1. Introduction

The iron and steel industry (hereafter referred to as the steel industry) is an important fundamental industry of China’s economy. After the founding of New China, the development of steel industry has gone through three stages. The first stage was from 1949 to 1960. The steel industry achieved rapid development under the influence of a “steel-oriented” mindset and the large-scale steelmaking movement, and steel output rose sharply. In the second stage, from 1960 to 1980, the development of the steel industry during this period was in a sluggish state. Many factors had brought about a huge negative impact on the development of the steel industry, causing the steel industry to stagnate. In the third stage, after the 1980s, the steel industry developed rapidly. The rank of annual output jumped to the top in the world in 1996. In recent years, the annual steel output has ranked first in the world, achieving a leap in the development of the steel industry.

For a long time, the steel industry has provided important raw material guarantees for national construction, which has strongly supported the development of related industries, promoted the process of industrialization and modernization in China, and promoted the improvement of people’s livelihood and social development.

Though the iron and steel industry has achieved remarkable achievements, it also faces many problems. The national steel industry equipment level is uneven, especially in terms of energy conservation and emission mitigation; a lot of debts of energy conservation and environmental protection investment were left over. Many enterprises have not achieved the comprehensive and stable discharge of pollutants; energy conservation and environmental protection facilities need to be further upgraded. Though the energy consumption and pollutant emissions of steel, per ton, have decreased in recent years, it cannot offset the increase in total energy consumption and pollutants caused by the increasing production. With the booming advancement of national industrialization and urbanization and the continuous upgrading of the consumption structure, the energy conservation and emission reduction work will become increasingly serious to the steel industry. At the same time, social development, ecological civilization construction, people’s living needs, public opinion concerns, and more will impose new and more stringent requirements on energy conservation and emission reduction.

Obviously, for future development prospects, the steel industry still needs to make great efforts to adhere to green development, in addition to adhering to structural adjustment and innovation drive. It should aim to reduce energy consumption and pollutant emissions and to fully implement energy conservation and emission reduction. The government should keep on renovating, continuously optimizing the original fuel structure, vigorously developing the circular economy, actively researching and promoting green steel throughout the life cycle, and building a new pattern of steel manufacturing and social harmonious development.

At present, emission reduction policies such as the carbon trading mechanism or the carbon taxation mechanism have not been fully implemented. What are their impacts on the production level and economic profit of enterprises and the steel industry? Whether or not it is suitable for the actual situation of the steel industry is still unclear. Therefore, it is an urgent and difficult task for the steel industry to figure out the way to achieve green development in order to complete increasingly stringent emission reduction tasks.

In China, on 18th December, 2017, the National Development and Reform Commission announced the “National Carbon Emissions Trading Market Construction Plan (Power Generation Industry),” setting the threshold for China’s power generation industry to be included in the carbon market: Annual emissions of 26,000 tons of carbon dioxide or above. It provides a reference for other industrial sectors, so this paper will study the carbon trading mechanism’s impact on production level based on this program.

The remainder of this paper is organized as follows: In

Section 2, a literature review focusing on the distribution mode and policy influence of carbon trading system is provided; in

Section 3, a two-stage game theory modeling is constructed, and policy assumptions and data sources are provided; in

Section 4, results and discussions are presented based on accounting data and statistical analysis; and in

Section 5, conclusions and policy recommendations for China’s iron and steel industry are drawn.

2. Literature Review of Distribution Mode and Policy Influence of Carbon Trading System

Dales [

1] first proposed the concept of emissions trading, which aims to apply Coase’s theorem of “efficiency in resource allocation through clear definition of rights” to water pollution control. In 2005, the European Union established the Emission Trading Scheme (ETS), covering more than 11,000 companies including manufacturing. The United States, the United Kingdom, and Australia have also established emission trading systems and exchanges. In China, although the “National Carbon Emissions Trading Market Construction Plan (Power Generation Industry)” was announced and the threshold for China’s power generation industry to be included in the carbon market was set, the quota allocation method has not yet been announced. Moreover, the carbon market was only included in the power, cement, and electrolytic aluminum industries at the beginning, leaving the steel industry unincluded.

Scholars have studied the carbon trading mechanism from the perspectives of applicable industries, allocation, and influences. In the applicable industry research, most of the studies have been focused on the power industry where data and methods are relatively mature. Li and Colombier [

2] analyzed the effects of different energy conservation and emission reduction policies on reducing carbon dioxide in the construction industry based on energy demand, population growth, and economic development trends. The results showed that the carbon emission trading mechanism has played a prominent role in improving the buildings’ energy efficiency and energy-saving technologies’ promotion. Anger [

3], Chen and Tseng [

4], and Alberola [

5] discussed the application of carbon trading mechanisms in electricity, the manufacturing industry, and aviation. Considine and Larson [

6] examined fuel switching in electricity production following the introduction of the European Union’s Emissions Trading System (EU ETS) for greenhouse gas emissions. Shen et al. [

7] used structural modeling methods to determine the factors affecting the carbon trading mechanisms’ implementation in construction industry and explained the complex relationship between factors. In combination with the carbon footprint and the classic transportation model, Su [

8] added carbon trading mechanism to the traditional three-level transportation network model and comprehensively analyzed the impact of carbon quotas and trading mechanisms on operating costs and transportation networks. Based on the Computable General Equilibrium (CGE) model, Zhang [

9] studied the impact of China’s establishment of carbon trading system on the construction industry.

