Abstract

Nord Pool is the leading power market in Europe. It has been documented that the forward contracts traded in this market exhibit a significant forward premium, which could be a sign of market inefficiency. Efficient power markets are important, especially when there is a goal to increase the share of the power mix stemming from renewable energy sources. We therefore contribute to the understanding of this topic by examining how the forward premium in the Nord Pool market depend on several economic and physical conditions. We utilise two methods: ordinary least squares and quantile regression. The results show that the reservoir level and the basis (the difference between the forward and spot price) have a significant impact on the forward premium. The realised volatility of futures prices and the implied volatility of the stock market have strong effects on both the conditional lower and upper tails of the forward premium. We also find that, as the market has matured, the forward premium has decreased, indicating an increase in market efficiency.

1. Introduction

There are important differences between electricity and other commodities and financial assets. It cannot be stored in economically meaningful quantities and its demand and supply are highly dependent on the weather conditions. This, in combination with very inelastic demand, leads to much higher volatility in electricity prices compared to the prices of most other commodities and financial assets [1].

These specific properties of electricity spot prices induce a need for derivatives which can be used for hedging purposes. The most important tools for companies that depend heavily on the electricity price are forward and futures contracts. These contracts enable them to fix the price of electricity sold today for delivery at some point in the future.

As electricity cannot be easily stored, the classical no-arbitrage spot-futures relationship does not hold [2]. The alternative approach is based on equilibrium models where the difference between the forward price and spot price is described by a forward premium. The research questions in such studies are usually: (1) whether a significant forward premium exists; and (2) which market and physical conditions have an impact on the observed premium. Examples of recent studies within the Nordic power market are those by Botterud et al. [3], Lucia and Torró [4] and Weron and Zator [5].

No consensus has yet been reached on whether or not mature electricity markets should exhibit a forward premium, or which factors should impact the magnitude and sign of that premium. Electricity markets are developing rapidly and analysis based on as long history as available, particularly including recent market developments, is therefore very important. Some of the more influential early works, such as those of Bessembinder and Lemmon [2], Villaplana [6] and Longstaff and Wang [7], suffer from a short data time span. Additionally, as electricity markets are still relatively immature compared to other commodity markets, an important question yet to be answered is whether the observed premium represents the market price of risk or whether it represents market inefficiencies [5].

Botterud et al. [8], Lucia and Torró [4] and Weron and Zator [5] all found evidence of a forward premium in futures contracts traded on the Nordic electricity market. These papers use regression methods to describe the relationship between the observed forward premium and market conditions. Building upon these papers, we extend the understanding in this field further in several ways.

First, the research available thus far has mostly focused on short-term contracts, primarily day-ahead futures (Bessembinder and Lemmon [2], Longstaff and Wang [7]) and weekly contracts (Lucia and Torró [4], Botterud et al. [3]). Mork [9] did some analyses on the forward premium for futures with a delivery period of one month, but the data set they used is old and analyses of more recent data are lacking. Our paper will therefore focus on one-month futures for which there are no recent studies on the forward premium in the Nordic electricity market.

Second, we consider a time series of eight years of historical spot and medium-term futures contract prices traded for the Nord Pool market between 2005 and 2013. Specifically, we examine the relationship between the forward premium in medium-term futures and various market related variables. Here, we follow Botterud et al. [3] and Weron and Zator [5], among others. The empirical analysis includes variables that have been studied earlier, such as the reservoir levels [3] and volatility of the spot price [2], as well as variables that have not been examined previously. To this end, we propose a model that can explain the forward premium by the demand for futures, temperature, the volatility of the spot price, reservoir levels, overall market risk as expressed by the VIX index and the basis (the difference between the forward and spot price).

Third, the paper analyses the evolution of the Nordic electricity market over time. By splitting the sample in two, we can assess potential changes in the market structure over the eight years considered. As noted by Mork [9], one would assume that the forward premium decreases and speculative participation increases over time as market participants gain experience and understanding of the market mechanisms increases. Using the most recent data available enables us to analyse how market efficiency and investor experience impact the forward premium for Nordic electricity futures.

Fourth, we use quantile regression in addition to OLS estimates to examine the effects of the market variables across all quantiles. While quantile regression has been utilised in various fields of energy economics such as modelling electricity price [10], to our knowledge, it has not been used within this research area. This approach provides important information to market participants about what influences the tails of the forward premium.

The rest of this paper is organised as follows. Section 2 describes some stylised properties of electricity markets and electricity as a traded commodity. Section 3 reviews the literature on the forward premium in futures and forwards with a special focus on applications to the electricity market. Section 4 presents the methodology and data selection. Our empirical analysis and results are discussed in Section 5. Section 6 concludes.

2. The Nordic Electricity Market

2.1. The Physical Electricity Market

The Nordic physical electricity market is operated by Nord Pool Spot ASA. At present, it runs a combined day-ahead spot market (Elspot) and an intraday market covering the same area to ensure balance in the grid (Elbas) Trading in the day-ahead market closes at 12:00 on the preceding day. Trading in Elbas takes place until one hour before delivery.

Market participants in the Elspot market place orders to buy or sell electricity for each hour of the next day. Nord Pool’s algorithm then generates the system price by aggregating the orders. This ensures that electricity is produced at the lowest cost every hour of the day as the system price represents the cost of producing 1 kWh of electricity from the most expensive source to balance the system Since electricity in Norway is produced primarily from hydropower, there is strong seasonality also in the supply side of this market.

The system price does not take transmission constraints into account. This would likely lead to congestion and, thus, to alleviate this, the market is divided into several price areas with different prices based on the supply and demand in the given area. The bidding areas are divided by country and then further divided within each country based on the decision of the transmission system operator in each country. For instance, Norway is divided into five price areas, whereas all of Denmark is in the same price area). The Nord Pool system price is first generated on a per hour basis. Demand usually follows a predictable pattern within a 24-hour period. Demand is highest during working hours, as businesses contribute significantly to demand, and lower in the evening and at night. The daily spot price is then generated by taking the arithmetic average of all 24 hours of the day. This daily spot price is then used as the underlying asset for the traded financial derivatives.

Trading on Elspot and Elbas requires physical delivery of the electricity that is traded. Therefore, trade in these markets is dominated by electricity generating companies and utilities. Within the Nord Pool area there are more than 370 power producing companies and more than 370 utilities selling electricity to end-users.

2.2. Financial Market

In addition to the physical markets, there is a financial market for trading derivatives based on the Nord Pool prices. The financial market is currently operated by Nasdaq Commodities Europe. The financial market used to be a subsidiary of Nord Pool, but in 2008 it was spun off into a separate entity and sold to Nasdaq. Nasdaq Commodities offer a variety of derivatives based on the system and area prices within the area covered by the physical Nord Pool markets. The derivatives offered include options, futures, forwards and contracts for differences. Contracts for differences are used to hedge price area risk. The futures and forward contracts offered are used by participants in the physical electricity markets to hedge their price risk as well as speculative investors looking to make a profit.

Nasdaq offers two different types of futures contracts on the Nord Pool system price, “normal” futures and differed settlement (DS) futures. The difference between them is the length of the delivery periods and how the mark-to-market amount during the trading period is settled. The standard futures are marked-to-market every day during the trading period and the change in price will be credited or debited to the buyer or seller of the futures every day. The deferred settlement futures will just accumulate the gains and loses and the difference between the price of the futures when it was bought and the final futures price will be settled at the beginning of the delivery period. The futures offered on Nasdaq OMX have times to maturity varying from one day up to several years. The contracts also specify the the time period for delivery. All futures contracts available are cash-settled with no physical delivery expected. Bye and Hope [11] indicated that the volume in the derivatives is about five times the volume of physical trade and that the ratio has been increasing since 2003.

3. Risk and Forward Premium in Electricity Markets

3.1. The Pricing of Futures

Traditionally, there have been two main approaches to pricing forwards and futures (see, for instance, Hirshleifer [12] or Fama and French [13]). One line of reasoning is based on no-arbitrage assumptions and the possibility of creating a replicating portfolio to the forward. If no-arbitrage conditions hold, the replicating portfolio should have the same value as the forward contract. Using this insight, the relationship between the forward price and the spot price is relatively easily obtainable.

