Abstract

Corporate social responsibility (CSR) is one of the main drivers of corporate reputation. Many studies show that CSR can positively affect financial performance (FP) and vice versa. However, the relationship between FP and CSR depends on the type of industry in which the company operates, and there is little research regarding the energy sector in this area. The basis of empirical research in this study is slack resource theory which argues that financial performance is the cause of corporate social performance. This paper aims to analyze if financial performance affects corporate social responsibility adoption in energy sector companies. In order to achieve this goal, the study specifically examines the relationship between selected financial performance indicators and CSR adoption. Analyzing an international sample of 219 companies from thirty-two countries for 2020, we observed the statistically significant relations between financial performance and the implementing of the CSR strategy of the energy industry companies. The Return on Assets measure (ROA) and the Earnings Before Interest and Taxes measure (EBIT) were significantly higher among companies implementing the CSR strategy. The Enterprise Value to earnings before interest, taxes, depreciation, and amortization ratio (EV EBITDA) was lower among companies that adopted CSR. We did not confirm that the Return on Equity measure (ROE), Beta coefficient, and EBITDA per Share correlated with CSR adoption. Our research had implications for firms’ investment policies in social initiatives and highlighted the relation between the financial performance and CSR initiatives of the energy sector companies.

1. Introduction

Corporate Social Responsibility (CSR) is a concept that is often defined in scientific literature. Most definitions of corporate social responsibility describe CSR as a concept whereby companies voluntarily incorporate social and environmental issues into their economic activities and have interactions with stakeholders [1]. At an early stage, it was thought that CSR could only be satisfied by fulfilling responsibilities to individuals and not to society as a whole [2]. However, later, other researchers started to define CSR as a more integral concept relating to the full range of business obligations to society, including legal, economic, ethical, and other optional categories of business activity [3]. For example, CSR is defined as activities that seem to serve a particular social good, going beyond the company’s interests and what is required by law [4]. They can include supporting local businesses or charities, developing recycling programs, promoting minority employment [5], adopting advanced human resource management programs, and producing products which integrate social attributes [6]. Therefore, the basic concepts of corporate social responsibility are to reflect the company’s total commitment to its internal stakeholders, such as employees, shareholders and external stakeholders, including suppliers, customers and the community. Thus, CSR combines economic, public, and social responsibilities. The content and goals of CSR may differ depending on the country of origin of the company. The implementation of CSR may depend on the macroeconomic conditions in the country [7] and the existing differences in regional economic development [8], special economic zones [9], differences in productivity, regional innovation performance, the effectiveness of labor market policy [10], and productivity convergence in the regions from which the researched companies come from [11,12].

The result of CSR is corporate social performance (CSP), defined in the literature as a configuration of CSR principles, social-response processes, programs, policies, and observable results related to the company’s social relations [13]. Undoubtedly, activities in the field of CSR bring about social benefits. Still, in the literature, there is a discussion of whether they improve the financial performance of the companies and if the CSR depends on the financial performance, and empirical research in this area has not yet reached a consensus.

A review of empirical studies on the relationship between CSR and financial performance shows that most studies treat social performance as an independent variable used to predict financial performance [14]. Approximately 50% of the studies found a positive relationship between CSR and FP [15]. The fact that CSR gives a competitive advantage translates into better financial performance is justified by the theory of instrumental stakeholders and the hypothesis of social impact. The instrumental stakeholder theory framework assumes that if the interests of multiple stakeholders of an organization are taken into account, they can improve the company’s image and status. The focus on such aspects can positively affect the company’s productivity, financial performance and value creation [16,17]. Inspired by this theory, the hypothesis of social impact suggests that good (bad) social outcomes generate good (bad) financial results [18,19]. It postulates that if a company satisfies its stakeholders, e.g., by implementing social projects, it will improve its image and reputation, and thus its financial results. On the other hand, if a company fails to achieve positive social impact, it will create image concerns among stakeholders, increasing costs and reducing profits [20].

Good social performance is also associated with managerial competencies and good management practices, leading to good financial results. For example, large companies benefit from favorable long-term stock performance [21], and companies with substantial shareholder rights tend to have a lower cost of equity capital than their competitors [22]. Good stakeholder relations and acceptance by the community have a positive effect on the financial outcomes of the companies in the long term. For instance, building a new plant in such a case is more accessible because of lower costs through government regulation; this can also obtain government tax breaks [23]. Moreover, CSR can stimulate human capital accumulation. A firm that adopted CSR on a high level is usually more attractive to employees and has a low turnover, which reduces the costs of recruiting and training employees [24]. The literature describes many other different ways in which CSR adoption can affect a company’s FP, e.g., CSR can positively influence a company’s resources and capabilities. It can positively impact reputation, which can lower operating costs in terms of reducing waste and risks, or can positively impact employee engagement and productivity [25]. The four benefits of a commitment to CSR are cost reduction, competitive advantages, reputation and legitimacy building, and the search for win–win outcomes. These benefits create a solid resource base and lead to excellent financial results [26].

Other researchers (around 5%) believe that CSR adoption has a negative impact on FP [15,27]. According to them, investments in any CSR activities increase costs due to inefficient resource allocation [28,29], create conflicts of interest between stakeholders [6], thus creating unfavorable competition conditions for firms in a competitive market, and ultimately harm the company’s performance. Therefore, firms which have adopted CSR bear higher expenditures and have a lower competitive advantage than companies without CSR [30]. The spending on CSR activities may therefore not be covered by the generated profits. Consequently, CSR activities have a negative effect on the company’s FP [31,32]. The negative relationship of CSR–FP is theorized within the compromise hypothesis [33]. This theory is that the company must meet its different needs within a limited resource base. Directing resources towards CSR can consume vital resources that could be used for more productive purposes. The negative relationship is also explained by the hypothesis of managerial opportunism, which assumes that the goal of managers and stakeholders may be contradictory, and in such a case, managers can only support their own interests [33].

Only a few studies regard the inverse relationship between CSR and FP, implying that FP precedes CSR and treats enterprises’ CSR as a dependent variable [14]. Empirical evidence showing that better FP affects good CSR confirms the slack resource theory, according to which a financially successful company is better positioned to invest in CSR. This theory states that companies only engage in CSR when the company brings financial benefits. In this case, the firm has enough financial resources to invest in social projects. Financial success is, therefore, the main driver of CSR. The first empirical study to support this theory found that a company’s social performance was positively related to the company’s previous and future FP [20]. In most other studies, the relationship between social and financial performance was positive in many different contexts and sectors because the companies with better financial results spent more resources on social activities.

