Does Energy Price Induce China’s Green Energy Innovation?

Abstract

1. Introduction

2. Research Hypotheses

3. Analysis of the Effect of Energy Price on Green Energy Innovation

3.1. Model Specification

3.2. Variables and Data

3.2.1. Variable Measurement

3.2.2. Data Sources and Statistical Description

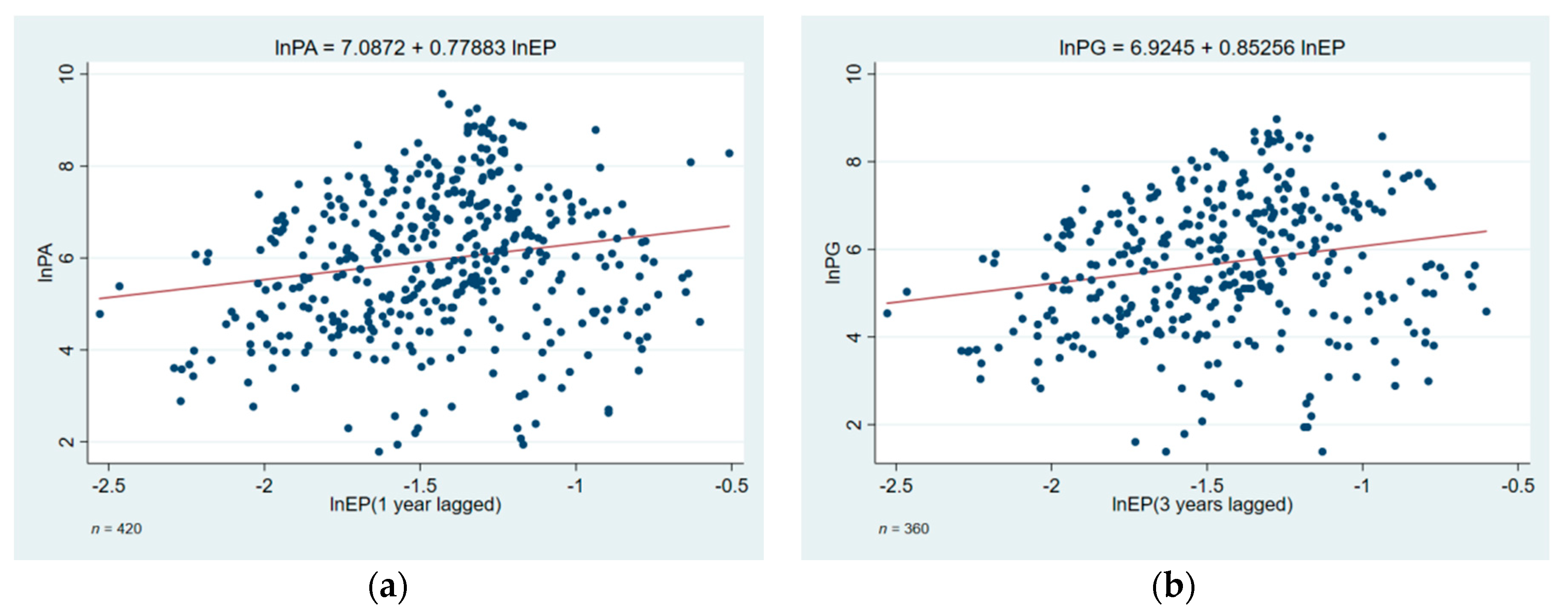

3.3. Full Sample Results

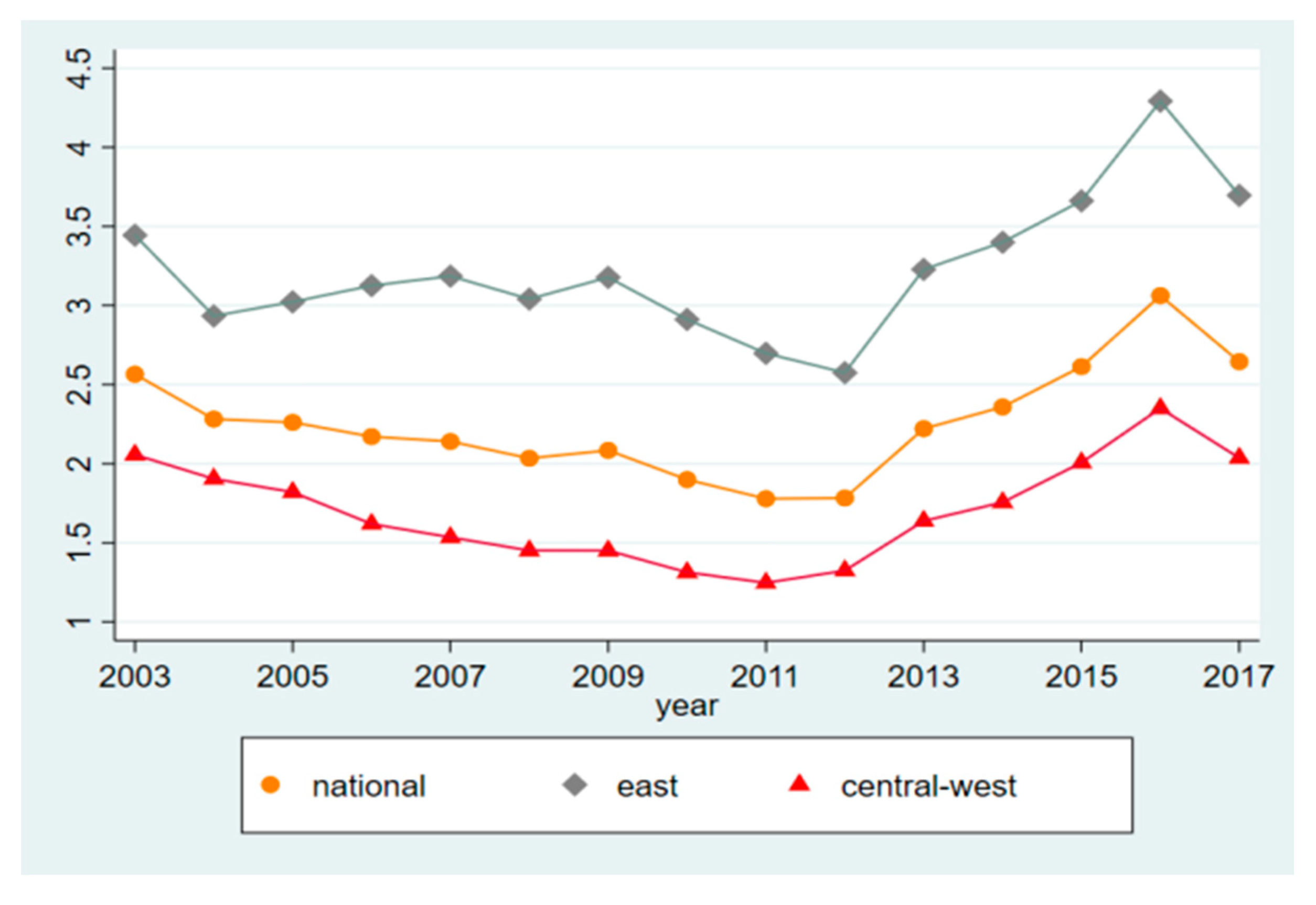

3.4. Results and Analysis of the Regional Differences

4. Does Energy Price Distortion Inhibit the Effect of Energy Price on Green Energy Technology Innovation

4.1. Models and Variables

4.1.1. Model Setting

4.1.2. Measurement of Energy Price Distortion

4.2. Empirical Results and Analysis

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Obs | Mean | Std. Dev. | Min | Max | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| lnPA | 420 | 5.966 | 1.569 | 1.792 | 9.576 | −0.192 | 2.632 |

