Regulation, Innovation, and Systems Integration: Evidence from the EU

Abstract

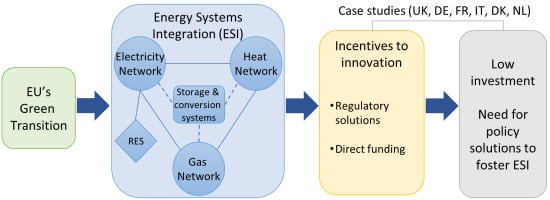

1. Introduction

2. Regulatory Instruments: Insights from the Economic Literature

2.1. Controlling the Price

2.2. Efficient Investments

2.3. Investment in Infrastructure

2.4. A Focus on Outputs

2.5. Investment in Innovation—Input- vs. Output-Based Incentives

3. Incentives to Innovation and Investments in ESI in the EU

3.1. United Kingdom

- (1)

- A shortening of the price control length from 8 to 5 years, as in the current regulatory period the high uncertainty in the energy sector generated unreliable assumptions and forecasts, which led to allowances being set too high and performance targets too low;

- (2)

- An increase in innovation delivered through business as usual while keeping the innovation stimulus package. While the NIA was generally considered useful by stakeholders as it increases collaboration between network operators, some stakeholders pointed out a diminishing interest in the NIC. The IRM is also under scrutiny because a shorter price control period reduces its usefulness;

- (3)

- An overall simplification of the price control, especially regarding how outputs and costs are set.

3.2. Germany

3.3. France

3.4. Italy

3.5. Denmark

3.6. The Netherlands

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| ACM | Authority for Consumers and Markets |

| ARERA | Autorità di Regolazione per Energia Reti e Ambiente |

| CHP | Combined Heat and Power |

| CRE | Commission de Régulation de l’Énergie |

| DERA | Danish Energy Regulatory Authority |

| DG | Distributed Generation |

| DH | District Heating |

| DKK | Danish Krone |

| DR | Demand Response |

| DSO | Distribution System Operator |

| DUR | Danish Utility Authority |

| EB | Electric Battery |

| EDUP | Energy Technology Development and Demonstration Program |

| ENTSO-E | European Network of Transmission System Operators for Electricity |

| ENTSOG | European Network of Transmission System Operators for Gas |

| ESI | Energy Systems Integration |

| EU | European Union |

| ICT | Information and Communications Technology |

| IRM | Innovation Roll-out Mechanism |

| NIA | Network Innovation Allowance |

| NIC | Network Innovation Competition |

| P2G | Power To Gas |

| PV | Photovoltaics |

| R&D | Research And Development |

| RAB | Regulatory Asset Base |

| RD&D | Research, Development and Demonstration |

| RES | Renewable Energy Sources |

| RIIO | Revenue equals Incentives plus Innovation plus Outputs |

| SG | Smart Grids |

| TSO | Transmission System Operator |

| UK | United Kingdom |

| WACC | Weighted Average Cost of Capital |

Appendix A

Appendix B

References

- European Commission. A European Green Deal. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en (accessed on 3 March 2020).

- European Commission. Communication from the Commission to the European Parliament the Council. The European Economic and Social Committee and the Committee of the Regions COM(2019) 640 Final; The European Green Deal: Brussels, Belgium, 2019; pp. 1–24. [Google Scholar]

- Gowrisankaran, G.; Reynolds, S.S.; Samano, M. Intermittency and the Value of Renewable Energy. J. Political Econ. 2016, 124, 1187–1234. [Google Scholar] [CrossRef]

- Ruester, S.; Schwenen, S.; Batlle, C.; Pérez-Arriaga, I. From distribution networks to smart distribution systems: Rethinking the regulation of European electricity DSOs. Util. Policy 2014, 31, 229–237. [Google Scholar] [CrossRef]

- Cambini, C.; Soroush, G. Designing grid tariffs in the presence of distributed generation. Util. Policy 2019, 61, 100979. [Google Scholar] [CrossRef]

- Bauknecht, D.; Brunekreeft, G. Distributed Generation and the Regulation of Electricity Networks. In Competitive Electricity Markets; Elsevier Global Energy Policy and Economics Series; Elsevier: Oxford, UK, 2008; pp. 469–497. [Google Scholar]

- Brown, T.; Schlachtberger, D.; Kies, A.; Schramm, S.; Greiner, M. Synergies of sector coupling and transmission reinforcement in a cost-optimised, highly renewable European energy system. Energy 2018, 160, 720–739. [Google Scholar] [CrossRef]

- Kroposki, B.; Garrett, B.; MacMillan, S.; Rice, B.; Komomua, C.; O’Malley, M.; Zimmerle, D. Energy Systems Integration: A Convergence of Ideas; National Renewable Energy Laboratory: Golden, CO, USA, 2012.

