1. Introduction

With the recent global economic recovery, retirement of aging facilities, and mergers/company reorganizations, global demand for new international investments in steel is expected to increase [

1]. In years past, most steel investors enjoyed low risks and superior market conditions due to a high demand and a focus on domestic versus international projects. This negated the need for complex investment platforms. However, the recent global recovery has equated to most opportunities being international, posing significant risks for steel plant investors entering unknown markets. To mitigate said risks, steel investment companies organize a consortium of local companies rather than make direct, singular overseas investments. The result is a multi-company contract agreement which creates an entity known as a special purpose company (SPC), with the steel industry typically using a project company model [

2,

3]. While an apt investment platform, the tolling agreement has been found to better handle and allocate project risks across contracting companies [

4]. Existing research has investigated the use of tolling agreements to govern energy, gas, and highway SPC-sponsor contracts. This publication builds off of these findings, filling a gap in the body of knowledge by researching the impact of the tolling investment platform’s impact on steel investor profitability.

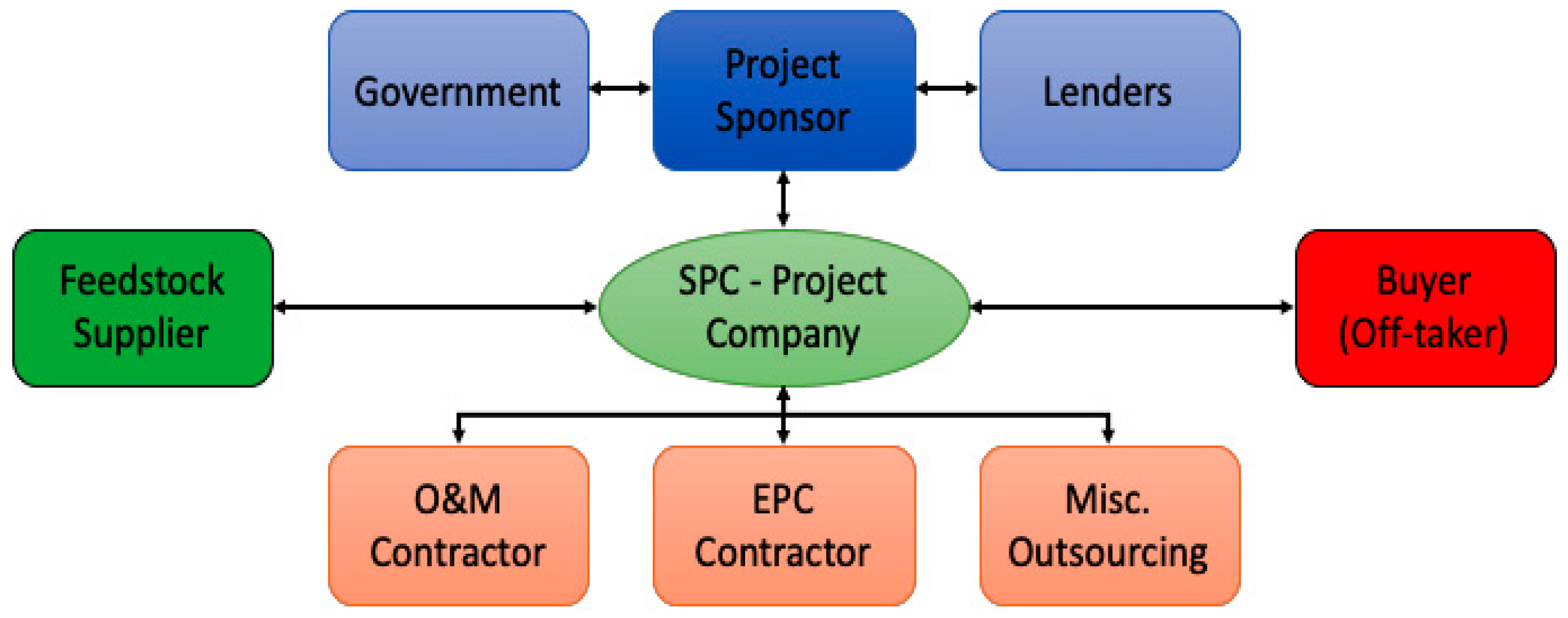

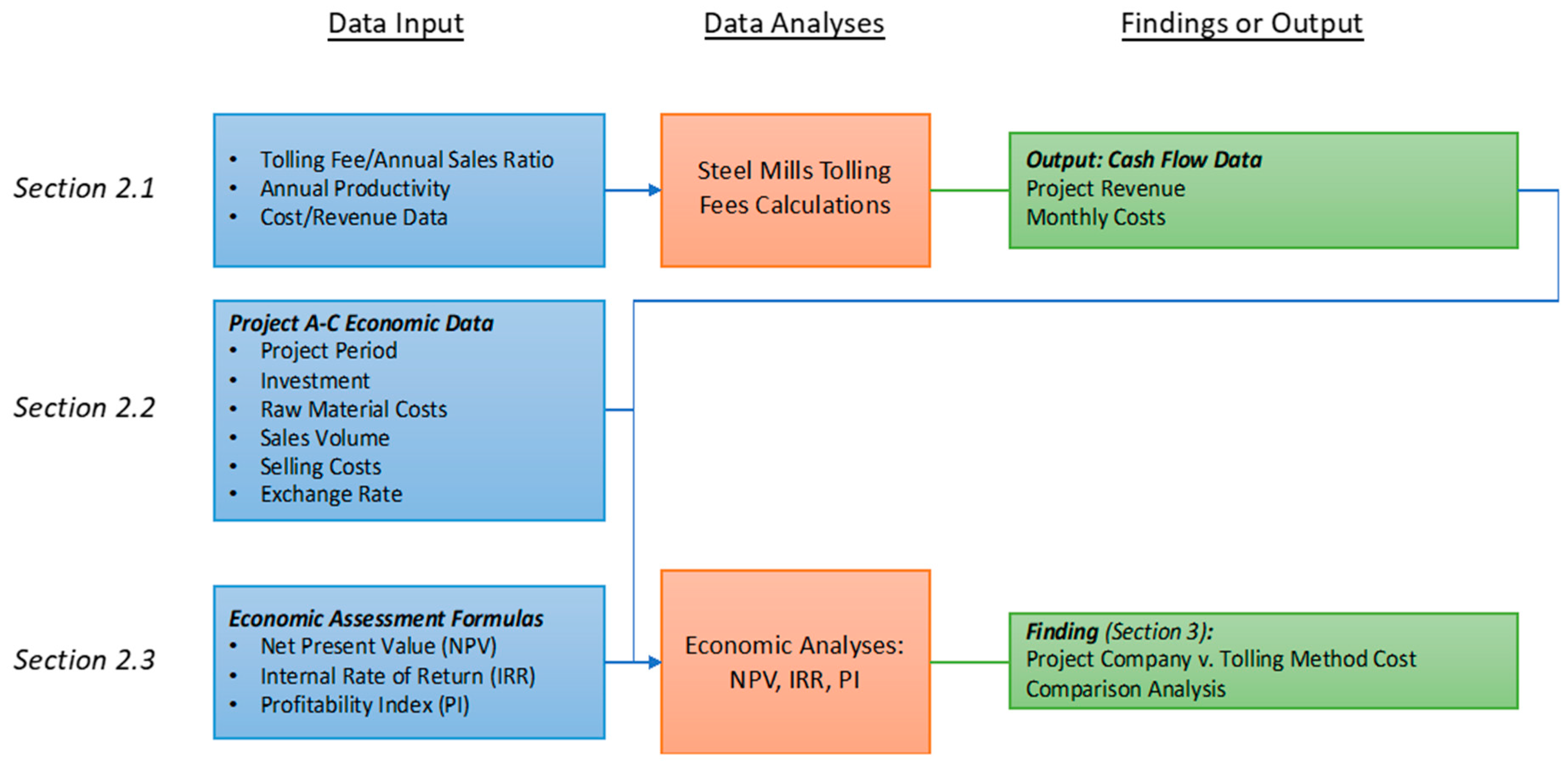

Figure 1 and

Figure 2 show a comparison of the project company and tolling agreement models. With the traditional project company model, the project sponsor seeks out project opportunities and financing from international governments and/or lenders. In this model, this is the extent of the project sponsor’s responsibilities, as seen in

