Abstract

Energy policy affects the functioning of the economic and financial systems of countries worldwide. This paper provides a theoretical overview of the economy–energy nexus and discusses the particular cases of the energy policy dynamics amid the sustainability goals. This paper integrates multiple perspectives on the energy–economy nexus, with a particular focus on the energy trilemma, 4As of energy security and PESTEL approach. This allows the development of a comprehensive framework for the analysis of energy security and the sustainability interaction. A review of manifestations of the different dimensions of energy security and sustainability is carried out to identify the most topical facets of the issue. Then, the cases of the selected European Union countries (Ireland, Greece, Denmark and Lithuania) are presented to highlight the effects and features of the recent energy policy changes there. Indeed, these countries apply a PSO levy mechanism on electricity tariffs and are diverse in their geopolitical situation, economic development, geographical situation and energy dependency level. The analysis of the situations of such different countries applying the PSO levy mechanism makes it possible to perform a broader and more in-depth assessment and comparison of electricity tariff regulations. Thus, the developed theoretical model is applied to identify the major outcomes of the energy policy regimes (with a focus on tariff regulation) in the selected countries.

1. Introduction

Within each region, the economic and financial systems are affected by the energy system. In this context, energy security is perhaps the most important concept. Issues related to energy security issues began to be deliberated more and more actively on the eve of World War I, when the military leadership of England made the decision to switch naval fuel from coal to oil, thus creating conditions for England to become dependent on oil imports from abroad (Persia) [1]. Throughout the twentieth century and the beginning of the 21st century, energy security was impacted by many factors, such as global and local markets, developing infrastructures, new energy technologies and new ways to use them, financial markets, political agreements and the number of suppliers of primary energy sources. Eventually, the convolution of the aforementioned factors led to energy crises (such as oil crisis in the 1970s) [2]. Thus, energy policy has become an important factor for geopolitical and economic decisions, shaping the future of countries and society. The energy planning has become particularly important [3,4,5].

In this context, the European Union (EU) is no exception. Home to almost 450 million people, the EU is actively and purposefully pursuing its goals of energy security and energy transition. Electricity production and consumption have become integral parts of energy security. The liberalization of the EU electricity market aims at integration and international energy connections [6]. In addition, energy transition to tackle climate change by moving from fossil fuels towards 100% renewable energy by 2050 has been foreseen. These objectives call for a certain level of state intervention and the coordination of support mechanisms. Indeed, the aforementioned policy objectives require costly measures that are not commercially attractive in the short run and often provoke unreasonable public resistance. One of the mechanisms to finance the policy-oriented measures in the energy sector is the provision of the Public Service Obligation, which was defined in the EU Directive 2009/72/EC.

There have been studies focused on the general issues surrounding energy security. Bigerna, Bollino & Galkin [7] examined the impact of oil import portfolio optimization on energy security. Ashaye, Alharahsheh & Pius [8] examined the relationship between energy security and economic development. Lixia [9] examined energy security concepts, systems and indicators. Srivastav [10] examined the relationship between energy security and sustainability; Strielkowski, Veinbender, Tvaronavičienė & Lace [11] examined the economic efficiency and energy security of smart cities. Sutrisno, Nomaler & Alkemade [12] examined the impact of energy market developments on energy security. The case studies focused on Poland [13], Italy [14], India [15], Denmark [16], China [17], Indonesia [18], the EU [19], Latin America [20], Pakistan [21], Russia [22] and Andalusia [23].

The PSO has also been addressed in the earlier literature. Farrell & Lyons [24] examined the impact of the Irish PSO levy on electricity consumption. Skok, Mileta & Baricevic [25] examined the possibilities of forecasting the electricity load of the Croatian PSO electricity supplier in the short term. Karova [26] examined PSO in the context of electricity. Rusche [27] analyzed electricity generation from the RES as a PSO (however, this study took a legal rather than an economic point of view). Therefore, there is still a lack of more detailed and context-specific analyses of the impact of the PSO levy on electricity tariffs and energy security.

This article analyzes PSO solely in the context of the electricity market. The security of the supply and protection of the environment are taken into account throughout the analysis. The presence of the PSO implies that the final private and commercial electricity consumers pay an additional amount to their electricity bills (so-called PSO levy), which is then distributed to PSO-supplying companies (usually in the form of a subsidy). Since the treatment of PSO is different in every country and is often adjusted to the local needs, this requires a country-by-country analysis. This article examines the PSO mechanisms of four EU countries, as well as their impact on their energy security. These countries (Ireland, Greece, Denmark, Lithuania) have been selected to take into account different geographical locations, different energy systems and their challenges, different economic situations, different geopolitical situations of the regions and, finally, different PSO mechanisms.

The aim of this work is to assess the impact of the PSO levy on the electricity tariffs applied by the four EU countries (Ireland, Greece, Denmark and Lithuania) on their energy security. To ensure a better understanding of the context, the scientific concepts of public service obligation and energy security are first briefly discussed. Then, the literature examining the PSO mechanisms and energy security aspects in the four countries is analyzed (131 sources). The results of the case studies are compared with the Energy Trilemma Index to further examine the relationship between the PSO levy and the energy security level of the countries.

This paper is structured as follows. First, in Section 2, public service obligation and energy security definitions are examined. Section 3 describes the research approach taken in this work. Section 4 presents the results of the literature review. Section 5 is dedicated to the analysis of individual cases (countries). Finally, Section 6 presents the conclusions.

2. Preliminaries

2.1. PSO Definition

Different countries, including the EU Member States, often use various means of intervening in electricity price tariffs to subsidize a certain energy niche in the country. In most cases, electricity generation from RES is considered. The following terms referring to such interventions are found in the scientific literature:

- RES charge [28,29], RES levy [30];

- RES surcharge [30,31];

- RES payment [32,33];

- Payment for green electricity [34];

- EEG surcharge [35];

- PSO levy [36,37];

- PSO charge [38];

- PSO surcharge [39];

- PSO tariff [40];

- PSO element [41].

Although Harker, Kreutzmann and Waddams [42] note that PSO is most commonly applied in telecommunications, transport (rail, aviation), postal and energy services, this article examines PSO specifically in the context of electricity. Although the precise interpretation of PSO, based on the principle of subsidiarity at the EU level, is left to the discretion of each individual country [43], several PSO definitions prevailing in the electricity context can be singled out (Appendix A).

In general, the PSO ensures security of supply and protection of the environment [43]. In addition, the policies related to PSO have changed in recent decades. Initially, it used to be the exclusive prerogative of the country, whereas, currently, it is often provided by private or semi-private companies [26]. The common feature is that this levy is mandatory and compulsory in every country.

In principle, another mandatory and compulsory levy created by the state negatively affects the spirit of entrepreneurship and the freedom of entrepreneurs’ decision making. Kirzner [44] and Foss and Klein [45] examine this in their works, which state that state-regulated price mechanisms, regulations, antitrust and production volumes inhibit business discovery opportunities and the entrepreneurial spirit in general. As entrepreneurs are the driving force of any country’s economy, a negative investment climate or a poor entrepreneurial microclimate is something to be avoided in any case. However, the positive impact of the PSO levy on the country’s energy security and sustainability may in some ways offset the negative impact on the country’s entrepreneurs and their decision-making freedom.

This article examines, in particular, the PSO-based support schemes and their impact on energy security in the context of the electricity market. The PSO levy on electricity prices has been applied in the following countries: Portugal [46], Turkey [47], Belgium [48], Bulgaria [40], Luxembourg [49], Denmark [50], Lithuania [51], Greece [52] and Ireland [53]. This article examines four countries (Denmark, Lithuania, Greece, Ireland) and the impact of the PSO levy on their energy security. According to Finger and Finon [54], the regulator can choose from three different PSO funding methods: “public funding, funding by customers via an uplift” and “funding by competitors in relation to their market share or their turnover”. This article analyzes the cases where PSO is funded by all final electricity consumers by them paying the PSO levy together with their electricity bills. This is well-defined in the Irish Electricity Regulation Act [55]: “It shall be the duty of each final customer, which duty is owed to the electricity supplier which invoices such customer, to pay to that supplier the amount of the PSO Levy properly invoiced to such customer in accordance with this Order”.

Harker, Kreutzmann and Waddams [42] examined PSO mechanisms in the EU and compared the cases of Belgium, France, Germany and the UK. They concluded that the PSO is an important political tool in setting boundaries between EU and Member State law in the context of energetics, allowing for maintenance of the balance between healthy competition and active social policies. However, the final users of services often suffer from the increased prices (as in the cases covered in this article). Moreover, clear and transparent PSO compensation mechanisms are needed. Rusche [27] examined the possibilities of subsidizing the production of electricity from RES by collecting a PSO levy. The latter study concluded that this is not in conflict with the legislation, and payments to producers of electricity from RES are also allowed. Furthermore, it was noted that such payments are based on feed-in tariffs. Such regulatory mechanisms operate in many EU countries.

Karova [26] noted that regulatory intervention is sometimes necessary due to market failures and “to the need of satisfying a number of socially desirable objectives”. The inclusion of PSO in the EU Energy Liberalization Directives is an example of such an intervention when seeking to find a compromise among a well-functioning internal EU energy market, compliance with competition rules and the provision of an effective public service. Karova [26] also noted that the financial burden of providing PSO by the suppliers of these services requires some kind of financial mechanism to compensate/subsidize them. These can be direct or indirect state subsidies or a special fund. Moreover, compensation (if it is not proportional to the PSO) can act as state aid. Such an aid scheme often distorts competition in the market by conferring certain advantages on the legal entity providing the public service over other market participants. This situation often requires deeper and legal clarification and is often the subject of disputes between legal market participants. Member States must therefore obtain clarification from the European Commission that their PSO levy model complies with the legal framework.

