Increasing Electric Vehicle Uptake by Updating Public Policies to Shift Attitudes and Perceptions: Case Study of New Zealand

Abstract

1. Introduction

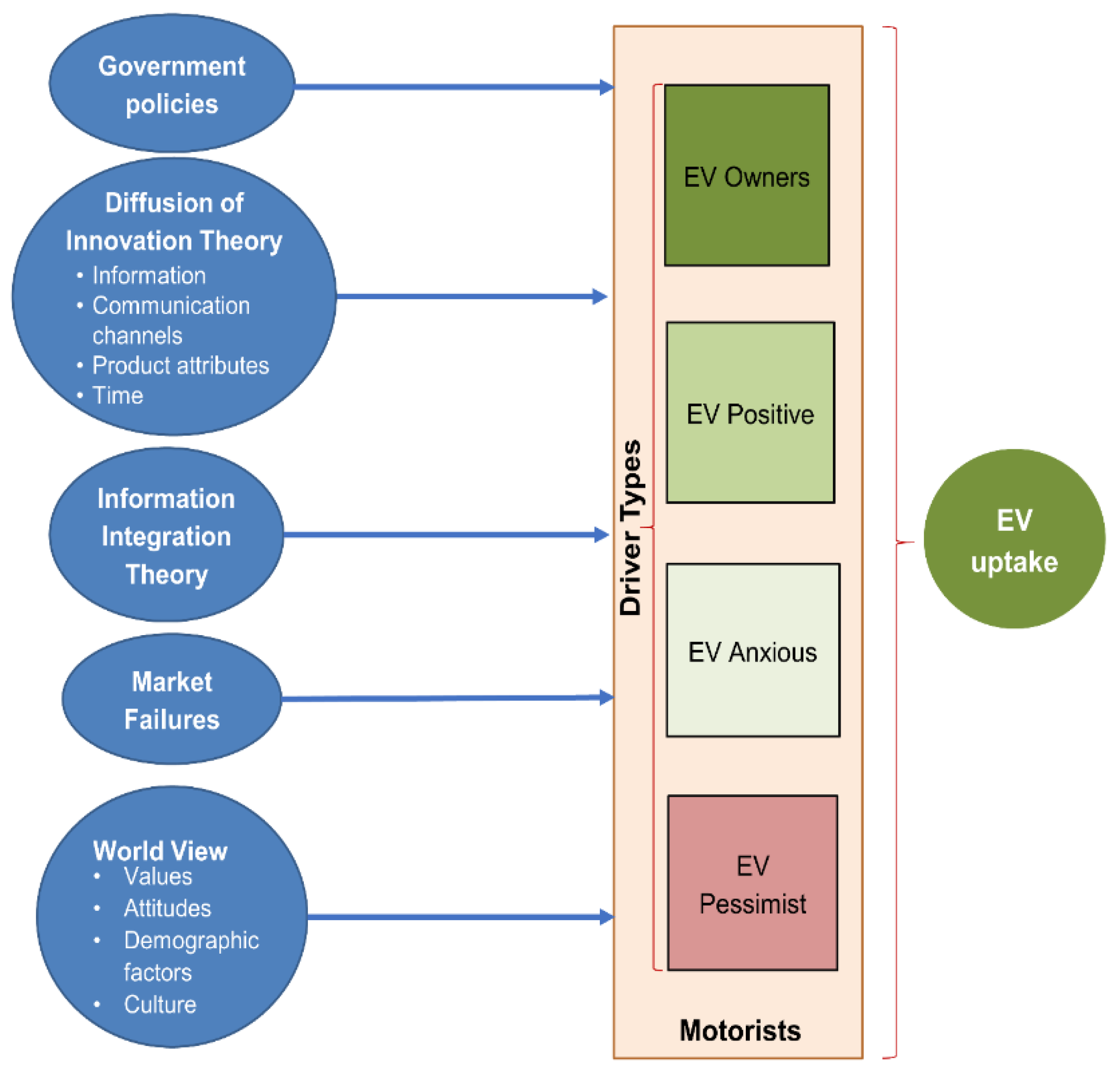

2. Background: Factors Affecting Electric Vehicle (EV) Uptake

3. Conceptual Framework and Methods

3.1. Conceptual Framework

3.2. Methohods

3.2.1. Methodological Approach

3.2.2. Sampling Frame and Survey Data Collection

3.2.3. Statistical Data Analysis

3.2.3.1. Market Segmentation by Attitude to EVs

3.2.3.2. Segmentation by Likelihood to Purchase a BEV

4. Results

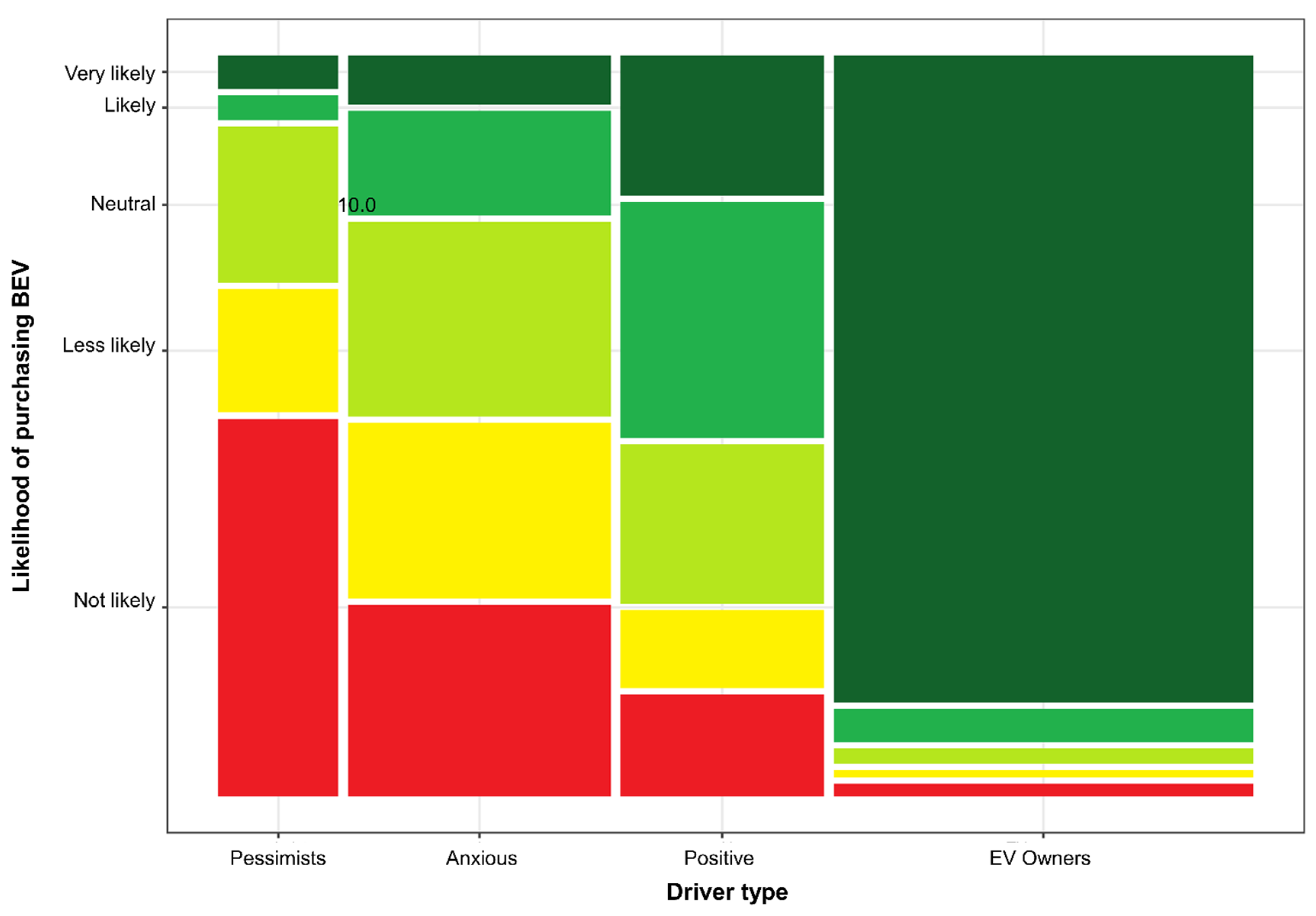

4.1. Results of the Driver Type Analysis

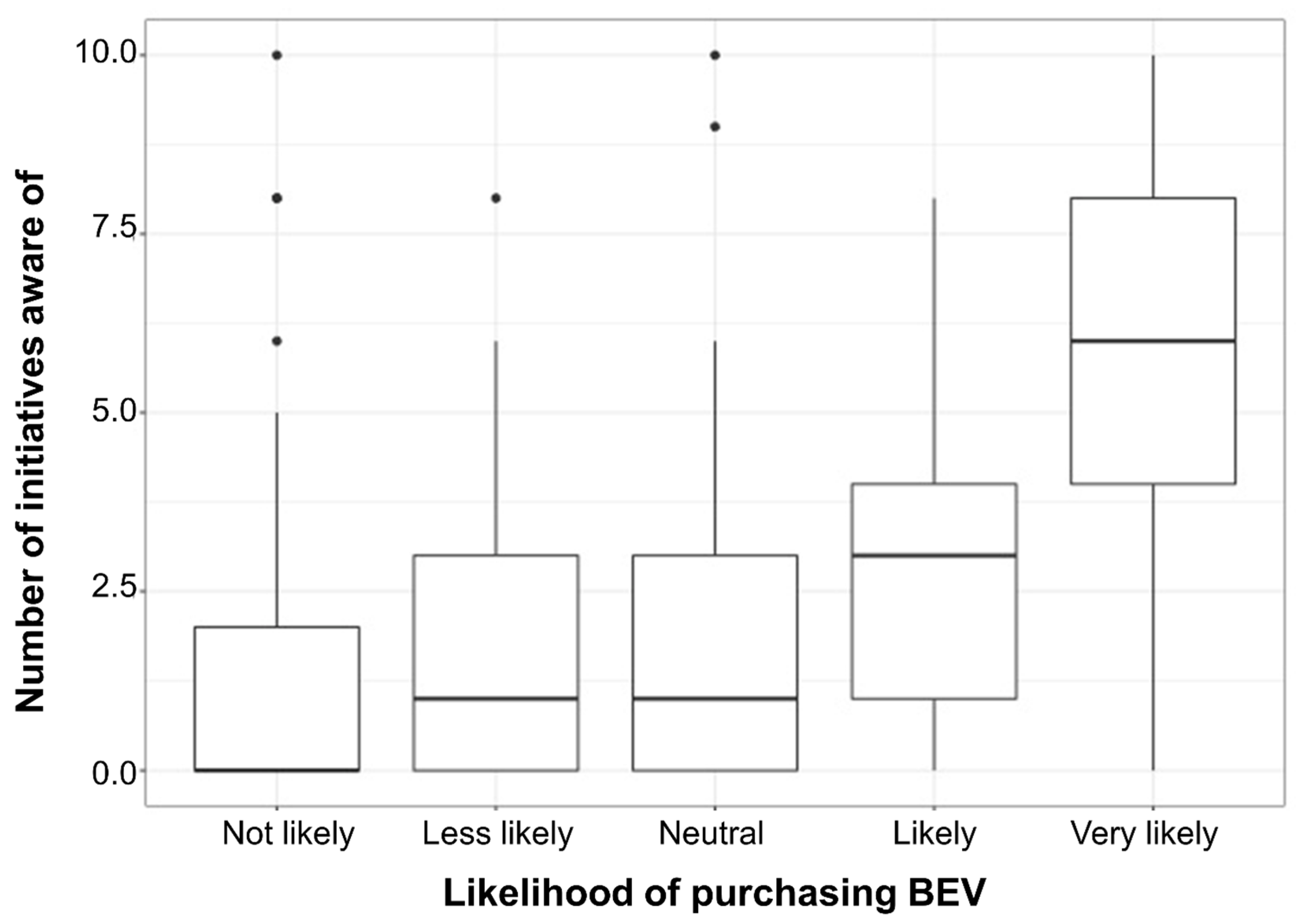

4.2. Results of Likelihood to Buy Ratio Tests

5. Discussion of the Results

5.1. Profiling Driver Types

5.1.1. EV Owners

5.1.2. EV Positives

“I would definitely buy an EV. The car we’ve got now, we got it in 2017, we could have gone electric car potentially, just above the price range, but we weren’t