Abstract

This study examines whether oil and gas risk factors are priced in the returns of Malaysian oil and gas stocks employing asset pricing model with improved version of Fama-MacBeth two-stage panel regression. The findings reveal that oil price risk, gas price risk, and exchange rate risk are priced factors in the returns of oil and gas stocks, alongside market-based risk factors. Oil price, gas price and exchange rate factors are found to be associated with positive risk premium implying that they are systematic risk factors in the Malaysian oil and gas industry. Investors demand compensation for exposure to changes in oil price, gas price and exchange rate, implying that the risk cannot be eliminated through diversification. The risk premium for common systematic risk factors such as market, book-to-market, and momentum factors are found to be negative. The results suggest that in the Malaysian oil and gas industry, momentum driven strategy produces negative returns and investors receive higher returns from investing in growth oriented oil and gas stocks. Our results offer implications for asset pricing and portfolio management.

1. Introductions

Do oil and gas investors price industry-specific risk? To what extent industry-specific risk factors such as oil price, gas price, and exchange rate factors are priced in the returns of oil and gas stocks? While there is a vast literature on the relationship between oil prices and stock returns at various levels (firm, industry, and aggregate stock market), and a separate literature on oil price-exchange rate nexus, limited studies have investigated whether industry-specific risk factors such as oil price, gas price, and exchange are important priced factors in the oil and gas industry. As highlighted in a recent study by Ramos et al. [1], studies on the importance of industry-specific factors in asset pricing has been neglected except for the banking industry. Examples of such studies are Baek and Bilson, [2], Gandhi and Lustig [3], Viale et al. [4], among others and on balance the findings suggest that industry-specific risk factors are important priced factors in the banking sector. Ramos et al. [1] find empirical support that size, momentum, and oil are priced factors in the cross-section returns of oil industry, hence suggesting that investors demand to be compensated for their exposure to oil price risk. However, in addition to common risk factors, their study examined only one industry-specific factor that is oil price since oil price changes play pivotal role in the oil and gas industry.

Besides oil, gas is also an important fuel in today’s expanding global economy. According to International Energy Agency’s (IEA) [5] World Energy Outlook 2019, global demand for natural gas is projected to continue growing over the next 5 years, driven by both the increasing international gas trade and fast-growing Asian economies. Furthermore, the importance of natural gas has been highlighted in IEA’s [6] press release dated 7 June 2019 in the following excerpts: “Natural gas can contribute to a cleaner global energy system … 2018 was another golden year for natural gas, driven by China’s battle against air pollution … China is expected to account for more than 40% of global gas demand growth to 2024, propelled by the government’s goal of improving air quality by shifting away from coal.”

Empirical studies have also documented that relationship exists between oil prices and exchange rates [7,8,9,10,11], among others. The relationship between industry-specific risk factors such oil price, gas price, exchange and stock returns, while important has been lacking. Merton [12] recognizes the importance of risk factors in investing as these factors affect how much investors are willing to pay for assets. According to Merton [12], besides market risk factor, stocks’ exposure to time-varying investment opportunity is a crucial factor in determining the average stock returns. Hence, given the importance of risk factors in influencing average stock returns and risk premium, we investigate the link between oil and gas risk factors and the average stock returns of oil and gas industry. More specifically, we conjecture that stock returns of oil and gas industry are affected by oil price, gas price and exchange rate risk factors alongside common risk factors. Such investigation enhances understanding on asset pricing implications of oil and gas risk factors and whether investors demand compensation for exposure to these industry-specific risk factors.

The literature on the relationship between risk factors and stock returns of oil and gas firms comprises two major strands. The first strand employs time series approaches to investigate the effects of risk factors on oil and gas industry stock returns (e.g., [13,14,15,16,17,18,19,20,21,22,23,24,25]. This literature strand highlights that in addition to market risk factor, oil price factor (e.g., [14,22,23,24]), gas price (e.g., [15]), and exchange rate factor (e.g., [16]) are important risk factors influencing the variations in oil and gas stock returns. Exposure to these risk factors applies to both individual stocks and aggregate stock market. The second literature strand has employed cross-sectional approaches based on Fama-MacBeth (FM, hereafter) [26] two-stage procedure in examining the relationship between risk factors and oil and gas stock returns in the US (e.g., [1,27]). The findings of Scholtens and Wang [27] show that returns of oil stocks are positively related to market return, oil price changes, and negatively related to firm’s book-to-market value. Ramos et al. [1] documented that size, momentum, and oil price factors are positively priced in cross-section of returns of the oil and gas industry. These studies documented that risk factors such as market, value, size, and oil price are all important risk factors for oil and gas industry, as these risk factors are priced in the stock returns of oil and gas industry. The findings of both studies cited above are similar in the contexts of risk premia. More specifically, Scholtens and Wang [27] have suggested that oil price factor is an industry specific risk factor, whereas Ramos et al. [1] suggested that oil price factor is a systematic risk factor. Hence, these inconclusive findings and arguments further motivate this study to examine to what extent oil price risk factor provides risk preimium for investors.

