Seasonal Energy Storage Potential Assessment of WWTPs with Power-to-Methane Technology

Abstract

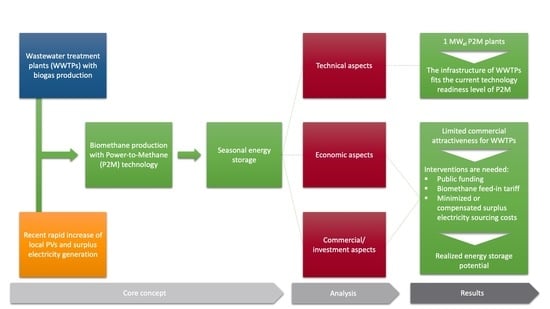

1. Introduction

Economic, commercial, and investment aspects of P2M seasonal energy storage do not motivate WWTPs to act as future P2M operators, consequently, there is a need for change in the regulatory environment to incite them to realize their seasonal energy storage potential with P2M deployment.

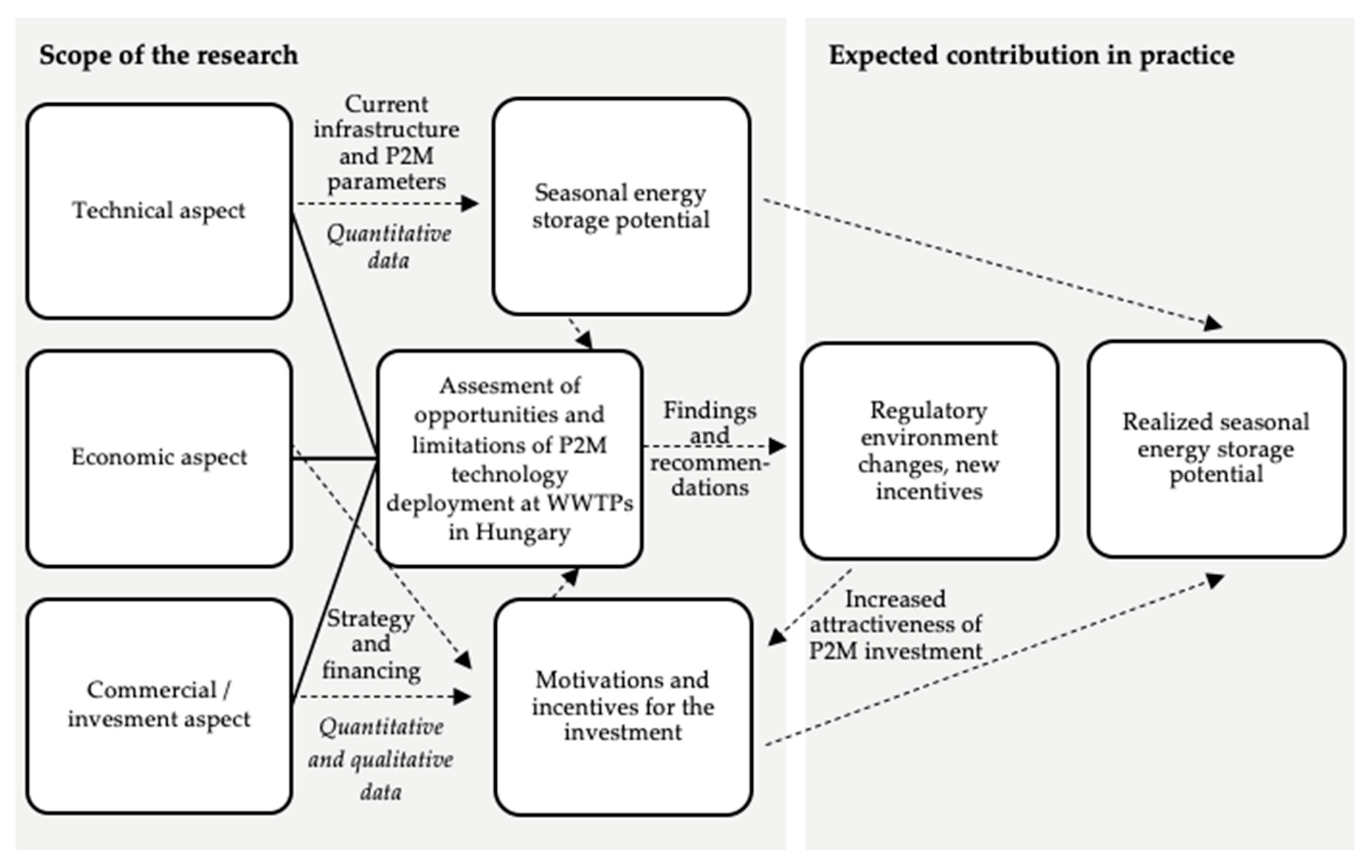

2. Materials and Methods

2.1. Technology Description

2.2. WWTPs in Hungary

2.3. Data Collection

2.4. Data Analyses

2.4.1. Applied Model for the Calculation of Seasonal Energy Storage Potential

- -

- Wobbe index: 45.66–54.76 MJ/m3

- -

- HHV: 31.00–45.28 MJ/m3 (8.61–12.58 kWh/ m3)

