Brexit and UK Energy Security: Perspectives from Unconventional Gas Investment and the Effects of Shale Gas on UK Energy Prices

Abstract

1. Introduction

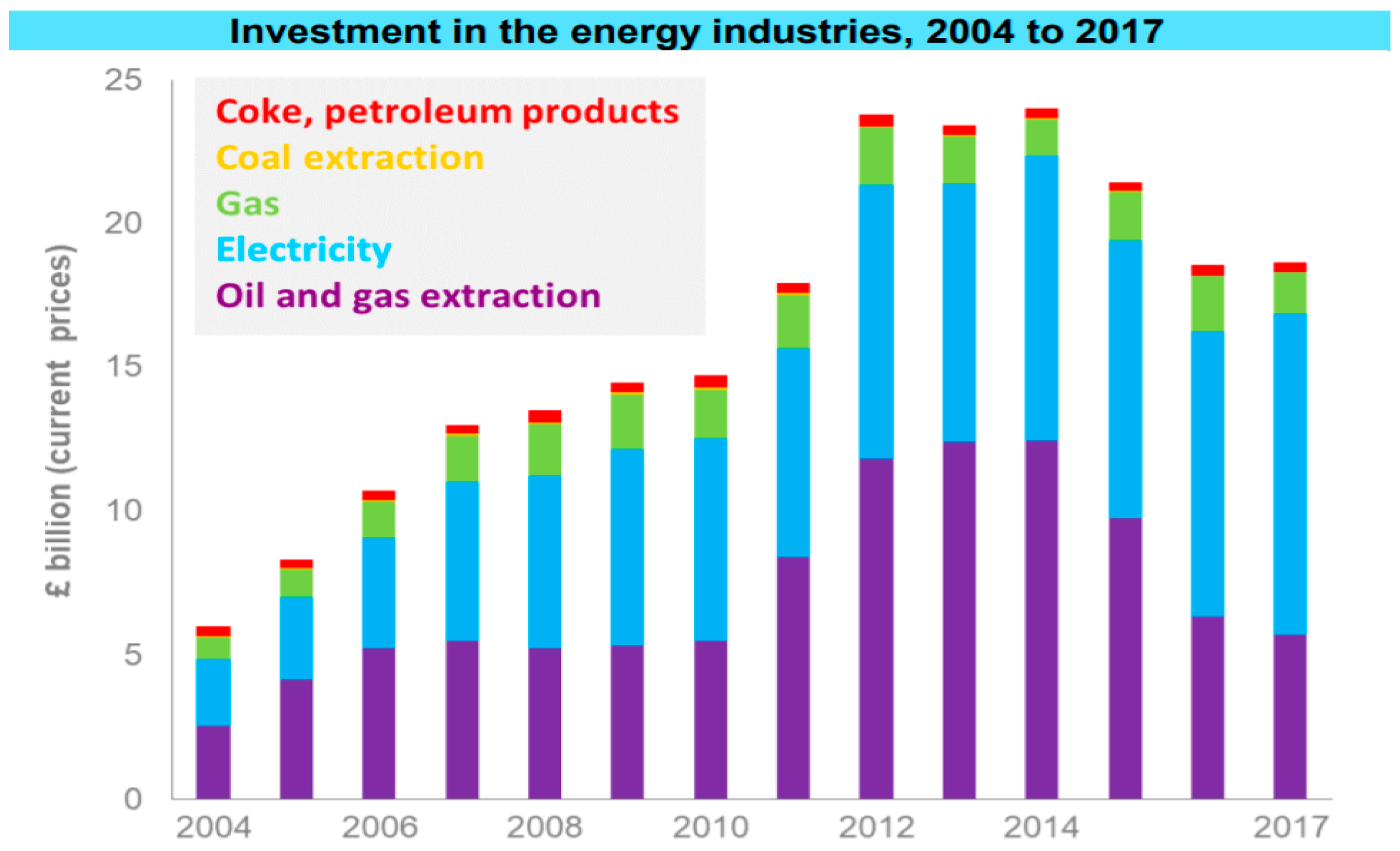

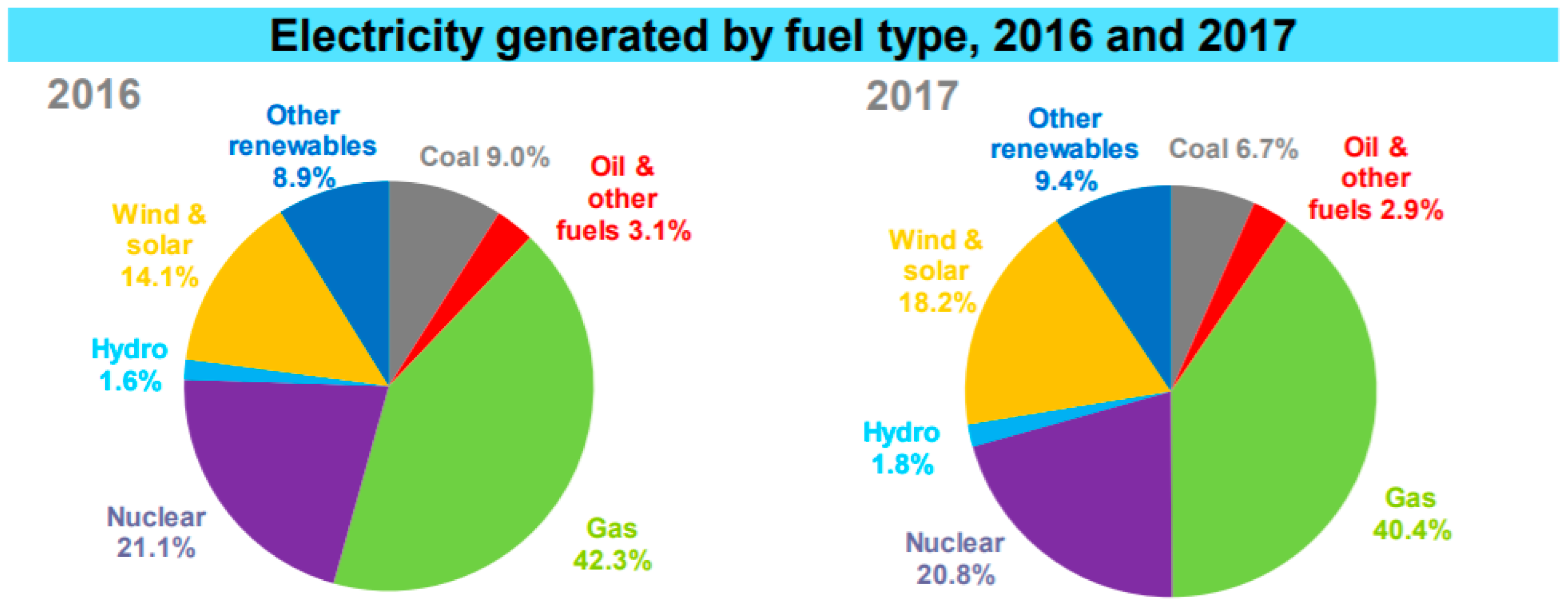

2. Brexit and Shale Gas Investment

2.1. Brexit: Background and Definitions

2.2. Effects of Brexit on Investment in Shale Gas

2.3. Brexit and Regulation of UK Fracking

3. UK Energy Security Implications

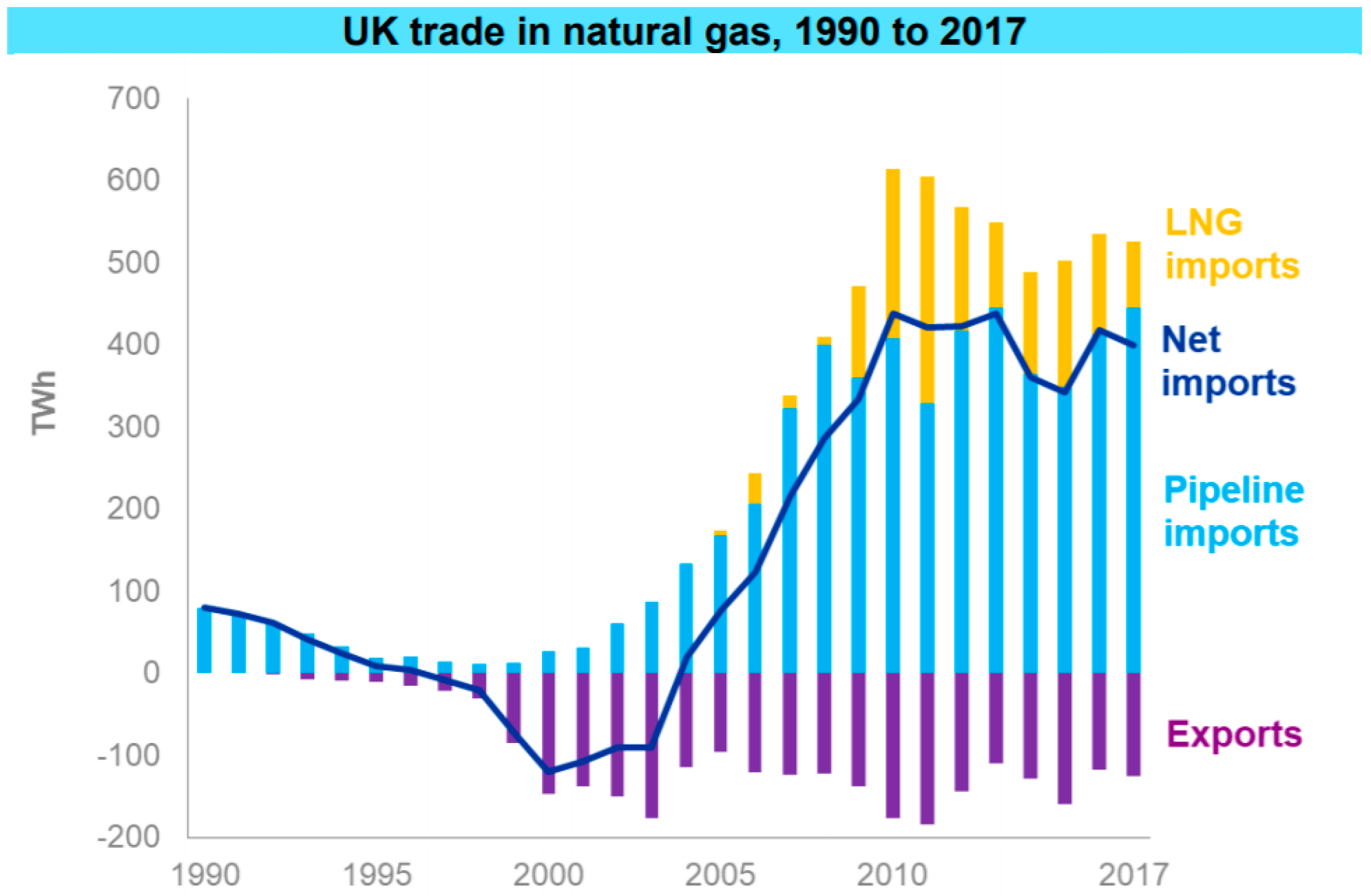

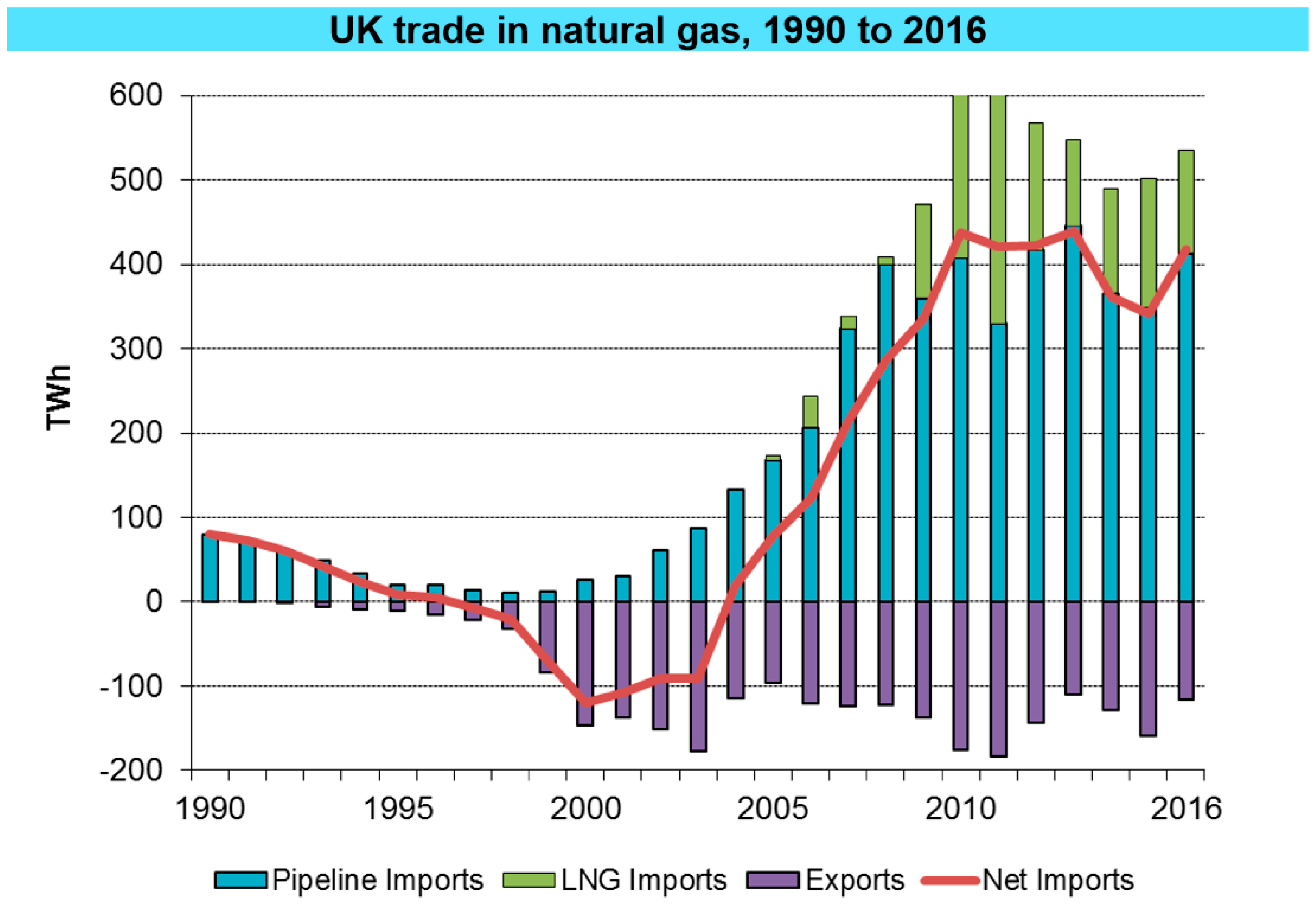

3.1. UK Energy Security Situation

3.2. Brexit and Effects of Trade Protectionism

4. The Moderating Effects of Shale Gas on UK Energy Price

4.1. The Potential of Shale Gas for the UK and Gov’t Expectation

4.2. Brexit, Energy Price and the Role of Shale Gas

4.3. The IEM, Natural Gas Trade and UK Energy Supply and Prices Post Brexit

4.4. Brexit, Exchange Rates and Energy Prices

5. Conclusions and Recommendations

Author Contributions

Funding

Conflicts of Interest

References

- Moloney, N. Financial Services, the EU, and Brexit: An Uncertain Future for the City? Ger. Law J. 2016, 17, 75–82. [Google Scholar]

