Economic and Carbon Costs of Electricity Balancing Services: The Need for Secure Flexible Low-Carbon Generation

Abstract

:1. Introduction

- Decarbonisation aims to reduce greenhouse gas (GHG) emissions, typically measured in the equivalent impact of carbon dioxide emissions (CO2eq), ultimately seeking net-zero emission power systems [4].

2. Materials and Methods

3. Results

3.1. The Economic Cost of Balancing Services

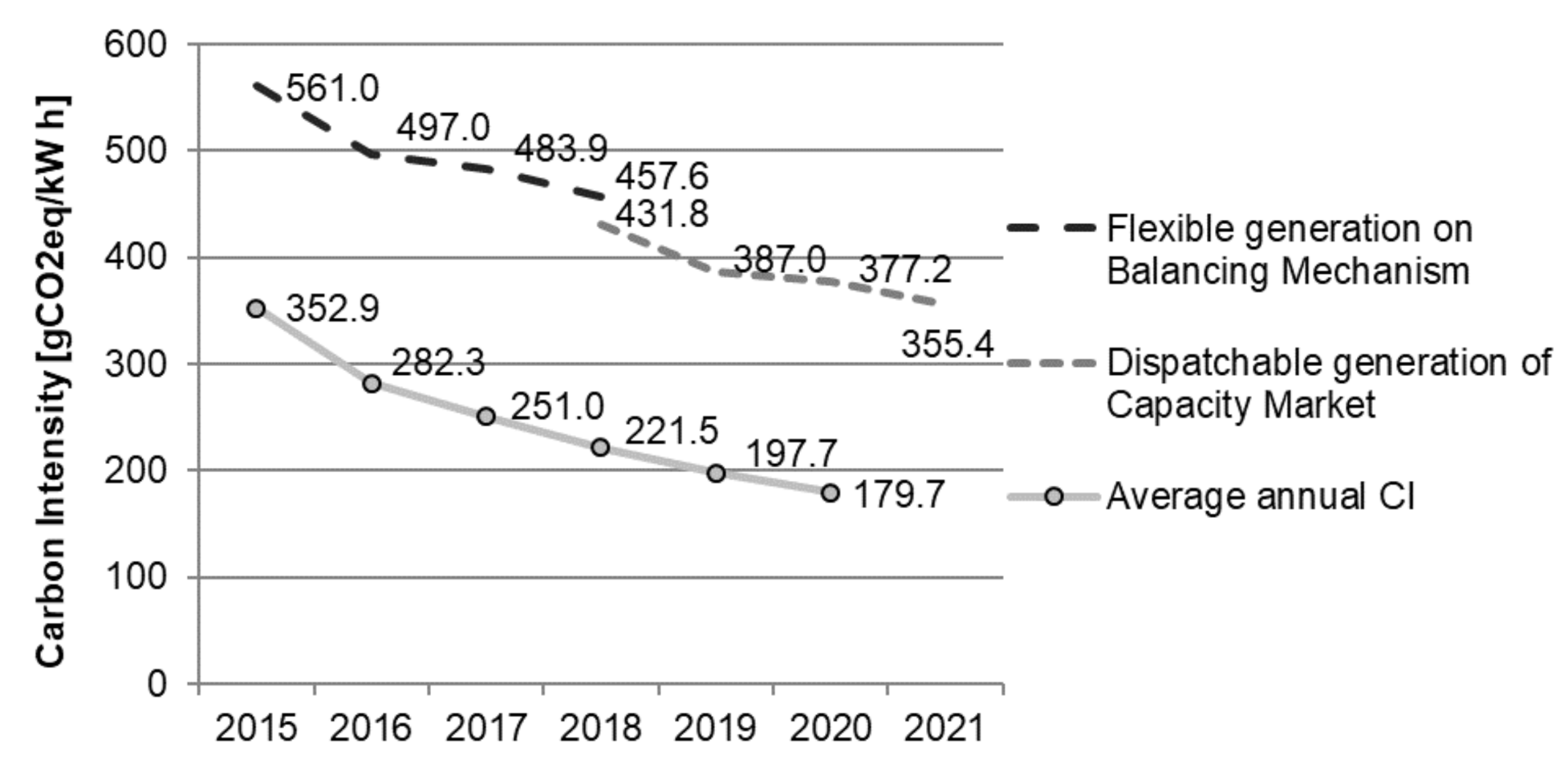

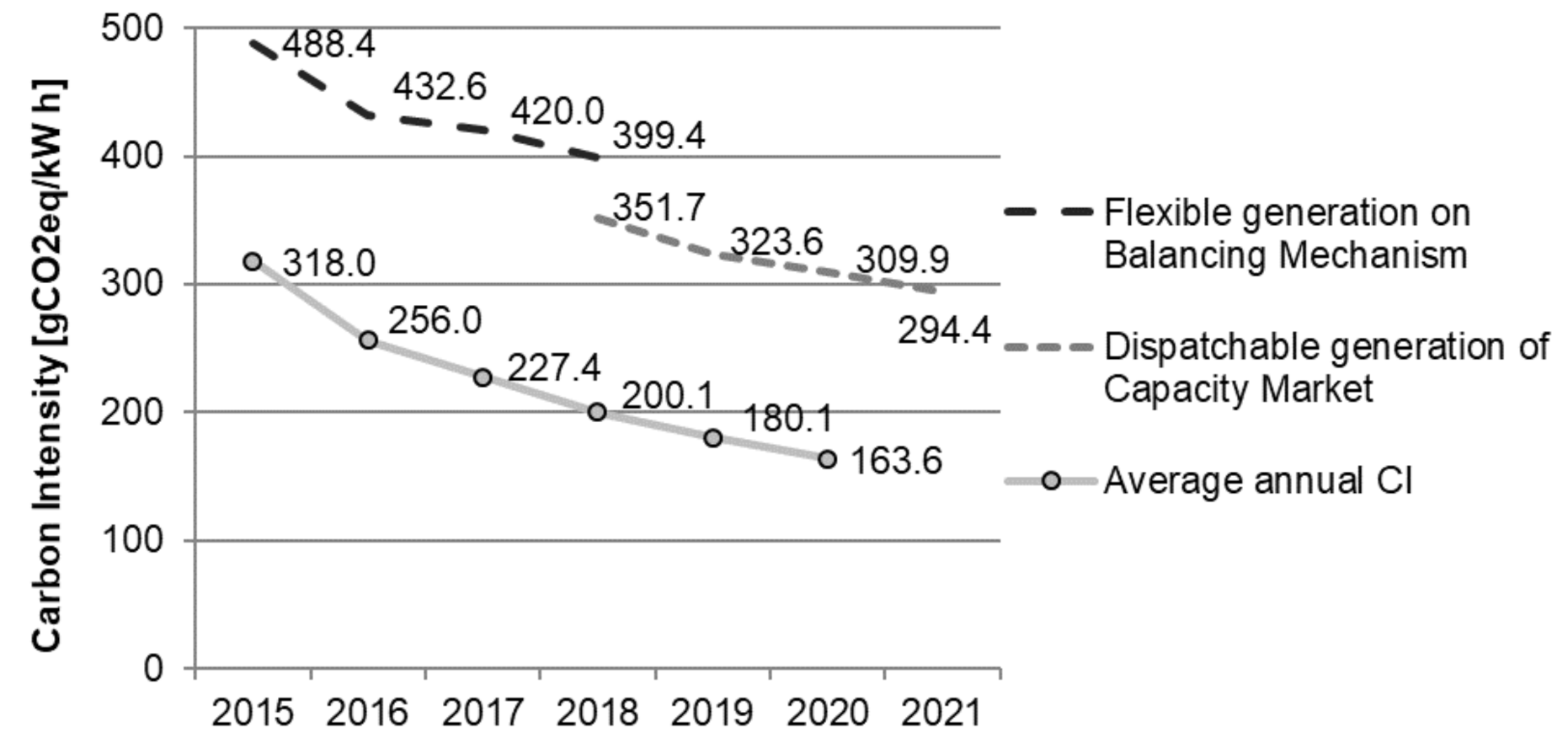

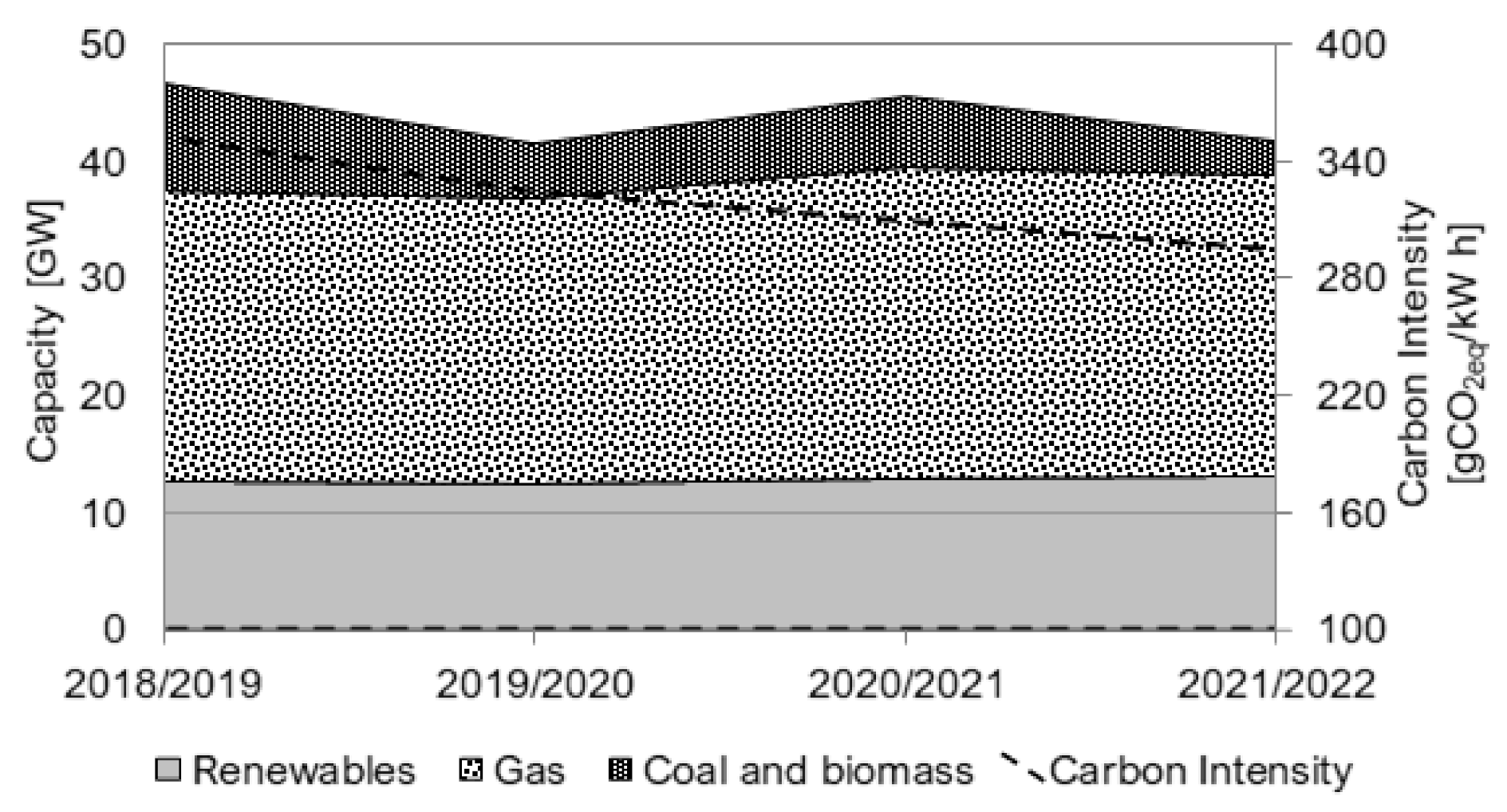

3.2. The Carbon Cost of Balancing Services

3.3. Summary and Discussion of the Results

4. Discussion: Policy Interventions and Wider Applicability

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Technology and Fuel Used | This Work, Based on Scope-1 | This Work, Based on Scope-1 and Scope-3 | Staffell [68] | Bruce et al. [69] and Rogers and Parson [70] | |

|---|---|---|---|---|---|

| Combined Cycle Gas Turbine (using natural gas) | 393 ± 6 | 449 ± 7 | 394 ± 6 | 394 | |

| Oil (using Fuel Oil) | 1170 ± 191 | 1390 ± 229 | 935 ± 122 | 935 | |

| Coal (assuming ‘coal for electricity generation’ as fuel) | 942 ± 30 | 1096 ± 35 | 937 ± 15 | 937 | |

| Open Cycle Gas Turbine (using natural gas) | 656 ± 11 | 748.5 ± 12 | 651 ± 10 | 651 | |

| Other (using a mix of bioenergy) | Until 2 November 2017 (including biomass) | 28 ± 1 | 126 ± 3 | 120 ± 120 | 120 |

