Weather Risk Management in Energy Sector: The Polish Case

Abstract

1. Introduction

2. Conceptual Framework of the Study

2.1. The Facets of Weather Risk from Energy Sector Perspective

2.2. Weather Risk Management with Weather Derivatives

- the accumulation period or the period of time over which the index accumulates; usually it is a month or a season;

- the location of the weather station that reports daily temperatures for a particular region; typically, the station is located in a major city;

- so called “tick size,” which is the dollar amount attached to each HDD or CDD; this is the amount to be paid per unit of the CDD or HDD.

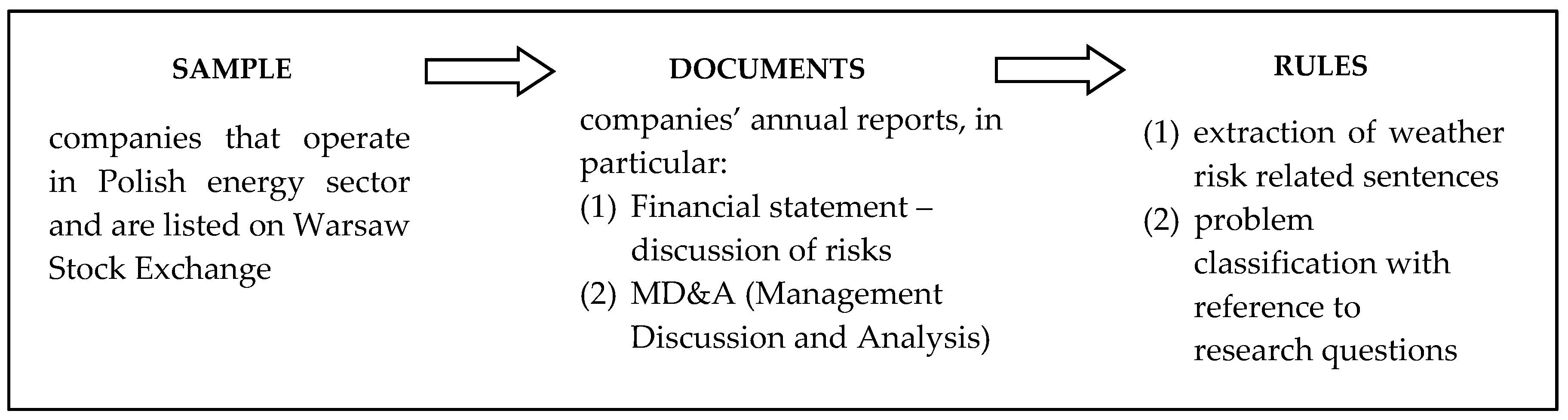

3. Research Design and Method

- financial statement: companies explain the risk related to their performance, which is mandatory with reference to several risk categories;

- MD&A (management discussion and analysis): according to the corporate governance code of companies listed on the Warsaw Stock Exchange [71], public companies are requested to disclose their risk management systems (in this, the identified risk exposures and the risk mitigation actions taken against these risks);

- the statement on non-financial performance: in Poland the statement of non-financial performance is a mandatory element of annual reports for the largest companies since 2017; the statement discusses (among other issues) the risk-management related disclosures.

