1. Introduction

The growing presence of distributed energy resources (DER) makes more and more necessary a change in the classical conception of energy markets. By giving end users the possibility of producing their own energy, the figure of the prosumer appears as an additional role to the traditional ones of pure producer and consumer. According to the latest annual forecast report [

1] of the International Energy Agency (IEA), energy from renewable sources will increase its penetration in the coming years, from 26% share of global generation in 2019 to 30% in 2024. To do so, the agency estimates that the renewable power installed worldwide will increase by 50% in that period. Moreover, it is expected that almost 30% of this increase will be covered by distributed solar photovoltaic (PV) generation, which implies the installation of between 300 and 400 GW (+250%) of additional power in the aforementioned five-year period. PV installations owned by individuals, communities or industries will represent an increasing percentage of the total installed distributed PV power. The availability of ownership data varies greatly between countries, but taking the example of Germany, which has one of the most developed renewable sectors in the world, it can be seen how in 2016 more than 42.5% of PV generation capacity was owned by private individuals or farmers, while only 15.7% was owned by standard power providers (the remaining being owned by industries, project planners or the business sector) [

2].

While the primary objective of end users when installing DER is self-consumption, energy surpluses might become common as the efficiency of the consumption equipment and the productivity of the generators improve. This surplus energy can be stored in different types of energy storage systems (ESS) such as pumped hydro storage, hydrogen or batteries, etc., to be consumed later during periods when production is lower than consumption. However, if the excess production exceeds the storage capacity, a generation curtailment should be carried out in those instants when it does not exist instantaneous consumption, which translates into energy waste. Currently, many states have implemented legislative mechanisms to encourage renewable sources to account for an ever-increasing proportion of the national annual electricity generation, and compel traditional distribution system operators (DSO) to absorb excess renewable production and to compensate the end user for this surplus. To have DSO as the only alternative to which to sell the excess production poses a problem for DER owners, since it leaves to its total discretion (possibly forced also by public administrations) the determination of the main parameters of the trade, namely: amount of power/energy, price per unit and form of economic compensation. Furthermore, in a global context, the emergence of the shared economy concept [

3] has revolutionised other sectors such as passenger transport or tourist accommodation. It seems therefore logical to envisage a future in which heterogeneous end users (households, factories, work-centres, electric vehicles, etc.) pertaining to the same microgrid can exchange energy peer-to-peer (eP2P) according to their production and consumption profiles [

4].

Peer-to-peer energy trading has raised considerable interest within the scientific community in recent years. Different approaches and techniques has been proposed to incorporate P2P trade into the energy system [

5], including game theory [

6], distributed trading algorithms [

7] (including consensus [

8]), evolutionary algorithms (including Particle Swarm Optimization [

9] and Genetic algorithms [

10]) and market-driven trading [

11,

12], which is the one used in this study. The interested reader is referred also to [

13] for a comprehensive survey on architectures, power routing and security and privacy issues. A large body of literature is devoted to applications in which a series of peers under the same point of common coupling (PCC), or alternatively within the same microgrid, aggregate their generation and their consumption so that they interface the grid to import/export only the net of what they need/exceed as a community. The costs and incentives are then shared out by prorating the contribution of each peer to the total consumption and total supply (energy produced that does not need to be imported from the network) [

14,

15,

16].

Regarding explicitly market-driven P2P energy trading, the traditional approach is to negotiate energy packages (EP) of fixed or arbitrary size, ahead of time. In other words, the agreement between buyer and seller occurs in a time period prior to that of the actual consumption of the transacted energy [

17]. Depending on whether buyer and/or seller have the corresponding ESS to store the energy before its consumption, the physical transfer of the energy between them can occur immediately after the trade or at a later instant, exactly when the consumption is supposed be done. When no one has an ESS, the seller negotiates the transfer of an energy package that has not yet been physically generated, and the buyer negotiates the purchase of an energy package that is expected to be consumed. In either case, any divergence between the forecasts and the actual values (of generation and/or consumption) would cause a breach of the agreed transaction, with the corresponding power imbalance for the grid.

Only a few works have addressed the inherent uncertainty in residential eP2P trading due to the stochastic nature of renewable generation and electricity consumption. Liu et al. [

18] propose an intraday hour-ahead P2P market (as an additional alternative to demand side management) to trade the imbalances of the day-ahead peer-to-grid market. Another solution, proposed by Zhang et al. [

19], consists on trading energy and uncertainty jointly, so that PV owners sell electricity to consumers and consumers with flexible loads sell regulating capacity to PV owners. Both previous approaches mitigate but do not eliminate the effect of uncertainties, as they might still affect the smaller EP traded in intraday markets, or the flexibility used as adjustable capacity. An alternative form, presented by the authors of this paper in [

20], is to commercialise power quotas (PQ) either for supply or demand, that are negotiated (and adapted) in real time. In this way, only real surpluses and deficits are traded at any given time, and uncertainties do not affect market operations. However, real-time markets are often characterized by greater price volatility than time-ahead markets, precisely because of their uncertainty. Furthermore, the existence of ESS on the seller’s and buyer’s side allows the transfer of energy ahead of consumption, extending market time, monetisation possibilities and the rate of renewable energy used.

Therefore, this paper proposes the coexistence of two parallel markets for residential eP2P trading. In the first one, already stored energy packages are matched with available storage capacity ahead of time, so that transfer breaches can not occur. In the second one, power quotas are negotiated in real time, tackling uncertainty through real time adaptation of transferred power. Those agents who do not have an ESS can still benefit from the time-ahead market and use the real-time market as a regulation mechanism in case of imbalances.

