Real-Time Bidding Model of Cryptocurrency Energy Trading Platform

Abstract

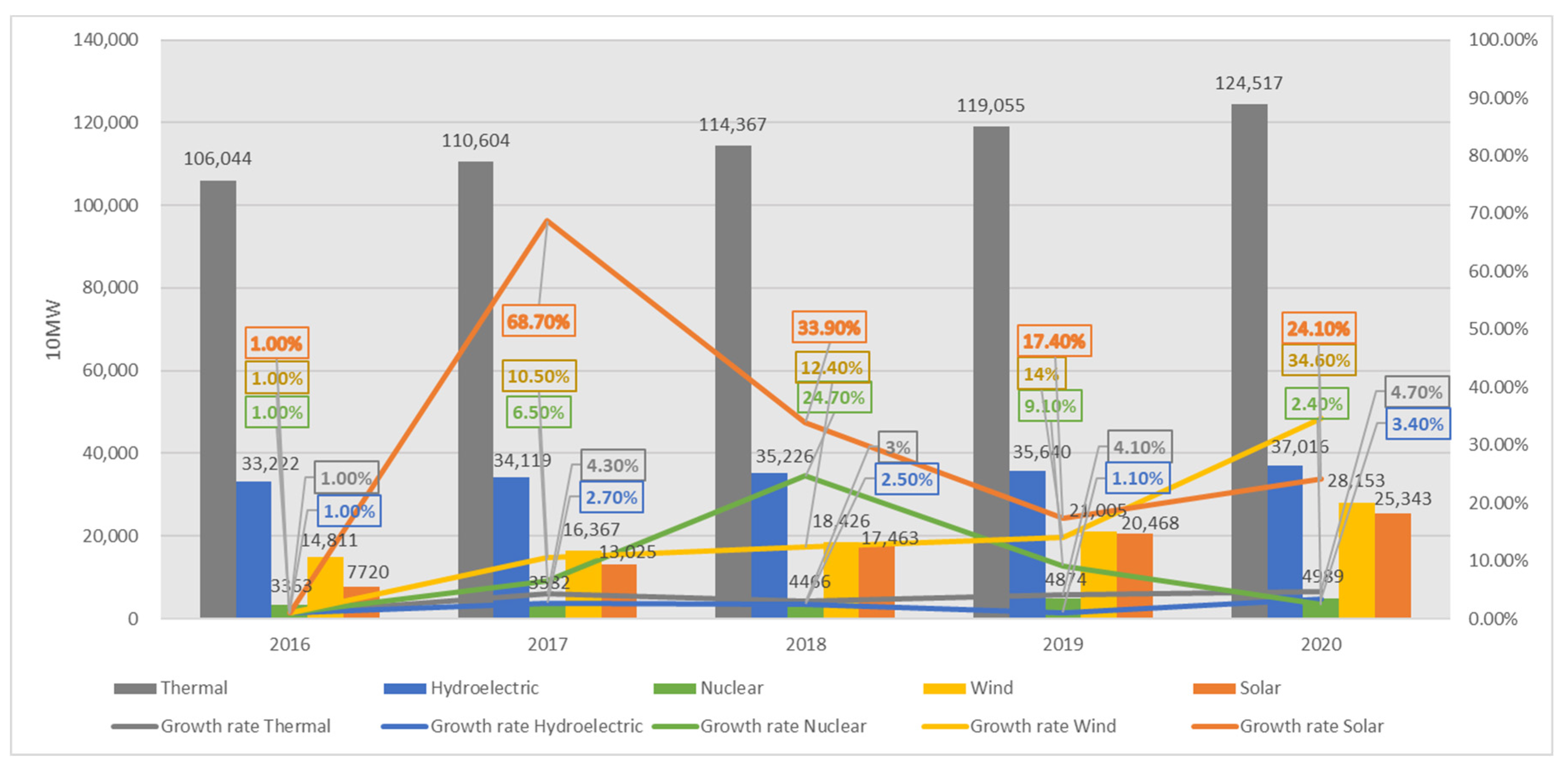

1. Introduction

- (1)

- Only certified members are allowed to participate and attacks are avoided from external users.

- (2)

- The consensus mechanism only needs to focus on efficiency without considering security. The system has a faster transaction speed and a higher transaction processing capacity.

- (3)

- No miners need to maintain the system, which can effectively reduce transaction costs.

- (4)

- The user’s identity information is authenticated by the administrator of the permissioned blockchain, which can better protect the user’s privacy information during the transaction process.

- (1)

- It is generally assumed that consumers and producers can conduct P2P transactions directly, without considering the matching process between users and the release of transaction information. Due to the distributed characteristics, participating users cannot know the counterparty information, so blockchain is not suitable for information publishing and sharing systems [27].

- (2)

- It is impossible to realise real real-time bidding by setting electricity quantity and electricity price in advance and using a blockchain transaction function to complete an irrevocable quotation [28].

- (3)

- Users of the platform need to write a smart contract to participate in transactions. Smart contracts have high requirements and are prone to error risks, which are not conducive to users’ use and attracting new users [29].

- (4)

- Power consumption is a period of continuous process, and transaction confirmation is a time point. The risk of fraudulent transaction may exist if they are not synchronised.

- (1)

- Using blockchain technology and taking the main grid as the centre, an energy Internet trading platform CETP is constructed based on a permissioned blockchain.

- (2)

- CETP uses EBC as the token of electricity transaction between participants and indirectly realises real-time electricity bidding through real-time bidding against EBC.

- (3)

- Referring to the exchange model, ECE realises the release of trading information and matching of trading, and realises the independence of electricity bidding and electricity trading.

- (4)

- Introduce bidders to participate in real-time bidding, attract more user funds to participate and maintain the relative stability of electricity price.