| lnPG | 360 | 5.684 | 1.523 | 1.386 | 8.976 | −0.277 | 2.688 |

| lnEP | 420 | −1.440 | 0.352 | −2.529 | −0.509 | −0.130 | 2.933 |

| lnL | 420 | 7.098 | 1.231 | 2.631 | 9.598 | −0.608 | 3.673 |

| lnS | 420 | 6.892 | 1.552 | 3.169 | 10.485 | −0.032 | 2.565 |

| FDI | 420 | 0.036 | 0.031 | 0.001 | 0.215 | 1.770 | 7.686 |

| Dum2009 | 420 | 0.500 | 0.500 | 0 | 1 |

References

- Kwakwa, P.A.; Alhassan, H.; Aboagye, S. Environmental Kuznets curve hypothesis in a financial development and natural resource extraction context: Evidence from Tunisia. Quant. Financ. Econ. 2018, 2, 981–1000. [Google Scholar] [CrossRef]

- Cheon, A.; Urpelainen, J. Oil prices and energy technology innovation: An empirical analysis. Glob. Environ. Chang. 2012, 22, 407–417. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Does electricity price matter for innovation in renewable energy technologies in China? Energy Econ. 2019, 78, 259–266. [Google Scholar] [CrossRef]

- Parker, S.; Bhatti, M.I. Dynamics and drivers of per capita CO2 emissions in Asia. Energy Econ. 2020, 104798. [Google Scholar] [CrossRef]

- Hicks, J.R. The Theory of Wages. Econ. J. 1932, 43, 460–472. [Google Scholar] [CrossRef]

- Ley, M.; Stucki, T.; Woerter, M. The impact of energy prices on green innovation. Energy J. 2016, 37, 41–75. [Google Scholar] [CrossRef]

- Nicolli, F.; Vona, F. Heterogeneous policies, heterogeneous technologies: The case of renewable energy. Energy Econ. 2016, 56, 190–204. [Google Scholar] [CrossRef]

- Nunes, I.C.; Catalaolopes, M. The Impact of Oil Shocks on Innovation for Alternative Sources of Energy: Is there an asymmetric response when oil prices go up or down? J. Commod. Mark. 2019, 100108. [Google Scholar] [CrossRef]

- Lanzi, E.; Sue Wing, I. Directed technical change in the energy sector: An empirical test of induced directed innovation. In Proceedings of the WCERE 2010 Conference, Montreal, QC, Canada, 28 June–2 July 2010. [Google Scholar]

- Verdolini, E.; Galeotti, M. At home and abroad: An empirical analysis of innovation and diffusion in energy technologies. J. Environ. Econ. Manag. 2011, 61, 119–134. [Google Scholar] [CrossRef]

- Noailly, J.; Smeets, R. Directing technical change from fossil-fuel to renewable energy innovation: An application using firm-level patent data. J. Environ. Econ. Manag. 2015, 72, 15–37. [Google Scholar]

- Kruse, J.; Wetzel, H. Energy Prices, Technological knowledge, and innovation in green energy technologies: A dynamic panel analysis of European patent data. CESifo Econ. Stud. 2016, 63, 397–425. [Google Scholar] [CrossRef]

- Ahmad, S. On the theory of induced invention. Econ. J. 1966, 76, 344–357. [Google Scholar] [CrossRef]

- Kamien, M.; Schwartz, N. Optimal induced technical change. Econometrica: J. Econom. Soc. 1968, 36, 1–17. [Google Scholar] [CrossRef]

- Binswanger, H.P. A microeconomic approach to innovation. Econ. J. 1974, 84, 940–958. [Google Scholar] [CrossRef]

- Zhou, S.; Teng, F. Estimation of urban residential electricity demand in China using household survey data. Energy Policy 2013, 61, 394–402. [Google Scholar] [CrossRef]

