1. Introduction

Digital companies occupy more leading places on the lists of the world’s biggest corporations and are having an ever-larger impact on societies. Technology and digital business models create new powerful opportunities to improve lives and societies. The concept of impact investing is the starting point for understanding the modern principles of development and progress. Only progress that does not upset the balance within the Triple Bottom Line concept can be socially acceptable and can have a positive impact on natural resources and people’s quality of life. Progress is usually achieved through projects, including investments. Attention should therefore be paid to the social, environmental and ethical aspects of investment processes in the context of their life cycle. The design of modern business models for enterprises, especially startups, is investments. Therefore, the joint implementation of the impact investing and Sustainable Business Models concepts should help to improve the investment attractiveness of companies. Investment in business models that have a positive impact on society by generating value aimed at eradicating poverty, expanding quality of life, increasing the income and wealth of the poor, mitigating climate change, resolving conflicts, promoting renewable energy sources, etc., should be better for generations than strenuous efforts to maximize profit and social inequalities. Views on the concepts of Impact Investment and sustainable business models are discussed in the literature from many points of view. The key assumption of the Impact Investment concept is that it is a typical form of investment aimed at generating financial profit while taking social effects into account. In a sense, it is a substitute for charity, whereby there is usually no financial gain, and project financing is usually in the form of donations. The specific feature of the affected entities is that their goals are doubled or even tripled, achieving a social and/or environmental objective along with a financial return [

1]. In addition to generating economic profit, the aim of investment in the form of impact investing is to create socio-environmental changes. Socially engaged investors are willing to accept lower profits and even higher risks in return for the achievement of specific social objectives. In this way, a new approach to value creation is shaped [

2]. In addition to socially oriented investments, enterprises are emerging that are driven by the creation of social value [

3]. In this respect, social business models are created whereby components are built to balance economic profit and social impact [

4]. Such an approach requires looking at organizations and investments in terms of the needs of numerous stakeholders [

5]. Impact investing is a way to achieve positive things for the benefit of the wider community, not just investors. Moreover, the world’s largest investors are increasingly mindful of the impact their investments generate, and impact investing has become a new and fast-growing investment area. Such trends could be expected to lead to the increased interest of technology firms in socially oriented initiatives. Not all technology companies, however, have social impact as their central focus. While the literature has explored the relationship between financial performance and corporate social responsibility, this is a different phenomenon, where social aspects become the core focus of business models. Hence, we ask the question: do companies in the digital economy achieve greater capitalization by investing in social aspects than those that do not invest in social aspects? Additionally, we examine whether the specificity of the digital economy more broadly favors the creation of sustainable digital business models.

Such research questions indicate a cognitive gap in the assessment of the place and role of impact investing in shaping the pro-social investment strategies of companies operating in the digital economy, as well as their sustainable digital business models. Both the strategy and the business model are currently key ontological entities that determine the functioning of modern companies. Digital entrepreneurship means the reconfiguration of the state of play in the global business space. Investments in social aspects play a significant role in the development of digital companies.

The key objective of the research emerged from such a cognitive perspective. The key objective is to present and examine a structure of a digital business model based on mechanisms resulting from the creation of social value that contribute to the growth of the capitalization of the economic value of companies. Social value is built on the capital market investment processes of companies and its impact on their economic value. The subject of the research is based on the recognition of the place and role of investing in social factors by changing the shaping of the digital business model and designing its new architecture based on social components. The scope of the research covers digital economy companies that invest in social aspects while expecting the anticipated return on capital employed in the short term, long term and social profit from these activities.

The ability to create social profit increases the investment attractiveness of these companies. The scope of the research also includes an assessment of the specificity of the digital ecosystem in terms of its impact on the willingness and construction of sustainable digital business models by companies. The research also includes an assessment of companies in terms of their positive social impact on the investment attractiveness of the companies concerned. At the same time, companies operating in this part of the business ecosystem, which is aimed at creating social profit, were investigated. In this way, two areas of business assessment, namely economic and social, were identified. It was assumed that companies oriented towards the creation of social values in the short term and long term would generate social and economic profit at the same time.

Modern conditions of global business are mainly focused on creating digital business models, which are used to transform the traditional forms of delivering products and services into solutions based on digital platforms. There is a widespread digital transformation involving the full or partial use of digital solutions in the exchange of values. The search for new innovative value delivery propositions allows for changes in economic systems and an influence on the discovery of non-standard formulas. These solutions enable changes in people’s habits, an increased awareness in the area of the use of natural resources, an increased responsibility towards the natural environment, decreased consumption, increased social trust, and the building of social relationships. Digital platforms mean that through wider access to information, innovative business monetization formulas are created. The positive effect of the strategy of searching for opportunities for the growth of digital business is outlined. This effect is a social effect, which is expressed through the occurrence of two important phenomena. The first phenomenon is building large volumes of communities that are interested in the value delivered through the digital business model.

The digital economy generates new conditions for creating entrepreneurial solutions. Technology defines the rise of innovative business models, the functioning of which would not be possible without these technologies. The unrestricted ingenuity of entrepreneurs is currently aimed at finding innovative solutions based on taking advantage of opportunities offered by digital technology. Existing solutions using traditional forms of economic activity are being changed by propositions derived from Internet-based resources, information and communication technologies. This provides an opportunity to create business projects, the impact of which, in many cases, can quickly reach the level of global impact. The deployment of digital technologies affects what happens outside the organization’s borders, namely the transformation into a business ecosystem. The character and potential impact of digital technologies on business models depends on the type of organization and the company’s supply chain deploying digital technologies (i.e., established on the market or a new market participant) [

6]. Digital business ecosystems represent a new approach to using technological and economic innovations. A specific type of infrastructure and software enables a large number of cooperative business users, services or others to communicate and shape a new form of interaction [