In turn, the negative relations between CSR and FP are justified by the hypothesis of managerial opportunism. According to this hypothesis, the more an enterprise is financially effective, the less it will be socially effective. This is explained by the fact that managers who do not achieve good financial results invest in social activities to justify their poor performance. However, when FP is high, they avoid investing in social activities to increase their private profit in the short term [33].

In conclusion, the cause-and-effect relationship between CSR and FP can veer in both directions. Most authors consider the possibility of a “virtuous circle” created by simultaneous and interactive interaction as increased CSR leads to better financial performance and vice versa [17,20].

According to some researchers, applying a corporate social responsibility strategy depends on the industry’s sensitivity to the environment. Companies with production processes that harmfully affect the environment need more information than companies from other industries. Such companies include, among others, companies from the energy sector [34]. Energy companies are increasingly forced to take on greater social responsibilities, including labor rights, stakeholder engagement, environmental performance, human rights, and social impact [35]. This is mainly because the energy sector, responsible for the vast majority of emissions, requires optimization measures to reduce emissions. These activities can have different costs, application difficulties, environmental and social impacts [36]. By its nature, the energy sector plays a crucial role in sustainable development and is also a forerunner in CSR issues [37]. However, in this sector there are many varied challenges related to the management and implementation of CSR. These include high costs, a lack of information and awareness, insufficient human resources, poor cooperation with stakeholders, a lack of beneficiary involvement and the integration of CSR initiatives into more extensive development plans, an excessive focus on technical and management solutions [38,39].

Our study considered energy companies that are recently being forced to address a broader set of CSR and sustainability-related efforts and activities. Due to increasing demands from stakeholders related to CSR and sustainability issues, energy companies are under pressure to respond adequately to these needs and expectations, comply with national and international laws and regulations; and follow global initiatives and practices to improve sustainability performance. As a result of the environmental and social issues caused by business organizations operating in environmentally sensitive industries, the importance of CSR and sustainability-related reporting practices based on globally recognized reporting guidelines, has increased.

There is a wide range of research focusing on CSR in the context of energy. However, studies examining the relationship between CSR adoption and FP are scarce. Most of the research on the energy sector concerns the impact of CSR on financial performance. For example, other studies based on data from Thomson Reuters for 2011–2018 showed that higher CSR performance did not guarantee better financial results, as demonstrated by both the market and accounting results [40]. Another study found that the three individual dimensions of environmental responsibility (product innovation, resource reduction, and emission reduction) were positively related to the financial performance of companies. Still, the impact of the third dimension (emission reduction) was not significant [41]. A positive effect of CSR on corporate FP was also found in a study that examined the data of 210 energy firms worldwide. These results were measured as a market capitalization value [42]. A study that used a case study approach demonstrated the link between socially responsible corporate performance and profitability [43]. Although this study did not investigate the direction of causation, the results nevertheless indicated that CSR was positively associated with a better financial performance (profitability) and the relationship was statistically significant.

In conclusion, while many efforts have been made to understand the effect of CSR on FP, the accessible empirical evidence remains ambiguous. Research on the impact of CSR activities on FP can be divided into those who support positive correlation and those whoclaim the opposite. While some studies showed that the additional revenues generated by companies from CSR exceeded the expenditures incurred, the other studies argued that the costs incurred to conduct CSR activities exceeded the profits [44].

Although the existing research considers CSR in the context of the energy industry from many different perspectives, and despite its general importance in the energy sector, most studies concern the analysis of the impact of CSR on FP. The inverse link of FP–CSR in the energy sector is underrepresented in this context; we found only one item treating CSR as a dependent variable. The analysis of panel data for 14 companies from the energy sector for the years 1991 and 2009 carried out by Pätäri et al. [25] aimed to examine whether investments in CSR affected corporate financial performance and the reverse relationship. CSR was measured here using two separate constructs: strengths and concerns of CSR used in the ratings provided by MSCI ESG Research. The results did not support bidirectional causality between CSR and FP. According to these results, changes in two FP indicators, ROA and return on invested capital (ROIC), did not cause Granger causality in the total number of CSR strengths or concerns. According to Nelling and Webb [5], Corporate Social Performance (CSP) seemed to derive from the unobservable characteristics of companies rather than their financial performance.

Despite a great interest in CSR, and especially its relationship with financial results, the results of previous studies are inconclusive. It is difficult to determine whether CSR influences FP, or whether companies that achieved financial success are more proactive in sustainable development. This means that the field is full of ambiguities. Moreover, previous researchers focused mainly on the various dimensions of CSR rather than its adoption, and, to date, little research has been conducted in the energy sector. The impact of the FP on CSR adoption in the energy sector has not been investigated so far. Therefore, our goal is to reduce this research gap.

We would like to address the research gap in the literature by examining the relationships between energy sector companies’ financial performances and CSR adoption. It is worth emphasizing that the degree of linkage between CSR and FP may vary depending on the measurement of specific financial ratios. Thus, this study aims to investigate whether and to what extent various financial indicators affect the implementation of CSR strategy in companies in the energy sector. This study proposes that six different indicators can measure financial performance: ROA, ROE, EBIT, Enterprise Value to EBITDA, EBITDA per Share, and Beta coefficient. These indicators are considered the potential factors that may impact CSR adoption. The study further examines whether each of the five FP indicators positively influences the implementation of the CSR strategy in energy companies. Therefore, our research hypotheses are as follows:

Hypothesis 1 (H1).

ROA has a positive impact on CSR adoption among energy sector companies.

Hypothesis 2 (H2).

ROE has a positive impact on CSR adoption among energy sector companies.

Hypothesis 3 (H3).

EBIT has a positive impact on CSR adoption among energy sector companies.

Hypothesis 4 (H4).

The Enterprise Value to EBITDA ratio has a positive impact on CSR adoption among energy sector companies.

Hypothesis 5 (H5).

EBITDA per Share has a positive impact on CSR adoption among energy sector companies.

Hypothesis 6 (H6).

The Beta coefficient has a positive impact on CSR adoption among energy sector companies.

This survey provides energy sector company managers with a clear insight into which kinds of financial performance are conducive to implementing a CSR strategy. The rest of the article is structured as follows. The second section describes the data collection and methodology, the third section presents the empirical results, and the final section discusses the findings and conclusions.

2. Materials and Methods

The methodology of the study involves a three-stage approach: (i) identification of the variables that may impact CSR adoption, (ii) investigation of the descriptive statistics and correlation between identified independent variables (iii) estimation of a logit model to examine the impact of identified independent variables on CSR adoption. The research focused on energy sector companies.