- Sohag, K.; Begum, R.A.; Abdullah, S.M.S.; Jaafar, M. Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 2015, 90, 1497–1507. [Google Scholar] [CrossRef]

- Lichtenberg, F.R. Energy prices and induced innovation. Res. Policy 1986, 15, 67–75. [Google Scholar] [CrossRef]

- Popp, D. Induced Innovation and Energy Prices. Am. Econ. Rev. 2002, 92, 160–180. [Google Scholar] [CrossRef]

- Linn, J. Energy Prices and the Adoption of Energy-Saving Technology. Econ. J. 2008, 118, 1986–2012. [Google Scholar] [CrossRef]

- Kong, D.; Yang, X.; Xu, J. Energy price and cost induced innovation: Evidence from China. Energy 2020, 192, 116586. [Google Scholar] [CrossRef]

- Acs, Z.J.; Anselin, L.; Varga, A. Patents and innovation counts as measures of regional production of new knowledge. Res. Policy 2002, 31, 1069–1085. [Google Scholar] [CrossRef]

- Boyd, G.A. Estimating plant level energy efficiency with a stochastic frontier. Energy J. 2008, 29, 23–43. [Google Scholar] [CrossRef]

- Hsieh, C.T.; Klenow, P.J. Misallocation and Manufacturing TFP in China and India. Q. J. Econ. 2009, 124, 1403–1448. [Google Scholar] [CrossRef]

- Ouyang, X.; Wei, X.; Sun, C.; Du, G. Impact of factor price distortions on energy efficiency: Evidence from provincial-level panel data in China. Energy Policy 2018, 118, 573–583. [Google Scholar] [CrossRef]

- Tan, R.; Lin, B.; Liu, X. Impacts of eliminating the factor distortions on energy efficiency——A focus on China’s secondary industry. Energy 2019, 183, 693–701. [Google Scholar] [CrossRef]

- Leng, Y.; Du, S. Energy prices distortions and smog pollution—Empirical evidence for China. Ind. Econ. Res. 2016, 71–79. [Google Scholar]

- Li, K.; F, L.; He, L. How population and energy price affect China’s environmental pollution? Energy Policy 2019, 129, 386–396. [Google Scholar] [CrossRef]

- Sun, C.; Lin, B. Reforming residential electricity tariff in China: Block tariffs pricing approach. Energy Policy 2013, 60, 741–752. [Google Scholar] [CrossRef]

- Fattouh, B.; EI-Katiri, L. Energy subsidies in the Middle East and North Africa. Energy Strategy Rev. 2013, 2, 108–115. [Google Scholar] [CrossRef]

- Zhao, X.; Ma, C.; Hong, D. Why did China’s energy intensity increase during 1998–2006: Decomposition and policy analysis. Energy Policy 2010, 38, 1379–1388. [Google Scholar] [CrossRef]

- Wang, Q.; Pan, J.; Zeng, N.; Ding, Y.; Wang, H.; Gregg, J. China’s Energy Policy Comes at a Price. Science 2008, 321, 1156–1157. [Google Scholar] [CrossRef] [PubMed]

- Romer, P.M. Endogenous Technological Change. J. Political Econ. 1990, 98, 71–102. [Google Scholar] [CrossRef]

- Jones, C. Times series tests of endogenous of growth models. Q. J. Econ. 1995, 110, 494–525. [Google Scholar] [CrossRef]

- Furman, J.L.; Porter, M.E.; Stern, S. The determinants of national innovative capacity. Res. Policy 2002, 31, 899–933. [Google Scholar] [CrossRef]

- Krammer, S.M. Drivers of national innovation in transition: Evidence from a panel of Eastern European countries. Res. Policy 2009, 38, 845–860. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Wang, Z.; Huang, Z. Green loan and subsidy for promoting clean production innovation. J. Clean. Prod. 2018, 187, 421–431. [Google Scholar] [CrossRef]

