Comparative Analysis of Technical Route and Market Development for Light-Duty PHEV in China and the US

Abstract

:1. Introduction

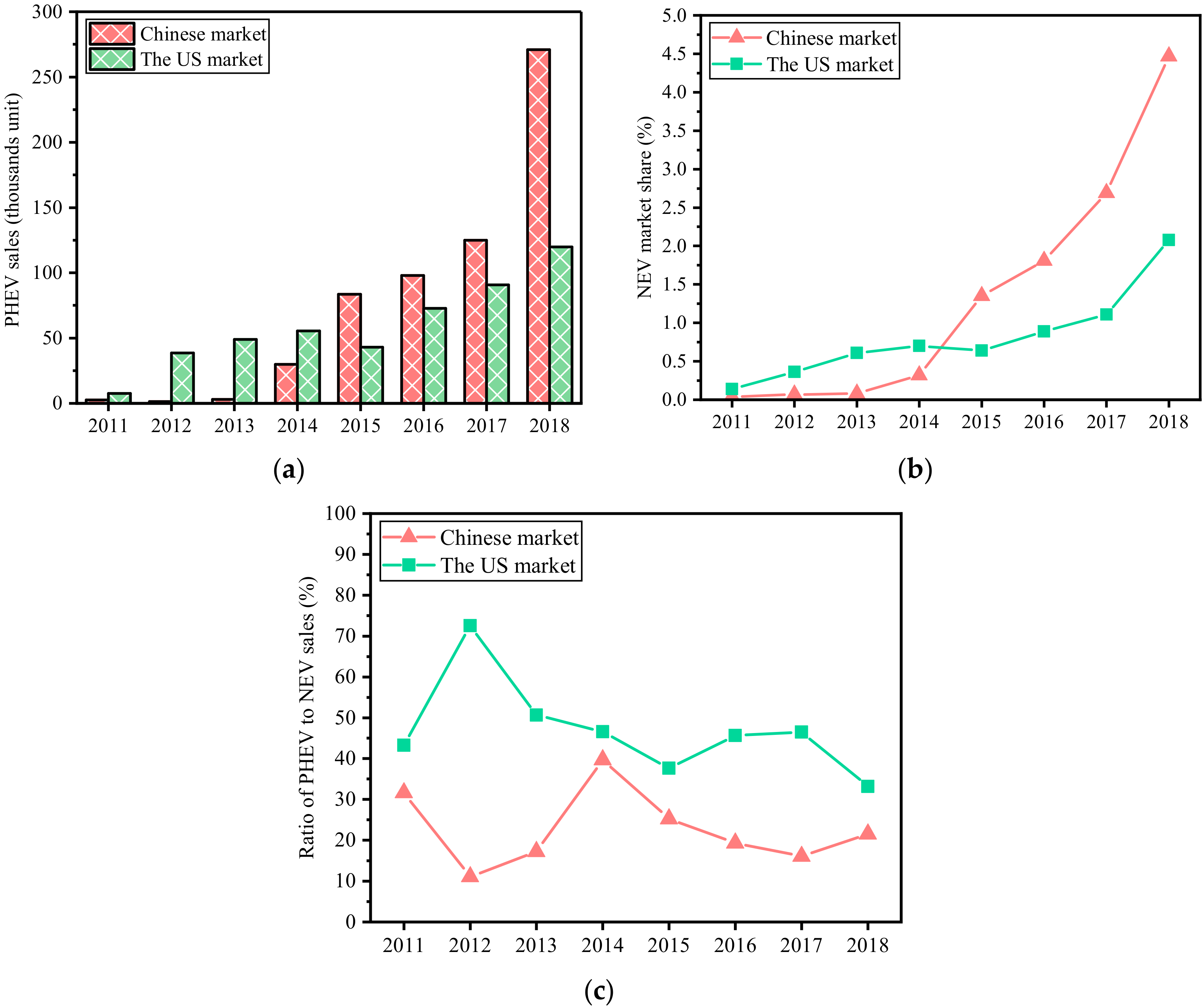

2. Analysis of the PHEV Market Development

2.1. Development Trend

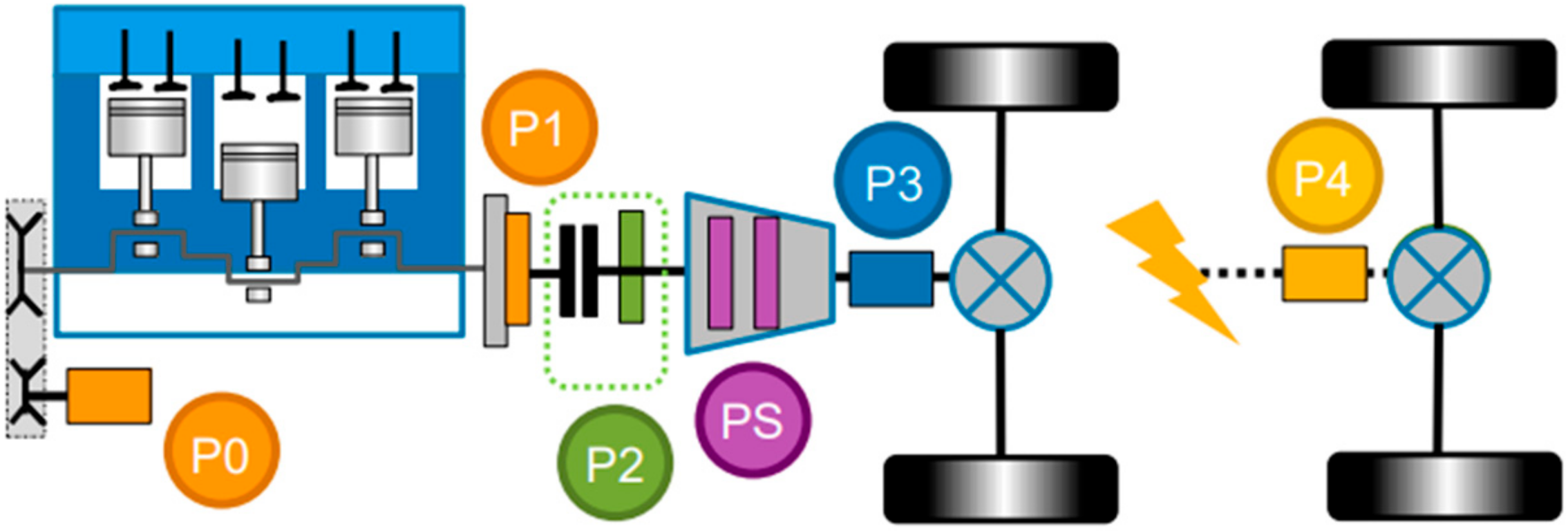

2.2. Composition Characteristics

3. Analysis of PHEV Technical Route

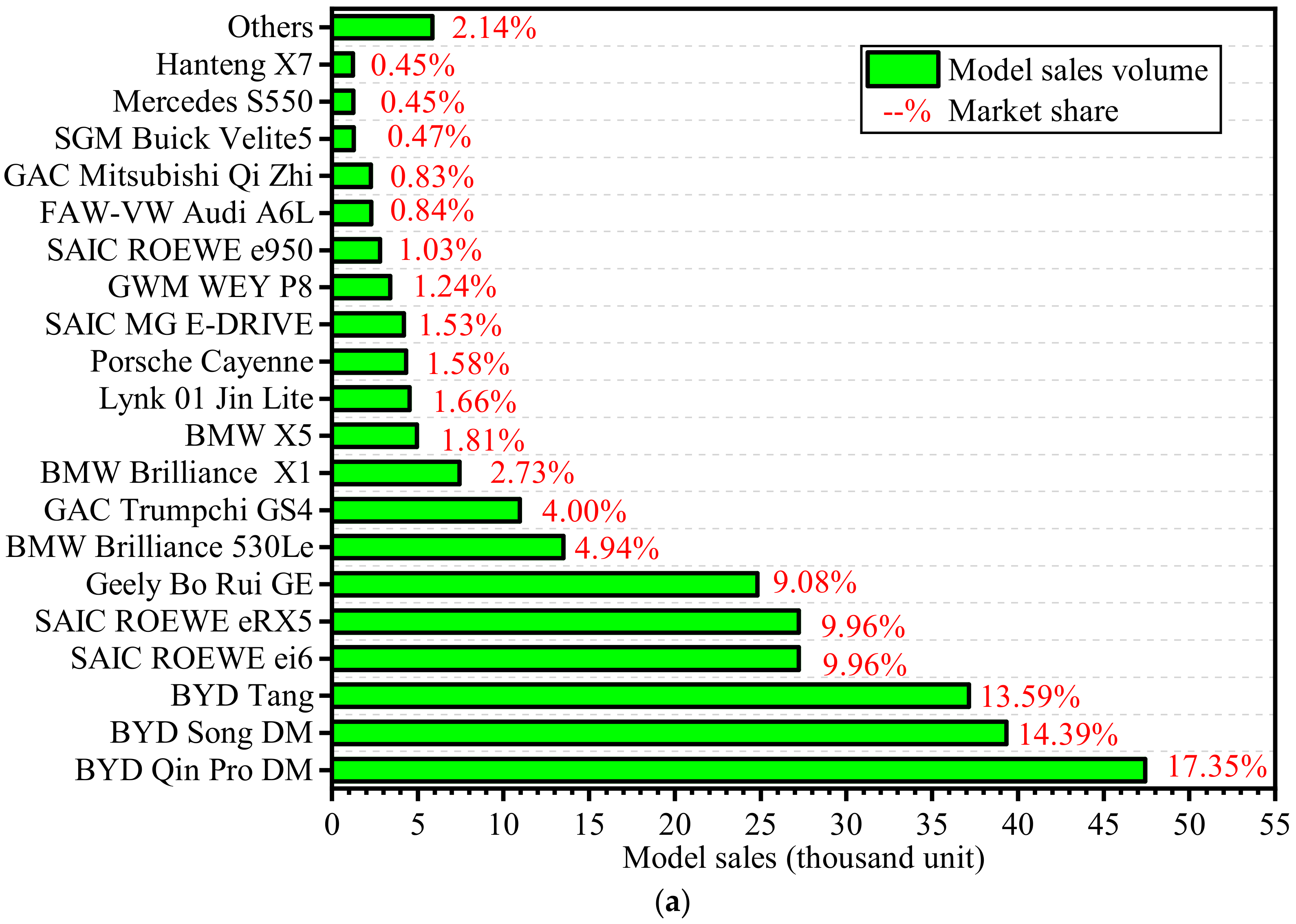

3.1. Classification of Architectures

3.1.1. Classification Method

3.1.2. Architectures of Models

