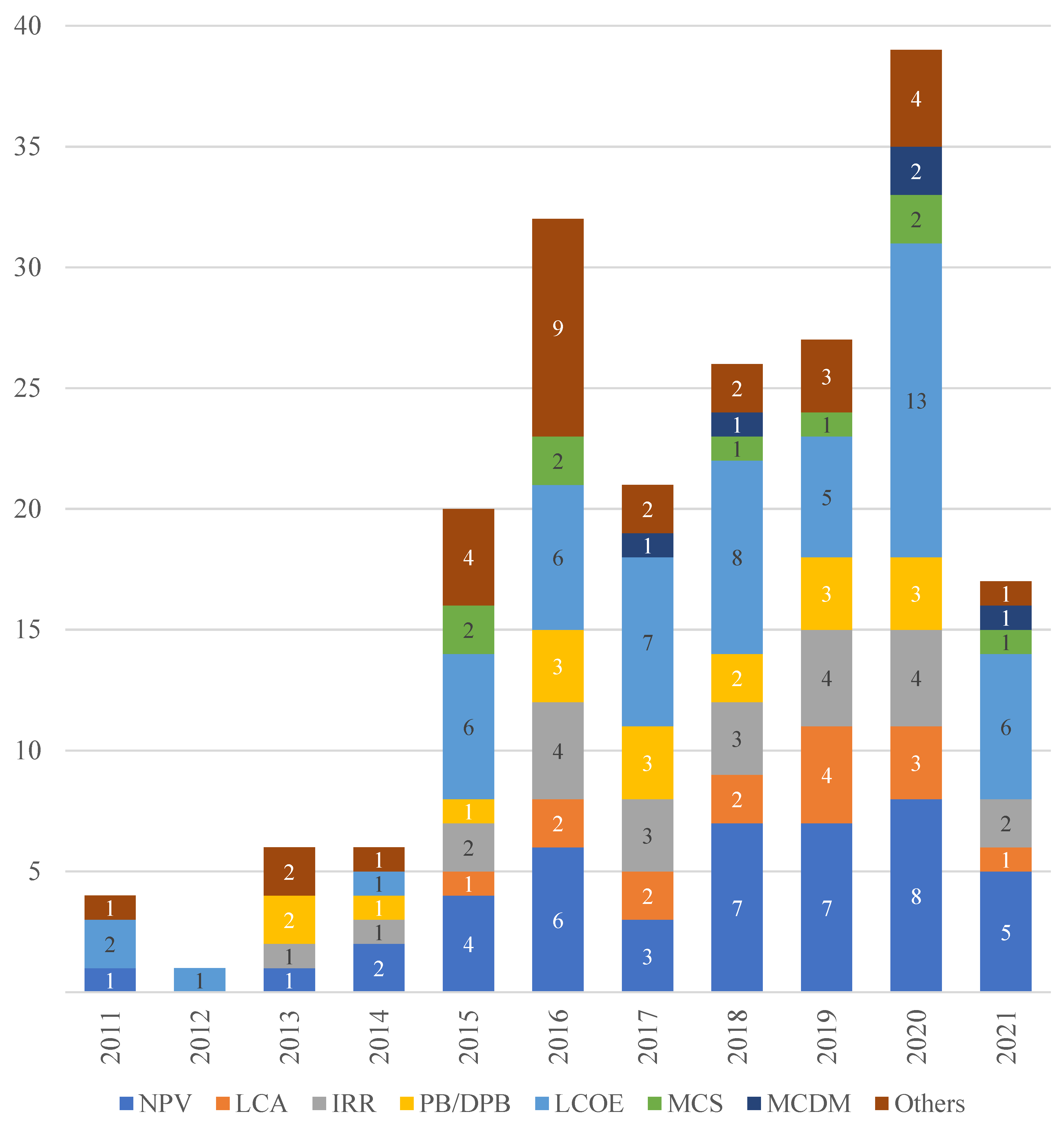

3.1. Characteristics of the Literature on Economic Feasibility in Offshore Wind Energy Generation

3.2. Evaluation Criteria and Methods

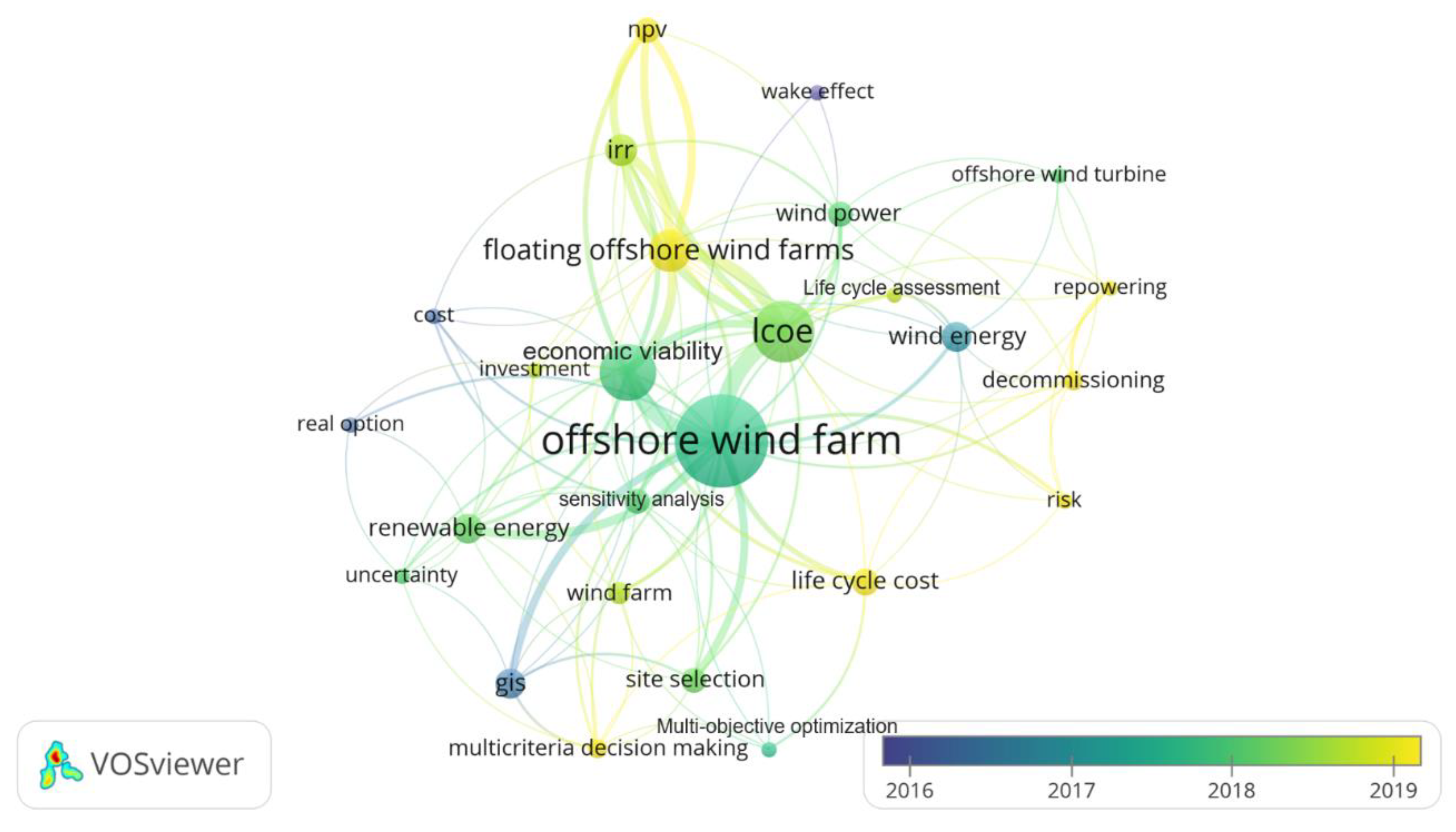

3.3. Offshore Wind Power Trends and Research Agenda

- (i)

- Wind farms

- (ii)

- Risk

- (iii)

- Floating Offshore Wind Farms

- (iv)

- Decommissioning and Repowering

- (v)

- Net Present Value (NPV)

- (vi)

- Life Cycle Cost (LCC)

- (vii)

- Multi-Criteria Decision-Making Methods (MCDM)

Research Agenda

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Lloyd, B.; Subbarao, S. Development challenges under the Clean Development Mechanism (CDM)—Can renewable energy initiatives be put in place before peak oil? Energy Policy 2009, 37, 237–245. [Google Scholar] [CrossRef]

- Rodrigues, S.; Restrepo, C.; Kontos, E.; Pinto, R.T.; Bauer, P. Trends of offshore wind projects. Renew. Sustain. Energy Rev. 2015, 49, 1114–1135. [Google Scholar] [CrossRef]

- Ling, Y.; Cai, X. Exploitation and utilization of the wind power and its perspective in China. Renew. Sustain. Energy Rev. 2012, 16, 2111–2117. [Google Scholar] [CrossRef]

- IRENA—International Renewable Energy Agency. Renewable Power Generation Costs in 2017; IRENA: Abu Dhabi, United Arab Emirates, 2018. [Google Scholar]

- Esteban, M.D.; Diez, J.J.; López, J.S.; Negro, V. Why offshore wind energy? Renew. Energy 2011, 36, 444–450. [Google Scholar] [CrossRef] [Green Version]

- GWEC—Global Wind Energy Council Global Wind Report 2018. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwiz-rqD-8TyAhWOCewKHULQCnQQjBAwAXoECAQQAQ&url=https%3A%2F%2Fgwec.net%2Fwp-content%2Fuploads%2F2019%2F04%2FGWEC-Global-Wind-Report-2018.pdf (accessed on 20 January 2021).

- Gatzert, N.; Kosub, T. Risks and risk management of renewable energy projects: The case of onshore and offshore wind parks. Renew. Sustain. Energy Rev. 2016, 60, 982–998. [Google Scholar] [CrossRef]

- Markard, J.; Petersen, R. The offshore trend: Structural changes in the wind power sector. Energy Policy 2009, 37, 3545–3556. [Google Scholar] [CrossRef]

- Liu, Q.; Sun, Y.; Wu, M. Decision-making methodologies in offshore wind power investments: A review. J. Clean. Prod. 2021, 295, 126459. [Google Scholar] [CrossRef]

