Abstract

The European Union’s environmental goal by 2050 is to become the first climate-neutral continent in the world. This means specific efforts for diversifying the energy mix and investing in low-carbon energy. Our study investigates the nexus among carbon emissions, energy consumption and mix, and economic growth in a modified framework that includes the contribution of inward foreign direct investments and international trade to lowering air pollution. We have used a two-step approach to explore in more detail the links between these variables in 24 EU countries over the period 1995–2018, followed by a panel VECM analysis. Our results indicate that there is a unidirectional link between economic growth and CO2 emissions, which should imply a decoupling of environmental improvement measures from the pace of economic growth. We also find bidirectional causal relationships between low-carbon energy shares in consumption and CO2 emissions, as well as between low-carbon energy share in consumption and GDP per capita, which confirms both pollution haven and the halo effect hypotheses for FDI on gas emissions. However, in the long term, FDI, exports, and imports have positively impacted the reduction in CO2 emissions; therefore, stronger EU investment and trade integration should be promoted to improve the quality of the environment.

1. Introduction

The increased awareness of the negative impact of climate change on economies has determined common actions at the international level for reducing greenhouse gas (GHG) emissions. Consequently, country-level targets were established under the Kyoto Protocol in 1997, and efforts in this direction were enforced once with the Paris Agreement in 2015.

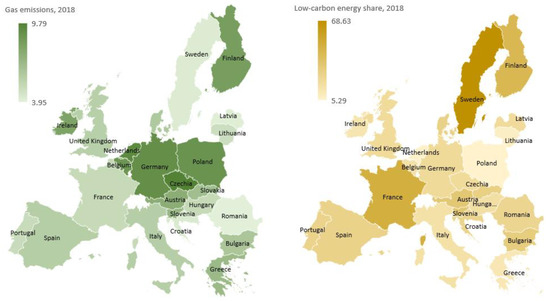

The European Union (EU) implemented a greenhouse gas emissions trading scheme in 2005, intending to monitor and reduce carbon dioxide (CO2) emissions [1]. The EU Emissions Trading System (ETS) was the first and largest such scheme [2]. In addition, under the European Effort Sharing Regulation, each Member State has agreed to limit the GHG emissions between 2013 and 2020 [3]. EU decided to continue this initiative, and for the period 2021–2030, each Member State has to annually reduce emissions for the sectors not covered by the EU ETS. The aim is to have 30% less emissions in 2030 as compared to 2005. Figure 1 (left side) shows the result of implementing these initiatives, displaying gas emissions per capita for EU countries as of the end of 2018. In addition, since the 1990s, EU countries started to implement environmental taxation schemes [4] to include the costs of pollution and other environmental costs, for penalizing the polluters and providing an appropriate price according to the harm done to the environment [5,6]. This is another instrument for influencing the behavior of economic agents. Although such a measure implies large harmonization of the fiscal measures between all EU member states, studies proved that environmental fiscal efforts in a certain location are generating similar ways of acting in the surroundings [7]. We consider that, in this context, detailed empirical studies are needed to determine the types of energy resources that lead to an increase in economic growth and, at the same time, contribute to the decrease in CO2 emissions, to tackle them by stimulative taxation and influence a certain expected behavior. Further on, the European Green Deal, presented in 2019, reinforced the EU’s objective of fighting against climate change. EU has set the ambitious target of becoming the first climate-neutral continent in the world by 2050 [8]. The measures under the Green Deal envisage major structural changes in order to achieve the ambitious goal of a transition from coal energy to cleaner sources, such as renewable energy. As an illustration, Figure 1 (right side) shows the share of low-carbon energy sources in primary energy consumption in each EU country, also at the end of 2018. Studies have already indicated that an increase in renewables in the energy mix would contribute to a reduction in gas emissions [9]. Although it is a significant step towards restoring environmental degradation, there are still many unknowns that could erode the EU project. Firstly, it implies a significant effort for the EU Member States located in the Eastern region that are still highly relying on fossil fuel, which are going to be the most affected [10,11]. In addition, Member States have not yet reached a decision on including nuclear energy capabilities among the objectives that will be financed through the Green Deal. Although nuclear energy is a low-carbon source of energy, it has severe negative effects on the environment if a catastrophe is produced, but it is strongly supported by several EU governments due to its economic importance and high shares of nuclear energy in total energy consumptions—see, in this respect, the Joint letter from the Czech Republic, French Republic, Hungary, Republic of Poland, Romania, Slovak Republic, and Republic of Slovenia on the role of nuclear power in the EU climate and energy policy [12].

Figure 1.

Gas emissions per capita in EU countries versus low-carbon energy share in primary energy consumption, 2018. (Left panel) Gas emissions (metric tons per capita). (Right panel) Low-carbon energy share (%). Source: Our World in Data and authors’ representations.

Despite obstacles, specific measures must be proactively pursued in an effort to reduce global warming, as economic growth and energy consumption have a deep impact on environmental degradation [13,14]. The analysis of the relationship between economic growth and CO2 emissions has as its starting point the 1990s, demonstrating that economic activities stimulate climate change and greenhouse gas emissions [15]. The first in-depth research conducted in the 1990s on the potential impact of the North American Free Trade Agreement (NAFTA) found that reducing trade barriers can affect the environment due to the expansion and change of the economic activity and the shift of production techniques [16].

At present, three strands of literature concerned with studying the relationship between economic growth, energy consumption, and environmental pollution can be detected [17,18]. The first strand is related to the study of the relationship between economic growth and environmental degradation, which was usually investigated using the environmental Kuznets curve (EKC). EKC states that pollution level in a country increases as the income grows, but beyond a certain level of per capita income the trend reverses; i.e., at high levels of income, economic growth leads to environmental improvement [19]. Studies that have investigated the EKC hypothesis for different regions showed mixed results [20,21,22,23]. The EU is not an exception. Extant research proves that economic growth leads to declines in carbon emissions, confirmed for all the countries in the EU from 1990 until 2015 [24]. The EKC hypothesis was also supported for 15 EU countries and confirmed by others [9,25,26]. After considering spatial effects in a fixed-effects dynamic panel model throughout 1990–2015 encompassing 26 EU countries, authors found that while GDP leads to an increase in carbon emissions, its spatial effects had negative impacts [27]. However, other authors failed to confirm that GDP growth contributes to the reduction in greenhouse gas emissions [15,17]. Still, GDP growth and the use of nonrenewable energy seem to have an enforcing effect on CO2 emissions reductions [28].

Another strand of literature tested the relationship between energy consumption and economic growth. Usually, when using the aggregate energy consumption, an increase in CO2 emissions is found, and this has also been observed for the EU [9,26]. A similar result was found when electricity consumption was used as a proxy for energy consumption for selected EU countries during the 2001–2014 period [25]. A clearer picture is observable when focusing on different sources of energy. In the context of transition to cleaner sources of production, when considering renewable energy, studies’ results generally agree that it contributes to a reduction in environmental degradation. Thus, authors state that, while energy consumption has the biggest impact on CO2 emissions in the EU countries, an increased use of renewable energy resources in the final energy mix has the potential to diminish pollution [29]. Others show that CO2 emissions were reduced following the increased use of renewable energy but enhanced using nonrenewables [9]. A similar result was previously identified for 16 EU countries, in an analysis from 1990 to 2018 [17]. The authors suggest improving the energy mix to promote renewable energy, which diminishes GHG emissions, while fossil energy increases pollution. Further studies were conducted for different EU countries, but with similar results [15,20,27,28].

The third strand of literature combines the previous approaches [17,30], proposing an investigation of economic growth, energy use, and pollution. In addition, the use of other explanatory variables is increasing. As the EU Green Deal also intends to stimulate the use of green technologies in the view of moving to a circular economy, we consider that trade openness and foreign direct investment (FDI) should be carefully assessed due to their potential impact on the environment. In fact, existing studies indicate three directions in which impact could be manifested: the composition, the scale, and the technology spillovers [9,31]. Composition is related to the specialization of a country based on its comparative advantage. If specialization occurs in sectors with energy-intensive pollution, the environmental degradation is higher. The scale effect reflects the direct relationship between trade and GDP, therefore leading to higher consumption and, finally, increased pollution. Through technology transfer due to trade flows, more environmental-friendly technologies could be adopted, thus limiting carbon emissions. Thus, trade could promote sustainable development if, in the phase of industrial development, intra-trade is supported by the use of renewable energy and clean technology [31,32]. Moreover, the literature considering the impact of FDI on the quality of the environment points towards two conflicting hypotheses. The pollution haven hypothesis states that developing countries, eager to attract FDI, have lower environmental standards, which allows for the transfer and localization of more polluting industries. On the contrary, in the halo effect hypothesis, FDI is seen as a vehicle for the transfer of advanced and cleaner technologies, with a positive impact on reducing emissions [13].

The studies on the impact of trade openness and FDI on pollution reported mixed results until now, reflecting the previously mentioned hypotheses. For Europe, most of the studies indicate that trade openness improves the quality of the environment by mitigating CO2 emissions [9,15]. Other authors identify a positive and significant association between trade openness and renewable energy consumption, which leads to a decrease in carbon emissions, stating the EU countries are transferring green technology due to a higher liberalization of trade [30]. On the other hand, there is literature that concludes in favor of a negative impact of trade openness on carbon dioxide emissions (i.e., trade openness increases emissions), while also identifying bidirectional Granger causality relationships between CO2 emissions, energy consumption, GDP, and trade openness in the long run [26]. Studies on the FDI–pollution link also provided inconclusive results. FDI was found to increase CO2 emissions in developing countries in the period 2002–2008 and in OECD countries or Asian economies from 1982 to 2014 [33,34,35,36]. However, no significant effect was found on ASEAN economies [13]. Studies considering the EU as a whole are scarce, to our knowledge.