Policy makers, economists, and researchers have different opinions on the issue of the allocation of quotas, due to their own situations. Ahman and Zetterberg [

10] believed that, according to the different basic calculation data, the free distribution method can be divided into two distribution methods: Carbon emissions and production. However, the latter has higher data requirements than the former. Goeree et al. [

11] believed that the free distribution method based on historical emissions as the basis for allocating quotas will lead to high carbon emission enterprises obtaining large quotas of carbon emission quotas due to historical data accounting, as well as raising quota prices in quota trading in the carbon market. Zetterberg et al. [

12] suggested that the government should reward companies that have adopted emission reduction actions at the beginning of the carbon trading system, which will incentivize companies to obtain more quotas by increasing output. Grimm and Ilieva [

13] believed that the allocation baseline for carbon emission rights will change over time and technology, so they cannot be allocated with reference to historical emissions data. For this reason, they proposed a scalable free allocation model. Wang and Wang [

14] studied the carbon emission rights allocation in Beijing. They believed that distribution model combining free and auction is more suitable for China’s national conditions. In the Emission Trading Scheme in Korea, Lee and Yu [

15] observed the actual CO

2 emission levels in the first compliance year and estimated the maximum and minimum emission levels by conducting a sensitivity analysis. They also estimated the surplus or deficit of emission permits during the first phase by comparing the estimated emission levels and the permit supply. Finally, they explored the supply and future prospects of offset credits, as well as the allocated permits. Guo, Chen, and Long [

16] studied the initial quota allocation of the consuming government (based on the perspective of government and family evolutionary game) and found that when the government’s evolutionary stability strategy is “strict policy,” the family’s evolutionary stabilization strategy will be affected by carbon reduction costs and purchasing carbon emission rights costs. Zhang, Li and Jia [

17] established a Computable General Equilibrium (CGE) model to analyze the impact of different ETS quota allocation schemes on the electricity industry and determined the best choice of a quota allocation scheme for the electricity industry in China. The research on China’s carbon trading market may provide an important case for the global carbon trading market. In the European Union’s Emissions Trading System (EU ETS), Duscha [

18] analyzed the demand for certificates from a reserve of about 400 million allowances under different assumptions on production development as well as different design options for Phase IV. The analysis was built on freely available allocation data from Phase III along with projections of production trends from different time periods in the past.

The impact of implementing carbon emission trading policies is mainly reflected by the impact on macroeconomic factors such as government welfare, emission reduction effects, and prices. Chen and Wu [

19] constructed a model for the free allocation and sale of carbon allowances. The results showed that China’s implementation of carbon emission trading can reduce the economic losses caused by CO

2 emission reduction. Ellerman et al. [

20] believed that developing countries can take full use of the new export chances brought about by carbon trading mechanisms to reap the benefits, while the countries with rich energy can have the largest revenues. Babiker M, Reilly J, and Viguier L [

21] used CGE model to find that carbon emissions trading plays a negative role on social welfare. Wang, Chen, and Zou [

22] found that carbon emission trading has a strong impact on prices. CO

2 emission reduction policies can stimulate energy efficiency in the energy sector to reduce carbon emissions effectively. However, China’s GDP growth and labor efficiency will be negatively affected. Jamasb and Kohler [

23] used learning curve theory to find that carbon emission trading could play a role in updating and promoting energy-saving and emission-reducing technologies; they also found that the continuous popularization of energy-saving and emission-reducing technologies would, in turn, reduce carbon emission reduction costs. Aviyonah and Uhlmann [

24] believed that environmental externalities could be measured by carbon trading prices, and carbon trading mechanisms can generate profits for companies that reduce CO

2 emissions costs. Cong and Wei [

25] studied the impact of power companies under different carbon trading allocation criteria and found that different allocations would also change carbon prices and electricity prices. Wu et al. [

26] found that after the establishment of the carbon trading system, net exports of high-energy-consuming industries such as steel and electricity were greatly affected, and the power industry was even more affected. Li and Zhu [

27] obtained the carbon emission trading’s impact on high energy industries by constructing a partial equilibrium model of the three commodities in two countries and an emission reduction cost curve based on the micro level of technology. The results showed that in the carbon market with free quota allocation, carbon emission trading may cause distortion effects of non-backward capacity and backward production capacity. Wu, Fan, and Xia [