7]. Modern business model solutions are based on a configuration approach where technical, organizational and community-building solutions are intertwined. Business models present a holistic approach to shaping business solutions, which is their undoubted strength and a reason for the interest of management theorists and practitioners. The holistic structure of business models is structured around three key issues: value proposition, value architecture and financial sustainability. The value proposition includes product offering, market segmentation and a revenue model. The value architecture is related to discovering value—sensing, capture, creation and value distribution. Financial sustainability allows for the maintenance of the business model in an economic and social equilibrium, including balancing the objectives of the various groups of stakeholders. The triad consists of three financial aspects, namely monetization and building the profitability and value of the business model, the results of which depend on two basic variables such as the volume of the community involved and the logic of creating, delivering, capturing and retaining value. This concept is therefore based on the assumption that the starting point for the business model to achieve the ability to monetize is the logic of creating, delivering, capturing and retaining value through the functionalities of the business model built. The condition for maintaining this logic is the building of a community that creates a business ecosystem around the business model. The size of the volume of this community, and thus its scale of impact on revenues, monetizes the business model. This, in turn, creates the conditions for achieving profitability, which contributes to an increase in value for shareholders from the use of the business model. In the case of the digital economy, and in particular the sharing economy, this value-oriented logic of the business model should, in addition to the financial aspect, create social values, which should be positively perceived by the actors of the sharing process using this business model. In this way, the volume of the community can grow dynamically. Digital business models are therefore based on slightly different forms of business conduct. Here, one of the most important business goals is to build a community centered around the “central theme” of the business model, where, on the basis of a common communication platform combining supply and demand, it is possible to achieve the monetization effect of the business model. This “central theme” of the business model determines the effectiveness of the solution. In the case of solutions based on the concept of the sharing economy, these themes include shared drives, car sharing, shared food, personal services, etc. A condition for building an effective business model in the digital economy is the capture of an idea in a simple and market-acceptable way related to the building of a digital platform similar to an IT application, which will be user-friendly and attractive (related to environmental factors, building social relations, supporting those in need, and others). Digital business models revolutionize the approach to management processes. Innovative technologies make the current business formulas based on the traditional assumptions of the value chain inapplicable. The digital revolution stimulates business models. So-called bilateral markets are developing. A bilateral market, also referred to as a bilateral network, is an economic platform with two separate user groups that provide a common benefit. The profits for each group show economies of scale due to demand. Bilateral market platforms select the right price to charge each group, where one group “powers” the other [

8]. The dynamics of complex systems, such as digital business models, are a distinctive feature, which result from the essence of such ontological entities. Synergies of these models with business ecosystems through scalability determines demand-side behavior. In this way, they are able to increase their impact on the social and economic space. The dynamics of the changes in digital business models are determined by the concepts of the new economy. Cognitive computing describes technology platforms based on the scientific disciplines of artificial intelligence and signal processing. This computing is of particular importance in terms of the dynamic activity of new business entities. These platforms include natural language processing, speech recognition and object recognition, reasoning, machine learning, human–computer interactions and the generation of dialogue [

9]. “Dynamism” in the context of this value-creation formula shapes and operationalizes complex objects such as digital business models. Market changes force the need to adjust business models to market expectations, both through their digital transformation and by fulfilling the assumptions of innovative concepts of the new economy.

This community often shares similar values and interests and its strength is that goal-oriented (very often such goals are social) people create positive attitudes towards everyday practices regarding quality of life. The second aspect of the impact of digital platforms is the direct or indirect production of pro-ecological, pro-social effects that would not be possible in a traditional economy based on the traditional value chain. In this context, it is reasonable to analyze the concept of impact investing in terms of its influence on the implementation of social goals through digital business models. Their development requires investment. Most companies that operate in the digital economy seek sources of financing for their ambitious and non-standard forms of delivering value. The creation of value is crucial in the context of impact investing. The concept of impact investing is part of the assumption for the growth of the digital economy operationalized through digital business models. The assumptions of impact investing are holistic and include a set of rules focused on the social impact of investments in terms of issues such as features which define social-oriented investments, location, the impact of stakeholders and institutions on investment, the internal needs of the organization, e.g., social finance, SRI (socially responsible investing), bonds with social impact, venture philanthropy and microfinance. Mercedes Alda and Ruth Vicente conclude that specialist and non-specialist managers take financial and non-financial aspects into account in the management of SRI funds. Non-professionals take advantage of broader market knowledge and take non-financial aspects into account in the management of SRI funds. They avail the financial focus of conventional funds and are able to share knowledge between SRI and conventional fund markets to outperform the competition. Activities on capital markets are also assessed in terms of value migration in the context of social factors. A decade ago, social entrepreneurship was considered a completely new phenomenon. Currently, numerous publications, business reports, financial statements and expert opinions confirm the widespread interest in this issue in business theory and practice. It seems to be an important segment of the investment portfolio both at present and in the future. The purpose of investments that are part of the assumptions of impact investing is, in addition to achieving economic profit, to create positive socio-environmental changes. This social impact should be measurable. Investors should search for business benefits in pro-social investments; therefore, in many cases they can, in the short term, accept lower rates of return for long-term economic and non-economic benefits. The focus is on the so-called social profit, which favors the creation of positive relationships with business venture stakeholders. Investors analyze how to implement investments to obtain social profits from them. The digital economy has a wide range of possibilities in this respect. In the context of contemporary needs and problems, various forms of capital transfer to social enterprises should be sought. In terms of investment implementation, two extreme approaches have emerged:

- -

the first approach is a typical investment formula, the goal of which is to generate financial profit in the first place, and which has not taken social effects into account so far;

- -

the second approach is a form of charitable activity, where financial profit has not been the focus until now.