2.1. Data and Sample

This study uses non-probability sampling with a purposive sampling method which determines research samples using defined criteria. The criteria used by researchers for sampling are as follows: public companies from the energy sector listed in the Thomson Reuters Eikon (TR EIKON) database in 2020 who have a number of full-time employees higher than 150 with complete financial and non-financial data related to the research variables. We made this choice based on the assumptions that Corporate Social Responsibility (CSR) was associated mainly with big companies; they are often better resourced and are more able to invest in CSR. They attract more media attention, and they are particularly concerned with protecting and enhancing their reputations with the broader public and key stakeholders. The coverage of the TR EIKON database extends worldwide, reaching 99% of the market capitalization. The database contains more than 72,000 firm-level data of publicly traded companies from 150 countries. TR EIKON provides company fundamentals also published for the energy sector, including companies that produce, supply, and distribute energy. The analysis covered 219 companies from 32 countries (Table 1).

Table 1.

The number of analyzed firms by country.

As can be seen from Table 1, most of the firms covered by the analysis have their headquarters in the USA (41.10%), Canada (17.35%), and China (7.31%). The headquarters of almost 13% of the analyzed companies are in Europe. The majority of countries (18) are represented only by one company.

2.2. Key Variables

The dependent variable in the model is CSR adoption. CSR is a complex construct to measure due to its multidimensionality and invisibility. Various empirical and theoretical studies measure CSR in many distinct methods. In our research, CSR adoption is measured by a dummy variable, which takes the value of 1 if the company has implemented CSR and 0 if it has not. Measuring CSR by using a dichotomous variable was already measured in several previous studies [45,46,47,48,49].

FP indicators used in the previous studies can be roughly split into market and accounting measures. Market measures (e.g., Tobin Q) are calculated from the investors’ points of view on a particular date. Accounting measures (e.g., EPS, ROA, ROE) are calculated on time results [50]. Unlike market measures, accounting measures can reflect managerial performance and the internal decision-making process [4]. Moreover, identifying the relationship between CSR and FP using accounting measures rather than market measures is more appropriate for detection [51]. Therefore, based on the previous research, we consider six independent variables (ROA, ROE, EBIT, Enterprise Value to EBITDA, EBITDA per Share, and Beta coefficient) as the possible factors that may influence the adoption of CSR strategy.

Return on Assets (ROA) is the first variable related to the company’s FP. Profitability ratios show the company’s ability to generate profit. One of the main profitability indicators is the ROA used by investors for investment decisions depending on potential returns [52]. Some studies show that ROA has a positive effect on goodwill. In this way, higher returns and rates of return force investors to invest, thereby increasing share prices and goodwill [53]. ROA is a measure of financial performance, commonly used in analyzing the effect of CSR on company finance [48,54,55,56,57].

Return on Equity (ROE) is an FP measure calculated by dividing the net income by equity. ROE demonstrates a company’s ability to turn capital investments into profits. In other words, it measures the returns made on each monetary unit of equity. It is one of the all-time favorite and most widely used general measure of corporate financial performance [58], also confirmed by Monteiro [59]. ROE is popular with investors because it combines the income statement (net profit/loss) with the balance sheet (equity). The fact that ROE results from a structured financial ratio analysis, known as the Du Pont analysis, also contributes to its popularity with analysts, financial managers and shareholders [60]. ROE is already used in research on this topic [47,50].

Earnings Before Interest and Taxes (EBIT) is the company’s net income before taxes and interest costs. EBIT is used to analyze the effectiveness of the company’s core business without capital structure costs and tax expenses affecting profit. The approach of using EBIT in terms of CSR adoption is already presented in the literature [55,61,62].

EBITDA stands for earnings before interest, taxes, depreciation, and amortization, and is used to evaluate a company’s operating performance. It can be seen as a representative of the cash flow of the business of the entire company. EBITDA is already analyzed in the literature as a financial performance measure regarding CSR adoption [63,64].

In terms of the enterprise value to earnings before interest, taxes, depreciation, and amortization (EV EBITDA), the enterprise value (EV) includes both debt and equity, and EBITDA is the profit available to investors. Since a change in capital structure has no systematic effect on company performance, this ratio is less susceptible to manipulation by changes in capital structure. Only when such a change lowers the cost of capital will it lead to a higher multiple [65].

The Beta coefficient (BETA) measures an investment’s volatility and risk compared to the overall market. Beta is a statistical tool, which gives an idea of how a fund will move in relation to the market. In other words, it is a statistical measure that shows how sensitive a fund is to market moves. EV EBITDA and the Beta coefficient have not been previously used in the literature to analyze the FP–CSR relationship.

2.3. Research Model

In the second stage of our research, we estimated the correlation between the independent variables. Following that, we specified and estimated a logit model in order to examine the impact of identified independent variables on CSR adoption. Several authors already used the logit model in similar research studies [36,66,67].

The model is specified as follows:

logit (Probability of CSR adoption) = β0 + β1(ROA) + β2(ROE) + β3(EBIT)

+ β4(EBITDA per share) + β5(EV EBITDA) + β6(BETA) + e

+ β4(EBITDA per share) + β5(EV EBITDA) + β6(BETA) + e

Data were analyzed based on descriptive statistics, such as means, standard deviations, medians, and interquartile ranges. Differences were calculated with the Mann–Whitney test. A p-value of less than 0.05 was considered statistically significant. We used STATISTICA, (TIBCO Software INC., Statsoft Polska, version 13.3, Palo Alto, CA, USA).

3. Results

3.1. Descriptive Statistics and Correlation Matrix

Table 2 provides a condensed view of various descriptive statistics for all independent variables. The average values of ROA and ROE were −8.317% and 27.39%, respectively. The Beta coefficient was 1.447. The average earnings before interest were EUR 467,626,496.818. Descriptive statistics are presented in Table 3 separately for companies that have implemented CSR and for other companies.

Table 2.

Descriptive statistics of the sample firms.

Table 3.

Comparison of variables of companies that confirmed and did not confirm CSR adoption.

Based on the analysis of data, 72.6% of the companies adopted CSR. We found statistically significant differences between companies that confirmed and did not confirm CSR adoption in terms of ROA and EBIT. The average ROA in companies that confirmed CSR adoption was two times higher than among companies that did not confirm CSR adoption. The average values of ROA were −6.15% and −13.131% for companies that adopted and did not adopt CSR, respectively. In terms of the value of EBIT, we observed that it was almost 30 times higher among companies that adopted CSR compared to the other companies covered by the analysis. We did not observe a statistically significant difference between companies that adopted and did not adopt CSR in terms of ROE, Beta coefficient, EBITDA per Share, and EV EBITDA.