28] used a multi-regional computable general equilibrium (CGE) model to analyze the economic impacts of ETS policy when combined with renewable energy sources (RES) policies in China. Dai, Xie, and Liu [

29] used the CGE model to assess the carbon emissions trading’s impact and renewable energy policies on economic contribution and to explore the influence of carbon trading volume, carbon price, and emission limits on the GDP in different sectors. Using the real trading data from the EU carbon market, Liu, Gao, and Guo [

30] constructed a network model by integrating time windows with the network model; three types of network features were examined. The growth pattern of the carbon trading network was analyzed. Fernández et al. [

31] analyzed the effectiveness of the carbon market as a basic tool in the reduction of emissions. The analysis also included other overlapping policies aimed at fighting climate change—the promotion of renewables, for example.

On the study of the comparison and selection of carbon tax and carbon trading, it could be found that domestic and foreign scholars have not reached a consensus. Aviyonah and Uhlmann [

24] argued that the carbon tax mechanism is easier to implement than the carbon trading mechanism because carbon trading mechanisms face the challenge of setting emission reduction targets. Mann [

32] contended that a carbon tax policy is more important because carbon tax has the advantages of a simple implementation, a favorable emission reduction path for enterprises, and a small space for local governments to implement local protectionism. Wang et al. [

33] believed that in the short term, the carbon trading mechanism is more cost-effective because of the higher cost in CO

2 emission reduction technology.

For ease of reference, the references and summary information involved in this section are shown in

Table 1.

Through the literature review of emission reduction policies, especially carbon trading mechanisms, we can find that the macroeconomic energy and economic model can be used to calculate carbon trading quotas, carbon prices, and other values, which can better analyze the impact on the economy, environment, and emission reduction. However, most of this research was conducted from a macro perspective, and there is less literature on using game theory to study the mutual decision-making and emission reduction mechanism between the industry and enterprises from both microscopic and macroscopic perspective. There is also relatively less research literature on the integration of policies such as mechanisms into the emission reduction model and the comparison of single and mixed emission reduction policies. With the continuous economy development and the constant attention of environmental concerns, emission mitigation pressure will increase continuously. An individual carbon emission reduction policy cannot meet the needs of national economic development and emission mitigation. Carbon capture and storage (CCS), carbon sinks, and other significant reductions methods are possible to be integrated into the overall mitigation system. There are few papers on relevant game theory, and, as such, more research needs to be introduced. In addition, China has not yet started the carbon tax mechanism, and the official has not formulated detailed implementation plans. Therefore, this paper uses the carbon trading mechanism as the background of emission reduction policies to conduct corresponding policy research and analysis.

Secondly, we find that researchers have usually focused on national level and entire sectors (industry, service industry, agriculture). Research on a provincial level or a single industry department are few. The iron and steel industry is a basic industry and one of the most CO2-emitting heavy industrial sectors, which needs to do some further important emission reduction tasks research.

Thirdly, the model gives priority to the literature while giving less focus to empirical analysis in the previous research, and the parameters usually derive from the existing data of developed countries. The study of two typical enterprises is the most classic. In China, there are significant regional differences and economic development imbalances, and these areas’ steel industry information and parameters need to be supplemented.

Above all, the reasonable CO2 emission reduction policy will be the core issue in this paper. Therefore, this paper organizes the six main areas’ steel industry’s energy, environment, and economic data. Integrated with the government corresponding long-term plan, the carbon trading mechanism—including production subsidies, CCS, and CO2 external losses—is included in this research; then, a two-stage dynamic game model is constructed. Using the background of different carbon emissions’ decreased demand, we discuss game behavior in different regions under different reduction targets; and, finally, we investigate different emissions reduction scenarios’ effect and economic impact.

4. Results and Discussions

4.1. The Parameter Fitting’s Results

In this paper, referring to the research of Ma and Li [

41], the market demand for steel industry is expressed by the apparent consumption, and the product price was obtained by dividing the industrial output value by the output. In the selection of the curve form, the inverse demand curve can be approximated as a straight line inclined to the lower right. The inverse demand curve fitting equation is as follows:

In 2010, CO2 emissions average level in steel industry was 3.1710 tons CO2 per ton of steel (the same below, omitted). In the calculation below, the base period data of each region is the basic data for 2015 unless otherwise specified. According to the collection and calculation, the average level of CO2 emission in 2015 was 2.8210. Correspondingly, the CO2 emission levels of the six regions in 2015 were e1 = 2.3344, e2 = 3.5698, e3 = 2.9040, e4 = 2.8779, e5 = 3.2202, and e6 = 4.5864.

