The Impact of Oil Price on Transition toward Renewable Energy Consumption? Evidence from Russia

Abstract

1. Introduction

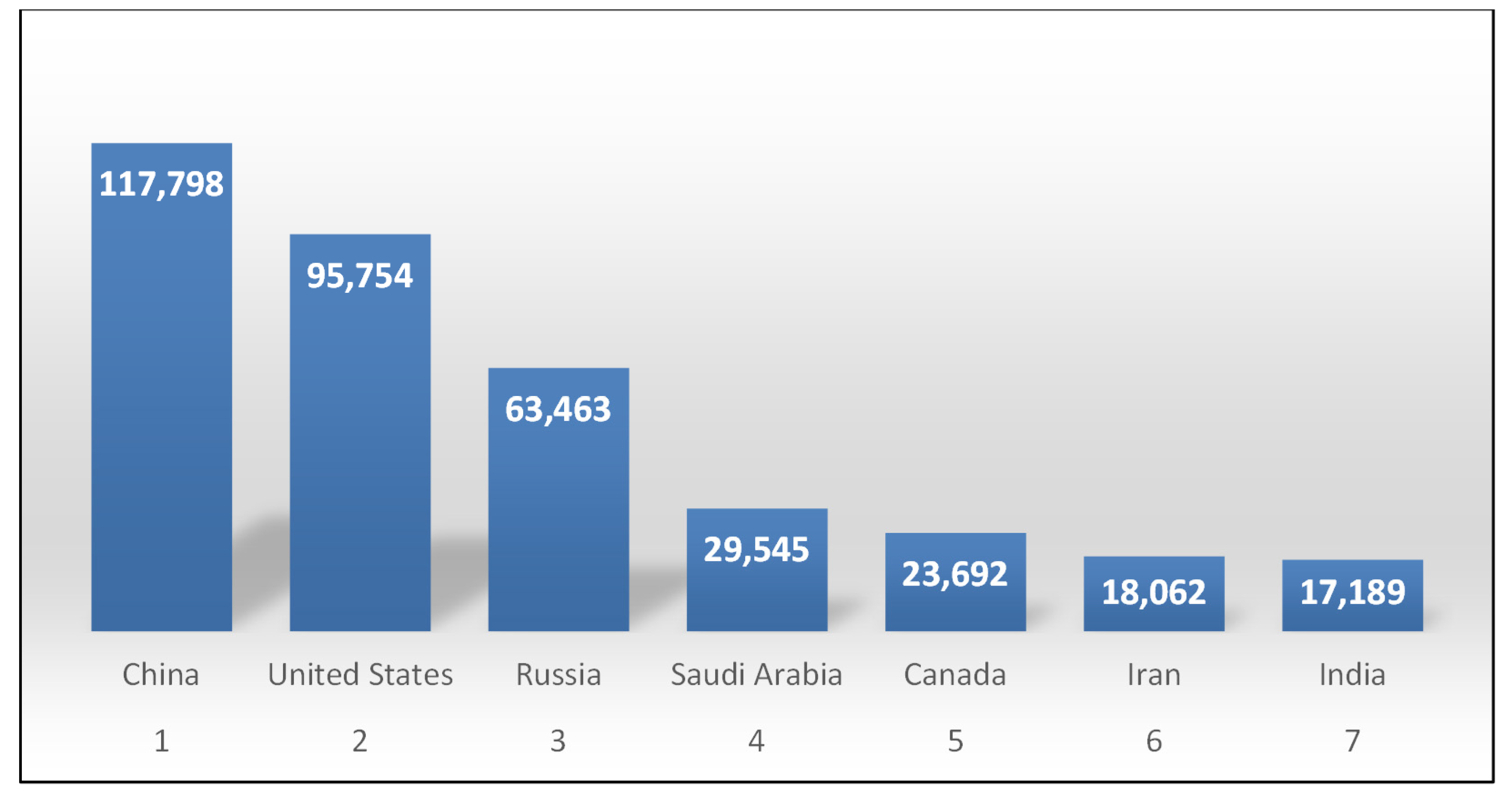

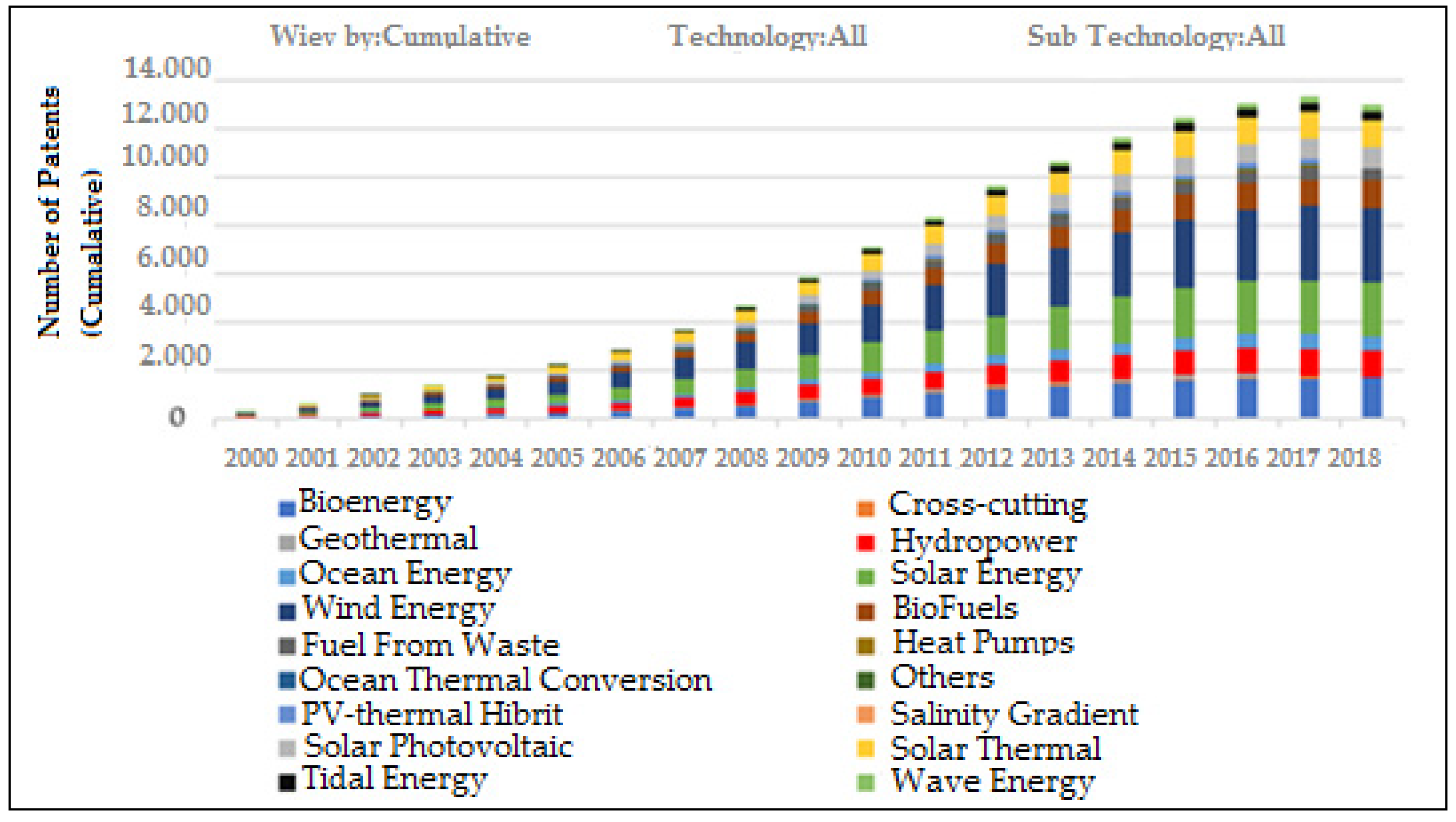

2. Energy and Renewable Energy in Russia

3. Literature Review

4. Model and Data

4.1. Functional Specification and Data

4.2. Methodology

5. Empirical Results and Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Nomenclatures

| ADF | Augmented Dickey-Fuller |

| ARDL | Autoregressive Distributed Lags Bounds Testing |

| BRICS | Brazil, Russia, India, China, South Africa |

| CO2 | Carbon Dioxide |

| CPI | Consumer Price Index |

| DOLS | Dynamic Ordinary Least Squares Technique |

| EU | European Union |

| FMOLS | Fully Modified Ordinary Least Squares Technique |

| GCC | Gulf Cooperation Council |

| GDP | Gross Domestic Product per capita |

| GMM | Generalized Method of Moments |

| GLS | Generalized Least Squares |

| REC | Renewable Energy Consumption |

| OP | Oil Price |

| OPEC | The Organization of the Petroleum-Exporting Countries |

| OECD | The Organization for Economic Co-operation and Development |

| OLS | Ordinary Least Squares |

| STSM | The Structural Time Series Modeling |

| TVC | Time-Varying Coefficient Cointegration Approach |

| VECM | Vector Error Correction Method |

| VAR | Vector Autoregression |

References