Based on above premises, in this study, we, thus, explore the asset pricing implications of industry-specific factors such as oil price, gas price, and exchange rate factor. We investigate whether these risk factors are priced in stock returns of Malaysian oil and gas industry employing FM two-stage panel regression. The present study contributes to the oil and gas literature in the following ways. The first contribution relates to methodology. This study employs an enhanced version of the FM method with a two-step panel regression which is a novel contribution that differentiates it from other studies that use the standard Fama-MacBeth [26] two stage cross-section approach. Unlike the standard FM cross-section regression, the enhanced version of FM panel regression assesses the impacts of oil and gas risk factors and allows for concurrent analysis of cross-sectional and time-series of the data. Fama-MacBeth’s [26] two stage cross-section approach is an established method which has been widely used in asset pricing studies. However, the method has received several criticisms. Petersen [28], among others, criticizes FM regression with regard to standard errors estimation and biasness in the point estimates. Additionally, Goyal [29] and Kan and Robotti [30] also suggest that the panel regression approach be adopted in the second step of FM regression when a small number of portfolios and assets are considered in the analysis, as it is easier to manage the panel setting. Moreover, panel regression corrects for both time and cross-sectional Heteroskedasticity and Autocorrelation Consistency (HAC), whereas the FM regression corrects for only cross-sectional HAC. Petersen [28] discussed details on panel regression using FM two steps pointing out that consideration of cross-sectional regression and panel regression in the second step is conditional on firms’ characteristics and time variations. Thus, in this study, drawing on the shortcoming of Fama-MacBeth two-step cross-section, we combine the first step of FM and panel regression as the second step in a two-stage regression setting, as such consideration help to resolve issues related to standard errors estimation and biasness. As additional analysis, we have also estimated pooled regression and the cross-section of the second step of Fama-MacBath procedure to show consistency and robustness of the estimated results. Henceforth, with empirical estimation support, our enhanced estimation method suggests a new way of investigating the risk-return nexus using the FM two-stage panel regression in the area of financial economics.

Second, in addition to oil price factor, there exists other oil and gas industry specific risk factors like gas price [16] and exchange rate factor [15,18]. These risk factors are closely followed by investors because the risk factors are related to oil and gas firms’ business activity, cash flow, and profitability and thus play important roles in influencing the expected returns of oil and gas firms. Despite this, the importance of gas and exchange rate risk factors have been largely overlooked in firm-level studies on asset pricing implications which employ the well-known factor models of Fama and French [31] and Carhart [32] (e.g., [17,18,27] among others). Similarly, studies such as Ramos et al. [1] and Scholtens and Wang [27] employing Fama-MacBeth [26] two-stage cross-section method also focus on only one major risk factor, the oil factor. For reason that gas prices and exchange rates are also important industry specific risk factors, in this study, in addition to oil factor, we also include gas price and exchange rate as proxies for oil and gas risk factors in the empirical investigation to assess how these risk factors are related to average stock returns and whether investors demand compensation for exposure to oil longstanding academic interest in asset pricing, the importance of industry-specific features has been overlooked. Thus far, banking is the only sector that has been the object of such analysis.” The findings of the current study contribute to enhancing understanding on the importance of industry-specific factors in asset pricing particularly in the oil and gas industry.

Third, we expand the literature by examining oil exporting emerging economy. The studies of Scholtens and Wang [26] and Ramos et al. [1] focused on oil and gas stocks in the U.S. which is an oil importing country. Hence, the study findings and implications cannot be generalized for oil and gas industry of oil exporting and emerging country, due to differences in economic dependency, stock market dependency to changes in oil price, gas price, and exchange rate, as well as investors’ approaches to risk. Furthermore, as noted by Basher and Sadorsky [33] (p. 226) “…emerging economies tend to be more energy intensive than more developed economies and are therefore more exposed to higher oil prices.” The findings of the present study allow for comparison of findings between oil importing and exporting economies on oil price-stock returns relationship.

2. Stylized Facts

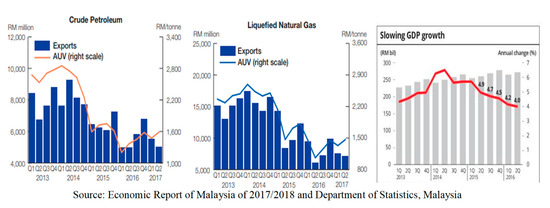

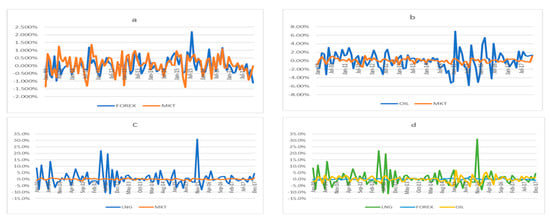

According to Energy Information Administration (EIA) [34,35], “Malaysia is the world’s third-largest exporter of liquefied natural gas and the second-largest oil and natural gas producer in Southeast Asia”. On average, oil and gas industry has been growing by over 7.0 percent during the last 10 years and the industry contributes more than 25% to government’s annual revenue. However, the recent world’s oil and gas market shocks of 2015–2016 had resulted in tremendous decline in total export value of crude oil and liquefied natural gas from Q2: 2015 to Q2: 2016, as shown by Figure 1, which had also affected government’s revenue negatively. Hence, the slowdown of the country’s economic growth. Later, as oil and gas price started to recover, the export value of both crude oil and liquefied natural gas also started to grow from Q3: 2016: to Q2: 2017. Additionally, like many other oil exporting economies [36], the stock market returns of Malaysia are also affected by oil price shocks [25]. Figure 2 shows that returns of the Malaysian stock market moves with changes in oil price, gas price, and exchange rate. These are clear indications that changes in oil and gas prices are associated with stock market performance as well as export revenues of the Malaysian government, particularly those generated from the oil and gas sector.

Figure 1.

Crude Oil and Liquefied Natural Gas Exports for period of Q1: 2013 to Q2: 2017 and GDP growth slowing.

Figure 2.

Movements of Stock Market Returns with (a) Changes in Exchange Rate and (b) Oil Returns, (c) Gas Returns and (d) all O&G risk factors.

