Drivers and Barriers to the Adoption of Fuel Cell Passenger Vehicles and Buses in Germany

Abstract

1. Introduction

2. Analytical Framework: Factors Influencing the Market Penetration of Fuel Cell Mobility

2.1. Overview of Framework

2.2. Description of Four Categories

2.2.1. Supply-Side Factors

| Influencing Factor | Explanation | Key Literature |

|---|---|---|

| 1.1 Supply of vehicles | The volume of the current or expected production of fuel cell vehicles from various automakers and the availability of differing models and vehicle types. | [16,28,49,52,53,60,61] |

| 1.2 Cost of production | The cost of producing fuel cell vehicles and associated components. | [9,23,24,49,50,52] |

| 1.3 Technological state | The maturity, reliability and performance of core components in vehicles (e.g., fuel cell stacks and fuel tanks) and the ability to mass-produce these. | [9,23,28,49,55,56,62] |

| 1.4 Environmental regulations | The presence of policies such as vehicle emissions limits or minimum ZEV production quotas that target automakers. | [3,51,57,58,61] |

| 1.5 Government support | The presence of government schemes to support technology production in the automotive industry such as R&D funding or information sharing networks. | [9,24,63] |

| 1.6 Maintenance and repair networks | The availability of human resources and service networks from automakers to maintain and repair vehicles. | [28,59,64] |

2.2.2. Infrastructure Factors

| Influencing Factor | Explanation | Key Literature |

|---|---|---|

| 2.1 Availability of refuelling stations | The number and capacity of hydrogen refuelling stations relative to the population of on-road vehicles. | [16,18,53,54,65,67] |

| 2.2 Cost of refuelling stations | The cost of constructing or operating refuelling stations. | [9,23,66] |

| 2.3 Cost of hydrogen | The production and retail cost of hydrogen fuel for transport, as determined by production and delivery methods. | [24,66,68] |

| 2.4 Profitability of refuelling stations | The ability to recover investments in refuelling stations for operators, as influenced by on-road vehicle numbers, government or industry support mechanisms, and construction or operation costs. | [24,64] |

| 2.5 Economic support schemes | The availability of financial support schemes from government or industry to subsidise the cost of constructing or operating refuelling stations. | [53,61] |

| 2.6 Reliability of refuelling stations | The reliability of hydrogen refuelling station equipment and the frequency of breakdowns and downtime. | [16] |

| 2.7Availability of low or zero-carbon hydrogen | The availability of low or zero-carbon hydrogen fuel at an affordable price. | [16,61,64] |

2.2.3. Demand-Side Factors

| Influencing Factor | Explanation | Key Literature |

|---|---|---|

| 3.1 Consumer purchase incentives | The availability and attractiveness of monetary incentives (e.g., purchase subsidies, tax reductions) or non-monetary incentives (e.g., driving or parking privileges) to stimulate vehicle purchases. | [4,50,63,69,70] |

| 3.2 Actual demand for vehicles | The degree to which market demand exists for fuel cell vehicles, with or without incentives. | [6,63,64,65] |

| 3.3 Public awareness | The degree to which the general public is aware of hydrogen mobility and support its diffusion. | [6,53,63,73] |

2.2.4. Institutional Factors

3. Methodology

3.1. Study Design

- (1)

- Expert survey: This elicited the opinion of experts versed in Germany’s fuel cell mobility market about the principal factors driving or hampering the production and diffusion of passenger vehicles and buses. Drawing on scholarship both inside and outside the transportation field [63,80,81,82,83], this method helped to reduce the influence of the authors subjective judgement when identifying the most important drivers and barriers.

- (2)

- Expert interviews: These were conducted with experts based in Germany and other European countries to obtain more detailed, qualitative information than that obtained through the expert survey.

- (3)

- Document analysis: Secondary documents were consulted to build understanding into Germany’s fuel cell mobility market and source evidence for specific issues identified in expert surveys or interviews.