- Hou, P.; Zhu, J.; Ma, K.; Yang, G.; Hu, W.; Chen, Z. A review of offshore wind farm layout optimization and electrical system design methods. J. Mod. Power Syst. Clean Energy 2019, 7, 975–986. [Google Scholar] [CrossRef] [Green Version]

- Igwemezie, V.; Mehmanparast, A.; Kolios, A. Current trend in offshore wind energy sector and material requirements for fatigue resistance improvement in large wind turbine support structures—A review. Renew. Sustain. Energy Rev. 2018, 101, 181–196. [Google Scholar] [CrossRef] [Green Version]

- Martinez-Luengo, M.; Kolios, A.; Wang, L. Structural health monitoring of offshore wind turbines: A review through the Statistical Pattern Recognition Paradigm. Renew. Sustain. Energy Rev. 2016, 64, 91–105. [Google Scholar] [CrossRef] [Green Version]

- Luengo, M.M.; Kolios, A. Failure Mode Identification and End of Life Scenarios of Offshore Wind Turbines: A Review. Energies 2015, 8, 8339–8354. [Google Scholar] [CrossRef] [Green Version]

- Lumbreras, S.; Ramos, A. Offshore wind farm electrical design: A review. Wind. Energy 2012, 16, 459–473. [Google Scholar] [CrossRef]

- Ladenburg, J.; Lutzeyer, S. The economics of visual disamenity reductions of offshore wind farms—Review and suggestions from an emerging field. Renew. Sustain. Energy Rev. 2012, 16, 6793–6802. [Google Scholar] [CrossRef]

- Şener, E.C.; Sharp, J.L.; Anctil, A. Factors impacting diverging paths of renewable energy: A review. Renew. Sustain. Energy Rev. 2018, 81, 2335–2342. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Junior, P.R.; Rocha, L.; Morioka, S.; Bolis, I.; Chicco, G.; Mazza, A.; Janda, K. Economic Analysis of the Investments in Battery Energy Storage Systems: Review and Current Perspectives. Energies 2021, 14, 2503. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Diaz-Casas, V. Sensitivity analysis of floating offshore wind farms. Energy Convers. Manag. 2015, 101, 271–277. [Google Scholar] [CrossRef]

- NREL—National Renewable Energy Laboratory Estimating Renewable Energy Economic Potential in the United States: Methodology and Initial Results. Available online: https://www.nrel.gov/docs/fy15osti/64503.pdf (accessed on 20 January 2021).

