The Impact of Smart Prepaid Metering on Non-Technical Losses in Ghana

Abstract

1. Introduction

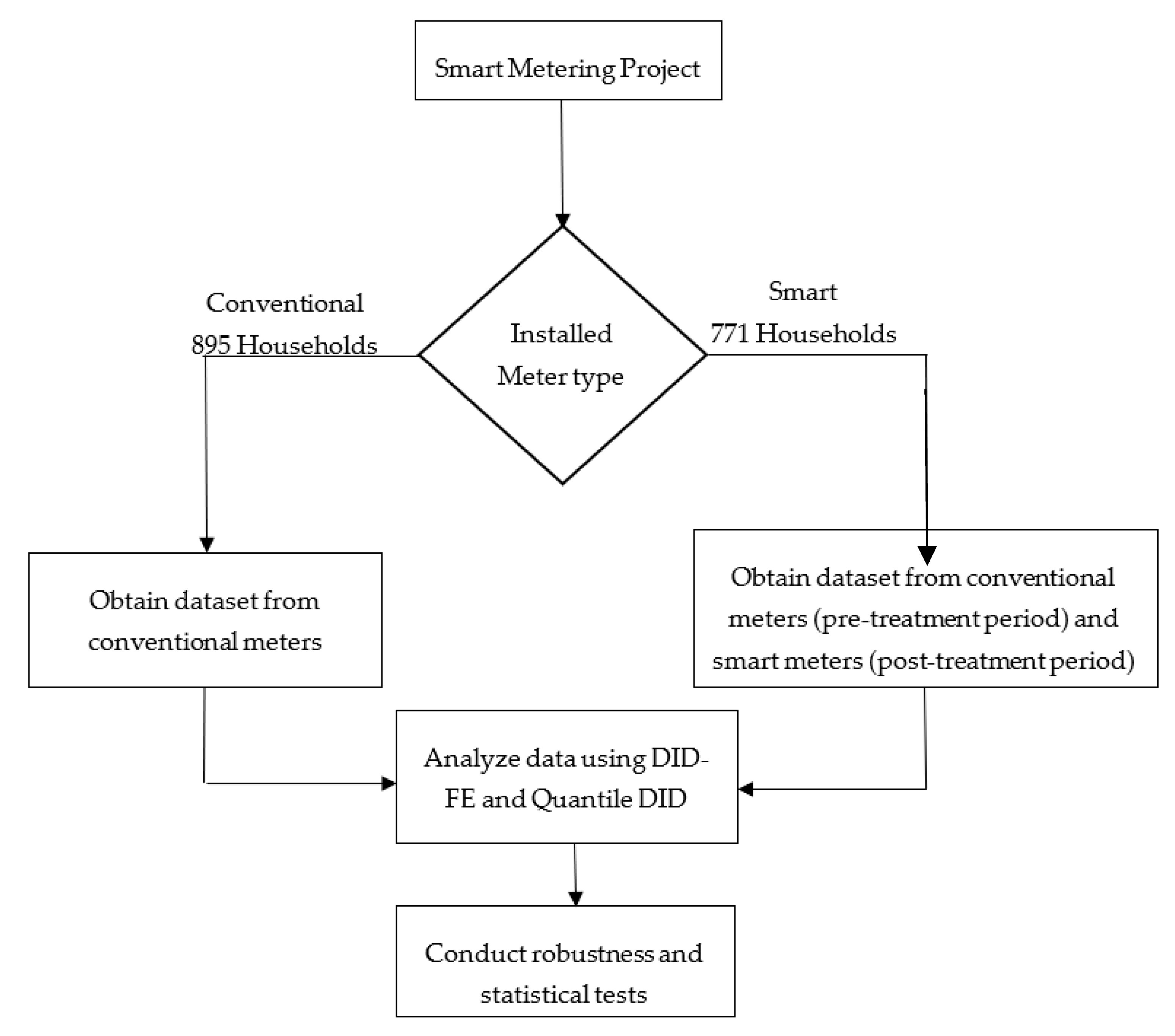

2. Smart Prepaid Metering Program in Berekum

3. Data and Empirical Strategy

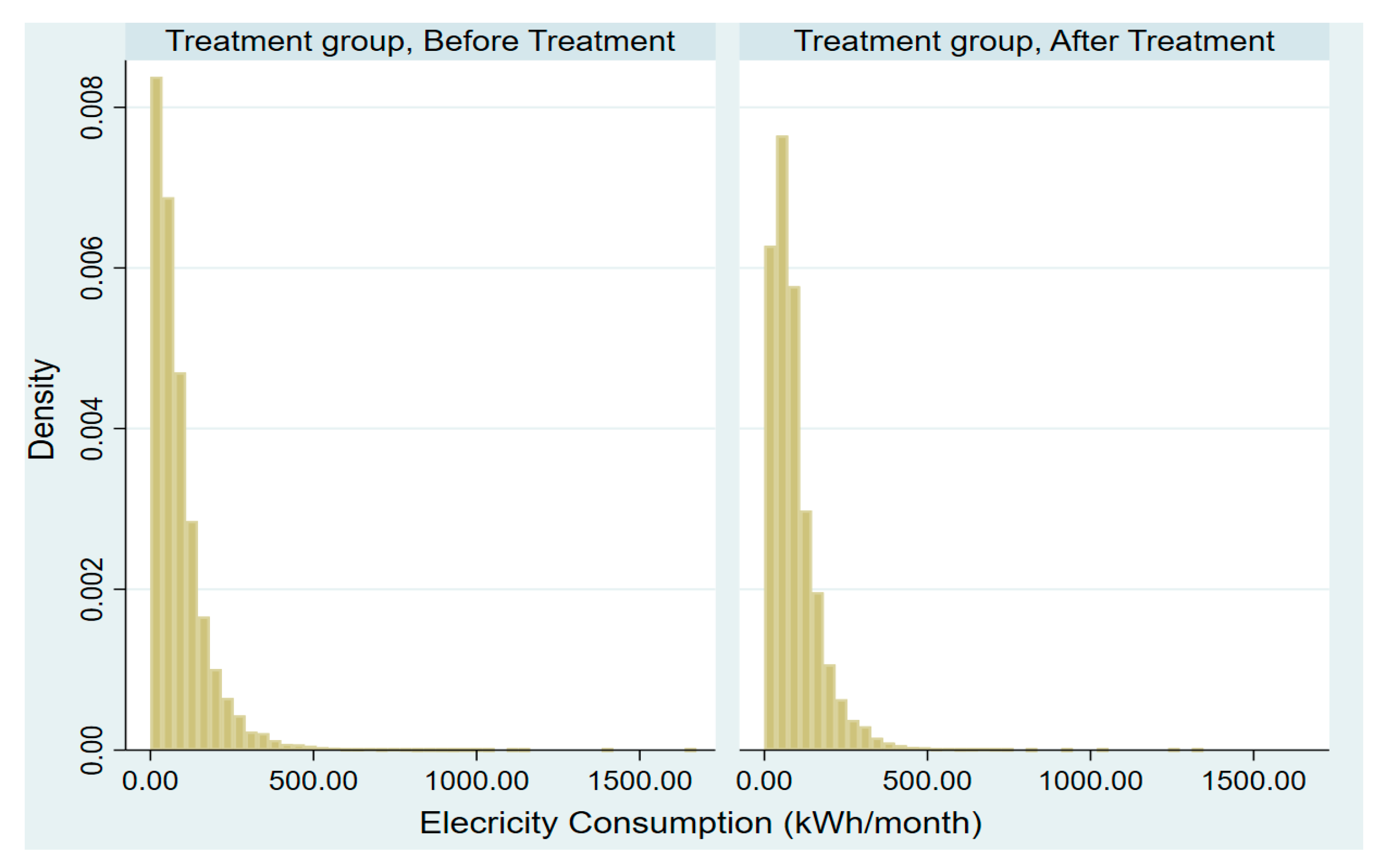

3.1. Data Description

3.2. Identification Strategies

3.2.1. Difference-in-Differences with Fixed Effects (DID-FE)

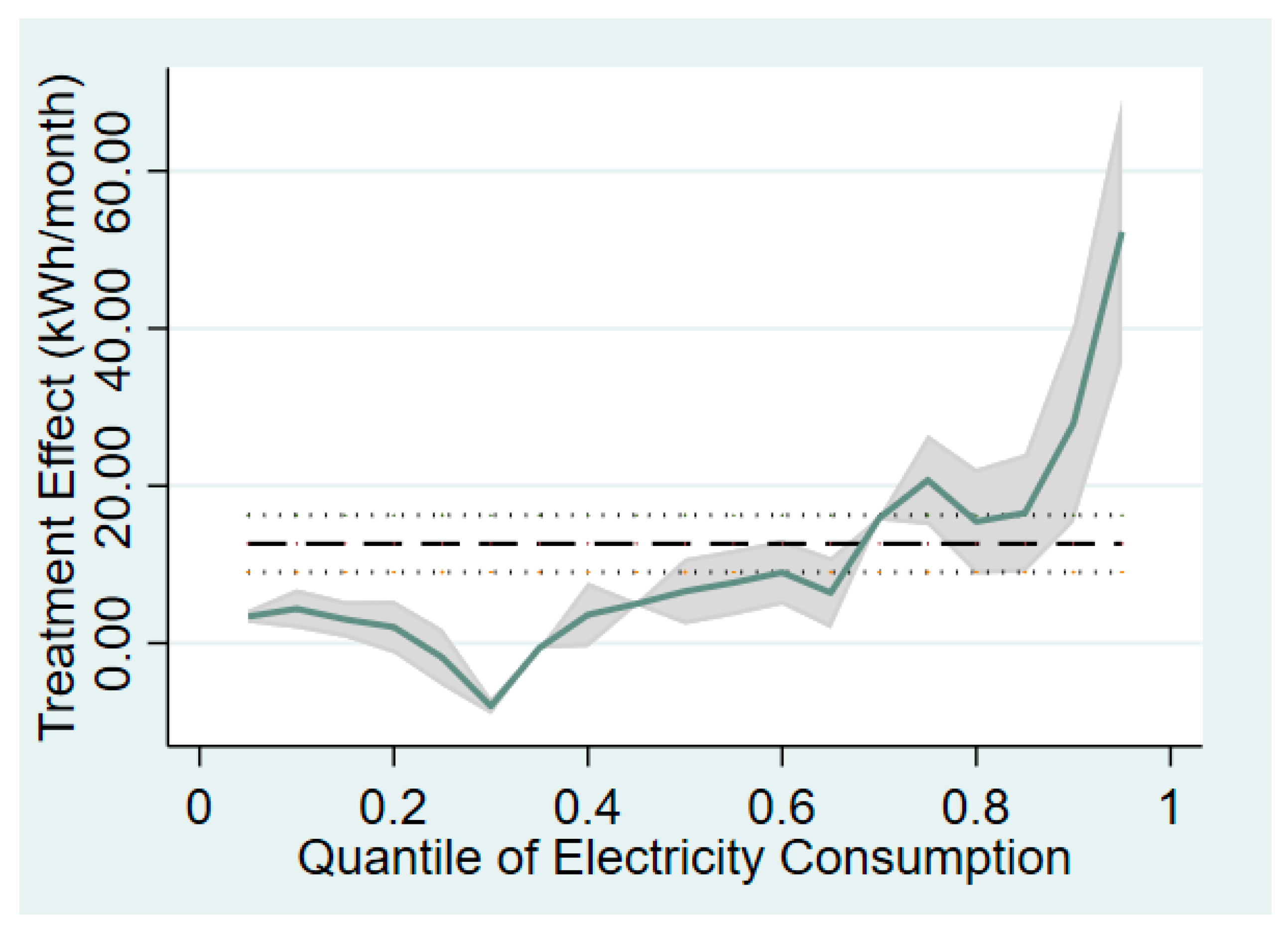

3.2.2. Quantile Difference-in-Differences

4. Results and Discussion

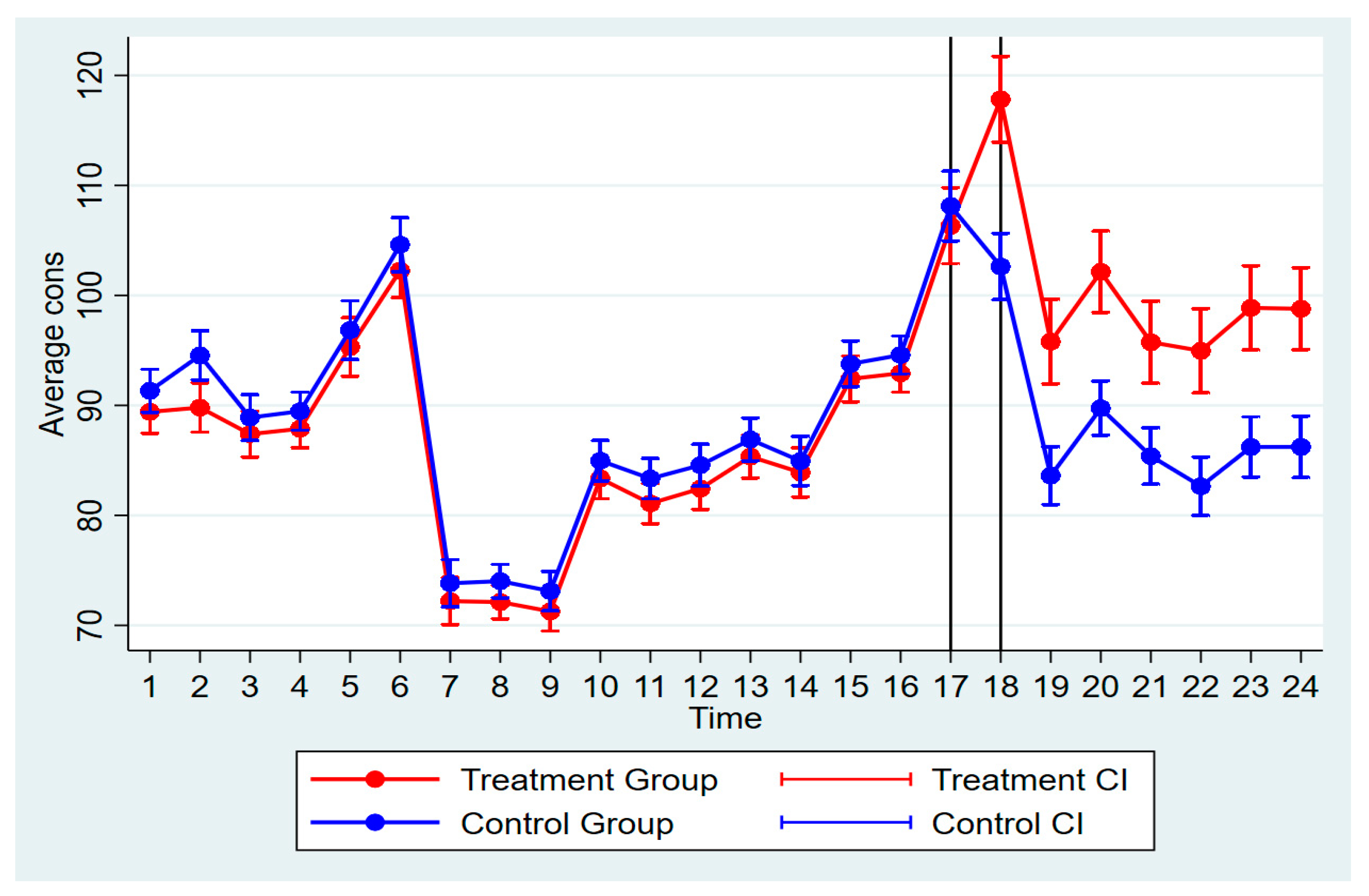

4.1. Results of DID Fixed Effects

Robustness Checks

- (a)

- Statistical tests to confirm common trend assumption

- (b)

- Simple comparison of post-treatment values between treatment and control groups

- (c)

- Balance Test

4.2. Results of the Quantile DID Regression

