1.1. Background

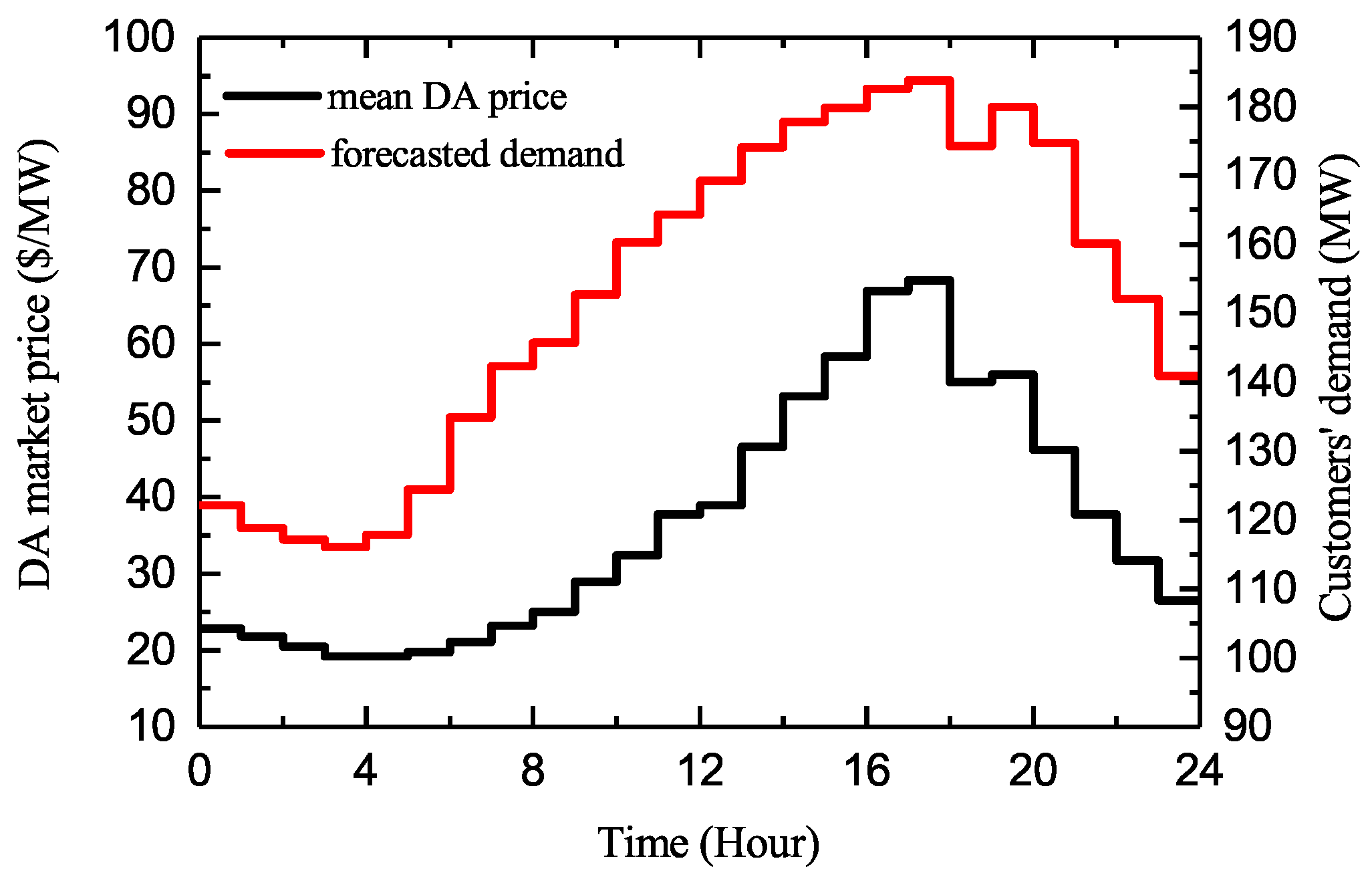

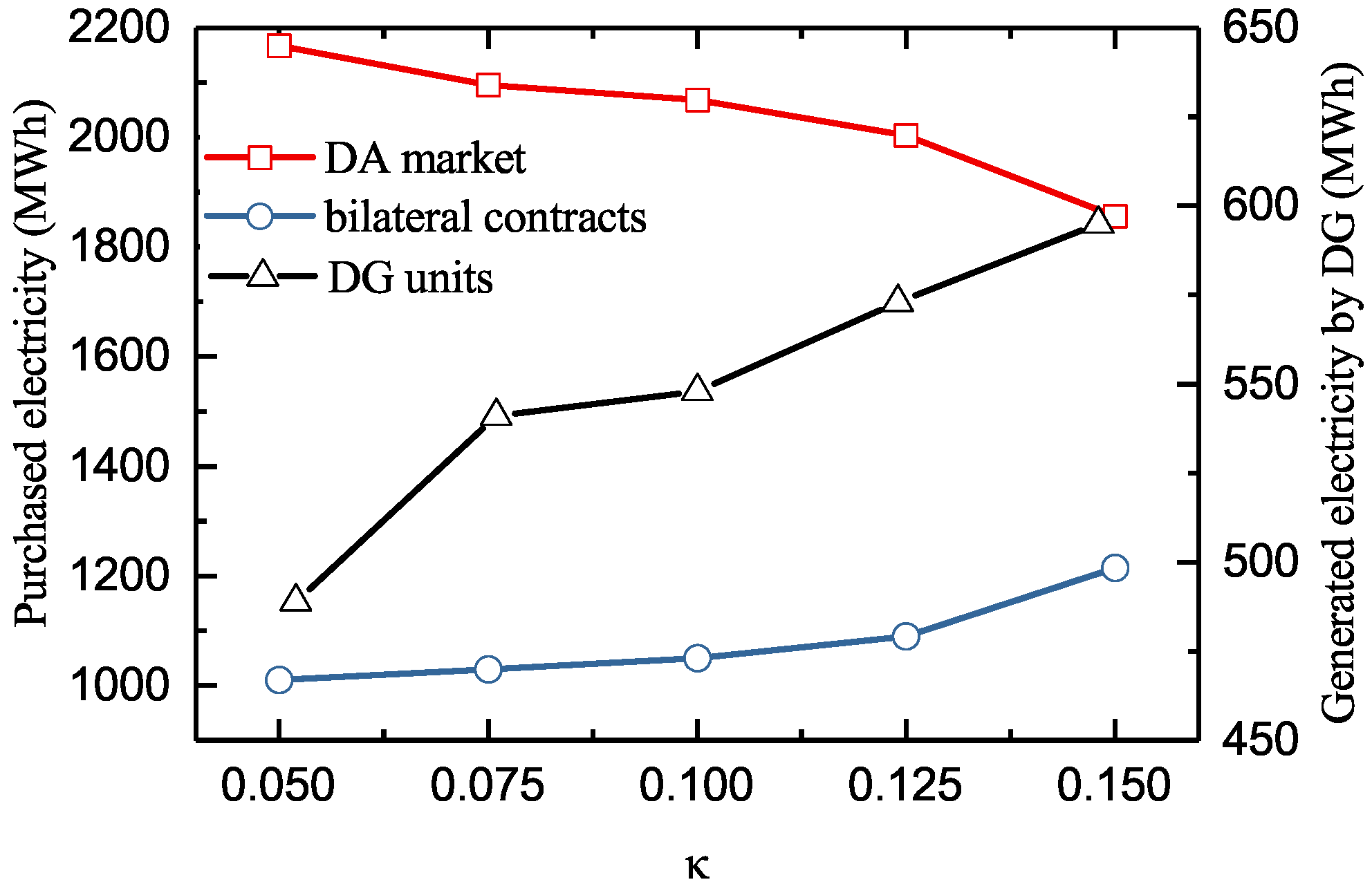

In the deregulated electricity market, retailers can acquire electricity through various options, e.g., the day-ahead (DA) wholesale market, bilateral contracts and self-owned distributed generation (DG). Due to the high volatility of the DA market prices [

1], retailers need to adopt risk management methods to mitigate the risk arising from market price uncertainty. In addition, with the rapid development of smart grid technologies around the world, customers’ demand response (DR) has received massive attentions and applications. DR programs (DRP) can be classified into two main categories: price-based DRP and incentive-based DRP [

2,

3]. Specifically, in the price-based DRP, such as time-of-use (TOU) pricing [

4] and real time pricing(RTP) [

5], customers adjust their demand in response to price changes over time. In the incentive-based DRP, e.g., direct load control, interruptible load (IL), demand bidding and emergency DR, appropriate incentive payments should be given to customers for their participation in the programs [

2]. It is recognized that retailers can deploy their customers’ DR capability to manage risk caused by the uncertainty of the DA wholesale market prices [

6]. To this end, investigating electricity procurement strategy from various options for retailers with DR capability is of great importance, especially when the DA market price uncertainty is considered.

Risk management has been one of the main concerns of decision makers for many years [

7]. As most of decisions to be made are subject to uncertainties, various risk management methods are applied in different areas of the power system such as power distribution operation [

8], transmission planning [

9] and electricity market [

10]. Risk management is one of the most valuable tasks for electricity sector decision makers to protect their benefit while confronting the uncertainties in price, availability of transmission lines and many other factors. Besides, the study results shown in [

11] suggest that adopting integrated and comprehensive risk management systems can help non-financial firms such as companies in the electricity sector, to gain a higher firm value.