In each country, the PSO scheme is regulated by the energy law, electricity laws, PSO administration law, PSO pricing methodology law and RES law [42]. At the EU level, the PSO is defined by Directive 2009/72/EC [56]. When analyzing the PSO levy mechanism, it is necessary to take into account the 2003 Altmark Trans Case decision, which was ruled by the Court of Justice of the European Communities, the main points of which read as follows [42,57,58]:

- the undertaking (in receipt of compensation) must actually have public service obligations, which are defined;

- the parameters for the calculation of compensation must be established in advance in an objective and transparent manner, to avoid conferring an economic advantage on it over its competitors;

- compensation cannot exceed what is necessary to cover all or part of the costs of the obligation;

- where a public procurement process is not used to appoint the undertaking, the level of compensation must be determined on the basis of the costs that an efficient undertaking would incur.

2.2. Energy Security Definition

Over time, the concept of energy security has shifted from a narrow definition, covering only the country’s self-sufficiency with energy resources, to a much broader concept that encompasses such dimensions as diversity, cost, technology, environment, efficiency and reliability [59]. Appendix B provides some definitions of energy security. In essence, they refer to a stable and reliable supply of energy at affordable prices.

Many definitions and descriptions of energy security are found in the literature. For example, Winzer [60] examined 36 definitions of energy security and concluded that the term should be separated from other policy goals (e.g., related to economic efficiency and sustainability) by defining it as “the continuity of energy supplies relative to demand”. Such an approach implies narrowing the definition to the security of supply [61]

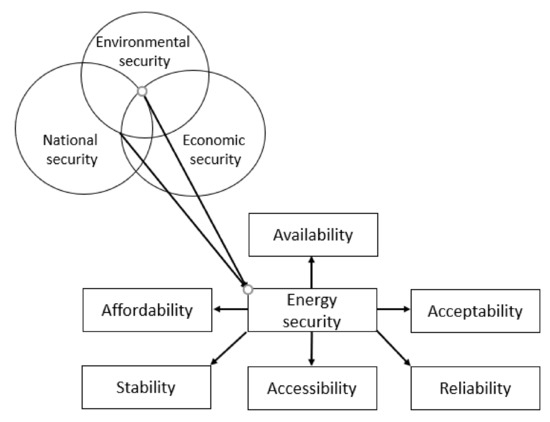

The definition and components of energy security can be seen in Figure 1. Energy security is a constituent part of national security, environmental security and economic security, or “is where environmental, economic and national securities converge” [62]. The national security level represents a country’s ability to be independent from other countries in many areas [63,64]. Environmental security represents a country’s ability to control and reduce the impact of human activities on the environment [65,66,67]. Finally, economic security is a country’s ability to control its economic vulnerability [68]. Figure 1 shows that energy security can be examined in four important aspects, which are termed the 4As [69]: affordability (low price, decentralization, public subsidies), availability (security of supply, penetration of RES, diversification), acceptability (sustainability of energy systems and acceptable environmental impact) and accessibility (economic cost, connection to utility grid). The literature also mentions stability [70], which includes national policies and environmental impacts, and reliability [71], which includes physical security, cyber security and intermittency.

Figure 1.

The nexus of energy security and other dimensions (designed by the authors, based on [62,69,70,71,72,73]).

When examining the impact of PSO on energy security, it is necessary to choose specific methods to assess the level of energy security in a certain country. In the literature, such indicators of energy security as the overall energy import dependency (provided by Eurostat) and country-specific supplier concentration index (provided by Eurostat) are used [74]. Azzuni and Breyer [59] analyzed the definitions of energy security and distinguished 15 dimensions (availability, diversity, cost, technology and efficiency, location, timeframe, resilience, environment, health, culture, literacy, employment, policy, military and cyber security). These dimensions were used to measure the energy security index.

However, in this article, the impact of the PSO levy on energy security will be assessed on the basis of the Energy Trilemma Index that is calculated by the World Energy Council. The Energy Trilemma Index was developed by the World Energy Council to assess countries along three key dimensions (economic, social, environmental) [75]. This annual index evaluates 128 countries (as of 2021) according to their capacity to deliver an accessible, affordable, secure and environmentally sustainable energy supply. In addition, countries are compared by a composite score, which shows how well they can ensure a trade-off among economic, social and environmental dimensions [74]. Countries are compared to each other; so, for example, if a certain country has not seen any changes in the energy system, but other countries have significantly improved/worsened their performance, this will affect the results for all countries.

The Energy Trilemma Index is measured by three main aspects [76]:

- Energy security (import dependence, diversity of electricity generation, energy storage) measures a country’s capacity to meet current and future energy needs and also to withstand and recover quickly from a system shock with the least possible disruption to supply.

- Energy equity (access to electricity, electricity prices, gasoline and diesel prices) assesses a country’s ability to provide universal access to reliable and affordable energy for household and commercial use.

- Environmental sustainability (final energy intensity, low-carbon electricity generation, CO2 emissions per capita) reveals the country’s transition to an environmentally friendly energy system with the minimal contribution to climate change.

The index is based on global and national data and is intended for policymakers, the investment and financial sector and academia.

3. Methodological Approach

This work analyzes the literature in an effort to elucidate the impact of the public service obligation levy (in electricity tariffs) on the energy security of selected countries. It includes a general analysis of manifestations of the concepts of public service obligation and energy security in the literature. Then, the paper proceeds with the cases of selected countries where the PSO levy mechanism is applied. The legal basis, its evolution, the distribution of the PSO levy, its impact on energy security and factors influencing the PSO levy are discussed for each country in the context of the Energy Trilemma Index.

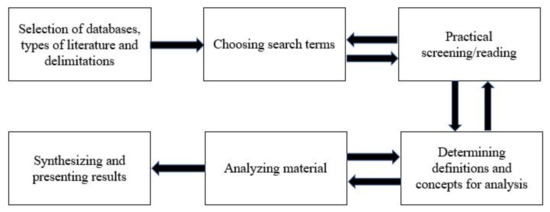

There are a number of methods for analyzing the scientific literature. For example, one can mention an integrative literature review [77], meta-analysis of the literature [78,79], narrative literature review [80], systematic literature review [81], scoping review [82] and critical review [83]. The theoretical model for the literature analysis used in this work is outlined in Figure 2 and follows the guidelines of Zacho and Mosgaard [84]. The particular procedure used for this paper is depicted in Figure 3.

Figure 2.

Process of a literature review (designed by the authors, based on [84]).

Figure 3.

The flow of literature analysis followed in this work (designed by the authors).

After formulating the problem and the task, the definitions of public service obligation and energy security used in the academic literature are examined. The EU countries that apply the PSO levy are then selected. Finally, the literature sources are analyzed. The literature review includes not only scientific papers, but also reports and policy documents related to the PSO levy. The literature review focuses on sources published from 1996 to 2021.

The Google Scholar database was used as the source of the relevant references due to its operationality, i.e., simple interface, comprehensive data sources and possibilities for customized queries. The conventional Google search engine was also used to search for reports and policy documents. The following keywords were used in the database: (Ireland OR Greece OR Denmark OR Lithuania OR Irish OR Greek OR Danish OR Lithuanian) AND (Public service obligation OR, PSO) AND (levy OR charge OR surcharge OR payment) AND (energy security OR security of supply OR renewable energy sources OR RES OR indigenous energy sources OR energy independence OR diversification of the energy sources OR diversification of the energy suppliers). Abbreviations and keyword roots were also used in the search (as recommended by [85]), thus broadening the research sample.

4. Results of the Literature Review

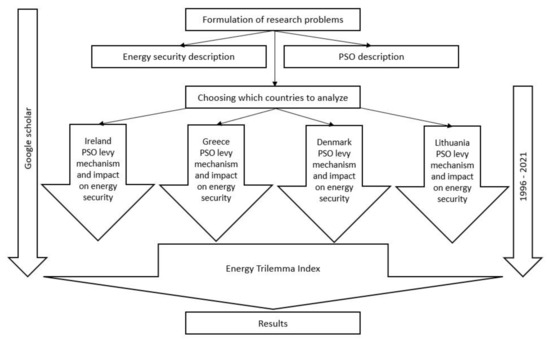

During the literature review, the goal was to find the most up-to-date information. The distribution of the sources across years is shown in Figure 4. The newest sources from 2019–2021 account for 39% of all sources considered (51 sources out of 131). The sources from 2009–2021 make up the absolute majority (126 sources from 131, or 96%) of the sample. This leads to the conclusion that this article is based on the latest and most relevant sources, as a result of which the article presents the real situations and mechanisms of the PSO levy and their impact in the long and short term.

Figure 4.

Classification of sources by year of publication (created by the authors).

Most of the identified sources were scientific papers (92 out of 131 sources, or 70%). Since the topic of this work is rather specific, other types of literature were also considered. A total of 20 reports and 19 policy documents were also analyzed. The classification and categorization of a source were based on the name of the source itself or its description.

