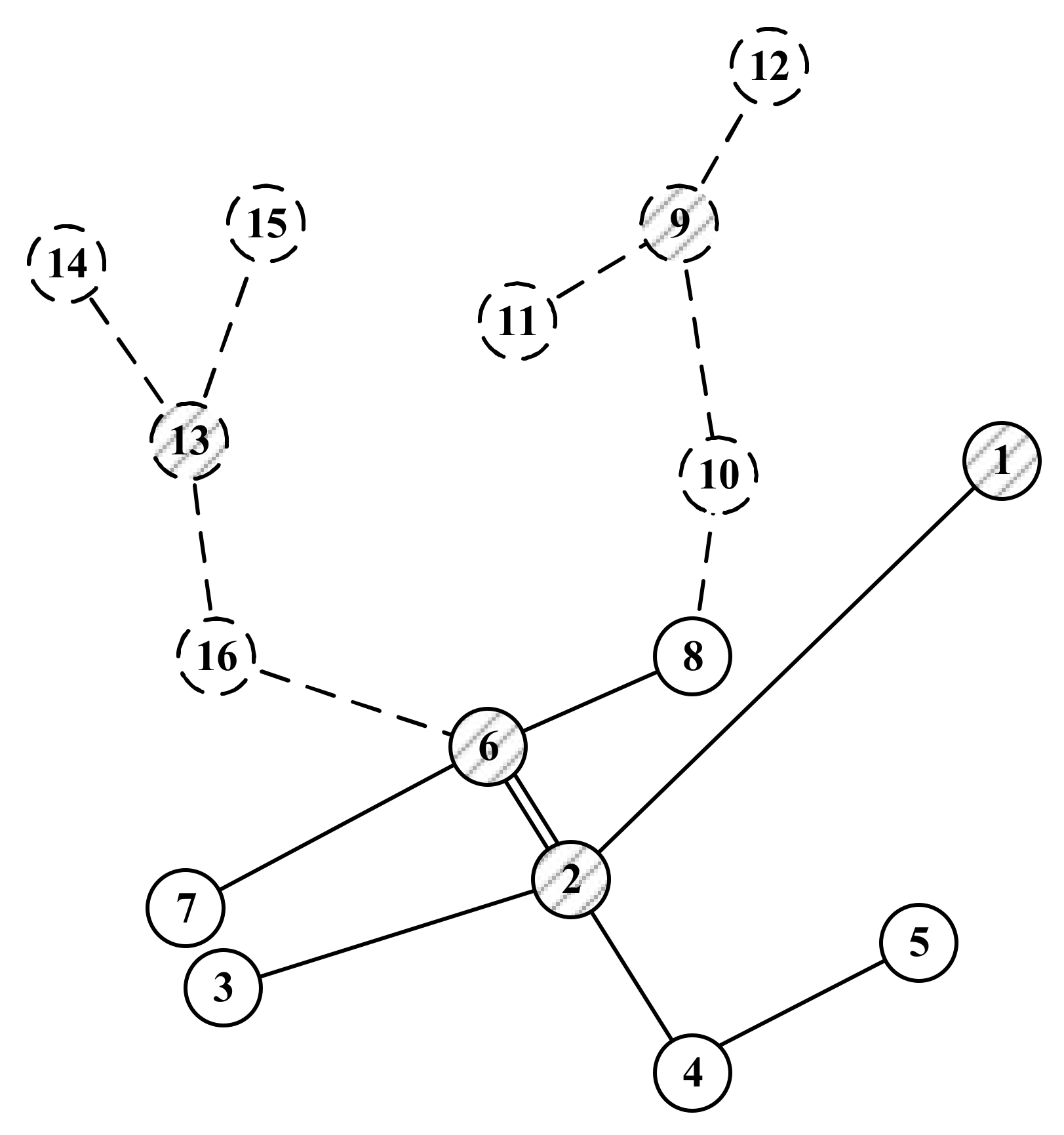

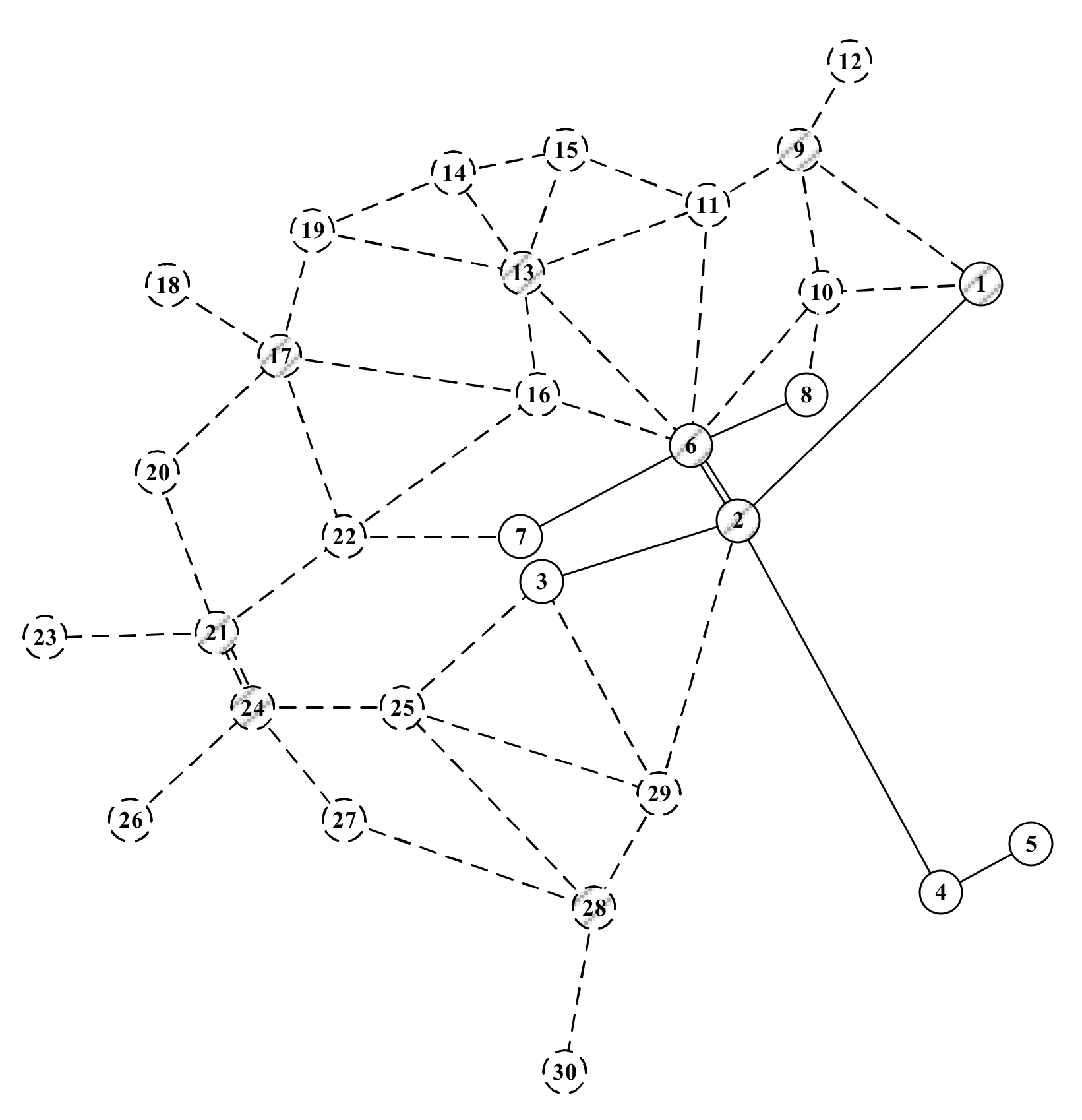

The economic evaluation system is divided into two levels: reliability and economy. The planning and evaluation decision of the power generation and transmission system is essentially the game of reliability and economy. At present, reliability decisions in the expansion planning of power generation and transmission systems often use a single user power outage loss value to turn the reliability indicator of the power generation and transmission system into an economic indicator, as the optimization goal of the power generation and transmission system planning [

