Abstract

Malaysia is in the process of liberalising its electricity supply industry (ESI) further, with the second reform series announced in September 2018. If everything goes as planned, Malaysia would be the third country in the Association of Southeast Asia Nations (ASEAN) to have a fully liberalised ESI after the Philippines and Singapore. A number of initiatives have been in the pipeline to be executed and a lot more will be planned. At this juncture, it is important for Malaysia to look for the best practices and lessons that can be learnt from the experience of other countries that have successfully liberalised their ESIs. Being in the same region, it is believed that there is a lot that Malaysia can learn from the Philippines and Singapore. This paper therefore presents and deliberates on the chronological development of the countries’ progressive journeys in liberalising their ESIs. The aim is to discern the good practices, the challenges as well as the lessons learnt from these transformations. Analysis is being made and discussed from the following four perspectives; legislative framework, implementation phases, market components and impact on renewable energy penetration. Findings from this study would provide useful insight for Malaysia in determining the course of actions to be taken to reform its ESI. Beyond Malaysia, the findings can also serve as the reference for the other ASEAN countries in moving towards liberalising their ESIs.

1. Introduction

Like most other countries, the electricity supply industry (ESI) in Malaysia started rather spontaneously, driven by the need of individual enterprises to electrify their businesses. Natural monopoly began in 1982 after the private and state owned electricity supply companies are consolidated under the National Electricity Board (NEB). Subsequently, NEB became the sole state-owned body that ‘monopolised’ the supply of electricity to the whole of peninsular Malaysia, having the transmission lines that stretched over 6300 km and close to two million customers at the time [1]. In a monopolised or vertically integrated ESI, the operations of generation, transmission and distribution of electricity are owned and managed by one giant utility company as an entity or together with a number of other companies related to it. Thus, competition is almost non-existent. On the contrary, a liberalised or ‘open’ ESI provides opportunities for other players in the industry to participate in the business. It therefore promotes competition, which often translates into efficiency that results from improved operation, management, customer services et cetera. A liberalised ESI also facilitates the creation of regional electricity market where electricity is traded between a number of nearby countries. Such regional electricity market does not exist yet in the Association of Southeast Asia Nations (ASEAN) region, although the intention is there and is not new. The ASEAN Power Grid (APG) initiative was mandated in December 1997 with the aim to enhance regional energy sustainability, security and reliability [2]. According to the plan, the construction of the APG would begin with a regional power interconnection on cross-border bilateral terms, which then expands to sub-regional basis towards a totally integrated South East Asia power grid system. More than twenty years after the mandate, the envisioned APG is still very much a work-in-progress [2]. While the physical interconnection of the grids is mostly ready, the electricity trading between the countries is not [3]. The latter is currently done through bilateral power purchase agreements between the bordering countries. In comparison, the Nord Pool, which started the similar initiative at about the same time, has been thriving successfully and even regarded as the most robust, efficient and harmonised regional electricity market [4,5]. The success is largely attributed to, and made possible by, the region’s move to liberalise their ESIs. With ESI liberalisation, efficiency is attained through means such as increased competition in the market that leads to improved operations [6], which can result in the elimination of unnecessary overhead supply (reserve margin) in the monopolised markets [7]. This allows for the capital resources to be utilised more effectively. Liberalised ESIs also promote the creation of pooled energy sources that allows for more efficient use of electricity through increased consumers’ response to prices [8]. Greater interconnections have also allowed for increased energy security [9]. In terms of governance, liberalisation has significantly improved the governance of monopoly utilities, the prospects for competition and innovation, and the quality of policy instruments for environmental emissions control [10].

Thus far, there are only two ASEAN countries that have liberalised their ESIs fully and have their own electricity markets; the Philippines and Singapore. Bearing differences in terms of geographical condition, economic development status, total population et cetera, both countries have undergone different experience in liberalising the ESIs. While it has been a ‘bumpy ride’ for the Philippines, Singapore experiences a smoother transition. Malaysia is expected to be the next ASEAN country to go for full ESI liberalisation. In September 2018 [11], the Malaysia electricity supply industry (MESI) started the second series of its reform, MESI 2.0, where opening the electricity market further is put forth as one of the main agenda. To address the stated MESI 2.0 objectives, recommendations have been made for Malaysia to consider unbundling of its ESI, using the achievements of the countries in the Nordic as comparison [12]. However, emulating the Nordic countries might not be the best option due to the vast differences between the two regions in many aspects. The two countries in the Southeast Asia region that have already attained full ESI liberalisation would be more relevant for Malaysia to look at. This article therefore presents the chronological review of the Philippines’ and Singapore’s ESIs transformation towards liberalisation with the aim to identify the good practices, the challenges as well as the lessons learnt from their experience. In particular, the review focuses on the following perspectives.

- The regulatory framework and institutional bodies to institute reform.

- The phases of reform implementation.

- The components that constitute the wholesale electricity market.

- The impact of ESI liberalisation on the renewable energy (RE) penetration.

The first three are essential to be considered right from the beginning of a reform move while the RE penetration is included in the scope because Malaysia has clearly set its RE targets. Thus, it is relevant to identify the extent to which ESI liberalisation is able to help achieve the targets. The required information is obtained from the published research work, technical reports, newspaper clips and online communication with the relevant authorities. Analysis results conclude on the significant role played by the enacted legislative framework that is subsequently followed by the formation of the institutional bodies and agencies with sufficient authorities to instate the ESI reform. It is also found that gradual yet clearly defined phases of reform with explicit activities and targets are important to ensure its smooth implementation. Despite the differences in market operations, common components that constitute an electricity market can be identified. However, no significant impact is seen on the amount of RE penetration into the grids as a result of the liberalisation. Beyond Malaysia, the recommendations can potentially be considered for use by the other ASEAN countries too. This is especially necessary when a review of the reform experiences of the countries found a significant disparity between the expected and actual outcomes [13].

The rest of this article is organised into the following sections. Section 2 and Section 3 elaborate on the Philippines’ and Singapore’s ESI reform journeys respectively. Analysis, lessons learnt and policy implications are presented in Section 4. Section 5 concludes the article and points to potential future work and outlook.

2. ESI Liberalisation in the Philippines

Liberalisation of the Philippines’ ESI began in 2001. Prior to the liberalisation, the state-owned monopoly National Power Corporation (NPC) was the vertically integrated power utility engaged in the production, transmission and distribution of electricity and used to be the largest provider and generator of electricity in the Philippines. The efforts towards energy restructuring in the Philippines started to materialise with the change in government in 1986. The Energy Regulatory Board (ERB) constituted in 1987 assumed the responsibility to regulate the energy sector, overseeing the power rates and services of the private electric utilities in the country. The year 1988 saw the beginning of independent power producers (IPPs) in response to an executive order from the then President, driven by the need to address the looming electricity shortages in the island [14]. By 1994, more than 40 IPP contracts were accumulated, a number that is more than any other developing countries [15]. Table 1 shows the current generation market share in the Philippines. The Asian financial crisis in 1997 led to the Philippines having the second highest electricity prices in the world that was putting more pressure for reform. Thus, a more serious move towards deregulation of the industry began in 2001, when the Republic Act 9136, known as the Electric Power Industry Reform Act (EPIRA) was enacted after almost eight years on the table. It was regarded as the most comprehensive piece of legislation of its kind in Asia by the Asian Development Bank. Being comprehensive, it is also the most complicated with the involvement of many parties [16]. The EPIRA called for the following [17].

Table 1.

Key generation players’ share in the Philippines [18].

- Creation of the National Transmission Company (TransCo) to assume the transmission function of the NPC.

- Privatisation of NPC assets, including the newly created TransCo.

- Creation of an independent, quasi-judicial entity called the Energy Regulatory Commission (ERC) to ensure a transparent, competitive, and reliable electricity market.