4.1. Literature on the Cases of the Selected Countries

First, EU countries that had applied or have been applying a PSO levy in electricity pricing were selected. The prices and costs of EU energy analysis by ECOFYS [40] was used as a source of information as it indicates which countries add a PSO levy to their electricity tariffs. Four countries were selected, namely Ireland, Greece, Denmark and Lithuania. The main reasons for choosing these countries are as follows: (1) they all apply a PSO levy mechanism; 2) they exhibit different geographical locations; (3) they rely on different energy systems; (4) they exhibit different levels of economic development; (5) they operate in different geopolitical situations.

Ireland occupies 5/6 of the Island of Ireland, which is located to the west of mainland Europe. It has a border only with Northern Ireland, which is a part of Great Britain. Ireland has been a member of the EU since 1973. The Irish GDP stood at EUR 365.05 billion in 2018, with the largest sector being industry, accounting for 36.5% of the GDP [86]. See Section 5.1 for more details.

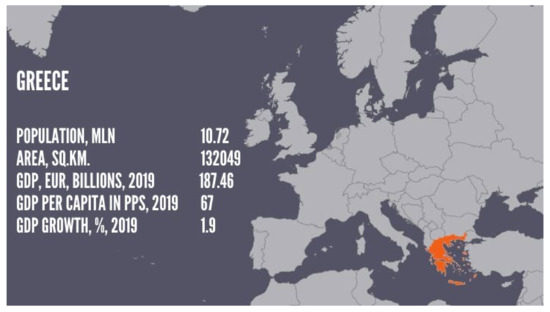

Greece is a country in Southern Europe, located near the Mediterranean Sea and occupying the southern part of the Balkan Peninsula. Greece spreads over more than 100 islands (19% of the country’s total territory). It has continental borders with Albania, Northern Macedonia, Bulgaria and Turkey. Greece has been a member of the EU since 1981. Its GDP stood at EUR 187.46 billion in 2018, with wholesale and retail trade, transport, accommodation and food services contributing 25.1% [86]. More details are provided in Section 5.2.

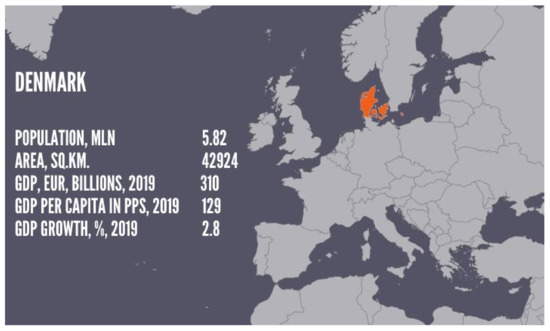

Denmark is located in Northern Europe, the Jutland Peninsula and the surrounding islands. It has a continental border only with Germany. Denmark has been a member of the EU since 1973. Its GDP amounted to EUR 310 billion in 2018, with the highest share (21.6%) attributed to the public sector [86]. More details are provided in Section 5.2.

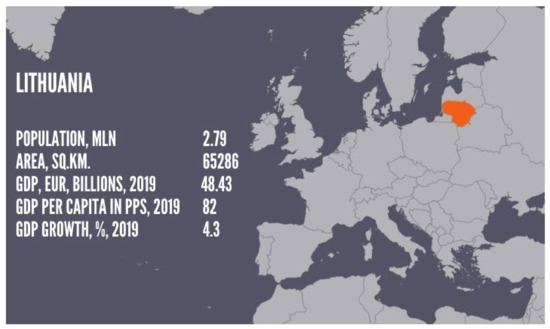

Lithuania is located in the central part of Europe and has continental borders with Latvia, Belarus, Poland and Russia. It is located near the Baltic Sea. It has been an EU member since 2004. The Lithuanian GDP stood at EUR 48.43 billion in 2018, with the largest contribution (33%) from wholesale and retail trade, transport, accommodation and food services [86]. More details are provided in Section 5.4.

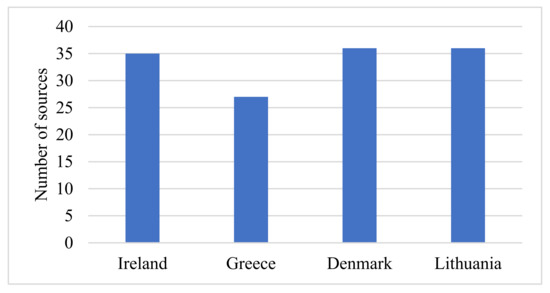

The distribution of the analyzed sources across countries is shown in Figure 5. Around thirty sources related to each state allowed for a fairly detailed analysis. Greece showed the lowest number of relevant sources (27), indicating a lack of PSO-related research for this country. A total of 131 sources were examined and there was only one source [40] that discussed all of the four aforementioned countries.

Figure 5.

Sources by countries examined (designed by the authors).

4.2. Literature on PSO and Energy Security

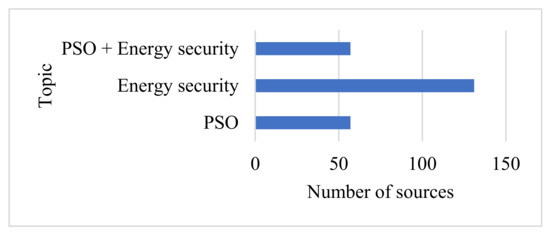

As the literature was analyzed in order to find intersections between PSO and energy security for either of the selected countries, 131 sources dealing with PSO and at least one aspect of energy security were found. The distribution of sources across PSO and energy security topics is shown in Figure 6.

Figure 6.

Classification of the selected sources across the topics (designed by the authors).

Figure 6 suggests that at least one dimension of energy security was mentioned in all 131 sources. Meanwhile, 57 sources (out of 131) addressed PSO aspects. This means that the PSO levy is not a particularly popular area of analysis. Therefore, we sought to shed more light on the indirect links between the PSO levy and energy security. Specifically, after asserting how the PSO levy is distributed, we looked at its impacts on each country’s energy security.

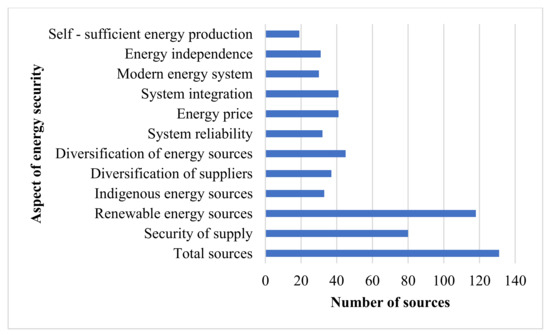

It is possible distinguish the different dimensions of energy security manifested in the references under analysis (Figure 7). The main aspects of energy security discussed in the sources, as shown in Figure 7, include security of supply and renewable energy sources. Then, indigenous energy sources, diversification of suppliers, diversification of energy sources, system reliability, energy price, system integration, modern energy system, energy independence and self -sufficient energy production are noted at similar frequencies.

Figure 7.

Classification of sources by energy security topic examined (created by the author).

RES-related issues were addressed in most sources (118 out of 131 sources, or 90%). This is quite reasonable, as the support of the PSO levy fund is often allocated to the development of RES. Next comes security of supply (80 out of 131, 61%), which can be explained by fact that security of supply is one of the most important aspects of energy security and is also one of the areas most supported by the PSO levy fund. All other sources were assessed a fairly similar number of times, i.e., from 30 to 45 out of 131.

5. Case Studies

The previous section provided general information on the PSO and energy security research for the selected countries (Denmark, Greece, Ireland and Lithuania) based on the literature review. This chapter examines the case of each country individually, focusing on the specifics of PSO levy collection and distribution, the impact of these processes on countries’ energy security and sustainability and countries’ performance in terms of the Energy Trilemma Index. Moreover, at the beginning, there is a short section outlining the EU’s energy goals and initiatives, which provides an overview of the overall direction of the EU’s energy transition.

Table 1 shows the mechanisms for the application of the PSO levy in the four selected countries, i.e., to whom it is distributed. Three out of the four countries support (subsidize) electricity generation from RES through the PSO levy. Two countries subsidize security of supply under this scheme. Two countries (Greece and Lithuania) subsidize the implementation of strategic infrastructure projects (Lithuania focuses on electricity connections with other countries, whereas Greece supports the connection of islands to the mainland electricity system). There are also certain aspects that are relevant to a single country: Lithuania supports a nuclear decommissioning fund and electricity generation from thermal power plants, Denmark focuses on research and development and distributed power generation, Greece supports social tariffs and regional electricity price compensation, and Ireland supports electricity generation from local energy sources through the PSO levy.

Table 1.

Distribution of the collected PSO levy by country (designed by the authors).

There is another item to which the PSO levy is allocated by all the countries concerned and which is not shown in Table 1, namely the “equalization” (compensation) of the preceding period’s PSO levy fund. As the PSO levy fund is formed on an ex ante basis, overpayment or underpayment may occur in a certain period, which needs to be offset by the PSO budget for the next period. This item is of a financial nature and does not provide additional information in regard to the energy policy.

The Energy Trilemma Index was chosen to assess the impact of the PSO levy on energy security at the country level. The indicators comprising the Energy Trilemma Index for the four countries examined are shown in Table 2. Obviously, the countries differ in many regards. We further discuss each case (country) individually.

Table 2.

Energy Trilemma Index for selected EU countries in 2020 (designed by the authors, based on [87]).

