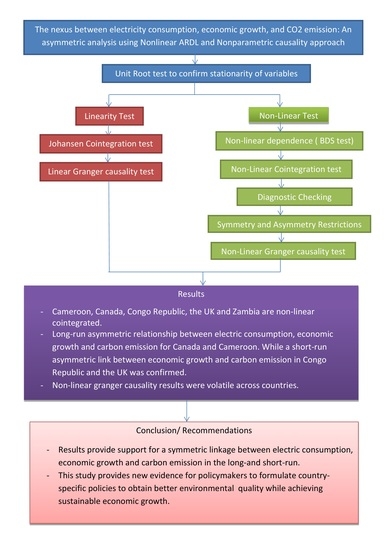

The Nexus Between Electricity Consumption, Economic Growth, and CO2 Emission: An Asymmetric Analysis Using Nonlinear ARDL and Nonparametric Causality Approach

Abstract

1. Introduction

2. Data and Methodology

2.1. Data

2.2. Methodology

3. Empirical Results

3.1. Stationarity Test

3.2. Cointegration Analysis

3.3. Granger Causality Test

3.4. BDS Test

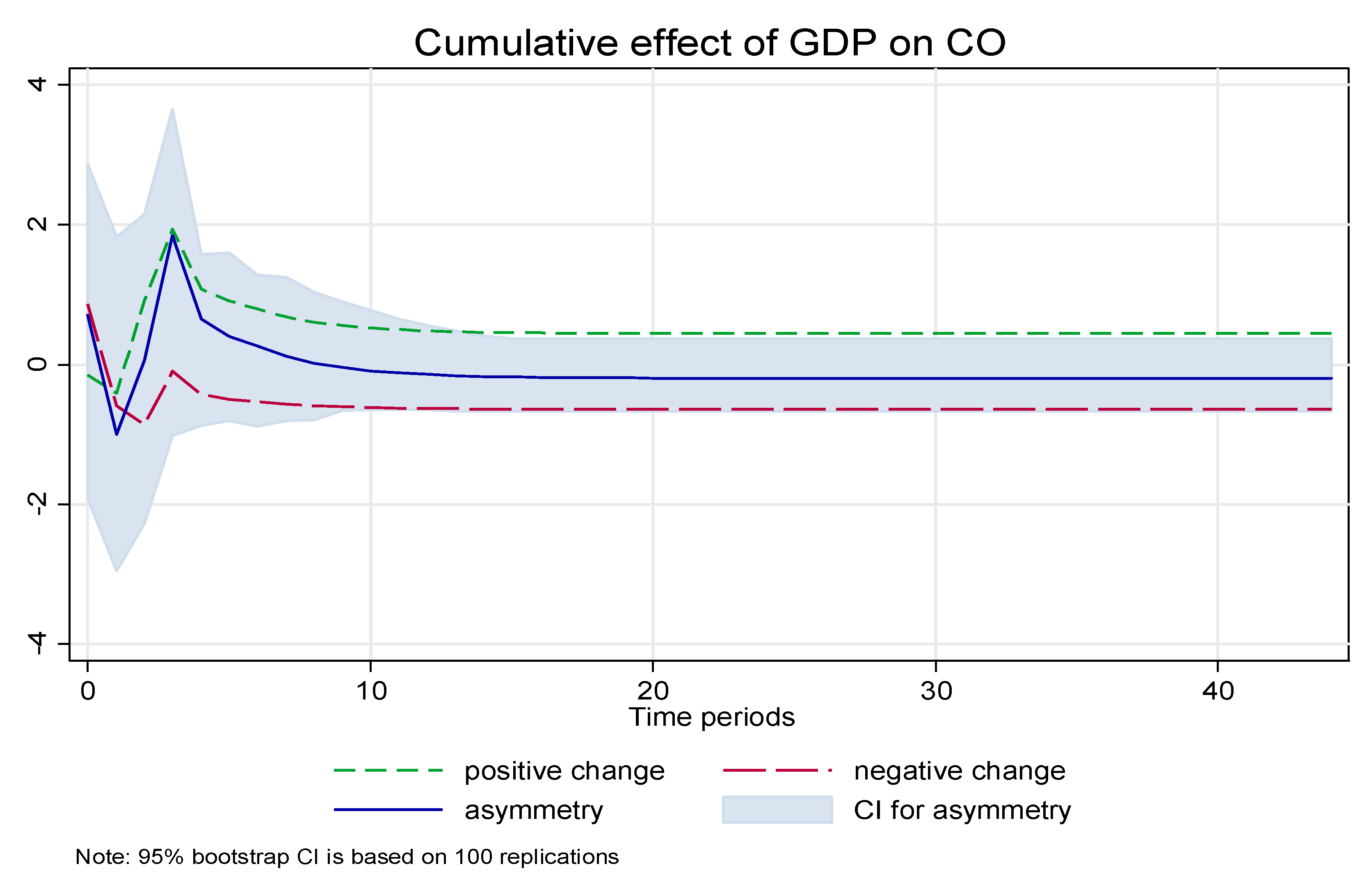

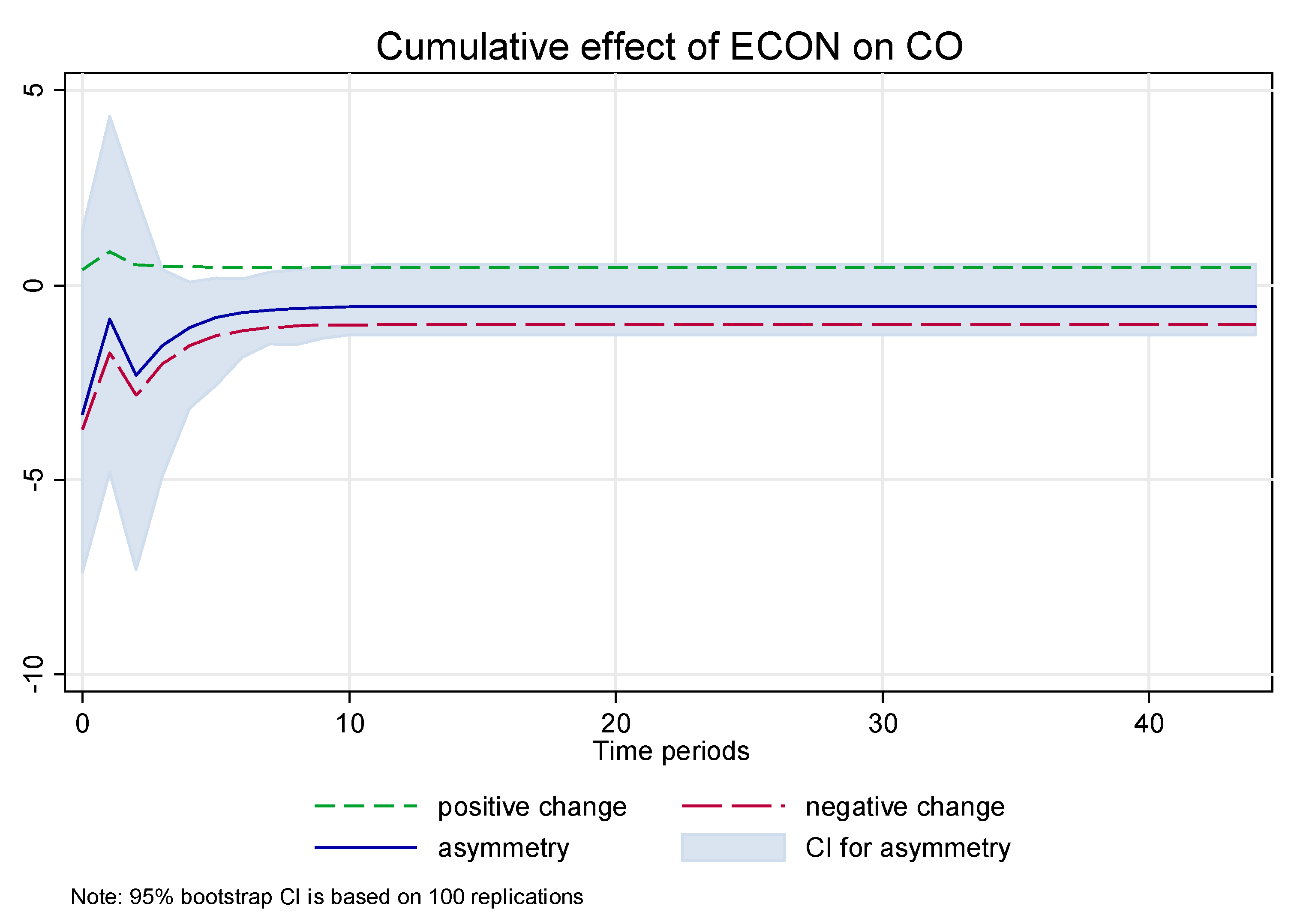

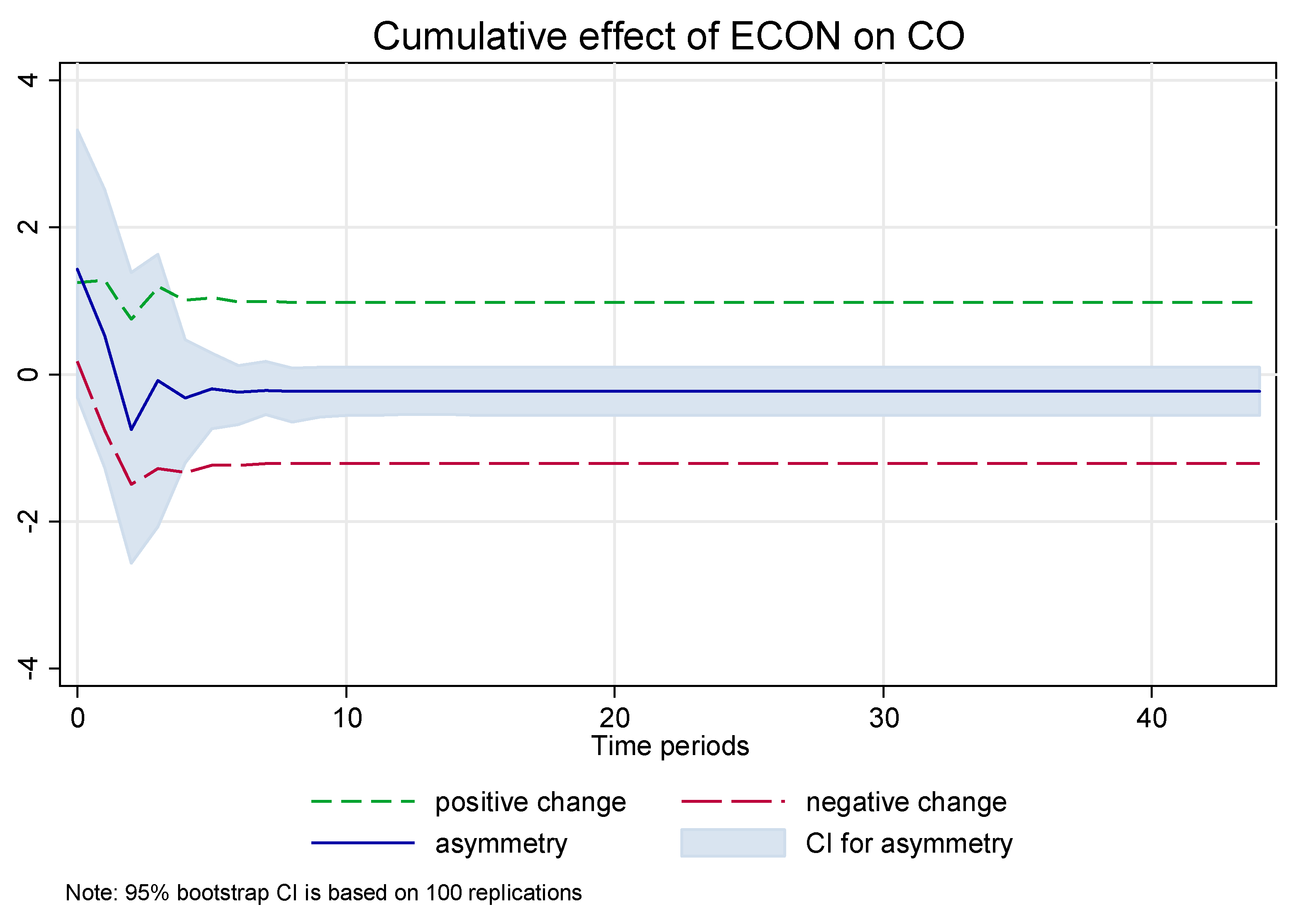

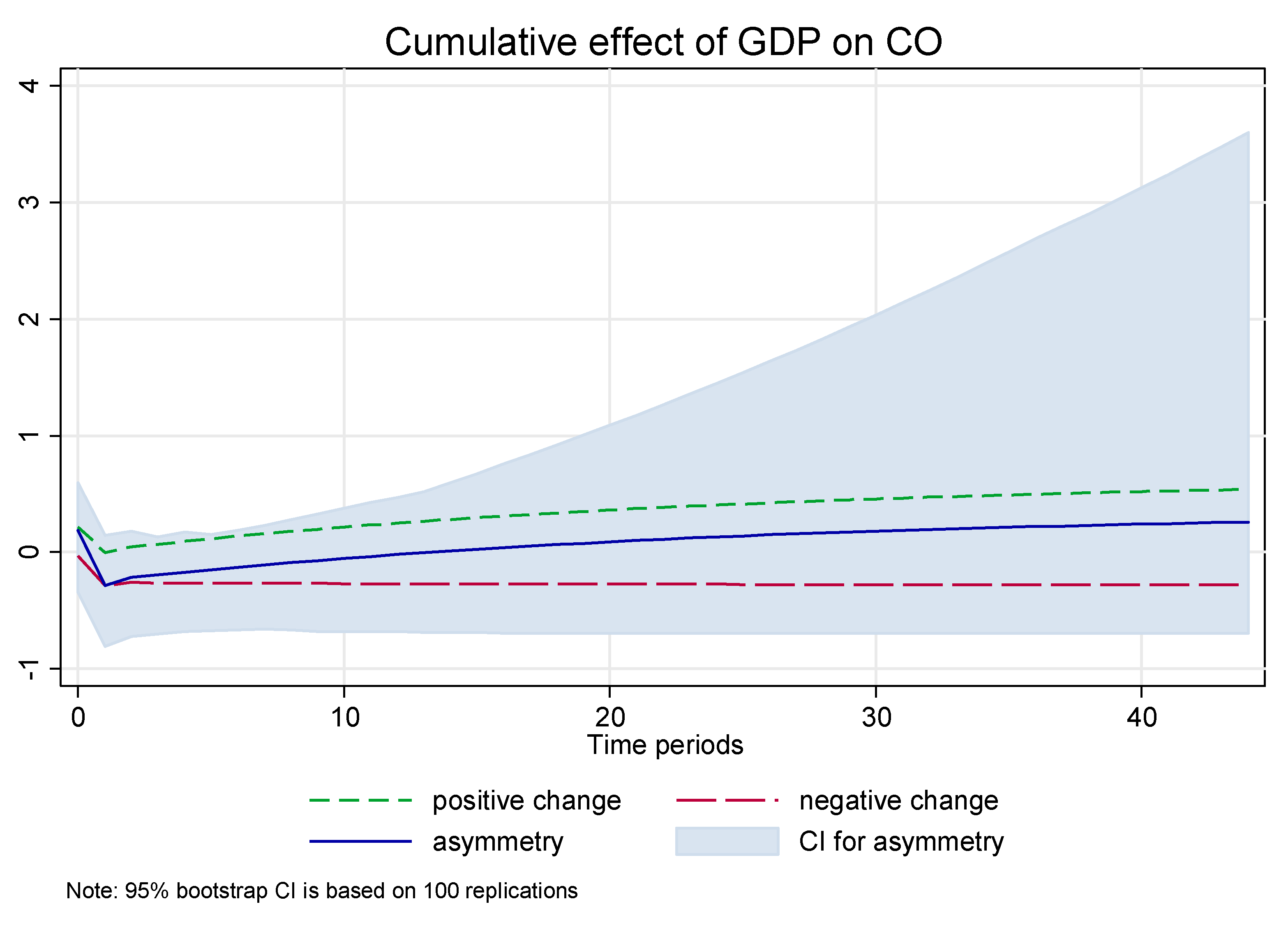

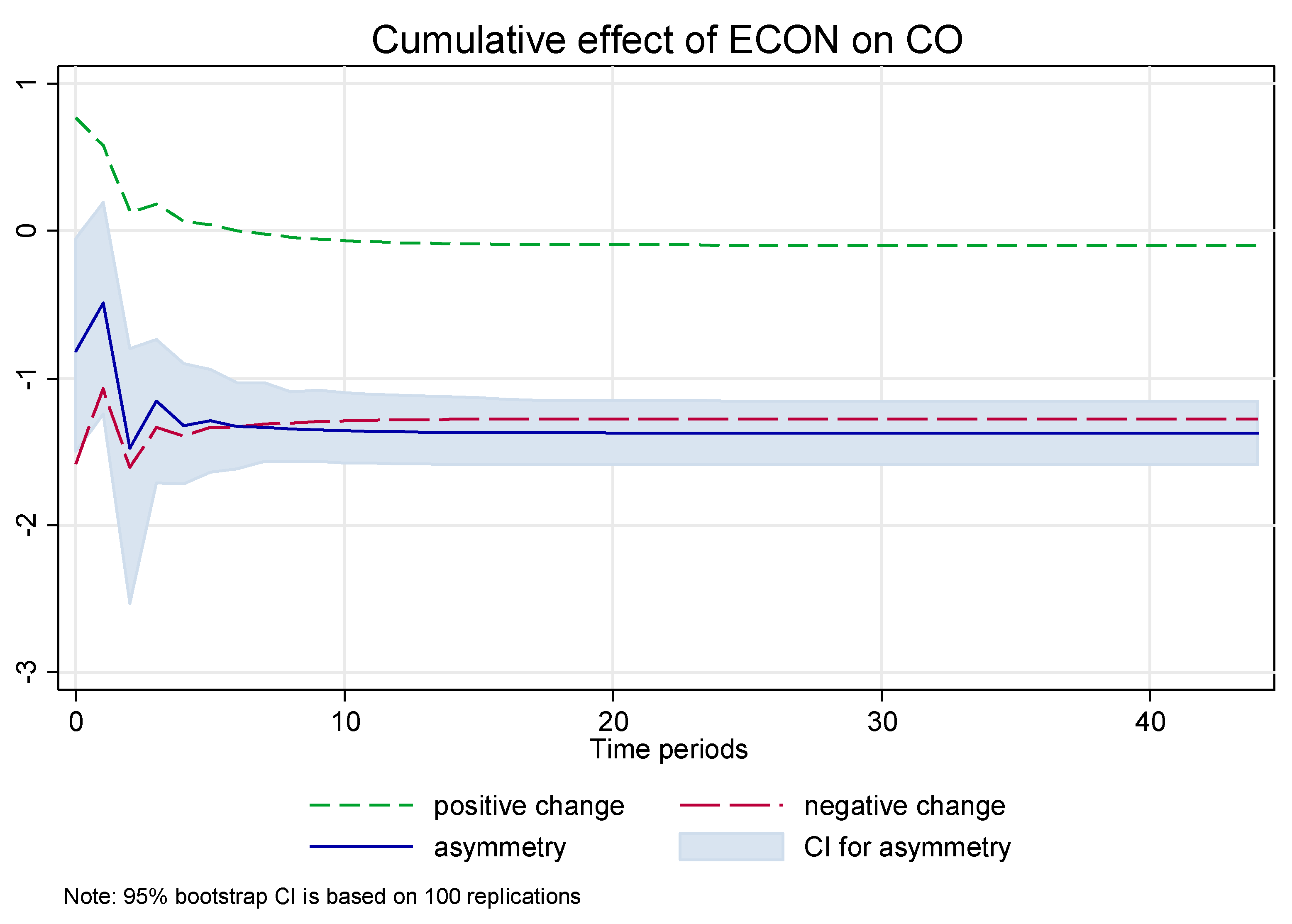

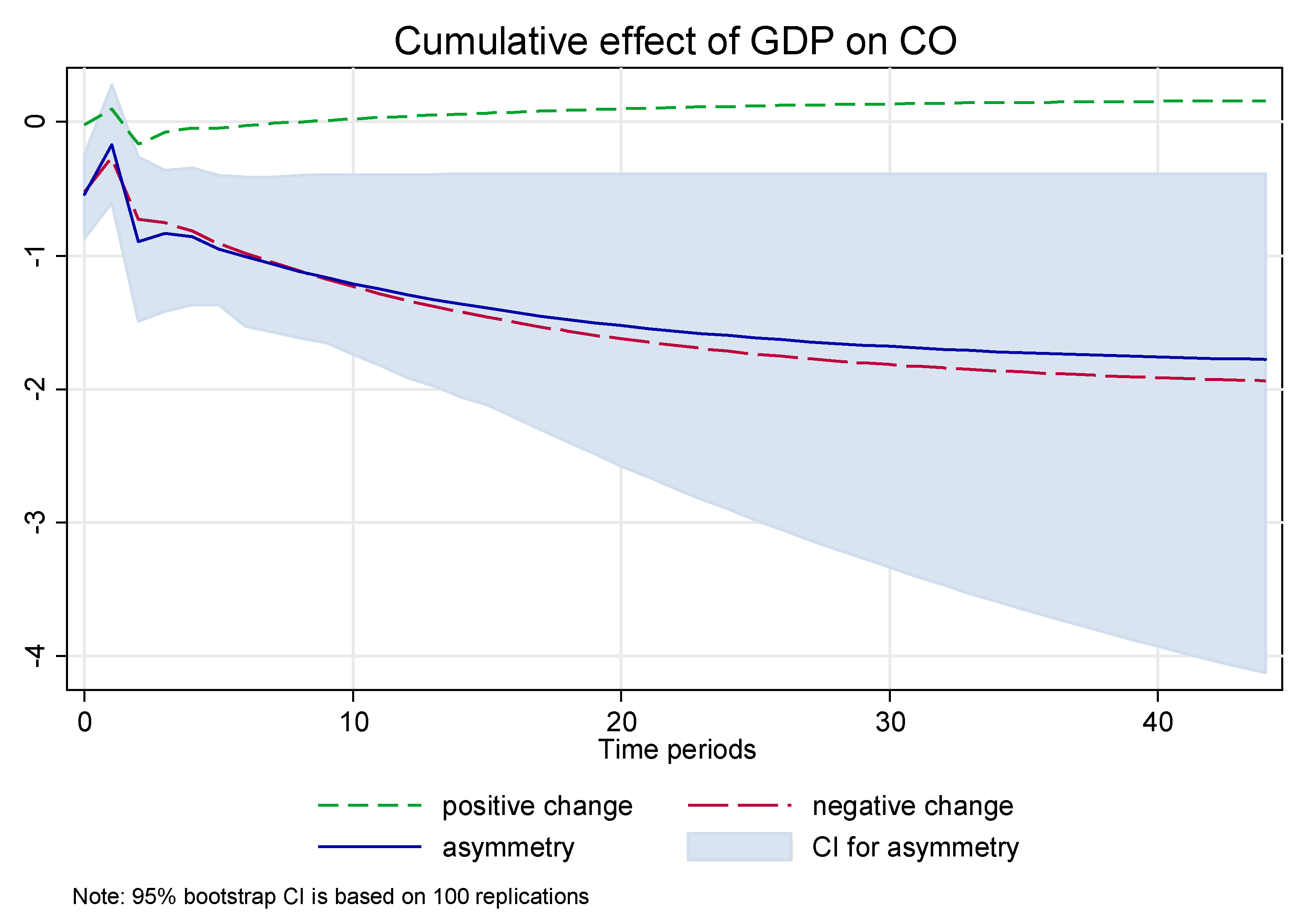

3.5. NARDL Estimated Result

3.6. Diagnostic Tests

3.7. Wald Statistics

3.8. Asymmetric Causality Result

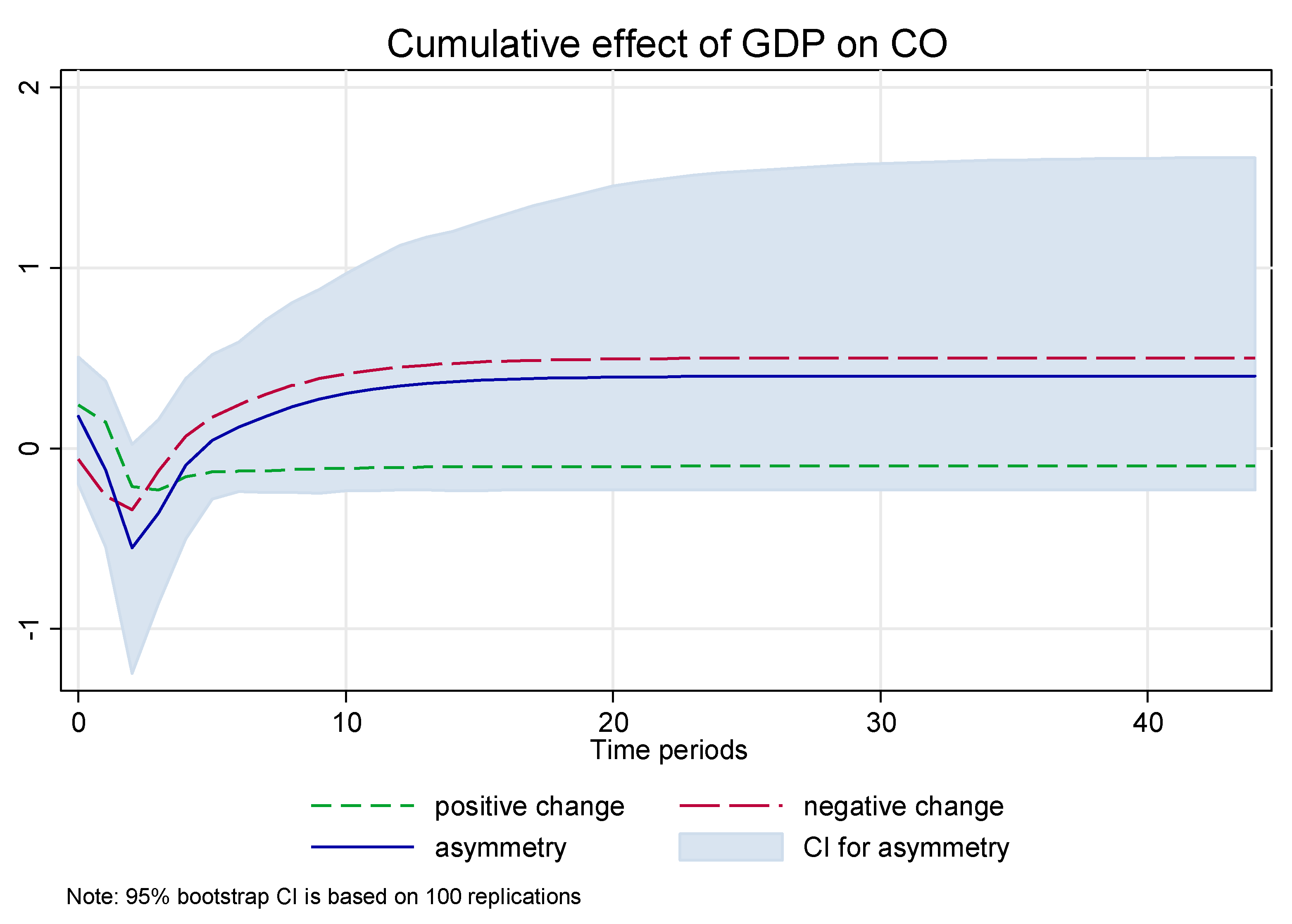

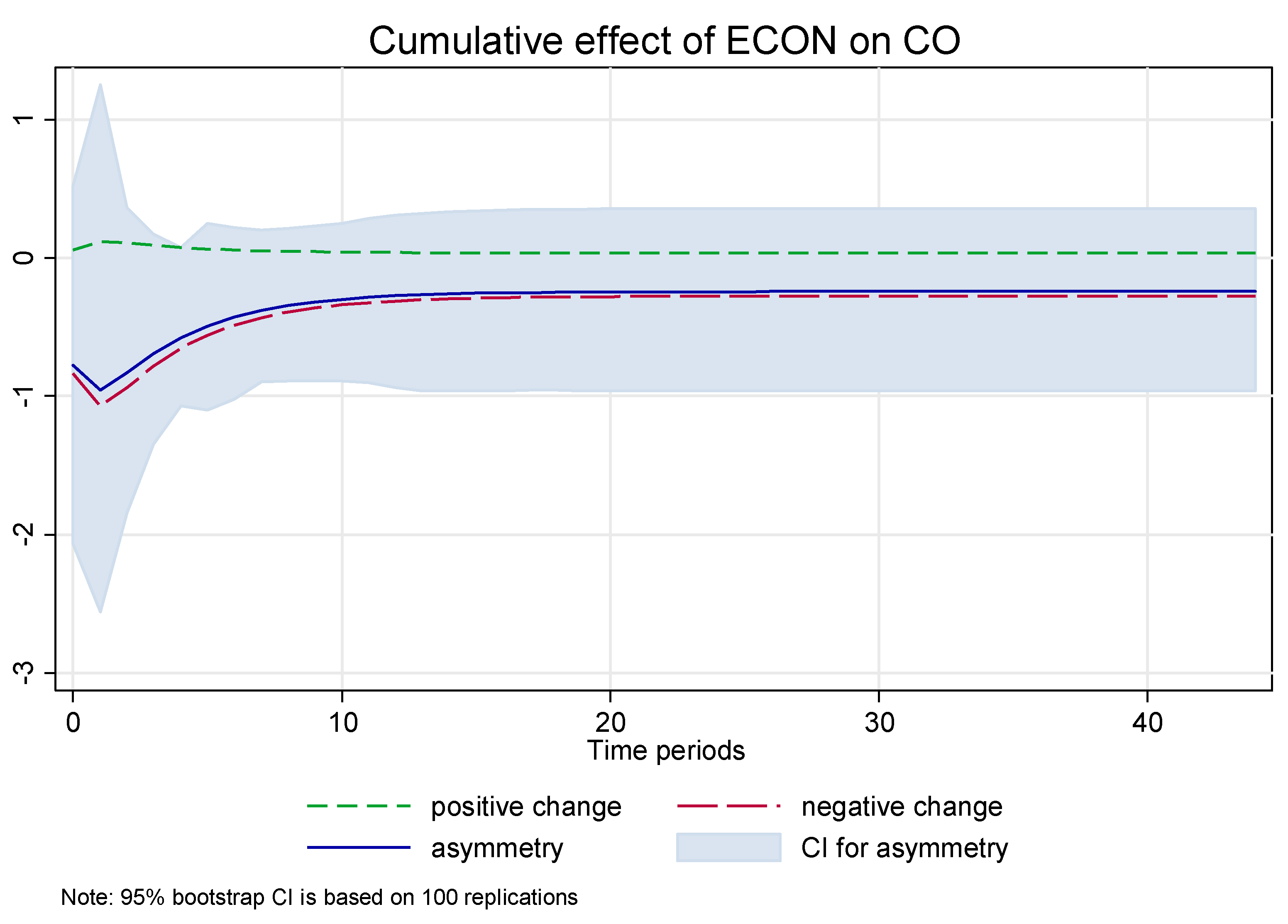

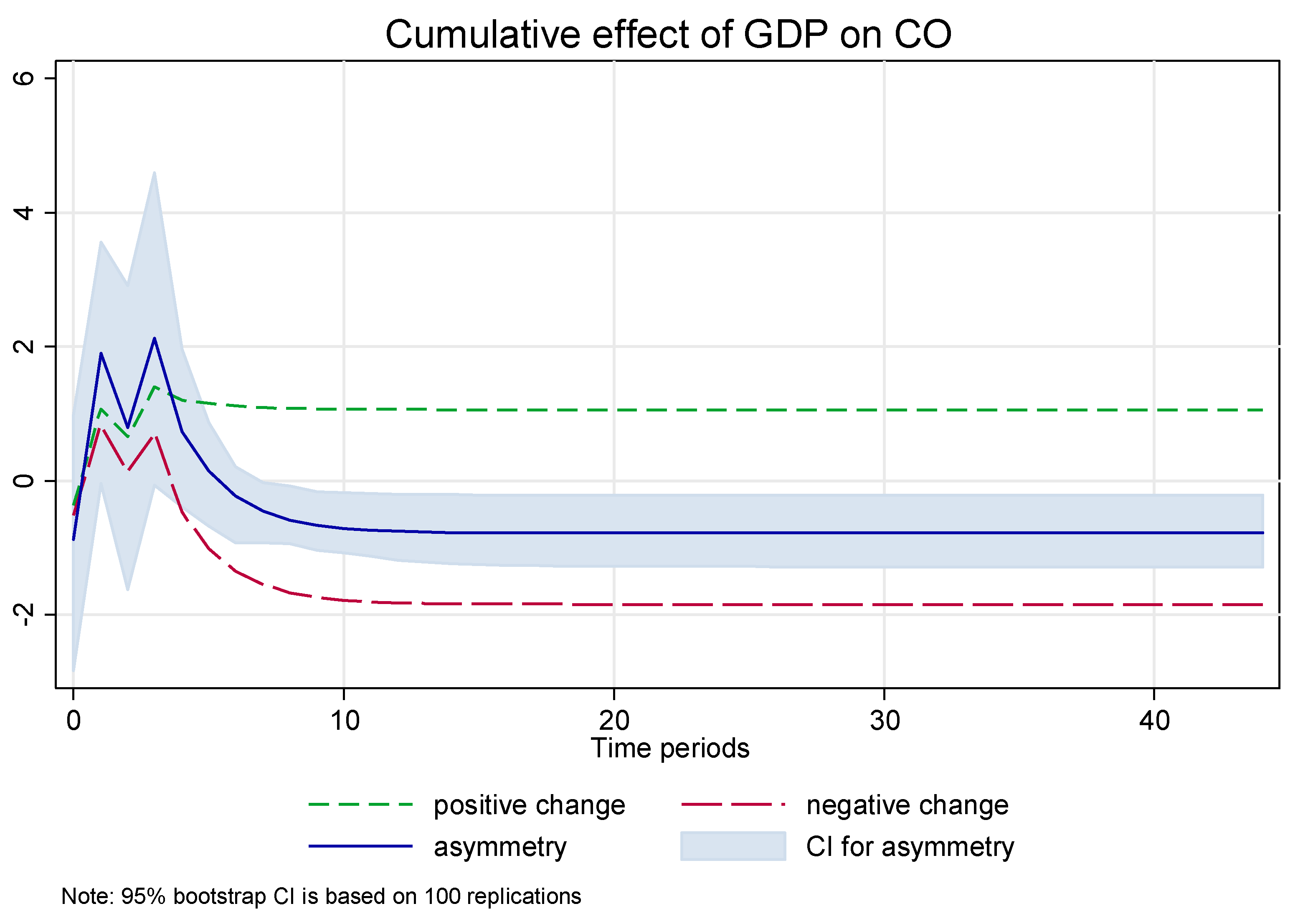

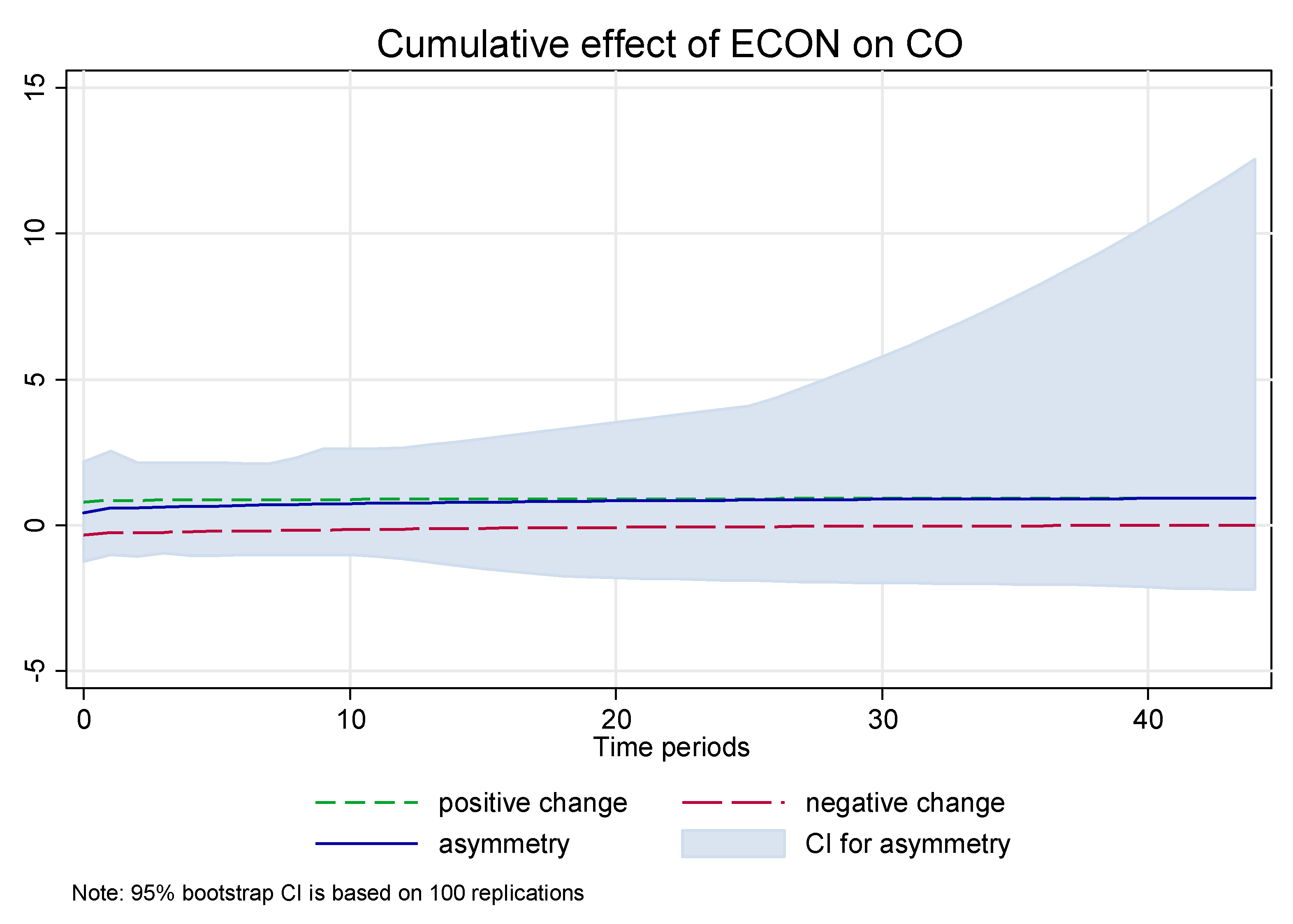

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- Ang, J.B. CO2 emissions, energy consumption, and output in France. Energy Policy 2007, 35, 4772–4778. [Google Scholar] [CrossRef]