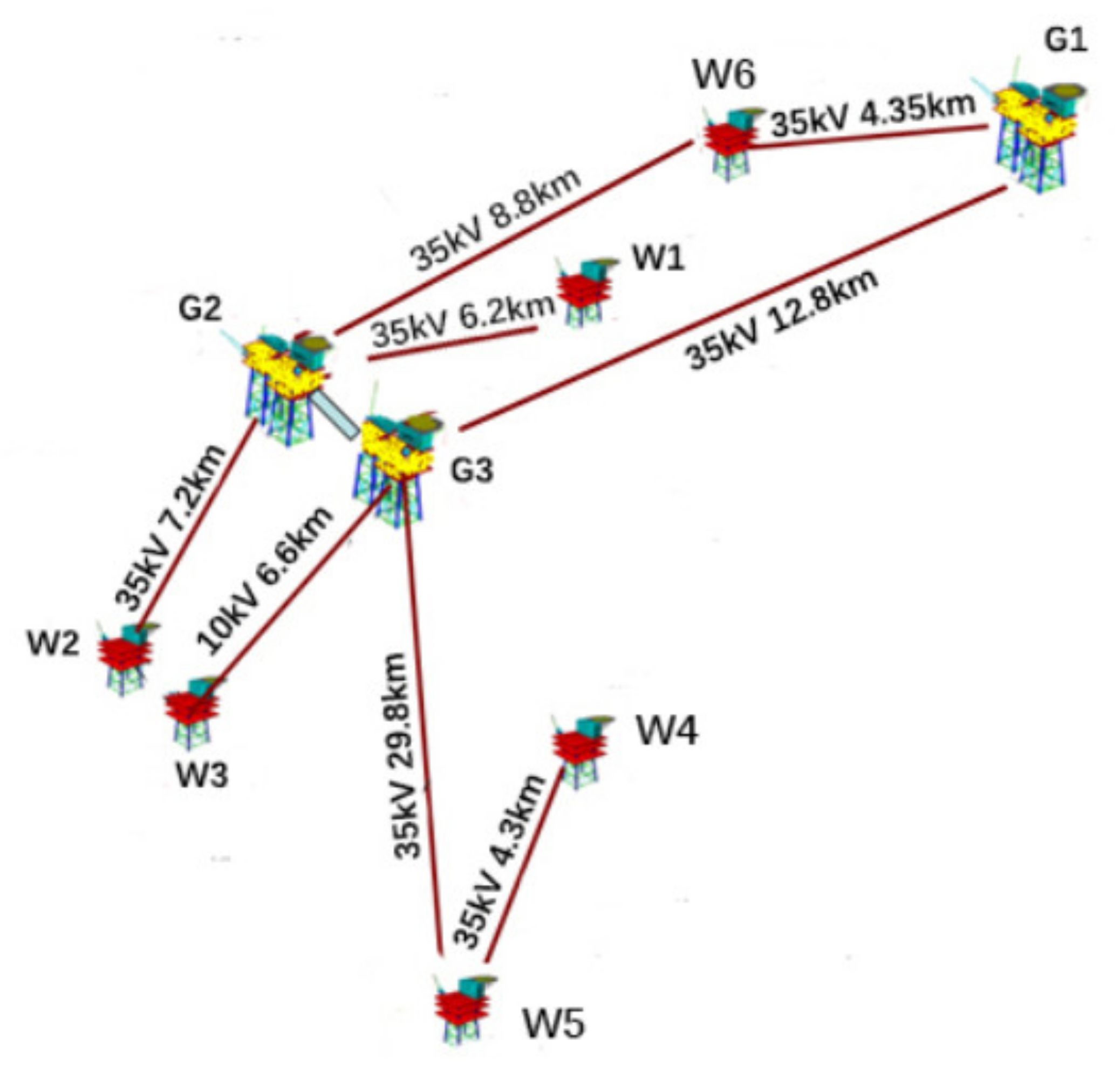

14]. In the economic evaluation system of the offshore oil platform power system, this article considers including more energy economic indicators and reliability indicators that fit the offshore multi-platform interconnected power system to make a comprehensive economic evaluation of the production planning of offshore oil platforms.