TransCo was created immediately in the same year and started operating and managing the power transmission system that links power plants to the electricity distribution utilities nationwide in 2003. The ERC, an independent, quasi-judicial regulatory body that promotes competition, encourages market development, ensures customer choice and penalises abuse of market power, replaced the ERB. The EPIRA also resulted in the creation of the Power Sector Assets and Liabilities Management (PSALM) Corporation in 2001, a wholly-owned and -controlled government entity to take over the ownership of all existing generation assets of the NPC, IPP contracts, real estate, and all other disposable assets including the transmission assets of the TransCo. By the same token, PSALM assumed all outstanding obligations of NPC arising from loans, issuance of bonds, securities, and other instruments of indebtedness. The principal purpose of PSALM is to manage the orderly sale and privatisation of these assets with the objective of optimally liquidating all of the NPC’s financial obligations. The Small Power Utilities Group (SPUG), which provides electricity to the off-grid customers and has been in existence since 1996, was put under the NPC and will absorb the remaining unsold assets of the NPC. Under this new structure, the Philippines’ ESI is constituted of the following key players [19].

- DOE: Government agency in charge of planning and policy making for the electricity sector. EPIRA mandated DOE to organise and establish the appropriate market design and governance structure of the Wholesale Electricity Spot Market (WESM) and supervise the restructuring of the electricity industry.

- ERC: Regulates natural monopolies (distribution and transmission wires business), issues generation and supply licenses, oversees competition in the power market and enforces the implementing rules and regulations of the EPIRA.

- PSALM: Government-owned and controlled corporation that manages the orderly sale, disposition, and privatisation of NPC generation and other disposable assets, and its IPP contracts; as well as optimally liquidate all the NPC’s financial obligations and stranded contract costs.

- PEMC: Non-stock, nonprofit and non-independent corporation established by the DOE to perform the market operator (MO) functions in the WESM.

- NPC: State-owned and responsible for the missionary electrification function for the government in areas that are not connected to the main grids through the SPUG, manage watershed areas supporting power plants, manage dams nationwide and coordinate with all stakeholders to ensure safety of its communities and environs, and manage undisposed power generating assets.

- TransCo: Provides and maintains the physical infrastructure (transmission network and associated facilities) necessary to transport electricity.

- National Grid Corporation of the Philippines (NGCP): Private sector concessionaire that is operating the national transmission system.

- National Electrification Administration (NEA): Government agency mandated to develop and implement programs to prepare and strengthen electric cooperatives for the deregulated electricity market.

The EPIRA also mandated the WESM to be established within one year of the Act. As a result, rules and regulation with regards to the conduct of the WESM were announced in 2002. In November 2003, the Philippine Electricity Market Corporation (PEMC) was incorporated as a non-stock, non-profit corporation tasked to establish and govern an efficient, competitive, transparent, and reliable market for the wholesale purchase of electricity and ancillary services. In August the following year, PEMC was designated as the MO to undertake the preparations for and the initial operations of the WESM until an independent market operator (IMO) is established and ready to take it over. The system operator (SO), TransCo, is responsible for operating the power system in accordance with the WESM Rules, Grid Code or any instruction from the MO or the ERC to ensure security and reliability of the power system. On 28 February 2008, NGCP was granted the right to take over and operate the whole of TransCo’s regulated transmission business while the ownership of all transmission assets and related real properties remained with TransCo. A congressional franchise to operate the transmission network was granted to NGCP on 8 December 2008.

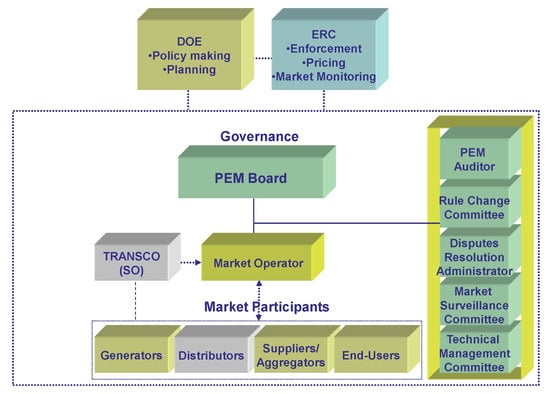

Figure 1 shows the governance of the Philippines’ WESM. From the figure, it can be seen that there are four trading participants in WESM; generators (GenCo), distribution utilities (DU), retail electricity suppliers (RES) and directly connected customers (DCC) [20]. GenCos are at the supply side, comprising the privatised GenCos and the IPPs. As at April 2018, there were 113 generation companies in the Luzon-Visayas grid alone and all of them are WESM participants [21]. At the demand side, there are DUs, RESs and DCCs. DUs are responsible to provide open and non-discriminatory access to its system and provide wheeling services to the end users (captive customers (Monthly usage of less than 750 kW)) within its franchise area. Suppliers/aggregators engage in the supply of electricity to the contestable customers (Monthly usage of at least 750 kW) after securing an RES license from the ERC. They are allowed to supply electricity to the contestable customers within a contiguous area. The DCCs are industrial or bulk electricity customers who are connected to the transmission grid and directly supplied with electricity by a GenCo, PSALM or NPC [22]. The respective functions of the MO, SO and WESM participants are summarised in Table 2.

Figure 1.

Wholesale Electricity Spot Market (WESM) governance.

Table 2.

Key players in WESM.

After several months of trial operations, the WESM commenced commercial operations in the Luzon grid on 26 June 2006. Four years into the commercial operations in Luzon, the Visayas grid was integrated into the WESM and commenced commercial operations on 26 December 2010. In June 2017, WESM in Mindanao was officially launched but until now, it is yet to begin its commercial operation. It was expected to be commercially operational in January 2020, after a number of revisions. However, in a more recent news, further delay is expected [23]. Beginning 26 September 2018, the Independent Electricity Market Operator of the Philippines, Inc. (IEMOP) becomes the operator of the electricity market to manage the registration of market participants, receive generation offers, come out with market prices and dispatch schedules of the generation plants, and handle billing, settlement, and collections, among other functions [24]. This is an important milestone towards more independent and transparent operation of the WESM.

At the retail market level, the EPIRA also provides for the implementation of the retail competition and open access (RCOA) upon the fulfilment of the five pre-conditions, which were achieved in 2011 [25]. Thus, the RCOA was launched in June 2013 for contestable customers. The threshold for customer contestability began with 1 MW, which means that consumers whose power usage reach a monthly average of at least 1 MW are required to choose and buy their electricity from the retail electricity suppliers (RES). The threshold for contestability is gradually decreased. In May 2016, customers with an average monthly peak demand of at least 750 kW are mandated to enter into a retail electricity contract with a RES by June 2017. If it is not due to the temporary restraining order (TRO) by the Supreme Court resulting from the petition submitted by a few contestable customers [26,27], the contestability level would have been lowered further to include customers with an average peak demand between 500 kW and 749 kW [28]. At the time of writing, the high court has yet to lift its order. The number of customers enrolled in the open access scheme of the electricity retail market, as reported by the PEMC, reached 940 in November 2017 [26], nearly four times the number of contestable customers when it was launched in 2013. From the 940 customers, 862 are contestable customers with an average monthly peak demand of 1 MW and 78 with an average monthly peak demand of between 750 kW and 999 kW. This represents 23% of the energy share in the market, while DUs and bulk users have the remaining 77%. As at December 2019, there is a total of 1408 contestable customers from Luzon (1264) and Visayas (144) regions [29]. There are also 33 licensed RES, 25 local RES and 44 Supplier of Last Resort (SOLR) in the RCOA system. Table 3 shows the retail electricity market concentration of the Philippines. SOLR is an entity that provides last resort supply to contestable customers who suddenly find themselves without a RES. In spite of the TRO, more and more contestable customers who were earlier issued certificates of contestability by the ERC are opting to voluntarily migrate. The remaining customers, know as the captive customers, continue to be served by the DUs in respective areas.

Table 3.

Retailers’ market share in the Philippines based on the number of contestable customers [29].

Concerning RE, the Philippines has set to triple the RE capacity than that achieved in 2017 to 15,304 MW by the end of 2030 [30]. In the Philippines, RE is traded separately in WESM. The Renewable Energy Act (R. A. 9513) or the RE Act provides for the establishment of the RE Market (REM). Pursuant to Section 8 of the RE Act, the DOE shall establish the REM and shall direct the PEMC to incorporate changes to the WESM to accommodate RE trading. The Philippines Renewable Energy Market System (PREMS), a platform to facilitate market competitiveness, efficiency, and transparency in the trading of RE certificates (REC) based on the REM Rules should have been in operation by now [31]. DUs have also been mandated to source a minimum portion of energy from renewable sources to guarantee a market for RE generators. Beginning with 1% in 2020, this portion will be increased on a yearly basis and this will be monitored via PREMS.