3.2. Expert Surveys

- Strong barrier

- Moderate barrier

- No influence

- Moderate driver

- Strong driver

3.3. Interviews

3.4. Document Analysis

3.5. Data Analysis

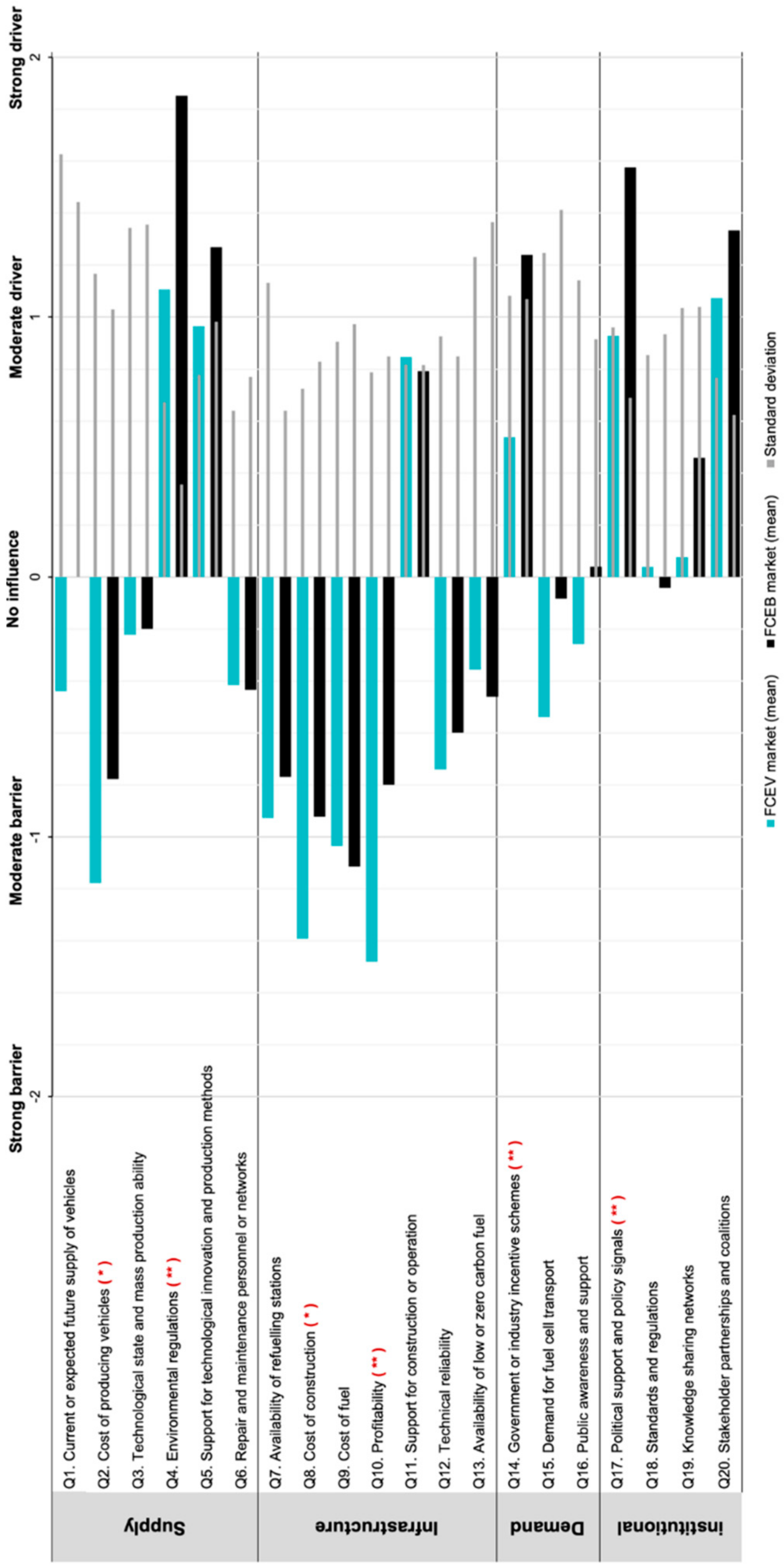

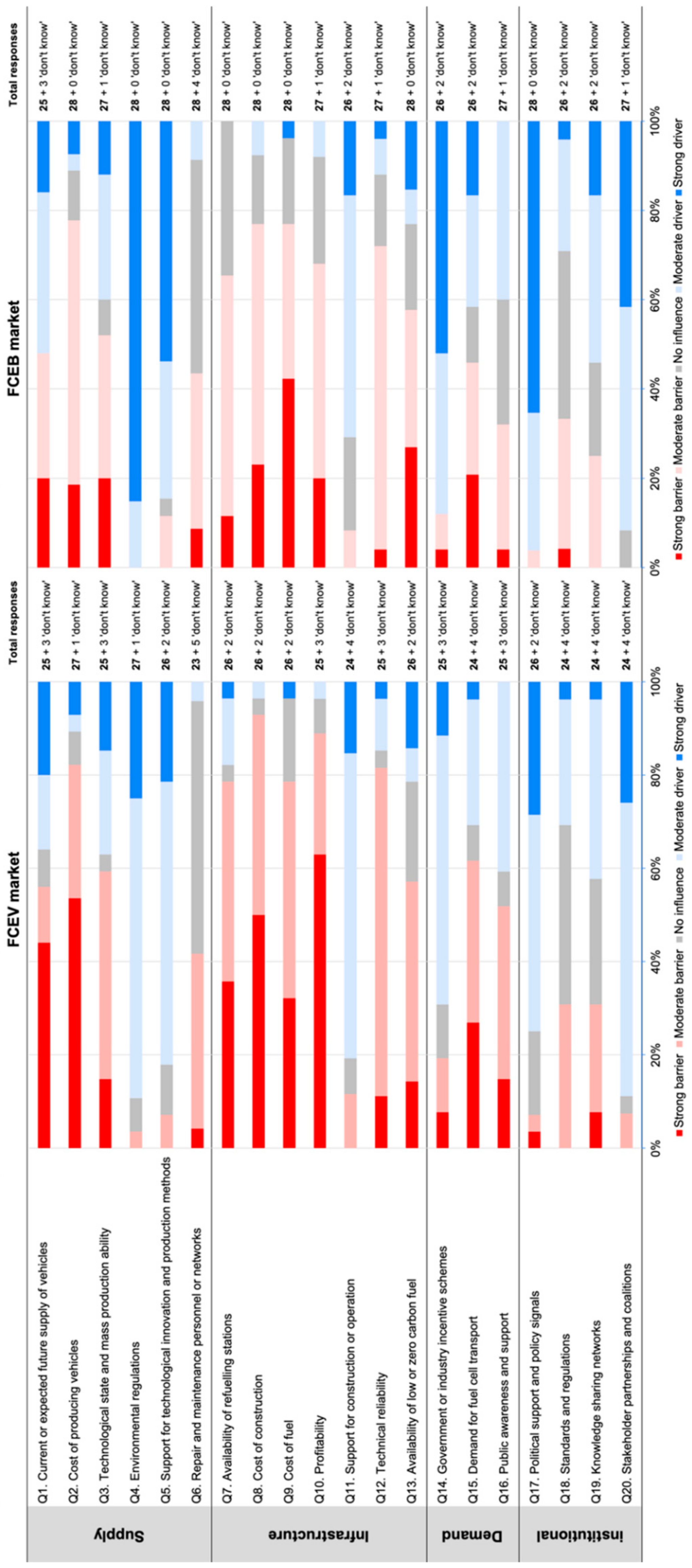

4. Results

4.1. Supply-Side Conditions

4.2. Infrastructure

4.3. Demand-Side

4.4. Cross-Cutting Institutional Issues

5. Conclusions and Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Sperling, D. Three Revolutions: Steering Automated, Shared and Electric Vehicles to a Better Future; Island Press: Washington, DC, USA, 2018. [Google Scholar]

- Sovacool, B.K. Experts, theories, and electric mobility transitions: Toward an integrated conceptual framework for the adoption of electric vehicles. Energy Res. Soc. Sci. 2017, 27, 78–95. [Google Scholar] [CrossRef]

- Meckling, J.; Nahm, J. The politics of technology bans: Industrial policy competition and green goals for the auto industry. Energy Policy 2019, 126, 470–479. [Google Scholar] [CrossRef]

- Styczynski, A.; Hughes, L. Public policy strategies for next-generation vehicle technologies: An overview of leading markets. Environ. Innov. Soc. Transit. 2018. [Google Scholar] [CrossRef]

- Taeihagh, A.; Lim, H.S.M. Governing autonomous vehicles: Emerging responses for safety, liability, privacy, cybersecurity, and industry risks. Transp. Rev. 2019, 39, 103–128. [Google Scholar] [CrossRef]

- Van de Kaa, G.; Scholten, D.; Rezaei, J.; Milchram, C. The Battle between Battery and Fuel Cell Powered Electric Vehicles: A BWM Approach. Energies 2017, 10, 1707. [Google Scholar] [CrossRef]

- International Energy Agency. Global EV Outlook 2020. Available online: https://www.iea.org/reports/global-ev-outlook-2020 (accessed on 1 December 2020).

- International Energy Agency. Hydrogen. Available online: www.iea.org/reports/hydrogen (accessed on 1 December 2020).

- Trencher, G.; Taeihagh, A.; Yarime, M. Overcoming barriers to developing and diffusing fuel-cell vehicles: Governance strategies and experiences in Japan. Energy Policy 2020, 142. [Google Scholar] [CrossRef]

- Nakui, K. An Overview of the Fuel Cell and Hydrogen Technology Development Policies in Japan. J. Chem. Eng. Jpn. 2006, 39, 489–502. [Google Scholar] [CrossRef]

