Abstract

Attaining sustainable development and cleaner production is a major challenge both for developed and developing economies; income, institutional regulations, institutional quality and international trade are the key determinants of environmental externalities. The current work attempts to study the role of environmental taxes and regulations on renewable energy generation for developed economies. For that, the authors have used the annual dataset for the period 1994 to 2018. More specifically, the study investigates the impacts of environmental taxes, environment-related technologies and the environmental policy stringency index on renewable electricity generation in 29 developed countries. Given the short available data of these countries, the authors have developed panel cointegration and panel regressions models (fully modified ordinary least square (FMOLS), quantile regressions). The heterogeneous panel empirics stated that environmental regulations and income level support renewable electricity generation. The conclusions further mention that bureaucratic qualities such as decision making and trade openness tend to reduce renewable energy generation. The empirical findings allowed us to draw new narrative and implications. Overall, the conclusions argue that innovative regulations and policies can be useful for attaining specific sustainable development goals (e.g., SDG-7: cleaner and cheap energy).

1. Introduction

Energy has been an important, influential factor in the economic and political policies and bilateral relations of countries and in the formation of legal rules since the very first day when it began to occupy its irrevocable place in human life. Different types were added to energy—which did not have diversity in the earlier periods when it was first discovered—due to the reduction of sources and due to environmental concerns today []. The countries which have sources of energy elaborate some energy policies and implement them. Some countries with limited possibilities in terms of sources of energy, on the other hand, develop new roles for themselves in energy and play important roles in leading world policy in order not to fall out of the world order [,,].

The share of renewable energy is still small in the total energy generation despite several advantages it has [,]. It is because fossil fuels are still subsidized, the total cost of pollution is not included in the cost of fossil fuels and, as a result, the starting cost of investment in renewable energy is high []. In addition to that, energy demand is increasing slowly in developed countries, and it takes time to change the current energy infrastructure and the habits of energy use. In developing countries, however, energy demand is increasing rapidly, and fossil fuels are playing essential roles in meeting the demand []. Additionally, it does not seem currently possible for energy generated from renewable sources to compete with fossil fuels in terms of pricing.

For all these reasons, investments in renewable energy have limited possibilities to develop rapidly on its own and to compete with fossil fuel technologies, and they should be encouraged by governments so that they can reach the optimal level. Technological innovations, financial developments and possibilities for accessing new markets have effects on reducing the costs in electricity generation by using renewable sources of energy. The use of wind energy and solar energy, especially in coastal areas, can now compete with fossil fuels in terms of costs even without calculating the externalities [,,].

Previous studies have largely demonstrated that natural resources have significant effects on energy generation. Two approaches are available in this respect, namely, supply-side and demand-side approaches.

- The supply-side approach demonstrates that renewable energy sources display the same important effect on economic growth as other natural resources, labour force and capital. Thus, renewable energy sources should be prioritised in struggling with global warming [,,].

- The demand-side approach has demonstrated that the main factors determining the demand for renewable energy sources are political factors (public policy, tax, incentives, R&D spending), socioeconomic factors (income, net energy import, CO2 emission, fossil fuel prices, the share of fossil fuels used in total energy consumption), country-specific factors (access to potential renewable energy sources, deregulating the activities on electricity markets, demographic factors, urbanisation, environmental policies, etc.) [,,].

One single support instrument is not sufficient for the development of renewable energy sources because of the countries’ different access to new potential energy sources and because of the different costs of renewable technologies. The mechanisms of renewable energy incentives are generally divided into nonfiscal incentives and tax incentives. The incentives implemented in countries are in the form of subsidies aiming to increase income (tariff taxes and portfolio standards, etc.) and tax incentives directed at reducing costs. The subsidies are used as the basic instrument of policy, whereas tax incentives are rather complementary. Yet, tax incentives are quite effective vehicles, especially in reducing the starting costs of renewable energy technologies and in accelerating entrance into energy markets. Tax incentives are also used in reducing the costs and thus increasing profits in generating renewable energy. They are among the widely used types of incentives and are described as the precautions which diminish the tax burden or completely remove the tax in sectors of the economy which are to be supported []. The incentives can be given at any of the stages of production, investment and consumption. Research has also shown that tax incentives are quite influential in reducing the starting costs of renewable energy technologies and in accelerating entrance into the energy market []. Tax incentives (exceptions, reduction, low rate, etc.) are used as a complementary policy in OECD countries in general. The main instruments of tax incentives include exemption and exceptions, reduction, amortization regime, retrospective and prospective offset of losses, tax holidays and tax postponing. Apart from that, higher rates of taxation on fossil fuels and introducing additional taxes such as carbon tax are also taxational precautions [,,,,,,].

Other market-based regulation or policy instruments—which are the arrangements made by the government to make a country’s economy stable and to eliminate the imbalance in markets—represent the policies that the government implements by monitoring the market activities and the behaviors of the private sector in the economy and thus acts as a referee. One of the essential instruments of support used in encouraging renewable energy is the practice of renewable portfolio standard. It is an amount-based instrument of incentive. Accordingly, mandatory targets and quotes are set for producers to generate a certain percentage of energy through renewable sources [,]. The certificates—which are also called credit for renewable energy, the green certificate, green label or certificate of renewable energy—can be considered as a kind of environmental credit because they can also be merchandised. The possibility to buy and sell the certificates enables those who cannot meet the quota to meet their quota by buying certificates and those who exceed their quota to obtain extra income by selling the certificates. The value of green certificates is usually determined by conditions of supply and demand on the market [,,,,,,].

Other non-tax incentives: Alternative options of policy such as the public tender system and net measurement are also used for supporting renewable energy sources. The system of tender aims to increase the competition power of renewable energy. In this method, which is used especially in large scale projects, the power administration promises to buy electricity above the market price in accordance with the contract made with the firm who has won the tender. The cost of the investment to society displays minimum efficiency and this represents an important disadvantage. It becomes difficult in practice for energy producers to conduct the projects as a result of giving low bids to run power plants. In another method, net measurement, consumers are given the opportunity to generate their own electricity with renewable energy sources and to sell the surplus to the national network at high prices [,,,,,,].

The originality of this research is demonstrated by three major contributions:

- (i)

- This is the first attempt, to the best of our knowledge, to study the ambiguous role of environmental regulations on renewable energy generation. In doing so, the authors used three key variables’ data: environmental taxes, the environmental policy index and environment-related technologies for the case of 29 developed OECD countries. The reason behind selecting 29 developed OECD countries was that these countries are responsible for 35% of the global carbon emissions alone because of fossil fuel energy consumption, which recorded more than 50% early in the 1990s []. Since 2000, the CO2 emissions related to energy consumption have been reduced, while economic growth is recorded positive. This is mainly because of the structural transformation in the production processes in the industries, energy supply and energy efficiency improvements and innovation. Therefore, it is essential to identify the role of adopted variables in renewable energy generation (REG) in this specific group of countries. Based on these facts, we have constructed three models as discussed in the methodology section, to identify the influence of these three variables of concern, i.e., the policy stringency index, environmental taxes, and environment-related technologies. However, other controlled variables (discussed earlier) were included accordingly to each model. This way we can stress how environmental tax and regulations affect the renewable energy generation.

- (ii)

- The present study undertakes the role of economic and institutional factors for renewable energy generation. This is explained by the reason that overall trade activities, urbanization growth and bureaucratic decisions affect resource utilization and energy consumption. In such a scenario, effective decision making and environmental policies can together trigger renewable energy generation. Few of the recent studies showed that trade openness and renewable energy use are cointegrated in the long run. They have also demonstrated a one-way causality running from trade openness to renewable energy use in the short run []. The same causality was found analysing MENA economies. By applying folly modified ordinary least squares (FMOLS) regression, some authors demonstrated that trade openness and institutional stability are major determinants for the environment state []. Some authors demonstrated that bureaucratic quality is a significant factor for decreasing pollution in the long run, and there is a negative one-way relationship running from CO2 emissions to bureaucratic quality []. Others indicated that the quality of institutions and renewable energy use positively influence economic growth and the environment for 85 developed and developing counties, using FMOLS panel estimations []. It was demonstrated that institutional factors determine a decrease of pollution and an increase of economic growth for D-8 countries which use mainly conventional energy and display a low institutional frame, during 1990–2016, by applying Autoregressive Distributed Lag (ARDL), Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS) techniques [].