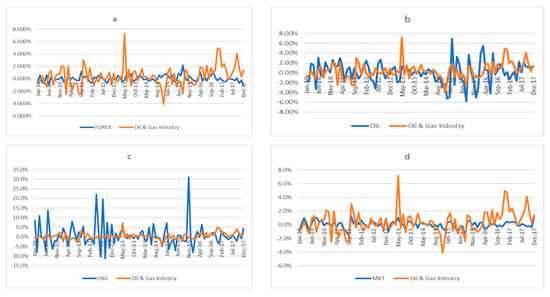

According to Malaysia Petroleum Resources Corporation [37], while there are thousands of small and large firms operating businesses in oil and gas sector, less than forty (40) firms are listed on the Main Board of the Bursa Malaysia stock exchange. In addition, although Malaysia is a net exporting country in the world’s oil and gas market, all oil and gas companies in Malaysia are price takers of international crude oil and gas prices. Thus, uncertainty in oil and gas prices importantly affect the performance and volatility of oil and gas stocks since operating costs and profits of oil and gas firms are subject to fluctuation of oil and gas prices. As stated in Romas et al., [21] (p. 79) “firm profitability and operating decisions such as exploration and investment decisions all depend on commodity prices, and as so, might affect expected stock returns”. In support of the given statement, Table 1 shows that firms in Malaysian oil and gas sector for examples, Alam Maritim Resources, Bumi Armada, Petronas Dagangan, and UMW suffered net losses and significant share price decline in 2015 and 2016 due to prolonged period of low oil and gas prices. The situation improved in 2017 with recovery in oil and gas prices. In addition, Figure 3 indicates that returns of oil and gas stocks exhibit more rapid fluctuation than changes in oil and gas prices. Oil and gas stock returns are also shown to be higher than stock market returns. Such observation implies that uncertainty in oil and gas prices is a major contributing factor to the relatively more volatile oil and gas stock returns as compared to the overall stock market.

Table 1.

Changes in Earning per Share and Stock Price of Selected Firms for period of 2014 to 2017.

Figure 3.

Movements of Oil Industry Portfolio Returns with (a) Exchange Rate changes, (b) Oil price changes, (c) Gas price changes, and (d) Market Return.

Furthermore, for firms operating in net oil and gas exporting country, exchange rate factor also plays an important role in influencing energy stock prices and thus contributes to making stock prices more volatile. In support of this assertion, Figure 3 also shows that returns of oil and gas stocks move together with exchange rate changes, where oil and gas stock returns are shown to appreciate more in response to a small amount of exchange rate depreciation, and vice-versa.

3. Methodology

3.1. Empirical Methods

This study employs the augmented Fama and MacBeth [26] two-stage panel regression asset pricing model for examining risk-return relationship in the Malaysian oil and gas industry. Based on Global Industry Classification Standard (GSIC) code of 2017, there are seven oil and gas sub industries in the oil and gas industry. As such, this study employs rolling regressions for each of the seven sub-industry portfolio returns using Fama and French’s [31] three risk factors (market, SMB (small-minus-big), HML (high-minus-low)), Carhart’s [32] momentum factor WML (winner-minus-loser), and three oil and gas risk factors namely, oil price, gas price, and exchange rate to obtain the beta coefficients for each week.

To understand the importance of the oil and gas risk factors in explaining stock returns of oil and gas industry, we perform the analyses in two phases. In the first phase, the analysis includes only the common risk factors of Fama and French [31] and Carhart [32] as which are the market, SMB, HML, and WML factors as regressors. The oil and gas risk factors are omitted in this phase. Hence, the time series rolling regression without the oil and gas risk factors is given by the following time-series Equation (1) which is employed to estimate the beta coefficients for market, SMB, HML, and WML:

where T = t − 20, …, t − 1. are returns of each sub-industry i for each week t. are returns of market portfolio for each week t. SMB, HML and WML are size factor, book to market value factor, and momentum factor, respectively. is the pricing error. , , and are the coefficients obtained the rolling regressions. This study rolls a window of 20 week returns forward one week at a time. As study sample period begins in January 2010, the beta coefficients can be estimated for each week for the period from June 2010 through December 2017. In the next step, we apply the previously estimated beta in the following augmented Fama-MacBeth’s panel regression instead of Fama MacBeth’s original cross-sectional regression:

where , , , and are risk premium for the respective common risk factors.

In the second phase of the analysis, we consider both the oil and gas risk factors (oil price, gas price, and exchange rate factor) and the common risk factors (market, SMB, HML, and WML) together in the models. This is for us to examine whether oil and gas risk factors are important determinants of average stock returns after we control for other well-known asset pricing factors. If the estimated coefficients of oil and gas risk factors are important determinants of average stock returns, then the risk premium should be statistically significant in the Fama-MacBeth regression. That said, Equation (3) investigates the asset pricing implications of oil and gas factors and whether investors demand compensation for exposure to industry-specific risk factors such as oil price, gas price, and exchange rate in the presence of common risk factors of Fama and French [31] and Carhart [8]. The first step in Fama-MacBeth’s two-step approach is to estimate the beta coefficients for market, SMB, HML, WML, oil price, gas price and exchange rate risk factors using time series regressions where excess returns is regressed against all the risk factors as shown by the following Equation (3):

where T = t − 20, …, t − 1. are returns of each sub-industry i for each week t. are returns of market portfolio for each week t. SMB, HML and WML are size factor, book to market value factor, and momentum factor, respectively. ∆OIL, ∆LNG, and ∆EX are changes in oil prices, LNG prices, and exchange rates, respectively. is the pricing error. , , , , and are the coefficients obtained from the rolling regressions. This study rolls a window of 20 week returns forward one week at a time. As study sample period begins in January 2010, the beta coefficients can be estimated for each week for the period from June 2010 through December 2017. In the second step, we apply the previously estimated beta in the following augmented Fama-MacBeth’s panel regression instead of the original cross-sectional regression to obtain estimates of the risk premium for each factor:

where , , , , , and are risk premium for the respective common risk factors as well as oil and gas risk factors. The inclusion of oil and gas risk factors in Equation (4) allows us to examine how the standard asset pricing factors perform when pricing industry-specific risk of the oil and gas industry.