- Ramiah, V.; Pham, H.N.A.; Moosa, I. The sectoral effects of Brexit on the British economy: Early evidence from the reaction of the stock market. J. Appl. Econ. 2017, 49, 2508–2514. [Google Scholar] [CrossRef]

- Jackson, G. Brexit, Investment and the Oil and Gas Industry. Financial Times. 10 August 2018. Available online: https://ftalphaville.ft.com/2018/08/10/1533891681000/Brexit--investment-and-the-oil---gas-industry/ (accessed on 11 September 2018).

- McCormic, M. No-deal Brexit risks North Sea shutdown, says industry body. Financial Times. 11 September 2018. Available online: https://www.ft.com/content/c7477e8a-b516-11e8-bbc3-ccd7de085ffe (accessed on 11 September 2018).

- Department for Business, Energy and Industrial Strategy. UK Energy in Brief 2018; Office of National Statistics Publication: London, UK, 2018.

- UK Onshore Operators Group. Onshore Oil and Gas in the UK; UKOOG: London, UK, 2013. [Google Scholar]

- Oil and Gas Authority. 14th Onshore Oil and Gas Licensing Round; The National Archives: London, UK, 2015.

- UK Parliament. Energy generation in Wales: Shale Gas—Welsh Affairs Committee. 2014. Available online: https://publications.parliament.uk/pa/cm201415/cmselect/cmwelaf/284/28405.htm (accessed on 10 November 2018).