- (iii)

- Lastly, the current study offers novel findings and new implications regarding sustainable development and overall cleaner production. In doing so, the study attempts to highlight new policies regarding sustainable development goals (SDG-7: cleaner and cheap energy) for developed economies. Developed countries turn towards renewable energy sources to reduce their energy dependence, diversify their energy sources, diminish the risks and shocks that can be experienced in the context of sudden increases of primary energy input prices, reduce and prevent local and global environmental problems, cause low carbon effects, create new areas of business, expand the economy and make positive contributions to employment []. Additionally, renewable energy also supports the access to energy sources at appropriate prices [,,].

The rest of this research is organized as follows: Section 2 presents the findings of the previous studies on this topic, Section 3 presents the data and methodology used, Section 4 presents and discusses the empirical results; conclusions reiterate the major findings of the paper. The last section designs some practical and policy recommendation.

2. Literature Review

The debate about environmental taxes, energy consumption and generation and environmental protection has gained interest and supported the design of some important policy measures such as pollution taxes in industries, the control of the energy price, settling the energy consumption for each economic sector and elaborating some economic and environmental policy frames []. Many researchers have proven that implementing the environmental tax decreases greenhouse emissions and the use of fossil fuels [,,]. Still, the results are mixed, depending on the analyzed countries or the methods used in the analysis.

Many studies have demonstrated that pollution tax does not help decrease energy demand in all cases, but it can help elaborate some important efficiency measures for energy use [,]. He et al. [] analyzed the relationship between environmental taxes and energy efficiency for OECD economies and found that environment-friendly technology displays a positive influence on energy efficiency. Morley [] has studied the influence of environmental tax on energy consumption in European countries using the generalized methods of moments (GMM) model and found that environmental taxes do not significantly impact energy consumption of the analyzed economies. This weak relation between energy use and environmental taxes in Europe has already been emphasized by many previous studies [,,]. In Borzan [], using a fixed panel quantile regression, the authors found that environmental tax determines a significant increase of energy use for EU economies based on low energy consumption, while for developed EU economies, it determines an insignificant decrease in energy use.

Many studies have demonstrated the efficiency of implementing environmental taxes on reducing CO2 emissions [,,,,,,]. Hashmi and Alam [] investigated the impact of environment-related innovations and environmental taxes on mitigating emissions for OECD countries using GMM and fixed effects regressions. They found that environmental taxes reduce CO2 emissions. The same results were obtained by other studies [,] for OECD countries and China or for Nordic and G7 countries. Others found that the environmental U-curve is valid for the environmental regulations and CO2 emissions in China [].

Wolde-Yemane and Weldemeskel demonstrated that both the environmental policy stringency index and environmental taxes represent major tools in fighting against environmental pollution for emerging economies, based on heterogeneous panel data where cross-sectional dependence was analyzed and the Augmented Mean Group estimator (AMG) was used []. However, Mardones and Cabello [] have shown that environmental taxes do not have a significant influence on CO2 emissions in Chile. Some other authors [,] even demonstrated that environmental taxation increases polluting emissions both in developed and developing economies or in EU countries, respectively, or the role of renewable energy on reducing pollution. Alola et al. reached the same conclusion for EU countries using Granger causality and cointegration tests [].

The relation between environmental tax and economic growth showed mixed results. Andreoni [] demonstrated that environmental taxation decreases GDP in European countries. Others have also demonstrated a negative relation between environmental taxes (% of GDP) and economic growth in Romania []. On the contrary, Lin and Jia found a bidirectional relation between environmental taxation and economic growth in China [].

The results on the relation between GDP and renewable energy use are also mixed. Chang et al. performed a panel regression analysis for OECD countries during 1997–2006 and found there was no direct relation between GDP and renewable energy use []. A stronger relationship between renewable energy use and GDP growth was found for the countries with a high GDP growth rate. A bidirectional causal relation between renewable energy consumption and GDP growth was found for CEE countries as a whole and most of CEE countries (except Romania and Bulgaria) during 1990–2014 based on an ARDL approach [].

A bidirectional causality between renewable energy and economic growth was demonstrated for China during 1977–2011 []. Examining 34 OECD economies during 1990–2010, some authors proved there is bidirectional causality between renewable energy consumption and GDP []. For MENA countries, a bidirectional causality was found between economic growth and renewable or fossil fuel energy in the long run []. In a study that analyzed 18 emerging countries by FMOLS approach, authors found a unidirectional causality from economic growth to renewable energy consumption []. Same findings were achieved for MENA countries that rely on oil exports [], for Turkey [] or for Baltic countries []. On the other hand, no cointegration and no causality were found between renewable energy consumption and economic growth in Turkey in the long run [].

The nexus between economic growth, energy consumption and pollution was extensively investigated for many countries using various econometric methods, but few studies have included the variable of urbanization as a determinant of pollutant emission. Despite the studies that found a direct connection between urbanization, economic growth and energy consumption [], which leads to pollution increase, there are a few papers that have found a negative impact [] or an insignificant impact in emerging countries [].

There are studies analyzing the nexus between urbanization and renewable and nonrenewable energy consumption in OECD countries using data during 1980–2011 []. They proved that population, urbanization and population density represent important variables determining fuel fossil energy consumption. Total population also plays a major role in explaining renewable energy consumption. Still, Granger causality tests found no causality between renewable energy use and urbanization or other explanatory variable used in the analysis.

Yang et al. investigated the nexus between urbanization and renewable energy consumption. The increase of renewable energy consumption is determined by the urbanization ratio, energy intensity effect, economic growth and population increase. They have found a positive relationship between population or economic growth and renewable energy consumption, and a negative relationship between energy intensity and renewable energy consumption. They have also found that urbanization is more significant for the total energy consumption growth than for renewable energy consumption [].

Some studies deal with the relationship between trade openness and CO2 emissions [,]. All of them proved that trade openness determines a growing specialization of these opened economies in goods produced by energy-intensive economic sectors that increase pollution. Another explanation for the direct and positive impact of trade openness on pollution is represented by the fact that export sectors often benefit from lax environmental regulations. However, other studies [,] have proved that trade openness decreases pollution and energy consumption in the Arab Emirates or in the OECD countries.

Furthermore, only a few studies have included urbanization and trade openness at the same time in their research. A unidirectional causal relation from urbanization to energy consumption (positive relation) and significant positive relation between trade openness, GDP, energy consumption and pollution was found based on a European panel country []. Others proved a direct positive relationship between urbanization, trade openness and CO2 emission per capita, while renewable energy per capita and fossil energy price display a negative relationship with CO2 emission per capita. The impact of GDP per capita on CO2 emissions validate Environmental Kuznetz Curve (EKC) based on a fixed-effects model for G-20 countries during 2001–2010 []. Nathaniel et al. found no significant impact of renewable energy use on environmental quality in Middle Eastern and North African countries [].

Based on panel causality tests and panel cointegration tests, a significant negative relation was found for the long-time relationship between trade openness and renewable energy use in emerging economies during 1980–2015 []. Using ARDL test and Vector Error Correction Model (VECM) techniques, others found a bidirectional causality relationship between renewable energy consumption and trade openness in Brazil and India during 1971–2010 []. The same bidirectional causality was found in China, Sweden and the UK based on a GMM estimator during 1990–2011 [] or in Brazil []. Dogan and Seker found that trade openness and renewable energy consumption are cointegrated, but there is no causality between them during 1980–2012 in EU countries based on panel Granger causality test [].

Institutional stability is a major factor positively impacting environmental quality and sustaining economic output. The same study demonstrated that both renewable or conventional energy negatively impacts the environment, but institutional quality and environment-related technologies can support both environmental protection and economic growth.

Some research demonstrated a long-term causality running from all the institutional quality factors (bureaucratic quality, corruption, etc.) to renewable energy use, and they proved that these variables are cointegrated in MENA countries. When these institutional quality factors are included in the regression, all of them strongly determine renewable energy use, and the impact of renewable energy on GDP is stronger if institutional factors are added in the regression model. The influence of GDP on renewable energy use is unchanged whether institutional quality factors are included in the regression or not. Investments in renewable energy sources should be supported by a high-quality environmental frame—that can help countries to achieve their sustainable development goals []. Bellakhall et al. [] showed that low quality of institutional frame negatively affects investments in renewable energy sources for MENA countries, but this effect is counter-backed by trade openness. The positive trade effect on renewable energy investments is much more visible in countries displaying a poor institutional frame.