4. Results and Discussion

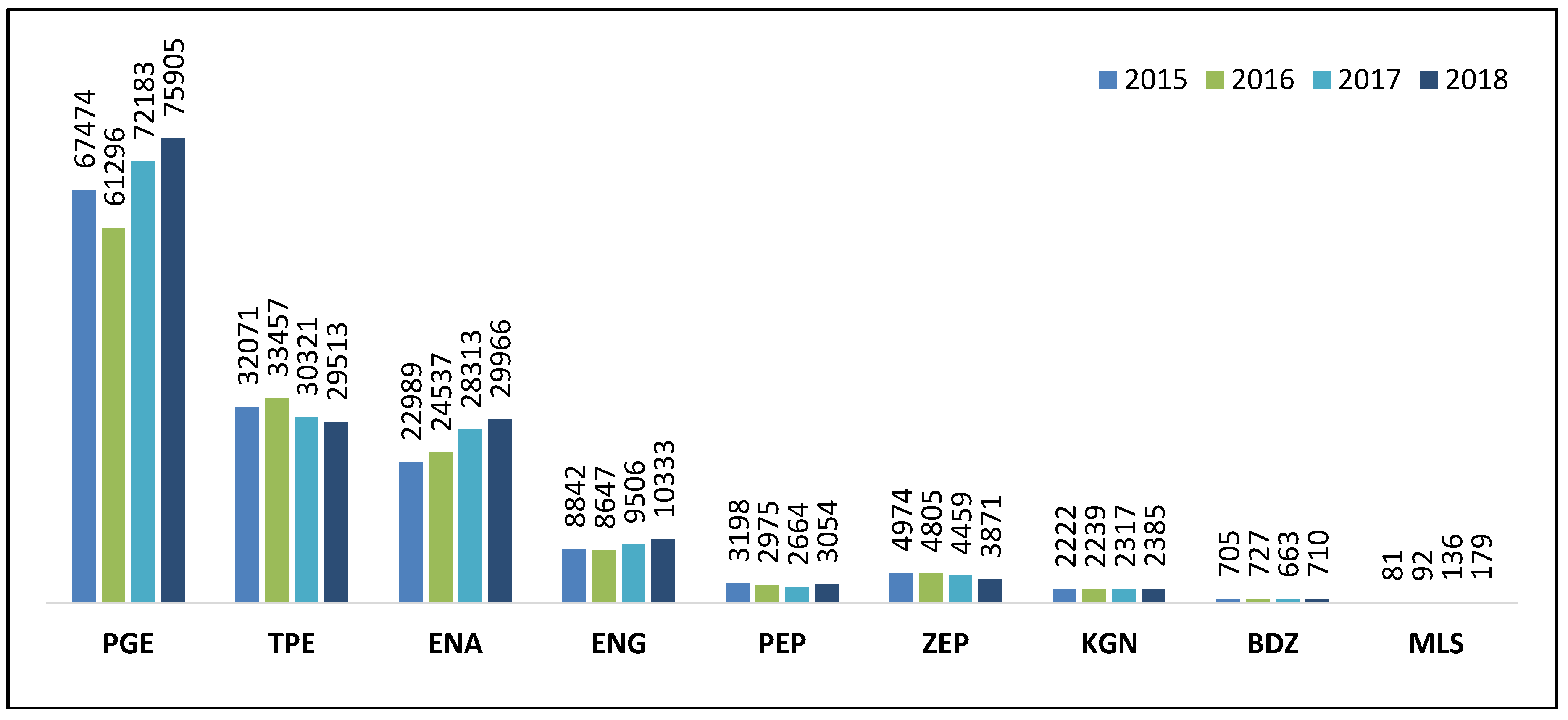

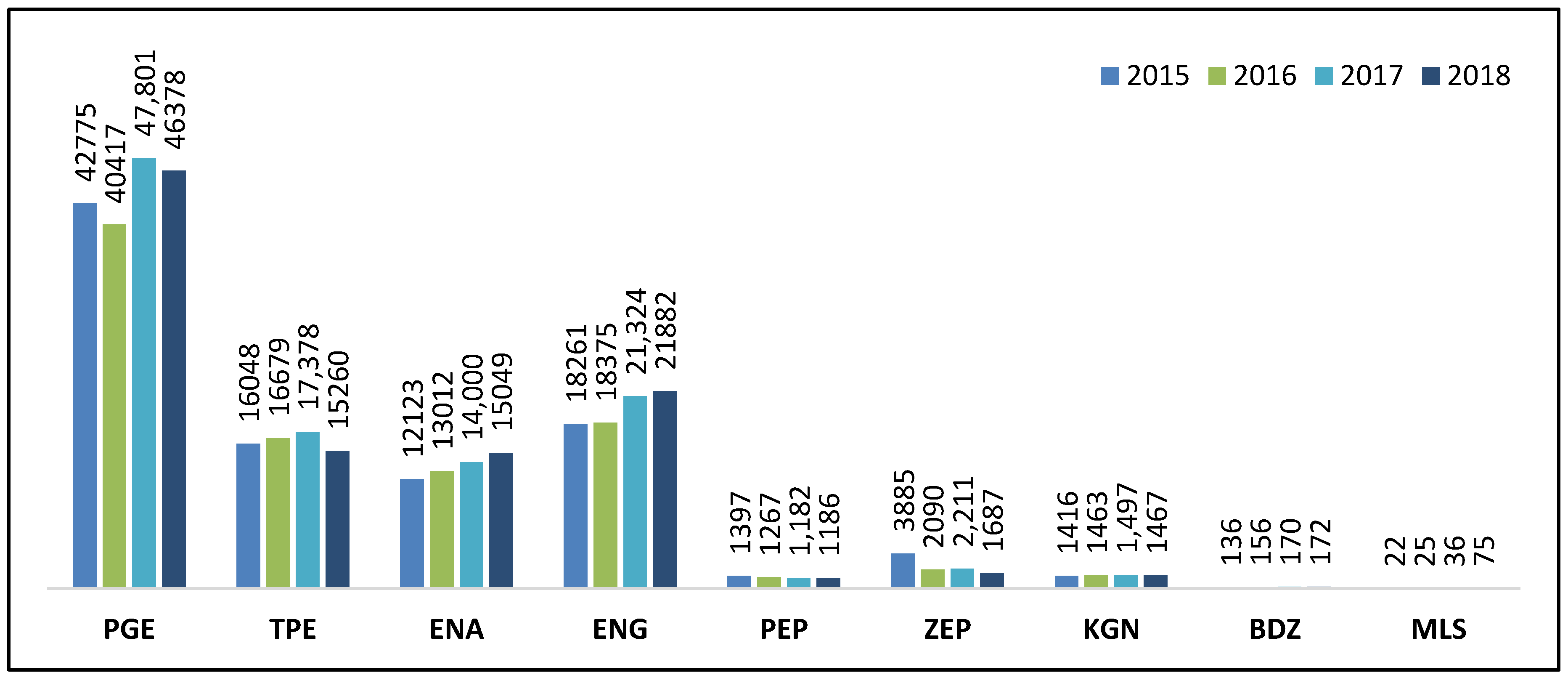

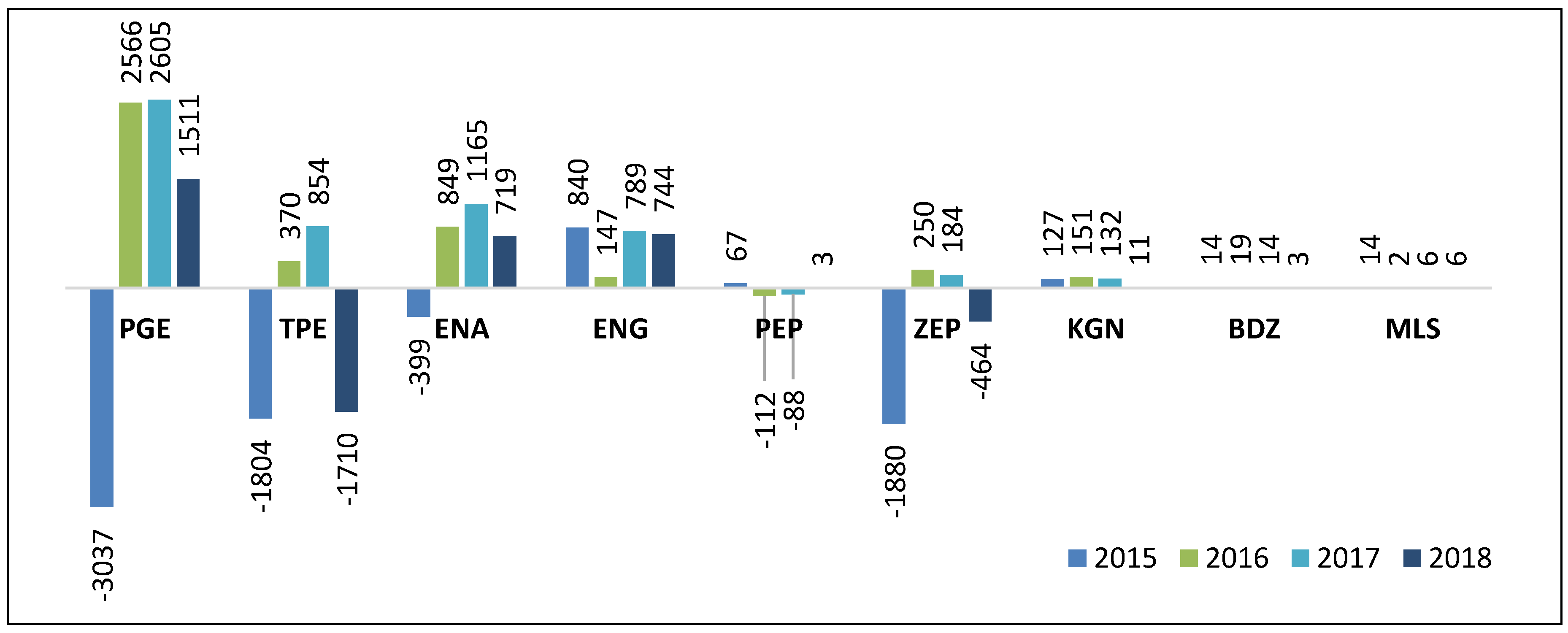

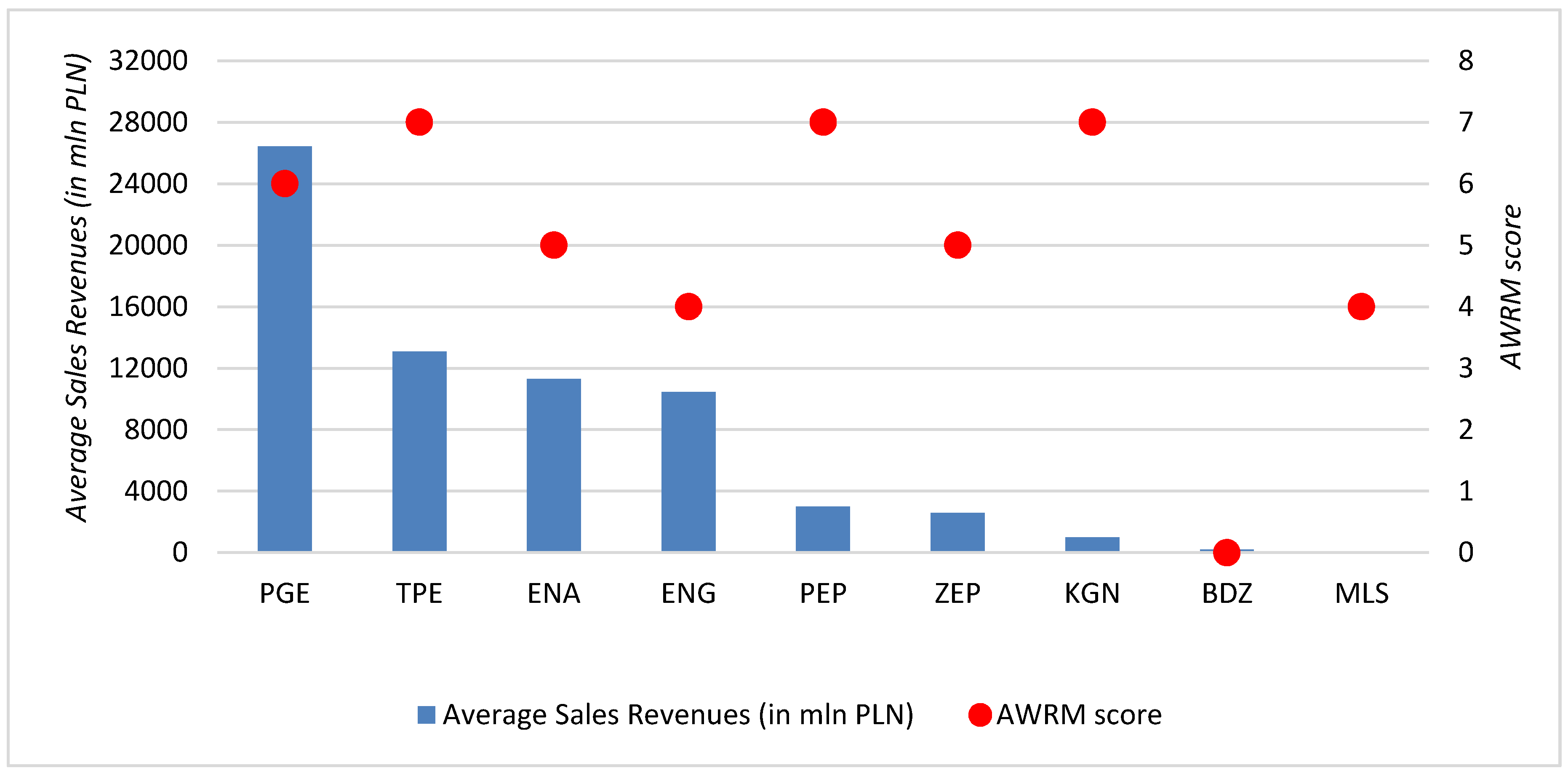

4.1. Analytical Background: Financial Position of Sampled Companies as Energy Market Players

4.2. Textual Content Analysis: The Findings

- hydrological events (draught) that threatened hydroelectric power plants (e.g., PGE and ENA);

- low levels of rivers or ice on rivers that could impact supplies (as the river is relevant route of goods shipment, e.g., ZEP);

- the chain of dependences, impact of weather risk on the farming industry which is a main supplier of biomass (e.g., PEP);

- dependence on wind speed conditions and seasonal changes (e.g., ZEP, PEP, and PGE).