- Department for Energy and Climate Change. Government’s Vision for Shale Gas in Securing Home Grown Energy Supplies for the UK; Andrea Leadsom’s Speech at the Shale World UK 2016 Conference in London; DECC: London, UK, 2016.

- HM Treasury. Harnessing the Potential of the UK’s Natural Resources: A Fiscal Regime for Shale Gas: Consultation Outcome; DECC Publication: London, UK, 2014.

- Stevens, P. Shale Gas Revolution: Hype and Reality. In Chatham House Report: Energy, Environment and Resources; Chatam House: London, UK, 2010. [Google Scholar]

- Stevens, P. Shale Gas in the United Kingdom. In Chatham House Report: Energy, Environment and Resources; Chatam House: London, UK, 2013. [Google Scholar]

- Papadopoulou, R. UK Shale Gas Development: Legal, Economic, Environmental and Political Challenges Posed to the Ambitious UK Shale Gas Plan; Saltire Projects Report: London, UK, 2013. [Google Scholar]

- Jones, P.; Hillier, D.; Comfort, D. Fracking in the UK: Planning and Property Issues. Prop. Manag. 2014, 32, 352–361. [Google Scholar] [CrossRef]

- Hayhusrt, R. Cuadrilla’s Bid to Change Rules for Lancs Shale Gas Site Raises Concerns about “Intensified Fracking”. 2017. Available online: https://drillordrop.com/2017/07/07/cuadrillas-bid-to-change-rules-for-lancs-shale-gas-site-raises-concerns-about-intensified-fracking/ (accessed on 12 January 2019).