On this background, the objective of the present study is to assess the energy–pollution–growth nexus and the contribution of trade and FDI to environmental footprint in EU, using a panel VAR/VECM model. We thus provide a new framework of analysis in which the role of international trade and foreign direct investment in the EU is established, given the heightened economic integration between EU countries, fueled and consolidated by investment and trading flows. In addition, we aim to clarify the impact of low-carbon energy on CO2 emissions, and not only of renewable energy, thus covering a less studied niche. The rationale behind our choice resides in the high shares of nuclear energy in primary energy consumption in many EU countries, which are difficult to replace by other low-carbon sources, even by 2050, as targeted by the EU. In this respect, we aim at providing a new understanding of the actual EU debate related to the clean technologies that could be used for safeguarding the environment. The structure of the paper is as follows: Section 2 presents the research methodology and the data sets used in our research, Section 3 provides the results and discussions, and Section 4 concludes and addresses several policy implications based on our study.

2. Materials and Methods

Our study investigates the nexus among gas emissions, energy consumption and mix, and economic growth in the European Union, in a modified framework that also includes the contribution of inward foreign direct investments and international trade. The period we cover is 1995–2018, using annual data for the variables; the sources are presented in Table 1. We collected data on 24 out of 28 EU countries—Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and the United Kingdom; the reason behind excluding 4 countries (Cyprus, Estonia, Luxembourg, and Malta) from the analysis is strictly related to data availability. All variables have been transformed using the natural logarithm in the econometric model with the aim of achieving consistent results. Table 2 shows the descriptive statistics of variables included in our study and is complemented by Appendix A, which presents the descriptive variables at the individual country level.

Table 1.

Variable definition, measurement units, and data sources.

Table 2.

Descriptive statistics of variables at the sample level.

We use a two-stage theoretical model for the assessment of the CO2 emissions–energy consumption–economic growth nexus. The first stage is specified in Equation (1):

Model 1:

where i designates the country (i = 1 to 24), t indicates the time (t = 1995 to 2018), and the acronyms of variables are presented in Table 1.

The second stage of the model is specified in Equation (2), which incorporates into the first-stage model the impact of foreign direct investments and international trade (exports and imports):

Model 2:

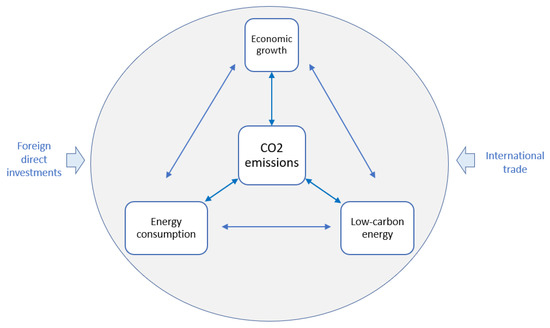

The inclusion of foreign direct investments and international trade into our model as moderating variables—see Figure 2—is motivated by their sizeable value and the tremendous role they have played in promoting economic integration between the EU member countries. Thus, the European Union was the most important global investor at the end of 2018, both in inward and outward terms—7196.8 billion euros in inward FDI and 8750 billion euros in outward FDI, according to UNCTAD World Investment Report data. Moreover, the EU held a share of 15.6% in global exports of goods and services (ranking second, after China) and of 13.9% in global imports of goods and services (ranking also second, after the United States) in 2019. The total value of EU member countries’ exports was 4315.8 billion euros, and the corresponding value for imports was 3990.2 billion euros, marking an excess of 325.6 billion euros [37]. Besides EU’s international trade value, a unique feature is the share that EU member countries hold, collectively, in the international trade of each other member. Thus, at the end of 2018, 66.7% of each EU member country’s exports and 70% of imports were taking place, on average, with the remaining 27 EU members, which represents the strongest evidence of the close links between EU countries. Moreover, these links are channels that may support the gas emissions–energy consumption and mix–economic growth nexus within the EU; thus, adding FDI and international trade variables to the base-case model (Model 1) enlarges the research framework and offers more insight into the economy–energy interdependence.

Figure 2.

Theoretical model. Source: Authors’ representation.

We implement a panel VAR/VEC methodology [38] on six main steps: first, we assess the time series stationarity using panel unit root tests; second, we examine the presence of cointegrating relationships between variables by applying the Pedroni panel cointegration test; third, we employ Granger based causality tests with the aim of revealing potential transmission mechanisms between variables; fourth, we evidence the long-term relationship between variables in a fully modified OLS setting (FMOLS); fifth, the short-run versus long-run relationships between variables are investigated; sixth, we employ impulse response functions (IRFs) and variance decomposition (VD) to test the reaction to shocks of variables in the VAR/VEC system.

The panel unit root tests we used verify time-series stationarity and level of integration. We used the Levin–Lin–Chu, Im–Pesaran–Shin, ADF–Fisher, and PP–Fisher tests with the null hypothesis of the existence of a unit root [39,40,41,42]. In case variables were nonstationary at level but stationary at the first difference—i.e., they were I(1)—the next step was to verify the presence of cointegration. The cointegration test we utilized was the one proposed by Pedroni for each of the two models [43], an extension of the Engle–Granger test of cointegration applied to simple time series [44], which is widely used in research on various topics. The equation used to test for cointegration was:

where t = 1 to T (number of years); i = 1 to N (number of countries); m = 1 to M (number of regressors); Y and X are I(1) variables; and parameters αi and δI are individual and trend effects, respectively. Under the null hypothesis—no cointegration—the residuals εi,t are I(1).

For implementing the panel causality test, we opted for the Dumitrescu–Hurlin test, which assumes that the regression coefficients in the bivariate regressions resulting from running Granger causality tests can vary across cross-sections [45]. In the context of our heterogeneous panel, this is a better assumption than the one used in the traditional Granger causality testing, which sees coefficients identical across all cross-sections. Further, the pooled FMOLS estimation method was used to calculate the long-run relationships between variables in both models [46]. The FMOLS estimation is able to correct the deviations in the standard OLS model as a result of endogenous and regression associations [47]. This is an extension to the panel setting of the FMOLS estimator proposed by Philips and Hansen [48]. The pooled FMOLS estimation with heterogenous long-run coefficients for first-stage residuals and long-run covariance estimates calculated using Bartlett kernel and Newey–West fixed bandwidth was applied to the following two equations, corresponding to the two models:

Next, we implemented the panel VECM methodology to observe the correction of short-term deviations from the long-run equilibrium of variables and the speed of adjustment of variables over the short term. The VECM estimation used the following equation:

where Y and X designate the dependent and independent variables and ECTt−1 is the lagged OLS residual from the long-run cointegrating equation—which explains how the previous period deviation from the long-run equilibrium between variables influences the short-run alteration in the dependent variable, through the λ coefficient that measures this adjustment speed. The term designates stochastic error terms, or the impulses/shocks.

We complement these results with IRFs and variance decompositions, based on the stochastic error terms, which allow us to assess the reaction of CO2 emissions to shocks in the estimation of the other variables included in the systems depicted by Models 1 and 2 (when the shock is produced in only one variable, we use IRFs, while variance decomposition is used to portray the simultaneous shocks produced in all variables). We employed 10 forward periods for IRF and variance decomposition and Cholesky one standard deviation innovations and factorization.

3. Results and Discussion

We present and discuss our results in two parts: the first explores in more detail the CO2 emissions–energy consumption and mix–economic growth nexus within the European Union, including the similarities and differences between the former communist EU member countries from Central and Eastern Europe that adhered to EU in 2004, 2007, and 2015 (10 countries: Bulgaria, Croatia, Czechia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia, and Slovenia) and their older and more developed EU members (14 countries: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Portugal, Spain, Sweden, and the United Kingdom); the second part shows and discusses the inter-relationships between these variables as revealed by the panel VAR/VEC methodology.

3.1. The CO2 Emissions–Energy Consumption and Mix–Economic Growth Nexus in the European Union

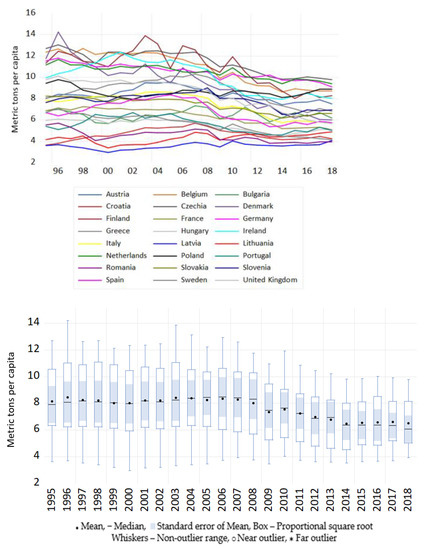

Figure 3 shows the evolution of CO2 emissions for the 24 EU countries in our sample between 1995 and 2018 for each individual country (top panel) and at aggregated EU level (bottom panel). At our sample level, CO2 emissions between 1995 and 2018 reached an average of 7.68 metric tons per capita, between a minimum of 3.56 metric tons in Latvia and a maximum of 11.47 metric tons in Czechia. Denmark had the most volatile evolution of CO2 emissions over time (considering the mean emissions and their standard deviation), and Poland had the least evolution. Altogether, CEE countries had lower mean emissions per capita compared to their more developed EU counterparts—6.44 metric tons against 8.55 metric tons—which may be explained by the different levels of economic development in the two parts of the EU [49]. At the EU level, CO2 emissions declined between 1995 and 2018 by 16.75% on average (or at an average 0.97% compound annual growth rate (CAGR)), more sharply between 2009 and 2014, but the reduction at the country level took place at quite different paces. Denmark was the leader of this decline, with a drop of 48.81% in its CO2 emissions, and other 20 EU countries reduced their emissions with percentages between 5.59% (Poland) and 42.13% (United Kingdom). At the same time, three countries have seen their emissions increasing over the period: Croatia (16.29%), Latvia (12.47%), and Lithuania (17.34%), an evolution linked to their economic progress accompanied by a lower energy efficiency compared to other CEE countries.

Figure 3.