In this paper, China’s steel industry CO

2 emissions from 2005 to 2016 were calculated by a non-parametric method, the CO

2 marginal abatement cost was estimated by shadow price, and then the marginal abatement cost curve (MACC) was obtained. The calculation method reference was made to the relevant literature of Duan et al. [

42,

43,

44] (the data was updated to 2016 and the function form was slightly changed), and the quadratic form was selected as the regression equation of MACC. The relationship between the emission intensity reduction in each region and the CO

2 MACC is shown in

Table 3. It should be pointed out that due to the estimation of shadow price, the error and uncertainty of the CO

2 marginal abatement cost curve are increased, which leads to a certain distance between the calculated abatement cost and the real abatement cost. This paper uses

to represent the actual emission reduction cost;

λ is 0.5, in order to reduce the error.

Through the combing of relevant policy documents, the future economic development goals of China’s iron and steel industry and target of energy conservation and CO2 emission mitigation have been designated as mostly textual narratives, and there are basically no quantitative indicators of data. Accurately predicting future steel industry emission reduction targets, product yields, and development levels is impractical. Based on this, the focus of this paper is to explore the influence of implementation of different emission mitigation policies combination in China’s steel industry’s social welfare (W), consumer surplus (CS), producer surplus (PS), output, and total CO2 emissions, as well as the enterprise’s output, profits, CO2 emissions, and other economic and environmental factors.

In the setting of the CO2 emission intensity reduction target, this paper refers to target of reducing the comprehensive energy consumption of ton steel by 12 kgce in 2020 (Steel Industry Adjustment and Upgrade Plan (2016–2020)). The target of 2020 is about 85% of the energy consumption level in 2010. Therefore, this paper sets the CO2 emission intensity in 2020 to be 15% lower than that in 2010. We will observe the reaction of output, profit, and emission intensity of iron and steel enterprises and industries when the emission reduction target under the condition of 15%–20%. We set the CO2 emission intensity in 2025 to be 20% lower than that in 2010 and observed the reaction of output, profit, and emission intensity of iron and steel enterprises and industries when the emission reduction targe under the condition of 20%–25%. We set the CO2 emission intensity in 2030 to be 25% lower than that in 2010 and observed the reaction of output, profit, and emission intensity of iron and steel enterprises and industries when the emission reduction target under the condition of 25%–30%.

Referring to Li’s research [

45], the average production cost of the base period can be obtained by calculating the business (regional) operating costs and steel production. This paper assumes that by 2020, the production costs in North China, East China, and South Central China will decrease significantly, and the production costs in Northeast China, Southwest China, and Northwest China will decrease less. Then, the gap will be gradually narrowed. By 2030, North China, East China, and South Central China will be basically in the same cost range, and the Northeast, Southwest, and Northwest regions will be located in another cost range. The external macro-environmental loss parameters refer to the study of Guenno and Tiezzi [

46],

θ = 14.55 Yuan/ton CO

2. In 2030, it is assumed that the steel industry will plan to build 1–2 million tons of government-funded demonstration projects. The cost curve refers to [

47,

48,

49,

50], and the linear curve is

. The unit is

RMB. Since the relationship between

PP and

SP is not easy to determine, let

PP =

SP in order to facilitate calculation; that is, when carbon trading is conducted between enterprises, the price used to purchase or sell unit quota is the same.

In the selection of the benchmark value of the carbon trading mechanism e0, considering that China has just started to pilot the carbon trading mechanism, the steel industry emission benchmark value should not be set too high. After the system is mature, the benchmark value should be set strictly. Assume that the benchmark value for 2020 is 2.8210 tons of CO2/per ton steel (the average CO2 emission intensity in 2015). The benchmark value for 2025 is 2.3782 (25% lower than the national emission level in 2010). For 2030, it will be 2.2197 (30% lower than the national emissions level in 2010).

The specific data simulation parameter settings are shown in

Table 3.

4.2. Empirical Analysis

4.2.1. Case 1, in 2020 Scenario

The carbon trading policy is the only emission mitigation policy. Detailed results are shown in

Figure 2 and

Figure 3,

Table 4 and

Table 5. When the emission reduction targets gradually increase from 15% to 20%, the transaction price of carbon emission allowance increases from 12.65 yuan/ton to 34.81 yuan/ton, which increases by 2.75 times. Total output, total social welfare (W), consumer surplus (CS), and producer surplus (PS) all show an upward trend, and the macro environmental damage caused by CO

2 emissions shows a decreasing trend. The total output maintains at around 854 million tons, which is a drop of nearly 25% compared to the 1.135 billion tons of steel production in 2016. This means that demands in the steel market declined significantly in 2020. As the emission reduction target gradually increases from 15% to 20%, total output,

W,

CS,

PS, and emission loss increase by 0.05%, 0.21%, 0.10%, 0.34%, and −5.84%, respectively.