Table 4 presents correlations between the analyzed variables. We found a positive correlation between ROA and ROE, ROA and EBIT, as well as the Beta coefficient and EBIT. A positive correlation indicated that the variables increased or decreased together. The pairwise correlation coefficients were less than 0.4, indicating multicollinearity, and were not observed in the model.

Table 4.

Spearman correlations coefficient between independent variables.

3.2. Binary Logit Model

To analyze the indicators affecting CSR adoption, we used the binary logit regression model. The dependent variable (CSR adoption) was a binary variable reaching the value of 1 (the company adopted CSR) or 0 (the company did not adopt CSR). The logit model, based on cumulative logistic probability functions, was computationally easier to use and could predict the probability of CSR adoption in the company. The results are presented in Table 5.

Table 5.

The multivariate logistic regression model.

The results confirm a statistically significant positive impact of ROA on CSR adoption. From Table 5, we found that, with a 95% confidence level, only ROA and EV EBITDA ratios had a significant effect on the CSR adoption with a p-value of less than the significance level alpha = 0.05, although these effects were minor. In the logistic model, if the odds ratio was greater than 1, the higher the value of the variable, and the higher the odds were of implementing CSR. Only ROA had a positive effect on CSR adoption. That is, increasing the ROA ratio level increased the probability of adopting CSR. In terms of the Enterprise Value to EBITDA ratio, a statistically significant negative effect was observed. We did not confirm the influence on CSR adoption in terms of the other analyzed variables. Thus, only Hypothesis 1 was supported.

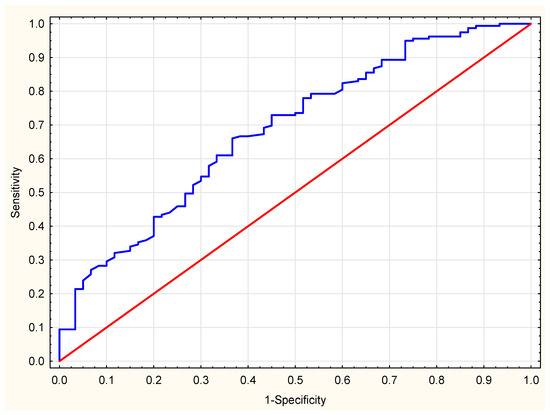

The area under the ROC curve was found to be 0.685 (Figure 1). Since the area under the curve was more than 0.5, and the closer the curve followed the left-hand border and then the top border of the ROC space, the more acceptable the model.

Figure 1.

ROC curves for model results with AUC of 0.685.

4. Discussion

One aspect of understanding the relationship between CSR and financial performance was understanding the direction of causation. This meant to understand what factor acts as a predecessor and the consequence of such a relationship. Most studies treated financial performance as a dependent variable. In the context of this study, we checked whether better financial performance led to CSR adoption. Our study, however, went beyond the boundaries of linking general financial performance to CSR and proceeded to assess the impact of specific financial indicators on CSR adoption.

This study applies the binary logit regression model to examine the impact of selected financial indicators on CSR adoption in companies from the energy sector. The ratios include ROA, ROE, EBIT, Enterprise Value to EBITDA, EBITDA per Share, and the Beta coefficient. The analysis results show that the only indicator that increases the probability of CSR adoption is ROA. The increase in the Enterprise Value to EBITDA has a negative impact. We do not find any relationship between CSR adoption and ROE, EBIT, EBITDA per Share, and the Beta coefficient. Compared to other metrics, companies with high returns on assets show the highest likelihood of CSR adoption. Such companies are more willing to invest in social initiatives than others. A way to encourage companies with a high ROA to adopt CSR as their primary means of improving their public image and long-term performance may be through society’s use of moral persuasion. This means to motivate companies to implement quality-of-life practices in the community in which they conduct business to contribute to that community’s educational, social, and economic development [68].

In this context, our research confirms the Slack Resources Theory, which explains the positive impact of FP on CSR. This theory indicates that better FP results in slack resources for companies mean that they can invest them in social ventures, thus emphasizing that better FP would cause better social performance [69]. Other studies in the literature confirm that better financial results translate into CSR adoption and better CSR activities. For instance, research conducted based on data from large American corporations showed that this also positively influenced the following year’s financial results [33]. Another study explored the relationship between CSR disclosure and financial performance, and vice versa, using different approaches, i.e., statistical through multiple regression modeling techniques. The study results showed that the financial results based on the company’s profitability had a cause-and-effect relationship with the disclosure of CSR, and vice versa [70]. Recent research also showed a significant causal link between FP and CSR adoption, as spending on social activities depended on financial outcomes. Profitability motivated an investment in social activities and inspired investor confidence [71]. Recent studies also showed that FP affected the company’s CSR in the short term and the long term [72].

The variable that was most often used to reflect financial performance in the FP–CSR relationship research was ROA; this could be found in at least 22 other studies [73]. Our analysis showed that ROA indicators had a positive and statistically significant impact on CSR adoption, thus supporting Hypothesis 1 (H1). In other words, ROA indicators were the only financial factor determining the ability of companies to engage in CSR activities. Similar results were reported by other researchers [74,75,76]. Dewi’s [77] research showed not only a direct positive impact of ROA on CSR but also ROE on CSR. The positive correlation between the financial ratios of ROA and ROE and the CSR showed that companies with social and financial performance tended to have wide-ranging social disclosure [29]. In our research, the impact of ROE on CSR adoption turned out to be statistically insignificant, so the Hypothesis 2 was not confirmed. The estimated probabilities from the model showed that profitability had little effect on CSR adoption (low odds ratio—OR). This important finding contradicted some existing research that showed that profitability had a significant direct impact on investment in CSR.

Other hypotheses were also not confirmed in this study. The relations between EV EBITDA and CSR adoption among energy sector companies were negative. We believe that the negative impact of the Enterprise Value on EBITDA was because high-value companies tended to develop and remain competitive. Hence, they devotde most of their resources to maintaining that value rather than engaging them in social endeavors. Other relationships between financial indicators and CSR adoption were not statistically significant.