The second approach used to model forward prices is based on equilibrium considerations. These models generally focus on the forward premium, the difference between the forward price and the expected spot price. In an equilibrium model, the forward premium represents the compensation for holding price or demand risk for a given commodity. The assumption is that the forward premium should be negative due to the demand for short positions in forwards created by producers of a commodity who are looking to hedge their risks. Hirshleifer [12] found that the optimal hedging positions, and thus the hedging pressure on the forward price, varies depending on whether demand is elastic or inelastic. This implies that the forward premium can be positive, zero or negative depending on the economic conditions of the market one wishes to model. One important note about the model considered in the paper is that it assumes that some consumers do not participate in the futures market. For electricity futures, this will probably not hold as both producers and “consumers”, for the most part utilities, will face price risks and thus have demand for futures contracts.

The theory of normal backwardation has generally been used to describe the forward premium in futures markets [9]. According to this theory, the forward premium depends on the risk preferences of investors wishing to hedge their positions, and speculators. If a market is in backwardation, futures prices are below the spot price and sellers pay a premium to hedge their prices at a point in the future. As there is a premium on average, speculators will have an incentive to buy futures [9]. The opposite situation is contango, where buyers have to pay a premium to fix their price in the future. The sign and size of the forward premium depend on the relative demand for hedges between buyers and sellers of a given commodity.

3.2. Definitions

The ex ante forward premium for a futures contract is the difference between the futures price and the expected spot price , where t is the time the future is bought and T is the time of maturity for the future contract. This can be presented as follows:

Another important measure is the basis, the difference between the forward price at time t for delivery at time T and the spot price at time t:

The problem with the ex ante premium is that the expected spot price is not readily available. The spot price is dependent on factors that are outside human control and impossible to know perfectly in advance, particularly the weather. To use this measure in an empirical analysis, some form of model for the expected spot price needs to be developed. This presents a difficult econometric problem, which was tackled by Villaplana [6] and Weron et al. [14], among t others. An alternative approach is to analyse the ex post forward premium instead. As this approach avoids assumptions regarding the model for the expected spot price, it is an attractive option [4].

The ex post forward premium is defined as the difference between the futures price and the spot price at maturity . The ex post forward premium can be decomposed into the ex ante forward premium and a forecast error. Under standard assumptions that the forecast errors are random noise, evidence of a non-zero ex post forward premium will also be evidence of a non-zero ex ante forward premium. Due to these properties most studies (see Weron and Zator [5] for a review) choose to analyse the ex post forward premium, as do we in this paper.

An important point made by Haugom and Ullrich [15] is that deregulated electricity markets are relatively immature and as such the assumption that the forecast errors are random noise may not be correct. In such cases, a non-zero ex post forward premium is not necessarily evidence of a non-zero ex ante premium, but could also be evidence of market inefficiencies.

There are some differences in how the forward premium is defined. As is often the case with financial data, it is preferable to present the premium as a relative value rather than an absolute value, because the positive skewness observed in electricity prices means that the premium in absolute value is heavily influenced by large outliers (see Daskalakis and Markellos [16] and Longstaff and Wang [7]).

The two most popular definitions are the percentage and logarithmic definitions of the forward premium as in Equations (3) and (4).

There is no consensus on whether it is most appropriate to define the forward premium logarithmically or as a percentage. Haugom et al. [17] argued that the logarithmic forward premium is most suited for OLS regression purposes. The logarithmic definition was used by Botterud et al. [3], Haugom et al. [17] and Haugom et al. [18], whereas the percentage definition of the forward premium was used by Daskalakis and Markellos [16] and Longstaff and Wang [7]. In this paper, both definitions are used, to analyse whether the results depend on the choice of the definition or not.

3.3. Risk Premium Versus Forward Premium

In the literature on electricity futures, the terminology referring to risk and forward premiums is not consistent. The forward premium as defined in Equation (1) is used in the majority of studies, including by Daskalakis and Markellos [16], Longstaff and Wang [7] and Lucia and Torró [4]. There seems to be some terminological confusion, however, as Weron and Zator [5] noted that different researchers have used the forward premium and risk premium interchangeably as terms to describe the premium defined in Equation (1). In this paper, we use the terminology “forward premium” as this is used in the majority of previous studies within the field.

3.4. Empirical Evidence of a Forward Premium in Electricity Futures

The seminal work on the forward premium in electricity futures is found in [2]. The paper develops an equilibrium model to explain the forward premium in the Pennsylvania, New Jersey and Maryland (PJM) electricity market in the United States under the assumption that the price is determined by power producers and retailers, without input from speculative investors. The model predicts that the forward premium should decrease with expected variance of the spot price and increase with expected skewness of the spot price.

Longstaff and Wang [7] tested the theoretical model of Bessembinder and Lemmon [2] empirically using hourly data for spot and day-ahead forward prices in the PJM electricity market in the United States. Although the dataset is limited to two years, the authors found evidence of a significant forward premium in the hourly prices and that some of the variation in the forward premium can be explained by the Bessembinder and Lemmon [2] model. They also found that the forward premium varies significantly with yearly seasonality and time of day. The paper also relates the observed forward premium to time-varying risk measures such as the conditional volatility of electricity demand, spot prices and total revenue, and examines the relative volatility of forward- and spot prices.

Villaplana [6] also analysed data from the PJM market with the aim of identifying a process that adequately describes the time series of spot price. Specifically, a jump-diffusion approach with two factors is used to capture the dynamics of the spot price. The connection to the seasonal pattern of the forward premium is captured through seasonality in the probability of jumps. In periods with low probability of jumps in the spot price, the forward premium should be small and mostly explained by the variance in the spot price. In periods where there is a significant probability of price jumps, this should drive demand for futures up and the forward premium with it. A higher probability of price jumps implies more positive skewness over the period as the possibility of large prices increases. Villaplana [6] reached the same conclusion as Bessembinder and Lemmon [2], namely that spot price skewness and variance drive the forward premium in this market.

Both Bessembinder and Lemmon [2] and Longstaff and Wang [7] found evidence of a significant forward premium in the PJM and CALPX electricity markets. Haugom and Ullrich [15] repeated the analysis conducted by Longstaff and Wang [7] using data from 2001 to 2011. Their main conclusion is that, even though there is some empirical support for the theoretical model in the early years, the coefficients are very unstable as the market matures and the model presented by Bessembinder and Lemmon [2] is not able to explain the behaviour of the forward prices in the PJM market sufficiently well. Haugom and Ullrich [15] concluded that the forward price has evolved into an unbiased predictor of the spot price. The forecast of the spot price is not significantly improved by including other information known to market participants.

Diko et al. [19] investigated three European electricity markets (the German EEX market, France’s Powernext and the Dutch APX) for the presence of a risk premium in day-ahead electricity futures. A significant risk premium is found for peak hours for all three markets. For off-peak hours, only EEX shows a significant short-term risk premium. Using a multi-factor model, the paper finds support for the Bessembinder and Lemmon [2] model in the peaks hours forward premium. The paper also finds, in agreement with Haugom and Ullrich [15], that the forward premium decreases in absolute value as the market matures.

3.5. Explaining Variation in the Forward Premium

The differences in generation mix between the PJM market and Nord Pool raise the question whether the results obtained from analysing the PJM market are directly applicable to Nord Pool. The main difference is the amount of available hydropower, which is substantially higher in the Nord Pool area [3]. As discussed in the previous section, electricity prices are influenced mainly by local supply and demand conditions and it is uncertain to what degree the findings in one electricity market can be generalised to others. For example, Álvaro Cartea and Villaplana [20] found that capacity risk could assume both positive and negative values depending on both the market and time period under study.

