1. Introduction

In recent years, generating electricity from renewable sources, namely, hydropower, wind, solar, and biomass, are becoming increasingly expressive [

1]. Among these renewable sources and their respective conversion technologies, the solar photovoltaic (PV) generation is the one that has been leading the expansion of installed capacity in the world [

1,

2]. In addition to presenting a competitive cost, it also brings together characteristics which give it a unique degree of application flexibility, such as great modularity, no direct pollution, and dependency only on endless solar irradiation, which is available at different levels, but in all locations [

1,

3,

4,

5]. These characteristics, when coupled with appropriate policies and market opportunities, make it attractive for both centralized generation (CG) and distributed generation (DG) [

1,

2,

6,

7].

The distributed PV generation accounts for about 40% of all PV capacity installed in the world [

2]. It is mainly represented by small-scale grid-connected PV systems on residential and commercial buildings [

2,

8]. By acting simultaneously as consumers and producers of electricity, the users of these buildings, who are respectively the owners of PV systems, are usually called prosumers [

9]. The incentive policies typically implemented in the DG sector, encourage prosumers to: (i) self-consume the electricity produced by the PV system to cover the electricity demand of the building; or (ii) inject it into the distribution grid in exchange for some type of energy or financial compensation, as an energy credit or a feed-in tariff [

6,

7,

8]. Since the PV production profile hardly converges entirely with the building’s consumption profile, especially in the case of residential users, it is common to combine these two options, i.e., to self-consume as much of the electricity produced as possible and inject the electricity surplus into the distribution grid [

6,

10].

Nevertheless, the existence of prosumers connected to the distribution grid is a critical issue for the distribution system operator (DSO). As these users are characterized by electricity generation next to the load, several potential benefits can be experienced, such as decreasing energy losses and increasing power quality [

11,

12]. In contrast, as the prosumer penetration increases, the PV generation intermittency and the uncontrolled electricity injections into the grid may cause a number of problems, such as power fluctuations and reduced voltage stability [

13,

14].

A convenient way to overcome these problems is to couple the battery energy storage system (BESS) to the PV system of the prosumers. This solution allows a portion of the electricity surplus to be stored instead of directly injected into the distribution grid, thus mitigating its operating stress [

15,

16,

17]. Furthermore, BESS allows prosumers to actively manage stored electricity to improve their incomes, which can be done through its self-consumption or by practicing arbitrage in its sales process [

6,

18], for example. Therefore, these two “end-user services” enabled by BESS, not only offer technical benefits for the prosumer integration in the distribution grid, but also contribute to its empowerment—which is extremely relevant for consolidating future smart grids [

19,

20]. However, the current high costs of BESS make it an economically unfeasible solution, especially for residential prosumers with PV system installed in a wide range of markets, such as those found in: Australia [

21], Brazil [

22], Germany [

23], Italy [

24], Netherlands [

8], Portugal [

25], Switzerland [

26] and United Kingdom [

20]. Therefore, the establishment of regulatory policies and economic incentives are essential to attract investment from residential prosumers in BESS, as well as promoting the consolidation of its industry at the local and international level [

4,

20,

27,

28,

29].

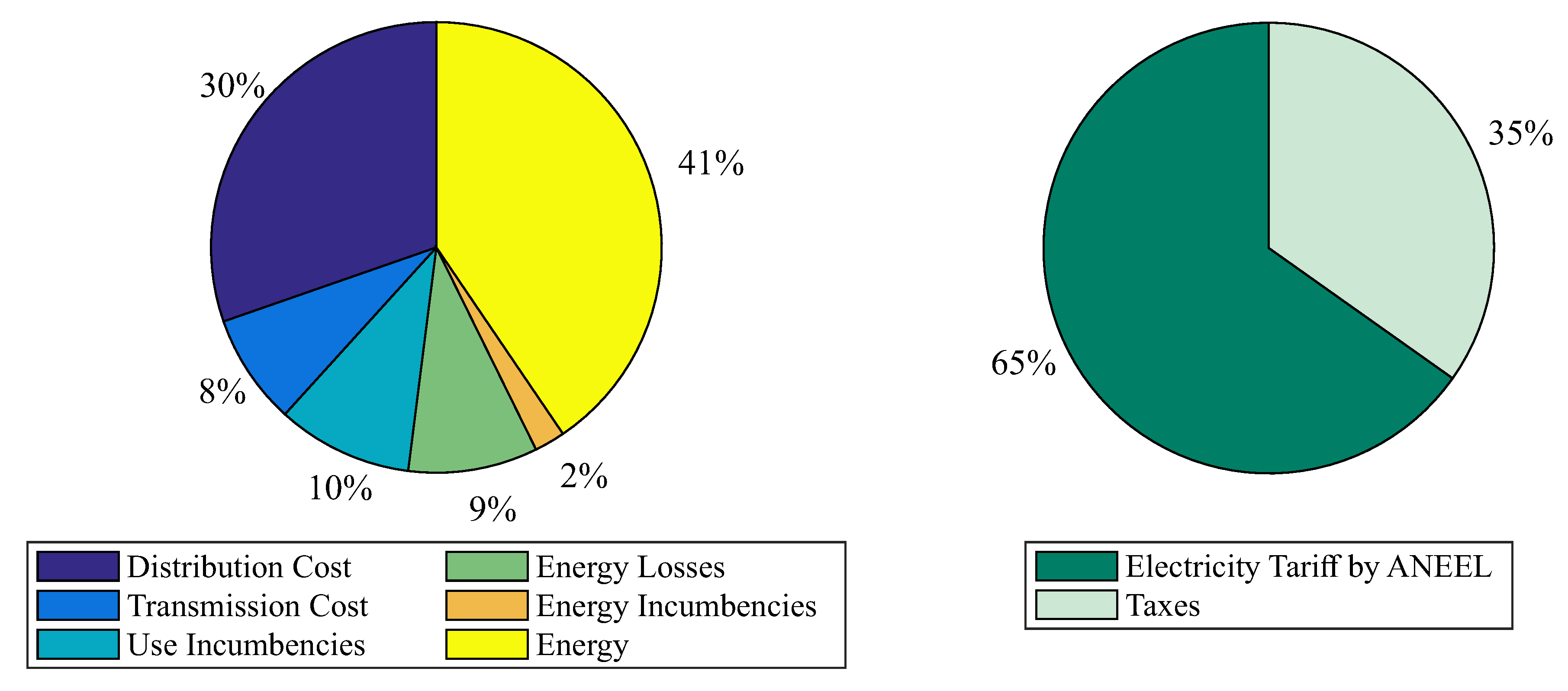

Regarding Brazil, a very interesting regulatory landscape is currently observed. In net-metering scheme regulated in this country, the prosumer receives one energy credit for each electricity unit injected into the distribution grid [

30]. This energy credit can be used within 60 months to offset the prosumer electricity bill in a one-for-one energy compensation [

31]. Hence, it is observed that the distribution grid acts virtually like a “zero-cost battery”, so there is no incentive for the prosumer to invest in BESS [

18]. As if that were not enough, the tax burden on storage batteries reaches 80% of their investment costs in the Brazilian market, making BESS an extremely expensive solution [

32]. Nonetheless, some regulatory changes in progress may make BESS more attractive to Brazilian prosumers. A regulatory review process is underway, in which its regulatory agency, the Brazilian Electricity Regulatory Agency (ANEEL), signals that the energy credits valuation will be reduced, thus promoting an increase in self-consumption by prosumers [