- Ahi, K.; Laidroo, L. Banking market competition in Europe—Financial stability or fragility enhancing? Quant. Financ. Econ. 2019, 3, 257–285. [Google Scholar] [CrossRef]

- Li, Z.; Dong, H.; Huang, Z.; Failler, P. Impact of foreign direct investment on environmental performance. Sustainability 2019, 11, 3538. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Albitar, K. Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 2020, 29, 1045–1055. [Google Scholar] [CrossRef]

- Li, T.; Liao, G. The Heterogeneous Impact of Financial Development on Green Total Factor Productivity. Front. Energy Res. 2020, 8, 29. [Google Scholar] [CrossRef]

- Wen, J.; Yang, D.; Feng, G.; Dong, M.; Chang, C. Venture capital and innovation in China: The non-linear evidence. Struct. Chang. Econ. Dyn. 2018, 46, 148–162. [Google Scholar] [CrossRef]

- Pan, X.; Ai, B.; Li, C.; Pan, X.; Yan, Y. Dynamic relationship among environmental regulation, technological innovation and energy efficiency based on large scale provincial panel data in China. Technol. Forecast. Soc. Chang. 2019, 144, 428–435. [Google Scholar] [CrossRef]

- Ardito, L.; Messeni Petruzzelli, A.; Albino, V. Investigating the antecedents of general purpose technologies: A patent perspective in the green energy field. J. Eng. Technol. Manag. 2016, 39, 81–100. [Google Scholar] [CrossRef]

- Hu, B. Measuring plant level energy efficiency in China’s energy sector in the presence of allocative inefficiency. China Econ. Rev. 2014, 31, 130–144. [Google Scholar] [CrossRef]

- Ouyang, X.; Sun, C. Energy savings potential in China’s industrial sector: From the perspectives of factor price distortion and allocative inefficiency. Energy Econ. 2015, 48, 117–126. [Google Scholar] [CrossRef]

- Tao, X.; Xing, J.; Huang, X.; Zhou, W. Energy price distortion and Factor Substitution in China’s Industrial Sector. Quant. Econ. Tech. Econ. Res. 2009, 26, 3–16. [Google Scholar]

- Aghion, P.; Dechezleprêtre, A.; Hemous, D.; Martin, R.; Van Reenen, J. Carbon taxes, path dependency, and directed technical change: Evidence from the auto industry. J. Political Econ. 2016, 124, 1–51. [Google Scholar] [CrossRef]

- Hall, B.H.; Jaffe, A.; Trajtenberg, M. Market value and patent citations. Rand J. Econ. 2005, 36, 16–38. [Google Scholar]

- Shatz, H.J.; Venables, A.J. The Geography of International Investment; World Bank Publications: Washington, DC, USA, 2000. [Google Scholar]

- Jungmittag, A.; Welfens, P.J. Beyond EU-US Trade Dynamics: TTIP Effects Related to Foreign Direct Investment and Innovation; IZA Institute of Labor Economics: Bonn, Germany, 2017. [Google Scholar]

- Rafique, M.Z.; Li, Y.; Larik, A.R.; Monaheng, M.P. The effects of FDI, technological innovation, and financial development on CO2 emissions: Evidence from the BRICS countries. Environ. Sci. Pollut. Res. 2020, 27, 23899–23913. [Google Scholar] [CrossRef]

- Nguyen, C.C.; Bhatti, M.I. Copula model dependency between oil prices and stock markets: Evidence from China and Vietnam. J. Int. Financ. Mark. Inst. Money 2012, 22, 758–773. [Google Scholar] [CrossRef]

- Nguyen, C.; Bhatti, M.I.; Henry, D. Are Vietnam and Chinese stock markets out of the US contagion effect in extreme events? Physica A Statistical Mechanics and its Applications 2017, 480, 10–21. [Google Scholar] [CrossRef]

- Alrahahleh, N.; Bhatti, M.I. Co-movement measure of information transmission on international equity markets. Physica A Statistical Mechanics and its Applications 2017, 470, 119–131. [Google Scholar] [CrossRef]

