The Economics of Coking Coal Mining: A Fossil Fuel Still Needed for Steel Production

Abstract

:1. Introduction

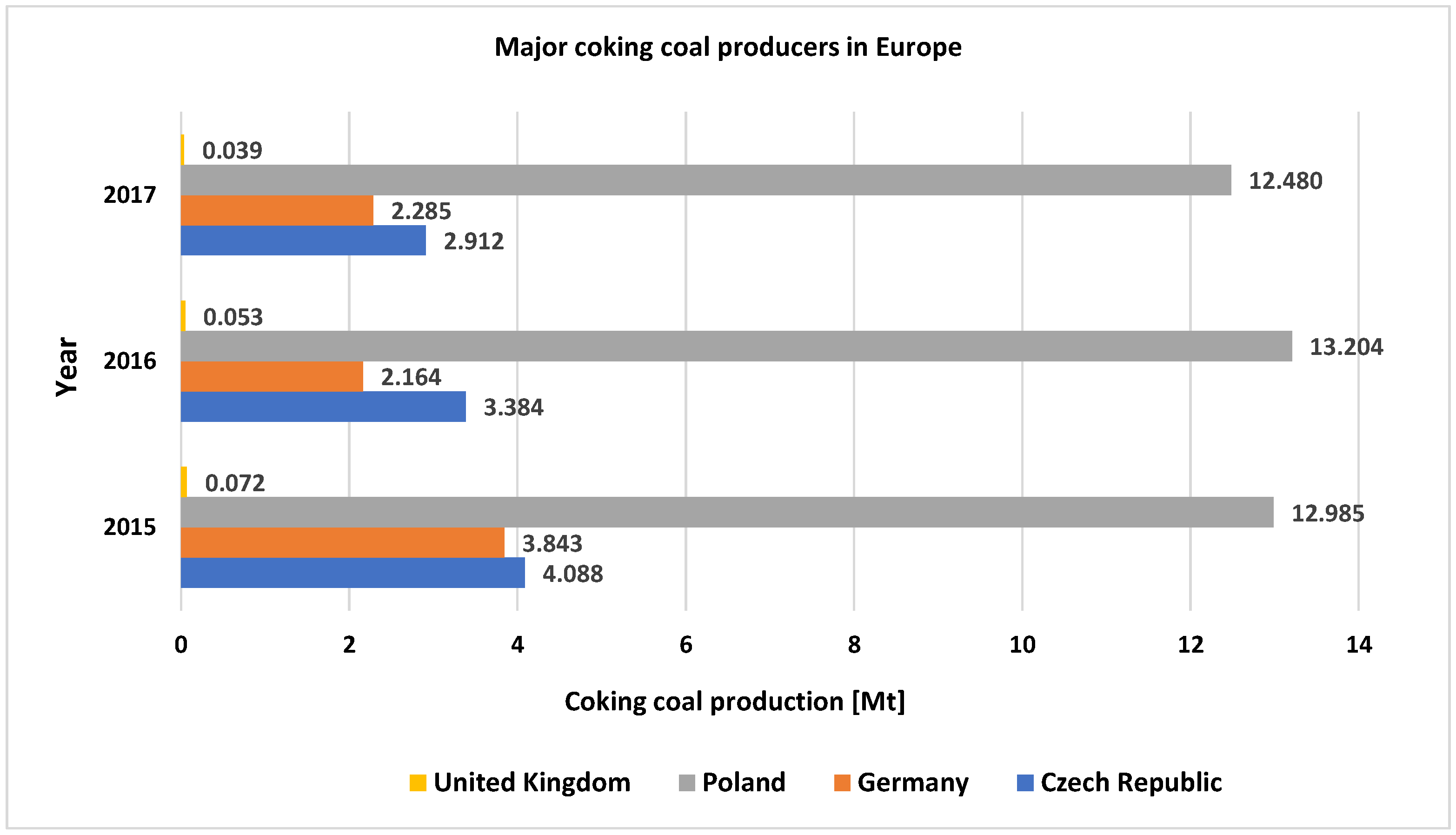

1.1. Coking Coal as a Critical Raw Material for EU

1.2. Coking Coal Production and Consumption

1.3. Dębieńsko Coking Coal Project

2. Materials and Methods

3. Results and Discussion

3.1. Economic Analysis

3.2. Financial Outcomes

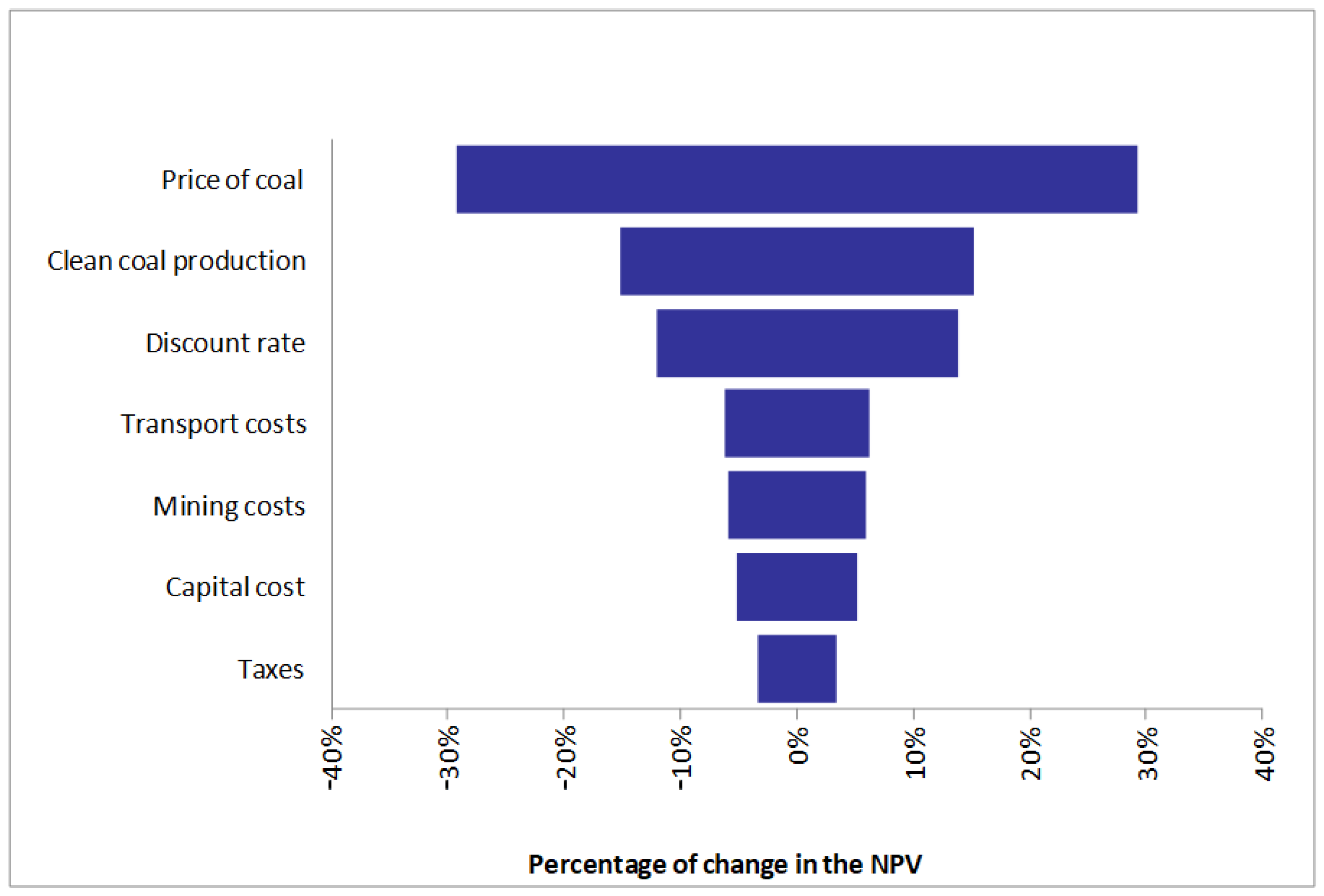