2.1.1. Economic Indicators

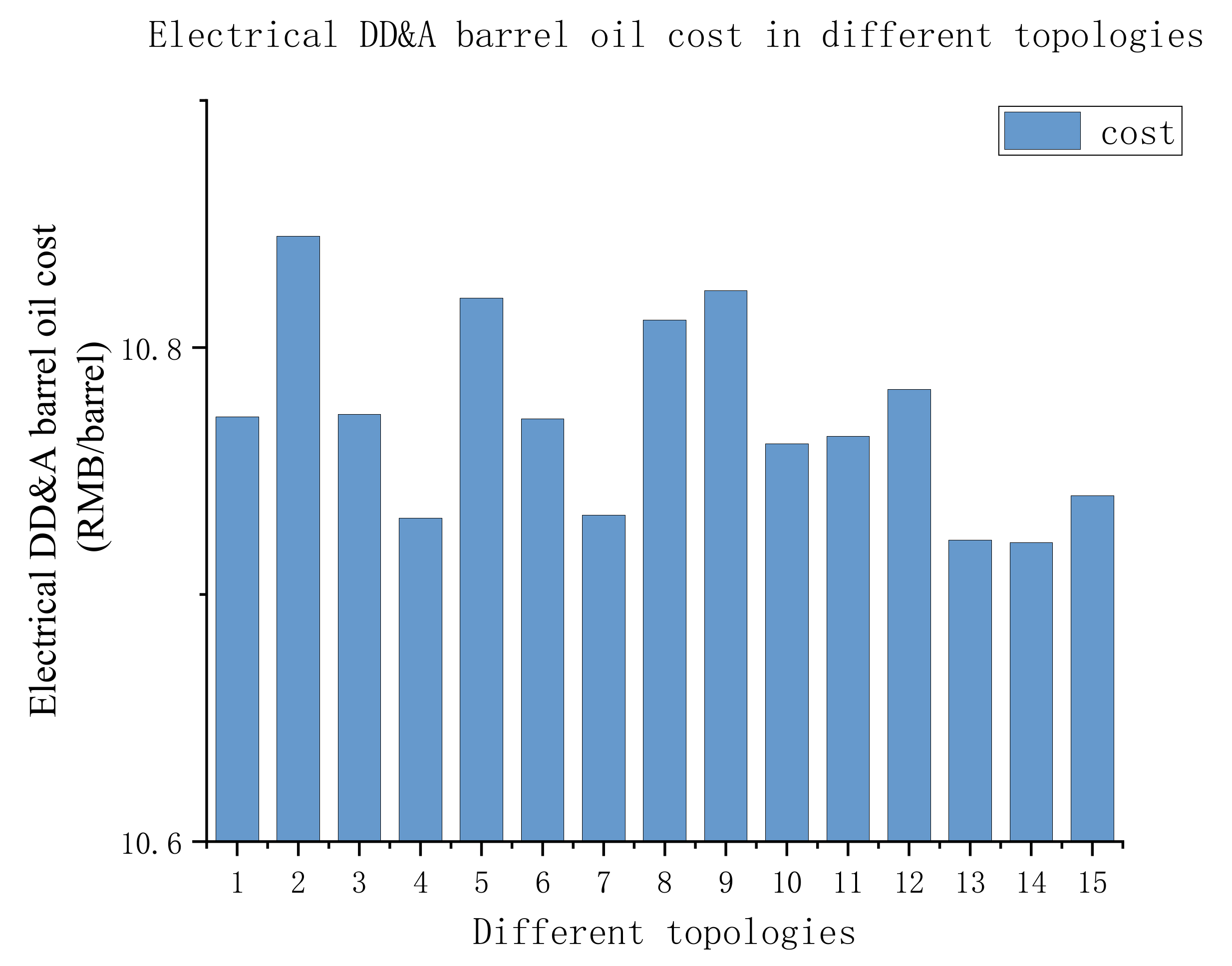

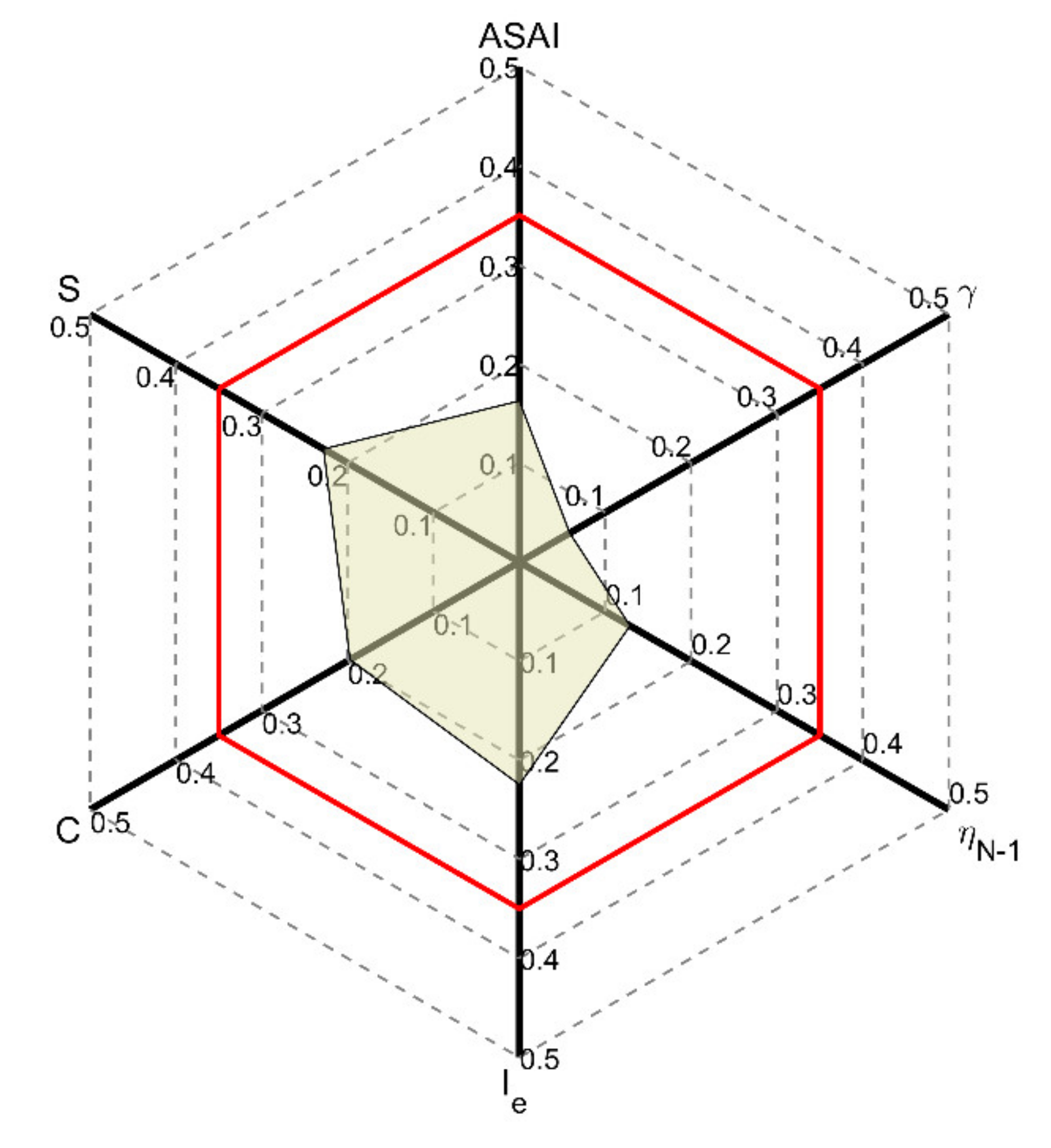

In terms of economic indicators, this article proposes the electrical depreciation, depletion, and amortization (DD&A) barrel oil cost S, the cost of network loss C, and the maximum expected benefit per unit power generation Ie. Based on the DD&A barrel oil cost widely used in the petroleum industry and the actual grid planning situation, the electrical DD&A barrel oil cost is proposed to evaluate different grid topologies.

The cost of a barrel of oil is an important indicator to measure the cost competitiveness of an oil company. The cost of a full barrel of oil represents the cost of each barrel of oil that the oil company spends [

15]. In the cost of a full barrel of oil, special revenue, financial expenses, and the income tax is an uncontrollable cost of barrel oil, which is often determined by the country’s fiscal and taxation policy and cannot be changed through the efforts of oil companies. Therefore, the five controllable barrels of oil costs are more valued by oil companies. They include production operation fees of barrels oil, depreciation, depletion and amortization cost of barrel oil (DD&A barrel oil cost), disposal fee of barrel oil, sales and management fee of barrel oil, and product tax of barrel oil (taxes other than income tax and special income). Among the five costs of barrel oil, the main component is the DD&A barrel oil cost. The DD&A barrel oil cost represents the expenses incurred by the oil company before commercial production and the depletion, amortization, and depreciation of related fixed assets. The DD&A barrel oil cost accounts for about 55% of the five costs of barrels of oil, it accounts for the largest weight. Therefore, to some extent, oil companies control the DD&A barrel oil cost, and basically control the changing trend of barrels of oil cost, thereby gaining a comparative advantage and creating more profits.