- Richards, P.; Fell, M.; Smith, L.; Keep, H. Shale Gas and Fracking; House of Commons Library: London, UK, 2013; pp. 1–28. [Google Scholar]

- Wilson, M.P.; Richard, J.D.; Gillian, R.F.; Bruce, R.J.; Peter, S.; Jon, G.G.; Sam, A. Anthropogenic earthquakes in the UK: A national baseline prior to shale exploitation. J. Mar. Pet. Geol. 2015, 68, 1–17. [Google Scholar] [CrossRef]

- Ifelebuegu, I.; Aidelojie, K.; Acquah-Andoh, E. Brexit and Article 50 of the Treaty of the European Union: Implications for UK Energy Policy and Security. Energies 2017, 10, 2143. [Google Scholar] [CrossRef]

- Oil and Gas UK. Business Outlook 2017; Oil and Gas UK Publication: London, UK, 2017. [Google Scholar]

- Oil and Gas UK. Activity Survey 2016; Oil and Gas UK Publication: London, UK, 2016. [Google Scholar]

- House of Commons Library. UK Offshore Oil and Gas Industry; Briefing Paper Number CBP 07268; House of Commons Library: London, UK, 29 March 2017. [Google Scholar]

- Jay, A. Cuadrilla’s Lancashire Fracking Plans Cleared by High Court. 2017. Available online: http://www.telegraph.co.uk/business/2017/04/12/cuadrillas (accessed on 12 January 2019).