- Zhao, X.M.; Liu, C.J.; Yang, M. The effects of environmental regulation on China’s total factor productivity: An empirical study of carbon-intensive industries. J. Clean. Prod. 2018, 179, 325–334. [Google Scholar] [CrossRef]

- Cebula, R.J.; Boylan, R. Uncertainty regarding the effectiveness of Federal Reserve monetary policies over time in the U.S.: An exploratory empirical assessment. Quant. Financ. Econ. 2019, 3, 244–256. [Google Scholar] [CrossRef]

- Lewbel, A. Constructing instruments for regressions with measurement error when no additional data are available, with an application to patents and R&D. Econom. J. Econom. Soc. 1997, 65, 1201–1213. [Google Scholar]

- Zhang, J. Estimation of China’s provincial capital stock (1952–2004) with applications. J. Chin. Econ. Bus. Stud. 2008, 6, 177–196. [Google Scholar] [CrossRef]

- Dai, X.; Cheng, L. Market distortions and aggregate productivity: Evidence from Chinese energy enterprises. Energy Policy 2016, 95, 304–313. [Google Scholar] [CrossRef]

| Variable Types | Variable Names | Variable Definitions |

|---|---|---|

| Dependent variables | Number of green energy patent applications (PA) | The number of patent applications for “Alternative energy production” and “Energy conservation” in WIPO’s IPC Green Inventory [44] |

| Number of green energy patents grants (PG) | The number of patent applications for “alternative energy production” and “energy conservation” in WIPO’s IPC Green Inventory [44] | |

| Core independent variables | Energy price (100 million yuan/ton) (EP) | Weighted price of coal, oil, natural gas and electric power |

| Control variables | R&D personnel in the field of green energy (L) | Authors’ estimation of the number of the full-time equivalent of R&D personnel in the field of green energy |

| Green energy knowledge stock (S) | Estimated by the perpetual inventory method | |

| Foreign direct investment (FDI) | FDI/GDP | |

| Time dummy variable (Dum 2009) | It is 0 before 2009 and 1 since 2010 |

| Variables | Dependent Variable: Logarithm of the Number of Green Energy Patent Applications (lnPA) | Dependent Variable: Logarithm of the Number of Green Energy Patent Grants (lnPG) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| FE | RE | FE | RE | FE-IV | FE | RE | FE | RE | FE-IV | |

| lnEP | 2.489 *** | 2.408 *** | 0.224 *** | 0.208 *** | 0.111 | 2.498 *** | 2.439 *** | 0.361 *** | 0.475 *** | 0.760 *** |

| (17.84) | (17.13) | (3.62) | (4.41) | (0.86) | (20.76) | (20.05) | (3.73) | (5.98) | (2.84) | |

| lnL | 0.0656 * | 0.0524 * | 0.0747 * | 0.328 *** | 0.255 *** | 0.320 *** | ||||

| (1.66) | (1.71) | (1.84) | (5.43) | (4.76) | (5.15) | |||||

| lnS | 0.891 *** | 0.959 *** | 0.894 *** | 0.792 *** | 0.805 *** | 0.730 *** | ||||

| (27.48) | (35.00) | (27.33) | (14.20) | (16.48) | (10.60) | |||||

| FDI | 0.728 | 1.065 ** | 0.680 | 6.929 *** | 4.734 *** | 6.473 *** | ||||

| (1.25) | (2.18) | (1.16) | (4.39) | (3.87) | (3.94) | |||||

| Dum2009 | −0.0173 | −0.118 *** | 0.009 | −0.282 *** | −0.276 *** | −0.338 *** | ||||

| (−0.34) | (−3.09) | (0.16) | (−4.27) | (−4.80) | (−4.44) | |||||

| Constant | 9.550 *** | 9.433 *** | −0.335 | −0.698 *** | −0.598 * | 9.319 *** | 9.234 *** | −1.472 *** | −0.817 *** | −0.387 |