- O’Malley, M.; Kroposki, B.; Hannegan, B.; Madsen, H.; Andersson, M.; D’haeseleer, W.; McGranaghan, M.F.; Dent, C.; Strbac, G.; Baskaran, S.; et al. Energy Systems Integration. Defining and Describing the Value Proposition; National Renewable Energy Laboratory: Golden, CO, USA, 2016.

- Ruth, M.F.; Kroposki, B. Energy Systems Integration: An Evolving Energy Paradigm. Electr. J. 2014, 27, 36–47. [Google Scholar] [CrossRef]

- Badami, M.; Fambri, G. Optimising energy flows and synergies between energy networks. Energy 2019, 173, 400–412. [Google Scholar] [CrossRef]

- Jamasb, T.; Llorca, M. Energy Systems Integration: Economics of a New Paradigm. Econ. Energy Environ. Policy 2019, 8, 7–28. [Google Scholar] [CrossRef]

- Cambini, C.; Congiu, R.; Jamasb, T.; Llorca, M.; Soroush, G. Energy Systems Integration: Implications for Public Policy; Working Paper No. 2-2020; Department of Economics, Copenhagen Business School: Frederiksberg, Denmark, 2020. [Google Scholar]

- ENTSO-E. ENTSOG TYNDP 2020 Scenario Report. Available online: https://www.entsos-tyndp2020-scenarios.eu/ (accessed on 23 March 2020).

- Joskow, P.L. Regulation of Natural Monopoly. In Handbook of Law and Economics; Polinsky, A.M., Shavell, S., Eds.; Elsevier: Oxford, UK, 2007; Volume 2, pp. 1227–1348. [Google Scholar]

- Baldwin, R.; Cave, M.; Lodge, M. Understanding Regulation: Theory, Strategy, and Practice, 2nd ed.; Oxford University Press: New York, NY, USA, 2012. [Google Scholar]

- Cambini, C.; Rondi, L. Incentive regulation and investment: Evidence from European energy utilities. J. Regul. Econ. 2010, 38, 1–26. [Google Scholar] [CrossRef]

- Poudineh, R.; Jamasb, T. Investment and Efficiency under Incentive Regulation: The Case of the Norwegian Electricity Distribution Networks; Cambridge Working in Economics, CWPE 1310; University of Cambridge: Cambridge, UK, 2013. [Google Scholar]

- Cullmann, A.; Nieswand, M. Regulation and investment incentives in electricity distribution: An empirical assessment. Energy Econ. 2016, 57, 192–203. [Google Scholar] [CrossRef]

- Averch, H.; Johnson, L.L. Behavior of the Firm under Regulatory Constraint. Am. Econ. Rev. 1962, 52, 1052–1069. [Google Scholar]

- Armstrong, M.; Sappington, D.E.M. Regulation, Competition and Liberalization. J. Econ. Lit. 2006, 44, 325–366. [Google Scholar] [CrossRef]

- Jamison, M.A. Regulation: Price Cap and Revenue Cap; Social Science Research Network: Rochester, NY, USA, 2007. [Google Scholar]

- Shleifer, A. A Theory of Yardstick Competition. RAND J. Econ. 1985, 16, 319–327. [Google Scholar] [CrossRef]

- Incentive Regulation: Evidence from German Electricity Networks. Available online: http://hdl.handle.net/10419/191982 (accessed on 31 March 2020).

- Müller, C. Advancing Regulation with Respect to Dynamic Efficient Network Investments: Insights from the United Kingdom and Italy. Compet. Regul. Netw. Ind. 2012, 13, 256–272. [Google Scholar] [CrossRef]

- Ofgem. Financial Model Manual—Distribution Price Control Review 5 (DPCR5); Procedure; Office of Gas and Electricity Markets: London, UK, 2009.

- Égert, B. Infrastructure investment in network industries: The role of incentive regulation and regulatory independence. CESifo Work. Pap. No. 2642 2009. [Google Scholar]

- Cambini, C.; Croce, A.; Fumagalli, E. Output-based incentive regulation in electricity distribution: Evidence from Italy. Energy Econ. 2014, 45, 205–216. [Google Scholar] [CrossRef]

- Ofgem. Handbook for Implementing the RIIO Model; Handbook; Office of Gas and Electricity Markets: London, UK, 2010.