- Watson, S.; Moro, A.; Reis, V.; Baniotopoulos, C.; Barth, S.; Bartoli, G.; Bauer, F.; Boelman, E.; Bosse, D.; Cherubini, A.; et al. Future emerging technologies in the wind power sector: A European perspective. Renew. Sustain. Energy Rev. 2019, 113, 109270. [Google Scholar] [CrossRef]

- Van Wee, B.; Banister, D. How to Write a Literature Review Paper? Transp. Rev. 2015, 36, 278–288. [Google Scholar] [CrossRef] [Green Version]

- Chadegani, A.A.; Salehi, H.; Yunus, M.M.; Farhadi, H.; Fooladi, M.; Farhadi, M.; Ebrahim, N.A. A Comparison between Two Main Academic Literature Collections: Web of Science and Scopus Databases. Asian Soc. Sci. 2013, 9, p18. [Google Scholar] [CrossRef] [Green Version]

- Azevêdo, R.D.O.; Junior, P.R.; Chicco, G.; Aquila, G.; Rocha, L.C.S.; Peruchi, R.S. Identification and analysis of impact factors on the economic feasibility of wind energy investments. Int. J. Energy Res. 2020, 45, 3671–3697. [Google Scholar] [CrossRef]

- Azevêdo, R.D.O.; Junior, P.R.; Rocha, L.; Chicco, G.; Aquila, G.; Peruchi, R. Identification and Analysis of Impact Factors on the Economic Feasibility of Photovoltaic Energy Investments. Sustainability 2020, 12, 7173. [Google Scholar] [CrossRef]

- Levitt, A.C.; Kempton, W.; Smith, A.P.; Musial, W.; Firestone, J. Pricing offshore wind power. Energy Policy 2011, 39, 6408–6421. [Google Scholar] [CrossRef]

- Hou, P.; Hu, W.; Soltani, M.; Chen, Z. Optimized Placement of Wind Turbines in Large-Scale Offshore Wind Farm Using Particle Swarm Optimization Algorithm. IEEE Trans. Sustain. Energy 2015, 6, 1272–1282. [Google Scholar] [CrossRef] [Green Version]

- Kim, J.-Y.; Oh, K.-Y.; Kang, K.-S.; Lee, J.-S. Site selection of offshore wind farms around the Korean Peninsula through economic evaluation. Renew. Energy 2013, 54, 189–195. [Google Scholar] [CrossRef]

- Astariz, S.; Vazquez, A.; Iglesias, G. Evaluation and comparison of the levelized cost of tidal, wave, and offshore wind energy. J. Renew. Sustain. Energy 2015, 7, 53112. [Google Scholar] [CrossRef]

- Ioannou, A.; Angus, A.; Brennan, F. A lifecycle techno-economic model of offshore wind energy for different entry and exit instances. Appl. Energy 2018, 221, 406–424. [Google Scholar] [CrossRef]

- Shafiee, M.; Brennan, F.; Espinosa, I.A. A parametric whole life cost model for offshore wind farms. Int. J. Life Cycle Assess. 2016, 21, 961–975. [Google Scholar] [CrossRef] [Green Version]

- Gonzalez, J.S.; Payan, M.B.; Santos, J.R. A New and Efficient Method for Optimal Design of Large Offshore Wind Power Plants. IEEE Trans. Power Syst. 2013, 28, 3075–3084. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Vizoso, A.F.; Couce, L.C.; Formoso, J.F. Economic feasibility of floating offshore wind farms. Energy 2016, 112, 868–882. [Google Scholar] [CrossRef]

- Chaouachi, A.; Covrig, C.F.; Ardelean, M. Multi-criteria selection of offshore wind farms: Case study for the Baltic States. Energy Policy 2017, 103, 179–192. [Google Scholar] [CrossRef]

- Möller, B. Continuous spatial modelling to analyse planning and economic consequences of offshore wind energy. Energy Policy 2010, 39, 511–517. [Google Scholar] [CrossRef]

- Schweizer, J.; Antonini, A.; Govoni, L.; Gottardi, G.; Archetti, R.; Supino, E.; Berretta, C.; Casadei, C.; Ozzi, C. Investigating the potential and feasibility of an offshore wind farm in the Northern Adriatic Sea. Appl. Energy 2016, 177, 449–463. [Google Scholar] [CrossRef]

- Caglayan, D.G.; Ryberg, D.S.; Heinrichs, H.; Linßen, J.; Stolten, D.; Robinius, M. The techno-economic potential of offshore wind energy with optimized future turbine designs in Europe. Appl. Energy 2019, 255, 113794. [Google Scholar] [CrossRef]

- Horgan, C. Using energy payback time to optimise onshore and offshore wind turbine foundations. Renew. Energy 2013, 53, 287–298. [Google Scholar] [CrossRef]

- Konstantinidis, E.I.; Kompolias, D.G.; Botsaris, P.N. Viability analysis of an offshore wind farm in North Aegean Sea, Greece. J. Renew. Sustain. Energy 2014, 6, 23116. [Google Scholar] [CrossRef]

- Min, C.-G.; Park, J.K.; Hur, D.; Kim, M.-K. The Economic Viability of Renewable Portfolio Standard Support for Offshore Wind Farm Projects in Korea. Energies 2015, 8, 9731–9750. [Google Scholar] [CrossRef] [Green Version]

- Wyman, C.M.; Jablonowski, C.J. A Workflow and Estimate for the Economic Viability of Offshore Wind Projects. Wind Eng. 2015, 39, 579–594. [Google Scholar] [CrossRef]

- Min, C.G.; Park, J.-K.; Hur, D.; Kang, Y.C. Economic considerations underlying the introduction of capacity mechanism in Korean offshore wind farms. Int. Trans. Electr. Energy Syst. 2015, 26, 2060–2073. [Google Scholar] [CrossRef]

- Nagababu, G.; Kachhwaha, S.; Savsani, V. Estimation of technical and economic potential of offshore wind along the coast of India. Energy 2017, 138, 79–91. [Google Scholar] [CrossRef]

- Huang, Y.-F.; Gan, X.-J.; Chiueh, P.-T. Life cycle assessment and net energy analysis of offshore wind power systems. Renew. Energy 2017, 102, 98–106. [Google Scholar] [CrossRef]

- Abdelhady, S.; Borello, D.; Shaban, A. Assessment of levelized cost of electricity of offshore wind energy in Egypt. Wind Eng. 2017, 41, 160–173. [Google Scholar] [CrossRef]

- Tseng, Y.-C.; Lee, Y.-M.; Liao, S.-J. An Integrated Assessment Framework of Offshore Wind Power Projects Applying Equator Principles and Social Life Cycle Assessment. Sustainability 2017, 9, 1822. [Google Scholar] [CrossRef] [Green Version]

- Damiani, R.; Ning, A.; Maples, B.; Smith, A.; Dykes, K. Scenario analysis for techno-economic model development of U.S. offshore wind support structures. Wind. Energy 2016, 20, 731–747. [Google Scholar] [CrossRef] [Green Version]

- Kim, C.-K.; Jang, S.; Kim, T. Site selection for offshore wind farms in the southwest coast of South Korea. Renew. Energy 2018, 120, 151–162. [Google Scholar] [CrossRef]

- Cali, U.; Erdogan, N.; Kucuksari, S.; Argin, M. Techno-economic analysis of high potential offshore wind farm locations in Turkey. Energy Strategy Rev. 2018, 22, 325–336. [Google Scholar] [CrossRef]

- Ioannou, A.; Angus, A.; Brennan, F. Parametric CAPEX, OPEX, and LCOE expressions for offshore wind farms based on global deployment parameters. Energy Sources Part B Econ. Plan. Policy 2018, 13, 281–290. [Google Scholar] [CrossRef] [Green Version]

