How Does Information and Communication Technology Capital Affect Productivity in the Energy Sector? New Evidence from 14 Countries, Considering the Transition to Renewable Energy Systems

Abstract

:1. Introduction

1.1. ICT and Productivity

1.2. Literature Review and Novelty of This Study

1.3. Research Framework

2. Materials and Methods

2.1. Performance Evaluation Indicators

2.1.1. Labor Productivity (LP)

2.1.2. Capital Productivity (CP)

2.1.3. Material Productivity (MP)

2.1.4. Total Factor Productivity (TFP)

2.2. Determinant Factor Analysis

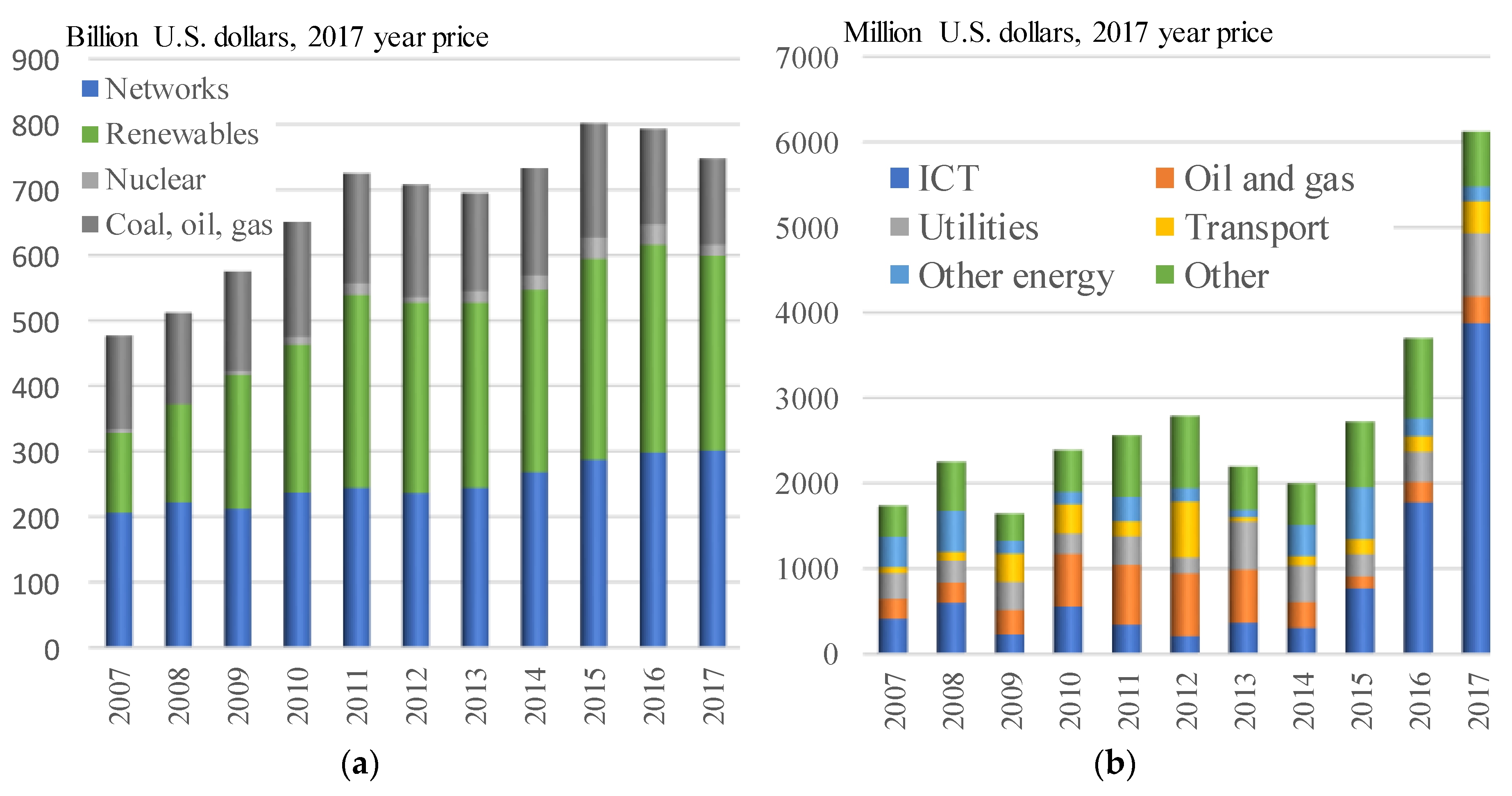

2.3. Data

3. Results

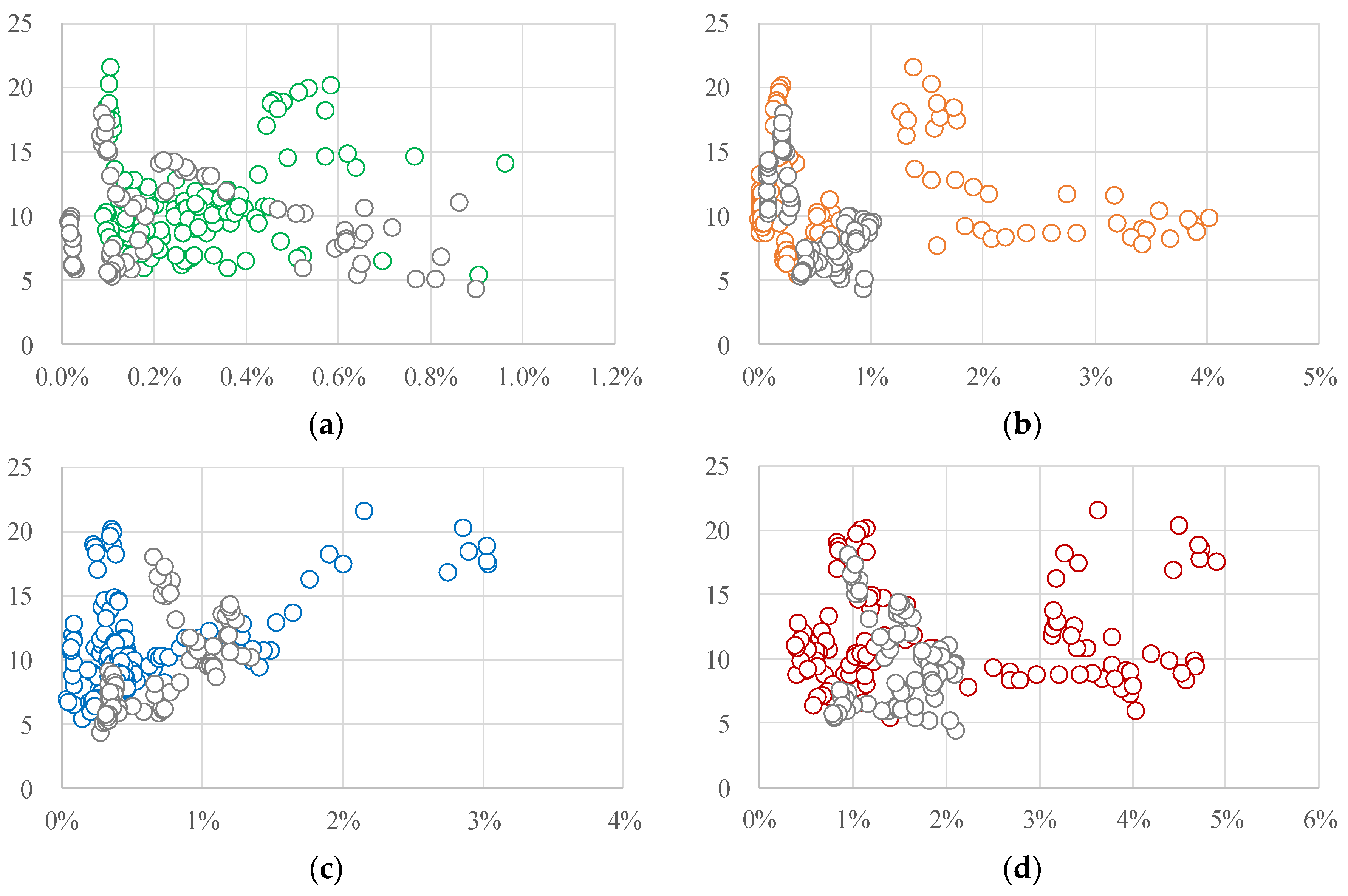

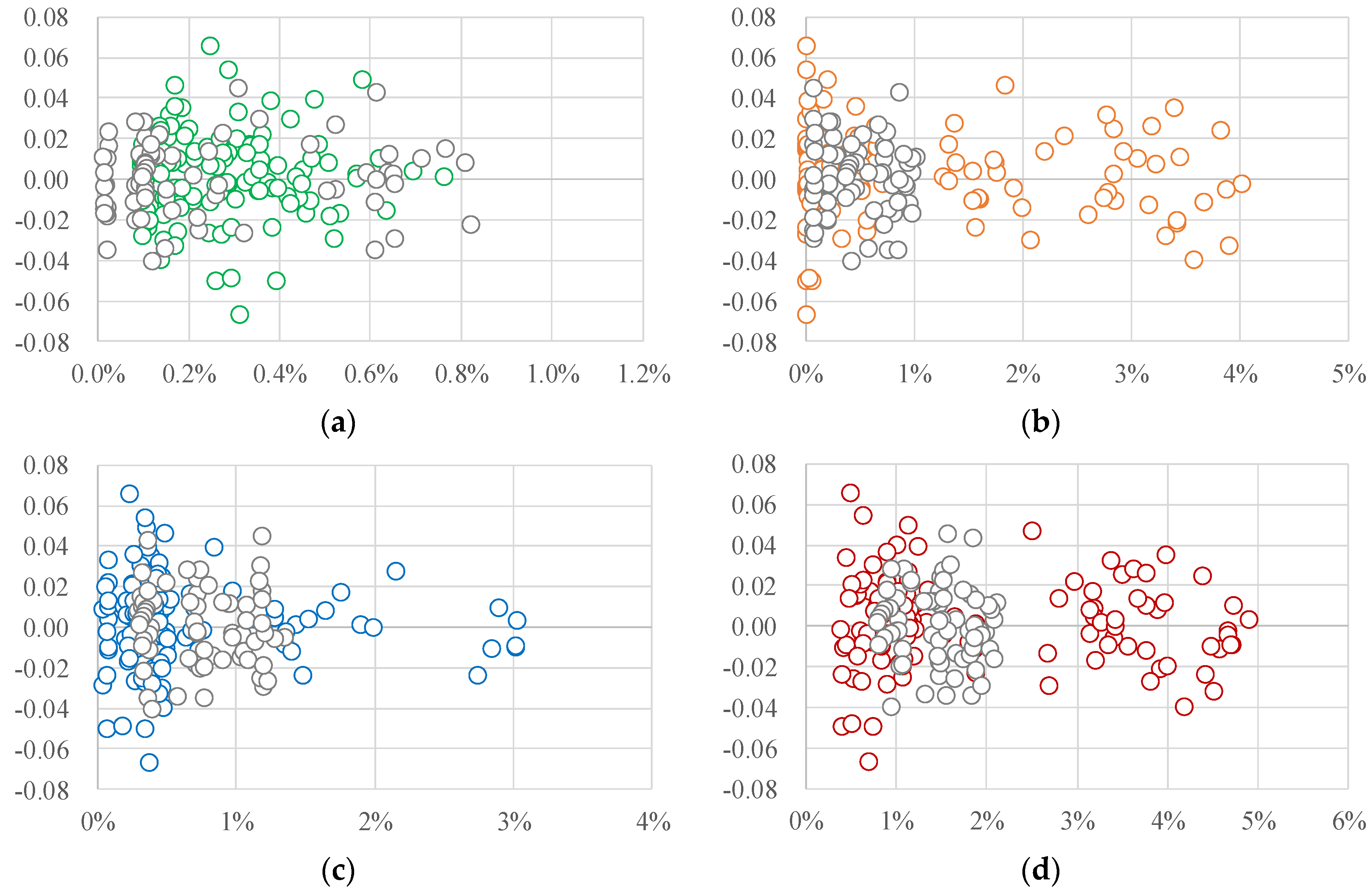

3.1. Bivariate Analysis of Productive Performance and ICT Capital

3.2. Determinant Analysis of the Productive Performance Indicators

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Basu, S.; Fernald, J. Information and communications technology as a general-purpose technology: Evidence from US industry data. Ger. Econ. Rev. 2007, 8, 146–173. [Google Scholar] [CrossRef]