Table 1. Alternatively, the SPC is responsible for constructing the plant, procuring the raw material, using said material to produce the steel, and generate revenue from selling their production. The SPC holds the procurement and sales risks.

Figure 1 shows the project company model breakdown which includes a project sponsor which includes both the government and lender(s) and a SPC which includes a project sponsor, a feedstock supplier, subcontractors, and a buyer.

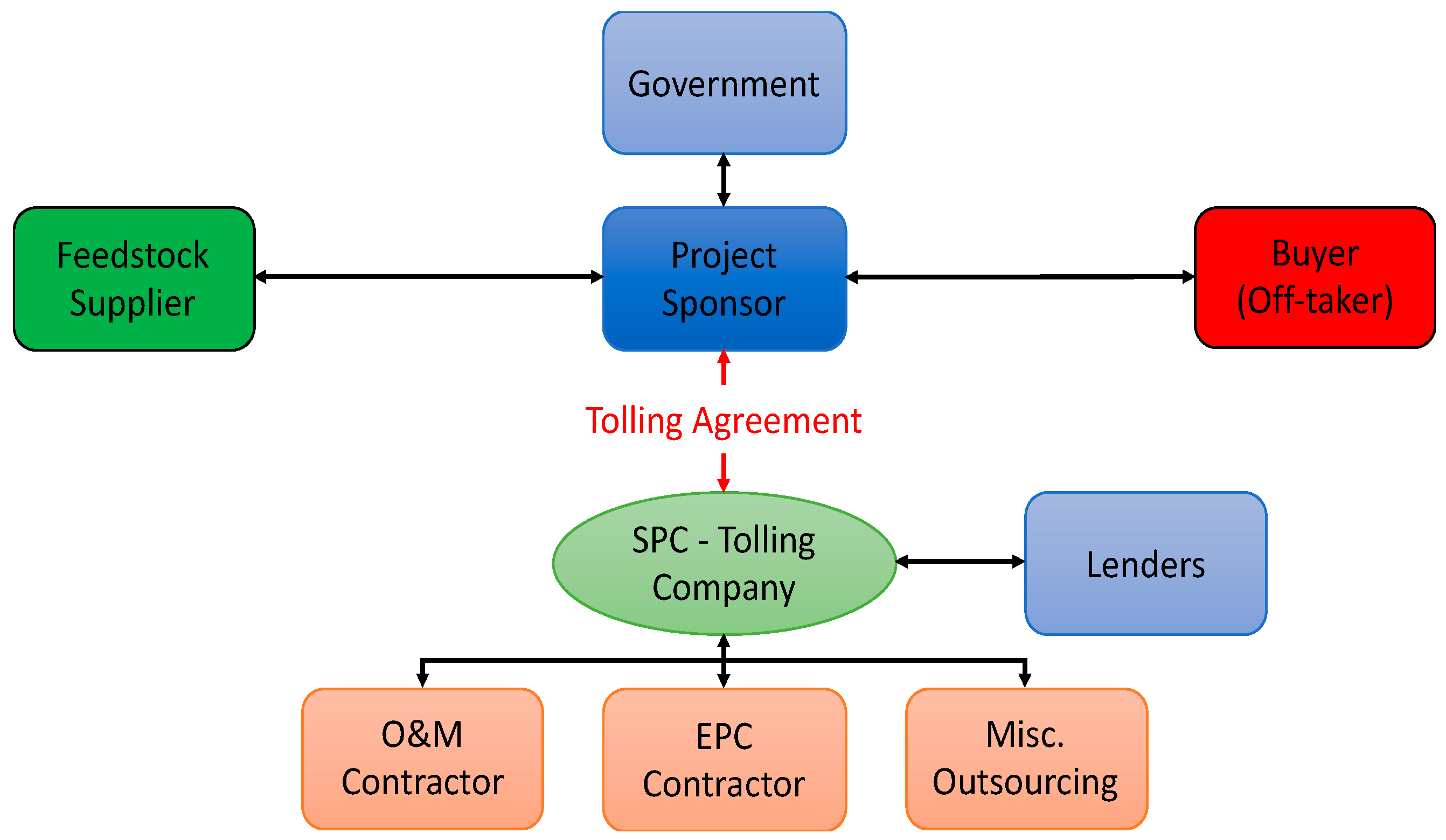

Alternatively, with the tolling model the SPC tolling company is separated from political (government), procurement, and sales risks but is still responsible for the plant construction and operation and maintenance. The tolling company also becomes responsible for the project financing. The tolling model is shown in

Figure 2 and includes the same entities as the project company model but with different contractual relationships.

The features of a tolling agreement that are atypical for traditional SPC agreements include the tolling fee and guaranteed production requirements. The tolling fee is the method of payment for steel produced and consists of the start-up, capacity, and variable payments, described in greater detail in

Section 2.1. The guaranteed production requirements govern the capacity payment and set the minimum and maximum production quantity and quality [

5].

Concerning the responsibility breakdown of each model,

Table 1 shows that in the project company model, all of the project responsibilities fall on the singular SPC entity. Alternatively, with the tolling model the project sponsor contracts with and is responsible for the purchasing of raw materials and selling of steel. The tolling company then manages the contractors and is responsible for acquiring project financing [