- Mytilinou, V.; Lozano-Minguez, E.; Kolios, A. A Framework for the Selection of Optimum Offshore Wind Farm Locations for Deployment. Energies 2018, 11, 1855. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, T.A.T.; Chou, S.-Y. Impact of government subsidies on economic feasibility of offshore wind system: Implications for Taiwan energy policies. Appl. Energy 2018, 217, 336–345. [Google Scholar] [CrossRef]

- Mytilinou, V.; Kolios, A.J. Techno-economic optimisation of offshore wind farms based on life cycle cost analysis on the UK. Renew. Energy 2018, 132, 439–454. [Google Scholar] [CrossRef]

- Kucuksari, S.; Erdogan, N.; Cali, U. Impact of Electrical Topology, Capacity Factor and Line Length on Economic Performance of Offshore Wind Investments. Energies 2019, 12, 3191. [Google Scholar] [CrossRef] [Green Version]

- Judge, F.; McAuliffe, F.D.; Sperstad, I.B.; Chester, R.; Flannery, B.; Lynch, K.; Murphy, J. A lifecycle financial analysis model for offshore wind farms. Renew. Sustain. Energy Rev. 2019, 103, 370–383. [Google Scholar] [CrossRef]

- Fischetti, M.; Pisinger, D. Mathematical Optimization and Algorithms for Offshore Wind Farm Design: An Overview. Bus. Inf. Syst. Eng. 2018, 61, 469–485. [Google Scholar] [CrossRef] [Green Version]

- Yeter, B.; Garbatov, Y.; Soares, C.G. Risk-based maintenance planning of offshore wind turbine farms. Reliab. Eng. Syst. Saf. 2020, 202, 107062. [Google Scholar] [CrossRef]

- Ioannou, A.; Angus, A.; Brennan, F. Stochastic financial appraisal of offshore wind farms. Renew. Energy 2019, 145, 1176–1191. [Google Scholar] [CrossRef]

- Hübler, C.; Piel, J.-H.; Stetter, C.; Gebhardt, C.G.; Breitner, M.H.; Rolfes, R. Influence of structural design variations on economic viability of offshore wind turbines: An interdisciplinary analysis. Renew. Energy 2019, 145, 1348–1360. [Google Scholar] [CrossRef]

- Adedipe, T.; Shafiee, M. An economic assessment framework for decommissioning of offshore wind farms using a cost breakdown structure. Int. J. Life Cycle Assess. 2021, 26, 344–370. [Google Scholar] [CrossRef]

- Spyridonidou, S.; Vagiona, D.G. Spatial energy planning of offshore wind farms in Greece using GIS and a hybrid MCDM methodological approach. Euro-Mediterr. J. Environ. Integr. 2020, 5, 1–13. [Google Scholar] [CrossRef]

- Jadali, A.M.; Ioannou, A.; Salonitis, K.; Kolios, A. Decommissioning vs. repowering of offshore wind farms—a techno-economic assessment. Int. J. Adv. Manuf. Technol. 2021, 112, 2519–2532. [Google Scholar] [CrossRef]

- dos Reis, M.M.L.; Mazetto, B.M.; da Silva, E.C.M. Economic analysis for implantation of an offshore wind farm in the Brazilian coast. Sustain. Energy Technol. Assess. 2020, 43, 100955. [Google Scholar] [CrossRef]

- Castro-Santos, L. Decision variables for floating offshore wind farms based on life-cycle cost: The case study of Galicia (North-West of Spain). Ocean Eng. 2016, 127, 114–123. [Google Scholar] [CrossRef]

- Mattar, C.; Guzmán-Ibarra, M.C. A techno-economic assessment of offshore wind energy in Chile. Energy 2017, 133, 191–205. [Google Scholar] [CrossRef]

- Del Jesus, F.; Guanche, R.; Losada, J. The impact of wind resource spatial variability on floating offshore wind farms finance. Wind. Energy 2017. [Google Scholar] [CrossRef]

- Kausche, M.; Adam, F.; Dahlhaus, F.; Großmann, J. Floating offshore wind—Economic and ecological challenges of a TLP solution. Renew. Energy 2018, 126, 270–280. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Filgueira-Vizoso, A.; Álvarez-Feal, C.; Carral, L. Influence of Size on the Economic Feasibility of Floating Offshore Wind Farms. Sustainability 2018, 10, 4484. [Google Scholar] [CrossRef] [Green Version]

- Baita-Saavedra, E.; Cordal-Iglesias, D.; Filgueira-Vizoso, A.; Castro-Santos, L.; Saavedra, B.; Iglesias, C.; Vizoso, F.; Santos, C. Economic Aspects of a Concrete Floating Offshore Wind Platform in the Atlantic Arc of Europe. Int. J. Environ. Res. Public Health 2019, 16, 4122. [Google Scholar] [CrossRef] [Green Version]

- Castro-Santos, L.; Bento, A.R.; Silva, D.; Salvação, N.; Soares, C.G. Economic Feasibility of Floating Offshore Wind Farms in the North of Spain. J. Mar. Sci. Eng. 2020, 8, 58. [Google Scholar] [CrossRef] [Green Version]

- Maienza, C.; Avossa, A.; Ricciardelli, F.; Coiro, D.; Troise, G.; Georgakis, C. A life cycle cost model for floating offshore wind farms. Appl. Energy 2020, 266, 114716. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Silva, D.; Bento, A.R.; Salvação, N.; Soares, C.G. Economic feasibility of floating offshore wind farms in Portugal. Ocean Eng. 2020, 207, 107393. [Google Scholar] [CrossRef]

- Spyridonidou, S.; Vagiona, D.G.; Loukogeorgaki, E. Strategic Planning of Offshore Wind Farms in Greece. Sustainability 2020, 12, 905. [Google Scholar] [CrossRef] [Green Version]

- Baita-Saavedra, E.; Cordal-Iglesias, D.; Filgueira-Vizoso, A.; Morató, À.; Lamas-Galdo, I.; Álvarez-Feal, C.; Carral, L.; Castro-Santos, L. An Economic Analysis of An Innovative Floating Offshore Wind Platform Built with Concrete: The SATH® Platform. Appl. Sci. 2020, 10, 3678. [Google Scholar] [CrossRef]

- Roggenburg, M.; Esquivel-Puentes, H.A.; Vacca, A.; Evans, H.B.; Garcia-Bravo, J.M.; Warsinger, D.M.; Ivantysynova, M.; Castillo, L. Techno-economic analysis of a hydraulic transmission for floating offshore wind turbines. Renew. Energy 2020, 153, 1194–1204. [Google Scholar] [CrossRef]

- Ghigo, A.; Cottura, L.; CaraDonna, R.; Bracco, G.; Mattiazzo, G. Platform Optimization and Cost Analysis in a Floating Offshore Wind Farm. J. Mar. Sci. Eng. 2020, 8, 835. [Google Scholar] [CrossRef]

