Effects of Local Electricity Trading on Power Flows and Voltage Levels for Different Elasticities and Prices

Abstract

1. Introduction

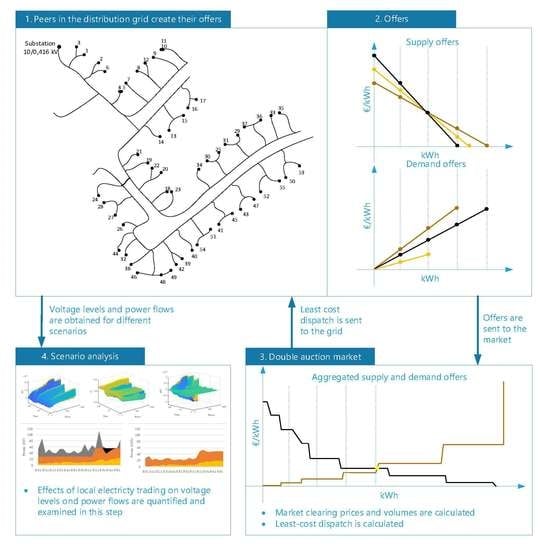

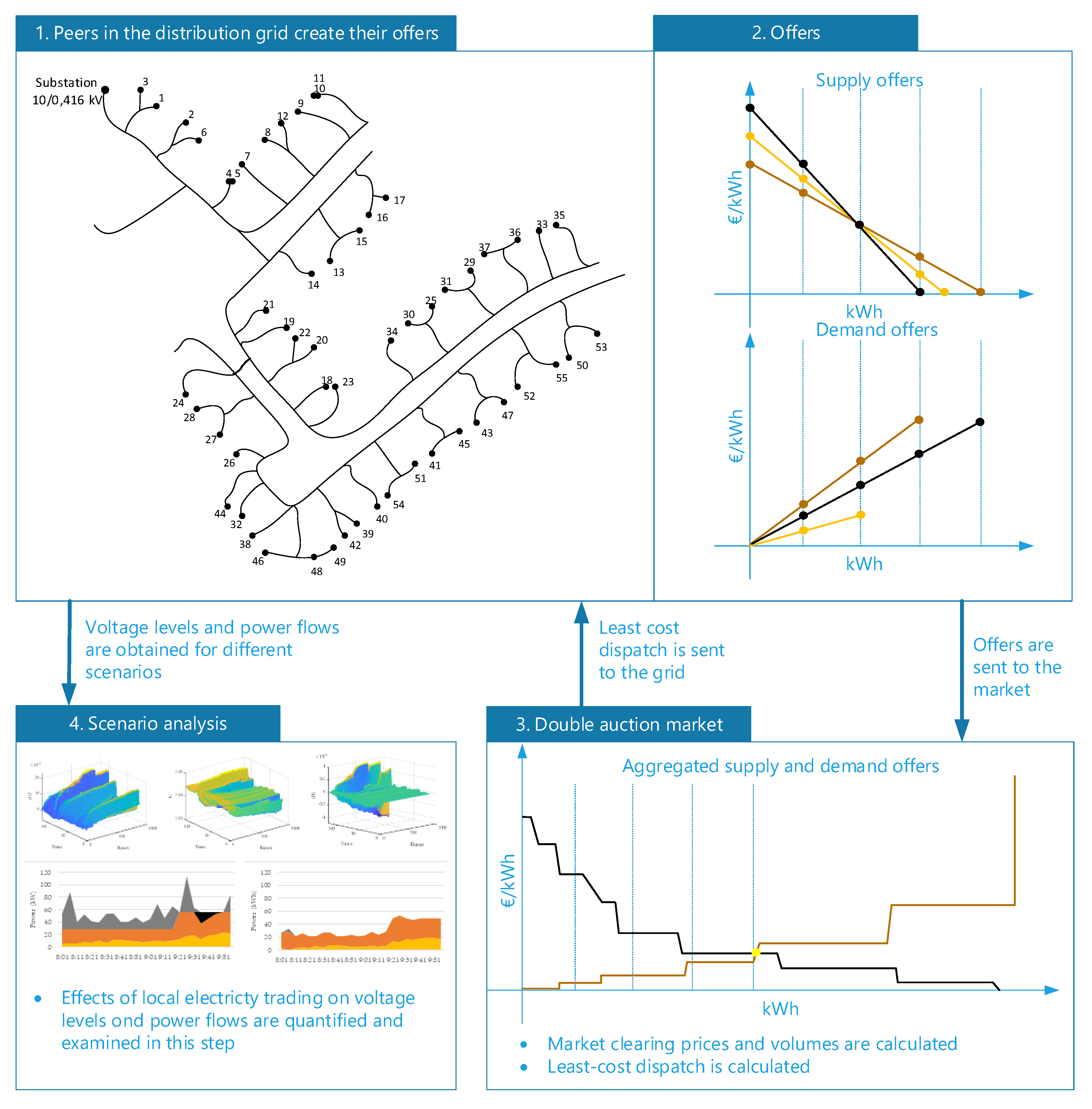

2. Method for Local Electricity Trading and Estimation of Its Impacts on the Grid

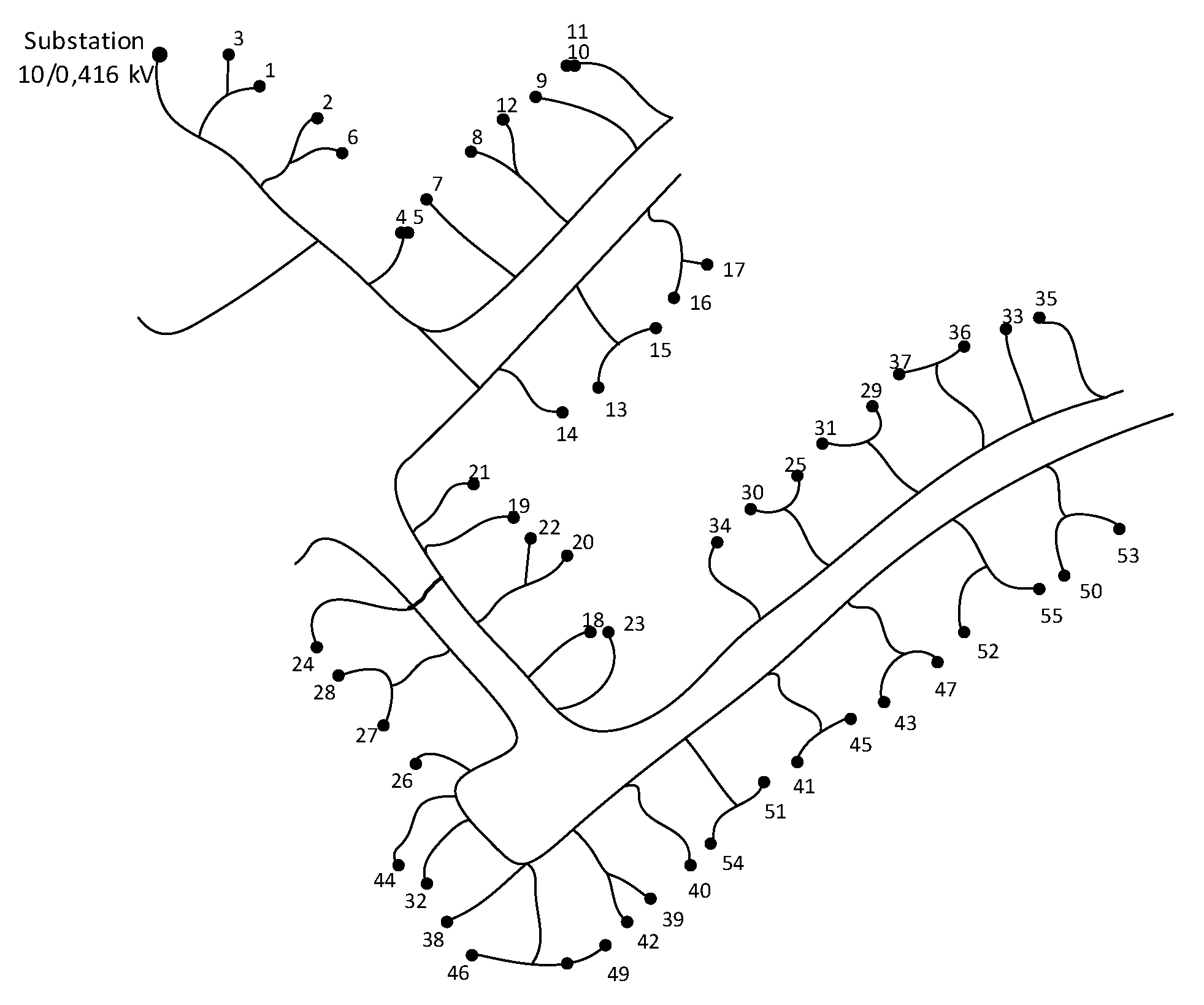

2.1. Auction-Based Method for LET

- -

- energy balance constraints for each time period , in time horizon made of periods, as listed in Equation (2):

- -

- technical constraints of maximal supply and demand capacities for each peer in period ( and respectively) have to be integrated into demand and supply offers, while individually can be written as in Equations (3) and (4):