To achieve the 15%–20% emission reduction target, enterprises in each region choose the emission intensity and output. As the emission reduction target increases, the emission intensity of Southwest China and Northwest China decreases more. When the industry emission reduction target is 20%, the Northwest region’s emission reduction rate reaches its maximum, which is 24.82%; the East China and North China range is moderate, with a range of 7%–13%; the emission reductions in the Northeast and South Central regions are small, and the Northeast is the smallest. For production, due to the different production costs and the impact of emission mitigation intensity, coupled with the implementation of the carbon trading policy, when the emission reduction targets grow, output of most regions has increased significantly, and only the steel production in Northeast China and Northwest China has declined. The output of the two regions has dropped significantly, which is approaching 3%.

Under the premise emission reduction target of 15%–20% and 2.8210 tons CO2/ton steel as the benchmark value, the CO2 emission intensity of North China, East China, and South Central China in the carbon trading market are lower than the benchmark value; they can choose to sell their carbon quota. The Northeast and Northwest regions have exceeded the benchmark value and need to purchase carbon quotas. For the Southwest region, when the emission reduction target is low (15%–18%), CO2 emission intensity is more than the benchmark and the enterprise needs to be purchased for the quotas; when the emission reduction target is high (18%–20%) and CO2 emission intensity is lower than the benchmark value, the enterprise can choose to sell its own carbon quotas.

4.2.2. Case 2, in 2025 Scenario

The mixed emission mitigation policy includes carbon trading and subsidy policies. Detailed results are shown in

Figure 4 and

Figure 5,

Table 6 and

Table 7. Due to the strict emission benchmark values, the CO

2 emission intensity of some regional enterprises cannot meet or fall below the benchmark value. The government needs to provide subsidies for enterprises with higher emission intensity. When the emission reduction targets gradually increase from 20% to 25%, the transaction price of carbon emission allowance increases from 47.21 yuan/ton to 84.43 yuan/ton, an increase of 1.79 times. The value is maintained at around 15.5 yuan to 17 yuan.

The total output, consumer surplus, and macro environmental damage caused by CO2 emissions have decreased, and the overall social welfare and producer surplus have shown an upward trend. This shows that, although the emission reduction target has become increasingly severe, the behavior of returning subsidies to enterprises has increased the production enthusiasm of producers and helps to increase corporate profits. The total output has remained at around 900 million tons. Though the emission reduction target has increased, the total output has increased slightly compared to the 2020 emission reduction targets case. When emission reduction targets increase from 20% to 25%, total output, W, CS, PS, and emission loss decrease by 0.09%, −0.07%, 0.18%, −0.50%, and 6.33%, respectively.