1.2. Literature Review

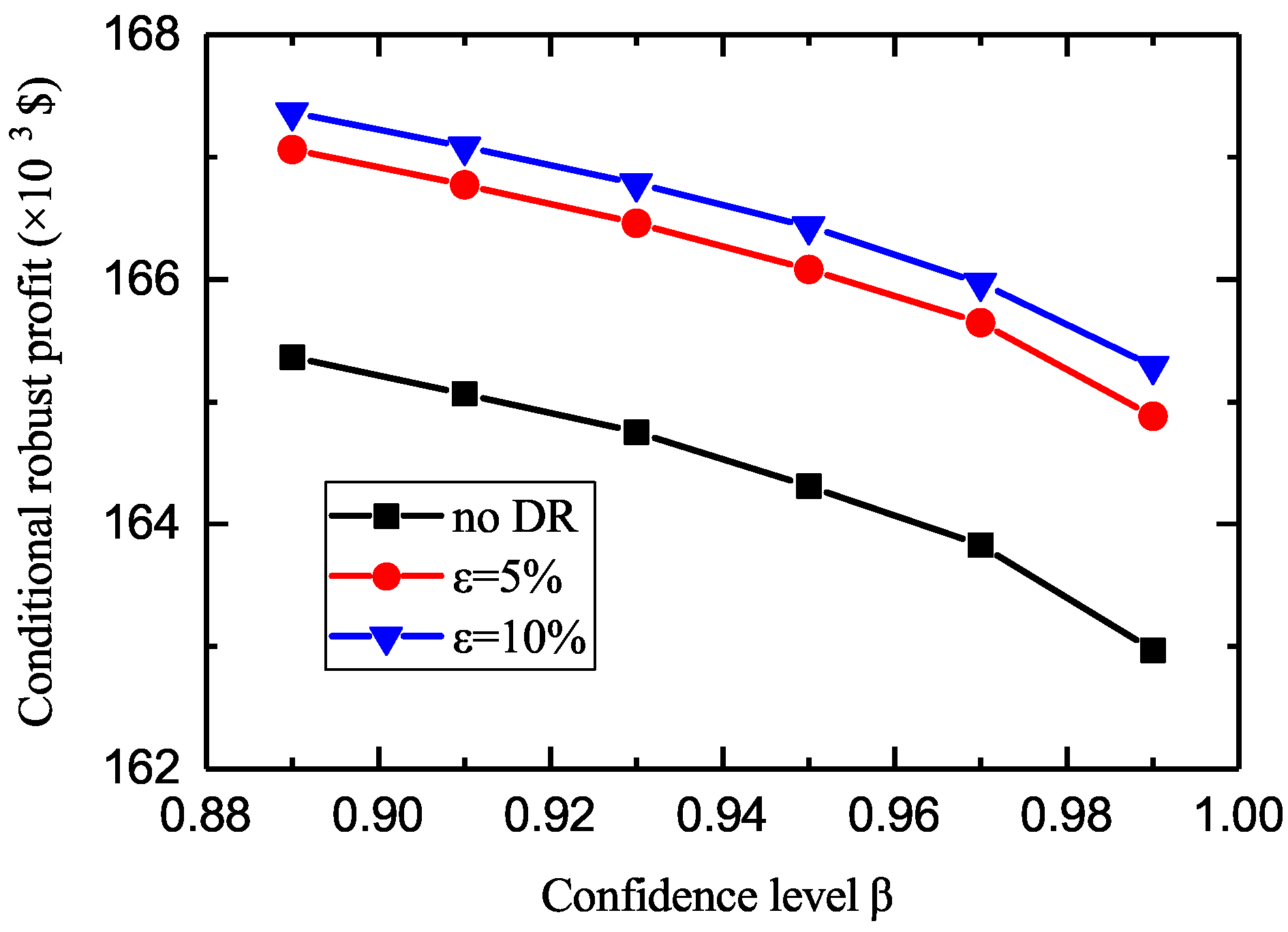

Different risk management methods for electricity retailers’ decision-making under uncertainty have been proposed in the literature. According to how uncertain parameters are considered, methods of risk management can be divided into two categories: probabilistic methods and non-probabilistic methods. The decision-making with probabilistic methods is commonly based on risk–reward trade-off analysis when the probability distribution function of uncertain data is known [