- Kretschmer, T. Information and Communication Technologies and Productivity Growth: A Survey of the Literature; OECD Digital Economy Papers, No. 195; OECD Publishing: Paris, France, 2012. [Google Scholar]

- Bassanini, A.; Scarpetta, S. Growth, technological change, and ICT diffusion: Recent evidence from OECD countries. Oxf. Rev. Econ. Policy 2002, 18, 324–344. [Google Scholar] [CrossRef]

- OECD. OECD Compendium of Productivity Indicators 2015; OECD Publishing: Paris, France, 2015. [Google Scholar]

- OECD. OECD Compendium of Productivity Indicators 2018; OECD Publishing: Paris, France, 2018. [Google Scholar]

- Miller, B.; Atkinson, R.D. Raising European Productivity Growth through ICT; The Information Technology and Innovation Foundation: Washington, DC, USA, 2014. [Google Scholar]

- Kvochko, E. Five Ways Technology Can Help the Economy; World Economic Forum: Cologny, Switzerland, 2013. [Google Scholar]

- International Telecommunication Union. ICT for Energy: Telecom and Energy Working together for Sustainable Development; Telecommunication Development Bureau: Geneva, Switzerland, 2017. [Google Scholar]

- International Energy Agency. World Energy Investment 2018; IEA Publications: Paris, France, 2018. [Google Scholar]

- Information Technology Industry Council. Benefits of Information Communications Technology to Energy Infrastructure; Information Technology Industry Council: Washington, DC, USA, 2014. [Google Scholar]

- Nagai, K.; Murakami, M.; Oowada, K.; Fukumoto, T.; Sato, Y.; Matsubara, T. Energy infrastructure and ICT systems. Hitachi Rev. 2016, 65, 20–25. [Google Scholar]

- World Energy Council. The Role of ICT in Energy Efficiency Management; World Energy Council: London, UK, 2018. [Google Scholar]

- David, P.A. The dynamo and the computer: An historical perspective on the modern productivity paradox. Am. Econ. Rev. 1990, 80, 355–361. [Google Scholar]

- Jorgenson, D.W. Information technology and the U.S. Economy. Am. Econ. Rev. 2001, 91, 1–32. [Google Scholar] [CrossRef]

- Stiroh, K.J. Information technology and the US productivity revival: What do the industry data say? Am. Econ. Rev. 2002, 92, 1559–1576. [Google Scholar] [CrossRef]

- Polák, P. The productivity paradox: A meta-analysis. Inf. Econ. Policy 2017, 38, 38–54. [Google Scholar] [CrossRef]

- Edquist, H.; Henrekson, M. Do R&D and ICT affect total factor productivity growth differently? Telecommun. Policy 2017, 41, 106–119. [Google Scholar] [CrossRef]

- Strobel, T. ICT intermediates and productivity spillovers-evidence from German and US manufacturing sectors. Struct. Chang. Econ. Dyn. 2016, 37, 147–163. [Google Scholar] [CrossRef]

- Ceccobelli, M.; Gitto, S.; Mancuso, P. ICT capital and labour productivity growth: A non-parametric analysis of 14 OECD countries. Telecommun. Policy 2012, 36, 282–292. [Google Scholar] [CrossRef]

- Wissner, M. ICT, growth and productivity in the German energy sector-on the way to a smart grid? Util. Policy 2011, 19, 14–19. [Google Scholar] [CrossRef]