| Since 2 November 2017 (excluding biomass reported separately) | 1 ± 0 | 56 ± 2 | 300 | ||

| Biomass (using wood pellets) | Since 2 November 2017 | 53 ± 5 | 180 ± 6 | 120 | |

| Pumped hydro storage 1 | 291 ± 97 1 | 306 ± 110 1 | Not included | 0 | |

References

- World Commission on Environment and Development. Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- United Nations General Assembly. The Future We Want—UN Resolution 66/288 Resolution Adopted by the General Assembly on 27 July 2012; United Nations: New York, NY, USA, 2012; p. 53. [Google Scholar]

- International Atomic Energy Agency; United Nations Department of Economic and Social Affairs; International Energy Agency; Eurostat; European Environment Agency. Energy Indicators for Sustainable Development: Guidelines and Methodologies; IAEA: Vienna, Austria, 2005. [Google Scholar]

- World Energy Council. World Energy Trilemma: Priority Actions on Climate Change and how to Balance the Trilemma; World Energy Council: London, UK, 2015. [Google Scholar]

- Fankhauser, S.; Tepic, S. Can poor consumers pay for energy and water? An affordability analysis for transition countries. Energy Policy 2007, 35, 1038–1049. [Google Scholar] [CrossRef]

- The European Parliament; The Council of the European Union. Directive 2005/89/EC of the European Parliament and of the Council of 18 January 2006 Concerning Measures to Safeguard Security of Electricity Supply and Infrastructure Investment (Text with EEA Relevance); Official Journal of the European Union; Publications Office of the European Union: Luxembourg, 2006; pp. 22–29. [Google Scholar]