4]. The tolling model allows for greater risk sharing, reducing the associated SPC risk premiums. Per existing literature, predicted risk-sharing benefits are as follows: (1) the raw material and sales risks are transferred to the project sponsor; (2) the SPC is able to receive a stable revenue stream through the received tolling fee; and (3) ownership of the steel plant can fall solely on the project sponsor as the tolling company is only involved in production and maintenance, which all result in (4), superior project financing due to the associated risk reduction [

4]. These advantages are also the model’s disadvantage as the SPC’s ability to earn high profit margins associated with smart procurement practices is reduced. Another disadvantage is the complex tolling fee agreement versus the typical sales and purchasing agreements [

4].

Although existing literature has cited the potential advantages of the tolling model, there has been performed no research on its use in the steel industry as it is still an unfamiliar concept. Rather, existing research has been focused on the tolling model’s efficacy in other industries such as the highway, energy, and gas sectors. Rouwendal and Verhoef [

6] presented the basic principles of the tolling agreement as it is used in the highway sector, including the link between congestion pricing and road capacity, policies that affect tolling pricing, and a model which shows these variables’ impact on economic efficiency. De Borger et al. [

7] presented strategic owner investment and pricing decisions using game theory to test the differing tolling strategies’ impacts on expected capacity, user demand, and associated revenue. Wirahadikusumah et al. [

8] identified risks associated with the tolling contract including estimation accuracy of future revenue, overloading of the asset, and inadequate feasibility studies. Chung and Hensher [

9] investigated the differences in how the private and public sectors valuate risk, presenting a risk profile index to capture the influence as perceived by each sector. Alasad and Motawa [

10] developed a system dynamics model to assess demand risks which impact the revenue received on toll road projects.