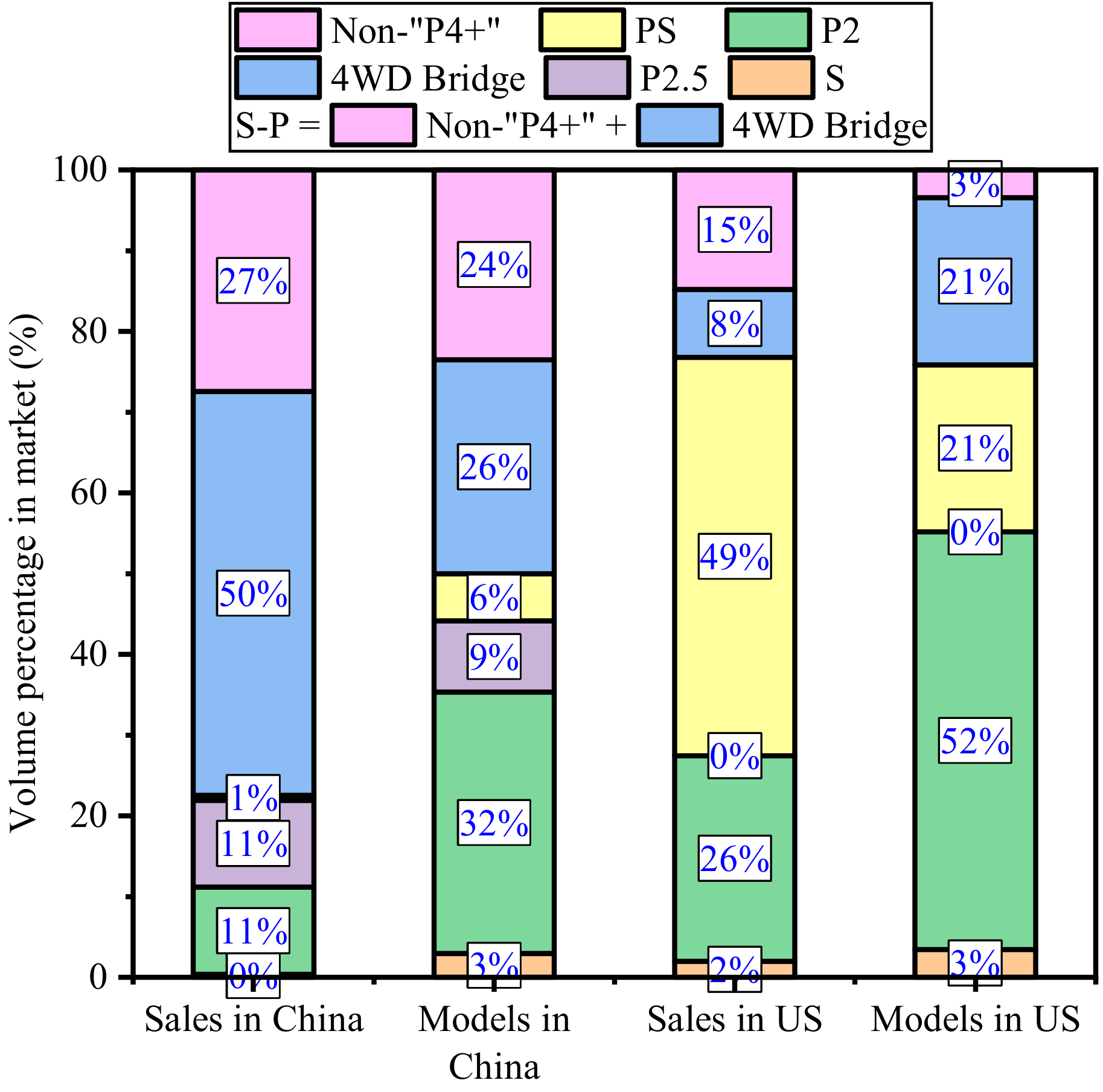

3.2. Proposition of Mainstream Architectures

3.3. Multi-Dimensional Comparative Analysis

4. Analysis of PHEV Testing Performance

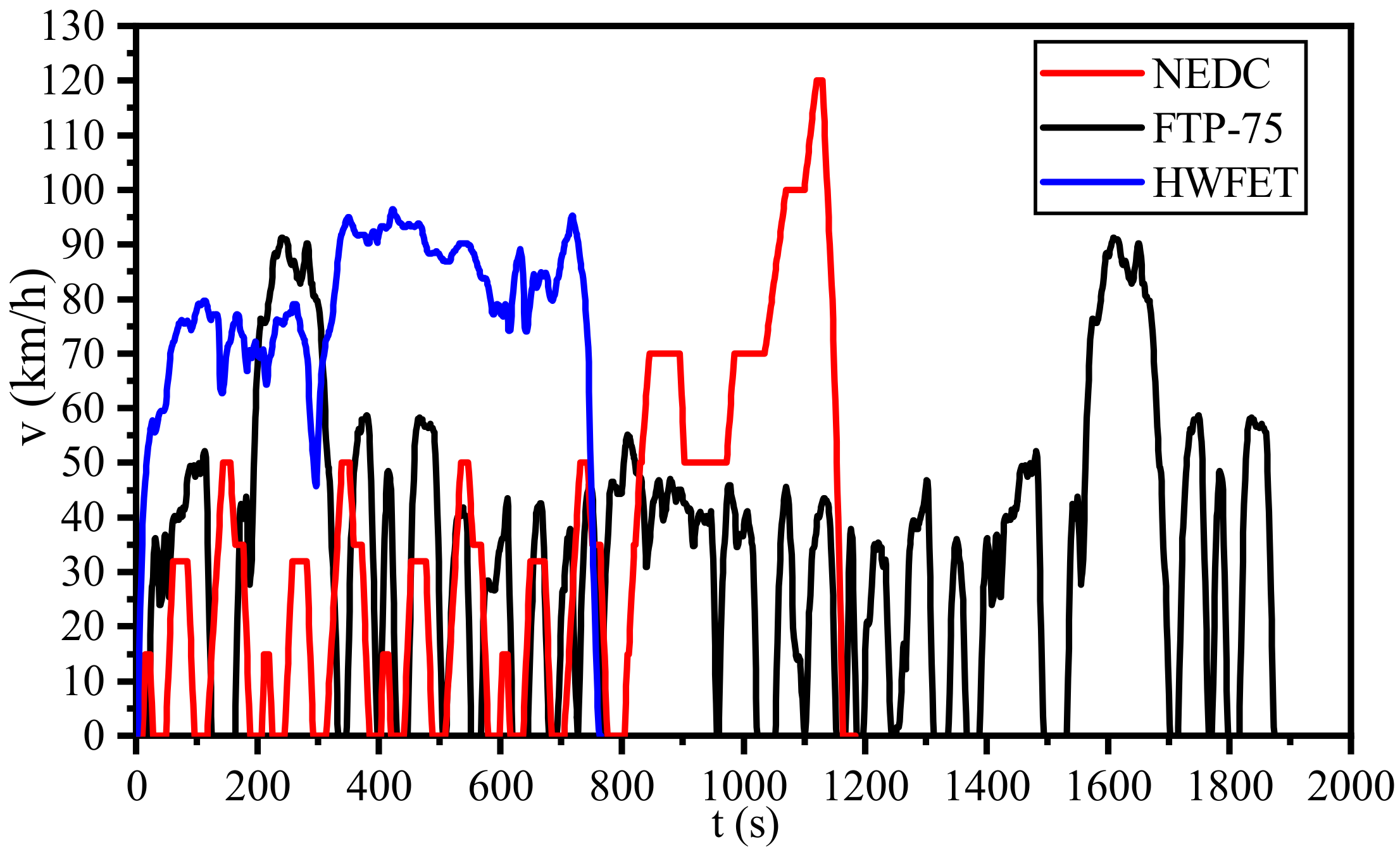

4.1. Comparison of Testing Methods

4.2. Fuel Economy Analysis

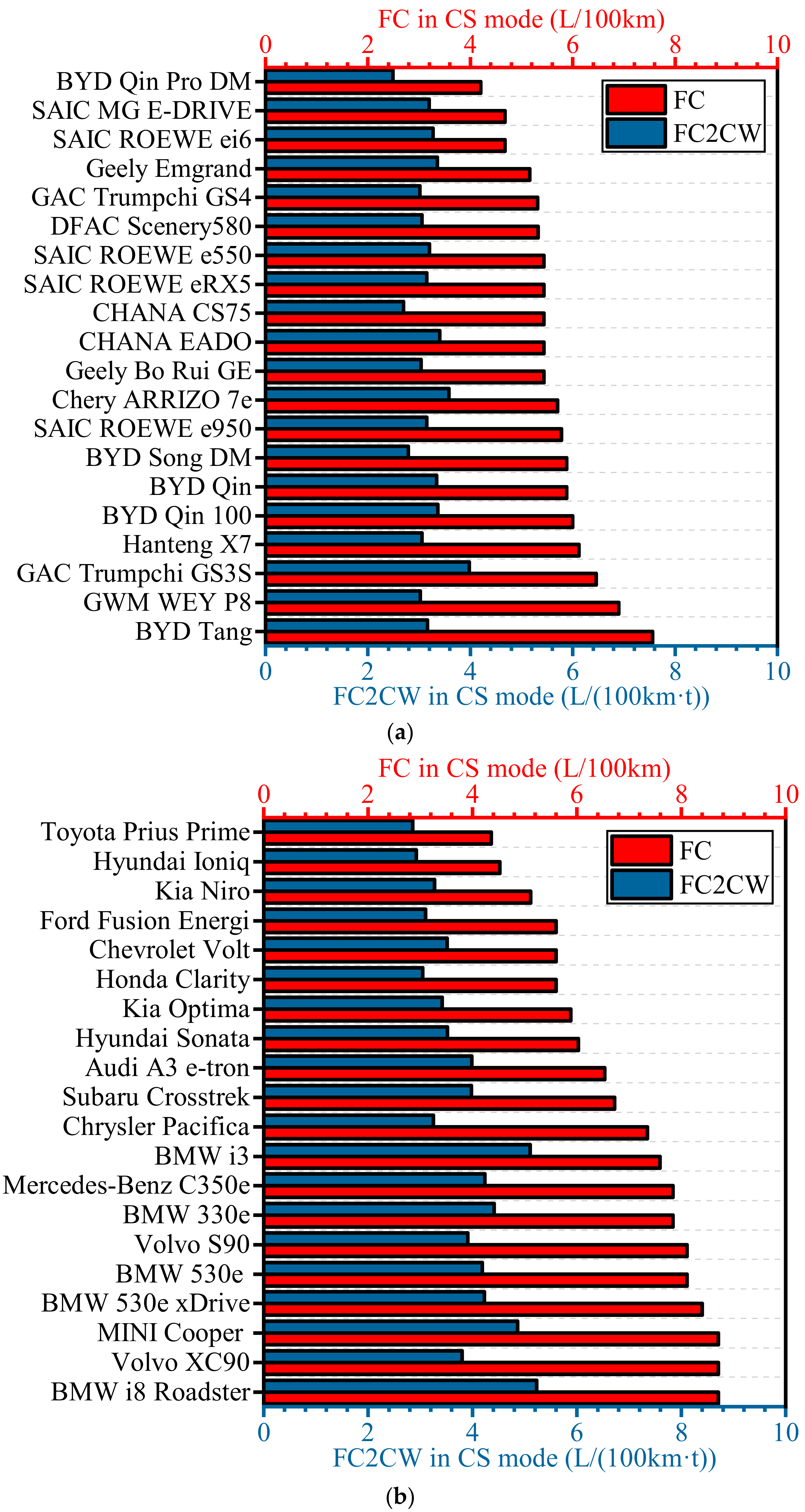

4.2.1. Fuel Consumption of Models

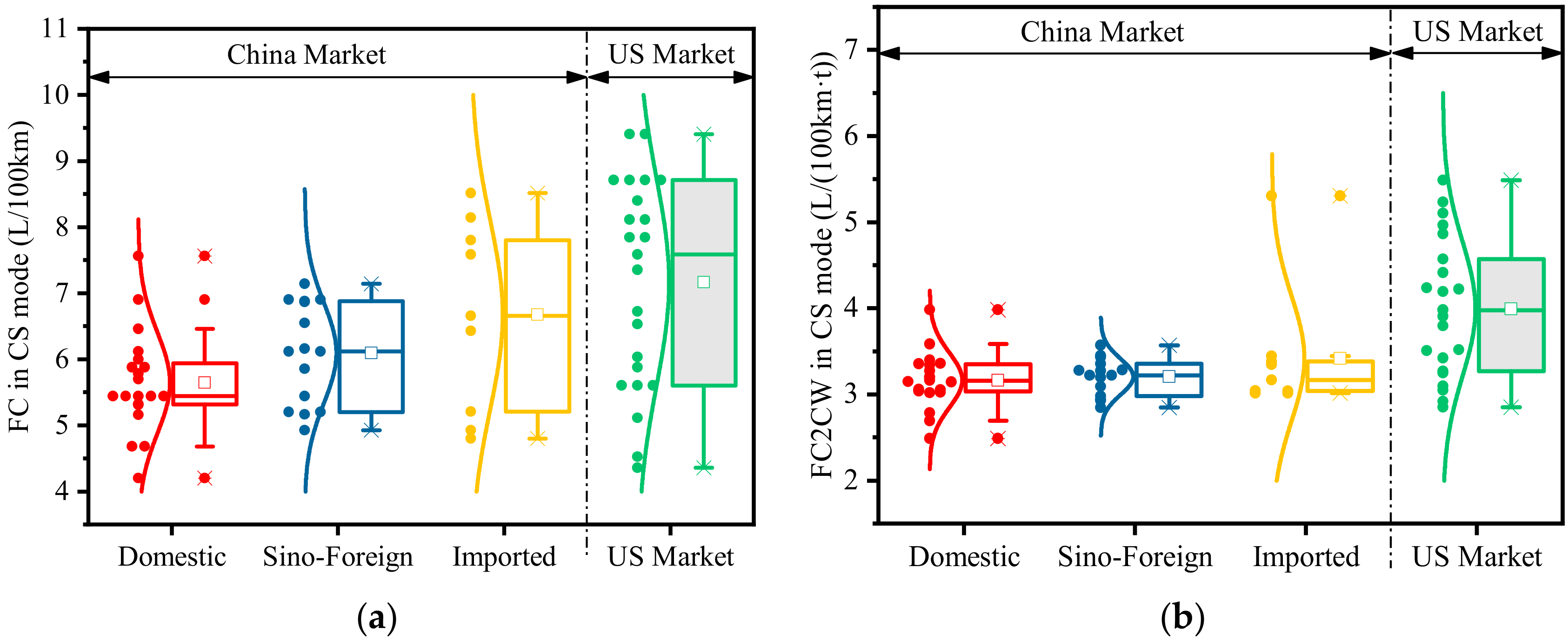

4.2.2. Fuel Consumption Distribution Characteristics

