Economic and Spatial Determinants of Energy Consumption in the European Union

Abstract

1. Introduction

2. Review of Previous Literature

3. Data and Methodology

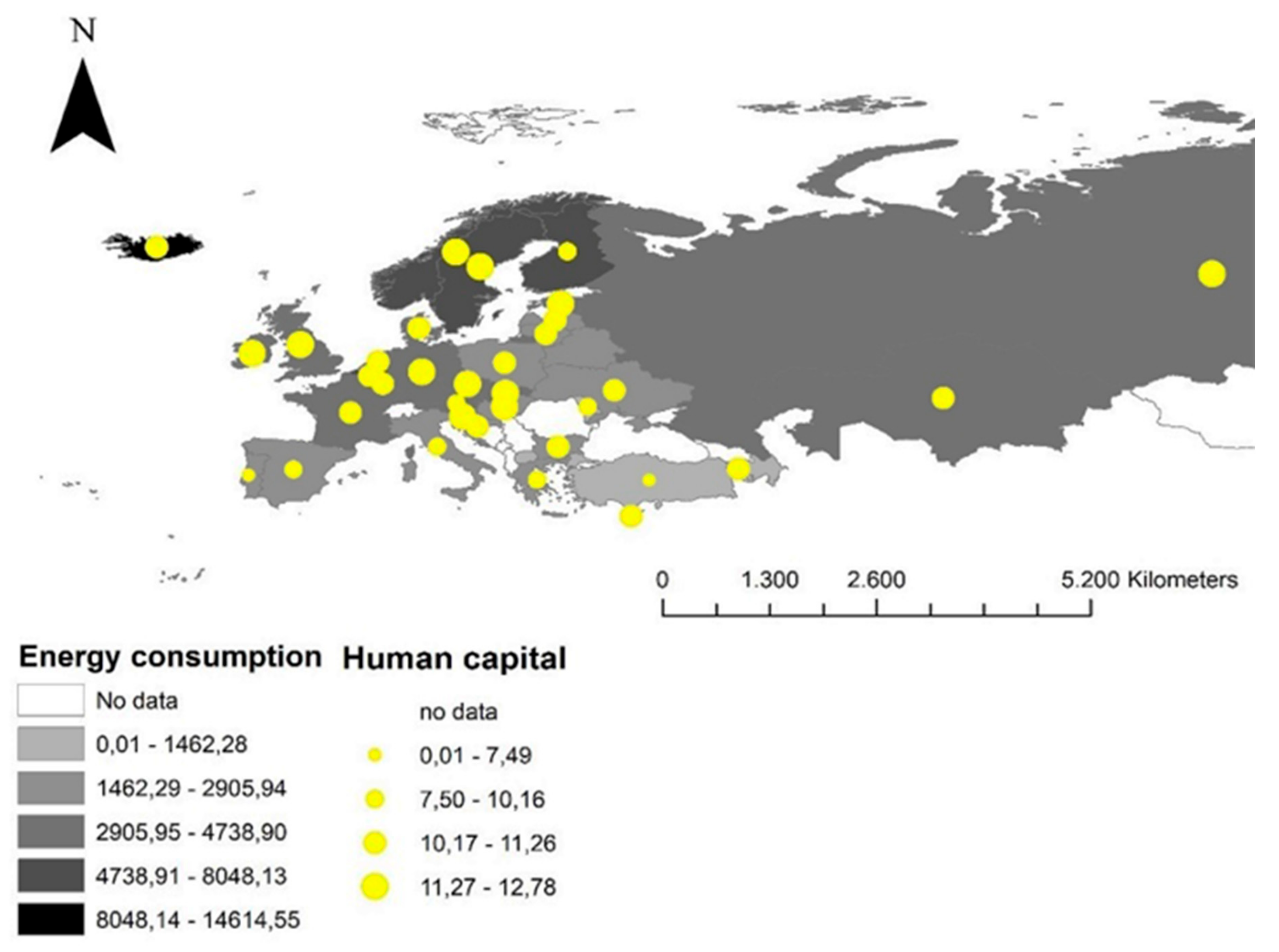

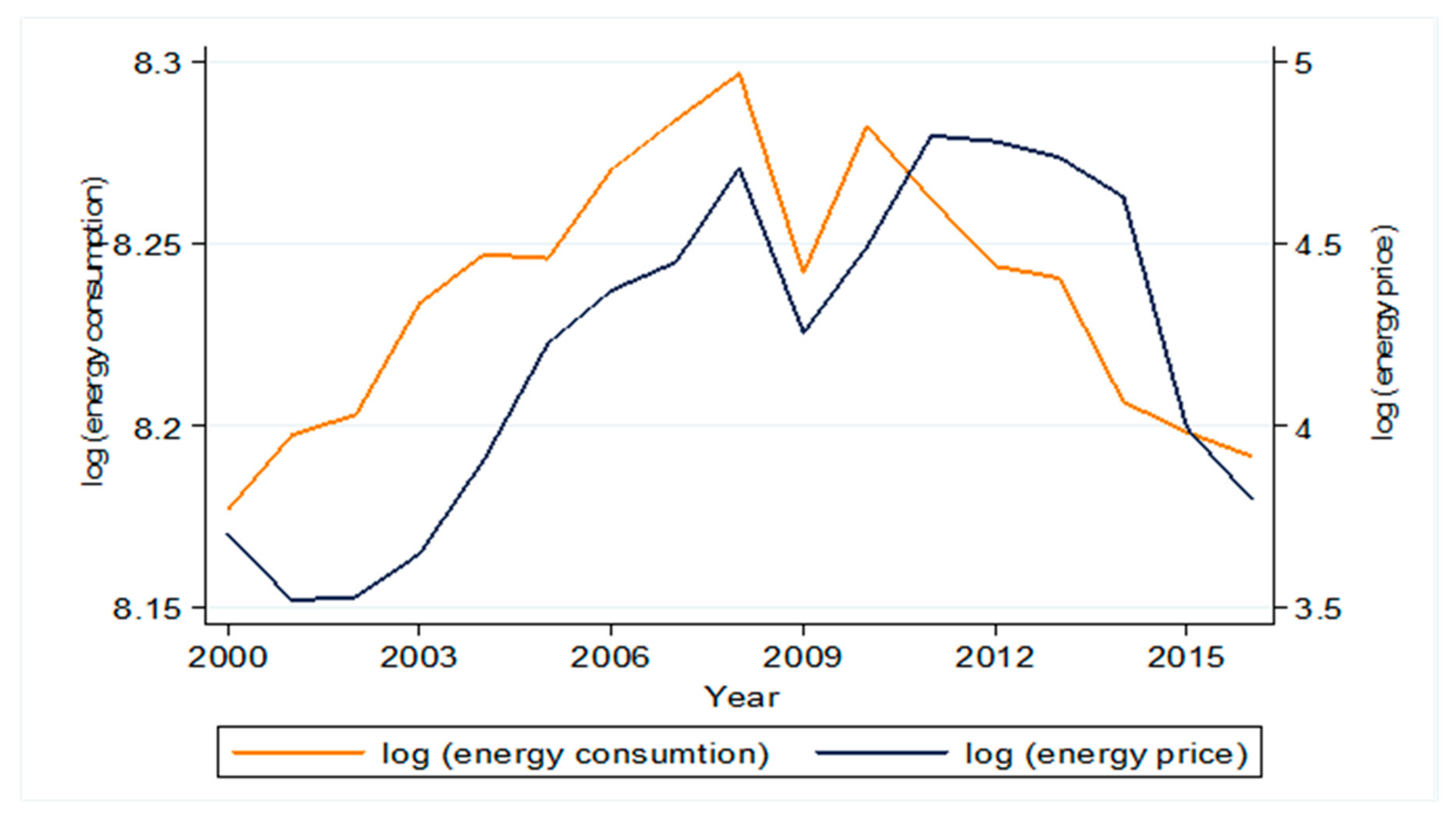

3.1. Data

3.2. Econometric Strategy

4. Results

5. Conclusions and Policy Recommendations

Author Contributions

Funding

Conflicts of Interest

References

- Hao, Y.; Huang, Z.; Wu, H. Do Carbon Emissions and Economic Growth Decouple in China? An Empirical Analysis Based on Provincial Panel Data. Energies 2019, 12, 2411. [Google Scholar] [CrossRef]

