A Quadratically Constrained Optimization Problem for Determining the Optimal Nominal Power of a PV System in Net-Metering Model: A Case Study for Croatia

Abstract

:1. Introduction

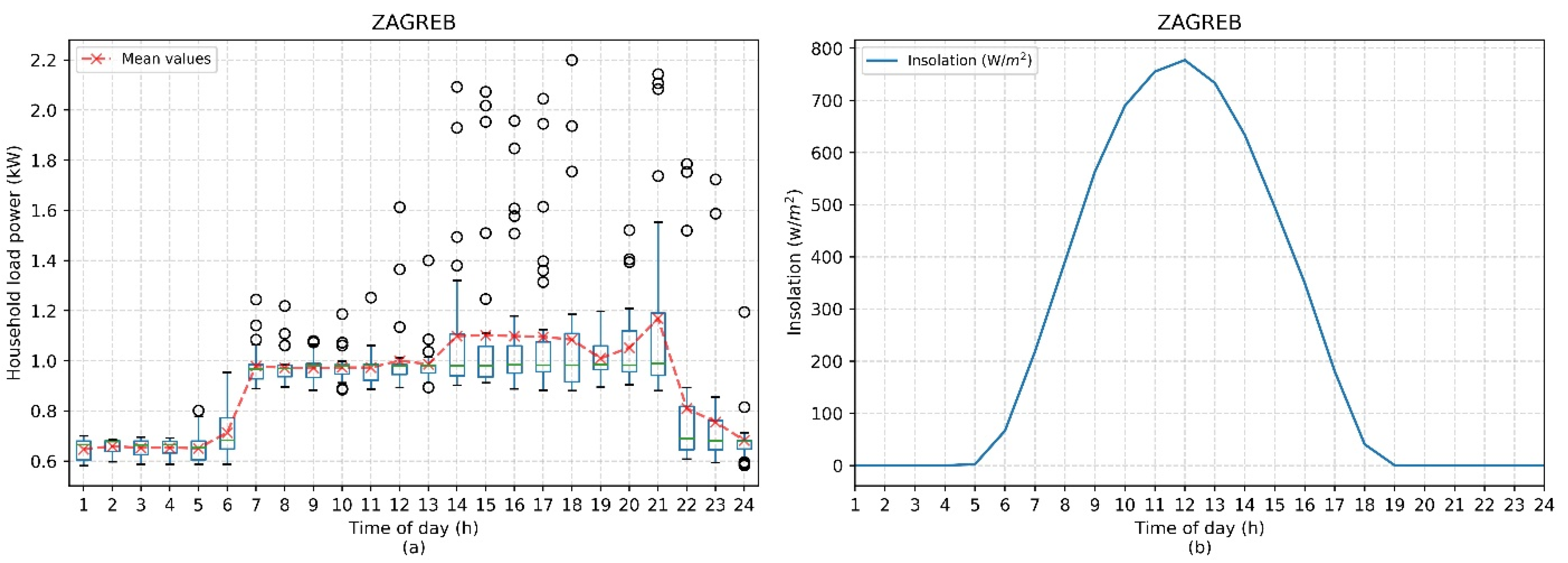

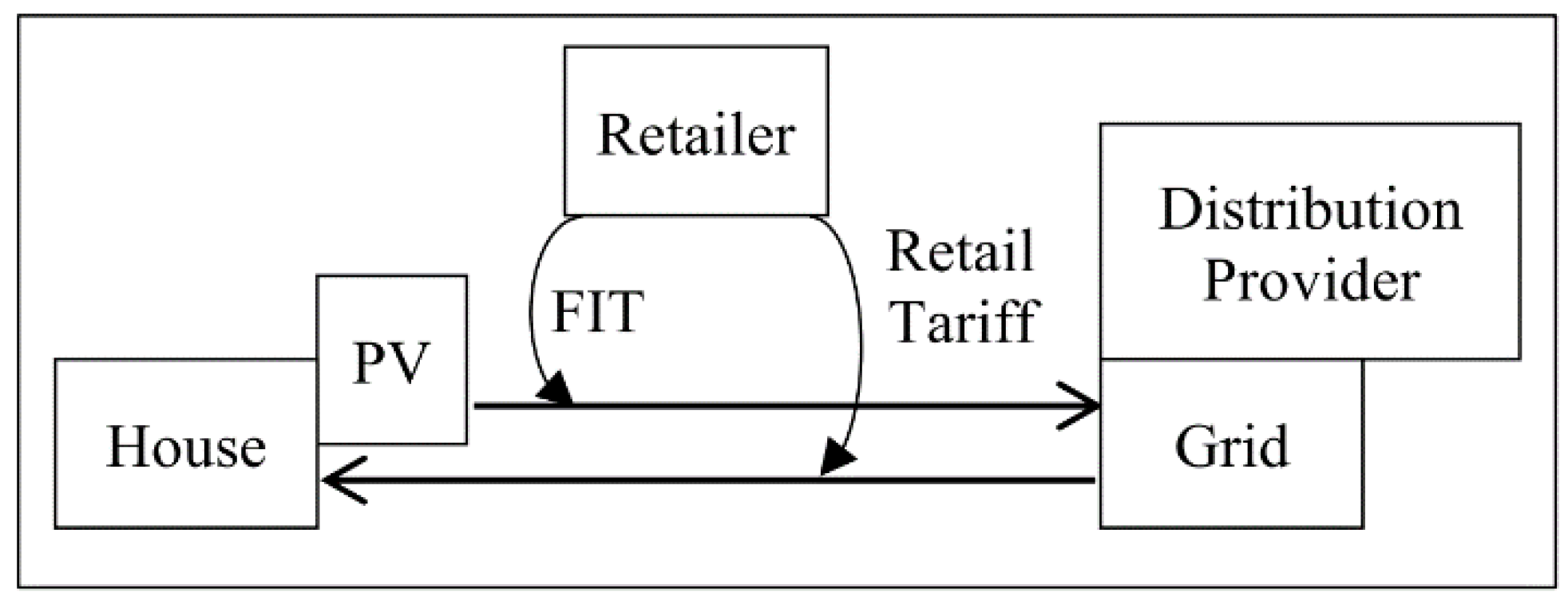

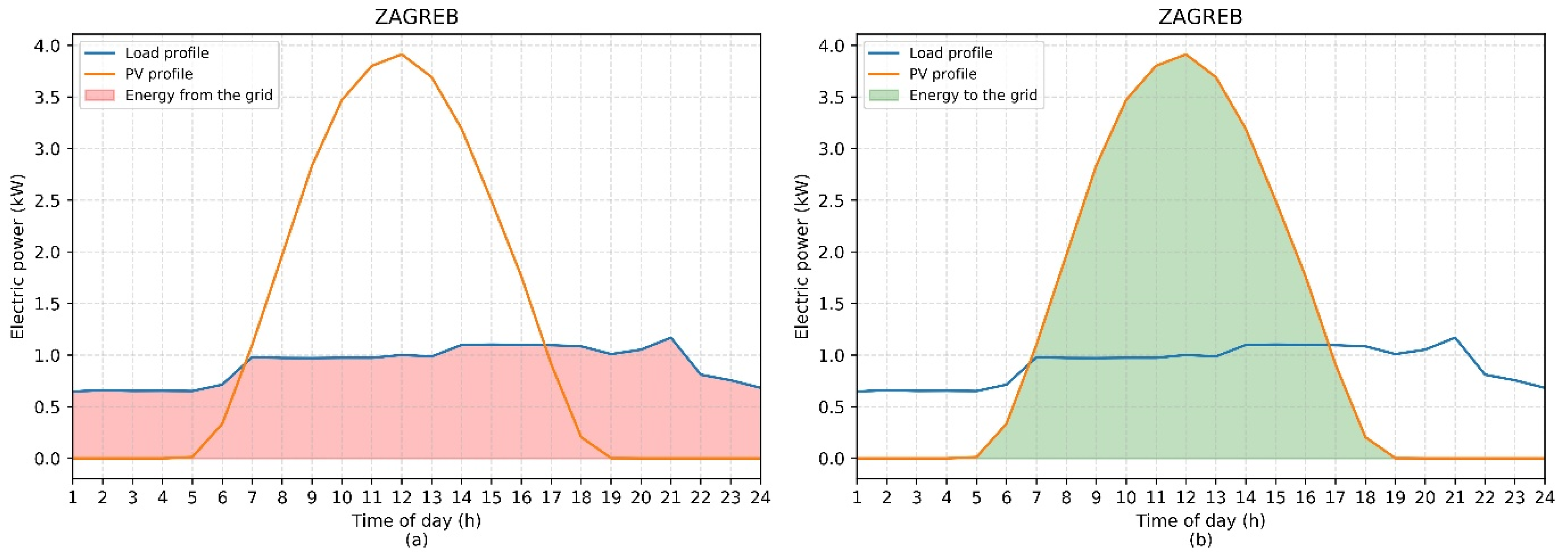

2. PV Market Models

2.1. Feed-in Tariff Model (FiT)

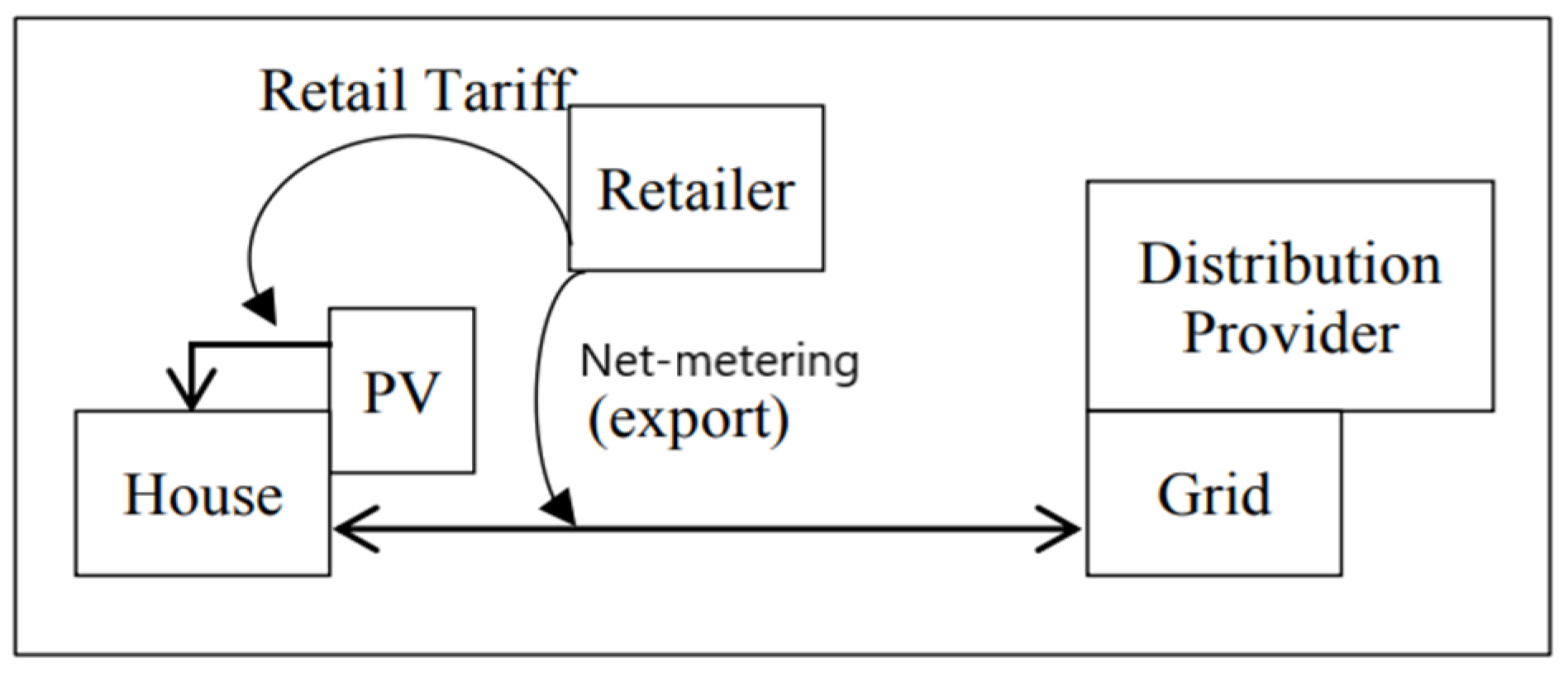

2.2. Net-Metering Model

2.3. Net-Metering Model in Croatia

- Have the status of a privileged (RES) producer of electrical energy.

- Have the right for permanent connection to the power grid as a simple construction object.

- The total connection power of all power plants in a single connection point does not exceed 500 kWp.

- Connection power in one direction (into the grid) does not exceed connection power in the other direction (into the household object).

- Electrical energy has to be delivered through the same connection point as from which it is bought from the grid.

- if Eel_import_(i) ≥ Eel_export_(i) ∀ i ∈ [1,12]:Πprosumer = 0.9 · Πaverage_electricity

- if Eel_import_(i) < Eel_export_(i) ∀ i ∈ [1,12]:where i represents time in months, Eel_import_(i) represents the total electricity imported from the grid in the ith month, Eel_export_(i) represents the total electricity exported to the grid in the ith month, Πaverage_electricity represents the average price of electricity with no extra fees added (such as grid fees, tax, etc.), and Πprosumer represents the total redemption price for surplus electrical energy in the prosumer model.