- Saidi, K.; Hammami, S. The impact of CO2 emissions and economic growth on energy consumption in 58 countries. Energy Rep. 2015, 1, 62–70. [Google Scholar] [CrossRef]

- Hamilton, T.G.A.; Kelly, S. Low carbon energy scenarios for sub-Saharan Africa: An input-output analysis on the effects of universal energy access and economic growth. Energy Policy 2017, 105, 303–319. [Google Scholar] [CrossRef]

- Appiah, K.; Du, J.; Musah, A.; Afriyie, S. Investigation of the relationship between economic growth and carbon dioxide (CO2) emissions as economic structure changes: Evidence from Ghana. Resour. Environ. 2017, 7, 160–167. [Google Scholar]

- Bouznit, M.; Pablo-Romero, M.d.P. CO2 emission and economic growth in Algeria. Energy Policy 2016, 96, 93–104. [Google Scholar] [CrossRef]

- Esso, J.; Keho, Y. Energy consumption, economic growth and carbon emissions: Cointegration and causality evidence from selected African countries. Energy 2016, 114, 492–497. [Google Scholar] [CrossRef]

- Mezghani, I.; Ben Haddad, H. Energy consumption and economic growth: An empirical study of the electricity consumption in Saudi Arabia. Renew. Sustain. Energy Rev. 2017, 75, 145–156. [Google Scholar] [CrossRef]

- Ahmad, A.; Zhao, Y.; Shahbaz, M.; Bano, S.; Zhang, Z.; Wang, S.; Liu, Y. Carbon emissions, energy consumption and economic growth: An aggregate and disaggregate analysis of the Indian economy. Energy Policy 2016, 96, 131–143. [Google Scholar] [CrossRef]

- Gao, J.; Zhang, L. Electricity Consumption–Economic Growth–CO2 Emissions Nexus in Sub-Saharan Africa: Evidence from Panel Cointegration. Afr. Dev. Rev. 2014, 26, 359–371. [Google Scholar] [CrossRef]

- Cowan, W.N.; Chang, T.; Inglesi-Lotz, R.; Gupta, R. The nexus of electricity consumption, economic growth and CO2 emissions in the BRICS countries. Energy Policy 2014, 66, 359–368. [Google Scholar] [CrossRef]

- Lean, H.H.; Smyth, R. CO2 emissions, electricity consumption and output in ASEAN. Appl. Energy 2010, 87, 1858–1864. [Google Scholar] [CrossRef]

- Akpan, G.; Akpan, U. Electricity Consumption, Carbon Emissions and Economic Growth in Nigeria. Int. J. Energy Econ. Policy 2012, 2, 292–306. [Google Scholar]

- Asumadu-Sarkodie, S.; Owusu, P. The relationship between carbon dioxide emissions, electricity production and consumption in Ghana. Energy Sources Part B Econ. Plan. Policy 2017. [Google Scholar] [CrossRef]

- Ajmi, A.N.; Hammoudeh, S.; Nguyen, D.K.; Sato, J.R. On the relationships between CO2 emissions, energy consumption and income: The importance of time variation. Energy Econ. 2015, 49, 629–638. [Google Scholar] [CrossRef]

- Farhani, S.; Rejeb, J.B. Energy consumption, economic growth and CO2 emissions: Evidence from panel data for MENA region. Int. J. Energy Econ. Policy 2012, 2, 71–81. [Google Scholar]

- Ssali, M.W.; Du, J.; Hongo, D.O.; Mensah, I.A. Impact of Economic Growth, Energy Use and Population Growth on Carbon Emissions in Sub-Sahara Africa. J. Environ. Sci. Eng. 2018, 7, 178–192. [Google Scholar]