- Barter, G.E.; Robertson, A.; Musial, W. A systems engineering vision for floating offshore wind cost optimization. Renew. Energy Focus 2020, 34, 1–16. [Google Scholar] [CrossRef]

- Serri, L.; Colle, L.; Vitali, B.; Bonomi, T. Floating Offshore Wind Farms in Italy beyond 2030 and beyond 2060: Preliminary Results of a Techno-Economic Assessment. Appl. Sci. 2020, 10, 8899. [Google Scholar] [CrossRef]

- Cordal-Iglesias, D.; Filgueira-Vizoso, A.; Baita-Saavedra, E.; Graña-López, M.; Castro-Santos, L. Framework for Development of an Economic Analysis Tool for Floating Concrete Offshore Wind Platforms. J. Mar. Sci. Eng. 2020, 8, 958. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Decastro, M.; Costoya, X.; Filgueira-Vizoso, A.; Lamas-Galdo, I.; Ribeiro, A.; Dias, J.; Gómez-Gesteira, M. Economic Feasibility of Floating Offshore Wind Farms Considering Near Future Wind Resources: Case Study of Iberian Coast and Bay of Biscay. Int. J. Environ. Res. Public Health 2021, 18, 2553. [Google Scholar] [CrossRef]

- Jung, G.-E.; Sung, H.-J.; Dinh, M.-C.; Park, M.; Shin, H. A Comparative Analysis of Economics of PMSG and SCSG Floating Offshore Wind Farms. Energies 2021, 14, 1386. [Google Scholar] [CrossRef]

- Chiang, A.C.; Keoleian, G.A.; Moore, M.R.; Kelly, J.C. Investment cost and view damage cost of siting an offshore wind farm: A spatial analysis of Lake Michigan. Renew. Energy 2016, 96, 966–976. [Google Scholar] [CrossRef] [Green Version]

- Schallenberg-Rodríguez, J.; Montesdeoca, N.G. Spatial planning to estimate the offshore wind energy potential in coastal regions and islands. Practical case: The Canary Islands. Energy 2018, 143, 91–103. [Google Scholar] [CrossRef]

- Deveci, M.; Cali, U.; Kucuksari, S.; Erdogan, N. Interval type-2 fuzzy sets based multi-criteria decision-making model for offshore wind farm development in Ireland. Energy 2020, 198, 117317. [Google Scholar] [CrossRef]

- Hong, L.; Möller, B. An economic assessment of tropical cyclone risk on offshore wind farms. Renew. Energy 2012, 44, 180–192. [Google Scholar] [CrossRef] [Green Version]

- Albani, A.; Ibrahim, M.Z.; Yong, K. The Feasibility Study of Offshore Wind Energy Potential in Kijal, Malaysia: The New Alternative Energy Source Exploration in Malaysia. Energy Explor. Exploit. 2014, 32, 329–344. [Google Scholar] [CrossRef] [Green Version]

- Iniesta, J.B.; Barroso, M.M. Assessment of Offshore Wind Energy Projects in Denmark. A Comparative Study With Onshore Projects Based on Regulatory Real Options. J. Sol. Energy Eng. 2015, 137, 41009. [Google Scholar] [CrossRef]

- Li, B.; DeCarolis, J.F. A techno-economic assessment of offshore wind coupled to offshore compressed air energy storage. Appl. Energy 2015, 155, 315–322. [Google Scholar] [CrossRef]

- Caralis, G.; Chaviaropoulos, P.; Albacete, V.R.; Diakoulaki, D.; Kotroni, V.; Lagouvardos, K.; Gao, Z.; Zervos, A.; Rados, K. Lessons learnt from the evaluation of the feed-in tariff scheme for offshore wind farms in Greece using a Monte Carlo approach. J. Wind Eng. Ind. Aerodyn. 2016, 157, 63–75. [Google Scholar] [CrossRef]

- Schwanitz, V.J.; Wierling, A. Offshore wind investments—Realism about cost developments is necessary. Energy 2016, 106, 170–181. [Google Scholar] [CrossRef]

- Rodrigues, S.; Restrepo, C.; Katsouris, G.; Pinto, R.T.; Soleimanzadeh, M.; Bosman, P.; Bauer, P. A Multi-Objective Optimization Framework for Offshore Wind Farm Layouts and Electric Infrastructures. Energies 2016, 9, 216. [Google Scholar] [CrossRef] [Green Version]

- Meere, R.; Ruddy, J.; McNamara, P.; O'Donnell, T. Variable AC transmission frequencies for offshore wind farm interconnection. Renew. Energy 2017, 103, 321–332. [Google Scholar] [CrossRef]

- Gonzalez-Rodriguez, A.G.; Payan, M.B.; Santos, J.R.; Gonzalez, J.S. Optimization of regular offshore wind-power plants using a non-discrete evolutionary algorithm. AIMS Energy 2017, 5, 173–192. [Google Scholar] [CrossRef]

- Amirinia, G.; Mafi, S.; Mazaheri, S. Offshore wind resource assessment of Persian Gulf using uncertainty analysis and GIS. Renew. Energy 2017, 113, 915–929. [Google Scholar] [CrossRef]

- Hou, P.; Hu, W.; Soltani, M.; Chen, C.; Zhang, B.; Chen, Z. Offshore Wind Farm Layout Design Considering Optimized Power Dispatch Strategy. IEEE Trans. Sustain. Energy 2016, 8, 638–647. [Google Scholar] [CrossRef]

- Kim, K.; Kim, B.; Kim, H. A decision-making model for the analysis of offshore wind farm projects under climate uncertainties: A case study of South Korea. Renew. Sustain. Energy Rev. 2018, 94, 853–860. [Google Scholar] [CrossRef]

- Scripcariu, M.; Sava, G.N.; Pluteanu, S.; Udrea, O. Offshore Wind Power Plant and Electrical Network Development: Romanian Case Study. J. Energy Eng. 2018, 144, 5017006. [Google Scholar] [CrossRef]

- Satir, M.; Murphy, F.; McDonnell, K. Feasibility study of an offshore wind farm in the Aegean Sea, Turkey. Renew. Sustain. Energy Rev. 2018, 81, 2552–2562. [Google Scholar] [CrossRef] [Green Version]

- Pereira, T.; Castro, R. Comparison of internal grid topologies of offshore wind farms regarding reliability and economic performance metrics analysis. IET Renew. Power Gener. 2019, 13, 750–761. [Google Scholar] [CrossRef]

- Wang, S.; Wang, S.; Liu, J. Life-cycle green-house gas emissions of onshore and offshore wind turbines. J. Clean. Prod. 2018, 210, 804–810. [Google Scholar] [CrossRef]