3.2. Dataset

We utilize data of thirty-three (33) publicly listed oil and gas companies in the Malaysian stock exchange (Bursa Malaysia) and employ weekly data for estimating stock returns. Our sample consists of weekly data of Monday to Monday for the period of 4 January 2010 to 2 January 2018, representing 417 weeks. There are two specific reasons for employing weekly data over daily or monthly data. First, it is known that market and firms may take time to absorb and interpret the information content of oil prices and its consequent impacts on stock prices. Hence, the use of weekly data overcome the issue of non-synchronous and trading bias associated with less actively traded stocks; and also reduces the noise of high frequency data. Second, monthly data provide just a single observation which has less credibility in producing highly reliable results. However, the use of weekly data resolves that issue as it considers a number of observations which deemed adequate to produce more consistent and reliable results.

Firm level data of oil and gas stocks were extracted from Bursa Malaysia and Yahoo Finance, which were later classified into seven sub-industry portfolios according to their Global Industry Classification Standard (GSIC) code. A 90-day T-bill rate extracted from the Central Bank of Malaysia (Bank Negara) is used as a proxy for risk-freerate. The size, value, and momentum factors were constructed following the study of Fama and French [31,38]. Oil prices and gas (LNG) prices were compiled from the website of Energy International Administration and DataStream. Exchange rate data expressed as value of ringgit for one U.S. dollar were retrieved from the Central Bank of Malaysia (Bank Negara) and DataStream (For e.g., oil price and gas price data were retrieved from EIA website (https://www.eia.gov/). Firm level data are available on https://finance.yahoo.com. Exchange rate are available on http://www.bnm.gov.my/index.php?ch=statistic&pg=_exchangerates).

4. Empirical Results

Table 2 reports descriptive statistics, normality test results, and unit root test results for oil and gas sub-industries and risk factors. The descriptive statistics suggest that oil and gas industry experienced higher volatility in stock returns than the market as shown by the higher standard deviation values as compared to those of the stock market returns. The unit root tests of augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) suggest that all data series are stationary at the level form.

Table 2.

Descriptive Statistics and Normality Test Results for Sub-Industry.

To gain insights on how oil and gas risk factors (oil price, gas price, exchange rate) relate to other common risk factors (market, size, value, and momentum), we compute the Pearson correlation coefficients and the results are reported in Table 3. The oil price factor is found to be positively correlated with all risk factors except the exchange rate factor and the highest correlation is with the momentum factor with a coefficient of 0.331. On the contrary, the exchange rate factor has negative correlation with all risk factors but its correlation with the gas factor is positive. The market factor is positively correlated with oil, negatively correlated with exchange rate, and has no correlation with the gas factor. Overall, the presented correlations between the common risk factors and oil and gas risk factors are low hence, suggesting that there is no information redundancy in the risk factors which justify the inclusion of all risk factors as regressors in the models.

Table 3.

Correlation Matrix for Risk Factors.

This study performs the augmented Fama and MacBeth [26] two-stage panel regression for investigating the extent to which oil and gas related risk factors are priced in stock returns. In the first-stage, following the approach of Fama and MacBeth [26], this study estimates the time varying coefficients of risk factors by employing rolling time-series regression. The estimated coefficients are then used as factor loading of risk factors for each cross-sectional unit. In the second-stage, instead of using Fama MacBeth’s original cross-sectional approach, this study estimates the panel regression which considers both the cross-sectional and time series errors.

Table 4 reports the estimated baseline results of Fama and MacBeth’s [26] second step regression without including the oil and gas risk factors. The regressions have only the common risk factors of Fama and French’s [16] (market, SMB, HML) and Carhart’s momentum factor WML. The results for Fama and MacBeth’s original cross-sectional regression, pooled regression, and augmented Fama and MacBeth with panel regression are presented in Panels A–C respectively. The sign for the estimated coefficients of risk factors for Fama and MacBeth’s original cross-sectional regression are similar to those of the other two estimations. Thus, panel regression in the second-stage is deemed more appropriate than the other estimations in interpreting the empirical results, since panel regression in the second-stage of augmented Fama and Macbeth’s regression help to resolve the problems of standard errors in the estimation. The results show that all the well-known common risk factors are indeed priced factors in the oil and gas industry. The market, value (HML), and momentum (WML) factors are shown to be significantly and negatively related to returns of firms in oil and gas industry.

Table 4.

Results of Fama-MacBeth (1973) Two-Stage Regression with Common Risk Factors.

In Table 5, we present the results of Fama and MacBeth’s [26] second step regression on the ability of oil and gas factors (oil price, gas price, and exchange rate) to explain the returns of oil and gas stocks after controlling for the effects of common risk factors (market, SMB, HML, and WML). The results for Fama and MacBeth’s original cross-sectional regression, pooled regression, and augmented Fama and MacBeth with panel regression are presented in Panels A, B, and C respectively. The estimated results of pooled regression and panel regression show that panel regression with random effects is appropriate for the model and results interpretations. For example, pooled regression would not be appropriate as its Durbin-Watson Statistic is lower than the lower cut-off value. In addition, the Hausman test for random effects (HM = 3.50, p-value = 0.95) and LM test for redundant fixed effects (F Stat = 2.88, p-value = 0.000) indicate that the effects are random in nature.