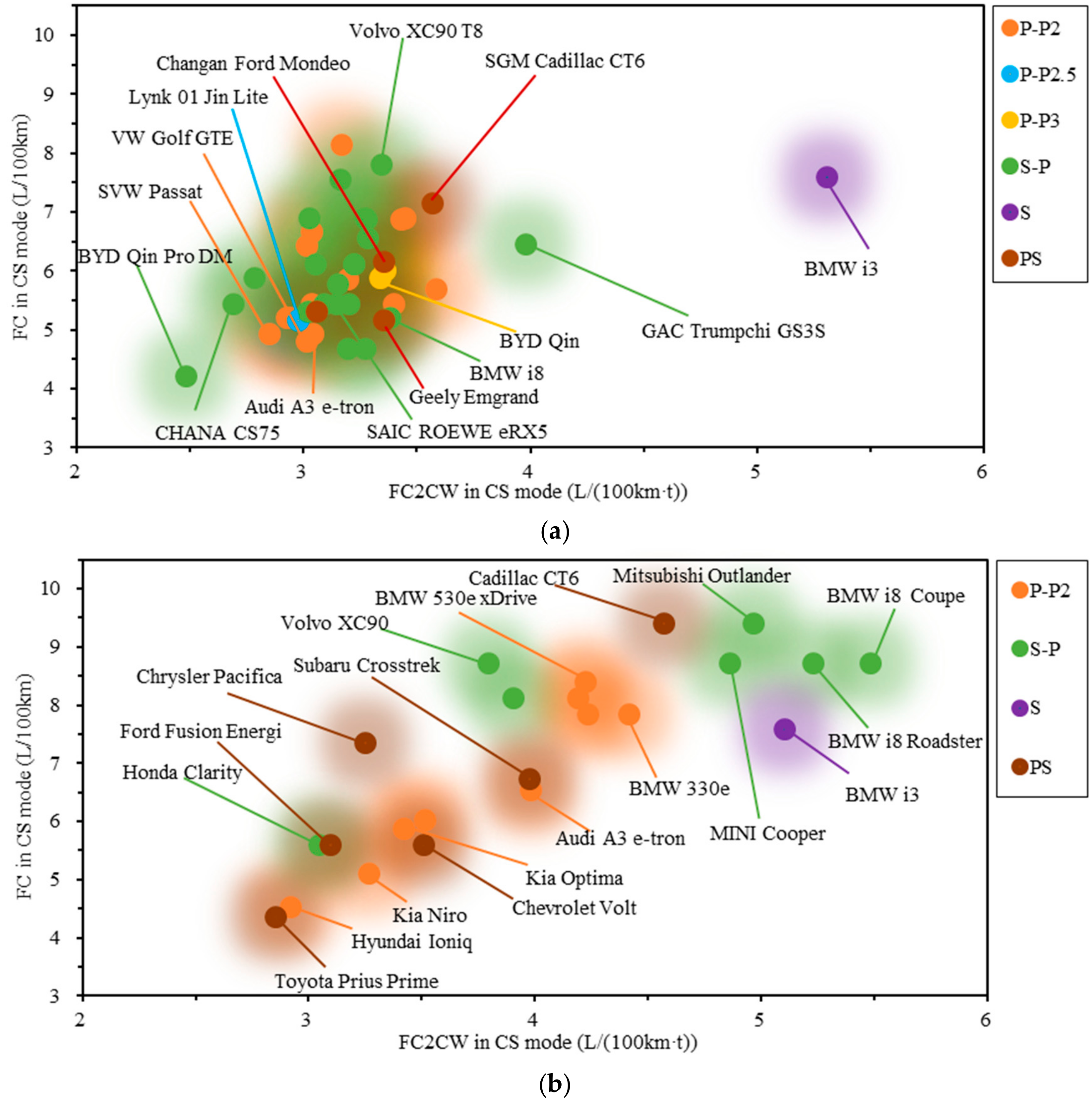

4.2.3. Fuel Consumption of Architectures

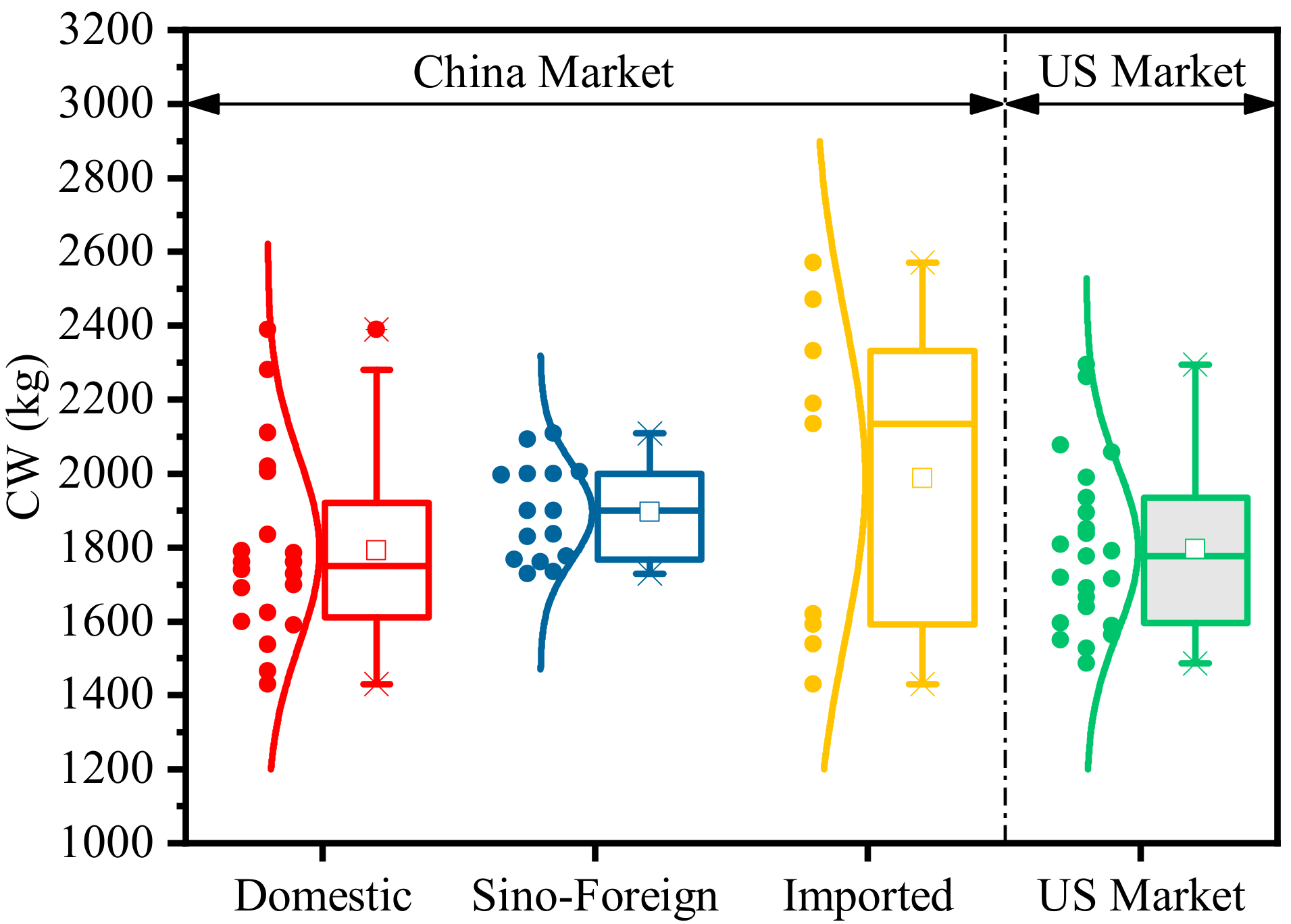

4.3. Curb Weight Analysis

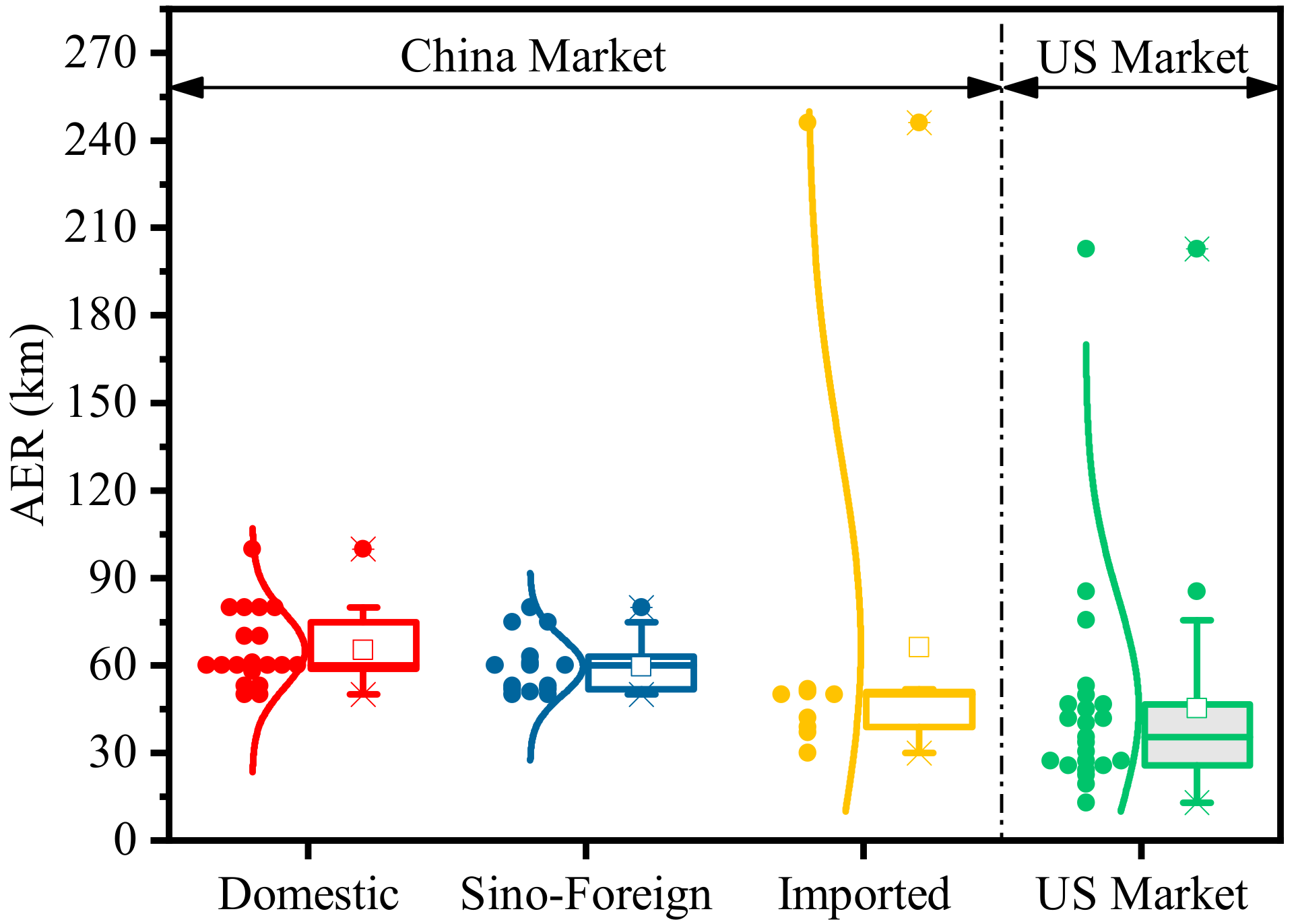

4.4. All Electric Range Analysis

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| AER | All Electric Range |

| BEV | Battery Electric Vehicle |

| BSA | Belt-driven Starter/Alternator |

| BSG | Belt-driven Starter/Generator |

| BMW | Bavarian Motor Works |

| BYD | Build Your Dream |

| CD | Charge-Depleting |