CO2 emissions per capita in EU countries, 1995–2018. (Top panel): Individual countries’ CO2 emissions (metric tons per capita); (Bottom panel): Boxplots of CO2 emissions per capita per year. Source: Our World in Data and authors’ representations.

Differences among EU countries in terms of CO2 emissions per capita, illustrated by the high standard deviation around the mean in the boxplots (bottom panel in Figure 3) may be explained by their energy consumption mix, economic structures, and adopted targets for emissions reduction. However, the higher homogeneity of CO2 emissions per capita among EU countries in recent years evidenced by smaller nonoutlier ranges in boxplots demonstrates that the EU Emissions Trading System and the Effort Sharing Regulation have been successful in reducing emissions within the EU and the increased convergence between EU countries in this respect. However, the Spearman correlation coefficient between the mean CO2 emissions and the percentage change in emissions over the 1995–2018 period at the EU level was −0.493 (p-value 0.014), indicating that countries with higher CO2 emissions have not necessarily decreased their emissions compared to lower CO2 emission countries; for example, Czechia, Finland, Belgium, and Germany—countries with mean levels of CO2 emissions above 10 metric tons per capita—have reduced their emissions by 20–30% over the period, but so have countries like Romania, France, Slovakia, and Italy, with CO2 emissions between 4 and 8 metric tons per capita.

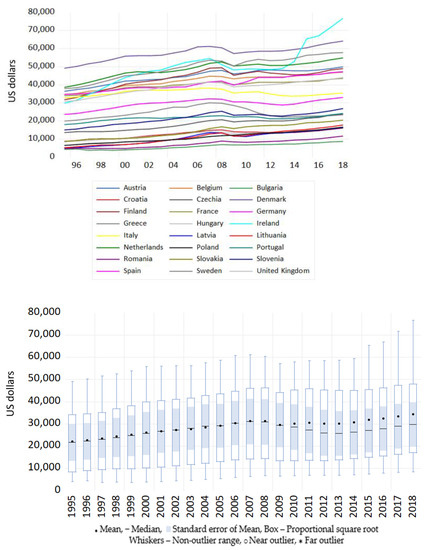

Figure 4, Figure 5, Figure 6 and Figure 7 offer more insight into the evolution of CO2 emissions, presenting the trends in economic growth—as real GDP per capita—and primary energy consumption per capita in the EU between 1995 and 2018. The growth of real GDP per capita is apparent for all EU countries, but more remarkable for Lithuania (232.95%), Ireland (158.17%), and Poland (154.21%)—see Figure 4. At the other end, countries such as Italy and Greece have recorded smaller rises over a 24-year period: 7.98% and 18.27%, respectively. The European sovereign debt crisis in 2009–2010 and the deep recession that lasted in both countries until 2014, which made their real GDP per capita not yet return to its 2008 level even at the end of 2019, are the main “culprits” for this meager growth. Overall, as the boxplots in the bottom part of Figure 4 show, the disparities in real GDP per capita between EU countries have increased after 2015, given the higher nonoutlier range that accompanies the mean real GDP per capita, although they declined between 2009 and 2014 compared to the times before the global financial crisis of 2007–2009. The differences between CEE countries and the more developed EU countries are easily observable at the mean level over the 1995–2018 period—the average real GDP per capita was 12,592.83 US dollars in CEE countries and 40,420.34 US dollars in the remaining EU countries—but CEE countries have grown much faster between 1995 and 2018 than their more developed EU counterparts (the growth rate in real GDP per capita was 130.11% for CEE economies against 43.85% for older EU members). Certainly, the free movement of goods and services, capital, and people (including workforce), as well as access to markets, driven by the EU membership, which further stimulated trade and foreign investments, was the main driver behind CEE countries’ growth. The vast research on the topic confirms this finding [46,47,48,49]. Nevertheless, the limited within-EU economic convergence process and increasing inequality among regions at the country level are seen as the main drivers of this increased heterogeneity in real GDP per capita among EU countries [50].

Figure 4.

Real GDP per capita in EU countries (US dollars), 1995–2018. (Top panel): Individual countries’ real GDP per capita (US dollars); (Bottom panel): Boxplots of real GDP per capita per year. Source: World Bank and authors’ representations.

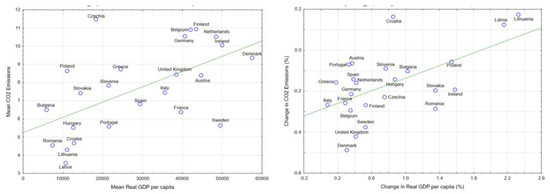

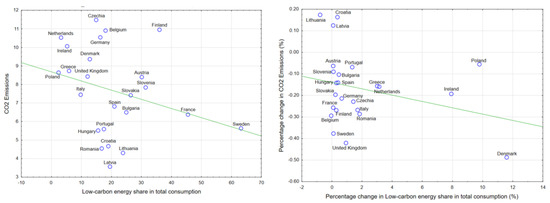

Figure 5.

Correlations between CO2 emissions and real GDP per capita, 1995–2018. (Left panel): Correlations between means of variables. (Right panel): Correlations between percentage changes of variables. Green line shows the linear trend. Source: Eurostat and authors’ representations.

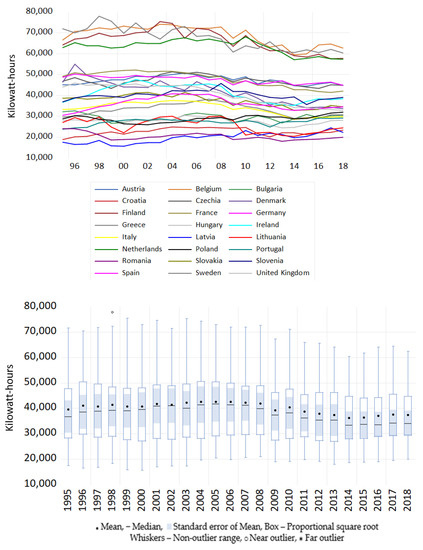

Figure 6.

Primary energy consumption per capita in EU countries, 1995–2018. (Top panel): Individual countries’ primary energy consumption per capita (kilowatt-hours); (Bottom panel): Boxplots of primary energy consumption per capita per year. Source: UNCTAD and authors’ representations.

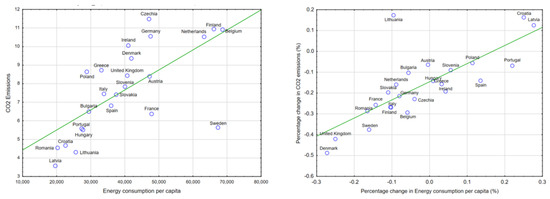

Figure 7.

Correlations between CO2 emissions and energy consumption per capita, 1995–2018. (Left panel) Correlations between means of variables. (Right panel) Correlations between percentage changes of variables. Green line shows the linear trend. Source: Authors’ representations.

We show in Figure 5 the correlations between CO2 emissions and real GDP per capita—as means between 1995 and 2018—at sample level (left side), as well as between the percentage change in CO2 emissions and the similar change in GDP per capita (right side). Both correlations are positive—0.577 and 0.575, respectively—and statistically significant at sample level (p-values 0.003), implying that higher levels of development and economic progress levels have been accompanied by more sizable CO2 emissions in EU countries. However, increases in real GDP per capita between 1995 and 2018 have been linked to declines in CO2 emissions in most EU countries—the exceptions are Croatia, Latvia, and Lithuania. Nevertheless, when CEE countries are considered, the correlation between changes in CO2 emissions and changes in real GDP per capita is 0.517, while in the case of more developed EU economies the correlation is virtually zero (0.057)—none are statistically significant though. In line with the findings behind EKC—i.e., although the deterioration of the environment is determined by economic development, as a country grows, its relationship with the environment changes and the level of environmental degradation declines—our findings show that improved economic performance and growth within the European Union went hand in hand with more concern for the environment and actions again environmental deterioration. Various studies prove the presence of the environmental Kuznets curve for a group of selected countries in the EU, when considering either old member states or newer countries, which experimented with the transition to a market economy, and testing both renewable and nonrenewable sources of energy [9,25,26,51,52,53,54]. Contradicting results were also obtained [15,17,28]. Our study reaches the conclusion that there is a unidirectional link between economic growth and CO2 emissions, considering both a larger panel of EU countries for an extended period and including other factors that usually affect the relation between energy consumption and GDP, such as FDI and trade openness.

Figure 6 presents the evolution of primary energy consumption per capita in the 24 countries included in our sample, at the individual level (top panel) and the aggregate sample level over the years (bottom panel). The consumption of primary energy has been quite diverse across the 24 countries, with a maximum of 68,751.92 KWh-year in Belgium, a minimum of 19,617.38 KWh-year in Latvia (means over the 1995–2018 period), and a mean of around 40,071.53 KWh-year for the sample—the boxplots in the bottom part of Figure 4 show very well the high dispersion of energy consumption within EU. Denmark has recorded the highest volatility of energy consumption over the years, and Germany the lowest, but both at levels above the sample average. Interestingly, although CEE countries had lower energy consumption per capita compared to the more developed EU countries during the time frame of our analysis (38,273.68 KWh-year versus 40,838.57 KWh-year), the difference between the two categories of countries within the EU is rather small, suggesting that countries’ specific patterns of consumption matter significantly, as does energy intensity. Over time, the countries in our sample have reduced their energy consumption by only 2.44%, between the highest increase of 27.71% for Latvia and the highest decline of 27.71% for Denmark. The result, illustrated in the boxplots in the bottom panel in Figure 6, was the declining dispersion of energy consumption per capita after 2010.