5.1. European Union Energy Goals

The European Union has a fairly clear and specific energy policy and objectives, starting with the 2007 climate and energy package. By 2020, three headline targets had been set for: (1) a 20% reduction in greenhouse gas emissions (compared to 1990 level), (2) a 20% EU final energy consumption from RES, (3) a 20% improvement in energy efficiency. The energy goals of each Member State were linked to the level of wealth of the country. In 2020, even more ambitious plans were set for 2030: (1) a 40% reduction, (2) 32%, (3) 32.5%. However, in the wake of the COVID-19 pandemic (and the ongoing), the “European Green Deal“ (September 2020) and “Fit for 55” (20 July 2021) set a target of reducing greenhouse gas emissions by 55% by 2030 [88].

The European Union has faced the problem and complexity of approving energy initiatives in the past and, without a doubt, will face it in the future. The EU’s application of the principle of subsidiarity is not always successful, especially in an area as problematic and affecting the national security of each Member State as energy policy. However, historically, the EU has always found a consensus between Member States’ interests in adopting and approving energy and climate change strategies and policies.

5.2. Ireland

The Irish electricity sector has undergone significant transformations towards sustainability and security objectives, including the diversification of electricity sources, promotion of local power generation [89] and an increase in the RES share [90,91]. Development of the indigenous onshore wind energy sources is instrumental for achieving the aforementioned policy objectives in Ireland [92]. The major challenge associated with this approach is that onshore wind installations cause undesirable social, economic and environmental effects both within and outside the power system [93,94]. The promotion of RES is also maintained by installing hydro, offshore wind, bioenergy, solar and combined heat and power plants [95]. Moreover, the development of smart grids and encouragement of public involvement in the management of virtual power plants, energy distribution, trade and management are also important for Ireland’s energy security and transition [96]. However, according to Yue et al. [97], reliance on renewable energy sources alone is not the most cost-effective way to achieve complete decarbonization. There is also a need for the diversification of energy sources, diversification of energy suppliers and digitization and modernization of the energy system, which Ireland is gradually implementing. These measures stimulate the energy transition and contribute to energy security in Ireland. The aforementioned policy objectives and measures require additional investments along with dedicated financing mechanisms. Therefore, Ireland is one of the EU countries where the PSO is included in the electricity bill [38,98] paid by all electricity consumers [53,95]. The stylized facts about Ireland are presented in Figure 8.

Figure 8.

Stylized facts about Ireland (designed by the authors, based on [86,99,100]).

The Irish PSO levy legal framework is managed by the Department of Communications, Climate Action and the Environment of Ireland with the approval of the European Commission on state aid. PSO levy calculations, forecasts and administrations are carried out by the Commission for Regulation of Utilities (CRU). The level of PSO is set from 1 October to 30 September each year [101].

For the period 2020/21, the Commission for the Regulation of Utilities (CRU) of Ireland has set EUR 6.52 excl. VAT per month for residential customers and the following scheme for business customers: PSO levy where Maximum Import Capacity < 30kVA = EUR 21.41 per month (excl. VAT) and PSO levy where Maximum Import Capacity => 30 kVA = EUR 2.78 per kVA per month (excl. VAT) [101]. This levy is intended to ensure security of the electricity supply and to support indigenous (peat; see [102]) and renewable energy sources (wind, hydro, solar, bio energy, combined heat and power) [38], as well as to promote environmental protection [55].

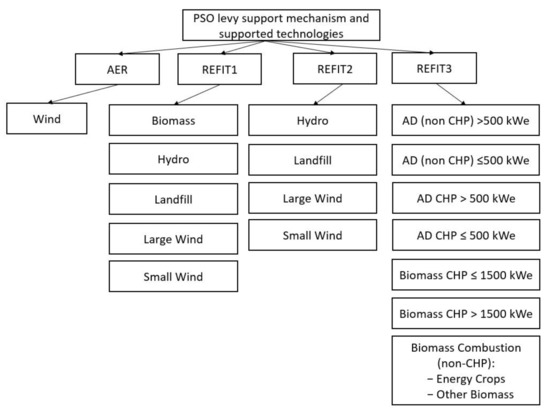

In Ireland, this levy was first adopted in the Electricity Regulation Act [55] and has been applied in practice since 2001 [103]. Renewable Energy Feed-in Tariff (REFIT) support is funded by this charge, compensating electricity suppliers for the additional costs incurred in purchasing electricity generated by PSO-supported electricity producers [104]. In other words, electricity consumers provide free insurance against low prices for RES (wind energy) through the PSO fee [105].

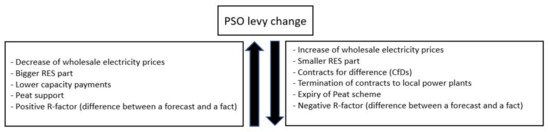

Di Cosmo and Linch [37] predicted that this levy could come under significant pressure due to the ongoing Irish capacity financing mechanism. Looking at the dynamics of the applied PSO levy in (see discussion below), this can be partly confirmed. The PSO fee is calculated on the basis of the estimated generation required, the planned wholesale electricity price next year (to cover the additional costs that they incur in purchasing PSO-supported electricity generation) and an adjustment to payments made two years previous once actual costs for the year are known [101,105]. It is the rising price of wholesale electricity that has led the PSO to decline in recent years. However, in 2020/21, we are already seeing a significant increase in PSO [101], one of the main reasons for which is the decrease in the wholesale electricity price, from 57.37 EUR/MWh in 2019/2020 to the indicative benchmark price 46.86 EUR/MWh in 2020/2021 until the final benchmark price of 53.66 EUR/MWh 2020/2021 [101]. This means that if the wholesale price of electricity falls, additional funds are needed to subsidize PSO-backed energy producers, which means that the PSO tax will increase. An examination of the changes in the Irish PSO tax, the following main upward and downward factors, is presented in Figure 9.

Figure 9.

Factors of Irish PSO levy changes (designed by the authors based on [101,106,107,108,109,110,111,112,113,114,115].

The distribution of the 2020/21 PSO levy applied in Ireland is shown in Appendix D. The measures supported by the PSO can be grouped into four categories. The Alternative Energy Requirement (AER) scheme was introduced in 1995. Since 2020/21, only offshore and onshore wind energy have been supported under this scheme. Small-scale hydropower, combined heat and power (CHP), biomass (landfill gas), biomass–CHP and biomass–anaerobic digestion had been supported in the earlier schemes The first Renewable Energy Feed-in-Tariff (REFIT) scheme, REFIT1, became operational in 2006. In 2012, REFIT2 and REFIT3 were launched. The main purpose of this scheme is to support renewable electricity generation. Unlike the RES scheme, REFIT is open to all suppliers (not merely Electric Ireland).

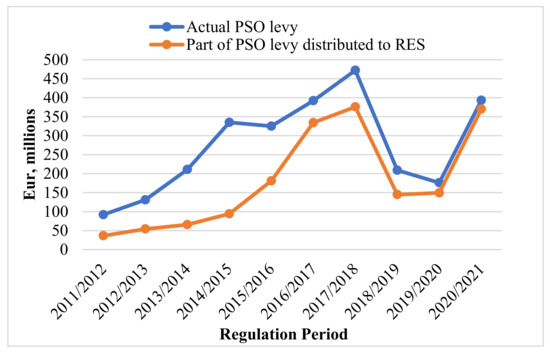

The level of the PSO is adjusted each year due to multiple factors, but the main one is the wholesale price of electricity [101]. The distribution of the PSO (Figure 10) shows that the share of the PSO allocated for the promotion of the RES is increasing and the country is aiming to achieve 70% by 2030 [116], although the total mandatory share set by the European Union is 40% [117] and by 2050 100% [118] electricity from RES. The increase in RES for electricity shows the country’s focus on achieving sustainable energy and increasing energy security. Most of the RES used in Ireland is produced or harnessed in Ireland itself, so there is no need to import it from other countries, which directly contributes to the greater energy security of Ireland [91]. Through comparison of the data from SEAI [91] on indigenous energy generation by source from 1990 to 2017, and the dynamics in the PSO tax introduced in 2001, one can note that the PSO directly contributes to the maintenance of energy from indigenous peat and the ever-increasing use of energy from indigenous RES.

Figure 10.

Irish PSO levy and PSO levy distributed to RES 2011–2021 (designed by the authors, based on [101]).

After examining the change in the level of PSO (Figure 10) and its objectives, we can draw some conclusions related to energy security in Ireland. Until the end of 2016, the money collected by the PSO levy was allocated to support the Aughinish Alumina (160 MW) and Tynagh (400 MW) power plants since they were built for securing the power supply in 2005/06. These power plants no longer receive PSO support for electricity generated after March 2016. As a result, there has been no PSO support for “security of supply” since that year. At the end of 2019, support for the peat scheme ended, which, at least for the time being, ended support for indigenous energy sources. Local biofuel (peat) combustion plants (Lough Ree, West Offaly) were supported, compensating up to 30% of their capacity annually. As a result, PSO support for “indigenous energy sources” has disappeared. Corresponding with the policy targets, a gradual increase in PSO funding for RES (wind, bioenergy, solar, hydro energy, CHP) can be noticed over 2011–2021. With the reduction or elimination of support for indigenous energy sources and security of supply, PSO support in 2020/21 is basically limited to RES.