Additionally, previous research showed that CSR adoption appeared to be positively related to profitability ratios. However, the links between CSR and profitability were studied using simple statistical methods and linear regression [43]. A similar analysis, which also used a regression approach, was carried out on data from 30 publicly listed Nigerian companies [78]. Another study explored the additional effect of leverage on CSR disclosures using data from 41 listed firms [79]. As in other studies, it was found that profitability and company size positively affected CSR adoption. Importantly, it was also found that highly leveraged firms were less likely to engage in CSR. The regression model was also used to study the CSP-CFP relationship in the context of emerging markets [80].

The previous research which showed that CSR adoption appeared to be positively related to profitability ratios did not consider that many different financial indicators. The profitability measure used in another regression model used the financial data of 40 listed companies; in addition to the Return on ROA assets, was the Return on equity (ROE) [56]. Accounting indicators such as the Return on assets (ROA), return on capital (ROE) and return on sales (ROS) were also used as indicators of the financial results. However, these studies did not show a significant relationship between the examined variables. Other methods used in the analysis of FP–CSR included Dynamic Circulation Viewpoint and Multivariate Analysis of Variance (MANOVA). These studies showed a positive and mutual relationship between the variables [81].

According to Reverte [82], neither profitability nor other financial indicators explain the differences in CSR disclosure practices between companies. Thus, it is worth considering the moderating influence of other variables on these relationships. Control variables should be included in the study when there is reason to believe that they may play a role in analyzing the relationships between CSR and FP. The most influential variables explaining the differentiation of companies in CSR assessments are those related to public or social visibility. The effect of visibility has a significant, positive relationship between visibility and CSR assessment, which is confirmed in other studies [83]. Other authors [84] argue that to investigate CSR’s impact on the company’s financial performance, the moderating role of corporate governance should be examined. In turn, other researchers [85] investigate the role of CEO power (measured by the relative pay of the director) and find that CEO power positively moderates the relationship between CSR and financial performance. Influential CEOs have considerable freedom in determining expenditure on social and environmental activities of enterprises. So, for example, they can suspend social and environmental activities to demonstrate a better financial performance, or they can, in other cases, increase spending to gain a personal reputation for being socially responsible. There are also studies providing empirical evidence of the relationship between board attributes and CSR engagement, as well as CSR engagement and financial performance in the global energy sector. These results indicate that board diligence and CSR committees are strong drivers of CSR performance [40].

5. Conclusions and Implications

Our study makes some contributions to the literature regarding CSR. First of all, this article is one of the few attempts to use specific financial indicators to examine the decisions of companies from the energy sector regarding the implementation of CSR. While other researchers attempted to investigate the impact of overall financial performance on CSR, they were not able to discern different forms of response to financial performance feedback, because they did not analyze the effect of individual financial metrics separately. Secondly, while the energy sector has a significant environmental and social impact, no empirical cross-sectional study specific to the industry has been carried out so far from an international database of large companies. As far as we know, no previous studies on this topic have focused on a sample of international firms. Third, although the analyzed studies examined the links between companies’ financial results and CSR, they are insufficiently investigated in the energy sector. Analyzing CSR adoption as a dependent variable is used to a limited extent and is not the subject of any research in the energy sector. By using this dummy variable, the results for CSR could be easily compared with other studies. Due to the variety of CSR measures, the possibility of comparing the results concerning CSR is limited. Therefore, this study adds new evidence to the existing literature by providing an empirical analysis of the relationship between FP and CSR adoption in the energy sector. The impact of the FP on CSR adoption in the energy sector has not been investigated so far. Therefore, our goal is to reduce this research gap.

Our findings also have some management implications. The results of our study may be helpful in the further understanding of the motivation of companies’ decisions in the field of CSR implementation. CSR activities are becoming more and more important for the sustainable business of companies, ensuring the legitimacy and facilitating exchange relations with their stakeholders [1,25]. We show that companies are more likely to engage in CSR activities when they achieve better financial results, as measured by the ROA ratio. The relationship between other financial measures and CSR adoption is not so clear.

Our study also offers a methodological improvement through the use of the binary logit regression model, which allows the determining of the likelihood that a company will engage in CSR, taking into account its financial characteristics. This approach avoids measurement errors encountered in studies aiming to determine whether there is a positive relationship between CSR investments and the financial results [74].

CSR has become an important research area for researchers looking into its relationship with other variables, such as financial performance. This study shows that, compared to other financial ratios, the size of the ROA has the most significant impact on shaping the company’s CSR policy. This evidence is based on the financial characteristics of energy sector companies with a number of full-time employees higher than 150. Other financial ratios examined include ROE, EBIT, Enterprise Value to EBITDA, EBITDA per Share, and Beta coefficient. However, most of the studied variables turned out to be statistically insignificant.

The approach in this study differs from previous studies, as CSR is measured as a binary variable, assuming values of 1 for companies that have implemented CSR and 0 for other cases. CSR is then linked to the size of the financial ratios under study using the binary logit regression model in this categorical form. The analysis results show that CSR is a positive function only for ROA and a negative growth function of the Enterprise Value to EBITDA. Clarifying the relationship between FP and CSR adoption is critical to promoting the implementation of CSR in all business companies and communities in every country worldwide [50].

6. Limitation and Future Research

This study has several limitations, which should be considered when evaluating the results. The study sample is based on firms listed in the Thomson Reuters EIKON database whose shares are traded in stock markets. Consequently, the results may not be generalizable to other firms not listed in a stock market. As far as we know, no previous studies on this topic focus on a sample of international firms. Our research contrasts with past research conducted in individual countries. Since the studied sector comprises large capital-intensive businesses, frequently operating as natural monopolies on national markets, choosing a single jurisdiction for analysis would not yield sufficient empirical material for quantitative analysis.

On the other hand, it would be interesting to undertake future research, including a complete sample to consistently support our hypotheses. A comparative analysis between countries in different cultural and geographical areas could generate an interesting line of future research. We also believe that interesting conclusions could be drawn by introducing various control variables into the analysis. Therefore, in future research, it would be worth also focusing on the relationship between financial performance and CSR, considering the control variables. The possible channels through which FP could affect CSR, or vice versa, could be the location of the firms, corporate governance, corporate visibility, the role of board diligence and the CSR committee, the gender of the director, corporate governance mechanisms, and the location of the firms.

In our study, we used only accounting-based indicators. We chose the six accounting variables presented in this paper because they permitted us, on the one hand, and were more appropriate for detection rather than market measures, on the other hand. According to some researchers, market results may be an interesting factor in assessing and understanding CSR implementation, which could be checked in subsequent studies.