quite there yet, but if we were doing it again now then we would definitely be able to” and “I would like to say for the environment, but probably the costs, it’s much cheaper to run.”

5.1.3. EV Anxious

5.1.4. EV Pessimists

5.2. Valuing the Environment

5.3. Identifying Concerns and Potential Barriers to EV Adoption

5.4. Information Acquisition When Buying Cars

5.5. Awareness of Initiatives

5.6. Incentivizing EV Uptake

5.7. Perceptions about EVs

6. Conclusions and Policy Implications

- Implement previously proposed policies of the ‘Clean Car Discount’ to reduce EVs’ purchase price, which was the most preferred by EV Positives; additionally, although this policy was not especially popular with motorists, the ‘Clean Car Standard’ could increase EV importation by manufacturers (enhancing EV choices for motorists), with no cost burden on the government, and hence taxpayers. However, this measure could provide a source of government income through penalties imposed on manufacturers if they fail to meet the standard. Importantly for New Zealanders, the measure will have the additional benefit of reducing emissions and ensuring polluters pay more;

- Increase funding for additional fast-charger deployment nation-wide, by all levels of government;

- Reframe EVs’ image to portray EVs as representing the good life by providing value for money and lifestyle gains for motorists; for example, that there is more money available for other things and that EVs are fun to drive. Such sentiments could be disseminated through increased advertising and more information campaigns, by governments and other stakeholders, for example, motoring organizations and manufacturers, including the availability of cheaper second-hand EVs and existence of smartphone apps that help locate rechargers;

- Increase procurement of EVs, for example, by government departments, to increase sales certainty for car dealers and increase communication via employees to increase EV awareness amongst motorists.