Many studies have performed economic assessments on the tolling agreement’s use for public-private partnership highway projects, finding the risk-sharing model to be fiscally attractive to owners. Rouhani et al. [

11] found tolling methods were able to maximize profitability and overall system efficiency in road pricing. This method is most advantageous when public agencies desire to have greater risk ownership and where significant revenue variability is expected [

12]. When the owners take greater ownership of risk on highly congested roads (at least 30-min deadlock at peak hours without a toll), the owner could increase revenue by 70% versus traditional models [

13]. Chen et al. [

14] present a modified, hybrid tolling model which includes a greater level of risk/reward sharing across the public and private entities. Although most studies promote the tolling model as more efficient, one highway study found the tolling model to be less than optimal. This study finds the owner best equipped to manage all but the construction risks, and transferring finance, maintenance, and/or operation responsibilities to a contractor to be less than preferable [

15]. While these studies are of merit, the highway industry is very different than gas, energy, and steel as the owner serves the public rather than financiers or corporations and has a near impossibility of failure (e.g., bankruptcy).

Studies within the energy sector have also found tolling agreements to be a valid risk management technique [

16]. Shi-Jie and Xia [

17] used a Monte Carlo simulation to assess the effects of different power price models on the valuation of tolling agreements, presenting an option pricing approach to maximize owner-received value. Another study proposes a tolling agreement in the power sector in which the energy manager of the power plant (project sponsor) has the option to switch the plant on or off to maximize revenue based on the fluctuations of electricity pricing [

18]. Woo et al. [

19] discuss the impact the discount rate has on economic evaluations of tolling agreements, proposing the use of a risk-adjusted discount rate and the variables to consider. Ryabchenko and Uryasev [

20] introduce a new approach for pricing energy derivatives using a tolling agreement, presenting an algorithm depicting the optimal operating strategy reflecting power plant operational constraints. Woo et al. [

21] propose a regression-based approach to benchmarking a reasonable tolling fee in the power sector. Wiser et al. [

22] assessed 27 renewable and gas-fired electricity tolling agreements, comparing the risk profiles of each finding renewable energy contracts to best mitigate fuel price volatility and environmental compliance risks. With renewable energy power generation increasing its market share, one study also investigated the impact renewable energy has on existing natural gas-fired power generation tolling agreements [

23]. Deng and Xia [

24] studied the effects of different electricity price assumptions had on the valuation of tolling contracts using Monte Carlo simulation as an assessment tool. The tolling method has also been found to successfully allocate risks on gas [

25] and shipping ports [

26] and provide SPC’s with financial benefits related to income tax [

27].

The authors have performed a holistic review of existing tolling model literature, focusing on publications which perform economic analyses. The most relevant studies of this review have been shown above. Within existing literature, multiple studies have been performed on the tolling model’s application to the gas, power, and highway sectors. Steel plant projects are structured differently and have different raw material, product sales, manufacturing, construction, and legislative risks. The impact of changing the risk ownership structure of a steel plant project through a tolling agreement will be different than other sectors. There have been publications dedicated to solving the economic pressures felt by steel producing companies including optimal risk-assessment processes [

28], optimal investment timing [

29], risk-sharing feedstock agreements [

30], and creating financing [

31] but minimal on the impact of differing SPC agreements. The lack of publications on the tolling agreement’s use on steel projects represents a gap in the literature. The authors only found two publications filling this gap, presenting the tolling model’s use on steel mills. In a presentation of tolling agreements used in Russian industries, Avdasheva [

32] found 94% of steel projects use a tolling agreement. While the study performs an economic analysis of the tolling model, it is based on the full Russian industrial sector and does not isolate the steel sector [

32]. Another publication presents a case study of an Indonesian steel plant which used a tolling agreement as a way to introduce billet steel byproduct into the steel production to maximize profit [

33]. While the findings are of merit, they focus on the cost impacts of introducing the byproduct and do not isolate the impacts the tolling agreement have on project profitability [

33]. This study fills a gap in the existing body of knowledge by assessing the efficacy of tolling agreements on steel plant projects. The paper’s unique contribution is in having only one variable, the use of a tolling agreement. Isolating the tolling agreement as the variable of study and focusing on the steel industry strengthen and enable generalizability of the findings to the population of international steel projects.