- Njoke, M.; Wu, Z.; Tamba, J.G. International Journal of Energy Economics and Policy Empirical Analysis of Electricity Consumption, CO2 Emissions and Economic Growth: Evidence from Cameroon. Int. J. Energy Econ. Policy 2019, 9. [Google Scholar] [CrossRef]

- Arango-Miranda, R.; Hausler, R.; Romero-Lopez, R.; Glaus, M.; Ibarra-Zavaleta, S.P. Carbon dioxide emissions, energy consumption and economic growth: A comparative empirical study of selected developed and developing countries.“The role of exergy”. Energies 2018, 11, 2668. [Google Scholar] [CrossRef]

- Riti, J.S.; Song, D.; Shu, Y.; Kamah, M. Decoupling CO2 emission and economic growth in China: Is there consistency in estimation results in analyzing environmental Kuznets curve? J. Clean. Prod. 2017, 166, 1448–1461. [Google Scholar] [CrossRef]

- Chen, P.Y.; Chen, S.T.; Hsu, C.S.; Chen, C.C. Modeling the global relationships among economic growth, energy consumption and CO2 emissions. Renew. Sustain. Energy Rev. 2016, 65, 420–431. [Google Scholar] [CrossRef]

- Ponta, L.; Raberto, M.; Teglio, A.; Cincotti, S. An Agent-based Stock-flow Consistent Model of the Sustainable Transition in the Energy Sector. Ecol. Econ. 2018, 145, 274–300. [Google Scholar] [CrossRef]

- Liu, H.; Lei, M.; Zhang, N.; Du, G. The causal nexus between energy consumption, carbon emissions and economic growth: New evidence from China, India and G7 countries using convergent cross mapping. PLoS ONE 2019, 14, e0217319. [Google Scholar] [CrossRef] [PubMed]

- Karanfil, F. How many times again will we examine the energy-income nexus using a limited range of traditional econometric tools? Energy Policy 2009, 37, 1191–1194. [Google Scholar] [CrossRef]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt; Springer: Berlin/Heidelberg, Germany, 2014; pp. 281–314. [Google Scholar]

- Narayan, P.K.; Narayan, S. Estimating income and price elasticities of imports for Fiji in a cointegration framework. Econ. Model. 2005, 22, 423–438. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Diks, C.; Panchenko, V. A new statistic and practical guidelines for nonparametric Granger causality testing. J. Econ. Dyn. Control 2006, 30, 1647–1669. [Google Scholar] [CrossRef]

- Hiemstra, C.; Jones, J.D. Testing for linear and nonlinear Granger causality in the stock price-volume relation. J. Financ. 1994, 49, 1639–1664. [Google Scholar]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework; Springer: New York, NY, USA, 2013. [Google Scholar]

- Kisswani, K.M. Evaluating the GDP–energy consumption nexus for the ASEAN-5 countries using nonlinear ARDL model. OPEC Energy Rev. 2017, 41, 318–343. [Google Scholar] [CrossRef]

- Banerjee, A.; Dolado, J.; Mestre, R. Error-correction Mechanism Tests for Cointegration in a Single-equation Framework. J. Time Ser. Anal. 1998, 19, 267–283. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econom. J. Econom. Soc. 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Broock, W.A.; Scheinkman, J.A.; Dechert, W.D.; LeBaron, B. A test for independence based on the correlation dimension. Econom. Rev. 1996, 15, 197–235. [Google Scholar] [CrossRef]

- Kumar, S. On the nonlinear relation between crude oil and gold. Resour. Policy 2017, 51, 219–224. [Google Scholar] [CrossRef]

- Ndoricimpa, A. Analysis of asymmetries in the nexus among energy use, pollution emissions and real output in South Africa. Energy 2017, 125. [Google Scholar] [CrossRef]

- Araç, A.; Hasanov, M. Asymmetries in the dynamic interrelationship between energy consumption and economic growth: Evidence from Turkey. Energy Econ. 2014, 44, 259–269. [Google Scholar] [CrossRef]

- Hatemi, J.A.; Uddin, G.S. Is the causal nexus of energy utilization and economic growth asymmetric in the US? Econ. Syst. 2012, 36, 461–469. [Google Scholar] [CrossRef]

- Ridzuan, A.R.; Razak, M.; Mohammad, N.J.; Fatimah, N.; Abdul Latiff, A.R. Nexus among Carbon Emissions, Real Output and Energy Consumption in Malaysia and South Korea: New Evidence using Non-Linear Autoregressive Distributed Lag (NARDL) Analysis. J. Ekon. Malays. 2018, 52, 39–54. [Google Scholar] [CrossRef]

| Author/Year | Period of Study | Country/Region | Methods | Results |

|---|---|---|---|---|

| [11] | 1980–2006 | ASEAN (five countries) | Panel vector error correction model | The long run shows Unidirectional Granger causality running from electricity consumption and emissions to economic growth while the short run shows emissions to electricity consumption |

| [12] | 1970–2008 | Nigeria | Multivariate Vector Error Correction Model (VECM) | In the long run, economic growth is associated with increasing electricity consumption, while an increase in electricity consumption leads to an increase in carbon emissions |

| [13] | 1971–2012 | Ghana | Autoregressive distributed lag model by employing a time–series data | Bidirectional causality from electricity production from hydroelectric sources to carbon dioxide emissions and unidirectional causality from carbon dioxide emissions to the total energy production |

| [14] | 1960–2010 | G-7 (seven countries) | Time-varying granger causality test, Times series, ADF unit root test | In Italy, France, Japan, USA, and energy consumption contributes to carbon emission |

| [2] | 1990–2012 | 58 countries | Dynamic panel data | The positive impact of CO2 emissions on energy consumption. Economic growth has a positive impact on energy consumption |

| [15] | 1973–2008 | 15 countries | Panel unit root tests, panel cointegration | No causal link between GDP and EC; and between CO2 emissions and EC in the short run. In the long run, there is a unidirectional causality running from GDP and CO2 emissions to EC |

| [10] | 1990–2010 | Five countries | Panel causality analysis | Electricity consumption is found to Granger cause CO2 emissions in India |

| [5] | 1970–2010 | Algeria | Autoregressive Distributed Lag model | Increase electricity consumption increase CO2 emissions |

| [16] | 1990–2014 | Six countries | Vector Error Correction Model (VECM) | Increase in energy use and population growth cause an increase in CO2 |

| [4] | 1970–2016 | Ghana | Linear regression | This means that GDP influences the CO2 emission level in Ghana |

| [17] | 1971–2014 | Cameroon | Autoregressive distributed lag bounds test ARDL | Unidirectional causality running from CO2 emissions to economic growth |

| [6] | 1971–2010 | 12 Countries | Bounds test to cointegration and Granger causality test | Long-run energy consumption and economic growth cause CO2 to increase economic growth causing CO2 emissions in the short run in Congo Dem Rep, Ghana, and Nigeria |

| [9] | 1980–2009 | 14 countries | Panel cointegration and panel vector error correction | Short-run unidirectional causality from economic growth to CO2 emissions, long-run bidirectional causality between electricity consumption and CO2 emissions, economic growth, and CO2 emission |

| Countries | Descriptive Statistics | CE | EC | EG | Countries | Descriptive Statistics | CE | EC | EG |

|---|---|---|---|---|---|---|---|---|---|

| Algeria | Mean | 2.922897 | 2.706138 | 3.305227 | Canada | Mean | 1.217516 | 4.165246 | 4.279594 |

| Maximum | 3.73552 | 3.134455 | 3.747584 | Maximum | 1.261646 | 4.23716 | 4.720509 | ||

| Minimum | 1.255271 | 2.126695 | 2.53325 | Minimum | 1.168529 | 3.962212 | 3.655154 | ||

| Std. Dev. | 0.55274 | 0.259778 | 0.274772 | Std. Dev. | 0.02182 | 0.075963 | 0.288002 | ||

| Cameroon | Mean | 0.290618 | 2.285986 | 2.890544 | France | Mean | 0.827528 | 3.752776 | 4.251049 |

| Maximum | 0.696833 | 2.439645 | 3.187681 | Maximum | 0.987179 | 3.888445 | 4.656425 | ||

| Minimum | 0.090935 | 2.18277 | 2.265908 | Minimum | 0.660218 | 3.439631 | 3.500927 | ||

| Std. Dev. | 0.163003 | 0.079939 | 0.220521 | Std. Dev. | 0.087691 | 0.134177 | 0.31244 | ||

| Congo Democratic Republic | Mean | 0.082502 | 2.08556 | 2.454593 | India | Mean | −0.130583 | 2.445387 | 2.600466 |

| Maximum | 0.151241 | 2.229148 | 2.789566 | Maximum | 0.237461 | 2.905534 | 3.196972 | ||

| Minimum | 0.017264 | 1.945406 | 2.011139 | Minimum | −0.440656 | 1.990218 | 2.074097 | ||

| Std. Dev. | 0.050656 | 0.093504 | 0.197494 | Std. Dev. | 0.202198 | 0.274709 | 0.305116 | ||

| Congo Republic | Mean | 0.493308 | 2.0636 | 3.006853 | Italy | Mean | 0.843616 | 3.606875 | 4.159629 |

| Maximum | 1.088754 | 2.33168 | 3.516191 | Maximum | 0.914686 | 3.765927 | 4.608956 | ||

| Minimum | 0.173913 | 1.751072 | 2.37261 | Minimum | 0.721882 | 3.332998 | 3.361351 | ||

| Std. Dev. | 0.214249 | 0.169441 | 0.279814 | Std. Dev. | 0.046015 | 0.131279 | 0.363219 | ||

| Ghana | Mean | 0.493308 | 2.0636 | 3.006853 | Japan | Mean | 0.94055 | 3.801452 | 4.289991 |

| Maximum | 1.088754 | 2.33168 | 3.516191 | Maximum | 0.996039 | 3.940019 | 4.686667 | ||

| Minimum | 0.173913 | 1.751072 | 2.37261 | Minimum | 0.869882 | 3.533478 | 3.356423 | ||

| Std. Dev. | 0.214249 | 0.169441 | 0.279814 | Std. Dev. | 0.041254 | 0.124557 | 0.377017 | ||

| Kenya | Mean | 0.280366 | 2.067376 | 2.616954 | UK | Mean | 0.973617 | 3.722652 | 4.210788 |

| Maximum | 0.382519 | 2.215705 | 3.119191 | Maximum | 1.072729 | 3.797336 | 4.701511 | ||

| Minimum | 0.189649 | 1.889894 | 2.181357 | Minimum | 0.812742 | 3.628864 | 3.423213 | ||

| Std. Dev. | 0.053723 | 0.075615 | 0.223473 | Std. Dev. | 0.058711 | 0.050998 | 0.381046 | ||