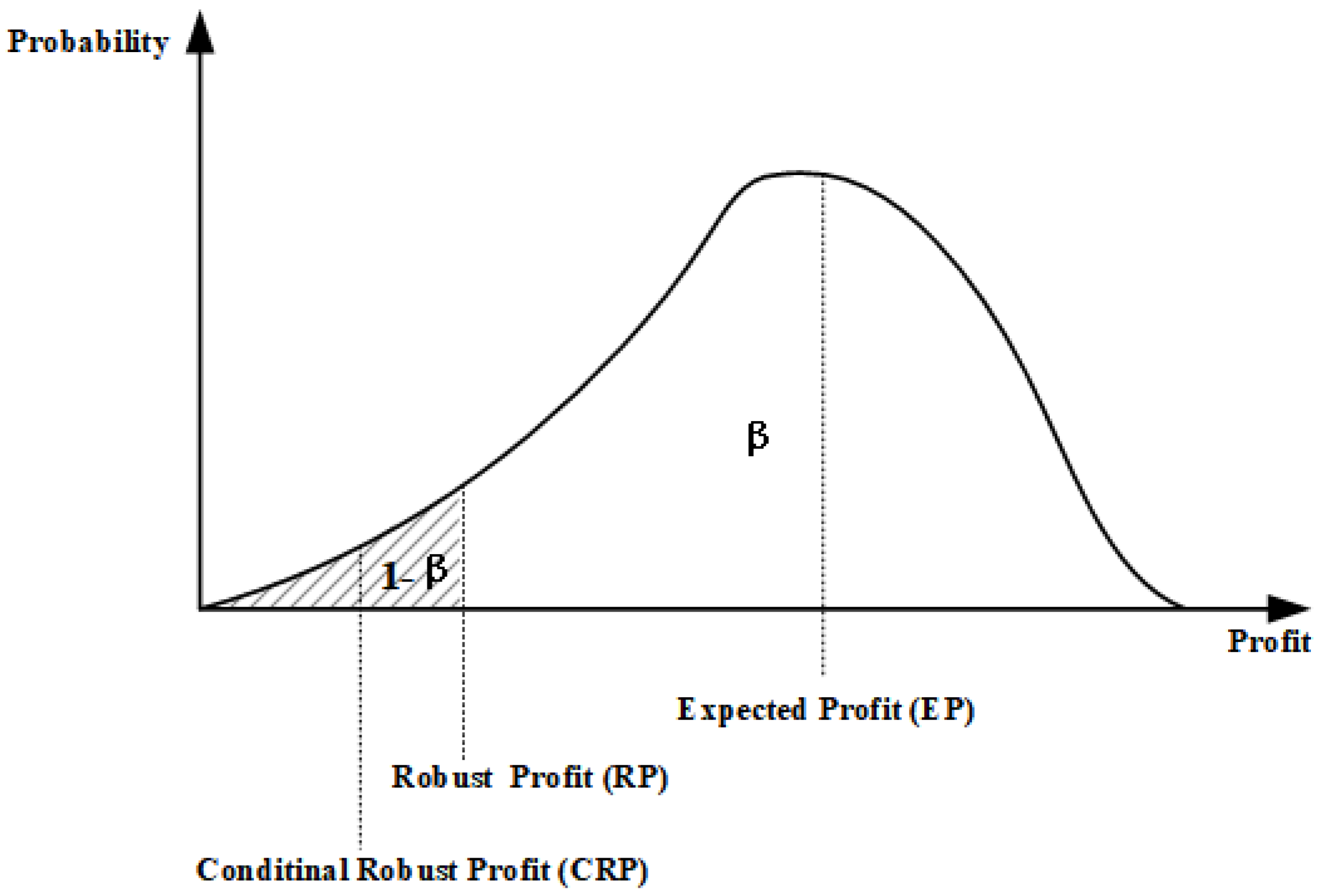

12]. In such a type of analysis, the risk is quantified by a measure of the loss such as the value-at-risk (VaR) [

13] or the conditional value-at-risk (CVaR) [

14,

15]. In [

13], the VaR method is used to determine a retailer’s optimal electricity portfolio strategy under uncertain market price and demand. However, the VaR is only coherent when underlying risk factors are normally distributed and suffers from being intractable when it is calculated using scenarios [

16]. Futhermore, the VaR does not indicate the extent of the losses that might be suffered beyond the amount indicated by this measure [

17]. The CVaR is an alternative measure to the VaR that provides an estimate of the losses that might be encountered in the tail [

17]. It is also considered as a more consistent measure of risk than the VaR [

18]. In [

14], the problem of designing retailers’ customized pricing strategies for customers is investigated while the CVaR is used to quantify the risk caused by the price fluctuations of the DA and real-time markets.