- Jaramillo, P.; Muller, N.Z. Air pollution emissions and damages from energy production in the U.S.: 2002–2011. Energy Policy 2016, 90, 202–211. [Google Scholar] [CrossRef]

- Casey, J.A.; Karasek, D.; Ogburn, E.L.; Goin, D.E.; Dang, K.; Braveman, P.A.; Rachel, M.F. Retirements of coal and oil power plants in California: Association with reduced preterm birth among populations nearby. Am. J. Epidemiol. 2018, 187, 1586–1594. [Google Scholar] [CrossRef] [PubMed]

- Chikkatur, A.P.; Chaudhary, A.; Ambuj, D.S. Coal power impacts, technology, and policy: Connecting the dots. Annu. Rev. Environ. Resour. 2011, 36, 101–138. [Google Scholar] [CrossRef]

- Pope, C.A.; Dockery, D.W. Health effects of fine particulate air pollution: Lines that connect. J. Air Waste Manag. Assoc. 2006, 56, 709–742. [Google Scholar] [CrossRef] [PubMed]

- Abel, G.; Jennifer, R.M.; Matthew, H.G.; Xinran, W.; Matthew, T.B.; Seth, A.R.; Anthony, L. Blame Where Blame Is Due: Many Americans Support Suing Fossil Fuel Companies for Global Warming Damages. Environ. Sci. Policy Sustain. Dev. 2020, 62, 30–35. [Google Scholar] [CrossRef]

- Giovanni, N.; Natale, A.; Gerardo, N.; Roberto, B. A technical and environmental comparison between hydrogen and some fossil fuels. Energy Convers. Manag. 2015, 89, 205–213. [Google Scholar] [CrossRef]

- Dincer, I.; Marc, A.R. Sustainability aspects of hydrogen and fuel cell systems. Energy Sustain. Dev. 2011, 15, 137–146. [Google Scholar] [CrossRef]