- Al-Nassar, W.; Neelamani, S.; Al-Salem, K.; Al-Dashti, H. Feasibility of offshore wind energy as an alternative source for the state of Kuwait. Energy 2018, 169, 783–796. [Google Scholar] [CrossRef]

- Yue, C.-D.; Liu, C.-C.; Tu, C.-C.; Lin, T.-H. Prediction of Power Generation by Offshore Wind Farms Using Multiple Data Sources. Energies 2019, 12, 700. [Google Scholar] [CrossRef] [Green Version]

- McDonagh, S.; Ahmed, S.; Desmond, C.; Murphy, J.D. Hydrogen from offshore wind: Investor perspective on the profitability of a hybrid system including for curtailment. Appl. Energy 2020, 265, 114732. [Google Scholar] [CrossRef]

- Pakenham, B.; Ermakova, A.; Mehmanparast, A. A Review of Life Extension Strategies for Offshore Wind Farms Using Techno-Economic Assessments. Energies 2021, 14, 1936. [Google Scholar] [CrossRef]

- Ziemba, P. Multi-Criteria Fuzzy Evaluation of the Planned Offshore Wind Farm Investments in Poland. Energies 2021, 14, 978. [Google Scholar] [CrossRef]

- Zuo, T.; Zhang, Y.; Meng, K.; Tong, Z.; Dong, Z.Y.; Fu, Y. Collector System Topology Design for Offshore Wind Farm’s Repowering and Expansion. IEEE Trans. Sustain. Energy 2020, 12, 847–859. [Google Scholar] [CrossRef]

- Fingersh, L.; Hand, M.; Laxson, A. Wind Turbine Design Cost and Scaling Model. Available online: https://www.nrel.gov/docs/fy07osti/40566.pdf (accessed on 20 January 2021).

- Myhr, A.; Bjerkseter, C.; Ågotnes, A.; Nygaard, T.A. Levelised cost of energy for offshore floating wind turbines in a life cycle perspective. Renew. Energy 2014, 66, 714–728. [Google Scholar] [CrossRef] [Green Version]

- Schwartz, E.; California Chair in Real Estate and Land Economics. The Real Options Approach to Valuation: Challenges and Opportunities. Lat. Am. J. Econ. 2013, 50, 163–177. [Google Scholar] [CrossRef]

- Daim, T.; Oliver, T.; Kim, J. (Eds.) Research and Technology Management in the Electricity Industry, Green Energy and Technology; Springer: London, UK, 2013. [Google Scholar] [CrossRef]

- Nguyen, K.H.; Kakinaka, M. Renewable energy consumption, carbon emissions, and development stages: Some evidence from panel cointegration analysis. Renew. Energy 2018, 132, 1049–1057. [Google Scholar] [CrossRef]

- Simons, P.J.; Cheung, W.M. Development of a quantitative analysis system for greener and economically sustainable wind farms. J. Clean. Prod. 2016, 133, 886–898. [Google Scholar] [CrossRef]

- Martínez-Cámara, E.; Sanz, F.; Pellegrini, S.; Jimenez, E.; Blanco, J. Life cycle assessment of a multi-megawatt wind turbine. Renew. Energy 2009, 34, 667–673. [Google Scholar] [CrossRef]

- Bond, K.; Benham, H.; Vaughan, E.; Butler-Sloss, S. The Sky’s the Limit. Available online: https://epbr.com.br/wp-content/uploads/2021/04/Sky-the-limit-report_Apr21-compressed.pdf (accessed on 20 January 2021).

- Saidur, R.; Rahim, N.A.; Islam, M.; Solangi, K. Environmental impact of wind energy. Renew. Sustain. Energy Rev. 2011, 15, 2423–2430. [Google Scholar] [CrossRef]

- Jin, Y.; Behrens, P.; Tukker, A.; Scherer, L. Water use of electricity technologies: A global meta-analysis. Renew. Sustain. Energy Rev. 2019, 115, 109391. [Google Scholar] [CrossRef]

- Pelc, R.; Fujita, R.M. Renewable energy from the ocean. Mar. Policy 2002, 26, 471–479. [Google Scholar] [CrossRef]

- Ahsan, D.; Pedersen, S. The influence of stakeholder groups in operation and maintenance services of offshore wind farms: Lesson from Denmark. Renew. Energy 2018, 125, 819–828. [Google Scholar] [CrossRef] [Green Version]

- Vaienti, C.; Ioannou, A.; Brennan, F. Cash flow at risk of offshore wind plants. In Proceedings of the 2017 6th International Conference on Clean Electrical Power (ICCEP), Santa Margherita Ligure, Italy, 27–29 June 2017; IEEE: Piscataway, NJ, USA, 2017; pp. 84–93. [Google Scholar]

- Edwards, I. Overcoming Challenges for the Offshore Wind Industry and Learning from the Oil and Gas Industry; Natural Power: Castle Douglas, Scotland, UK, 2011. [Google Scholar]

- Dong, M.; Li, Y.; Song, D.; Yang, J.; Su, M.; Deng, X.; Huang, L.; Elkholy, M.; Joo, Y.H. Uncertainty and global sensitivity analysis of levelized cost of energy in wind power generation. Energy Convers. Manag. 2021, 229, 113781. [Google Scholar] [CrossRef]

- Topham, E.; McMillan, D.; Bradley, S.; Hart, E. Recycling offshore wind farms at decommissioning stage. Energy Policy 2019, 129, 698–709. [Google Scholar] [CrossRef] [Green Version]

- Welstead, J.; Hirst, R.; Keogh, D.; Robb, G.; Bainsfair, R. Research and Guidance on Restoration and Decommissioning of Onshore Wind Farms. Available online: https://www.nature.scot/doc/naturescot-commissioned-report-591-research-and-guidance-restoration-and-decommissioning-onshore (accessed on 4 February 2021).

- Topham, E.; McMillan, D. Sustainable decommissioning of an offshore wind farm. Renew. Energy 2016, 102, 470–480. [Google Scholar] [CrossRef] [Green Version]

- Allan, R.; Avella, P.C. Reliability and economic assessment of generating systems containing wind energy sources. IEE Proc. C Gener. Transm. Distrib. 1985, 132, 8–13. [Google Scholar] [CrossRef]

- Diab, R.; O’Leary, B. Economic analysis of wind-generated electricity in remote areas of South Africa. Int. J. Energy Res. 1989, 13, 581–588. [Google Scholar] [CrossRef]

- Nayar, C.; Phillips, S.; James, W.; Pryor, T.; Remmer, D. Novel wind/diesel/battery hybrid energy system. Sol. Energy 1993, 51, 65–78. [Google Scholar] [CrossRef]

- Sathiamoorthy, M.; Probert, S. The integrated Severn barrage complex: Harnessing tidal, wave and wind power. Appl. Energy 1994, 49, 17–46. [Google Scholar] [CrossRef]