- Ishitani, H.; Baba, Y. The Japanese strategy for R&D on fuel-cell technology and on-road verification test of fuel-cell vehicles. In Making Choices about Hydrogen: Transport Issues for Developing Countries; United Nations University Press: New York, NY, USA, 2008; pp. 64–84. [Google Scholar]

- Verheul, B. Overview of Hydrogen and Fuel Cell Developments in China. Available online: https://www.nederlandwereldwijd.nl/documenten/publicaties/2019/03/01/waterstof-in-china (accessed on 20 July 2020).

- Li, J. Charging Chinese future: The roadmap of China’s policy for new energy automotive industry. Int. J. Hydrog. Energy 2020, 45, 11409–11423. [Google Scholar] [CrossRef]

- Kendall, K.; Kendall, M.; Liang, B.; Liu, Z. Hydrogen vehicles in China: Replacing the Western Model. Int. J. Hydrog. Energy 2017, 42, 30179–30185. [Google Scholar] [CrossRef]

- Haslam, G.E.; Jupesta, J.; Parayil, G. Assessing fuel cell vehicle innovation and the role of policy in Japan, Korea, and China. Int. J. Hydrog. Energy 2012, 37, 14612–14623. [Google Scholar] [CrossRef]

- Trencher, G. Accelerating the production and diffusion of fuel cell vehicles: Experiences from California. Energy Rep. 2020, 6, 2503–2519. [Google Scholar] [CrossRef]

- Hardman, S.; Tal, G. Who are the early adopters of fuel cell vehicles? Int. J. Hydrog. Energy 2018, 43, 17857–17866. [Google Scholar] [CrossRef]

- Lopez Jaramillo, O.; Stotts, R.; Kelley, S.; Kuby, M. Content Analysis of Interviews with Hydrogen Fuel Cell Vehicle Drivers in Los Angeles. Transp. Res. Rec. 2019, 2673, 377–388. [Google Scholar] [CrossRef]

- Coleman, D.; Kopp, M.; Wagner, T.; Scheppat, B. The value chain of green hydrogen for fuel cell buses–A case study for the Rhine-Main area in Germany. Int. J. Hydrog. Energy 2020, 45, 5122–5133. [Google Scholar] [CrossRef]

- Topler, J. Hydrogen Technology and Economy in Germany-History and Present State. In Hydrogen in an International Context: Vulnerabilities of Hydrogen Energy in Emerging Markets; Lordache, I., Ed.; River Publishers: Gistrup, Denmark; Delft, The Netherlands, 2017; pp. 3–48. [Google Scholar]

- Ehret, O.; Bonhoff, K. Hydrogen as a fuel and energy storage: Success factors for the German Energiewende. Int. J. Hydrog. Energy 2015, 40, 5526–5533. [Google Scholar] [CrossRef]

- International Energy Agency. Future of Hydrogen; IEA: Paris, France, 2019; Available online: https://www.iea.org/reports/the-future-of-hydrogen (accessed on 1 December 2020).