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ATE | Average Treatment Effect |

| BSP | Bulk Supply Point |

| CBMS | Customer Billing Management System |

| DID | Difference-in-Differences |

| DID-FE | Difference-in-Differences with Fixed Effects |

| FE | Fixed Effects |

| GEDAP | Ghana Energy Development and Access Project |

| GoG | Government of Ghana |

| GRIDCo | Ghana Grid Company |

| kV | kilovolt |

| KVA | kilovolt-amperes |

| kWh | kilowatt-hour |

| kWh/month | Electricity Consumption |

| NES | National Electrification Scheme |

| NILM | Non-Intrusive Load Monitoring |

| NTL(s) | Non-Technical Losses |

| OLS | Ordinary Least Squares |

| PURC | Public Utility Regulatory Commission of Ghana |

| SHEP | Self Help Electrification Project |

| SLTs | Special Load Tariffs |

Appendix A

References

- Otchere-Appiah, G.; Hagan, E.B. Potential for electricity generation from maize residues in rural Ghana: A case study of Brong Ahafo Region. Int. J. Renew. Energy Technol. Res. 2014, 3, 1–10. Available online: http://ijretr.org (accessed on 2 February 2021).

- Balezentis, T.; Streimikiene, D.; Mikalauskas, I.; Shen, Z. Towards carbon free economy and electricity: The puzzle of energy costs, sustainability and security based on willingness to pay. Energy 2021, 214, 119081. [Google Scholar] [CrossRef]

- Otchere-Appiah, G.; Hagan, E.B. Decentralized bioenergy generation: An option to extend access to electricity in remote areas and curb perennial power outages in Ghana. Int. J. Dev. Sustain. 2013, 2, 1513–1522. [Google Scholar]

- Kumi, E.N. The Electricity Situation in Ghana: Challenges and Opportunities; CGD Policy Paper; Center for Global Development: Washington, DC, USA, 2017; Available online: https://www.cgdev.org/publication/electricity-situation-ghana-challenges-and-opportunities (accessed on 2 February 2021).

- Siddharth, N.K.; Dhananjay, B.M. Commercial Loss Reduction Techniques in Distribution Sector—An Initiative by MSEDCL. International Journal of Advanced Research in Electrical. Electron. Instrum. Eng. 2014, 3, 1. [Google Scholar]

- Amadi, H.N.; Okafor, E.N. The Effects of Technical and Non-Technical Losses on Power Outages in Nigeria. Int. J. Sci. Eng. Res. 2015, 6, 9. [Google Scholar]

- Nguyen, T.C.; Bridle, R.; Wooders, P. A Financially Sustainable Power Sector: Developing Assessment Methodologies. Int. Inst. Sustain. Dev. 2014. Available online: https://www.iisd.org/system/files/publications/financially_sustainable_power_sector.pdf (accessed on 4 February 2021).