- -

- Hydrogen sulfide content: max. 20 mg/m3

- -

- Water vapor content: 0.17 g/m3

2.4.2. Applied Model for the Economic Analysis

2.4.3. Qualitative Data Analysis

3. Results

3.1. Seasonal Energy Storage Potential

3.1.1. Storage Potential of an “Average” WWTP Case

- rs-AD plant electric self-consumption percentage—15%

- ηCHP-CHP electric efficiency—35%

- HHVCH4–Higher heating value of methane—10.3 kWh/Nm3

3.1.2. Energy Storage Potential

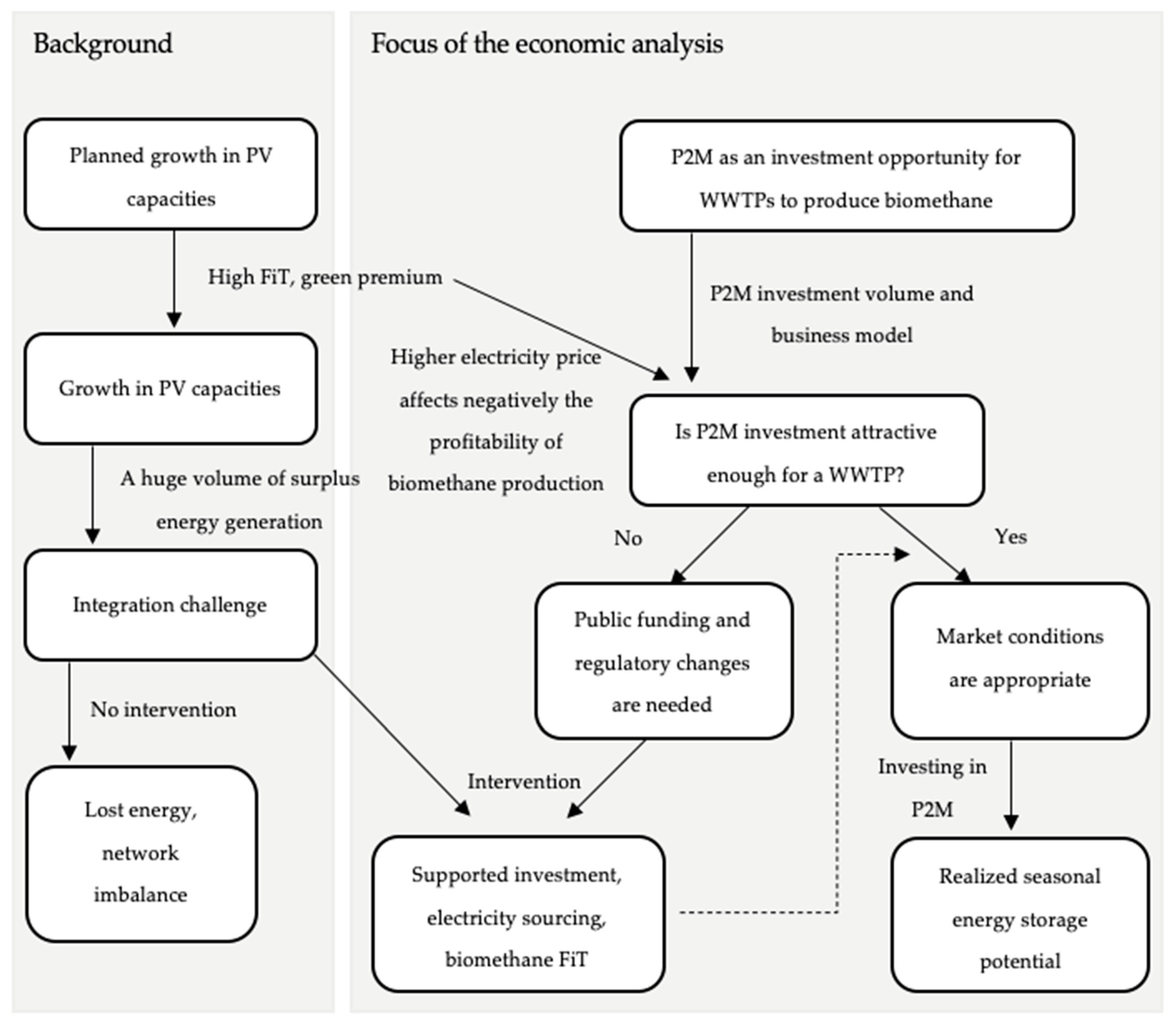

3.2. Commercial and Investment Perspectives

3.2.1. Investment Volume, Operating Expenses, and Revenues

3.2.2. Commercial Challenges

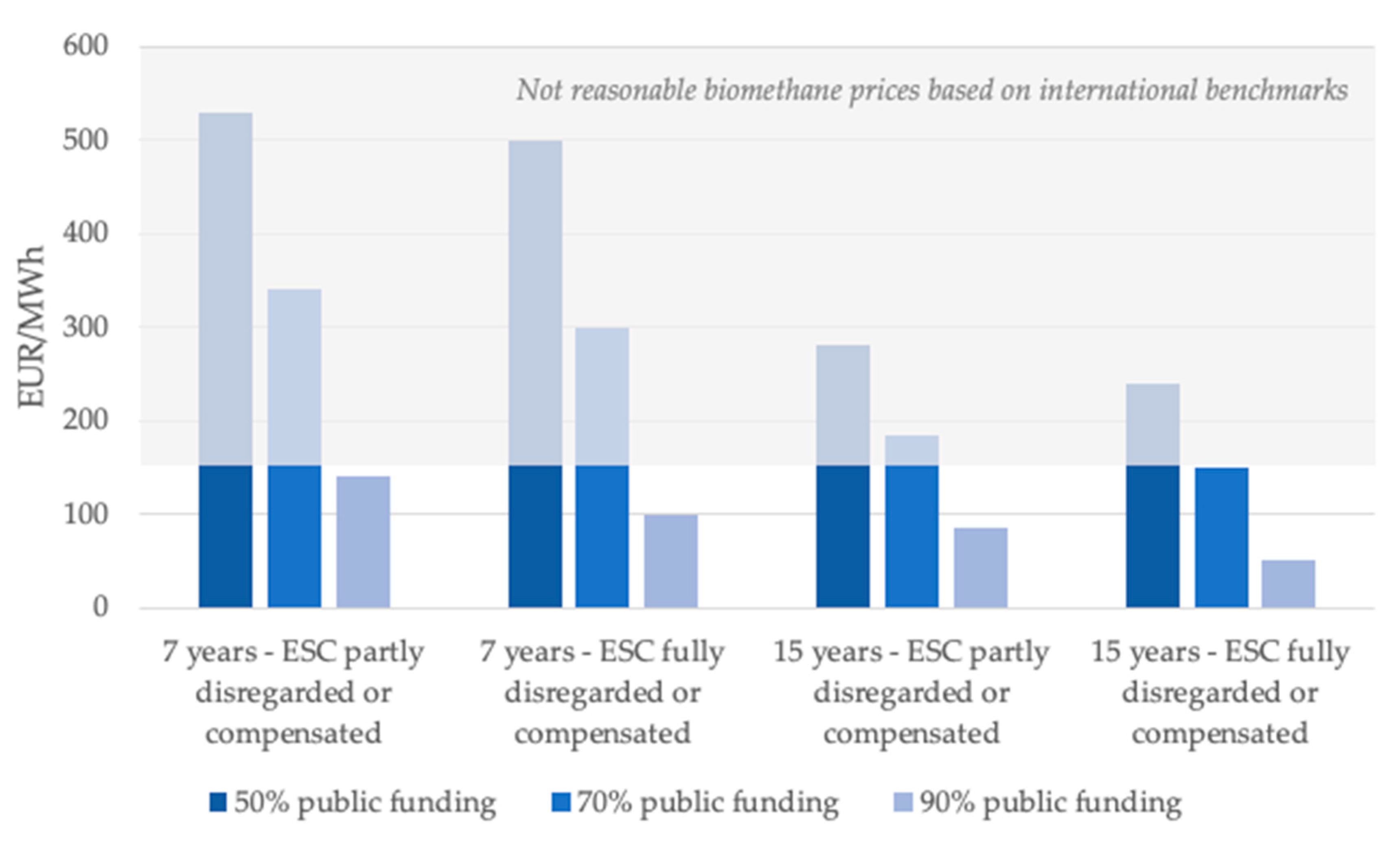

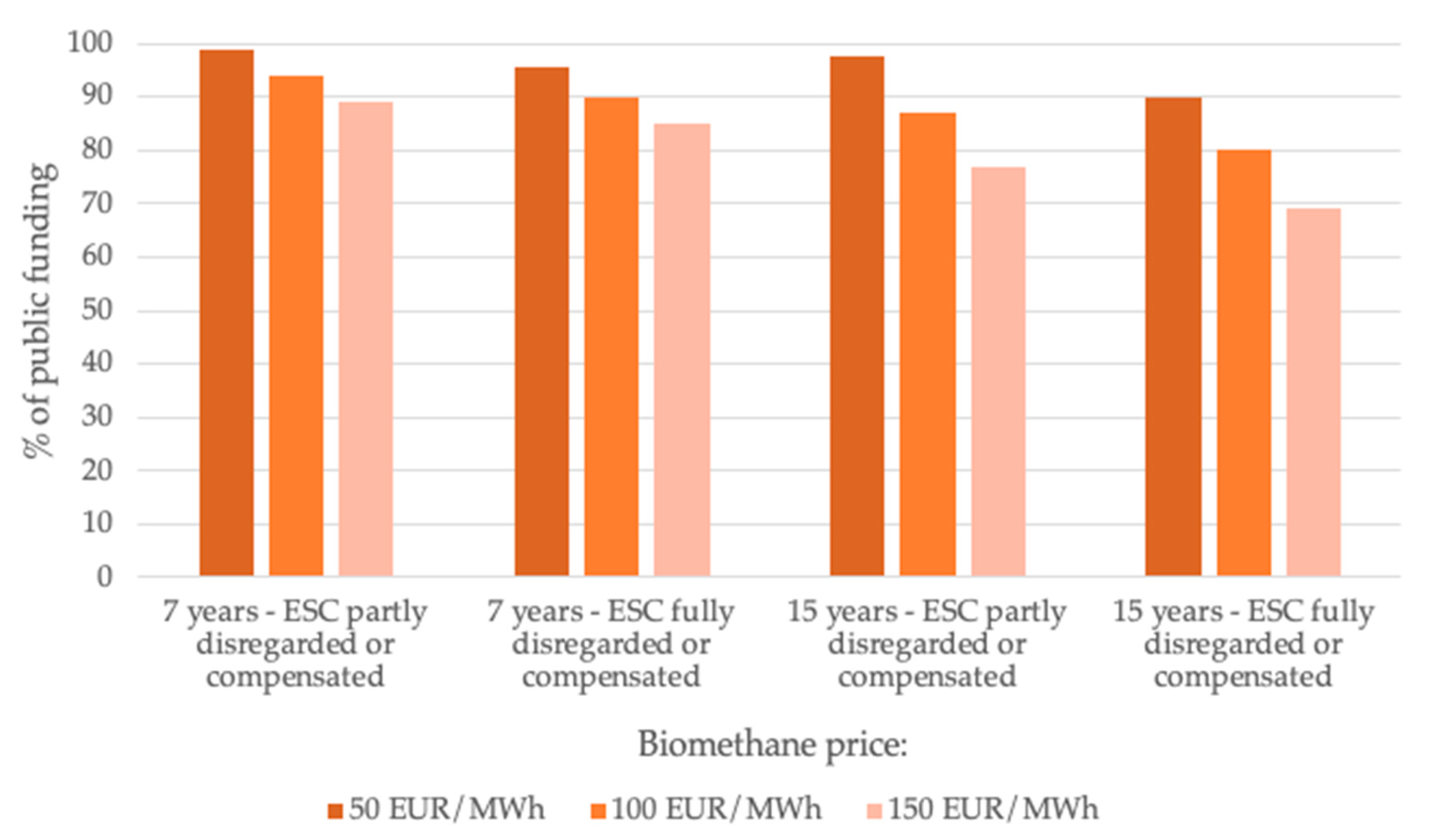

3.2.3. Scenarios to Incite WWTPs to Participate in Seasonal Energy Storage

4. Discussion

5. Conclusions

Economic, commercial and investment aspects of P2M seasonal energy storage do not motivate WWTPs to act as future P2M operators, consequently, there is a need for change in the regulatory environment to incite them to realize their seasonal energy storage potential with P2M deployment.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Category | Item | Thousand EUR | Unit | Source |

|---|---|---|---|---|

| Components, physical infrastructure | Electrolyzer system (PEM) | 1.6 | /kWel | STORE&GO: D8.3. p. 14, 25, 34, 35 D7.5. p. 48 |