- Madariaga, A.; de Alegría, I.M.; Martín, J.; Eguía, P.; Ceballos, S. Current facts about offshore wind farms. Renew. Sustain. Energy Rev. 2012, 16, 3105–3116. [Google Scholar] [CrossRef]

- Zionts, S. MCDM—If Not a Roman Numeral, Then What? Interfaces 1979, 9, 94–101. [Google Scholar] [CrossRef]

- Shad, R.; Khorrami, M.; Ghaemi, M. Developing an Iranian green building assessment tool using decision making methods and geographical information system: Case study in Mashhad city. Renew. Sustain. Energy Rev. 2017, 67, 324–340. [Google Scholar] [CrossRef]

- Gumus, S.; Kucukvar, M.; Tatari, O. Intuitionistic fuzzy multi-criteria decision making framework based on life cycle environmental, economic and social impacts: The case of U.S. wind energy. Sustain. Prod. Consum. 2016, 8, 78–92. [Google Scholar] [CrossRef]

- D’Agostino, D.; Parker, D.; Melià, P. Environmental and economic implications of energy efficiency in new residential buildings: A multi-criteria selection approach. Energy Strategy Rev. 2019, 26, 100412. [Google Scholar] [CrossRef]

| Authors (Year) | Citations (Citation/Year) | Summary |

|---|---|---|

| Levitt et al. [26] | 81 (7.4) | A cash-flow-based model was proposed to calculate the Levelized Cost of Energy (LCOE) and the break-even price. 35 projects in Europe, the United States, and China were analyzed, considering data appropriate from policies and electricity markets. |

| Hou et al. [27] | 74 (12.3) | The authors proposed a mathematical model that includes the variation of wind direction and wake deficit for selecting the location arrangement of wind turbines in large-scale farms. A Particle Swarm Optimization Algorithm in which the LCOE was defined as an objective function was applied in a German case study. |

| Kim et al. [28] | 53 (6.6) | This study deals with the ideal selection for a wind farm in South Korea. The economic technical feasibility was tested, considering among other parameters, a cost-benefit ratio (LCOE), the convenience of grid connection, and the power capacity to be installed. |

| Astariz et al. [29] | 50 (7.1) | The authors carry out an economic analysis of tidal, wave, and offshore wind energy. The LCOE is adopted in comparison, considering specific costs and investments for each type of project. Wave energy had the highest costs, while at the other extreme is offshore wind energy. |

| Ioannou et al. [30] | 46 (11.5) | The study developed a technical–economic lifecycle assessment framework for predicting the life cycle costs of offshore wind parks, which was later applied to a realistic case study in the UK. |

| Shafiee et al. [31] | 43 (7.2) | A cost breakdown structure for offshore wind farms is proposed. For this, a combined multivariate regression and neural network approach is developed to identify key cost drivers and evaluate the costs associated with the project’s phases, until the end of their useful life. Net Present Value (NPV) is used to test the feasibility of the project. |

| Gonzalez et al. [32] | 40 (4.4) | An improved genetic algorithm model is proposed for optimizing wind turbine installations in large offshore wind power plants with the aim of maximizing the economic profitability of the project. The proposed model is defined as complete and realistic for evaluating the economic behavior of this type of project. |

| Castro-Santos et al. [33] | 39 (6.5) | A methodology to assess the economic viability of a floating offshore wind farm is proposed and applied to a case study in Spain. The methodology considers that the project’s life cycle cost is composed of the total costs in all phases of the installation’s life cycle. |

| Chaouachi et al. [34] | 37 (7.4) | A multi-criteria approach is proposed for the evaluation of locations for the installation of offshore wind farms, considering economic and technical aspects. Analytic Hierarchy Process (AHP) is used. The proposed model is applied in three Baltic States: Estonia, Latvia, and Lithuania. |

| Luengo and Kolios [13] | 37 (5.3) | Through a literature review, the article contributes to the detailed identification of failure modes throughout the useful life of offshore wind turbines. The three most relevant end-of-life scenarios are analyzed: (i) repowering, (ii) extension of useful life, and (iii) decommissioning. |

| Möller Bernd [35] | 33 (3.0) | A spatial resource economic model is proposed to analyze area constraints, technological risks, and opportunity costs of maintaining area uses in Denmark. The SCREAM offshore wind model (Spatially Continuous Resource Economic Analysis Model) used raster-based geographical information systems (GIS) and considers numerous geographical factors and costs. |

| Schweizer et al. [36] | 31 (5.2) | The article presented a preliminary study on the technical and economic feasibility of installing an offshore wind farm in Italy. The Weighted Average Cost of Capital (WACC) and Capital Asset Pricing Model (CAPM) were used to calculate the discount rate, and then the economic viability was evaluated through the NPV and the Internal Rate of Return (IRR). |

| Authors | Analyzed Country | Consider the End of Life Scenarios? | LCOE | NPV | IRR | PB/DPB | LCC | MCS | MCDM | Others |

|---|---|---|---|---|---|---|---|---|---|---|

| Kim et al. [28] | Korean Penisula | No | ● | |||||||

| Horgan [38] | Not specified | No | ● | ● | ||||||

| Konstantinidis et al. [39] | Greece | No | ● | ● | ● | ● | ||||

| Min et al. [40] | South Korea | No | ● | ● | ● | |||||

| McDaniel Wyman and Jablonowski [41] | Not specified | Yes | ● | ● | ||||||

| Shafiee et al. [31] | Not specified | Yes | ● | ● | ● | ● | ||||

| Schweizer et al. [36] | Italy | Yes | ● | ● | ||||||

| Min et al. [42] | South Korea | No | ● | ● | ● | |||||

| Nagababu et al. [43] | India | No | ● | |||||||

| Huang et al. [44] | Taiwan/China | Yes | ● | ● | ● | |||||

| Abdelhady et al. [45] | Egypt | No | ● | |||||||

| Tseng et al. [46] | Taiwan | Yes | ● | |||||||

| Damiani et al. [47] | U.S | No | ● | |||||||

| Ioannou et al. [30] | United Kingdom | Yes | ● | ● | ||||||

| Kim et al. [48] | South Korea | No | ● | |||||||

| Cali et al. [49] | Turkey | Yes | ● | ● | ● | ● | ||||

| Ioannou et al. [50] | Not specified | Yes | ● | ● | ||||||

| Mytilinou et al. [51] | Not specified | Yes | ● | ● | ● | ● | ● | |||

| Nguyen and Chou [52] | Taiwan | No | ● | ● | ● | |||||

| Mytilinou and Kolios [53] | United Kingdom | Yes | ● | |||||||

| Kucuksari et al. [54] | Not specified | No | ● | ● | ● | |||||

| Judge et al. [55] | Not specified | Yes | ● | ● | ● | ● | ● | ● | ● | |

| Fischetti and Pisinger [56] | Denmark | No | ● | |||||||

| Yeter et al. [57] | Not specified | Yes | ● | ● | ||||||

| Ioannou et al. [58] | United Kingdom | Yes | ● | ● | ● | ● | ● | ● | ||

| Hübler et al. [59] | Germany | Yes | ● | ● | ● | |||||

| Adedipe and Shafiee [60] | Not specified | Yes | ● | ● | ● | ● | ||||

| Spyridonidou and Vagiona [61] | Greece | Yes | ● | |||||||

| Jadali et al. [62] | United Kingdom | Yes | ● | ● | ● | |||||

| Lozer dos Reis et al. [63] | Brazil | No | ● |

| Authors | Analyzed Country | Consider the End of Life Scenarios? | LCOE | NPV | IRR | PB/DPB | LCC | MCS | MCDM | Others |