Douglas and Popova [21] developed a regression model to describe the forward premium using the variance and skewness of the spot price as well as variables that impact demand for gas for heating, and the available gas in storage. The empirical analysis supports the intuition that gas storage levels should have a negative impact on the forward premium by decreasing the spot price skewness. Higher gas storage levels imply that the amount of potentially available electricity is higher, which leads to a smaller impact from demand shocks and thus a lower premium according to the model of Bessembinder and Lemmon [2]. However, there are large differences between the Nordic and American PJM electricity markets. In the PJM market considered by Douglas and Popova [21], low temperatures do not affect electricity demand by much, as gas is primarily used for heating, whereas very high temperatures drive electricity demand up due to air conditioning, which predominantly runs on electricity. This is in stark contrast to the Nordic electricity market where a large amount of electricity is used for heating and the peak demand over a year is always on the coldest days. However, the main finding that storage opportunities for the resources used to create electricity have a significant impact on the forward premium, is relevant to us. The Nordic electricity market has a large share of hydropower with reservoirs. Water can be stored in reservoirs and it is therefore likely that reservoir levels and weather conditions that impact reservoir levels will have an impact on the forward premium.

Bunn and Chen [22] reviewed the literature on the risk premium in electricity futures and noted that no consensus on the existence and explanation of the risk premium in electricity futures has yet been reached. One reason for this is that a large part of the literature has focused on using statistical features of the spot price, mainly its skewness and volatility, to model the risk premium. In their analysis of the British electricity market, they found evidence that the risk premium includes a premium in the underlying fuel, which in Britain is gas. Furthermore, supply and demand shocks are found to have a significant effect. Bunn and Chen [22] also found significant differences between day-ahead and one-month futures, where day-ahead futures reflect the operational aspects of the electricity market and one-month-ahead forwards are based on more fundamental expectations.

One of the first papers to analyse the forward premium in the Nordic electricity market was by Botterud et al. [8]. Using a dataset from 1996 and 2001, they found a significant positive forward premium, which increases as the length of the holding period increases. Botterud et al. [8] also examined the effect of deviations from normal reservoir levels on the forward premium. However, this is only done through visual inspection of graphical plots of the reservoir deviations, spot and futures prices and the risk premium, and the results are preliminary at best.

Botterud et al. [3] explained that several of the assumptions in the Bessembinder and Lemmon [2] model are not fulfilled in the Nord Pool market. The assumption that each producer faces a convex cost function does not hold for a system with a large amount of hydropower. Hydropower has very low actual production costs and scheduling decisions are based on the water value, which is the opportunity cost of production now versus deferring production.

4. Data

The time series of spot and futures prices used in our empirical analysis consists of daily system spot prices and daily prices for 1 month DS futures traded on Nasdaq OMX Europe. The dataset was obtained from Montel, a market information provider for European electricity markets.