Therefore, the problem of identifying the clear features of social investments in terms of the relationships between non-financial expectations and financial returns is revealed [

10]. A slightly different approach is emerging in the context of the digital economy. Here, the very idea of a business is often a project focused on social aspects. Social profit, in turn, results directly from the ideological assumptions of the venture. The social return on investment in this context is crucial in addition to economic profit [

5]. Investments in digital business and made by digital business are conducive to the transformation of the economy towards social factors. Concepts such as the Circular Economy, the Sharing Economy and Big Data have a positive impact on social aspects and optimize the use of natural resources. The Sharing Economy, understood as an economic model in which individuals have the possibility of borrowing or renting other goods, favors activities that optimize the use of limited resources [

11]. Steven Kane Curtis and Oksana Mont define SEBMs as the business model of a sharing platform, which mediates an exchange between a resource owner and a resource user to facilitate temporary access to under-utilized goods (key activity), resulting in a reduction in the transaction costs associated with sharing (value proposition). Platform or triadic business models may facilitate access and the transfer of ownership; however, we suggest that SEBMs only facilitate access and not the transfer of ownership. SEBMs simplify value creation by mediating an exchange between a resource owner and resource user, each of which interact with one another and carry out key activities to co-create value on the platform [

12]. The Circular Economy concept assumes that the impact which created products have on the environment is minimized by choosing ingredients and designing products and services that will enable their reuse [

13]. Big Data sets allow for the optimization of various areas of social life, which favors the development of analytics and quick decision making. Digital business models based on the assumptions of the new economy concepts fit the assumptions of the concept of, not only as temporary projects but also as those that have a permanent positive impact on social aspects, gradually eliminating substitutes, which operate in the traditional form and which adversely affect the natural environment from the market. This creates social enterprises that are hybrid organizations, and thus strive to achieve social and economic goals [

3]. It should be noted that hybrid organizations may have difficulty attracting investment. In terms of the value capture component, the digital logic allows entrepreneurs to provide impact complementarities (i.e., intertwining financial and socio-environmental value capture), supports the scalability of the socio-environmental value and facilitates the spillover of this value through digital means. This leads to multidimensional value capture by bridging multiple forms of value as well as the boundaries and the scale of the value captured [

14].

Therefore, the digital economy can cope with this due to the level of the investment attractiveness of digital business models [

15]. New ideas and their possibilities and advantages offer opportunities for creating sustainable economic systems which will ensure the production of economic and social value that benefits not only investors but also a wide group of stakeholders, including socially excluded people, the poor and those who need help. Capital should be directed to ventures which will bring social and environmental benefits as well as economic profit [

16]. The digital economy functions in the environment of many projects, which is important for the perception of this sector from an investment point of view. Their focus on social aspects results from the expectations of numerous stakeholder groups within contemporary, responsible global business. Digital solutions increase accessibility and connectivity, but this can counteract social and environmental aspirations. Digital technologies are thus not a remedy for sustainable development and should be used responsibly, with the potential contradictions of logic kept in mind [

14]. The new perspective introduced by this work contributes to an understanding of the perception that industry has of sustainability issues and digitalization in manufacturing. Digitalization is perceived as a force that can positively impact the BM of manufacturing enterprises from the inside through the selected application of this technology. BMI brought about by digitalization makes the company more profitable. On the other hand, sustainability is mostly framed as an external requirement where any required BMI must be aimed at limiting the losses [

17].

Digital business models are large spaces that create solutions which generate a positive social impact. They have significant potential in this regard [

4]. The essence of impact investing is the achievement of positive things for the benefit of the wider community and not just investors. A broad approach to this concept is in line with the principles of Sustainable Business Models. The main approach to these models is based, for example, on the assumptions of S. Schaltegger et al. who argued that that “the value proposition must provide both ecological or social and economic value through offering products and services–business models for sustainability describe analyze, manage, and communicate (i) a company’s sustainable value proposition to its customers, and all other stakeholders; (ii) how it creates and delivers this value; (iii) and how it captures economic value while maintaining or regenerating natural, social, and economic capital beyond its organizational boundaries” [

18]. In this approach, the business model should be considered in the life cycle [

19]. The archetypes of sustainable business models which are suitable for the challenges of the digital economy have been created [

20]. It should be noted that there is a certain gap related to the understanding of innovations, including digital ones, related to the building of a sustainable business model [

21].

Both the concept of impact investing and sustainable business models are part of contemporary trends in the management of social projects, especially in the digital economy.

A business model is part of a complex system. In such systems, value to individuals, society, organizations and the environment emerges as a result of the interaction of the different components of the business model in tandem with the wider system and context [

22].