3. Findings

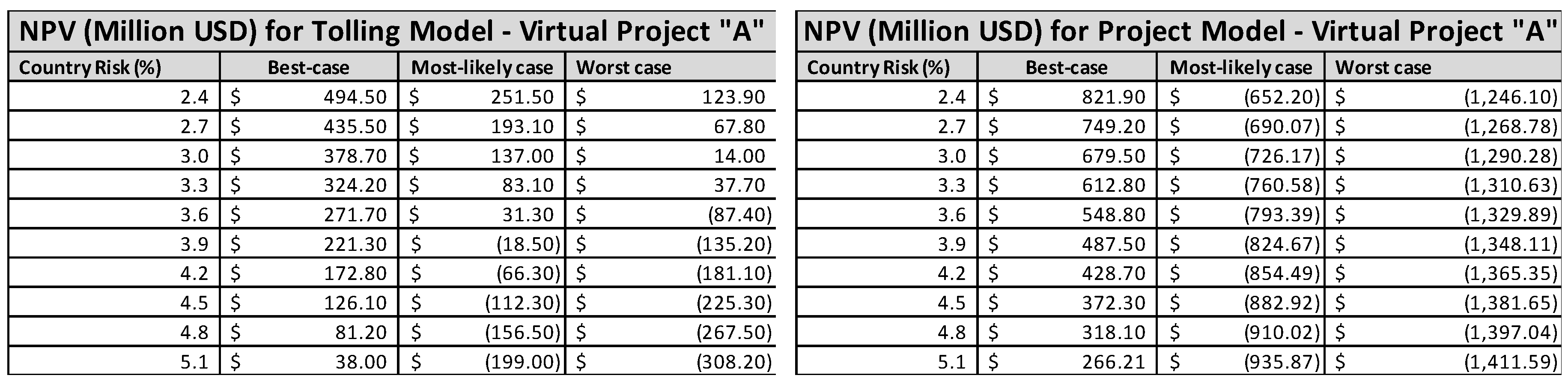

The authors tested the value-adding of the tolling model from the perspective of the project sponsor. The first step in performing this was to apply the project company and tolling model to the best, most likely, and worst cases of case study Project A.

Table 10 shows the results of the project company model economic evaluation. The targeted IRR was 12.5% and the payback period was 20 years. As can be seen, the best case would be considered economically feasible with an IRR greater than 12.5%, a positive NPV, and a PI over one. However, the most likely and worst-case scenarios were not economically feasible using a project company economic platform. In summary,

Table 10 shows that the project company model is only profitable in the best-case scenarios with IRR of 15.8% and NPV of 556 Mil USD, but the most likely and worst-case scenarios fail to secure profitability.

Table 11 depicts the same Project A best, most likely, and worst-case economic evaluation results. The targeted IRR was assumed to be 11.9%. As in the case of the project company model, the best-case economic evaluation of the tolling model was expected to be appropriate because the anticipated sales, tolling fee, and lower expected risks. However, it is interesting to note that the project company model results in

$328 million USD greater NPV than the tolling model in the best-case scenario. The most likely case had a poorer investment and operation environment yet, unlike the project company model, the tolling model still meets the project profitability criteria. The tolling company profitability is still healthy because the responsibility for raw material price risk, product selling price and sales volume risk, which is considered as the most critical risk excluding investment cost, belongs to the sponsor and not tolling company. Finally, in the worst-case scenario, where the factor for critical risk is more severely set, the tolling model shows a negative NPV value even though the IRR satisfies the criterion. Overall, the economic performance of the tolling model was superior to the project company model for all three cases of the case study.

The authors next performed an analysis on an Indian project that Company A has considered for project execution. The targeted IRR is assumed to be 12.5% and the payback period 20 years.

Table 12 shows a comparison of the project company and tolling model showing the latter to have a clear financial superiority. Both models would succeed in the best-case scenario, but only the tolling model would be financially viable for the worst-case scenario. Once again, while both are financially viable for the best-case scenario, the project company model results in

$228 million USD greater NPV than the tolling model in the best-case scenario. Based on only this analysis, Company A would be advised to pursue a traditional agreement in a strong/steady market and a tolling agreement in a volatile/weak market with the project sponsor for Project B. However, as the current volatile environment making the worst-case scenario highly likely, Company A would be advised to pursue a tolling agreement with for Project B.