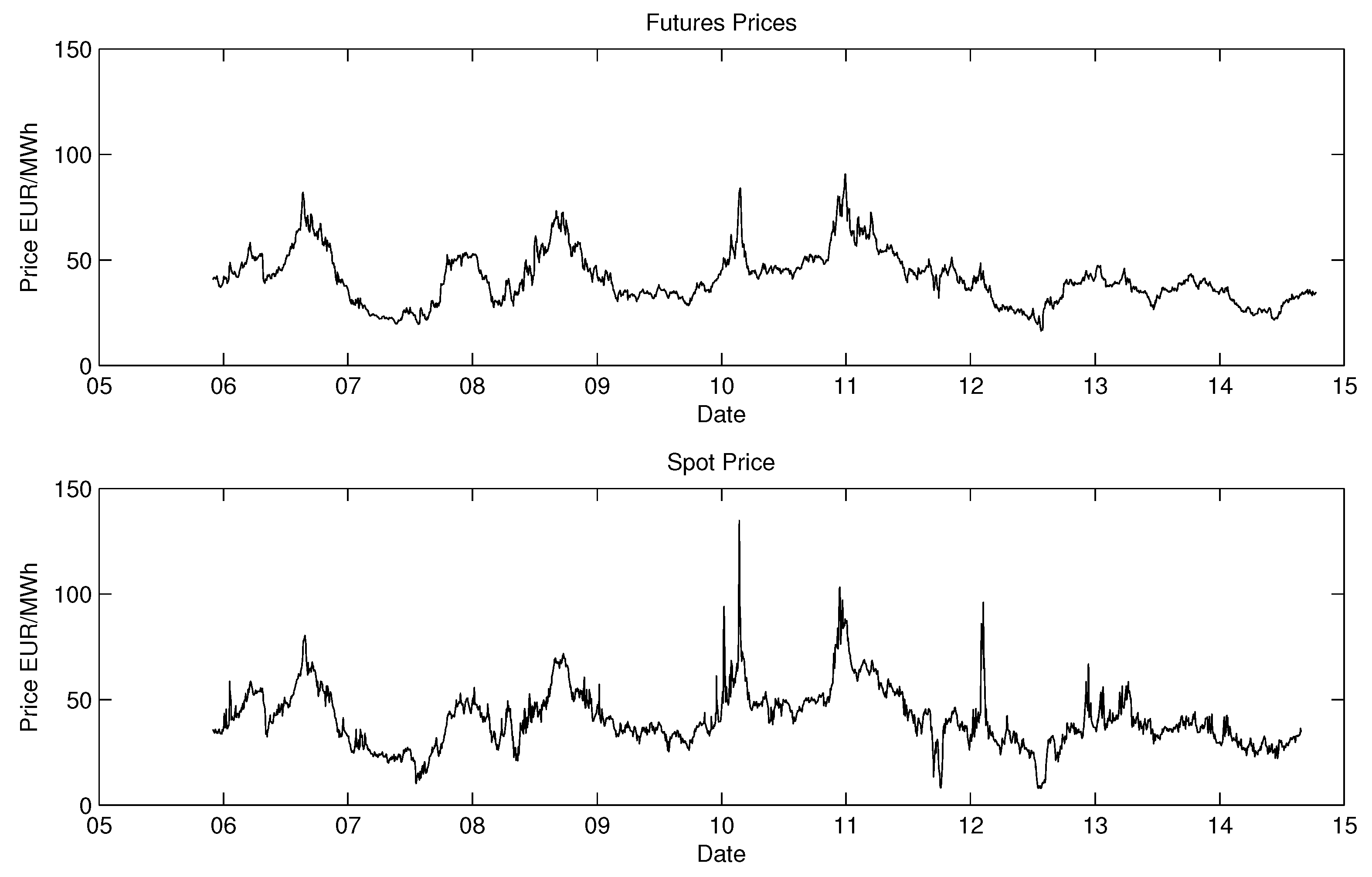

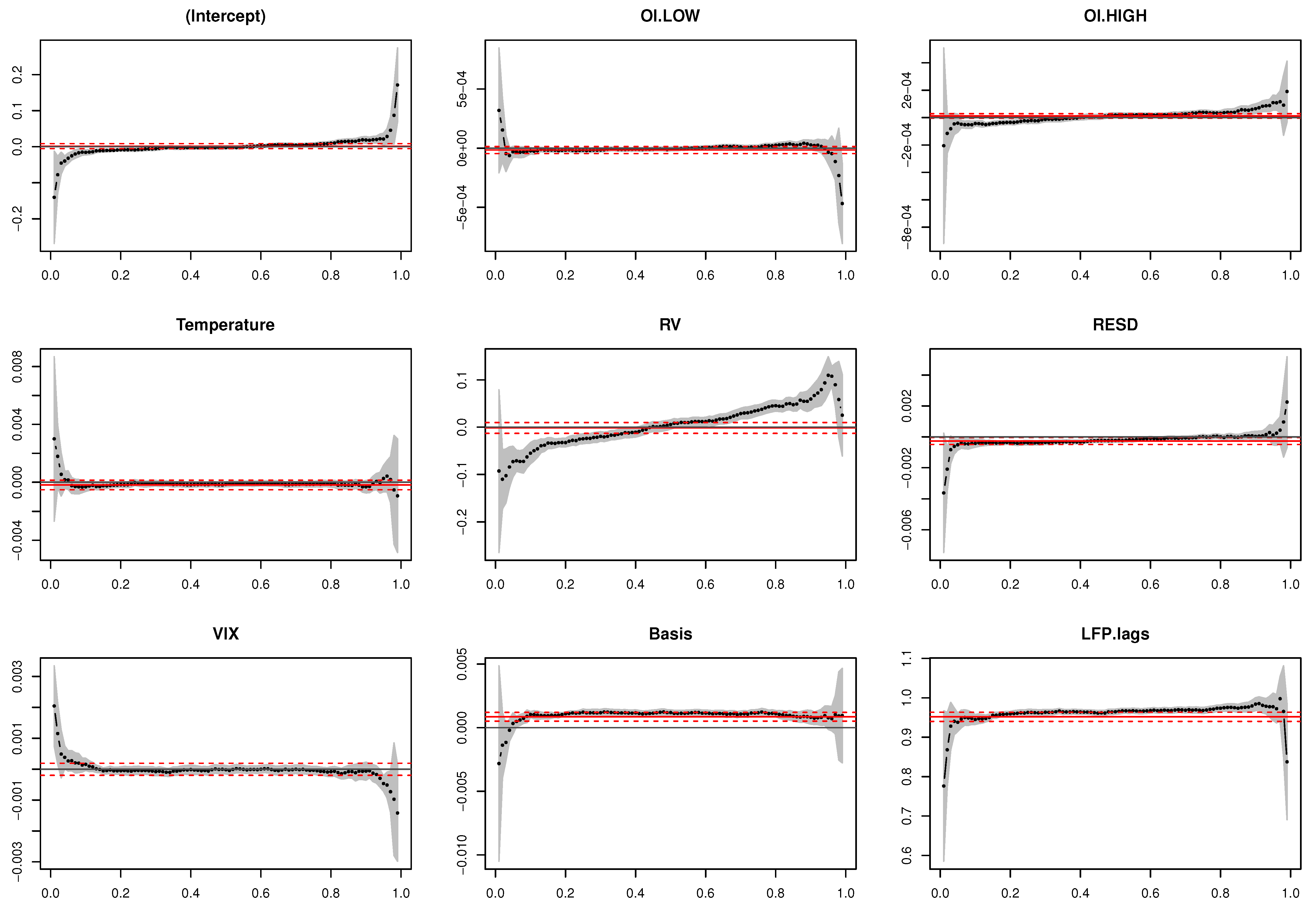

As expected, the spot prices show high seasonal variation and are highest during the winter months. The futures prices follow a very similar pattern, as can be seen in Figure 1. Figure 1 also clearly shows the infrequent upward spikes in the spot price that are typical in time series of electricity prices. The prices are highest during the winter. The peaks for the spot price are larger than the peaks for the futures price. This is also expected, as the spot price is more heavily influenced by short-term events with large ramifications, such as exceptionally cold weather. In general, the time series of spot and futures prices behave similarly to what one would expect. Large upward price spikes are found in electricity prices when market conditions are particularly bad. This effect is more pronounced for electricity than for any other commodity due to the fact that electricity cannot be stored.

Figure 1.

One-month futures and spot prices.

The time series of spot prices and futures consists of 2174 daily observations of the system spot price and the futures price between December 2005 and September 2014. We used these data to calculate the average spot price for every month during the period covered. The futures used in this study are one-month futures. This means that forward premium is found by taking the difference between the futures price and the average spot price during the delivery period. Using the definitions in Section 3.2, both the logarithmic and percentage forward premium are calculated.

For reservoir levels, the deviation from the daily mean is used. Only the reservoir levels in Norway are used, as they were the only ones that were publicly available.

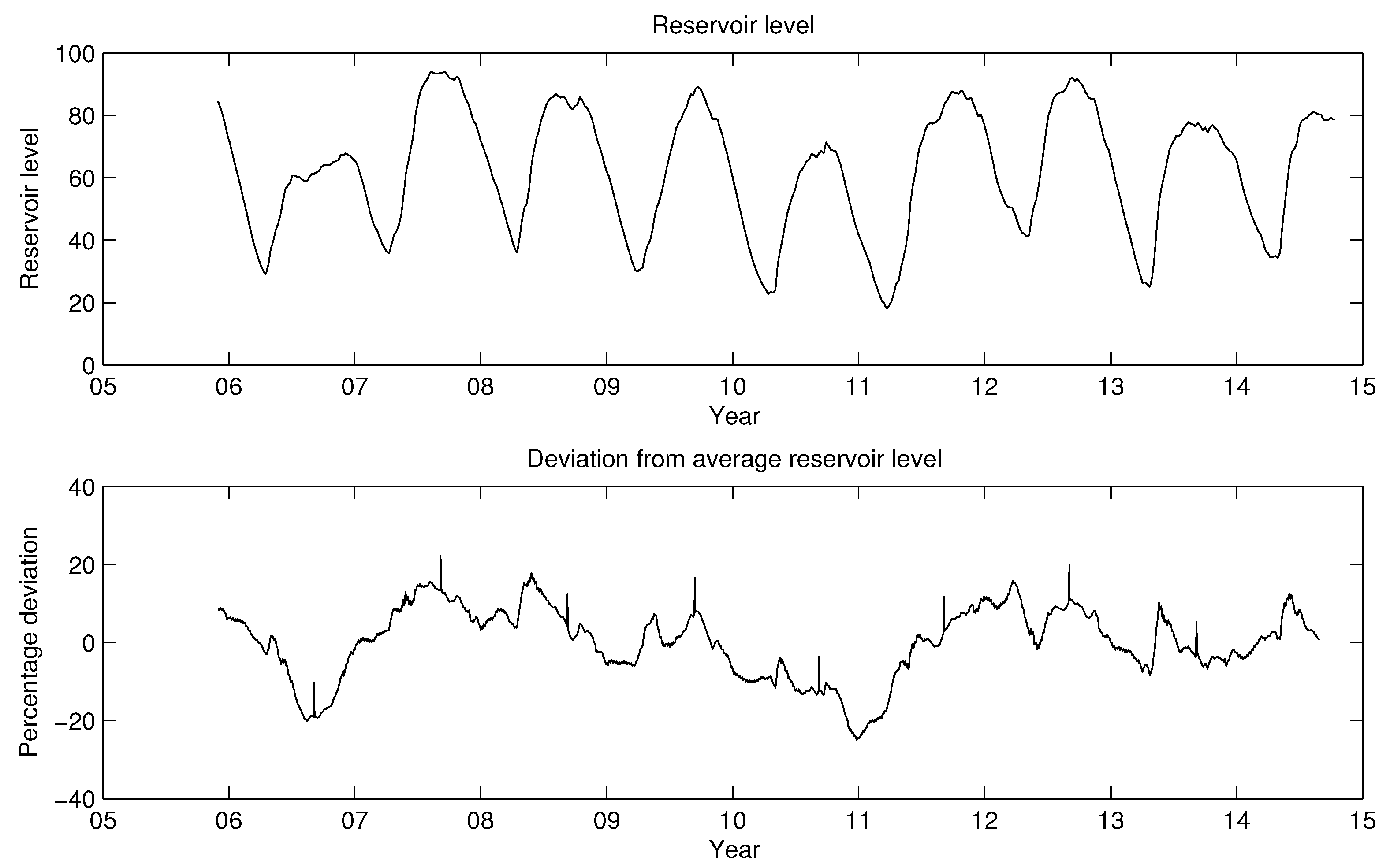

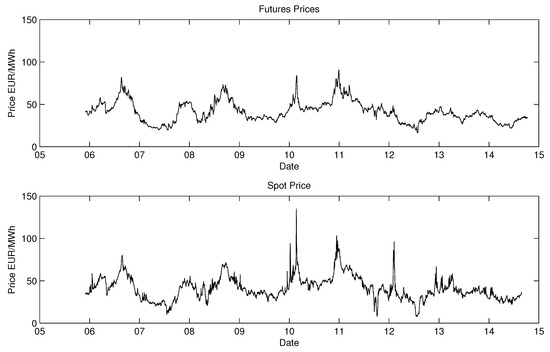

The error resulting from omitting the reservoir levels in other countries of the Nord Pool area is probably small, because Norway has about 65% of the hydropower within the Nord Pool area and reservoir levels within the region are correlated. The data for the reservoir levels were obtained from the Norwegian Water Resources and Energy Directorate (http://vannmagasinfylling.nve.no/Default.aspx?ViewType=AllYearsTable&Omr=NO) and consist of weekly aggregated reservoir levels for all hydropower reservoirs in Norway. As the data relate to weekly reservoir levels, some amount of transformation is needed to fit the daily values for the spot and futures prices. Assuming that the weekly levels are the levels at the beginning of the week and the first week of the year begins on the 1 January, the weekly values were transformed into daily values using linear interpolation. This transformation is not perfect, but it should be very close to the actual reservoir level on the given day. Using the obtained daily values, the deviation from the average reservoir level on any given day is calculated. The reservoir levels and their deviation from the average level are presented graphically in Figure 2. As expected, the reservoir levels follow a strong seasonal pattern. Inflows stop during winter and the reservoirs are tapped down until the snow starts melting. The deviation from average reservoir levels shows no obvious seasonal patterns.