18,

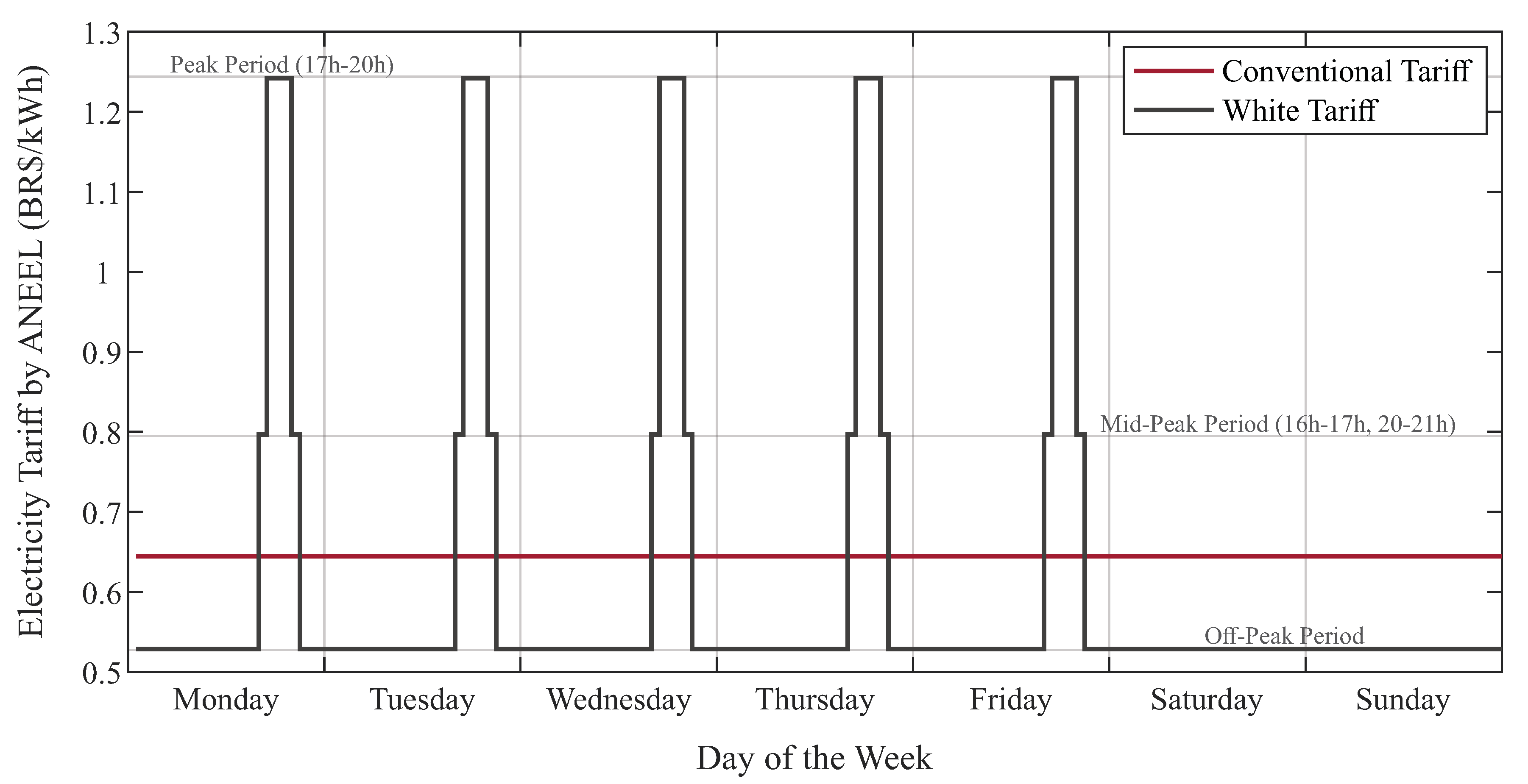

33]. Furthermore, from a process started in 2018, today all Brazilian residential prosumers (and consumers) may choose to be charged for the electricity consumed from distribution grid by a time-of-use (ToU) tariff scheme, called white tariff, instead of the conventional tariff scheme, which is characterized by a flat-rate tariff [

34]. This new scheme may encourage a residential prosumer, the owner of a PV+BESS, to shift the self-consumption of electricity stored from low-tariff to high-tariff periods, in order to reduce its overall electricity expenses [

6].

Given the topicality of these regulatory changes, few works in the specific literature address the technical and economic aspects of BESS coupling in new or even existing PV systems for residential prosumers under the Brazilian context. A study conducted by da Silva and Branco, found that a PV+BESS with 1.6 kWp of PV capacity and 6.67 kWh of storage capacity is not an attractive investment option for a prosumer located in the city of Belém (northern Brazil), with an electricity demand of 1.2 MWh/year, under the conventional tariff scheme [

22].

In turn, the “10-Year Energy Expansion Plan 2029”, which is an official document of the Brazilian government, developed by Energy Research Company (EPE), concludes that for a prosumer located in the state of Minas Gerais (Southeastern Brazil), with an electricity demand of about 8.6 MWh/year and 3.8 kWp of installed PV capacity, an increasing self-consumption gain is verified for up to 15 kWh of installed storage capacity [

18]. However, when analyzing these solutions economically, it was observed that battery cost would need to be one-fifth of its present value for the investment to be minimally feasible, in view of the conventional tariff scheme [

18].

More recently, EPE released a preview of a new study on the attractiveness of applying BESS to increase the prosumer self-consumption rate, taking into account the alternatives for valuing energy credits proposed by ANEEL in the current DG regulatory review process [

35]. Within this, the conditions that some residential and commercial prosumers, with electricity demand adjusted to 10 MWh/year and unspecified installed PV capacity, would experience when located in different cities and under the conventional tariff scheme were analyzed. The general conclusion was that, over a ten-year horizon, investment in BESS is not economically feasible for these prosumers in any one of the alternatives proposed by ANEEL [

35].

Despite these preliminary results, several issues related to PV+BESS feasibility, in the current and the glimpsed regulatory scenarios for DG in Brazil, still need to be adequately clarified. None of the mentioned works, for example, investigated the technical and economic conditions that the prosumers respectively considered could experience when choosing the white tariff scheme instead of the conventional tariff scheme. On the other hand, the attractiveness of investment in BESS verified for each alternative of valuing energy credits proposed by ANEEL, also need to be better discussed in order to enrich the current DG regulatory review process. In addition, there is a lack of information about the potential economic benefits that the market’s main incentive policies for BESS dissemination could offer to a residential prosumer interested in investing in this solution.

Aware of that, the present paper conducts a comprehensive study of the energy impacts and potential financial returns that a residential prosumer may experience when investing in a PV+BESS, considering the different Brazilian regulatory scenarios. In this way, a new methodology is proposed to represent the energy operation of the prosumer building. The home energy management strategy (HEMS) problem is modeled through linear programming, aiming to minimize the daily operating costs of a prosumer, accounting for the PV+BESS dispatch while meeting the residential load. In addition, considerations on the degradation of PV+BESS components and their eventual replacement are introduced. Therefore, the main contributions of this work are three-fold:

To model a complete linear HEMS problem, incorporating PV and BESS systems, and propose a new method for calculating battery degradation, inspired by consistent literature works;

to analyze and compare the economic investment of a BESS system in the current and future Brazilian regulatory scenarios, considering both conventional and white tariff schemes;

to promote a sensitivity analysis of the prosumer investment, considering different economic incentives policies, such as subsidies, credit rates, and battery replacement discounts.

In addition to this introductory section, the rest of the paper is organized as follows.

Section 2 presents a broader technical and economical literature review regarding PV+BESS system for residential prosumers.

Section 3 describes the main aspects of the Brazilian regulatory framework, taking into account the electricity tariff structure and the fundamental issues related to the DG development in this country.

Section 4 details the prosumers energy management system with the proposed model and methodology to optimize the daily operation. In

Section 5, the cases studied in the present paper are presented with the main results obtained considering the different regulatory scenarios.

Section 6 draws the main conclusions.

4. Prosumer Energy Management System

The analysis of a residential PV+BESS system is made possible through a procedure that simulates its operational behavior, with a convenient degree of precision and detail. This procedure seeks to consider more realistic conditions in the application context, thus elaborating a methodology to demonstrate the operation of energy exchanges in the system. An overview of the proposed analysis process is presented in

Figure 5.

The methodology aims to minimize the daily operating costs of the PV+BESS system, being modeled through linear programming to ensure efficient computational solutions, yet considering all system characteristics. More precisely, the proposed model considers the correct dispatch of the electricity produced by the PV system, the adequate attendance of the residential load and the technical constraints of the BESS, as well as the method developed for the estimation of the battery degradation and the technical and economic analysis metrics adopted in this work.

4.1. Proposed Model for Home Energy Management Strategy

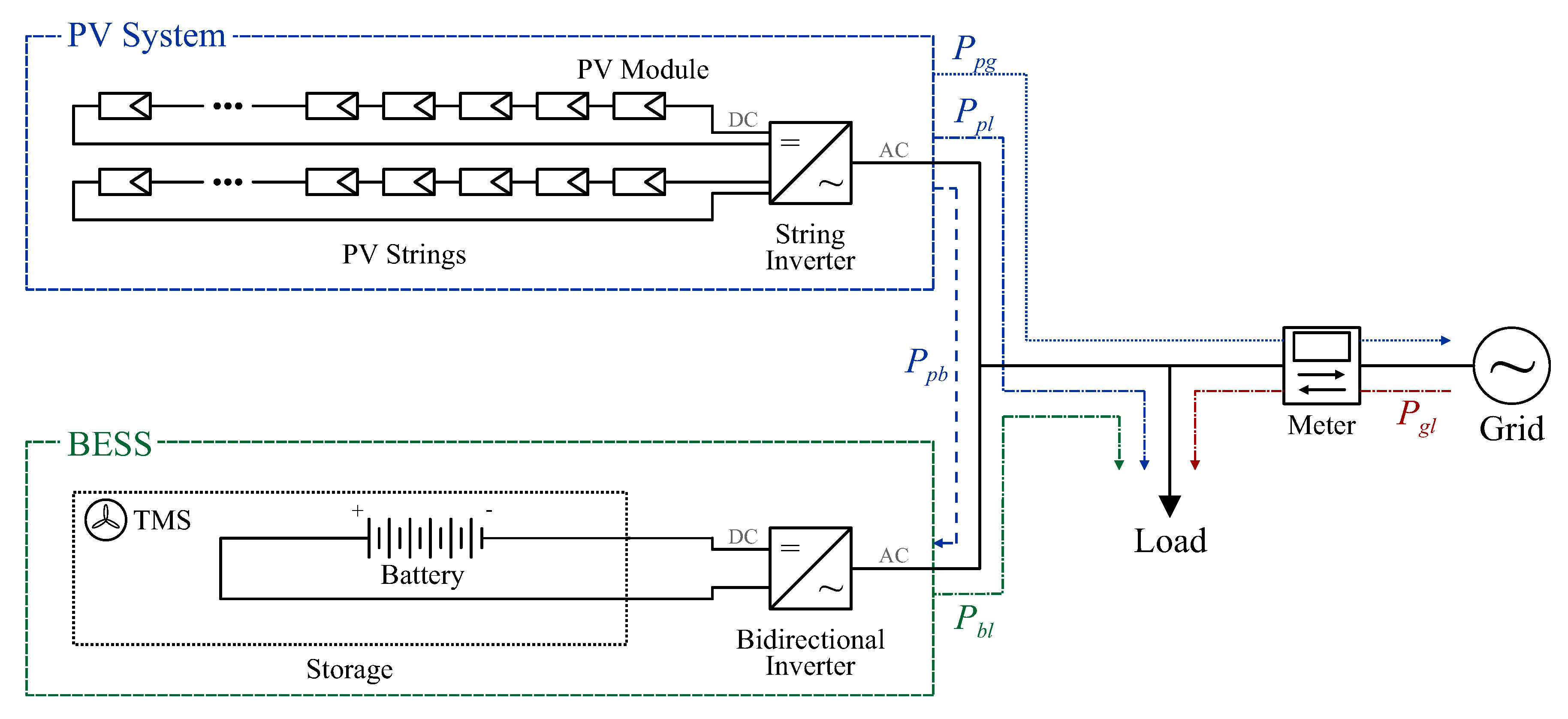

Since the Brazilian regulatory scenarios under evaluation are favorable to self-consumption (see

Section 3) and arbitrage is not a widespread practice among residential prosumers, direct electricity exchange between the BESS and the distribution grid was assumed as unfeasible in the present study. Therefore, HEMS must take into account only the energy flows represented in the

Figure 1; that is, from PV system to residential load (

), from PV system to BESS (

), from PV system to distribution grid (

), from BESS to load (

), and from distribution grid to residential load (

). In view of this, the linear optimization model represented by Equations (2a) to (2m) is proposed to simulate the daily energy operation of the residential building [

52,

76,

77]. Where

is the set of decision variables for each period t of the day.