- Singh, T. Analysis of Non-Technical Losses and Its Economic Consequences of Power System—A Case Study of Punjab State. Master’s Thesis, Thapar University, Patiala, India, 2009. [Google Scholar]

- Jamil, F. On the electricity shortage, price and electricity theft nexus. Energy Policy 2013, 54, 267–272. [Google Scholar] [CrossRef]

- World Bank, Electric Power Transmission and Distribution Losses (% of Output), 2018. Available online: https://data.worldbank.org/indicator/EG.ELC.LOSS.ZS?end=2014&start=2009 (accessed on 4 September 2020).

- World Bank. Reducing Technical and Non-Technical Losses in the Power Sector. Background Paper for the World Bank Group Energy Sector Strategy; World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Pless, J.; Bazilian, M.; Fell, H. Bribes, Bureaucra-cies, and Blackouts: Towards Understanding How Corruption Impacts the Quality of Electricity Supply to End-Users in Transition and Developing Economies. In Proceedings of the Energy & the Economy, 37th IAEE International Conference, New York, NY, USA, 15–18 June 2014. [Google Scholar]

- Tallapragada, P.; Shkaratan, M.; Izaguirre, A.K.; Helleranta, J.; Rahman, S.; Bergman, S. Monitoring Performance of Electric Utilities: Indicators and Benchmarking in Sub-Saharan Africa; The World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Smith, T.B. Electricity theft: A comparative analysis. Energy Policy 2004, 32, 2067–2076. Available online: http://www.provedor.nuca.ie.ufrj.br/eletrobras/estudos/smith1.pdf (accessed on 2 February 2021). [CrossRef]

- Antmann, P. Background Paper for the World Bank Group Energy Sector Strategy-Reducing Technical and Non-Technical Losses in the Power Sector, 2009. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/20786/926390WP0Box3800in0the0power0sector.pdf?sequence=1&isAllowed=y (accessed on 28 February 2021).

- Depuru, S.S.S.; Wang, L.; Devabhaktuni, V. Electricity theft: Overview, issues, prevention and a smart meter based approach to control theft. Energy Policy 2011, 39, 1007–1015. [Google Scholar] [CrossRef]

- Sharma, T.; Pandey, K.; Punia, D.; Rao, J. Of pilferers and poachers: Combating electricity theft in India. Energy Res. Soc. Sci. 2016, 11, 40–52. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Bambawale, M.J.; Gippner, O.; Dhakal, S. Electrification in the Mountain Kingdom: The implications of the Nepal Power Development Project (NPDP). Energy Sustain. Dev. 2011, 15, 254–265. [Google Scholar] [CrossRef]

- Dike, D.O.; Obiora, U.A.; Nwokorie, E.C.; Dike, B.C. Minimizing household electricity theft in Nigeria using GSM based prepaid meter. Am. J. Eng. Res. 2015, 4, 59–69. [Google Scholar]

- Nunoo, S.; Attachie, J. A methodology for the design of an electricity theft monitoring system. J. Theor. Appl. Inf. Technol. 2011, 26, 2. Available online: http://www.jatit.org/volumes/research-papers/Vol26No2/7Vol26No2.pdf (accessed on 26 February 2021).

- Never, B. Behave and save? Behaviour, energy efficiency and performance of micro and small enterprises in Uganda. Energy Res. Soc. Sci. 2016, 15, 34–44. [Google Scholar] [CrossRef]

- Enslev, L.; Mirsal, L.; Winthereik, B.R. Anticipatory infrastructural practices: The coming of electricity in rural Kenya. Energy Res. Soc. Sci. 2018, 44, 130–137. [Google Scholar] [CrossRef]

- Winther, T. Electricity theft as a relational issue: A comparative look at Zanzibar, Tanzania, and the Sunderban Islands, India. Energy Sustain. Dev. 2012, 16, 111–119. [Google Scholar] [CrossRef]

- Sabha, L. Measures to Check Commercial Losses, a Twelfth Report on Standing Committee on Energy Presented to the Ministry of Power; Ministry of Power: New Delhi, India, 2015.

- McDaniel, P.; McLaughlin, S. Security and privacy challenges in the smart grid. IEEE Secur. Priv. 2009, 7, 75–77. [Google Scholar] [CrossRef]

- Anas, M.; Javaid, N.; Mahmood, A.; Raza, S.M.; Qasim, U.; Khan, Z.A. Minimizing Electricity Theft Using Smart Meters in AMI. 2012. Available online: https://arxiv.org/pdf/1208.2321.pdf (accessed on 26 February 2021).