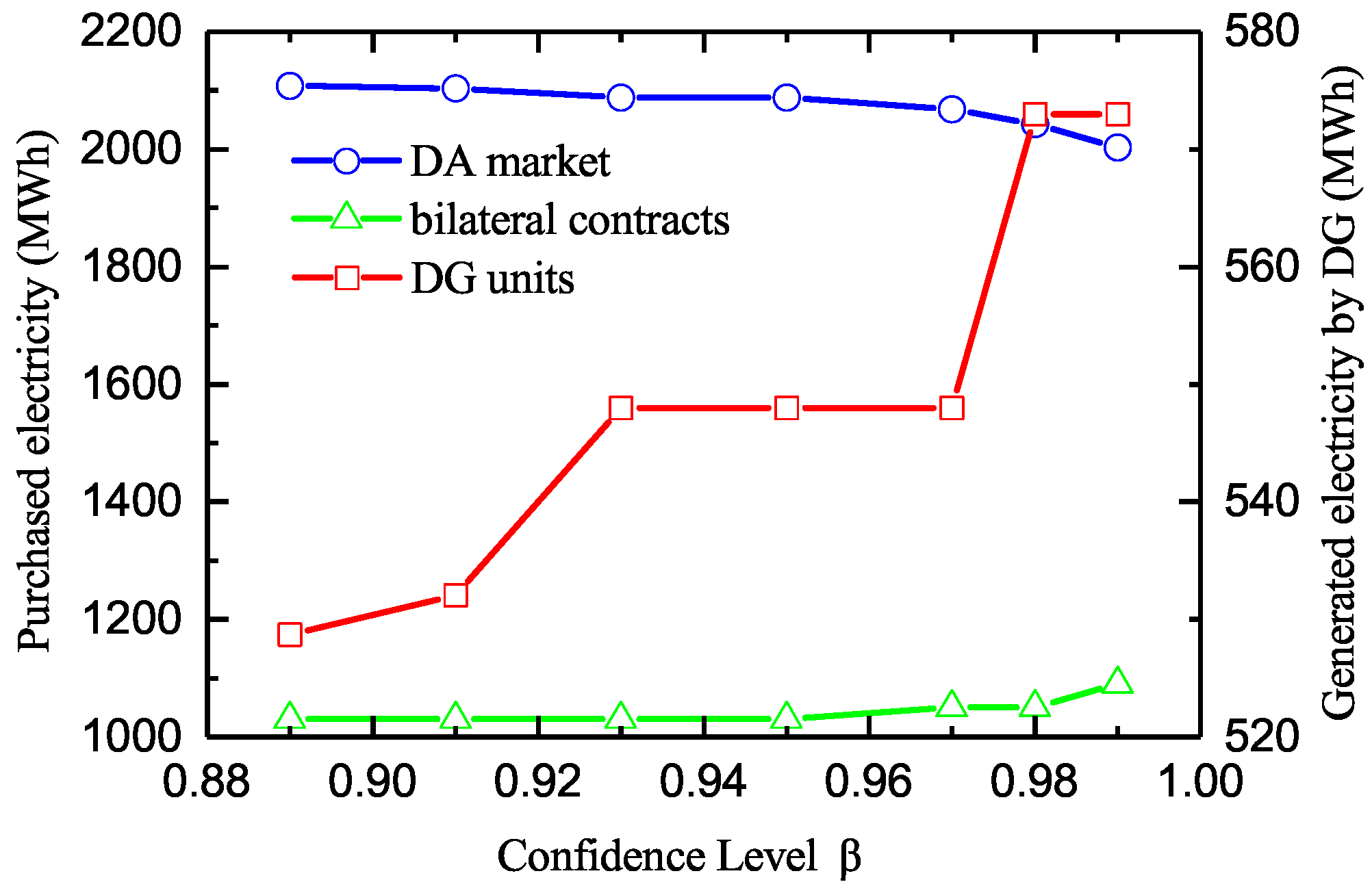

Non-probabilistic methods are adopted when the uncertain parameters are under severe uncertainty. The robust optimization (RO) is a modeling framework for immunizing against data uncertainties in which we optimize against the worst case that might arises with a min-max objective [

19]. The RO does not require specific probability distribution of the uncertain parameter, instead, the uncertain parameter is characterized by an uncertainty set, e.g., box uncertainty set, ellipsoidal uncertainty set and polyhedral uncertainty set. In [

20], the robust optimal bidding and offering strategy in the DA market by a retailer is obtained while the polyhedral uncertainty set is used to describe the uncertainty in the DA market prices. Ref. [

21] proposes a robust self-scheduling model for power generators while the uncertainty of electricity price is described by the ellipsoidal uncertainty set. However, with different uncertainty sets selected, the RO model may lead to over-conservatism or computational intractability [

22]. The information gap decision theory (IGDT) is another widely used non-probabilistic risk management approach that doesn’t need much data for uncertainty modeling. In addition, with two immunity functions namely robustness and opportunity functions, the IGDT informs the decision makers about the negative and positive outcomes resulted from uncertainties so that they can take appropriate decisions that may be safe or risky [

23]. In [

24], the IGDT method is used to obtain retailers’ optimal bidding and offering curves in the wholesale market in the presence of market price uncertainty. In [

25], a robust bi-level decision-making framework for retailers to supply electricity to price-sensitive customers is presented while the IGDT approach is used to evaluate the financial risk arising from uncertain wholesale prices. The main limitation of the IGDT method is that it also suffers from being over-conservative and the degree of conservativeness cannot be controlled by the decision makers [

26].