2.2. Method for Simulation of Effects of LET on LV Distribution Grid Power Flows and Voltage Levels

3. Case Study

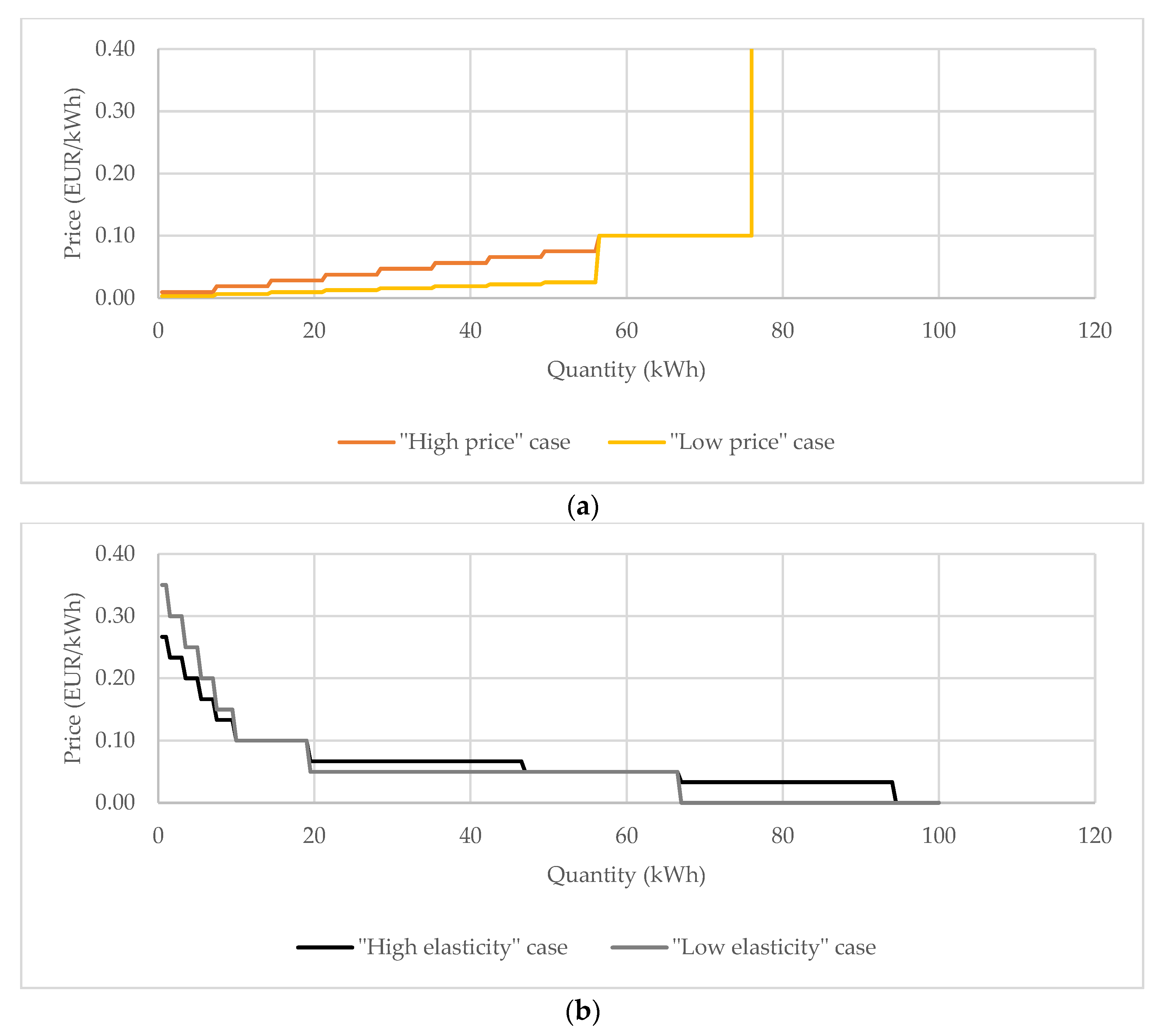

3.1. Scenarios and Input Data

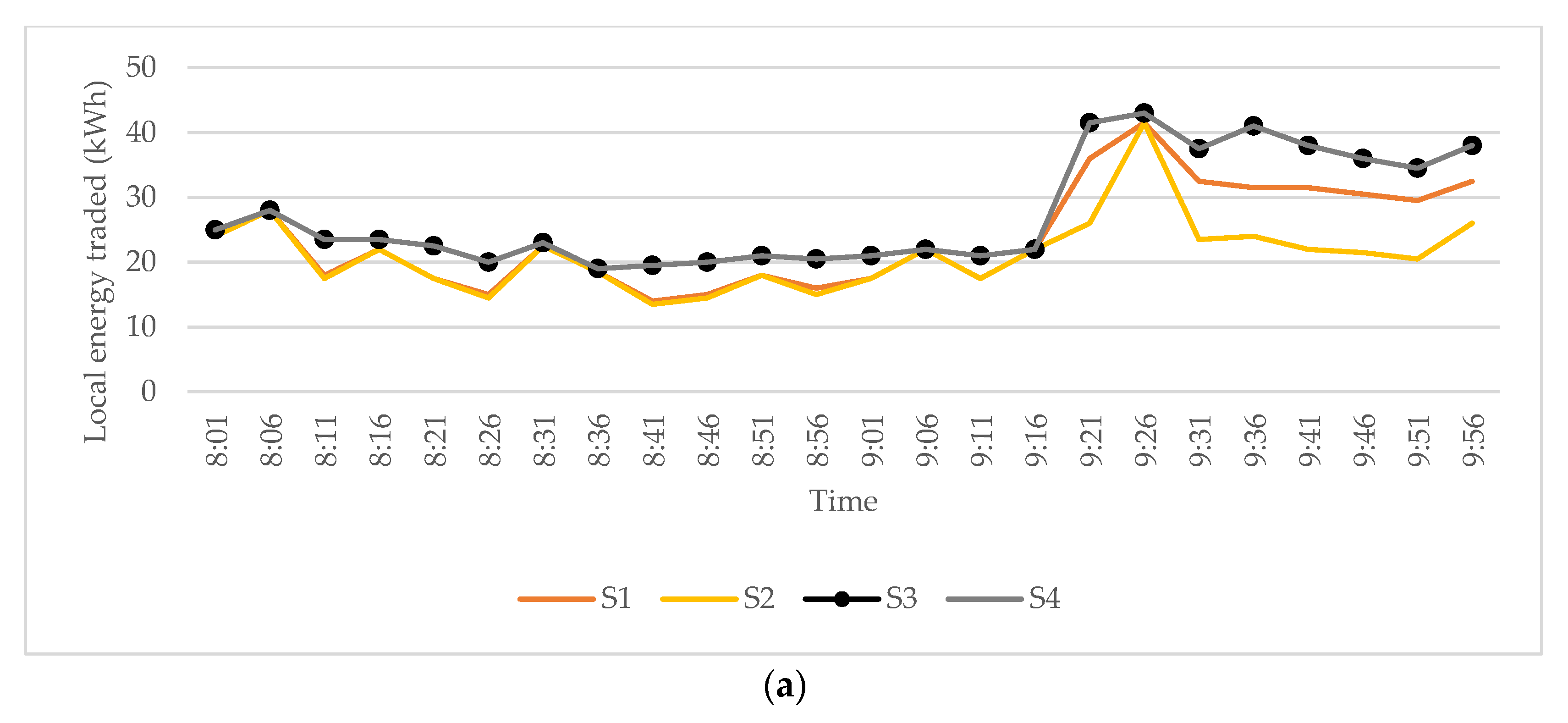

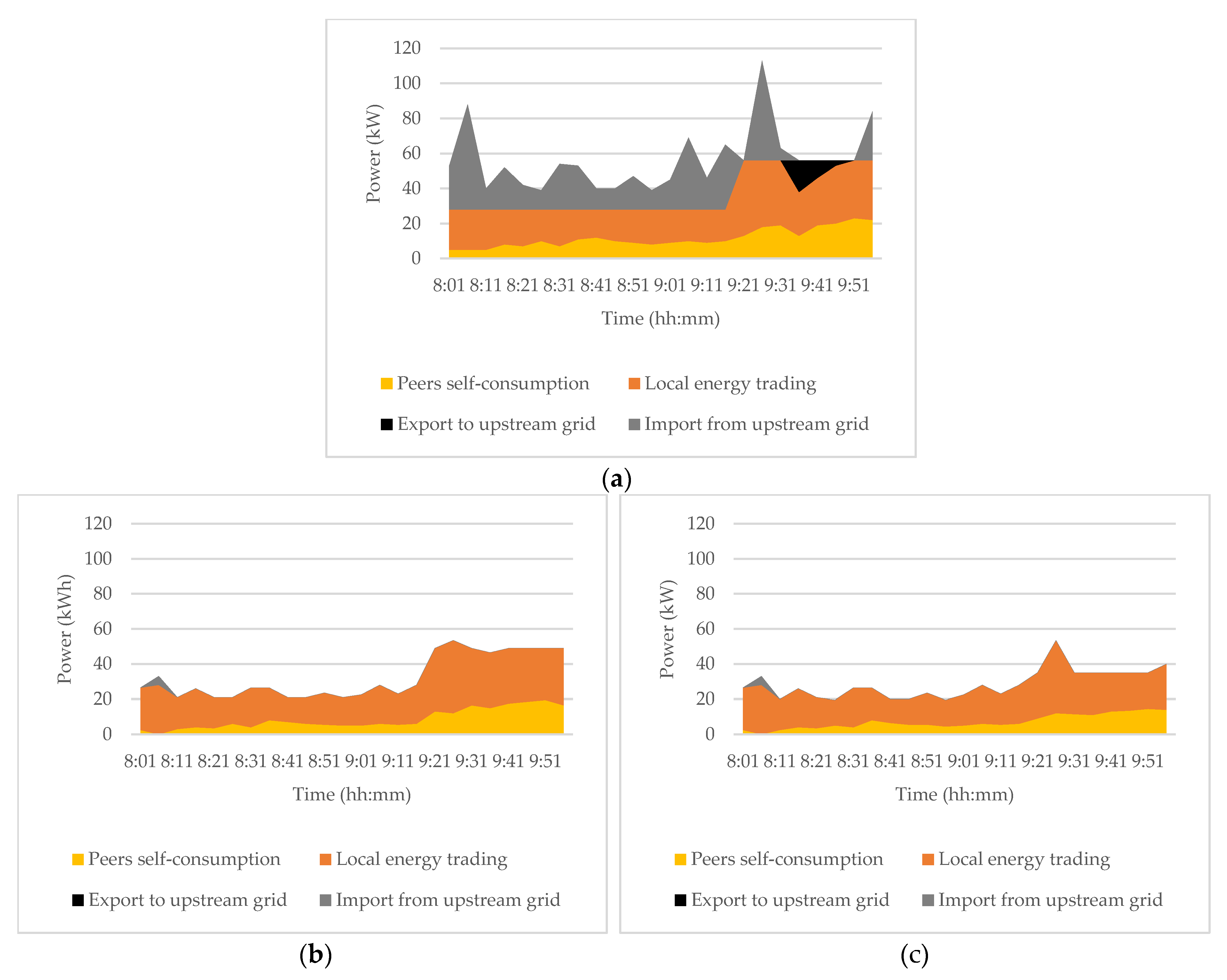

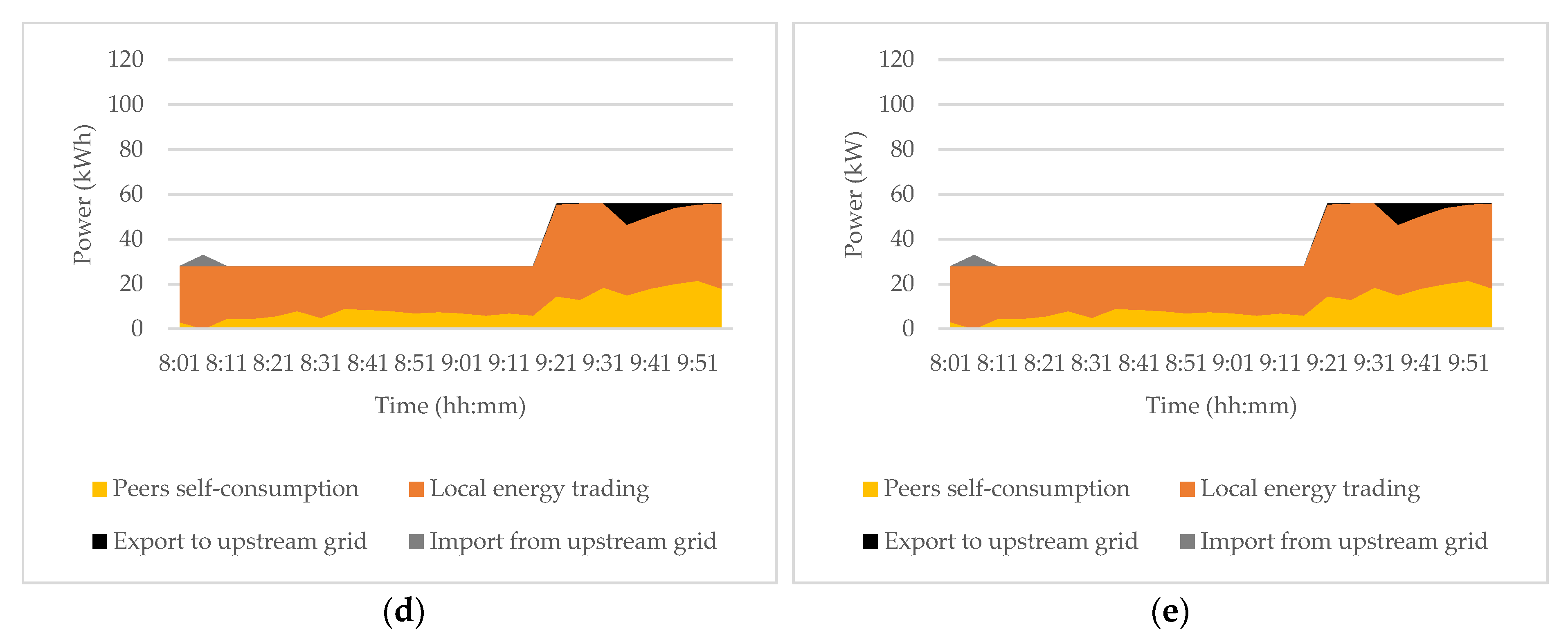

3.2. Outputs of the First Stage of the Simulation: Equilibrium Quantities and Prices

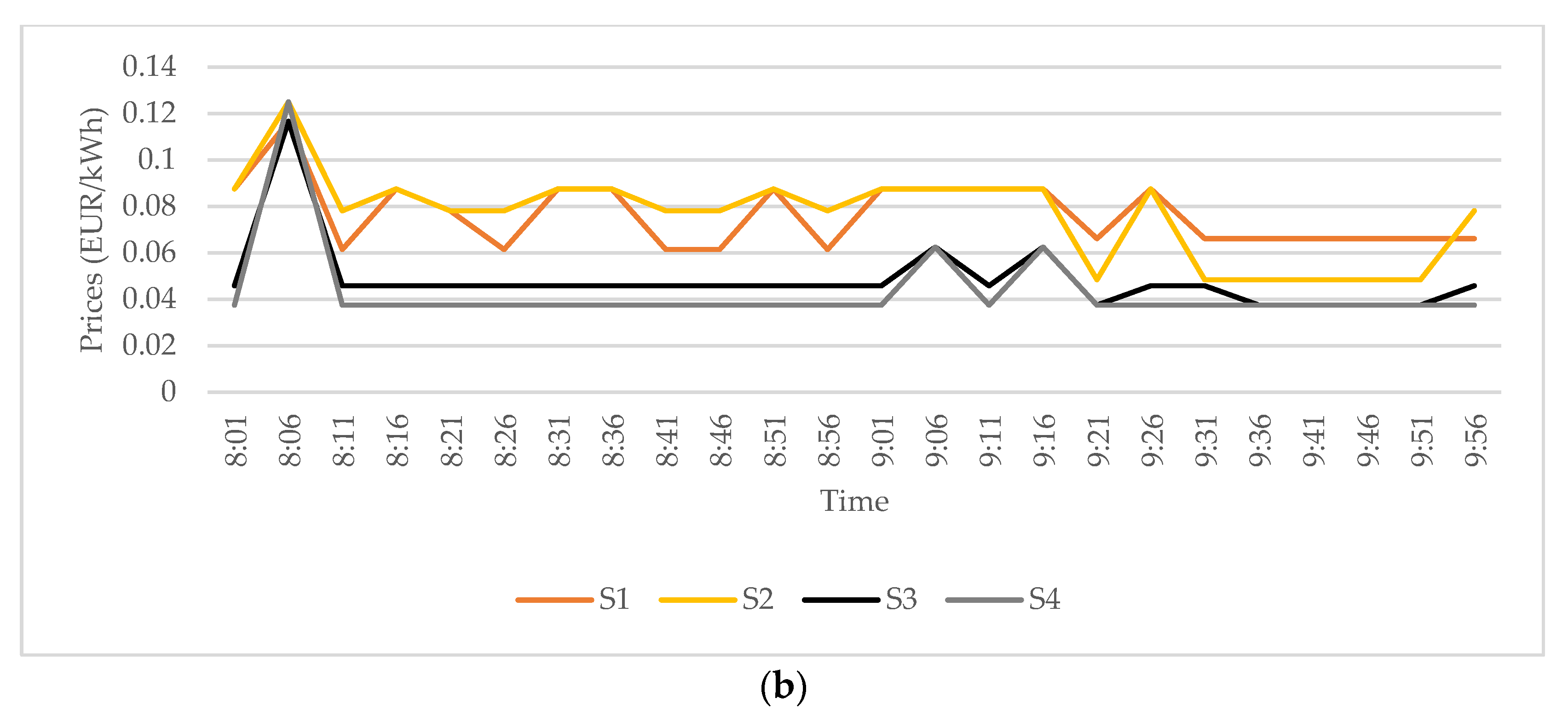

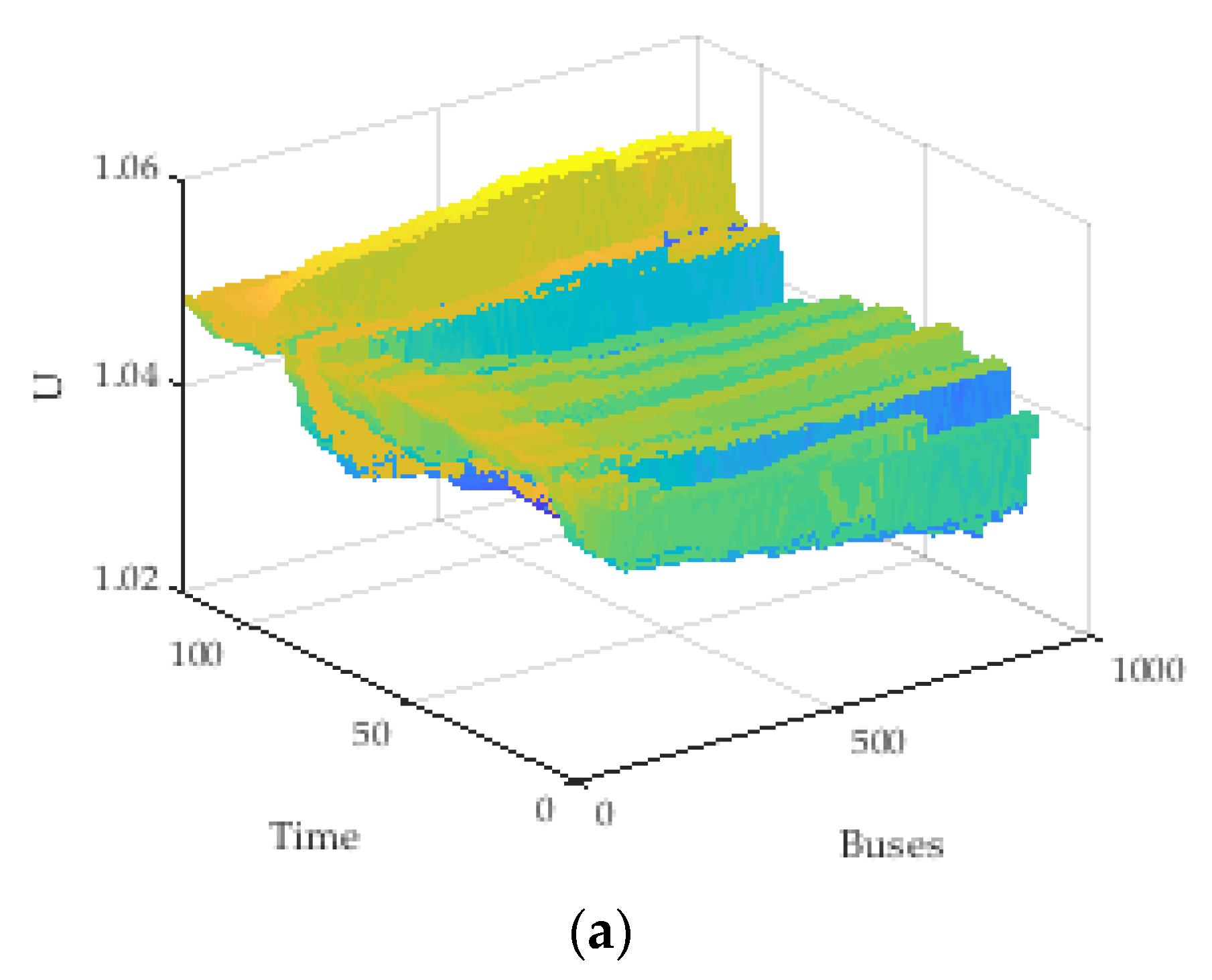

3.3. Results: Power Flows

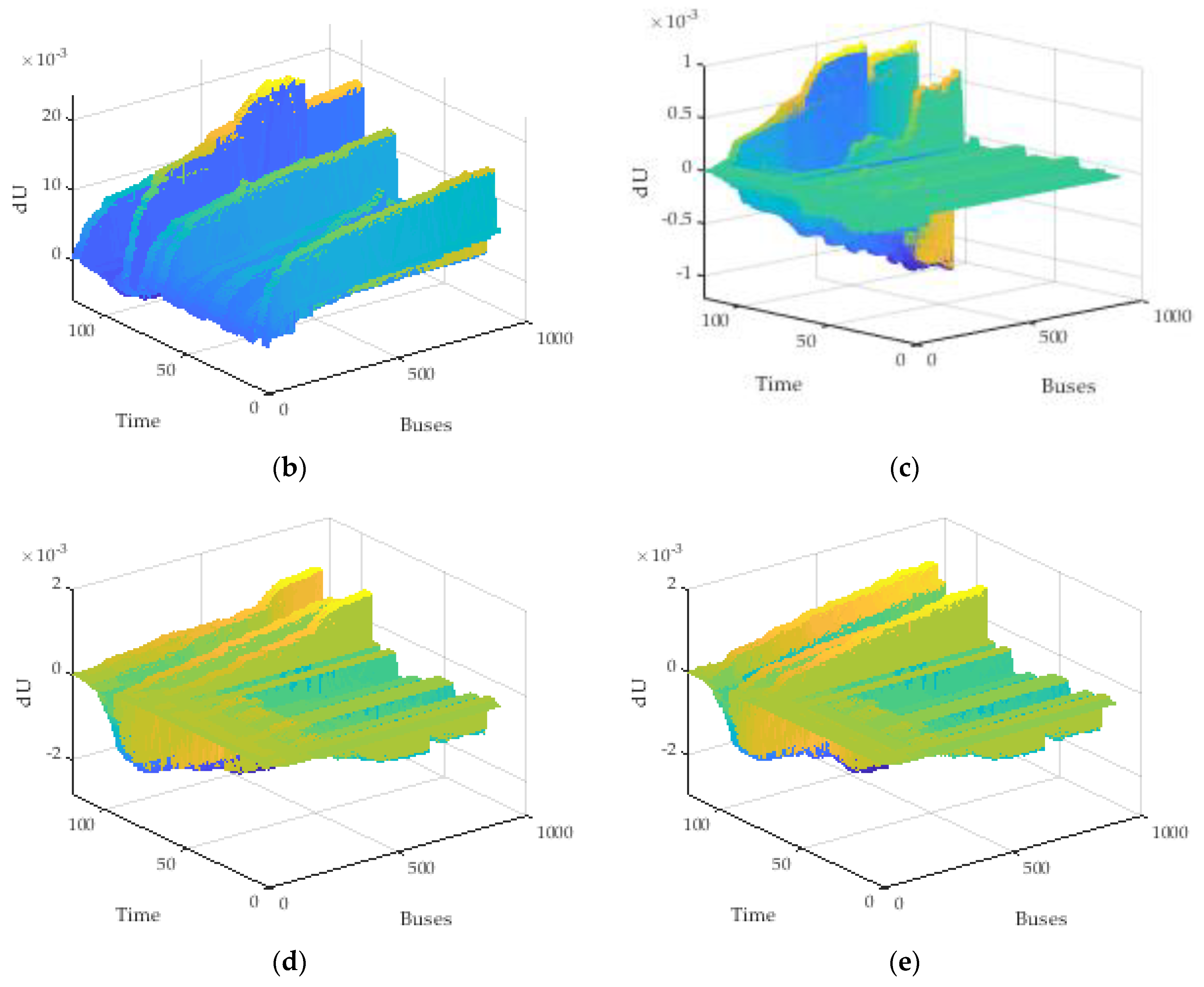

3.4. Results: Voltage Levels

4. Discussion