If the relation between renewable energy consumption, CO2 emissions and environmental tax or GDP was largely analyzed in previous studies, the relation between renewable energy generation and other variables were scarcely presented and only in relation with GDP or environmental tax. But environmental protection and depleting fossil fuels claim for an increase of renewable energy production and consumption. The EU has proposed a system with a growing share of renewable electricity sources [] and an ambitious goal of 100% renewable energy [].

Simionescu et al. found a very low positive impact of GDP per capita on renewable energy in electricity during 2007–2017 for EU countries, except Luxembourg. However, causality between the two variables was not identified based on Granger causality tests []. Others proved that environmental taxes positively supported the increase of renewable energy consumption or renewable electricity generation in the Baltic states during 2005–2015 [].

3. Methodology

3.1. Data Sources and Model Development

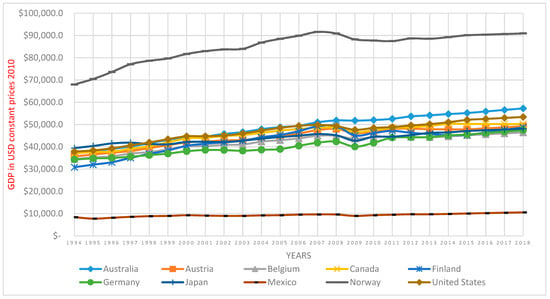

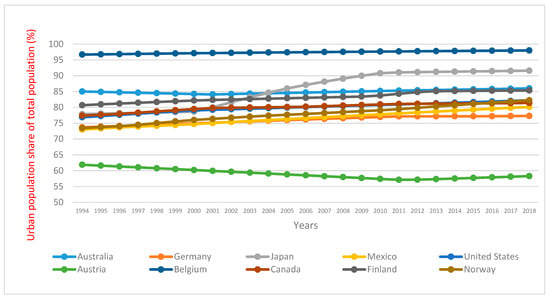

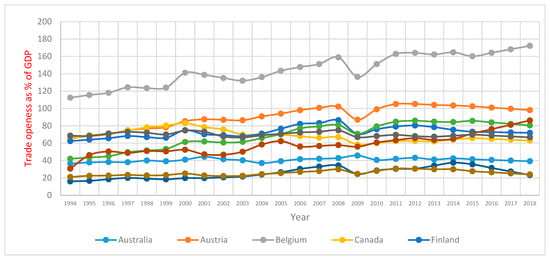

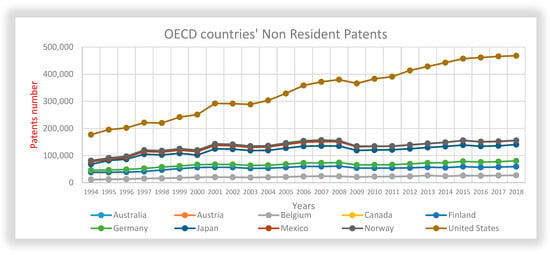

This study aims to check the role of environmental taxes, environment-related technologies and the environmental policy index on renewable energy generation (REG). For that, the study used the data of 29 developed countries (OECD member states) for all studied variables (Table 1) throughout 1994–2018 (The country list is provided in Appendix A in Table A1). Table A1 highlights the list of analyzed OECD countries. The dependent variable (REG) was taken as electricity generation produced by several renewable sources such as hydro powers, wind power, solar power, geothermal, biomass and biofuel, etc. The reason for taking the variable electricity from renewable energy sources is that electricity is being used for both residential and commercial purposes all over the world. Also, renewable energy has been one of the main sources of electricity in the past few years []. However, the controlled explanatory variables were gross domestic product (GDP), urbanization, trade openness, bureaucratic quality and non-resident patents. The authors attempted to use three key factors to check the impacts of environmental regulations and policies. These factors included environmental taxes, environment-related technologies and the environmental policy index. Based on these three key variables, the authors built three preferred model specifications. The variables gross domestic product (GDP), urbanization, trade openness, bureaucratic quality and non-resident patents were considered as controlling factors. The variables, along with their specifications and data sources, are presented in Table 1. However, detailed definitions and figures graph for ten OECD countries are provided in Appendix A: Figure A1 represents GDP; Figure A2 represents urbanization; Figure A3 represents trade openness; Figure A4 represents non-residential patents and Figure A5 represents environment-related taxes. Based on the noncontrolled variables, three constructed models are given as:

Table 1.

Variables’ specification.

Model 1:

Model 2:

Model 3:

For all the concerned variables we have used the log (ln) form purposively, to convert their growth pattern from exponential to linear and proportional variance to constant variance. Notably, the main reason for using three-model specification was that the environmental policy index comprises several environmental indicators, and such an approach can give us some robust and consistent outcomes. Moreover, governance-related impact, economic activities and environmental regulation impact have been identified separately in three different models to avoid the multicollinearity and endogeneity issues because of the inclusion of an indexed variable.

3.2. Estimation Strategy

Ignoring the issue of cross-section dependence may deliver inconsistent and misleading results []. So, before testing the properties of stationarity, this study employed the Breusch–Pagan LM test and Pesaran cross-sectional (CD) test to identify the cross-section dependence/independence. For the Pesaran (CD) test, the general equation is given as:

For the Pesaran (CD) test, the null hypothesis illustrates independence. At the same time, the alternative hypothesis reveals the validation of cross-section dependence.

As the authors worked on panel data, it was important to ascertain the stationarity properties for the data. In this concern, we utilized the Fisher’s augmented Dickey–Fuller test and the Phillips–Perron unit root tests developed by some authors in their studies [,]. This approach was applied on the panel for both at level and at first difference. Both tests assume the null hypothesis as the presence of the unit root in the data.

In an attempt to find whether the study variables were in the long-run correlation or not, we employed three tests, i.e., the Pedroni residual cointegration test [], the Kao residual cointegration test [] and the Johansen Fisher panel cointegration test, specifically. The null hypothesis for the panel statistics of all these three tests reveals no cointegration, while the alternative hypothesis for certain panel statistics validates cointegration.

3.3. Long-Run Estimates

For the long-run estimates and elasticities of the variables in comparison to the dependent variable, we have applied fully modified ordinary least square (FMOLS) []. The author illustrates that the common time dummies are proposed to capture some sort of cross-sectional dependence. After FMOLS, we also checked into the data whether it possessed random effects of fixed effects. Therefore, we used the test assuming random effects as the null hypothesis []. However, the statistics confirmed a suitable model with fixed effect. Hence, the fixed effect ordinary least square (OLS) was employed to estimate the elasticities and the real impact of the independent variables on renewable energy generation, which was the dependent variable (random effect estimations are available on demand).

Quantile regression is the expansion of a collection of models with specific conditional quantile functions of the classical least square approximation of the conditional mean []. Conventional OLS enables researchers to estimate only the conditional “mean and median” positioned at the distribution’s center, which may give an inadequate sketch in a conditional distribution []. In contrast, the quantile regression, beside the conditional mean, simply gives evidence concerning points in the conditional distribution [,,]; in this way, it gives a full representation of the distribution. Additionally, there are numerous other features of quantile regression. Firstly, instead of the sum of squared residuals, the quantile regression estimator reduces the weighted sum of absolute residuals, and hence the predicted coefficient variable is not responsive to outliers. Secondly, a quantile regression model utilizes a linear representation of programming as well as facilitates an investigation. Thirdly, when the conditional distribution does not pose a standard shape, such as fat-tailed, asymmetric or truncated distribution, this analysis is beneficial. Thus, a far more comprehensive analysis of predictors’ influence on the dependent variable can be obtained through the quantile regression approach. It is important to mention here that the prime reason for the applying quantile regression method is to gain a more in-depth relationship between the environment-related factors and renewable energy generation. The quantile regression method helps to improve the traditional mean of the dependent variable with certain values of the independent variables. In general, quantile regression is applied at conditional quantiles, which show different impacts, or it can give us the idea about range of effects of key variables of interest on the dependent variable. Panel quantile regression also reports different impacts of variables over different time spans []. For instance, quantile regression is applied here at 25th, 50th and 75th quantiles, and it provides more robust and heterogeneous impacts of the exogenous variables on the dependent variable. The quantile method reports the heterogeneous effects of covariates through conditional quantiles of the key response factors. It is also a recommended approach to gain conditional quantile impacts of different variables [].