- Glachant, J.-M.; Khalfallah, H.; Perez, Y.; Rious, V.; Saguan, M. Implementing Incentive Regulation and Regulatory Alignment with Resource Bounded Regulators. Compet. Regul. Netw. Ind. 2013, 14, 265–290. [Google Scholar] [CrossRef]

- Jamasb, T.; Pollitt, M. Liberalisation and R&D in network industries: The case of the electricity industry. Res. Policy 2008, 37, 995–1008. [Google Scholar]

- Moisés Costa, P.; Bento, N.; Marques, V. The Impact of Regulation on a Firm’s Incentives to Invest in Emergent Smart Grid Technologies. Energy J. 2017, 38. [Google Scholar] [CrossRef]

- Lo Schiavo, L.; Delfanti, M.; Fumagalli, E.; Olivieri, V. Changing the regulation for regulating the change: Innovation-driven regulatory developments for smart grids, smart metering and e-mobility in Italy. Energy Policy 2013, 57, 506–517. [Google Scholar] [CrossRef]

- Bauknecht, D. Incentive Regulation and Network Innovations, EUI RSCAS, 2011/02, Loyola de Palacio Programme on Energy Policy; European University Institute: Florence, Italy, 2011. [Google Scholar]

- Ofgem. The Network Innovation Review: Our Policy Decision; Final Decision; Office of Gas and Electricity Markets: London, UK, 2017.

- Pöyry. An Independent Evaluation of the LCNF—A Report to Ofgem; Pöyry Management Consulting: London, UK, 2016. [Google Scholar]

- Ofgem. Decision on Strategy for the Next Transmission and Gas Distribution Price Controls—RIIO-T1 and GD1 Business Plans, Innovation and Efficiency Incentives; Supplementary Annex (RIIO-T1 and GD1 Overview Papers); Office of Gas and Electricity Markets: London, UK, 2011.

- Ofgem. Electricity Network Innovation Allowance Governance Document—v3; Governance Document v.3; Office of Gas and Electricity Markets: London, UK, 2017.

- Ofgem. Gas Network Innovation Allowance Governance Document—v3; Governance Document v.3; Office of Gas and Electricity Markets: London, UK, 2017.

- Ofgem. Electricity Network Innovation Competition Governance Document—v3; Governance Document v.3; Office of Gas and Electricity Markets: London, UK, 2017.

- Ofgem. Gas Network Innovation Competition Governance Document—v3; Governance Document v.3; Office of Gas and Electricity Markets: London, UK, 2017.

- ENA Smarter Networks Portal|Smart Grid Projects UK. Available online: https://www.smarternetworks.org/ (accessed on 3 March 2020).

- Ofgem. Assessment of Benefits from the Rollout of Proven Innovations through the Innovation Roll-Out Mechanism (IRM); Decisions; Office of Gas and Electricity Markets: London, UK, 2015.

- Ofgem. RIIO-2 Framework Decision; Decisions; Office of Gas and Electricity Markets: London, UK, 2018.

- Ofgem. RIIO-2 Sector Specific Methodology Consultation; Consultation; Office of Gas and Electricity Markets: London, UK, 2018.

- Verordnung über die Anreizregulierung der Energieversorgungsnetze. Available online: https://www.global-regulation.com/translation/germany/384896/ordinance-on-the-incentive-regulation-of-energy-distribution-networks.html (accessed on 31 March 2020).

- BMWi. Innovations for the Energy Transition—7th Energy Research Programme of the Federal Government; Federal Ministry for Economic Affairs and Energy: Berlin, Germany, 2018; p. 96.

- CRE. Délibération de la Commission de Régulation de L’énergie du 10 Mars 2016 Portant Décision sur le Tarif péréqué D’utilisation des Réseaux publics de Distribution de gaz Naturel de GRDF; Délibération; Commission de Régulation de l’Energie: Paris, France, 2016. [Google Scholar]

- CRE. Délibération de la Commission de Régulation de L’énergie du 17 Novembre 2016 Portant décision sur les Tarifs D’utilisation des Réseaux Publics D’électricité dans le Domaine de Tension HTB; Délibération; Commission de Régulation de l’Energie: Paris, France, 2016. [Google Scholar]

- CRE. Délibération de la Commission de Régulation de L’énergie du 15 Décembre 2016 Portant Décision sur le Tarif D’utilisation des Réseaux de Transport de gaz Naturel de GRTgaz et de TIGF; Délibération; Commission de Régulation de l’Energie: Paris, France, 2016. [Google Scholar]

- CRE. Délibération de la Commission de Régulation de L’énergie du 14 Juin 2018 Portant Projet de Décision sur les Tarifs D’utilisation des Réseaux publics D’électricité dans les Domaines de Tension HTA et BT; Délibération 2018-117; Commission de Régulation de l’Energie: Paris, France, 2018. [Google Scholar]