- Naveed, K.; Watanabe, C.; Neittaanmäki, P. The transformative direction of innovation toward an IoT-based society-increasing dependency on uncaptured GDP in global ICT firms. Technol. Soc. 2018, 53, 23–46. [Google Scholar] [CrossRef]

- Managi, S.; Guan, D. Multiple disasters management: Lessons from the Fukushima triple events. Econ. Anal. Policy 2017, 53, 114–122. [Google Scholar] [CrossRef]

- OECD. Green Growth Indicators 2017; OECD Publishing: Paris, France, 2017. [Google Scholar]

- OECD. OECD Digital Economy Outlook 2015; OECD Publishing: Paris, France, 2015. [Google Scholar]

- Biagi, F.; Falk, M. The impact of ICT and e-commerce on employment in Europe. J. Policy Model. 2017, 39, 1–18. [Google Scholar] [CrossRef]

- Trillo-Montero, D.; Santiago, I.; Luna-Rodriguez, J.J.; Real-Calvo, R. Development of a software application to evaluate the performance and energy losses of grid-connected photovoltaic systems. Energy Convers. Manag. 2014, 81, 144–159. [Google Scholar] [CrossRef]

- Nijhuis, M.; Gibescu, M.; Cobben, J.F.G. Assessment of the impacts of the renewable energy and ICT driven energy transition on distribution networks. Renew. Sustain. Energy Rev. 2015, 52, 1003–1014. [Google Scholar] [CrossRef]

- Baptist, S.; Hepburn, C. Intermediate inputs and economic productivity. Philos. Trans. A Math. Phys. Eng. Sci. 2013, 371, 20110565. [Google Scholar] [CrossRef]

- Comin, D. Total factor productivity. In The New Palgrave Dictionary of Economics; Macmillan, P., Ed.; Palgram Macmillan: London, UK, 2008; pp. 1806–1877. [Google Scholar]

- Elgin, C.; Çakır, S. Technological progress and scientific indicators: A panel data analysis. Econ. Innov. New Technol. 2015, 24, 263–281. [Google Scholar] [CrossRef]

- Chambers, R.G.; Chung, Y.; Färe, R. Profit, directional distance functions, and nerlovian efficiency. J. Optim. Theory Appl. 1998, 98, 351–364. [Google Scholar] [CrossRef]

- Luenberger, D.G. Benefit functions and duality. J. Math. Econ. 1992, 21, 461–481. [Google Scholar] [CrossRef]

- United Nations Statistics Division. International Standard Industrial Classification of All Economic Activities Revision 4; United Nations Statistics Division: New York, NY, USA, 2008. [Google Scholar]

- Timmer, M.P.; Dietzenbacher, E.; Los, B.; Stehrer, R.; de Vries, G.J. An illustrated user guide to the world input–output database: The case of global automotive production. Rev. Int. Econ. 2015, 23, 575–605. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W.; Swarts, J.; Thomas, D. An introduction to data envelopment analysis with some of its models and their uses. Res. Gov. Nonprofit Account. 1989, 5, 125–163. [Google Scholar]

- Jäger, K. EU KLEMS Growth and Productivity Accounts 2017 Release—Description of Methodology and General Notes; The Conference Board: New York, NY, USA, 2018. [Google Scholar]

- Paiho, S.; Saastamoinen, H.; Hakkarainen, E.; Similä, L.; Pasonen, R.; Ikäheimo, J.; Rämä, M.; Tuovinen, M.; Horsmanheimo, S. Increasing flexibility of Finnish energy systems-a review of potential technologies and means. Sustain. Cities Soc. 2018, 43, 509–523. [Google Scholar] [CrossRef]