Table 5.

Results of Fama-MacBeth (1973) Two-Stage Regression with Common and O&G Risk Factors.

In addition, the sign for the estimated coefficients of risk factors for Fama and MacBeth’s original cross-sectional regression are similar to those of the other two estimations. Thus, panel regression in the second-stage is deemed more appropriate than the other estimations in interpreting the empirical results, since panel regression in the second-stage of augmented Fama and Macbeth’s regression help to resolve the problems of standard errors in the estimation. We observe that the results for common risk factors remain negative and statistically significant after the inclusion of oil and gas risk factors in the models. However, the magnitude of the effects for common risk factors reduces compared to the earlier results in Table 4 without including the oil and gas risk factors. Furthermore, the R2 of the regressions without and with the oil and gas risk factors in Table 4 and Table 5 respectively clearly indicate that adding the oil and gas risk factors increases the explanatory power of all the models. In the absence of oil and gas risk factors in Table 4, the R2 value ranges from 9.82 percent to 10.77 percent, whereas in Table 5 with oil and gas factors included, the R2 value ranges from 16.05 percent to 18.60 percent.

The results for oil and gas risk factors show that oil price, gas price, and exchange rate are all significantly and positively related to oil and gas average stock returns, suggesting that oil and gas risk factors are positively priced in stock returns. In general, risk is priced when investors cannot eliminate the risk through diversification. Our findings that oil and gas risk factors are positively priced imply that investors are not able to diversify oil and gas risk and thus demand compensation for exposure to the risk factors. The results for common risk factors were similar to those reported in Table 4 but with reduced explanatory power than before possibly because some of the effects have been captured by the oil and gas risk factors. Overall, the findings suggest that oil and gas risk factors are indeed systematic risk factors in the oil and gas industry.

5. Discussion

In this section, we focus our discussions on the results presented in Table 5 employing Fama and MacBeth [26] two-step panel regression that include both the common risk factors and oil and gas risk factors as regressors to investigate whether oil price, gas price, and exchange rate factors are priced in the average stock returns of oil and gas industry after controlling for common risk factors.

5.1. Common Risk Factors

The results in Table 5 show that the risk premium for common risk factors such as market, value, and momentum are negative and significant in all models. The finding of negative relationship between market risk factor and average returns of oil and gas stocks is broadly consistent with studies that have found a negative relationship between oil prices and aggregate stock returns. While numerous other studies have found a positive relationship, e.g., Narayan and Narayan, [39]; Zhu et al. [40]; among others, there are also other studies that have found no relationship between oil prices and stock returns or have found inconclusive finding, such as Apergis and Miller, [41]; Hatemi et al. [42]; among others) (see e.g., Basher et al. [7]; Basher and Sadorsky [33], among others).

As argued by Narayan and Sharma [43] and Arouri [44], the mixed findings for studies on oil price-stock returns relationship at aggregate market level can be explained by differences in the sectorial composition of the market index. In stock markets which are more diversified, returns of aggregate stock indices is a good reflection of the average returns of many industries whereas in less diversified markets, returns of aggregate stock markets may not fully reflect the average returns across industries. Furthermore, as stated in Mollick and Assefa [45] (p. 2), “…there is no reasons why oil prices should impact aggregate indexes uniformly since a stock index is a combination of firms that may profit or lose in response to oil price fluctuations”. That said, our finding that market factor is negatively related to the returns of oil and gas stocks possibly suggests the presence of small sector representation of oil and gas component stocks in the aggregate stock market index. If such presumption is correct, then when oil and gas price rises, while returns of oil and gas stocks generally increase, returns of the majority of stocks in other sectorial composition of market index may not necessarily respond similarly, hence resulting in an overall negative returns of the aggregate stock market.

The finding of negative market risk premium seems to contradict the basic premise of CAPM theory, as the theory posits that returns are positively related to market factor and thus investors are compensated with a positive risk premium for exposure to market risk. However, the literature has provided some rationale for the negative relationship. In the context of oil and gas industry, one possible explanation is that due to the highly volatile nature of oil and gas stocks, investors are unable to rationally assess the relationships between the returns of oil and gas stocks and aggregate stock market largely because of the firms’ strong economic dependence on oil and gas risk factors. Investors’ irrationality leads to excessive risk taking of the market factor which consequently results in them getting a negative risk premium. Additionally, in line with Glosten et al. [46] argument, it can be said that in a highly volatile oil market, investors of oil and gas stocks may not necessarily be looking for high returns for bearing high risk which can be described as being consistent with a polynomial risk-return relationship. Also, if investors are of the opinion that the future is riskier than now, investors would rather invest now than in the future even when the asset provides a low risk premium. Having said that, such investment behaviorial tendencies of investors cause the price of risky asset to be high which in turn reduces the risk premium. Moreover, existing empirical studies also provide support for the negative risk-return relationship in emerging and highly volatile stock markets [47,48,49]. Our finding on the negative trade-off between market risk and stock returns offers insights to investors and practitioners alike that the risk and return trade-off for oil and gas stock can potentially be negative.

The coefficient of SMB, representing the size premium demonstrates that size factor is not significantly related to oil and gas stock returns, suggesting that investing in small firms does not provide risk premium to investors. Such finding is not surprising because oil and gas industry is generally a capital-intensive industry dominated by large firms. Therefore, the size premium which rewards small-sized firms has little or no explanatory power in explaining stocks returns of oil and gas industry. Furthermore, these findings are not similar to those of Scholtens and Wang [27] and Ramos et al. [1], where size factor has been found to be a priced factor in the cross-section of returns in the US oil market. Our finding implies that the effects of size factor are market specific and so are the pricing of this risk factor.