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| BEV | Battery Electric Vehicle |

| EV | Electric vehicle |

| GHG | Greenhouse gas |

| ICEV | Internal combustion engine vehicle |

| NZ | New Zealand |

| PHEV | Plug-in hybrid electric vehicle |

References

- Nanaki, E.A.; Koroneos, C.J. Climate change mitigation and deployment of electric vehicles in urban areas. Renew. Energy 2016, 99, 1153–1160. [Google Scholar] [CrossRef]

- Broadbent, G.H. Comment on “Consumer purchase intentions for electric vehicles: Is green more important than price and range?” K. Degirmenci, MH Breitner Transportation Research Part D 51 (2017) 250. Transp. Res. Part D Transp. Environ. 2018, 65, 849–852. [Google Scholar] [CrossRef]

- Miotti, M.; Supran, G.J.; Kim, E.J.; Trancik, J.E. Personal Vehicles Evaluated against Climate Change Mitigation Targets. Environ. Sci. Technol. 2016, 50, 10795–10804. [Google Scholar] [CrossRef] [PubMed]

- Madziel, M.; Campisi, T.; Jaworski, A.; Tesoriere, G. The development of strategies to reduce exhaust emissions from passenger pars in Rzeszow City—Poland. A preliminary assessment of the results produced by the increase of E-fleet. Energies 2021, 14, 1046. [Google Scholar] [CrossRef]

- Campisi, T.; Ignaccolo, M.; Tesoriere, G.; Inturri, G.; Torrisi, V. The Evaluation of Car-Sharing to Raise Acceptance of Electric Vehicles: Evidences from an Italian Survey among University Students. In Proceedings of the Conference on Sustainable Mobility, Skiathos Island, Greece, 27–29 May 2020; SAE Technical Papers: Warrendale, PA, USA, 2020. [Google Scholar] [CrossRef]

- European Commission. European Alternative Fuels Observatory. Available online: https://www.eafo.eu/ (accessed on 10 November 2020).

- IEA. Global EV Outlook 2020; OECD Publishing: Paris, France, 2020. [Google Scholar] [CrossRef]

- Brand, C.; Cluzel, C.; Anable, J. Modeling the uptake of plug-in vehicles in a heterogeneous car market using a consumer segmentation approach. Transp. Res. Part A Policy Pract. 2017, 97, 121–136. [Google Scholar] [CrossRef]

- Haustein, S.; Jensen, A.F. Factors of electric vehicle adoption: A comparison of conventional and electric car users based on an extended theory of planned behavior. Int. J. Sustain. Transp. 2018, 12, 484–496. [Google Scholar] [CrossRef]

- Stern, P.C. Toward a coherent theory of environmentally significant behavior. J. Soc. Issues 2000, 56, 407–424. [Google Scholar] [CrossRef]

- Kotler, P.; Lee, N. Marketing in the Public Sector: A Roadmap for Improved Performance; Wharton School Publishing: Upper Saddle River, NJ, USA, 2007; ISBN 0-13-187515-9. [Google Scholar]

- Green, E.H.; Skerlos, S.J.; Winebrake, J.J. Increasing electric vehicle policy efficiency and effectiveness by reducing mainstream market bias. Energy Policy 2014, 65, 562–566. [Google Scholar] [CrossRef]

- Liao, F.; Molin, E.; van Wee, B. Consumer preferences for electric vehicles: A literature review. Transp. Rev. 2017, 37, 252–275. [Google Scholar] [CrossRef]

- Struben, J. The Diffusion of Complex Market Technologies: Multifaceted Dynamics for Alternative Fuel Vehicles. In Proceedings of the 2008 Industry Studies Conference Paper, Boston, MA, USA, 1–2 May 2008; Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1135732 (accessed on 17 May 2021).

- Cui, H.; Hall, D.; Lutsey, N. Update on the Global Transition to Electric Vehicles through 2019. 2020. Available online: https://theicct.org/publications/update-global-ev-transition-2019 (accessed on 17 May 2021).

- Ministry of Transport (New Zealand). Vehicle Fleet Statistics. Available online: https://www.transport.govt.nz/mot-resources/vehicle-fleet-statistics/ (accessed on 10 November 2020).

- NZ Government. Energy in New Zealand 2019; NZ Government: Wellington, New Zealand, 2019. [Google Scholar]

- Barton, B. Electric vehicles policy announcement. N. Z. Law J. 2016, 1, 268–270. Available online: https://hdl.handle.net/10289/11146 (accessed on 17 May 2021).

- Ministry of Transport (New Zealand). Electric Vehicles: Package of Measures To Encourage Uptake. 2016. Available online: https://www.transport.govt.nz/assets/Uploads/Cabinet/Electric-Vehicles-Package-of-Measures-to-Encourage-Uptake.pdf (accessed on 17 May 2021).