The calculation of DD&A barrel oil cost is shown in Formulas (1) and (2) [

16],

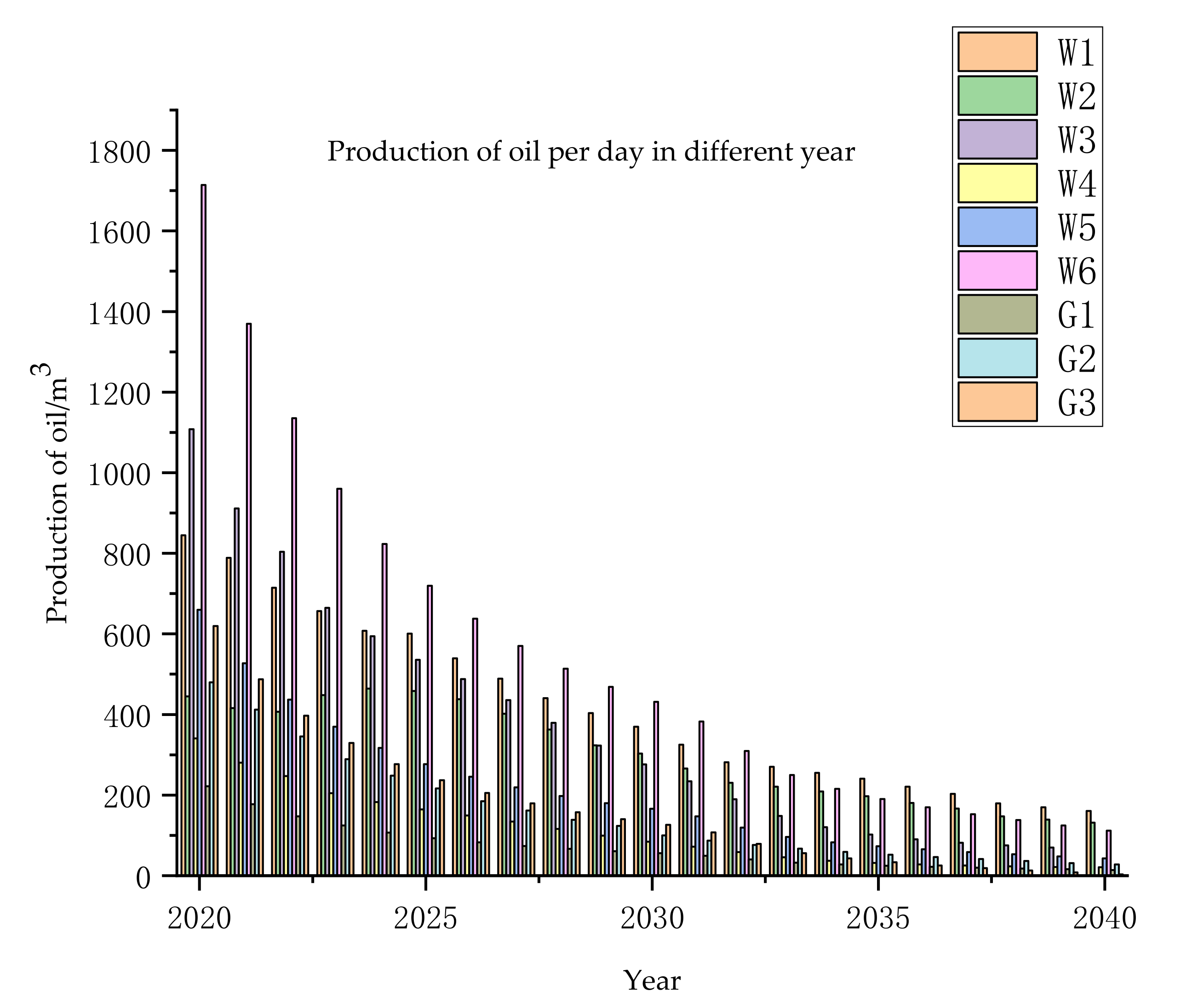

Current DD&A = +. Among them, is the current output of the oil field, is the initial proven reserves of the current oil field, is the reserves of oil fields that have public facilities but have not been exploited, and is the total investment in public facilities, including the total investment in public facilities at the beginning of the period and the investment in new public facilities in the current period. is the total investment after drilling and completion, i.e., the operating costs of the facilities in the current period.