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Kampman, B.; Blommerde, J.; Afman, M. The Potential of Energy Citizens in the European Union; CE Delft: Delft, The Netherlands, 2016. [Google Scholar]

- Fleer, J.; Zurmühlen, S.; Meyer, J.; Badeda, J.; Stenzel, P.; Hake, J.-F.; Sauer, U.S. Techno-economic evaluation of battery energy storage systems on the primary control reserve market under consideration of price trends and bidding strategies. J. Energy Storage 2018, 17, 345–356. [Google Scholar] [CrossRef]

- Güngör, V.C.; Sahin, D.; Kocak, T.; Ergüt, S.; Buccella, C.; Cecati, C.; Hancke, G.P. Smart grid technologies: Communication technologies and standards. IEEE Trans. Ind. Inform. 2011, 7, 529–539. [Google Scholar] [CrossRef]

- Burke, M.J.; Stephens, J.C. Energy democracy: Goals and policy instruments for sociotechnical transitions. Energy Res. Soc. Sci. 2017, 33, 35–48. [Google Scholar] [CrossRef]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Market framework for local energy trading: A review of potential designs and market clearing approaches. IET Gener. Transm. Distrib. 2018, 12, 5899–5908. [Google Scholar] [CrossRef]

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- Morstyn, T.; Farrrel, N.; Darby, S.J.; McCulloch, M.D. Using peer-to-peer energy-trading platforms to incentivize prosumers to form federated power plants. Nat. Energy 2018, 3, 94–101. [Google Scholar] [CrossRef]