2. A Conceptual Model for Sustainable Digital Business Models Based on Impact Investing and the Research Methodology

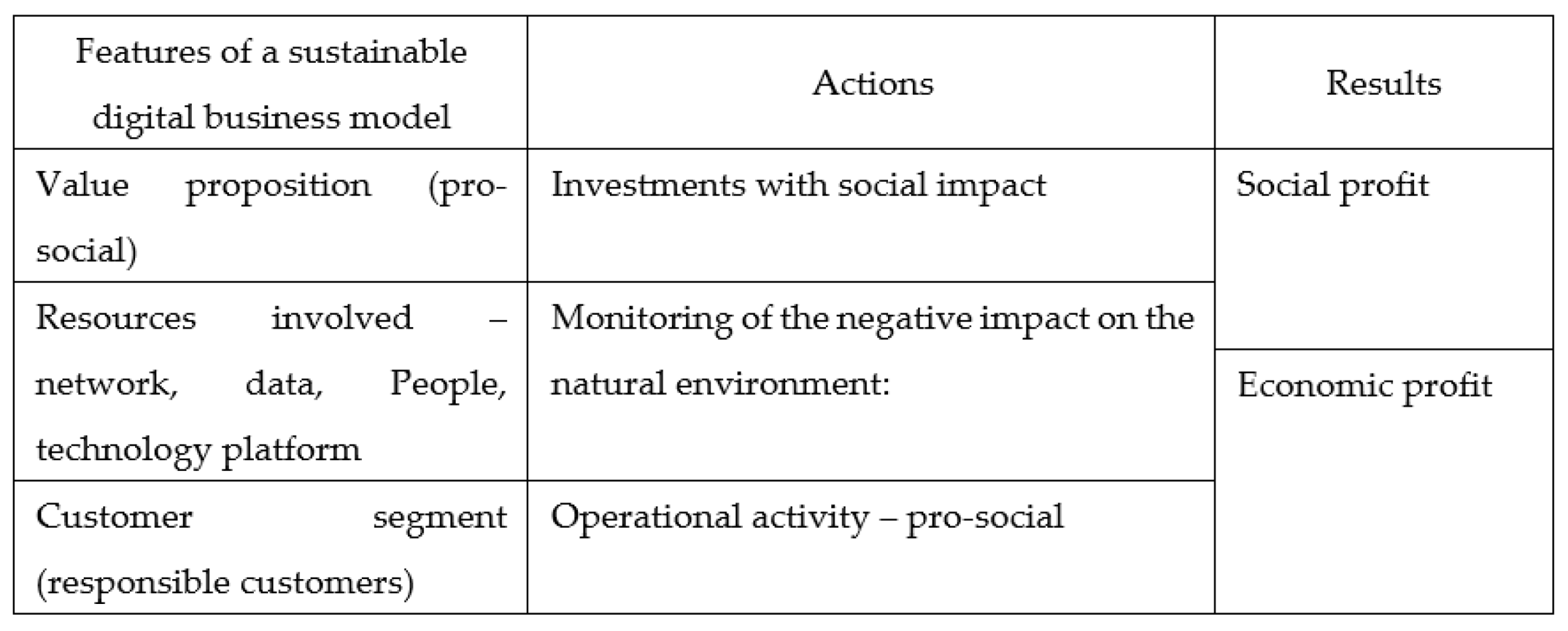

To date, on the basis of a review of the literature, a model was constructed which defines the factors of Sustainable Digital Business Models, including activities focused on creating social impact. This model is based on three key areas describing the assumptions for creating strategies for the basic features of a sustainable digital business model, which are: the value proposition (pro-social), engaged resources such as network data, people, the technology platform and the customer segment (consisting of responsible customers). Another area relates to actions, which includes implemented investments with social impact, a monitoring of the negative impact on the natural environment, and operational activity—pro-social. The results of the implementation of the assumptions of the sustainable digital business model and the activities focused on social aspects show the level at which social profit and economic profit are achieved, which constitutes the third part of the developed model presented in

Figure 1.

The proposed model will be employed to analyze public technology companies using digital business models. The description of the individual areas of the proposed model is presented below.

2.1. Value Proposition (Pro-Social)

The value proposition is one of the key aspects of configuring consistent business models. In some cases, the value proposition should not only refer to economic aspects but broaden its attributes to include social aspects. This situation occurs when economic factors are insufficient to convince users to take advantage of this value proposition and the condition for increasing the investment attractiveness of the business model is to equip it with factors that expose the social aspects. Especially in the case of digital business, building a community centered around pro-social ideas and exposing social profits means that both economic and social values must be complementary to attract business model users and investors. Non-economic aspects, which, first of all, include social and ecological factors, are very often the crucial value drivers accountable for the success of the digital business model. Therefore, they should not be overvalued in the design and operation of innovative business models. Research into the business models of enterprises operating in the area of the concepts of the new economy, namely the Sharing Economy [

23], the Big Data and the Circular Economy, is required to verify the network theory as well as the actor–network theory. They meet the indicated need to balance the economic and social aspects—the ethics of perception and the attitude to the consumption of natural resources and shape the positive relationships between the people who affect the quality of life of world citizens. As regards the assumptions of the Circular Economy, the term value proposition is based on the so-called environmental value. It involves the absolute value, which is a promise made by a company to improve the state of the environment through its impact throughout the entire value chain [

24]. As regards the digital economy, product-service systems (PSS) also apply, which support the design of circular and/or product system value propositions in the relation to business model innovation [

25]. Innovative business models of enterprises operating in the digital economy, as a rule, are not only aimed at maximizing profits, but are also aimed at positively affecting the determinants of corporate social responsibility. In this way, so-called sustainable innovations are created, which include the development of the value proposition for many stakeholders in the business model, including customers, suppliers, partners and shareholders, as well as the society and environment [

26]. By contextualizing SBMI, N.M.P. Bocken and T.H.J. Geradts describe how:

- -

institutional barriers and drivers to SBMI may be shaped by the (diverging) demands of a corporation’s most significant stakeholders;

- -

their perceived legitimacy of SBMI determines whether corporations embed responsibility and sustainability in their business models.

The perspective of organizational projects and dynamic capabilities provides a complementary viewpoint on how the necessary dynamic capabilities to SBMI are built through factors of organizational design [

27].

This is crucial for their market acceptance in the context of the social criterion as a condition for achieving lasting global success. A pro-social value proposition is a condition for implementing a strategy to design and improve sustainable digital business models.

2.2. Resources Involved—Network, Data, People, Technology Platforms

Modern resources included in the configuration of business models favor the creation of new features of business solutions. They shape specific business ecosystems that are not found in the traditional value chain. Currently, business ecosystems are based on a synergistic, networked connection of Big Data sets, which manage technological data platforms and coordinate all processes with people. The business ecosystem facilitates the implementation of the new formulas of business monetization, as well as the creation of a social effect understood as building a community and the creation of social profit. By creating a complex technical and business system, opportunities to co-create and build a range of values in the B2B and B2C relationship system arise [

28]. Digitalization means that the theories of economic science so far have not fully worked and new assumptions should be sought for the conceptualization and operationalization of business models. A. Smith’s classical economics represented by the theories of free market economies and economic policy, the theory of economic growth, the theory of exchange value (market prices) and the theory of foreign trade is opposed to the assumptions of the digital economy, and in particular the Sharing Economy, which is defined as a socio-economic system constructed around the distribution of human and material resources. It covers the common design, production, distribution, trade and consumption of goods and services by various people as well as organizations. The fundamental theories which underlie the digital economy are ecology theory, evolution theory, resource-based theory, complex network theory, competing values theory, actor–network theory, spectral graph theory, Claudio Ciborra’s theory and the Markov chain theory. These theories point to the complexity of systems that underlie the digital economy. Value in this context is a product of intentionally implemented data which form a complex business system. Innovative formulas for delivering value through the configuration of a business model should be sought in the uniqueness of the data used. The business model should interact with users in such a way as to highlight initiatives based on the assumptions of corporate social responsibility, including through social media [