The basic and simple model for quantile regression identifies the conditional quantile of explanatory variables as a linear function and is given as:

4. Empirical Results and Discussion

4.1. Descriptive Statistics

Table 2 represents the descriptive statistics for all the variables under discussion. The mean and median values and the maximum and minimum values for each variable are provided. Also, the values for standard deviation show that the variation of each variable’s value from its mean was not at a higher distance. Moreover, for the normality of the data, the test statistics of Jarque–Bera revealed that except for trade openness, which was normally distributed, all other variables were not normally distributed.

Table 2.

Descriptive statistics.

4.2. Preliminary Analysis

Each of these variables may or may not have cross-sectional dependence. However, to check whether there was cross-sectional dependence between the study variables, we used the Breusch–Pagan LM test and the Pesaran CD test under the null hypothesis of no cross-sectional dependence.

The results are displayed in Table 3 both for the Breusch–Pagan LM test and Pesaran CD test for all the three models we have applied. The results indicated highly significant values for all three models. Hence, we rejected the null hypothesis and accepted the alternative assumption that the variables were cross-sectionally dependent.

Table 3.

Cross-sectional dependence empirics.

The results of various panel unit root tests such as Fisher’s augmented Dickey–Fuller (ADF) and Phillips–Perron are presented in Table 4. While testing the stationarity of each variable at the level and also at the first difference, the null hypothesis for these tests “the presence of unit root in the panel” was rejected (i.e., the variables were nonstationary) for all the variables, i.e., renewable energy generation, the policy stringency index, gross domestic product (GDP), urbanization, trade openness, bureaucratic quality, environment-related technologies, environmental taxes and non-resident patents. As both values of the above-mentioned tests were significant at the level and the first difference, we rejected the null hypothesis and accepted that the panel data was stationary at level and at first difference. The values of all the discussed variables were highly significant at the 1% level of significance at the first difference. The values for all the variables at level were also significant at 1% except for urban population share, which was significant at the 5% significance level in both unit root tests and non-residential patents, which was significant at 5% significance level only in the Phillips–Perron results output. Based on the results, all the variables were stationary at level and at first difference. As a matter of fact, the entire series was integrated of order zero, i.e., I(0) and order 1, i.e., I(1).

Table 4.

Panel unit root testing.

4.3. Panel Cointegration Analysis

To identify the long-run correlation between the analyzed variables, we employed various cointegration tests such as the Pedroni residual cointegration test, Kao residual cointegration test and Johansen Fisher panel cointegration test, each test being discussed below.

Firstly, the result outcomes from employing the Pedroni residual cointegration test to all the variables in the three models are provided in Table 5a. The null hypothesis for the cointegration test is well-known: “there is no cointegration among the variables.” Based on the results of the cointegration test under discussion in these three models, Model 1 and Model 3 were counted as significant as six (i.e., Panel PP-Statistic, Panel ADF-Statistic, weighted Panel PP-Statistic, weighted Panel ADF-Statistic, Group PP-Statistic and Group ADF-Statistic) out of the total eleven statistics were highly statistically significant. Model 2 displayed only five (i.e., Panel PP-Statistic, weighted Panel PP-Statistic, weighted Panel ADF-Statistic, Group PP-Statistic and Group ADF-Statistic) significant statistics out of the total. Hence, based on Pedroni residual cointegration test, it was confirmed that there was a long-run correlation between the variables of Model 1 (renewable energy generation and environmental policy index along with other variables) and Model 3 (renewable energy generation and environmental technologies along with other variables), whereas long-run correlation found in Model 2 was less significant.

Table 5.

(a) Pedroni residual cointegration test. (b) Kao residual cointegration test. (c) Johansen Fisher panel cointegration test.

To check the true long-run cointegration among the variables in all the three models, the Kao residual cointegration test has been employed. The statistics, as provided in Table 5b, for all the three models, indicated highly significant values that rejected the null hypothesis, i.e., “there is no cointegration among the variables.” Instead, the variables were highly cointegrated in the long run.

After the Pedroni and Kao residual cointegration tests, we employed the Johansen Fisher panel cointegration test to confirm the long-run cointegration between the analyzed variables. The results are provided in Table 5c, demonstrating the long-run correlation between the analyzed variables. Similar to the earlier Pedroni and Kao cointegration tests’ null hypothesis, “the absence of cointegration between the variables” has been rejected, as all the values for Model 1, Model 2 and Model 3 were statistically significant. Hence, we accepted the alternative hypothesis and concluded there was a long-run correlation between the analyzed variables.

All the cointegration tests revealed the long-run correlation between the variables and signified that the findings of the current study are consistent with the results of other previous studies that indicate that there is cointegration between renewable energy and GDP [], trade openness [,], bureaucratic quality [], patents and environmental taxes [].

4.4. Long-Run Empirics and Discussion

The long-run estimates using the fully modified ordinary least square (FMOLS) are given in Table 6a. In Model 1, the panel’s GDP’s coefficient value was positive and statistically significant at the 1% level. The GDP coefficient value indicated that a one percent increase caused a 0.918% increase in renewable energy generation (REG). In the same model, the urban population also showed a positive and highly significant impact on REG. Specifically, it indicated that a one percent increase in the urban population caused a 0.728% increase in the dependent variable. Another variable was trade openness, which displayed a negative but significant value at the 10% level, indicating that a one percent increase in trade openness triggered down the REG by 0.266 percent. Here, bureaucratic quality presented a negative sign, but its effect was insignificant. Environmental taxes played a positive and significant role in renewable energy generation. To be more specific, an increase of one percent of environmental taxes increased the REG by 0.025%. It is well known that an increase in nonrenewable energy consumption leads to higher CO2 emissions [], which in turn causes environmental degradation [,] and this determines the law enforcement institutes and governments to implement strict rules and heavy environmental taxes that will target REG as well as its consumption. Finally, non-residential patents in the same model displayed a negative and highly statistically significant REG impact. It is noted that a one percent increase in the non-resident patents decreased the REG by 0.168%.

Table 6.

(a) Long run estimates using folly modified ordinary least square (FMOLS). (b) Long run estimates using fixed effects.

In the second model (Model 2), we have included environment-related technologies by replacing environmental taxes. Environment-related technologies showed a positive and highly significant impact on REG, indicating that a one percent increase in environment-related technologies increased REG by 1.128%. GDP and urban population reflected the same significant relation as in Model 1, with a slight difference in coefficient values. A one percent increase in GDP and urban population increased the REG by 0.726% and 0.900%, respectively. However, bureaucratic quality in the second model showed the opposite sign than the sign displayed in Model 1, but also insignificant. The relationship and the impact of trade openness and non-residents patents were found to be the same as in the previous model, where it was revealed that a one percent increase in either of these variables could determine a decrease of REG by 0.715% and 0.178%, respectively.

Replacing environmental taxes with the policy stringency index in Model 3 revealed positive and statistically significant results at the 1% level, reporting that a one percent increase of the policy stringency index enhanced REG by 0.651%. At the same time, GDP and urban population presented the same relationship and highly significant impact as in the previous models with a slight difference in coefficient values. Interestingly, here trade openness not only displayed insignificant results but also changed its impact from negative to positive on the REG variable. Similarly, bureaucratic quality exhibited a negative but insignificant relationship with the dependent variable. Finally, non-resident patents followed the same pattern of negative and statistically significant results, revealing that a one percent increase of non-resident patents caused a reduction of 0.188% in REG.

The findings of this current study show consistency with the results achieved by existing studies, revealing the positive impact of GDP [,] and urbanization [] on REG, and inconsistency with the findings of other studies [] concerning urbanization’s effect on renewable energy consumption. Specifically, an increase in per capita GDP and urbanization led to more environmentally friendly energy generation and consumption. The negative impact of trade openness on REG, as discussed earlier, revealed that trade openness provides opportunity to economies for product specialization and because of that, countries increase their consumption of non-renewables and lowers REG. These outcomes are consistent with the findings of other authors []. Bureaucratic quality showed mixed results, i.e., first showed a negative impact on REG in Model 1 and Model 3, which is consistent with the findings of other studies [,]. However, in Model 2 it showed a positive impact on REG, consistent with the findings of other authors []. Environmental taxes are being used to fight against CO2 emissions [], hence, they play a positive role in promoting REG. Finally, environment-related technology was also found to have consistent results with the empirical findings of some other authors []. Moreover, eco-innovation and R&D lowers nonrenewable energy consumption and enhances the use of renewable energy sources.