The remaining of the paper is organised as follows. The structures of the two markets are introduced in (

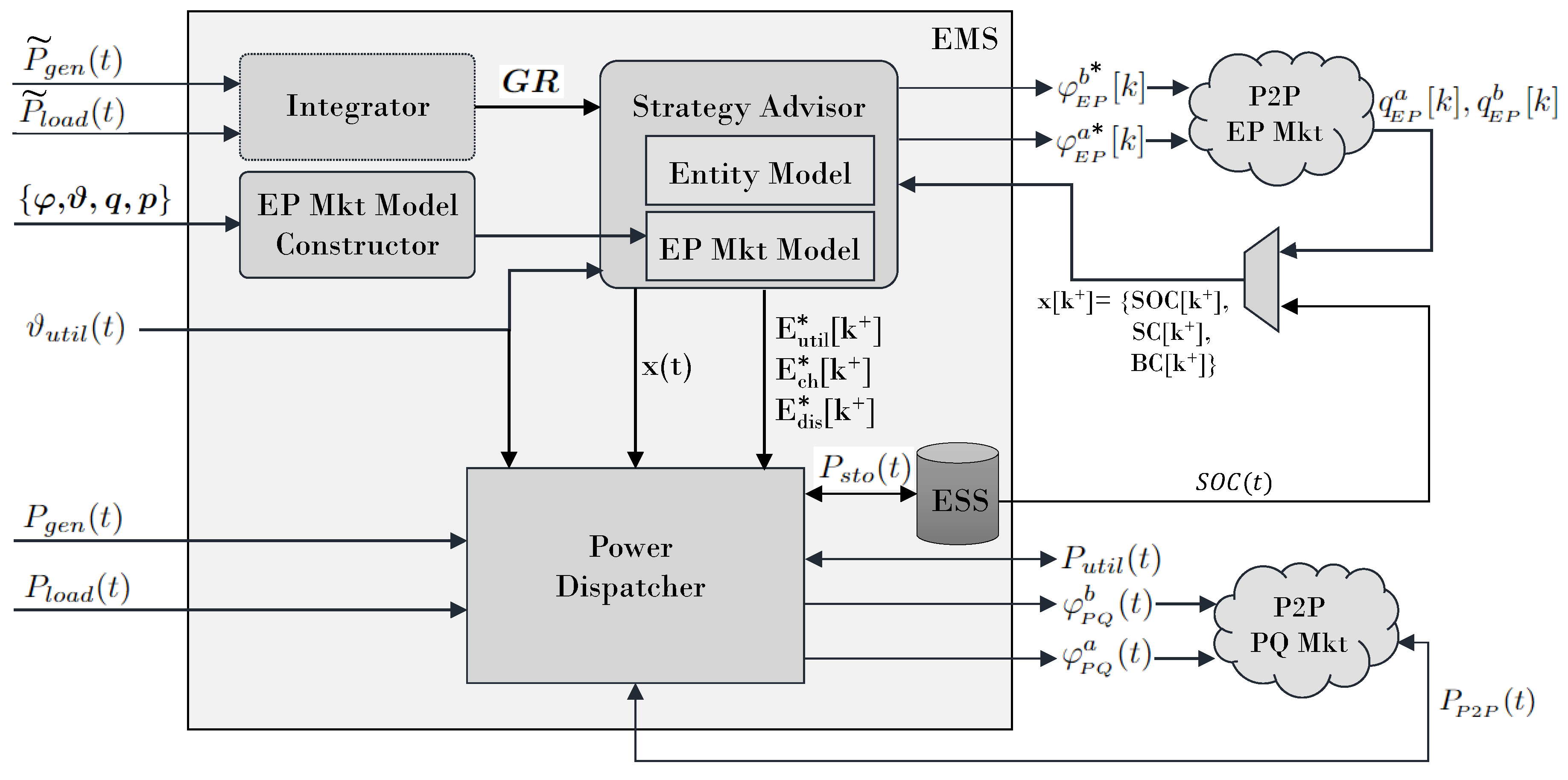

Section 2). An energy management system (EMS) allowing simultaneous participation in both markets is presented in (

Section 3 and

Section 5).

Section 4 derives two control formulations that simultaneously optimize participation in each market, one being stochastic and the other deterministic. The two control structures are simulated on an example case (

Section 6) to analyze their different effect on the operating result of the peers, which are discussed in

Section 7.

2. Integrated Energy Packages and Power Quotas Markets

A double auction (DA) based market [

21] is a trading institution in which both buyers and sellers can raise and modify their respective offers to buy (bids) and offers to sell (asks). In a discrete-time double auction (DDA), the change in allocation of goods or market clearing occurs at one or more fixed time instants between the start of the auction and the end of the trading period. Traders must place their bids and asks before each clearing instant, and both set of offers are used to determine the supply and demand staircases for commodities. The equilibrium point sets the (uniform) trading price, and thus the surpluses, for all the trades within that trading period.

In a continuous double auction (CDA), in contrast, buyers and sellers can individually choose to accept a bid or ask at any particular price (discriminatory price) at any point in time, and then update their allocation immediately.

In general, various forms of energy trading can coexist, associated with both continuous and discrete double auction structures. In our specific case, we propose the coexistence of a market for the trading of energy packages, based on a DDA, with another market for the trading of power quotas, based on a CDA.

The discrete market acts as a futures market. According to the Investopedia, a futures market is an auction market in which participants buy and sell commodity and futures contracts for delivery on a specified future date. Futures are exchange-traded derivatives contracts that lock in future delivery of a commodity or security at a price set at present time. Those agents who expect to have more consumption than generation, try to balance this expected deficit through the purchase of energy packages of adequate size in advance. Those agents who have a certain amount of stored energy, and who expect to have more generation than consumption, try to make the surplus profitable through the sale of energy packages. The EMS uses the power quota market as an alternative for continuous time compensation for possible errors in operational predictions. Even if energy packages have been purchased in advance to compensate for an expected deficit, an agent may find itself in an energy deficit situation if predictions fail (i.e., if its actual consumption is higher than expected, or if actual generation is lower than expected). Alternatively, those agents who did not expect to have a surplus can effectively experience it if their consumption is lower than expected or their production is higher than expected. In these cases, they can choose to store the surplus in their ESS, or sell it on the continuous market. In any case, it is assumed that all agents are individually rational (IR): deficit agents only buy in the P2P continuous market if the purchase price is lower than that offered by the energy retailer company; surplus agents only sell in the P2P continuous market if the sale price is higher than the utility they expect to obtain for the consumption of that energy in the future.