Figure 2.

Reservoir levels and deviation from average reservoir levels.

The temperature variable was created by using Norwegian weather data, obtained from the Norwegian Meteorological Institute (http://www.eklima.met.no), which offers a wide range of climate data free of charge. The variable was constructed by taking the measurement station closest to the largest population center in each Norwegian county and then calculating a population weighted average each day. There are some obvious weaknesses in this approach as the Nordic electricity market is larger than Norway. In addition, the weighting coefficients are hard to estimate accurately, as the population density varies heavily between measurement points. However, there is correlation between temperatures in Norway and the rest of the Nordic region, and therefore the weighted average temperature in Norway should also reflect to some extent the temperature in the Nord Pool area as a whole.

Open interest for the futures contract was obtained from Montel. Motivated by Haugom et al. [23], the variable was split in two: one for above average levels of open interest and one for levels below average. The explanation for this transformation is that the relation between open interest and the forward premium might not be monotonic. In particular, an average level of open interest might have a different impact on the forward premium than an unusually high or unusually low level of open interest. The high open interest variable is set to zero if open interest is below average and the low open interest variable is set to zero if open interest is above average. The definitions used are given as:

We obtained the realised volatility of forward prices from Birkelund et al. [24]. The VIX index was obtained from Montel. The effect of overall market risk on the forward premium in electricity futures has not been studied previously. The VIX is therefore included because the overall market risk might impact market participants’ risk aversion (including participants of electricity markets), and consequently the forward premium. The basis was constructed simply using the definition given in Equation (2).

5. Results

5.1. Preliminary Analysis

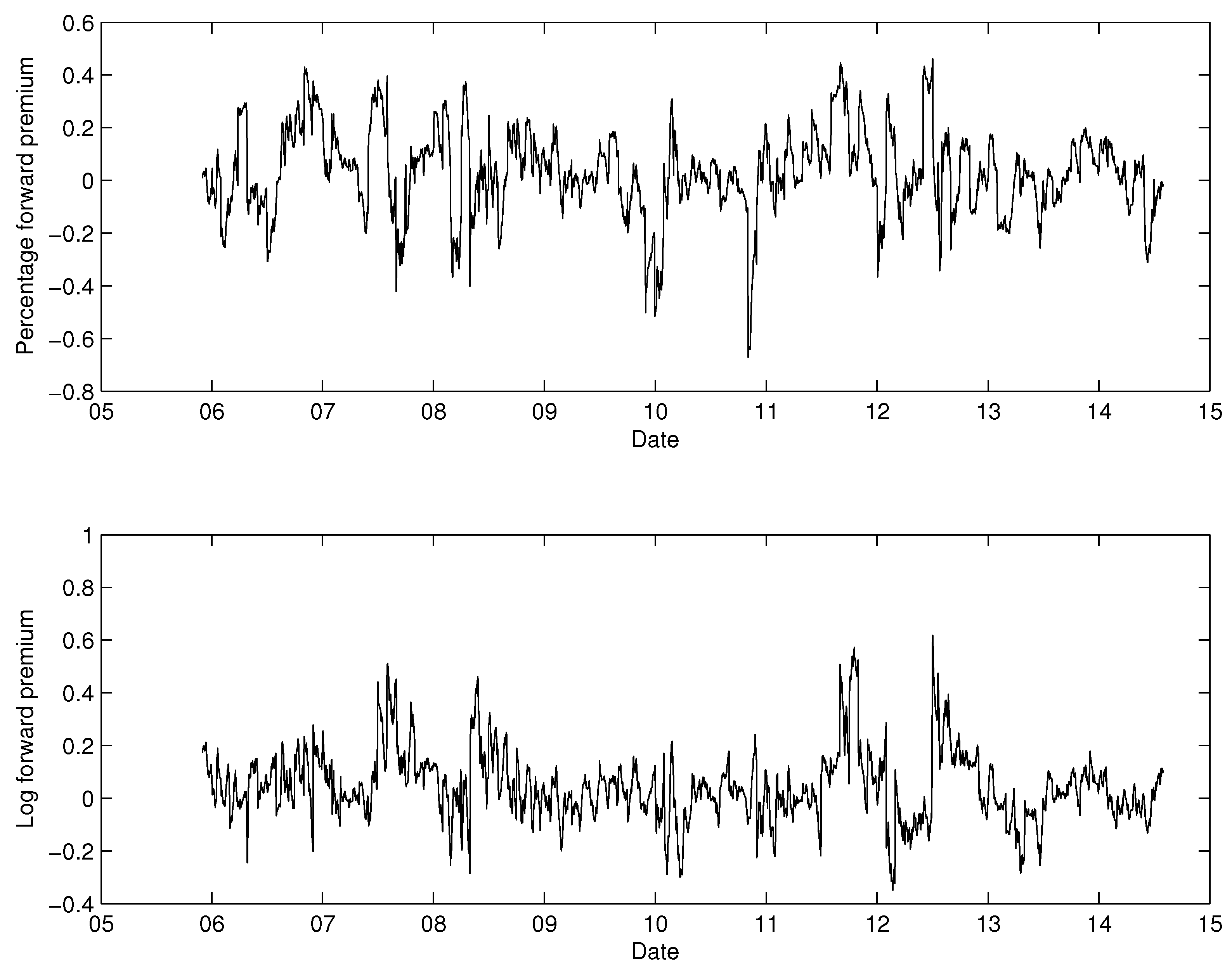

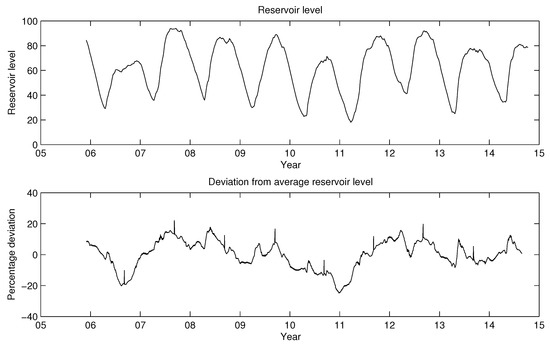

Figure 3 displays the evolution of the forward premium over time. The forward premium is larger during the winter months than during the summer months, although the largest negative forward premiums coincide with the largest spikes in spot prices, which usually happen during the winter. Such large price spikes are a consequence of severe and sometimes unexpected changes in the factors influencing the spot price. The forward premium does not exhibit any obvious seasonality pattern, whereas both the spot and forward prices do.

Figure 3.

Logarithmic and percentage forward premium.

5.2. Descriptive Statistics

Table 1 presents descriptive statistics for the spot price, futures prices and the forward premium. The spot price exhibits the expected statistical features, which is high skewness and high excess kurtosis. This means that the distribution of spot prices has heavy tails and that the right tail of the distribution is fatter than the left tail. It is more likely to experience high prices that deviate far from the mean than low prices that deviate far from the mean.

Table 1.

Descriptive statistics for the spot price, futures price and forward premium.