- Salim, R.; Yao, Y.; Chen, G.S. Does human capital matter for energy consumption in China? Energy Econ. 2017, 67, 49–59. [Google Scholar] [CrossRef]

- Shahbaz, M.; Gozgor, G.; Hammoudeh, S. Human Capital and Export Diversification as New Determinants of Energy Demand in the United States. Energy Econ. 2018, 78, 335–349. [Google Scholar] [CrossRef]

- Coers, R.; Sanders, M. The energy—GDP nexus; addressing an old question with new methods. Energy Econ. 2013, 36, 708–715. [Google Scholar] [CrossRef]

- Humbatova, S.I.; Qadim-Oglu Hajiyev, N. Oil factor in economic development. Energies 2019, 12, 1573. [Google Scholar] [CrossRef]

- Moshiri, S. The effects of the energy price reform on household’s consumption in Iran. Energy Policy 2015, 79, 177–188. [Google Scholar] [CrossRef]

- Moshiri, S.; Martínez Santillán, M.A. The welfare effects of energy price changes due to energy market reform in Mexico. Energy Policy 2018, 113, 663–672. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Adom, P.K. Determinants of Energy Consumption in Kenya: A NIPALS Approach. Energy 2018, 159, 696–705. [Google Scholar] [CrossRef]

- Council and the European Parliament. The Load Sharing Agreement is Found in the Annex of the Commission Communication to the Council and the European Parliament Preparing for the Application of the Kyoto Protocol COM230 Final of 19.05.1999. 1999. Available online: https://ec.europa.eu/clima/sites/clima/files/ets/docs/com_1999_230_en.pdf (accessed on 19 July 2019).

- Siksnelyte, I.; Zavadskas, E.K. Achievements of the European Union countries in seeking a sustainable electricity sector. Energies 2019, 12, 2254. [Google Scholar] [CrossRef]

- Statistical Review of World Energy. 2017. Available online: https://www.bp.com/content/dam/bp-country/de_ch/PDF/bp-statistical-review-of-world-energy-2017-full-report.pdf (accessed on 14 July 2019).

- World Bank. World Development Indicators: Ecuador; World Bank Group: Washington, DC, USA, 2017; Available online: https://datos.bancomundial.org/pais/ecuador (accessed on 14 July 2019).

- Anselin, L. Spatial Econometrics: Methods and Models; Springer Science & Business Media: Berlin, Germany, 2013; Volume 4. [Google Scholar]

- Kharbach, M.; Chfadi, T. Oil prices and electricity production in Morocco. Energy Strategy Rev. 2018, 22, 320–324. [Google Scholar] [CrossRef]

- Rajbhandari, A.; Zhang, F. Does energy efficiency promote economic growth? Evidence from a multicountry and multisectoral panel dataset. Energy Econ. 2018, 69, 128–139. [Google Scholar] [CrossRef]

- Carfora, A.; Pansini, R.V.; Scandurra, G. The causal relationship between energy consumption, energy prices and economic growth in Asian developing countries: A replication. Energy Strategy Rev. 2019, 23, 81–85. [Google Scholar] [CrossRef]

- Pan, G.; Gu, W.; Wu, Z.; Lu, Y.; Lu, S. Optimal design and operation of multi-energy system with load aggregator considering nodal energy prices. Appl. Energy 2019, 239, 280–295. [Google Scholar] [CrossRef]

- Wang, C.; Nie, P. How rebound effects of efficiency improvement and price jump of energy influence energy consumption? J. Clean. Prod. 2018, 202, 497–503. [Google Scholar] [CrossRef]

- Sohag, K.; Begum, R.A.; Syed Abdullah, S.M.; Jaafar, M. Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 2015, 90, 1497–1507. [Google Scholar] [CrossRef]

- Arbex, M.; Perobelli, F.S. Solow meets Leontief: Economic growth and energy consumption. Energy Econ. 2010, 32, 43–53. [Google Scholar] [CrossRef]