- AEEGSI. Deliberazione 23 Dicembre 2015—654/2015/R/EEL—Regolazione Tariffaria dei Servizi di Trasmissione, Distribuzione e Misura Dell’energia Elettrica, per il Periodo di Regolazione 2016-2023; Autorità per l’energia elettrica il gas ed il sistema idrico: Milan, Italy, 2015. [Google Scholar]

- AEEGSI. Deliberazione 24 Luglio 2014—367/2014/R/GAS—Regolazione Tariffaria dei Servizi di Distribuzione e Misura del gas per il Periodo di Regolazione 2014–2019 per le Gestioni D’ambito e Altre Disposizioni in Materia Tariffaria; Autorità per l’energia elettrica il gas ed il sistema idrico: Milan, Italy, 2014. [Google Scholar]

- ARERA. Documento per la Consultazione—512/2018/R/GAS—Criteri di Regolazione Tariffaria per il Servizio di Trasporto e Misura del Gas Naturale per il Quinto Periodo di Regolazione (5prt); Autorità di regolazione per energia reti e ambiente: Milan, Italy, 2018. [Google Scholar]

- AEEGSI. Documento per la Consultazione—683/2017/R/EEL—Applicazione Dell’approccio Totex nel Settore Elettrico. Primi Orientamenti per L’introduzione di Schemi di Regolazione Incentivante Fondati sul Controllo Complessivo Della Spesa; Autorità per l’energia elettrica il gas ed il sistema idrico: Milan, Italy, 2017. [Google Scholar]

- AEEG. Deliberazione 25 Marzo 2010—ARG/elt 39/10—Procedura e Criteri di Selezione Degli Investimenti Ammessi al Trattamento Incentivante di cui al Comma 11.4 Lettera d) Dell’Allegato A alla Deliberazione Dell’Autorità per L’energia Elettrica e il gas 29 Dicembre 2007, n. 348/07; Autorità per l’energia elettrica e il gas: Milan, Italy, 2010. [Google Scholar]

- DUR. National Report on Denmark Status for 2017; Danish Utility Regulator: Copenhagen, Denmark, 2018. [Google Scholar]

- CEER. Report on Regulatory Frameworks for European Energy Networks 2019; Council of European Energy Regulators: Brussels, Belgium, 2020. [Google Scholar]

- Energinet. System Plan 2018—Electricity and Gas in Denmark; Energinet: Fredericia, Denmark, 2018. [Google Scholar]

- Geothermica Denmark—EUDP—Energy Development and Demonstration Programme. Available online: http://www.geothermica.eu/about-geothermica/participants/denmark/ (accessed on 3 March 2020).

- Uddannelses-og Forskningsministeriet Innovation Fund Denmark: Report of the International Evaluation Panel 2019; Ministry of Higher Education and Science: Copenhagen, Denmark, 2019.

- DEA. Reporting Obligation According to Article 10 (2) of Directive no 2013/31/eu of the European Parliament and of the Council 2014; Danish Energy Agency: Copenhagen, Denmark, 2014. [Google Scholar]

- Patronen, J.; Kaura, E.; Torvestad, C. Nordic Heating and Cooling: Nordic Approach to EU’s Heating and Cooling Strategy; Nordic Council of Ministers: Copenhagen, Denmark, 2017. [Google Scholar]

- IEA. Energy Policies of IEA Countries—Denmark 2017 Review; International Energy Agency: Paris, France, 2017; p. 213. [Google Scholar]

- IEA. Energy Technology RD&D Budgets 2019; International Energy Agency: Paris, France, 2019. [Google Scholar]

| Category | No. Projects | Budget (£m) | Avg. Budget (£m) |

|---|---|---|---|

| Electric and hydrogen vehicles | 5 | 11.0 | 2.2 |

| Smart grids | 13 | 65.5 | 5.0 |

| Storage systems | 2 | 2.9 | 1.4 |

| Energy systems integration | 1 | 5.2 | 5.2 |

| Others | 97 | 467.4 | 4.8 |

| Total | 118 | 552.1 | 4.7 |

| Project Category | Project | Incentive Mechanism | Source of Funding | Total Budget | Main Stakeholders |

|---|---|---|---|---|---|

| Smart grids | SINTEG | Grants | National funds (up to €230 million) and private funds | €600 million | TSO and DSO |

| Storage | Energy Storage Funding Initiative—R&D and demonstration of storage technologies | Grants and privately matched funds | National and private funds | €200 million | TSO, DSO, and consumers |