| (46.76) | (31.03) | (−1.37) | (−5.98) | (−1.68) | (52.34) | (31.70) | (−3.82) | (−3.54) | (−0.49) | |

| Hausman | 16.26 *** | 301.88 *** | 15.01 *** | 500.71 *** | ||||||

| N | 420 | 420 | 420 | 420 | 420 | 360 | 360 | 360 | 360 | 360 |

| R2 | 0.450 | — | 0.945 | — | 0.993 | 0.567 | — | 0.892 | — | 0.967 |

| Variables | Dependent Variable: Logarithm of the Number of Green Energy Patent Applications (lnPA) | Dependent Variable: Logarithm of the Number of Green Energy Patent Grants (lnPG) | ||||

|---|---|---|---|---|---|---|

| FE | RE | FE-IV | FE | RE | FE-IV | |

| lnEP | −0.0368 | 0.122 | −0.214 | −0.0025 | 0.291 ** | 0.0692 |

| (−0.44) | (1.55) | (−1.45) | (−0.02) | (1.98) | (0.34) | |

| lnL | 0.211 *** | 0.121 ** | 0.196 *** | 0.473 *** | 0.325 *** | 0.482 *** |

| (3.47) | (2.44) | (3.12) | (4.76) | (3.76) | (4.78) | |

| lnS | 0.778 *** | 0.878 *** | 0.800 *** | 0.727 *** | 0.724 *** | 0.710 *** |

| (14.85) | (18.51) | (14.47) | (7.57) | (8.46) | (7.06) | |

| FDI | 1.255 | 1.054 | 1.356 * | 6.823 *** | 2.671 * | 6.771 *** |

| (1.65) | (1.53) | (1.75) | (3.45) | (1.72) | (3.42) | |

| Dum2009 | 0.0011 | −0.116 ** | 0.0366 | −0.334 *** | −0.276 *** | −0.342 *** |

| (0.02) | (−2.25) | (0.47) | (−3.18) | (−3.35) | (−3.23) | |

| Constant | −0.934 *** | −0.701 *** | −1.289 *** | −2.745 *** | −0.943 ** | −2.568 *** |

| (−2.77) | (−3.41) | (−3.08) | (−4.38) | (−2.51) | (−3.67) | |

| Hausman | 24.94 *** | 28.04 *** | ||||

| N | 154 | 132 | 154 | 154 | 132 | 154 |

| R2 | 0.957 | — | 0.956 | 0.898 | — | 0.898 |

| Variables | Dependent Variable: Logarithm of the Number of Green Energy Patent Applications (lnPA) | Dependent Variable: Logarithm of the Number of Green Energy Patent Grants (lnPG) | ||||

|---|---|---|---|---|---|---|

| FE | RE | RE-IV | FE | RE | RE-IV | |

| lnEP | 0.415 *** | 0.307 *** | 0.375 *** | 0.567 *** | 0.577 *** | 0.850 *** |

| (4.69) | (4.82) | (3.16) | (4.46) | (5.59) | (3.44) | |

| lnL | −0.00701 | 0.0445 | 0.0427 | 0.237 *** | 0.203 *** | 0.191 *** |

| (−0.13) | (1.09) | (1.05) | (2.94) | (2.87) | (2.65) | |

| lnS | 0.950 *** | 0.981 *** | 0.984 *** | 0.829 *** | 0.863 *** | 0.846 *** |

| (23.24) | (26.53) | (26.48) | (12.04) | (13.53) | (12.69) | |

| FDI | −0.122 | −0.146 | −0.104 | 5.717 ** | 5.049 ** | 4.979 ** |

| (−0.15) | (−0.19) | (−0.14) | (2.01) | (2.06) | (2.01) | |

| Dum2009 | −0.0701 | −0.124 ** | −0.154 ** | −0.285 *** | −0.306 *** | −0.389 *** |