- Bjerkan, K.Y.; Nørbech, T.E.; Nordtømme, M.E. Incentives for promoting Battery Electric Vehicle (BEV) adoption in Norway. Transp. Res. Part D Transp. Environ. 2016, 43, 169–180. [Google Scholar] [CrossRef]

- Mersky, A.C.; Sprei, F.; Samaras, C.; Qian, Z. Effectiveness of incentives on electric vehicle adoption in Norway. Transp. Res. Part D Transp. Environ. 2016, 46, 56–68. [Google Scholar] [CrossRef]

- Harding, R.; Hendriks, C.M.; Faruqi, M. Environmental Decision-Making: Exploring Complexity and Context; Federation Press: Sydney, Australia, 2009; ISBN 978-186287-748-1. [Google Scholar]

- Bagozzi, R.P.; Gopinath, M.; Nyer, P.U. The role of emotions in marketing. J. Acad. Mark. Sci. 1999, 27, 184–206. [Google Scholar] [CrossRef]

- Urry, J. The ‘System’ of Automobility. Theory Cult. Soc. 2004, 21, 25–39. [Google Scholar] [CrossRef]

- Kotler, P.; Zaltman, G. Social Marketing: An approach to planned social change. J. Mark. 1971, 35, 3–12. [Google Scholar] [CrossRef] [PubMed]

- Andreasen, A.R. The life trajectory of social marketing. Mark. Theory 2003, 3, 293–303. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 5th ed.; Simon and Schuster: New York, NY, USA, 2003; ISBN 9780743222099. [Google Scholar]

- Carley, S.; Siddiki, S.; Nicholson-Crotty, S. Evolution of plug-in electric vehicle demand: Assessing consumer perceptions and intent to purchase over time. Transp. Res. Part D Transp. Environ. 2019, 70, 94–111. [Google Scholar] [CrossRef]

- Rezvani, Z.; Jansson, J.; Bodin, J. Advances in consumer electric vehicle adoption research: A review and research agenda. Transp. Res. Part D Transp. Environ. 2015, 34, 122–136. [Google Scholar] [CrossRef]

- White, L.V.; Sintov, N.D. You are what you drive: Environmentalist and social innovator symbolism drives electric vehicle adoption intentions. Transp. Res. Part A Policy Pract. 2017, 99, 94–113. [Google Scholar] [CrossRef]

- Michie, S.; van Stralen, M.M.; West, R. The behaviour change wheel: A new method for characterising and designing behaviour change interventions. Implement. Sci. 2011, 6, 42. [Google Scholar] [CrossRef]

- White, K.; Habib, R.; Hardisty, D.J. How to SHIFT consumer behaviors to be more sustainable: A literature review and guiding framework. J. Mark. 2019, 83, 22–49. [Google Scholar] [CrossRef]

- Gong, S.; Ardeshiri, A.; Hossein Rashidi, T. Impact of government incentives on the market penetration of electric vehicles in Australia. Transp. Res. Part D Transp. Environ. 2020, 83, 102353. [Google Scholar] [CrossRef]

- Jones, A.; Begley, J.; Berkeley, N.; Jarvis, D.; Bos, E. Electric vehicles and rural business: Findings from the Warwickshire rural electric vehicle trial. J. Rural Stud. 2020, 79, 395–408. [Google Scholar] [CrossRef]

- Melton, N.; Axsen, J.; Moawad, B. Which plug-in electric vehicle policies are best? A multi-criteria evaluation framework applied to Canada. Energy Res. Soc. Sci. 2020, 64, 101411. [Google Scholar] [CrossRef]

- Best, A.; Holmes, B. Systems thinking, knowledge and action: Towards better models and methods. Evid. Policy A J. Res. Debate Pract. 2010, 6, 145–159. [Google Scholar] [CrossRef]

- Satish, S.M.; Bharadhwaj, S. Information search behaviour among new car buyers: A two-step cluster analysis. IIMB Manag. Rev. 2010, 22, 5–15. [Google Scholar] [CrossRef]

- Bator, F.M. The Anatomy of Market Failures. Q. J. Econ. 1958, 72, 351–379. [Google Scholar] [CrossRef]

- Anderson, N.H. Integration theory and attitude change. Psychol. Rev. 1971, 78, 171–206. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research and Applications, 6th ed.; Sage Publications, Inc.: Los Angeles, CA, USA, 2018; ISBN 9781506336169. [Google Scholar]

- Cresswell, J.W.; Poth, C.N. Qualitative Inquiry and Research Design, 4th ed.; Sage Publications, Inc.: Thousand Oaks, CA, USA, 2018; ISBN 978-1-5063-6117-8. [Google Scholar]

- Bryman, A. Social Research Methods, 4th ed.; Oxford University Press: Oxford, UK, 2012; ISBN 978 0 19 958805 3. [Google Scholar]

- Twyman, J. Getting It Right: YouGov and Online Survey Research in Britain. J. Elect. Public Opin. Parties 2008, 18, 343–354. [Google Scholar] [CrossRef]