- Zhao, H.R.; Guo, S.; Fu, L.W. Review on the costs and benefits of renewable energy power subsidy in China. Renew. Sustain. Energy Rev. 2014, 37, 538–549. [Google Scholar] [CrossRef]

- Barbir, F. Transition to renewable energy systems with hydrogen as an energy carrier. Energy 2009, 34, 308–312. [Google Scholar] [CrossRef]

- Bilgili, M.; Ozbek, A.; Sahin, B.; Kahraman, A. An overview of renewable electric power capacity and progress in new technologies in the World Renew. Sustain. Energy Rev. 2015, 49, 323–334. [Google Scholar] [CrossRef]

- Wüstenhagen, R.; Wolsink, M.; Bürer, M.J. Social acceptance of renewable energy innovation: An introduction to the concept. Energy Policy 2007, 35, 2683–2691. [Google Scholar] [CrossRef]

- Troster, V.; Shahbaz, M.; Gazi, U.S. Renewable energy, oil prices, and economic activity: A Granger-causality in quantiles analysis. Energy Econ. 2018, 70, 440–452. [Google Scholar] [CrossRef]

- Imad, J. The shift in US oil demand and its impact on OPEC’s market share. Energy Econ. 2001, 6, 659–666. [Google Scholar] [CrossRef]

- Kilian, L. Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef]

- Baffes, J.; Kose, M.A.; Ohnsorge, F.; Stocker, M. The Great Plunge in Oil Prices: Causes, Consequences, and Policy Responses. 2015. Available online: https://ssrn.com/abstract=2624398 (accessed on 18 June 2020). [CrossRef]