These diverging patterns in energy consumption per capita across EU countries may be explained, on one hand, by the horizontal policy measures implemented in the EU that aimed at improving energy efficiency in all economic sectors (households, manufacturing, and services sectors) and, on the other hand, by the specific impact at country level generated by the global financial crisis of 2007–2009, which led to lower energy demand growth [55]. Moreover, they reflect the different weights that economic sectors hold in energy consumption in EU countries, as well as population dynamics patterns. Thus, in terms of final energy consumption (disaggregated data on energy consumption by sector is available only for final energy consumption in EU in Eurostat database), transport was the most important energy consumer sector in 2018 in 11 out of the 24 countries included in our sample, namely Bulgaria, France, Greece, Ireland, Italy, Lithuania, Poland, Portugal, Slovenia, Spain, and the United Kingdom, ranging between 33.3% in Bulgaria and 39.5% in Spain. In Croatia, Denmark, Latvia, Hungary, and Romania, the residential sector holds the largest share in energy consumption (between 30.9% in Latvia and 35.2% in Croatia), while the manufacturing sector dominates energy consumption in Austria, Belgium, Czechia, Finland, Germany, Netherlands, Slovakia, and Sweden (between 29.4% in Germany and 46.7% in Finland). When demographic trends are considered, the EU’s total population has increased over the investigated timeframe by 30.5 million people (Eurostat), as a result of natural growth and net migration; the Western and more developed EU countries have recorded population gains while the Eastern and less developed countries have experienced population losses, due to a large extent to sizeable migration from the later to the former—for example, the cumulative net migration between 1995 and 2018 was negative in Romania (by 2.23 million people), Lithuania (606,000 people), Poland (235,000 people), and Croatia (229,000 people).

In a similar manner to Figure 5, Figure 7 shows the correlations between CO2 emissions and energy consumption per capita for the 1995–2018 period and the 24 countries in the sample, as mean values (left side) and percentage changes (right side). Again, both correlations are positive—0.673 and 0.763, respectively—and statistically significant at sample level (p-values 0.000), illustrating that higher levels of energy consumption came hand in hand with higher amounts of CO2 emissions in the EU when mean values are considered. However, in most EU countries, both energy consumption and CO2 emissions jointly declined over the investigated timeframe, and even in countries where the energy consumption increased between 1995 and 2018 (situated on the right side of the right panel in Figure 5), this has been accompanied in general by declines in CO2 emissions in the EU. The exceptions are Croatia and Latvia, for which both energy consumption and CO2 emissions increased, and Lithuania, where the average increase in CO2 emissions has been associated with a decline in energy consumption.

Overall, the correlation between changes in CO2 emissions and changes in energy consumption was higher in the more developed EU economies compared to the less developed CEE countries (0.862 against 0.650, both statistically significant at 5% level). This suggests that most EU countries have taken the path of increasing their energy intensity, and this trend is more apparent in the developed part of the EU, even if the rate of change in energy intensity differs from one country to another. Significant differences in energy intensity at global and regional levels depending on countries’ levels of development have also been revealed by other authors [56]. In the EU, the enlargement process that took place in 2004, 2007, and 2015 led to high disparities in energy intensity, as former communist countries from Central and Eastern Europe that became EU members had lower energy intensity compared to the other, more developed EU countries [57]. The inequality between energy sources—electricity, natural gas, oil, and coal—was found to be another major source of divergence among EU countries, particularly when economic development is considered [58]; thus, the authors argue that countries’ economic structures and energy mix are important drivers of this inequality, urging the strong support of the transition of most CEE countries to more carbon-friendly energy consumption.

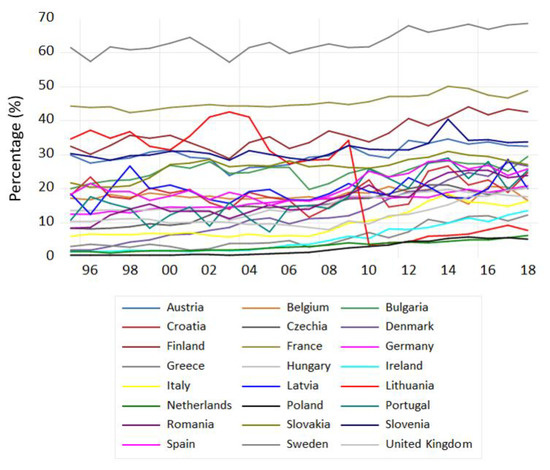

The last component of the nexus explored in our research, the energy mix, is represented by the share of low-carbon energy in total energy consumption. Figure 8 illustrates the trends in this share for EU countries, showing that two countries—Sweden and France—benefit from an energy mix shifted significantly towards low-carbon energy sources (63.25% for Sweden and 45.57% for France). However, many EU countries hold low and very low shares of low-carbon energy in their energy consumption, even below 10% as an average for 1995–2018 (Netherlands, Poland, Greece, Ireland, Italy), although this share is on an upward trend. On the other hand, the distribution of energy sources in the total low-carbon energy consumption is strikingly different: while Sweden relies on almost similar proportions of nuclear and hydro energy, France holds a 77% share of nuclear energy in the low-carbon sources. At the EU level, the differences between countries from the perspective of low-carbon energy sources and of their distribution across the various categories are nevertheless impressive, as revealed by the boxplots in the bottom panel in Figure 8 (for more details on energy source distribution across EU countries, see Appendix B). Thus, there are countries where nuclear energy is overwhelming, albeit in a decline, as share in total low-carbon energy (Belgium, Bulgaria, Czechia, Finland, France, Germany, Hungary, Slovakia, Slovenia, Spain, Sweden, and United Kingdom), others where hydro energy holds the largest share (Austria, Croatia, Greece, Italy, Latvia, Portugal, Poland, Romania), and a few that rely substantially on wind-powered energy (Denmark, Poland). It is also worth mentioning that 8 EU countries have not used nuclear energy completely between 1995 and 2018 and 12 have not used biofuels, although the share of biofuels has increased in all remaining 12 countries, while the share of nuclear energy has been on a steep decline all over EU (markedly in Germany, Bulgaria, Belgium, Netherlands, and United Kingdom). As evidenced in the top panel in Figure 8, Lithuania is a special case among EU countries: the country renounced the use of nuclear energy sources in 2010, closing its last Russian-built nuclear reactor at the end of 2009, because of EU pressure, replacing its weight in low-carbon energy by wind and hydro energy and relying more on fossil-powered energy. Undoubtedly, the importance of various sources of energy in total consumption, including low-carbon sources, is explained not only by national idiosyncrasies in terms of natural endowments but also by policy options in each country. However, EU policies promoting the growth in renewable energy and low-carbon sources, such as the Effort Sharing Decision, have also demonstrated their efficiency.

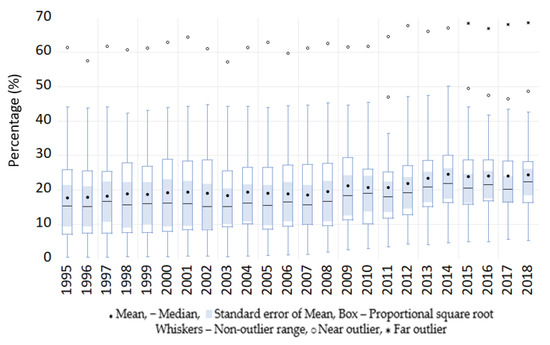

Figure 8.

Share of low-carbon energy in total primary energy consumption in EU countries, 1995–2018. (Top panel): Individual countries’ share of low-carbon energy consumption (%); (Bottom panel): Boxplots of low-carbon energy consumption share per year. Source: Our World in Data and authors’ representations.

We show in Figure 9 the correlations between CO2 emissions and the share of low-carbon energy sources in total energy consumption between 1995–2018, for all EU countries in our sample. The left side of Figure 9 portrays the negative correlation (−0.290) between the level of CO2 emissions and the low-carbon energy share in consumption, as 1995–2018 average for all countries; this suggests that countries with higher CO2 emissions had, to some extent, smaller shares of low-carbon energy, and vice-versa, which is the normal results. Nevertheless, six countries (Latvia, Lithuania, Romania, Croatia, Hungary, and Portugal) generated, on average, low CO2 emissions despite having lesser shares of low-carbon energy (below 25%). Again, the EKC is at work in these countries; in the early stages of post-communism development, CO2 emissions decreased with increasing revenues in Central and Eastern European countries, and they were coupled later, as EU member states, with the alignment to and adoption of the EU’s international climate change policy [59]. Thus, in these countries, the decline in CO2 emissions has taken place independently from the importance of low-carbon energy in total energy sources. Other authors argue that the lower levels of CO2 emissions in countries such as Romania are due to the high shares of renewable energy sources integrated into the Romanian energy balance, which reduced the primary energy supply by up to 48% [60]. Moreover, according to a 2020 report of the European Environment Agency [61], these countries are among the 12 EU countries that have achieved their targets set in the Renewable Energy Directive [62], demonstrating that these countries already have a declining slope in terms of carbon dioxide emissions. Contributing factors in this regard are the increase in EU spending on climate policy, international cooperation, and the financing of green technologies.

Figure 9.

Correlations between CO2 emissions and Share of low-carbon sources in total energy consumption, 1995–2018. (Left panel): Correlations between means of variables. (Right panel): Correlations between percentage changes of variables. Green line shows the linear trend. Source: Authors’ representations.

When considering the correlation between the dynamics of the two variables over time, the right side of Figure 7 also reveals a negative correlation (−0.285, not statistically significant at 5% level) but shows a grouping of countries that have increased their low-carbon energy share by 200% (they tripled the share in total energy consumption) and decreased the CO2 emissions by between 10% and 40%. Denmark is the leader from this perspective, as its low-carbon energy share went up from 3.1% in 1995 to 30.2% in 2018 and was accompanied by the highest decline in CO2 emissions in the EU (50% between 1995 and 2018). At the other end, Lithuania, as mentioned above, is the only EU country that simultaneously increased its CO2 emissions and decreased the share of low-carbon energy between 1995 and 2018. Our results support previous research findings on the energy source diversity of the EU and its progress in using renewable energy, including low-carbon sources, for positively impacting CO2 emissions [63,64,65]. Studies so far had generally pointed towards the positive impact of renewable energy in diminishing pollution [15,29], as previously mentioned. However, they mostly refer to the use of renewable energy. We take a novel approach in this study by testing the impact of low-carbon energy on CO2 emissions, given the actual debate at the EU level regarding the Green Deal and the inclusion of nuclear energy use among the capabilities to be financed through EU funds. To our knowledge, this is among the few studies in which low-carbon energy is used as a variable, not included in the general class of energy. We reach a similar conclusion to other authors who found that nuclear energy consumption contributed to reducing CO2 emissions, but our result is available for the whole panel of 24 EU countries, while their analysis was conducted only for Spain [66].