- Rajwanshi, H. Power Theft Management. PL (EL) 77 November 2019. Available online: https://www.scconline.com/blog/post/2019/11/13/power-theft-management/ (accessed on 2 March 2021).

- Northeast Group. Emerging Markets Smart Grid: Outlook 2015; LLC Northeast Group: Washington, DC, USA, 2014. [Google Scholar]

- Saikiran, B.; Hariharan, R. Review of methods of power theft in Power System. Int. J. Sci. Eng. Res. 2014, 5, 276–280. [Google Scholar]

- Yan, S.; Liu, X.; Jiang, Y.; Ma, L.; Wang, X.; Li, Z.; Lei, J.; Wang, C.; Dong, L.; Han, W. Analysis of Electricity Stealing and Research of Anti-stealing Measures. In Proceedings of the 3rd International Conference on Machinery, Materials and Information Technology Applications (ICMMITA, 2015), Qingdao, China, 28–29 November 2015. [Google Scholar]

- Razavi, R.; Fleury, M. Socio-economic predictors of electricity theft in developing countries: An Indian case study. Energy Sustain. Dev. 2019, 49, 1–10. [Google Scholar] [CrossRef]

- Siddall, W.; Bentley, J.; Spring, P. Energy Theft: Incentives to Change; IBM: London, UK, 2012. [Google Scholar]

- Bhatia, B.; Gulati, M. Reforming the Power Sector: Controlling Electricity Theft and Improving Revenue; Public Policy for the Private Sector Note; World Bank: Washington, DC, USA, 2004; pp. 1–4. Available online: https://www.esmap.org/sites/esmap.org/files/DocumentLibrary/VP332-Electricity-Reforms.pdf (accessed on 26 February 2021).

- Yakubu, O.; Babu, N.C.; Adjei, O. Electricity theft: Analysis of the underlying contributory factors in Ghana. Energy Policy 2018, 123, 611–618. [Google Scholar] [CrossRef]

- Vanmore, S.V.; Avalekar, P.; Patil, I. Prepaid and Postpaid Energy Meter for Billing System Using Microcontroller and GSM. Int. Res. J. Eng. Technol. 2016, 3. Available online: https://www.irjet.net/archives/V3/i2/IRJET-V3I2213.pdf (accessed on 16 February 2021).

- Sønderlund, A.L.; Smith, J.R.; Hutton, C.; Kapelan, Z. Using Smart Meters for Household Water Consumption Feedback: Knowns and Unknowns. In Proceedings of the 16th Conference on Water Distribution System Analysis, WDSA 2014, Bari, Italy, 14–17 July 2014; pp. 990–997. [Google Scholar]

- Rausser, G.; Strielkowski, W.; Štreimikienė, D. Smart meters and household electricity consumption: A case study in Ireland. Energy Environ. 2018, 29, 131–146. [Google Scholar] [CrossRef]

- Cook, B.; Gazzano, J.; Gunay, Z.; Hiller, L.; Mahajan, S.; Taskan, A.; Vilogorac, S. The smart meter and a smarter consumer: Quantifying the benefits of smart meter implementation in the United States. Chem. Cent. J. 2012, 6, S5. Available online: http://journal.chemistrycentral.com/content/6/S1/S5 (accessed on 20 February 2021). [CrossRef]

- Martiskainen, M.; Ellis, J. The Role of Smart Meters in Encouraging Behavioural Change—Prospects for the UK; University of Sussex: Brighton, UK, 2009; Available online: http://sro.sussex.ac.uk/id/eprint/59518/1/smart_meters_-_martiskainen_and_ellis.pdf (accessed on 20 February 2021).

- Department of Energy and Climate Change. Smart Metering Early Learning Project: Consumer Survey and Qualitative Research; 2015 DECC Technical Report; DECC: London, UK, 2015.

- Arif, A.; Al-Hussain, M.; Al-Mutairi, N.; Al-Ammar, E.; Khan, Y.; Malik, N. Experimental study and design of smart energy meter for the smart grid. In Proceedings of the Renewable and Sustainable Energy Conference (IRSEC), Ouarzazate, Morocco, 7–9 March 2013; pp. 515–520. [Google Scholar]

- Qiu, Y.; Xing, B.; Wang, Y.D. Prepaid electricity plan and electricity consumption behavior. Contemp. Econ. Policy 2016, 35, 125–142. [Google Scholar] [CrossRef]

- Jack, B.K.; Smith, G. Charging ahead Prepaid Electricity Metering in South Africa; Working Paper, Reference Number: E-89201-ZAF-2; NBER: Cambridge, MA, USA, 2017. [Google Scholar]