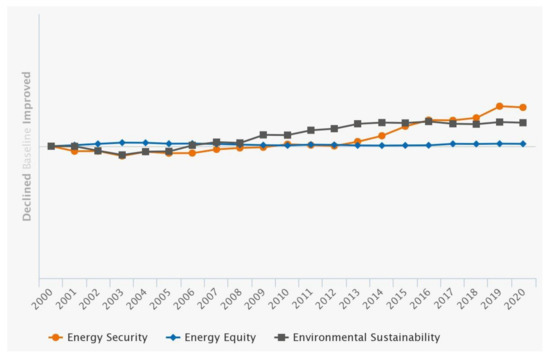

Comparing the change in the PSO levy applied since 2001 (Figure 10) and the Energy Trilemma Index (Figure 11), one can assess the impacts of this regulatory measure on the energy performance. Since 2008, a steady increase in the environmental sustainability indicator has been observed. The main reason for this is the increasing emphasis on low-carbon energy [119]. Since 2009, the share of the PSO fee has been allocated continuously to renewables, and since 2011, it has only been increasing [101,106,107,108,109,110,111,112,113,114,115,120] Since 2012, a surge in the energy security indicator can be seen. However, compared to other countries, this indicator is slightly lower, mainly due to the high dependence on imports and the low diversity of the primary energy supply [119]. The value of Ireland’s energy equity indicator is very high (98.1 out of 100); see Table 2. This can be explained by the presence of the universal access to electricity and stable energy prices [119].

Figure 11.

Trends of the components of the Energy Trilemma Index for Ireland, 2000–2020 (based on [121]).

Ireland ranks relatively high, at 17th (Although Ireland is ranked 17th in the 2020 Energy Trilemma ranking, the country essentially holds 20th position, with Austria and Finland sharing 4th place, France and the United Kingdom in 5th and Lithuania and Luxembourg in 16th. Therefore, with Ireland ranking 17th, it practically lands in 20th place.) place among 108 (Although there are 108 positions in the Energy Trilemma ranking, Austria and Finland are in 4th place, France and the United Kingdom are in 5th place, Lithuania and Luxembourg are in 16th place, Belgium and Slovakia are in 20th place, Iceland and Latvia are in 22nd place, Australia and Romania 25th, Argentina and Malta 30th, Costa Rica and Hong Kong 34th, Azerbaijan and Barbados 36th, Kazakhstan and Peru 42nd, Albania, Panama and Venezuela 43th, China and Saudi Arabia 55th Paraguay and Turkey 58th place, Montenegro and Oman 59th place, Mauritius and Serbia 60th place, Jamaica and Morocco 73rd place, Honduras and Sri Lanka 75th place, Jordan and Moldova 84th place, Kenya and Myanmar 89th place, so there are 128 countries in the overall ranking.) countries [87] in terms of the Energy Trilemma Index for year 2020. The indicators measured by this index and the influence of the PSO on them can be seen in Table 3.

Table 3.

PSO levy impact on Energy Trilemma Index for Ireland (created by the authors, based on [121]).

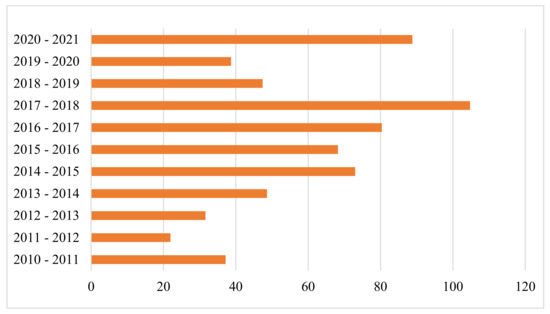

Looking at the change in the PSO levy on residential consumers between 2010 and 2021 (Figure 12), one can note that it decreased in 2011, 2015, 2018 and 2019. As for the period of 2020/21, the PSO fee is the highest since its implementation and amounts to an annual fee of EUR 88.80 with VAT for a domestic consumer. Comparing this levy with the annual median household gross income, which, in Ireland, is around EUR 47,000 [122], we can see that it represents a small proportion (0.19%) of the total annual household gross income. Farrell and Lyons [24], who examined the impact of PSO on electricity consumption in Ireland, conclude that an increase (or decrease) in PSO has an impact on household budget allocation by increasing (or decreasing) the overall price of electricity for the final consumer.

Figure 12.

PSO levy for residential users in Ireland during 2010–2021, EUR per year including VAT (designed by the authors based on [101]).

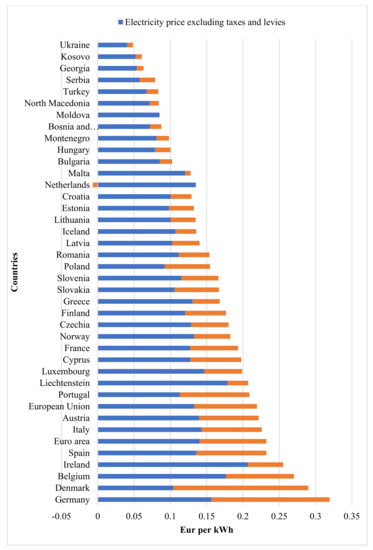

Among the EU countries (Figure 13), Ireland’s retail electricity price for household customers is the fourth highest, with only Germany, Denmark and Belgium exceeding its value. However, in terms of the net price of electricity (excluding any additional taxes and VAT), the price of electricity in Ireland is the highest in the EU. This negates the suggestion that only the PSO levy leads to this increase: even without all taxes, the price of Irish electricity is the most expensive in the EU.

Figure 13.

Electricity prices for household consumers in the EU, first half 2021 (created by the authors, based on [123]).

As the PSO levy is mandatory for all electricity consumers (both residential and business ones), it undoubtedly raises the overall price of electricity and affects indicators such as energy poverty, electricity affordability, the competitiveness of exporting companies [124], the Irish economy, the investment ecosystem, employment and cost competitiveness. Note than an increase in the PSO was observed in 2020 amid one of the highest electricity prices in the world, the global COVID-19 pandemic and the effects of Brexit [101]. Therefore, on the one hand, the PSO levy has a positive impact on the development and energy security of the Irish energy system, and on the other hand, some negative socio-economic impacts may appear.

5.3. Greece

In 2001, Greece initiated an electricity reform, which was aimed at the liberalization of the electricity market. According to Danias, Swales and McGregor [125] and Iliadou [126], the main obstacles to the reform are incumbent company dominance, the electricity sector’s dependence on indigenous lignite firing generation, the non-standard geographical location of the country, Greece’s presence in the periphery of EU electricity and gas markets, the country’s financial crisis and weak political will. The PSO fee in Greece has been in place since 2007. It is administered and coordinated by the Greek Regulatory Authority (RAE) and is intended to supply electricity to customers in Non-Interconnected Islands (NIIs) at the same rates as in mainland Greece [127]. Figure 14 presents the major facts on Greece.

Figure 14.

Stylized facts about Greece (designed by the authors, based on [86,99,100]).

The Greek electricity system can be divided into interconnected (continental Greece) and autonomous (Greek Islands) [128] or NIIs, which consist of fifty Greek islands in the Aegean Sea (which account for approximately 9% of the total Greek electricity demand). It includes micro isolated systems, e.g., Rhodes and Crete [129]. Electricity suppliers in the islands are compensated for the difference in price between the (higher) generation costs and system marginal prices in mainland Greece from a fund based on the PSO levy revenue.

According to Hatziargyriou, Margaris, Stavropoulou, Papathanassiou and Dimeas [130], the case of Greek NIIs is unique due to the large number of islands of different sizes, huge RES potential due to the geographical and meteorological locations, the challenge of finding the “golden mean” between RES penetration, low production costs and high-quality provision of electricity services to consumers. Although, according to Vasilakos [52], NIIs, especially the Greek islands in the Aegean, have very high RES potential, it still remains unfulfilled, mainly due to weak local grids. Thus, electricity generation in these islands is based on old, highly polluting and inefficient fuel-based plants. Another problem challenging the islands’ electrification is the seasonality of electricity use due to tourism [131].

As connecting the remote islands to mainland Greece is a costly, technically complex and not always cost-effective process, the Hellenic Electricity Distribution Network Operator (HEDNO) has developed and adapted a smart grid system, the “smart island”, that allows the monitoring and control of the functioning of all NIIs, both in terms of generation and distribution [130]. This has not only increased the energy security of the NIIs and the whole country, but also allowed for the optimal management of the generation, maximum use of RES, improvement of regulatory and coordination mechanisms and a transition towards transparent market management.

The PSO fee is used to finance important energy projects. Specifically, electricity connections between the Dodecanese Islands and Crete and between mainland Greece and the North Aegean Islands are seen as crucial ones for maintaining Greece’s energy security and RES development [52]. In addition, completing the electricity connection with Crete could be seen as one of the steps required for integration with Israel’s power network [132]. This would contribute to the country’s energy security due to the increased energy supply. The subsea cable between Attica and Crete is expected to become operational by the end of 2023, and interconnections of the Aegean islands are planned for late 2020s [133]. EU funding is also used when implementing these projects, but Vasilakos [52] emphasized the need to develop additional effective EU funding instruments (EIB, CEF, Commission Initiative for Clean Energy for the EU Islands, Structural Funds, etc.).