- Cano, Z.P.; Banham, D.; Ye, S.; Hintennach, A.; Lu, J.; Fowler, M.; Chen, Z. Batteries and fuel cells for emerging electric vehicle markets. Nat. Energy 2018, 3, 279–289. [Google Scholar] [CrossRef]

- Ajanovic, A.; Haas, R. Prospects and impediments for hydrogen and fuel cell vehicles in the transport sector. Int. J. Hydrog. Energy 2020. [Google Scholar] [CrossRef]

- Lipman, T.E.; Elke, M.; Lidicker, J. Hydrogen fuel cell electric vehicle performance and user-response assessment: Results of an extended driver study. Int. J. Hydrog. Energy 2018, 43, 12442–12454. [Google Scholar] [CrossRef]

- Harborne, P.; Hendry, C.; Brown, J. The Development and Diffusion of Radical Technological Innovation: The Role of Bus Demonstration Projects in Commercializing Fuel Cell Technology. Technol. Anal. Strateg. Manag. 2007, 19, 167–188. [Google Scholar] [CrossRef]

- Lipman, T.E.; Gray-Stewart, A.L.; Lidicker, J. Driver Response to Hydrogen Fuel Cell Buses in a Real-World Setting:Study of a Northern California Transit Bus Fleet. Transp. Res. Rec. 2015, 2502, 48–52. [Google Scholar] [CrossRef]

- Olabi, A.G.; Wilberforce, T.; Abdelkareem, M.A. Fuel cell application in the automotive industry and future perspective. Energy 2021, 214, 118955. [Google Scholar] [CrossRef]

- Galich, A.; Marz, L. Alternative energy technologies as a cultural endeavor: A case study of hydrogen and fuel cell development in Germany. Energy Sustain. Soc. 2012, 2, 2. [Google Scholar] [CrossRef]

- Federal Ministry for Economic Affairs and Energy. The National Hydrogen Strategy. Available online: https://www.bmwi.de/Redaktion/EN/Publikationen/Energie/the-national-hydrogen-strategy.html (accessed on 10 December 2020).

- National Organisation Hydrogen and Fuel Cell Technology (NOW). Dashboard. Available online: https://www.now-gmbh.de/en/ (accessed on 15 December 2020).

- Fuel Cells and Hydrogen Joint Undertaking (FCH-JU). Strategies for Joint Procurement of Fuel Cell Buses. Available online: https://www.fch.europa.eu/sites/default/files/Strategies_%20for_joint_procurement_of_FCbuses_final_report.pdf (accessed on 12 December 2020).

- National Organisation Hydrogen and Fuel Cell Technology (NOW). Electric Mobility with Hydrogen and Fuel Cells: State of Development and Market Introduction in the Area of Passenger Vehicles in Germany. Available online: https://www.now-gmbh.de/wp-content/uploads/2020/09/electric-mobility-with-hydrogen-2017_en_310817.pdf (accessed on 15 December 2020).

- Ehret, O.; Dignum, M. Automobility in Transition? A Socio-Technical Analysis of Sustainable Transport; Geels, F.W., Kemp, R., Dudley, G., Lyons, G., Eds.; Routledge: New York, NY, USA; Oxon, UK, 2012; pp. 229–249. [Google Scholar]

- Budde, B.; Alkemade, F.; Weber, K.M. Expectations as a key to understanding actor strategies in the field of fuel cell and hydrogen vehicles. Technol. Forecast. Soc. Chang. 2012, 79, 1072–1083. [Google Scholar] [CrossRef] [PubMed]

- BMW Group. The Powertrain for the BMW i Hydrogen NEXT: BMW Group Reaffirms Its Ongoing Commitment to Hydrogen Fuel Cell Technology (Press Release). Available online: https://www.press.bmwgroup.com/global/article/detail/T0306930EN/the-powertrain-for-the-bmw-i-hydrogen-next:-bmw-group-reaffirms-its-ongoing-commitment-to-hydrogen-fuel-cell-technology?language=en (accessed on 15 December 2020).

- Mazur, C.; Contestabile, M.; Offer, G.J.; Brandon, N.P. Assessing and comparing German and UK transition policies for electric mobility. Environ. Innov. Soc. Transit. 2015, 14, 84–100. [Google Scholar] [CrossRef]

- Musiolik, J.; Markard, J. Creating and shaping innovation systems: Formal networks in the innovation system for stationary fuel cells in Germany. Energy Policy 2011, 39, 1909–1922. [Google Scholar] [CrossRef]

- Hekkert, M.P.; Suurs, R.A.A.; Negro, S.O.; Kuhlmann, S.; Smits, R.E.H.M. Functions of innovation systems: A new approach for analysing technological change. Technol. Forecast. Soc. Chang. 2007, 74, 413–432. [Google Scholar] [CrossRef]