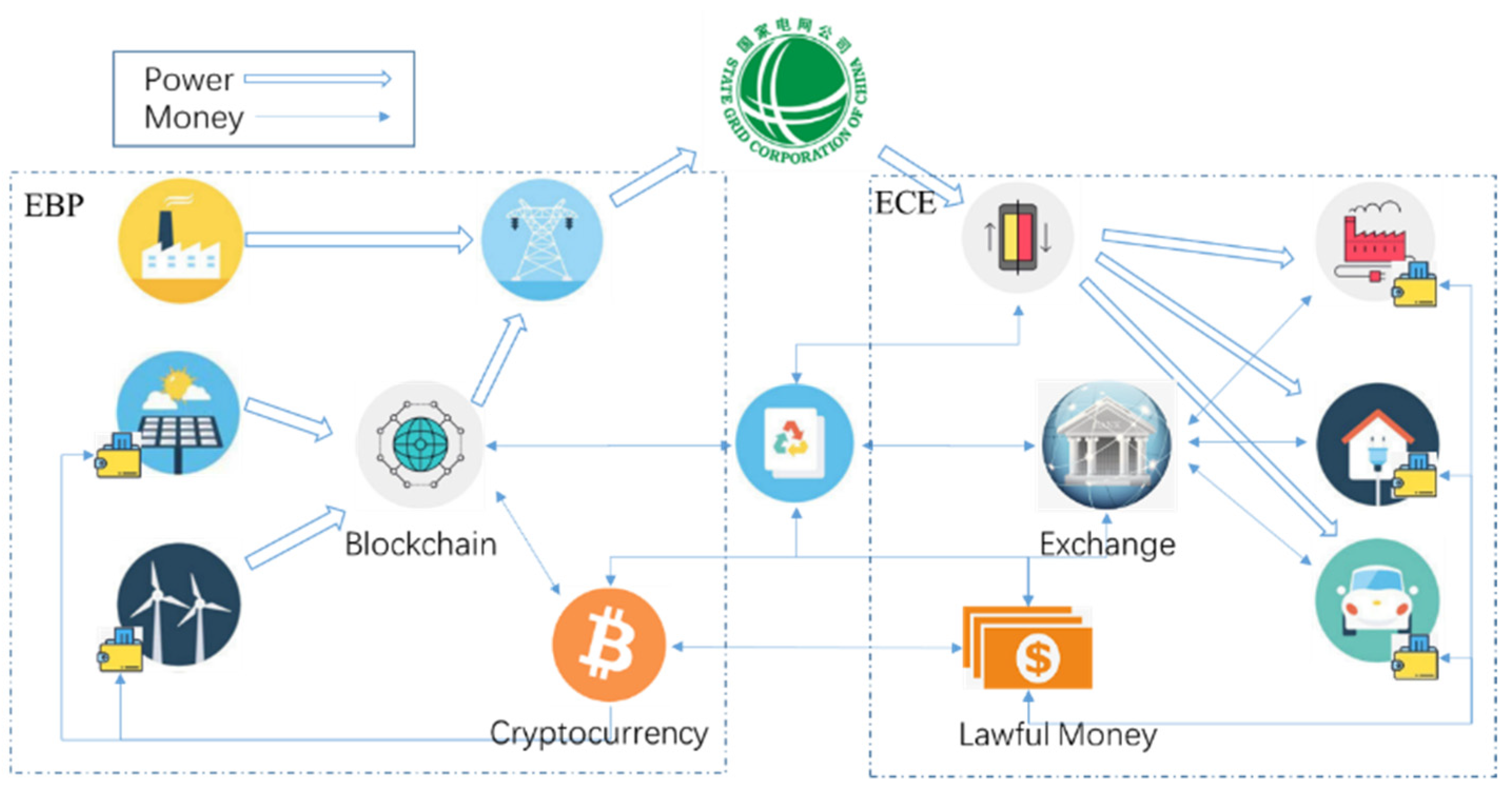

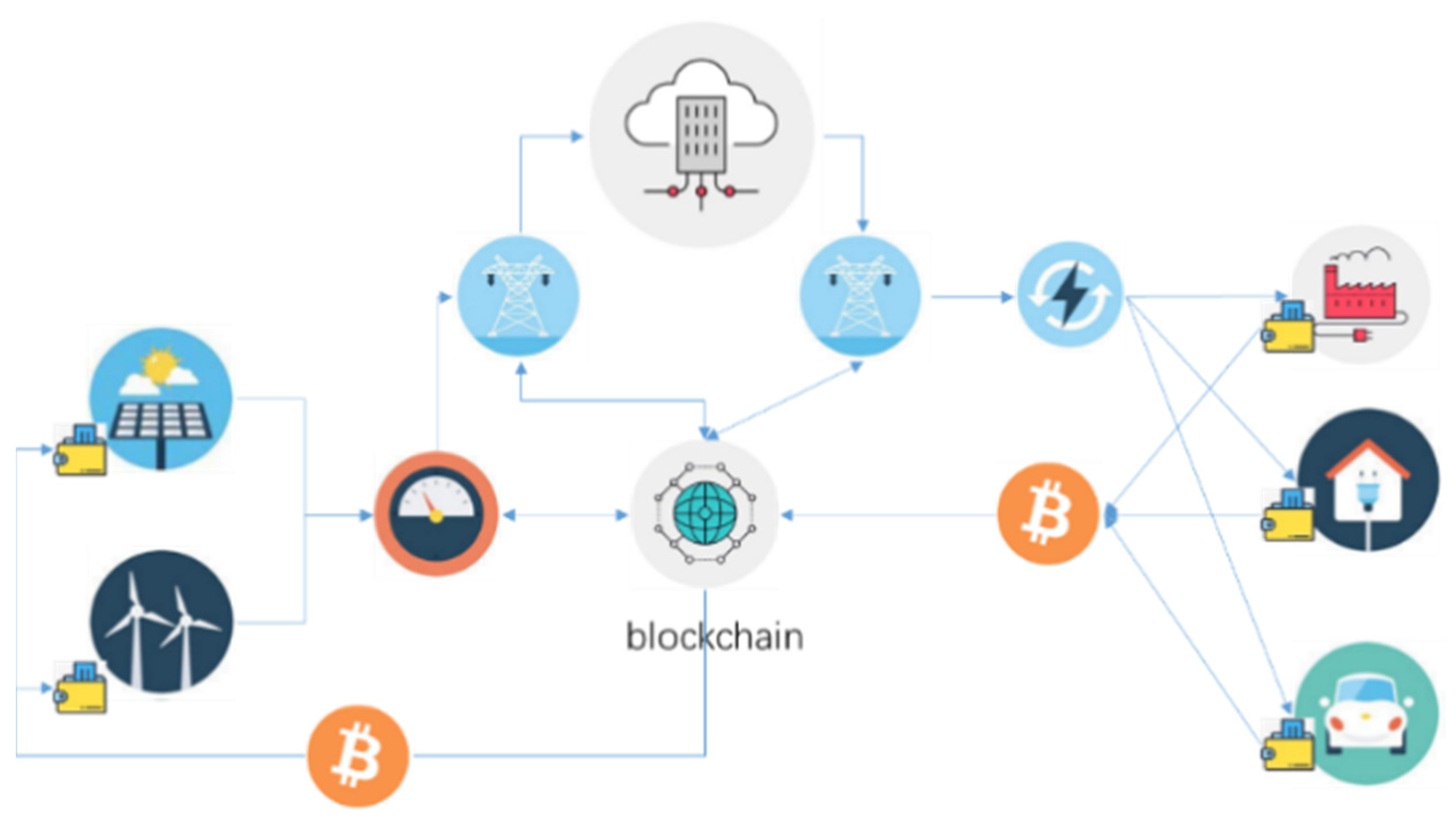

2. CETP Transaction Flow

2.1. Energy Blockchain Platform Transaction Flow

2.2. Energy Cryptocurrency Exchange Transaction Flow

3. Energy Cryptocurrency Exchange Model and Welfare Analysis