| (−1.09) | (−2.24) | (−2.19) | (−3.42) | (−3.96) | (−3.78) | |

| Constant | 0.0308 | −0.637 *** | −0.538 ** | −0.720 | −0.662 * | −0.0638 |

| (0.08) | (−3.50) | (−2.28) | (−1.34) | (−1.81) | (−0.10) | |

| Hausman | 8.83 | 2.84 | ||||

| N | 266 | 266 | 266 | 228 | 228 | 228 |

| R2 | 0.945 | 0.945 | 0.897 | 0.894 | ||

| Variables | Dependent Variable: Logarithm of the Number of Green Energy Patent Applications (lnPA) | Dependent Variable: Logarithm of the Number of Green Energy Patent Grants (lnPG) | ||||

|---|---|---|---|---|---|---|

| FE | RE | FE-IV | FE | RE | FE-IV | |

| lnEP | 0.340 *** | 0.391 *** | −0.120 | 0.382 ** | 0.652 *** | 0.498 |

| (2.80) | (4.43) | (−0.41) | (2.11) | (4.42) | (0.96) | |

| Dist | −0.444 *** | −0.104 * | −0.869 *** | −0.650 *** | −0.308 *** | −0.852 * |

| (−4.95) | (−1.69) | (−3.98) | (−4.02) | (−2.72) | (−1.90) | |

| lnEP × Dist | −0.201 *** | −0.0760 ** | −0.324 *** | −0.258 *** | −0.156 *** | −0.354 *** |

| (−5.05) | (−2.26) | (−4.33) | (−4.27) | (−2.99) | (−2.85) | |

| lnL | 0.0464 | 0.0550 * | 0.0277 | 0.303 *** | 0.242 *** | 0.297 *** |

| (1.20) | (1.75) | (0.67) | (5.10) | (4.45) | (4.69) | |

| lnS | 0.978 *** | 0.965 *** | 1.112 *** | 0.904 *** | 0.853 *** | 0.928 *** |

| (24.67) | (30.94) | (14.68) | (14.01) | (15.31) | (6.74) | |

| FDI | 0.842 | 0.965 * | 0.711 | 6.841 *** | 4.971 *** | 6.710 *** |

| (1.49) | (1.91) | (1.19) | (4.43) | (3.85) | (4.17) | |

| Dum2009 | −0.0312 | −0.136 *** | 0.0218 | −0.280 *** | −0.291 *** | −0.289 *** |

| (−0.64) | (−3.60) | (0.37) | (−4.27) | (−5.05) | (−3.54) | |

| Constant | −0.325 | −0.508 *** | −1.276 ** | −1.488 *** | −0.652 ** | −1.322 |

| (−1.14) | (−3.68) | (−2.17) | (−3.48) | (−2.39) | (−1.39) | |

| Hausman | 363.47 *** | 24.55 *** | ||||

| N | 420 | 420 | 420 | 360 | 360 | 360 |

| R2 | 0.949 | 0.943 | 0.897 | 0.896 | ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Liu, S.; Xu, X.; Failler, P. Does Energy Price Induce China’s Green Energy Innovation? Energies 2020, 13, 4034. https://doi.org/10.3390/en13154034

Liu Y, Liu S, Xu X, Failler P. Does Energy Price Induce China’s Green Energy Innovation? Energies. 2020; 13(15):4034. https://doi.org/10.3390/en13154034

Chicago/Turabian StyleLiu, Yue, Siming Liu, Xueying Xu, and Pierre Failler. 2020. "Does Energy Price Induce China’s Green Energy Innovation?" Energies 13, no. 15: 4034. https://doi.org/10.3390/en13154034

APA StyleLiu, Y., Liu, S., Xu, X., & Failler, P. (2020). Does Energy Price Induce China’s Green Energy Innovation? Energies, 13(15), 4034. https://doi.org/10.3390/en13154034