For identification in the model(s), whether it possesses random effects or fixed effects, we employed the Hausman test [], as shown in Table 6b. The test offers random effects in the concern model as the null hypothesis. However, the chi-square values here were highly significant, which led to the rejection of the null hypothesis. Therefore, the models have been estimated using fixed effect (the random effect model is available on demand).

The fixed effect estimates have asserted that GDP, urbanization and trade openness carried a positive and statistically significant influence over REG. All three variables were significant at the 1% level in all three models we have built. The results show consistency with the findings of some other authors [,,,]. In contrast, bureaucratic quality was found to have a highly statistically significant but negative impact on REG. The findings are also supported by other empirical findings [,]. Also, non-resident patents carried a negative influence over REG, but this influence was insignificant in Model 1 and Model 2 and highly statistically significant in Model 3. Additionally, the impact of environmental taxes in Model 1 was found to be positive and statistically significant, which revealed that a one percent increase in environmental taxes boosted REG by 0.038%. In Model 2, environment-related technologies were also found to have a positive and highly significant impact over REG. Specifically, a one percent increase in environment-related technologies enhanced REG by 0.232%, consistent with the empirical findings of some other authors []. Finally, the policy stringency index in Model 3 also indicated a positive and highly significant effect on REG. If the former increased by one percent, it caused a 0.108% increase in the latter.

After estimating the results for the concerned variables via FMOLS and fixed effect, it was also important to check the magnitude of each variable in three quantiles, i.e., 0.25, 0.50 and 0.75. The estimated results for Model 1 are presented in Table 7a. Among these variables, GDP, urbanization and environmental taxes showed a positive and highly significant impact over REG. However, the magnitude of GDP and urbanization decreased moving from the first quantile (0.25) to the third (0.75) quantile. In contrast, environmental tax magnitude increased moving from lower (0.25) to higher (0.75) quantile. Trade openness also showed significant results, but its impact and magnitude varied while moving from lower to higher quantile. At the initial stages, trade openness contributes to renewable energy, but after reaching a certain point, economies tend to get product specialization, which ultimately leads to more production/manufacturing activities and causes environmental damage.

Table 7.

(a) Estimates of quantile regression. (b) Estimates of quantile regression. (c) Estimates of quantile regression.

Non-resident patents showed a consistently negative and highly significant impact over REG; however, changes in the magnitude of coefficient values were also observed among these three quantiles. Bureaucratic quality showed inconsistent impact over the dependent variable (REG), i.e., a negative and insignificant effect in the 0.25 and 0.75 quantiles, but a significant impact in the 0.50 quantile. That shows that when bureaucratic quality is not entirely and efficiently working, it may hinder REG.

In the same three quantiles, the empirical investigation was conducted for Model 2, represented in Table 7b. In this second model specifically, GDP and urbanization followed the same pattern as in Model 1, positive and highly statistically significant with a slight decrease in the magnitude from lower to higher quantile. Environment-related technologies were also found to have a positive and highly significant impact on REG, with a decreasing magnitude over the quantiles from 0.25→0.50→0.75.

In addition to the previous, trade openness presented the same impact as bureaucratic quality, i.e., positive and highly significant in the 0.25 and 0.50 quantiles, but negative and insignificant impact in the 0.75 quantile. Also, the magnitude of trade openness decreased when moving quantiles. Bureaucratic quality in this model exhibited different outcomes than the previous model. At 0.25 quantile, bureaucratic quality was positive and significant at 5%, at 0.50 quantile, still positive and significant at 1%, but at 0.75 quantile, it became insignificant with a noticeable decrease in magnitude. Finally, non-resident patents displayed negative and highly statistically significant results throughout the model, but a slight change has been observed in its magnitude.

Moving to the last model (Model 3), quantile regression results are presented in Table 7c. It was confirmed that GDP, urbanization, trade openness, bureaucratic quality and non-resident patents presented a similar impact and significance level as in Model 2, with a slight change in magnitude across quantiles. However, the policy stringency index displayed a positive and highly statistically significant influence on REG. The magnitude was reported as decreasing while moving from the lower quantile to the higher quantile (0.25→0.50→0.75). This indicated that policy stringency magnitude shrinks over time, but the impact is highly significant.

5. Concluding Remarks and Implications

According to the results of the current study, GDP’s impact on renewable generation was strong and positive, and it was higher in models where the environmental stringency index and environmental tax were included. Other important factors positively impacting renewable energy generation were environment-related technologies, urbanization and the environmental policy stringency index that also displayed a positive impact on renewable energy generation. However, their impact decreased in time, according to the quantile panel estimations. The results of bureaucracy quality on renewable energy generation were not conclusive in all the estimations, but we must emphasize its negative impact on renewable energy generation in all three models estimated by fixed effects OLS. In Model 2, where bureaucracy quality was included together with environment-related technologies, its impact was highly significant and positive, but it also became insignificant in time, moving into the quantiles. When it was included together with the environmental stringency index, its impact was significant but negative at the beginning and became insignificant in time. Analyzed together with environmental tax, its impact was much weaker and negative, but it increased in time. These different impacts of this explanatory variable show that bureaucratic performance of institutions should be consistent in time for increasing renewable energy generation and for achieving sustainable development goals. Its positive impact on renewable energy generation was enhanced by adopting environment-related technologies. Trade openness negatively and strongly impacted renewable energy generation in time, affecting foreign investments in this area, but this was a strong explanatory variable positively impacting renewable energy generation. Quantile panel regressions show that, first, its impact was positive, but its impact turned into a negative one in time. The changing impact of trade openness can be explained by the product specialization process that requires more conventional energy use and a stronger institutional quality in developed countries. A greater positive impact of trade openness could be observed when it was analyzed in the presence of environmental tax. Innovation in the environmental area expressed as the number of non-residents’ environment-related patents represented a factor with a weaker and negative impact, but the least significant variable positively impacting renewable energy generation was environmental tax, although the results showed that its impact increased in time. According to the results, this instrument proves its efficiency in the long run, not in the short run.

Thus, economic growth and urbanization will support renewable energy generation across countries. Their positive effects will be enhanced by the measures adopted at the international or national level of stringency in the environmental area and by adopting clean environment-related technologies. Investments in renewable energy capacities continuously increased, overcoming the investments in conventional energy capacities, and their cost significantly decreased, although there were short periods of cost increase after the financial crisis of 2008–2009 []. Many countries worldwide adopted renewable energy targets, but to reach them, some coordinated policies should be designed and applied. Many models and scenarios show large implementation of clean technologies by 2030–2050 []. To support investments in renewable energy (RE) capacities, public authorities can use tax subsidies, credit guarantees, financing R&D investments in this area (R&D investments in the energy area decreased during the last decades) or tight environmental regulations. However, lately, public support for clean technologies significantly developed. Environmental tax solely does not represent a solution for increasing renewable energy generation or use because of a highly competitive frame in the energy and environmental tax area and because of the lack of significant effects in the short run. Based on the results, we can recommend a continuous adoption of environmental regulations at national and international levels that supports renewable energy generation and environmental protection. It is also necessary to develop performant environment-related technologies by supporting foreign investments in this field through implementing friendly policies in this area, especially in countries that lack major financial resources, by supporting R&D activities in the RE area and by decreasing the subsidies for fossil fuel energy. The polluters should pay for their actions. For achieving the goal of better environmental protection and sustainable environment, export sectors should face much stricter environmental regulations, because such lax regulations contribute to high specialization of these economies in the economic sectors based on conventional energy-intensive products. The bureaucratic performance of institutions should improve and be more consistent in time.