- Johnstone, N.; Managi, S.; Rodríguez, M.C.; Haščič, I.; Fujii, H.; Souchier, M. Environmental policy design, innovation and efficiency gains in electricity generation. Energy Econ. 2017, 63, 106–115. [Google Scholar] [CrossRef]

| Data Category | Data Variable | Unit | Mean Value | Std. dev. | Min. | Max. |

|---|---|---|---|---|---|---|

| Output variable | Gross output | MillionU.S. $ | 57,453 | 108,921 | 321 | 999,835 |

| Input variable | Labor compensation | MillionU.S. $ | 5,921 | 11,841 | 37 | 77,550 |

| Capital stock | MillionU.S. $ | 145,438 | 313,294 | 844 | 2,050,479 | |

| Intermediate material cost | MillionU.S. $ | 36,331 | 75,793 | 147 | 796,417 | |

| Countries (42) | Australia, Austria, Belgium, Brazil, Bulgaria, Canada, China, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, India, Indonesia, Ireland, Italy, Japan, Korea, Latvia, Lithuania, Luxembourg, Mexico, Netherlands, Norway, Poland, Portugal, Romania, Russia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Taiwan, United Kingdom, United States | |||||

| Data Category | Data Variable (Code) | Unit | Mean | Std. dev. | Min. | Max. |

|---|---|---|---|---|---|---|

| Dependent variable (Productivity indicator) | Labor productivity (LP) | $/$ | 10.369 | 3.713 | 4.240 | 21.470 |

| Capital productivity (CP) | $/$ | 0.511 | 0.282 | 0.180 | 1.340 | |

| Material productivity (MP) | $/$ | 1.830 | 0.509 | 1.180 | 3.510 | |

| Total factor productivity (TFP) | - | 0.001 | 0.020 | -0.068 | 0.065 | |

| Independent variable | ICT capital stock share (ICT) | % | 1.744 | 1.155 | 0.400 | 4.920 |

| IT capital stock share (IT) | % | 0.276 | 0.204 | 0.020 | 0.960 | |

| CT capital stock share (CT) | % | 0.813 | 1.025 | 0.010 | 4.030 | |

| Software capital stock share (Soft) | % | 0.656 | 0.565 | 0.050 | 3.040 | |

| R&D capital stock share (R&D) | % | 0.924 | 2.400 | 0.000 | 14.610 | |

| Share of solar photovoltaic and wind power generation (Renewable) | % | 1.963 | 3.060 | 0.000 | 15.840 | |

| Electricity price index (Price) | - | 80.364 | 16.743 | 42.400 | 115.200 | |

| Countries (14) | Austria, Czech Republic, Denmark, Finland, France, Germany, Italy, Luxembourg, Netherlands, Slovenia, Spain, Sweden, United Kingdom, United States | |||||