- Ilak, P.; Rajšl, I.; Herenčić, L.; Zmijarević, Z.; Krajcar, S. Decentralized electricity trading in the microgrid: Implementation of decentralized peer-to-peer concept for electricity trading (P2PCET). In Proceedings of the Mediterranean Conference on Power Generation, Transmission, Distribution and Energy Conversion (MEDPOWER 2018), Dubrovnik, Croatia, 12–15 November 2018. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Herenčić, L.; Ilak, P.; Rajšl, I.; Zmijarević, Z.; Cvitanović, M.; Delimar, M.; Pećanac, B. Overview of the main challenges and threats for implementation of the advanced concept for decentralized trading in microgrids. In Proceedings of the IEEE EUROCON 2019-18th International Conference on Smart Technologies, Novi Sad, Serbia, 1–4 July 2019. [Google Scholar] [CrossRef]

- Hirsch, A.; Parag, Y.; Guerrero, J. Microgrids: A review of technologies, key drivers, and outstanding issues. Renew. Sustain. Energy Rev. 2018, 90, 402–411. [Google Scholar] [CrossRef]

- Morstyn, T.; McCulloch, M. Multi-class energy management for peer-to-peer energy trading driven by prosumer preferences. IEEE Trans. Power Syst. 2019, 34, 4005–4014. [Google Scholar] [CrossRef]

- Shuai, Z.; Sun, Y.; Shen, Z.J.; Tian, W.; Tu, C.; Li, Y.; Yin, X. Microgrid stability: Classification and a review. Renew. Sustain. Energy Rev. 2016, 58, 167–179. [Google Scholar] [CrossRef]