- Wadham, M. Should I invest in Fracking? UK Investor Magazine. 15 July 2015. Available online: https://ukinvestormagazine.co.uk/should-i-invest-in-fracking/ (accessed on 11 September 2018).

- Gefira. Is the Polish Shale Gas Industry set for a Comeback? OilPrice.Com. 1 July 2017. Available online: https://oilprice.com/Energy/Energy-General/Is-The-Polish-Shale-Gas-Industry-Set-For-A-Comeback.html (accessed on 11 September 2018).

- Nelson, A. The Rise and Fall of Fracking in Europe. The Guardian. 29 September 2016. Available online: https://www.theguardian.com/sustainable-business/2016/sep/29/fracking-shale-gas-europe-opposition-ban (accessed on 11 September 2018).

- North American firms quit shale gas fracking in Poland. BBC. 8 May 2013. Available online: https://www.bbc.co.uk/news/business-22459629 (accessed on 11 September 2018).

- Thorpe, D. How can I invest in UK fracking? WhatInvestment.co.uk. 4 September 2014. Available online: http://www.whatinvestment.co.uk/how-can-i-invest-in-uk-fracking-2470277/ (accessed on 11 September 2018).

- Ficenec, J. Before you back Britain’s fracking boom, drill down into the details. The Telegraph. 28 July 2014. Available online: http://www.telegraph.co.uk/finance/personalfinance/investing/10901879/Before-you-back-Britains-fracking-boom-drill-down-into-the-details.html (accessed on 11 September 2018).

- Nelson, A. Fracking Firms Struggling to Raise Money from UK Banks Amid Environment Protests. The Independent. 29 September 2016. Available online: https://www.independent.co.uk/environment/fracking-firms-uk-bank-investing-raise-money-protests-environment-a7841636.html (accessed on 11 September 2018).

- Clarke, J.S. Low oil price forces firms to surrender fracking licences. Greenpeace–Unearthed. 17 December 2015. Available online: https://unearthed.greenpeace.org/2015/12/17/low-oil-price-forces-firms-to-surrender-fracking-licences/ (accessed on 11 September 2018).

- LaMaster, J.C.; Hammerson, M. Brexit and the UK Oil and Gas Sector. Denning Law J. 2016, 28, 9–15. [Google Scholar]

- Giles, C. Business fears Brexit will hit sales, study finds: Nottingham and Stanford universities’ survey of 2,500 companies shows growing concern. Financial Times. 25 September 2017. Available online: https://www.ft.com/content/6adf4c56-9eea-11e7-8cd4-932067fbf946 (accessed on 28 September 2018).

- Bloom, N.; Bunn, P.; Chan, S.; Mizen, P.; Smietanka, P.; Thwaites, G. The impact of Brexit on UK businesses: Evidence from the Decision Maker Panel; Presented by Paul Mizen, University of Nottingham and ESCoE 27 June 2018 to the Bank of England; Office for National Statistics: London, UK, 2018.

- UK Trade and Investment. Inward Investment Report 2014/15; UKTI/15/43; UK Trade & Investment URN Publication: London, UK, 2015. [Google Scholar]

- Dhingra, S.; Ottaviano, G.; Sampson, T.; Reenen, J.V. The Consequences of Brexit for UK Trade and Living Standards; PaperBrexit02: #CEPBREXIT; Centre for Economic Performance: London, UK, 2016. [Google Scholar]

- Dhingra, S.; Ottaviano, G.; Sampson, T.; Reenen, J.V. The Impact of Brexit on Foreign Investment in the UK; PAPERBREXIT03: #CEPBREXIT; Centre for Economic Performance: London, UK, 2016. [Google Scholar]

- Welfens, P.J.J.; Baier, F.J. BREXIT and FDI: Key Issues and New Empirical Findings. Int. J. Financ. Stud. 2018, 6, 46. [Google Scholar] [CrossRef]

- Frynas, J.G. Political Instability and Business: Focus on Shell in Nigeria. Third World Q. 1998, 19, 457–478. [Google Scholar] [CrossRef]

- Mommer, B. Oil Prices and Fiscal Regimes; WPM 24; Oxford Institute for Energy Studies: Oxford, UK, 1999. [Google Scholar]

- Umbach, F. Global Energy Security and the Implications for the EU. Energy Policy 2010, 38, 1229–1240. [Google Scholar] [CrossRef]

- Laaksone, E. Political risks of foreign direct investment in the Russian gas industry—The Shtokman gas field project in the Arctic Ocean. 2010. Available online: http://www.utupub.fi/bitstream/handle/10024/114816/LaaksonenEini.pdf?sequence=1&isAllowed=y (accessed on 12 January 2019).