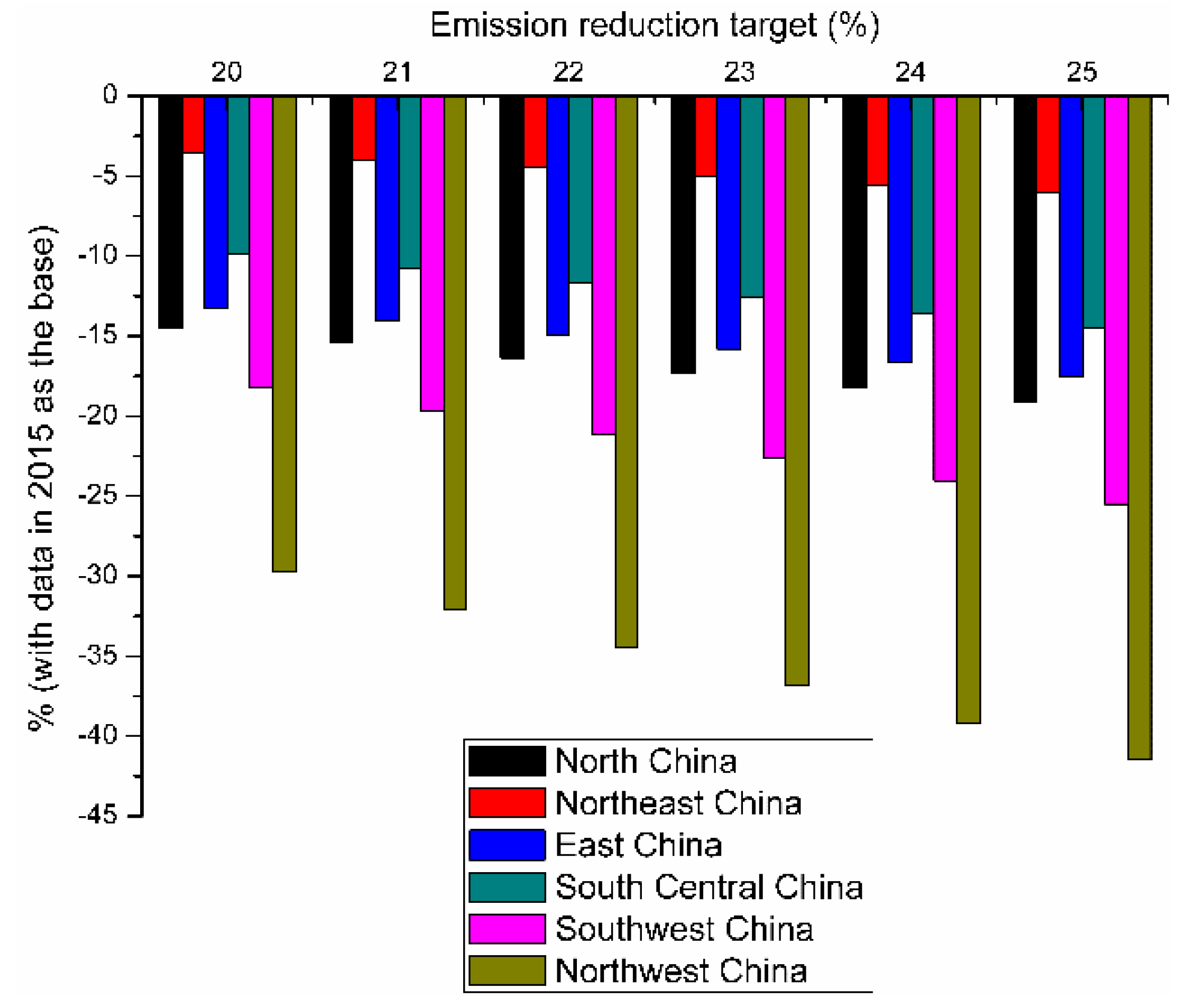

For the sub-region, to achieve the emission mitigation target of 20%–25%, enterprises in each region choose the emission intensity and output. When the emission reduction targets gradually increased, the rate of decline in emission reduction intensity in various regions has gradually increased. In Southwest and Northwest China, the emission reduction rate has exceeded 20% in most cases. When the industry emission reduction target is 25%, the emission reduction rate in the northwest region has reaches the maximum, which is 41.48%, in East China and North China. When the emission range is in the middle, the decline range is about 13%–19%. The emission reduction range in the Northeast and South Central regions is small, and, in the Northeast, it is the smallest. Along with the effects of carbon trading policies and subsidies, the output changes show great regional differences. The output of North China, East China, South Central, and Southwest China present an upward trend; steel production in Northeast China and Northwest China show a downward trend, with a drop of 2.5%–3%.

Under the premise emission reduction target of 20%–25% and 2.3782 tons CO2/ton steel as the carbon trading benchmark value, only the North China CO2 emission intensity is lower than the benchmark value, and the enterprise can choose to sell its own carbon quotas; CO2 emission intensity in other regions cannot be lower than the benchmark level, and carbon quotas need to be purchased. In addition, the government (steel industry) needs to return subsidies based on production to these regions.

4.2.3. Case 3, in 2030 Scenario

The mixed emission mitigation policies cover carbon trading policy, subsidies, and government-funded CCS demonstration projects. The results are shown in

Figure 6 and

Figure 7,

Table 8 and

Table 9. Due to the strict emission benchmark values, the CO

2 emission intensity of some regional enterprises cannot meet or fall below the benchmark value. The government needs to provide subsidies for enterprises with higher emission intensity. As the emission reduction target increases from 25% to 30%, the transaction price of carbon emission allowance increases from 91.70 yuan/ton to 137.59 yuan/ton—an increase of 1.79 times. The unit subsidy value is maintained at around 30–36 yuan; the CO

2 processed by the government-funded CCS demonstration project are always at the lowest value,

m = 1,000,000 ton.

When the emission reduction targets gradually increase from 25% to 30%, the total output, consumer surplus, and macro-environmental losses caused by CO2 emissions have decreased, and the overall social welfare and producer surplus have shown an upward trend. This suggests that, although the emission reduction target becomes increasingly severe, the behavior of returning subsidies to enterprises has increased the production enthusiasm of producers and helps to increase corporate profits. The total output has remained at around 933 million tons. Though the emission reduction target has increased, the total output has increased slightly compared to the 2025 emission reduction targets case. Total output, W, CS, PS, and emission loss decreased by 0.13%, −0.07%, 0.25%, −0.59%, and 6.81%, respectively.

For the sub-region, as the emission reduction target increases, and the rate of decline in emission reduction intensity in various regions has gradually increased. In most cases in Southwest China and Northwest China, the emission intensity decrease exceeded 30%. When the overall emission reduction target is 30%, the Northwest region’s reduction rate reaches the maximum, which is 54.43%. In North China, East China, and South Central China, the emission reduction rate is in the middle; the rate in the Northeast is the smallest. Along with the effects of mixed carbon trading policies, the output changes show great regional differences. In North China, East China, and South Central China, it showed an upward trend; the output of steel in Northeast China, Southwest China, and Northwest China show a downward trend.