- Bergek, A.; Jacobsson, S.; Sandén, B.A. ‘Legitimation’ and ‘development of positive externalities’: Two key processes in the formation phase of technological innovation systems. Technol. Anal. Strateg. Manag. 2008, 20, 575–592. [Google Scholar] [CrossRef]

- Kivimaa, P.; Kern, F. Creative destruction or mere niche support? Innovation policy mixes for sustainability transitions. Res. Pol. 2016, 45, 205–217. [Google Scholar] [CrossRef]

- Hacking, N.; Pearson, P.; Eames, M. Mapping innovation and diffusion of hydrogen fuel cell technologies: Evidence from the UK’s hydrogen fuel cell technological innovation system, 1954–2012. Int. J. Hydrog. Energy 2019, 44, 29805–29848. [Google Scholar] [CrossRef]

- Andreasen, K.P.; Sovacool, B.K. Hydrogen technological innovation systems in practice: Comparing Danish and American approaches to fuel cell development. J. Clean. Prod. 2015, 94, 359–368. [Google Scholar] [CrossRef]

- Decourt, B. Weaknesses and drivers for power-to-X diffusion in Europe. Insights from technological innovation system analysis. Int. J. Hydrog. Energy 2019, 44, 17411–17430. [Google Scholar] [CrossRef]

- Steinmueller, W.E. Economics of Technology Policy. In Handbook of the Economics of Innovation; Hall, B.H., Rosenberg, N., Eds.; North-Holland: Amsterdam, The Netherlands, 2010; Volume 2, pp. 1181–1218. [Google Scholar] [CrossRef]

- Dijk, M.; Iversen, E.; Klitkou, A.; Kemp, R.; Bolwig, S.; Borup, M.; Møllgaard, P. Forks in the Road to E-Mobility: An Evaluation of Instrument Interaction in National Policy Mixes in Northwest Europe. Energies 2020, 13, 475. [Google Scholar] [CrossRef]

- Farla, J.; Alkemade, F.; Suurs, R.A.A. Analysis of barriers in the transition toward sustainable mobility in the Netherlands. Technol. Forecast. Soc. Chang. 2010, 77, 1260–1269. [Google Scholar] [CrossRef]

- Xu, L.; Su, J. From government to market and from producer to consumer: Transition of policy mix towards clean mobility in China. Energy Policy 2016, 96, 328–340. [Google Scholar] [CrossRef]

- Pollet, B.G.; Kocha, S.S.; Staffell, I. Current status of automotive fuel cells for sustainable transport. Curr. Opin. Electrochem. 2019, 16, 90–95. [Google Scholar] [CrossRef]

- Kester, J.; Noel, L.; Zarazua de Rubens, G.; Sovacool, B.K. Policy mechanisms to accelerate electric vehicle adoption: A qualitative review from the Nordic region. Renew. Sustain. Energy Rev. 2018, 94, 719–731. [Google Scholar] [CrossRef]

- Wesseling, J.H.; Farla, J.C.M.; Hekkert, M.P. Exploring car manufacturers’ responses to technology-forcing regulation: The case of California’s ZEV mandate. Environ. Innov. Soc. Transit. 2015, 16, 87–105. [Google Scholar] [CrossRef]

- Staffell, I.; Scamman, D.; Velazquez Abad, A.; Balcombe, P.; Dodds, P.E.; Ekins, P.; Shah, N.; Ward, K.R. The role of hydrogen and fuel cells in the global energy system. Energy Environ. Sci. 2019, 12, 463–491. [Google Scholar] [CrossRef]

- McDowall, W. Are scenarios of hydrogen vehicle adoption optimistic? A comparison with historical analogies. Environ. Innov. Soc. Transit. 2016, 20, 48–61. [Google Scholar] [CrossRef]

- Leibowicz, B.D. Policy recommendations for a transition to sustainable mobility based on historical diffusion dynamics of transport systems. Energy Policy 2018, 119, 357–366. [Google Scholar] [CrossRef]

- Alvarez-Meaza, I.; Zarrabeitia-Bilbao, E.; Rio-Belver, R.M.; Garechana-Anacabe, G. Fuel-Cell Electric Vehicles: Plotting a Scientific and Technological Knowledge Map. Sustainability 2020, 12, 2334. [Google Scholar] [CrossRef]

- Whiston, M.M.; Azevedo, I.L.; Litster, S.; Whitefoot, K.S.; Samaras, C.; Whitacre, J.F. Expert assessments of the cost and expected future performance of proton exchange membrane fuel cells for vehicles. Proc. Natl. Acad. Sci. USA 2019, 116, 4899–4904. [Google Scholar] [CrossRef] [PubMed]

- Bento, N. Is carbon lock-in blocking investments in the hydrogen economy? A survey of actors’ strategies. Energy Policy 2010, 38, 7189–7199. [Google Scholar] [CrossRef]

- Yarime, M. Public coordination for escaping from technological lock-in: Its possibilities and limits in replacing diesel vehicles with compressed natural gas vehicles in Tokyo. J. Clean. Prod. 2009, 17, 1281–1288. [Google Scholar] [CrossRef]

- Matthews, L.; Lynes, J.; Riemer, M.; Del Matto, T.; Cloet, N. Do we have a car for you? Encouraging the uptake of electric vehicles at point of sale. Energy Policy 2017, 100, 79–88. [Google Scholar] [CrossRef]

- Bergman, N. Stories of the future: Personal mobility innovation in the United Kingdom. Energy Res. Soc. Sci. 2017, 31, 184–193. [Google Scholar] [CrossRef]