- Boe, K.S.; Jordal, T. Impact of Political Stability and Property Rights Protection on Oil and Gas Investments: A Cross-Country Analysis; Industrial Economics and Technology Management (NTNU): Trondheim, Norway, 2016. [Google Scholar]

- DBEIS. Guidance on fracking: Developing shale gas in the UK. 2018. Available online: https://www.gov.uk/government/publications/about-shale-gas-and-hydraulic-fracturing-fracking/developing-shale-oil-and-gas-in-the-uk (accessed on 12 January 2019).

- Department for Energy and Climate Change. Onshore Oil and Gas Exploration in the UK: Regulation and Best Practice; DECC: London, UK, 2015.

- Tawonezvi, J. The legal and regulatory framework for the EU’ shale gas exploration and production regulating public health and environmental impacts. Energy Ecol. Environ. 2017, 2, 1–28. [Google Scholar] [CrossRef]

- Erbach, G. Shale Gas and EU Energy Security; European Parliamentary Research Service, Briefing Paper December 2014 (2014b), Members’ Research Service PE 542.167; European Parliamentary Research Service: Brussels, Belgium, 2014. [Google Scholar]

- Island Gas Limited. Preliminary Reports for the Year Ended. 2016. Available online: https://www.igasplc.com/media/37016/prelims-2016-finalpresentation.pdf (accessed on 30 November 2018).

- Bolton, P. Energy Imports and Exports; Briefing Paper Number 4046; House of Commons Library: London, UK, 2018. [Google Scholar]

- Department for Business, Energy and Industrial Strategy. UK Energy Statistics 2017 and Q4 2017; Statistical Press Release; Office of National Statistics Publication: London, UK, 29 March 2018.

- Oil and Gas Authority. Regulatory Framework for Fracking. 2017. Available online: https://www.gov.uk/government/publications/about-shale-gas-and-hydraulicfracturing-fracking/developing-shale-oil-and-gas-in-the-uk (accessed on 30 November 2018).

- Gyagri, M.; Amarfio, E.M.; Marfo, S.A. Determinants of Global Pricing of Crude Oil—A Theoretical Review. Int. J. Pet. Petrochem. Eng. (IJPPE) 2017, 3, 7–15. [Google Scholar]

- US Energy Information Administration. Natural Gas Explained: Factors Affecting Natural Gas Price. 2017. Available online: https://www.eia.gov/energyexplained/index.php?page=natural_gas_factors_affecting_prices (accessed on 27 November 2018).

- Statistica. Average Monthly Brent Crude Oil Price from September 2017 to September 2018 (in U.S. Dollars per Barrel). 2018. Available online: https://www.statista.com/statistics/262861/uk-brent-crude-oil-monthly-price-development/ (accessed on 10 November 2018).

- Department for Business, Energy and Industrial Strategy. Energy and Climate Change Public Attitude Tracker—WAVE 21; Office of National Statistics Publication: London, UK, 2017.

- Intercontinental Exchange. ICE Europe Futures: UK Natural Gas Futures. 2018. Available online: https://www.theice.com/products/910/UK-Natural-Gas-Futures/data?marketId=142402&span=3 (accessed on 10 November 2018).

- House of Lords European Union Committee. Brexit: Energy Security. 10th Report of Session 2017–2019; HL Paper 63; House of Lords European Union Committee: London, UK, 2018. [Google Scholar]

- European Commission. Report from the Commission to the European Parliament and the Council on Trade and Investment Barriers 1 January 2016–31 December 2016; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- European Commission. Report from the Commission to the European Parliament and the Council on Trade and Investment Barriers 1 January 2017 31 December 2017; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Smith, B. Sanctions against Russia—In Brief; House of Commons Briefing Paper Number CBP 8284; House of Commons Library: London, UK, 12 April 2018. [Google Scholar]

- Parliament.UK. Natural Gas: Imports: Written Question—HL1673. 2016. Available online: https://www.parliament.uk/business/publications/written-questions-answers-statements/written-question/Lords/2016-09-07/HL1673/ (accessed on 12 January 2019).

- BBC. Salisbury Attack: How Much of the UK’s Gas Comes from Russia? 2018. Available online: https://www.bbc.co.uk/news/business-43421431 (accessed on 12 January 2019).

- Giles, G. Post-Brexit Trade May Hinge on Non-Tariff Barriers: Regulations and Standards Will Be the Difficult Part of Negotiations with EU. 18 December 2016. Available online: https://www.ft.com/content/69202760-c3a2-11e6-9bca-2b93a6856354 (accessed on 12 January 2019).

- British Geological Survey and Department for Energy and Climate Change. The Carboniferous Bowland Shale Gas Study: Geology and Resource Estimation; BGS/DECC Publication: London, UK, 2013.

- Broderick, J.; Anderson, K.; Wood, R.; Gilbert, P.; Sharmina, M.; Footitt, A.; Glynn, S.; Nicholls, F. Shale Gas: An Updated Assessment of Environmental and Climate Change Impacts; A Report Commissioned by the Co-Operative and Undertaken by Researchers; The Tyndall Centre, University of Manchester: Manchester, UK, 2011. [Google Scholar]

- The US Energy Information Administration. Technically Recoverable Shale Oil and Shale Gas Resources: United Kingdom. 2015. Available online: https://www.eia.gov/analysis/studies/worldshalegas/pdf/UK_2013.pdf (accessed on 10 November 2018).

