“Leaky Bucket” of Kazakhstan’s Power Grid: Losses and Inefficient Distribution of Electric Power

Abstract

1. Introduction

2. Materials and Methods

3. Results

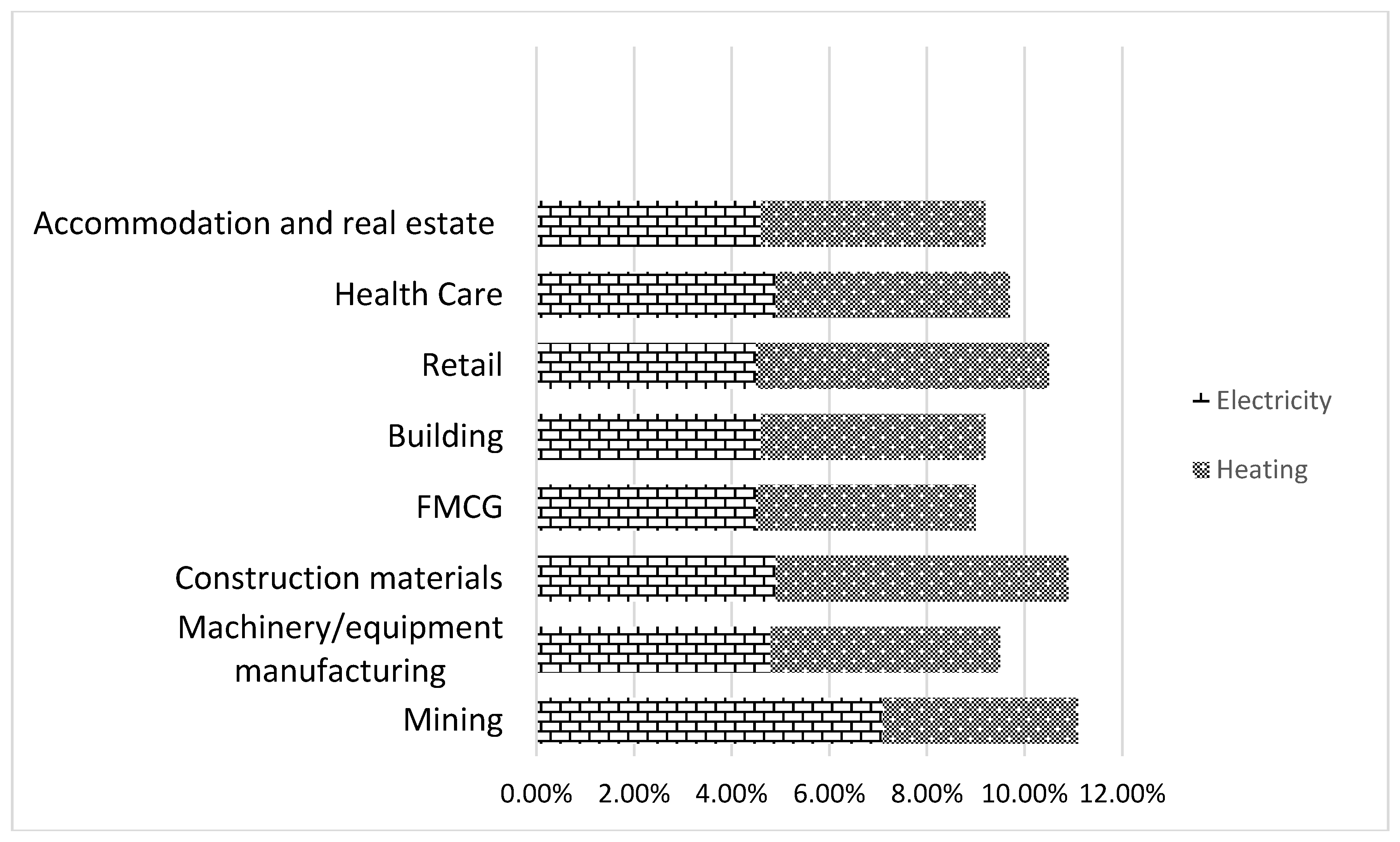

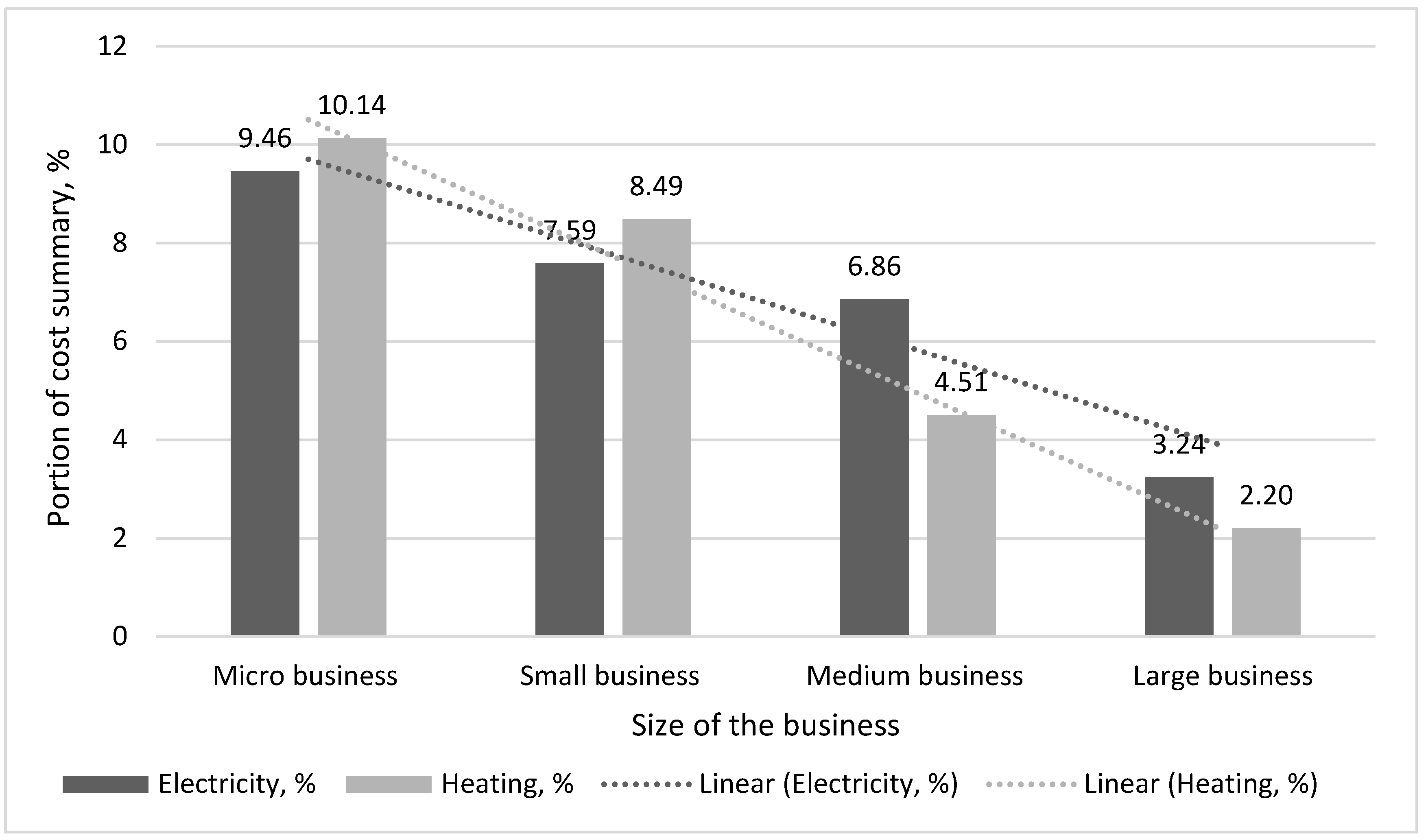

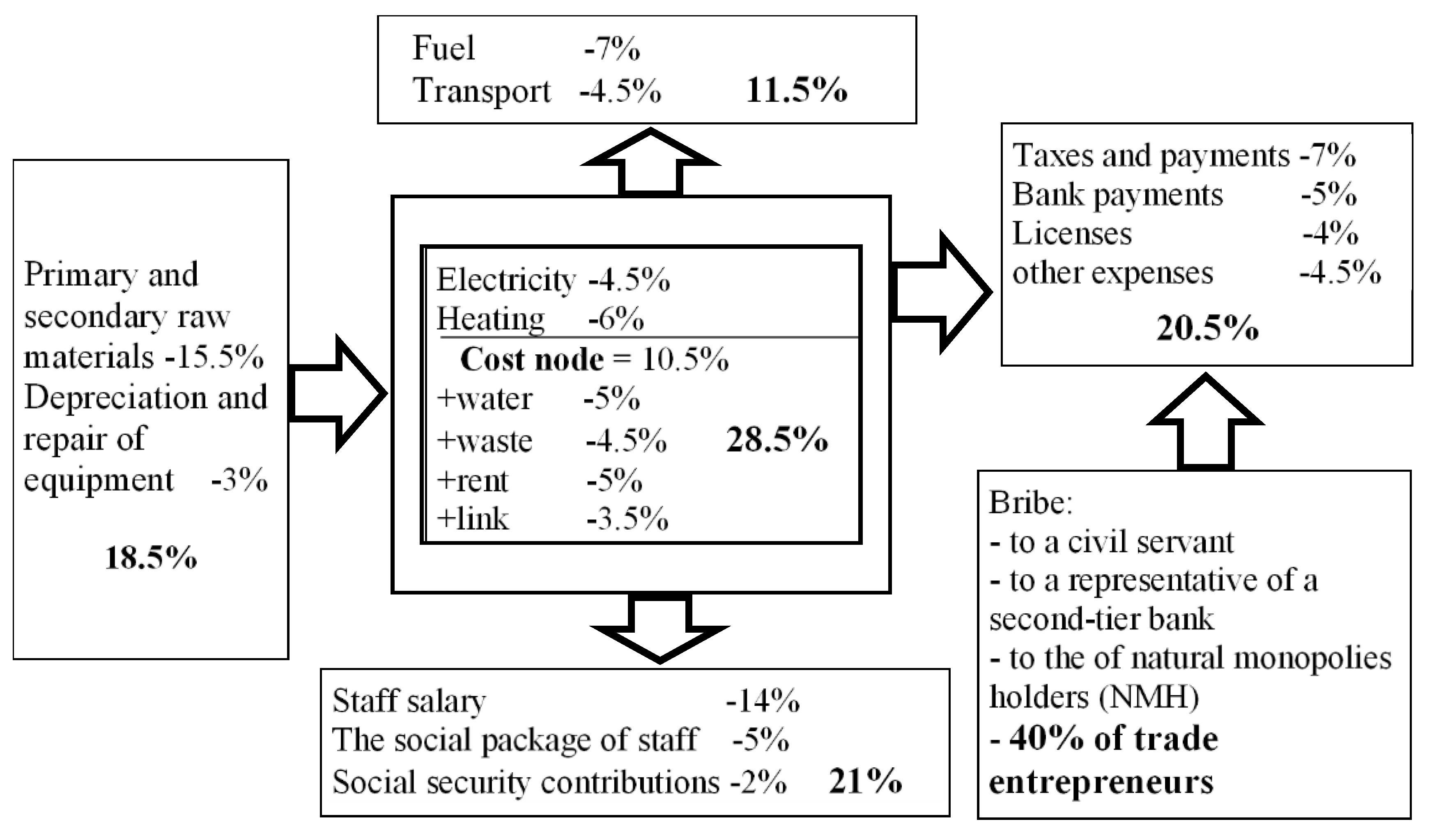

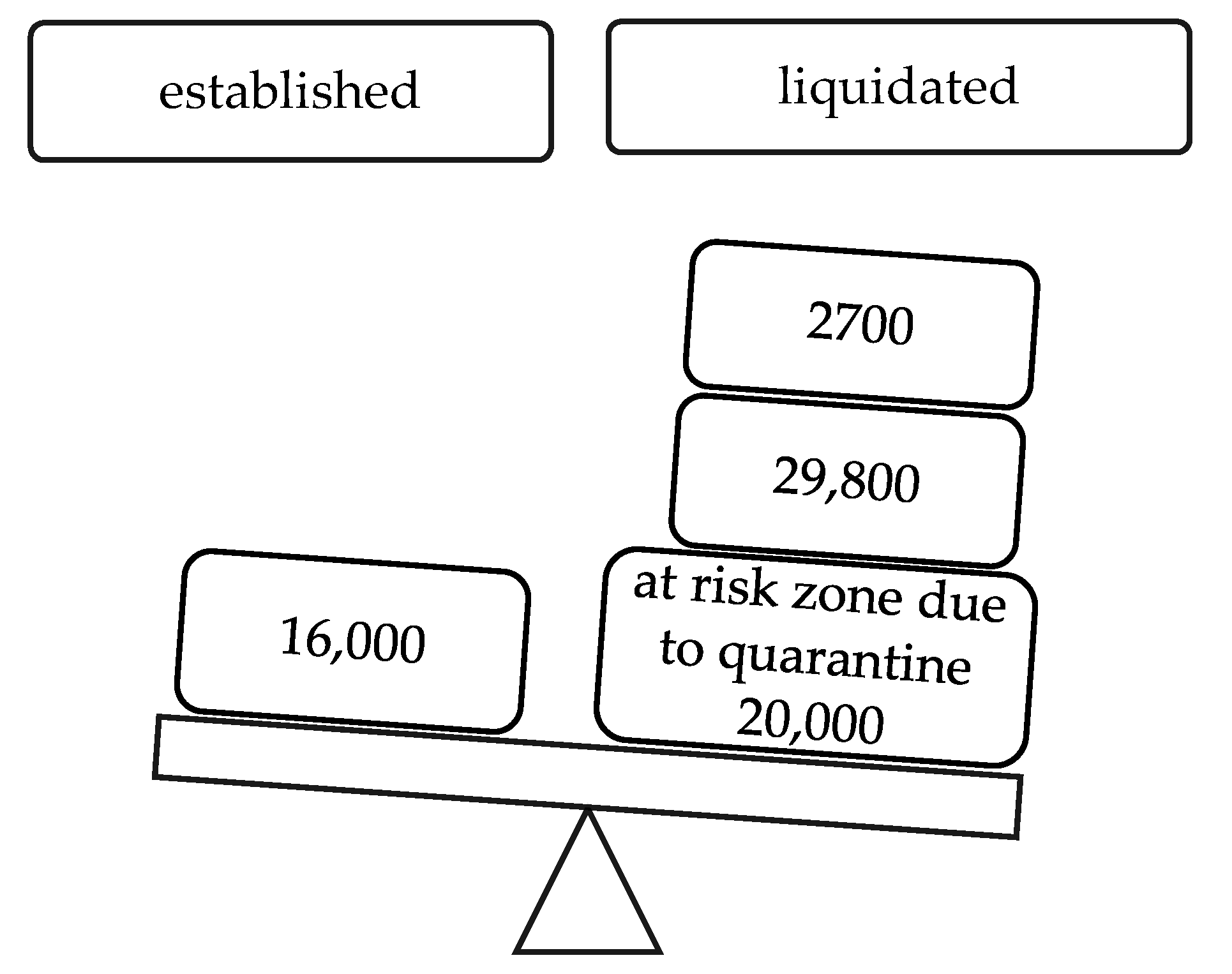

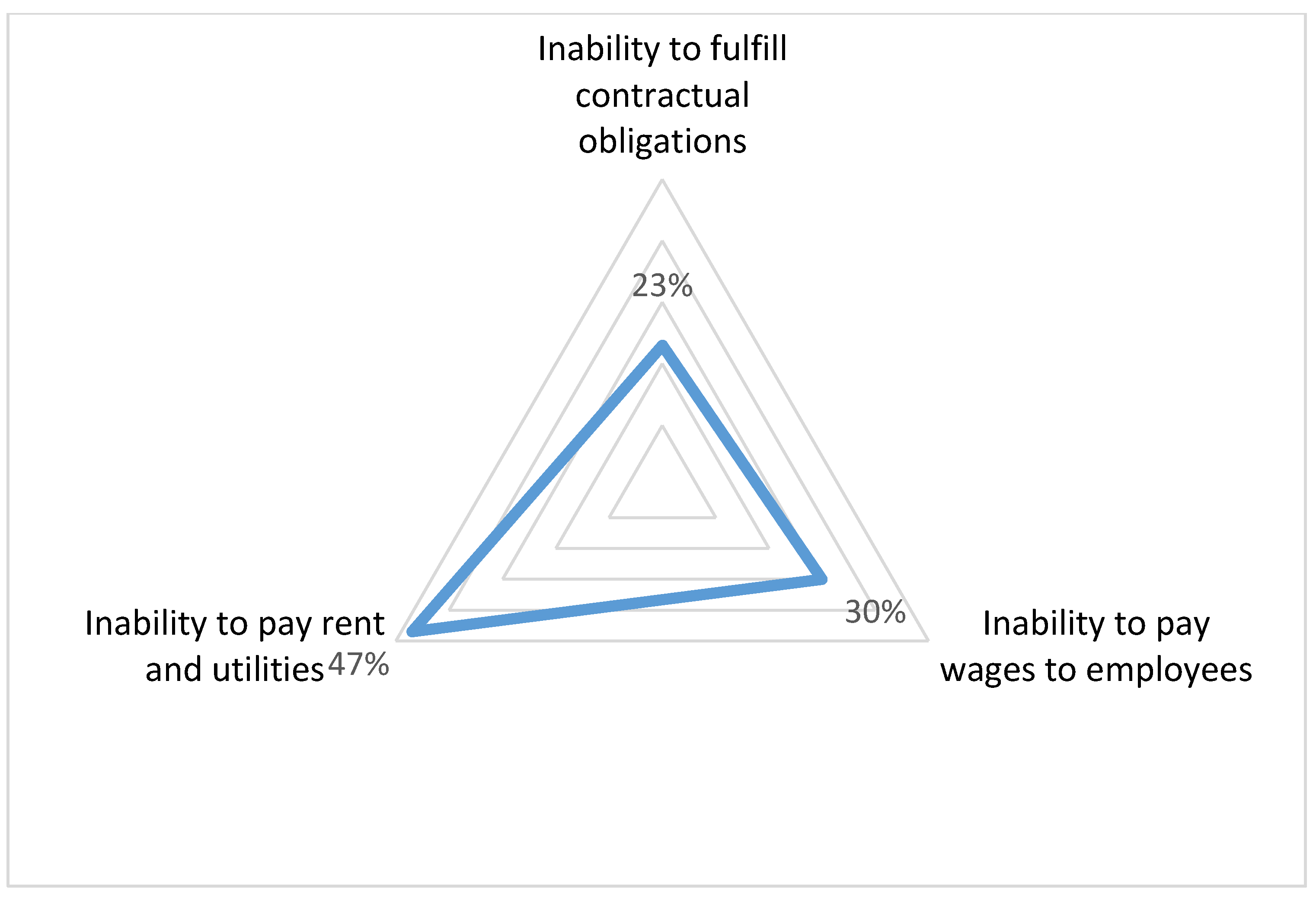

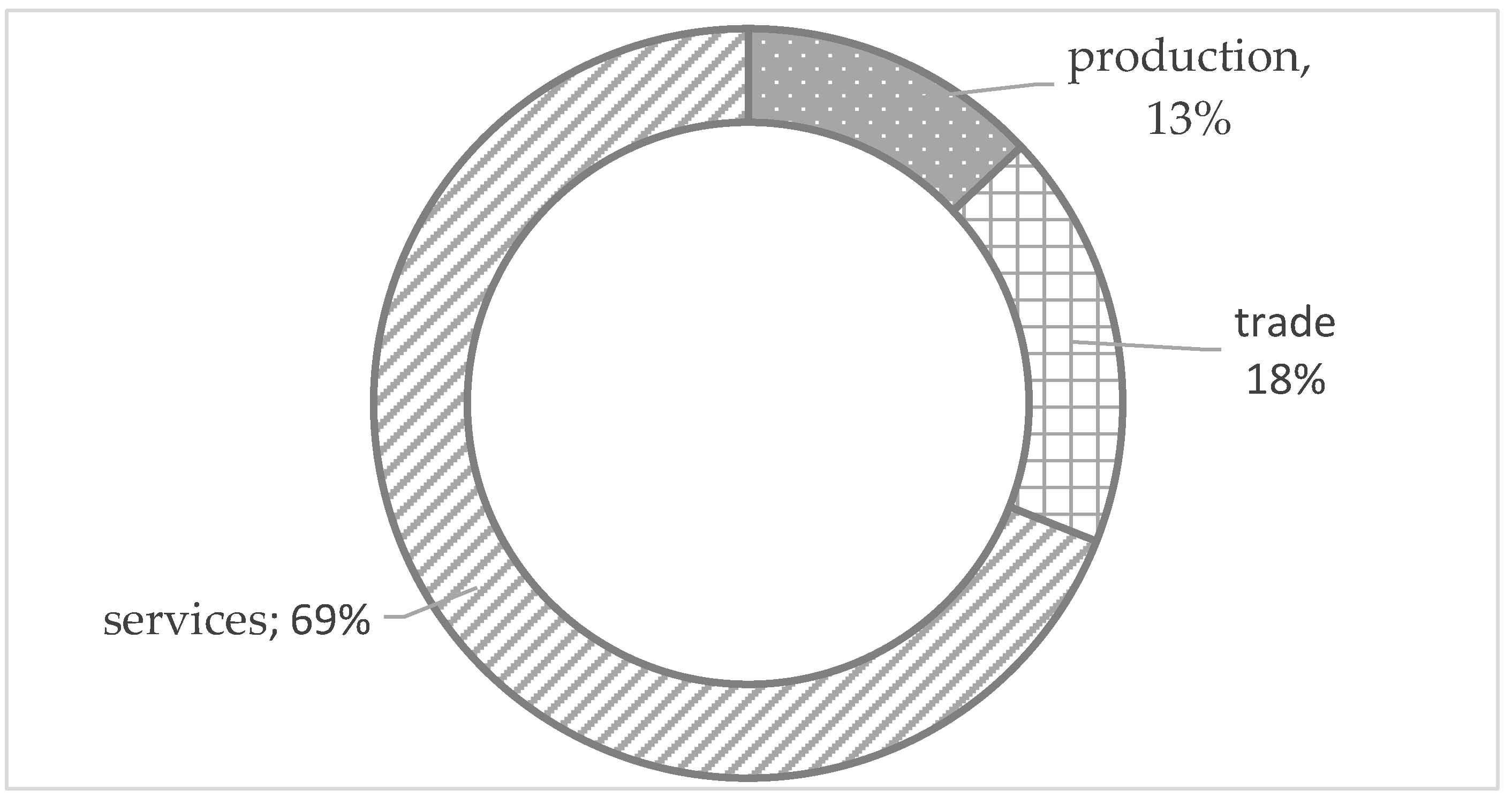

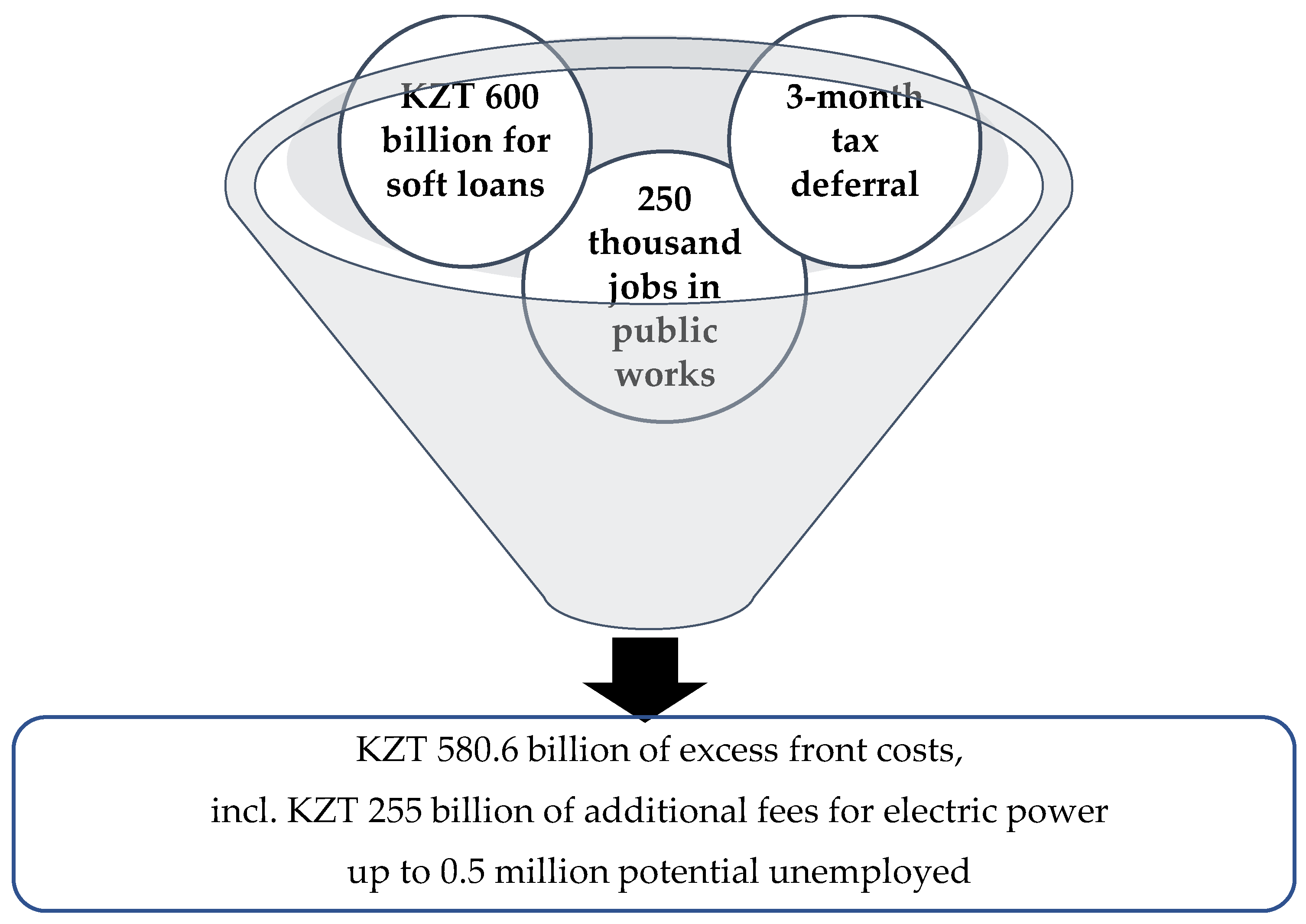

3.1. Common National Trends in Business Cost Analysis

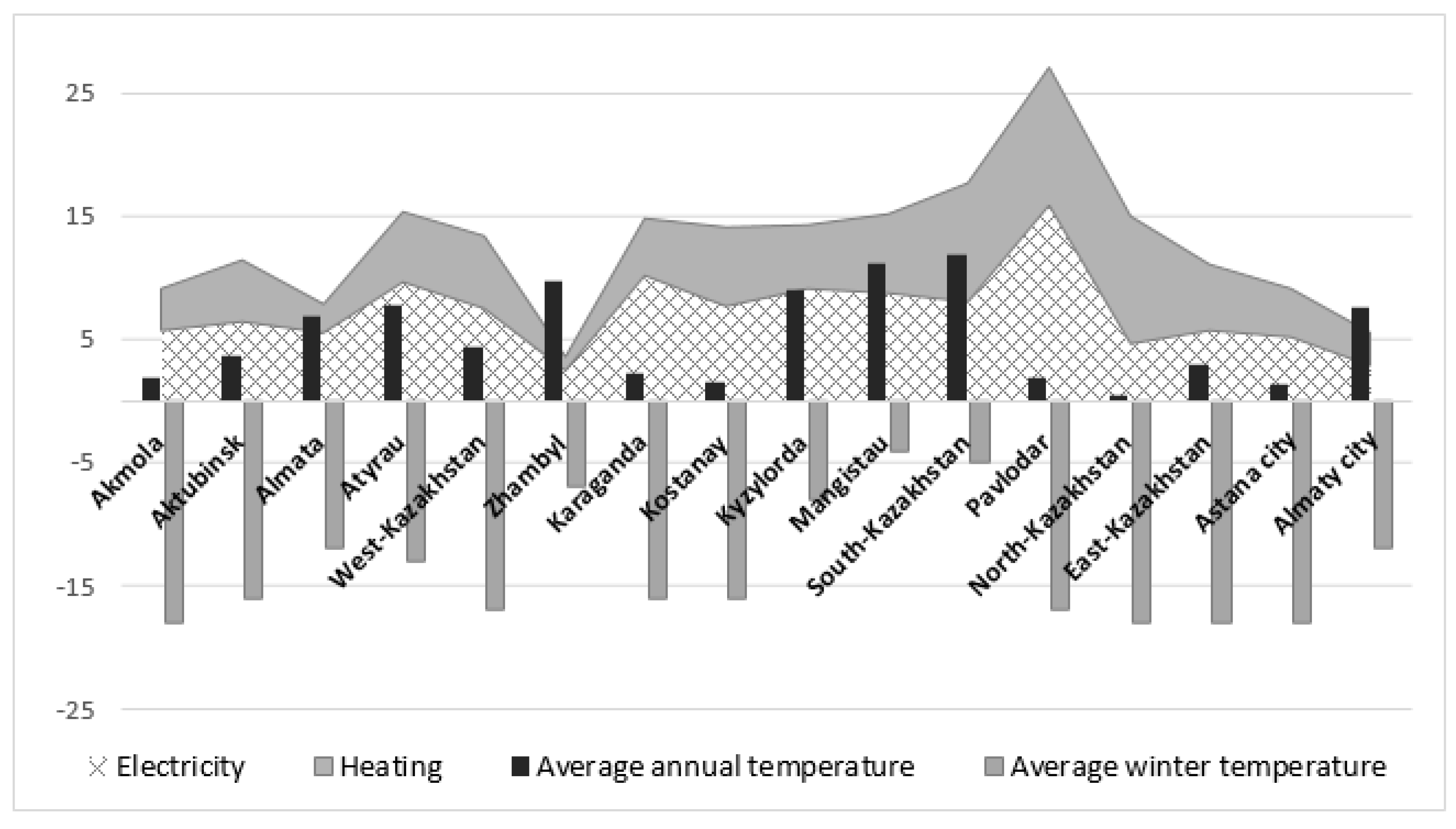

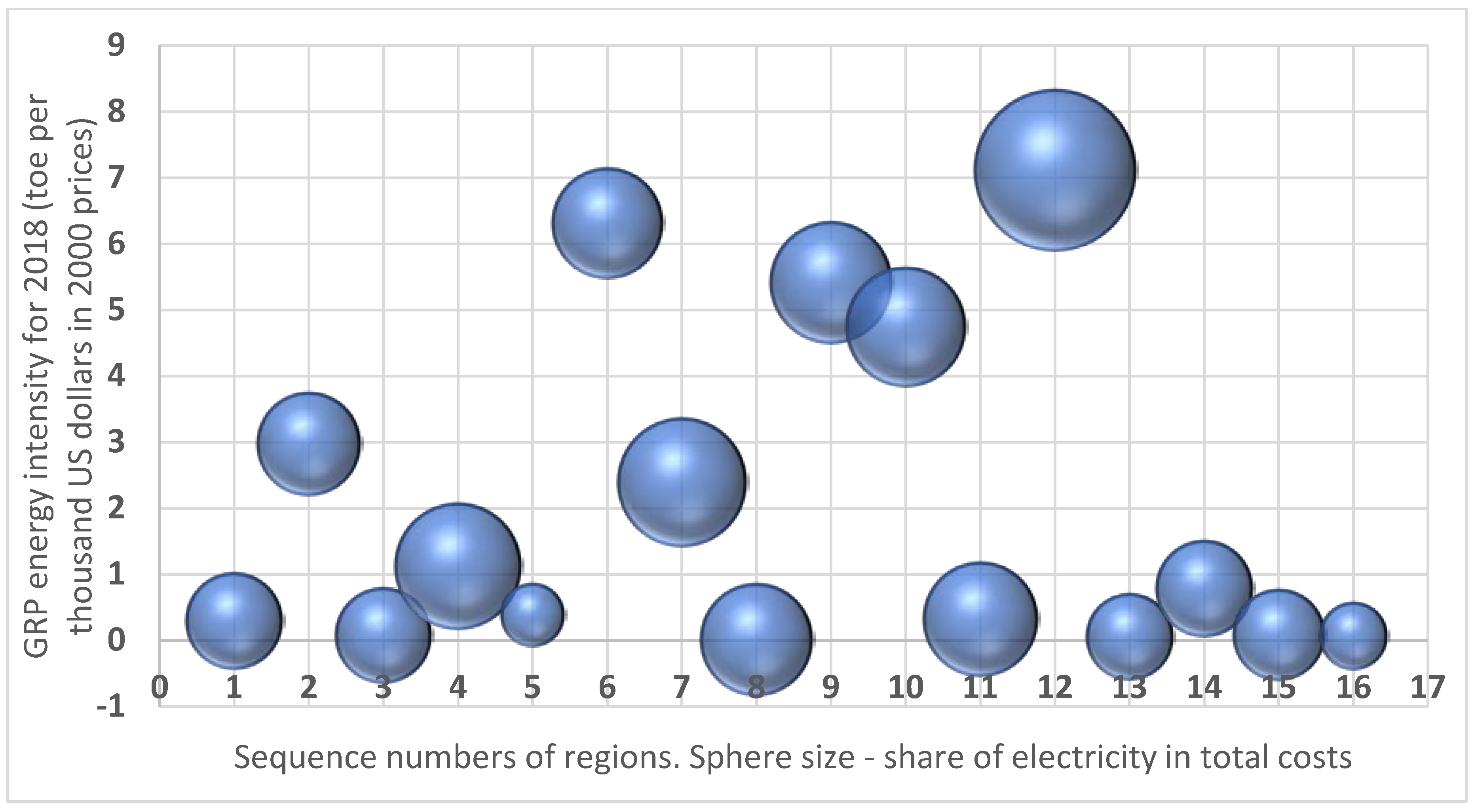

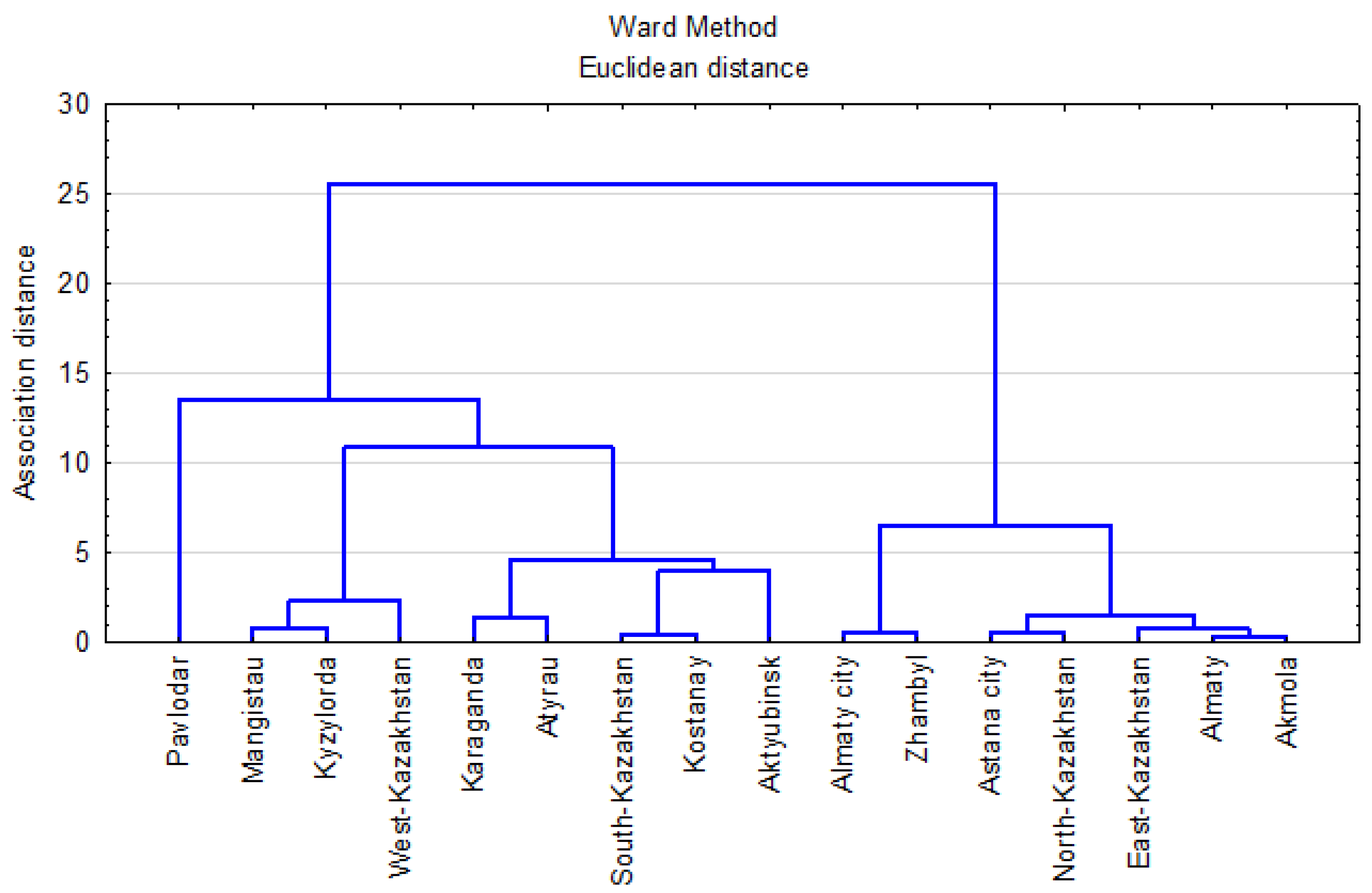

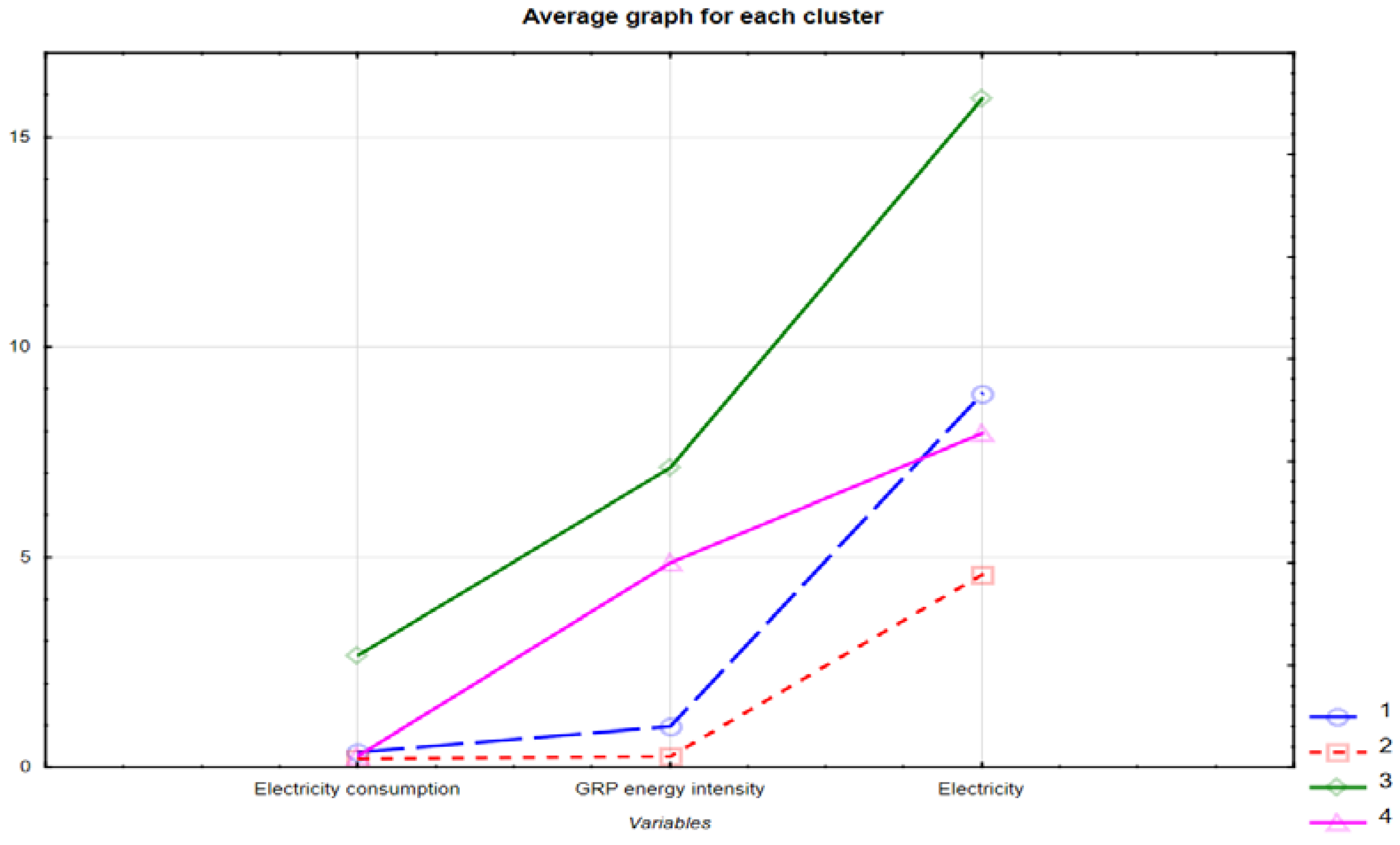

3.2. Regional Patterns of Costs for Electric Power and Heat Supply

- The desert climate in summer requires intensive air conditioning and cooling in offices and in public facilities.

- These regions have the highest administrative barriers, with widespread bribery on the part of NMHs.

3.3. The Price of Energy Barrier for Business

4. Discussion

- Improve the quality of electric power and optimize the structure of the regional economy.