3. ESI Liberalisation in Singapore

Beginning 1995, the Singapore’s ESI has been progressively liberalised and restructured. A regulatory framework is established, the generation and retail markets are opened up to the commercial players, and a wholesale electricity market is introduced. The aim was to gradually introduce competition in electricity generation and retail such that Singapore would have an electricity market that allows the investment, production and pricing decisions to be driven by market forces rather than central planning. The phases of liberalisation can be divided into four; corporatisation from 1995 to 1998, regulatory infrastructure from 1998 to 2001, privatisation and divestment from 2001 to 2009 and full market contestability from 2009 until now [32]. The first (reform) move began in 1995 when the government decided to corporatise the Public Utilities Board (PUB), who were in charge of the supply of water, electricity and piped gas. Under this first move, the electricity and gas undertakings of the PUB were put under the government’s investment arm, Temasek Holdings (TH). Under TH, Singapore Power (SP), which at the time was a vertically integrated monopoly wholly owned by the government, was created as the holding company for several new companies including PowerSenoko (now known as Senoko Energy), PowerSeraya, PowerGrid (now known as SP PowerAssets) and Power Supply (now known as SP Services). SP then took over the electricity and piped gas functions from the PUB, and the electricity generation, transmission, distribution, wholesale and retail became the responsibility of the SP. To undertake the responsibility, the companies under SP above were put in charge of the different segments of the ESI. Generation was put under PowerSenoko, PowerSeraya and Tuas Power (now known as Tuas Power Generation, a generation company that was set up as an independent company directly under TH). Power Grid was in charge of the transmission and distribution, and Power Supply, the electricity supply and utilities support services company, became the sole retailer. PUB was reconstituted to continue to supply water and undertake the new role of regulating the electricity and piped gas industries as a result.

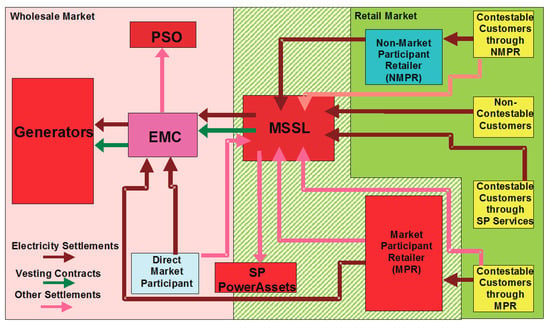

Moving on, the Singapore Electricity Pool (SEP) was launched in 1998. It was a day-ahead market with PowerGrid as the system operator and pool administrator. Singapore thus became the first ASEAN country to have the wholesale electricity trading market. At the time, Power Supply was the only buyer in the SEP where the three power generation companies above and a government-owned waste incineration plant competed to sell electricity in the market. Electricity tariffs were unbundled at the same time, making Singapore’s ESI to be the most liberalised in ASEAN by the late 1990s. Comprehensive review done by the government in 1999 resulted in the decision to liberalise the electricity market further being made in March 2000. The Electricity Act (Chap. 89A) was enacted in 2001, with the aim to create a competitive market framework for the electricity industry and provide safety, technical and economic regulation of the generation, transmission, supply and use of electricity. With it, the Energy Market Authority (EMA) of the Singapore Act (Chap. 92B) was also enacted to establish and incorporate the EMA of Singapore, to provide for its functions and powers. Consequently, the Energy Market Authority (EMA) was set up in 2001 as statutory board under the Ministry of Trade and Industry to regulate the energy market including electricity and gas industries. EMA’s main goals are to ensure a reliable and secure energy supply, promote effective competition in the energy market and develop a dynamic energy sector in Singapore [33]. With the EMA now regulating the ESI, PUB is further restructured to become the sole water authority under the Ministry of the Environment effective 1 April 2001. A division under the EMA undertakes the responsibility as the power system operator (PSO) to ensure secure operation of the power system. PowerGrid therefore only operates and maintains the transmission and distribution grid. A new company, the Energy Market Company Pte Ltd (EMC), a joint venture between EMA and M-co Pte Ltd from New Zealand, was established to undertake the responsibility for the operation and administration of the wholesale electricity market. The SEP lasted until December 2002. Beginning 1 January 2003, the New Electricity Market of Singapore (NEMS) took over its role. It represents a progression from the pool to fully competitive wholesale and retail electricity markets. Similar to the WESM in the Philippines, there is a total of eight key players in NEMS [33] as shown in Figure 2; EMA, EMC, PSO, transmission licensee (SP Power Assets), market support services licensee (MSSL) (SP Services), generators, retailers and consumers (contestable and non-contestable). Their respective descriptions are shown in Table 4.

Figure 2.

New Electricity Market of Singapore (NEMS) governance [33].

Table 4.

Key players in NEMS.

Starting July 2001, EMA has gradually opened the retail electricity market to competition to provide business consumers with more options to manage their electricity cost, beginning with those with maximum power requirement of 2 MW. They become known as ‘contestable consumers’ and at this stage of partial liberalisation, contestable consumers were able to purchase power from either retailers at a price plan that best meet their needs, or from the wholesale electricity market at the half-hourly wholesale electricity prices, or from the MSSL. In June 2003 and December 2003, the thresholds were lowered to customers having average monthly consumption of 20,000 kWh and 10,000 kWh respectively [34], down to 8000 kWh in 2004, to 4000 kWh in 2014 and 2000 kWh in 2015 [35,36]. The non-contestable consumers, mainly households and small businesses, buy electricity at the regulated tariff from the SP Services, the designated public electricity supplier that sells electricity to the non-contestable customers. Since 1 April 2018, EMA commenced the soft launch of open electricity market, where households and businesses in Jurong can choose to buy electricity from a retailer at a price plan that best meets their needs. From 1 November 2018, the open electricity market is extended to all consumers across Singapore by zones. This initiative provides about 1.4 million households and business accounts with more choice and flexibility when buying electricity, while being provided with the same electricity supply through the national power grid. Consumers who wish to remain with the SP Services and buy electricity at the regulated tariff can choose to do so. The switching is not compulsory and there is no deadline for switching. Transmission and distribution of the electricity is still owned and operated by the PowerGrid, and the prices remain regulated. Table 5 and Table 6 shows the concentration in Singapore’s generation and retail markets respectively Information obtained from https://www.ema.gov.sg/Statistics.aspx).

Table 5.

Key generation players’ share in Singapore.

Table 6.

Retailers’ market share in the Singapore.

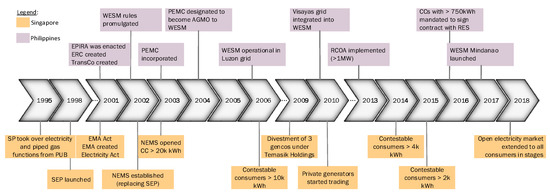

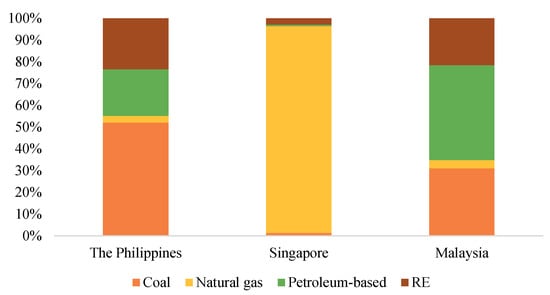

With regards to RE, Singapore aims to achieve up to 350 MW by 2020 and 2 GWp by 2030 of installed solar capacity, the latter amount is sufficient to power 350,000 homes in Singapore [37]. However, RE prospect is limited in Singapore due to the limited land area. Nevertheless, efforts are made to source the RE from the neighbouring countries including Laos using blockchain-enabled market place for RE [38]. Both the Philippines and Singapore are relying largely on fossil fuel to generate electricity namely coal, natural gas and petroleum-based. Singapore has only about 3% of RE share due to the limited renewable energy options other than solar. Hydro resource is not available, wind speeds and mean tidal range are low, and geothermal energy is not economically viable. Figure 3 summarises the transitions towards liberalisation that the Philippines and Singapore have gone through.