We further explore the CO2 emissions–energy consumption and mix–economic growth nexus in the European Union in the next subsection, deepening the comprehension of this powerful nexus with the help of the panel VAR/VEC methodology that brings forward unilateral or bidirectional causal relationships and impacts among the variables.

3.2. Results of the Panel VECM Estimation

We examine the impact of economic growth, energy consumption, and low-carbon energy sources on carbon emissions in the European Union using the panel VAR/VEC methodology and implementing the following steps: stationarity tests of variables, cointegration verification, Granger-based causality tests, VEC coefficient estimations, and impulse response and variance decomposition results.

Table 3 shows the results of panel unit root tests, which indicate that our variables are I(1). The null hypothesis for all tests is that series have a unit root, and it is rejected at level, but not at first difference. Therefore, the VAR/VECM model can be safely implemented.

Table 3.

Panel unit root tests results.

Further, since our series are nonstationary at level, we verified the presence of a cointegrating (or long-term) relationship among the variables, which investigates whether the series have constant covariance over time and opens the possibility of OLS modeling. Table 4 presents the results of the Pedroni cointegration test with four statistics out of seven (panel PP-statistics, panel ADF-statistics, group PP-statistics, and group ADF-statistics) statistically significant at the 1% level. Hence, the no cointegration null hypothesis is not confirmed, and the results point towards the presence of a long-run cointegrating relationship among the variables considered in our model. Consequently, the application of the modified VAR in the VEC framework is required for our panel.

Table 4.

Results of Pedroni cointegration test.

For the determination of the optimal number of lags in the panel VEC model, we used the Schwartz information criterion, which indicated 1 lag as the optimal number. Hence, the panel causality test was applied using 1 lag (see results in Table 5). According to the Dumitrescu–Hurlin causality test, bidirectional causality between all variables exists. We found bidirectional causality between CO2 emissions and ENGCONS, LOWC_SH, and FDI; between ENGCONS, LOWC_SH, and GDPR_CAP; between GDPR_CAP, LOWC_SH, EXPORTS, and IMPORTS; and between FDI, EXPORTS, and IMPORTS. Moreover, we identified unidirectional causal links from GDPR_CAP, EXPORTS, and IMPORTS to CO2 emissions; from ENGCONS to FDI; and from EXPORTS and IMPORTS to ENGCONS, LOWC_SH, and FDI. These results demonstrate the robust links between our variables within the EU and validate our panel models. Our empirical findings indicate a unidirectional link between economic growth and CO2 emissions, which suggests that economic progress in the EU has led to environmental harm. We thus confirm another study that also investigated the EU and found only unidirectional causality from real GDP to CO2 emissions but showed that environmental advancements take place once the GDP level passes the threshold level [9]. Similarly, other authors identified only unidirectional causality from real GDP to CO2 emissions, which they explain by the specific policies to address emissions adopted in different countries [67]. However, we contradict the findings of a bidirectional link between economic growth and CO2 emissions in the case of high-income countries, which, in the authors’ opinion, puts forward a trade-off between economic growth and environmental sustainability [68]. Furthermore, several studies failed to find a causal relationship between economic growth and CO2 emissions in the case of the United States and Turkey; hence, they see reductions in CO2 emissions not affecting economic growth [69,70]. The reasons behind these conflicting results may be due to various factors, such as countries’ idiosyncrasies and particularities of the economic model used (in terms of choice of time span, variables used in the model, econometric methodology, etc.).

Table 5.

Results of panel causality test.

Going further, the share of low-carbon energy sources in total energy consumption is in a bidirectional causal relationship with CO2 emissions and with GDPR per capita. These results confirm other findings, also for the EU, that renewable energy contributes to almost a half less to greenhouse gases compared to fossil energy, but they stay in line with results that reveal a more noticeable relationship between economic growth and renewable electricity consumption when the share of the renewable energy sector in the economy is higher [17,71]. Similar results for EU countries, and specifically for South-Eastern European countries, were also obtained [72,73,74]. However, other authors’ results were less decisive on the link between gas emissions and economic growth. For example, there is research that did not find causal links between the share of renewable energy and economic growth for EU countries, while authors disagreed on the importance of using low-carbon energy for reducing fossil fuels and then CO2 emissions, after implementing Lotka–Volterra models [75,76].

An interesting causal bidirectional relationship was discovered between foreign direct investments and CO2 emissions, suggesting not only that FDI has played an important role in determining air pollution within EU but also that the level of gas emissions may have generated foreign direct investments in sectors dependent on low-carbon energy. These findings support both the pollution halo hypothesis [77], which states that investors tend to move away from countries with stricter environmental policies towards countries with weaker regulations in this respect, and the pollution haven hypothesis [78], which maintains that FDI can lead to cleaner environments due to advanced technology transfer into host countries. A similar result was found by research that added trade and urbanization to FDI as determining factors for gas emissions at the global level [79]. In this framework, it is worth pinpointing the situation of the United Kingdom after Brexit in terms of both FDI and trade. Although it is early to assess the impact of Brexit on the country, estimates predict declines in FDI of around 30–40% compared to the years when United Kingdom was an EU member [80]. However, although FDI flows are important in terms of size, their sectoral destinations are even more important, and from this perspective, we believe that FDI will have a significant impact on the reduction in CO2 emissions by their presence in sectors and industries with lower carbon footprint, as part of the global climate action trend.

Table 6 shows the long-run links between our variables, for Models 1 and 2. In both models, the long-run relationship between ENGCONS and CO2 emissions is positive, but there is also a positive relationship between LOWC_SH and CO2 emissions—the latter result does not confirm the general expectation of a higher low-carbon energy share in consumption impact on gas emissions. This might be due to the very different patterns of energy consumption across EU countries, as the result is also verified when the share of renewable energy instead of low-carbon energy in total consumption is used [81]. Other authors have also examined the relationship between renewable and nuclear energy consumption, carbon dioxide emissions, and economic growth in a business cycle in Spain and showed that economic growth and CO2 emissions are positively correlated during expansions, but not during recessions [66]. Moreover, they note that the increase in nuclear energy consumption leads to a decrease in CO2 emissions during expansions, while the impact of the increase in renewable energy consumption on CO2 emissions is negative but insignificant. Their findings indicate that both nuclear and renewable energy consumption are supporting the decline in CO2 emissions, but increasing economic activity, which leads to higher emissions and offsets this positive impact of green energy [66]. However, the sign of GDPR_CAP changes from negative to positive when FDI and trade variables (EXPORTS and IMPORTS) are included in the cointegrating regression. Moreover, all coefficients’ signs for FDI, EXPORTS, and IMPORTS are negative, indicating a long-run impact of these variables on the reduction in CO2 emissions in the EU. We interpret these results as strong evidence of the positive contribution that economic integration within EU had on gas emissions.

Table 6.

Results of panel FMOLS estimation (CO2EMISS as dependent variable).

The panel VEC results presented in Table 7 for Model 1 complement the results of Granger-based causality tests and further explain the long and short-term nexus of CO2 emissions, energy consumption, low-carbon energy share in consumption, and economic growth in the EU. We note first that error correction terms are statistically significant at 5% level and negative only for CO2EMISS and GDPR_CAP, indicating that the previous years’ deviation from long-run equilibrium is corrected at a speed of 0.7% in the next year for CO2 emissions, while the speed of adjustment in the case of GDPR per capita is slightly higher, at 1.1%. Interestingly, when we observe the VEC results for Model 2 (see Table 8), both error correction coefficients for CO2 emissions and GDPR per capita preserve their signs and statistical significance; however, in the presence of FDI, imports, and exports, the speed of adjustment is lower—0.5% for CO2 emissions and 0.7% for GDPR per capita. Model 2 also reveals statistically significant error correction coefficients for energy consumption for capita (0.3% speed of adjustments from long-run equilibrium over a one-year period), as well as for FDI (positive, 9.1% speed of adjustment) and IMPORTS (negative, 1.0% adjustment speed).

Table 7.

Short-run versus long-run relationships: panel VECM results for Model 1.

Table 8.

Short-run versus long-run relationships: panel VECM results for Model 2.

Moving to short-run panel VEC results, Model 1 estimations show that a 1% change in CO2 emissions is associated with a 0.19% increase in GDP on average, but no other short-run influences from energy consumption per capita or low-carbon energy share are present. This is confirmed by Model 2—here, the 1% change in CO2 emissions is associated with a higher increase in GDPR per capita (0.38%), which might be explained by the boost that FDI and international trade exercise on economic growth. Short-run coefficients for Model 2 also point toward the negative influence of IMPORTS on CO2 emissions—1% change in gas emissions is associated, on average, with a 1.13% decline in imports.

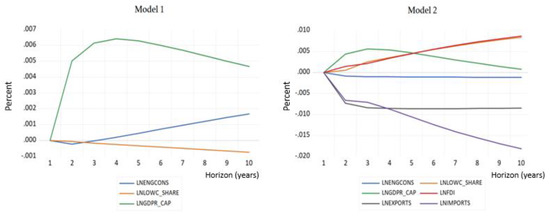

The last step of our analysis uncovers the impulse response functions (IRFs) for CO2 emissions, as resulting from both estimated models. These functions show the impact of a shock originating in one independent variable on the dependent variable, on an individual basis. The results presented in Figure 10 show that CO2 emissions’ response to forecast error associated with GDPR_CAP is positive in both models and persistent even up to 10 lags, albeit slightly diminished when FDI and international trade are part of the model. This supports our previous inference that economic growth is linked to more pollution and that FDI and international trade moderate this link. For what concerns the share of low-carbon energy consumption, the influence of a shock in this variable is negative in Model 1 and positive in Model 2, which leads to the conclusion that FDI and international trade are significant contributors to CO2 emissions. Their significance is observed in Model 2 IRF results, which indicate that forecast error in FDI is positively and persistently associated with CO2 emissions, while the impact of forecast errors in EXPORTS and IMPORTS negatively impacts CO2 emissions.