- Hamilton, J.D. Causes and Consequences of the Oil Shock of 2007-08. Natl. Bur. Econ. Res. 2009. [Google Scholar] [CrossRef]

- Weijermars, R.; Clint, O.; Pyle, I. Competing and partnering for resources and profits: Strategic shifts of oil Majors during the past quarter of a century. Energy Strategy Rev. 2014, 3, 72–87. [Google Scholar] [CrossRef]

- Ferrer, R.; Shahzad, S.J.H.; López, R.; Jareño, F. Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Econ. 2018, 76, 1–20. [Google Scholar] [CrossRef]

- Lee, D.; Baek, J. Stock prices of renewable energy firms: Are there asymmetric responses to oil price changes? Economies 2018, 6, 59. [Google Scholar] [CrossRef]

- Hsiao, C.Y.L.; Lin, W.; Wei, X.; Yan, G.; Li, S.; Sheng, N. The impact of international oil prices on the stock price fluctuations of China’s renewable energy enterprises. Energies 2019, 12, 4630. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. Oil prices and the stock prices of alternative energy companies. Energy Econ. 2008, 30, 998–1010. [Google Scholar] [CrossRef]

- Reboredo, J.C. Is there dependence and systemic risk between oil and renewable energy stock prices? Energy Econ. 2015, 48, 32–45. [Google Scholar] [CrossRef]

- Pata, U.K. The influence of coal and noncarbohydrate energy consumption on CO2 emissions: Revisiting the environmental Kuznets curve hypothesis for Turkey. Energy 2018, 160, 1115–1123. [Google Scholar] [CrossRef]

- Omri, A.; Daly, S.; Nguyen, D.K. A robust analysis of the relationship between enewable energy consumption and its main drivers. Appl. Econ. 2015, 47, 2913–2923. [Google Scholar] [CrossRef]

- Deniz, P. Oil Prices and Renewable Energy: An Analysis for Oil Dependent Countries. J. Res. Econ. 2019, 3, 139–152. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Mikayilov, I.J.; Humbatova, S.; Muradov, V. Do High Oil Prices Obstruct the Transition to Renewable Energy Consumption? Sustainability 2020, 12, 4689. [Google Scholar] [CrossRef]

- Sadorsky, P. Renewable energy consumption, CO2 emissions and oil prices in the G7 countries. Energy Econ. 2009, 31, 456–462. [Google Scholar] [CrossRef]

- Salim, R.A.; Rafiq, S. Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Econ. 2012, 34, 1051–1057. [Google Scholar] [CrossRef]

- Omri, A.; Nguyen, D.K. On the determinants of renewable energy consumption: International evidence. Energy 2014, 72, 554–560. [Google Scholar] [CrossRef]

- Murshed, M.; Tanha, M.M. Oil price shocks and renewable energy transition: Empirical evidence from net oil-importing South Asian economies. Energy Ecol. Environ. 2020, 1–21. [Google Scholar] [CrossRef]

- Marques, A.C.; Fuinhas, J.A. Drivers promoting renewable energy: A dynamic panel approach. Renew. Sustain. Energy Rev. 2011, 15, 1601–1608. [Google Scholar] [CrossRef]

- Nguyen, K.H.; Kakinaka, M. Renewable energy consumption, carbon emissions, and development stages: Some evidence from panel cointegration analysis. Renew. Energy 2019, 132, 1049–1052. [Google Scholar] [CrossRef]

- Energy Information Administration (EİA). Russia. 2021. Available online: https://www.eia.gov/international/rankings/country/RUS?pa=12&u=0&f=A&v=none&y=01%2F01%2F2018 (accessed on 22 March 2021).

- Enerdata. Russia Related Research. 2021. Available online: https://www.enerdata.net/estore/energy-market/russia/ (accessed on 12 March 2021).

- Our World in Data, Russia: How Is Energy Consumption Changing from Year-to-Year? 2021. Available online: https://ourworldindata.org/energy/country/russia (accessed on 20 March 2021).