Figure 3.

Timeline for the electricity market reform in the Philippines and Singapore.

4. Analysis and Discussion

Taking into consideration the stark contrast between the two countries in many aspects, including geography and demography, the success of the Philippines and Singapore in liberalising their ESIs is worthy of study. Table 1 shows some of the differences. In terms of the country size, vast difference can be seen between the two countries, even though both are islands. The Philippines is an archipelago of more than 7000 islands clustered into three major island groups, Luzon, Visayas and Mindanao. On the other hand, Singapore is a tiny island and the smallest country in ASEAN with a total size of 716 square kilometres (km). The country size is in itself posing different kinds of challenge to both countries in reforming their ESIs. It translates into the difference in terms of the population size, with the Philippines having 165 times more than Singapore. However, looking into the population density, Singapore is way more populous with 8358 people per square kilometre compared to just 363 overall in the Philippines. This serves as an indication of the economic growth of the countries, where Singapore is more advanced in terms of the economy in spite of the lower population and smaller size. As can be seen from Table 7, Singapore has the highest GDP growth of 7.1% in 2018 and has the highest GDP of USD 364 billion. Singapore has also been enjoying 100% electrification rate since at least 1990, while the Philippines is continuously working to improve access to electricity, which currently stands at 93% and brownouts are still common. Consequent to these, the electricity consumption in Singapore is more than half of the Philippines’, so does its installed capacity. Additionally, in Table 7, information about Malaysia is also included. As can be seen from the table, Malaysia sits between the two countries in most of the attributes included for comparison, which provides a good starting point for the discussion on the prospect of ESI liberalisation in Malaysia. Representing the two extreme conditions, the Philippines’ and Singapore’s success in attaining full liberalisation of their ESIs can serve as the motivation for Malaysia and other ASEAN countries to follow suit. In the following subsections, analysis and discussion with respect to the four perspectives mentioned in Section 1 are presented.

Table 7.

Selected demographic information of the Philippines and Singapore.

4.1. Regulatory Framework and Institutional Bodies

Apparent from the experience of both countries is the defining role of the legislative framework that subsequently entails the setting up of the regulatory and institutional bodies to enforce reform. The legislation must be enacted, and the established regulatory and institutional bodies must be given the authority they need to execute the transformation. The Philippines began to see the progress towards ESI liberalisation after the enactment of the EPIRA. Actions can be seen taken involving the revision and redefinition of the existing agencies’ scope of work and the establishment of the new ones to undertake the various tasks to reform. Similarly, Singapore’s more serious move towards liberalisation started with the enactment of the Electricity Act (Chapter 89A) that was followed by the EMA Act (Chapter 92B) to define the scope of work to be done and by whom. Furthermore, the authority given to the regulatory and institutional bodies has to cover the entire value chain of the ESI. For instance, the ERB of the Philippines only plays an active role in distribution rate regulation while transmission and generation (wholesale) rates are largely developed by the NPC with only minimal oversight by the ERB [39], which has led to issues in performance accountability, incentive for efficiency and financial burden on the government [39]. The legislation and institutional environment also needs to be designed in such a way that it survives the changes in the government because ESI liberalisation is not a one-off event [40,41]. Continuous development is foreseen and there probably will be no end to it [42]. Thus, it requires strong and sustained political commitment, extensive and detailed preparation, and continuous development to foster long-term investment.

In Malaysia, there is already a handful of laws and acts to govern the ESI, as listed below. Each comes with their respective regulations, orders, rules and other sub-legislation, where applicable [43].

- Electricity Supply Act (ESA) 1990

- Renewable Energy Act 2011

- Gas Supply Act 1993

- Renewable Energy Act 2011

- Environmental Quality Act 1974

- Occupational Safety and Health Act 1994

- Factories and Machinery Act 1967

- Petroleum Development Act 1974

- Petroleum (Safety Measures) Act 1984

- Petroleum and Electricity Control of Supplies Act 1974

For both MESI 1.0 and MESI 2.0 reforms, Malaysia Programme Office for Power Electricity Reform (MyPOWER) has been entrusted to spearhead the initiatives. The agency has been actively engaging the stakeholders through various workshops and discourses in order to gain inputs from them with regards to the subsequent reform plan (MESI 2.0). This is certainly an important move to ensure that the latter’s concerns are taken into account in instituting the reform and their support can hence be obtained. The next move to realise MESI 2.0 would be to define or revise the necessary legislation. Based on the timeline presented by the minister during the 10th International Greentech & Eco Products Exhibition & Conference Malaysia (IGEM 2019) in October 2019, a number of work on this has started since the fourth quarter of 2019 and is still on-going with varying expected completion dates. This includes detailing of rules, incentive mechanisms, reviewing and drafting amendment and regulatory controls, detailing of energy and capacity market design and rules, and detailing of retail regulatory framework including SOLR’s responsibilities and remuneration [44]. The new Act to cater for the whole reform initiatives is planned to be tabled in the second half of 2022. In formulating the required regulations, there is a number of lessons that can be learnt from the Philippines and Singapore. EPIRA has especially received unfavourable remarks from the critics, stating that it is not achieving its objectives and calling for its amendment [45]. In particular, the electricity price has been and keeps on increasing post EPIRA, which is claimed to be due to the ineffectiveness and inefficiency of its structure and the institutional bodies that constitute the ESI [17,46,47]. Therefore, Malaysia has to carefully identify the agencies and institutional bodies needed to implement the reform. It is also important to clearly delineate the boundary of each, especially in areas where their functions can potentially overlap. In this respect, Reference [48] pointed out the importance of a well designed reform structure as one of the lessons learned from the electricity reform moves around the world. Another reason that causes the benefits of the WESM not be realised is because only a very small amount of about 8.2% (As of 2015) electricity is being traded in the market, while the rest is sold through bilateral contracts [49], which defies the purpose of having the market. On the contrary, Singapore has made it compulsory for the generators with capacity of at least 1MW to register with NEMS [50]. The issue in Singapore on the other hand is concerning the competition at the retail market level. Since the opening of the Singapore’s retail electricity market in 2001, the market has been dominated by the “Gentailers”, which is the term used for retailers who share parent organisations with generation companies, as opposed to the “independent” retailers, who do not have any connection with the generators. There is also a plan to allow gentailers to operate in the MESI’s wholesale market [44]. Therefore, careful analysis and implementation mechanisms are needed to prevent oligopoly and to avoid the independent retailers from shying away when they are not able to develop successful business cases. Finally, it is also recommended for the government of Malaysia to consider not privatising the electricity industry fully and entirely. The government should be allowed to own and operate some assets, either on its own or through the government-linked company like Tenaga Nasional Berhad (TNB). This is especially important during critical and trying times when private companies, which are profit oriented, may decide to stop operation or shut down when business is not good [51]. This is also one of the problems faced in the Philippines because the EPIRA at the moment does not allow the government to own and operate assets.