Vourdoubas [134] argued that Crete can achieve carbon neutrality of power generation technically and economically if a connection is implemented between Crete (which has abundant solar and wind energy) by cables to the mainland Greece. This would allow the combination of the local generation of green solar and wind electricity with electricity transfer with the mainland. The generation of electricity from the RES and its circulation through connections with mainland Greece would have a positive impact, including the promotion of energy investments, lower use of imported and polluting fossil fuels, decarbonization of Crete’s energy sector and the creation of new local jobs [135]. This would have a direct impact on the country’s energy security, which is fully confirmed by Vlachou and Pantelias [136].

Although RES is not directly funded by the PSO, significant RES development in Greece has been driven by feed-in-tariffs (FITs) over the last 12 years. The FIT is supported by such financial mechanisms as the RES Levy or ETMEAR in Greece [30]. Therefore, both by itself and thanks to the directions set by the EU, the country aims to achieve 61% of RES in the gross electricity consumption by 2030 [132]. As the penetration of renewable energy sources gradually reached a high level, the Greek economic downturn in 2008 caused it to down. Nonetheless, regulatory efforts have been made to converge with other European electricity markets where a transition from a high FIT status to the market environment has been achieved [137]. The main directions of the Greek RES development are wind, photovoltaic (solar and photovoltaic panel), hydro (predominantly large-scale dams and growing wave energy), geothermal and localized biomass energy [128].

The transition from coal and oil to solar and wind technologies was examined by Mentis [138], Argenti and Knight [139], Loumakis, Giannini and Maroulis [30] and Vardopoulos [140]. However, both Katsaprakakis and Christakis [141] and Manolopoulos, Kitsopoulos, Kaldellis, and Bitzenis [142] highlighted a number of challenges facing RES development in Greece. Since 2009, when applications for funding for electricity generation projects from RES became available, licenses and applications have been approved without strategic planning, in contradiction to environmental and cultural requirements. Moreover, the projects were often technically too large for small islands (thus preventing projects dealing with other energy types in the local or regional area). In order to avoid such traps, local approval, detailed information, the participation of local investors and civil-society organizations and equal geographical distribution of projects should be facilitated. Higher RES penetration requires the installation of energy storage systems via batteries, pumped storage and hydrogen storage [131,143].

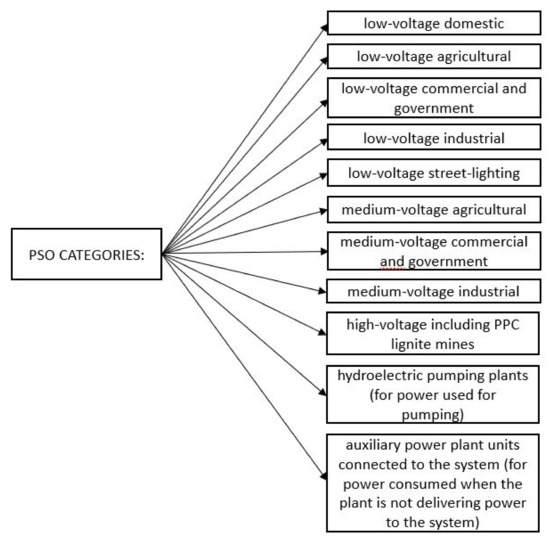

The PSO levy fund is also allocated to the so-called social residential tariff, which has been introduced and applied since 2011 and is aimed at the following vulnerable customer groups: low-income families, families with three or more children, the unemployed and people in need of medical care. In 2015, over 600,000 customers used this tariff [144]. The PSO fee is paid by all Greek electricity consumers, and it is divided into the categories shown in Appendix E. Note that similar categories prevail in all PSO-taxing countries.

The PSO levy amounts to between EUR 500 and 700 million annually in Greece. For example, in 2014–2016, the levy amounted to EUR 65 to 90 annually for each meter point in the Greek electricity system [144]. A comparison of the final electricity price for households in Greek and other EU countries (Figure 13) shows that the Greek price is close to the average level. This partially refutes the argument of the proponents of the abolition of the PSO that the PSO levy increases the price of electricity very significantly. The share of all additional taxes and VAT does not exceed 25% of the final electricity price in Greece.

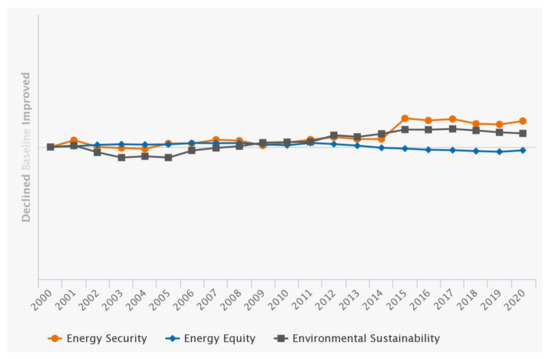

Given the trends in the application of the PSO levy in recent decades, it is possible compare this information with the Energy Trilemma Index estimates for Greece in 2000–2020 (Figure 15). The environmental sustainability improved over 2005–2012 and 2013–2015 and then fluctuated above the initial level of 2000. This is mainly due to the increasing share of RES in the electricity market and the reduction in CO2 emissions. This was largely influenced by abandoning lignite-fired power plants in Greece. By the first half of 2020, lignite accounted for only 12% of the electricity demand in the Greek system, although the result was 52% back in 2010 [133]. Although the PSO levy does not directly support RES in Greece, the electrification of the Greek islands contributes significantly to the extension of electricity from the islands with the greatest RES potential to other islands and mainland Greece (and vice versa). The environmental sustainability score for Greece is 73.2 out of 100 (Table 2). The score is higher than average, yet there is still room for improvement.

Figure 15.

Trends of the components of the Energy Trilemma Index for Greece, 2000–2020 (based on [133].

The energy equity indicator for Greece has changed very little over 2000–2020. During 2001–2013, it was slightly better than the initial level in 2000, and, in 2014–2020, it was slightly lower than the initial level. The PSO levy fund allows for the equalization of the price of electricity for the people living on the Greek islands and in mainland Greece. The social tariff also improves energy accessibility and affordability. However, energy access itself is quite complicated due to the fact that many islands are not connected to the common electricity system. Nonetheless, Greek is among the leaders in terms of energy equity score as it stood at 90.7 out of 100 (Table 2).

The energy security indicator maintained an upward trend, with minor downturns throughout 2000–2020 in Greece. Since 2005, the indicator level has been higher than the initial value for 2000. However, a comparison for Greece shows a value of the energy security indicator of 53.8 (Table 2), which is a rather poor result. This is mainly due to the country’s dependence on oil and gas imports, the low (but increasing) diversity of electricity generation and the poor (and even declining) ability of the country to meet the oil and gas demand considering the infrastructure capabilities, including storage and refining capacity.

Greece ranks 39th (Although Greece ranks 39th in the 2020 Energy Trilemma ranking, in reality, the country ranks 48th, as Austria and Finland share 4th place, France and the United Kingdom 5th, Lithuania and Luxembourg 16th, Belgium and Slovakia 20th, Iceland and Latvia 22th, Australia and Romania 25th, Argentina and Malta 30th, Costa Rica and Hong Kong 34th and Azerbaijan and Barbados 36th. Therefore, with Greece ranking 39th, it virtually holds 48th place.) among 108 (Although there are 108 positions in the Energy Trilemma ranking, Austria and Finland are in 4th place, France and the United Kingdom are in 5th place, Lithuania and Luxembourg are in 16th place, Belgium and Slovakia are in 20th place, Iceland and Latvia are in 22nd place, Australia and Romania 25th, Argentina and Malta 30th, Costa Rica and Hong Kong 34th, Azerbaijan and Barbados 36th, Kazakhstan and Peru 42nd, Albania, Panama and Venezuela 43th, China and Saudi Arabia 55th Paraguay and Turkey 58th place, Montenegro and Oman 59th place, Mauritius and Serbia 60th place, Jamaica and Morocco 73rd place, Honduras and Sri Lanka 75th place, Jordan and Moldova 84th place and Kenya and Myanmar 89th place, so there are 128 countries in the overall ranking.) [87] countries in the world according to the World Energy Council’s Energy Trilemma Index (as of 2020). The indicators measured by this index and the influence of the PSO levy on them are discussed in Table 4.

Table 4.

PSO levy impact on Energy Trilemma Index for Greece (designed by the authors, based on [133]).

The National Energy and Climate Plan of Greece [132] envisages several measures that are related to the PSO levy. Indeed, they are focused on the interconnections and upgrades of the existing energy systems. Particular attention is paid to emergency handling and the NIIs. The electricity interconnection projects between mainland Greece and the islands, supported by the PSO levy fund, make a significant contribution to Greece’s energy security. Thus, one can conclude that Greece’s National Energy and Climate Plan is in line with the country’s energy security needs (as indicated by the Energy Trilemma Index). In Greece, as is the case in other countries that apply the PSO levy, private electricity suppliers have some doubts over the country’s ability to implement EU Energy and Competition Law. According to Metaxas and Associates [145], after the official notification of the European Commission to Greece of possible restrictions on competition in the electricity market, several private electricity trading companies objected to the PSO levy sizing methodology, which is strictly based on the elements of the Public Power Corporation (PPC). Indeed, the methodology stipulates that the PPC is practically the only provider and recipient of the PSO levy. However, as stated in the European Commission’s explanation (2014) to the complaint of the Greek energy company Energa, the compensation granted to the PPC for the delivery of the public service obligation of supplying electricity on the NIIs at standard tariffs starting from 2007 constitutes state aid.