The coefficient of book-to-market risk premium (HML), also referred to as value premium, shows that book-to-market risk factor has significant and negative impact on oil and gas industry stock returns. This finding is in line with those of Ramos et al., [1] but exhibits inconsistency with the hypotheses of Fama-French [15,16] related to extended Capital Asset Pricing Model (CAPM). The negative effects of book-to-market risk factor on oil and gas stock returns imply that value stocks provide negative returns to investors. In other words, the observed negative value premium suggests that stocks with low book-to-market ratio, i.e., growth stocks have higher returns than those with high book-to-market ratio. The significant negative coefficient of the value factor indicates that investors demand compensation for investing in growth stocks which are riskier investment and have stock prices that are more volatile than the general market. Such explanation is intuitive given that oil and gas stocks are exposed to volatile price movement and the industry is also set to grow further boosted by the increasing oil and gas demand of fast-growing emerging economies.

The coefficient of momentum risk premium indicates that momentum risk factor has negative influence on oil and gas industry stock. The negative effect of momentum factor suggests that momentum strategies are not helpful to investors in oil and gas industry, probably due to the highly volatile return patterns of oil and gas stocks which exposes investors to larger downside risk. The price movement of oil and gas factors is complex and so uncertain that investors are not able to benefit from using momentum strategy. It is for this reason that momentum investing provides investors with average negative returns. The findings of Sanusi and Ahmad [24] also show that portfolio construction using momentum strategy is not useful for investors in the oil and gas industry. Other studies also provide support that momentum strategies perform poorly because assets or stock prices are usually mispriced in down economic state and highly volatile market condition [50]. In the context of the Malaysian market, Cheema [51] finds that there is an absence of momentum profit during and after downstate conditions for both Islamic and non-Islamic stock returns.

5.2. Oil and Gas Risk Factors

The coefficients related to oil and gas risk factors show that oil price, gas risk and exchange rate have significant positive effects on the average stock returns of oil and gas firms hence suggesting that, oil and gas risk factors are priced in the average stock returns. Investors demand compensation for exposure to oil price risk, gas price risk, and exchange rate risk implying that these risks cannot be eliminated through diversification. In other words, investors are not able to fully diversified oil and gas risk due to the highly volatile movements of oil and gas prices and uncertainty in the world’s economy. The coefficients of the oil and gas risk premium are statistically significant even after controlling for the effects of the common systematic risk factors. In fact, after the inclusion of oil and gas risk factors into models, while the coefficients of common risk factors remain statistically significant, the magnitudes of the effects have reduced.

Our findings suggest that investors care about the exposure that firms have to oil and gas risk factors since these factors directly impact firms’ earnings and cash flows due to firms’ strong economic dependence on the oil and gas factors. Furthermore, while oil price, gas price, and exchange rate factor are industry-specific risks for oil and gas industry, these risk factors undeniably have potential to affect the stock market and economy. For this reason and based on our findings that oil and gas risk factors are priced in the average stock returns, these risk factors can therefore be considered as systematic risk factors. Overall, this evidence suggests that investors give importance to industry-specific risks. The findings provide better understanding of the risks faced by investors so that they can better manage risks in an uncertain and volatile oil and gas market. These findings are supported by Scholtens and Wang [27] and Ramos et al. [1] as their studies have shown that the oil price risk is systematically priced in the stock returns of oil and gas industry, and that oil price risk factor exhibits positive risk premium. Our results for oil and gas industry are broadly consistent with the findings of banking sector, where industry-specific risk that directly affect firms’ earnings and cash flows are shown to be priced in the returns of banking stocks.

5.3. Additional Analysis with Time Series Approach

To examine the time-series relationship, we have conducted additional analysis using GARCH (1,1)-X type time series approach. The estimated results of time series approach are presented in Table 6. These empirical results also indicate that most sub-industries are shown to be positively and significantly related to oil price and exchange rate risk factors. The finding shows that gas price risk factor is positively related to stock returns of three oil and gas sub-industries. Thus, based on time-series results, one could expect that oil and gas risk factors provide risk premium to investors. The Fama-MacBeth two-stage panel regression has shown that oil price, gas price, and exchange rate risk factors are priced in the oil and gas industry stock returns. The implication of the empirical results is that these risk factors are systematic risk factors for oil and gas industry alongside the market-based systematic risk factor.

Table 6.

Results of Time Series Regressions.

6. Summary and Concluding Remarks

This study aims to investigate the extent to which oil and gas risk factors (oil price, gas price, and exchange rate factor) are priced factors in the Malaysian oil and gas stock returns by employing a novel approach of Fama-MacBeth two-stage panel regression. Our sample study covers weekly data from the period of 4 January 2010 to 2 January 2018. Our results show that oil and gas risk factors are associated with positive risk premium even after we control for the effects of common risk factors. Hence, industry-specific risk factors do matter in oil and gas industry. The positive risk premium suggests that investors demand compensation for exposure to oil price, gas price, and exchange rate factors. The findings that oil and gas risk factors are priced in the oil and gas industry stock returns imply that investors cannot eliminate the risk through diversification. These findings are consistent with those of Scholtens and Wang [27] and Ramos et al. [1] although both studies examine only the oil risk factor. Additionally, we find that market, book-to-market and momentum factors are negatively associated with oil and gas stock returns. Such negative relationship is oftentimes treated as ‘anomaly’ in asset pricing literature as it contradicts the basic assumption of asset pricing theory that there is a positive relationship between risk and return. However, in the context of oil and gas industry, the observed negative risk premium seems possible given the highly uncertain and volatile price movement of oil and gas risk factors. The negative risk premium for market factor imply that oil and gas stocks have little sectorial composition in the market index due to their volatile return patterns, and thus do not move in tandem with market returns. The negative premium for value and momentum factors suggest that investors earn higher returns from investing in growth stocks rather than value stocks and that momentum strategy does not work in the oil and gas industry. In sum, our study provides evidence that investors price industry-specific risks such as oil price, gas price, and exchange rate factor. Our findings offer important implications for asset pricing and investment management purposes. For example, investors should take into consideration not only the risk associated with market-based factors but also oil and gas industry risk factors when investing in Malaysian oil and gas stocks. More especially, investors may follow the factor investing approach considering oil price, gas price, and exchange rate are important factors, as these factors could be some risk premium. In doing so, investors should observe the co-movements of individual stocks with O&G risk factors. Additionally, risk seeker should find higher oil beta and exchange rate beta carrying oil and gas stocks which may yield returns with expected risk premiums.