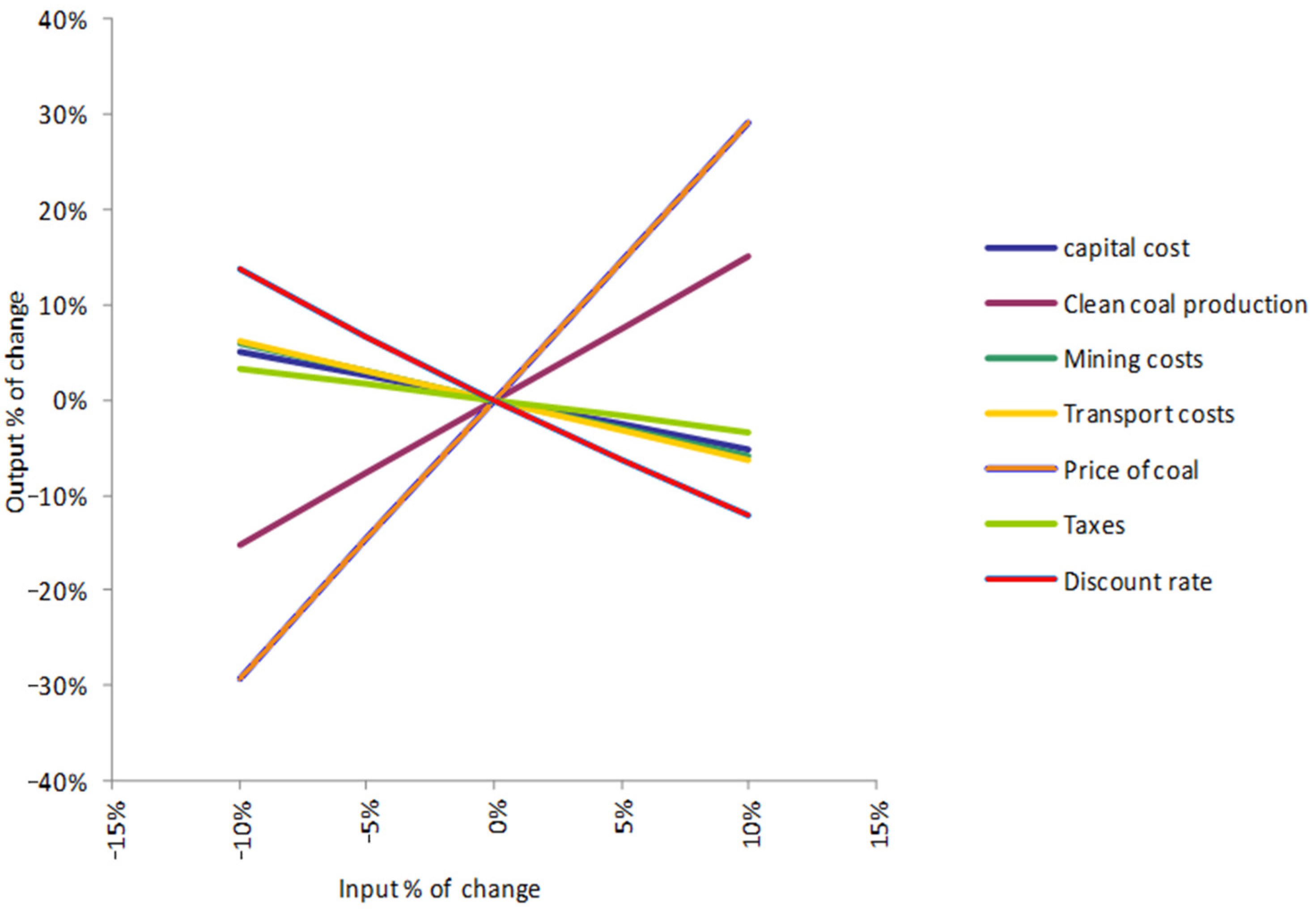

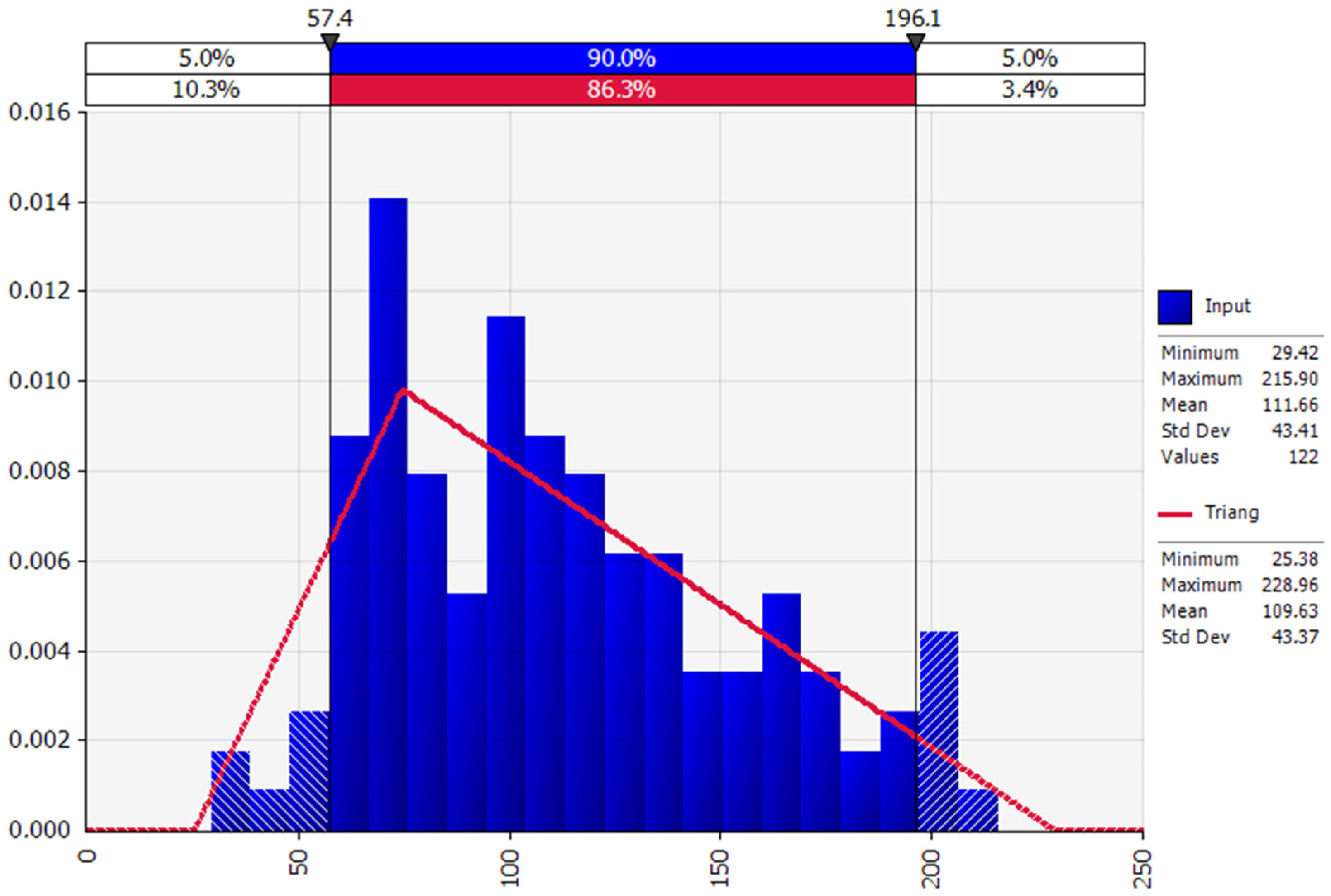

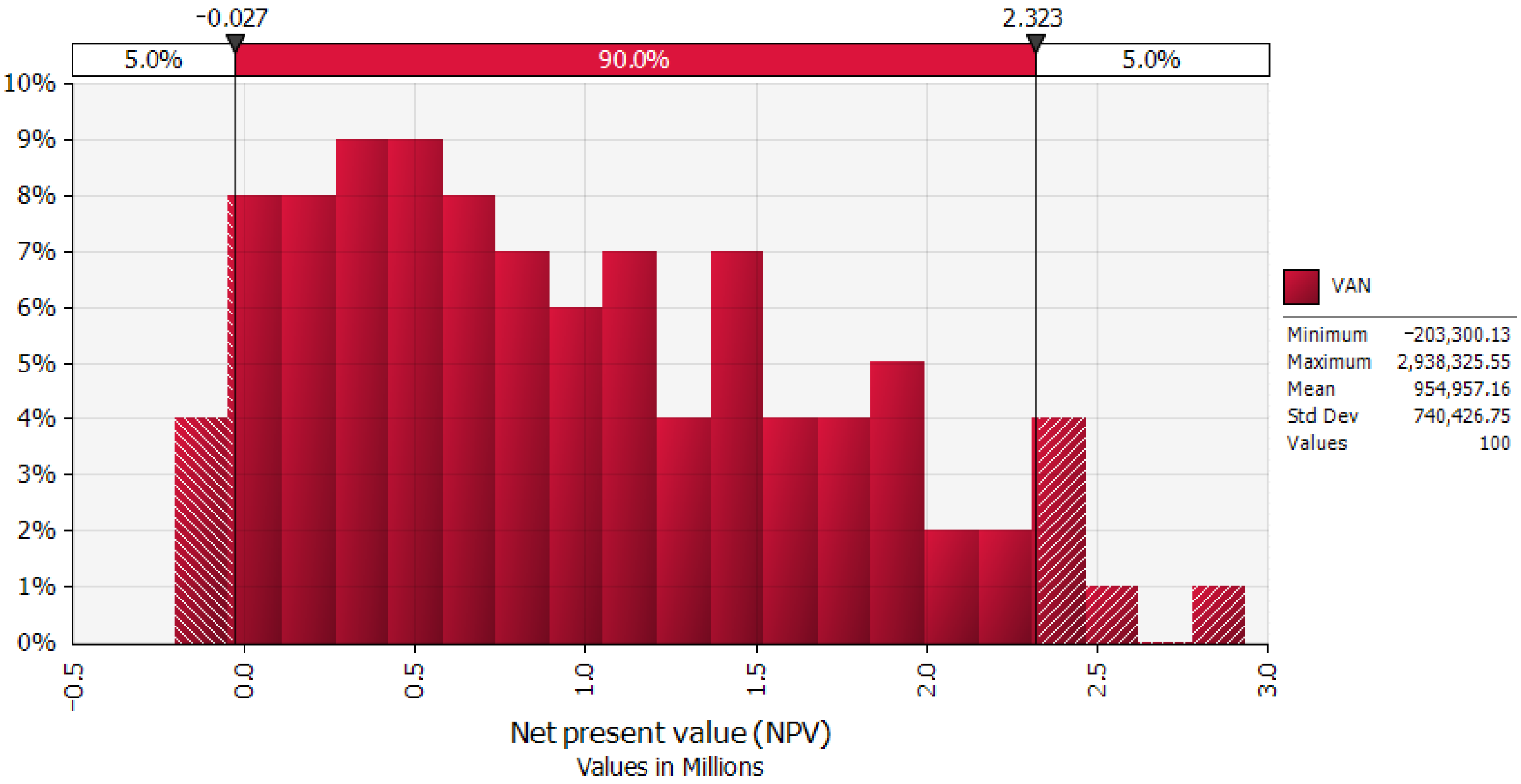

3.3. Sensitivity and Uncertainty Analysis

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. Tackling the Challenges in Commodity Markets and on Raw Materials; European Commission: Brussels, Belgium, 2011. [Google Scholar]

- European Commission. The Raw Materials Initiative—Meeting Our Critical Needs for Growth and Jobs in Europe; European Commission: Brussels, Belgium, 2008. [Google Scholar]

- European Commission. On the Review of the List of Critical Raw Materials for the EU and the Implementation of the Raw Materials Initiative; European Commission: Brussels, Belgium, 2014. [Google Scholar]

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions on the 2017 List of Critical Raw Materials for the EU; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- European Commission. Methodology for Establishing the EU List of Critical Raw Materials. Guidelines; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Blengini, G.A.; Nuss, P.; Dewulf, J.; Nita, V.; Peirò, L.T.; Vidal-Legaz, B.; Latunussa, C.; Mancini, L.; Blagoeva, D.; Pennington, D.; et al. EU methodology for critical raw materials assessment: Policy needs and proposed solutions for incremental improvements. Resour. Policy 2017, 53, 12–19. [Google Scholar] [CrossRef] [Green Version]

- Díez, M.A.; Alvarez, R.; Barriocanal, C. Coal for metallurgical coke production: Predictions of coke quality and future requirements for cokemaking. Int. J. Coal Geol. 2002, 50, 389–412. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Available online: https://www.iea.org/data-and-statistics (accessed on 3 November 2021).