- Upham, P.; Bögel, P.; Dütschke, E.; Burghard, U.; Oltra, C.; Sala, R.; Lores, M.; Brinkmann, J. The revolution is conditional? The conditionality of hydrogen fuel cell expectations in five European countries. Energy Res. Soc. Sci. 2020, 70, 101722. [Google Scholar] [CrossRef]

- Bethoux, O. Hydrogen Fuel Cell Road Vehicles and Their Infrastructure: An Option towards an Environmentally Friendly Energy Transition. Sustainability 2020, 12, 6132. [Google Scholar] [CrossRef]

- Astiaso Garcia, D. Analysis of non-economic barriers for the deployment of hydrogen technologies and infrastructures in European countries. Int. J. Hydrog. Energy 2017, 42, 6435–6447. [Google Scholar] [CrossRef]

- Saritas, O.; Meissner, D.; Sokolov, A. A Transition Management Roadmap for Fuel Cell Electric Vehicles (FCEVs). J. Knowl. Econ. 2019, 10, 1183–1203. [Google Scholar] [CrossRef]

- Hardman, S.; Shiu, E.; Steinberger-Wilckens, R. Changing the fate of Fuel Cell Vehicles: Can lessons be learnt from Tesla Motors? Int. J. Hydrog. Energy 2015, 40, 1625–1638. [Google Scholar] [CrossRef]

- Ball, M.; Weeda, M. The hydrogen economy–Vision or reality? Int. J. Hydrog. Energy 2015, 40, 7903–7919. [Google Scholar] [CrossRef]

- Hardman, S.; Shiu, E.; Steinberger-Wilckens, R.; Turrentine, T. Barriers to the adoption of fuel cell vehicles: A qualitative investigation into early adopters attitudes. Transp. Res. Part A Policy Pract. 2017, 95, 166–182. [Google Scholar] [CrossRef]

- Hu, H.; Green, R. Making markets for hydrogen vehicles: Lessons from LPG. Int. J. Hydrog. Energy 2011, 36, 6399–6406. [Google Scholar] [CrossRef][Green Version]

- Bergman, N. Electric vehicles and the future of personal mobility in the United Kingdom. In Transitions in Energy Efficiency and Demand: The Emergence, Diffusion and Impact of Low-Carbon Innovation; Jenkins, K., Hopkins, D., Eds.; Taylor and Francis, Earthscan: London, UK; New York, NY, USA, 2019; pp. 53–71. [Google Scholar]

- Liao, F.; Molin, E.; van Wee, B. Consumer preferences for electric vehicles: A literature review. Transp. Rev. 2017, 37, 252–275. [Google Scholar] [CrossRef]

- Li, W.; Long, R.; Chen, H.; Geng, J. A review of factors influencing consumer intentions to adopt battery electric vehicles. Renew. Sustain. Energy Rev. 2017, 78, 318–328. [Google Scholar] [CrossRef]

- Biresselioglu, M.E.; Demirbag Kaplan, M.; Yilmaz, B.K. Electric mobility in Europe: A comprehensive review of motivators and barriers in decision making processes. Transp. Res. Part A Policy Pract. 2018, 109, 1–13. [Google Scholar] [CrossRef]

- Itaoka, K.; Saito, A.; Sasaki, K. Public perception on hydrogen infrastructure in Japan: Influence of rollout of commercial fuel cell vehicles. Int. J. Hydrog. Energy 2017, 42, 7290–7296. [Google Scholar] [CrossRef]

- Steinhilber, S.; Wells, P.; Thankappan, S. Socio-technical inertia: Understanding the barriers to electric vehicles. Energy Policy 2013, 60, 531–539. [Google Scholar] [CrossRef]

- Dong, F.; Liu, Y. Policy evolution and effect evaluation of new-energy vehicle industry in China. Resour. Policy 2020, 67, 101655. [Google Scholar] [CrossRef]

- Jacobsson, S.; Bergek, A. Transforming the energy sector: The evolution of technological systems in renewable energy technology. Ind. Corp. Chang. 2004, 13, 815–849. [Google Scholar] [CrossRef]

- Liu, Y.; Kokko, A. Who does what in China’s new energy vehicle industry? Energy Policy 2013, 57, 21–29. [Google Scholar] [CrossRef]

- Lowes, R.; Woodman, B.; Fitch-Roy, O. Policy change, power and the development of Great Britain’s Renewable Heat Incentive. Energy Policy 2019, 131, 410–421. [Google Scholar] [CrossRef]

- Markard, J.; Geels, F.W.; Raven, R. Challenges in the acceleration of sustainability transitions. Environ. Res. Lett. 2020, 15, 081001. [Google Scholar] [CrossRef]

- Adhikari, M.; Ghimire, L.P.; Kim, Y.; Aryal, P.; Khadka, S.B. Identification and Analysis of Barriers against Electric Vehicle Use. Sustainability 2020, 12, 4850. [Google Scholar] [CrossRef]

- Catenacci, M.; Verdolini, E.; Bosetti, V.; Fiorese, G. Going electric: Expert survey on the future of battery technologies for electric vehicles. Energy Policy 2013, 61, 403–413. [Google Scholar] [CrossRef]

- Greiner, R. Improving the Net Benefits from Tourism for People Living in Remote Northern Australia. Sustainability 2010, 2, 2197–2218. [Google Scholar] [CrossRef]

- Keeley, A.R.; Matsumoto, K.i. Investors’ perspective on determinants of foreign direct investment in wind and solar energy in developing economies–Review and expert opinions. J. Clean. Prod. 2018, 179, 132–142. [Google Scholar] [CrossRef]

- Zubaryeva, A.; Thiel, C.; Barbone, E.; Mercier, A. Assessing factors for the identification of potential lead markets for electrified vehicles in Europe: Expert opinion elicitation. Technol. Forecast. Soc. Chang. 2012, 79, 1622–1637. [Google Scholar] [CrossRef]

- European Comission. Clean Vehicles Directive. Available online: https://ec.europa.eu/transport/themes/urban/clean-vehicles-directive_en (accessed on 12 December 2020).