The objective function (2a) aims to minimize the operating costs that are divided into the sum of two components:

, which is related to the electricity cost, i.e., the energy cost of the daily functioning of the prosumer’s residence; and

, which is a virtual cost related to HEMS. Considering the issues discussed about the net metering scheme in

Section 3,

can be written as given in (3), where:

The weighting factor, , is used to perform the analysis of the different regulatory scenarios and is multiplied by the portion that interacts with the network ().

The second component of the objective function, represented by

, can be designated to ensure BESS availability. As the system has been modeled to prioritize the self-consumption mode, i.e., it prioritizes the load supply by the PV system. In case there is energy surplus, i.e., when the PV generation is greater than the prosumer consumption, this surplus is used to charge the batteries. Only after these priorities are met, surplus generation is injected into the power grid. To this end, these priorities are established by means of bonus penalties (economic incentives) in the objective function. For all energy supplied directly by the PV system to the prosumer’s load

, an incentive of 5 times the energy tariff paid to the retailer

is considered. Similarly, for all the energy provided by the PV system to the BESS system

, an incentive of 2 times the retailer’s tariff

is considered. Note that there is no incentive for injecting into the grid, so the sequence of incentives for establishing the desired priorities is fulfilled. Equation (4) expresses this relationship for

, ensuring that the optimization process itself will be in charge of following the criteria for coordinating energy flows, as mentioned above, depending on the weights assigned to each possible option.

With regard to the constraints of the problem, it is worth noting that Equation (2b) represents the energy balance of the energy generated by the PV system, while Equation (2c) sets the energy balance of the residential demand in a given time interval t.

The remaining constraints (from (2d) to (2k)) refer to battery operational management. Equation (2d) sets the state of charge (SoC) of the battery

, in function of its previous

, its self-discharge (SD) rate, and the amount of charged or discharged energy in the present space of time. Bearing in mind that batteries cannot charge and discharge at the same time, these actions are represented by a single variable

, which is a free variable. Therefore, if: (i)

is null, it means that the battery is not used in the time interval in question; (ii)

assumes positive values, it means that the battery is charging; and (iii)

assumes negative values, the battery is discharging. It is important to highlight that this

logic is effective thanks to the support of the constraints described in (2i), (2j) and (2k), which guarantee the mutually exclusive occurrence of

and

. It is also essential to emphasize that the

logic and these support constraints characterize the main differential brought by this model proposed for HEMS concerning others available in the literature, which generally make use of binary variables to guarantee the mentioned mutually exclusive occurrence [

28,

78,

79]

With respect to (2e) and (2f), they are inequalities that represent the battery efficiency limits, taking into account its minimum () and maximum state of charge (), its charging () and discharging efficiencies (), the efficiency of the bidirectional inverter () and nominal battery capacity (). Likewise, Equations (2g) and (2h) represent the limits imposed by the battery charging () and discharging rates () allowed between two subsequent time intervals (), respectively. It is worth mentioning that the signals have been adjusted in these constraints to ensure that they are active only when necessary.

It is pertinent to highlight that since the derating capacity of PV modules is the most significant among the components of a PV system, usually calculated from a typical degradation rate (see

Section 2), it is proposed in the present study that its effect is directly computed on the known information or, in other words, on the operational records of the PV system. Thus, assuming that the drop in PV generation is directly proportional to the derating capacity of the PV modules, the electricity produced by the PV system in each time interval corresponding to a day of PV system operation is respectively given by Equation (5).

where

is the PV generation recorded,

is the considered daily degradation rate and

n is the respective day of the simulation.

In order to make the optimization model as close as possible to the real one, other considerations were made, such as the degradation of the battery’s nominal capacity, as already mentioned. This premise becomes necessary due to the action of time and with the charging and discharging cycles to which the storage system is subjected, thus suffering a natural wear in its storage capacity. Constraints (2d), (2e), (2f), (2g), and (2h) are updated daily with the new nominal battery capacity. The way this update is carried out and its calculation procedures are described below.

4.2. Estimation of Battery Degradation

To calculate the battery degradation and update its nominal capacity daily, some procedures are performed. First, the effects of calendric aging and cyclic aging must be duly calculated. Therefore, considering that the battery EOL is when it reaches 80% of its nominal capacity (see

Section 2), the daily degradation rate due to calendric aging (

) can be estimated from (6) [

56], where

is the battery lifetime reported in its datasheet by the manufacturer.

On the same line, the daily degradation rate due to cyclic aging (

) can be estimated by (7) [

56], where

is the total number of discharging-charging cycles that it can take considering a depth of discharge (DoD) of 100%. It is worth to mention that this information is also usually reported on the datasheet by the manufacturer.

Since the battery can perform a variable number of discharge–charge cycles with different levels of DoD in a typical day operation, the Rainflow Algorithm needs to be applied to identify them (see

Section 2). As discussed in [

53,

61,

62,

63,

64,

65], this technique is widely used to assess stress and fatigue of components and structures. In the case of the present study, it was used to determine the number of complete cycles and half cycles of charging and discharging. To apply this algorithm, it is necessary to first obtain the SoC profile of the battery, then as shown in [

63,

65], three consecutive intervals are calculated:

, , and ;

if and , then there is a complete cycle associated with . The points and are extracted and the identification of the points continues, with new intervals, using ...;

if the condition above was not satisfied, change the identification points to , , , until there is no more identification of complete cycles.

The remaining points are considered residual rainflow and are counted as half a cycle, as detailed in [

62]. A half cycle is formed by the points at the local ends of the residuals. Emphasizing that the simulation is daily, a SoC profile is obtained every day, allowing to estimate battery degradation and update its daily nominal capacity. After performing the cycle count related to the SoC profile of the storage system, their respective DoDs is obtained.

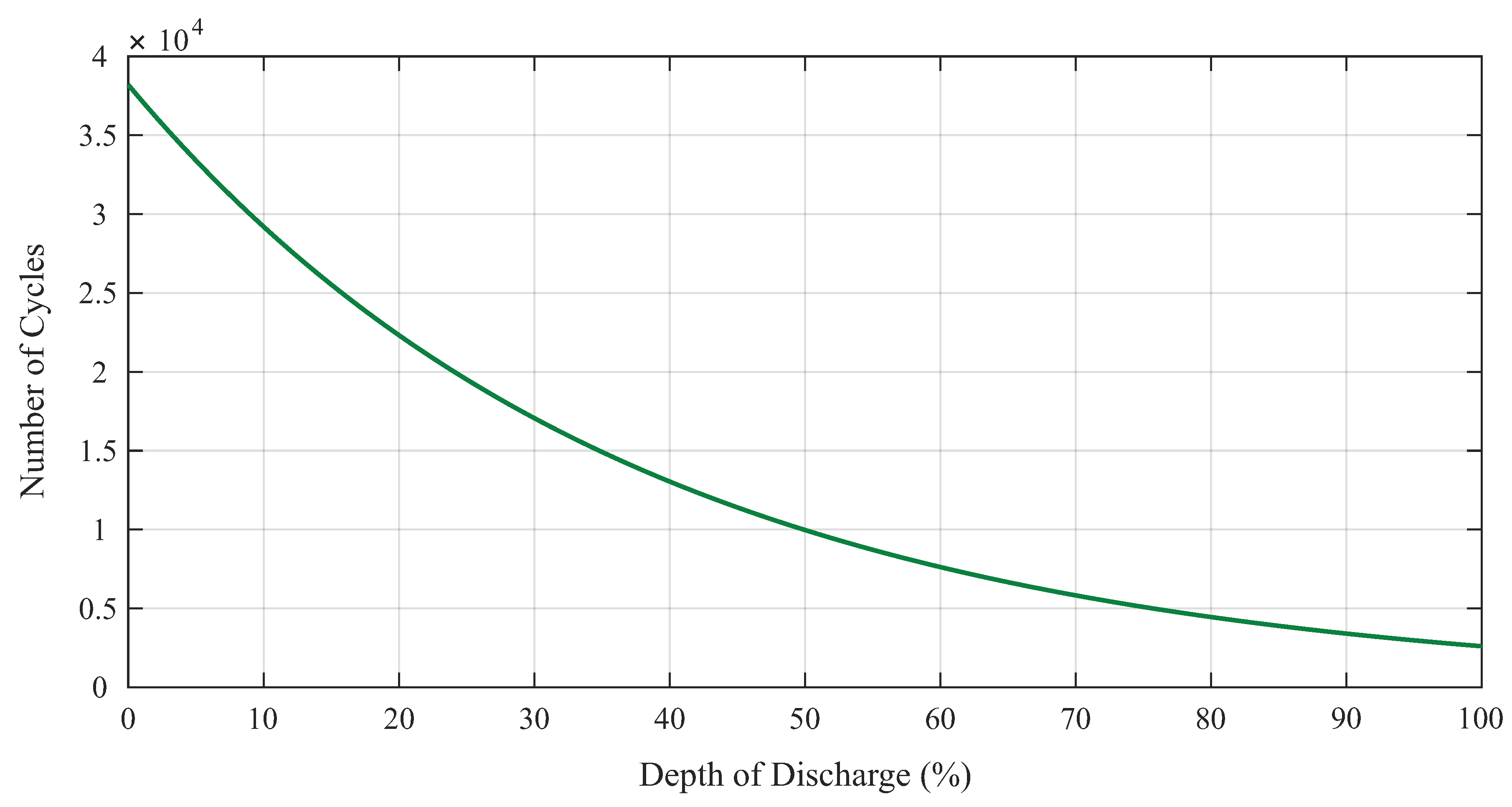

At the end, the remaining points are considered residual rainflow and are counted as half cycles of discharging or charging in the respective depth. The equivalence between these results returned by the Rainflow Algorithm and the number of cycles that would be verified if they were related to a DoD of 100%, is made considering that the loss of cycle life is a constant [

57,

80]. This is done using (8), where

is a nonlinear function that describes the "total number of cycles

versus DoD" curve (see

Figure 2).