- Helm, D. Energy policy: Security of supply, sustainability and competition. Energy Policy 2002, 30, 173–184. [Google Scholar] [CrossRef]

- Heptonstall, P.; Gross, R.; Steiner, F. The Costs and Impacts of Intermittency—2016 Update; UK Energy Research Centre: London, UK, 2017. [Google Scholar]

- Leslie, J. Zero Carbon Operation 2025; National Grid ESO: Warwick, UK, 2019; p. 4. [Google Scholar]

- Intergovernmental Panel on Climate Change. Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2014; 1435p. [Google Scholar]

- Lund, P.D.; Lindgren, J.; Mikkola, J.; Salpakari, J. Review of energy system flexibility measures to enable high levels of variable renewable electricity. Renew. Sustain. Energy Rev. 2015, 45, 785–807. [Google Scholar] [CrossRef] [Green Version]

- Huber, M.; Dimkova, D.; Hamacher, T. Integration of wind and solar power in Europe: Assessment of flexibility requirements. Energy 2014, 69, 236–246. [Google Scholar] [CrossRef] [Green Version]

- Papaefthymiou, G.; Dragoon, K. Towards 100% renewable energy systems: Uncapping power system flexibility. Energy Policy 2016, 92, 69–82. [Google Scholar] [CrossRef]

- Liebensteiner, M.; Wrienz, M. Do Intermittent Renewables Threaten the Electricity Supply Security? Energy Econ. 2019, 87, 104499. [Google Scholar] [CrossRef]