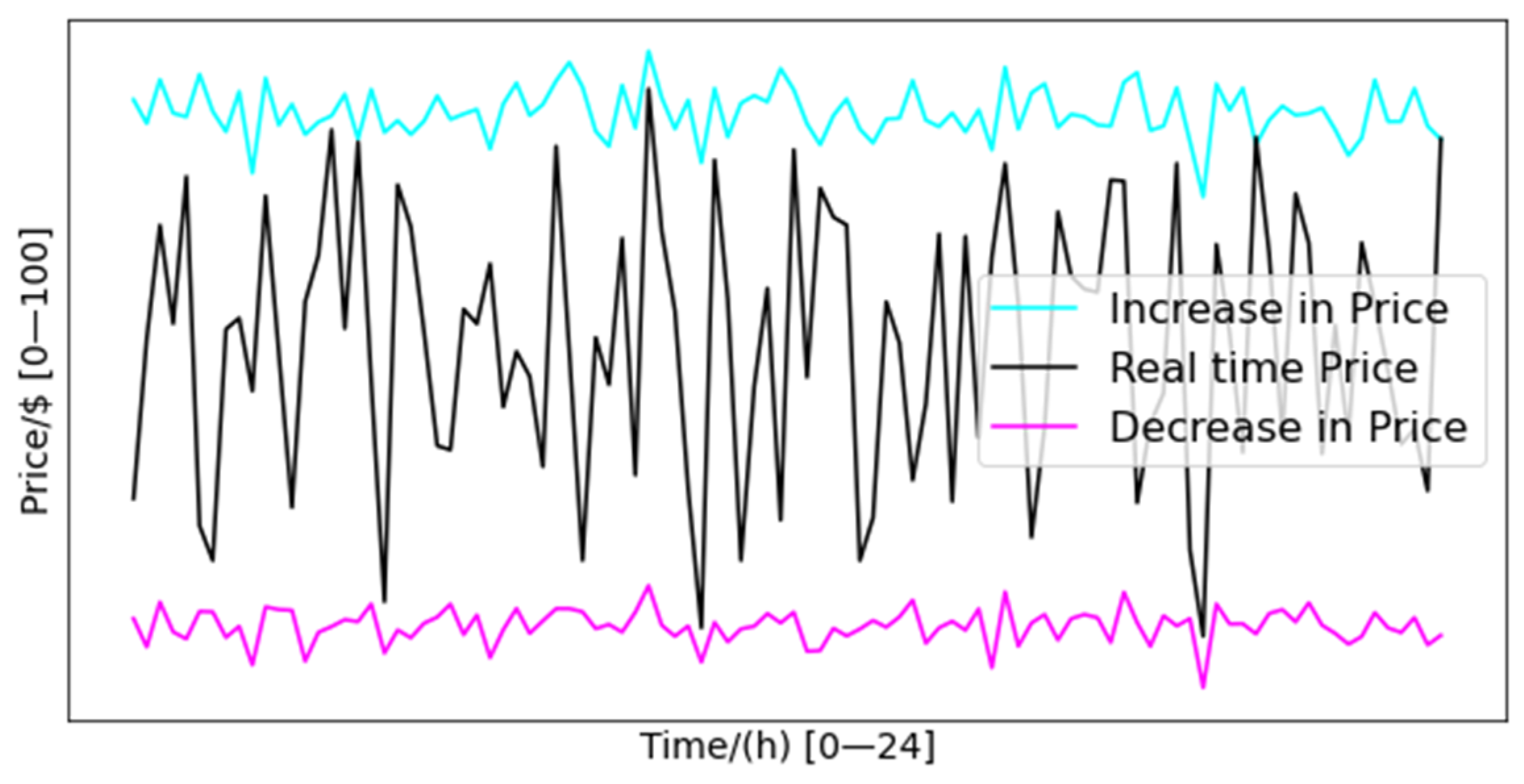

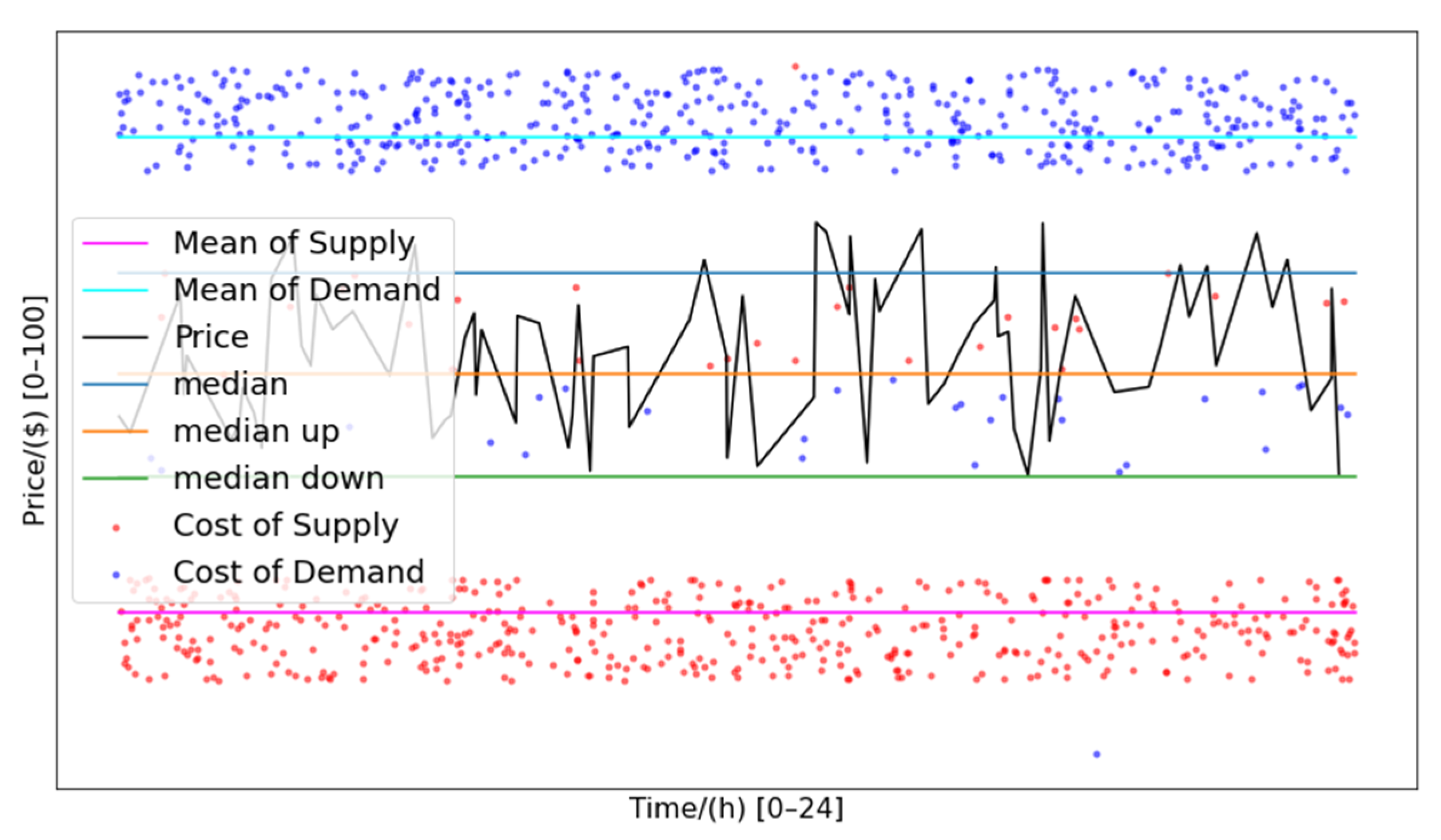

Welfare Model Based on Energy Blockchain Cryptocurrency Bidding

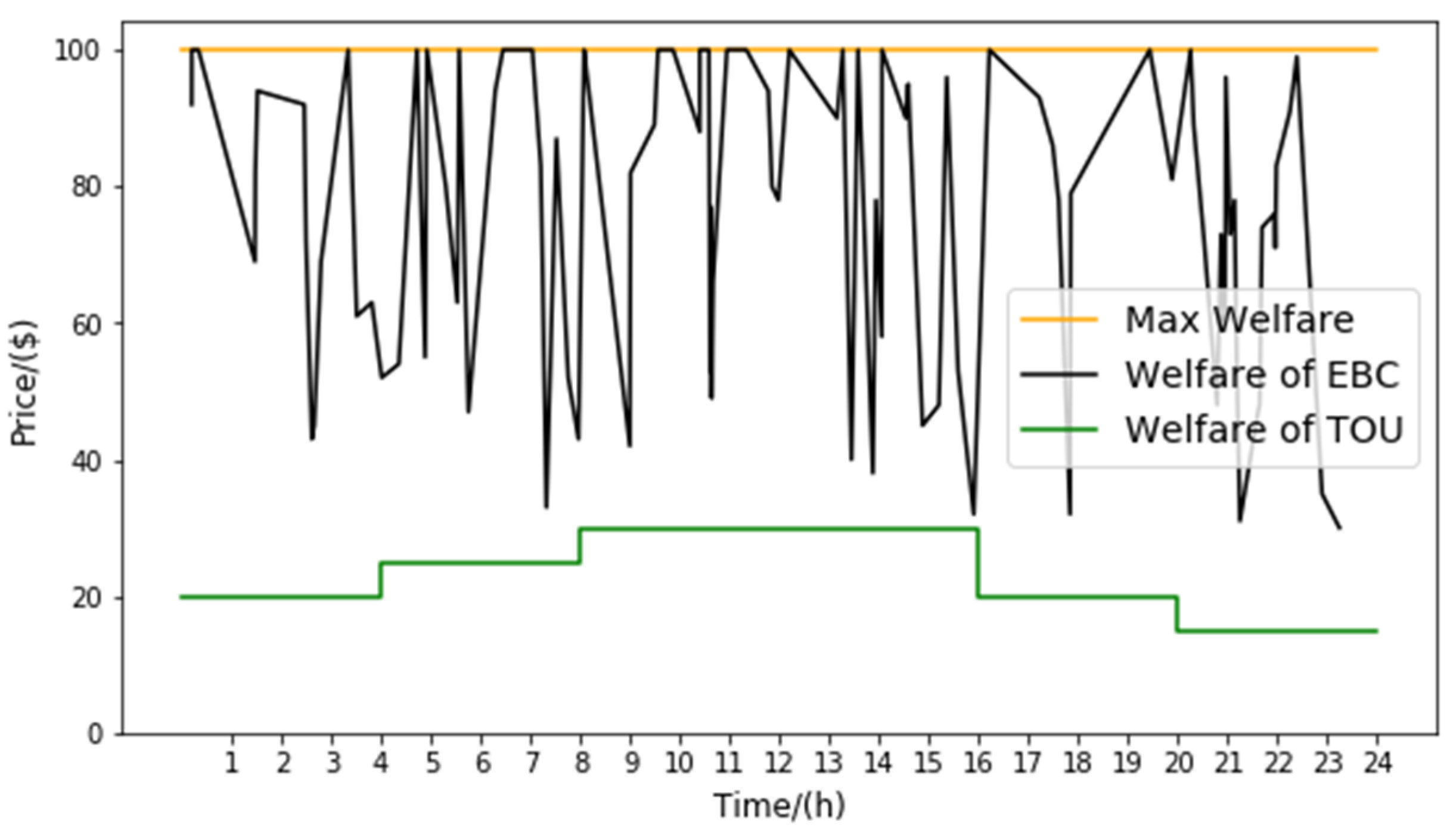

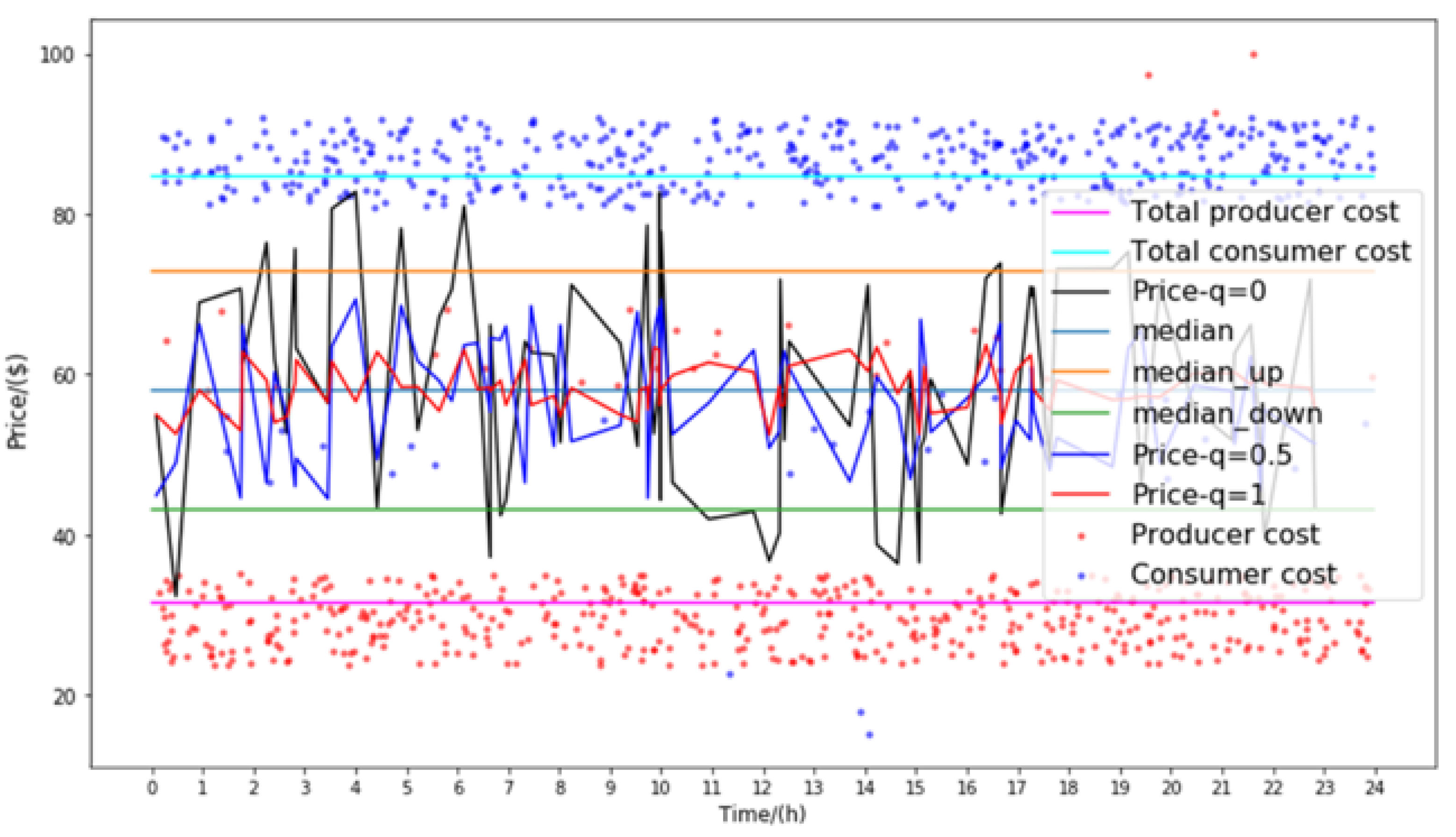