5. Conclusions

Funding

Conflicts of Interest

Appendix A

| Company | Documents 1 | No. of Pages | Size of File in KB |

|---|---|---|---|

| BDZ | Consolidated financial statement 2017 | 116 | 7524 |

| Consolidated financial statement 2018 | 119 | 8443 | |

| ENA | Consolidated financial statement 2017 | 121 | 2397 |

| Consolidated financial statement 2018 | 147 | 3768 | |

| Management Discussion and Analysis 2017 | 150 | 13,193 | |

| Management Discussion and Analysis 2018 | 184 | 5968 | |

| ENG | Consolidated financial statement 2017 | 70 | 1943 |

| Consolidated financial statement 2018 | 77 | 1952 | |

| Management Discussion and Analysis 2017 | 141 | 6348 | |

| Management Discussion and Analysis 2018 | 131 | 4270 | |

| PGE | Consolidated financial statement 2017 | 91 | 2483 |

| Consolidated financial statement 2018 | 95 | 3006 | |

| Management Discussion and Analysis 2017 | 141 | 4943 | |

| Management Discussion and Analysis 2018 | 132 | 5279 | |

| PEP | Consolidated financial statement 2017 | 85 | 2088 |

| Consolidated financial statement 2018 | 98 | 2520 | |

| Management Discussion and Analysis 2017 | 50 | 1239 | |

| Management Discussion and Analysis 2018 | 53 | 1597 | |

| TPE | Consolidated annual report 2017 | 316 | 7856 |

| Consolidated annual report 2018 | 367 | 11,782 | |

| KGN | Consolidated financial statement 2017 | 96 | 1246 |

| Consolidated financial statement 2018 | 100 | 1638 | |

| Management Discussion and Analysis 2017 | 82 | 1854 | |

| Management Discussion and Analysis 2018 | 87 | 2144 | |

| ZEP | Consolidated annual report 2017 | 202 | 5601 |

| Consolidated financial statement 2018 | 127 | 3547 | |

| Management Discussion and Analysis 2018 | 67 | 2372 | |

| MLS 2 | Consolidated financial statement 2018 | 83 | 1287 |

| Management Discussion and Analysis 2018 | 73 | 7089 |

| Company | Summary of Information Disclosed in Analyzed Documents |

|---|---|

| PGE |

|

| TPE |

|

| ENA |

|

| ENG |

|

| PEP |

|

| ZEP |

|

| KGN |

|

| ECB | Not reported |

| MLS |

|

| Company | Summary of Information Disclosed in Analyzed Documents |

|---|---|

| PGE |

|

| TPE |

|

| ENA |

|

| ENG |

|

| PEP |

|

| ZEP |

|

| KGN |

|

| ECB | Not reported |

| MLS |

|

| Company | Summary of Information Disclosed in Analyzed Documents |

|---|---|

| PGE |

|

| TPE | Several detailed actions reported:

|

| ENA |

|

| ENG |

|

| PEP | Several detailed actions described:

|

| ZEP |

|

| KGN | Several detailed actions described:

|

| ECB | Not reported |

| MLS |

|

References

- IPPC. Global Warming of 1.5 °C. 2018. Available online: http://www.ipcc.ch/report/sr15/ (accessed on 20 November 2019).

- NASA. Long-Term Warming Trend Continued in 2017: NASA, NOAA. Release 18-003; 18 January 2018. Available online: https://www.nasa.gov/press-release/long-term-warming-trend-continued-in-2017-nasa-noaa (accessed on 20 November 2019).

- NASA. 2018 Fourth Warmest year in Continued Warming Trend, according to NASA, NOAA. News; 6 February 2019. Available online: https://climate.nasa.gov/news/2841/2018-fourth-warmest-year-in-continued-warming-trend-according-to-nasa-noaa/ (accessed on 20 November 2019).

- Rose, A.; Dormady, N. A Meta-Analysis of the Economic Impacts of Climate Change Policy in the United States. Energy J. 2011, 32, 143–165. [Google Scholar] [CrossRef]

- Rosennzweig, C.; Iglesius, A.; Yang, X.B.; Epstein, P.; Chivian, E. Climate Change and Extreme Weather Events—Implications for Food Production, Plant Diseases, and Pests. Glob. Chang. Hum. Health 2001, 2, 90–104. Available online: https://digitalcommons.unl.edu/cgi/viewcontent.cgi?article=1023&context=nasapub (accessed on 20 November 2019). [CrossRef]

- Van Aalst, M.K. The impacts of climate change on the risk of natural disasters. Disasters 2006, 30, 5–15. [Google Scholar] [CrossRef] [PubMed]

- Dell, M.; Jones, B.; Olken, B. What Do We Learn from the Weather? The New Climate-Economy Literature. J. Econ. Lit. 2014, 53, 740–798. [Google Scholar] [CrossRef]

- Schneider, S.H.; Lane, J. An Overview of ‘Dangerous’ Climate Change. In Avoiding Dangerous Climate Change; Schellnhuber, H.J., Cramer, W., Nakicenovic, N., Wigley, T., Yohe, G., Eds.; Cambridge University Press: Cambridge, UK, 2006; pp. 7–23. ISBN 978-0-521-86471-8. [Google Scholar]

- Bosello, F.; Zhang, J. Assessing Climate Change Impacts: Agriculture. Working Paper No. 94.05. Fondazione ENI Enrico Mattei, 2005. Available online: https://www.econstor.eu/dspace/bitstream/10419/73909/1/NDL2005-094.pdf (accessed on 15 July 2019).