Figure 10.

Response of CO2 emissions to shocks in independent variables. (Left panel) Model 1 results. (Right panel): Model 2 results. The figure shows the response of CO2 emissions to Cholesky one standard deviation innovations in the other variables. Source: Authors’ representations.

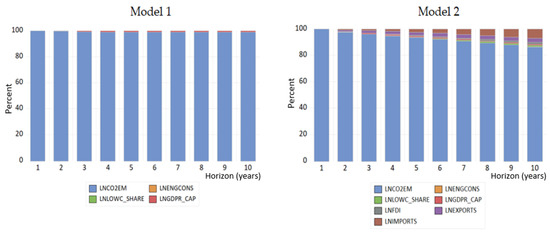

We complement the IRF results with insights from variance decomposition, which shows the impact of cumulative forecast error in all independent variables on CO2 emissions. Figure 11 reveals that, by far, the largest impact on CO2 emissions over 10 time periods comes from its own shock, although very slowly diminishing from 100% over 1 period to 96.22% over 10 periods (Model 1). However, when FDI and international trade are included, we observe a higher decline in the forecast error in CO2 emissions, which is replaced by the forecast error of IMPORTS that increases from 0% in the 1st period to 0.93% in the 2nd period and to 7.17% in the 10th period. Jointly, forecast errors in FDI, EXPORTS, and IMPORTS contribute by 11.67% to shocks in CO2 emissions over a 10-year period, which confirms the significant contribution of foreign investments and international trade to CO2 emissions in the EU.

Figure 11.

Response of CO2 emissions to shocks in independent variables using Cholesky factors. (Left panel) Model 1 results. (Right panel) Model 2 results.

4. Conclusions

Our study investigates the nexus among gas emissions, energy consumption and mix, and economic growth in a modified framework that includes the contribution of inward foreign direct investments and international trade in a panel of 24 EU countries over the period 1995–2018. Our two-step approach first explored in detail the relations between the variables by evidencing the similarities and differences between old and new EU Member States and then revealed the potential transmission mechanisms between variables using Granger causality tests and a VECM model. Our research confirms the previous results in the literature referring to the bidirectional relationships between the share of low-carbon energy sources in total energy consumption and CO2 emissions and between the share of low-carbon energy sources in total energy consumption and GDP per capita.

Nevertheless, these results suggest several policy implications. Therefore, we consider that additional efforts in building an energy mix including both renewable and nuclear sources of energy could have a positive impact on reducing environmental degradation and enhancing economic growth. In addition, measures for environmental improvement should be decoupled from the pace of economic growth, given that economic progress so far in the EU has led to environmental harm. The EU has already taken steps in this direction by implementing the ETS and the Effort Sharing Regulation, which only target the limitation of emissions without considering countries’ development level. We believe that such measures deserve to be continued.

Our study could also be used in what regards the efforts for adapting environmental taxation for penalizing the pollution producers while compensating those with a more non-emissions behavior. In the context of our results, taxation should favor the use of all sources of low-carbon energy, not only renewables, given their impact on increasing economic growth and reducing environmental degradation. Further studies could build on this result by investigating the impact of each low-carbon energy resource (wind, solar, hydro, and nuclear power) on pollution in order to help policymakers draw better measures as regards the protection of the environment.

For the EU, FDI had an important role in environmental degradation, but this might have been accompanied by FDI in sectors dependent on low-carbon energy. In this context, more attention should be given to the type of FDI attracted by EU countries. In addition, FDI, exports, and imports had a positive impact on the reduction in CO2 emissions within the EU. Given the strong interconnections between EU countries in terms of trade and investment, such integration had a beneficial impact on reducing gas emissions and should be further encouraged. However, the energy picture for the whole EU is diversified and strongly dependent on countries’ natural endowments and policy options, which might represent a hindrance to the EU’s strategy of gas emissions reduction. Becoming the first climate-neutral continent in the world by 2050 implies high effort from each country and strong commitment for the EU in its integrality. Investing in low-carbon technologies and further enhancing FDI and trade inside the EU are means that could facilitate the progress in reaching this aim.

Author Contributions

Conceptualization, A.H., O.C.P., E.Z.; methodology, A.H., O.C.P., L.B. S.C.C.; investigation, A.H., O.C.P., E.Z., L.B., D.G.D.; writing—original draft, E.Z., L.B., D.G.D., S.C.C., writing—review and editing, A.H., O.C.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data used in this study is publicly available and mentioned in the paper.

Conflicts of Interest

The authors declare no conflict of interest.

List of Abbreviations

| ADF | Augmented Dickey–Fuller |

| ASEAN | Association of Southeast Asian Nations |

| CAGR | Compound Annual Growth Rate |

| CEE | Central and Eastern Europe |

| CO2 | Carbon Dioxide |

| ECT | Error Correction Term |

| EKC | Environmental Kuznets Curve |

| ETS | Emissions Trading System |

| EU | European Union |

| FDI | Foreign Direct Investment |

| FMOLS | Fully Modified Ordinary Least Squares |

| GDP | Gross Domestic Product |

| GHG | Greenhouse Gas |

| IRF | Impulse Response Function |

| KWh | Kilowatt-Hour |

| NAFTA | North American Free Trade Agreement |

| PP | Phillips–Perron |

| OECD | Organisation for Economic Co-operation and Development |

| OLS | Ordinary Least Squares |

| UNCTAD | United Nations Conference on Trade and Development |

| USA | United States of America |

| VAR | Vector Autoregression |

| VEC | Vector Error Correction |

| VECM | Vector Error Correction Model |

| VD | Variance Decomposition |

Appendix A

Table A1.

Descriptive statistics of variables—individual countries and entire sample.

Table A1.

Descriptive statistics of variables—individual countries and entire sample.