5.4. Denmark

Denmark shows rather high levels of energy security and sustainability [146,147,148,149]. Indeed, Denmark has achieved a transition from a country that was 100% dependent on imported oil and coal in the 1970s to a country that is currently completely independent of any foreign energy sources and a world leader in the share of wind energy in the country’s electricity system (more than 20%) [150]. As of 2019, the share of RES in electricity generation stood at 72% [151], which places Denmark among the leading countries in the world in this regard. The major facts about Denmark are provided in Figure 16.

Figure 16.

Stylized facts about Denmark (designed by the authors, based on [86,99,100]).

Although Denmark has substantial natural energy source endowments, it had been heavily dependent on imported fossil fuel until the 1980s. After the oil crisis in the mid-1970s, the Danish government abandoned its nuclear energy plans in 1985 [152] and focused on wind energy and combined heat and power. In 1981, Denmark approved its first energy plan, which set an ambitious target to achieve 1,000 MW of wind energy generation capacity by 2000 [153]. Energy 21, the Danish Action Plan for Energy [154], aims to install 5500 MW wind turbines by 2030 and to achieve full independence from coal, oil and gas by 2050.

The use of wind energy in Denmark has been around longer if compared to other countries. In 1978, the Danish government established an experimental wind turbine station, Riso National Laboratory [153]. The development of wind turbines in 1984–2000 was supported through a feed-in tariff [155]. In 2000, the feed-in tariff was changed to green certificates, which were issued to renewable electricity producers, who could then trade them at a premium with anyone who wanted to buy renewable energy or who was obliged to do so [50].

Electricity generation from RES (namely wind energy) is supported through price premiums added to the market price, capped at a maximum amount, and tenders for offshore wind power. This process is coordinated by the Danish Energy Agency and all subsidy costs are passed on to electricity consumers through the PSO [156,157]. Thus, Denmark is another EU country applying a PSO levy [158]. Kitzing, Katz, Schröder, Morthorst and Andersen [41] refer to this levy as the PSO element. It is bound to fund such policy initiatives as support for renewable energies, decentralized plants and research and development regarding the electricity system.

Following the Energy Agreement of 2018, Denmark plans to generate 55% of its electricity power from RES by 2030. This is considered a guarantee for ensuring energy security in Denmark [159]. The PSO levy, which finances RES projects, contributes to the development of the sustainable and secure energy system. Currently, the price of electricity in Denmark consists of four elements: production, transmission, distribution and PSO. The latter is to be abolished in 2022 [160].

The Organization for Economic Co-Operation and Development [161] indicated that the Danish market rules for green energy and the PSO were not precisely defined. Thus, there have been improvements in green electricity support schemes and the PSO system. All electricity consumers are obliged to purchase renewable energy certificates and bear the cost of PSO [161]. Energinet.dk is responsible for distributing proceeds from the PSO levy to the entitled stakeholders [41].

Electricity customers (mostly business customers) consuming more than 100 GWh per year have paid a reduced PSO levy [41] from 2014 onwards [162] to maintain their international competitiveness. The PSO Agreement reduced Danish electricity bills by DKK 2.7 billion in 2016 (more than EUR 363 million at the exchange rate on 11 March 2021) and, with the complete abolition of the PSO levy in 2022, will allow Danish businesses to pay perhaps the lowest price for electricity in the European Union [163]. Figure 13 also indicates that the taxes and levies comprise the major part of the retail electricity price in Denmark.

The PSO tariff is set quarterly and is publicly available on the Energinet.dk website. In the third quarter of 2015, it accounted for approximately 10% of the final electricity price for residential customers [162]. The Ministry of Environment and Energy retains key regulatory powers in the electricity sector, including setting the PSO [161]. In 2011–2012, the major share of the proceeds from the PSO levy (60–80%) was dedicated to renewable energy and decentralized plant development [41]. These are expected to contribute to Danish energy security [159]. The third-largest part is for adjustment for profit or loss from previous periods that occurs when the market price of electricity departs from the forecasts made when setting the fixed (guaranteed) price for the renewable energy. In essence, the PSO decreases with increasing market price [41]. The fourth (and smallest) part is allocated to research and development activities initiated by the PSO Energinet.dk [162].

According to 2012 data, the average Danish household spent 5–6% of its income on electricity bills, and this was a relatively high figure among all the EU countries (the average was 3–4%). However, the high living standard in Denmark did not cause extreme difficulties [164]. In 2014, the PSO levy was slightly reduced by shifting a part of the funding to the federal budget, with considerable public questioning and pressure to reduce or eliminate it [162]. For the most part, the criticism came from industrial customers. In 2016, the Danish government decided that the PSO tariff would be completely abolished by the end of 2021 [165,166]. As a result, a decline from 17.45 EUR/MWh in 2018 to zero in 2022 is expected [167]. The main reason for this is its contradiction with the EU Treaty, as foreign companies cannot receive the same subsidies under the same conditions as Danish companies. With the abolition of the PSO, RES will be supported by the Danish national budget, and this will reduce the price of electricity for consumers by around 10% [162].

Thanks to the PSO levy, 350 MW nearshore (10 km from the Danish coast) and 600 MW offshore wind projects have been financed since 2012. This promotes the development of RES and integration with the German electricity market, which in turn is an important aspect of energy security [159,162]. Indeed, wind energy is an important component of the existing and future Danish energy system. Jacobsen, Hevia-Koch & Wolter [168] examine the advantages, disadvantages and cost drivers of nearshore and offshore wind energy; Ladenburg, Hevia-Koch, Petrović, & Knapp [169] examine the differences between onshore and offshore wind farms and public attitudes towards them; Berg, Apostolou & Enevoldsen [170] examine the wind energy market in Denmark and the economic feasibility of integrating various capacities of water electrolysis systems; Jørgensen, Anker, & Lassen [171] examine wind energy support and compensation schemes; Koivisto, Gea-Bermúdez, Kanellas, Das & Sørensen [172] examine wind energy opportunities and prospects across the North Sea region, comparing the connection of each offshore wind farm to the main system individually and the collective advantages and disadvantages; Lund and Mathiesen [173] predict different scenarios for Denmark to achieve 100% RES use and confirm that this is technically possible.

Sovacool & Tambo [174] found that Danish respondents value energy safety less than other countries. However, Denmark is one of the safest countries energy-wise in the world [175]. The maturity of Danish society and the energy direction set by the Danish government, government-sponsored and sponsored initiatives led to the mass establishment of so-called wind cooperatives in the 1970s: small, rural, farmed and privately owned wind turbines [152]. Of course, the oil crisis of the 1970s also contributed to this, which led to the search for new energy sources. Moreover, as early as the 1990s, there were an estimated 2000 such privately operated wind turbines in Denmark. However, with the liberalization of the electricity market, many of these small wind farms were bought by larger energy companies that had more financial and technical potential to replace small wind turbines with larger (and more expensive) ones [152]. Active support policy has led to the development of Danish wind energy with such manufacturers as Vestas and Siemens Wind Power, which account for more than 30% of the global wind turbine market [150].

Examining Denmark’s final electricity price for households in the EU context, it is visible (Figure 13) that the price is the second most expensive in the EU, surpassing only Germany. However, the net electricity price (excluding any additional taxes and VAT) appears to be one of the lowest in the EU (only in Poland, Estonia, Hungary and Bulgaria). Additional taxes and VAT account for two thirds of the final price of electricity for household consumers and this significantly increases the final price of electricity. However, the share of the PSO levy is around 10% of the final electricity price and it therefore cannot be considered as the main reason for such expensive electricity.

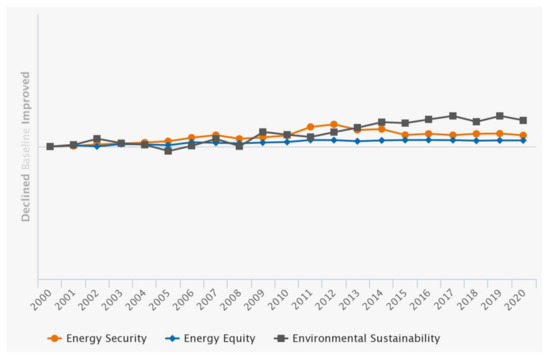

Denmark holds a very high third place (as of 2020; see Table 2) in terms of the Energy Trilemma Index [87] and is undoubtedly among the world leaders in energy security and sustainability. This is mainly influenced by the import independence, affordability of electricity, increased low-carbon power generation and diversity of power generation sources. In many ways, the PSO levy impacts many of these indicators. A more detailed deliberation on the impact of the PSO levy in the Danish case is provided in Table 5. Examining the changes in the Energy Trilemma Index for Denmark (Figure 17), one can draw conclusions on the influence of the PSO levy on the index.

Table 5.

PSO levy impact on Energy Trilemma Index for Denmark (designed by the authors, based on [176]).

Figure 17.

Trends of the components of the Energy Trilemma Index for Denmark, 2000–2020 (based on [176]).

The environmental sustainability has increased since 2000, with certain fluctuations over 2000–2020. Note that the indicator fell below the initial value for 2000 in 2005. The country’s determination to become a net-zero-emissions country by 2050 and the active use of wind energy and other RES contribute to the high value of this indicator. According to this indicator, Denmark ranks 10th among all the indexed countries. The PSO levy contributes to this as a tool to support the development of RES in a clear, comprehensible and targeted manner.