Finally, the authors performed an analysis on an Iranian project that Company A has considered for project execution. The targeted IRR is assumed to be 11.9% and the payback period 25 years.

Table 13 shows a comparison of the project company and tolling model. Like Project B, the tolling model is less profitable than the project company model when the investment environment is favorable. However, in a situation where the investment environment changes drastically, the worst-case scenario, negative economic evaluation results are obtained in the project company model, while stable profitability is confirmed in the Tolling Model. Similar to Project B, assuming the current market will maintain a “worst case” status, Company A would be advised to pursue a tolling agreement with for Project C.

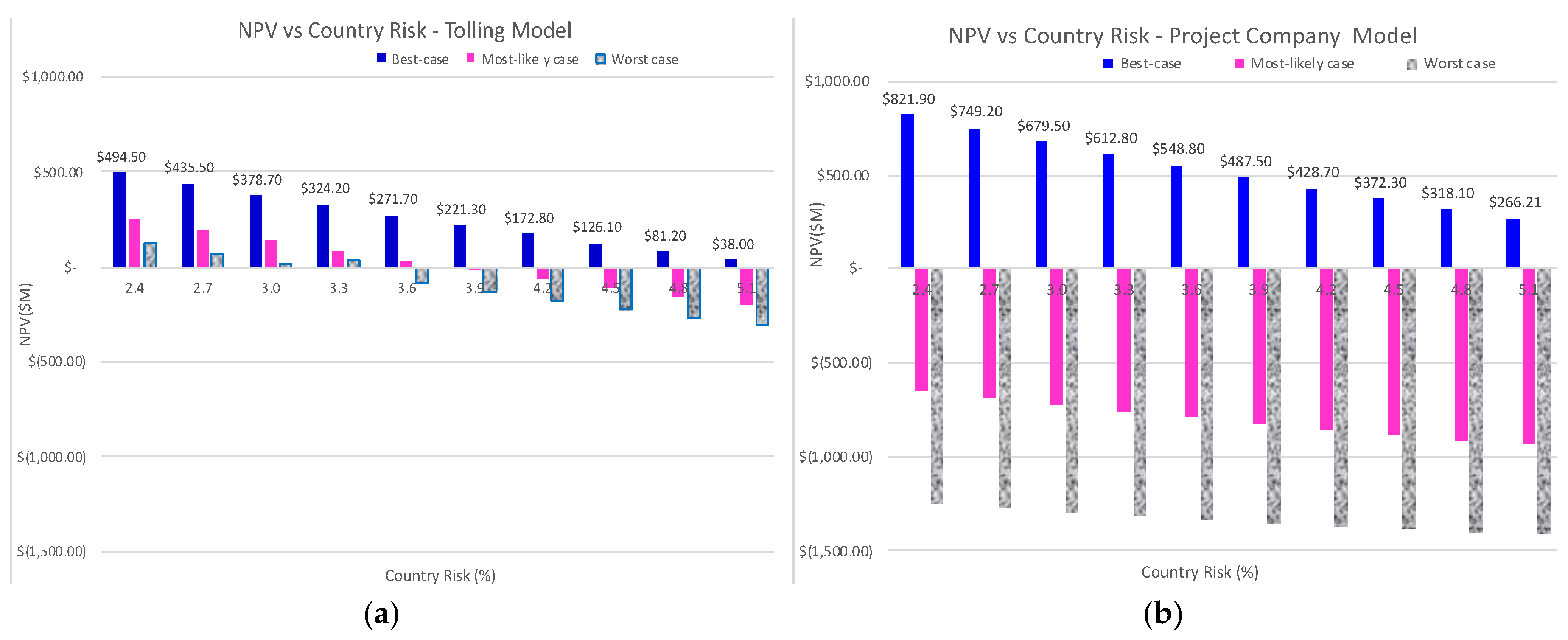

One of the greater impacts to a project’s success is the country risk. For this paper, the authors used a country risk of 3.58 for Project A based on Company A’s domestic work.