- Pearson, K.X. On the criterion that a given system of deviations from the probable in the case of a correlated system of variables is such that it can be reasonably supposed to have arisen from random sampling. Lond. Edinb. Dublin Philos. Mag. J. Sci. 1900, 50, 157–175. [Google Scholar] [CrossRef]

- Hay, I. Qualitative Research Methods in Human Geography, 2nd ed.; Oxford University Press: Melbourne, Australia, 2005; ISBN 0-19-55079-X. [Google Scholar]

- Holm, S. A Simple Sequentially Rejective Multiple Test Procedure. Scand. J. Stat. 1979, 6, 65–70. [Google Scholar]

- Christensen, R.H.B. Analysis of Ordinal Data with Cumulative Link Models—Estimation with the R Package Ordinal, R-Package Version. 2015. Available online: https://cran.r-project.org/web/packages/ordinal/vignettes/clm_article.pdf (accessed on 17 May 2021).

- Figenbaum, E.; Kolbenstvedt, M.; Elvebakk, B. Electric Vehicles—Environmental, Economic and Practical Aspects—As Seen by Current and Potential Users; Institute of Transport Economics (TØI): Oslo, Norway, 2014. [Google Scholar]

- Figenbaum, E.; Kolbenstvedt, M. Learning from Norwegian Battery Electric and Plug-in Hybrid Vehicle Users; Institute of Transport Economics (TØI): Oslo, Norway, 2016. [Google Scholar]

- Bunce, L.; Harris, M.; Burgess, M. Charge up then charge out? Drivers’ perceptions and experiences of electric vehicles in the UK. Transp. Res. Part A Policy Pract. 2014, 59, 278–287. [Google Scholar] [CrossRef]

- Haugneland, P.; Bu, C.; Hauge, E. The Norwegian EV success continues. In Proceedings of the EVS29 International Battery, Hybrid and Fuel Cell Electric Vehicle Symposium, Montreal, QC, Canada, 19–22 June 2016; pp. 1–9. [Google Scholar]

- Broadbent, G.H.; Metternicht, G.; Drozdzewski, D. An Analysis of Consumer Incentives in Support of Electric Vehicle Uptake: An Australian Case Study. World Electr. Veh. J. 2019, 10, 11. [Google Scholar] [CrossRef]

- Ma, S.C.; Fan, Y. A deployment model of EV charging piles and its impact on EV promotion. Energy Policy 2020, 146, 111777. [Google Scholar] [CrossRef]

- Lieven, T. Policy measures to promote electric mobility—A global perspective. Transp. Res. Part A Policy Pract. 2015, 82, 78–93. [Google Scholar] [CrossRef]

- Barton, B.; Schutte, P. Electric Vehicle Policy: New Zealand in a Comparative Context; University of Waikato: Hamilton, New Zealand, 2015. [Google Scholar]

- European Commission. CO2 Emission Performance Standards for Cars and Vans. Available online: https://ec.europa.eu/clima/policies/transport/vehicles/regulation_en (accessed on 10 May 2021).

- Ford, R.; Stephenson, J.; Scott, M.; Williams, J.; Rees, D.; Wooliscroft, B. Keen on EVs: Kiwi Perspectives on Electric Vehicles, and Opportunities to Stimulate Uptake; Centre for Sustainability, University of Otago: Dunedin, New Zealand, 2015; ISBN 978-0-9941219-6-7. [Google Scholar]

- Friis, F. An alternative explanation of the persistent low EV-uptake: The need for interventions in current norms of mobility demand. J. Transp. Geogr. 2020, 83, 102635. [Google Scholar] [CrossRef]

- Moore, G.A. Crossing the Chasm: Marketing and Selling Disruptive Products to Mainstream Customers, 3rd ed.; Harper Business: New York, NY, USA, 2014; ISBN 978-0-06-229298-8. [Google Scholar]

- Figenbaum, E.; Assum, T.; Kolbenstvedt, M. Electromobility in Norway: Experiences and opportunities. Res. Transp. Econ. 2015, 50, 29–38. [Google Scholar] [CrossRef]

- Happer, C.; Philo, G. The role of the media in the construction of public belief and social change. J. Soc. Polit. Psychol. 2013, 1, 321–336. [Google Scholar] [CrossRef]