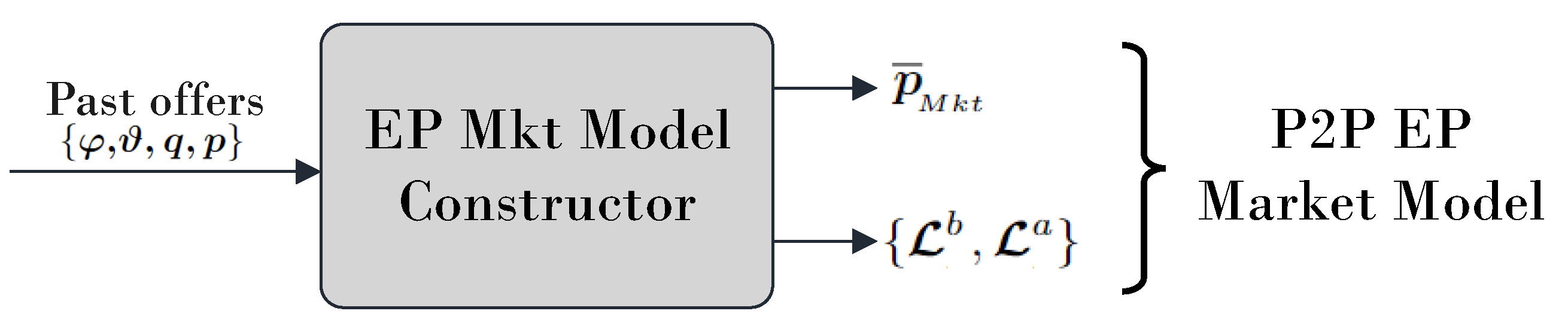

4. A Strategy Advisor Based on Model Predictive Control

The main objective of the Strategy Advisor is to meet the projected energy demand along the prediction horizon and to do so at the lowest possible cost. To this end, taking into account the existence and availability of the two markets, it generates an optimal dispatch plan that controls the energy flows for each of the sources that the entity has available. The vector of controllable variables is

. Its components correspond to the following energy quantities:

is the amount of energy to be consumed from the utility during the

i-th period;

and

respectively correspond to the amount of energy to be charged or discharged from the ESS during

i-th period;

is the amount of energy that the entity intends to buy at the

i-th period, which will be bid in the market session held in

; finally,

is the amount of energy that the entity attempts to sell in the

i-th period, which will be asked in the market session held in

. Therefore, the function corresponding to the cost of energy operation of the entity along a certain prediction horizon,

N is:

where the tilde (

˜) over a variable indicates it is a random variable. By multiplying the price

by the buying liquidity complement

, the expected purchase prices of those market instants with low liquidity are artificially increased. Thus, during optimisation, agents acting as buyers will be more reluctant to plan their purchases at such market sessions. Alternatively, by multiplying the price

by the selling liquidity

, the expected selling prices of those market instants with low liquidity are artificially lowered. Thus, during optimisation, agents acting as sellers will be more reluctant to plan their sales at such market sessions.

4.1. The Expected Value Problem

The economic objective function in (

8) extends over a prediction horizon. Therefore, its elements refer to the future values of its inputs, which are the controllable variables, and to the future values of the state of the system and its outputs, which would result from the application of those inputs. Optimisation also depends on the forecast profiles of consumption, generation and prices for the two existing markets. These values, as already mentioned, are stochastic and therefore subject to uncertainty. A possible simplification consists in disregarding information on the uncertainty, taking a nominal scenario, and optimizing actions on the nominal scenario. As the common practice for defining a nominal scenario is to replace random variables by their expectation, the resulting problem is called the expected value problem, the solution of which constitutes a nominal plan [

22]. At the next decision stage, the Strategy Advisor will recompute the plan by solving an updated expected value problem on a new nominal scenario that incorporates the observations of the current stage.

In this sense, the following formulation is deterministic, as it is based on nominal consumption, production and price profiles, without taking into account the aforementioned uncertainties. Specifically, within the optimisation, the market-related random variables are replaced by their respective expectations, . Since there is no a priori statistical information available on market uncertainty, the expectation of variables in future instants is replaced by the average value of those variables in past isotemporal sessions (market sessions held at the same time period of the day but in previous days).

Thus, the optimisation problem to be solved in each

is the cost minimisation of the energy operation of the entity, which is defined by the formulation (

9)–(

23):

where

is the energy transfer capacity of the entity’s converters (i.e., the maximum amount of energy that can be injected into/drained from the grid during a single period, and

is the maximum allowable depth of discharge of the ESS. Please note that all variables are normalised with respect to the maximum storage capacity of the entity’s ESS, so that both states and control inputs are expressed in units of batteries.

Constraints (

10) and (

12) determine how the system evolves over time, while constraint (

13) imposes that the expected load must be always meet, no matter which sources are used. The following assumptions has been considered in the controller as design criteria, which affect several constraints:

- A.1.

Following the prudence concept, quantities sold on the market are immediately deducted from the SOC, even though the physical transfer has not even begun. This avoids the possibility of selling already committed energy. On the contrary, the acquired energy is not assumed as immediately incorporated, but is added over time. This prevents the optimiser from allocating energy that is expected to be acquired in a future instant but will not be available until a later future instant (constraint (

10)).