In order to achieve sustainable development goals, the use of renewable energy sources should go beyond the electricity energy area. The countries that have access to large renewable energy sources should invest more and more in that available energy sources area in order to ensure fair, cheap and full access to them for all. Ensuring fair and affordable access to sustainable energy for all will lead to new economic perspectives, create new jobs, contribute to better health of the population, welfare, social and economic development of all economies. The positive impacts of environmental regulations as a whole guide us that developed OECD nations can integrate resources for promotion of cleaner and renewable energy sources. Such an approach will be useful for achieving the sustainable development goals (SDG-7: clean and cheap energy for all). Similarly, OECD countries can allocate a specific amount of capital for the technological advancement and promotion of cleaner technologies and sustainability. Such initiatives as a whole might be fruitful to reducing greenhouse gas emissions and overcoming energy security issues. In the same line, our study guides that decision making at the bureaucratic level for energy mix and overall economic policies should be synchronized and effective. Legislators and policy makers should be careful and should ensure that environmental regulations are implemented effectively. For instance, there must be policies for providing subsidies for replacing fossil fuels with renewable sources to avoid market disruption of coal and oil, and an effective carbon price mechanism, etc.

Limitations of this study are represented by the sample of countries included in the analysis and by the explanatory variables included in the analysis. Renewable energy generation and consumption represent a complex process influenced by a wide range of factors. Analyzing developing countries in the context of renewable energy generation could represent further research, because these countries rely mostly on conventional energy sources and also face important financial constraints. Including a few more explanatory variables into the analysis, such as corruption or other institutional quality factors, governmental public expenses or R&D expenses for environmental purposes, foreign direct investments (FDI) or financial development index and energy prices index, could also represent a direction for further research, or some other methodology can be applied, such as using AMG estimator for determining renewable energy generation development in the presence of cross-sectional dependence among variables.

Author Contributions

This paper is the result of joint work by all the authors. U.S. (conceptualization, data, estimations, editing); M.R. (literature review, introduction, supervision, editing); S.R. (methodology, discussion); C.I. (introduction, editing); Z.Y. (conclusions, editing); S.A.I. (estimations). All authors have read and agreed to the published version of the manuscript.

Funding

No funding was received for this research.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Dataset used in the analysis are available at the web sources indicated in Table 1.

Conflicts of Interest

The authors declare no conflict of interests.

Abbreviations

| REG | renewable energy generation |

| FMOLS | fully modified ordinary least square |

| OLS | ordinary least squares |

| SDGs | sustainable development goals |

| MENA | Middle East and North Africa countries |

| R&D | research and development |

| GDP | growth domestic product |

| GMM | generalized methods of moments |

| EU | European Union |

| CD | cross-dependence |

| ICRG | International Country Risk Guide |

| FDI | foreign direct investments |

Appendix A

Table A1.

List of developed OECD countries under study.

Table A1.

List of developed OECD countries under study.

| No. | Countries | No. | Countries |

|---|---|---|---|

| 1 | Australia | 16 | Luxembourg |

| 2 | Austria | 17 | Mexico |

| 3 | Belgium | 18 | Netherlands |

| 4 | Canada | 19 | New Zealand |

| 5 | Czech Republic | 20 | Norway |

| 6 | Denmark | 21 | Poland |

| 7 | Finland | 22 | Portugal |

| 8 | France | 23 | Slovak Republic |

| 9 | Germany | 24 | Spain |

| 10 | Greece | 25 | Sweden |

| 11 | Hungary | 26 | Switzerland |

| 12 | Ireland | 27 | Turkey |

| 13 | Italy | 28 | United Kingdom |

| 14 | Japan | 29 | United States |

| 15 | Korea |

GDP: The sum of gross value added by all resident producers and product taxes and subtracting any subsidies not included in the value of the products in the economy as per the World Bank. GDP data are in constant 2010 US dollars.

Figure A1.

Ten OECD countries’ GDP in US dollars—2010 constant prices.

Urbanization: According to Britannica 2020 reports, urbanization is the procedure due to which large number of people permanently shift to and settle in relatively small areas, resulting in the formation of cities. Here, it is a share of urban population of total population (%).

Figure A2.

Ten OECD countries’ urbanization ratio (%).

Trade Openness: Openness of trade is the sum of exports and imports as a share of GDP (%).

Figure A3.

Ten OECD countries’ trade openness (%).

Patents (non-residents): As per World Bank 2020, patent applications are worldwide patent applications filed through the PCT procedure or with a national patent office for special rights for an invention. A process or product which provides a new way of doing or offering something a new technical solution to a problem. A patent protects the invention of the owner for a limited period of time, generally 20 years. Below there are non-resident patents in number.

Figure A4.

Ten OECD countries’ non-resident patents (number).

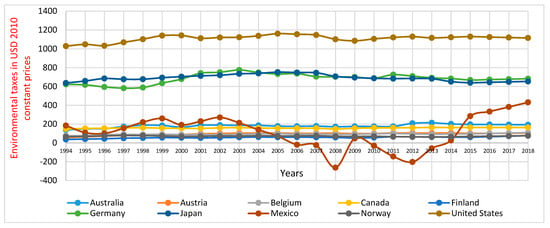

Environmental Taxes: A kind of economic instrument that addresses environmental problems. They are designed to assume environmental costs and provide economic incentives for businesses and people to promote ecologically sustainable activities. As per Japan Center for sustainable environment and Society (JACSES), carbon taxes are considered as a kind of Environmental Taxes. Environmental Taxes are in US dollar 2010 constant prices.

Figure A5.

Ten OECD countries’ environmental taxes in US dollars—2010 constant prices.

References

- Işik, C. Natural gas consumption and economic growth in Turkey: A bound test approach. Energy Syst. 2010, 1, 441–456. [Google Scholar] [CrossRef]

- He, P.; Chen, L.; Zou, X.; Li, S.; Shen, H.; Jian, J. Energy taxes, carbon dioxide emissions, energy consumption and economic consequences: A comparative study of nordic and G7 countries. Sustainability 2019, 11, 6100. [Google Scholar] [CrossRef]

- Isik, C.; Dogru, T.; Turk, E.S. A nexus of linear and non-linear relationships between tourism demand, renewable energy consumption, and economic growth: Theory and evidence. Int. J. Tour. Res. 2018, 20, 38–49. [Google Scholar] [CrossRef]

- Dogan, E.; Ulucak, R.; Kocak, E.; Isik, C. The use of ecological footprint in estimating the Environmental Kuznets Curve hypothesis for BRICST by considering cross-section dependence and heterogeneity. Sci. Total Environ. 2020, 723, 138063. [Google Scholar] [CrossRef] [PubMed]

- Isik, C.; Radulescu, M. Investigation of the relationship between renewable energy, tourism receipts and economic growth in Europe. Stat.-Stat. Econ. J. 2017, 97, 85–94. [Google Scholar]

- Işik, C.; Doğan, E.; Ongan, S. Analysing the tourism–energy–growth nexus for the top 10 most-visited countries. Economies 2017, 5, 40. [Google Scholar] [CrossRef]

- Shahzad, U.; Fareed, J.; Shahzad, F.; Shahzad, K. Investigating the nexus between economic complexity, energy consumption and ecological footprint for the United States: New insights from quantile methods. J. Clean. Prod. 2021, 279, 123806. [Google Scholar] [CrossRef]

- Bashir, M.A.; Sheng, B.; Dogan, B.; Sarwar, S.; Shahzad, U. Export product diversification and energy efficiency: Empirical evidence from OECD countries. Struct. Chang. Econ. Dyn. 2020, 55, 232–243. [Google Scholar] [CrossRef]

- Ghazouani, A.; Xia, W.; Jebli, M.B.; Shahzad, U. Exploring the Role of Carbon Taxation Policies on CO2 Emissions: Contextual Evidence from Tax Implementation and Non-Implementation European Countries. Sustainability 2020, 12, 8680. [Google Scholar] [CrossRef]

- Dogru, T.; Bulut, U.; Kocak, E.; Isik, C.; Suess, C.; Sirakaya-Turk, E. The nexus between tourism, economic growth, renewable energy consumption, and carbon dioxide emissions: Contemporary evidence from OECD countries. Environ. Sci. Pollut. Res. 2020, 27, 40930–40948. [Google Scholar] [CrossRef]

- Ulucak, R.; Kassouri, Y. An assessment of the environmental sustainability corridor: Investigating the non-linear effects of environmental taxation on CO2 emissions. Sustain. Dev. 2020, 28, 1010–1018. [Google Scholar] [CrossRef]

- Hashmi, R.; Alam, K. Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: A panel investigation. J. Clean. Prod. 2019, 231, 1100–1109. [Google Scholar] [CrossRef]