- Promote energy saving and enhance the technical level of local enterprises.

- Promote the general development and strengthening regional coordination.

Author Contributions

Funding

Conflicts of Interest

References

- Zhang, Y.M.; Ana Maria, M.; Behnke, R.; Kushanova, A.; Iskhakova, A.; Liu, F. Synthesis Report: Unlocking Energy Efficiency Potentials in Cities in Kazakhstan (English); World Bank Group: Washington, DC, USA, 2018; Available online: http://documents.worldbank.org/curated/en/267161521612788850/Synthesis-report-unlocking-energy-efficiency-potentials-in-cities-in-Kazakhstan (accessed on 4 April 2020).

- Kumar, S.; Fujii, H.; Managi, S. Substitute or complement? Assessing renewable and nonrenewable energy in OECD countries. Appl. Econ. 2015, 4714, 1438–1459. [Google Scholar] [CrossRef]

- Karatayev, M.; Clarke, M.L. A review of current energy systems and green energy potential in Kazakhstan. Renew. Sustain. Energy Rev. 2016, 55, 491–504. [Google Scholar] [CrossRef]

- Kazmaganbetova, M.; Suleimenov, B.; Ayashev, K.; Kerimray, A. Sectoral structure and energy use in Kazakhstan’s regions. In Proceedings of the 4th IET Clean Energy and Technology Conference, CEAT 2016, Kuala Lumpur, Malaysia, 14–15 Novembre 2016. [Google Scholar]