4. Introduce a Bidder Welfare Model

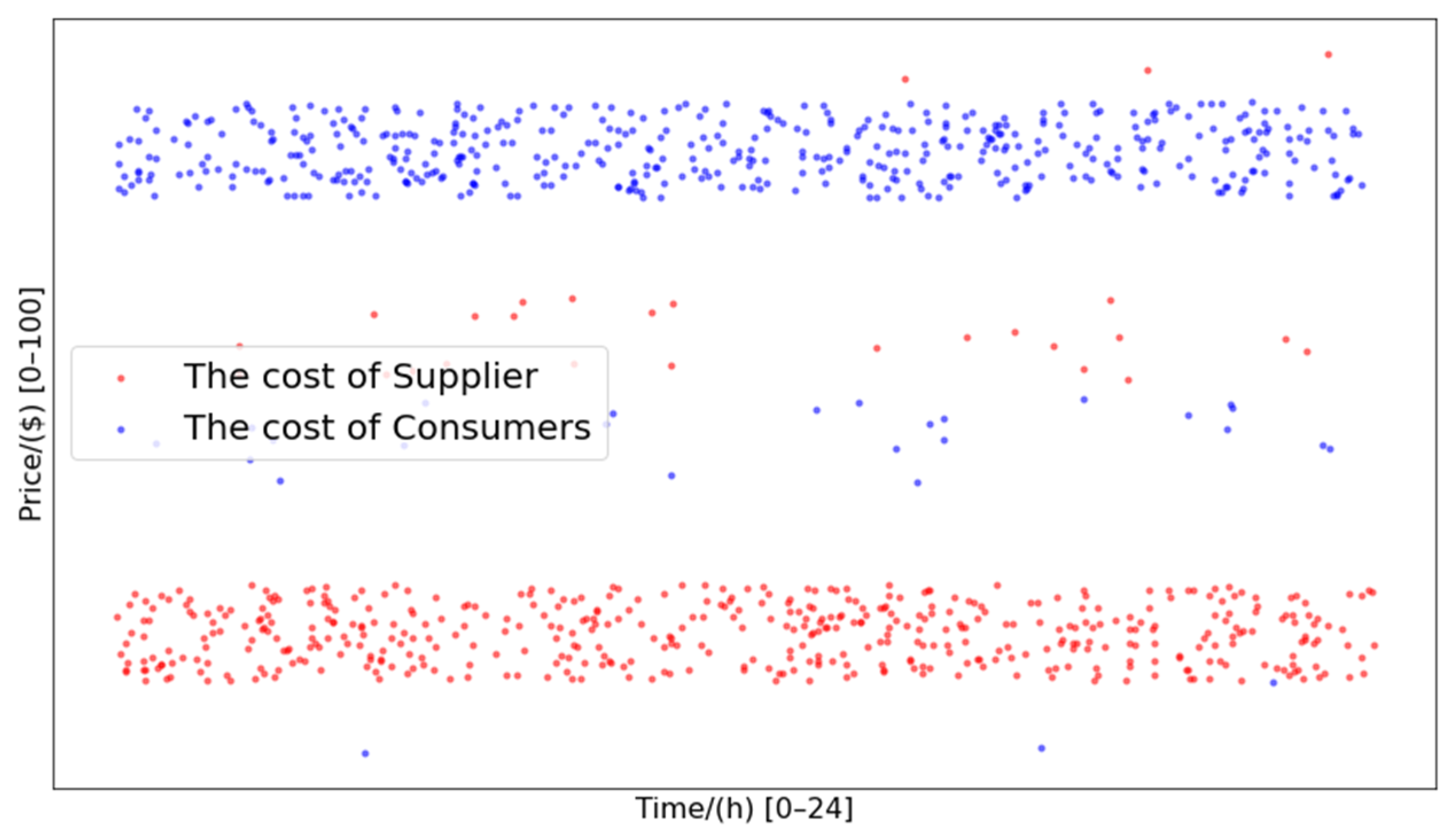

5. Simulation Results

6. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lu, W.T.; Dai, C.; Fu, Z.H.; Liang, Z.H.; Guo, H.C. An interval-fuzzy possibilistic programming model to optimize China energy management system with CO2 emission constraint. Energy 2018, 142, 1023–1039. [Google Scholar] [CrossRef]

- Dong, L.; Wang, S.; Peng, Y. An overview of development of tidal current in China: Energy resource, conversion technology and opportunities. Renew. Sustain. Energy Rev. 2010, 14, 2896–2905. [Google Scholar]

- Huang, W.; Ma, D.; Chen, W. Connecting water and energy: Assessing the impacts of carbon and water constraints on China’s power sector. Appl. Energy 2017, 185, 1497–1505. [Google Scholar] [CrossRef]