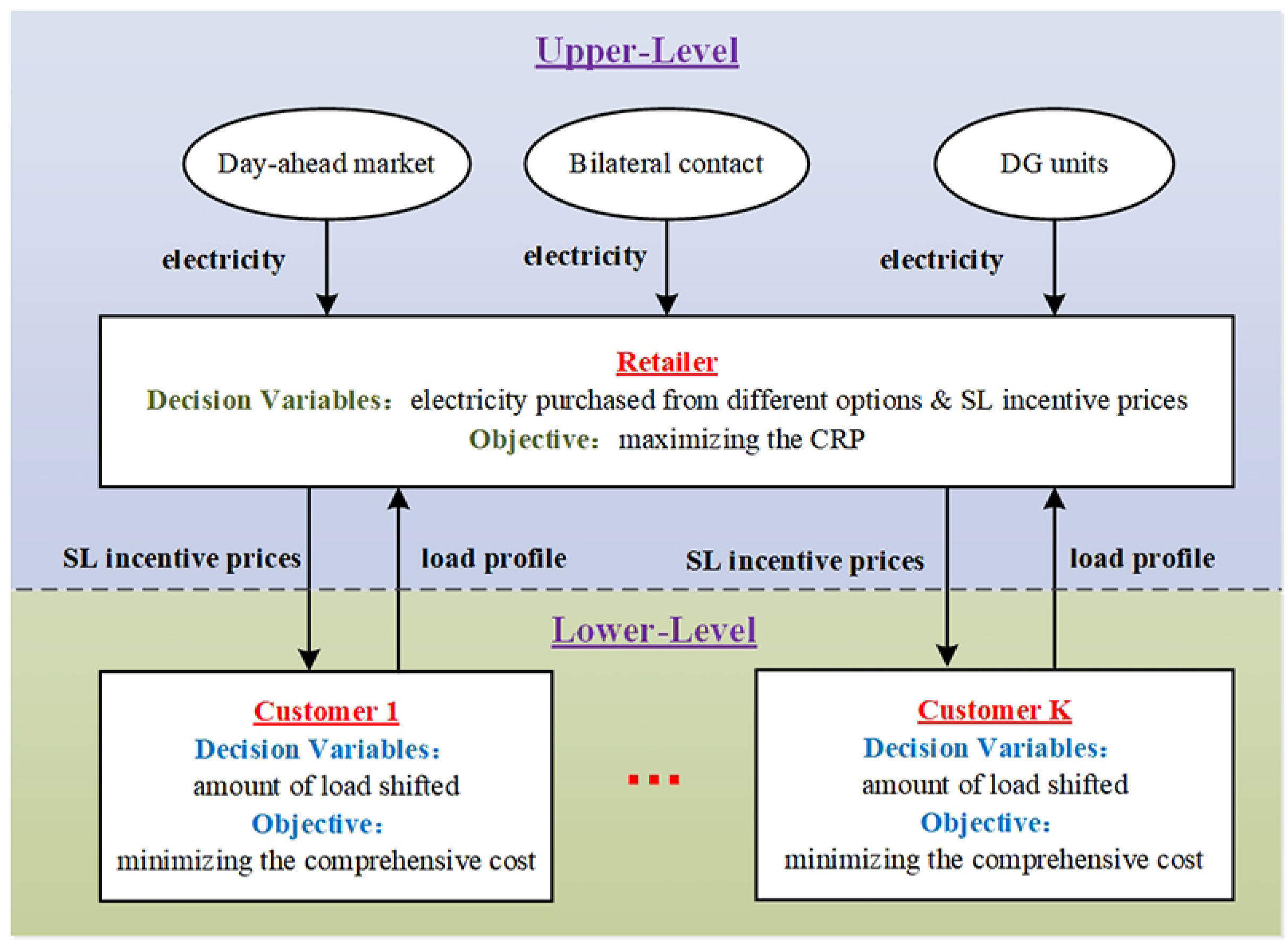

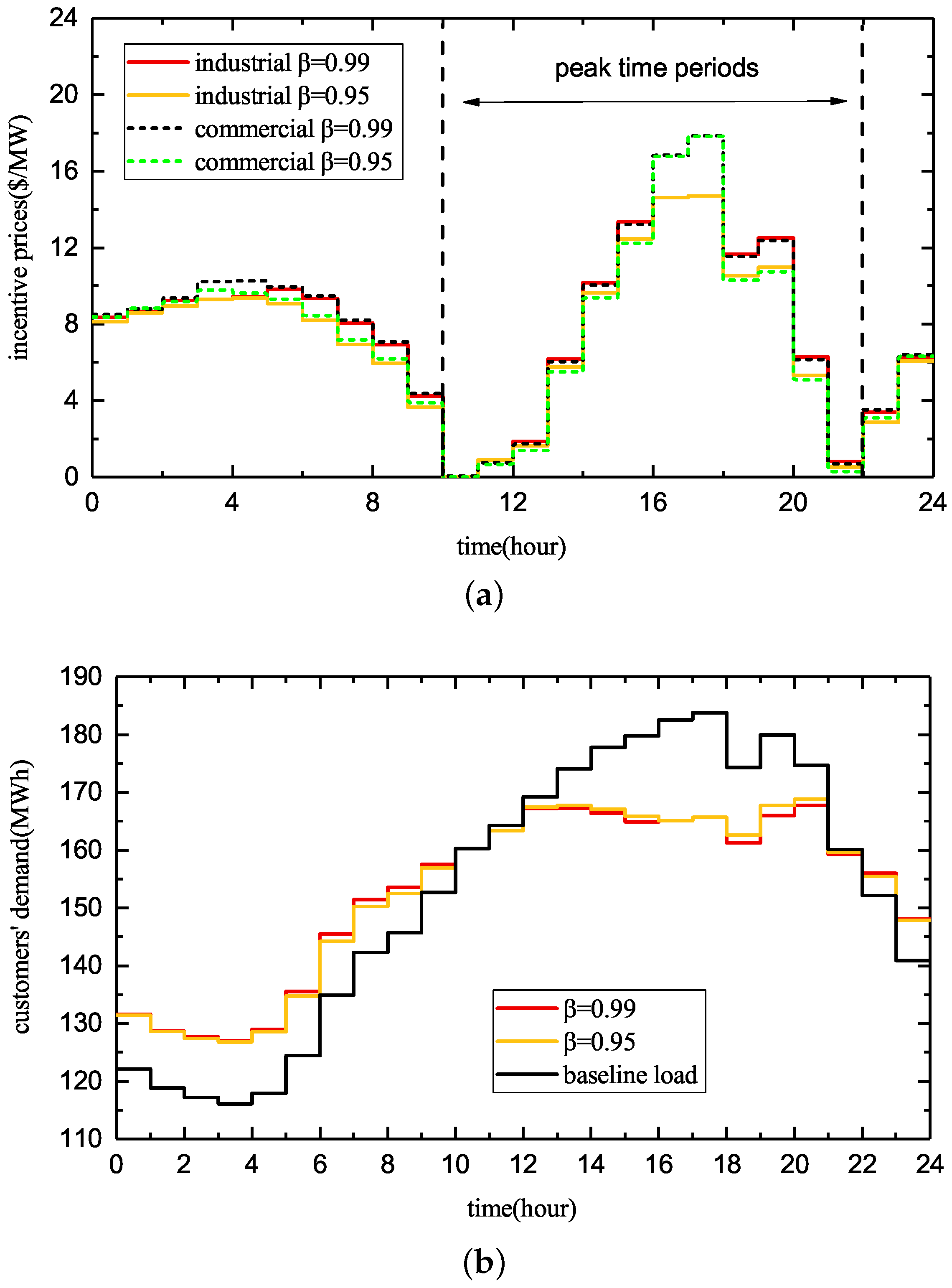

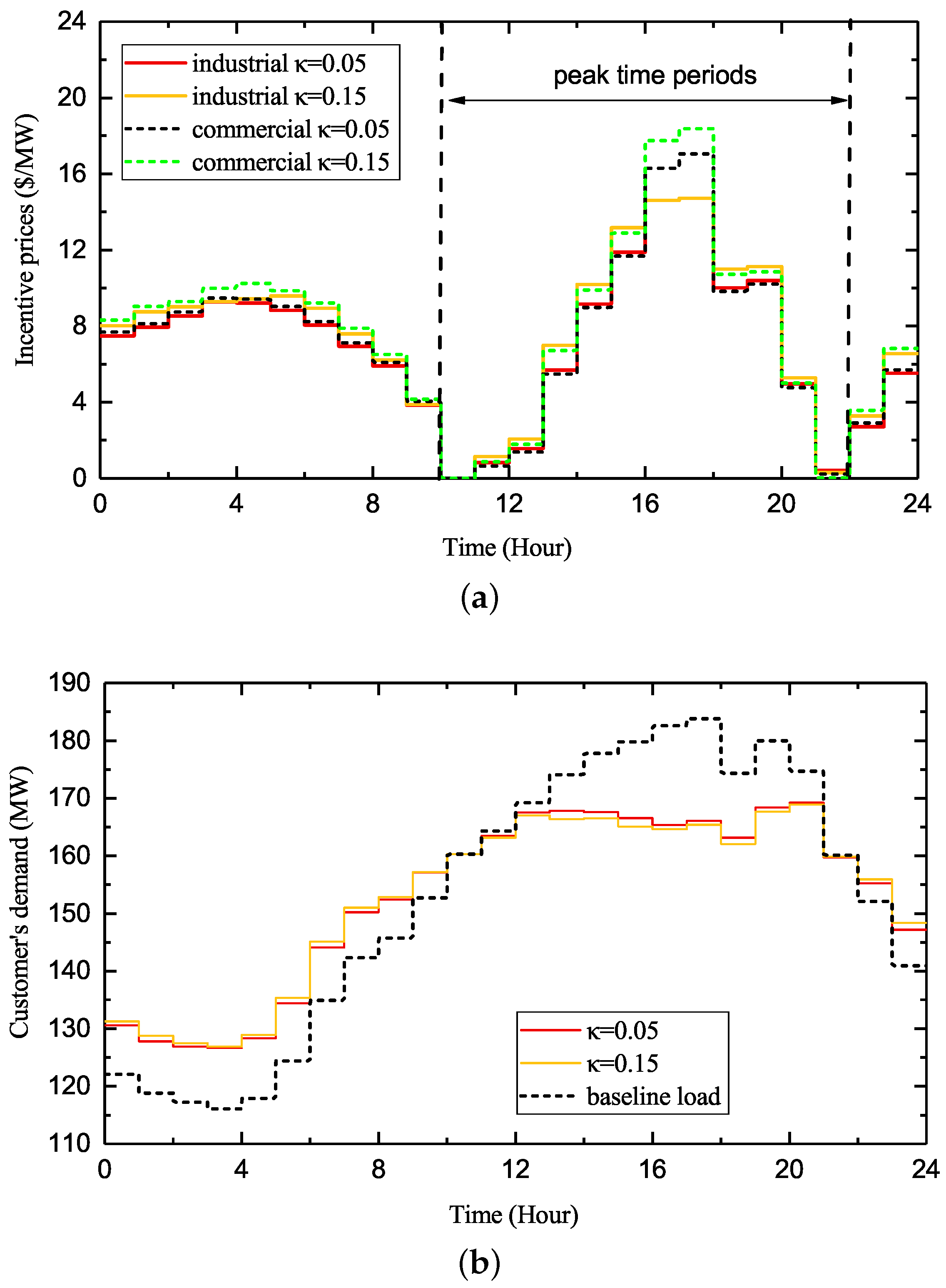

Recently, increasing attention has been devoted to the development of decision-making strategies for electricity retailers taking DRPs into consideration. In [

27], the energy procurement and TOU pricing strategies of a retailer are specified while the RO method is used for risk menagement under spot market price uncertainty. In [

28], a two-stage two-level model for the energy pricing and procurement problem faced by a retailer is proposed. Specifically, consumers’ DR with respect to the RTP is characterized by a two-level model in the first stage. In the second stage, risk-averse energy procurement of the retailer accounting for market price uncertainty is modeled by a linear RO. In [

29], a multi-objective model for a retailer with IL capability is proposed to maximize the retailer’s profit and minimize the peak demand while the uncertainties of market prices and demand are not considered. In [