- Sineviciene, L.; Sotnyk, I.; Kubatko, O. Determinants of energy efficiency and energy consumption of Eastern Europe post-communist economies. Energy Environ. 2017, 28, 870–884. [Google Scholar] [CrossRef]

- Sikora, J.; Niemiec, M.; Szeląg-Sikora, A.; Gródek-Szostak, Z.; Kuboń, M.; Komorowska, M. The Impact of a Controlled-Release Fertilizer on Greenhouse Gas Emissions and the Efficiency of the Production of Chinese Cabbage. Energies 2020, 13, 2063. [Google Scholar] [CrossRef]

- Madani, D.H.; Sarsenov, I. Kazakhstan: Adjusting to Lower Oil Prices; Challenging Times Ahead—Biannual Economic Update (Fall 2015) (English); Kazakhstan economic update; World Bank Group: Washington, DC, USA, 2015; Available online: http://documents.worldbank.org/curated/en/619601467991052702/Kazakhstan-adjusting-to-lower-oil-prices-challenging-times-ahead-biannual-economic-update-Fall-2015 (accessed on 2 April 2020).

- Campisi, D.; Gitto, S.; Morea, D. Economic feasibility of energy efficiency improvements in street lighting systems in Rome. J. Clean. Prod. 2018, 175, 190–198. [Google Scholar] [CrossRef]

- Nazarbayev, N.A. The Strategy for Development of the Republic of Kazakhstan until the Year 2030. Available online: http://www.akorda.kz/en/official_documents/strategies_and_programs (accessed on 1 May 2020).

- Okun, A. Equality and Efficiency, the Big Tradeoff; Brookings Institute: Washington, DC, USA, 1975. [Google Scholar]

- El Iysaouy, L.; El Idrissi, N.E.; Tvaronavičienė, M.; Lahbabi, M.; Oumnad, A. Towards energy efficiency: Case of Morocco. Insights Reg. Dev. 2019, 1, 259–271. [Google Scholar] [CrossRef]

- Tyo, A.; Jazykbayeva, B.; Ten, T.; Kogay, G.; Spanova, B. Development tendencies of heat and energy resources: Evidence of Kazakhstan. Entrep. Sustain. Issues 2019, 7, 1514–1524. [Google Scholar] [CrossRef]

- Dudin, M.N.; Frolova, E.E.; Protopopova, O.V.; Andrey Alievich Mamedov, A.A.; Odintsov, S.V. Study of innovative technologies in the energy industry: Nontraditional and renewable energy sources. Entrep. Sustain. Issues 2019, 6, 1704–1713. [Google Scholar] [CrossRef]