| Methanation system (biological) | 0.5 | /kWel | ||

| Infrastructure, installation, storage for gas puffer (H2, CO2), injection | 1.1 | /kWel | ||

| Other | Project development, planning, expert services, quality management | +28% | on costs of total components | |

| Tender-specific R&D, software and maintenance tasks | +50% | Own estimation based on interviews |

Appendix B

| Category | Item | EUR | Unit | Source |

|---|---|---|---|---|

| Input materials-unit prices | Electricity price | None | - | Disregard based on the fundamental assumption of the study |

| Water | 0.6 | /kWel | Hungarian waterworks | |

| Power grid fees/System usage | Variables: None or 1,1 | /kWel | Based on Hungarian Energy and Public Utility Regulatory Authority [74] | |

| Operation and maintenance costs | Electrolysis system | 4.0% | % of CAPEX at 8000 operating hours | Own estimation based on STORE&GO D8.3. p. 35 |

| Methanation system | 5.0% | |||

| Infrastructure, installation, storage for gas puffer (H2, CO2), injection | 3.5% | |||

| Revenues | Biomethane | Variables: 50–150 | /MWh | Based on Koonaphapdeelert, et al. [37] |

| Waste heat | 55 | /MWh | STORE&GO D7.7 p. 65 | |

| CO2 quota | 25 | /tons | [75] | |

| Oxygen | 0.07 | /Nm3 | STORE&GO D7.7 p. 65 | |

| Operation data | Operating hours | 1200 | /year | - |