- Bager, S.; Mundaca, L. Making ‘Smart Meters’ smarter? Insights from a behavioural economics pilot field experiment in Copenhagen, Denmark. Energy Res. Soc. Sci. 2017, 28, 68–76. [Google Scholar] [CrossRef]

- Mwaura, M.F. Adopting electricity prepayment billing system to reduce non-technical energy losses in Uganda: Lesson from Rwanda. Util. Policy 2012, 23, 72–79. [Google Scholar] [CrossRef]

- Viegas, J.L.; Esteves, P.R.; Melício, R.; Mendes, V.; Vieira, S.M. Solutions for detection of non-technical losses in the electricity grid: A review. Renew. Sustain. Energy Rev. 2017, 80, 1256–1268. [Google Scholar] [CrossRef]

- Rodríguez, R.G.; Mares, J.J.; Quintero, M.C.G. Computational Intelligent Approaches for Non-Technical Losses Management of Electricity. Energies 2020, 13, 2393. [Google Scholar] [CrossRef]

- Gul, H.; Javaid, N.; Ullah, I.; Qamar, A.; Afzal, M.K.; Joshi, G.P. Detection of Non-Technical Losses Using SOSTLink and Bidirectional Gated Recurrent Unit to Secure Smart Meters. Appl. Sci. 2020, 10, 3151. [Google Scholar] [CrossRef]

- Ghana Statistical Service GSS. 2010 Population and Housing Census. Berekum District Analytical Report (2014). Available online: https://new-ndpc-static1.s3.amazonaws.com/CACHES/PUBLICATIONS/2016/06/06/Berekum+Municipal+2010PHC.pdf (accessed on 28 February 2021).

- Northern Electricity Distribution Company. Northern Electricity Distribution Company Annual Report; NEDCo: Tamale, Ghana, 2018; Unpublished. [Google Scholar]

- Darby, S. Energy feedback in buildings: Improving the infrastructure for demand reduction. Build. Res. Inf. 2008, 36, 499–508. [Google Scholar] [CrossRef]

- Carroll, J.; Lyons, S.; Denny, E. Reducing household electricity demand through smart metering: The role of improved information about energy saving. Energy Econ. 2014, 45, 234–243. [Google Scholar] [CrossRef]

- Liu, A.; Giurco, D.; Mukheibir, P.; White, S. Detailed water-use feedback: A review and proposed framework for program implementation. Util. Policy 2016, 43, 140–150. [Google Scholar] [CrossRef]

- Cook, B.L.; Manning, W.G. Thinking beyond the mean: A practical guide for using quantile regression methods for health services research. Shanghai Arch. Psychiatry 2013, 25, 55–59. [Google Scholar]

- Yu, K.; Lu, Z.; Stander, J. Quantile regression: Applications and current research areas. J. R. Stat. Soc. Ser. D 2003, 52, 331–350. [Google Scholar] [CrossRef]

- Lee, C.Y.; Lotsu, S.; Islam, M.; Yoshida, Y.; Kaneko, S. The Impact of an Energy Efficiency Improvement Policy on the Economic Performance of Electricity-Intensive Firms in Ghana. Energies 2019, 12, 3684. [Google Scholar] [CrossRef]

- Torres-Reyna, O. Panel Data Analysis Fixed and Random Effects Using Stata (v.4.2); Princeton University: Princeton, NJ, USA, 2007; Available online: http://dss.princeton.edu/training/ (accessed on 4 February 2021).

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, UK, 2010. [Google Scholar]

- Wing, C.; Simon, K.; Bello-Gomez, R.A. Designing Difference in Difference Studies: Best Practices for Public Health Policy Research. Annu. Rev. Public Health 2018, 39, 453–469. [Google Scholar] [CrossRef]

- Koenker, R.; Bassett, G. Regression Quantiles. Econometrica 1978, 46, 33. [Google Scholar] [CrossRef]

- Koenker, R.; Hallock, K.F. Quantile Regression. J. Econ. Perspect. 2001, 15, 143–156. [Google Scholar] [CrossRef]

- Fenske, N.; Kneib, T.; Hothorn, T. Identifying Risk Factors for Severe Childhood Malnutrition by Boosting Additive Quantile Regression. J. Am. Stat. Assoc. 2011, 106, 494–510. [Google Scholar] [CrossRef]

- Ajodhia, V.; Mulder, W.; Slot, T. Tariff Structures for Sustainable Electrification in Africa; European Copper Institute (ECI): Arnhem, The Netherlands, 2012; pp. 1–56. [Google Scholar]

- Koenker, R. Quantile Treatment Effects. In International Encyclopedia of the Social & Behavioral Sciences, 2nd ed.; Elsevier: Amsterdam, The Netherlands, 2015. [Google Scholar]