- Andriushchenko, K.; Buriachenko, A.; Rozhko, O.; Lavruk, O.; Skok, P.; Hlushchenko, Y.; Muzychka, Y.; Slavina, N.; Buchynska, O.; Kondarevych, V. Peculiarities of sustainable development of enterprises in the context of digital transformation. Entrep. Sustain. Issues 2020, 7, 2255–2270. [Google Scholar] [CrossRef]

- Sarma, U.; Karnitis, G.; Zuters, J.; Karnitis, E. District heating networks: Enhancement of the efficiency. Insights Reg. Dev. 2019, 1, 200–213. [Google Scholar] [CrossRef]

- Pechancová, V.; Hrbáčková, L.; Dvorský, J.; Chromjaková, F.; Stojanovic, A. Environmental management systems: An effective tool of corporate sustainability. Entrep. Sustain. Issues 2019, 7, 825–841. [Google Scholar] [CrossRef]

- Rogalev, A.; Komarov, I.; Kindra, V.; Zlyvk, O. Entrepreneurial assessment of sustainable development technologies for power energy sector. Enterp. Sustain. Issues 2018, 6, 429–445. [Google Scholar] [CrossRef]

- Zou, Y.; Lu, Y. Analysis on the regional characteristics of energy utilization efficiency in China based on the space Autoregressive Model. Appl. Stat. 2005, 10, 67–71. (In Chinese) [Google Scholar]