4.2. Clearly Defined Implementation Phases and Targets

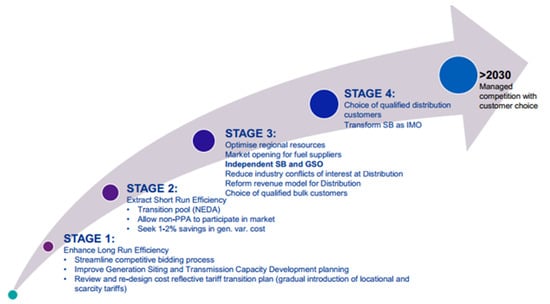

Apart from flawed design, flawed implementation of a reasonable reform design can be the cause of problematic ESI reform [52]. Liberalising the ESI is a long-term endeavour, involving many parties and possibly transcending governments. Singapore did it in about 24 years from corporatisation of the PUB to the full opening of the retail electricity market, which was attained in 2019 [53]. The Philippines, which started five years later than Singapore is in the last few steps of the staggered opening of the retail electricity market, which is now put on hold due to the TRO explained earlier. For such a long-term transformation process, meticulous planning with clearly defined stages and milestones is important. The importance of implementing the reform in ‘proper’ sequence is also emphasised in Reference [48]. The logical sequence ideally begins with raising the prices to cost-recovering levels, followed by creating regulatory institutions and restructuring the sector, and then privatisation [48]. Such sequence can lead to significant improvements in several dimensions of operating performance and in a variety of country settings. Furthermore, the transformation can be made more systematic and smoother with clearly defined and communicated activities and targets. Singapore for example can clearly divide their electricity industry reform into four distinct phases; corporatisation, regulatory infrastructure, privatisation and divestment, and full market contestability, as explained earlier in Section 3. Although the stages of the ESI liberalisation in the Philippines are not found specifically mentioned in any source, similar approach to Singapore is seen as shown in Figure 3. In general, it can be seen that the first step would be the detachment of the monopolistic agency that governs the ESIs through privatisation or corporatisation. It ends with the staggered opening of the retail markets by gradually lowering the contestability thresholds of the consumers. With respect to privatisation, findings from Reference [54] show that privatisation improves efficiency if accompanied by independent regulation, privatisation and independent regulation have no significant effect on prices and private investment is stimulated by independent regulation. As for Malaysia, privatisation of the NEB, the government agency in charge of the electricity supply industry was already accomplished in 1990, which subsequently known as TNB. However, the private, government-linked company that took over was still a monopoly. The presence of the first generation IPPs has reduced the monopoly at the generation sector a little bit. Until now, the IPPs account up to about 50% of the total electricity generation in the country. In this respect, Malaysia bears similarity with the Philippines where at the onset of the liberalisation is the involvement of IPPs, albeit the number is not as many as the Philippines’. The first reform series that started in 2011 (MESI 1.0) had envisaged the managed market model that will eventually lead to the presence of the franchisers at the retail market with contestable and non-contestable consumers to be achieved by 2020 [55]. However, the progress has been slower than expected. It only started to take a more serious turn recently after the new government took over with the launching of the next wave of reform, MESI 2.0 [12], which indicates strong political influence in determining its course. A MESI reform roadmap comprising four stages as shown in Figure 4 has been presented to the Panel Perundingan Tenaga (energy consultative panel) in March 2018. The first stage focuses on the long run efficiency while the second stage focuses on the short run efficiency. The first three foci of the third stage are to optimise regional resources, to open the market for fuel supplies and to create independent single buyer (SB) and grid system operator (GSO). The first two are already in implementation and the focus of discussion during the meeting was the third focus as the next move forward. In stage 4, choice of qualified distribution customers will be made and the independent SB is expected to become the electricity market operator. However, the timeline is not clearly stated in the roadmap except that beyond 2030, managed competition with customers having the choice of retailers would be the focus. In the revised roadmap [44] presented in October 2019, aggregated timeline has been included with more details. Among others, it is planned that the hybrid wholesale market to be ready by 2029. The hybrid market comprises the capacity market on top of the existing energy market, while still honouring the last batch of the PPAs that will end in 2045 [56]. While capacity market ensures reliability by paying generators to commit generation for delivery in years to come, the energy market pays generators only when they provide power day-to-day [57]. The need for capacity market in a liberalised ESI is also in line with the recommendation made in Reference [58] concerning the risks of energy-only market in supporting intermittent RE. The full price-based retail is also expected to be ready by 2029, with the pilot opening of the retail market expected to happen in the second quarter of 2021 [44]. Thus, it can be seen that the plan forward has been clearly laid out with the activities and respective targets made explicit known. The next step would be the execution of the activities, monitoring and revising them in the course of doing so, taking into account the challenges and delays in the first reform series, as well as lessons from other countries. It is also important to ensure timeliness of the execution, allowing the affected parties to adapt to the changes.

Figure 4.

Malaysia electricity supply industry (MESI) roadmap—https://www.singlebuyer.com.my/MESI.php.

4.3. Composition of the Market Components

Next, our analysis looks into the components that constitute the electricity markets. The essence that differentiate between a liberalised ESI and a monopolised one is the presence of the electricity market, both at the wholesale and retail levels. At the wholesale market, generators (the supply side) bid to offer the lowest price to the potential buyers (the demand side). At the retail market, the buyers will subsequently supply electricity to their respective customers, who are the consumers of electricity or the end-users. Despite the different progress achieved, approaches taken and challenges faced by the Philippines and Singapore in liberalising the ESIs and setting up their open electricity markets, similarity is seen in terms of the components that constitute the markets as shown in Table 8. These components can therefore be regarded as the main components of an open ESI. The agencies and/or companies that correspond to the components in the respective markets are also shown in the table.

Table 8.

Components in an electricity market.

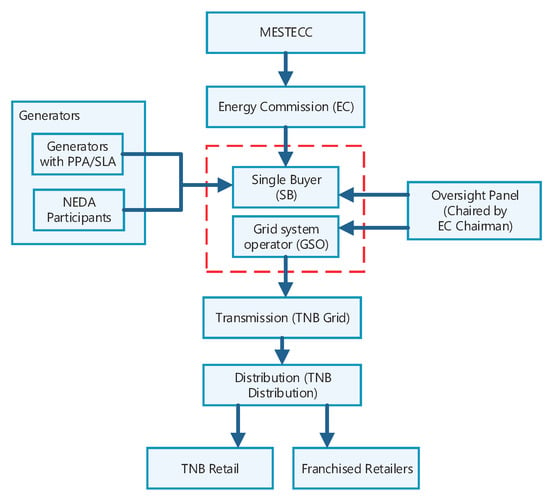

The current structure of MESI is still largely monopolistic. Competition only exists at the generation sector where the generators sell electricity to the Single Buyer (SB) as shown in Figure 5. Wholesale market in the sense discussed above does not exist and electricity trading is done according to the bilateral agreements (PPA/SLA/NEDA) signed between the generators and the SB. TNB, being the main electricity provider in Malaysia, is still a main player in the generation sector, having more that 50% generation capacity in the peninsular Malaysia alone [59]. It is still monopolising the transmission and distribution sectors, and in almost full control of the retail sector. The Energy Commission (EC) has been regulating the MESI since 2001. It is expected that the EC will continue to assume the role as the regulator once the open electricity market is operationalised, with the necessary redefinition of the scope and possibly renaming or rebranding too. Rebranding and redefining the scope of the regulator are needed to emphasise the independence from the government, to change public perception and to clarify the refreshed scope of the EC. In the Philippines too, the ERB had its name changed to ERC after liberalisation and in Singapore, EMA was established to replace the PUB.

Figure 5.

The current MESI structure.

A market operator (MO) also needs to be created to manage and coordinate the activities in the wholesale electricity market. Ideally, an independent MO (IMO) is expected. However, transition period is foreseen where government agency, a division of the regulator or a government-owned company will operate during the initial phase of the market. For example, the WESM is run by the government through the PEMC [60] since the market went into operation in 2006 until 2018 [24], although the initial intention was to have the IMO in within the first year of the market launch. The other important component of an electricity market is the System Operator (SO), who is responsible for the dispatch of the electricity traded in the wholesale market. Thus, the SO is not involved in the trading process. TransCo was the first SO in WESM, which was later given to NGCP, while in NEMS, a division of EMA (the regulator) is the SO. Looking at the current MESI structure shown in Figure 5, SB and the Grid System Operator (GSO) would most likely be the MO and SO respectively to undertake the initial operation of the open electricity market to be established, based on the experience they have. At the moment, both are ring-fenced entities under TNB [61]. As mentioned earlier, the plan to free them from TNB is already on the MESI roadmap even prior to the start of MESI 2.0 as can be seen from Figure 4. Commercial operation date for the enhanced SB and GSO is expected to be in the first quarter of 2021 [44]. Transformation of the independent SB into IMO is also on the roadmap. The transmission on the other hand should remain a regulated monopoly as per practiced in the Philippines and Singapore. The same arrangement is also seen in the Nordic countries.