- Brouwer, A.S.; van den Broek, M.; Seebregts, A.; Faaij, A. Impacts of large-scale Intermittent Renewable Energy Sources on electricity systems, and how these can be modeled. Renew. Sustain. Energy Rev. 2014, 33, 443–466. [Google Scholar] [CrossRef]

- Ummels, B.C.; Gibescu, M.; Pelgrum, E.; Kling, W.L.; Brand, A.J. Impacts of Wind Power on Thermal Generation Unit Commitment and Dispatch. IEEE Trans. Energy Convers. 2007, 22, 44–51. [Google Scholar] [CrossRef] [Green Version]

- Gowrisankaran, G.; Reynolds, S.S.; Samano, M. Intermittency and the Value of Renewable Energy. J. Political Econ. 2016, 124, 1187–1234. [Google Scholar] [CrossRef] [Green Version]

- Grave, K.; Paulus, M.; Lindenberger, D. A method for estimating security of electricity supply from intermittent sources: Scenarios for Germany until 2030. Energy Policy 2012, 46, 193–202. [Google Scholar] [CrossRef]

- National Renewable Energy Laboratory. Western Wind and Solar Integration Study; National Renewable Energy Laboratory U.S. Department of Energy: Golden, CO, USA, 2010; p. 536.

- Lew, D.; Brinkman, G.; Ibanez, E.; Florita, A.; Heaney, M.; Hodge, B.M.; Gross, R.; Steiner, F. The Western Wind and Solar Integration Study Phase 2; National Renewable Energy Laboratory—U.S. Department of Energy: Golden, CO, USA, 2013; p. 244.

- Lund, H. Large-scale integration of wind power into different energy systems. Energy 2005, 30, 2402–2412. [Google Scholar] [CrossRef]

- Traber, T.; Kemfert, C. Gone with the wind?—Electricity market prices and incentives to invest in thermal power plants under increasing wind energy supply. Energy Econ. 2011, 33, 249–256. [Google Scholar] [CrossRef] [Green Version]

- Sahin, C.; Shahidehpour, M.; Erkmen, I. Generation risk assessment in volatile conditions with wind, hydro, and natural gas units. Appl. Energy 2012, 96, 4–11. [Google Scholar] [CrossRef]

- Bessa, R.; Moreira, C.; Silva, B.; Matos, M. Handling renewable energy variability and uncertainty in power systems operation. Wiley Interdiscip. Rev. Energy Environ. 2014, 3, 156–178. [Google Scholar] [CrossRef]

- Galvan, E.; Mandal, P.; Haque, A.U.; Tseng, T.-L. Optimal Placement of Intermittent Renewable Energy Resources and Energy Storage System in Smart Power Distribution Networks. Electr. Power Compon. Syst. 2017, 45, 1543–1553. [Google Scholar] [CrossRef]

- Weitemeyer, S.; Kleinhans, D.; Vogt, T.; Agert, C. Integration of Renewable Energy Sources in future power systems: The role of storage. Renew. Energy 2015, 75, 14–20. [Google Scholar] [CrossRef] [Green Version]

- Strbac, G. Demand side management: Benefits and challenges. Energy Policy 2008, 36, 4419–4426. [Google Scholar] [CrossRef]

- Lauer, M.; Dotzauer, M.; Hennig, C.; Lehmann, M.; Nebel, E.; Postel, J.; Kleinhans, D.; Vogt, T. Flexible power generation scenarios for biogas plants operated in Germany: Impacts on economic viability and GHG emissions. Int. J. Energy Res. 2016, 41, 63–80. [Google Scholar] [CrossRef] [Green Version]

- Szarka, N.; Scholwin, F.; Trommler, M.; Fabian Jacobi, H.; Eichhorn, M.; Ortwein, A.; Dotzauer, M.; Lehmann, M. A novel role for bioenergy: A flexible, demand-oriented power supply. Energy 2013, 61, 18–26. [Google Scholar] [CrossRef]

- Knorr, K.; Zimmermann, B.; Kirchner, D.; Speckmann, M.; Spieckermann, R.; Widdel, M.; Wunderlich, M.; Mackensen, R.; Rohrig, K.; Steinke, F.; et al. Kombikraftwerk 2—Final Report; Fraunhofer Institute for Energy Economics and Energy System Technology: Kassel, Germany, 2014; p. 218. [Google Scholar]

- Alizadeh, M.I.; Parsa Moghaddam, M.; Amjady, N.; Siano, P.; Sheikh-El-Eslami, M.K. Flexibility in future power systems with high renewable penetration: A review. Renew. Sustain. Energy Rev. 2016, 57, 1186–1193. [Google Scholar] [CrossRef]

- Hahn, H.; Krautkremer, B.; Hartmann, K.; Wachendorf, M. Review of concepts for a demand-driven biogas supply for flexible power generation. Renew. Sustain. Energy Rev. 2014, 29, 383–393. [Google Scholar] [CrossRef]

- Persson, T.; Murphy, J.D.; Jannasch, A.-K.; Ahern, E.; Liebetrau, J.; Trommler, M.; Parsa Moghaddam, M.; Amjady, N. A Perspective on the Potential Role of Biogas in Smart Energy Grids; Baxter, D., Ed.; IEA Bioenergy: Paris, France, 2014. [Google Scholar]

- Lafratta, M.; Thorpe, R.B.; Ouki, S.K.; Shana, A.; Germain, E.; Willcocks, M.; Lee, J. Dynamic biogas production from anaerobic digestion of sewage sludge for on-demand electricity generation. Bioresour. Technol. 2020, 310, 123415. [Google Scholar] [CrossRef] [PubMed]