- Gao, Z.; Wang, Y. Regional Division of Energy Productivity in China and Analysis on Impact Factors. J. Quant. Tech. Econ. 2006, 46, 57. (In Chinese) [Google Scholar]

- Chehabeddine, M.; Tvaronavičienė, M. Securing regional development. Insights Reg. Dev. 2020, 2, 430–442. [Google Scholar] [CrossRef]

- Shi, D.; Wu, L.; Fu, X.; Wu, B. Regional Energy Efficiency Differences in China and Its Causes Study—Stochastic frontier production function-based variation decomposition. Manag. World 2008, 2, 35–43. (In Chinese) [Google Scholar]

- Campisi, D.; Gitto, S.; Morea, D. An evaluation of energy and economic efficiency in residential buildings sector: A multi-criteria analisys on an Italian case study. Int. J. Energy Econ. Policy 2018, 8, 185. [Google Scholar]

- Petrenko, Y.; Pizikov, S.; Mukaliev, N.; Mukazhan, A. Impact of Production and Transaction Costs on Companies’ Performance According Assessments of Experts. Entrep. Sustain. Issues 2018, 6, 398–410. [Google Scholar] [CrossRef]

- International Standard Cost Model Manual—OECD.org. Available online: http://www.oecd.org/gov/regulatory-policy/34227698.pdf (accessed on 15 January 2020).