| KfW Bank—loans for electric batteries (EBs) | Low-interest loans | Government-owned development bank | €80 million | Consumers | |

| Conversion | CHP Act | Surcharge to electricity from CHP | Increase in network tariffs | Max annual fund of €1.5 billion | Generators |

| Project Category | Project | Incentive Mechanism | Source of Funding | Total Budget | Main Stakeholders |

|---|---|---|---|---|---|

| Smart grids | SMILE, FlexGrid | Grants and adjustment to the revenue allowance | EU and national funds and increase in network tariffs | €640 million | TSO and DSO |

| SG pilot projects | Grants and adjustment to the revenue allowance | National funds and increase in network tariffs | €192 million | TSO and DSO | |

| Storage | 11 pilot projects in isolated networks and RINGO project | Adjustment to the revenue allowance | Increase in network tariffs | €160 million | TSO and DSO |

| Conversion | Jupiter 1000 project | Grants | EU, national and private funds | €30 million | TSO |

| Project Category | Project | Incentive Mechanism | Source of Funding | Total Budget | Main Stakeholders |

|---|---|---|---|---|---|

| Smart grids—integration of DG | SG pilot projects | +2% WACC for 12 years | Increase in network tariffs | €17.4 million | DSOs |

| e-Distribuzione—SG projects | Grants | National Operational Program (PON): EU + national funds | €180 million | DSO | |

| 2G smart meters | e-Distribuzione—Open Meter project | No incentive (mandatory) | Increase in metering tariffs | €3.9 billion | DSO |

| Conversion and storage systems | Terna S.p.A.—Project Lab and Large-Scale Energy Storage pilot projects | +2% WACC for 12 years | Increase in network tariffs | €253 million | TSO |

| Project Category | Project | Incentive Mechanism | Source of Funding | Total Budget | Main Stakeholders |

|---|---|---|---|---|---|

| Smart grids | EnergyLab Nordhavn, Ecogrid 2.0 | Grants | EUDP programme 1 | DKK 226.53 million | TSO and DSO |

| CITIES, FED | National Funds | Innovation Fund 2 | DKK 114.34 million | TSO and DSO | |

| Storage | CORE | Grants | EUDP programme | DKK 12.53 million | TSO and DSO |

| Conversion (P2G) | BioCat | Public funding | ForskEL 3 | DKK 59.95 million | DSO |

| Biocat Roslev, P2G-Biocat 3, EP2Gas | Grants | EUDP programme | DKK 37.16 million | TSO and DSO | |

| HyBalance | European and national funds | Horizon 2020 and EUDP programme | €15 million | TSO and DSO | |

| Energy systems integration | SEMI, SMARTCE2H, Hybrid Energy Networks | Grants | EUDP programme | DKK 19 million | TSO and DSO |

| EPIMES | National Funds | Innovation Fund | DKK 7 million | TSO and DSO | |

| District heating | Greater Copenhagen DH system, FLEX-TES, LHCPB | Grants | EUDP programme | DKK 206.22 million | TSO and DSO |

| HEAT 4.0 | National funds | Innovation Fund | DKK 37.27 million | DSO |

| Project Category | Project | Incentive Mechanism | Source of Funding | Total Budget | Main Stakeholders |

|---|---|---|---|---|---|

| Power to gas or hydrogen | HEAVENN | Grants | EU, national and private funds. | €90 million | TSO and DSO |

| Investment Agenda Hydrogen Northern Netherlands 1 | Subsidy to hydrogen production | Public and private funds. | €2.8 billion | TSO and DSO | |

| Energy systems integration | Integrated Energy System Analysis | Grants | National funds | € 1.8 million | TSO and DSO |

| Top Sector projects | Grants | Top Sector programme | € 2.8 million | TSO and DSO |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cambini, C.; Congiu, R.; Soroush, G. Regulation, Innovation, and Systems Integration: Evidence from the EU. Energies 2020, 13, 1670. https://doi.org/10.3390/en13071670

Cambini C, Congiu R, Soroush G. Regulation, Innovation, and Systems Integration: Evidence from the EU. Energies. 2020; 13(7):1670. https://doi.org/10.3390/en13071670

Chicago/Turabian StyleCambini, Carlo, Raffaele Congiu, and Golnoush Soroush. 2020. "Regulation, Innovation, and Systems Integration: Evidence from the EU" Energies 13, no. 7: 1670. https://doi.org/10.3390/en13071670

APA StyleCambini, C., Congiu, R., & Soroush, G. (2020). Regulation, Innovation, and Systems Integration: Evidence from the EU. Energies, 13(7), 1670. https://doi.org/10.3390/en13071670