A common approach to

is shown in (9) [

80]. Its coefficients

,

,

,

, and

can be estimated through of “total number of cycles

versus DoD” curve, which is often presented in the battery datasheet. Notwithstanding, some manufacturers sometimes report only a few points on this curve instead of presenting their entire graph. Therefore, if the number of points reported is less than four, the coefficients

and

can be considered null, without major impact on the function effectiveness.

After performing these procedures, it is obtained the degradation of the nominal battery capacity (

) [

56], represented in (10), where,

is the storage capacity verified on the previous simulation day.

Therefore, it is interesting to note that these procedures described above essentially consist of an innovative set of expressions and good practices previously validated by the literature, which allows estimating battery degradation in a very convenient way. Moreover, it is pertinent to note that from these procedures, it becomes possible to estimate the battery lifetime straight through Equation (11).

That way of calculating the lifetime was used in economic evaluations to estimate the time for replacing the battery, also making the economic analysis more realistic. These assessments will be further explained later.

4.3. Evaluation Metrics

The metrics most commonly used to assess the impacts caused by the installation of a PV+BESS on the electricity dynamics of a residential building are: self-consumption rate and degree of self-sufficiency, as presented in [

37]. The former seeks to assess the amount of electricity produced by the PV system, which was used for exclusive purpose of the prosumer, i.e., meeting the residential load and charging the battery. In contrast, the latter seeks to describe the share of the residential demand that is supplied by the PV+BESS. The mathematical expressions used to calculate these metrics are given by (12) and (13), respectively, where N is the total number of days of the simulation.

The economic evaluation is carried out to determine the return on investment considering different possibilities of business models. These models will be further explored to determine a better cost-benefit of the PV+BESS system. The analyses were performed considering the Net Present Value (NPV), payback, and the Internal Rate of Return (IRR), as in [

81]. NPV is the most common way to analyze investment in a residential solar system, as it is a method used to observe the present value of the future cash flow, allowing to know the expected profit of the investment. Payback is defined as the period of time to recover the amount invested while the IRR is defined as the percentage of return on investment. Through this metric it is possible to establish a rate of attractiveness of the investment, in a very intuitive way, to determine the viability of the project.

6. Conclusions

In this work, a linear optimization model was proposed to simulate the daily energy operation of a residence. This model minimizes the energy costs associated with HEMS, considering the cost of energy, different regulatory scenarios, criteria for coordinating energy flows, and technical restrictions on generation PV and BESS. The consideration of the technical restrictions of the battery through a continuous approach and the proposed method for estimating the degradation of BESS is highlighted as one of the main contributions of the present work.