- Miller, M.; Alberini, A. Sensitivity of price elasticity of demand to aggregation, unobserved heterogeneity, price trends, and price endogeneity: Evidence from U.S. Data. Energy Policy 2016, 97, 235–249. [Google Scholar] [CrossRef]

- Leng Wong, S.; Chia, W.M.; Chang, Y. Energy consumption and energy R&D in OECD: Perspectives from oil prices and economic growth. Energy Policy 2013, 62, 1581–1590. [Google Scholar]

- Yazdan, G.F.; Behzad, V.; Shiva, M. Energy Consumption in Iran: Past Trends and Future Directions. Procedia-Soc. Behav. Sci. 2012, 62, 12–17. [Google Scholar] [CrossRef]

- Ing, Y.S.; Liao, H.F.; Huang, K.S. The extended Durbin method and its application for piezoelectric wave propagation problems. Int. J. Solids Struct. 2013, 50, 4000–4009. [Google Scholar] [CrossRef][Green Version]

- Li, B.; Wu, S. Effects of local and civil environmental regulation on green total factor productivity in China: A spatial Durbin econometric analysis. J. Clean. Prod. 2017, 153, 342–353. [Google Scholar] [CrossRef]

- Lv, Y.; Chen, W.; Cheng, J. Modelling dynamic impacts of urbanization on disaggregated energy consumption in China: A spatial Durbin modelling and decomposition approach. Energy Policy 2019, 133, 110841. [Google Scholar] [CrossRef]

- Shurui, J.; Jingyou, W.; Lei, S.H.I.; Zhong, M. Impact of Energy Consumption and Air Pollution on Economic Growth An Empirical Study Based on Dynamic Spatial Durbin Model. Energy Procedia 2019, 158, 4011–4016. [Google Scholar] [CrossRef]

- LeSage, J.; Pace, R.K. Introduction to Spatial Econometrics; Chapman and Hall/CRC: London, UK, 2009. [Google Scholar]

- Akadiri, S.; Bekun, F.V.; Sarkodie, S.A. Contemporaneous interaction between energy consumption, economic growth and environmental sustainability in South Africa: What drives what? Sci. Total Environ. 2019, 686, 468–475. [Google Scholar] [CrossRef]

- Bekun, F.V.; Emir, F.; Sarkodie, S.A. Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci. Total Environ. 2019, 655, 759–765. [Google Scholar] [CrossRef]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 2019, 650, 2483–2489. [Google Scholar] [CrossRef]

- Bekun, F.V.; Alola, A.A.; Sarkodie, S.A. Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci. Total Environ. 2019, 657, 1023–1029. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Crentsil, A.O.; Owusu, P.A. Does energy consumption follow asymmetric behavior? An assessment of Ghana’s energy sector dynamics. Sci. Total Environ. 2019, 651, 2886–2898. [Google Scholar] [CrossRef]

- Fang, Z.; Chang, Y. Energy, human capital and economic growth in Asia Pacific countries—Evidence from a panel cointegration and causality analysis. Energy Econ. 2016, 56, 177–184. [Google Scholar] [CrossRef]

- Li, K.; Lin, B. Impact of energy technology patents in China: Evidence from a panel cointegration and error correction model. Energy Policy 2016, 89, 214–223. [Google Scholar] [CrossRef]

- Huang, B.N.; Hwang, M.J.; Yang, C.W. Causal relationship between energy consumption and GDP growth revisited: A dynamic panel data approach. Ecol. Econ. 2008, 67, 41–54. [Google Scholar] [CrossRef]

- Salim, R.A.; Hassan, K.; Shafiei, S. Renewable and non-renewable energy consumption and economic activities: Further evidence from OECD countries. Energy Econ. 2014, 44, 350–360. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R.; del Corral Morales, L.D. The Effect of Education on a Country’s Energy Consumption: Evidence from Developed and Developing Countries. 2017. Available online: https://ideas.repec.org/p/pre/wpaper/201733.html (accessed on 14 July 2019).