- Sharma, A.K.; Vashishtha, A. Weather derivatives: Risk-hedging prospects for agriculture and power sectors in India. J. Risk Financ. 2007, 8, 112–132. [Google Scholar] [CrossRef]

- Smith, P.; Olesen, J.E. Synergies between the mitigation of, and adaptation to, climate change in agriculture. J. Agric. Sci. 2010, 148, 543–552. [Google Scholar] [CrossRef]

- Adams, R.M.; Hurd, B.H.; Lenhart, S.; Leary, N. Effects of Global Climate Change on Agriculture: An interpretative Review. Clim. Res. 1998, 11, 19–30. Available online: https://www.int-res.com/articles/cr/11/c011p019.pdf (accessed on 15 July 2019). [CrossRef]

- Scott, D. Climate Change and Tourism in the Mountain Regions of North America. In Proceedings of the First International Conference on Climate Change and Tourism, Djerba, Tunisia, 9–11 April 2003. [Google Scholar]

- Bas, A.; Nicholls, S.; Viner, D. Implications of Global Climate Change for Tourism Flows and Seasonality. J. Travel Res. 2007, 45, 285–296. [Google Scholar] [CrossRef]

- Bosello, F.; Roson, R.; Tol, R. Economy-Wide Estimates of the Implications of Climate Change: Human Health. Ecol. Econ. 2006, 58, 579–591. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.175.5630&rep=rep1&type=pdf (accessed on 15 December 2019). [CrossRef]

- Štulec, I. Effectiveness of Weather Derivatives as Risk Management Tool in Food Retail: The Case of Croatia. Int. J. Financ. Stud. 2017, 5, 2. [Google Scholar] [CrossRef]

- Zara, C. Weather derivatives in the wine industry. Int. J. Wine Bus. Res. 2010, 22, 222–237. [Google Scholar] [CrossRef]

- Schaefer, R.; Szklo, A.S.; de Lucena, A.; Borba, B.; Nogueira, L.; Fleming, F.; Troccoli, A.; Harrison, M.; Boulahya, M. Energy sector vulnerability to climate change: A review. Energy 2012, 38, 1–12. [Google Scholar] [CrossRef]

- Campbell, S.D.; Diebold, F.X. Weather forecasting for weather derivatives. J. Am. Stat. Assoc. 2005, 100, 6–16. [Google Scholar] [CrossRef]

- Ronalds, B.F.; Wonhas, A.; Troccoli, A. A New Era for Energy and Meteorology. In Weather Matters for Energy; Troccoli, A., Dubus, L., Haupt, S.E., Eds.; Springer: New York, NY, USA, 2014; pp. 3–16. ISBN 978-1-4614-9220-7. [Google Scholar]

- Wójcik, R.; Miętus, M. Some features of long-term variability in air temperature in Poland (1951–2010), original title: Niektóre cechy wieloletniej zmienności temperatury powietrza w Polsce (1951–2010). Przegląd Geogr. 2014, 86, 339–364. [Google Scholar] [CrossRef]

- Kundzewicz, Z.; Forland, E.; Piniewski, M. Challenges for developing national climate services—Poland and Norway. Clim. Serv. 2017, 8, 17–25. [Google Scholar] [CrossRef]

- HELCOM. Climate Change in the Baltic Sea Area. Helsinki Commission. Balt. Sea Environ. Proc. 2007, 111. Available online: https://www.helcom.fi/wp-content/uploads/2019/08/BSEP111.pdf (accessed on 15 December 2019).

- Lehmann, A.; Getzlaff, K.; Herlass, J. Detailed assessment of climate variability in the Baltic Sea area for the period 1958-2009. Clim. Res. 2011, 46, 185–196. [Google Scholar] [CrossRef]

- Tomczyk, A.; Półrolniczak, M.; Bednorz, E. Circulation Conditions’ Effect on the Occurrence of Heat Waves in Western and Southwestern Europe. Atmosphere 2017, 8, 31. [Google Scholar] [CrossRef]

- Bednorz, E.; Czernecki, B.; Tomczyk, A.; Półrolniczak, M. If not NAO then what?—regional circulation patterns governing summer air temperatures in Poland. Theor. Appl. Climatol. 2019, 126, 1325–1337. [Google Scholar] [CrossRef]

- BBC. EU carbon neutrality: Leaders Agree 2050 Target without Poland. 13 December 2019. Available online: https://www.bbc.com/news/world-europe-50778001 (accessed on 5 January 2020).

- Eurostat. Consumption and Production of Hard Coal. 2019. Available online: https://ec.europa.eu/eurostat/web/products-eurostat-news/-/DDN-20190823-1 (accessed on 15 December 2019).

- Stat.gov.pl. Consumption of Fuels and Energy Carriers in 2018. Released 05 December 2019; Statistics Poland. Available online: https://stat.gov.pl/en/topics/environment-energy/energy/consumption-of-fuels-and-energy-carriers-in-2018,8,13.html (accessed on 15 December 2019).

- Binkowski, P. The conditions of creation and prospects of weather derivatives development on the domestic market, original title: Warunki tworzenia i perspektywy rozwoju derywatów pogodowych na rynku krajowym. Współczesna Ekon. 2008, 2, 37–57. [Google Scholar]

- Preś, J. Zarządzanie ryzykiem pogodowym; CeDeWu: Warszawa, Polska, 2008; ISBN 978-83-60089-56-9. [Google Scholar]

- Krippendorff, K. Validity in content analysis. In Computerstrategien fur die Kommunikationsanalyse; Mochmann, E., Ed.; Campus: Frankfurt, Germany, 1980; pp. 69–112. [Google Scholar]

- Barrieu, P.; Scailett, O. A primer on weather derivatives. Int. Ser. Oper. Res. Manag. Sci. 2010, 138, 155–175. [Google Scholar] [CrossRef]

- Mraoua, M.; Bari, D. Temperature stochastic modeling and weather derivatives pricing: Empirical study with Moroccan data. Afr. Stat. 2007, 2, 22–43. [Google Scholar] [CrossRef]

- Bartodziej, G.; Tomaszewski, M. Blackout w rejonie Szczecina. Uwagi i wnioski. Energetyka 2008, 10, 682–684. Available online: https://www.cire.pl/pliki/2/blackout_szczecin.pdf (accessed on 15 February 2019).