The energy equity indicator exceeded the initial level over 2000–2020 and Denmark was ranked as the 15th country (Table 2) among all the indexed countries. Stable access to electricity and electricity prices allowed Denmark to maintain such a position. The indicator remained rather stable throughout the period covered. The PSO levy had an effect on this indicator only in regard to the increase in the electricity price for the final consumers.

According to the energy security indicator, Denmark holds a very high position of fourth place (Table 2). The increasing diversity of power generation sources and import independence are the main reasons for such a result. The indicator followed an inverse U-shaped trend throughout 2000–2020, with a peak in 2012. This indicator is highly influenced by the PSO levy through RES and decentralized production support measures.

5.5. Lithuania

Lithuania is endowed with limited energy sources and is quite dependent on energy imports [177]. For decades, Ignalina NPP was the main source of electricity in the country. When Lithuania joined the EU, it was agreed on the closure of Ignalina NPP and complete shutdown took place in 2009 [178,179]. Thus, almost overnight, Lithuania transitioned from a large exporter of electricity into a country that imported 70% of its electricity from Russia [180,181]. The increasing importance of the imports’ diversification and energy-mix diversification led to further initiatives to support the RES and interconnections with such countries as Sweden and Poland. The major facts on Lithuania are provided in Figure 18.

Figure 18.

Stylized facts about Lithuania (designed by the authors, based on [86,99,100]).

Streimikiene, Burneikis and Punys [182] discussed which RES would be most suitable to replace the shutdown nuclear power plant. Later on, Gaigalis and Katinas [183] reported that, in 2015–2020, energy consumption increased around 1.3 times, whilst wind energy production increased 2.5 times, biogas energy 2.8 times, and the total emissions of greenhouse gasses decreased by 3% and air pollutants by 23% in Lithuania. Galinis et al. [184] examined the implications of gradual and delayed carbon price increases in the four Baltic Sea region countries in the context of energy security. The latter study noted that the Lithuanian local generation is deeply diversified both in terms of power plants and primary energy resources, including gas, wind, biomass and municipal waste as the main ones. From 2030, the contribution of wind energy is projected to be significantly higher, and the growing share of domestic energy resources (wind, solar, biomass) in total primary energy consumption has a very positive impact on energy security.

Although the Lithuanian electricity system still belongs to the Integrated/Unified Power System (IPS/UPS), along with Russia and Belarus, electricity connections with Poland and Sweden contribute to the country’s energy security [149]. Švedas [185] examined the possibilities for Lithuania to no longer be an energy island and emphasized that the Swedish–Lithuanian NordBalt connection and LitPolLink connection between Lithuania and Poland create a major change on the geo energy map in the Baltic Sea region. This was confirmed by Pikšrytė, Mažylis and Povilaitis [186], who examined Lithuania’s energy strategy in the European context.

Electricity connections with other countries are an important aspect of Lithuania’s energy security and are partly financed by the PSO levy fund (Table 6). In addition, Pérez, Scholten and Stegen [187] argued that Lithuania’s determination and policies leading to disconnection from the IPS/UPS and synchronization with European networks will further increase the country’s energy security. Blažauskas, Włodarski and Paulauskas [188] studied offshore wind energy development in Lithuania among other South-East Baltic countries and also highlighted the importance of the electricity connections for wind energy development.

As of 2016, wind energy accounted for the largest share of RES (54%) in Lithuania, followed by hydropower (22%), even though there is a lack of marine technologies in Lithuania. Bioenergy (21%) came next [189]. Klevas, Bobinaite, Maciukaitis and Tarvydas [190] examined RES (wind energy) support measures and policies in Lithuania and noted that support from structural funds should be used in the short term. A feed-in tariff was also mentioned as an effective support tool allowing the maintenance of the competitiveness of the wind energy in the market. Improvements in the energy infrastructure were also discussed as a prerequisite for further development of the RES in Lithuania.

According to Štreimikienė, Strielkowski, Bilan & Mikalauskas [191], Lithuania shows the lowest energy and carbon intensity of all economies, as well as specific branches of the economy, the highest energy import dependency, and its share of RES in final energy is above the EU-28 level (and has increased by approximately 70% since 2004). In addition, the country needs more policies to increase the energy efficiency and use of RES, and to increase the diversification of the fuel mix. The support provided by the PSO levy fund to certain energy segments contributes directly or indirectly to many of the aforementioned issues (Table 6).

Lithuania is yet another EU country where the PSO levy is applied and paid for by all electricity consumers. In Lithuania, the PSO levy has been applied since 2004 [192]. In 2005, the PSO levy accounted for 10% of the retail price, 20% in 2013 and 10% again in 2021 [192]. The Energy Ministry of Lithuania requires electricity suppliers to purchase electricity from RES on a mandatory basis if the electricity consumer delivers a request [51]. Electricity producers providing PSO in the energy sector receive a fixed tariff for each unit of electricity produced and supplied [193].

The purpose of supplying PSO is to implement the strategic goals of the Lithuanian energy, economic and environmental policy, respecting the interests of all electricity consumers [194]. Lithuanian PSO can be used to finance the optimization, development and/or reconstruction of power networks implemented by the power network operators in order to ensure the development of production using renewable energy. This service is provided by operators of the transmission system and of distribution networks [194]. Table 6 shows a detailed overview of the stakeholders that the PSO levy is supplied for in Lithuania.

Table 6.

Distribution of Lithuanian PSO levy (created by the authors, based on [194]).

Table 6.

Distribution of Lithuanian PSO levy (created by the authors, based on [194]).

| Nr. | PSOs | Description |

|---|---|---|

| 1. | Production of renewable energy (RE) and balancing | The PSO includes production of electricity using renewable energy and its balancing |

| 2. | Effective production at thermal power plants | Includes production of electricity in the thermal mode at combined power and thermal production cycle plants, whereby these power plants supply heat to the heat supply systems and the quantity of primary energy saved is such as to ensure that the overall production of heat and electricity can be considered effective |

| 3. | Assurance of safety of power supply and of system reserves | Includes production of electricity in specified power plants, where production of electricity is necessary in order to ensure the security of electricity supply and the reserves of the electricity system in specified power plants whose operation is necessary to ensure the national energy security |

| 4. | Strategic electricity production projects | Includes development of electricity production capacities that are of strategic importance for the safety and reliability of the operation of the electricity system and/or for the assurance of the national energy security |

| 5. | Strategic infrastructure projects | Includes implementation of strategic power sector projects connected with improvement of energy security by providing connecting lines with power systems of other countries and/or connecting Lithuanian power systems with power systems of other Member States |

| 6. | Ignalina NPP Decommissioning Fund | Includes assurance of the safety of operation of energy sites and handling of radioactive waste |

| 7. | Connection of RE to power networks | Includes connection of renewable energy sources to power networks. This service is provided by operators of the transmission system and of distribution networks |

| 8. | Network development due to RE | Includes optimization, development and/or reconstruction of power networks implemented by the power network operators in order to ensure development of production using renewable energy, and this service is provided by operators of the transmission system and of distribution networks |

The PSO is set every year by the National Energy Regulatory Council (NERC) and is published on its website. The NERC also annually determines the projected electricity market price, which is used to determine the PSO budget [194], and the legal basis and scope of the PSO are determined by the national government. The PSO levy is administered and distributed by the state-owned company Baltpool [195] according to the guidelines. Appendix C shows how the funds collected from the PSO levy are distributed to the various RES. Energy production from RES is supported through the PSO and, in 2018, for example, this support amounted to EUR 84.4 million [196].

Wind energy is the most developed in Lithuania and its capacity has increased around 2.8 times during 2011–2018 (from 191 MW to 532 MW), which corresponds to the average annual growth of 17% (Table 7). In second place is hydro power, although it has maintained a slight upward trend (from 126 MW in 2011 to 128 MW in 2018). The hydro power capacities changed the least among other types of energy (by 0.22% per year). Solar and biomass showed similar installed capacity for 2018, although the growth rates for these technologies were 47% per year and 13% per year, respectively. However, the steepest increase in the installed capacity of the solar power plants was observed in 2011–2013, when the capacity increased from 1 MW to 69 MW and only a slight growth was noted in 2013–2018 (from 69 MW to 72 MW). Biogas plant capacity increased from 14 MW in 2011 to 38 MW in 2018 at the annual growth rate of 16%. These figures are more or less in line with the share of PSO levy allocated to RES—EUR 26.99 million in 2011 and EUR 114.217 million in 2018 (Appendix C).

Table 7.

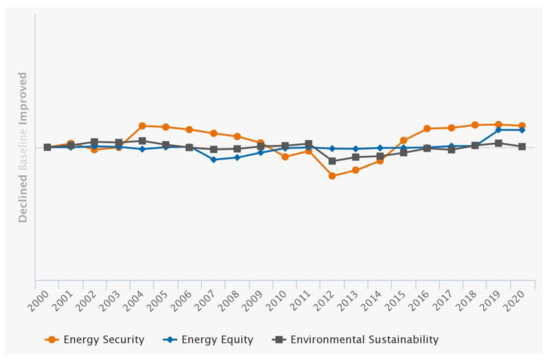

Installed capacity of RES power plants in Lithuania during 2011–2018, MW (designed by the authors, based on [196]).