| Country | Mean | Median | Maximum | Minimum | Standard Deviation |

|---|---|---|---|---|---|

| CO2 emissions per capita | |||||

| Austria | 8.391 | 8.2925 | 9.5940 | 7.4390 | 0.6325 |

| Belgium | 10.901 | 11.4655 | 12.7210 | 8.6280 | 1.5414 |

| Bulgaria | 6.495 | 6.5090 | 7.3570 | 5.6650 | 0.4623 |

| Croatia | 4.658 | 4.4965 | 5.6960 | 3.6660 | 0.5437 |

| Czechia | 11.472 | 11.9390 | 13.0400 | 9.7890 | 1.1061 |

| Denmark | 9.355 | 9.7435 | 14.2400 | 6.0240 | 2.2427 |

| Finland | 10.939 | 11.1890 | 13.9000 | 8.0480 | 1.7200 |

| France | 6.369 | 6.6560 | 7.2800 | 5.1040 | 0.7572 |

| Germany | 10.541 | 10.5800 | 11.7940 | 9.0870 | 0.7258 |

| Greece | 8.721 | 8.9125 | 10.3050 | 6.7230 | 1.1282 |

| Hungary | 5.512 | 5.7900 | 6.1220 | 4.4440 | 0.5623 |

| Ireland | 10.050 | 10.4900 | 12.3910 | 7.9500 | 1.5198 |

| Italy | 7.446 | 7.8580 | 8.6220 | 5.7410 | 1.0512 |

| Latvia | 3.564 | 3.6175 | 4.0760 | 2.9630 | 0.2696 |

| Lithuania | 4.297 | 4.3885 | 4.8800 | 3.3910 | 0.4166 |

| Netherlands | 10.518 | 10.6865 | 11.7040 | 9.3890 | 0.6494 |

| Poland | 8.631 | 8.5360 | 9.8000 | 7.9610 | 0.4516 |

| Portugal | 5.581 | 5.3950 | 6.6970 | 4.5990 | 0.6835 |

| Romania | 4.538 | 4.4830 | 5.7040 | 3.8180 | 0.5666 |

| Slovakia | 7.411 | 7.6675 | 8.2460 | 6.1990 | 0.6970 |

| Slovenia | 7.838 | 8.0090 | 9.0060 | 6.5470 | 0.6589 |

| Spain | 6.812 | 6.6990 | 8.3940 | 5.3860 | 0.9925 |

| Sweden | 5.630 | 5.8395 | 7.1460 | 4.1880 | 0.8936 |

| United Kingdom | 8.428 | 9.2155 | 10.1260 | 5.6620 | 1.4634 |

| All | 7.6708 | 7.6800 | 14.2400 | 2.9630 | 2.5178 |

| Energy consumption per capita | |||||

| Austria | 47,311.500 | 47,493.130 | 50,621.480 | 44,369.910 | 1932.522 |

| Belgium | 68,751.920 | 71,212.180 | 74,007.260 | 59,524.370 | 4603.571 |

| Bulgaria | 29,485.310 | 29,768.040 | 32,565.310 | 26,584.990 | 1732.751 |

| Croatia | 22,599.890 | 22,467.170 | 24,910.580 | 18,803.770 | 1707.007 |

| Czechia | 47,111.540 | 46,838.950 | 51,297.280 | 43,317.380 | 2363.869 |

| Denmark | 41,966.840 | 43,137.500 | 55,056.310 | 33,821.550 | 5669.903 |

| Finland | 66,163.810 | 67,560.850 | 75,468.200 | 57,559.990 | 5343.702 |

| France | 47,892.640 | 49,128.840 | 52,299.910 | 41,553.880 | 3764.403 |

| Germany | 47,623.970 | 48,144.880 | 50,310.620 | 44,902.430 | 1725.549 |

| Greece | 33,146.000 | 33,305.590 | 38,311.690 | 28,991.960 | 2894.166 |

| Hungary | 27,754.950 | 27,891.580 | 30,463.140 | 24,560.780 | 1477.280 |

| Ireland | 41,061.590 | 39,861.870 | 47,597.050 | 35,287.920 | 4000.771 |

| Italy | 33,896.820 | 34,082.120 | 37,656.210 | 28,650.490 | 2990.222 |

| Latvia | 19,617.380 | 19,974.920 | 24,388.020 | 15,624.210 | 2404.568 |

| Lithuania | 25,660.330 | 26,491.140 | 30,174.540 | 20,430.440 | 3397.808 |

| Netherlands | 63,313.490 | 64,235.200 | 68,190.150 | 57,127.700 | 3409.888 |

| Poland | 28,907.000 | 29,015.260 | 32,106.320 | 25,954.790 | 1621.946 |

| Portugal | 27,347.220 | 27,618.870 | 29,169.070 | 23,912.120 | 1485.646 |

| Romania | 20,334.800 | 19,987.840 | 24,050.500 | 18,010.160 | 1662.873 |

| Slovakia | 37,538.000 | 38,383.720 | 41,549.630 | 32,904.990 | 2714.350 |

| Slovenia | 40,097.580 | 39,838.040 | 45,695.760 | 35,576.910 | 2113.526 |

| Spain | 36,040.360 | 35,439.760 | 40,828.320 | 30,471.460 | 3066.714 |

| Sweden | 67,374.460 | 67,624.710 | 77,932.240 | 60,350.690 | 5402.208 |

| United Kingdom | 40,719.390 | 43,095.160 | 45,930.370 | 32,950.190 | 4771.765 |

| All | 40,071.530 | 37,581.430 | 77,932.240 | 15,624.210 | 14,792.970 |

| Low-carbon share in energy consumption | |||||

| Austria | 30.213 | 29.908 | 34.771 | 23.867 | 2.815 |

| Belgium | 18.144 | 17.856 | 20.743 | 15.612 | 1.344 |

| Bulgaria | 25.020 | 25.408 | 29.446 | 19.951 | 2.616 |

| Croatia | 18.997 | 18.731 | 26.817 | 11.702 | 3.838 |

| Czechia | 14.940 | 15.031 | 21.147 | 8.367 | 4.504 |

| Denmark | 12.879 | 11.408 | 27.821 | 1.996 | 8.016 |

| Finland | 36.065 | 35.499 | 44.213 | 28.960 | 4.290 |

| France | 45.568 | 44.771 | 50.226 | 42.309 | 2.051 |

| Germany | 16.354 | 16.669 | 20.913 | 12.545 | 2.429 |

| Greece | 5.933 | 4.130 | 12.443 | 2.127 | 3.503 |

| Hungary | 15.614 | 14.530 | 19.756 | 10.827 | 2.604 |

| Ireland | 5.305 | 3.617 | 13.708 | 1.517 | 4.023 |

| Italy | 9.829 | 7.058 | 18.470 | 5.957 | 4.336 |

| Latvia | 19.554 | 19.416 | 28.696 | 12.567 | 3.360 |

| Lithuania | 23.960 | 30.015 | 42.601 | 3.625 | 14.490 |

| Netherlands | 3.256 | 3.036 | 6.427 | 1.236 | 1.484 |

| Poland | 2.424 | 1.263 | 5.890 | 0.490 | 2.051 |

| Portugal | 17.599 | 15.899 | 29.068 | 7.504 | 6.485 |

| Romania | 16.818 | 15.438 | 25.493 | 8.403 | 5.197 |

| Slovakia | 26.480 | 26.930 | 31.110 | 20.418 | 2.990 |

| Slovenia | 31.492 | 31.015 | 40.579 | 28.455 | 2.667 |

| Spain | 21.045 | 19.515 | 28.449 | 15.142 | 4.129 |

| Sweden | 63.247 | 62.189 | 68.632 | 57.317 | 3.323 |

| United Kingdom | 12.102 | 10.568 | 20.351 | 8.068 | 3.501 |

| All | 20.535 | 18.002 | 68.632 | 0.490 | 14.334 |

| Real GDP per capita | |||||

| Austria | 44,689.460 | 46,037.610 | 50,051.790 | 36,537.990 | 3999.165 |

| Belgium | 42,063.060 | 43,374.590 | 47,035.610 | 34,767.030 | 3629.123 |

| Bulgaria | 5969.732 | 6256.195 | 8674.723 | 3784.078 | 1566.777 |

| Croatia | 12,826.390 | 13,658.710 | 15,971.150 | 8619.096 | 2128.203 |

| Czechia | 18,276.500 | 19,414.360 | 23,800.970 | 13,566.920 | 3176.473 |

| Denmark | 57,559.760 | 58,264.600 | 64,271.880 | 49,122.870 | 3899.367 |

| Finland | 43,471.140 | 45,454.490 | 49,440.860 | 31,901.710 | 5135.951 |

| France | 39,663.050 | 40,395.510 | 43,720.030 | 33,917.930 | 2690.277 |

| Germany | 40,686.490 | 40,084.520 | 47,313.850 | 34,786.730 | 3880.285 |

| Greece | 24,519.480 | 23,411.040 | 30,054.890 | 19,909.530 | 3021.265 |

| Hungary | 12,613.080 | 13,172.220 | 16,793.380 | 8970.048 | 2208.242 |

| Ireland | 49,952.590 | 48,692.480 | 76,662.670 | 29,694.650 | 11,535.300 |

| Italy | 35,607.650 | 35,494.130 | 38,272.200 | 32,863.960 | 1586.202 |

| Latvia | 10,729.270 | 11,523.270 | 16,263.230 | 5147.244 | 3522.757 |

| Lithuania | 11,056.350 | 11,529.310 | 17,742.260 | 5328.749 | 3844.399 |

| Netherlands | 48,524.830 | 50,283.700 | 54,894.130 | 38,676.070 | 4393.476 |

| Poland | 11,089.680 | 10,947.350 | 16,648.770 | 6549.133 | 2995.672 |

| Portugal | 21,600.920 | 21,833.720 | 24,085.420 | 18,059.220 | 1396.508 |

| Romania | 7415.211 | 7698.739 | 11,540.620 | 4775.307 | 2143.346 |

| Slovakia | 14,430.910 | 15,093.730 | 20,551.110 | 8731.685 | 3819.491 |

| Slovenia | 21,521.190 | 22,856.180 | 26,760.480 | 15,141.930 | 3361.130 |

| Spain | 29,473.240 | 30,092.310 | 32,949.080 | 23,737.480 | 2553.243 |

| Sweden | 49,575.650 | 51,321.590 | 57,911.230 | 37,870.920 | 6200.384 |

| United Kingdom | 38,497.420 | 39,583.660 | 43,324.050 | 30,679.540 | 3691.444 |

| All | 28,825.540 | 27,656.460 | 76,662.670 | 3784.078 | 16,368.810 |

| Foreign direct investments | |||||

| Austria | 106,328.10 | 127,422.50 | 201,902.30 | 19,000.69 | 67,253.70 |

| Belgium | 390,538.00 | 432,849.30 | 810,944.20 | 112,960.00 | 194,546.60 |

| Bulgaria | 25,978.79 | 30,709.12 | 50,960.16 | 445.47 | 21,343.08 |

| Croatia | 18,238.49 | 24,508.99 | 42,136.49 | 495.92 | 13,411.79 |

| Czechia | 80,783.75 | 96,124.48 | 164,224.50 | 7350.06 | 53,422.05 |

| Denmark | 80,237.19 | 92,938.44 | 116,993.30 | 22,267.80 | 28,890.02 |

| Finland | 58,932.20 | 71,035.70 | 96,640.81 | 8155.02 | 32,223.42 |

| France | 521,245.60 | 580,144.00 | 820,572.30 | 184,215.00 | 203,652.20 |

| Germany | 709,648.00 | 788,122.30 | 1,077,019.00 | 235,254.20 | 266,116.00 |

| Greece | 25,693.91 | 24,690.27 | 53,220.81 | 10,970.80 | 11,253.53 |

| Hungary | 64,817.83 | 81,427.19 | 109,150.30 | 11,303.52 | 34,276.10 |

| Ireland | 320,985.40 | 205,664.70 | 1,057,987.00 | 44,186.51 | 308,057.80 |

| Italy | 257,675.60 | 320,187.30 | 428,272.40 | 65,349.97 | 124,544.10 |

| Latvia | 8231.40 | 9189.09 | 17,543.35 | 615.46 | 6068.02 |

| Lithuania | 10,245.66 | 12,443.86 | 19,554.59 | 352.00 | 7082.88 |

| Netherlands | 664,556.50 | 570,412.40 | 1,692,647.00 | 110,755.90 | 499,649.80 |

| Poland | 119,263.10 | 132,104.60 | 238,482.80 | 7843.19 | 81,568.90 |

| Portugal | 90,191.59 | 105,091.90 | 165,356.60 | 18,591.69 | 49,249.59 |

| Romania | 43,301.50 | 53,063.15 | 92,887.18 | 821.00 | 34,153.24 |

| Slovakia | 32,745.26 | 42,290.67 | 59,508.90 | 1297.10 | 21,961.47 |

| Slovenia | 8468.51 | 9761.54 | 17,349.14 | 1808.39 | 4971.20 |

| Spain | 427,097.40 | 511,549.40 | 735,506.50 | 105,722.80 | 224,577.90 |

| Sweden | 223,944.00 | 255,976.70 | 396,179.70 | 31,042.62 | 129,278.20 |

| United Kingdom | 934,092.50 | 968,693.90 | 1,930,484.00 | 199,771.80 | 533,783.70 |