- Pablo-Romero, M.D.P.; Sánchez-Braza, A. Productive energy use and economic growth: Energy, physical and human capital relationships. Energy Econ. 2015, 49, 420–429. [Google Scholar] [CrossRef]

- Huntington, H.G. Short- and long-run adjustments in U.S. petroleum consumption. Energy Econ. 2010, 32, 63–72. [Google Scholar] [CrossRef]

- Valizadeh, J.; Sadeh, E.; Javanmard, H.; Davodi, H. The effect of energy prices on energy consumption efficiency in the petrochemical industry in Iran. Alex. Eng. J. 2018, 57, 2241–2256. [Google Scholar] [CrossRef]

- Lee, C.C.; Chiu, Y.B. Modeling OECD energy demand: An international panel smooth transition error-correction model. Int. Rev. Econ. Financ. 2013, 25, 372–383. [Google Scholar] [CrossRef]

- Gately, D.; Huntington, H. The Asymmetric Effects of Changes in Price and Income on Energy and Oil Demand. Energy J. 2015, 23, 19–55. [Google Scholar] [CrossRef]

- Bentzen, J.; Engsted, T. Short- and long-run elasticities in energy demand. Energy Econ. 2002, 15, 9–16. [Google Scholar] [CrossRef]

- Yuan, C.; Liu, S.; Wu, J. The relationship among energy prices and energy consumption in China. Energy Policy 2010, 38, 197–207. [Google Scholar] [CrossRef]

- Labandeira, X.; Labeaga, J.M.; López-Otero, X. A meta-analysis on the price elasticity of energy demand. Energy Policy 2017, 102, 549–568. [Google Scholar] [CrossRef]

- Jiang, L.; Folmer, H.; Ji, M. The drivers of energy intensity in China: A spatial panel data approach. China Econ. Rev. 2014, 31, 351–360. [Google Scholar] [CrossRef]

- Huang, J.; Du, D.; Hao, Y. The driving forces of the change in China’s energy intensity: An empirical research using DEA-Malmquist and spatial panel estimations. Econ. Model. 2017, 65, 41–50. [Google Scholar] [CrossRef]

- Jiang, L.; Folmer, H.; Ji, M.; Zhou, P. Revisiting cross-province energy intensity convergence in China: A spatial panel analysis. Energy Policy 2018, 121, 252–263. [Google Scholar] [CrossRef]

- Han, F.; Xie, R.; Fang, J. Urban agglomeration economies and industrial energy efficiency. Energy 2018, 162, 45–59. [Google Scholar] [CrossRef]

- Hao, Y.; Peng, H. On the convergence in China’s provincial per capita energy consumption: New evidence from a spatial econometric analysis. Energy Econ. 2017, 68, 31–43. [Google Scholar] [CrossRef]

- Liu, X.; Lin, J.; Hu, J.; Lu, H.; Cai, J. Economic Transition, Technology Change, and Energy Consumption in China: A Provincial-Level Analysis. Energies 2019, 12, 2581. [Google Scholar] [CrossRef]

- Pirlogea, C.; Cicea, C. Econometric perspective of the energy consumption and economic growth relation in European Union. Renew. Sustain. Energy Rev. 2012, 16, 5718–5726. [Google Scholar] [CrossRef]

- Beşir, L.; Aldea, A. Assessing eco-efficiency of countries in the context of renewable and non-renewable energy consumption: A non-parametric partial frontier perspective. Econ. Comput. Econ. Cybern. Stud. Res. 2019, 53, 131–148. [Google Scholar]

- Hausman, J.A. Specification tests in econometrics. Econom. J. Econom. Soc. 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Greene, W.H. Econometric Analysis; Pearson Education: London, UK, 2003. [Google Scholar]

- Wang, Q.; Su, M.; Li, R.; Ponce, P. The effects of energy prices, urbanization and economic growth on energy consumption per capita in 186 countries. J. Clean. Prod. 2019, 225, 1017–1032. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Introducción a La Econometría. Un Enfoque Moderno, 4a ed.; Cengage Learning Editores: México DF, México, 2010. [Google Scholar]