Currently, there are three types of generators in MESI; generators under the TNB who have service level agreements (SLAs) with the SB, IPPs who trade electricity with the SB according to the power purchase agreements (PPAs) and other generators who sell electricity to the SB following the new enhanced dispatch agreements (NEDA) [62]. These generators would be the candidates for the wholesale sellers in MESI wholesale electricity market. Ideally, all electricity trading should be done through the wholesale market. Bilateral contracts between the sellers and buyers may still be allowed on a very small number of specific cases, but with limited percentage. In both WESM and NEMS, three categories of wholesale buyers are identified; suppliers, distribution utilities and directly connected end-users. Depending on the categories, buyers at the wholesale market either consume the electricity themselves or become the sellers at the retail market. Suppliers serve contestable customers, that is, customers whose electricity usage exceed certain imposed limit and as a result, are allowed to choose suppliers whom they deem can offer them the best values. Distribution utilities (MSSL in NEMS) are the default retailers that supply electricity to the rest of the consumers, known as non-contestable or captive customers, at the regulated price. They are not able to choose suppliers until they are eligible to become contestable customers. The last category of the wholesale buyers is the directly connected customers. These are the large power consumers who buy electricity in bulk directly from the wholesale market for their own use. Electricity consumers in Malaysia are categorised into residential, industrial and commercial [63]. Almost all of them are served by TNB retail at the moment. Retail electricity market is currently non-existent in MESI. Thus, in essence, there is no competition at the retail level. Franchised retailers do exist, but with the scope limited to managing the supply of electricity to the tenants of shopping malls or office complexes. The industrial customers are either directly connected to the grid (via switching stations) or to the substations depending on the amount of the maximum demand levels [64]. They are therefore foreseen to be the potential directly connected customers who will buy electricity directly from the wholesale market for their own use. TNB Retail, as the incumbent retailer is expected to play the role as the SOLR, due to the experience and extensive infrastructure that they already have. Thus, it can be seen that current MESI structure is able to prepare itself well into liberalisation. Nevertheless, it is worth noting that the electricity markets have evolved or are also evolving into hybrid forms, liberalised but not fully due to the lack of some of the institutional and other preconditions for the full and effective implementation of the standard reform model, which is beginning to be acceptable new norms of liberalisation [48].

4.4. Influence on the RE Penetration

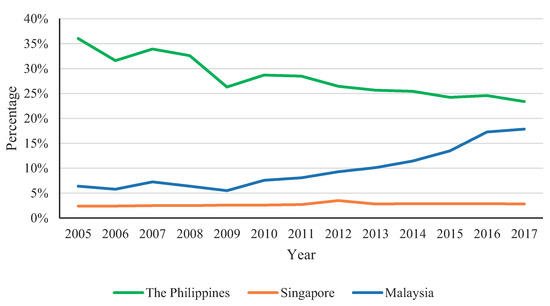

Finally, the extent to which the electricity market liberalisation has influenced the RE penetration into the grid, if any, is also analysed in this study. This is a topic of interest because Malaysia has set the aim to achieve 20% RE penetration by the year 2030 [65] and 50% by the year 2050 [66], excluding those from large (>100 MW) hydro power stations [59]. Thus, it is important to ascertain in what ways MESI liberalisation can help to achieve the target. Promoting energy efficiency and the use of RE resources are amongst the objectives of ESI liberalisation [67]. One of the means is by having more RE actors into the industry as a result of liberalisation [68]. Findings from Reference [69] suggest that reduction in the monopolistic power of state-owned utilities due to liberalisation has had positive effect on RE policies when various types of actors are ensured access to the grid instead of it being provided to only a few large private firms. It also found that liberalisation increases public support for renewable energy. As explained earlier in the respective sections above, the Philippines and Singapore have also put their own targets with regards to RE. Figure 6 shows the current state with respect to the electricity generation mix in the Philippines, Singapore and Malaysia. At a glance, no significant relationship can be seen between the RE penetration and electricity market liberalisation. It can be seen from the figure that Malaysia is already doing good with respect to the RE penetration, with about 20% RE in its generation mix, a small percentage away behind the Philippines. Looking over a period of time from 2005 to 2018, Malaysia is also showing a good progress with respect to the increased RE penetration as shown in Figure 7. Based on this raw information, for the moment, there is no clear evidence on the influence of the liberalised electricity market per se on the increased RE penetration. In addition, from the experience of Japan, its government does not rely on electricity liberalisation alone to give further impetus to RE development [68]. It is being supported by other initiatives too. Government intervention is also found needed to achieve the objectives of liberalised ESI [58]. For example, as pointed out by Reference [70], generators should have a wide market for the products they are creating, to ensure that they receive the fairest price and the government can help to institute the necessary policies to facilitate this. In this regards, it can be seen that the government of Malaysia has already been introducing a number of schemes to promote RE, including the large scale solar (LSS) (A solar PV plant producing between 1 MWac and 50 MWac connected to either distribution or transmission network [71]), the feed-in tariff (FiT) and the net energy metering (NEM) [72]. Based on the current setting, once the wholesale electricity market is available in MESI, the LSS generators can become the market participants and compete to sell electricity to the wholesale buyers. This is plausible especially with the solar generation cost that is becoming lower and lower than the generation costs from the conventional resources [73]. At the moment, the LSS generators are already selling electricity to the SB together with the other generators through PPAs as shown earlier in Figure 5. For the lower scale solar and other distributed RE generators, FiT and NEM schemes are available. However, as of June 2018, only 10 MW of the allocated 500 MW quota for NEM are taken [72]. Thus, the Malaysian government should continue its effort to promote and support RE penetration through various initiatives, along with the ESI reform initiatives.

Figure 6.

Energy mix in the Philippines, Singapore and Malaysia.

Figure 7.

Percentage of renewable energy (RE) the generation mix in the Philippines, Singapore and Malaysia.

5. Conclusions and Outlook

In this paper, the chronological review of the Philippines’ and Singapore’s experience in liberalising their ESIs is presented. While the Philippines went through an eventful transformation, it was a smoother sailing for Singapore. Nevertheless, both have respective lessons and best practices that Malaysia can learn in the process of liberalising its ESI. The purpose of focusing on the Philippines and Singapore in the review, as mentioned earlier, is because of their current state of ESI liberalisation, which is considered to be in the more advanced stage compared to the other ASEAN countries. The importance of legislative framework and phased implementation are amongst the lessons that Malaysia can learn from their experience. Similarities in terms of components that constitute the electricity markets would serve as the starting point for Malaysia in determining its future electricity market components. Analysis on the impact of the liberalised electricity markets on the RE penetration into the grids provides useful insight for Malaysia in retaining the existing initiatives towards meeting its RE targets. A foreseen challenge for Malaysia in liberalising MESI is in terms of the public acceptance, particularly the households or the residential consumers. Energy liberalisation in general has led to positive and globally widespread but modest efficiency gains across all energy sectors but a lack of clearly visible direct benefits to the households in many countries [10]. Pricing in particular is expected to be one of the main issues. Electricity prices can rise for some or all customer groups (reducing their welfare) while the overall social welfare goes up [10]. This is expected to be the case for Malaysia where the government has been subsidising the electricity tariff for so long. Therefore, there is an urgent need to identify electricity pricing schemes that strike a more satisfactory balance between economic efficiency and social equity as proposed in Reference [48], which will be a subject for a future study. Beyond Malaysia, liberalisation of the ESIs in all ASEAN countries can also be considered in realising the APG. Experience from the other regions, such as the Nordic, shows that liberalised ESI aligns very well in accommodating renewables and attaining efficiency. With the depleting fossil fuel and the energy demand that is predicted to exceed the production of indigenous energy resources of the region based on the recent Southeast Asia energy outlook, increased penetration of renewables into the grid, and more efficient use of energy would be the silver bullets in alleviating the impact of depleting natural indigenous energy resources for the benefits of the generations to come. Thus, it is a potential that future direction of the ASEAN countries with regards to the energy and electricity is towards the liberalisation of the ESIs. Furthermore, extending the ESI liberalisation to the whole of ASEAN in realising the APG requires a more authoritative form of coalition, similar to the European Union where each member state is, by law, obliged to comply to the directions. Having said that, integrated and fully connected APG does not have to wait until all ASEAN countries have liberalised their ESIs in order to materialise. It would be sufficient to have the necessary regulations imposed for the setting up of compatible ESIs that can harmoniously connect and communicate regionally. For this, the ESI in each ASEAN country needs to be studied in detail to identify the extent to which they can be harmonised. However, it is not within the ambit of this research to provide the detailed review on the ESI of each ASEAN country. It can be a separate study on its own, and a future work that we are considering.