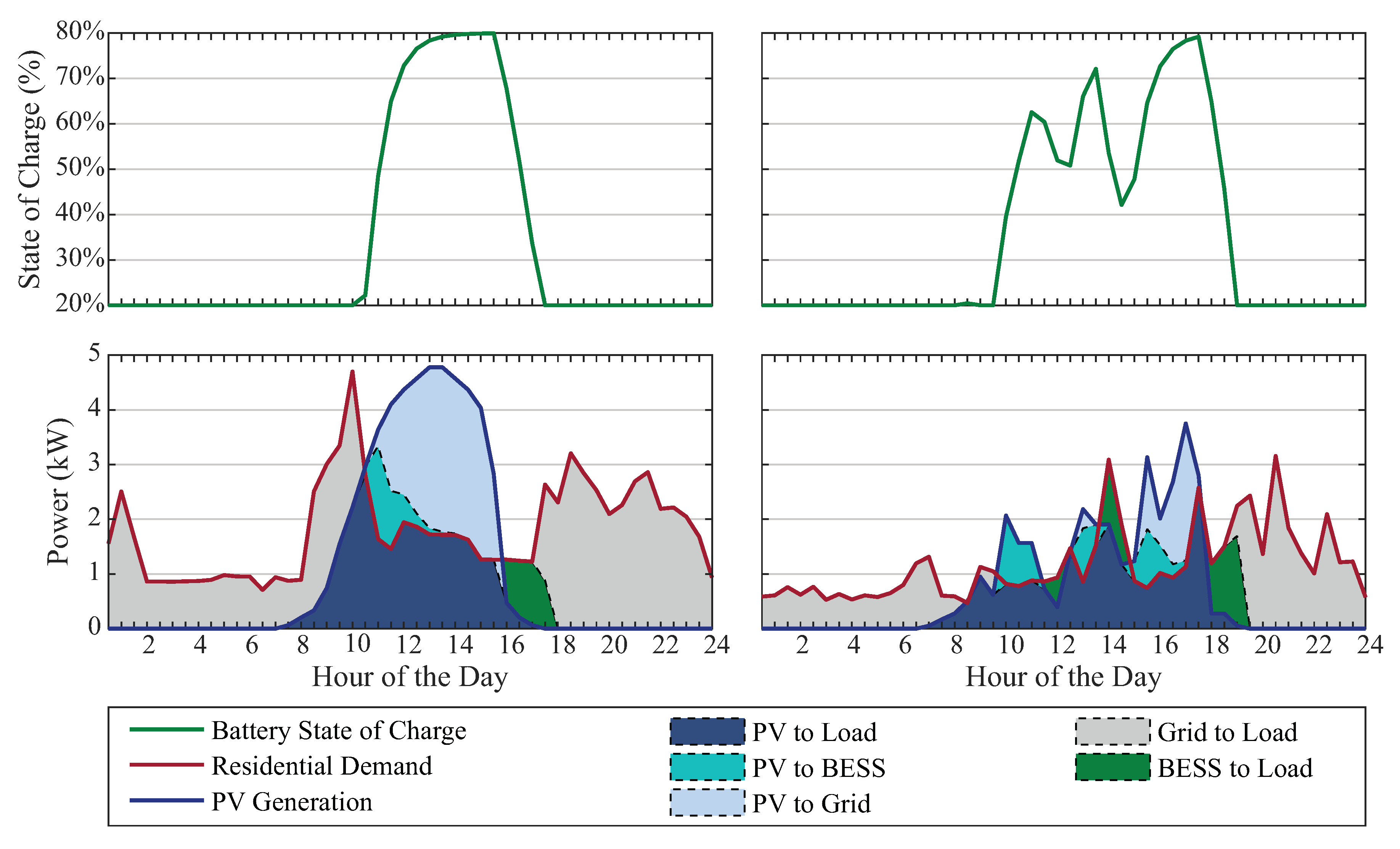

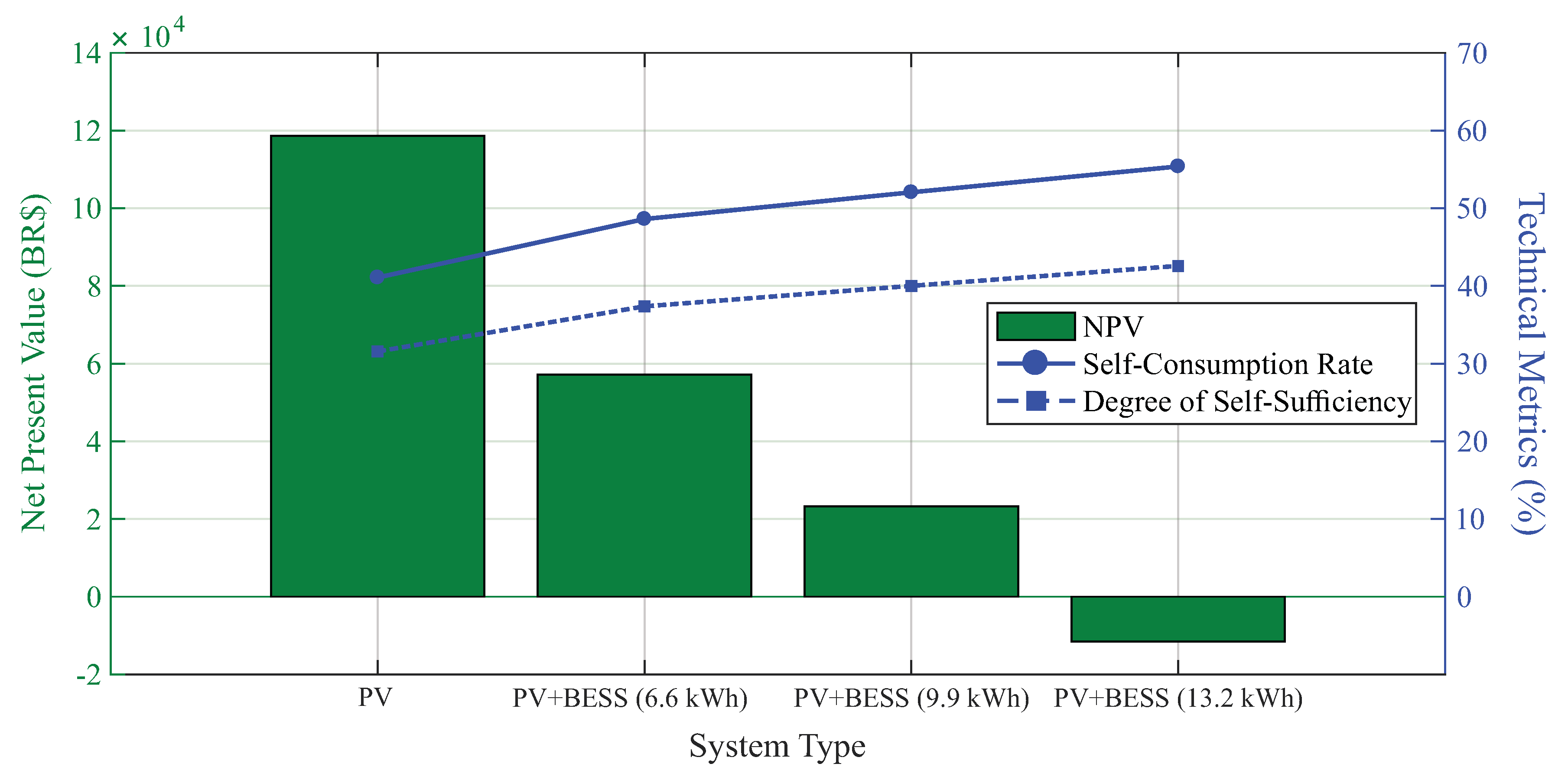

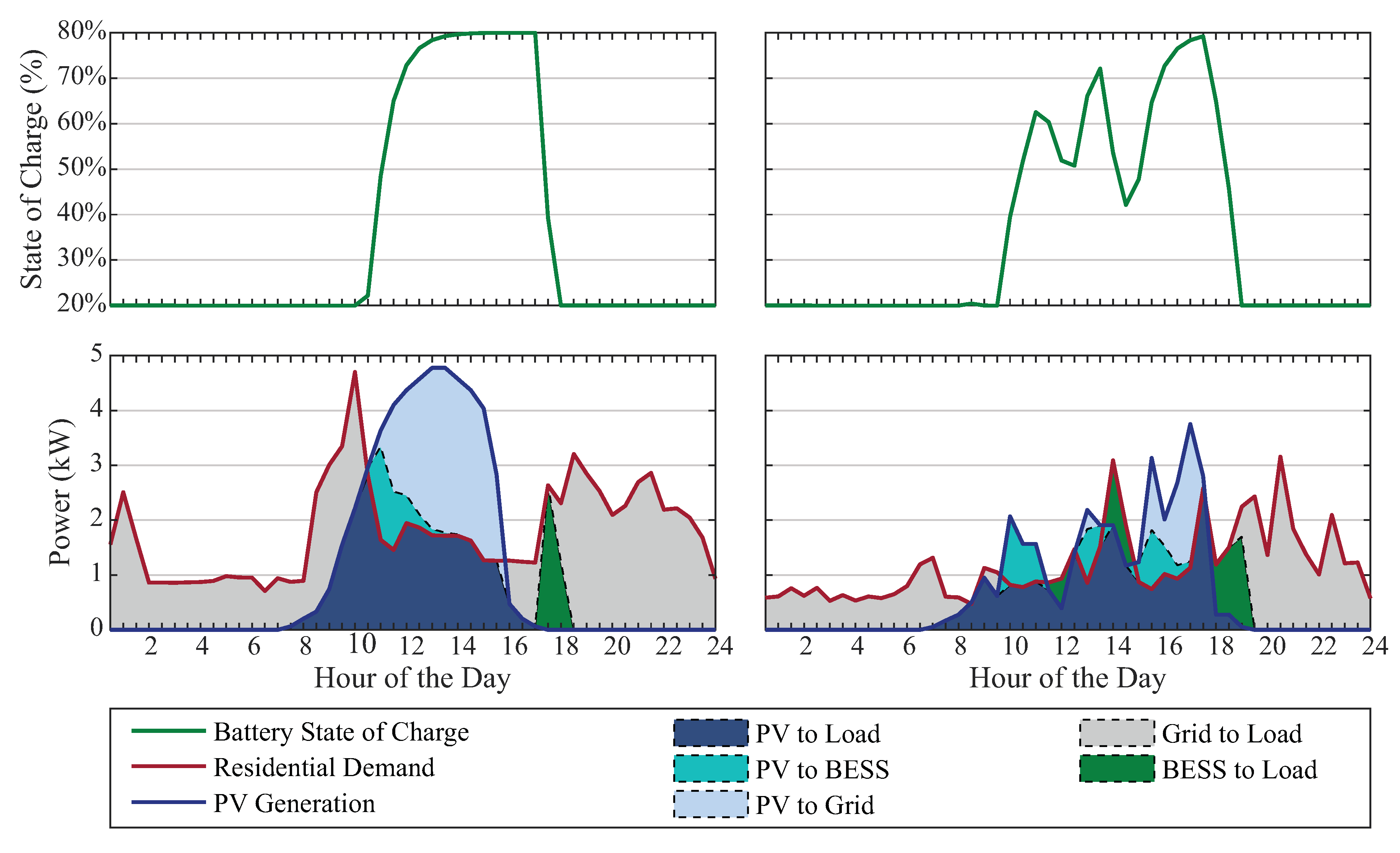

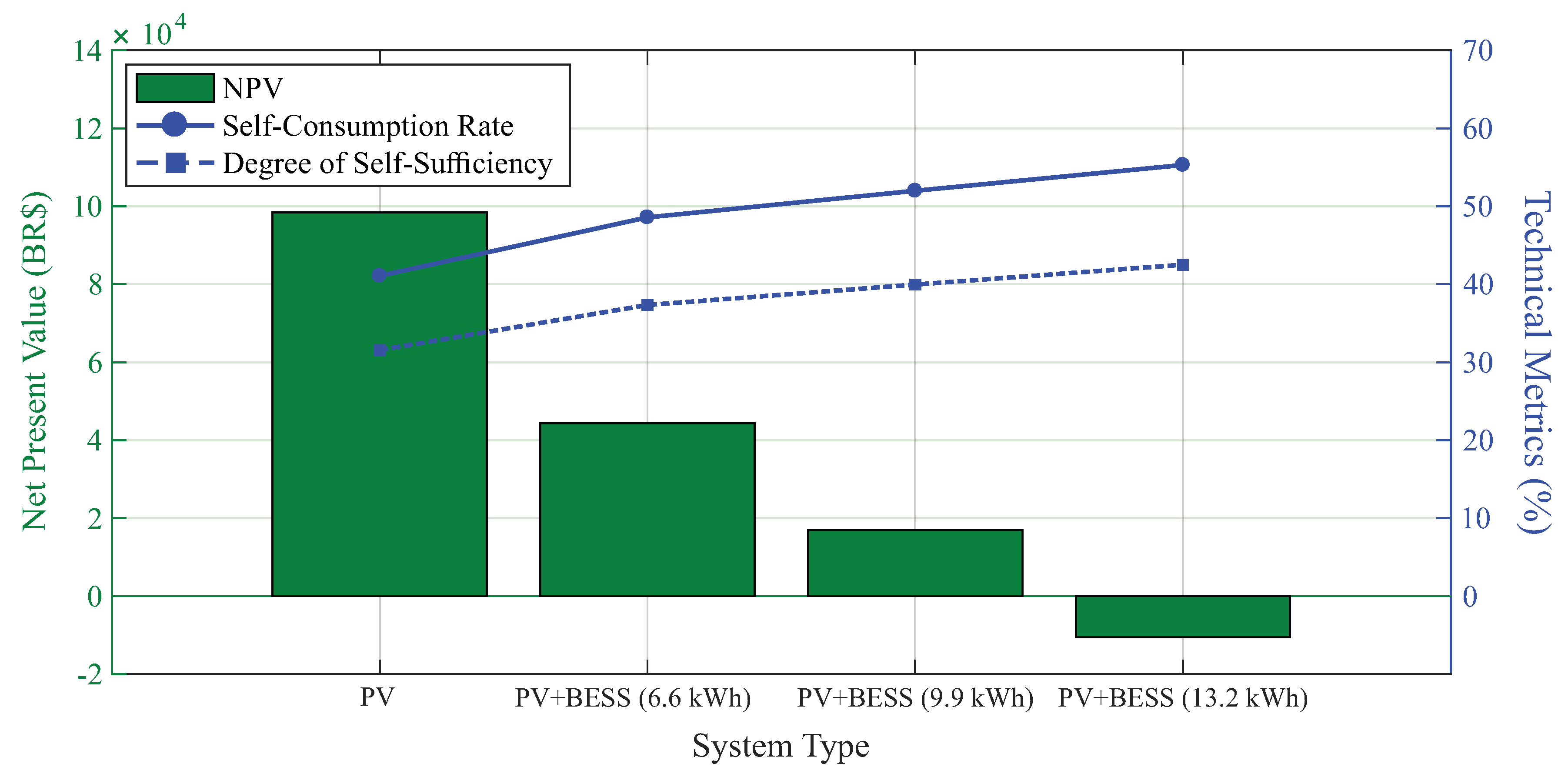

In the first study case conducted, the feasibility of the PV system with and without BESS was analyzed considering the current Brazilian regulatory scenarios and two different tariff schemes. From the results obtained it was possible to observe: (i) technical metrics did not show any difference regardless of the tariff system; (ii) the insertion of the battery into the system increase, approximately, between 8 and 14% the self-consumption rate and, approximately, between 6 and 11% the degree of self-sufficiency. Comparing the financial metrics, there is a better economic performance of the system PV+BESS considering the conventional tariff (flat) than the white tariff (ToU), in the first two cases of this analysis, resulting in a difference of approximately 29% and 36% in the NPV, respectively. However, in the scenario in which the BESS has greater capacity, the white tariff presents a result, even if not viable, slightly better than the conventional tariff.