|---|---|---|---|---|---|---|---|---|---|---|

| Castro-Santos and Diaz-Casas [19] | Spain | Yes | ● | ● | ● | ● | ● | ● | ||

| Castro-Santos et al. [33] | Spain | No | ● | ● | ● | ● | ● | ● | ||

| Castro-Santos [64] | Spain | Yes | ● | |||||||

| Mattar and Guzmán-Ibarra [65] | Chile | Yes | ● | ● | ● | ● | ||||

| del Jesus et al. [66] | Spain | No | ● | ● | ● | ● | ||||

| Kausche et al. [67] | Not specified | Yes | ● | |||||||

| Castro-Santos et al. [68] | Portugal/Spain/Galicia | Yes | ● | |||||||

| Baita-Saavedra et al. [69] | Portugal/Spain | Yes | ● | ● | ● | ● | ● | |||

| Castro-Santos et al. [70] | Spain | Yes | ● | ● | ● | |||||

| Maienza et al. [71] | Italy | Yes | ● | ● | ||||||

| Castro-Santos et al. [72] | Portugal | Yes | ● | ● | ||||||

| Spyridonidou et al. [73] | Greece | Yes | ● | |||||||

| Baita-Saavedra et al. [74] | Spain | Yes | ● | ● | ● | ● | ||||

| Roggenburg et al. [75] | Not specified | No | ● | |||||||

| Ghigo et al. [76] | Italy | Yes | ● | |||||||

| Barter et al. [77] | Not specified | Yes | ● | |||||||

| Serri et al. [78] | Italy | No | ● | |||||||

| Cordal-Iglesias et al. [79] | Spain | Yes | ● | ● | ● | ● | ||||

| Castro-Santos et al. [80] | Spain/Portugal | No | ● | ● | ● | |||||

| Jung et al. [81] | Not specified | No | ● | ● | ● |

| Authors | Analyzed Country | Consider the End of Life Scenarios? | LCOE | NPV | IRR | PB/DPB | LCC | MCS | MCDM | Others |

|---|---|---|---|---|---|---|---|---|---|---|

| Chiang et al. [82] | U.S | No | ● | ● | ● | |||||

| Schallenberg-Rodríguez and García Montesdeoca [83] | Not specified | Yes | ● | |||||||

| Caglayan et al. [37] | Not specified | No | ● | |||||||

| Deveci et al. [84] | Ireland | No | ● | ● | ● | ● |

| Authors | Analyzed Country | Consider the End of Life Scenarios? | LCOE | NPV | IRR | PB/DPB | LCC | MCS | MCDM | Others |

|---|---|---|---|---|---|---|---|---|---|---|

| Levitt et al. [26] | United States/Europe | No | ● | ● | ● | |||||

| Möller Bernd [35] | Denmark | No | ● | |||||||

| Hong and Möller [85] | China | No | ● | |||||||

| Gonzalez et al. [32] | Not specified | Yes | ● | ● | ● | |||||

| Albani et al. [86] | Malaysia | No | ● | ● | ||||||

| Iniesta and Barroso [87] | Denmark | No | ● | ● | ||||||

| Hou et al. [27] | Germany | No | ● | |||||||

| Astariz et al. [29] | Not specified | Yes | ● | ● | ||||||

| Luengo and Kolios [13] | Not specified | Yes | ● | ● | ||||||

| Li and DeCarolis [88] | U.S | No | ● | |||||||

| Caralis et al. [89] | Greece | No | ● | ● | ● | |||||

| Schwanitz and Wierling [90] | Not specified | Yes | ● | |||||||

| Rodrigues et al. [91] | Netherlands | Yes | ● | ● | ● | ● | ● | |||

| Meere et al. [92] | Not specified | No | ● | |||||||

| Gonzalez-Rodriguez et al. [93] | Not specified | Yes | ● | ● | ||||||

| Chaouachi et al. [34] | Baltic States | Yes | ● | |||||||

| Amirinia et al. [94] | Iran | No | ||||||||

| Hou et al. [95] | Germany | No | ● | |||||||

| Kim et al. [96] | South Korea | No | ● | ● | ||||||

| Scripcariu et al. [97] | Romania | No | ● | ● | ||||||

| Satir et al. [98] | Turkey | No | ● | ● | ||||||

| Pereira and Castro [99] | Not specified | No | ● | ● | ||||||

| Wang et al. [100] | Not specified | Yes | ● | |||||||

| Al-Nassar et al. [101] | Kuwait | No | ● | ● | ● | ● | ● | |||

| Yue et al. [102] | Taiwan | No | ● | |||||||

| McDonagh et al. [103] | Not specified | Yes | ● | ● | ||||||

| Pakenham et al. [104] | Not specified | Yes | ● | |||||||

| Ziemba [105] | Poland | No | ● | |||||||

| Zuo et al. [106] | Not specified | Yes | ● |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pires, A.L.G.; Rotella Junior, P.; Morioka, S.N.; Rocha, L.C.S.; Bolis, I. Main Trends and Criteria Adopted in Economic Feasibility Studies of Offshore Wind Energy: A Systematic Literature Review. Energies 2022, 15, 12. https://doi.org/10.3390/en15010012

Pires ALG, Rotella Junior P, Morioka SN, Rocha LCS, Bolis I. Main Trends and Criteria Adopted in Economic Feasibility Studies of Offshore Wind Energy: A Systematic Literature Review. Energies. 2022; 15(1):12. https://doi.org/10.3390/en15010012

Chicago/Turabian StylePires, Arthur Leandro Guerra, Paulo Rotella Junior, Sandra Naomi Morioka, Luiz Célio Souza Rocha, and Ivan Bolis. 2022. "Main Trends and Criteria Adopted in Economic Feasibility Studies of Offshore Wind Energy: A Systematic Literature Review" Energies 15, no. 1: 12. https://doi.org/10.3390/en15010012

APA StylePires, A. L. G., Rotella Junior, P., Morioka, S. N., Rocha, L. C. S., & Bolis, I. (2022). Main Trends and Criteria Adopted in Economic Feasibility Studies of Offshore Wind Energy: A Systematic Literature Review. Energies, 15(1), 12. https://doi.org/10.3390/en15010012