29]. This also applies to digital information services [

30]. Comprehensive activities performed through the use of the appropriate configuration of system activities based on the optimal use of digital technology builds the digital identity of companies by creating opportunities to use the full potential of current technical and organizational solutions. This is also related to artificial intelligence. Businesses, which are the true drivers of the global economy and development, can support the adoption of digital technologies based on AI in the production processes, increase investments in AI and related technologies, exploit the potential of the data economy and strengthen the educational offers at every level to bring AI to the workforce [

31].

2.3. Customer Segment (Responsible Customers)

Customer segmentation is a fundamental aspect of the implementation of marketing strategies. As regards corporate social responsibility, the goal is to look for responsible customers, i.e., those who pay attention to ecological, ethical and social factors when choosing a service, a product and how value is delivered. As regards the digital economy, customer segmentation is based on the customer’s voluntary use of a given technology platform. In the case of technology companies, it is important to consistently accumulate huge volumes of time-stamped data about all kinds of customer interactions [

32]. This interaction can be different when it comes to creating value for stakeholders. Often, the choice of a specific digital platform is determined by the customer’s commitment to the social and economic idea, which is the value driver of a given business model. Customer segmentation is performed by a customer belonging to a given digital platform. Therefore, customer segmentation is already designed at the stage of designing the business model, its functionality, as well as the value proposition and the method of value delivery. The selection of the target customer group is a key aspect which is taken into account in the process of matching the features of the business model to its recipients. In many cases, pro-social and environmental user awareness determines their volume. Economic factors are not a priority here; therefore, in many cases, monetization occurs later than the procurement of the expected volume of users. First, there should be a match between the values of the business model supplier and users in order to win users and, as a consequence, achieve the expected results in the sphere of monetization. The social and ecological responsibility and sensitivity of users, especially in times of climate crisis, epidemic outbreaks, problems arising from social inequalities, as well as people’s migration, makes these issues important in terms of seeking new business formulas for improving people’s quality of life and the natural environment.

2.4. Investments with Social Impact

Investments in the areas of the digital economy are currently the most popular in terms of seeking a positive return on investment. Aware and responsible investors know that short-term investments do not ensure the sustainable development of companies, and in the long term, they can even lead to the bankruptcy of companies. Therefore, they search for such investments that, first of all, are socially acceptable (they do not adversely affect the natural environment) and are also attractive in terms of opinions and the impact of various stakeholder groups [

33] on the business intentions pursued. The social impact of investment activity on the development of the digital economy is of crucial importance. If the digital economy changes the contemporary reality of business, the social aspect has a positive impact on existing business assumptions. First of all, investments limited by the sources of finance should create value not only for shareholders or managers but also for the business environment represented by key stakeholder groups. The optimization of business solutions should balance economic and social goals [

34,

35]. An example would be the digital media market proving the impact of new technologies on the implementation of sustainability strategies [

29]. This seems to be the only way to survive in a modern business environment full of risks. Aware managers who follow CSR principles should stimulate pro-ecological and pro-social behavior in their companies. This is the expectation of societies, which mostly accept only such businesses or public solutions that indicate directions for optimizing the use of natural resources and have a positive impact on the natural environment. The protection of the planet now seems to be a key priority; therefore, this type of initiative should be included in business solutions, which should be attractive to investors and should also encourage the joining of increasingly bigger groups of users who share the same, usually pro-ecological, values for the survival of companies and the achievement of a positive social impact such as that expected by modern users of digital platforms and ordinary citizens alike. The operationalization of strategies which prove the pro-ecological and social attitude of companies operating in the digital economy is the implementation of so-called impact investing. This concept as described above sets priorities in the identification of these factors in the process of implementing investments that have a positive impact on the internal and external aspects of the development of digital companies, provided that in this concept, the impact on society, people, their social trust, pro-ecological attitude, etc., should be measurable and be included in short-term and long-term strategic decisions. In this approach, it is important to build an appropriate impact investing measurement system. Bryan Dufour proposes a model that contains the three gaps identified between SIM (social impact measurement) and PE (policy evaluation) and addresses how these approaches fit together and the benefits of choosing one approach over the other for each gap. This model is shaped by powers that we identify based on what we perceive as the main drivers for the gaps observed. These five powers are:

- -

the culture of the evaluating entity: entrepreneurial for SIM, administrative for PE;

- -

the motivation underlying the evaluation: to prove and verify impacts for SIM and to optimize programs for PE;

- -

the resources available for the evaluation: limited for SIM, abundant for PE;

- -

the scope of the evaluation: micro for SIM (often focuses on one specific organization), and macro for PE (covers programs at the national level);

- -

the evaluating entity’s proximity to stakeholders: high for SIM, low for PE [

36].

2.5. Monitoring of the Negative Impact on the Natural Environment

Operational activity in every company generates either a positive or unfavorable impact on the natural environment. The adverse impact on the natural environment is described in a number of technical and operational standards, including the ISO 14000 series for environmental management and other aspects such as energy management, business continuity and information security. As regards the digital economy, the proposed solutions are not so obvious. The specificity of value creation in business ecosystems based on information technology favors the search for activities designed to optimize the use of resources and the initiation of activities focused on creating a positive impact using the potential of the digital economy. The DNA of digital business models has a positive impact on social and environmental aspects. This is clearly seen in business models based on modern concepts such as the Circular Economy, the Sharing Economy and Big Data. Other derivative theories and approaches also focus on social factors such as the Gig Economy or the Barter Economy. These ideas clearly favor the minimization of resource consumption, the reduction in environmental pollution and the neutralization of the risk of adverse impacts on the natural environment. At the same time, they increase people’s quality of life by increasing the availability of services and the individual’s impact on the social system. Managers should set plans that progress towards CE business models, understanding that their firms may thereby gain social, economic and environmental benefits. Investments in CE principles have the potential to enhance the public reputation of firms, reduce the costs related to raw material consumption and improve the efficient use of resources [

37].