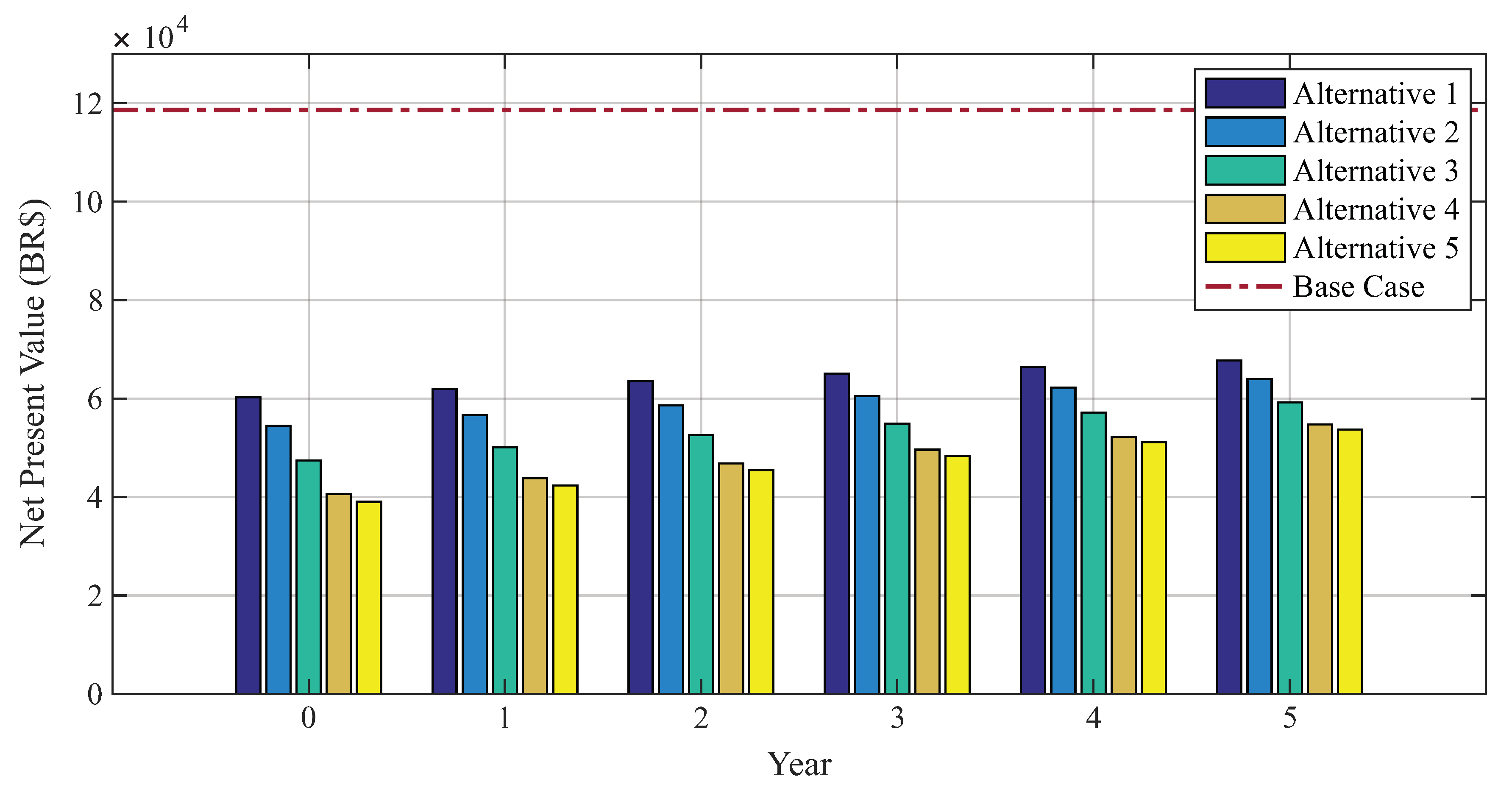

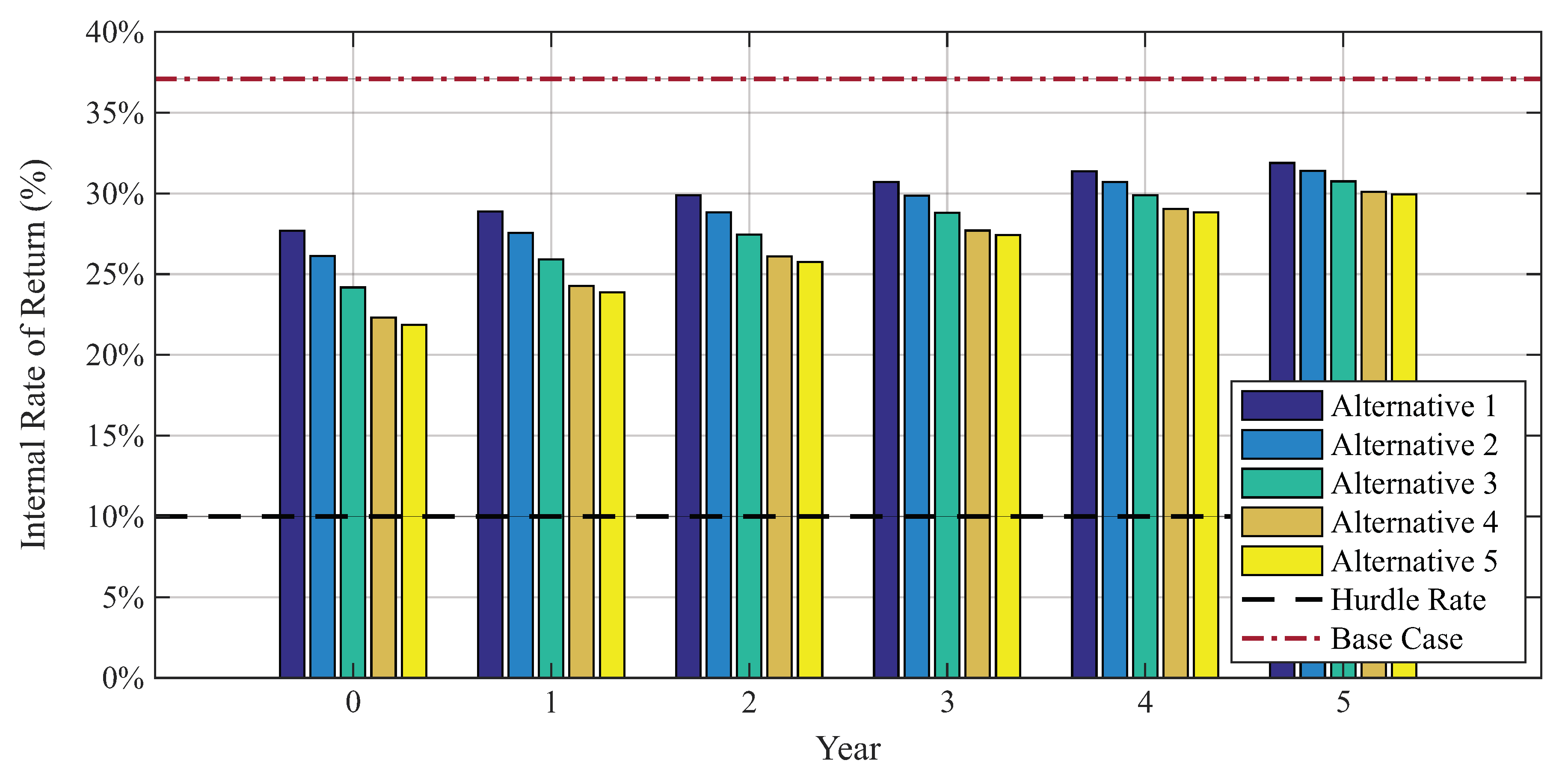

In turn, in the second study case conducted, the impacts of the different regulatory scenarios proposed by ANEEL for the future of DG in Brazil were analyzed. From the results found, it was possible to determine that the longer the current scenario is maintained, the better the performance of the projects. Due to the high investment value of BESS, NPV returned negative for practically all regulatory scenarios analyzed, with the exception of alternative 1, starting in the second year, and alternative 2, starting in the fourth year of analysis.