Under the premise emission reduction target of 25%–30% and 2.2197 tons CO2/ton steel as the carbon trading benchmark value, only the North China CO2 emission intensity is lower than the benchmark value, and the enterprise can choose to sell its own carbon quotas. CO2 emission intensity in other regions cannot be lower than the benchmark value under most emission reduction targets; they need to purchase carbon quotas, and the government (steel industry) needs to return subsidies based on production. When the target is high (29%–30%), the CO2 emission intensity in Southwest China and Northwest China is slightly lower than the benchmark value, so they can choose to sell their carbon quotas.

4.2.4. Comparison of Single Emission Reduction Policies and Mixed Emission Reduction Policies

Section 4.2.2 and

Section 4.2.3 discuss the impact of the implementation of the mixed emission reduction policy on the changes in the economic and environmental factors of steel companies and industries under the carbon trading mechanism. This section calculates the changes in the output and emission reduction intensity of enterprises and other economic factors in the implementation of the single policy under the same emission reduction targets, then compares and analyzes the single and mixed emission reduction policy.

(1) Comparison of only carbon trading policies and mixed policies in 2025.

After calculation and as shown in

Table 10,

Figure 8,

Figure 9 and

Figure 10, the social welfare, total output, producer surplus, consumer surplus, carbon allowance transaction price, and the macro environmental damage caused by CO

2 emissions and the decline in CO

2 emission intensity under the mixed policy mechanism in various regions have increased more than that under the situation of the single policy. Under the mixed policy mechanism, the carbon price trading price and the regional emission intensity decrease than that in the single policy mechanism, but the gap is negligibly small.

The rate of change reflects the intensity of changes in various indicators as the emission reduction target increases (compared to 20% reduction in 2010). From the figures, it can be found that in production change rates when emission reduction targets are low (20%–24%), steel production under a single policy changes significantly. When emission reduction targets are high (24%–25%), the change of steel production under the mixed policy is more obvious. In the change rate of producer surplus and social welfare, the two policy conditions are basically flat, and the single policy changes slightly larger.

(2) Comparison of only carbon trading policies and mixed policies in 2030.

Calculations have found that in the case of emission reduction targets of 25%–30%, the CO2 emissions processed by CCS demonstration projects are at the lowest value; that is, under each emission reduction target, the CCS demonstration project is only at the lowest maintenance stage.

Similarly, after calculation and as shown in

Table 11,

Figure 11,

Figure 12 and

Figure 13, the social welfare, total output, producer surplus, consumer surplus, carbon allowance transaction price, and the macro environmental damage caused by CO

2 emissions and the decline in CO

2 emission intensity under the mixed policy mechanism in various regions have increased more than that under the situation of the single policy. Under the mixed policy mechanism, the carbon price trading price and the regional emission intensity decrease more than that in the single policy mechanism, but the gap is so small that they can be ignored.

The rate of change reflects the intensity of changes in various indicators as the emission reduction target increases (compared to 25% reduction in 2010). From the figures, it can be found that in production change rate, the effect of implementing a single policy on output change is significantly less than the impact of the implementation of the mixed policy. In the change rate of W and PS, when emission reduction targets are low (26%–28%), change rates are basically flat under the two policy conditions and slightly larger under a single policy. When emission reduction targets are higher (28%–30%), changes under mixed policies are more pronounced.

4.3. Discussions

Current research on the emissions mitigation targets is scarce. Therefore, this paper does not discuss optimal emissions intensity and methods. Only the above three scenarios (2020, 2025, 2030) have been analyzed. For China’s industrial sector, the results of parameters and numerical calculations are few and lack certain references. Since the country has not announced the relevant details and trading methods of the carbon trading market, the carbon trading benchmark value is set based on the historical data. Moreover, due to these certain assumptions, there are some gaps between the calculations results and the actual situation, but some trends and rules can still be found and determined.

Since the carbon trading mechanism is based on the government’s provision of a free carbon quota for each company, the benchmarks are set differently, and the results will vary. Under the conditions set in this paper, whether under the single carbon trading policy or the mixed policy, when the reduction target increases from 15% to 30%, the quota trading price steadily increases from 12.65 Yuan to about 137 Yuan (nearly 11 times), and the social welfare and producer surplus of the steel industry show an increasing trend—nearly 14% and 4%, respectively. While the macro-loss of CO2 emissions shows a decreasing trend (decrease by more than 10%), other indicators increase or decrease. This shows that from the perspective of the implementation of the policy, the carbon trading policy and the mix with other emission reduction policies are conducive to the improvement of the economic level and emission reduction level of the steel industry.

For the sub-region, when the CO2 emission reduction target gradually increases, the regional emission reduction pressure gradually increases as well. However, there are differences between regions. The decline range in emission reductions in Northwest China and Southwest China is much bigger than other four regions, and the range in the northeast region is the smallest.