- Fortov, V.E.; Popel, O.S. The current status of the development of renewable energy sources worldwide and in Russia. Therm. Eng. 2014, 61, 389–398. [Google Scholar] [CrossRef]

- Matraeva, L.; Solodukha, P.; Erokhin, S.; Babenko, M. Improvement of Russian energy efficiency strategy within the framework of “green economy” concept (based on the analysis of experience of foreign countries). Energy Policy 2019, 125, 478–486. [Google Scholar] [CrossRef]

- Gusev, A. Comparison of Energy Efficiency Measures in Russia to Those Implemented by Developed Countries (Including IEA Measures); German Institute for International and Security Affairs (SWP): Berlin, Germany, 2013. [Google Scholar]

- IRENA. Remap 2030 Renewable Energy Prospects for the Russian Federation, Working Paper, Abu Dhabi. 2017. Available online: www.irena.org/remap (accessed on 22 March 2021).

- Cherepovitsyn, A.; Tcvetkov, P. Overview of the prospects for developing a renewable energy in Russia. Int. Conf. Green Energy Appl. ICGEA 2017, 113–117. [Google Scholar] [CrossRef]

- Tatiana, A.L.; Laitner, J.A.; Potashnikov, Y.V.; Barinova, V.A. The slow expansion of renewable energy in Russia: Competitiveness and regulation issues. Energy Policy 2018, 120, 600–609. [Google Scholar] [CrossRef]

- Mitrova, T.; Melnikov, Y. Energy transition in Russia. Energy Transit. 2019, 3, 73–80. [Google Scholar] [CrossRef]

- CMS. The Renewable Energy Law Review (Russia). 2019. Available online: https://cms.law/en/rus/publication/the-renewable-energy-law-review (accessed on 7 May 2021).

- The International Renewable Energy Agency (IRENA). The Energy Technology Mix in Russia. 2021. Available online: https://www.irena.org/Statistics/View-Data-by-Topic/Innovation-and-Technology/Patents-Evolution (accessed on 7 May 2021).

- Apergis, N.; Payne, J.E. The causal dynamics between renewable energy, real GDP, emissions and oil prices: Evidence from OECD countries. Appl. Econ. 2014, 46, 4519–4525. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Renewable energy, output, CO2 emissions, and fossil fuel prices in Central America: Evidence from a nonlinear panel smooth transition vector error correction model. Energy Econ. 2014, 42, 226–232. [Google Scholar] [CrossRef]

- Azad, A.K.; Rasul, M.G.; Khan, M.M.K.; Omri, A.; Bhuiya, M.M.K.; Ali, M.H. Modelling of renewable energy economy in Australia. Energy Procedia 2014, 61, 1902–1906. [Google Scholar] [CrossRef][Green Version]

- Apergis, N.; Payne, J.E. Renewable energy, output, carbon dioxide emissions, and oil prices: Evidence from South America. Energy Sources B Econ. Plan. Policy 2015, 10, 281–287. [Google Scholar] [CrossRef]

- Bamati, N.; Roofi, A. Development level and the impact of technological factor on renewable energy production. Renew. Energy 2020, 151, 946–955. [Google Scholar] [CrossRef]

- Tuzcu, S.E.; Tuzcu, A. Renewable Energy and Proven Oil Reserves Relation: Evidence from OPEC Members. Çankırı Karatekin Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi 2014, 4, 121–136. [Google Scholar]

- Brini, R.; Amara, M.; Jemmali, H. Renewable energy consumption, International trade, oil price and economic growth inter-linkages: The case of Tunisia. Renew. Sustain. Energy Rev. 2017, 76, 620–627. [Google Scholar] [CrossRef]

- Alege, P.; Jolaade, A.; Adu, O. Is there Cointegration between Renewable Energy and Economic Growth in Selected Sub-saharan African Counries? Int. J. Energy Econ. Policy 2018, 8, 219–226. [Google Scholar]

- Payne, J.E. The causal dynamics between US renewable energy consumption, output, emissions, and oil prices. Energy Sources B Econ. Plan. Policy 2012, 7, 323–330. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D. How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 2019, 128, 114–124. [Google Scholar] [CrossRef]

- World Bank (WB). World Development Indicators. 2021. Available online: https://data.worldbank.org/indicator/ (accessed on 11 February 2021).