30,

31], stochastic optimization models for retailers with reward-based load-reduction DR are proposed while the CVaR is adopted for risk measurement. It is shown that retailers can avoid unfavorable prices in the real-time market and amend imbalances in demand by participating in the reward-based DRP. Retailers’ energy allocation in the wholesale market, contracts market and short-term DR bidding market is investigated in [

32] based on the RO to minimize the electricity procurement cost. In [

33], a CVaR-based bi-level optimization model for retailers’ trading strategy with multi-segment IL contracts offered to customers is developed. The proposed strategy can help retailers to gain more market share and enhance their competitiveness.

To date, most of the research on retailers’ risk-based decision-making with consideration of the incentive-based DRPs focus on specifying retailers’ DR incentive strategies for customers’ IL. Besides the IL, the shiftable load (SL) is another important DR resource that plays an increasing role in demand side management [

34,

35]. In addition, simulation results based on historic data in [

36] show that shifting customers’ load demand from peak to off-peak periods can reduce retailers’ expenditures and their fluctuations. The SL resources are scheduled by retailers with time varying prices in most literature [

14,

37]. In [

38], the problem of load-shifting in smart grid is formulated as a Stackelberg game in which the energy provider offers price discounts to motivate customers to shift their load from peak periods, but the uncertainty of market prices is neglected. From above literature review we notice that, very few studies address the problem of how to deploy customers’ incentive-based SL for retailers’ risk management in electricity procurement from various options.