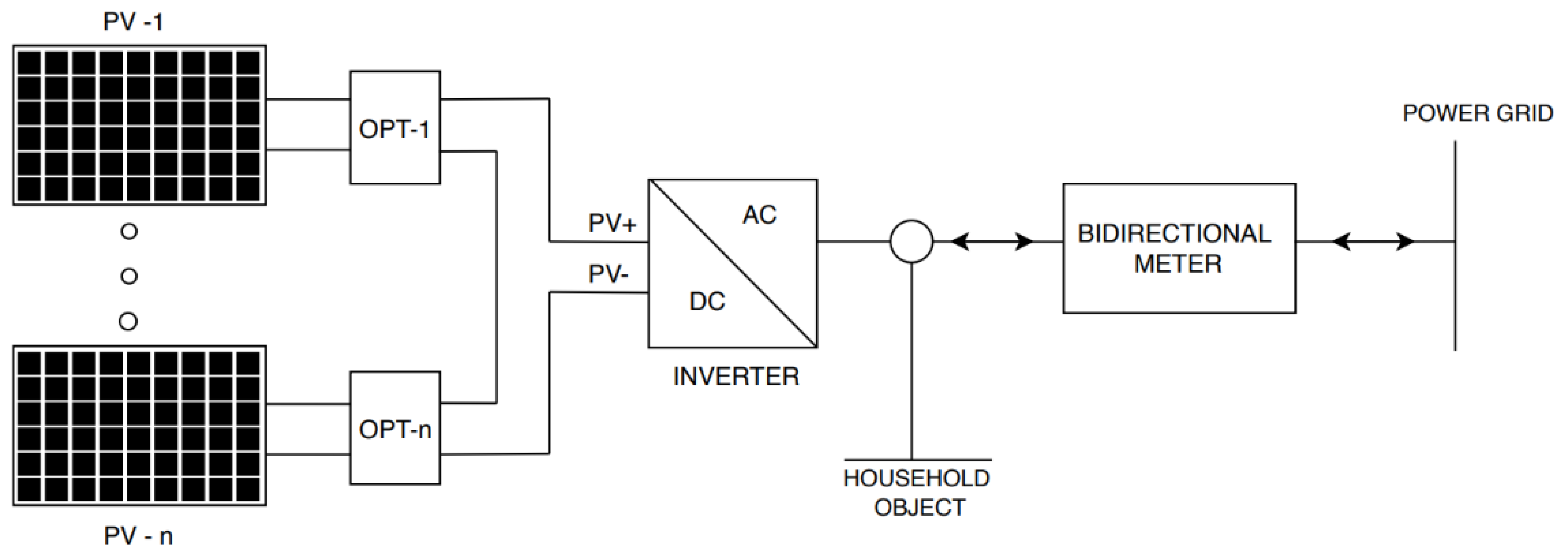

3. PV Model and Optimization Algorithm

- ΔEannual—yearly difference between imported and exported electrical energy (kWh)

- EPV—yearly production of electrical energy from PV system (kWh)

- Econs—yearly consumption of electrical energy of a household (kWh)

- Econs_ht—yearly consumption of electrical energy of a household during HT (kWh)

- Econs_lt—yearly consumption of electrical energy of a household during LT (kWh)

- Eimport_ht_(i)—the amount of imported electricity from the grid during the HT in the ith month (kWh)

- Eimport_lt_(i)—the amount of imported electricity from the grid during the LT in the ith month (kWh)

- Eexport_ht_(i)—the amount of exported electricity to the grid during the HT in the ith month (kWh)

- Eexport_lt_(i)—the amount of exported electricity to the grid during the LT in the ith month (kWh)

- kcons_ht_(i)—coefficient of HT consumption for the ith month (0–1) given in a vector of 12 months

- kcons_lt_(i)—coefficient of LT consumption for the ith month (0–1) given in a vector of 12 months

- PPV—the nominal power of a PV system (kWp) → the variable of decision

- PPV_p—the nominal power of one PV panel (kWp)

- PPV_vector—vector of possible PPV for a certain case, with a discrete step of PPV_p

- PPV_binary—vector of binary values for possible PPV, the same length as PPV_vector

- APV_p—the surface area of one PV panel (m2)

- Ireff—reference yearly insolation ) for a panel fixed at 35° and oriented to the south

- ηPV_p—efficiency of one PV panel (0–1)

- kloss—coefficient of total PV system losses on annual basis (0–1)

- kins_(i)—coefficient of insolation (0–1) for the ith month given in a vector of 12 months

- Econs_var—the amount of variable consumption of electricity on annual basis (kWh)

- EPV_var—the amount of variable PV production of electricity on annual basis (kWh)

- ΔEvar—the difference between ΔEannual and total variable electricity (Econs_var + EPV_var) (kWh)

- ΔEvar_MAX—MAX(ΔEvar), upper limit for a 0.3 kWp PV panel (kWh)

- Πvar_PV—variable costs of a PV system (PV components, installation costs, and maintenance) (EUR). Installation costs are given in EUR and are converted into HRK using the exchange rate of 7.45.

- Πfix_PV—fixed costs of a PV system (costs of PV project and bidirectional meter) (EUR)

- Πtot_PV—total investment costs of a PV system (EUR)

- i—month (1–12)

- y—year (1–30)

- Πht—retail price of electricity during HT()

- Πlt—retail price of electricity during LT ()

- Πht_ws—wholesale price of electricity during HT ()

- Πlt_ws—wholesale price of electricity during LT ()

- kΠ_NM—the coefficient for a redemption price of electricity according to the net-metering model )

- tproject—the total lifetime of a PV project (years), assumed to be 30 (years)

- Πbefore—total electricity costs before the installation of a PV system (HRK) (over a period of tproject)

- Πafter—total electricity costs after the installation of a PV system (HRK) (over a period of tproject)

- Πsavings—total electricity savings after the installation of a PV system (HRK) (over a period of tproject)

- kdiscount—the discount rate used in calculations of a PV project (%)

- NPV—the net present value of a PV project (HRK)

- PP—payback period of a PV project (years)