- Anders, F.; de Oliveira, G.M. Impact evaluation using Difference-in-Differences. Center for Organization Studies (CORS), School of Economics, Business and Accounting (FEA), University of São Paulo (USP), São Paulo, Brazil. RAUSP Manag. J. 2019, 54, 519–532. [Google Scholar]

- Schnabl, P. The International Transmission of Bank Liquidity Shocks: Evidence from an Emerging Market. J. Financ. 2012, 67, 897–932. [Google Scholar] [CrossRef]

- Courtemanche, C.; Zapata, D. Does Universal Coverage Improve Health? The Massachusetts Experience. SSRN Electron. J. 2012, 33, 36–69. [Google Scholar]

- Saha, D.; Bhattacharjee, A.; Chowdhury, D.; Hossain, E.; Islam, M. Comprehensive NILM Framework: Device Type Classification and Device Activity Status Monitoring Using Capsule Network. IEEE Access 2020, 8, 179995–180009. [Google Scholar] [CrossRef]

- Hasan, M.; Chowdhury, D.; Khan, Z.R. Non-Intrusive Load Monitoring Using Current Shapelets. Appl. Sci. 2019, 9, 5363. [Google Scholar] [CrossRef]

- Hasan, M.; Chowdhury, D.; Shahir, A.; Hasan, K. Statistical Features Extraction and Performance Analysis of Supervised Classifiers for Non-Intrusive Load Monitoring. Eng. Lett. 2019, 27, 776–782. [Google Scholar]

| Dependent Variable | N. Obs. | Mean | s.d. | Min | Max |

|---|---|---|---|---|---|

| Electricity Consumption (kWh/month) Total Sample Control | 39,982 21,480 | 89.576 88.511 | 86.984 91.331 | 0 0 | 1674 1674 |

| Treated Before | 18,502 26,654 | 90.813 86.595 | 81.634 87.153 | 0 0 | 1319 1674 |

| After | 13,328 | 95.539 | 86.342 | 0 | 1046 |

| Dependent Variable: | (1) |

|---|---|

| Electricity consumption (kWh/month) | DID-FE |

| Treatment Effect: | 12.656 *** |

| (2.372) | |

| Household fixed effectsTime fixed effects | YesYes |

| Observations | 39,982 |

| Number of households | 1666 |

| R-squared | 0.025 |

| Treatment | Control | |||||||

|---|---|---|---|---|---|---|---|---|

| Dependent Variable | Obs. | Mean | Obs. | Mean | Diff | S.E | t_Value | p_Value |

| Electricity consumption (kWh/month) | 6168 | 101.305 | 7160 | 90.571 | 10.734 | 1.497 | −7.15 | 0.000 *** |

| Treatment | Control | |||||||

|---|---|---|---|---|---|---|---|---|

| Dependent Variable | Obs. | Mean | Obs. | Mean | Diff | S.E | t_Value | p_Value |

| Electricity consumption (kWh/month) | 12,334 | 85.567 | 14,320 | 87.481 | −1.914 | 1.071 | 1.8 | 0.074 * |

| Dependent Variable: Electricity Consumption | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| (kWh/month) | ATE | q10 | q25 | q50 | q75 | q90 |

| Treatment Effect | 12.648 *** | 4.370 *** | −1.810 | 6.650 *** | 20.600 *** | 27.900 *** |

| (2.372) | (1.075) | (1.601) | (1.675) | (2.804) | (5.385) | |

| Observations | 39,982 | 39,982 | 39,982 | 39,982 | 39,982 | 39,982 |

| R-squared | 0.004 | 0.002 | 0.006 | 0.006 | 0.004 | 0.003 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Otchere-Appiah, G.; Takahashi, S.; Yeboah, M.S.; Yoshida, Y. The Impact of Smart Prepaid Metering on Non-Technical Losses in Ghana. Energies 2021, 14, 1852. https://doi.org/10.3390/en14071852

Otchere-Appiah G, Takahashi S, Yeboah MS, Yoshida Y. The Impact of Smart Prepaid Metering on Non-Technical Losses in Ghana. Energies. 2021; 14(7):1852. https://doi.org/10.3390/en14071852

Chicago/Turabian StyleOtchere-Appiah, Gideon, Shingo Takahashi, Mavis Serwaa Yeboah, and Yuichiro Yoshida. 2021. "The Impact of Smart Prepaid Metering on Non-Technical Losses in Ghana" Energies 14, no. 7: 1852. https://doi.org/10.3390/en14071852

APA StyleOtchere-Appiah, G., Takahashi, S., Yeboah, M. S., & Yoshida, Y. (2021). The Impact of Smart Prepaid Metering on Non-Technical Losses in Ghana. Energies, 14(7), 1852. https://doi.org/10.3390/en14071852