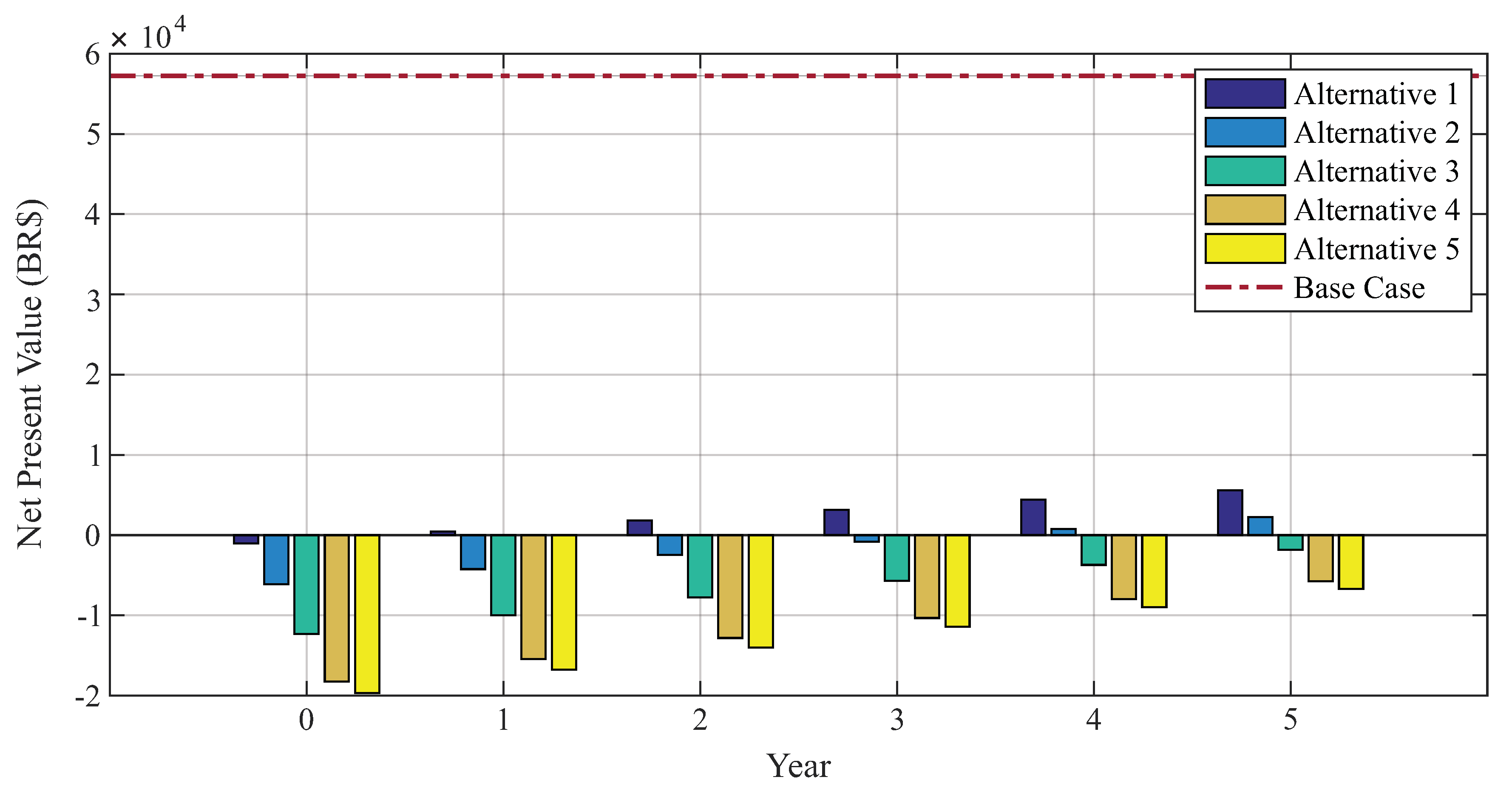

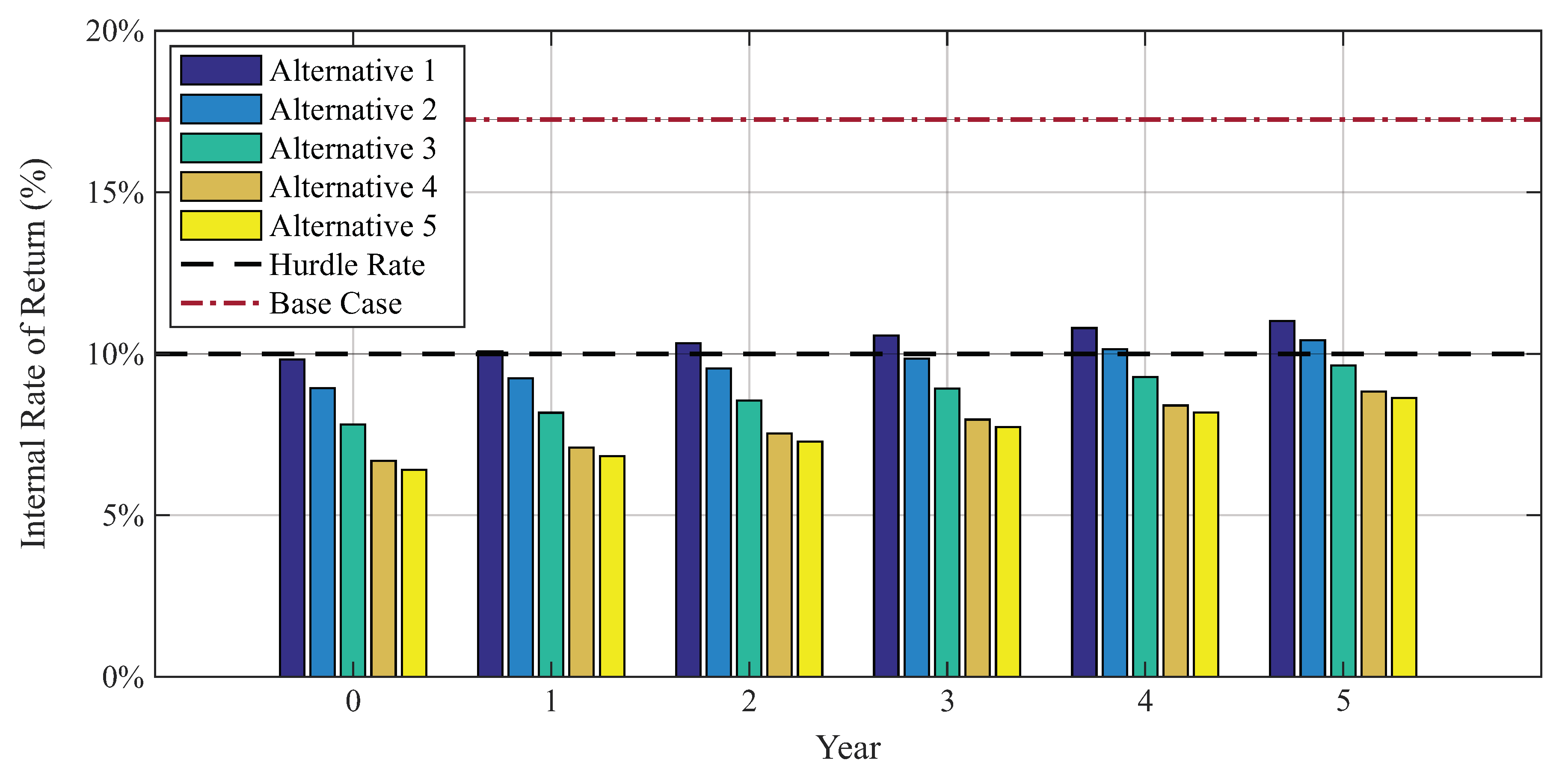

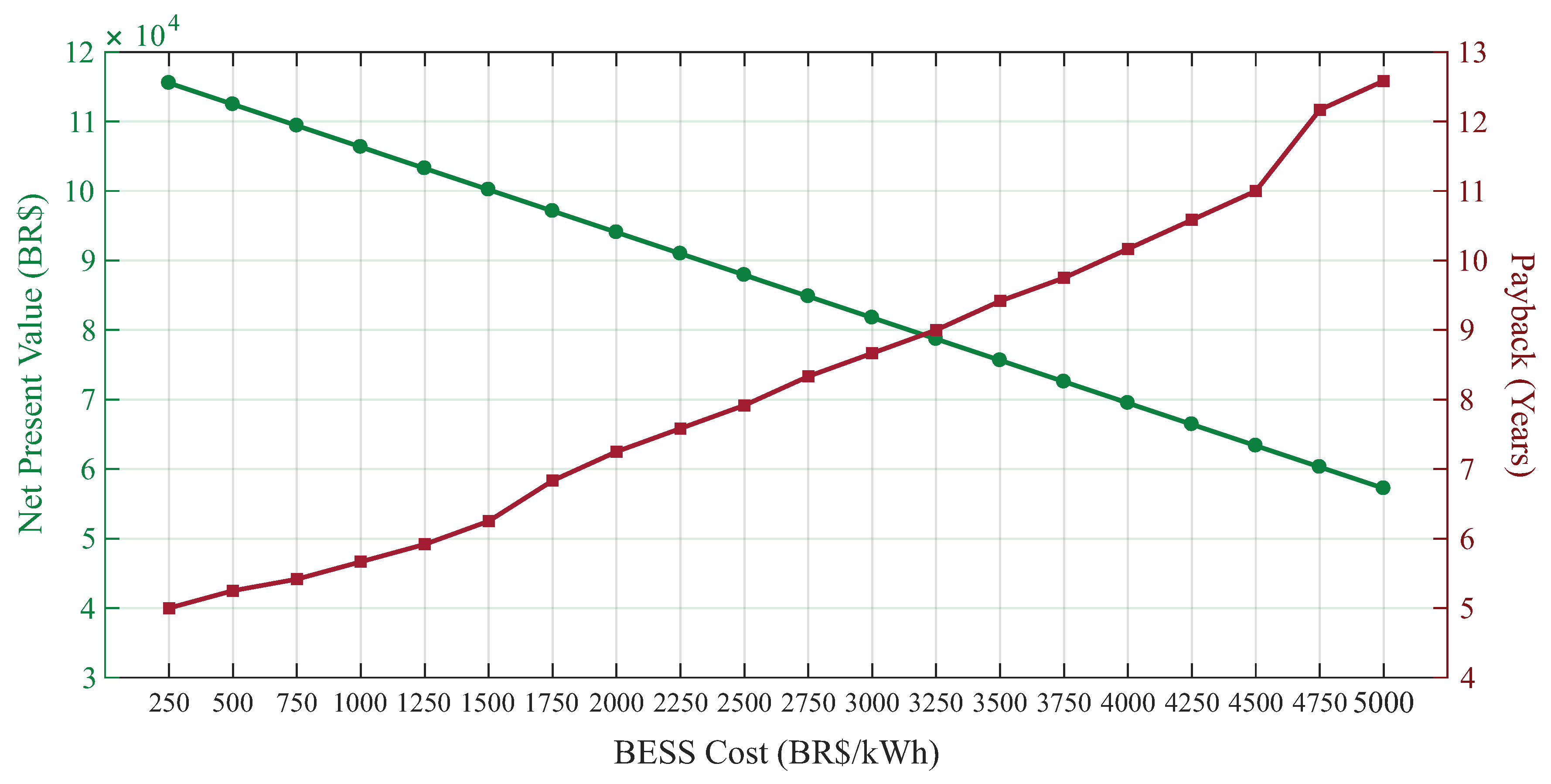

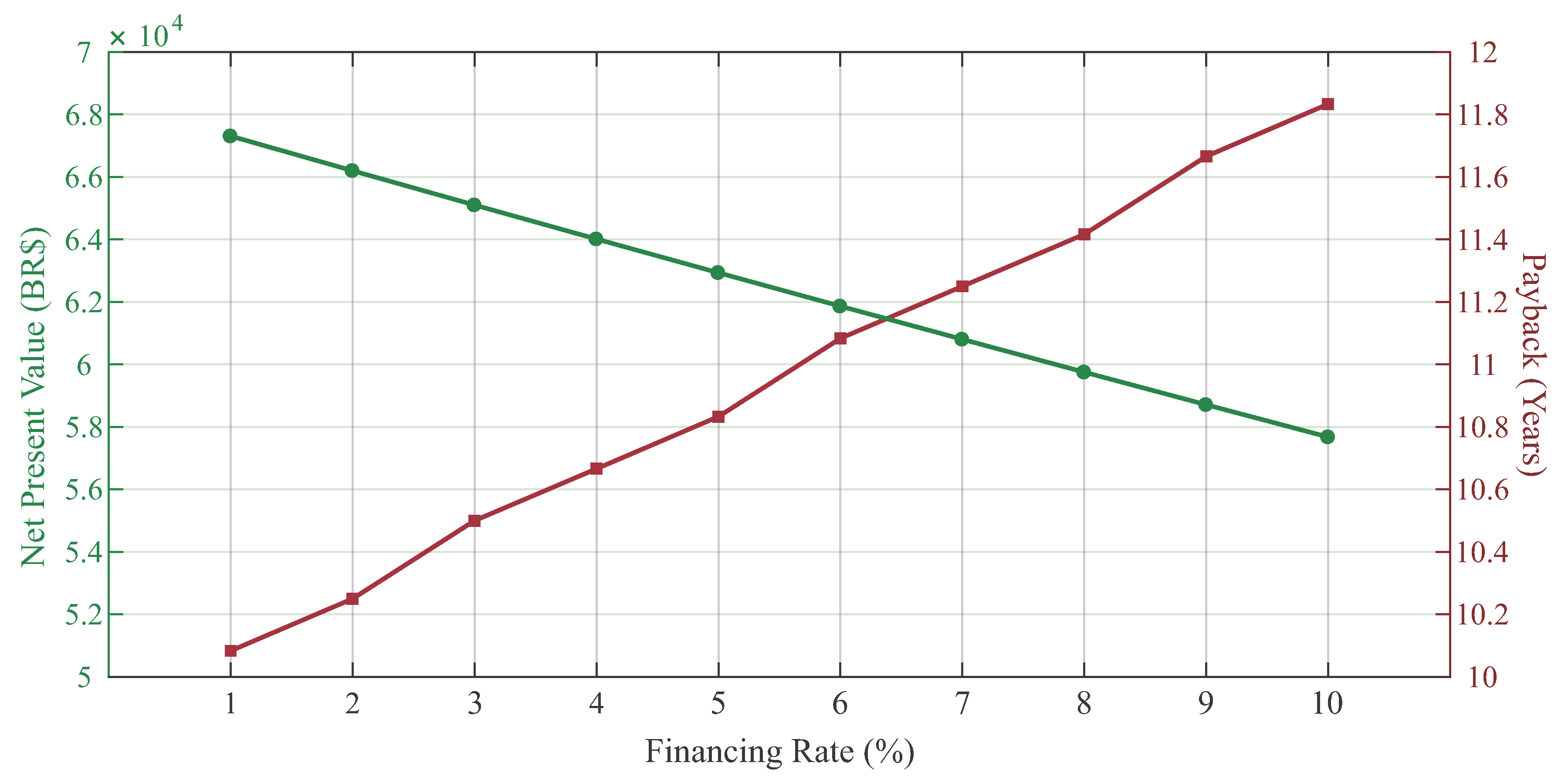

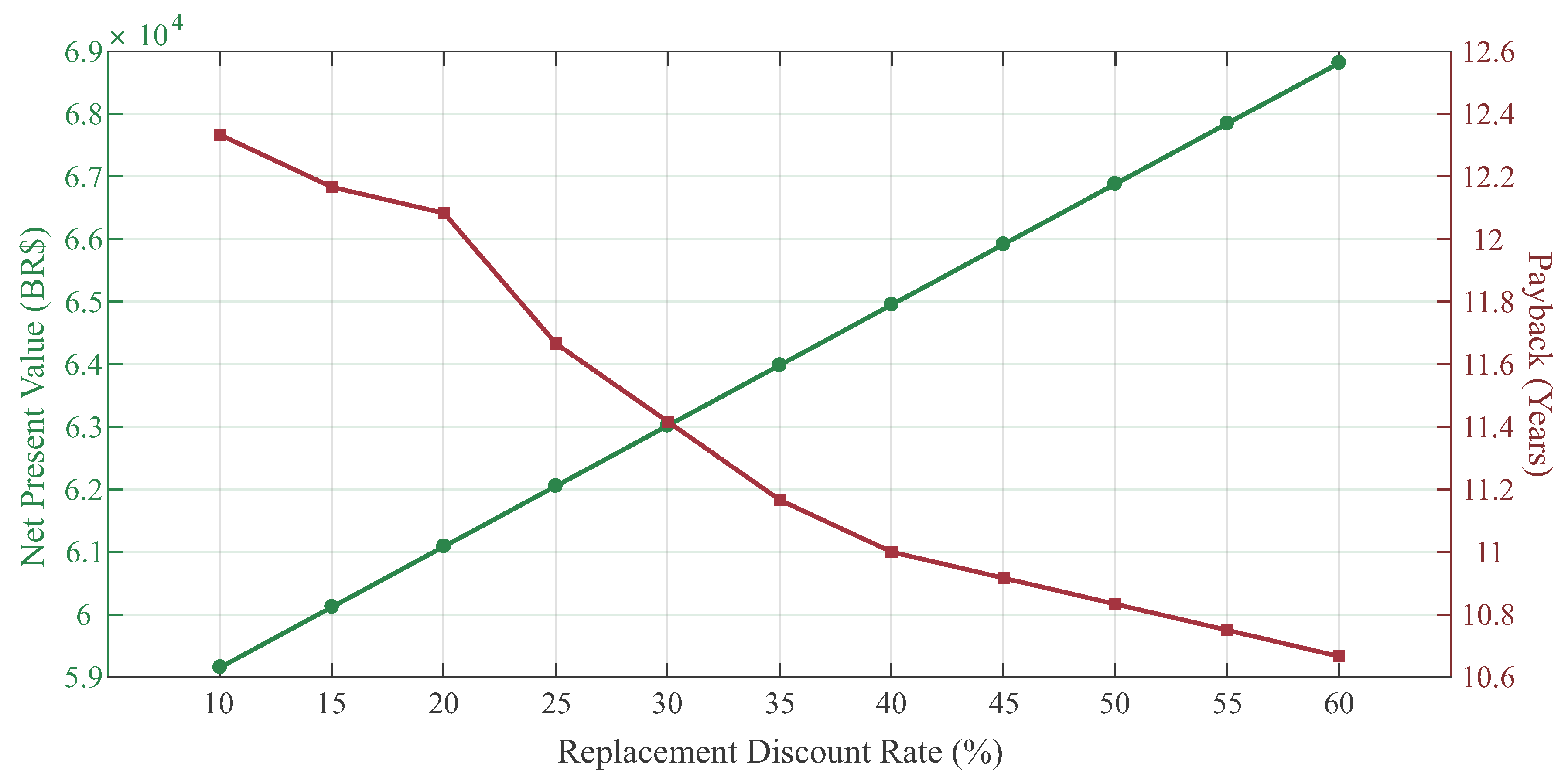

Finally, in the third study case conducted, three business models were investigated considering: (i) government subsidies; (ii) financing rates; and (iii) discount rates for BESS replacing. Comparing the best case of each business model with the BESS base case, one can conclude that there is a decrease in the payback about 50%, 20%, 16%, respectively. Business model 1 is the one presenting the highest NPV, hence providing the best incentives and investment opportunities from the consumer’s perspective.

From the results presented, it was possible to justify the importance of considering the battery degradation model. In addition, the study can contribute as a basis for relevant discussions in the sector through the comparative analyses carried out of the technical and economic impacts of the possible regulatory scenarios considering two types of tariff schemes. Individually, the business models showed that it is very difficult to make this type of investment attractive in the Brazilian context, but the results obtained were of great importance to envision new possibilities, such as considering a combination of the models. Another opportunity for future work would be the use of the product service provider model, being a complement to the business models analyzed.