- Shahzad, U. Environmental taxes, energy consumption, and environmental quality: Theoretical survey with policy implications. Environ. Sci. Pollut. Res. 2020, 27, 24848–24862. [Google Scholar] [CrossRef] [PubMed]

- Borozan, D. Unveiling the heterogeneous effect of energy taxes and income on residential energy consumption. Energy Policy 2019, 129, 13–22. [Google Scholar] [CrossRef]

- Ding, S.; Zhang, M.; Song, Y. Exploring China’s carbon emissions peak for different carbon tax scenarios. Energy Policy 2019, 129, 1245–1252. [Google Scholar] [CrossRef]

- He, P.; Ning, J.; Yu, Z.; Xiong, H.; Shen, H.; Jin, H. Can environmental tax policy really help to reduce pollutant emissions? An empirical study of a panel ARDL model based on OECD countries and China. Sustainability 2019, 11, 4384. [Google Scholar] [CrossRef]

- Morley, B. Empirical evidence on the effectiveness of environmental taxes. Appl. Econ. Lett. 2012, 19, 1817–1820. [Google Scholar] [CrossRef]

- Cui, L.; Shu, C.; Su, X. How much do exports matter for China’s growth? In Asia and China in The Global Econom; Cheung, Y.W., Guonan, M., Eds.; World Scientific: Singapore, 2011; pp. 351–380. [Google Scholar] [CrossRef]

- Fatima, T.; Shahzad, U.; Cui, L. Renewable and non-renewable energy consumption, trade and CO2 emissions in high emitter countries: Does the income level matter? J. Environ. Plan. Manag. 2020. [Google Scholar] [CrossRef]

- OECD. Environment at A Glance: Climate Change. Environment at A Glance: Indicators. 2019. Available online: www.oecd.org/environment/env-at-a-glance (accessed on 21 November 2020).

- Yazdi, S.K.; Mastorakis, N. The Dynamic Links between Economic Growth, Energy Intensity and CO2 Emissions in Iran. Recent Adv. Appl. Econ. 2014, 10, 140–146. [Google Scholar]

- Al-Mulali, U.; Ozturk, I.; Lean, H.H. The influence of economic growth, urbanisation, trade openness, financial development and renewable energy on pollution in Europe. Nat. Hazards 2015, 79, 621–644. [Google Scholar] [CrossRef]

- Adams, S.; Mensah Klobodu, E.K. Urbanisation, democracy, bureaucratic quality, and environmental degradation. J. Policy Modeling 2017, 39, 1035–1051. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Awaworyi Churchill, S.; Paramati, S.R. The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renew. Energy 2017, 111, 157–167. [Google Scholar] [CrossRef]

- Mahjabeen, N.; Shah, S.Z.; Chughtai, S.; Simonetti, B. Renewable energy, institutional stability, environment and economic growth nexus of D-8 countries. Energy Strategy Rev. 2020, 29, 100484. [Google Scholar] [CrossRef]

- Isik, C.; Ongan, S.; Özdemir, D. The economic growth/development and environmental degradation: Evidence from the US state-level EKC hypothesis. Environ. Sci. Pollut. Res. 2019, 26, 30772–30781. [Google Scholar] [CrossRef] [PubMed]

- Işık, C.; Ongan, S.; Özdemir, D. Testing the EKC hypothesis for ten US states: An application of heterogeneous panel estimation method. Environ. Sci. Pollut. Res. 2019, 26, 10846–10853. [Google Scholar] [CrossRef]

- Sarwar, S.; Shahzad, U.; Chang DTang, B. Economic and non-economic sector reforms in carbon mitigation: Empirical evidence from Chinese provinces. Struct. Chang. Econ. Dyn. 2019, 49, 146–154. [Google Scholar] [CrossRef]

- Andreoni, V. Environmental taxes: Drivers behind the revenue collected. J. Clean. Prod. 2019, 221, 17–26. [Google Scholar] [CrossRef]

- He, P.; Sun, Y.; Shen, H.; Jian, J.; Yu, Z. Does environmental tax affect energy efficiency? An empirical study of energy efficiency in OECD countries based on DEA and Logit model. Sustainainability 2019, 11, 3792. [Google Scholar] [CrossRef]

- Ekins, P.; Speck, S. Competitiveness and exemptions from environmental taxes in Europe. Environ. Resour. Econ. 1999, 13, 369–396. [Google Scholar] [CrossRef]

- Ciaschini, M.; Pretaroli, R.; Severini, F.; Socci, C. Regional double dividend from environmental tax reform: An application for the Italian economy. Resour. Econ. 2012, 66, 273–283. [Google Scholar] [CrossRef]

- Vera, S.; Sauma, E. Does a carbon tax make sense in countries with still a high potential for energy efficiency? Comparison between the reducing-emissions effects of carbon tax and energy efficiency measures in the Chilean case. Energy 2015, 88, 478–488. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. The energy, environmental and economic impacts of carbon tax rate and taxation industry: A CGE based study in China. Energy 2018, 159, 558–568. [Google Scholar] [CrossRef]

- Freire-González, J. Environmental taxation and the double dividend hypothesis in CGE modelling literature: A critical review. J. Policy Model. 2018, 40, 194–223. [Google Scholar] [CrossRef]

- Metcalf, G. Paying for Pollution: Why a Carbon Tax Is Good for America, 1st ed.; Tufts University: Medford, MA, USA, 2019. [Google Scholar] [CrossRef]

- Zhang, J.; Zhang, Y. Carbon tax, tourism CO2 emissions and economic welfare. Ann. Tour. Res. 2018, 69, 18–30. [Google Scholar] [CrossRef]

- Wolde-Yemane, R.; Weldemeskel, E.M. Do environmental taxes and environmental stringency policies reduce CO2 emissions? Evidence from 7 emerging economies. Environ. Sci. Pollut. Res. 2020. Available online: https://doi.org/10.1007/s11356-020-11475-8 (accessed on 23 October 2020).

- Mardones, C.; Cabello, M. Effectiveness of local air pollution and GHG taxes: The case of Chilean industrial sources. Energy Econ. 2019, 83, 491–500. [Google Scholar] [CrossRef]

- King, M.; Tarbush, B.; Teytelboym, A. Targeted carbon tax reforms. Eur. Econ. Rev. 2019, 119, 526–547. [Google Scholar] [CrossRef]

- Alola, A.A.; Bekun, F.V.; Sarkodie, S.A. Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci. Total Environ. 2019, 685, 702–709. [Google Scholar] [CrossRef]

- Andrei, J.; Mieila, M.; Popescu, G.; Nica, E.; Manole, C. The impact and determinants of environmental taxation on economic growth communities in Romania. Energies 2016, 9, 902. [Google Scholar] [CrossRef]

- Chang, T.H.; Huang, C.M.; Lee, M.C. Threshold effect of the economic growth rate on the renewable energy development from a change in energy price: Evidence from OECD countries. Energy Policy 2009, 37, 5796–5802. [Google Scholar] [CrossRef]

- Marinas, M.; Dinu, M.; Socol, A.; Socol, C. Renewable energy consumption and economic growth. Causality relationship in Central and Eastern European countries. PLoS ONE 2018, 13, e0202951. [Google Scholar] [CrossRef] [PubMed]

- Lin, B.; Moubarak, M. Renewable energy consumption—Economic growth nexus for China. Renew. Sustain. Energy Rev. 2014, 40, 111–117. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R. The impact of renewable energy consumption to economic growth: A panel data application. Energy Econ. 2016, 53, 58–63. [Google Scholar] [CrossRef]

- Kahia, M.; Ben Aïssa, M.S.; Charfeddine, L. Renewable and non-renewable energy use—Economic growth nexus: The case of MENA Net Oil Importing Countries. Renew. Sustain. Energy Rev. 2017, 7, 127–140. [Google Scholar]

- Sadorsky, P. Renewable energy consumption and income in emerging economies. Energy Policy 2009, 37, 4021–4028. [Google Scholar] [CrossRef]

- Kahia, M.; Ben Aïssa, M.S.; Charfeddine, L. Impact of renewable and non-renewable energy consumption on economic growth: Evidence from the MENA Net Oil Exporting Countries (NOECs). Energy 2017, 116, 102–115. [Google Scholar] [CrossRef]