- A.2.

Once a purchase or sale agreement has been reached, the physical transfer of the energy associated with that transaction begins immediately and continues uninterruptedly until it is completed (constraints (

11) and (

12). In other words, transfers cannot be postponed.

- A.3.

Own production is dedicated primarily to self-consumption. Therefore, is not a controllable variable but a parameter computed on the basis of the forecast generation and consumption.

- A.4.

Purchasing energy from the utility for later consumption is forbidden (constraint (

18)). In other words, during periods of low tariff prices, the entity cannot acquire more energy than it needs from the utility in order to store it and consume it during periods of high tariffs.

- A.5.

In the same market session, each entity can only play one role, either buyer or seller (constraint (

20)). Given that transfers must be started immediately after they are settled, an entity with unsatisfied sales commitments cannot go to the market as a buyer (constraint (

21)); conversely, as long as it has unsatisfied buy commitments, an entity cannot go to the market as a seller (constraint (

22)).

- A.6.

In the optimisation process, the strategic advisor assumes that future offers will be fully matched in the market (i.e., the optimiser assumes that and ). Immediately after the clearing of the k-th market session, the advisor already knows the real result of the offers shouted in that period. If the offers have not been matched, the available energy differs from that assumed in the optimal strategy profile, so it may be necessary to re-run the optimiser to adjust the values of and . In any case, given that the optimiser is run before the next market session (for which the results of the immediately previous session are already available), the quantities actually offered, and , are always the optimal ones based on the actual state at any given time.