| Directly connected PV capacity | 0% | - | Based on WWTP interviews | |

| Sold/injected biomethane | 100% | /total produced | ||

| Used or sold waste-heat | 50% | /total produced | ||

| Used or sold oxygen | 50% | /total produced |

Abbreviations

| AD | Anaerobic digestion |

| AFFR | Automatic frequency restoration reserve |

| CAPEX | Capital expenditures |

| CGEN | Combined Gas and Electricity Networks |

| CHP unit | Combined heat and power unit |

| EMG-BES | Bioelectrochemical system for electromethanogenesis |

| ESC | Electricity sourcing costs |

| FiT | Feed-in tariff |

| GHG | Greenhouse gas |

| HHV | Higher heating value |

| LNG | Liquefied natural gas |

| OPEX | Operating expenditures |

| P2G | Power-to-gas |

| P2H | Power-to-hydrogen |

| PM | Power-to-methane |

| PE | Population Equivalent |

| PEMEC | Polymer electrolyte membranes electrolysis |

| PV | Photovoltaics |

| R&D&I | Research, development, and innovation |

| SNG | Synthetic Natural Gas |

| TSO | Transmission System Operator |

| WWTP | Wastewater treatment plant |

References

- Bailera, M.; Lisbona, P.; Romeo, L.; Espatolero, S. Power to Gas Projects Review: Lab, Pilot and Demo Plants for Storing Renewable Energy and CO2. Renew. Sustain. Energy Rev. 2017, 69, 292–312. [Google Scholar] [CrossRef]