- Gupta, E. Climate Change and the Demand for Electricity: A Non-Linear Time Varying Approach. Working Paper. 6 December 2011. Available online: https://www.isid.ac.in/~pu/conference/dec_11_conf/Papers/EshitaGupta.pdf (accessed on 15 February 2019).

- Henley, A.; Peirson, J. Non-Linearities in Electricity Demand and Temperature: Parametric Versus Non Parametric Methods. Oxf. Bull. Econ. Stat. 1997, 59, 149–162. [Google Scholar] [CrossRef]

- Hekkenberg, M.; Moll, H.C.; Uiterkamp, A. Dynamic Temperature Dependence Patterns in Future Energy Demand Models in the Context of Climate Change. Energy 2009, 34, 1797–1806. [Google Scholar] [CrossRef]

- Cian, E.; Lanzi, E.; Roson, R. The Impact of Temperature Change on Energy Demand: A Dynamic Panel Analysis. Fondazione Eni Enrico Mattei, 2007. Available online: http://www.feem.it/Feem/Pub/Publications/WPapers/default.htm (accessed on 15 February 2019).

- Baker, T.; Ekins, P.; Johnstone, N. Global Warming and Energy Demand; Routledge Global Environmental Change Book Series: London, UK, 2007; ISBN 978-0415116015. [Google Scholar]

- Morna, I.; van Vuuren, D.P. Modeling global residential sector energy demand for heating and air conditioning in the context of climate change. Energy Policy 2009, 37, 507–521. [Google Scholar] [CrossRef]

- MacMinn, R.D. Insurance and Corporate Risk Management. J. Risk Insur. 1987, 54, 658–677. [Google Scholar] [CrossRef]

- Froot, K.A.; Scharfstein, D.S.; Stein, J.C. Risk Management: Coordinating Corporate Investment and Financing Policies. J. Financ. 1993, 48, 1629–1658. [Google Scholar] [CrossRef]

- Perez-Gonzalez, F.; Yun, H. Risk Management and Firm Value: Evidence from Weather Derivatives. J. Financ. 2013, 68, 2143–2176. [Google Scholar] [CrossRef]

- McShane, M.; Nair, A.; Rustambekov, E. Does Enterprise Risk Management Increase Firm Value? J. Account. Audit. Financ. 2011, 26, 641–658. [Google Scholar] [CrossRef]

- Bromiley, P.; McShane, M.; Nair, E.; Rustambekov, E. Enterprise Risk Management: Review, Critique, and Research Directions. Long Range Plan. 2015, 48, 265–276. [Google Scholar] [CrossRef]

- Vaughan, E.; Vaughan, T. Fundamentals of Risk and Insurance; John Wiley & Sons: Hoboken, NJ, USA, 2003. [Google Scholar]

- Rejda, G.E. Principles of Risk Management and Insurance; Addison Wesley Longman: London, UK, 2001. [Google Scholar]

- Dorfman, M. Introduction to Risk Management and Insurance; Pearson-Prentice Hall: Upper Saddle River, NJ, USA, 2005. [Google Scholar]

- Hopkin, P. Fundamentals of Risk Management: Understanding, Evaluating and Implementing Effective Risk Management, 3rd ed.; Kogan Page: London, UK, 2015. [Google Scholar]

- Audient, P.; Amado, J.; Rabb, B. Climate Risk Management Approaches in the Electricity Sector: Lessons from Early Adapters. In Weather Matters for Energy; Troccoli, A., Dubus, L., Haupt, S.E., Eds.; Springer: New York, NY, USA, 2014; pp. 17–62. ISBN 978-1-4614-9220-7. [Google Scholar]

- Zillman, J.W. Weather and climate information delivery within national and international frameworks. In Weather Matters for Energy; Troccoli, A., Dubus, L., Haupt, S.E., Eds.; Springer: New York, NY, USA, 2014; pp. 201–218. ISBN 978-1-4614-9220-7. [Google Scholar]

- NatCatSERVICE. Available online: https://natcatservice.munichre.com/ (accessed on 15 December 2019).

- Wieczorek-Kosmala, M.; Błach, J. Financial Slack and Company’s Risk Retention Capacity. In Multiple Perspectives in Risk and Risk Management; Linsley, P., Shrives, P., Wieczorek-Kosmala, M., Eds.; Springer: Cham, Switzerland, 2019; pp. 145–168. ISBN 978-3-030-16045-6. [Google Scholar] [CrossRef]

- Cao, M.; Wei, J. Weather derivatives valuation and market price of weather risk. J. Futures Mark. 2004, 24, 1065–1089. [Google Scholar] [CrossRef]

- Alaton, P.; Djehiche, B.; Stillberger, D. On modelling and pricing weather derivatives. Appl. Math. Financ. 2002, 9, 1–20. [Google Scholar] [CrossRef]

- Yang, C.; Brockett, P.; Wen, M. Basis risk and hedging efficiency of weather derivatives. J. Risk Financ. 2009, 10, 517–536. [Google Scholar] [CrossRef]

- Woodard, J.D.; Garcia, P. Basis risk and weather hedging effectiveness. Agric. Financ. Rev. 2008, 68, 99–117. [Google Scholar] [CrossRef]

- Stulz, R.M. Should we fear Derivatives? J. Econ. Perspect. 2004, 18, 173–192. [Google Scholar] [CrossRef]

- Turvey, C.G. Weather Derivatives for Specific Event Risk in Agriculture. Rev. Agric. Econ. 2001, 23, 333–351. [Google Scholar] [CrossRef]