| Nigeria | Mean | 0.647774 | 1.914257 | 2.882562 | US | Mean | 1.288325 | 4.056198 | 4.359856 |

| Maximum | 1.009958 | 2.195338 | 3.508219 | Maximum | 1.352387 | 4.136866 | 4.740623 | ||

| Minimum | 0.32556 | 1.455917 | 2.204795 | Minimum | 1.212467 | 3.876062 | 3.748915 | ||

| Std. Dev. | 0.189814 | 0.184298 | 0.329372 | Std. Dev. | 0.033216 | 0.075537 | 0.292382 | ||

| Zambia | Mean | 0.395191 | 2.905056 | 2.753087 | |||||

| Maximum | 0.993839 | 3.074348 | 3.273904 | ||||||

| Minimum | 0.154271 | 2.754684 | 2.366496 | ||||||

| Std. Dev. | 0.243848 | 0.102734 | 0.232855 |

| Variables | Test | Algeria | Cameroon | Congo Dem Rep | Congo Rep | Ghana | Kenya | Nigeria | |||||||||

| C | T | C | T | C | T | C | T | C | T | C | T | C | T | ||||

| CE | ADF | l(0) | l(0) | l(0) | l(1) | l(1) | l(1) | l(0) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | ||

| PP | l(0) | l(0) | l(0) | l(1) | l(1) | l(1) | l(0) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | |||

| ADF | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(0) | l(0) | l(1) | l(1) | l(1) | l(1) | |||

| EC | PP | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | ||

| EG | ADF | l(0) | l(1) | l(0) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | ||

| PP | l(1) | 1(1) | l(0) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | |||

| Variables | Test | Zambia | Canada | France | Italy | Japan | UK | USA | India | ||||||||

| C | T | C | T | C | T | C | T | C | T | C | T | C | T | C | T | ||

| ADF | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | |

| CE | PP | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) |

| ADF | l(1) | l(1) | l(0) | l(1) | l(0) | l(1) | l(1) | l(1) | l(0) | l(1) | l(1) | l(1) | l(0) | l(1) | l(1) | l(1) | |

| EC | PP | l(1) | l(1) | l(0) | l(1) | l(0) | l(1) | l(0) | l(1) | l(0) | l(1) | l(1) | l(1) | l(0) | l(1) | l(1) | l(1) |

| ADF | l(1) | l(1) | l(1) | l(1) | l(0) | l(1) | l(1) | l(1) | l(0) | l(1) | l(0) | l(1) | l(0) | l(1) | l(1) | l(1) | |

| EG | PP | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(1) | l(0) | l(1) | l(1) | l(1) | l(0) | l(1) | l(1) | l(1) |

| Trace Statistic | H0:NO OF CE(s) | Eigenvalue | Trace Statistic | Critical Value (5%) | Prob |

|---|---|---|---|---|---|

| Algeria | None | 0.365236 | 30.37804 | 29.79707 | 0.0428 ** |

| At most 1 | 0.166102 | 11.28894 | 15.49471 | 0.1943 | |

| Cameroon | None | 0.29695 | 25.95364 | 29.79707 | 0.1301 |

| At most 1 | 0.203942 | 11.15588 | 15.49471 | 0.2021 | |

| Congo Dem Rep | None | 0.256361 | 20.54377 | 29.79707 | 0.3867 |

| At most 1 | 0.146507 | 8.103374 | 15.49471 | 0.4544 | |

| Congo Rep | None | 0.225797 | 23.63666 | 29.79707 | 0.2162 |

| At most 1 | 0.209306 | 12.88795 | 15.49471 | 0.119 | |

| Ghana | None | 0.301613 | 20.03568 | 29.79707 | 0.4205 |

| At most 1 | 0.105791 | 4.958435 | 15.49471 | 0.8132 | |

| Kenya | None | 0.290905 | 21.88823 | 29.79707 | 0.3047 |

| At most 1 | 0.156141 | 7.450056 | 15.49471 | 0.5259 | |

| Nigeria | None | 0.293901 | 23.80702 | 29.79707 | 0.2087 |

| At most 1 | 0.139925 | 9.19106 | 15.49471 | 0.348 | |

| Zambia | None | 0.257435 | 24.82933 | 29.79707 | 0.1676 |

| At most 1 | 0.212006 | 12.32823 | 15.49471 | 0.1419 | |

| Canada | None | 0.366401 | 31.36772 | 29.79707 | 0.0327 ** |

| At most 1 | 0.236336 | 12.2015 | 15.49471 | 0.1475 | |

| France | None | 0.479654 | 38.678 | 29.79707 | 0.0037 *** |

| At most 1 | 0.226027 | 11.24103 | 15.49471 | 0.1971 | |

| Italy | None | 0.415557 | 36.0706 | 29.79707 | 0.0083 *** |

| At most 1 | 0.195721 | 13.51258 | 15.49471 | 0.0973 * | |

| Japan | None | 0.34359 | 35.13987 | 29.79707 | 0.011 ** |

| At most 1 | 0.239756 | 17.45914 | 15.49471 | 0.025 ** | |

| UK | None | 0.227995 | 16.03352 | 29.79707 | 0.7099 |

| At most 1 | 0.11482 | 5.165407 | 15.49471 | 0.791 | |

| USA | None | 0.413801 | 32.89273 | 29.79707 | 0.0213 ** |

| At most 1 | 0.215557 | 10.4607 | 15.49471 | 0.247 | |

| India | None | 0.298482 | 19.45833 | 29.79707 | 0.4603 |

| At most 1 | 0.090786 | 4.568985 | 15.49471 | 0.8527 |

| Countries | Null Hypothesis | F-Statistic | Prob. | Countries | Null Hypothesis | F-Statistic | Prob. |

|---|---|---|---|---|---|---|---|

| Algeria | EC → CE | 3.73024 | 0.0334 ** | Canada | EC → CE | 0.74139 | 0.4834 |

| CE → EC | 0.08119 | 0.9222 | CE → EC | 0.72094 | 0.493 | ||

| EG → CE | 3.27775 | 0.0489 ** | EG → CE | 1.63525 | 0.2087 | ||

| CE → EG | 0.74281 | 0.4827 | CE → EG | 0.79083 | 0.461 | ||

| EG → EC | 0.23354 | 0.7929 | EG → EC | 1.78988 | 0.1811 | ||

| EC → EG | 1.6241 | 0.2108 | EC → EG | 2.75741 | 0.0765 * | ||

| Cameroon | EC → CE | 0.214 | 0.8083 | France | EC → CE | 2.77659 | 0.0752 * |

| CE → EC | 0.18237 | 0.834 | CE → EC | 0.27136 | 0.7638 | ||

| EG → CE | 0.60465 | 0.5516 | EG → CE | 4.31595 | 0.0207 ** | ||

| CE → EG | 0.00533 | 0.9947 | CE → EG | 2.66944 | 0.0826 * | ||

| EG → EC | 1.25546 | 0.2968 | EG → EC | 3.20115 | 0.0522 * | ||

| EC → EG | 0.48177 | 0.6215 | EC → EG | 1.92822 | 0.1597 | ||

| Congo Dem Rep | EC → CE | 6.24997 | 0.0046 *** | Italy | EC → CE | 3.65751 | 0.0355 ** |

| CE → EC | 1.23849 | 0.3016 | CE → EC | 1.18316 | 0.3176 | ||

| EG → CE | 2.20409 | 0.1246 | EG → CE | 4.02528 | 0.0262 ** | ||

| CE → EG | 0.71053 | 0.498 | CE → EG | 1.65053 | 0.2058 | ||

| EG → EC | 0.37974 | 0.6867 | EG → EC | 0.30598 | 0.7382 | ||

| EC → EG | 0.57248 | 0.569 | EC → EG | 3.31447 | 0.0474 ** | ||

| Congo Rep | EC → CE | 0.10508 | 0.9005 | India | EC → CE | 6.89505 | 0.0028 *** |