- Blanco, H.; Faaij, A. A Review at The Role of Storage in Energy Systems with A Focus on Power to Gas and Long-Term Storage. Renew. Sustain. Energy Rev. 2018, 81, 1049–1086. [Google Scholar] [CrossRef]

- Csedő, Z.; Zavarkó, M. The role of inter-organizational innovation networks as change drivers in commercialization of disruptive technologies: The case of power-to-gas. Int. J. Sustain. Energy Plan. Manag. 2020, 28, 53–70. [Google Scholar] [CrossRef]

- Jäger-Waldau, A. PV Status Report 2019; Publications Office of the European Union: Luxembourg, 2019. [Google Scholar] [CrossRef]

- Sarkar, D.; Odyuo, Y. An ab initio issues on renewable energy system integration to grid. Int. J. Sustain. Energy Plan. Manag. 2019, 23, 27–38. [Google Scholar] [CrossRef]

- Schiebahn, S.; Grube, T.; Robinius, M.; Tietze, V.; Kumar, B.; Stolten, D. Power to Gas: Technological Overview, Systems Analysis and Economic Assessment for A Case Study in Germany. Int. J. Hydrogen Energy 2015, 40, 4285–4294. [Google Scholar] [CrossRef]

- Götz, M.; Lefebvre, J.; Mörs, F.; McDaniel Koch, A.; Graf, F.; Bajohr, S.; Reimert, R.; Kolb, T. Renewable Power-To-Gas: A Technological and Economic Review. Renew. Energy 2016, 85, 1371–1390. [Google Scholar] [CrossRef]

- Schäfer, M.; Gretzschel, O.; Steinmetz, H. The Possible Roles of Wastewater Treatment Plants in Sector Coupling. Energies 2020, 13, 2088. [Google Scholar] [CrossRef]

- Gretzschel, O.; Schäfer, M.; Steinmetz, H.; Pick, E.; Kanitz, K.; Krieger, S. Advanced Wastewater Treatment to Eliminate Organic Micropollutants In Wastewater Treatment Plants in Combination With Energy-Efficient Electrolysis At WWTP Mainz. Energies 2020, 13, 3599. [Google Scholar] [CrossRef]

- Ceballos-Escalera, A.; Molognoni, D.; Bosch-Jimenez, P.; Shahparasti, M.; Bouchakour, S.; Luna, A.; Guisasola, A.; Borràs, E.; Della Pirriera, M. Bioelectrochemical Systems For Energy Storage: A Scaled-Up Power-To-Gas Approach. Appl. Energy 2020, 260, 114138. [Google Scholar] [CrossRef]

- Maroušek, J.; Stehel, V.; Vochozka, M.; Kolář, L.; Maroušková, A.; Strunecký, O.; Peterka, J.; Kopecký, M.; Shreedhar, S. Ferrous Sludge from Water Clarification: Changes in Waste Management Practices Advisable. J. Clean. Prod. 2019, 218, 459–464. [Google Scholar] [CrossRef]

- Maroušek, J.; Kolář, L.; Strunecký, O.; Kopecký, M.; Bartoš, P.; Maroušková, A.; Cudlínová, E.; Konvalina, P.; Šoch, M.; Moudrý, J., Jr.; et al. Modified Biochars Present An Economic Challenge To Phosphate Management In Wastewater Treatment Plants. J. Clean. Prod. 2020, 272, 123015. [Google Scholar] [CrossRef]

- Ghaib, K.; Ben-Fares, F. Power-To-Methane: A State-Of-The-Art Review. Renew. Sustain. Energy Rev. 2018, 81, 433–446. [Google Scholar] [CrossRef]

- Ameli, H.; Qadrdan, M.; Strbac, G. Techno-Economic Assessment of Battery Storage and Power-To-Gas: A Whole-System Approach. Energy Procedia 2017, 142, 841–848. [Google Scholar] [CrossRef]

- Collet, P.; Flottes, E.; Favre, A.; Raynal, L.; Pierre, H.; Capela, S.; Peregrina, C. Techno-Economic and Life Cycle Assessment of Methane Production Via Biogas Upgrading and Power to Gas Technology. Appl. Energy 2017, 192, 282–295. [Google Scholar] [CrossRef]

- Peters, R.; Baltruweit, M.; Grube, T.; Samsun, R.; Stolten, D. A Techno Economic Analysis of The Power to Gas Route. J. Co2 Util. 2019, 34, 616–634. [Google Scholar] [CrossRef]

- Maroušek, J.; Strunecký, O.; Stehel, V. Biochar Farming: Defining Economically Perspective Applications. Clean Technol. Environ. Policy 2019, 21, 1389–1395. [Google Scholar] [CrossRef]

- Maroušek, J.; Rowland, Z.; Valášková, K.; Král, P. Techno-Economic Assessment of Potato Waste Management in Developing Economies. Clean Technol. Environ. Policy 2020, 22, 937–944. [Google Scholar] [CrossRef]