- European Parliament. Setting Emission Performance Standards for New Passenger Cars as Part of the Community’s Integrated Approach to Reduce CO2 Emissions from Light-Duty Vehicles. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:02009R0443-20180517 (accessed on 12 December 2020).

- Federal Ministry of Transport and Digital Infrastructure; Federal Ministry for Economic Affairs and Energy. Evaluation of the National Innovation Program Hydrogen and Fuel Cell Technology Phase 1. Available online: https://www.now-gmbh.de/wp-content/uploads/2020/08/now_nip-evaluation-summary_web.pdf (accessed on 4 January 2020).

- H2 Mobility. Hydrogen Cars: All Models at a Glance. Available online: https://h2.live/en/wasserstoffautos (accessed on 12 December 2020).

- Daimler Truck AG. Technology Strategy for Electrification: World Premiere of Mercedes-Benz Fuel-Cell Concept Truck. Available online: https://www.daimler-truck.com/innovation-sustainability/efficient-emission-free/mercedes-benz-genh2-fuel-cell-truck.html (accessed on 20 December 2020).

- Stolzenburg, K.; Whitehouse, N.; Whitehouse, S. JIVE Best Practice and Commercialisation Report 2 and JIVE 2 Best Practice Information Bank Report 1. Available online: https://www.fuelcellbuses.eu/sites/default/files/documents/Best_Practice_Report_January_2020__JIVE_D3.24_JIVE_2_D3.7.pdf (accessed on 28 December 2020).

- Müller, K.K.; Schnitzeler, F.; Lozanovski, A.; Skiker, S.; Ojakovoh, M. Clean Hydrogen in European Cities (CHIC): Final Report. Available online: https://fuelcellbuses.eu/public-transport-hydrogen/final-report-chic-clean-hydrogen-european-cities (accessed on 12 December 2020).

- Dolman, M.; Koch, F.; Starikovs, A. Joint Procurement of Fuel Cell Buses: Lessons Learnt. Available online: https://www.fuelcellbuses.eu/sites/default/files/documents/JIVE_D1-1_Lessons_from_FCB_Procurement_final.pdf (accessed on 28 December 2020).

- H2 Mobility. Hydrogen Stations in Germany&Europe. Available online: https://h2.live/en (accessed on 12 December 2020).

- Robinius, M.; Linßen, J.; Grube, T.; Reuß, M.; Stenzel, P.; Syranidis, K.; Kuckertz, P.; Stolten, D. Comparative Analysis of Infrastructures: Hydrogen Fueling and Electric Charging of Vehicles. Available online: https://juser.fz-juelich.de/record/842477/files/Energie_Umwelt_408_NEU.pdf (accessed on 1 January 2021).

- Randall, C. Germany Doubles EV Subsidies, No More Diesel Support. Available online: https://www.electrive.com/2020/06/04/germany-doubles-ev-subsidies-no-more-diesel-support/ (accessed on 28 December 2020).

- Federal Ministry for Economic Affairs and Energy. Liste der Förderfähigen Elektrofahrzeuge (List of Eligible Electric vehicles). In German. Available online: https://www.bafa.de/SharedDocs/Downloads/DE/Energie/emob_liste_foerderfaehige_fahrzeuge.pdf?__blob=publicationFile&v=130 (accessed on 25 December 2020).

- European Commission. The European Green Deal. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1588580774040&uri=CELEX:52019DC0640 (accessed on 31 December 2020).

- European Commission. A Hydrogen Strategy for a Climate-Neutral Europe. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52020DC0301 (accessed on 31 December 2020).

- Volkswagen Newsroom. Battery or Fuel Cell, That Is the Question. Available online: https://www.volkswagen-newsroom.com/en/stories/battery-or-fuel-cell-that-is-the-question-5868 (accessed on 30 December 2020).

- Volkswagen. Hydrogen or Battery? A Clear Case, Until Further Notice. Available online: https://www.volkswagenag.com/en/news/stories/2019/08/hydrogen-or-battery--that-is-the-question.html (accessed on 30 December 2020).