| All | 217,635.00 | 85,934.33 | 1,930,484.00 | 352.00 | 317,413.20 |

| Exports | |||||

| Austria | 164,657.40 | 182,254.50 | 253,738.70 | 81,455.89 | 63,301.74 |

| Belgium | 318,656.50 | 326,188.10 | 448,408.40 | 192,360.80 | 90,579.40 |

| Bulgaria | 21,379.29 | 22,115.44 | 43,544.76 | 5794.81 | 13,235.10 |

| Croatia | 18,251.85 | 20,798.75 | 30,734.35 | 6971.82 | 7756.15 |

| Czechia | 101,696.70 | 110,011.30 | 191,473.90 | 28,175.79 | 57,742.70 |

| Denmark | 131,044.20 | 146,344.00 | 197,966.80 | 62,168.04 | 50,541.73 |

| Finland | 80,215.30 | 83,427.55 | 128,210.40 | 47,615.81 | 25,120.82 |

| France | 613,028.90 | 653,658.00 | 906,005.90 | 362,551.70 | 198,607.00 |

| Germany | 1218,323.00 | 1,318,181.00 | 1870,154.00 | 592,281.90 | 488,111.10 |

| Greece | 50,654.34 | 58,589.85 | 82,115.31 | 17,808.40 | 21,738.74 |

| Hungary | 79,782.63 | 92,089.61 | 134,234.30 | 18,063.17 | 41,313.14 |

| Ireland | 195,670.70 | 195,504.50 | 458,422.20 | 49,396.85 | 114,968.90 |

| Italy | 473,180.80 | 505,306.20 | 656,466.70 | 293,608.30 | 138,602.10 |

| Latvia | 10,231.27 | 9987.12 | 21,106.02 | 2084.83 | 6634.88 |

| Lithuania | 19,156.27 | 18,534.40 | 40,399.55 | 3184.94 | 12,862.45 |

| Netherlands | 498,985.90 | 537,224.80 | 822,982.00 | 240,686.90 | 210,983.20 |

| Poland | 148,030.80 | 150,640.30 | 325,560.70 | 35,711.26 | 94,856.49 |

| Portugal | 62,716.99 | 65,254.17 | 105,302.20 | 32,087.02 | 24,839.83 |

| Romania | 43,791.51 | 40,692.95 | 101,091.30 | 9405.27 | 30,513.83 |

| Slovakia | 51,814.94 | 56,367.84 | 101,452.50 | 10,895.02 | 33,567.06 |

| Slovenia | 24,986.94 | 27,439.81 | 45,797.06 | 10,358.76 | 12,000.90 |

| Spain | 312,238.10 | 334,147.50 | 499,138.20 | 133,482.10 | 125,961.40 |

| Sweden | 181,483.40 | 193,734.00 | 260,921.90 | 94,857.15 | 64,223.53 |

| United Kingdom | 613,860.70 | 657,149.00 | 876,134.30 | 318,737.80 | 194,844.10 |

| All | 226,410.00 | 99,804.65 | 1,870,154.00 | 2084.83 | 308,443.40 |

| Imports | |||||

| Austria | 155,662.60 | 168,598.10 | 237,317.50 | 83,271.82 | 57,236.83 |

| Belgium | 310,788.30 | 318,859.10 | 449,293.00 | 181,167.00 | 97,284.57 |

| Bulgaria | 22,863.43 | 26,777.98 | 41,535.46 | 5730.30 | 13,393.17 |

| Croatia | 20,042.39 | 22,955.87 | 33,852.26 | 9152.32 | 7658.06 |

| Czechia | 96,865.43 | 103,804.40 | 176,637.20 | 30,008.80 | 51,535.32 |

| Denmark | 116,889.60 | 134,109.00 | 177,851.20 | 56,464.35 | 45,655.77 |

| Finland | 74,307.33 | 84,531.93 | 117,562.00 | 37,115.57 | 28,973.11 |

| France | 618,783.70 | 674,788.20 | 936,045.80 | 322,358.40 | 228,631.60 |

| Germany | 1,074,005.00 | 1,153,768.00 | 1,627,473.00 | 563,558.20 | 399,074.30 |

| Greece | 63,311.09 | 66,478.02 | 121,503.90 | 24,420.88 | 26,282.70 |

| Hungary | 76,725.98 | 89,848.10 | 127,330.50 | 18,856.16 | 37,535.22 |

| Ireland | 161,753.30 | 168,311.10 | 335,538.50 | 43,734.03 | 89,761.84 |

| Italy | 452,465.90 | 489,604.00 | 669,946.60 | 253,229.40 | 144,366.00 |

| Latvia | 11,470.92 | 12,287.15 | 21,168.61 | 2191.94 | 6764.64 |

| Lithuania | 20,159.62 | 20,400.74 | 39,373.53 | 3898.94 | 12,524.27 |

| Netherlands | 441,593.30 | 471,415.40 | 732,271.50 | 215,125.10 | 181,988.30 |

| Poland | 150,062.00 | 155,750.90 | 305,661.90 | 33,821.83 | 88,627.72 |

| Portugal | 71,615.10 | 79,543.12 | 107,549.50 | 39,536.59 | 22,217.28 |

| Romania | 50,610.07 | 54,116.40 | 108,700.70 | 11,307.55 | 32,368.09 |

| Slovakia | 51,894.84 | 57,695.64 | 100,620.20 | 10,643.54 | 32,155.31 |

| Slovenia | 24,061.18 | 26,980.13 | 41,120.95 | 10,592.13 | 10,769.26 |

| Spain | 319,897.60 | 366,190.90 | 506,419.10 | 133,516.80 | 122,715.30 |

| Sweden | 159,635.00 | 166,907.10 | 242,699.40 | 80,559.03 | 60,214.26 |

| United Kingdom | 655,061.70 | 713,073.80 | 917,328.60 | 326,578.70 | 207,056.20 |

| All | 216,688.60 | 92,991.14 | 1,627,473.00 | 2191.94 | 284,395.80 |

Source: Authors’ calculations.

Appendix B

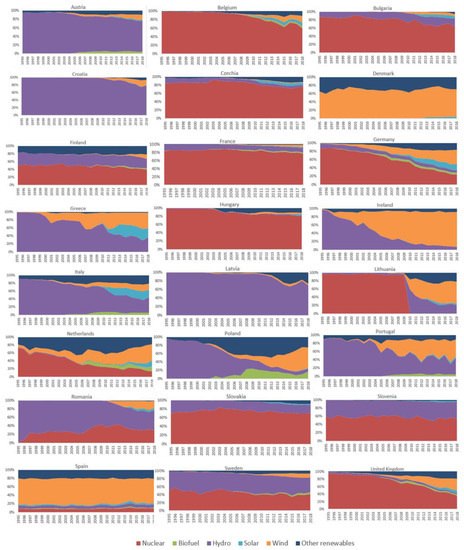

Figure A1.

Low-carbon energy consumption mix in EU, individual countries (1995–2018). Source: Authors’ calculations based on Our World in Data based on Global Carbon Project; BP, Maddison; UNWPP—https://ourworldindata.org/per-capita-co2 [Accessed on 3 February 2021]. Hannah Ritchie and Max Roser (2020)—“Energy”. Published online at OurWorldInData.org. Retrieved from: ‘https://ourworldindata.org/energy’ (Online Resource) [Accessed on 3 February 2021]. Authors’ representation.

References

- Official Journal of the European Union. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32003L0087 (accessed on 20 February 2021).

- Ellerman, A.D.; Buchner, B.K. The European Union Emissions Trading Scheme: Origins, Allocation, and Early Results. Rev. Environ. Econ. Policy 2007, 1, 66–87. [Google Scholar] [CrossRef]

- Official Journal of the European Union. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2018.156.01.0026.01.ENG (accessed on 20 February 2021).

- Rubio, E.V.; Rubio, J.M.Q.; Moreno, V.M. Convergence analysis of environmental fiscal pressure across EU-15 countries. Energy Environ. 2015, 26, 789–802. [Google Scholar] [CrossRef]

- European Environment Agency. Available online: https://www.eea.europa.eu/publications/92-9167-000-6 (accessed on 7 May 2021).

- European Commission. Available online: https://ec.europa.eu/taxation_customs/consultations-get-involved/tax-consultations/green-paper-market-based-instruments-environment-related-policy-purposes_en (accessed on 6 May 2021).

- Rubio, E.V.; Rubio, J.M.Q.; Moreno, V.M. Environmental fiscal effort: Spatial convergence within economic policy on taxation. Rev. Econ. Mund. 2017, 45, 87–100. [Google Scholar]

- European Commission. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1576150542719&uri=COM%3A2019%3A640%3AFIN (accessed on 23 February 2021).

- Dogan, E.; Seker, F. Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Bulai, V.C.; Horobet, A. Assessing the Local Developmental Impact of Hydrocarbon Exploitation in a Mature Region: A Random Forest Approach. Eur. J. Interdiscip. Stud. 2019, 11. [Google Scholar] [CrossRef]

- Barbu, L. How Does the Romanian State Support the Increase of Energy Efficiency of Buildings by Using Public Funds? Stud. Bus. Econ. 2020, 15, 5–17. [Google Scholar] [CrossRef]

- Euractiv. Available online: https://www.euractiv.com/section/energy-environment/news/macron-orban-urge-eu-to-actively-support-nuclear-power/ (accessed on 11 March 2021).

- Zhu, H.; Duan, L.; Guo, Y.; Yu, K. The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: Evidence from panel quantile regression. Econ. Model. 2016, 58, 237–248. [Google Scholar] [CrossRef]

- Ozcan, B.; Tzeremes, P.G.; Tzeremes, N.G. Energy consumption, economic growth and environmental degradation in OECD countries. Econ. Model. 2020, 84, 203–213. [Google Scholar] [CrossRef]

- Leitão, N.C.; Lorente, D.B. The linkage between economic growth, renewable energy, tourism, CO2 emissions, and international trade: The evidence for the European Union. Energies 2020, 13, 4838. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Ag14reement; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar] [CrossRef]

- Bölük, G.; Mert, M. Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: Evidence from a panel of EU (European Union) countries. Energy 2014, 74, 439–446. [Google Scholar]