- Lafratta, M.; Thorpe, R.B.; Ouki, S.K.; Shana, A.; Germain, E.; Willcocks, M.; Lee, J. Demand-Driven Biogas Production from Anaerobic Digestion of Sewage Sludge: Application in Demonstration Scale. Waste Biomass Valorization 2021. [Google Scholar] [CrossRef]

- Meeus, L.; Purchala, K.; Belmans, R. Development of the internal electricity market in Europe. Electr. J. 2005, 18, 25–35. [Google Scholar] [CrossRef]

- van der Veen, R.A.; Hakvoort, R.A. The electricity balancing market: Exploring the design challenge. Util. Policy 2016, 43, 186–194. [Google Scholar] [CrossRef] [Green Version]

- Black, M.; Strbac, G. Value of storage in providing balancing services for electricity generation systems with high wind penetration. J. Power Sources 2006, 162, 949–953. [Google Scholar] [CrossRef]

- Guinot, B.; Montignac, F.; Champel, B.; Vannucci, D. Profitability of an electrolysis based hydrogen production plant providing grid balancing services. Int. J. Hydrogen Energy 2015, 40, 8778–8787. [Google Scholar] [CrossRef]

- Joos, M.; Staffell, I. Short-term integration costs of variable renewable energy: Wind curtailment and balancing in Britain and Germany. Renew. Sustain. Energy Rev. 2018, 86, 45–65. [Google Scholar] [CrossRef]

- Gianfreda, A.; Parisio, L.; Pelagatti, M. A review of balancing costs in Italy before and after RES introduction. Renew. Sustain. Energy Rev. 2018, 91, 549–563. [Google Scholar] [CrossRef] [Green Version]

- Clauß, J.; Stinner, S.; Solli, C.; Lindberg, K.B.; Madsen, H.; Georges, L. Evaluation method for the hourly average CO2eq. Intensity of the electricity mix and its application to the demand response of residential heating. Energies 2019, 12, 1345. [Google Scholar] [CrossRef] [Green Version]

- Yin, R.K. Case Study Research: Design and Methods, 5th ed.; SAGE Publications, Inc.: Los Angeles, CA, USA, 2013. [Google Scholar]

- Castro, M. Assessing the risk profile to security of supply in the electricity market of Great Britain. Energy Policy 2017, 111, 148–156. [Google Scholar] [CrossRef]

- Committee on Climate Change. Net Zero: The UK’s Contribution to Stopping Global Warming; Committee on Climate Change: London, UK, 2019. [Google Scholar]

- Committee on Climate Change. The Sixth Carbon Budget: The UK’s Path to Net Zero; Committee on Climate Change: London, UK, 2020. [Google Scholar]

- Department for Business Energy & Industrial Strategy. Consolidated Version of the Capacity Market Rules; The National Archives: London, UK, 2017; p. 193. [Google Scholar]

- ELEXON Limited. The Balancing and Settlement Code. Consolidated Operational version; Version 15; ELEXON Limited: London, UK, 2001; p. 979. [Google Scholar]

- Office of Gas and Electricity Markets. Balancing and Settlement Code (BSC) P305: Electricity Balancing Significant Code Review Developments; OFGEM: London, UK, 2015; p. 16. [Google Scholar]

- Rodriguez-Alvarez, A.; Orea, L.; Jamasb, T. Fuel poverty and Well-Being: A consumer theory and stochastic frontier approach. Energy Policy 2019, 131, 22–32. [Google Scholar] [CrossRef] [Green Version]

- Liddell, C.; Morris, C.; McKenzie, S.J.P.; Rae, G. Measuring and monitoring fuel poverty in the UK: National and regional perspectives. Energy Policy 2012, 49, 27–32. [Google Scholar] [CrossRef]

- Vincent, L. Total Household Expenditure on Energy; Department for Business Energy & Industrial Strategy: London, UK, 2018.

- Office of Gas and Electricity Markets (OFGEM). State of the Energy Market 2019. State of the Energy Market; OFGEM: London, UK, 2019; p. 181. [Google Scholar]

- ELEXON Limited. Balancing Mechanism Reporting Service Dataset. Available online: https://api.bmreports.com/BMRS/ (accessed on 26 November 2020).

- ELEXON Limited. Balancing Mechanism Reporting Service. Available online: https://www.bmreports.com/bmrs/ (accessed on 26 November 2020).

- National Grid. Final Auction Results—T-4 Capacity Market Auction for 2019/20. 2015, p. 20. Available online: https://www.emrdeliverybody.com/Capacity%20Markets%20Document%20Library/T-4%20Final%20Results%202015.pdf (accessed on 26 November 2020).

- National Grid. Final Auction Results—T-1 Capacity Market Auction for 2018/19. 2018, p. 20. Available online: https://www.emrdeliverybody.com/Capacity%20Markets%20Document%20Library/Final%20Results%20T-1%202017%20(13.02.2018).pdf (accessed on 26 November 2020).

- National Grid. Final Auction Results—T-4 Capacity Market Auction 2014. 2014, p. 42. Available online: https://www.emrdeliverybody.com/Capacity%20Markets%20Document%20Library/T-4%202014%20Final%20Auction%20Results%20Report.pdf (accessed on 26 November 2020).

- National Grid. Final Auction Results—T-4 Capacity Market Auction for 2020/21. 2016, p. 26. Available online: https://www.emrdeliverybody.com/Capacity%20Markets%20Document%20Library/Final%20Results%20Report%20-%20T-4%202016.pdf (accessed on 26 November 2020).