Author Contributions

Conceptualization, H.A.; methodology, H.A.; validation, I.S.M.Z., B.N.J.; formal analysis, H.A.; investigation, H.A. and I.S.M.Z.; resources, H.A. and I.S.M.Z.; writing–original draft preparation, H.A.; writing–review and editing, H.A., I.S.M.Z. and B.N.J.; supervision, B.N.J.; project administration, H.A.; funding acquisition, H.A. All authors have read and agree to the published version of the manuscript.

Funding

This research was funded by Universiti Tenaga Nasional grant number RJO10517844/008.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Zamin, N.Z.M.; Abidin, N.Z.Z.; Ibrahim, J.B. Single buyer—A step forward in Malaysian Electricity Supply Industry reform. In Proceedings of the IEEE 2013 Tencon—Spring, Sydney, Australia, 17–19 April 2013; pp. 391–397. [Google Scholar] [CrossRef]

- Aris, H.; Jøgensen, B.N. ASEAN Power Grid 20 years after: An overview of its progress and achievements. IOP Conf. Ser. Earth Environ. Sci. 2020, 463, 1–8. [Google Scholar] [CrossRef]

- Li, Y. ASEAN Sets New Momentum Moving towards an Integrated Electricity Market in the Region. Available online: http://www.eria.org/news-and-views/asean-sets-new-momentum-moving-towards-an-integrated-electricity-market-in-the-region/ (accessed on 4 April 2019).

- Amundsen, E.S.; Bergman, L. Why has the Nordic electricity market worked so well? Util. Policy 2006, 14, 148–157. [Google Scholar] [CrossRef]

- Mundaca, L.T.; Dalhammar, C.; Harnesk, D. The Integrated NORDIC Power Market and the Deployment of Renewable Energy Technologies: Key Lessons and Potential Implications for the Future ASEAN Integrated Power Market. In Energy Market Integration in East Asia: Renewable Energy and its Deployment into the Power System; Kimura, S., Phoumin, H., Jacobs, B., Eds.; ERIA Research Project Report 2012-26; ERIA: Jakarta, Indonesia, 2013; pp. 25–97. [Google Scholar]

- Stridbaek, U. Lessons from Liberalised Electricity Markets; Technical Report; OECD iLibrary: Paris, France, 2006. [Google Scholar]

- Bustos-Salvagno, J.; Fuentes H, F. Electricity Interconnection in Chile: Prices versus Costs. Energies 2017, 10, 1438. [Google Scholar] [CrossRef]

- Department of Trade Industry. The Social Effects of Energy Liberalisation the UK Experience; Technical Report; Department of Trade Industry: London, UK, 2000.

- Owen, A.D.; Finenko, A.; Tao, J. Power Interconnection in Southeast Asia; Routledge: London, UK, 2019. [Google Scholar] [CrossRef]

- Pollitt, M.G. The role of policy in energy transitions: Lessons from the energy liberalisation era. Energy Policy 2012, 50, 128–137. [Google Scholar] [CrossRef]

- Mohamad, H.F.; Amran, S.N.M.E. Electricity Industry to Undergo Transformation with MESI 2.0. Available online: https://www.nst.com.my/business/2018/09/412549/electricity-industry-undergo-transformation-mesi-20 (accessed on 10 January 2019).

- Aris, H.; Jørgensen, B.N.; Hussain, I.S. Electricity supply industry reform in Malaysia: Current state and way forward. Int. J. Recent Technol. Eng. 2019, 8, 6534–6541. [Google Scholar]

- Sharma, D. Electricity Reforms in the ASEAN: A Panoramic Discourse. Econ. Political Wkly. 2005, 40, 5318–5326. [Google Scholar]

- Woodhouse, E.J. The IPP Experience in the Philippines; Technical Report; Stanford University: Stanford, CA, USA, 2005. [Google Scholar]

- Hall, D.; Nguyen, T.A. Electricity Liberalisation in Developing Countries. Prog. Dev. Stud. 2017, 17, 99–115. [Google Scholar] [CrossRef]

- Sharma, D.; Madamba, S.E.; Chan, M.L. Electricity industry reforms in the Philippines. Energy Policy 2004, 32, 1487–1497. [Google Scholar] [CrossRef]

- Santiago, A.; Roxas, F. Understanding Electricity Market Reforms and the Case of Philippine Deregulation. Electr. J. 2010, 23, 48–57. [Google Scholar] [CrossRef]

- Afable, P.P.R. The Players: Philippine Power Industry; Technical Report; KPMG Global Energy Institute: Cebu, Philippines, 2014. [Google Scholar]

- Asian Development Bank. Philippines: Electricity Market and Transmission Development Project; Technical Report; Asian Development Bank: Mandaluyong, Philippines, 2016. [Google Scholar]

- Navarro, A.M.; Detros, K.C.; dela Cruz, K.J. Post-EPIRA Impacts of Electric Power Industry Competition Policies; Technical Report; Philippine Institute for Development Studies: Quezon City, Philippines, 2016.

- Oplas, B.S., Jr. Electricity Competition, EPIRA, and WESM. Available online: https://www.bworldonline.com/electricity-competition-epira-and-wesm/ (accessed on 17 March 2019).

- Rudnick, H.; Velasquez, C. Learning from Developing Country Power Market Experiences The Case of the Philippines; Technical Report; Policy Research Working Paper 8721; The World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Rivera, D. DOE Expects WESM Mindanao Opening to be Delayed. Available online: https://www.philstar.com/business/2020/01/11/1983734/doe-expects-wesm-mindanao-opening-be-delayed (accessed on 22 April 2020).

- Rivera, D. Independent Operator Takes over Wholesale Power Spot Market. Available online: https://www.philstar.com/business/2018/09/27/1854925/independent-operator-takes-over-wholesale-power-spot-market (accessed on 16 January 2019).

- Department of Energy. DEPARTMENT CIRCULAR NO. DC 2012-05-2005. Available online: https://www.officialgazette.gov.ph/2012/05/09/doe-dc-no-2012-05-005-s-2012/ (accessed on 15 May 2019).

- Lagare, J.B. 940 Customers Listed in Power Retail Market—WESM. Available online: https://www.manilatimes.net/940-customers-listed-power-retail-market-wesm/370648/ (accessed on 24 June 2019).

- Dimalanta, M.C.; Balot, S.F.; Zareno, J.G.B. Chapter 27 Philippines. In The Energy Regulation and Markets Review, 7th ed.; Schwartz, D.L., Ed.; Law Business Research Ltd.: London, UK, 2018; pp. 337–351. [Google Scholar]

- Inquirer.Net. WESM CEO: Fully Implement RCOA to Lower Electricity Prices. Available online: https://business.inquirer.net/261010/wesm-ceo-fully-implement-rcoa-to-lower-electricity-prices (accessed on 5 May 2019).

- Corporation, P.E.M. QUARTERLY RETAIL MARKET ASSESSMENT REPORT 26 September–25 December 2019; Technical Report; PEMC: Philippines, 2020. [Google Scholar]

- WWF Philippines. Renewables Best Way to Power Philippine Development. Available online: https://wwf.org.ph/what-we-do/climate/renewables/renewables-to-power-ph-dev/ (accessed on 15 April 2020).

- Lectura, L. DOE Launches First Renewable-Energy On-Line Trading Platform in Philippines. Available online: https://businessmirror.com.ph/2019/12/18/doe-launches-first-renewable-energy-on-line-trading-platform-in-philippines/ (accessed on 30 March 2020).

- Low, M. Liberalized Electricity Markets? A Case Study of Singapore. Paper Presented at the International Conference of Applied Energy (ICAE) 2012, Suzhou, China, 5–8 July 2012. [Google Scholar]

- Energy Market Authority. Introduction to the National Electricity Market of Singapore; Technical Report; Energy Market Authority: Singapore, 2010.