- Mardoyan, A.; Braun, P. Analysis of Czech Subsidies for Solid Biofuels. Int. J. Green Energy 2014, 12, 405–408. [Google Scholar] [CrossRef]

- Eveloy, V.; Gebreegziabher, T. A Review of Projected Power-To-Gas Deployment Scenarios. Energies 2018, 11, 1824. [Google Scholar] [CrossRef]

- Ministry for Innovation and Technology of Hungary. National Energy Strategy 2030; Ministry for Innovation and Technology of Hungary: Budapest, Hungary, 2020. [Google Scholar]

- Mazza, A.; Bompard, E.; Chicco, G. Applications of Power to Gas Technologies in Emerging Electrical Systems. Renew. Sustain. Energy Rev. 2018, 92, 794–806. [Google Scholar] [CrossRef]

- Fasihi, M.; Bogdanov, D.; Breyer, C. Techno-Economic Assessment of Power-to-Liquids (PtL) Fuels Production and Global Trading Based on Hybrid PV-Wind Power Plants. Energy Procedia 2016, 99, 243–268. [Google Scholar] [CrossRef]

- Ferry, J.G. Enzymology of One-Carbon Metabolism in Methanogenic Pathways. Fems Microbiol. Rev. 1999, 23, 13–38. [Google Scholar] [CrossRef] [PubMed]

- Mets, L. Methanobacter Thermoautotrophicus Strain and Variants. Thereof. Patent EP2661511B1, 5 January 2012. [Google Scholar]

- Lovato, G.; Alvarado-Morales, M.; Kovalovszki, A.; Peprah, M.; Kougias, P.G.; Rodrigues, J.A.D.; Angelidaki, I. In-Situ Biogas Upgrading Process: Modeling and Simulations Aspects. Bioresour. Technol. 2017, 245, 332–341. [Google Scholar] [CrossRef] [PubMed]

- Ministry of Interior of Hungary. Information on the National Implementation Program of Directive 91/271/EEC About Waste Water Drainage and Treatment of Settlements of Hungary; Ministry of Interior of Hungary: Budapest, Hungary, 2018. [Google Scholar]

- Adil, A.M.; Ko, Y. Socio-Technical Evolution of Decentralized Energy Systems: A Critical Review and Implications for Urban Planning and Policy. Renew. Sustain. Energy Rev. 2016, 57, 1025–1037. [Google Scholar] [CrossRef]

- Act, No. XL of 2008 on Natural Gas Supply, Hungary. Available online: http://njt.hu/cgi_bin/njt_doc.cgi?docid=117673.386422 (accessed on 14 August 2020).

- Governmental Decree No. 19 of 2009 (I.30.) Implementing the Provisions of the Act, Hungary. Available online: http://njt.hu/cgi_bin/njt_doc.cgi?docid=124061.388348/ (accessed on 14 August 2020).

- STORE&GO. The Project STORE&GO—Shaping the Energy Supply for the Future. Available online: https://www.storeandgo.info/about-the-project/ (accessed on 21 February 2020).

- Lund, H.; Østergaard, P.A.; Connolly, D.; Ridjan, I.; Mathiesen, B.V.; Hvelplund, F.; Thellufsen, J.Z.; Sorknæs, P. Energy Storage and Smart Energy Systems. Int. J. Sustain. Energy Plan. Manag. 2016, 11, 3–14. [Google Scholar] [CrossRef]

- Pintér, G.; Zsiborács, H.; Baranyai, N.H.; Vincze, A.; Birkner, Z. The Economic and Geographical Aspects of the Status of Small-Scale Photovoltaic Systems in Hungary—A Case Study. Energies 2020, 13, 3489. [Google Scholar] [CrossRef]

- Thema, M.; Weidlich, T.; Hörl, M.; Bellack, A.; Mörs, F.; Hackl, F.; Kohlmayer, M.; Gleich, J.; Stabenau, C.; Trabold, T.; et al. Biological CO2-Methanation: An Approach To Standardization. Energies 2019, 12, 1670. [Google Scholar] [CrossRef]

- Varone, A.; Ferrari, M. Power to Liquid and Power to Gas: An Option for the German Energiewende. Renew. Sustain. Energy Rev. 2015, 45, 207–218. [Google Scholar] [CrossRef]

- Solargis. Solar Resource Maps of Hungary. Available online: https://solargis.com/maps-and-gis-data/download/hungary (accessed on 15 August 2020).