Author Contributions

For research articles with several authors, a short paragraph specifying their individual contributions must be provided. The following statements should be used Conceptualization, M.E.H. and L.S.W.; Data curation, M.E.H.; Funding acquisition, L.S.W and M.A.S.Z.; Methodology, M.E.H.; Supervision, L.S.W.; Writing—original draft, M.E.H.; Writing—review & editing, L.S.W. and M.A.S.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

We declare no conflict of interest.

References

- Ramos, S.B.; Taamouti, A.; Veiga HWang, C.W. Do investors price industry risk? Evidence from the cross-section of the oil industry. J. Energy Mark. 2017, 10, 79–108. [Google Scholar] [CrossRef]

- Baek, S.; Bilson, J.F. Size and value risk in financial firms. J. Bank. Financ. 2015, 55, 295–326. [Google Scholar] [CrossRef]

- Gandhi, P.; Lustig, H. Size anomalies in US bank stock returns. J. Financ. 2015, 70, 733–768. [Google Scholar] [CrossRef]

- Viale, A.; Kolari, J.; Fraser, D. Common risk factors in bank stocks. J. Bank. Financ. 2009, 33, 464–472. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). World Energy Outlook; International Energy Agency: Paris, France, 2019. [Google Scholar]

- International Energy Agency. Demand from Asia is set to power the growth of the global gas industry over the next five years. Press release, 7 June 2019. [Google Scholar]

- Basher, S.A.; Haug, A.A.; Sadorsky, P. Oil prices, exchange rates and emerging stock markets. Energy Econ. 2012, 34, 227–240. [Google Scholar] [CrossRef]

- Golub, S. Oil prices and exchange rates. Econ. J. 1983, 93, 576–593. [Google Scholar] [CrossRef]

- Lizardo RAMollick, A.V. Oil price fluctuations and US dollar exchange rates. Energy Econ. 2010, 32, 399–408. [Google Scholar] [CrossRef]

- Sadorsky, P. The empirical relationship between energy future prices and exchange rates. Energy Econ. 2000, 22, 253–266. [Google Scholar] [CrossRef]

- Zhang, Y.F.; Fan, Y.; Tsai, H.T.; Wei, Y.M. Spillover effects of US exchange rate on oil prices. J. Policy Model. 2008, 30, 973–991. [Google Scholar] [CrossRef]

- Merton, R.C. An intertemporal capital asset pricing model. Econometrica 1973, 41, 867–887. [Google Scholar] [CrossRef]

- Boyer, M.M.; Filion, D. Common and fundamental factors in stock returns of Canadian oil and gas companies. Energy Econ. 2007, 29, 428–453. [Google Scholar] [CrossRef]

- Faffa, R.W.; Brailsford, T.J. Oil price risk and the Australian stock market. J. Energy Financ. Dev. 1999, 4, 69–87. [Google Scholar] [CrossRef]

- Jin, Y.; Jorion, P. Firm value and hedging: Evidence from U.S. oil and gas producers. J. Financ. 2006, 61, 893–919. [Google Scholar] [CrossRef]

- Lanza, A.; Manera, M.; Grasso, M.; Giovannini, M. Long-run models of oil stock prices. Environ. Model. Softw. 2005, 20, 1423–1430. [Google Scholar] [CrossRef]

- Mohanty, S.; Nandha, M.; Bota, G. Oil shocks and stock returns: The case of the Central and Eastern European (CEE) oil and gas sectors. Emerg. Mark. Rev. 2010, 11, 358–372. [Google Scholar] [CrossRef]

- Mohanty, S.K.; Nandha, M. Oil Risk Exposure: The Case of the U.S. Oil and Gas Sector. Financ. Rev. 2011, 46, 165–191. [Google Scholar] [CrossRef]

- Nandha, M.; Faff, R. Does oil move equity prices? A global view. Energy Econ. 2007, 30, 986–997. [Google Scholar] [CrossRef]

- Park, J.; Ratti, R.A. Oil price shocks and stock markets in the U.S. and 13 European countries. Energy Econ. 2008, 30, 2587–2608. [Google Scholar] [CrossRef]

- Ramos, S.B.; Veiga, H. Risk factors in oil and gas industry returns: International evidence. Energy Econ. 2011, 33, 525–542. [Google Scholar] [CrossRef]

- Sadorsky, P. Risk factors in stock returns of Canadian oil and gas companies. Energy Econ. 2001, 23, 17–28. [Google Scholar] [CrossRef]

- Sadorsky, P. The oil price exposure of global oil companies. Appl. Financ. Econ. Lett. 2008, 4, 93–96. [Google Scholar] [CrossRef]

- Sanusi, M.S.; Ahmad, F. Modelling oil and gas stock returns using multi factor asset pricing model including oil price exposure. Financ. Res. Lett. 2016, 18, 89–99. [Google Scholar] [CrossRef]