- Institute of Directors [IOD]. Infrastructure for Business #6: Getting Shale Gas Working; IoD Publication: London, UK, 2013. [Google Scholar]

- Department for Business, Energy and Industrial Strategy. UK Energy in Brief 2017; Office of National Statistics Publication: London, UK, 2017.

- Department for Business, Energy and Industrial Strategy. UK Energy in Brief 2016; Office of National Statistics Publication: London, UK, 2016.

- Department for Business, Energy and Industrial Strategy. UK Energy in Brief 2015; Office of National Statistics Publication: London, UK, 2015.

- Office of National Statistics. Quarterly Energy Prices—September 2018; Office of National Statistics Publication: London, UK, 2018.

- Rogers, H. UK Shale Gas: Hype, Realisties and Difficult Questions; Oxford Energy Comment; Oxford Institute for Energy Studies: Oxford, UK, July 2013. [Google Scholar]

- US Energy Information Administration. Frequently Asked Questions: How Much Shale Gas Is Produced in the United States? 2018. Available online: https://www.eia.gov/tools/faqs/faq.php?id=907&t=8 (accessed on 10 November 2018).

- US Energy Information Administration. Short Term Energy Outlook November 2018. Available online: https://www.eia.gov/outlooks/steo/pdf/steo_full.pdf (accessed on 10 November 2018).

- EPRINC. Natural Gas Industry Fakes the Moon Landing, EPRINC Briefing Memorandum, Washington, DC. 1 July 2011. Available online: http://eprinc.org/wp-content/uploads/2011/07/EPRINC-NaturalGasMoonLanding1.pdf (accessed on 10 November 2018).

- US Energy Information Administration. Natural Gas. 2018. Available online: https://www.eia.gov/dnav/ng/hist/rngwhhdW.htm (accessed on 10 November 2018).

- Grubb, M.; Tindale, S. Brexit and Energy: Cost, Security and Climate Policy Implications; EINOTE: London, UK, May 2016. [Google Scholar]

- House of Commons. The Potential Impact of Brexit on the Creative Industries, Tourism and the Digital Single Market; HC365; House of Commons Publication: London, UK, 25 January 2018. [Google Scholar]

- Department for Business, Energy and Industrial Strategy. Digest of UK Energy Statistics 2018; Office of National Statistics Publication: London, UK, July 2018.

- Department for Business, Energy and Industrial Strategy. Table 4.3 Natural Gas Imports and Exports; Government Publishing Services: London, UK, 2018.

- UK Parliament. Energy Generation in Wales: Shale Gas—Welsh Affairs Committee. 2014. Available online: https://publications.parliament.uk/pa/cm201415/cmselect/cmwelaf/284/28406.htm (accessed on 10 November 2018).

- Howell, R.A. UK public beliefs about fracking and effects of knowledge on beliefs and support: A problem for shale gas policy. Energy Policy 2018, 113, 721–730. [Google Scholar] [CrossRef]

- European Parliament Research Service [EPRS]. Unconventional gas and oil in North America: The Impact of Shale Gas and Tight Oil on the US and Canadian Economies and on Global Energy Flows; 140814REV1; European Parliamentary Research Service Publication: Brussels, Belgium, June 2014. [Google Scholar]

- Energy UK. Gas Supplies | Energy UK. 2018. Available online: https://www.energy-uk.org.uk/energy-industry/gas-generation/gas-supplies.html (accessed on 30 November 2018).

- Pollitt, G.M. The economic consequences of Brexit: Energy. Oxf. Rev. Econ. Policy 2017, 33, S134–S143. [Google Scholar] [CrossRef]

- Raval, A. UK gets first big shipment of US liquefied natural gas. Financial Times. 5 July 2017. Available online: https://www.ft.com/content/f7ea9416-616e-11e7-8814-0ac7eb84e5f1 (accessed on 10 November 2018).

- Shiryaevskaya, A. LNG shipments to U.K. Increase as U.S. Ramps up. Bloomberg. 6 April 2018. Available online: https://www.bloomberg.com/news/articles/2018-04-06/summer-of-lng-starts-with-a-bang-in-u-k-as-u-s-plant-ramps-up (accessed on 10 November 2018).