To analyze the indicators affecting CSR adoption, we used the binary logit regression model. The dependent variable (CSR adoption) was a binary variable reaching the value 1 (company adopted CSR) or 0 (the company did not adopt CSR). The logit model, based on the cumulative logistic probability functions, was computationally easier to use and could predict the probability of CSR adoption in the company. Another widely recognized alternative approach to the analysis of CSR adoption was the Environmental, Social, and Governance (ESG) score measure, used with a linear regression model. The study of the degree of applicability of CSR implementation was also a possible extension of future work.

Author Contributions

Conceptualization, M.C. and M.K.-A.; methodology, M.C. and M.K.-A.; validation, M.C. and M.K.-A.; formal analysis, M.C. and M.K.-A.; investigation, M.C. and M.K.-A.; resources, M.C. and M.K.-A.; data curation, M.C.; writing—original draft preparation, M.C. and M.K.-A.; writing—review and editing, M.C. and M.K.-A.; visualization, M.C. and M.K.-A.; supervision, M.C. and M.K.-A.; project administration, M.C. and M.K.-A.; funding acquisition, M.K.-A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are available at the Thomson Reuters Eikon database and require a Thomson Reuters Eikon account login.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Commission of the European Communities. Promoting a European Framework for Corporate Social Responsibility: Green Paper; Office for Official Publications of the European Communities: Luxembourg, 2001. [Google Scholar]

- Chamberlain, N.W. The limits of Corporate Responsibility; Institute of National Affairs: Port Moresby, Papua New Guinea, 1979. [Google Scholar]

- Carroll, A.B. Corporate Social Responsibility. Bus. Soc. 1999, 38, 268–295. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate Social Responsibility: A Theory of the Firm Perspective. Acad. Manag. Rev. 2001, 26, 117. [Google Scholar] [CrossRef]

- Nelling, E.; Webb, E. Corporate social responsibility and financial performance: The “virtuous circle” revisited. Rev. Quant. Financ. Acc. 2008, 32, 197–209. [Google Scholar] [CrossRef]

- Barnett, M.L. Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Acad. Manag. Rev. 2007, 32, 794–816. [Google Scholar] [CrossRef]

- Glavopoulos, E.; Bersimis, S.; Georgakellos, D.; Sfakianakis, M. Investigating the factors affecting companies’ attitudes towards CSR and CER during the fiscal crisis in Greece. J. Environ. Plan. Manag. 2013, 57, 1612–1641. [Google Scholar] [CrossRef]

- Roszko-Wójtowicz, E.; Grzelak, M.M.; Laskowska, I. The impact of research and development activity on the TFP level in manufacturing in Poland. Equilibrium 2019, 14, 711–737. [Google Scholar] [CrossRef] [Green Version]

- Piersiala, L. The usage pattern of development method to assess the functioning of special economic zones: The case of Poland. Equilibrium 2019, 14, 167–181. [Google Scholar] [CrossRef] [Green Version]

- Rollnik-Sadowska, E.; Dąbrowska, E. Cluster analysis of effectiveness of labour market policy in the European Union. Oeconomia Copernic. 2018, 9, 143–158. [Google Scholar] [CrossRef]

- Kijek, A.; Matras-Bolibok, A. Technological convergence across European regions. Equilibrium 2020, 15, 295–313. [Google Scholar] [CrossRef]

- Kijek, T.; Matras-Bolibok, A. The relationship between TFP and innovation performance: Evidence from EU regions. Equilibrium 2019, 14, 695–709. [Google Scholar] [CrossRef]

- Wood, D.J. Corporate Social Performance Revisited. Acad. Manag. Rev. 1991, 16, 691–718. [Google Scholar] [CrossRef] [Green Version]

- Scholtens, B. A note on the interaction between corporate social responsibility and financial performance. Ecol. Econ. 2008, 68, 46–55. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. People and Profits?: The Search for a Link between a Company’s Social and Financial Performance; Psychology Press: Hove East Sussex, UK, 2001; ISBN 1135642265. [Google Scholar]

- Donaldson, T.; Preston, L.E. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Acad. Manag. Rev. 1995, 20, 65. [Google Scholar] [CrossRef] [Green Version]

- Hillman, A.J.; Keim, G.D. Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strateg. Manag. J. Strat. Mgmt. J. 2001, 22, 125–139. [Google Scholar] [CrossRef]

- Allouche, J.; Laroche, P.; Allouche, J.; Laroche, P. A Meta-analytical investigation of the relationship between corporate social and financial performance. Rev. Gest. Ressour. Hum. 2005, 57, 18. [Google Scholar]

- Wang, Q.; Dou, J.; Jia, S. A Meta-Analytic Review of Corporate Social Responsibility and Corporate Financial Performance. Bus. Soc. 2016, 55, 1083–1121. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B.; Carroll, W.E. The corporate social performance-financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Ferreira, E.J.; Sinha, A.; Varble, D. Long-run performance following quality management certification. Rev. Quant. Financ. Acc. 2007, 30, 93–109. [Google Scholar] [CrossRef]

- Cheng, C.A.; Collins, D.; Huang, H.H. Shareholder rights, financial disclosure and the cost of equity capital. Rev. Quant. Financ. Acc. 2006, 27, 175–204. [Google Scholar] [CrossRef]

- Parmar, B.L.; Freeman, R.E.; Harrison, J.S.; Wicks, A.C.; Purnell, L.; De Colle, S. Stakeholder Theory: The State of the Art. Acad. Manag. Ann. 2010, 4, 403–445. [Google Scholar] [CrossRef]

- Albinger, H.S.; Freeman, S.J. Corporate Social Performance and Attractiveness as an Employer to Different Job Seeking Populations. J. Bus. Ethics 2000, 28, 243–253. [Google Scholar] [CrossRef]

- Pätäri, S.; Arminen, H.; Tuppura, A.; Jantunen, A. Competitive and responsible? The relationship between corporate social and financial performance in the energy sector. Renew. Sustain. Energy Rev. 2014, 37, 142–154. [Google Scholar] [CrossRef]

- Kurucz, E.C.; Colbert, B.A.; Wheeler, D. The Business Case for Corporate Social Responsibility. Oxford Handb. Corp. Soc. Responsib. 2009, 83–112. [Google Scholar] [CrossRef]

- Berens, G.; Van Riel, C.B.M.; Van Rekom, J. The CSR-Quality Trade-Off: When can Corporate Social Responsibility and Corporate Ability Compensate Each Other? J. Bus. Ethic 2007, 74, 233–252. [Google Scholar] [CrossRef] [Green Version]