When calculating the current barrel of oil DD&A, dividing the current output by the current DD&A results in what is shown in Formulas (3) and (4)

and so,

It can be concluded that the barrel of oil DD&A is not affected by its current output, which is closely related to the current new investment and oilfield reserves.

When considering the cost of electrical DD&A barrel oil cost. F1 is the total investment in power facilities, including the construction costs of generators and submarine cables; W1 is the total investment after drilling and completion, i.e., the operating costs incurred by power facilities.

Different power topologies will produce different network losses C. When converting network losses into economic benefits, this article chooses to convert the power generation loss from network losses into the gas amount consumed by the corresponding generator, so as to determine the economic value of corresponding network loss according to the gas amount. Its calculation method is shown in Formula (5).

where C is the cost of network loss,

is the network loss of different topologies, P

s is the total power generation of the network,

is the total gas consumption, and M

gas is the price of natural gas.

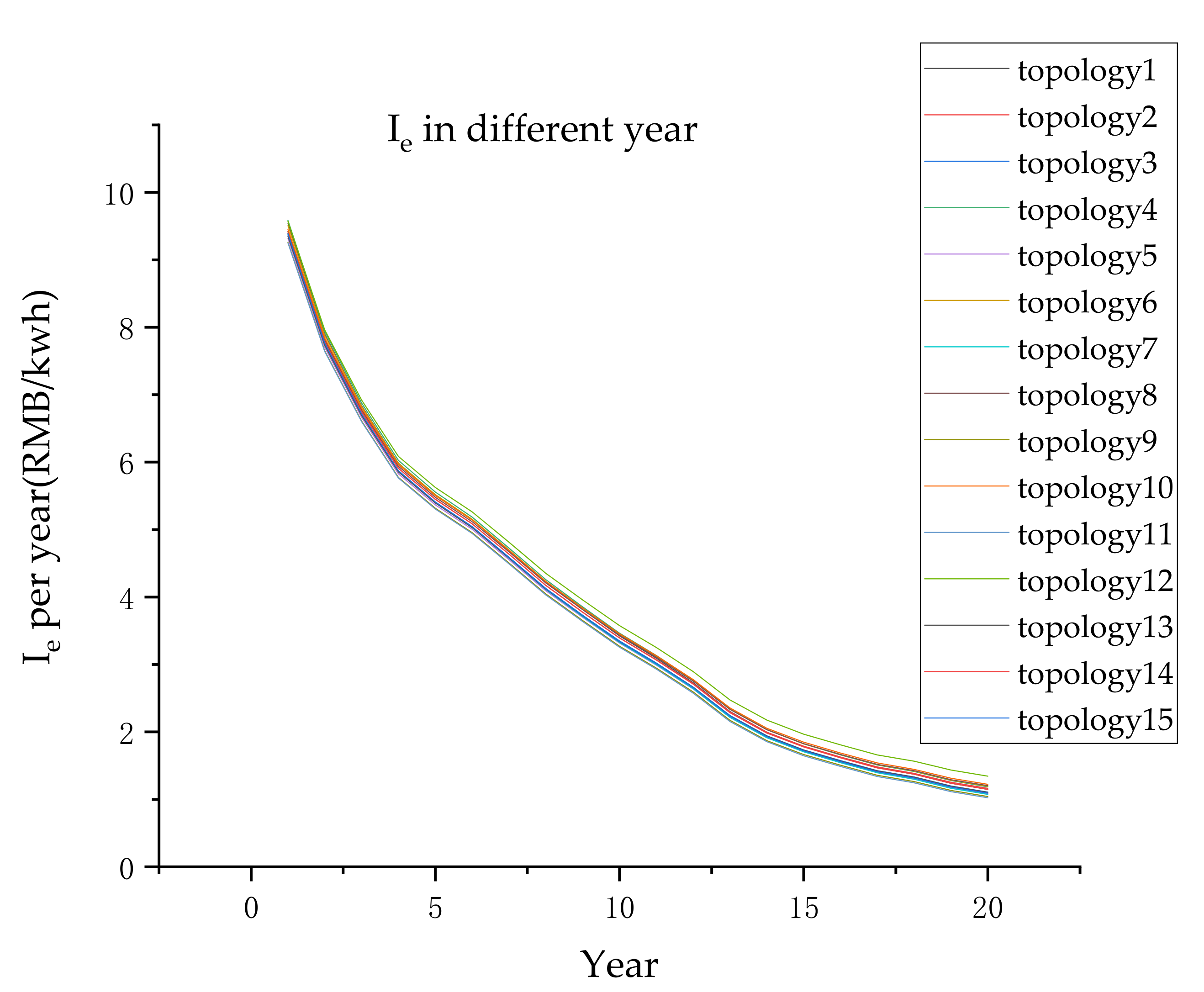

In order to measure the production benefits of different grid topologies, this article selects maximum expected benefit per unit power generation I

e as an economic benefit indicator, its calculation method is shown in Formula (6).

Among them, is the gas price, is the natural gas production after deducting the natural gas consumed by the gas turbine, is the price of oil, is oil production, and W is the total power generation after deducting network losses.

2.1.2. Reliability Indicators

In terms of reliability indicators, this article proposes n−1 pass rate , voltage qualification rate γ, power supply reliability ASAI (Average Service Availability Index) and other indicators.

When calculating the n−1 pass rate, this article calculates the n−1 fault for different submarine cables and the power outage loss when fault occurs. The n−1 pass rate calculation method is shown in Formula (7).

Among them, m is the number of lines that do not occur power loss during the N − 1 calculation, and M is the total number of lines in the grid.

When calculating the voltage qualification rate, what is required is the proportion of the number of nodes whose system node voltage is within the allowable deviation range under the typical load operating conditions. The voltage qualification rate calculation method is shown in Formula (8).

Among them, n is the total number of nodes whose voltage does not meet the standard, and N is the total number of nodes in the grid.