- Koonaphapdeelert, S.; Aggarangsi, P.; Moran, J. Biomethane: Production and Applications; Springer: Singapore, 2020. [Google Scholar]

- Glaser, B.G.; Strauss, A.L. The Discovery of Grounded Theory: Strategies for Qualitative Research; Aldine de Gruyter: Chicago, IL, USA, 1967. [Google Scholar]

- Corbin, J.M.; Strauss, A.L. Basics of Qualitative Research: Techniques and Procedures for Developing Grounded Theory; SAGE: Los Angeles, CA, USA, 2008. [Google Scholar]

- Zhang, Y.; Wildemuth, B.M. Qualitative analysis of content. Hum. Brain Mapp. 2005, 30, 2197–2206. [Google Scholar]

- Bai, A. A Biogáz (The Biogas); Száz Magyar Falu Könyvesháza: Budapest, Hungary, 2007. [Google Scholar]

- Kisari, K. Economic Assessment and Organizational Aspects of the Applicability of the LEAN Model in Biogas Plants. Ph.D. Thesis, Szent István University, Gödöllő, Hungary, 2017. [Google Scholar]

- Sinóros-Szabó, B. Evaluation of Biogenic Carbon Dioxide Market and Synergy Potential for Commercial-Scale Power-to-Gas Facilities in Hungary. In Proceedings of Innovációs Kihívások a XXI. Században (Innovation Challenges in the XXI. Century), LXI. Georgikon Days Conference, 3–4 October 2019; Pintér, G., Csányi, S., Zsiborács, H., Eds.; University of Pannonia–Georgikon Faculty: Keszthely, Hungary, 2019; pp. 371–380. ISBN 9789633961308. [Google Scholar]

- Böhm, H.; Zauner, A.; Goers, S.; Tichler, R.; Pieter, K. D7.5. Report on Experience Curves and Economies of Scale; STORE&GO: Karlsruhe, Germany, 2018. [Google Scholar]

- Van Leeuwen, C.; Zauner, A.D. 8.3. Report on the Costs Involved with PtG Technologies and Their Potentials Across the EU; STORE&GO: Karlsruhe, Germany, 2018. [Google Scholar]

- Zauner, A.; Böhm, H.; Rosenfeld, D.C.; Tichler, R. D7.7. Analysis on Future Technology Options and on Techno-Economic Optimization; STORE&GO: Karlsruhe, Germany, 2019. [Google Scholar]

- Györke, G.; Groniewsky, A.; Imre, A. A Simple Method of Finding New Dry and Isentropic Working Fluids for Organic Rankine Cycle. Energies 2019, 12, 480. [Google Scholar] [CrossRef]

- Hungarian Power Exchange. Annual and Monthly Reports. Available online: https://hupx.hu/hu/piaci-adatok/dam/rendszeres-riportok (accessed on 18 August 2020).

- European Biogas Association. About Biogas and Biomethane. Available online: https://www.europeanbiogas.eu/about-biogas-and-biomethane/ (accessed on 18 June 2020).

- Murphy, J.D. Green Gas Facilitating a Future Green Gas Grid through the Production of Renewable Gas; (eBook electronic edition); IEA Bioenergy: Paris, France, 2018; ISBN 978-1-910154-38-0. [Google Scholar]

- Ecotricity. What is Green Gas? Available online: https://www.ecotricity.co.uk/our-green-energy/our-green-gas/what-is-green-gas (accessed on 18 June 2020).

- Junginger, M.; Baxter, D. Biomethane—Status and Factors Affecting Market Development and Trade, electronic version; IEA Bioenergy: Paris, France, 2014; ISBN 978-1-910154-10-6. [Google Scholar]

- Jepma, C.; van Leeuwen, C.; Hulshof, D. D8.1. Exploring the Future for Green Gases; STORE&GO: Karlsruhe, Germany, 2017. [Google Scholar]

- Hulshof, D.; Jempa, C.; Mulder, M. D8.2. Report on the Acceptance and Future Acceptability of Certificate-Based Green Gases; STORE&GO: Karlsruhe, Germany, 2018. [Google Scholar]

- Kreeft, G.J. D7.2. European Legislative and Regulatory Framework on Power-to-Gas; STORE&GO: Karlsruhe, Germany, 2017. [Google Scholar]

- NKM National Utilities. Átlagos Éves Fogyasztás (Average Annual Consumption). Available online: https://www.nkmenergia.hu/aram/pages/aloldal.jsp?id=550565 (accessed on 15 September 2020).

- Vos, K.D. Negative Wholesale Electricity Prices in the German, French and Belgian Day-Ahead, Intra-Day and Real-Time Markets. Electr. J. 2015, 28, 36–50. [Google Scholar] [CrossRef]

- Statista. Annual Volume of Electricity Produced from Solar Photovoltaic in the European Union (EU-28) in 2019, by Country. Available online: https://www.statista.com/statistics/863238/solar-photovoltaic-power-electricity-production-volume-european-union-eu-28/ (accessed on 15 August 2020).

- Guerra, O.; Zhang, J.; Eichman, J.; Denholm, P.; Kurtz, J.; Hodge, B. The Value of Seasonal Energy Storage Technologies for The Integration of Wind and Solar Power. Energy Environ. Sci. 2020, 13, 1909–1922. [Google Scholar] [CrossRef]

- Sarwar, S.; Shahzad, U.; Chang, D.; Tang, B. Economic and Non-Economic Sector Reforms in Carbon Mitigation: Empirical Evidence from Chinese Provinces. Struct. Chang. Econ. Dyn. 2019, 49, 146–154. [Google Scholar] [CrossRef]

- Doğan, B.; Driha, O.M.; Balsalobre Lorente, D.; Shahzad, L. The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustain. Dev. 2020, 1, 1–12. [Google Scholar] [CrossRef]