- Ocal, O.; Aslan, A. Renewable energy consumption-economic growth nexus in Turkey. Renew. Sustain. Energy Rev. 2013, 8, 494–499. [Google Scholar] [CrossRef]

- Furouka, F. Renewable electricity consumption and economic development: New findings from the Baltic countries. Renew. Sustain. Energy Rev. 2017, 71, 450–463. [Google Scholar] [CrossRef]

- Bulut, U.; Muratoglu, G. Renewable energy in Turkey: Great potential, low but increasing utilisation, and an empirical analysis on renewable energy-growth nexus. Energy Policy 2018, 123, 240–250. [Google Scholar] [CrossRef]

- Chen, J.; Zhou, C.; Wang, S.; Li, S. Impacts of energy consumption structure, energy intensity, economic growth, urbanisation on PM2.5 concentrations in countries globally. Appl. Energy 2018, 230, 94–105. [Google Scholar] [CrossRef]

- Sharma, S.S. Determinants of carbon dioxide emissions: Empirical evidence from 69 countries. Appl. Energy 2011, 88, 376–382. [Google Scholar] [CrossRef]

- Sadorsky, P. The effect of urbanisation on CO2 emissions in emerging economies. Energy Econ. 2014, 41, 147–153. [Google Scholar]

- Salim, R.; Shafiei, S. Urbanisation and renewable and non-renewable energy consumption in OECD countries: An empirical analysis. Econ. Model. 2014, 38, 581–591. [Google Scholar] [CrossRef]

- Yang, J.; Zhang, W.; Zhang, Z. Impacts of urbanisation on renewable energy consumption in China. J. Clean. Prod. 2016, 114, 443–451. [Google Scholar] [CrossRef]

- Andersson, R.; Quigley, J.M.; Wilhelmsson, M. Urbanisation, productivity, and innovation: Evidence from investment in higher education. J. Urban Stud. 2009, 66, 2–15. [Google Scholar]

- Mukherjee, S.; Chakraborty, D. Is environmental sustainability influenced by socio-economic and sociopolitical factors? Cross-country empirical analysis. Sustain. Dev. 2013, 21, 353–371. [Google Scholar] [CrossRef]

- Sbia, R.; Shahbaz, M.; Hamdi, H. A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ. Model. 2014, 36, 191–197. [Google Scholar] [CrossRef]

- Nicolli, F.; Vona, F. Energy Market Liberalization and Renewable Energy Policies in OECD Countries. Energy Policy 2019, 128, 853–867. [Google Scholar] [CrossRef]

- Kasman, A.; Duman, Y.S. CO2 emissions, economic growth, energy consumption, trade and urbanisation in new EU member and candidate countries: A panel data analysis. Econ. Model. 2015, 44, 97–103. [Google Scholar] [CrossRef]

- Zaekhan, Z.; Nachrowi, D. The lmpact of Renewable Energy and GDP per Capita on Carbon Dioxide Emission in the G-20 Countries. Ekon. Dan Keuang. Indones. 2015, 60, 145–174. [Google Scholar] [CrossRef]

- Nathaniel, S.; Anyanwu, O.; Shah, M. Renewable energy, urbanisation, and ecological footprint in the Middle East and North Africa region. Environ. Sci. Pollut. Res. 2020, 27, 14601–14613. [Google Scholar] [CrossRef] [PubMed]

- Zeren, F.; Akkus, H.T. The relationship between renewable energy consumption and trade openness: New evidence from emerging economies. Renew. Energy 2020, 147, 322–329. [Google Scholar] [CrossRef]

- Sebri, M.; Salha, O.B. On the causal dynamics between economic growth, renewable energy consumption, CO2 emissions and trade openness: Fresh evidence from BRICS countries. Renew. Sustain. Energy Rev. 2014, 39, 14–23. [Google Scholar] [CrossRef]

- Tiba, S.; Omri, A.; Frikha, M. The four-way linkages between renewable energy, environmental quality, trade and economic growth: A comparative analysis between high and middle-income countries. Energy Syst. 2015, 7, 103–144. [Google Scholar] [CrossRef]

- Hdom, H.A.D.; Fuinhas, J.A. Energy production and trade openness: Assessing economic growth, CO2 emissions and the applicability of the cointegration analysis. Energy Strategy Rev. 2020, 30, 100488. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Saidi, H.; El Montasser, G.; Ajmi, A.N. The Role of Institutions in the Renewable Energy-Growth Nexus in the MENA Region: A Panel Cointegration Approach. Environ. Model. Assess. 2018, 25, 259–276. [Google Scholar]

- Bellakhall, R.; Ben Kheder, S.; Haffoudhi, H. Governance and Renewable Energy Investment in MENA Countries: How does Trade Matter? Economic Research Forum, Working Paper 1153. 2017. Available online: https://erf.org.eg/app/uploads/2017/11/1153.pdf (accessed on 27 November 2020).

- European Commission. A Policy Framework for Climate and Energy in the period from 2020 to 2030; European Commission: Juba, South Sudan, 2014; Available online: http://ec.Europa.Eu/eurostat/data/database (accessed on 15 May 2017).

- Fura, B.; Wojnar, J.; Kasprzyk, B. Ranking and classification of eu countries regarding their levels of implementation of the europe 2020 strategy. J. Clean. Prod. 2017, 165, 968–979. [Google Scholar] [CrossRef]

- Simionescu, M.; Bilan, Y.; Krajnáková, E.; Streimikiene, D.; Gedek, S. Renewable Energy in the Electricity Sector and GDP per Capita in the European Union. Energies 2019, 12, 2520. [Google Scholar] [CrossRef]

- Streimikiene, D.; Siksnelyte, I.; Zavadskas, E.K.; Cavallaro, F. The Impact of Greening Tax Systems on Sustainable Energy Development in the Baltic States. Energies 2018, 11, 1193. [Google Scholar] [CrossRef]

- Omri, A.; Nguyen, D.K. On the determinants of renewable energy consumption: International evidence. Energy 2014, 72, 554–560. [Google Scholar] [CrossRef]

- Campello, M.; Galvao, A.F.; Juhl, T. Testing for slope heterogeneity bias in panel data models. J. Bus. Econ. Stat. 2019, 37, 749–760. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econom. J. Econom. Soc. 1981, 1, 1057–1072. [Google Scholar] [CrossRef]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Pedroni, P. Fully modified OLS for heterogeneous cointegrated panels. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels; Emerald Group Publishing Limited: Bingley, UK, 2001. [Google Scholar]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Hausman, J. Specification Tests in Econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar]

- Koenker, R.; Bassett, G., Jr. Regression quantiles. Econom. J. Econom. Soc. 1978, 1, 33–50. [Google Scholar] [CrossRef]

- Mosteller, F.; Tukey, J.W. Data Analysis and Regression: A Second Course in Statistics; Addison-Wesley: Reading, MA, USA, 1978. [Google Scholar]

- Eide, E.R.; Showalter, M.H. Factors affecting the transmission of earnings across generations: A quantile regression approach. J. Hum. Resour. 1999, 34, 253–267. [Google Scholar] [CrossRef]

- Buchinsky, M. Changes in the US wage structure 1963-1987: Application of quantile regression. Econom. J. Econom. Soc. 1994, 62, 405–458. [Google Scholar]

- Buchinsky, M. Estimating the asymptotic covariance matrix for quantile regression models a Monte Carlo study. J. Econom. 1995, 68, 303–338. [Google Scholar]

- Su, C.W.; Umar, M.; Khan, Z. Does fiscal decentralisation and eco-innovation promote renewable energy consumption? Analysing the role of political risk. Sci. Total Environ. 2020, 751, 142–220. [Google Scholar]

- Fernando, Y.; Hor, W.L. Impacts of energy management practices on energy efficiency and carbon emissions reduction: A survey of Malaysian manufacturing firms. Resour. Conserv. Recycl. 2017, 126, 62–73. [Google Scholar] [CrossRef]

- Edenhofer, O.; Seyboth, K.; Creutzig, F.; Schlomer, S. On the Sustainability of Renewable Energy Sources. Annu. Rev. Environ. Resour. 2013, 38, 169–200. [Google Scholar] [CrossRef]

- Edenhofer, O.; Knopf, B.; Barker, T.; Baumstark, L.; Bellevrat, E. The economics of low stabilisation: Model comparison of mitigation strategies and costs. Energy J. 2010, 31, 11–49. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).