2.6. Social Profit

Social profit is one of the key goals of socially responsible companies and organizations. An increasing quantity of companies see the benefits of the possibility of achieving economic and social goals [

38]. Generally, several approaches to defining social profit can be presented. Social profit is understood as the amount of social and humanitarian benefit obtained as a result of investing in the good of others. The concept of “social profit” is a more positive, more accurate descriptor of a focus on benefits for all social stakeholders [

39]. To create social profit, social capital which will ensure that social goals are achieved is necessary [

40]. In some cases, the managers of responsible companies are willing to forgo part of their economic value in favor of creating social profit. Increasingly, social profit is becoming a driver of activity and an indicator of the development of digital economy companies. The use of social media is also crucial in this respect [

41]. Social profit resulting from the implementation of environmental protection measures and other social goals is the result of a social factor-oriented digital business model. The achievement of social profit is inscribed in this type of business model because social ideas are expected by modern users of digital platforms. The generation of people brought up with full access to information via mobile devices promote the dissemination of knowledge of social problems and overcome them through solutions based on digital technologies. Digital platforms which combine supply and demand enable the achievement of economies of scale through the availability of solutions in global terms, create a network effect by entering into relationships with a large number of users, create a new framework for modern business and create challenges for lawmakers ahead of the legal order in the context of the value proposition. In these conditions, they try to achieve social effects that could not be achieved on the basis of the traditional value chain and traditional organizational and technical solutions. The cases described by Melea Press, Isabelle Robert and Muriel Maillefert illustrate how the associated legitimacy is developed and made available to ecosystem stakeholders as a resource to use for future projects. In this way, organizations undertake new sustainable development projects, which change their BMs as they add new content, structures and management [

42].

2.7. Economic Profit

Economic profit in the context of the assumptions of traditional economic theories is the fundamental goal of the existence of companies. The concept of the maximization of the economic value of companies and their profit is derived from the assumptions of the concept of Value Based Management. VBM is broadly defined as an integrated management approach based on the assessment of the financial and non-financial elements of the functioning of companies, including management process control systems [

43,

44,

45]. The criticism of this concept allowed the emergence of the principles of the concept of sustainability [

46,

47] in business and a broad view of the needs of various stakeholder groups [

48,

49]. It is necessary to achieve economic profit to implement the development strategies of digital companies which can serve social purposes in many cases. In this context, it has a positive dimension. Currently, the widespread criticism of corporate actions, the intention of which is only to increase economic profit without a positive impact on the internal and external environment of the business activity, can be observed. The business activity which degrades the natural environment is increasingly critically received and blocked by so-called green stakeholders. An approach based on the assumption that full market dominance is the only goal should also not be the intention of contemporary businesses. This is currently the case for global digital economy companies such as Apple, Amazon, Google and Facebook. Therefore, the social aspect of their impact is fundamental to the neutralization of these dominant strategies. Economic profit can only be socially acceptable if it enables the creation of social effects.

For the purposes of testing and verifying the adopted assumptions, the question of whether digital economy companies achieve greater capitalization by investing in social aspects than those that do not was asked. In addition, the question of whether the specificity of the digital economy fosters the creation of sustainable digital business models was verified as well.

The proposed model was employed to analyze public technology companies using digital business models. Comparative case studies of those companies using digital business models that are characterized by a strategy of balancing the approach to different needs of stakeholders and orient their activities in the long term were conducted. The study used secondary data.

One of the key aspects of the research was the selection of a suitable research sample. This has a fundamental impact on the reliability and therefore the quality of the analyses obtained. The ideal solution is to select the sample in terms of the type of research conducted. The research used purposive sampling consisting of a non-random, subjective selection of respondents to social surveys, where the researcher’s aim, however, is generally to create a closely representative sample. It is most commonly used, among others:

- -

during pilot studies, to test the research tool among different population members due to the variables studied;

- -

in small subsets of populations;

- -

in comparative studies where the characteristics of certain social categories are significant, conducted only on arbitrarily selected parts of these categories (e.g., comparisons of certain characteristics particular to private and public employees);

- -

in case studies which differ from generally accepted standards.