| CE → EC | 0.87121 | 0.4269 | CE → EC | 1.0526 | 0.3592 | ||

| EG → CE | 0.21994 | 0.8036 | EG → CE | 4.26296 | 0.0216 ** | ||

| CE → EG | 2.83068 | 0.0718 * | CE → EG | 0.50571 | 0.6072 | ||

| EG → EC | 4.06945 | 0.0253 ** | EG → EC | 3.24986 | 0.0501 * | ||

| EC → EG | 1.62577 | 0.2105 | EC → EG | 0.09422 | 0.9103 | ||

| Ghana | EC → CE | 1.84932 | 0.1716 | Japan | EC → CE | 6.9755 | 0.0027 *** |

| CE → EC | 1.6038 | 0.2148 | CE → EC | 2.86315 | 0.0698 * | ||

| EG → CE | 1.47154 | 0.2427 | EG → CE | 2.77791 | 0.0752 * | ||

| CE → EG | 0.17242 | 0.8423 | CE → EG | 0.83034 | 0.4439 | ||

| EG → EC | 0.22212 | 0.8019 | EG → EC | 2.1134 | 0.1352 | ||

| EC → EG | 0.82095 | 0.4479 | EC → EG | 0.47837 | 0.6236 | ||

| Kenya | EC → CE | 0.01659 | 0.9836 | UK | EC → CE | 1.07729 | 0.351 |

| CE → EC | 0.78295 | 0.4645 | CE → EC | 1.03759 | 0.3644 | ||

| EG → CE | 2.93706 | 0.0655 * | EG → CE | 0.20035 | 0.8193 | ||

| CE → EG | 0.14195 | 0.8681 | CE → EG | 3.51439 | 0.0401 ** | ||

| EG → EC | 2.19865 | 0.1252 | EG → EC | 0.66932 | 0.5181 | ||

| EC → EG | 1.06938 | 0.3536 | EC → EG | 1.75129 | 0.1876 | ||

| Nigeria | EC → CE | 2.22935 | 0.1219 | USA | EC → CE | 2.49945 | 0.0959 * |

| CE → EC | 2.13579 | 0.1325 | CE → EC | 2.56572 | 0.0905 * | ||

| EG → CE | 0.45624 | 0.6372 | EG → CE | 4.51722 | 0.0176 ** | ||

| CE → EG | 0.40931 | 0.6671 | CE → EG | 0.6751 | 0.5153 | ||

| EG → EC | 3.04042 | 0.0599 * | EG → EC | 0.84132 | 0.4392 | ||

| EC → EG | 0.41647 | 0.6624 | EC → EG | 0.2421 | 0.7862 | ||

| Zambia | EC → CE | 1.10585 | 0.3416 | ||||

| CE → EC | 4.43946 | 0.0187 ** | |||||

| EG → CE | 0.45031 | 0.6409 | |||||

| CE → EG | 1.60523 | 0.2145 | |||||

| EG → EC | 0.81827 | 0.449 | |||||

| EC → EG | 2.43537 | 0.1015 |

| Countries | Dimension | CE | EC | EG | |||

|---|---|---|---|---|---|---|---|

| BDS Statistic | Prob. | BDS Statistic | Prob. | BDS Statistic | Prob. | ||

| Algeria | 2 | 0.105003 | 0.00 | 0.193952 | 0.00 | 0.170057 | 0.00 |

| 3 | 0.199553 | 0.00 | 0.331602 | 0.00 | 0.284167 | 0.00 | |

| 4 | 0.260678 | 0.00 | 0.427578 | 0.00 | 0.353515 | 0.00 | |

| 5 | 0.297169 | 0.00 | 0.499455 | 0.00 | 0.399866 | 0.00 | |

| 6 | 0.321721 | 0.00 | 0.555203 | 0.00 | 0.428102 | 0.00 | |

| Cameroon | 2 | 0.107452 | 0.00 | 0.128301 | 0.00 | 0.181131 | 0.00 |

| 3 | 0.175527 | 0.00 | 0.202189 | 0.00 | 0.304475 | 0.00 | |

| 4 | 0.200206 | 0.00 | 0.236603 | 0.00 | 0.398374 | 0.00 | |

| 5 | 0.225961 | 0.00 | 0.235713 | 0.00 | 0.45754 | 0.00 | |

| 6 | 0.229277 | 0.00 | 0.215287 | 0.00 | 0.502727 | 0.00 | |

| Congo Dem Rep | 2 | 0.162146 | 0.00 | 0.156763 | 0.00 | 0.101517 | 0.00 |

| 3 | 0.282315 | 0.00 | 0.2707 | 0.00 | 0.173873 | 0.00 | |

| 4 | 0.35722 | 0.00 | 0.345889 | 0.00 | 0.211222 | 0.00 | |

| 5 | 0.403951 | 0.00 | 0.386062 | 0.00 | 0.220255 | 0.00 | |

| 6 | 0.43287 | 0.00 | 0.403532 | 0.00 | 0.20939 | 0.00 | |

| Congo Rep | 2 | 0.055223 | 0.00 | 0.143762 | 0.00 | 0.155829 | 0.00 |

| 3 | 0.059604 | 0.00 | 0.238804 | 0.00 | 0.249817 | 0.00 | |

| 4 | 0.069555 | 0.00 | 0.291545 | 0.00 | 0.306989 | 0.00 | |

| 5 | 0.099616 | 0.00 | 0.334446 | 0.00 | 0.32828 | 0.00 | |

| 6 | 0.113852 | 0.00 | 0.355971 | 0.00 | 0.350033 | 0.00 | |

| Ghana | 2 | 0.076573 | 0.00 | 0.024998 | 0.0002 | 0.158845 | 0.00 |

| 3 | 0.109389 | 0.00 | 0.045023 | 0.0014 | 0.248843 | 0.00 | |

| 4 | 0.130795 | 0.00 | 0.066833 | 0.0025 | 0.290209 | 0.00 | |

| 5 | 0.164108 | 0.00 | 0.086105 | 0.0047 | 0.294131 | 0.00 | |

| 6 | 0.171535 | 0.00 | 0.102613 | 0.008 | 0.260864 | 0.00 | |

| Kenya | 2 | 0.086154 | 0.00 | 0.169199 | 0.00 | 0.164273 | 0.00 |

| 3 | 0.142116 | 0.00 | 0.283358 | 0.00 | 0.258597 | 0.00 | |

| 4 | 0.164537 | 0.00 | 0.366134 | 0.00 | 0.304532 | 0.00 | |

| 5 | 0.179836 | 0.00 | 0.422513 | 0.00 | 0.326773 | 0.00 | |

| 6 | 0.186924 | 0.00 | 0.459999 | 0.00 | 0.320852 | 0.00 | |

| Nigeria | 2 | 0.114579 | 0.00 | 0.161318 | 0.00 | 0.141255 | 0.00 |

| 3 | 0.196433 | 0.00 | 0.270383 | 0.00 | 0.221377 | 0.00 | |

| 4 | 0.239216 | 0.00 | 0.336179 | 0.00 | 0.25643 | 0.00 | |

| 5 | 0.259247 | 0.00 | 0.377794 | 0.00 | 0.263086 | 0.00 | |

| 6 | 0.254886 | 0.00 | 0.40926 | 0.00 | 0.247394 | 0.00 | |

| Zambia | 2 | 0.200475 | 0.00 | 0.178221 | 0.00 | 0.147771 | 0.00 |

| 3 | 0.343935 | 0.00 | 0.306271 | 0.00 | 0.225614 | 0.00 | |

| 4 | 0.445896 | 0.00 | 0.39345 | 0.00 | 0.254843 | 0.00 | |

| 5 | 0.514128 | 0.00 | 0.44653 | 0.00 | 0.245413 | 0.00 | |

| 6 | 0.558996 | 0.00 | 0.479374 | 0.00 | 0.201134 | 0.00 | |

| Canada | 2 | 0.080204 | 0.00 | 0.206258 | 0.00 | 0.199779 | 0.00 |

| 3 | 0.103005 | 0.00 | 0.3539 | 0.00 | 0.336459 | 0.00 | |

| 4 | 0.084996 | 0.00 | 0.457202 | 0.00 | 0.431374 | 0.00 | |

| 5 | 0.078235 | 0.00 | 0.525923 | 0.00 | 0.497456 | 0.00 | |

| 6 | 0.068592 | 0.00 | 0.56914 | 0.00 | 0.547155 | 0.00 | |

| France | 2 | 0.163412 | 0.00 | 0.204949 | 0.00 | 0.196726 | 0.00 |

| 3 | 0.289459 | 0.00 | 0.350851 | 0.00 | 0.331367 | 0.00 | |

| 4 | 0.380143 | 0.00 | 0.45149 | 0.00 | 0.423886 | 0.00 | |

| 5 | 0.4408 | 0.00 | 0.522092 | 0.00 | 0.487027 | 0.00 | |

| 6 | 0.485373 | 0.00 | 0.569992 | 0.00 | 0.532607 | 0.00 | |

| India | 2 | 0.189838 | 0.00 | 0.202638 | 0.00 | 0.170306 | 0.00 |

| 3 | 0.321817 | 0.00 | 0.341536 | 0.00 | 0.27571 | 0.00 | |

| 4 | 0.412688 | 0.00 | 0.439773 | 0.00 | 0.336546 | 0.00 | |

| 5 | 0.480644 | 0.00 | 0.511783 | 0.00 | 0.363189 | 0.00 | |

| 6 | 0.531615 | 0.00 | 0.565432 | 0.00 | 0.362527 | 0.00 | |

| Italy | 2 | 0.124107 | 0.00 | 0.205388 | 0.00 | 0.198287 | 0.00 |

| 3 | 0.199055 | 0.00 | 0.347467 | 0.00 | 0.337188 | 0.00 | |

| 4 | 0.255769 | 0.00 | 0.445715 | 0.00 | 0.432288 | 0.00 | |

| 5 | 0.304765 | 0.00 | 0.513719 | 0.00 | 0.49981 | 0.00 | |

| 6 | 0.348158 | 0.00 | 0.561999 | 0.00 | 0.548191 | 0.00 | |

| Japan | 2 | 0.130974 | 0.00 | 0.20226 | 0.00 | 0.19826 | 0.00 |

| 3 | 0.214075 | 0.00 | 0.342598 | 0.00 | 0.332145 | 0.00 | |

| 4 | 0.279849 | 0.00 | 0.438075 | 0.00 | 0.423417 | 0.00 | |

| 5 | 0.328569 | 0.00 | 0.502306 | 0.00 | 0.485776 | 0.00 | |

| 6 | 0.360967 | 0.00 | 0.547246 | 0.00 | 0.532357 | 0.00 | |

| UK | 2 | 0.136697 | 0.00 | 0.182075 | 0.00 | 0.192947 | 0.00 |

| 3 | 0.209694 | 0.00 | 0.313775 | 0.00 | 0.329044 | 0.00 | |

| 4 | 0.240209 | 0.00 | 0.403705 | 0.00 | 0.422667 | 0.00 | |

| 5 | 0.226817 | 0.00 | 0.456634 | 0.00 | 0.488736 | 0.00 | |

| 6 | 0.231836 | 0.00 | 0.487238 | 0.00 | 0.537163 | 0.00 | |

| USA | 2 | 0.108404 | 0.00 | 0.196528 | 0.00 | 0.207598 | 0.00 |

| 3 | 0.157763 | 0.00 | 0.336914 | 0.00 | 0.352866 | 0.00 | |

| 4 | 0.174652 | 0.00 | 0.43523 | 0.00 | 0.454769 | 0.00 | |

| 5 | 0.174586 | 0.00 | 0.498253 | 0.00 | 0.527503 | 0.00 | |

| 6 | 0.186507 | 0.00 | 0.540499 | 0.00 | 0.579837 | 0.00 | |

| Countries | NARDL Model | |

|---|---|---|

| FPSS Nonlinear | t BDM | |

| Algeria | 1.484 | −2.596 |

| Cameroon | 3.4408 | −3.3761 * |

| Congo Dem Rep | 2.2482 | −2.82 |

| Congo Rep | 4.9467 ** | −3.443 * |

| Ghana | 3.1382 | −2.6191 |

| Kenya | 2.0282 | −2.0245 |

| Nigeria | 2.6851 | −1.2945 |

| Zambia | 5.8399 ** | −1.6406 |

| Canada | 3.8426 | −4.1233 *** |

| France | 1.3881 | −2.0747 |

| India | 2.2959 | −2.4902 |

| Italy | 2.9466 | −0.2466 |

| Japan | 2.4658 | −0.7259 |

| UK | 3.3391 | −3.811 ** |

| USA | 1.0729 | −1.0617 |

| Countries | Diagnostics | t-Statistics | Countries | Diagnostics | t-Statistics |