- Durbin, J.; Watson, G.S. Testing for serial correlation in least squares regression III. Biometrika 1971, 58, 1–9. [Google Scholar] [CrossRef]

| Variables | Definition |

|---|---|

| Log (Energy consumption) | Primary energy consumption (Kilogram of oil equivalent per capita). |

| Policy | Primary energy savings that takes values of “1” if it belongs to the EU and “0” if not. |

| Human capital | Years of schooling of the population. |

| Log (Oil price) | Price of oil barrel, at constant prices of 2017 US $. |

| Log (Value added in agriculture) | Value added in agriculture, at constant prices of 2010 US $. |

| Log (Value added in industry) | Value added in industry, at constant prices of 2010 US $. |

| Log (Value added in services) | Value added in services, at constant prices of 2010 US $. |

| Log (Employment in agriculture) | Percentage of employment in agriculture of total employment. |

| Log (Employment in industry) | Percentage of employment in industry of total employment. |

| Log (Employment in services) | Percentage of employment in services of total employment. |

| Log (Research and Development) | Activities undertaken to increase the flow of scientific and technical knowledge (constant 2010 US $). |

| Variable | Mean | Std. Dev. | Min. | Max. | N | |

|---|---|---|---|---|---|---|

| Log (Energy consumption) | Overall | 8.080203 | 0.5538243 | 6.427251 | 9.807975 | N = 578 |

| Between | 0.5524187 | 6.75565 | 9.564859 | n = 34 | ||

| Within | 0.1000853 | 7.619505 | 8.341815 | T = 17 | ||

| Human capital | Overall | 10.78649 | 1.324494 | 6.1 | 13.70181 | N = 578 |

| Between | 1.214325 | 6.861587 | 12.77734 | n = 34 | ||

| Within | 0.5662041 | 8.912348 | 13.44276 | T = 17 | ||

| Log (Oil price) | Overall | 4.208679 | 0.44449427 | 3.521414 | 4.797749 | N = 578 |

| Between | 0 | 4.208679 | 4.208679 | n = 34 | ||

| Within | 0.4449427 | 3.521414 | 4.797749 | T = 17 | ||

| UE | Overall | 0.7647059 | 0.4245499 | 0 | 1 | N = 578 |

| Between | 0.4305615 | 0 | 1 | n = 34 | ||

| Within | 0 | 0.7647059 | 0.7647059 | T = 17 | ||

| Log (Value added in agriculture) | Overall | 22.22418 | 1.447231 | 18.44183 | 25.141 | N = 578 |

| Between | 1.460601 | 18.91101 | 24.90293 | n = 34 | ||

| Within | 0.1424082 | 21.71601 | 23.02636 | T = 17 | ||

| Log (Value added in industry) | Overall | 24.48103 | 1.74011 | 20.30617 | 27.68176 | N = 578 |

| Between | 1.756646 | 20.56688 | 27.54817 | n = 34 | ||

| Within | 0.1665738 | 23.81526 | 25.15466 | T = 17 | ||

| Log (Value added in services) | Overall | 25.39299 | 1.759867 | 21.00189 | 28.47332 | N = 578 |

| Between | 1.77704 | 21.77784 | 28.37365 | n = 34 | ||

| Within | 0.1637854 | 24.61704 | 25.8756 | T = 17 | ||

| Log (Employment in agriculture) | Overall | 1.827805 | 0.9113976 | 0.0953102 | 3.756538 | N = 578 |

| Between | 0.9049958 | 0.2440247 | 3.648656 | n = 34 | ||

| Within | 0.1853086 | 1.375283 | 2.3399934 | T = 17 | ||

| Log (Employment in industry) | Overall | 3.228002 | 0.2445035 | 2.332144 | 3.703768 | N = 578 |

| Between | 0.2275576 | 2.709302 | 3.66466 | n = 34 | ||

| Within | 0.097136 | 2.850844 | 3.591393 | T = 17 | ||

| Log (Employment in services) | Overall | 4.151188 | 0.1849056 | 3.427515 | 4.48074 | N = 578 |