- Noel, L.; Zarazua de Rubens, G.; Sovacool, B.K.; Kester, J. Fear and loathing of electric vehicles: The reactionary rhetoric of range anxiety. Energy Res. Soc. Sci. 2019, 48, 96–107. [Google Scholar] [CrossRef]

| # | Key Policies | Programs and Initiatives |

|---|---|---|

| 1 | Information/promotion campaign focused on businesses and households | Portal page |

| EV specific information | ||

| Available models | ||

| Information links: assistance for potential EV buyers and sellers | ||

| EV dealer list and guide | ||

| Buyer guide | ||

| Guide to recharging | ||

| Adoption of standardized signage | ||

| The Energy Efficiency & Conservation Authority has adopted geo-targeted ads to be displayed within 100 m of EV dealerships | ||

| Ride and drive events | ||

| Total cost of ownership calculator | ||

| Battery recycling facility | ||

| 2 | Encourage business and public procurement | Use bulk purchasing to reduce prices and increase model availability |

| Wellington City Council procurement program | ||

| 3 | Contestable fund | Multiple rounds of project funding |

| 4 | EV target | 2% of car fleet by end 2021 |

| 5 | Improve regulatory framework | Support private and public infrastructure rollout |

| Charging standards set | ||

| Rollout of high-speed rechargers | ||

| Development of EV Roam—a cloud based mobile app | ||

| All rechargers are interoperable | ||

| Wellington City Council trial of smart recharging poles | ||

| 6 | Extend EV road user charge exemption | To end 2021 |

| 7 | Revise tax rules to ensure equity for EVs | Review of depreciation rate and review of fringe benefit tax |

| 8 | Change regulations | Road Controlling Authorities to allow access to bus and HOV lanes |

| 9 | Form leadership group | Industry local government and agency representation |

| Question Code | Issue | n | Method | Test Statistic | df | p-Value |

|---|---|---|---|---|---|---|

| Gender | Gender | 748 | Chisq | 54.7 | 3 | <0.0001 |

| Age group 1 | Age | 749 | Chisq | 66.5 | 18 | <0.0001 |

| D6 | Education level/highest achieved | 741 | Chisq | 29.7 | 6 | 0.0003 |

| D10 | Cars in household (1 or multiple) | 749 | Chisq | 39.6 | 3 | <0.0001 |

| A3 | Purchase new or used cars | 623 | Chisq | 3.2 | 3 | 0.3576 |

| A5 | Frequency of trips > 150 km | 749 | Chisq | 32.5 | 12 | 0.0059 |

| A6 | Amount willing to spend on a car | 728 | Chisq | 50.7 | 3 | <0.0001 |

| A8 | Amount of research when buying a car | 749 | Chisq | 98.6 | 3 | <0.0001 |

| A13 | Primary information source | 695 | Chisq | 189.4 | 18 | <0.0001 |

| A14_Magazines | Car research in car magazines | 749 | Chisq | 5.0 | 3 | 0.3433 |

| A14_Newspaper | Car research in newspapers | 749 | Chisq | 10.2 | 3 | 0.0676 |

| A14_Online | Car research online or social media | 749 | Chisq | 142.8 | 3 | <0.0001 |

| A14_14 | Rarely reads about cars | 749 | Chisq | 42.6 | 3 | <0.0001 |

| A20b | Hope for NZ in the future | 704 | Chisq | 123.1 | 12 | <0.0001 |

| A22_11 | Have not heard of EV initiatives | 749 | Chisq | 143.9 | 3 | <0.0001 |

| A23_12 a | I would never buy an EV | 749 | Chisq | 84.9 | 2 | <0.0001 |

| Word use | Negative word association with EVs | 749 | Chisq | 294.0 | 3 | <0.0001 |

| Word use | Expensive | 749 | Chisq | 76.7 | 3 | <0.0001 |

| Word use | Economical | 749 | Chisq | 79.2 | 3 | <0.0001 |

| Word use | Low-range | 749 | Chisq | 54.1 | 3 | <0.0001 |

| Word use | Ecofriendly | 749 | Chisq | 22.9 | 3 | <0.0001 |

| Word use | Fun | 749 | Chisq | 11.7 | 3 | <0.0001 |

| A15_1 | Likelihood of purchasing BEV | 731 | ANOVA | 22.9 | 3 | <0.0001 |

| A15_2 | Likelihood of purchasing PHEV | 730 | ANOVA | 33.3 | 3 | <0.0001 |

| A17_1 | Importance of vehicle range | 743 | ANOVA | 66.7 | 3 | <0.0001 |

| A17_2 | Importance of purchase price | 749 | ANOVA | 267.2 | 3 | <0.0001 |

| A17_3 | Importance of total ownership costs | 740 | ANOVA | 266.4 | 3 | <0.0001 |

| A17_4 | Importance of suitable EV model | 746 | ANOVA | 156.3 | 3 | <0.0001 |

| A17_5 | Importance of cheaper servicing costs | 709 | ANOVA | 34.9 | 3 | <0.0001 |

| A17_6 | Importance of fast charger network | 737 | ANOVA | 41.3 | 3 | <0.0001 |

| A17_7 | Importance of battery life | 740 | ANOVA | 48.2 | 3 | <0.0001 |

| A22_count | Count # initiatives heard of | 749 | ANOVA | 160.5 | 3 | <0.0001 |

| Response Option | Attitude to EVs | Frequency | Percent | Analysis Group |

|---|---|---|---|---|

| 1 | It’s about time, why wouldn’t you | 43 | 7.3 | EV Positives |

| 2 | Yes please, it would save how much fuel? | 111 | 18.9 | |

| 3 | Yes please, but make it a plug-in hybrid for now, thanks | 117 | 19.9 | EV Anxious |