|---|---|---|---|---|---|

| Algeria | SC | 19.45 (0.3648) | Canada | SC | 19.7 (0.3499) |

| HT | 0.5752 (0.4482) | HT | 0.42 (0.517) | ||

| FF | 0.5179 (0.675) | FF | 0.4713 (0.7071) | ||

| JB | 0.9748 (0.6142) | JB | 2.415 (0.2989) | ||

| Cameroon | SC | 16.59 (0.4824) | France | SC | 14.38 (0.7613) |

| HT | 1.303 (0.2537) | HT | 1.25 (0.2635) | ||

| FF | 4.825 (0.0813) | FF | 0.341 (0.7959) | ||

| JB | 1.303 (0.5213) | JB | 1.568 (0.4566) | ||

| Congo Dem Rep | SC | 11.5 (0.9058) | India | SC | 11.24 (0.8838) |

| HT | 0.5148 (0.4731) | HT | 0.1308 (0.7176) | ||

| FF | 1.268 (0.3076) | FF | 0.4375 (0.7287) | ||

| JB | 3.927 (0.1404) | JB | 0.342 (0.8428) | ||

| Congo Rep | SC | 18.8 (0.3353) | Italy | SC | 23.74 (0.1636) |

| HT | 1.25 (0.2635) | HT | 0.3765 (0.5395) | ||

| FF | 3.592 (0.0592) | FF | 0.5003 (0.6881) | ||

| JB | 0.5108 (0.7746) | JB | 0.01372 (0.9932) | ||

| Ghana | SC | 17.5 (0.5561) | Japan | SC | 17.54 (0.4866) |

| HT | 0.6912 (0.4057) | HT | 2.095 (0.1478) | ||

| FF | 0.7177 (0.5511) | FF | 0.01084 (0.9984) | ||

| JB | 0.1825 (0.9128) | JB | 1.713 (0.4246) | ||

| Kenya | SC | 16.15 (0.513) | UK | SC | 17.51 (0.5552) |

| HT | 0.2476 (0.6187) | HT | 0.5324 (0.4656) | ||

| FF | 1.506 (0.27) | FF | 1.84 (0.1668) | ||

| JB | 1.421 (0.4914) | JB | 0.01132 (0.9944) | ||

| Nigeria | SC | 17.3 (0.5026) | America | SC | 12.06 (0.7964) |

| HT | 0.5741 (0.4486) | HT | 0.2597 (0.6103) | ||

| FF | 1.542 (0.2362) | FF | 1.391 (0.3476) | ||

| JB | 1.67 (0.4339) | JB | 1.565 (0.4573) | ||

| Zambia | SC | 21.13 (0.2204) | |||

| HT | 1.263 (0.2611) | ||||

| FF | 0.8364 (0.5401) | ||||

| JB | 2.531 (0.2822) |

| Countries | Wald Statistics | EC | EG |

|---|---|---|---|

| Cameroon | WLR-E | 23.42 (0.002) *** | 20.22 (0.003) *** |

| WSR-E | 1.717 (0.231) | 1.889 (0.212) | |

| Congo Rep | WLR-E | 0.1894 (0.671) | 0.5281 (0.481) |

| WSR-E | 0.1184 (0.737) | 9.392 (0.01) ** | |

| Zambia | WLR-E | 0.3459 (0.575) | 0.2628 (0.624) |

| WSR-E | 1.585 (0.248) | 2.357 (0.169) | |

| Canada | WLR-E | 5.377 (0.033) ** | 12.05 (0.003) *** |

| WSR-E | 0.1241 (0.729) | 0.4578 (0.508) | |

| UK | WLR-E | 0.5955 (0.447) | 1.79 (0.192) |

| WSR-E | 2.562 (0.121) | 3.887 (0.059) * |

| Countries | EC | EG | ||

|---|---|---|---|---|

| Long | Short | Long | Short | |

| Cameroon | A | S | A | S |

| Congo Rep | S | S | S | A |

| Zambia | S | S | S | S |

| Canada | A | S | A | S |

| UK | S | S | S | A |

| Country | Null Hypothesis | Test Statistics | p-value | Causality | Country | Null Hypothesis | Test Statistics | p-value | Causality |

|---|---|---|---|---|---|---|---|---|---|

| Algeria | CE→EC | 1.297 | 0.90272 | No Causality | America | CE→EC | 0.08 | 0.46792 | No Causality |

| EC→CE | 1 | 0.15864 | No Causality | EC→CE | 1.091 | 0.13773 | No Causality | ||

| CE→EG | 1.078 | 0.85958 | No Causality | CE→EG | 0.741 | 0.7708 | No Causality | ||

| EG→CE | 1.15 | 0.12498 | No Causality | EG→CE | 1.169 | 0.12115 | No Causality | ||

| EC→EG | 1.019 | 0.84601 | No Causality | EC→EG | 0.75 | 0.22651 | No Causality | ||

| EG→EC | 0.615 | 0.26937 | No Causality | EG→EC | 0.777 | 0.22651 | No Causality | ||

| Cameroon | CE→EC | 0.654 | 0.25645 | No Causality | Canada | CE→EC | 0.932 | 0.82433 | No Causality |

| EC→CE | 1.253 | 0.89487 | No Causality | EC→CE | 1.094 | 0.13707 | No Causality | ||

| CE→EG | 1.308 | 0.90464 | No Causality | CE→EG | 1.295 | 0.90237 | No Causality | ||

| EG→CE | 1.533 | 0.93736 | No Causality | EG→CE | 0.809 | 0.20929 | No Causality | ||

| EC→EG | 1.112 | 0.13315 | No Causality | EC→EG | 0.913 | 0.18057 | No Causality | ||

| EG→EC | 0.7 | 0.2421 | No Causality | EG→EC | 0.856 | 0.80411 | No Causality | ||

| Congo Dem Rep | CE→EC | 1.407 | 0.07976 * | Causality | France | CE→EC | 0.701 | 0.75848 | No Causality |

| EC→CE | 1.473 | 0.07036 * | Causality | EC→CE | 1.054 | 0.14586 | No Causality | ||

| CE→EG | 0.076 | 0.46961 | No Causality | CE→EG | 1.099 | 0.1358 | No Causality | ||

| EG→CE | 0.591 | 0.27738 | No Causality | EG→CE | 0.808 | 0.20952 | No Causality | ||

| EC→EG | 0.395 | 0.65362 | No Causality | EC→EG | 1.233 | 0.10883 | No Causality | ||

| EG→EC | 0.287 | 0.38698 | No Causality | EG→EC | 0.621 | 0.26728 | No Causality | ||

| Congo Rep | CE→EC | 0.747 | 0.2274 | No Causality | Italy | CE→EC | 1.105 | 0.86535 | No Causality |

| EC→CE | 1.952 | 0.02546 ** | Causality | EC→CE | 1.358 | 0.08725 * | Causality | ||

| CE→EG | 0.259 | 0.39778 | No Causality | CE→EG | 0.869 | 0.19249 | No Causality | ||

| EG→CE | 0.966 | 0.16693 | No Causality | EG→CE | 0.639 | 0.26127 | No Causality | ||

| EC→EG | 0.876 | 0.80953 | No Causality | EC→EG | 0.965 | 0.16735 | No Causality | ||

| EG→EC | 1.867 | 0.03098 ** | Causality | EG→EC | 0.745 | 0.22809 | No Causality | ||

| Ghana | CE→EC | 0.113 | 0.45501 | No Causality | Japan | CE→EC | 1.362 | 0.91344 | No Causality |

| EC→CE | 1.167 | 0.12154 | No Causality | EC→CE | 1.652 | 0.04925 ** | Causality | ||

| CE→EG | 0.526 | 0.29934 | No Causality | CE→EG | 0.939 | 0.1739 | No Causality | ||

| EG→CE | 1.083 | 0.13935 | No Causality | EG→CE | 1.613 | 0.05342 * | Causality | ||

| EC→EG | 0.954 | 0.16998 | No Causality | EC→EG | 0.745 | 0.22828 | No Causality | ||

| EG→EC | 0.739 | 0.77004 | No Causality | EG→EC | 1.384 | 0.08313 * | Causality | ||

| Kenya | CE→EC | 0.057 | 0.47716 | No Causality | India | CE→EC | 0.747 | 0.22757 | No Causality |

| EC→CE | 1.381 | 0.0836 * | Causality | EC→CE | 1.231 | 0.10916 | No Causality | ||

| CE→EG | 1.208 | 0.88656 | No Causality | CE→EG | 0.828 | 0.20392 | No Causality | ||

| EG→CE | 1.086 | 0.13882 | No Causality | EG→CE | 1.161 | 0.12275 | No Causality | ||

| EC→EG | 0.982 | 0.16298 | No Causality | EC→EG | 0.828 | 0.20377 | No Causality | ||

| EG→EC | 1.264 | 0.10315 | No Causality | EG→EC | 0.825 | 0.20463 | No Causality | ||

| Nigeria | CE→EC | 0.845 | 0.80089 | No Causality | UK | CE→EC | 1.144 | 0.12631 | No Causality |

| EC→CE | 1.694 | 0.04509 ** | Causality | EC→CE | 1.403 | 0.08033 * | Causality | ||

| CE→EG | 1.124 | 0.13044 | No Causality | CE→EG | 1.099 | 0.86422 | No Causality | ||

| EG→CE | 0.164 | 0.43472 | No Causality | EG→CE | 1.62 | 0.05257 * | Causality | ||

| EC→EG | 0.189 | 0.57493 | No Causality | EC→EG | 0.893 | 0.18586 | No Causality | ||

| EG→EC | 0.037 | 0.51462 | No Causality | EG→EC | 0.762 | 0.22293 | No Causality | ||

| Zambia | CE→EC | 0.244 | 0.59628 | No Causality | |||||

| EC→CE | 1.898 | 0.02882 ** | Causality | ||||||

| CE→EG | 0.06 | 0.52381 | No Causality | ||||||

| EG→CE | 1.113 | 0.86705 | No Causality | ||||||

| EC→EG | 0.314 | 0.62331 | No Causality | ||||||

| EG→EC | 1.086 | 0.86124 | No Causality | ||||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chukwunonso Bosah, P.; Li, S.; Kwaku Minua Ampofo, G.; Akwasi Asante, D.; Wang, Z. The Nexus Between Electricity Consumption, Economic Growth, and CO2 Emission: An Asymmetric Analysis Using Nonlinear ARDL and Nonparametric Causality Approach. Energies 2020, 13, 1258. https://doi.org/10.3390/en13051258

Chukwunonso Bosah P, Li S, Kwaku Minua Ampofo G, Akwasi Asante D, Wang Z. The Nexus Between Electricity Consumption, Economic Growth, and CO2 Emission: An Asymmetric Analysis Using Nonlinear ARDL and Nonparametric Causality Approach. Energies. 2020; 13(5):1258. https://doi.org/10.3390/en13051258

Chicago/Turabian StyleChukwunonso Bosah, Philip, Shixiang Li, Gideon Kwaku Minua Ampofo, Daniel Akwasi Asante, and Zhanqi Wang. 2020. "The Nexus Between Electricity Consumption, Economic Growth, and CO2 Emission: An Asymmetric Analysis Using Nonlinear ARDL and Nonparametric Causality Approach" Energies 13, no. 5: 1258. https://doi.org/10.3390/en13051258

APA StyleChukwunonso Bosah, P., Li, S., Kwaku Minua Ampofo, G., Akwasi Asante, D., & Wang, Z. (2020). The Nexus Between Electricity Consumption, Economic Growth, and CO2 Emission: An Asymmetric Analysis Using Nonlinear ARDL and Nonparametric Causality Approach. Energies, 13(5), 1258. https://doi.org/10.3390/en13051258