- Eurostat. Supply, Transformation and Consumption of Solid Fossil Fuels: Coking Coal Indigenous Production; European Commission: Luxembourg, 2019. [Google Scholar]

- Eurostat. Supply, Transformation and Consumption of Solid Fossil Fuels: Coking Coal Calculated Inland Consumption; European Commission: Luxembourg, 2019. [Google Scholar]

- Alves Dias, P.; Kanellopoulos, K.; Medarac, H.; Kapetaki, Z.; Miranda-Barbosa, E.; Shortall, R.; Czako, V.; Telsnig, T.; Vazquez-Hernandez, C.; Lacal Arántegui, R.; et al. EU Coal Regions: Opportunities and Challenges Ahead; Publications Office of the European Union: Luxembourg, 2018. [Google Scholar]

- Bertrand, G.; Cassard, D.; Arvanitidis, N.; Stanley, G. Map of critical raw material deposits in Europe. Energy Procedia 2016, 97, 44–50. [Google Scholar] [CrossRef] [Green Version]

- Vaněk, M.; Bora, P.; Maruszewska, E.W.; Kašparková, A. Benchmarking of mining companies extracting hard coal in the Upper Silesian Coal Basin. Resour. Policy 2017, 53, 378–383. [Google Scholar] [CrossRef]

- European Union. EU-Ukraine Relations—Factsheet; European Union External Action: Brussels, Belgium, 2019. [Google Scholar]

- Jastrzębska Spółka Węglowa SA. Available online: https://www.jsw.pl/en/ (accessed on 14 October 2021).

- Prairie Mining Limited. Projects. Available online: http://pdz.com.pl/projekty/debiensko/ (accessed on 1 October 2021).

- Prairie Mining Limited. Scoping Study Indicates Debiensko Mine Restart Will Deliver Lowest Cost Hard Coking Coal into Europe. Available online: http://www.pdz.com.au/uploads/1/7/9/6/17961663/170315_-_debiensko_scoping_study_final__website_.pdf (accessed on 15 October 2021).

- JORC Code. Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves; Australasian Joint Ore Reserves Committee: Victoria, Australia, 2012. [Google Scholar]

- Prairie Mining Limited. Annual Report. Available online: http://www.pdz.com.au/company-reports (accessed on 15 October 2021).

- Matyjaszek, M.; Wodarski, K.; Krzemień, A.; Escanciano García-Miranda, C.; Suárez Sánchez, A. Coking coal mining investment: Boosting European Union’s raw materials initiative. Resour. Policy 2018, 57, 88–97. [Google Scholar] [CrossRef]

- Suárez Sánchez, A.; Krzemień, A.; Riesgo Fernández, P.; Iglesias Rodríguez, F.J.; Sánchez Lasheras, F.; de Cos Juez, F.J. Investment in new tungsten mining projects. Resour. Policy 2015, 46, 177–190. [Google Scholar] [CrossRef] [Green Version]

- Riesgo García, M.V.; Krzemień, A.; Manzanedo del Campo, M.Á.; Menéndez Álvarez, M.; Gent, M.R. Rare earth elements mining investment: It is not all about China. Resour. Policy 2017, 53, 66–76. [Google Scholar] [CrossRef]

- Sterba, J.; Krzemień, A.; Riesgo Fernández, P.; Escanciano García-Miranda, C.; Fidalgo Valverde, G. Lithium mining: Accelerating the transition to sustainable energy. Resour. Policy 2019, 62, 416–426. [Google Scholar] [CrossRef]

- Riesgo García, M.V.; Krzemień, A.; Sáiz Bárcena, L.C.; Diego Álvarez, I.; Castañón Fernández, C. Scoping studies of rare earth mining investments: Deciding on further project developments. Resour. Policy 2019, 64, 101525. [Google Scholar] [CrossRef]

- Sterba, J.; Krzemień, A.; Fidalgo Valverde, G.; Diego Álvarez, I.; Castañón Fernández, C. Energy-sustainable industrialized growth in the Czech Republic: The Cínovec lithium mining project. Resour. Policy 2020, 68, 101707. [Google Scholar] [CrossRef]

- Krzemień, A.; Riesgo Fernández, P.; Suárez Sánchez, A.; Diego Álvarez, I. Beyond the pan-european standard for reporting of exploration results, mineral resources and reserves. Resour. Policy 2016, 49, 81–91. [Google Scholar] [CrossRef]

- London Stock Exchange. AIM Rules—Guidance for Mining and Oil & Gas Companies; Stock Exchange AIM Notice: London, UK, 2006. [Google Scholar]

- Lipiński, A.; Lipińska, K. New polish geological and mining law. Pol. Yearb. Environ. Law 2011, 1, 57–84. [Google Scholar] [CrossRef]