- Sheng, Z.; Zhang, X. Nuclear energy development in China: A study of opportunities and challenges. Energy 2010, 35, 4282–4288. [Google Scholar]

- Wu, H.; Li, Z.; Brian, K.; Zina, B.M.; John, W.; Jeffrey, T. A distributed ledger for supply chain physical distribution visibility. Information 2017, 8, 137. [Google Scholar] [CrossRef]

- Hong, S. P2P networking based internet of things (IoT) sensor node authentication by blockchain. Peer-to-Peer Netw. Appl. 2020, 13, 579–589. [Google Scholar] [CrossRef]

- Kim, H.M.; Laskowski, M.; Zargham, M.; Turesson, H.; Kabanov, D. Token economics in real life: Cryptocurrency and incentives design for insolar’s blockchain network. Computer 2021, 54, 70–80. [Google Scholar] [CrossRef]

- Khan, M.Y.; Zuhairi, M.F.; Ali, T.; Marmolejo-Saucedo, J.A. An extended access control model for permissioned blockchain frameworks. Wirel. Netw. 2020, 26, 4943–4954. [Google Scholar] [CrossRef]

- Ss, A.; Hezfa, B. Distributed voltage regulation using permissioned blockchains and extended contract net protocol. Int. J. Electr. Power Energy Syst. 2021, 9, 106945. [Google Scholar]

- Lucas, A.; Geneiatakis, D.; Soupionis, Y.; Nai-Fovino, I.; Kotsakis, E. Blockchain technology applied to energy demand response service tracking and data sharing. Energies 2021, 14, 1881. [Google Scholar] [CrossRef]

- Fairley, P. Blockchain world—Feeding the blockchain beast if bitcoin ever does go mainstream, the electricity needed to sustain it will be enormous. IEEE Spectr. 2017, 54, 36–59. [Google Scholar] [CrossRef]

- Sikorski, J.J.; Haughton, J.; Kraft, M. Blockchain technology in the chemical industry: Machine-to-machine electricity market. Appl. Energy 2017, 195, 234–246. [Google Scholar] [CrossRef]

- Jiang, Y.; Zhou, K.; Lu, X.; Yang, S. Electricity trading pricing among prosumers with game theory-based model in energy blockchain environment. Appl. Energy 2020, 271, 115239. [Google Scholar] [CrossRef]

- Tanwar, S.; Kaneriya, S.; Kumar, N.; Zeadally, S. ElectroBlocks: A blockchain-based energy trading scheme for smart grid systems. Int. J. Commun. Syst. 2020, 15, 4547. [Google Scholar] [CrossRef]

- Ante, L.; Steinmetz, F.; Fiedler, I. Blockchain and energy: A bibliometric analysis and review. Renew. Sustain. Energy Rev. 2021, 137, 110597. [Google Scholar] [CrossRef]

- Hwang, J.; Choi, M.-I.; Tacklim, L.; Seonki, J.; Seunghwan, K.; Sounghoan, P.; Sehyun, P. Energy prosumer business model using blockchain system to ensure transparency and safety. Energy Procedia 2017, 141, 194–198. [Google Scholar] [CrossRef]

- Zizzo, G.; Riva Sanseverino, E.; Ippolito, M.G.; Silvestre, D.; Luisa, M.; Gallo, P. A technical approach to P2P energy transactions in microgrids. IEEE Trans. Ind. Inform. 2018, 14, 4792–4803. [Google Scholar]

- Xia, M.; Li, X. Design and implementation of a high quality power supply scheme for distributed generation in a micro-grid. Energies 2013, 6, 4924–4944. [Google Scholar] [CrossRef]

- Silvestre, M.; Gallo, P.; Ippolito, M.G.; Musca, R.; Sanseverino, E.R.; Tran, Q.T.T.; Zizzo, G. Ancillary services in the energy blockchain for microgrids. IEEE Trans. Ind. Appl. 2019, 55, 7310–7319. [Google Scholar] [CrossRef]

- Bedin, A.; Capretz, M.; Mir, S. Blockchain for collaborative businesses. Mob. Netw. Appl. 2021, 26, 277–284. [Google Scholar] [CrossRef]

- Sawa, T. Blockchain technology outline and its application to field of power and energy system. Electr. Eng. Jpn. 2019, 206, 11–15. [Google Scholar] [CrossRef]

- Liu, C.; Chai, K.K.; Lau, E.T.; Chen, Y. Blockchain based energy trading model for electric vehicle charging schemes. In Proceedings of the Smart Grid and Innovative Frontiers in Telecommunications, Auckland, New Zealand, 23–24 April 2018; Volume 7, pp. 64–72. [Google Scholar]

- Zhang, H.; Zhang, H.; Song, L.; Yue, C. Peer-to-Peer energy trading in DC packetized power microgrids. IEEE J. Sel. Areas Commun. 2020, 38, 17–30. [Google Scholar] [CrossRef]

- Kim, B.; Ren, S.; van der Schaar, M.; Lee, J.W. Bidirectional energy trading and residential load scheduling with electric vehicles in the smart grid. IEEE J. Sel. Areas Commun. 2013, 31, 1219–1234. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Grttner, J.; Rock, K.; Kessler, S.; Weinhardt, C. Designing microgrid energy markets. Appl. Energy 2017, 210, 870–880. [Google Scholar] [CrossRef]

- Tsao, Y.C.; Thanh, V.V. Toward sustainable microgrids with blockchain technology-based peer-to-peer energy trading mechanism: A fuzzy meta-heuristic approach. Renew. Sustain. Energy Rev. 2021, 136, 110452. [Google Scholar] [CrossRef]