- National Grid. Final Auction Results—T-4 Capacity Market Auction for 2021/22. 2018, p. 31. Available online: https://www.emrdeliverybody.com/Capacity%20Markets%20Document%20Library/Final%20T-4%20Results%20(Delivery%20Year%2021-22)%2020.02.2018.pdf (accessed on 26 November 2020).

- Hawkes, A.D. Estimating marginal CO2 emissions rates for national electricity systems. Energy Policy 2010, 38, 5977–5987. [Google Scholar] [CrossRef]

- Siler-Evans, K.; Lima Azevedo, I.; Morgan, M.G. Marginal Emissions Factors for the U.S. Electricity System. Environ. Sci. Technol. 2012, 46, 4742–4748. [Google Scholar] [CrossRef] [PubMed]

- Hawkes, A.D. Long-run marginal CO2 emissions factors in national electricity systems. Appl. Energy 2014, 125, 197–205. [Google Scholar] [CrossRef] [Green Version]

- Zheng, Z.; Han, F.; Li, F.; Zhu, J. Assessment of marginal emissions factor in power systems under ramp-rate constraints. CSEE J. Power Energy Syst. 2015, 1, 37–49. [Google Scholar] [CrossRef]

- Böing, F.; Regett, A. Hourly CO2 Emission Factors and Marginal Costs of Energy Carriers in Future Multi-Energy Systems. Energies 2019, 12, 2260. [Google Scholar] [CrossRef] [Green Version]

- Huber, J.; Lohmann, K.; Schmidt, M.; Weinhardt, C. Carbon efficient smart charging using forecasts of marginal emission factors. J. Clean. Prod. 2021, 284, 124766. [Google Scholar] [CrossRef]

- National Grid ESO. Connection and Use of System Code; National Grid ESO: Warwick, UK, 2020; p. 135. [Google Scholar]

- Staffell, I. Measuring the progress and impacts of decarbonising British electricity. Energy Policy 2017, 102, 463–475. [Google Scholar] [CrossRef] [Green Version]

- Bruce, A.R.W.; Ruff, L.; Kelloway, J.; MacMillan, F.; Rogers, A. Carbon Intensity Forecast Methodology. National Grid ESO: Warwick, UK. Available online: https://github.com/carbon-intensity/methodology/raw/master/Carbon%20Intensity%20Forecast%20Methodology.pdf (accessed on 26 July 2021).

- Rogers, A.; Parson, O. GridCarbon: A Smartphone App to Calculate the Carbon Intensity of the UK Electricity Grid. Available online: https://www.cs.ox.ac.uk/people/alex.rogers/gridcarbon/gridcarbon.pdf (accessed on 26 November 2020).

- Department for Business Energy & Industrial Strategy (BEIS). Final UK Greenhouse Gas Emissions National Statistics 2020. In Final UK Greenhouse Gas Emissions National Statistics from 1990; The National Archives: London, UK, 2020. [Google Scholar]

- Department for Business Energy & Industrial Strategy (BEIS). Digest of UK Energy Statistics 2020; BEIS: London, UK, 2020. [Google Scholar]

- Department for Business Energy & Industrial Strategy (BEIS); Department for Environment Food & Rural Affairs (DEFRA). UK Government GHG Conversion Factors for Company Reporting. Government Conversion Factors for Company Reporting of Greenhouse Gas Emissions. 1 January 2015; The National Archives: London, UK, 2015.

- Department for Business Energy & Industrial Strategy (BEIS); Department for Environment Food & Rural Affairs (DEFRA). UK Government GHG Conversion Factors for Company Reporting. Government Conversion Factors for Company Reporting of Greenhouse Gas Emissions. 1 June 2016; The National Archives: London, UK, 2016.

- Department for Business Energy & Industrial Strategy (BEIS); Department for Environment Food & Rural Affairs (DEFRA). UK Government GHG Conversion Factors for Company Reporting. Government Conversion Factors for Company Reporting of Greenhouse Gas Emissions. 4 August 2017; The National Archives: London, UK, 2017.

- Department for Business Energy & Industrial Strategy (BEIS); Department for Environment Food & Rural Affairs (DEFRA). UK Government GHG Conversion Factors for Company Reporting. Government Conversion Factors for Company Reporting of Greenhouse Gas Emissions. 8 June 2018; The National Archives: London, UK, 2018.

- Department for Business Energy & Industrial Strategy (BEIS); Department for Environment Food & Rural Affairs (DEFRA). UK Government GHG Conversion Factors for Company Reporting. Government Conversion Factors for Company Reporting of Greenhouse Gas Emissions. 9 June 2020; The National Archives: London, UK, 2020.

- Department for Business Energy & Industrial Strategy (BEIS); Department for Environment Food & Rural Affairs (DEFRA). UK Government GHG Conversion Factors for Company Reporting. Government Conversion Factors for Company Reporting of Greenhouse Gas Emissions. 4 June 2019; The National Archives: London, UK, 2019.