- Singapore Power. Retail Competition for Electricity Supply in Singapore; Singapore Power: Singapore, 2016. [Google Scholar]

- Law, F.M. More Choices for all Electricity Users in 2018. Available online: https://www.todayonline.com/singapore/singapores-electricity-market-be-fully-liberalised-h2-2018 (accessed on 21 October 2019).

- Energy Market Authority. Smart Energy Sustainable Future Energy Market Authority Annual Report 2018/19; Technical Report; Energy Market Authority: Singapore, 2019.

- Min, A.H. Singapore Sets Solar Energy Target for 2030 that Would Provide Enough Power for 350,000 Homes. Available online: https://www.channelnewsasia.com/news/singapore/solar-power-target-energy-350000-homes-2030-hdb-rooftops-12042228 (accessed on 28 February 2020).

- Goh, M. Blockchain Tech Is Taking on Renewable Energy Trading in Singapore. Available online: https://www.cnbc.com/2018/11/07/blockchain-tech-is-taking-on-renewable-energy-trading-in-one-country.html (accessed on 5 May 2020).

- Stanley Bowden, R.; Ellis, M. Restructing the Philippine electric power industry. Electr. J. 1995, 8, 38–44. [Google Scholar] [CrossRef]

- Pollitt, M. Electricity reform in Argentina: Lessons for developing countries. Energy Econ. 2008, 30, 1536–1567. [Google Scholar] [CrossRef]

- Hall, D.; Thomas, S.; Corral, V. Global Experience with Electricity Liberalisation; Paramadina University: Jakarta, Indonesia, 2009; Seminar; 19 January 2010. [Google Scholar]

- Nepal, R.; Jamasb, T. Caught between theory and practice: Government, market, and regulatory failure in electricity sector reforms. Econ. Anal. Policy 2015, 46, 16–24. [Google Scholar] [CrossRef]

- Aziz, F.A.; Khor, K. Chapter 21 Malaysia. In The Energy Regulation and Markets Review, 7th ed.; Schwartz, D.L., Ed.; Law Business Research Ltd.: London, UK, 2018; pp. 261–276. [Google Scholar]

- Ministry of Energy, Science, Technology, Environment and Climate Change. Reimagining Malaysian Electricity Supply Industry (MESI 2.0); Ministry of Energy, Science, Technology, Environment and Climate Change: Malaysia, 2019.

- Gamboa, R. Amending Epira. Available online: https://www.philstar.com/business/2013/01/08/894346/amending-epira (accessed on 20 March 2020).

- Carino, L.V. Regulatory Governance in the Philippines: Lessons for Policy and Institutional Reform; Technical Report; University of Manchester: Manchester, UK, 2005. [Google Scholar]

- Fe Villamejor-Mendoza, M. Bringing Electricity Reform to the Philippines. Electr. J. 2008, 21, 42–58. [Google Scholar] [CrossRef]

- Kessides, I.N. The Impacts of Electricity Sector Reforms in Developing Countries. Electr. J. 2012, 25, 79–88. [Google Scholar] [CrossRef]

- Ho, E. Electricity Derivative Market for the Philippines. Available online: https://asian-power.com/regulation/commentary/electricity-derivative-market-philippines (accessed on 20 May 2020).

- Energy Market Company. Generation Facility Registration. Available online: https://www.emcsg.com/aboutthemarket/generationfacilityregistration (accessed on 4 April 2020).

- Gonzales, I. Special Report: What’s Wrong with EPIRA? Available online: https://www.philstar.com/headlines/2014/01/14/1278583/special-report-whats-wrong-epira (accessed on 10 April 2020).

- Roxas, F.; Santiago, A. Broken dreams: Unmet expectations of investors in the Philippine electricity restructuring and privatization. Energy Policy 2010, 38, 7269–7277. [Google Scholar] [CrossRef]

- Liew, E. Open Electricity Market (OEM) Singapore—10 Important Things to Know. Available online: https://sg.finance.yahoo.com/news/open-electricity-market-oem-singapore-160000715.html (accessed on 12 March 2020).

- Pollitt, M. Evaluating the evidence on electricity reform: Lessons for the South East Europe (SEE) market. Util. Policy 2009, 17, 13–23, The Political Economy of Electricity Market Reform in South East Europe. [Google Scholar] [CrossRef]

- Hasan, A.F. Malaysian Electricity Supply Industry (MESI) Reform Initiatives; Energy Commission: Putrajaya, Malaysia, 2014.

- Tan, C.C. Disruption is Coming to the Local Power Industry. Available online: https://www.theedgemarkets.com/article/disruption-coming-local-power-industry (accessed on 15 June 2019).

- Ihnen, J. Capacity Market v Energy Market—What’s the Diff? Available online: https://michaelsenergy.com/capacity-market-v-energy-market-whats-diff/ (accessed on 30 April 2020).

- Owen, A.D. Do Liberalized Electricity Markets Discourage Investment in Renewable Energy Technologies? Electr. J. 2014, 27, 53–59. [Google Scholar] [CrossRef]

- Suruhanjaya Tenaga. Peninsular Malaysia Electricity supply Industry Outlook 2019; Technical Report; Suruhanjaya Tenaga: Putrajaya, Malaysia, 2019.

- Gatdula, D.L. Independent Operator Expected to Handle WESM Operations. Available online: https://www.philstar.com/business/2010/08/11/601183/independent-operator-expected-handle-wesm-operations (accessed on 20 July 2019).

- Single Buyer. Ring-Fencing. Available online: https://www.singlebuyer.com.my/ringfencing.php (accessed on 23 March 2020).

- Zainul, I.F. NEDA to Encourage Healthy Competition. Available online: https://www.thestar.com.my/business/business-news/2015/10/10/neda-to-encourage-healthy-competition (accessed on 20 January 2020).

- Suruhanjaya Tenaga. Review on Electricity Tariff in Peninsular Malaysia under the Incentive-Based Regulation Mechanism; Suruhanjaya Tenaga: Putrajaya, Malaysia, 2013.

- Tenaga Nasional Berhad. Electricity Supply Application Handbook; Technical Report; Tenaga Nasional Berhad: Kuala Lumpur, Malaysia, 2011. [Google Scholar]

- Eusoff, N.S. Malaysia Sets New Goal of 20% Clean Energy Generation by 2030. Available online: https://www.theedgemarkets.com/article/malaysia-sets-new-goal-18-clean-energy-generation-2030 (accessed on 14 April 2020).

- Inus, K. Malaysia Will Meet 2050 target of 50% Renewable Energy. Available online: https://www.nst.com.my/news/nation/2018/01/328695/malaysia-will-meet-2050-target-50-renewable-energy (accessed on 14 April 2020).

- Willems, B.; Ehlers, E. Cross-Subsidies in the Electricity Sector. Compet. Regul. Netw. Ind. 2008, 9, 201–227. [Google Scholar] [CrossRef]

- Gao, A.M.Z.; Fan, C.T.; Liao, C.N. Application of German energy transition in Taiwan: A critical review of unique electricity liberalisation as a core strategy to achieve renewable energy growth. Energy Policy 2018, 120, 644–654. [Google Scholar] [CrossRef]

- Nicolli, F.; Vona, F. Energy market liberalization and renewable energy policies in OECD countries. Energy Policy 2019, 128, 853–867. [Google Scholar] [CrossRef]

- Alder, M. Renewable energy and liberalised electricity markets. Renew. Energy 2001, 24, 409–413. [Google Scholar] [CrossRef]

- Abidin, N.Z.Z.; Jamaluddin, M.; Dawood, A.R. Harnessing the Power of the Sun—Malaysia’s Maiden Journey in Large-Scale Solar PV. In Proceedings of the JCNC—Conference 2016; CIGRE: Paris, France, 2016; pp. 1–10. [Google Scholar]

- Sustainable Energy Development Authority (SEDA) Malaysia. Net Energy Metering (NEM). Available online: http://www.seda.gov.my/reportal/nem/ (accessed on 14 September 2019).

- Zainuddin, A. Latest Solar Farm Bids Lowest at 17.8 Sen. Available online: https://themalaysianreserve.com/2019/09/04/latest-solar-farm-bids-lowest-at-17-8-sen/ (accessed on 20 January 2020).

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).