- Stam, E. Entrepreneurial ecosystems and regional policy: A sympathetic critique. Eur. Plan. Stud. 2015, 23, 1759–1769. [Google Scholar] [CrossRef]

- Stam, F.C.; Spigel, B. Entrepreneurial ecosystems. USE Discussion Paper Ser. 2016, 13, 16–19. [Google Scholar]

- Capital. In Kazakhstan have been registered almost 440000 small firms. Available online: https://kapital.kz/business/84686/v-kazakhstane-zaregistrirovano-pochti-440-tysyach-malykh-kompaniy.html (accessed on 2 March 2020).

- Song, M.; Chen, Y.; An, Q. Spatial econometric analysis of factors influencing regional energy efficiency in China. Environ. Sci. Pollut. Res. 2018, 25, 13745–13759. [Google Scholar] [CrossRef] [PubMed]

- Viholainen, J.; Luoranen, M.; Väisänen, S.; Niskanen, A.; Horttanainen, M.; Soukka, R. Regional level approach for increasing energy efficiency. Appl. Energy 2016, 163, 295–303. [Google Scholar] [CrossRef]

- Li, M.-J.; He, Y.-L.; Tao, W.-Q. Modeling a hybrid methodology for evaluating and forecasting regional energy efficiency in China. Appl. Energy 2017, 185, 1769–1777. [Google Scholar] [CrossRef]

- Aldayarov, M.; Dobozi, I.; Nikolakakis, T. Stuck in Transition: Reform Experiences and Challenges Ahead in the Kazakhstan Power Sector (English); Directions in Development—Energy and Mining; World Bank Group: Washington, DC, USA, 2017; Available online: http://documents.worldbank.org/curated/en/104181488537871278/Stuck-in-transition-reform-experiences-and-challenges-ahead-in-the-Kazakhstan-power-sector (accessed on 15 March 2020).

- Speech by President Kassym-Zhomart Tokaev at a Meeting of the State Commission on the State of Emergency. Available online: http://www.akorda.kz/ru/speeches/internal_political_affairs/in_speeches_and_addresses/vystuplenie-prezidenta-kasym-zhomarta-tokaeva-na-zasedi-po-chrezvychainomu-polozheniyu (accessed on 15 March 2020).

- World Bank. Kazakhstan—Systematic Country Diagnostic: A New Growth Model. for Building a Secure Middle Class. (English); World Bank Group: Washington, DC, USA, 2018; Available online: http://documents.worldbank.org/curated/en/664531525455037169/Kazakhstan-Systematic-country-diagnostic-a-new-growth-model-for-building-a-secure-middle-class (accessed on 20 March 2020).

- Summary Report: Kazakhstan Energy Week/XII Kazenergy Eurasian Forum «Fueling the Future: Innovation Growth». Available online: http://kazenergyforum.com/wp-content/uploads/files/KEW-2019-summary-report-en.pdf (accessed on 28 March 2020).

- Analytical Research “Promotion of the Electricity Governance Initiative in Kazakhstan”. Available online: https://www.soros.kz/wp-content/uploads/2018/02/research_about_electricity_governance_initiative.pdf (accessed on 23 March 2020).

- Pacudan, R.; De Guzman, E. Impact of energy efficiency policy to productive efficiency of electric power distribution industry in the Philippines. Energy Econ. 2002, 24, 41–54. [Google Scholar] [CrossRef]

| № | Business Size | Number of Respondents | Response Rate, % |

|---|---|---|---|

| 1 | Micro business | 203 | 7% |

| 2 | Small business | 1556 | 57% |

| 3 | Medium business | 787 | 28% |

| 4 | Large business | 235 | 8% |

| Total | 2781 | 100% |

| Share of Item in Total Costs | Micro Business | Small Business | Medium Business | Large Business |

|---|---|---|---|---|

| Electric power | 9.46 | 7.59 | 6.86 | 3.24 |

| Heating | 10.14 | 8.49 | 4.51 | 2.20 |

| № | Costs | 10–40 Thousand KZT | 41–100 Thousand KZT | 101–700 Thousand KZT |

|---|---|---|---|---|

| 1 | Connecting (disconnecting) electrical installations to the power grid for the enterprise | 66 | 20 | 14 |

| 2 | Connecting to the heating network of the thermal power plant | 48 | 30 | 22 |

| 3 | Connection of electric installations to the power grids of NMH companies, according to requirements stated in NMH specifications | 80 | 10 | 10 |

| 4 | Connecting to the heating network of the thermal power plant, according to the technical specifications set by the NMH | 37 | 52 | 11 |

| 5 | Permits from the NMH for works related to changes in the energy metering scheme | 71 | 5 | 24 |

| 6 | Additional verification of the commercial energy meter prior to connection (in case if the consumer has been disconnected for violation of the terms of the power supply contract); | 56 | 31 | 13 |

| 7 | Additional verification of the commercial energy meter prior to connection (in case if the consumer has been disconnected for violation of the terms of the heat supply contract) | 86 | - | 14 |

| 8 | Costs related to losses caused by obtaining information on the availability of free power generation capacities of the NMH | 88 | 12 | - |

| Regions | Akmola | Aktyubinsk | Almaty | Atyrau | West-Kazakhstan | Zhambyl | Karaganda | Kostanay |

| Electricity | 5.7 | 6.5 | 5.6 | 9.7 | 7.5 | 2.5 | 10.1 | 7.7 |

| Heating | 3.4 | 5.0 | 2.3 | 5.7 | 5.9 | 1.0 | 4.8 | 6.4 |

| Average annual t° | 1.8 | 3.6 | 6.9 | 7.7 | 4.4 | 9.7 | 2.3 | 1.6 |

| Average t° of winter period | −18 | −16 | −12 | −13 | −17 | −7 | −16 | −16 |

| Regions | Kyzylorda | Mangistau | South-Kazakhstan | Pavlodar | North-Kazakhstan | East-Kazakhstan | Astana city | Almaty city |

| Electricity | 9.1 | 8.7 | 8.0 | 15.9 | 4.6 | 5.7 | 5.1 | 2.8 |

| Heating | 5.1 | 6.4 | 9.6 | 11.2 | 10.4 | 5.3 | 4.0 | 2.7 |

| Average annual t° | 9 | 11.1 | 11.9 | 1.9 | 0.5 | 3 | 1.40 | 7.6 |

| Average t° in winter | −8 | −4 | −5 | −17 | − | − | −18 | −12 |

| Regions | Number of NMH | Electric Energy | Deviation from the Mean | Squares of the Deviations | Product of the Deviations | ||