Under the mixed policy mechanism, compared with the single carbon trading policy, the social welfare function, total output, producer surplus, consumer surplus, carbon quota trading price, macro-loss caused by CO2 emissions, and emission reductions of the entire steel industry improve. Though under the same emission reduction target, the carbon allowance trading price in the single policy is less than that in the mixed policy, and the decline range in regional emissions reduction in the single policy is also lower than that under the mixed policies (though it is almost negligible—no more than 1 Yuan and 0.01 ton CO2/ton). Therefore, under the carbon trading mechanism, it is necessary to comprehensively consider the balance between the whole industry and regions and to consider whether to use a single carbon trading mechanism or a mixed mechanism under the comprehensive evaluation.

Through numerical simulation, when the benchmark values in 2020, 2025, and 2030 are 2.8210 tons of CO2/ton steel, 2.3782 tons of CO2/ton steel, and 2.2197 tons of CO2/ton steel, respectively, China’s future steel output will be in the range of 854–934 million tons under the mixed policy mechanism. The carbon price trading price range is between 12.65–137.59 yuan. The subsidy unit value ranges from 15.5–36.5 yuan. The CCS demonstration projects are only in the minimum maintenance stage and have not played a significant role in social emission reduction. Under the single carbon trading policy, the future steel output will be in the range of 854–932 million tons, and the price of carbon trading quotas will be between 12.65 and 136.59 yuan.

Obviously, whether it is a single carbon trading policy or a mixed policy, when the market is balanced, the output is reduced by more than 200 million tons from the peak in 2016 (1.1346 billion tons). North China and East China have decreased a lot, while the northeast, southwest, and northwest regions have increased in production. This shows that the implementation of carbon trading policies and mixed policies have alleviated the polarization of production in various regions to some extent, which is conducive to optimizing the distribution of production between regions and enterprises so that enterprises can better achieve the best profit.

5. Conclusions

Through the introduction of carbon trading policy, subsidy policy, CCS, and other emission reduction policies, a two-stage multi-oligopoly enterprise production selection model including emission reduction policies is established. This paper makes a preliminary study on the changes of total production and social welfare indexes, which are under the restriction of the industry emission reduction target and emission reduction policy, and carries on the quantitative research with the operation data of iron and steel industry. The model is an abstraction and hypothesis of a practical problem, which causes the calculation results in this paper to potentially deviate a little from the actual situation. This paper emphasizes the change trends of corresponding indicators with the increase of governmental pressure on emissions reduction.

The main conclusions are as follows:

Under the carbon trading policy mechanism, the carbon quota trading price increases as the reduction targets increase, and the steel industry social welfare and producer surplus show an increasing trend. The CO2 emission macro loss shows a decreasing trend, and the other indexes increase or decrease. When the emission reduction targets gradually increase, the pressure on emission reduction among regional oligarchic enterprises also gradually increases. The emission reduction rate of oligarchs in Northwest and Southwest China is much bigger than that in other regions. Oligarchy enterprises in North China, East China and South Central China are second. Oligopolistic enterprises in Northeast China are the lowest. Since the benchmark values are set differently, the numerical results will be different, but the trends are basically similar.

Compared with the single carbon trading policy, the indicators under the mixed policy have increased. In the view of change rate in production, social welfare, and producer surplus, when under the lower emission reduction target, the change under a single policy is greater; when under the higher target, change caused by the mixed policy is more obvious.

Based on the above results and conclusions, the Chinese steel industry should focus on the following two aspects when formulating emission mitigation targets and auxiliary emission mitigation policies:

Firstly, the Chinese iron and steel industry at present is in the stage of excess production capacity, which means that the output capacity is far greater than the actual consumption level. Through the calculation of this paper, when the market reaches the equilibrium, the production and consumption are less than the present level, especially in 2016. As a result, for China’s iron and steel industry (government) should alleviate the contradiction of excess production capacity and bring relief to the industry. It is immediate and necessary for the government to ban new production and push obsolete and backward-producing enterprises out of the market as soon as possible.

Secondly, at present, there is no clear-text regulation of the use conditions and industry scope of carbon trading policies in China. This paper uses the benchmark method to conduct a preliminary study on the carbon trading mechanism of the steel industry. In combination with the actual situation, we propose that in the use of single and mixed emission reduction policies under the carbon trading mechanism, the government should consider the whole industry sector, regional balance, and carbon trading benchmarks to determine the implementation of a single or mixed carbon trading policy. In the selection of the carbon trading benchmark value, it is necessary to carefully select according to the emission reduction target and the requirements for economic indicators.

This paper conducted a preliminary study on the carbon trade mechanism. With the gradual improvement of relevant national policies, laws, and regulations, this study will continue to explore the details of the carbon trading market of the steel industry and the game behavior between enterprises. Future research will be more closely linked to national policies and will be gradually extended to other high-energy industries such as cement industry and chemical industry.