The futures price is on average larger than the spot price. Both the mean and median futures prices are larger than their counterparts for the spot price. This indicates that the forward premium is positive on average for the entire sample. The futures price also exhibits positive skewness and excess kurtosis, although the excess kurtosis is substantially smaller compared to the spot price. This can also bee seen in Figure 1 where the spikes in the spot price are much higher than they are for the forward price. The highest spot price in the sample is more than three times the mean spot price. Such price variations represent huge potential losses for utilities and end-users of electricity. As can be seen from graphing the futures and spot prices, the volatility is higher for spot prices than for futures, but the difference is not very large.

The forward premium exhibits very high volatility. The maximum and minimum values are both an order of magnitude larger than the mean and median forward premium. Both the negative and positive peaks for the forward premium are in the range of 20–30 Euro per MWh. These characteristics, in combination with the very high excess kurtosis, suggest that the forward premium has a fat-tailed distribution. The negative skewness of the forward premium is a natural consequence of the price spikes observed in the spot market from time to time.

When we look at the statistics for the percentage and log forward premium some differences emerge. The forward premium is positive on average under both definitions. The medians are very similar, but the mean log forward premium is substantially higher than the mean percentage forward premium. The volatilities of the two definitions are very similar. The biggest differences are in the skewness and kurtosis of the distribution and the maximum and minimum values. The percentage definition of the forward premium yields a distribution with negative skewness, which indicates a fatter left tail. The logarithmic definition however has quite high positive skewness with a fat right tail. The logarithmic definition results in a distribution with substantially higher kurtosis. This was also indicated by looking at the relationship between means and medians for the two definitions. For the logarithmic forward premium, the mean is higher than the median, which indicates that the distribution has a fatter right tail.

5.3. Model Specification

To explain the variation in the forward premium, we propose a multiple linear regression model. The model is defined as follows.

Here, is the ex post forward premium on day t, is the deviation from the mean open interest if it is below average, is the deviation from open interest when above average, is the temperature, is the realised volatility of forward prices, is the deviation from average reservoir levels, is the level of the CBOE Volatility Index (VIX), is the basis and is an error term assumed uncorrelated with other variables at time t.

Factors that increase the risk of high prices should have a positive impact on the forward premium and factors that increase the chance of low prices should have a negative impact on the forward premium. The predicted signs are summarised in Table 2.

Table 2.

The predicted signs of the coefficients in the regression model.

Open interest is an indicator of demand for futures. We expect that market actors have higher demand for futures in situations that they perceive as more risky. Therefore, open interest should have a positive association with forward premium. We split open interest variable in two, and , because we expect that low open interest might have a different relation to the forward premium than high open interest. We expect the regression coefficients for both open interest variables to be positive.

As temperatures decrease, the demand for electricity increases, and so does the risk of high prices. This should result in a negative sign for as lower temperatures would have a positive impact on the forward premium.

Deviation from average reservoir levels was used by Lucia and Torró [4] and reservoir levels was used by Botterud et al. [3] as explanatory variables in their regression models. Deviations from average reservoir levels are chosen rather than reservoir levels themselves to avoid using a variable with strong seasonal patterns [5]. shows the effects from increased supply on the price of electricity. If reservoir levels are lower than average the chance of price spikes increases and the demand for futures should increase. This should lead to an increase in the forward premium. Hence, the coefficient should be negative.

The situation is a little bit more complicated where the volatility of the forward price and the VIX index are concerned. The sign of the forward premium depends primarily on whether electricity producers or consumers have higher demand for hedging. The volatility of the electricity price and the VIX index reflect various sources of uncertainty. We expect that higher uncertainty will amplify the forward risk premium in both directions. Hence, in situations when the forward premium is positive, we expect realised volatility and the VIX index to have a positive impact on the forward premium. However, when the forward premium is negative, we expect realised volatility and the VIX index to have a negative impact on the forward premium. Since the forward premium is positive on average, we expect an overall positive impact from these variables.

The basis is the difference between the futures price and the spot price today and contains information about the expected premium [4]. The expectation is that an increase in the difference between the futures price and the current spot price will induce a positive impact on the forward premium with being positive.

The lagged value of the dependent variable should have a positive sign, as the forward premium is likely autocorrelated. Thus, we would expect to be positive.

5.4. OLS Regression Results

The results from the regressions for both the log and percentage forward premium are summarised in Table 3. For both model specifications, the basis and the deviation from the average reservoir level are the only exogenous variables that have a significant impact on the forward premium. (The lagged value of the forward premium itself also has a strong and significant effect, which suggests that the forward premium is highly correlated over time.) Weron and Zator [5], Lucia and Torró [4] and Botterud et al. [3] all found that reservoir levels have significant effects on the forward premium. Lucia and Torró [4] also found that the basis has significant effects on the forward premium. Our results therefore support the findings of these previous studies. All the coefficients show the predicted signs, except for for low open interest. However, this coefficient is very close to zero and not significant.

Table 3.

Results from the OLS regression. Heteroskedasticity-consistent standard errors are shown in brackets. ***, ** and * indicate significance at the 1%, 5% and 10% levels.

Neither realised volatility nor the VIX index has any impact on the mean forward premium using the OLS regression. This was somewhat expected given our reasoning in the previous section. The quantile regression results reveal whether the effects of the volatility variables are stronger in the tails compared to the center of the distribution.

Several papers have noted that the forward premium in electricity markets decreases as the markets mature. It is interesting to examine whether this is also the case for the Nordic electricity market. We therefore split the total sample into two subsamples. The first subsample covers the period from December 1, 2005 to March 31, 2010 and the second subsample covers the period from March 31, 2010 to July 31, 2014. The results from the second subsample are of particular interest as there is significantly less existing research based on data after 2009. It has already been shown that the forward premium has declined somewhat over time, but changes in the effects of the considered variables have not received much attention previously.

We see that the overall explanatory power of the model estimated for the last part of the sample is slightly better than for the first half of the sample, and that this holds for both definitions of the forward premium. In general, the two definitions of the forward premium yield models that are similar in terms of the size and sign of the coefficients. The only difference is that the high open interest coefficient is negative for the percentage definition and positive for the logarithmic definition of the forward premium, in the first period. However, this result is of minor importance as both estimates are statistically insignificant.

There are some important differences between the estimated coefficients for the two different sub-periods. First, both the basis and the deviation from average reservoir level have significant effects at the 1% level for the period from 2005 to 2009, but no significant effect at any level for the period from 2010 to 2014. The coefficient estimates for these are also reduced by an order of magnitude for the model estimated for the second sub-period in both models.

The coefficients for low open interest, realised volatility and temperature change sign between the sub periods. Low open interest has a positive coefficient for the first period and a negative coefficient for the second period. The impact of the realised volatility and temperature changes between these two subperiods from negative to positive. Temperature has a significant impact at the 10 % level for the first subsample. The coefficient for realised volatility both changes sign and increases in magnitude (in absolute value), but in no model is its effect significant.

The coefficients are all smaller in the second period, except for the VIX. For example, the coefficients for the basis and the deviation from average reservoir level, which are significant in the first period, are reduced by an order of magnitude in the second period. This result indicates that as the market has matured the forward premium has, on average, decreased in the Nordic electricity market.

The results indicate that the estimates from Lucia and Torró [4] and Botterud et al. [3] may not fully describe the current behaviour of the market. Since both the basis and reservoir deviation have a smaller and less significant impact in the second subperiod, the results of Botterud et al. [3] and Lucia and Torró [4] should not be extrapolated into the future and used to describe the current behaviour of the forward premium in the Nordic electricity market.