|---|---|---|---|---|---|---|---|

| x | y | dx | dy | dx2 | dy2 | dx dy | |

| Akmola | 6 | 5.7 | −1.25 | −1.50 | 1.56 | 2.25 | 1.88 |

| Aktyubinsk | 3 | 6.5 | −4.25 | −0.70 | 18.06 | 0.49 | 2.98 |

| Almaty | 17 | 5.6 | 9.75 | −1.60 | 95.06 | 2.56 | −15.60 |

| Atyrau | 5 | 9.7 | −2.25 | 2.50 | 5.06 | 6.25 | −5.63 |

| Zhambyl | 1 | 2.5 | −6.25 | −4.70 | 39.06 | 22.09 | 29.38 |

| West-Kazakhstan | 4 | 7.5 | −3.25 | 0.30 | 10.56 | 0.09 | −0.97 |

| Karaganda | 7 | 10.1 | −0.25 | 2.90 | 0.06 | 8.41 | −0.73 |

| Kostanay | 4 | 7.7 | −3.25 | 0.50 | 10.56 | 0.25 | −1.63 |

| Kyzylorda | 2 | 9.1 | −5.25 | 1.90 | 27.56 | 3.61 | −9.98 |

| Kyzylorda | 4 | 8.7 | −3.25 | 1.50 | 10.56 | 2.25 | −4.88 |

| South-Kazakhstan | 3 | 8.0 | −4.25 | 0.80 | 18.06 | 0.64 | −3.40 |

| Pavlodar | 4 | 15.9 | −3.25 | 8.70 | 10.56 | 75.69 | −28.28 |

| North-Kazakhstan | 8 | 4.6 | 0.75 | −2.60 | 0.56 | 6.76 | −1.95 |

| East-Kazakhstan | 6 | 5.7 | −1.25 | −1.50 | 1.56 | 2.25 | 1.88 |

| Astana city | 20 | 5.1 | 12.75 | −2.10 | 162.56 | 4.41 | −26.78 |

| Almaty city | 22 | 2.8 | 14.75 | −4.40 | 217.56 | 19.36 | −64.90 |

| Amount | 116 | 115.2 | 629.0 | 157.4 | −128.6 | ||

| Mean | 7.25 | 7.20 | |||||

| Correlation coefficient | 0.5 | ||||||

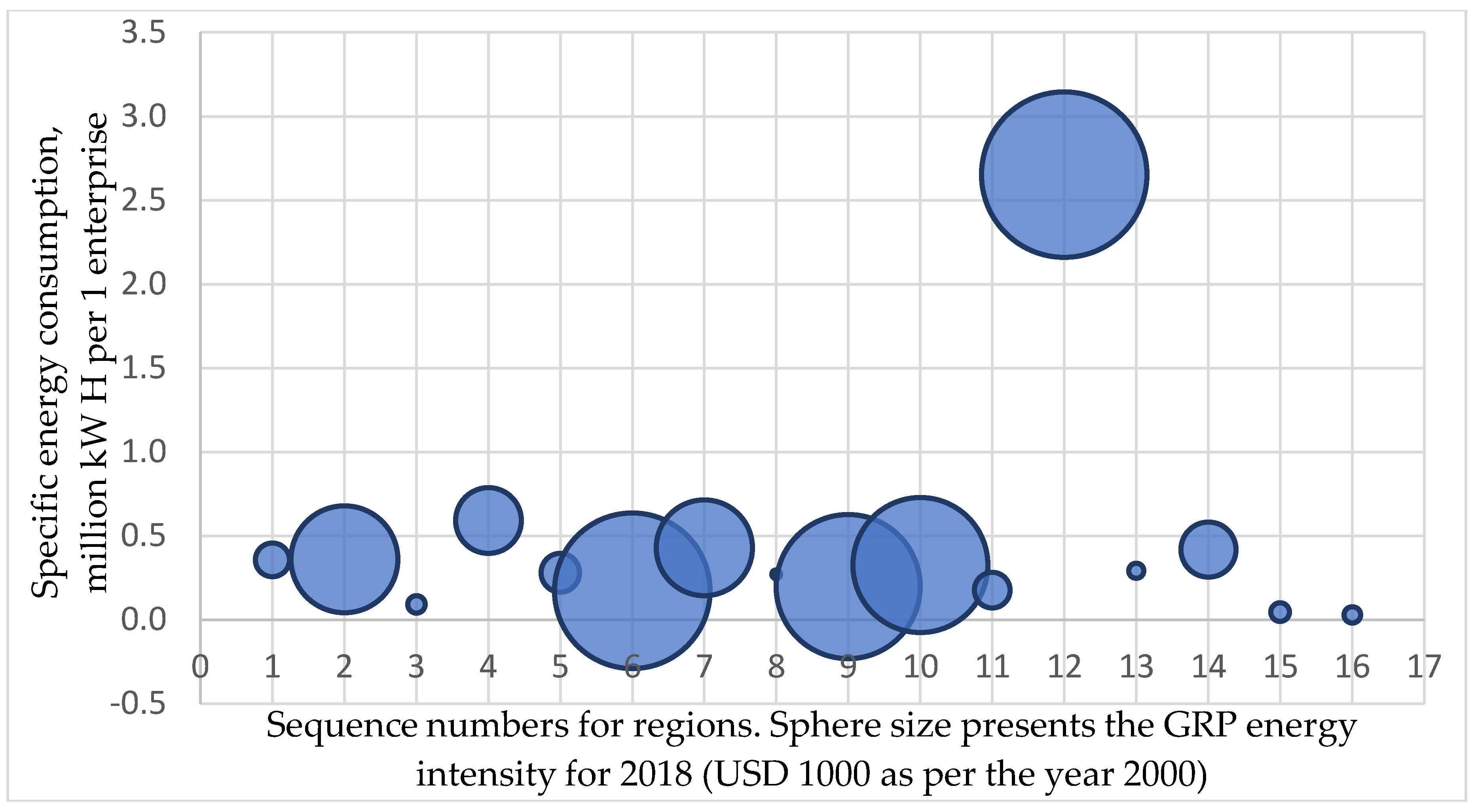

| Indicator | Cluster 1 | Cluster 2 | Cluster 3 | Cluster 4 |

|---|---|---|---|---|

| Electric energy consumption | 0.366858 | 0.216713 | 2.65252 | 0.264953 |

| GRP energy intensity | 0.970000 | 0.254286 | 7.12000 | 4.867500 |

| Electric power costs | 8.875000 | 4.571429 | 15.90000 | 7.950000 |

| № | Transaction Costs | Response Rate, % |

|---|---|---|

| 1 | Fines | 32% |

| 2 | Permits from the state monopolists and quasi-state sector, as well as regular controls | 25% |

| 3 | Access to BVI loans | 24% |

| 4 | Legal costs | 23% |

| 5 | Bribes for public officers | 16% |

| 6 | Bribes for second-tier bank representatives | 13% |

| 7 | Bribes for the representatives of the natural monopolists (NMH) | 9% |

| № | Transaction Costs for Heat and Electric Power | Share in Cost Structure, % | Recommendations | Volume of Costs Reduced, mln KZT |

|---|---|---|---|---|

| 1 | Connection (disconnection) of electrical installations to the power grid | 5.55 | Cut back by 50% | 40,921.7 |

| 2 | Connection to the heating networks of the energy supplier (power producer); | 8.0 | Cut back by 50% | 25,450.5 |

| 3 | Permits from the NMH for changing the energy metering scheme; | 6.26 | Cancel | 123,903.8 |

| 4 | Additional verification of the device of commercial metering of electric power prior to connection (if the consumer has been disconnected for violation of the power supply contract); | 8.3 | Cut back by 50% | 25,450.5 |

| 9 | Additional verification of the unit of commercial heating meters prior to connection (in case if the consumer has been disconnected for violation of the terms of the heating supply contract); | 5.58 | Cut back by 50% | 30,317.4 |

| 10 | Obtaining information on the free capacities of NMH (information costs on electric power and heating supply) | 5.9 | Cancel | 8930.0 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Velinov, E.; Petrenko, Y.; Vechkinzova, E.; Denisov, I.; Ochoa Siguencia, L.; Gródek-Szostak, Z. “Leaky Bucket” of Kazakhstan’s Power Grid: Losses and Inefficient Distribution of Electric Power. Energies 2020, 13, 2947. https://doi.org/10.3390/en13112947

Velinov E, Petrenko Y, Vechkinzova E, Denisov I, Ochoa Siguencia L, Gródek-Szostak Z. “Leaky Bucket” of Kazakhstan’s Power Grid: Losses and Inefficient Distribution of Electric Power. Energies. 2020; 13(11):2947. https://doi.org/10.3390/en13112947

Chicago/Turabian StyleVelinov, Emil, Yelena Petrenko, Elena Vechkinzova, Igor Denisov, Luis Ochoa Siguencia, and Zofia Gródek-Szostak. 2020. "“Leaky Bucket” of Kazakhstan’s Power Grid: Losses and Inefficient Distribution of Electric Power" Energies 13, no. 11: 2947. https://doi.org/10.3390/en13112947

APA StyleVelinov, E., Petrenko, Y., Vechkinzova, E., Denisov, I., Ochoa Siguencia, L., & Gródek-Szostak, Z. (2020). “Leaky Bucket” of Kazakhstan’s Power Grid: Losses and Inefficient Distribution of Electric Power. Energies, 13(11), 2947. https://doi.org/10.3390/en13112947