- Deng, X.; Barnett, B.J.; Vedenov, D.V.; West, J.W. Hedging Dairy Production Losses Using Weather-Based Index Insurance. Agric. Econ. 2007, 36, 271–280. [Google Scholar] [CrossRef]

- Watson, D.; Head, A. Corporate Finance Principles and Practice; Pearson: Harlow, UK, 2013; ISBN 978-0-273-76274-4. [Google Scholar]

- James, B.; Stanga, K. Differences in Disclosure needs of major users of financial statements. Account. Bus. Res. 1997, 7, 187–192. [Google Scholar] [CrossRef]

- Bowman, E.H. Content analysis of annual reports for corporate strategy and risks. Interfaces 1984, 14, 61–71. [Google Scholar] [CrossRef]

- White, M.; Marsh, E.E. Content Analysis: A Flexible Methodology. Libr. Trends 2006, 55, 22–45. [Google Scholar] [CrossRef]

- Beretta, S.; Bozzolan, S. A framework for the analysis of firm risk communication. Int. J. Account. 2004, 39, 265–288. [Google Scholar] [CrossRef]

- Linsley, P.; Shrives, P. Risk reporting: A study of risk disclosure in the annual reports of UK companies. Br. Account. Rev. 2006, 38, 387–404. [Google Scholar] [CrossRef]

- Michelon, G.; Bozzolan, S.; Beretta, S. Board monitoring and internal control system disclosure in different regulatory environments. J. Appl. Account. Res. 2014, 16, 138–164. [Google Scholar] [CrossRef]

- Elshandidy, T.; Shrives, P.; Bamber, M.; Abraham, S. Risk reporting: A review of the literature and implications for future research. J. Account. Lit. 2018, 40, 54–82. [Google Scholar] [CrossRef]

- Abraham, S.; Cox, P. Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. Br. Account. Rev. 2007, 39, 227–248. [Google Scholar] [CrossRef]

- Best Practice for GPW Listed Companies 2016. Available online: https://www.gpw.pl/pub/GPW/o-nas/DPSN2016_EN.pdf (accessed on 15 February 2019).

- Milne, M.J.; Adler, R.W. Exploring the reliability of social and environmental disclosures content analysis. Account. Audit. Account. J. 1999, 12, 237–256. [Google Scholar] [CrossRef]

- Elshandidy, T.; Neri, L. Corporate governance, risk disclosure practices and market liquidity: Comparative evidence from the UK and Italy. Corp. Gov. Int. Rev. 2015, 23, 331–356. [Google Scholar] [CrossRef]

- Weber, R.P. Basic Content Analysis; Sage Publications: Newblury Park, CA, USA, 1990. [Google Scholar]

| Company | Full Name of the Company | Main Business Activity |

|---|---|---|

| BDZ | ZESPÓŁ ELEKTROCIEPŁOWNI BĘDZIN S.A. | generation of electricity and heat; heat distribution (water steam and hot water) |

| ENA | ENEA S.A. | trading electricity and fuel gas on retail and wholesale market; generation and distribution of electricity (from bituminous coal, biomass, gas, wind, water and biogas); bituminous coal mining |

| ENG | ENERGA S.A. | generation, transmission and sale of electricity and heat; sale of gas |

| PGE | PGE POLSKA GRUPA ENERGETYCZNA S.A. | conventional power generation, distribution, retail and wholesale of energy (combines own fuel (lignite) resources, power generation, and final distribution networks) |

| PEP | POLENERGIA S.A. | generation of power from conventional and renewable sources, as well as electricity trading and distribution (offshore wind farms, biomass power plant under development); the first private energy company in Poland |

| TPE | TAURON POLSKA ENERGIA S.A. | generation, distribution and supply of electricity and heat; hard coal mining; one of the largest distributors of electricity in Poland |

| KGN | ZESPÓŁ ELEKTROCIEPŁOWNI WROCŁAWSKICH KOGENERACJA S.A. | generation of heat and electrical power and the transmission and distribution of heat (for Wroclaw and surroundings) |

| ZEP | ZESPÓŁ ELEKTROWNI PĄTNÓW-ADAMÓW-KONIN S.A. | producer of electricity generated from brown coal |

| MLS | ML SYSTEM S.A. | the design, engineering, and production of building-integrated photovoltaic (BIPV) cell systems which generate electrical power from sunlight |