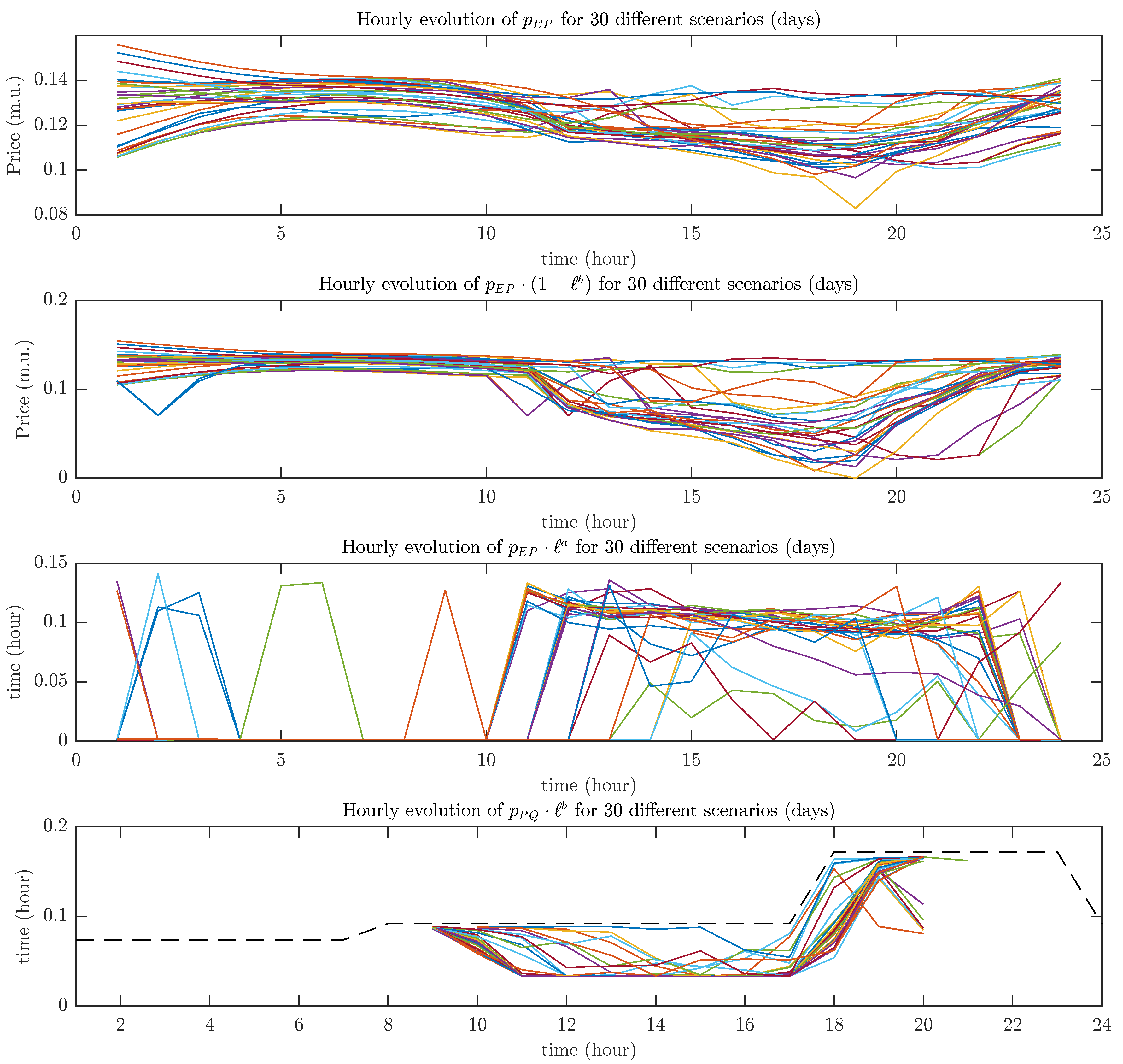

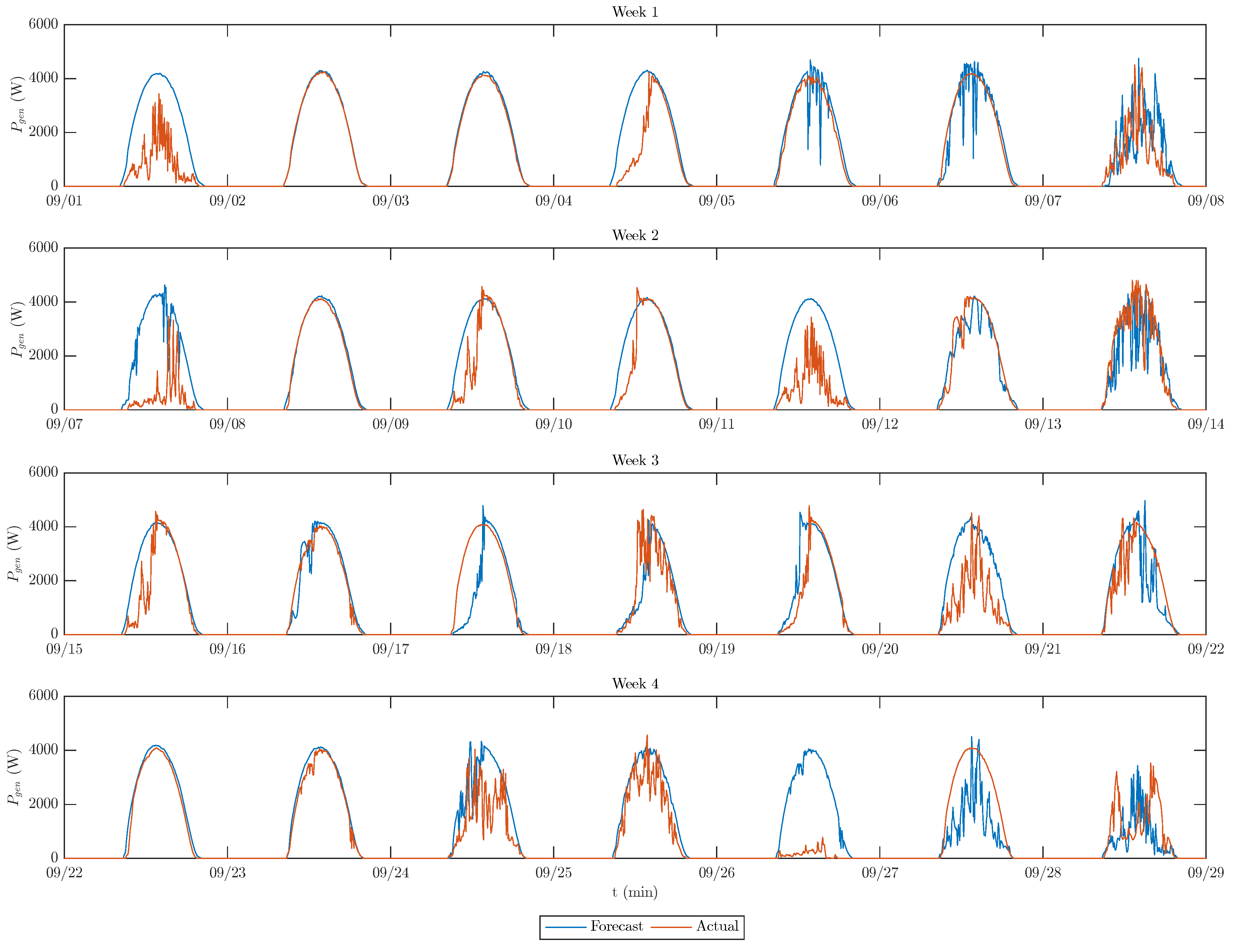

4.2. Multiple Scenarios SMPC Approach (MS-SMPC)

From the point of view of each agent, both P2P markets are considered stochastic systems, since the outputs (

) for each one of the agent’s offers might be different for the same inputs (

), depending on the offers made by the other participant agents, which are considered an unknown disturbance. Scenario-based optimisation provides an intuitive way to approach the solution to the problem of stochastic optimisation. The idea behind this approach is to compute an optimal finite-horizon input sequence that is feasible under

sampled ‘scenarios’ of the uncertainty, thus obtaining a certain level of robustness [

23]. One of the advantages of this approach is that it does not assume a prior knowledge of the statistical properties that characterise uncertainty (e.g., a certain probability distribution function) as is generally required in stochastic optimisation. Each scenario consists of values for some or all of the stochastic processes that affect the system. Furthermore, it has been widely used for performing optimal power dispatch (e.g., [

24]) and for optimal participation in energy markets [

25]. In our case, only the stochasticity of the P2P markets’ prices is proposed to be addressed. Therefore, each scenario is a full horizon sample of the prices for the two markets,

Specifically, within the optimisation, the market-related random variables , , and are replaced by their corresponding values for each scenario, , , and .

The offers that determine actual market parameters depend directly on the energy result expected by the different agents, which is given in turn by their consumption and generation forecasts. These predictions depend fundamentally on the climatology, and therefore present a significant level of correlation between consecutive days, as well as between identical days of previous years, provided that the typology of day (workable or weekend) is the same. Therefore, the approach proposed here to build the set of scenarios is to use the set of time series representing market realisations in past days (i.e., the evolution of the average prices and liquidities over similar periods of previous days). The Multiple Scenarios Stochastic MPC (MS-SMPC) problem then reads as follows:

7. Discussion

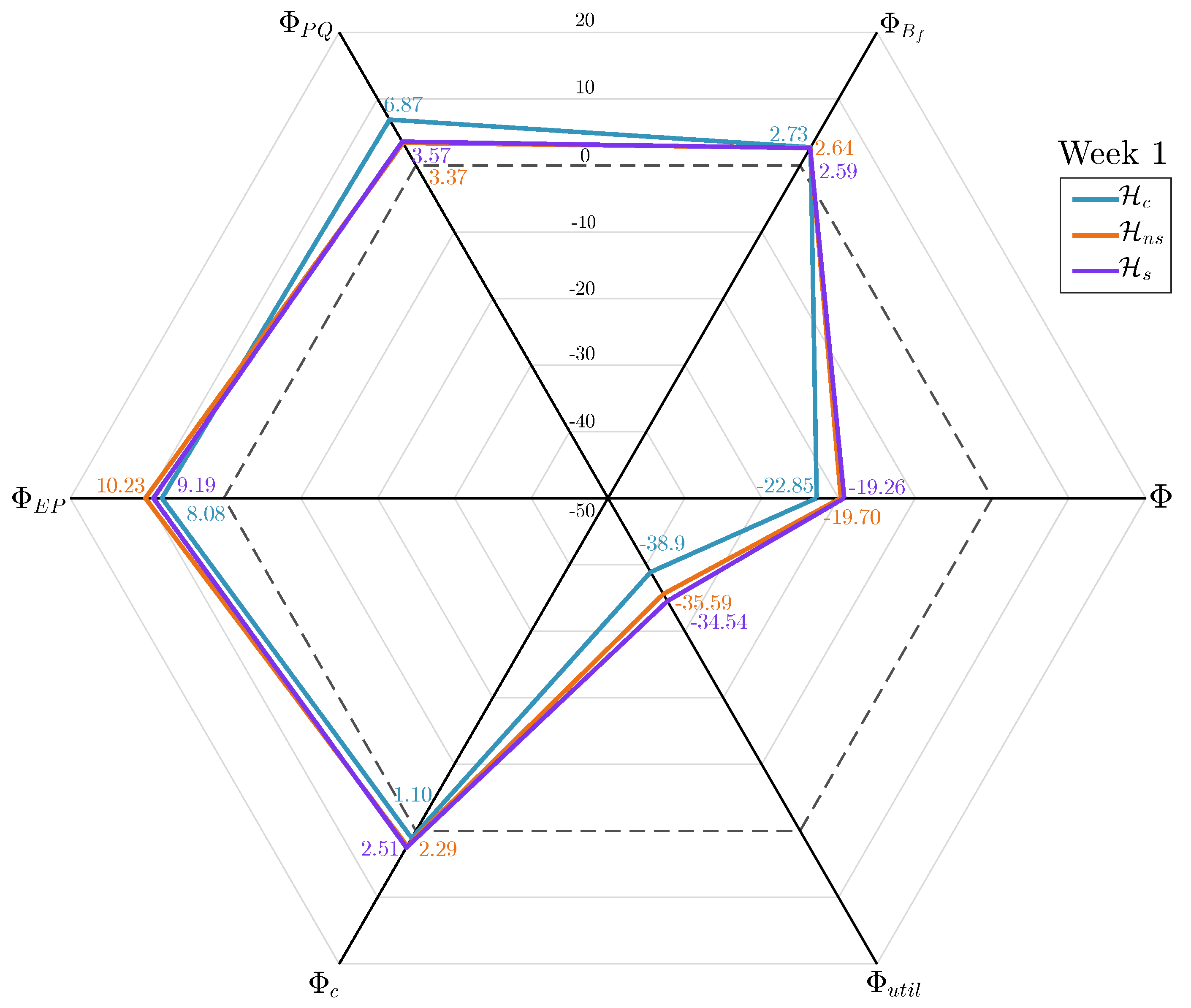

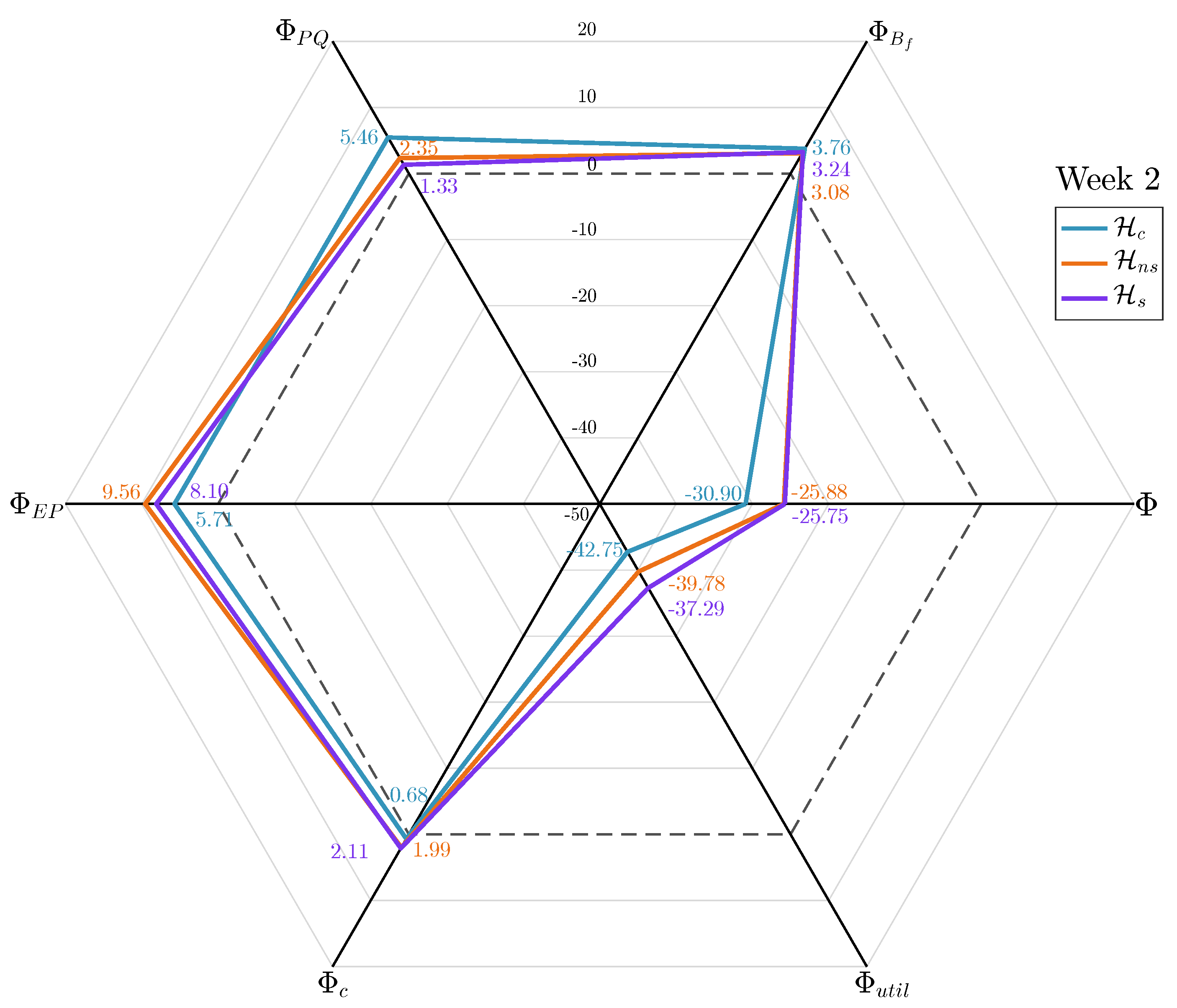

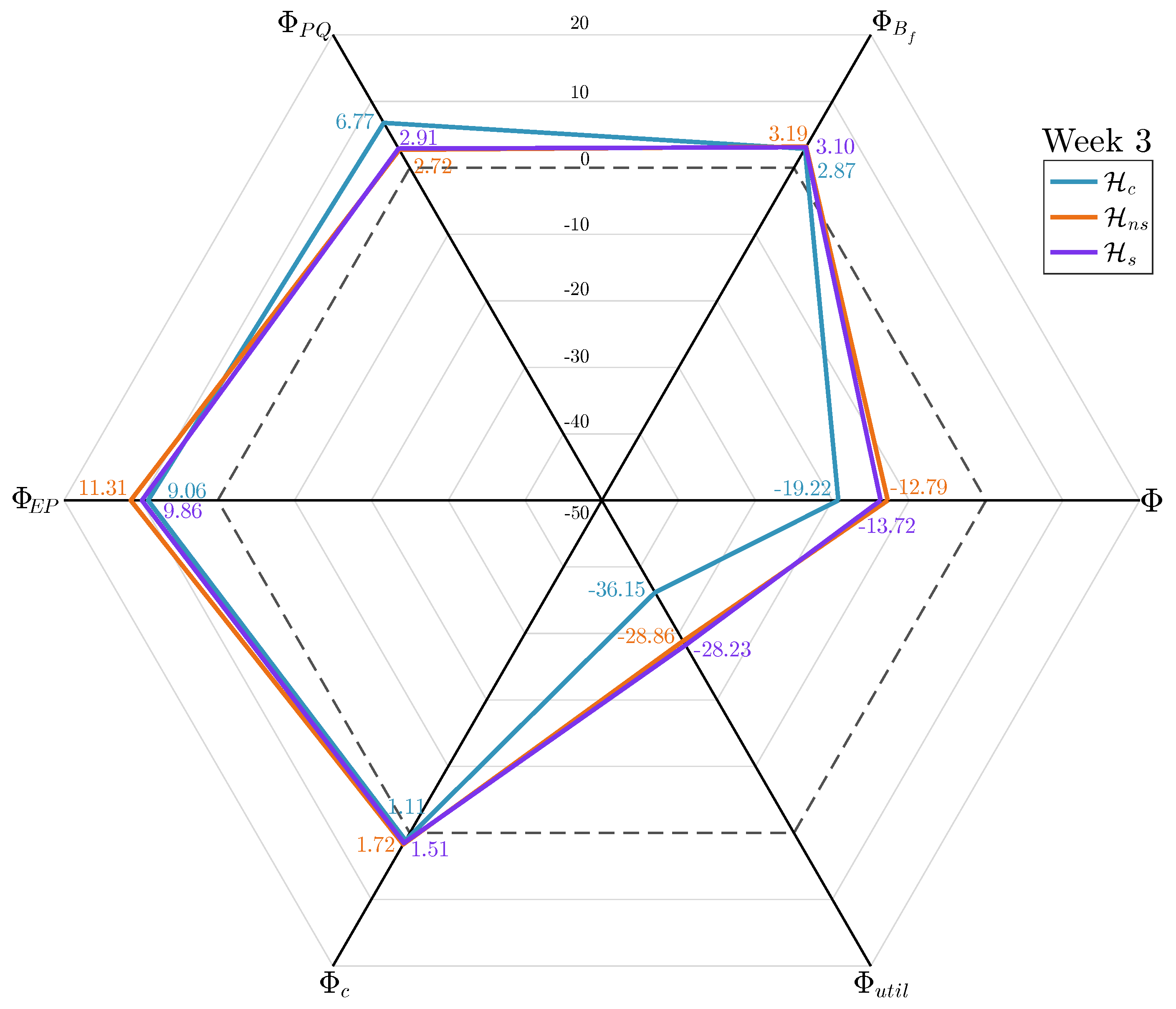

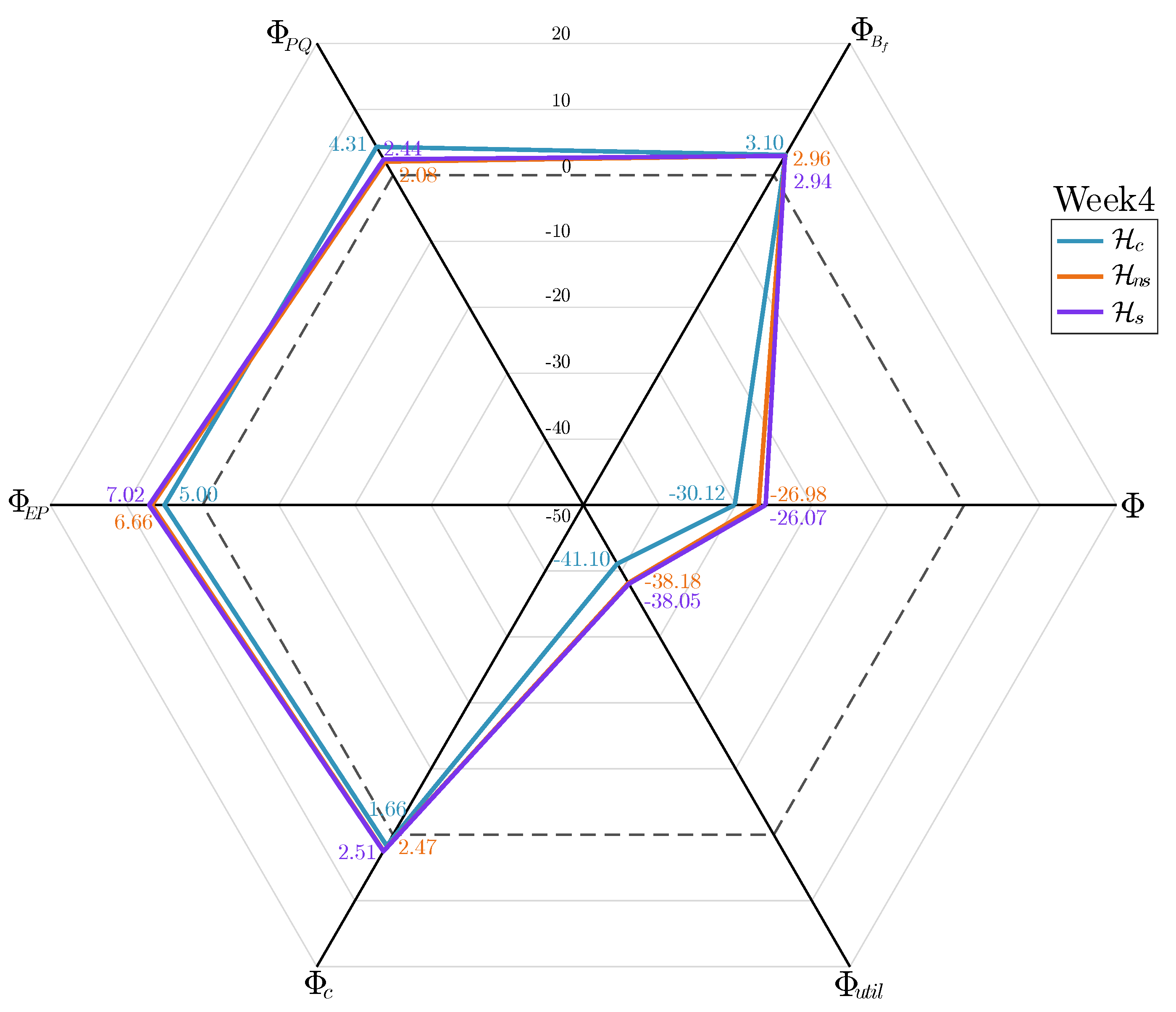

This article proposes the simultaneous participation of energy traders in two energy markets which run in parallel while being executed simultaneously. The discrete EP-Market acts as a futures market, allowing traders to purchase/sell energy packages in advance of the occurrence of a forecast deficit. The continuous PQ-Market acts as a spot market, in which power quotas are negotiated to balance deficits and excesses instantly. To allow this simultaneous participation, a specifically designed EMS is required to allow the automation of the procedures for determining private valuation, price adaptation and role selection for each of the two markets. Entities with an excess of energy generation act as sellers, and have the option of either selling as much as they can as soon as possible (in the immediately following market moments) or offering the aforementioned excess at certain future market moments where the price obtained is historically more advantageous. They must