- Đaković, J.; Ilak, P.; Baškarad, T.; Krpan, M.; Kuzle, I. Effectiveness of wind turbine fast frequency response control on electrically distanced active power disturbance mitigation. In Proceedings of the Mediterranean Conference on Power Generation, Transmission, Distribution and Energy Conversion (MEDPOWER 2018), Dubrovnik, Croatia, 12–15 November 2018. [Google Scholar] [CrossRef]

- Levron, Y.; Guerrero, J.M.; Beck, Y. Optimal power flow in microgrids with energy storage. IEEE Trans. Power Syst. 2013, 3, 3226–3234. [Google Scholar] [CrossRef]

- Lin, J.; Magnago, F.H.; Foruzan, E.; Albarracín-Sánchez, R. Chapter 8—Market design issues of distributed generation. In Distributed Generation Systems; Gharehpetian, G.B., Agah, S.M.M., Eds.; Butterworth-Heinemann: Oxford, UK, 2017; pp. 369–413. [Google Scholar] [CrossRef]

- Feng, X.; Shekhar, A.; Yang, F.; Hebner, R.E.; Bauer, P. Comparison of hierarchical control and distributed control for microgrid. Electr. Power Compon. Syst. 2017, 10, 1043–1056. [Google Scholar] [CrossRef]

- Netztechnik/Netzbetriebim VDE (FNN). Power Generation System Connected to the Low/Voltage Distribution (VDE-AR-N 4105:2011-08); Netztechnik/Netzbetriebim VDE (FNN): Berlin, Germany, 2011. [Google Scholar]

- Helman, U.; Singh, H.; Sotkiewicz, P. Chapter 19—RTOs, regional electricity markets, and climate policy. In Generating Electricity in a Carbon-Constrained World; Academic Press: Cambridge, MA, USA, 2010; pp. 527–563. [Google Scholar] [CrossRef]

- Guerrero, J.M.; Vasquez, J.C.; Matas, J.; de Vicuna, L.G.; Castilla, M. Hierarchical control of droop-controlled AC and DC microgrids—A general approach toward standardization. IEEE Trans. Ind. Electron. 2011, 1, 158–172. [Google Scholar] [CrossRef]

- Zia, M.F.; Elbouchikhi, E.; Benbouzid, M. Microgrids energy management systems: A critical review on methods, solutions, and prospects. Appl. Energy 2018, 222, 1033–1055. [Google Scholar] [CrossRef]

- Tushar, W.; Saha, T.K.; Yuen, C.; Morstyn, T.; Al-Masood, N.; Poor, H.V.; Bean, R. Grid influenced peer-to-peer energy trading. IEEE Trans. Smart Grid 2019, 1. [Google Scholar] [CrossRef]

- Long, C.; Wu, J.; Zhou, Y.; Jenkins, N. Peer-to-peer energy sharing through a two-stage aggregated battery control in a community Microgrid. Appl. Energy 2018, 226, 261–276. [Google Scholar] [CrossRef]

- Guerrero, J.; Chapman, A.C.; Verbič, G. Decentralized P2P energy trading under network constraints in a low-voltage network. IEEE Trans. Smart Grid 2019, 10, 5163–5173. [Google Scholar] [CrossRef]

- Ilak, P.; Rajš, I.; Đaković, J.; Delimar, M. Duality based risk mitigation method for construction of joint hydro-wind coordination short-run marginal cost curves. Energies 2018, 11, 1254. [Google Scholar] [CrossRef]

- Ilak, P.; Rajšl, I.; Krajcar, S.; Delimar, M. The impact of a wind variable generation on the hydro generation water shadow price. Appl. Energy 2015, 154, 197–208. [Google Scholar] [CrossRef]

- Ilak, P.; Krajcar, S.; Rajšl, I.; Delimar, M. Pricing energy and ancillary services in a day-ahead market for a price-taker hydro generating company using a risk-constrained approach. Energies 2014, 7, 2317–2342. [Google Scholar] [CrossRef]

- IEEE PES AMPS DSAS Test Feeder Working Group. Available online: http://sites.ieee.org/pes-testfeeders/resources/ (accessed on 20 September 2019).

- EUPHEMIA Public Description, Version 1.4 Final. Available online: https://hupx.hu/uploads/Piac%C3%B6sszekapcsol%C3%A1s/Euphemia%20Public%20Description.pdf (accessed on 20 September 2019).

- Frank, S.; Rebennack, S. An introduction to optimal power flow: Theory, formulation, and examples. IIE Trans. 2016, 48, 1172–1197. [Google Scholar] [CrossRef]

- IEEE Power and Energy Society. The IEEE European Low Voltage Test Feeder; IEEE Power and Energy Society: Piscataway, NJ, USA, 2015. [Google Scholar]

- IMPACT. Available online: https://impact.fer.hr/ (accessed on 20 September 2019).

- MATLAB. Available online: https://ch.mathworks.com/products/matlab.html (accessed on 20 September 2019).

- IEEE 906 Bus European LV Test Feeder in Simscape Power Systems. Available online: https://ch.mathworks.com/matlabcentral/fileexchange/66991-ieee-906-bus-european-lv-test-feeder-in-simscape-power-systems (accessed on 20 September 2019).

- Werner, B.; Nielen, S.; Valitov, N.; Engelmeyer, T. Price elasticity of demand in the EPEX spot market for electricity—New empirical evidence. Econ. Lett. 2015, 3, 5–8. [Google Scholar] [CrossRef]

- Thimmapuram, P.R.; Kim, J. Consumers’ price elasticity of demand modeling with economic effects on electricity markets using an agent-based model. IEEE Trans. Smart Grid 2013, 4, 390–397. [Google Scholar] [CrossRef]

- The National Renewable Energy Laboratory (NREL). Solar Power Data for Integration Studies. Available online: https://www.nrel.gov/grid/solar-power-data.html (accessed on 20 September 2019).