- Euracoal. EURACOAL Market Report 2019 No.1; European Association for Coal and Lignite: Brussels, Belgium, 2019. [Google Scholar]

- SIMCO. Precios FOB Exportaciones Carbón Coquizable Colombia $/t; SIMCO: Bogotá, Colombia, 2016. [Google Scholar]

| Country | Coking Coal Consumption [Mt] | ||

|---|---|---|---|

| 2015 | 2016 | 2017 | |

| Austria | 1.731 | 1.815 | 1.763 |

| Belgium | 1.677 | 1.638 | 1.615 |

| Czech Republic | 3.704 | 3.117 | 3.421 |

| Finland | 1.254 | 1.213 | 1.261 |

| France | 4.465 | 4.343 | 4.516 |

| Germany | 11.719 | 15.132 | 15.825 |

| Hungary | 1.327 | 1.223 | 1.320 |

| Italy | 2.246 | 2.440 | 2.309 |

| Netherlands | 4.463 | 4.354 | 4.393 |

| Poland | 13.457 | 13.178 | 13.054 |

| Romania | 14 | 10 | 8 |

| Slovakia | 2.739 | 2.718 | 2.720 |

| Spain | 1.834 | 1.862 | 1.802 |

| Sweden | 1.592 | 1.542 | 1.513 |

| United Kingdom | 5.063 | 2.775 | 3.010 |

| TOTAL | 57.286 | 57.361 | 58.534 |

| Dębieńsko HCC Resources | Indicated [Mt] | Inferred [Mt] | Total |

| 93 | 208 | 301 |

| Parameter | Value |

|---|---|

| Average RoM production | 4 Mtpa |

| Life of Mine (LoM) production | 104 Mt |

| Life of Mine Plant Feed Coal Production | 100.3 Mt |

| Average product yield | 67.8% |

| Life of Mine following the first production | 26 years |

| Average Sealable HCC production | 2.6 Mtpa |

| Total saleable production | 65 Mt |

| Parameter | Value |

|---|---|

| Life of Mine (LoM) | 26 years |

| Yield | 68% |

| Clean coal production | 2.600 Mtpa |

| Year 0 | Year 1–20 | Year 20–26 | |

|---|---|---|---|

| Capital costs | 372,000 | ||

| Working capital | 57,590 | ||

| Mining costs | 49,400 | 49,400 | |

| Processing costs | 14,040 | 14,040 | |

| Transport costs | 51,740 | 51,740 | |

| Royalties | 2080 | 2080 | |

| Total costs | 65,520 | 65,520 | |

| Revenue | 260,000 | 260,000 | |

| Earnings before interest, taxes, depreciation and amortization (EBITDA) | 194,480 | 194,480 | |

| Amortization | 18,600 | 0 | |

| Pre-tax benefit | 175,880 | 194,480 | |

| Taxes | 33,417 | 36,951 | |

| Post-tax benefit | 142,463 | 157,529 | |

| Cash Flows | 429,590 | 161,063 | 157,529 |

| Project | After-Tax NPV (% Discount) | After-Tax IRR | Payback Period (Years) |

|---|---|---|---|

| Lublin | 1390 M$ (8%) | 26.6% | 3 |

| Dębieńsko | 660 M$ (10%) | 28.0% | 5 |

| Points (X-Values) | Probability |

|---|---|

| 2.400 | 0.2 |

| 2.500 | 0.4 |

| 2.600 | 0.2 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Duda, A.; Fidalgo Valverde, G. The Economics of Coking Coal Mining: A Fossil Fuel Still Needed for Steel Production. Energies 2021, 14, 7682. https://doi.org/10.3390/en14227682

Duda A, Fidalgo Valverde G. The Economics of Coking Coal Mining: A Fossil Fuel Still Needed for Steel Production. Energies. 2021; 14(22):7682. https://doi.org/10.3390/en14227682

Chicago/Turabian StyleDuda, Adam, and Gregorio Fidalgo Valverde. 2021. "The Economics of Coking Coal Mining: A Fossil Fuel Still Needed for Steel Production" Energies 14, no. 22: 7682. https://doi.org/10.3390/en14227682

APA StyleDuda, A., & Fidalgo Valverde, G. (2021). The Economics of Coking Coal Mining: A Fossil Fuel Still Needed for Steel Production. Energies, 14(22), 7682. https://doi.org/10.3390/en14227682