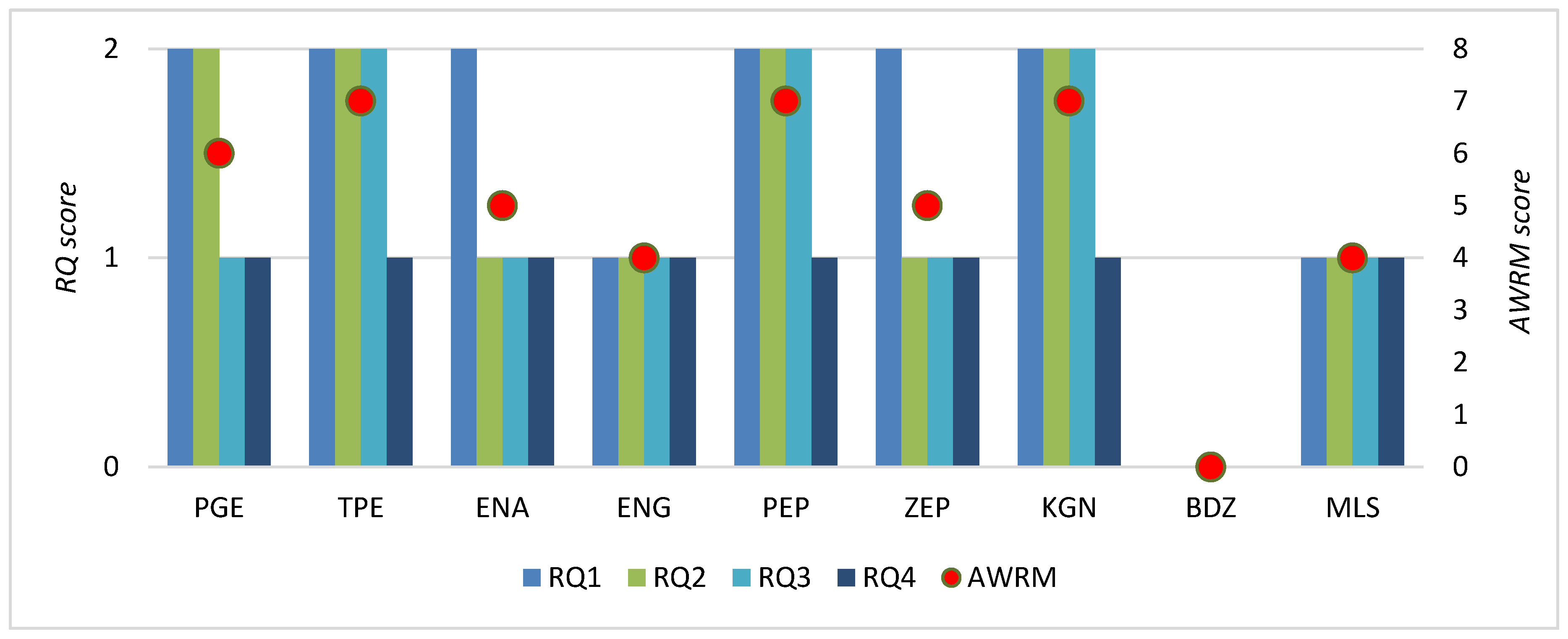

| Research Question | Coding Rules |

|---|---|

| RQ1. Does the company identify its relevant weather risk exposures? | 0–not reported 1–yes, identified with reference to distribution 2–yes, identified with reference to other business processes as well |

| RQ2. Does the company evaluate the impact of weather risk in the cost-revenues dimension? | 0–not addressed 1–yes, evaluated in general way 2–yes, evaluated in detailed way (numerical assessment is provided) |

| RQ3. Does the company disclose the information on methods/measures used to hedge/manage weather risk? | 0–not reported 1–yes, in general way 2–yes, more detailed actions described |

| RQ4. Does the company report on the use of derivatives and hedging weather exposures with derivatives? | 0–not reported 1–yes, company reports the use of derivatives other than weather derivatives 2–yes, company repots the use of weather derivatives |

| Company | ROE | ROA | ROS | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2015 | 2016 | 2017 | 2018 | 2015 | 2016 | 2017 | 2018 | |

| PGE | −7.1 | 6.3 | 5.4 | 3.3 | −4.5 | 4.2 | 3.6 | 2.0 | −10.6 | 9.1 | 11.3 | 5.8 |

| TPE | −11.2 | 2.2 | 4.9 | −11.2 | −5.6 | 1.1 | 2.8 | −5.8 | −9.9 | 2.1 | 11.0 | −19.8 |

| ENA | −3.3 | 6.5 | 8.3 | 4.8 | −1.7 | 3.5 | 4.1 | 2.4 | −4.1 | 7.5 | 10.2 | 5.7 |

| ENG | 4.6 | 0.8 | 3.7 | 3.4 | 9.5 | 1.7 | 8.3 | 7.2 | 7.8 | 1.4 | 7.5 | 7.2 |

| PEP | 4.8 | −8.8 | −7.4 | 0.3 | 2.1 | −3.8 | −3.3 | 0.1 | 2.4 | −3.7 | −3.2 | 0.1 |

| ZEP | −48.4 | 12.0 | 8.3 | −27.5 | −37.8 | 5.2 | 4.1 | −12.0 | −63.8 | 9.3 | 7.5 | −20.1 |

| KGN | 8.9 | 10.3 | 8.8 | 0.8 | 5.7 | 6.7 | 5.7 | 0.5 | 13.0 | 14.7 | 13.0 | 1.2 |

| BDZ | 10.6 | 12.5 | 8.5 | 1.6 | 2.0 | 2.7 | 2.2 | 0.4 | 8.8 | 10.2 | 7.0 | 1.4 |

| MLS | 62.3 | 8.6 | 17.1 | 7.6 | 17.2 | 2.3 | 4.5 | 3.2 | 27.4 | 6.1 | 11.2 | 4.6 |

| Company | RQ1 | RQ2 | RQ3 | RQ4 | AWRM |

|---|---|---|---|---|---|

| PGE | 2 | 2 | 1 | 1 | 6 |

| TPE | 2 | 2 | 2 | 1 | 7 |

| ENA | 2 | 1 | 1 | 1 | 5 |

| ENG | 1 | 1 | 1 | 1 | 4 |

| PEP | 2 | 2 | 2 | 1 | 7 |

| ZEP | 2 | 1 | 1 | 1 | 5 |

| KGN | 2 | 2 | 2 | 1 | 7 |

| BDZ | 0 | 0 | 0 | 0 | 0 |

| MLS | 1 | 1 | 1 | 1 | 4 |

| Mean | 1.56 | 1.33 | 1.22 | 0.89 | 5.00 |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wieczorek-Kosmala, M. Weather Risk Management in Energy Sector: The Polish Case. Energies 2020, 13, 945. https://doi.org/10.3390/en13040945

Wieczorek-Kosmala M. Weather Risk Management in Energy Sector: The Polish Case. Energies. 2020; 13(4):945. https://doi.org/10.3390/en13040945

Chicago/Turabian StyleWieczorek-Kosmala, Monika. 2020. "Weather Risk Management in Energy Sector: The Polish Case" Energies 13, no. 4: 945. https://doi.org/10.3390/en13040945

APA StyleWieczorek-Kosmala, M. (2020). Weather Risk Management in Energy Sector: The Polish Case. Energies, 13(4), 945. https://doi.org/10.3390/en13040945