- European Committee for Electrotechnical Standardization. EN50160, Voltage Characteristics of Electricity Supplied by Public Distribution Systems; European Committee for Electrotechnical Standardization: Brussels, Belgium, 2010. [Google Scholar]

- Titus, R.J. Exact voltage drop calculations. In Proceedings of the 1992 IEEE Industry Applications Society Annual Meeting, Houston, TX, USA, 4–9 October 1992. [Google Scholar] [CrossRef]

- Shayani, R.A.; de Oliveira, M.A.G. Photovoltaic generation penetration limits in radial distribution systems. IEEE Trans. Power Syst. 2011, 26, 1625–1631. [Google Scholar] [CrossRef]

- ENTSO. Net Transfer Capacities (NTC) and Available Transfer Capacities (ATC) in the Internal Market of Electricity in Europe (IEM); ENTSO: Brussels, Belgium, 2000; Available online: https://www.entsoe.eu/fileadmin/user_upload/_library/ntc/entsoe_NTCusersInformation.pdf (accessed on 2 December 2019).

| Scenario | S1 | S2 | S3 | S4 | SREF |

|---|---|---|---|---|---|

| Maximal supply offering price | High | High | Low | Low | NA (feed-in-tariff) |

| Price elasticity of demand | Increased | Decreased | Increased | Decreased | Perfectly inelastic (passive demand) |

| Item | SREF | S1 | S2 | S3 | S4 |

|---|---|---|---|---|---|

| Total microgrid consumption | 1321 | 783.5 | 687 | 883 | 883 |

| Total microgrid production | 896 | 778.5 | 682 | 896 | 896 |

| Peers self-consumption | 282 | 205.5 | 172.5 | 235 | 235 |

| Local electricity trading | 583 | 573 | 509.5 | 643 | 643 |

| Import from upstream grid | 456 | 5 | 5 | 5 | 5 |

| Export to upstream grid | −31 | 0 | 0 | −18 | −18 |

| Scenario | SREF | S1 | S2 | S3 | S4 |

|---|---|---|---|---|---|

| Average voltage level | 1.04490 | 1.04977 | 1.04983 | 1.05008 | 1.05008 |

| Average voltage level difference from the nominal | −0.486% | −0.022% | −0.016% | 0.007% | 0.007% |

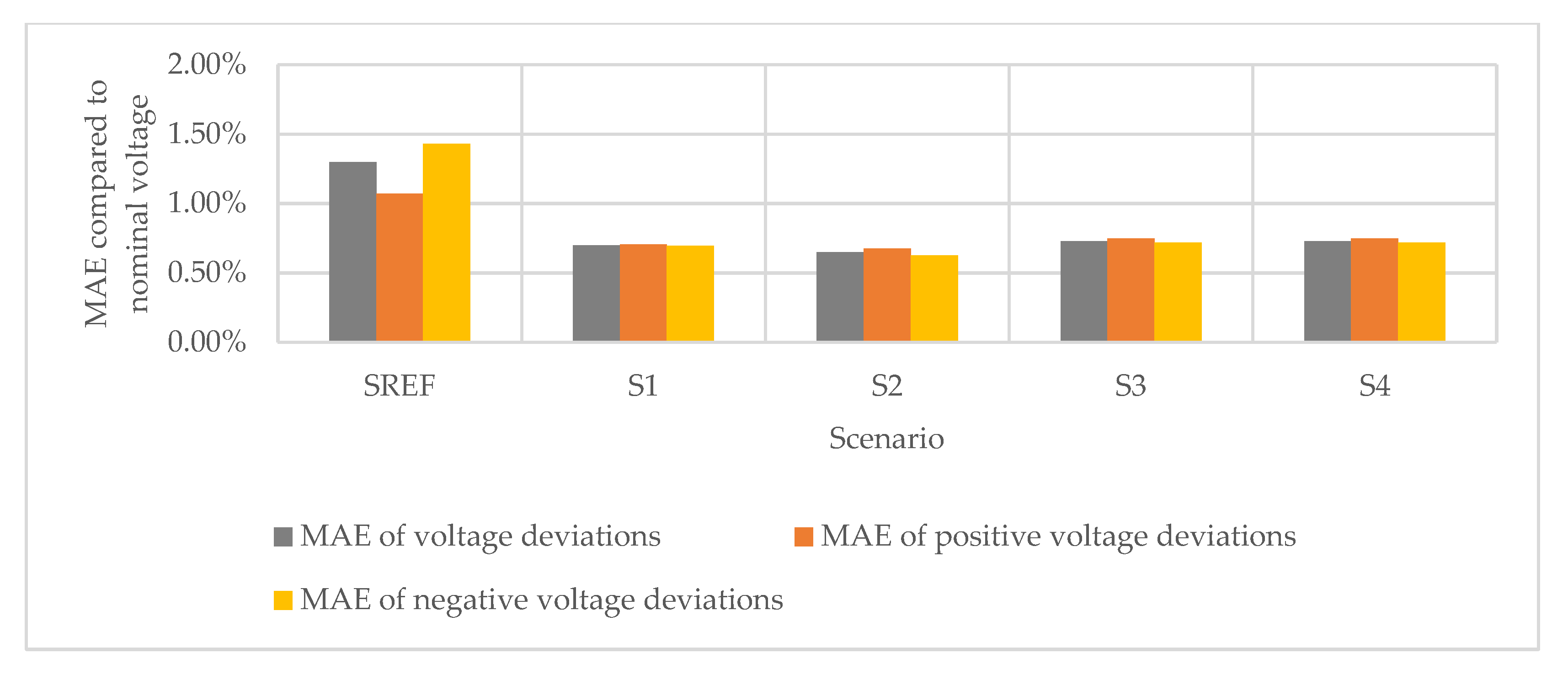

| Scenario | SREF | S1 | S2 | S3 | S4 |

|---|---|---|---|---|---|

| MAE (all voltage deviations) (%) | 1.300% | 0.700% | 0.650% | 0.730% | 0.730% |

| MAE (positive voltage deviations) (%) | 1.072% | 0.707% | 0.676% | 0.751% | 0.751% |

| MAE (negative voltage deviations) (%) | 1.432% | 0.697% | 0.626% | 0.718% | 0.718% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Herenčić, L.; Ilak, P.; Rajšl, I. Effects of Local Electricity Trading on Power Flows and Voltage Levels for Different Elasticities and Prices. Energies 2019, 12, 4708. https://doi.org/10.3390/en12244708

Herenčić L, Ilak P, Rajšl I. Effects of Local Electricity Trading on Power Flows and Voltage Levels for Different Elasticities and Prices. Energies. 2019; 12(24):4708. https://doi.org/10.3390/en12244708

Chicago/Turabian StyleHerenčić, Lin, Perica Ilak, and Ivan Rajšl. 2019. "Effects of Local Electricity Trading on Power Flows and Voltage Levels for Different Elasticities and Prices" Energies 12, no. 24: 4708. https://doi.org/10.3390/en12244708

APA StyleHerenčić, L., Ilak, P., & Rajšl, I. (2019). Effects of Local Electricity Trading on Power Flows and Voltage Levels for Different Elasticities and Prices. Energies, 12(24), 4708. https://doi.org/10.3390/en12244708