- Federal Reserve Bank of, St. Louis-FRED. Federal Reserve Economic Data. 2021. Available online: https://fred.stlouisfed.org (accessed on 11 February 2021).

- Dickey, D.; Fuller, W. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Phillips, P.B.; Perron, P. Testing for Unit Roots in Time Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.C.B.; Schmidt, P.; Shin, Y. Testing the null hypothesis of stationarity against the alternative of a unit root. J. Econom. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Park, J. Canonical cointegrating regressions. Econometrica 1992, 60, 119–143. [Google Scholar] [CrossRef]

- Mackinnon, J.G. Numerical Distribution Functions for Unit Root and Cointegration Test. J. Appl. Econ. 1996, 11, 601–618. [Google Scholar] [CrossRef]

| Study | Period | Country(s) | Method(s) | Result (Impact of Oil Price on REC) |

|---|---|---|---|---|

| Sadorsky [27] | 1980–2005 | G7 countries | Panel FMOLS and DOLS | Negative |

| Marques and Fuinhas [31] | 1990–2006 | 24 European Union countries | GMM | Insignificant impact |

| Salim and Rafiq [28] | 1980–2006 | 6 emerging economies | Panel FMOLS, Panel DOLS, and Panel ARDL |

|

| Payne [53] | 1949–2009 | USA | Toda-Yamamoto causality test | No causality between REC and real oil prices |

| Apergis and Payne [45] | 1980–2011 | 25 OECD countries | Panel cointegration Model | Positive |

| Apergis and Payne [46] | 1980–2010 | 7 Central American countries | Panel VECM | Positive |

| Tuzcu and Tuzcu [50] | 1985–2007 | 7 OPEC members | Panel data techniques | There is no statistically significant impact of oil price on REC |

| Azad et al. [47] | 1990–2011 | Australia | GMM | Positive |

| Omri and Nguyen [29] | 1990–2011 | 64 countries | Dynamic system-GMM panel model | Negative |

| Omri and Nguyen [24] | 1990–2011 | 64 countries | Pooled OLS, Panel Fixed and Random Effects | Positive |

| Apergis and Payne [48] | 1980–2010 | 11 South American | Panel FMOLS | Positive |

| Brini et al. [51] | 1980–2011 | Tunisia | Granger causality test and ARDL |

|

| Alege [52] | 2001–2014 | 40 countries in Sub-Saharan African countries | Panel cointegration and the pair-wise Granger causality |

|

| Troster et al. [12] | 1989–2016 | USA | Granger-causality test | No causality between oil prices and REC |

| Deniz [25] | 1995–2014 | GMM and Panel VAR | Oil importing and exporting countries |

|

| Nguyen and Kakinaka [32] | 1990–2013 | 107 countries | Panel data method |

|

| Ji and Zhang [54] | 1992–2013 | China | VAR | Oil prices explained about 20% of the total variations in REC |

| Bamati and Roofi [49] | 1990–2015 | Panel of 25 countries | Panel GLS | Positive |

| Mukhtarov et al. [26] | 1992–2015 | Azerbaijan | STSM | Negative |

| Murshed and Tanha [30] | 1990–2018 | Bangladesh, India, Pakistan, and Sri Lanka | Panel DOLS and FMOLS | Negative |

| Variable | The ADF Test | The PP Test | The KPSS Test | |||||

|---|---|---|---|---|---|---|---|---|

| Level | k | First Difference k | Level | First Difference | Level | First Difference | ||

| REC | −2.4206 | 0 | −7.7681 *** | 0 | −2.4206 | −12.710 *** | 0.7530 | 0.0649 *** |

| OP | −1.2838 | 0 | −3.6249 ** | 0 | −1.2358 | −3.6253 ** | 0.7814 | 0.1435 *** |

| GDP | −0.9593 | 2 | −3.5340 ** | 1 | 0.6576 | −3.5223 ** | 0.8829 | 0.3339 *** |

| CO2 | 1.4275 | 0 | −3.9772 *** | 0 | −1.4375 | −4.0353 *** | 0.7490 | 0.3994 ** |

| Information Criteria | ||||||

|---|---|---|---|---|---|---|

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | 73.27637 | NA | 4.03 × 10−8 | −5.676206 | −5.281251 | −5.576876 |