4. Results

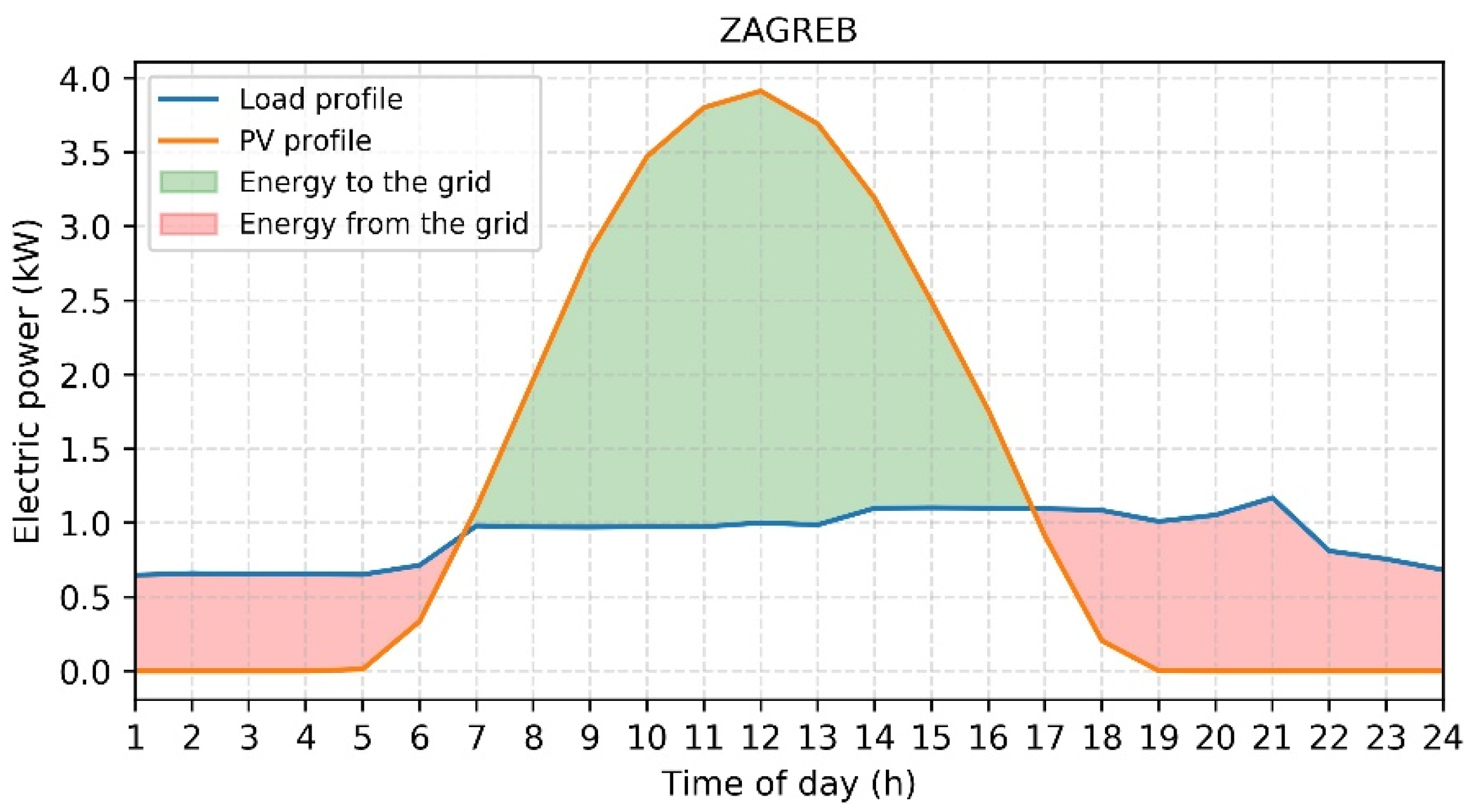

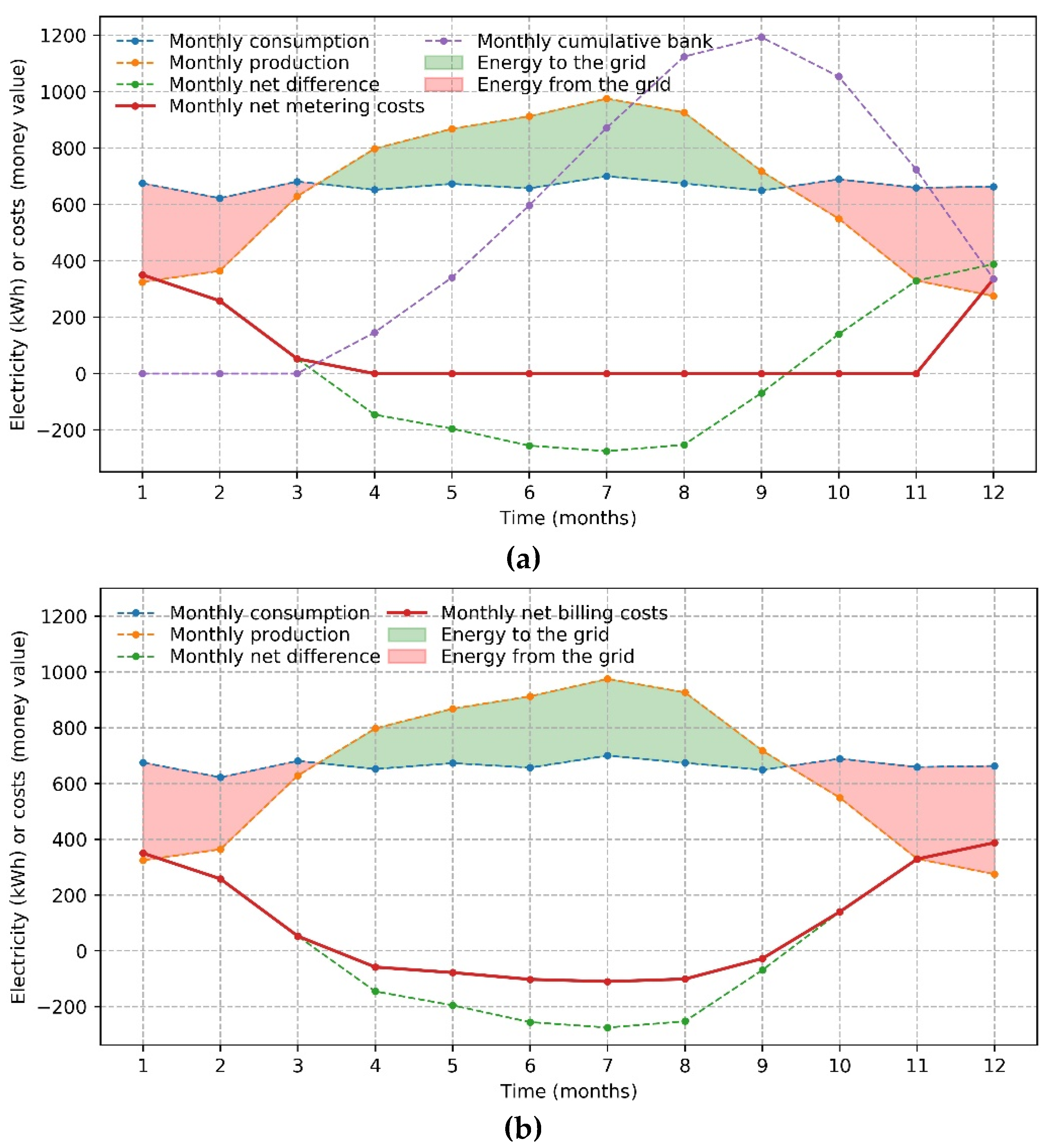

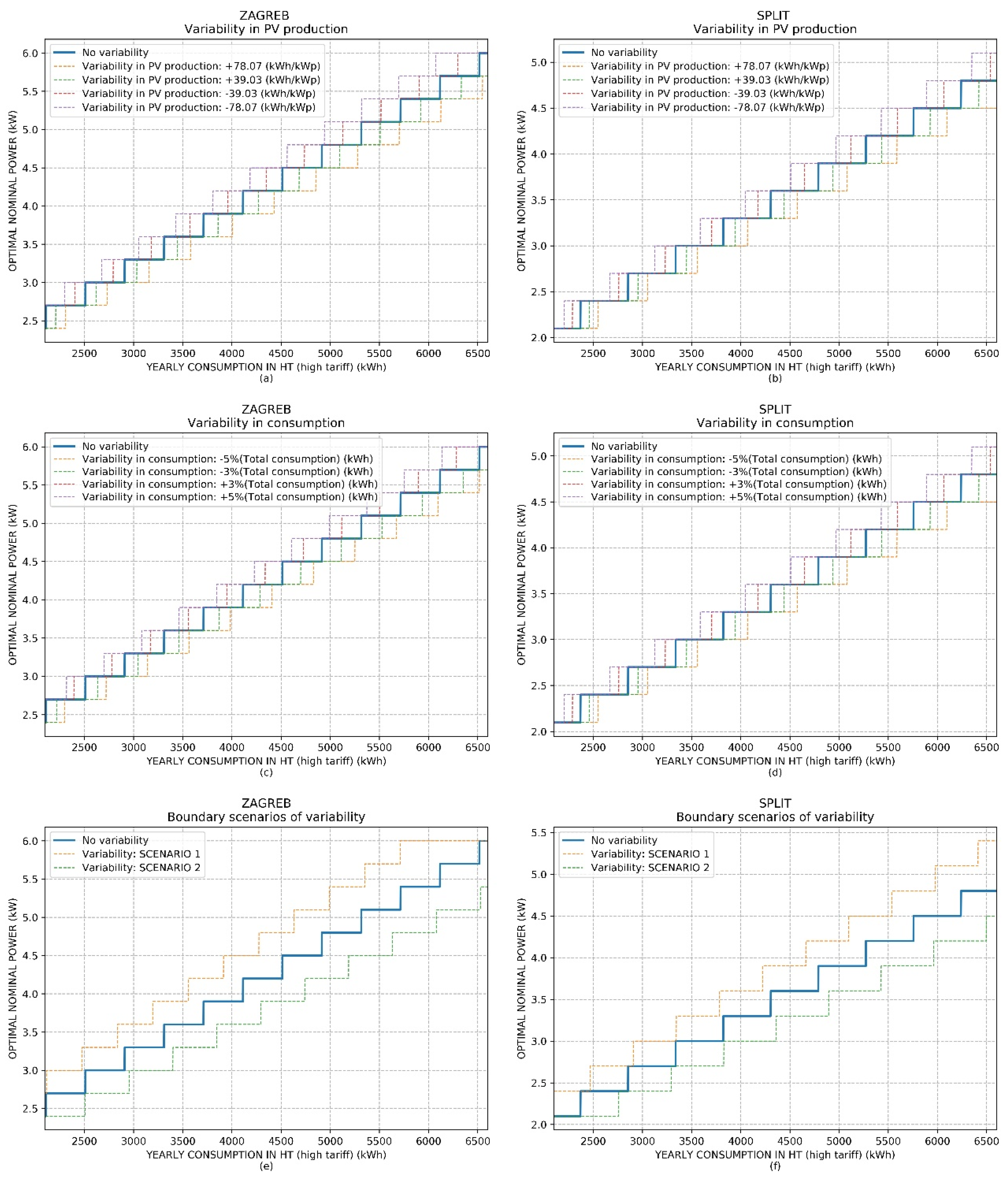

4.1. Optimal PV Power Simulations

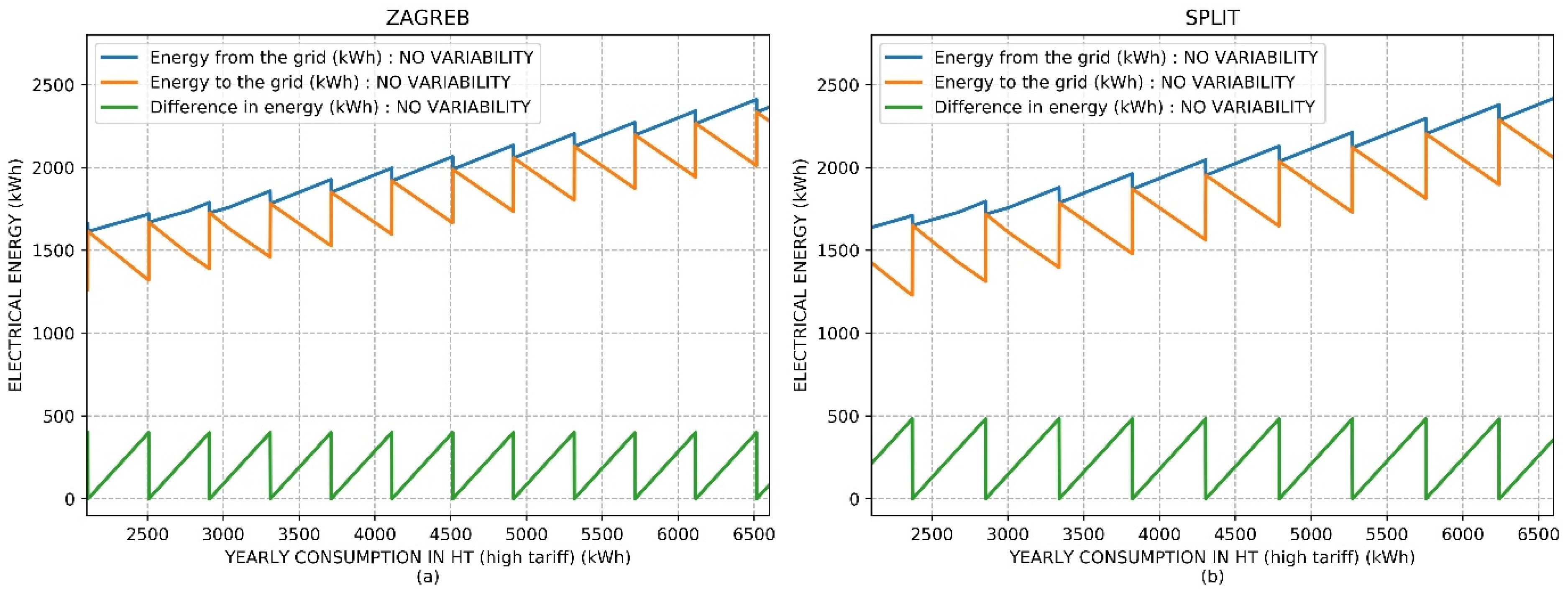

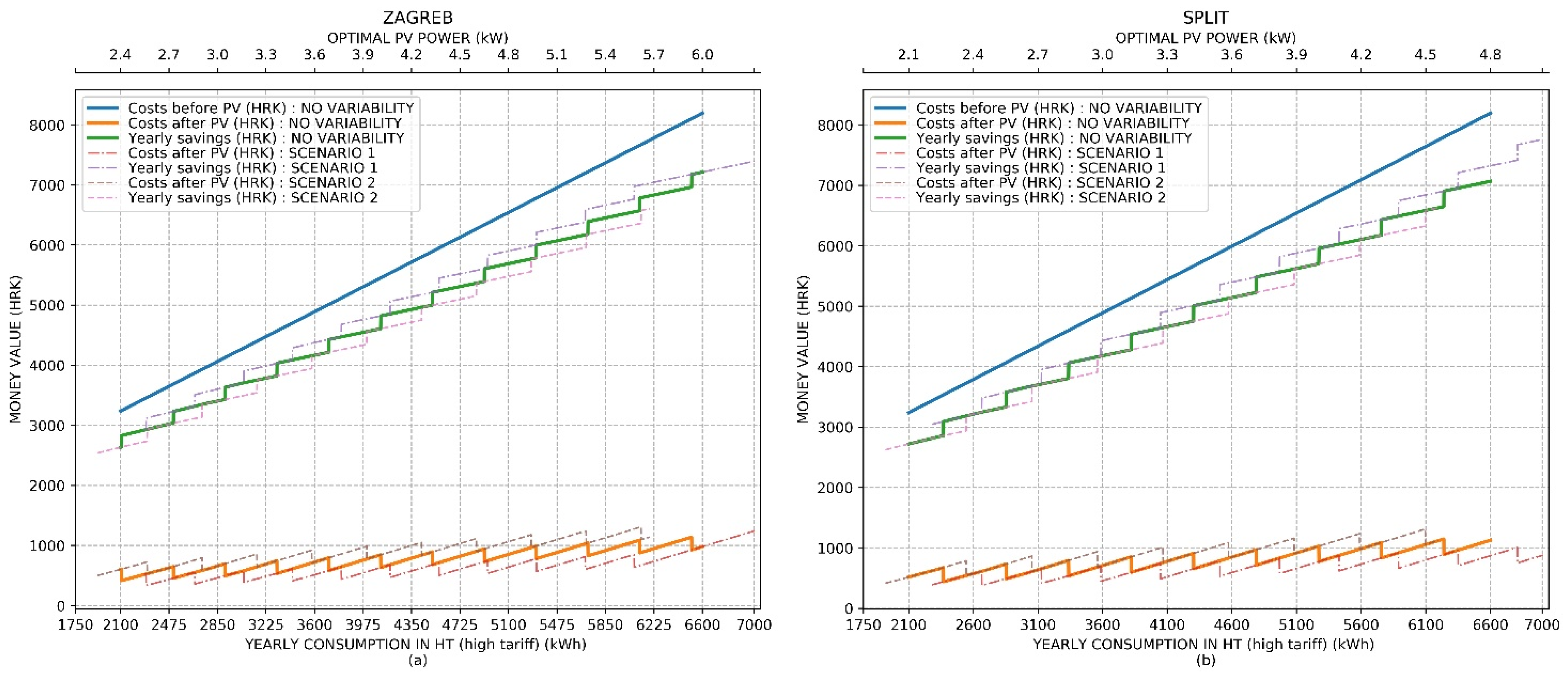

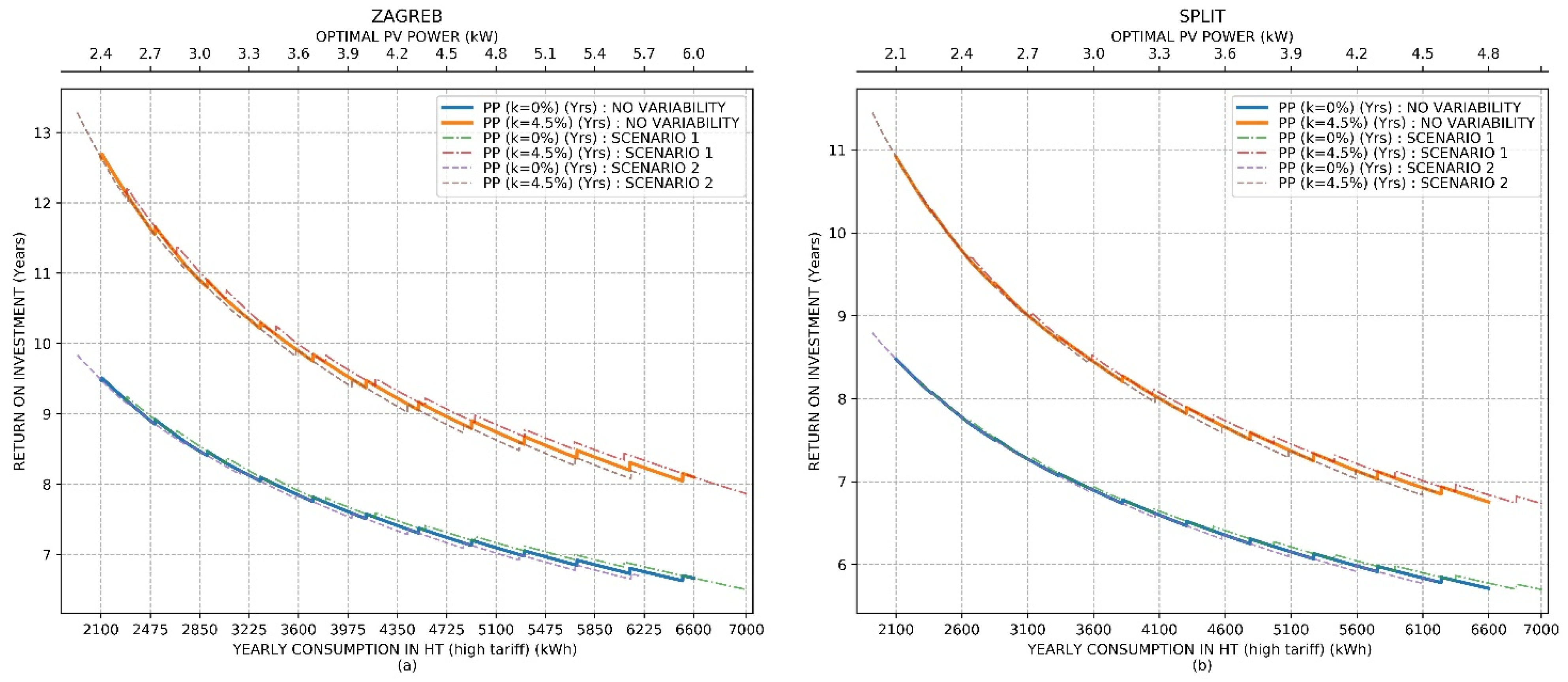

4.2. Energy Balance and Financial Simulations

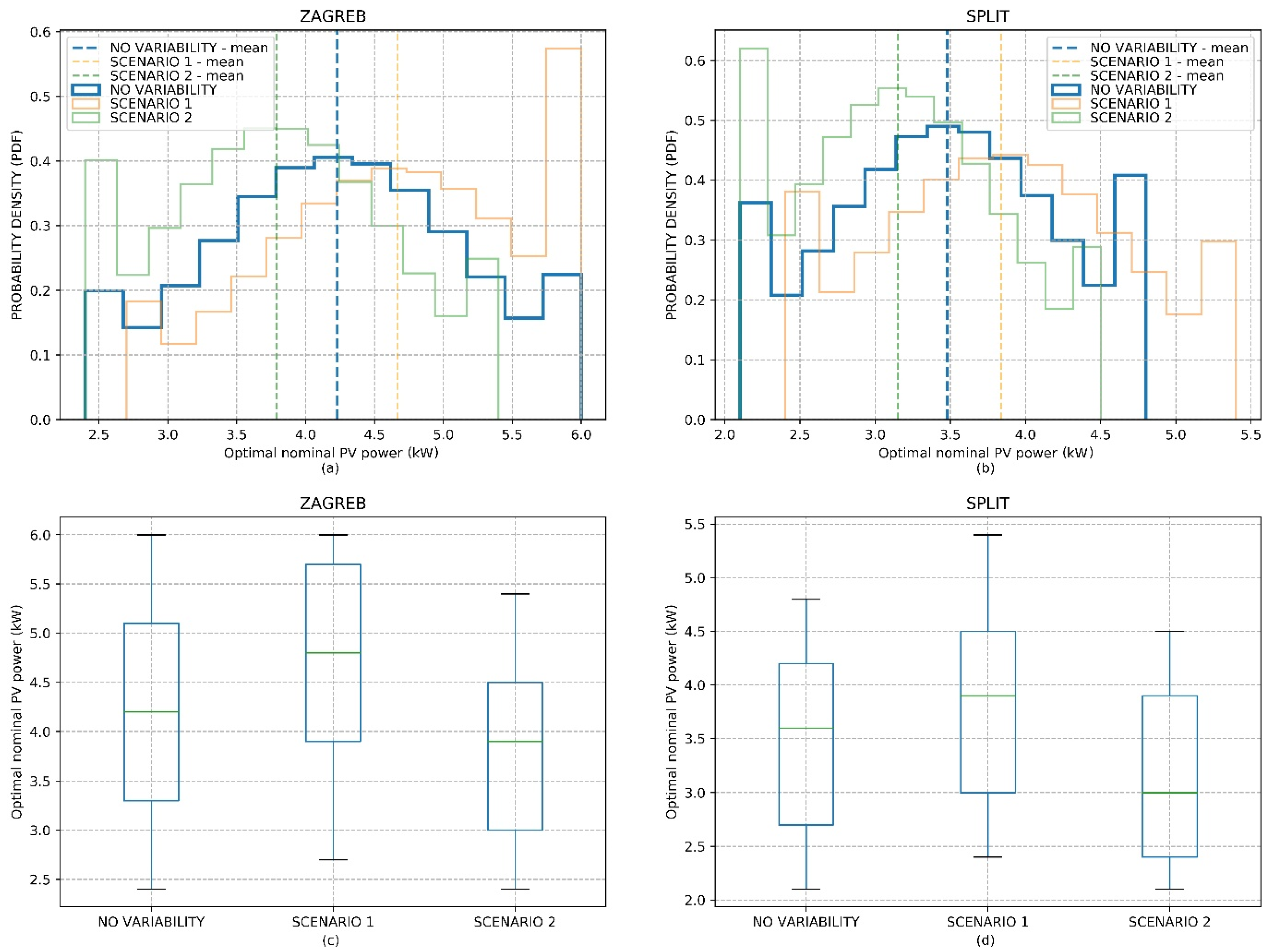

4.3. Statistical Analysis of the Obtained Results

4.4. Discussion of Results

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- IEA-ETSAP; IRENA. Renewable Energy Integration in Power Grid: Technology Brief; IRENA: Abu Dhabi, UAE, 2015. [Google Scholar]