- Intergovernmental Panel on Climate Change (IPCC). 2006 IPCC Guidelines for National Greenhouse Gas Inventories; Eggleston, H.S., Buendia, L., Miwa, K., Ngara, T., Tanabe, K., Eds.; National Greenhouse Gas Inventories Programme: Hayama, Japan, 2006. [Google Scholar]

- International Financial Institution Technical Working Group on Greenhouse Gas Accounting. GHG Accounting for Grid Connected Renewable Energy Projects; United Nations Framework Convention on Climate Change: Bonn, Germany, 2019. [Google Scholar]

- Department for Business Energy & Industrial Strategy (BEIS). 2019 Government Greenhouse Gas Conversion Factors for Company Reporting—Methodology Paper for Emission Factors Final Report; Hill, N., Karagianni, E., Jones, L., MacCarthy, J., Bonifazi, E., Hinton, S., Afais, P., Smith, J., Eds.; The National Archives: London, UK, 2019. [Google Scholar]

- Drax Group PLC. Annual Report and Accounts 2018: Enabling a Zero Carbon, Lower Cost Energy Future; Drax Group PLC: Selby, UK, 2019; p. 192. [Google Scholar]

- International Energy Agency. CO2 Emissions from Fuel Combustion 2017; International Energy Agency: Paris, France, 2017. [Google Scholar]

- European Environment Agency (EEA). CO2 Emission Intensity. Available online: https://www.eea.europa.eu/data-and-maps/daviz/co2-emission-intensity (accessed on 26 November 2020).

- Department of Agriculture Environment and Rural Affairs. Northern Ireland Carbon Intensity Indicators 2020; Department of Agriculture, Environment and Rural Affairs: Belfast, UK, 2020; p. 32.

- ELEXON Limited. ELEXON Portal. 2020. Available online: https://www.elexonportal.co.uk/ (accessed on 26 November 2020).

- Graf, C.; Marcantonini, C. Renewable energy and its impact on thermal generation. Energy Econ. 2017, 66, 421–430. [Google Scholar] [CrossRef]

- The Competition and Markets Authority. Energy Market Investigation—Wholesale Electricity Market Rules; The National Archives: London, UK, 2015; p. 30.

- BS EN ISO 14040. Environmental Management. Life Cycle Assessment. Principles and Framework; British Standards Institute: London, UK, 2006. [Google Scholar]

- BS EN ISO 14044, 2006+A1. Environmental Management. Life Cycle Assessment. Requirements and Guidelines; British Standards Institute: London, UK, 2018. [Google Scholar]

- International Renewable Energy Agency. Renewable Power Generation Costs in 2018; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- The European Parliament; The Council of the European Union. Regulation (EU) 2019/943 of the European Parliament and of the Council of 5 June 2019 on the Internal Market for Electricity (Text with EEA Relevance); Official Journal of the European Union; Publications Office of the European Union: Luxembourg, 2019; p. 70. [Google Scholar]

- Sensfuß, F.; Ragwitz, M.; Genoese, M. The merit-order effect: A detailed analysis of the price effect of renewable electricity generation on spot market prices in Germany. Energy Policy 2008, 36, 3086–3094. [Google Scholar] [CrossRef] [Green Version]

- Clò, S.; Cataldi, A.; Zoppoli, P. The merit-order effect in the Italian power market: The impact of solar and wind generation on national wholesale electricity prices. Energy Policy 2015, 77, 79–88. [Google Scholar] [CrossRef]

- World Energy Council. World Energy Trilemma Index Report 2020. Available online: Trilemma.worldenergy.org (accessed on 14 May 2021).

- Turconi, R.; Boldrin, A.; Astrup, T. Life cycle assessment (LCA) of electricity generation technologies: Overview, comparability and limitations. Renew. Sustain. Energy Rev. 2013, 28, 555–565. [Google Scholar] [CrossRef] [Green Version]

- Xie, J.-B.; Fu, J.-X.; Liu, S.-Y.; Hwang, W.-S. Assessments of carbon footprint and energy analysis of three wind farms. J. Clean. Prod. 2020, 254, 120159. [Google Scholar] [CrossRef]

- Zafrilla, J.-E.; Arce, G.; Cadarso, M.-Á.; Córcoles, C.; Gómez, N.; López, L.-A.; Marcantonini, C.; Zoppoli, P. Triple bottom line analysis of the Spanish solar photovoltaic sector: A footprint assessment. Renew. Sustain. Energy Rev. 2019, 114, 109311. [Google Scholar] [CrossRef]

- Desideri, U.; Proietti, S.; Zepparelli, F.; Sdringola, P.; Bini, S. Life Cycle Assessment of a ground-mounted 1778kWp photovoltaic plant and comparison with traditional energy production systems. Appl. Energy 2012, 97, 930–943. [Google Scholar] [CrossRef]

- Fthenakis, V.M.; Kim, H.C. Greenhouse-gas emissions from solar electric- and nuclear power: A life-cycle study. Energy Policy 2007, 35, 2549–2557. [Google Scholar] [CrossRef]