- Margolis, J.D.; Walsh, J.P. Misery Loves Companies: Rethinking Social Initiatives by Business. Adm. Sci. Q. 2003, 48, 268. [Google Scholar] [CrossRef] [Green Version]

- López, M.V.; Garcia, A.; Rodriguez, L. Sustainable Development and Corporate Performance: A Study Based on the Dow Jones Sustainability Index. J. Bus. Ethics 2007, 75, 285–300. [Google Scholar] [CrossRef]

- Shen, C.-H.; Chang, Y. Ambition Versus Conscience, Does Corporate Social Responsibility Pay off? The Application of Matching Methods. J. Bus. Ethics 2008, 88, 133–153. [Google Scholar] [CrossRef] [Green Version]

- Cai, Y.; Jo, H.; Pan, C. Doing Well While Doing Bad? CSR in Controversial Industry Sectors. J. Bus. Ethics 2011, 108, 467–480. [Google Scholar] [CrossRef]

- Groza, M.D.; Pronschinske, M.R.; Walker, M. Perceived Organizational Motives and Consumer Responses to Proactive and Reactive CSR. J. Bus. Ethics 2011, 102, 639–652. [Google Scholar] [CrossRef]

- Preston, L.E.; O’Bannon, D.P. The Corporate Social-Financial Performance Relationship. Bus. Soc. 1997, 36, 419–429. [Google Scholar] [CrossRef]

- Bowen, F.E. Environmental visibility: A trigger of green organizational response? Bus. Strat. Environ. 2000, 9, 92–107. [Google Scholar] [CrossRef]

- Agudelo, M.A.L.; Johannsdottir, L.; Davidsdottir, B. Drivers that motivate energy companies to be responsible. A systematic literature review of Corporate Social Responsibility in the energy sector. J. Clean. Prod. 2019, 247, 119094. [Google Scholar] [CrossRef]

- Georgopoulou, E.; Sarafidis, Y.; Mirasgedis, S.; Zaimi, S.; Lalas, D. A multiple criteria decision-aid approach in defining national priorities for greenhouse gases emissions reduction in the energy sector. Eur. J. Oper. Res. 2003, 146, 199–215. [Google Scholar] [CrossRef]

- Omer, A.M. Green energies and the environment. Renew. Sustain. Energy Rev. 2008, 12, 1789–1821. [Google Scholar] [CrossRef]

- Frynas, J.G. The false developmental promise of Corporate Social Responsibility: Evidence from multinational oil companies. Int. Aff. 2005, 81, 581–598. [Google Scholar] [CrossRef]

- Streimikiene, D.; Simanaviciene, Z.; Kovaliov, R. Corporate social responsibility for implementation of sustainable energy development in Baltic States. Renew. Sustain. Energy Rev. 2009, 13, 813–824. [Google Scholar] [CrossRef]

- Shahbaz, M.; Karaman, A.S.; Kilic, M.; Uyar, A. Board attributes, CSR engagement, and corporate performance: What is the nexus in the energy sector? Energy Policy 2020, 143, 111582. [Google Scholar] [CrossRef]

- Lee, S.P. Environmental responsibility, CEO power and financial performance in the energy sector. Rev. Manag. Sci. 2021, 1–20. [Google Scholar] [CrossRef]

- Pätäri, S.; Jantunen, A.; Kyläheiko, K.; Sandström, J. Does Sustainable Development Foster Value Creation? Empirical Evidence from the Global Energy Industry. Corp. Soc. Responsib. Environ. Manag. 2011, 19, 317–326. [Google Scholar] [CrossRef]

- Ekatah, I.; Samy, M.; Bampton, R.; Halabi, A. The Relationship Between Corporate Social Responsibility and Profitability: The Case of Royal Dutch Shell Plc. Corp. Reput. Rev. 2011, 14, 249–261. [Google Scholar] [CrossRef]

- Cho, S.J.; Chung, C.Y.; Young, J. Study on the Relationship between CSR and Financial Performance. Sustainability 2019, 11, 343. [Google Scholar] [CrossRef] [Green Version]

- Cardebat, J.-M.; Sirven, N. Responsabilité sociale et rendements boursiers: Une relation négative? Manag. Avenir 2009, 29, 363–378. [Google Scholar] [CrossRef]

- Chetty, S.; Naidoo, R.; Seetharam, Y. The Impact of Corporate Social Responsibility on Firms’ Financial Performance in South Africa. Contemp. Econ. 2015, 9, 193–214. [Google Scholar] [CrossRef] [Green Version]

- El Yaagoubi, J. Impact of CSR on financial performance of Casablanca Stock Exchange companies: A longitudinal study-ProQuest. Int. J. Innov. Appl. Stud. 2020, 29, 1142–1152. [Google Scholar]

- Sun, W.; Zhao, C.; Cho, C.H. Institutional transitions and the role of financial performance in CSR reporting. Corp. Soc. Responsib. Environ. Manag. 2018, 26, 367–376. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. Acc. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Lin, C.-S.; Chang, R.-Y.; Dang, V.T. An Integrated Model to Explain How Corporate Social Responsibility Affects Corporate Financial Performance. Sustainability 2015, 7, 8292–8311. [Google Scholar] [CrossRef] [Green Version]

- Moore, G. Corporate Social and Financial Performance: An Investigation in the U.K. Supermarket Industry. J. Bus. Ethics 2001, 34, 299–315. [Google Scholar] [CrossRef]

- Obradovich, J.; Gill, A. The Impact of Corporate Governance and Financial Leverage on The Impact of Corporate Governance and Financial Leverage on the Value of American Firms. Int. Res. J. Financ. Econ. 2013, 91, 1–14. [Google Scholar]

- Biger, N.; Mathur, N.A. The effects of capital structure on profitability: Evidence from United States. Int. J. Manag. 2011, 28, 3. [Google Scholar]

- Angelia, D.; Suryaningsih, R. The Effect of Environmental Performance and Corporate Social Responsibility Disclosure Towards Financial Performance (Case Study to Manufacture, Infrastructure, And Service Companies that Listed at Indonesia Stock Exchange). Procedia-Soc. Behav. Sci. 2015, 211, 348–355. [Google Scholar] [CrossRef] [Green Version]

- Qamar, R.; Pet, M. Relationship between Corporate Social Responsibility (CSR) and Corporate Financial Performance (CFP): Literature review approach. Elixir Fin. Mgmt. 2012, 46, 8404–8409. [Google Scholar]

- Uadiale, O.; Fagbemi, T. Corporate Social Responsibility and Financial Performance in Developing Economies: The Nigerian Experience. J. Econ. Sustain. Dev. 2012, 3, 44–55. [Google Scholar]