Figure 6, below, depicts the sensitivity of the NPV based on changes in the country risk factor. As can be seen, the greater the country risk, or country instability, the lower the NPV. What is also seen from

Figure 6 is that the tolling model has a much lower variance from the best to worst case scenarios than the traditional project company model. From the data and this finding, we can summarize that the tolling model reduces the risks of losses in instable countries.

5. Conclusions

The highway, energy, and gas sectors have found success in the tolling economic platforms to minimize or hedge these risks and the steel industry must follow suite. As such, this research investigates the financial feasibility of using the tolling model as a new investment model for executing overseas steel plant project. The assessment was made based on data collected from Company A, a steel-iron project sponsor with over 50 years of domestic and 20 years of international project experience. This study has found that the project company model results in superior profitability for the project company in healthy or “best case” markets. For the virtual project, which is an average of all Company A experiences, the project company model resulted in a $328 million USD increase in NPV profits versus the tolling model. Similarly, for the Indian and Iranian case studies, the project company model resulted in a $3.7 and $4.2 million USD increase, respectively, in NPV profits versus the tolling model. Company A and many other steel project sponsors attempt to only invest in projects with healthy markets and have experienced success with this model from the late 90’s to 2008. However, since the 2008 recession the raw material market and/or steel sales have been extremely volatile, and the market has significantly worsened.

Company A has experienced “worst-case” economic conditions on approximately half of their projects from 2008 to 2018. With the “worst-case” economic conditions, this study found the tolling model to be an improvement to the project company model. In the worst-case scenario of the Indian and Iranian steel project, the tolling model was found to result in an NPV profit $932 and $940 million USD, respectively, increase in comparison the project company model. However, both the project sponsor and tolling models had NPV profit losses in the worst-case scenario of the virtual project. These project savings are caused by transferring the political, raw material price, final product sales volume, and sales price risks to the project sponsor in volatile markets. The tolling model also allows the tolling company a stable revenue source (the tolling fee) over the duration of the agreement. Due to this reduction in risks, the tolling company also benefits from the ability to attain funding under low pricing and long-term conditions. Furthermore, the sponsor can borrow under non-recourse conditions. The findings of this research support the tolling model as a win-win for both tolling company and sponsor in volatile markets. However, when the market is more favorable, the traditional project company model produces superior profitability.

Company A’s existing investment strategy and operational processes are similar to other Asian countries such as South Korea, Taiwan, Japan, and Singapore. As such, this study’s findings are generalizable to steel companies in these countries. These findings also suggest that there may be advantages of using the tolling model for any first-world steel company. However, further research would be required to confirm. The limiting factor in generalizing findings to wealthy North American, European, or Australian nations is that Company A benefits from cheap labor and material, in-country ore production, and an in-country increase in steel demand which is not experienced by said nations.

Limitations and Future Work

The tolling model is still an unfamiliar concept in the steel industry. As such, all investigative research of this study was performed on projects executed with the traditional model. Future research will include analyzing executed tolling model steel project cases and compare them to executed traditional model steel projects of equivalent size and scope. Furthermore, the three presented scenarios (best, most likely, and worst) assumed in the project company and tolling model economic evaluation do not take all cases into consideration. The accuracy of the economic forecasting related to the volatility should be increased in future research through inquiring the investment and operation environment at the time of approval and at the time of start-up. Once more accurate data is available, a probabilistic assessment will be performed to better understand the ranges in potential profitability and sensitivity to market variables. Finally, overseas steel plant projects to which the tolling model can be applied may be very small. Problems can arise with sponsors who are ignorant of the tolling model or are less capable of risk hedging. However, this can be solved by maximizing common interest and nurturing a mutual trust between the project sponsor and tolling company.