also decide on the quantities to be offered in the discrete market, taking into account that the stock sold in the time-ahead market is no longer available for sale in the real-time market. On the other hand, entities that foresee having an energy deficit (those whose expected consumption is greater than their foreseen generation) have to decide whether to try to anticipating it by obtaining energy packages in the discrete market, which is generally more expensive but less volatile, or to risk trying to cancel their deficit in the continuous market of power quotas, which is generally cheaper but less liquid. In this sense, the proposed EMS can incorporate the strategy advice functionality, consisting on the determination of the optimal energy operation profile and encompasses the storage utilisation, the energy acquisition from the power grid and the interactions foreseen in the two eP2P markets. This article proposes a possible implementation of this Strategy Advisor, based on MPC, including two variants, one based on a single nominal scenario, and the other based on SMPC, which optimises contemplating multiple scenarios. Simulations carried out on the case study show that both variants offer an improvement in economic performance of between 10% and 30% compared to the case of not using a SA. Furthermore, the MS-SMPC-based variant generally performs slightly better than the nominal variant, as it contemplates more possible market price evolution profiles (derived from different PV generation scenarios), although to state this conclusively it would be necessary to make a deeper statistical analysis which is beyond the scope of this article. These savings are mainly achieved by buying less energy from the grid and replacing it with cheaper energy, either previously bought and stored or bought instantaneously; and by selling a greater portion of the surplus energy in market sessions where the price is higher. But it’s not all advantages. This improvement is also achieved through an intensification of the use of storage systems, which could lead to a reduction in their lifespan. The translation of depreciation costs into the calculation of energy operating costs is an open issue, both in terms of the selection of the usage level indicator and in terms of the monetisation of such usage.