- Wu, M.-W.; Shen, C.-H. Corporate social responsibility in the banking industry: Motives and financial performance. J. Bank. Financ. 2013, 37, 3529–3547. [Google Scholar] [CrossRef]

- Rappaport, A. Creating Shareholder Value: A Guide for Managers and Investors; The Free Press: New York, NY, USA, 1998; ISBN 0-684-84456-7. [Google Scholar]

- Monteiro, A. A quick guide to financial ratios: Education. Pers. Financ. 2006, 307, 8–10. [Google Scholar]

- Ahsan, A.M.; Mainul Ahsan, A.F.M. Can Return on equity be used to predict portfolio performance? Can Roe be used to predict portfolio performance? Manag. Financ. Mark. 2012, 7, 132–148. [Google Scholar]

- Choi, J.-S.; Kwak, Y.-M.; Choe, C. Munich Personal RePEc Archive Corporate Social Responsibility and Corporate Financial Performance: Evidence from Korea Corporate Social Responsibility and Corporate Financial Performance: Evidence from Korea; MPRA: Munich, Germany, 2010. [Google Scholar]

- Mwanja, S.K.; Evusa, Z.; Ndirangu, A.W. Influence of Corporate Social Responsibility on Firm Performance among Companies Listed on the Nairobi Securities Exchange. Int. J. Appl. Econ. Financ. Acc. 2018, 3, 56–63. [Google Scholar] [CrossRef]

- Michelon, G.; Boesso, G.; Kumar, K. Examining the Link between Strategic Corporate Social Responsibility and Company Performance: An Analysis of the Best Corporate Citizens. Corp. Soc. Responsib. Environ. Manag. 2012, 20, 81–94. [Google Scholar] [CrossRef] [Green Version]

- Oeyono, J.; Samy, M.; Bampton, R. An examination of corporate social responsibility and financial performance. J. Glob. Responsib. 2011, 2, 100–112. [Google Scholar] [CrossRef]

- Koller, T.; Goedhart, M.; Wessels, D. The Right Role for Multiples in Valuation. McKinsey Financ. 2005, 15, 7–11. [Google Scholar]

- Uduji, J.I.; Okolo-Obasi, E.N. Multinational Oil Firms’ CSR Initiatives in Nigeria: The Need of Rural Farmers in Host Communities. J. Int. Dev. 2016, 29, 308–329. [Google Scholar] [CrossRef] [Green Version]

- Ting, H.W.; Ramasamy, B.; Ging, L.C. Management systems and the CSR engagement. Soc. Responsib. J. 2010, 6, 362–373. [Google Scholar] [CrossRef]

- Obi, P.; Ode-Ichakpa, I. Financial indicators of corporate social responsibility in Nigeria: A binary choice analysis. Int. J. Bus. Gov. Ethics 2020, 14, 34. [Google Scholar] [CrossRef]

- McGuire, J.B.; Sundgren, A.; Schneeweis, T. Corporate Social Responsibility and Firm Financial Performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar] [CrossRef]

- Gautam, R.; Singh, A.; Bhowmick, D. Demystifying relationship between Corporate Social Responsibility (CSR) and financial performance: An Indian business perspective. Indep. J. Manag. Prod. 2016, 7, 1034–1062. [Google Scholar] [CrossRef] [Green Version]

- Agrawal, O.; Bansal, P.; Kathpal, S. Effect of Financial Performance on Corporate Social Responsibility and Stock Price: A Study of BSE Listed Companies. Int. J. Emerg. Technol. 2020, 11, 286–291. [Google Scholar]

- Maqbool, S.; Hurrah, S.A. Exploring the Bi-directional relationship between corporate social responsibility and financial performance in Indian context. Soc. Responsib. J. 2020. [Google Scholar] [CrossRef]

- Prado, G.F.D.; Piekarski, C.M.; da Luz, L.M.; de Souza, J.T.; Salvador, R.; de Francisco, A.C. Sustainable development and economic performance: Gaps and trends for future research. Sustain. Dev. 2019, 28, 368–384. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strat. Manag. J. 2009, 31, 463–490. [Google Scholar] [CrossRef]

- Laguir, I.; Marais, M.; El Baz, J.; Stekelorum, R. Reversing the business rationale for environmental commitment in banking. Manag. Decis. 2018, 56, 358–375. [Google Scholar] [CrossRef]

- Lee, S.; Heo, C.Y. Corporate social responsibility and customer satisfaction among US publicly traded hotels and restaurants. Int. J. Hosp. Manag. 2009, 28, 635–637. [Google Scholar] [CrossRef]

- Dewi, D.M. CSR effect on market and financial performance. Dinar 2014, 1, 198–216. [Google Scholar] [CrossRef] [Green Version]

- Okegbe, T.O.; Egbunike, F.C. Corporate Social Responsibility and Financial Performance of Selected Quoted Companies in Nigeria. NG-J. Soc. Dev. 2016, 5, 168–189. [Google Scholar] [CrossRef]

- Uwuigbe, U.; Egbide, B.-C. Corporate Social Responsibility Disclosures in Nigeria: A Study of Listed Financial and Non-Financial Firms. J. Manag. Sustain. 2012, 2, 160. [Google Scholar] [CrossRef] [Green Version]

- Aras, G.; Aybars, A.; Kutlu, O. Managing corporate performance. Int. J. Prod. Perform. Manag. 2010, 59, 229–254. [Google Scholar] [CrossRef]

- Chang, D.-S.; Kuo, L.-C.R. The effects of sustainable development on firms’ financial performance—An empirical approach. Sustain. Dev. 2008, 16, 365–380. [Google Scholar] [CrossRef]

- Reverte, C. Determinants of Corporate Social Responsibility Disclosure Ratings by Spanish Listed Firms. J. Bus. Ethics 2008, 88, 351–366. [Google Scholar] [CrossRef]

- Li, Z.F.; Morris, T.; Young, B. Corporate Visibility in Print Media and Corporate Social Responsibility. Sustainability 2018, 10, 18. [Google Scholar]

- Pekovic, S.; Vogt, S. The fit between corporate social responsibility and corporate governance: The impact on a firm’s financial performance. Rev. Manag. Sci. 2020, 15, 1095–1125. [Google Scholar] [CrossRef]

- Li, Y.; Gong, M.; Zhang, X.-Y.; Koh, L. The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. Br. Account. Rev. 2018, 50, 60–75. [Google Scholar] [CrossRef] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).