- Sovacool, B.K. Valuing the greenhouse gas emissions from nuclear power: A critical survey. Energy Policy 2008, 36, 2950–2963. [Google Scholar] [CrossRef]

| Auction | 2014 T-4 | 2015 T-4 | 2016 T-4 | 2017 T-4 | 2017 T-1 |

| Delivery year | 2018/19 | 2019/20 | 2020/21 | 2021/22 | 2018/19 |

| Clear price [GBP/kW/year] | 19.40 | 18.00 | 22.50 | 8.40 | 6.00 |

| Capacity [GW] | 49.3 | 46.3 | 52.4 | 50.4 | 5.8 |

| Total cost [GBP] | 956 m | 834 m | 1179 m | 423 m | 35 m |

| Period (from–to, dd/mm/yy) | Real PAR | Real Market Price | Marginal PAR | Recalculated Market Price | |||

|---|---|---|---|---|---|---|---|

| Average [GBP/MW·h] | Standard Deviation | Average [GBP/MW·h] | Standard Deviation | ||||

| 01/02/2015 | 30/04/2015 | PAR500 | GBP 41.88 | 38.31% | PAR50 | GBP 43.27 | 51.34% |

| 01/05/2015 | 31/07/2015 | PAR500 | GBP 41.90 | 38.79% | PAR50 | GBP 42.91 | 51.87% |

| 01/08/2015 | 04/11/2015 | PAR500 | GBP 43.67 | 47.41% | PAR50 | GBP 46.19 | 64.82% |

| 05/11/2015 | 01/02/2016 | PAR50 | GBP 38.54 | 53.68% | PAR1 | GBP 38.90 | 57.50% |

| 02/02/2016 | 30/04/2016 | PAR50 | GBP 35.79 | 84.26% | PAR1 | GBP 36.35 | 89.69% |

| 01/05/2016 | 31/07/2016 | PAR50 | GBP 34.78 | 72.66% | PAR1 | GBP 34.92 | 79.16% |

| 01/08/2016 | 31/10/2016 | PAR50 | GBP 38.86 | 107.95% | PAR1 | GBP 39.99 | 141.77% |

| 01/11/2016 | 31/01/2017 | PAR50 | GBP 55.86 | 129.88% | PAR1 | GBP 57.17 | 142.85% |

| 01/02/2017 | 30/04/2017 | PAR50 | GBP 41.29 | 59.85% | PAR1 | GBP 41.56 | 64.20% |

| 01/05/2017 | 31/07/2017 | PAR50 | GBP 41.54 | 108.36% | PAR1 | GBP 42.00 | 120.94% |

| 01/08/2017 | 31/10/2017 | PAR50 | GBP 43.80 | 53.45% | PAR1 | GBP 44.16 | 56.69% |

| 01/11/2017 | 31/01/2018 | PAR50 | GBP 51.96 | 41.27% | PAR1 | GBP 52.19 | 42.61% |

| 01/02/2018 | 30/04/2018 | PAR50 | GBP 57.62 | 80.36% | PAR1 | GBP 57.62 | 80.37% |

| 01/05/2018 | 31/07/2018 | PAR50 | GBP 52.98 | 38.14% | PAR1 | GBP 52.98 | 38.14% |

| 01/08/2018 | 04/11/2018 | PAR50 | GBP 61.28 | 39.60% | PAR1 | GBP 61.28 | 39.61% |

| Technology and Fuel Used | This Work, Based on Scope-1 | Staffell [68] | Bruce et al. [69] and Rogers and Parson [70] | |

|---|---|---|---|---|

| Combined Cycle Gas Turbine (using Natural Gas) | 393 ± 6 | 394 ± 6 | 394 | |

| Oil (using Fuel Oil) | 1170 ± 191 | 935 ± 122 | 935 | |

| Coal (assuming “coal for electricity generation” as fuel) | 942 ± 30 | 937 ± 15 | 937 | |

| Open Cycle Gas Turbine (using Natural Gas) | 656 ± 11 | 651 ± 10 | 651 | |

| Other (using a mix of bioenergy) | Until 2 November 2017, including biomass | 28 ± 1 | 120 ± 120 | 120 |

| Since 2 November 2017, excluding biomass reported separately | 1 ± 0 | 300 | ||

| Biomass (using wood pellets) | Since 2 November 2017 | 53 ± 5 | 120 | |

| Pumped hydro storage 1 | 291 ± 97 | Not included | 0 | |

| Generation | Overall Estimated Daily Cost | CI in 2018 [g CO2eq/kW·h] | Variation of CI 2015–2018 | |

|---|---|---|---|---|

| BM | 8 TW·h | GBP1.3 m | 399.4 | −18% |

| CM | 33 TW·h | GBP2.7 m | 359.7 | −17% |

| Grid | 301 TW·h | GBP100.5 m | 199.6 | −36% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lafratta, M.; Leach, M.; Thorpe, R.B.; Willcocks, M.; Germain, E.; Ouki, S.K.; Shana, A.; Lee, J. Economic and Carbon Costs of Electricity Balancing Services: The Need for Secure Flexible Low-Carbon Generation. Energies 2021, 14, 5123. https://doi.org/10.3390/en14165123

Lafratta M, Leach M, Thorpe RB, Willcocks M, Germain E, Ouki SK, Shana A, Lee J. Economic and Carbon Costs of Electricity Balancing Services: The Need for Secure Flexible Low-Carbon Generation. Energies. 2021; 14(16):5123. https://doi.org/10.3390/en14165123

Chicago/Turabian StyleLafratta, Mauro, Matthew Leach, Rex B. Thorpe, Mark Willcocks, Eve Germain, Sabeha K. Ouki, Achame Shana, and Jacquetta Lee. 2021. "Economic and Carbon Costs of Electricity Balancing Services: The Need for Secure Flexible Low-Carbon Generation" Energies 14, no. 16: 5123. https://doi.org/10.3390/en14165123

APA StyleLafratta, M., Leach, M., Thorpe, R. B., Willcocks, M., Germain, E., Ouki, S. K., Shana, A., & Lee, J. (2021). Economic and Carbon Costs of Electricity Balancing Services: The Need for Secure Flexible Low-Carbon Generation. Energies, 14(16), 5123. https://doi.org/10.3390/en14165123