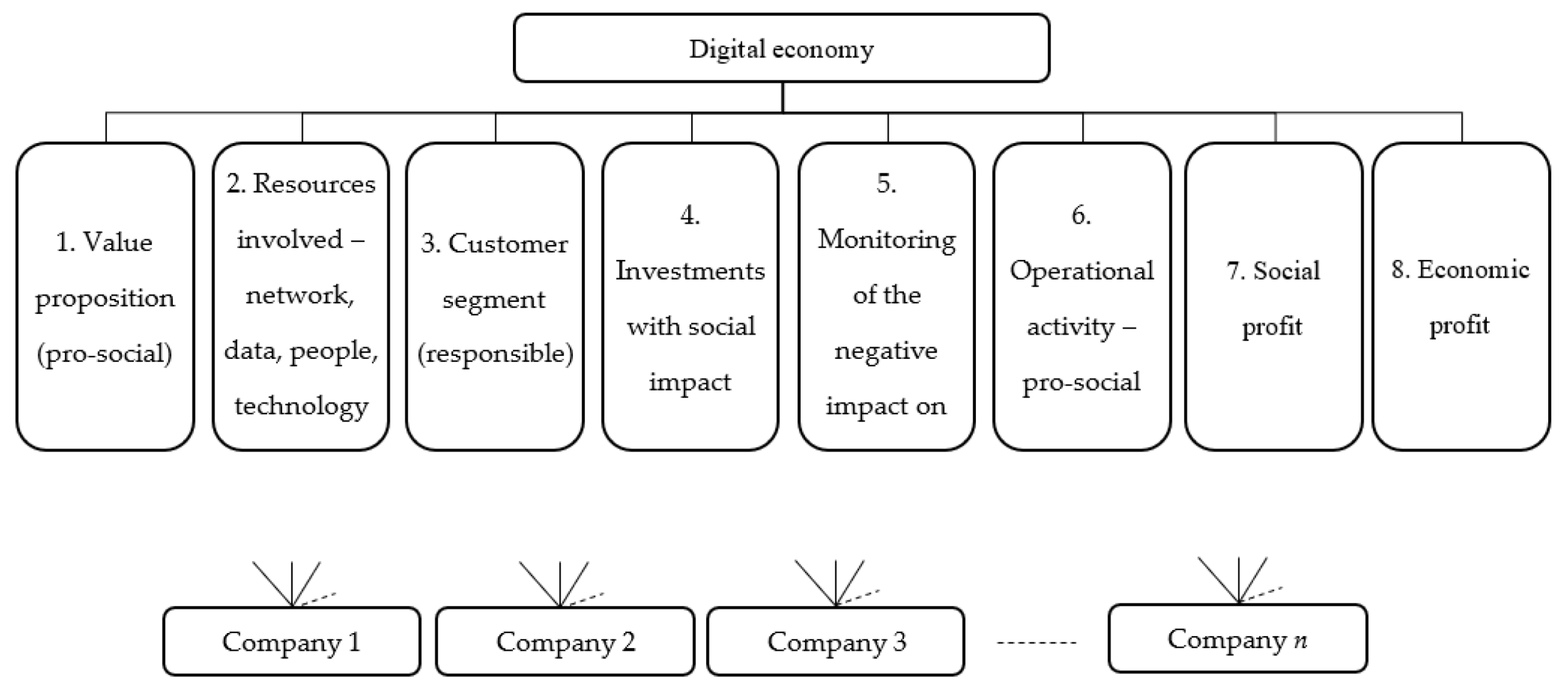

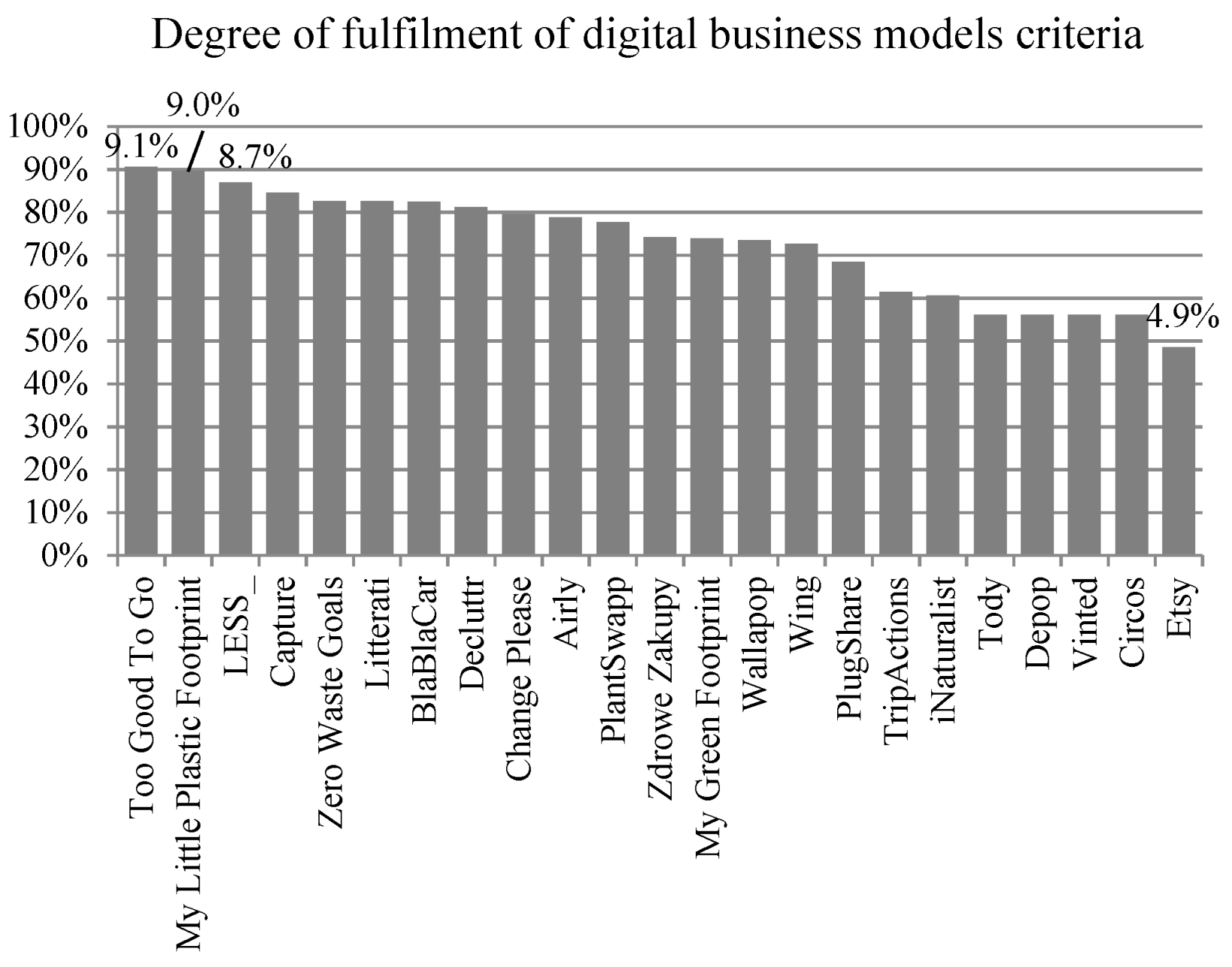

Efforts were made to make the most appropriate decision when choosing an appropriate research method from among heuristic methods and techniques requiring the analysis of available information, as well as the prediction of future phenomena based on creative thinking and logical combinations. Therefore, the AHP method was chosen, where the criteria in terms of which selected sample is studied are significant. The Analytic Hierarchy Process (AHP) method is a method of hierarchical problem analysis and was developed by American scholar T.L. Saaty in 1970. The method is still modified and is mainly used to support decision choices. Companies selected for the research were understood by the authors as digital business models, the idea of which is embedded in a pro-social management intention. Purposive sampling was applied, which in this situation was considered to be the most effective in terms of the objective of the paper.