| Between | 0.1790478 | 3.604715 | 4.416045 | n = 34 | ||

| Within | 0.0549631 | 3.971507 | 4.311132 | T = 17 | ||

| Log (Research + Development) | Overall | 21.40826 | 2.161992 | 15.81353 | 25.77943 | N = 578 |

| Between | 2.172433 | 16.81423 | 25.20842 | n = 34 | ||

| Within | 0.292599 | 20.38957 | 23.54424 | T = 17 | ||

| Variables | Total | EU | NEU |

|---|---|---|---|

| Human capital | −0.0270 * | −0.0291 *** | 0.135 * |

| (−2.20) | (−3.13) | (2.44) | |

| Oil price | 0.102 | −0.321 | 0.357 |

| (0.46) | (−1.92) | (0.44) | |

| Constant | 6.621 *** | 9.702 *** | 3.939 |

| (9.16) | (17.28) | (1.56) | |

| Chis square (p-value) | 0.0000 | 0.0000 | 0.0000 |

| Serial correlation test (p-value) | 0.8129 | 0.6944 | 0.8260 |

| Cross-sectional independence (p-value) | 0.0000 | 0.0000 | 0.2244 |

| Fixed effects (time) | YES | YES | YES |

| Fix effects (country) | YES | YES | YES |

| Observations | 578 | 442 | 136 |

| Variables | GLS |

|---|---|

| Policy | −1.311 *** |

| (−5.40) | |

| Human capital | −0.0100 |

| (−1.13) | |

| Oil price | −1.316 *** |

| (−5.11) | |

| Value added in agriculture | −0.00161 |

| (−0.11) | |

| Value added in industry | 0.128 *** |

| (4.25) | |

| Value added in services | 0.306 *** |

| (6.57) | |

| Employment in agriculture | 0.0251 |

| (1.29) | |

| Employment in industry | 0.259 *** |

| (4.92) | |

| Employment in services | 0.243 ** |

| (2.30) | |

| Research + Development | −0.00706 |

| (−0.77) | |

| Constant | 0.734 |

| (0.88) | |

| Chis square (p-value) | 0.0000 |

| Serial correlation test (p-value) | 0.6706 |

| Fixed effects (time) | YES |

| Fix effects (country) | YES |

| Observations | 578 |

| Variables | SDM |

|---|---|

| Main | |

| L.Wlce | 0.387 ** |

| (3.04) | |

| Spatial | |

| rho | 0.192 * |

| (2.21) | |

| Variance | |

| sigma2_e | 0.00470 *** |

| (17.47) | |

| Wx | |

| Human capital | −0.138 *** |

| (−3.91) | |

| Renewable Energy Price | −0.0446 * |

| (−2.28) | |

| Value added in industry | 0.223 * |

| (2.05) | |

| Value added in services | −0.381 ** |

| (−2.74) | |

| Employment in industry | −0.520 *** |

| (−3.42) | |

| Employment in services | 0.703 * |

| (2.49) | |

| Observations | 544 |

| AIC | −1372.3 |

| BIC | −1307.8 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Flores-Chamba, J.; López-Sánchez, M.; Ponce, P.; Guerrero-Riofrío, P.; Álvarez-García, J. Economic and Spatial Determinants of Energy Consumption in the European Union. Energies 2019, 12, 4118. https://doi.org/10.3390/en12214118

Flores-Chamba J, López-Sánchez M, Ponce P, Guerrero-Riofrío P, Álvarez-García J. Economic and Spatial Determinants of Energy Consumption in the European Union. Energies. 2019; 12(21):4118. https://doi.org/10.3390/en12214118

Chicago/Turabian StyleFlores-Chamba, Jorge, Michelle López-Sánchez, Pablo Ponce, Patricia Guerrero-Riofrío, and José Álvarez-García. 2019. "Economic and Spatial Determinants of Energy Consumption in the European Union" Energies 12, no. 21: 4118. https://doi.org/10.3390/en12214118

APA StyleFlores-Chamba, J., López-Sánchez, M., Ponce, P., Guerrero-Riofrío, P., & Álvarez-García, J. (2019). Economic and Spatial Determinants of Energy Consumption in the European Union. Energies, 12(21), 4118. https://doi.org/10.3390/en12214118