- Sovacool, B.K.; Schmid, P.; Stirling, A.; Walter, G.; MacKerron, G. Differences in carbon emissions reduction between countries pursuing renewable electricity versus nuclear power. Nat. Energy 2020, 5, 928–935. [Google Scholar] [CrossRef]

| Influencing Factor | Explanation | Key Literature |

|---|---|---|

| 4.1 Political support and policy signals | The degree to which government actors support hydrogen and fuel cell technology through policies, statements and commitments. | [16,24,61,63] |

| 4.2 Standards and regulations | The degree to which standards (e.g., for refuelling protocols and storage pressures) and regulations (e.g., hydrogen safety laws) influence the cost, risk of redundancy and diffusion speed for hydrogen mobility and infrastructure. | [24,61,66,74] |

| 4.3 Knowledge sharing networks | The availability and effectiveness of measures to stimulate the sharing of knowledge and experiences for all relevant stakeholders. | [9,39,43,61] |

| 4.4 Partnerships and coalitions | The availability and effectiveness of coalitions or partnerships that mobilise different stakeholders for joint actions like business development, research, political lobbying etc. | [3,16,39,40,77,79] |

| Focus of Question |

|---|

| (i) Supply-side (production of vehicles) |

|

| (Optional) In your view, what are the most important differences regarding the barriers or drivers related to the production or supply of fuel cell passenger vehicles and buses in Germany? |

| (ii) Infrastructure (refuelling stations and hydrogen supply) |

|

| (Optional) In your view, what are the most important differences regarding the barriers or drivers related to infrastructure (e.g., refuelling stations and supply/cost of hydrogen etc.) for fuel cell passenger vehicles and buses in Germany? |

| (iii) Demand-side (vehicle adoption) |

|

| (Optional) In your view, what are the most important differences regarding the barriers or drivers related to public awareness of demand for fuel cell passenger vehicles or buses in Germany? |

| (iv) Cross-cutting institutional issues |

|

| (Optional) In your view, what are the most important differences regarding the barriers or drivers related to cross-cutting institutional factors for fuel cell passenger vehicles or buses in Germany? |

| Sector | Example Organisations | No. Responses | Portion of Total |

|---|---|---|---|

| Industry: Automotive makers (passenger vehicles and bus) | BMW Group, Honda R&D Europe (Germany), Toyota | 4 | 14% |

| Industry: Alliances | German Hydrogen and Fuel Cell Association (DWV) | 2 | 7% |

| Industry: Consulting firms | adelphi, Clean Energy Future Consulting Bystry, Element Energy, Ludwig-Boelkow-Systemtechnik, Roland Berger, Spilett New Technologies | 9 | 32% |

| Industry: Equipment manufacturers (fuel cells and engineering) | Ballard Europe, Wenger Engineering | 2 | 7% |

| Industry: Fuel suppliers | Linde Hydrogen FuelTech, Shell Hydrogen | 2 | 7% |

| Research institutions | Centre for Hydrogen Bavaria (H2.B), Center for Solar Energy and Hydrogen Research (ZSW), The Hydrogen and Fuel Cell Center (ZBT) | 7 | 25% |

| Government (including public-private) | EnergyAgency NRW, State Agency for New Mobility Solutions and Automotive (E-mobil BW) | 2 | 7% |

| Organisation (German Abbreviation) | Country (City) | Date |

|---|---|---|

| Government agencies (public-private) | ||

| EnergyAgency NRW | Germany (Dusseldorf) | 20 October 2020 |

| Industry: Alliances | ||

| H2 Mobility Deutschland | Germany (Berlin) | 9 October 2020 |

| German Hydrogen and Fuel Cell Association (DWV) | Germany (Berlin) | 19 November 2020 |

| Industry: Automotive (bus and passenger vehicles) | ||

| Toyota Motor Europe | Belgium (Brussels) | 28 April 2020 |

| Caetano Bus | Portugal (Porto) | 26 November 2020 |

| Honda R&D Europe Germany | Germany (Offenbach) | 30 November 2020 |

| BMW Group | Germany (Munich) | 2 December 2020 |

| Industry: Consulting | ||

| HySolutions | Germany (Hamburg) | 14 October 2020 |

| WSW mobil | Germany (Wuppertal) | 19 October 2020 |

| Ludwig Bölkow Systemtechnik (LBST) | Germany (Munich-Ottobrunn) | 30 October 2020 |

| Hydrogen Power Storage & Solutions (HYPOS) East Germany | Germany (Halle [Saale]) | 12 November 2020 |

| Price Waterhouse Coopers (PwC) Germany | Germany (Berlin) | 27 November 2020 |

| EBISUblue | Germany (Kassel) | 27 November 2020 |

| Industry: Fuel suppliers | ||

| Linde | Germany (Pullach) | 30 September 2020 |

| Shell New Energies | Germany (Hamburg) | 25 November 2020 |

| Research institutes | ||

| Aachen University of Applied Sciences | Germany (Aachen) | 1 October 2020 |

| Fraunhofer Institute for Systems and Innovation Research ISI | Germany (Karlsruhe) | 30 October 2020 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Trencher, G.; Edianto, A. Drivers and Barriers to the Adoption of Fuel Cell Passenger Vehicles and Buses in Germany. Energies 2021, 14, 833. https://doi.org/10.3390/en14040833

Trencher G, Edianto A. Drivers and Barriers to the Adoption of Fuel Cell Passenger Vehicles and Buses in Germany. Energies. 2021; 14(4):833. https://doi.org/10.3390/en14040833

Chicago/Turabian StyleTrencher, Gregory, and Achmed Edianto. 2021. "Drivers and Barriers to the Adoption of Fuel Cell Passenger Vehicles and Buses in Germany" Energies 14, no. 4: 833. https://doi.org/10.3390/en14040833

APA StyleTrencher, G., & Edianto, A. (2021). Drivers and Barriers to the Adoption of Fuel Cell Passenger Vehicles and Buses in Germany. Energies, 14(4), 833. https://doi.org/10.3390/en14040833