When calculating the power supply reliability, the success flow method is used to calculate the probability of the system running successfully, and this probability is used as the power supply reliability of the system. The calculation process is as follows:

Firstly, the system is layered, and the search is started from the main feeder. The branch feeders on the main feeder and their connected components (including circuit breakers, transformers, overhead lines or cables, etc.) are divided into the same layer. At the same time, we looked for whether the branch feeder also contains lower-level branch feeders, and obtained network level statistics through layered search.

Secondly, according to the results obtained from the network level analysis, starting from the last layer, the values were increased sequentially [

17]. The specific steps were as follows:

- a.

Do a series analysis of each branch feeder in the last layer, and set the probability of successful operation of all components on the same line as the probability of successful operation of a branch feeder. For the j-th branch feeder of the i-th layer,

Among them, means the probability of successful operation of component k, which is in the j-th branch feeder of the i-th layer of the system.

In particular, for some important loads, dual lines are often used for power supply. Without considering the load limit, only when the two circuits exit operation at the same time will affect the load side power supply, so the probability of successful operation can be calculated in parallel.

In the formula: Pij1 and Pij2 are respectively the probability of successful operation of the first and second line in the double circuit line.

Each branch feeder of the i-th layer is weighted by the proportion of the load to the total load of the i-th layer, and is equivalent to component M

i. The calculation is as follows:

In the formula, aij is the proportion of the j-th branch feeder in the total load of the i-th layer, and the i-th layer contains n branch feeders.

- b.

Put the i-th layer branch feeder obtained from the calculation and analysis in the previous step as an equivalent element Mi into the (i−1) layer, the branch load number is the total number of load of the i-th layer, repeat the above steps to obtain the equivalent successful operation probability of the i-th layer.

- c.

Repeat the steps until the equivalent value reaches the highest level, so as to obtain a main feeder line containing only series nodes (or components), and obtain its equivalent successful operation probability P.

This probability of successful operation P can be used as reliability indicator ASAI during system operation.