- Twidell, J.; Weir, T. Renewable Energy Resources, 3rd ed.; Routledge: London, UK, 2015. [Google Scholar]

- Kryzia, D.; Olczak, P.; Wrona, J.; Kopacz, M.; Kryzia, K.; Galica, D. Dampening Variations in Wind Power Generation Through Geographical Diversification. IOP Conf. Ser. Earth Environ. Sci. 2019, 214, 012038. [Google Scholar] [CrossRef]

- Szablicki, M.; Rzepka, P.; Sołtysik, M.; Czapaj, R. The idea of non-restricted use of LV networks by electricity consumers, producers, and prosumers. In Proceedings of the 14th International Scientific Conference “Forecasting in Electric Power Engineering” (PE 2018), Podlesice, Poland, 26–28 September 2018; p. 84. [Google Scholar]

- Kuchmacz, J.; Mika, L. Description of development of prosumer energy sector in Poland. Polityka Energetyczna Energ. Policy J. 2018, 21, 5–20. [Google Scholar] [CrossRef]

- Wang, H.; Lei, Z.; Zhang, X.; Zhou, B.; Peng, J. A review of deep learning for renewable energy forecasting. Energ. Convers. Manag. 2019, 198, 111799. [Google Scholar] [CrossRef]

- Bayindir, R.; Demirbaş, Ş.; Irmak, E.; Cetinkaya, U.; Ova, A.; Yeşil, M. Effects of renewable energy sources on the power system. In Proceedings of the 2016 IEEE International Power Electronics and Motion Control Conference (PEMC), Varna, Bulgaria, 18–23 September 2016; pp. 388–393. [Google Scholar]

- Saqib, N.; Haque, K.F.; Zabin, R.; Preonto, S.N. Analysis of Grid Integrated PV System as Home RES with Net Metering Scheme. In Proceedings of the International Conference on Robotics, Electrical and Signal Processing Techniques (ICREST), Dhaka, Bangladesh, 10–12 January 2019; pp. 395–399. [Google Scholar]

- Soria, M.; Vásquez, P. Deterministic and stochastic optimization-based decision-making approaches for effectively coping with residential photovoltaic micro-systems sizing problem under net-metering schemes. In Proceedings of the IEEE Fourth Ecuador Technical Chapters Meeting (ETCM), Guayaquil, Ecuador, 13–15 November 2019; pp. 1–6. [Google Scholar]

- PVGIS. Available online: https://re.jrc.ec.europa.eu/pvg_tools/en/#PVP (accessed on 11 December 2020).