| 1 | 144.5878 | 105.4169 | 3.45 × 10−10 | −10.48590 | −9.301035 | −10.18791 |

| 2 | 174.1625 | 33.43225 * | 1.29 × 10−10 * | −11.66631 * | −9.691533 * | −11.16966 * |

| 3 | 188.9660 | 11.58532 | 2.45 × 10−10 | −11.56226 | −8.797577 | −10.86695 |

| Panel A: LM Test | Panel E: Johansen Cointegration Rank Test (Trace) | |||||||

|---|---|---|---|---|---|---|---|---|

| Lags | LM-Statistic | p-Value | Null Hypothesis | Eigenvalue | Trace Statistics | 0.05 Critical Value | p-Value | |

| 1 | 15.5047 | 0.488 | None | 0.77816 | 71.0141 | 63.8761 | 0.011 | |

| 2 | 19.7932 | 0.229 | At most 1 | 0.59520 | 36.3802 | 42.9152 | 0.192 | |

| 3 | 13.1405 | 0.662 | At most 2 | 0.40299 | 15.5798 | 25.8721 | 0.526 | |

| 4 | 23.1438 | 0.109 | At most 3 | 0.14918 | 3.71583 | 12.5179 | 0.782 | |

| Panel B: Normality Test b | Panel F: Johansen Cointegration Rank Test (Maximum Eigenvalue) | |||||||

| Statistic | d.f. | p-value | Null hypothesis | Eigenvalue | Max-Eigen Statistic | 0.05 Critical value | p-value | |

| Jarque-Bera | 5.975 | 8 | 0.650 | None | 0.77816 | 34.6338 | 32.1183 | 0.024 |

| At most 1 | 0.59520 | 20.8004 | 25.8232 | 0.200 | ||||

| At most 2 | 0.40299 | 11.8640 | 19.3870 | 0.427 | ||||

| Panel C: Heteroscedasticity Test c | At most 3 | 0.14918 | 3.71583 | 12.5179 | 0.782 | |||

| White | d.f. | p-value | ||||||

| Statistic | 172.84 | 170 | 0.424 | |||||

| Panel D: Stability Test d | ||||||||

| Modulus | Root | |||||||

| 0.80274 | 0.46076 − 0.65733i | |||||||

| 0.80274 | 0.46076 + 0.65733i | |||||||

| 0.49499 | −0.06458 − 0.49076i | |||||||

| 0.49499 | −0.06458 + 0.49076i | |||||||

| Methods | OP | GDP | CO2 |

|---|---|---|---|

| Coef. (t-Stat.) | Coef. (t-Stat.) | Coef. (t-Stat.) | |

| VECM | −0.43 (−2.87) ** | 0.99 (2.77) ** | −0.66 (−1.54) |

| CCR | −0.14 (−5.83) *** | 0.20 (3.59) *** | −0.01 (−0.44) |

| Residuals diagnostics tests results of VECM | |||

| 5.73 (0.991) | |||

| 104.7 (0.14) | |||

| 192.7 (0.431) | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Karacan, R.; Mukhtarov, S.; Barış, İ.; İşleyen, A.; Yardımcı, M.E. The Impact of Oil Price on Transition toward Renewable Energy Consumption? Evidence from Russia. Energies 2021, 14, 2947. https://doi.org/10.3390/en14102947

Karacan R, Mukhtarov S, Barış İ, İşleyen A, Yardımcı ME. The Impact of Oil Price on Transition toward Renewable Energy Consumption? Evidence from Russia. Energies. 2021; 14(10):2947. https://doi.org/10.3390/en14102947

Chicago/Turabian StyleKaracan, Rıdvan, Shahriyar Mukhtarov, İsmail Barış, Aykut İşleyen, and Mehmet Emin Yardımcı. 2021. "The Impact of Oil Price on Transition toward Renewable Energy Consumption? Evidence from Russia" Energies 14, no. 10: 2947. https://doi.org/10.3390/en14102947

APA StyleKaracan, R., Mukhtarov, S., Barış, İ., İşleyen, A., & Yardımcı, M. E. (2021). The Impact of Oil Price on Transition toward Renewable Energy Consumption? Evidence from Russia. Energies, 14(10), 2947. https://doi.org/10.3390/en14102947