5.5. Quantile Regression Results

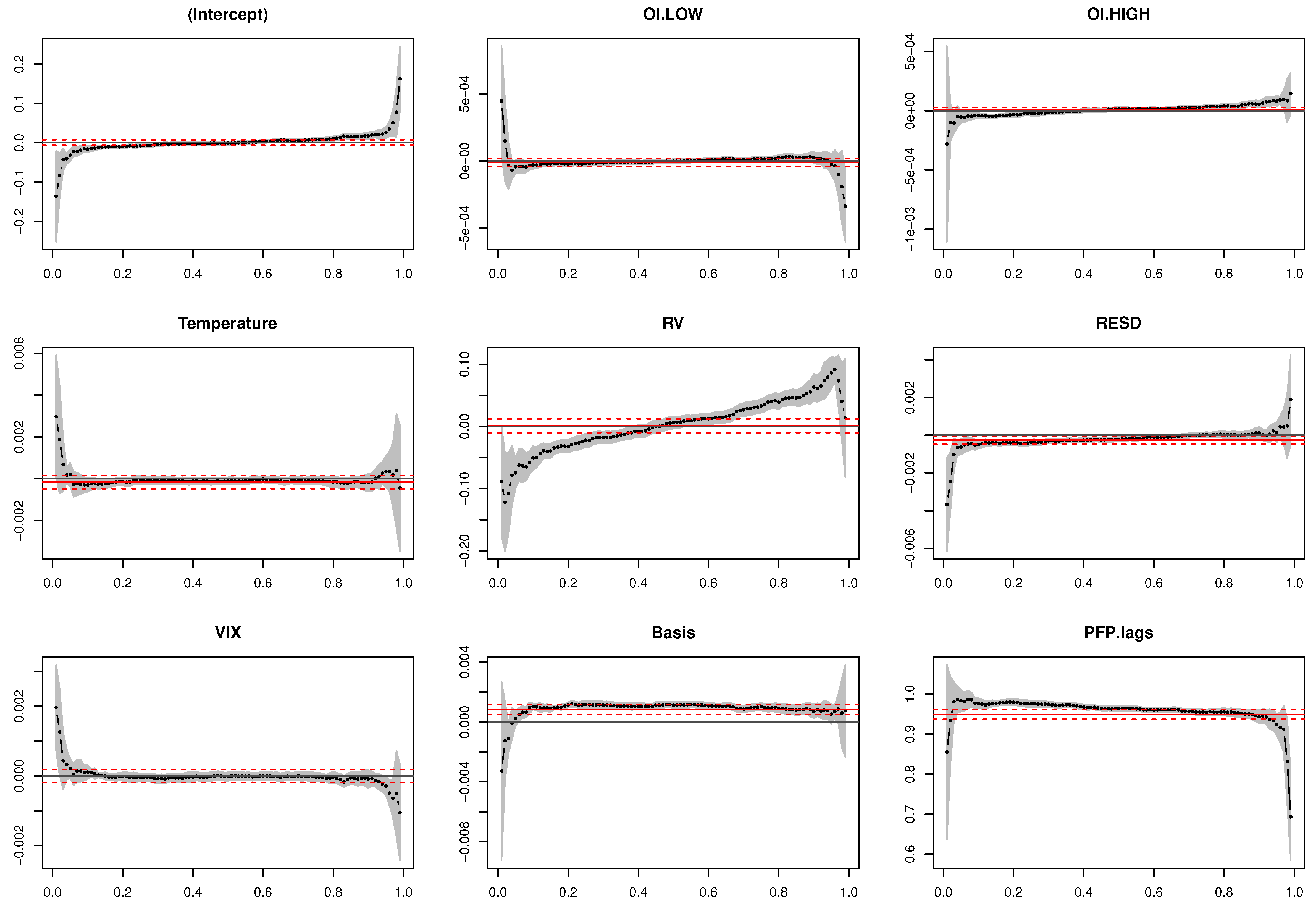

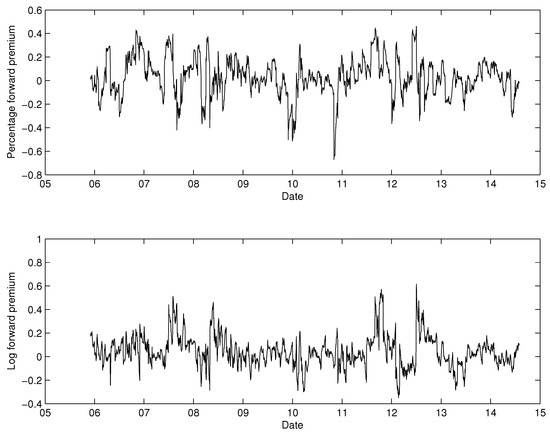

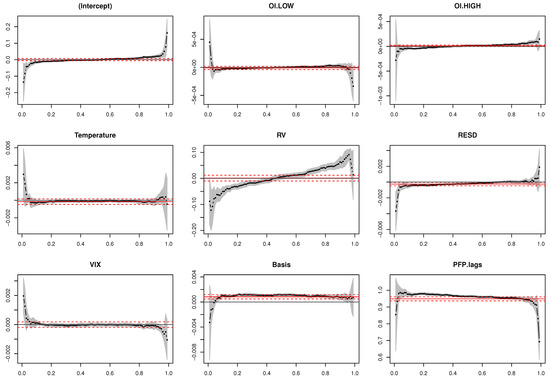

Figure 4 presents the results from estimating the model for the percentage forward premium at all quantiles. The black dotted line presents the coefficient estimates from the quantile regression plotted over all quantiles. The gray shaded area indicates the confidence bands for the coefficient estimates. The OLS results are also plotted with the solid red line representing the OLS coefficient estimate and the dashed red lines indicating the upper and lower bounds of the confidence intervals.

Figure 4.

Quantile regression coefficients plotted for various quantiles with percentage forward premium as the dependent variable.

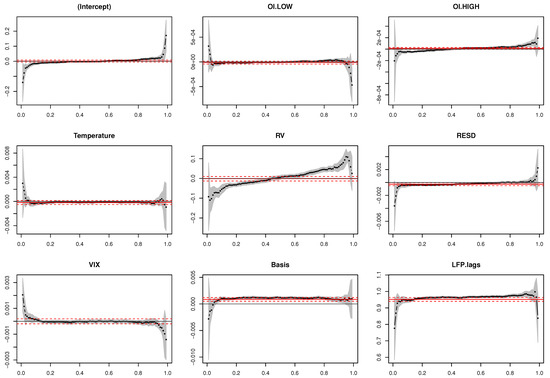

Figure 5 presents the result from estimating the model for the logarithmic risk premium definition, with the figure showing the same measures as Figure 4 does for the percentage definition.

Figure 5.

Quantile regression coefficients plotted for various quantiles with the logarithmic forward premium as the dependent variable.

Our overall finding is that the impact of the various explanatory variables on the mean/median forward premium is fairly small. The confidence bands for both the conditional median and mean include zero for all variables except the included lagged value of the dependent variable, the basis and the deviation from average reservoir level. This is in line with the findings from the OLS estimation. However, when we examine all the variables, we can clearly see that the effects are not constant across the quantiles.

The coefficient for low open interest is very close to zero over nearly all quantiles, and the results are almost identical for the two definitions of the forward premium. A significant impact is found only in the far left and right tails. The coefficients in the left tail are positive and significant, while the opposite is the case in the right tail. As this variable is always zero or negative, we can see that an increase in open interest when open interest is low in general reduces the volatility of the forward premium. Interestingly, the coefficients for high open interest show the opposite pattern. This means that an increase in open interest when open interest already is high increases the volatility of the forward premium.

The coefficient for temperature also reveals an effect close to zero over the majority of quantiles. However, there is a positive and significant effect for the lower quantiles. This makes sense; when the forward premium is very low, electricity spot prices are extremely high, and in such cases a temperature increase will lead to lower spot prices and thus have a positive impact on the forward premium. In the opposite case, there are not usually severe weather conditions of any kind (but the market may have expected cold weather) and so a change in the temperature will only have a minor impact.

The deviation from average reservoir level shows a distinct pattern. Around the mean and towards the lower quantiles the coefficients are close to zero. The effects are negative in the lower tail, whereas in the upper tail the coefficients become positive. As the variable measures the deviation from the average reservoir level, a higher value means more water is stored in the reservoirs. This should reduce the risk of low future supply. This is also exactly what we find in the quantile regressions. Since the deviation from the average reservoir level has negative values when the current reservoir level is low, an increase in the reservoir level will induce a higher level of lower conditional forward premia. Similarly, when reservoir levels are low (and the deviation is negative) an increase in the reservoir level will induce lower levels of the conditional higher quantiles. These two effects in general mean that the volatility of the forward premium is reduced when the reservoir level increases.