- Shahzad, U.; Fareed, Z.; Shahzad, F.; Shahzad, K. Investigating the Nexus Between Economic Complexity, Energy Consumption and Ecological Footprint for The United States: New Insights from Quantile Methods. J. Clean. Prod. 2020, 279, 123806. [Google Scholar] [CrossRef]

- Graessley, S.; Šuleř, P.; Klieštik, T.; Kicová, E. Industrial Big Data Analytics for Cognitive Internet of Things: Wireless Sensor Networks, Smart Computing Algorithms, And Machine Learning Techniques. Anal. Metaphys. 2019, 18, 23–29. [Google Scholar] [CrossRef]

- Scher, S.; Messori, G. Predicting Weather Forecast Uncertainty with Machine Learning. Q. J. R. Meteorol. Soc. 2018, 144, 2830–2841. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Modell Generation; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Graessley, S.; Horák, J.; Kováčová, M.; Valášková, K.; Poliak, M. Consumer Attitudes and Behaviors in The Technology-Driven Sharing Economy: Motivations for Participating in Collaborative Consumption. J. Self Gov. Manag. Econ. 2019, 7, 25–30. [Google Scholar] [CrossRef]

- Zhou, S.; Hu, Z.; Gu, W.; Jiang, M.; Zhang, X. Artificial Intelligence Based Smart Energy Community Management: A Reinforcement Learning Approach. Csee J. Power Energy Syst. 2019, 5, 1–10. [Google Scholar] [CrossRef]

- Maroušek, J.; Strunecký, O.; Kolář, L.; Vochozka, M.; Kopecký, M.; Maroušková, A.; Batt, J.; Poliak, M.; Šoch, M.; Bartoš, P.; et al. Advances In Nutrient Management Make It Possible To Accelerate Biogas Production And Thus Improve The Economy Of Food Waste Processing. Energy Sour. Part A Rec. Util. Environ. Eff. 2020, 1–10. [Google Scholar] [CrossRef]

- Imre, A.R.; Kustán, R.; Groniewsky, A. Thermodynamic Selection of the Optimal Working Fluid for Organic Rankine Cycles. Energies 2019, 12, 2028. [Google Scholar] [CrossRef]

- Vochozka, M.; Rowland, Z.; Suler, P. The specifics of valuating a business with a limited lifespan. Ad Alta J. Interdiscip. Res. 2019, 9, 339–345. [Google Scholar]

- Stehel, V.; Rowland, Z.; Marecek, J. Valuation of intangible asset deposit into capital company in case of specific transaction. Ad Alta J. Interdiscip. Res. 2019, 9, 287–291. [Google Scholar]

- Machová, V.; Vochozka, M. Analysis of Business Companies Based on Artificial Neural Networks. Shs Web Conf. 2019, 61, 01013. [Google Scholar] [CrossRef]

- Nikoo, M.; Mahinpey, N. Simulation of Biomass Gasification in Fluidized Bed Reactor Using ASPEN PLUS. Biomass Bioenergy 2008, 32, 1245–1254. [Google Scholar] [CrossRef]

- Hungarian Energy and Public Utility Regulatory Authority, "Decree 15/2016. (XII. 20.). 2016. Available online: http://njt.hu/cgi_bin/njt_doc.cgi?docid=199406.376281 (accessed on 14 August 2020).

- Insider Inc. CO2 European Emission Allowances. Available online: https://markets.businessinsider.com/commodities/co2-european-emission-allowances (accessed on 14 August 2020).

| Data | Technical, Technological, Infrastructural | Economic, Commercial, Investment Related |

|---|---|---|

| General (Senior executive and director level) |

|

|

| Specific (Director and expert level) |

|

|

| Financial Factors | Variable 1 | Variable 2 | Variable 3 |

|---|---|---|---|

| Electricity sourcing costs (ESC) | Partly disregarded or compensated: P2M plants do not have to pay for the energy or it is compensated with flexibility/energy storage fees but has to pay the grid power fees for system usage. | Fully disregarded or compensated: P2M plants do not have to pay for the energy, nor for system usage or these are compensated with flexibility/energy storage fees. | |

| Biomethane FiT (EUR/MWh) | 50 | 100 | 150 |

| CAPEX support (% of public funding) | 50 | 70 | 90 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Csedő, Z.; Sinóros-Szabó, B.; Zavarkó, M. Seasonal Energy Storage Potential Assessment of WWTPs with Power-to-Methane Technology. Energies 2020, 13, 4973. https://doi.org/10.3390/en13184973

Csedő Z, Sinóros-Szabó B, Zavarkó M. Seasonal Energy Storage Potential Assessment of WWTPs with Power-to-Methane Technology. Energies. 2020; 13(18):4973. https://doi.org/10.3390/en13184973

Chicago/Turabian StyleCsedő, Zoltán, Botond Sinóros-Szabó, and Máté Zavarkó. 2020. "Seasonal Energy Storage Potential Assessment of WWTPs with Power-to-Methane Technology" Energies 13, no. 18: 4973. https://doi.org/10.3390/en13184973

APA StyleCsedő, Z., Sinóros-Szabó, B., & Zavarkó, M. (2020). Seasonal Energy Storage Potential Assessment of WWTPs with Power-to-Methane Technology. Energies, 13(18), 4973. https://doi.org/10.3390/en13184973