It is worth noting that in the ranking, the data of the components were ranked on the basis of a set of predefined criteria, the aggregation of which allowed the creation of a ranking. This proposed solution aimed to conduct an appropriate assessment, followed by the ranking and selection of individual components. It is important for this approach to have a single common objective [

50]. In this case, it was to present and examine a configuration of a digital business model based on components resulting from the creation of social value contributing to the increased capitalization of the economic value of companies. As the AHP method is hierarchical, after defining the research objectives, the criteria were defined for which their significance was assessed in pairs. The significance of the alternatives for each criterion was then assessed in terms of each criterion. The important advantages of this method relate to the relatively simple and easy to understand modeling in a hierarchical context, the introduction of a clear scale of assessment and a method of prioritization, assuming that the identified priorities for selecting the factors in the process of their verification are taken into account. In order to fully apply this method, the availability of expert opinions related to the criteria used is important [

51].

The data included public documents and reports available in databases. This was complemented with a search of the databases for evidence of pro-social activity and the creation of social effects resulting from the strategic intentions of the management boards of the companies analyzed.

We expected that the results would allow us to determine whether enterprises whose value proposition is derived from the designed coherent business model based on the assumptions of equality, ecology and social values (value economics) achieve success measured by the ability to monetize business without harming the realization of social profits, which, thanks to the community centered around the idea, increases the probabilities of maximizing the market value of companies while maintaining the adopted values based on the assumptions of the new economy and the implementation of pro-social investments in line with the assumptions of the impact investing concept. Social impact is visible by verifying the attributes of business models from the point of view of the investment attractiveness of enterprises operating this type of digital business model.

The research presented indicates the key problems of the contemporary global economy based on the assumptions of value economics. Until now, these issues have not been so strongly exposed in terms of the functioning of these digital business models, whose managers, through their intended management intentions, aim to balance not only the goals of various stakeholder groups but economic and social profits too, as well as exerting influence to build social good.

Finally, the research also aims to provide insights into how value should be created through pro-social investments for creating Sustainable Digital Business Models, whether investors are willing to invest in digital enterprises that used social aspects and how social effects should be defined by investments.

6. Limitations

A limitation of the research is the choice of criteria for evaluation. In the literature, research into the digital transformation of business models is in its infancy and there are many issues which require clarification. The article is a step towards a better understanding of the processes of the digitalization of business models that have operated in the traditional way so far.

The specificity of companies may also be a limitation. Those whose business models largely depend on legal requirements must create digital solutions on their own. These firms should believe that in a liberalized and very competitive market the readiness to create an ecosystem of the digital economy may in the future help the company gain a competitive advantage [

58]. One important additional limitation is the possible ambiguity of the assessments conducted within the framework of the assessment, ranking and selection process. In addition, the ranking method is an expert method, which makes it subject to the likelihood of errors due to the limited rationality and knowledge of the assessors.

It should be mentioned that this method does not adhere to rules such as transitivity and non-reversal, which is a significant limitation. It is worth noting that an important limitation in the research is the very approach to conducting the research, which includes the determinants of investing in social aspects, which include the expectation of positive economic returns in the short and long term from these investments. Such an approach is relatively innovative and is built on the logic of understanding, creating and implementing digital business models. An innovative approach is included, among others, in the proposed digital business model canvas built with social factors. The original digital business model is subject to research based on the ranking of its individual components in the context of the impact on the capitalization of digital companies, which is undoubtedly a new perspective for understanding the shape of these business models. The contribution to the development of management and quality science therefore includes a specific presentation of the component structure of the digital business model, which is built from social factors that create both social and economic value. In this innovative approach, there is no conflict between these values and, on the contrary, it includes a kind of synergy and symbiosis. The outcome of this area of business understanding is the unique architecture of the digital business model, in which it is worth investing in both the short-term and long-term.

It should be noted that today’s technological development in the scope of the digital economy has significantly expanded the opportunities in the area of social investment, the effects of which are visible in the economic and social sphere.

It is therefore impossible to separate these areas from each other, as they create a unique business ecosystem based on the traditional economy and the digital economy. Today, technology is becoming a connecting factor for the concurrent achievement of business goals from various cognitive perspectives. In addition, universal access to mobile devices and applications focused on creating a social effect is the basis for a great number of investments that positively affect the modern, changing image of modern business. In this context, the technological development of companies determines new opportunities in the field of social engineering.

As regards the need to study the subject presented in the context of future research, it would be reasonable to explore the processes of the digital transformation of the business models in other sectors of the economy and services. It is worth looking into the differences between digital transformation processes in sectors considered to be traditional, such as the digital transformation of services, rail transport and heavy industry. The differences between these areas in the context of universal digitalization could create results that would allow for a better understanding of the changes that are taking place in the dynamically developing digital economy and their impact on the business models of companies. These issues are important in the theoretical and in the utilitarian sense. Understanding digital transformation processes in terms of the development of social aspects is crucial because due to the growth of social aspects, business models have a wider scope and can increase economic efficiency and affect the added value of digitalization, that is social profit. The social aspect is also associated with the issue of trust, which is the leading criterion for the development of digitalization. In addition, the influence and role of the mutual process integration of railway companies through digital transformation should be indicated as a research gap and thus should be the subject of future research. These issues will be the subject of further research by the authors.