- Gissey, G.C.; Grubb, M.; Staffell, I.; Agnolucci, P.; Ekins, P. Wholesale Cost Reflectivity of Great Britain and European Electricity Prices; Ofgem Commissioned UCL Report: London, UK, November 2018. [Google Scholar]

- Ofgem. Infgraphic: Bills, Prices and Profits: Facts and figures on Britain’s energy market, larger supplier prices and profits, energy bills and switching. Ofgem, 3 December 2018. Available online: https://www.ofgem.gov.uk/system/files/docs/2019/01/bills_prices_profits_december.pdf (accessed on 12 January 2019).

| No. | 2016 | 2017 | ||

|---|---|---|---|---|

| Country | No. of Barrier Measures | Country | No. of Barrier Measures | |

| 1 | Russia | 33 | Russia | 36 |

| 2 | Brazil | 23 | China | 25 |

| 3 | China | 23 | Indonesia | 23 |

| 4 | India | 23 | India | 21 |

| 5 | Indonesia | 17 | Brazil | 21 |

| 6 | South Korea | 17 | South Korea | 20 |

| 7 | Argentina | 16 | Turkey | 20 |

| 8 | USA | 16 | USA | 20 |

| 9 | Turkey | 15 | Australia | 14 |

| 10 | Australia | 13 | Thailand | 12 |

| Basin | Shale Gas (Tcf) | Shale Oil, (Billion bbl) | Date Announced | ||||

|---|---|---|---|---|---|---|---|

| P10 | P50 | P90 | P10 | P50 | P90 | ||

| Bowland Shale | 2281 | 1329 | 822 | - | 27-Jul-13 | ||

| Midland Valley of Scotland Shale | 134.6 | 80.3 | 49.4 | 11.2 | 6.0 | 3.2 | 30-Jun-14 |

| Jurassic Shale of the Weald Basin | - | 4.4 | 23-May-14 | ||||

| Jurassic Shale of the Wessex Area | - | 1.1 | - | ||||

| Wales | 10.3 | 26-Jun-14 | |||||

| Total | 1419.6 | 11.5 | |||||

| Fuel | 2000 | 2010 | 2013 | 2014 | 2015 | 2016 | 6-Year Average |

|---|---|---|---|---|---|---|---|

| Coal | 39 | 52 | 84 | 87 | 60 | 46 | 61 |

| Gas | −11 | 40 | 52 | 47 | 43 | 47 | 36 |

| Oil | 55 | 14 | 40 | 43 | 37 | 34 | 37 |

| Total | −17 | 29 | 48 | 47 | 38 | 36 | 30 |

| Fuel | 1990 | 2000 | 2010 | 2015 | 2016 |

|---|---|---|---|---|---|

| Coal | 99.1 | 62.7 | 100.0 | 93.4 | 86.1 |

| Electricity | 84.1 | 60.0 | 100.0 | 112.3 | 107.9 |

| Gas | 72.4 | 45.4 | 100.0 | 110.4 | 91.7 |

| Heavy Fuel Oil | 25.9 | 33.3 | 100.0 | 70.7 | 69.5 |

| Industrial Prices | 74.4 | 51.9 | 100.0 | 105.2 | 98.7 |

| Fuel | 1996 | 2000 | 2005 | 2010 | 2015 | 2016 |

|---|---|---|---|---|---|---|

| Solid Fuels | 62.4 | 61.0 | 70.8 | 100.0 | 105.2 | 103.2 |

| Electricity | 86.4 | 70.3 | 73.9 | 100.0 | 118.7 | 116.4 |

| Gas | 59.9 | 52.0 | 63.3 | 100.0 | 122.3 | 113.1 |

| Liquid Fuels | 48.4 | 55.1 | 74.0 | 100.0 | 75.8 | 66.5 |

| Domestic Fuels | 71.5 | 61.6 | 69.4 | 100.0 | 119.0 | 113.5 |

| No. | Name | Capacity per Year | Percent |

|---|---|---|---|

| 1 | The UK-Belgium Interconnector (IUK)—a bi-directional pipeline | 25.5 BCM | 31.8 |

| 2 | The UK-Netherlands pipeline | 14.2 BCM | 17.7 |

| 4 | The Vesterled Pipeline Link—Connects Scotland to Norwegian Gasfileds | 14.2BCM | 17.7 |

| 4 | The Langeled Pipeline—connects England to Norway | 26.3 BCM | 32.8 |

| Total | 80.2 BCM | 100 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Acquah-Andoh, E.; Ifelebuegu, A.O.; Theophilus, S.C. Brexit and UK Energy Security: Perspectives from Unconventional Gas Investment and the Effects of Shale Gas on UK Energy Prices. Energies 2019, 12, 600. https://doi.org/10.3390/en12040600

Acquah-Andoh E, Ifelebuegu AO, Theophilus SC. Brexit and UK Energy Security: Perspectives from Unconventional Gas Investment and the Effects of Shale Gas on UK Energy Prices. Energies. 2019; 12(4):600. https://doi.org/10.3390/en12040600

Chicago/Turabian StyleAcquah-Andoh, Elijah, Augustine O. Ifelebuegu, and Stephen C. Theophilus. 2019. "Brexit and UK Energy Security: Perspectives from Unconventional Gas Investment and the Effects of Shale Gas on UK Energy Prices" Energies 12, no. 4: 600. https://doi.org/10.3390/en12040600

APA StyleAcquah-Andoh, E., Ifelebuegu, A. O., & Theophilus, S. C. (2019). Brexit and UK Energy Security: Perspectives from Unconventional Gas Investment and the Effects of Shale Gas on UK Energy Prices. Energies, 12(4), 600. https://doi.org/10.3390/en12040600