The coefficient for realised volatility displays a very distinct pattern of influence on the forward premium. At the median, the coefficient is close to zero, which is in line with the findings from the OLS regressions. The coefficient changes from negative in the left tail to positive in the right tail. The interpretation is very simple: volatility of the electricity futures price is translated into the volatility of the forward premium. An increase in the realised volatility of the forward price means that the conditional lower quantiles of the forward premium become more negative and the conditional upper quantiles become more positive.

The situation is the opposite with the VIX index. This can be easily understood once we realise that, first, the forward premium is defined as the difference between the futures price now and the spot price one month later, and, second, realised volatility is the volatility of the futures price now, whereas the VIX index is the one-month implied volatility of the stock market. As discussed above, the realised volatility of futures prices is basically the volatility of the futures/forward price now. By contrast, the VIX index is one-month implied volatility, and therefore it is related to the volatility of the spot price in one month. Since the spot price enters the calculation of the forward premium with a negative sign, the VIX index has the opposite impact on the quantiles of the forward premium, after controlling for the realised volatility of futures prices.

The basis has a positive and significant impact on the forward premium across most quantiles. In the lower tail, the coefficients are negative and significant. This means that a higher forward price today (with “delivery” in the future) compared to the current spot price will induce a lower value of the conditional lower quantiles of the forward premium. This makes sense as a higher basis means that we expect higher spot prices in the future. This will particularly influence the lower tails of the forward premium.

6. Conclusions

In this paper, we provide new empirical evidence of the behaviour of the forward premium in the Nordic electricity market. We do this by using both traditional OLS regression analysis and a quantile regression approach.

Our results show that some of the variation in the conditional mean of the forward premium can be explained by temperature, deviation from the mean reservoir level and variation in the basis. However, these findings only hold for the first period of the sample (2005–2009). For the second part of the sample period (2010–2014), the effects from these variables are no longer significant. On the other hand, open interest, when it is above the average level, has a positive impact on the forward premium in the second half of our data sample.

Participants in electricity markets need to measure and manage the risk associated with taking long- and short-term positions. It is therefore important to understand the impact of various variables on the mean and other aspects of the forward premium distribution. Our findings regarding the effects in the tails of the distribution are of particular interest as these can be directly related to Value-at-Risk modelling and forecasting.

The results from the quantile regression show that the impacts of the various variables are not constant across the distribution of the forward premium. For most of the independent variables, the effects increase (in absolute terms) in the tails of the distribution. Our results show that the realised volatility of futures prices and the implied volatility of the stock market are particularly important in explaining variation in the upper and lower quantiles of the forward premium distribution.

Author Contributions

Conceptualisation and methodology, E.H., P.M. and M.T.; formal analysis, investigation and writing—original draft preparation, M.T.; writing—review and editing, supervision and project administration, E.H. and P.M. All authors have read and agreed to the published version of the manuscript.

Funding

P.M. acknowledges the support provided by the Czech Grant Agency under Grant No. 19-26812X.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Weron, R. Market price of risk implied by Asian-style electricity opions and futures. Energy Econ. 2008, 30, 1098–1115. [Google Scholar] [CrossRef]

- Bessembinder, H.; Lemmon, M.L. Equilibrium Pricing and Optimal Hedging in Electricity Forward Markets. J. Financ. 2002, 57, 1347–1382. [Google Scholar] [CrossRef]

- Botterud, A.; Kristiansen, T.; Ilic, M.D. The relationship between spot and futures prices in the Nord Pool electricity market. Energy Econ. 2010, 32, 967–978. [Google Scholar] [CrossRef]

- Lucia, J.J.; Torró, H. On the Risk Premium in Nordic Electricity Futures prices. Int. Rev. Econ. Financ. 2011, 20, 750–763. [Google Scholar] [CrossRef]

- Weron, R.; Zator, M. Revisiting the relationship between spot and futures prices in the Nord Pool electricity market. Energy Econ. 2014, 44, 178–190. [Google Scholar] [CrossRef]

- Villaplana, P. Pricing Power Derivatives: A Two-Factor Jump-Diffusion Approach. Available online: https://ssrn.com/abstract=493943 (accessed on 1 January 2020).

- Longstaff, F.A.; Wang, A.W. Electricity Forward Prices: A High-Frequency Empirical Analysis. J. Financ. 2004, 59, 1877–1900. [Google Scholar] [CrossRef]

- Botterud, A.; Bhattacharyya, A.D.; Ilic, M.D. Futures and spot prices—An analysis of the Scandinavian electricity market. In Proceedings of the 34th Annual North American Power Symposium, Tempe, AZ, USA, 13–15 October 2002. [Google Scholar]

- Mork, E. The dynamics of risk premiums in Nord Pool’s futures market. Energy Stud. Rev. 2006, 14, 170–185. [Google Scholar] [CrossRef]

- Do, L.P.C.; Lyócsa, Š.; Molnár, P. Impact of wind and solar production on electricity prices: Quantile regression approach. J. Oper. Res. Soc. 2019, 70, 1752–1768. [Google Scholar] [CrossRef]

- Bye, T.; Hope, E. Deregulation of electricity markets: The Norwegian experience. Econ. Political Wkly. 2005, 40, 5269–5278. [Google Scholar]

- Hirshleifer, D. Hedging pressure and future price movements in a general equilibrium model. Econometrica 1990, 58, 411–428. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Commodity futures prices: Some evidence on forecast power, premiums, and the theory of storage. J. Bus. 1987, 60, 55–73. [Google Scholar] [CrossRef]

- Weron, R.; Simonsen, I.; Wilman, P. Modeling Highly Volatile and Seasonal Markets: Evidence from the Nord Pool Electricity Market. Available online: https://ideas.repec.org/p/wpa/wuwpem/0303007.html (accessed on 1 January 2020).

- Haugom, E.; Ullrich, C.J. Market Efficiency and risk premia in short-term forward prices. Energy Econ. 2012, 34, 1931–1941. [Google Scholar] [CrossRef]

- Daskalakis, G.; Markellos, R.N. Are Electricity Risk Premia Affected by Emission Allowance Prices? Evidence From the EEX, Nord Pool and Powernext. Energy Policy 2009, 37, 2594–2604. [Google Scholar] [CrossRef]

- Haugom, E.; Hoff, G.A.; Mortensen, M.; Westgaard, S.; Molnár, P. The forecasting power of mid-term futures contracts. J. Energy Mark. 2014, 7, 1–23. [Google Scholar]

- Haugom, E.; Hoff, G.A.; Molnár, P.; Mortensen, M.; Westgaard, S. The forward premium in the Nord Pool Power market. Emerg. Mark. Financ. Trade 2018, 54, 1793–1807. [Google Scholar] [CrossRef]

- Diko, P.; Lawford, S.; Limpens, V. Risk Premia in electricity forward prices. Stud. Nonlinear Dyn. Econom. 2006, 10, 7. [Google Scholar] [CrossRef]

- Cartea, Á.; Villaplana, P. Spot price modeling and the valuation of electricity forward contracts: The role of demand and capacity. J. Bank. Financ. 2008, 32, 2502–2519. [Google Scholar] [CrossRef]

- Douglas, S.; Popova, J. Storage and the electricity forward premium. Energy Econ. 2008, 30, 1712–1727. [Google Scholar] [CrossRef]

- Bunn, D.W.; Chen, D. The forward premium in electricity futures. J. Empir. Financ. 2013, 23, 173–186. [Google Scholar] [CrossRef]

- Haugom, E.; Langeland, H.; Molnár, P.; Westgaard, S. Forecasting volatility of the US oil market. J. Bank. Financ. 2014, 47, 1–14. [Google Scholar] [CrossRef]

- Birkelund, O.H.; Haugom, E.; Molnár, P.; Opdal, M.; Westgaard, S. A comparison of implied and realized volatility in the Nordic power forward market. Energy Econ. 2015, 48, 288–294. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).