- Liu, C.; Chai, K.K.; Zhang, X.; Chen, Y. Peer-to-Peer electricity trading system: Smart contracts based proof-of-benefit consensus protocol. Wirel. Netw. 2021, 27, 4217–4228. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Notheisen, B.; Beer, C.; Dauer, D.; Weinhardt, C. A blockchain-based smart grid: Towards sustainable local energy markets. Comput. Sci. Res. Dev. 2018, 33, 207–214. [Google Scholar] [CrossRef]

- Seven, S.; Yao, G.; Soran, A.; Onen, A.; Muyeen, S.M. Peer-to-peer energy trading in virtual power plant based on blockchain smart contracts. IEEE Access 2020, 8, 175713–175726. [Google Scholar] [CrossRef]

- Cai, T.; Cai, H.J.; Wang, H.; Muyeen, S.M. Analysis of blockchain system with token-based bookkeeping method. IEEE Access 2019, 7, 50823–50832. [Google Scholar] [CrossRef]

- Leonhard, R. Developing renewable energy credits as cryptocurrency on ethereum’s blockchain. Soc. Sci. Electron. Publ. 2016, 12, 1–15. [Google Scholar] [CrossRef]

- Ittay, E. Blockchain Technology: Transforming libertarian cryptocurrency dreams to finance and banking realities. Computer 2017, 50, 38–49. [Google Scholar]

- Wang, L.; Liu, J.; Yuan, R.; Wu, J.; Li, M. Adaptive bidding strategy for real-time energy management in multi-energy market enhanced by blockchain. Appl. Energy 2020, 279, 115866. [Google Scholar] [CrossRef]

- Poongodi, M.; Sharma, A.; Vijayakumar, V.; Bhardwaj, V.; Kumar, R. Prediction of the price of Ethereum blockchain cryptocurrency in an industrial finance system. Comput. Electr. Eng. 2020, 81, 106527. [Google Scholar]

- Song, H.; Zhu, N.; Xue, R.; He, J.; Wang, J. Proof-of-Contribution consensus mechanism for blockchain and its application in intellectual property protection. Inf. Process. Manag. 2021, 58, 102507. [Google Scholar] [CrossRef]

- Dai, W.; Deng, J.; Wang, Q.; Cui, C.; Zou, D.; Hai, J. SBLWT: A secure blockchain lightweight wallet based on trustzone. IEEE Access 2018, 6, 40638–40648. [Google Scholar] [CrossRef]

- Caldarelli, G.; Rossignoli, C.; Zardini, A. Overcoming the blockchain oracle problem in the traceability of non-fungible products. Sustainability 2020, 12, 2391. [Google Scholar] [CrossRef]

- Tsallis, C.; Souza, A.; Curado, E. Stock exchange: A statistical model. Chaos Solitons Fract. 1995, 6, 561–567. [Google Scholar] [CrossRef]

- Lin, T.; Yang, X.; Wang, T.; Peng, T.; Hao, W. Implementation of High-Performance Blockchain Network Based on Cross-Chain Technology for IoT Applications. Sensors 2020, 20, 3268. [Google Scholar] [CrossRef] [PubMed]

- Arjomandi-Nezhad, A.; Fotuhi-Firuzabad, M.; Dorri, A.; Dehghanian, P. Proof of humanity: A tax-aware society-centric consensus algorithm for blockchains. Peer-to-Peer Netw. Appl. 2021, 14, 3634–3646. [Google Scholar] [CrossRef]

- Yadav, A.S.; Kushwaha, D.S. Blockchain-based digitization of land record through trust value-based consensus algorithm. Peer-to-Peer Netw. Appl. 2021, 14, 3540–3558. [Google Scholar] [CrossRef]

- Pogosyants, A.; Segala, R.; Lynch, N. Verification of the randomized consensus algorithm of aspnes and herlihy: A case study. Distrib. Comput. 2002, 13, 155–186. [Google Scholar] [CrossRef]

- Arghandeh, R.; Woyak, J.; Onen, A.; Jung, J.; Broadwater, R.P. Economic optimal operation of community energy storage systems in competitive energy markets. Appl. Energy 2014, 135, 71–80. [Google Scholar] [CrossRef]

- Wang, C.; Guo, L.; Deslauriers, J.C.; Bai, L.; Li, F.; Yu, Z.; Schiettekatte, J. Optimal design of battery energy storage system for a wind-diesel off-grid power system in a remote Canadian community. IET Gener. Transmiss. Distrib. 2016, 10, 608–616. [Google Scholar]

- Li, W.; Cao, M.; Wang, Y.; Tang, C.; Lin, F. Mining pool game model and nash equilibrium analysis for pow-based blockchain networks. IEEE Access 2020, 8, 101049–101060. [Google Scholar] [CrossRef]

- Kim, S.; Hahn, S.G. Mining pool manipulation in blockchain network over evolutionary block withholding attack. IEEE Access 2019, 7, 144230–144244. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, Y.; Li, J.; Gao, J. Real-Time Bidding Model of Cryptocurrency Energy Trading Platform. Energies 2021, 14, 7216. https://doi.org/10.3390/en14217216

Wu Y, Li J, Gao J. Real-Time Bidding Model of Cryptocurrency Energy Trading Platform. Energies. 2021; 14(21):7216. https://doi.org/10.3390/en14217216

Chicago/Turabian StyleWu, Yue, Junxiang Li, and Jin Gao. 2021. "Real-Time Bidding Model of Cryptocurrency Energy Trading Platform" Energies 14, no. 21: 7216. https://doi.org/10.3390/en14217216

APA StyleWu, Y., Li, J., & Gao, J. (2021). Real-Time Bidding Model of Cryptocurrency Energy Trading Platform. Energies, 14(21), 7216. https://doi.org/10.3390/en14217216