- Ulusoy, V.; Özdurak, C. The Impact of Oil Price Volatility to Oil and Gas Company Stock Returns and Emerging Economies. Int. J. Energy Econ. Policy 2018, 8, 144–158. [Google Scholar]

- Fama, E.; MacBeth, J. Risk, return, and equilibrium: Empirical tests. J. Political Econ. 1973, 81, e607–e636. [Google Scholar] [CrossRef]

- Scholtens, B.; Wang, L. Oil risk in oil stocks. Energy J. 2008, 29, 89–111. [Google Scholar] [CrossRef]

- Petersen, M.A. Estimating standard errors in finance panel data sets: Comparing approaches. Rev. Financ. Stud. 2009, 22, 435–480. [Google Scholar] [CrossRef]

- Goyal, A. Empirical cross-sectional asset pricing: A survey. Financ. Mark. Portf. Manag. 2012, 26, 3–38. [Google Scholar] [CrossRef]

- Kan, R.; Robotti, C. Evaluation of asset pricing models using two-pass cross-sectional regressions. In Handbook of Computational Finance; Springer: Berlin/Heidelberg, Germany, 2012; pp. 223–251. [Google Scholar]

- Fama, E.F.; French, K.R. Common Risk Factors in the Returns on Stocks and Bonds. J. Financ. Econ. 1993, 33, 3–56. [Google Scholar] [CrossRef]

- Carhart, M.M. On persistence in mutual fund performance. J. Financ. 1997, 52, 57–82. [Google Scholar] [CrossRef]

- Basher, S.A.; Sadorsky, P. Oil price risk and emerging stock markets. Glob. Financ. J. 2006, 17, 224–251. [Google Scholar] [CrossRef]

- Energy Information Administration. Malaysia Report: International Energy Data and Analysis; Energy Information Administration: Washington, DC, USA, 2019.

- Energy Information Administration. A Malaysia Oil Market Overview; Energy Information Administration: Washington, DC, USA, 2019.

- Demirer, R.; Jategaonkar, S.P.; Khalifa, A.A. Oil price risk exposure and the cross-section of stock returns: The case of net exporting countries. Energy Econ. 2015, 49, 132–140. [Google Scholar] [CrossRef]

- Malaysian Petroleum Resources Corporation. Industry Insights: Malaysia Oil & Gas Overview. Available online: https://www.mprc.gov.my/ (accessed on 1 January 2019).

- Fama, E.F.; French, K.R. Size, value, and momentum in international stock returns. J. Financ. Econ. 2012, 105, 457–472. [Google Scholar] [CrossRef]

- Narayan, P.K.; Narayan, S. Modelling the impact of oil prices on Vietnam’s stock prices. Appl. Energy 2010, 87, 356–361. [Google Scholar] [CrossRef]

- Zhu, H.M.; Li, R.; Yu, K. Modelling dynamic dependence between crude oil prices and Asia Pacific stock returns. Int. Rev. Econ. Financ. 2014, 29, 208–223. [Google Scholar] [CrossRef]

- Apergis, N.; Miller, S.M. Do structural oil-market shocks affect stock prices? Energy Econ. 2009, 31, 569–575. [Google Scholar] [CrossRef]

- Hatemi, J.A.; Al Shayed, A.; Roca, E. The effect of oil prices on stock prices: Fresh evidence from asymmetric causality tests. Appl. Econ. 2017, 49, 1584–1592. [Google Scholar] [CrossRef]

- Narayan, P.K.; Sharma, S.S. New evidence on oil price and firm returns. J. Bank. Financ. 2011, 35, 3253–3262. [Google Scholar] [CrossRef]

- Arouri, M.E.H. Does crude oil move stock markets in Europe? A sector investigation. Econ. Model. 2011, 28, 1716–1725. [Google Scholar] [CrossRef]

- Mollick, A.V.; Assefa, T.A. US stock returns and oil prices. The tale from daily data and the 2008–2009 financial crisis. Energy Econ. 2013, 36, 1–18. [Google Scholar] [CrossRef]

- Glosten, L.R.; Jagannathan, R.; Runkle, D.E. On the relation between the expected value and the volatility of the nominal excess return on stocks. J. Financ. 1993, 48, 1779–1801. [Google Scholar] [CrossRef]

- Nurjannah; Galagedera, D.U.; Brooks, R. Conditional Relation between Systematic Risk and Returns in the Conventional and Downside Frameworks: Evidence from the Indonesian Market. J. Emerg. Mark. Financ. 2012, 11, 271–300. [Google Scholar] [CrossRef]

- Theriou, N.G.; Aggelidis, V.P.; Maditinos, D.I.; Šević, Ž. Testing the relation between beta and returns in the Athens stock exchange. Manag. Financ. 2010, 36, 1043–1056. [Google Scholar] [CrossRef]

- Tuyon, J.; Ahmad, Z. Behavioural finance perspectives on Malaysian stock market efficiency. Borsa Istanb. Rev. 2016, 16, 43–61. [Google Scholar] [CrossRef]

- Min, B.K.; Kim, T.S. Momentum and downside risk. J. Bank. Financ. 2016, 72, S104–S11. [Google Scholar] [CrossRef]

- Cheema, M.A.; Nartea, G.V. Momentum returns, market states, and market dynamics: Are Islamic stocks different? In Proceedings of the 18th Malaysian Finance Association Annual Conference (MFAC) 2016 and the 7th Islamic Banking, Accounting and Finance Conference (iBAF) 2016, Melaka, Malaysia, 29–31 May 2016. [Google Scholar]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).