| Dependent Variable | LP | CP | MP | TFP | ||||

|---|---|---|---|---|---|---|---|---|

| Coef. | Sig | Coef. | Sig | Coef. | Sig | Coef. | Sig | |

| ICT | −90.60 | *** | −0.63 | - | −5.49 | - | −0.01 | - |

| R&D | −27.23 | *** | −2.08 | *** | 4.30 | *** | −0.07 | - |

| Price | 0.04 | *** | 0.00 | ** | −0.00 | - | −0.00 | *** |

| Renewable | 35.37 | *** | 0.77 | ** | −1.89 | ** | −0.04 | - |

| Constant | 8.12 | *** | 0.44 | *** | 2.06 | *** | 0.02 | *** |

| Observation | 210 | 210 | 210 | 196 | ||||

| Within | 0.463 | 0.224 | 0.203 | 0.060 | ||||

| Between | 0.040 | 0.149 | 0.000 | 0.222 | ||||

| Overall | 0.113 | 0.047 | 0.012 | 0.061 | ||||

| Wald chi2 | 166.990 | 51.620 | 48.410 | 12.490 | ||||

| Prob > chi2 | 0.000 | 0.000 | 0.000 | 0.014 | ||||

| Dependent Variable | LP | CP | MP | TFP | ||||

|---|---|---|---|---|---|---|---|---|

| Coef. | Sig | Coef. | Sig | Coef. | Sig | Coef. | Sig | |

| IT | −350.15 | *** | −9.56 | - | 71.38 | *** | −0.54 | - |

| CT | −119.79 | *** | −4.19 | ** | −23.47 | *** | 0.00 | - |

| Software | 56.01 | - | 9.41 | *** | −3.09 | - | −0.12 | - |

| R&D | −25.11 | *** | −1.90 | *** | 4.55 | *** | −0.09 | - |

| Price | 0.04 | *** | 0.00 | *** | 0.00 | - | −0.00 | *** |

| Renewable | 22.42 | *** | −0.15 | - | −2.40 | *** | −0.04 | - |

| Constant | 8.69 | *** | 0.44 | *** | 1.70 | *** | 0.03 | *** |

| Observation | 210 | 210 | 210 | 196 | ||||

| Within | 0.492 | 0.277 | 0.307 | 0.066 | ||||

| Between | 0.159 | 0.001 | 0.054 | 0.170 | ||||

| Overall | 0.229 | 0.011 | 0.018 | 0.064 | ||||

| Wald chi2 / F-value | 188.210 | 70.390 | 14.010 | 12.850 | ||||

| Prob > chi2 / Prob > F | 0.000 | 0.000 | 0.000 | 0.045 | ||||

| Dependent Variable | LP | CP | MP | TFP | ||||

|---|---|---|---|---|---|---|---|---|

| Coef. | Sig | Coef. | Sig | Coef. | Sig | Coef. | Sig | |

| IT | −245.66 | * | −15.80 | ** | 64.35 | *** | −0.84 | - |

| CT | −128.26 | *** | −9.73 | *** | −22.02 | *** | 0.09 | - |

| Software | 83.95 | - | 10.68 | ** | −27.52 | *** | −0.34 | - |

| R&D | −23.35 | *** | −2.13 | *** | 3.65 | *** | −0.09 | - |

| Price | 0.04 | *** | 0.00 | - | 0.00 | * | −0.00 | *** |

| Renewable | 36.33 | *** | −1.12 | * | −5.44 | *** | −0.16 | - |

| IT*Renewable | −7,540.18 | ** | 598.92 | *** | 329.89 | - | 28.52 | - |

| CT*Renewable | 776.87 | - | 203.60 | *** | −81.32 | - | −7.87 | - |

| Software*Renewable | 648.79 | - | −101.97 | *** | 259.97 | *** | 9.45 | - |

| Constant | 8.02 | *** | 0.52 | *** | 1.87 | *** | 0.03 | *** |

| Observation | 210 | 210 | 210 | 196 | ||||

| Within | 0.497 | 0.404 | 0.347 | 0.077 | ||||

| Between | 0.261 | 0.001 | 0.010 | 0.168 | ||||

| Overall | 0.307 | 0.015 | 0.000 | 0.070 | ||||

| Wald chi2 / F-value | 180.110 | 14.110 | 11.030 | 14.050 | ||||

| Prob > chi2 / Prob > F | 0.000 | 0.000 | 0.000 | 0.121 | ||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fujii, H.; Shinozaki, A.; Kagawa, S.; Managi, S. How Does Information and Communication Technology Capital Affect Productivity in the Energy Sector? New Evidence from 14 Countries, Considering the Transition to Renewable Energy Systems. Energies 2019, 12, 1786. https://doi.org/10.3390/en12091786

Fujii H, Shinozaki A, Kagawa S, Managi S. How Does Information and Communication Technology Capital Affect Productivity in the Energy Sector? New Evidence from 14 Countries, Considering the Transition to Renewable Energy Systems. Energies. 2019; 12(9):1786. https://doi.org/10.3390/en12091786

Chicago/Turabian StyleFujii, Hidemichi, Akihiko Shinozaki, Shigemi Kagawa, and Shunsuke Managi. 2019. "How Does Information and Communication Technology Capital Affect Productivity in the Energy Sector? New Evidence from 14 Countries, Considering the Transition to Renewable Energy Systems" Energies 12, no. 9: 1786. https://doi.org/10.3390/en12091786

APA StyleFujii, H., Shinozaki, A., Kagawa, S., & Managi, S. (2019). How Does Information and Communication Technology Capital Affect Productivity in the Energy Sector? New Evidence from 14 Countries, Considering the Transition to Renewable Energy Systems. Energies, 12(9), 1786. https://doi.org/10.3390/en12091786