| 4 | Great idea, but where would I charge it? | 84 | 14.3 | |

| 5 | If everyone else is maybe… | 25 | 4.3 | |

| 6 | Will they save the planet? Don’t think so | 76 | 12.9 | EV Pessimists |

| 7 | I would never be seen in one of those | 13 | 2.2 | |

| 8 | I do a lot of driving, convince me | 57 | 9.7 | |

| 9 | Don’t know | 62 | 10.5 |

| Initiative | EV Owners | EV Positives | EV Anxious | EV Pessimists | ||||

|---|---|---|---|---|---|---|---|---|

| Aware | Prefer | Aware | Prefer | Aware | Prefer | Aware | Prefer | |

| EV ride and drive events | 84.3 | 18.4 | 9.1 | 11.0 | 9.5 | 11.9 | 6.7 | 12.4 |

| Importation of secondhand EVs | 85.6 | 40.7 | 18.8 | 36.4 | 18.4 | 36.8 | 12.4 | 24.7 |

| First registration tax exempt until 2021 | 45.2 | 14.4 | 18.8 | 29.2 | 11.9 | 24.7 | 16.9 | 15.7 |

| EV use of bus lanes | 61.0 | 10.2 | 13.6 | 25.3 | 11.4 | 21.4 | 12.4 | 20.2 |

| Information website | 43.0 | 4.9 | 14.3 | 17.5 | 11.4 | 17.4 | 6.7 | 15.7 |

| Nation-wide fast charge network | 87.5 | 53.4 | 35.7 | 48.1 | 38.3 | 56.2 | 36.0 | 22.5 |

| Smartphone app for charger locations | 27.9 | 3.6 | 20.8 | 33.1 | 17.9 | 36.8 | 12.4 | 18.0 |

| EV Grants—Contestable fund | 59.7 | 13.4 | 7.8 | 11.5 | 6.5 | 7.5 | 6.7 | 4.5 |

| Potential Clean Car Discount | 73.8 | 29.2 | 30.5 | 51.3 | 30.3 | 42.8 | 23.6 | 31.5 |

| Potential Clean Car Standard | 49.5 | 12.5 | 24.7 | 20.8 | 21.4 | 14.9 | 13.5 | 6.7 |

| I am not aware of any initiatives | 0.7 | 35.1 | 38.3 | 41.6 | ||||

| Don’t know | 5.9 | 3.2 | 8.5 | 12.4 | ||||

| I would never buy an EV | 1.9 | 1.5 | 30.3 | |||||

| I would have bought an EV regardless | 52.1 | |||||||

| Question Code | n | Test Statistic | df | p-Value |

|---|---|---|---|---|

| A16_Driver Type, attitude to EVs | 731 | 409.2 | 4 | <0.0001 |

| A8_Motorist does a lot of research/or not | 861 | 78.6 | 1 | <0.0001 |

| A13_Information source | 799 | 132.3 | 7 | <0.0001 |

| A14_Car Magazine | 861 | 0.2 | 1 | 1 |

| A14_Newspaper | 861 | 0.1 | 1 | 1 |

| A14_Online | 861 | 107.0 | 1 | <0.0001 |

| A14_14 Rarely reads car articles | 861 | 42.8 | 1 | <0.0001 |

| A22_11 Not heard of initiatives | 861 | 170.8 | 1 | <0.0001 |

| A22_count Number initiatives heard of | 861 | 313.2 | 1 | <0.0001 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Broadbent, G.H.; Metternicht, G.I.; Wiedmann, T.O. Increasing Electric Vehicle Uptake by Updating Public Policies to Shift Attitudes and Perceptions: Case Study of New Zealand. Energies 2021, 14, 2920. https://doi.org/10.3390/en14102920

Broadbent GH, Metternicht GI, Wiedmann TO. Increasing Electric Vehicle Uptake by Updating Public Policies to Shift Attitudes and Perceptions: Case Study of New Zealand. Energies. 2021; 14(10):2920. https://doi.org/10.3390/en14102920

Chicago/Turabian StyleBroadbent, Gail Helen, Graciela Isabel Metternicht, and Thomas Oliver Wiedmann. 2021. "Increasing Electric Vehicle Uptake by Updating Public Policies to Shift Attitudes and Perceptions: Case Study of New Zealand" Energies 14, no. 10: 2920. https://doi.org/10.3390/en14102920

APA StyleBroadbent, G. H., Metternicht, G. I., & Wiedmann, T. O. (2021). Increasing Electric Vehicle Uptake by Updating Public Policies to Shift Attitudes and Perceptions: Case Study of New Zealand. Energies, 14(10), 2920. https://doi.org/10.3390/en14102920