- Prahastono, I.; Sinisuka, N.I.; Nurdin, M.; Nugraha, H. A Review of Feed-In Tariff Model (FIT) for Photovoltaic (PV). In Proceedings of the 2nd International Conference on High Voltage Engineering and Power Systems, Denpasar, Indonesia, 2–5 October 2019; pp. 76–79. [Google Scholar]

- Olivia, S.; McGill, I. Dynamic Model Approach To Assess Feed In Tariffs For Residential Pv Systems. In Proceedings of the International Association of Energy Economics (IAEE) Conference, Daegu, Korea, 16–20 June 2013. [Google Scholar]

- Punda, L.; Capuder, T.; Pandžić, H.; Delimar, M. Integration of renewable energy sources in southeast Europe: A review of incentive mechanisms and feasibility of investments. Renew. Sustain. Energ. Rev. 2017, 71, 77–88. [Google Scholar] [CrossRef]

- Alasadi, S.; Abdullah, M.P. Comparative Analysis between Net and Gross Metering for Residential PV System. In Proceedings of the IEEE 7th International Conference on Power and Energy (PECon), Kuala Lumpur, Malaysia, 3–4 December 2018; pp. 434–439. [Google Scholar]

- Iliopoulos, T.G.; Fermeglia, M.; Vanheusden, B. The EU’s 2030 Climate and Energy Policy Framework: How net metering slips through its net. Rev. Eur. Comp. Int. Environ. Law 2020, 29, 245–256. [Google Scholar] [CrossRef]

- Olczak, P.; Kryzia, D.; Matuszewska, D.; Kuta, M. “My Electricity” Program Effectiveness Supporting the Development of PV Installation in Poland. Energies 2021, 14, 231. [Google Scholar] [CrossRef]

- NARODNE NOVINE. Available online: https://narodne-novine.nn.hr/clanci/sluzbeni/2018_12_111_2151.html (accessed on 15 December 2020).

- Zhang, X.; Chen, M.; Fu, Y.; Li, Y. A Step-Down Partial Power Optimizer Structure for Photovoltaic Series-Connected Power Optimizer System. In Proceedings of the IEEE International Power Electronics and Application Conference and Exposition (PEAC), Shenzhen, China, 4–7 November 2018; pp. 1–4. [Google Scholar]

- Lee, C.-Y.; Ahn, J. Stochastic Modeling of the Levelized Cost of Electricity for Solar PV. Energies 2020, 13, 3017. [Google Scholar] [CrossRef]

- Aleksiejuk-Gawron, J.; Milčiuvienė, S.; Kiršienė, J.; Doheijo, E.; Garzon, D.; Urbonas, R.; Milčius, D. Net-Metering Compared to Battery-Based Electricity Storage in a Single-Case PV Application Study Considering the Lithuanian Context. Energies 2020, 13, 2286. [Google Scholar] [CrossRef]

- EEA. Available online: https://www.eea.europa.eu/data-and-maps/daviz/drivers-of-the-change-in-4#tab-chart_2 (accessed on 19 January 2021).

| Countries | Components of FiT | Remarks |

|---|---|---|

| Netherlands | Investment cost subsidy | - |

| Austria, Belgium, and Sweden | Investment cost subsidy. Incentive for energy production. | The amount of incentives depends on the current regulations in certain countries respectively. |

| BIH, Bulgaria, Cyprus, Czech Republic, Estonia, Hungary, England, Italy, Germany, Croatia, Latvia, Lithuania, Luxembourg, Macedonia, Malta, Montenegro, France, Portugal, Romania, Serbia, Slovakia, Slovenia, Spain, Switzerland, Ukraine, Greece | Incentive for energy production over a certain period. | The amount of incentives depends on the type and capacity of PV, location, and the regulations that apply in each sector or part of a certain country respectively. |

| EU Country | Type | Contracts Duration | Grid Charges | Aggregated Installed Capacity Limit | Consumers Involved | Technologies |

|---|---|---|---|---|---|---|

| Cyprus | Net metering, Net billing | 10 or 15 years | ✔ | ✔ | Residential and low-voltage non-residential (up to 10 kWp each) | Solar PV for net metering, all RES for net billing |

| Flanders (Belgium) |

Net metering, Net billing | ✖ | ✔ | ✖ | Up to 10 kWp | All renewable electricity |

| Greece |

Net metering, Virtual net metering | 25 years | ✖ | ✖ | Residential and non-residential (up to 1 MW) | All renewable electricity |

| Italy | Net billing | 1 year (automatic renewal) | ✔ | ✔ | Residential and non-residential (up to 500 kWp) | All renewable electricity |

| Poland | Net billing | 1 year | ✔ | ✔ | Residential and non-residential (up to 50 kWp) | Solar PV |

| Elements of Price | HT (High Tariff) | LT (Low Tariff) |

|---|---|---|

| Wholesale price (HRK/kWh) | 0.49 | 0.24 |

| Grid fee (HRK/kWh) | 0.35 | 0.17 |

| RES fee (HRK/kWh) | 0.105 | 0.105 |

| Solidarity fee (HRK/kWh) | 0.03 | 0.03 |

| Electricity TAX | 0.13 | 0.13 |

| Total retail price (HRK/kWh) | 1.10 | 0.62 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Budin, L.; Grdenić, G.; Delimar, M. A Quadratically Constrained Optimization Problem for Determining the Optimal Nominal Power of a PV System in Net-Metering Model: A Case Study for Croatia. Energies 2021, 14, 1746. https://doi.org/10.3390/en14061746

Budin L, Grdenić G, Delimar M. A Quadratically Constrained Optimization Problem for Determining the Optimal Nominal Power of a PV System in Net-Metering Model: A Case Study for Croatia. Energies. 2021; 14(6):1746. https://doi.org/10.3390/en14061746

Chicago/Turabian StyleBudin, Luka, Goran Grdenić, and Marko Delimar. 2021. "A Quadratically Constrained Optimization Problem for Determining the Optimal Nominal Power of a PV System in Net-Metering Model: A Case Study for Croatia" Energies 14, no. 6: 1746. https://doi.org/10.3390/en14061746

APA StyleBudin, L., Grdenić, G., & Delimar, M. (2021). A Quadratically Constrained Optimization Problem for Determining the Optimal Nominal Power of a PV System in Net-Metering Model: A Case Study for Croatia. Energies, 14(6), 1746. https://doi.org/10.3390/en14061746