| CHANA | Changan Auto |

| CS | Charge-Sustaining |

| CW | Curb Weight |

| DCT | Dual Clutch Transmission |

| DM | Dual Mode |

| EDU | Electric Drive Unit |

| EPA | Environmental Protection Agency |

| EUDC | Extra Urban Driving Cycle |

| FC | Fuel Consumption |

| FC2CW | Fuel Consumption to Curb Weight |

| FCEV | Fuel Cell Electric Vehicle |

| FTP | Federal Test Procedure |

| GAC | Guangzhou Automobile Company |

| GM | General Motors |

| GWM | Great Wall Motors |

| HWFET | Highway Fuel Economy Test |

| HEV | Hybrid Electric Vehicle |

| IMA | Integrated Motor Assist |

| IMMD | Intelligent Multi Mode Drive |

| ISG | Integrated Starter/Generator |

| MIIT | Ministry of Industry and Information Technology |

| MPG | Miles per Gallon |

| NEDC | New European Driving Cycle |

| NEV | New Energy Vehicle |

| PEV | Plug-in Electric Vehicle |

| PHEV | Plug-in Hybrid Electric Vehicle |

| PM | Particulate Matter |

| PS | Power Split |

| REEV | Range-extended Electric Vehicle |

| R&D | Research and Development |

| SAE | Society of Automotive Engineers |

| SAIC | Shanghai Automotive Industry Corporation |

| SOC | State of Charge |

| SVW | Shanghai Volkswagen |

| S-P | Series-Parallel |

| TCO | Total Cost of Ownership |

| THS | Toyota Hybrid System |

| VW | Volkswagen |

| 4UDC | Four Urban Driving Cycles |

| 4WD | Four-Wheel Driven |

References

- Du, J.; Ouyang, D. Progress of Chinese electric vehicles industrialization in 2015: A review. Appl. Energy 2017, 188, 529–546. [Google Scholar] [CrossRef]

- Kong, F.; Jiang, J.; Ding, Z.; Hu, J.; Guo, W.; Wang, L. A personalized rolling optimal charging schedule for plug-in hybrid electric vehicle based on statistical energy demand analysis and heuristic algorithm. Energies 2017, 10, 1333. [Google Scholar] [CrossRef]

- Liu, F.; Zhao, F.; Liu, Z.; Hao, H. China’s electric vehicle deployment: Energy and greenhouse gas emission impacts. Energies 2018, 11, 3353. [Google Scholar] [CrossRef]

- Du, J.Y.; Ouyang, M.G.; Chen, J.F.; Hao, H. Evaluation of the plug-in electric vehicles technological roadmap in china. In Proceedings of the International Electric Vehicle Symposium and Exhibition, Seoul, Korea, 3–6 May 2015; pp. 1–7. [Google Scholar]

- Vergis, S.; Chen, B. Comparison of plug-in electric vehicle adoption in the United States: A state by state approach. Res. Transp. Econ. 2015, 52, 56–64. [Google Scholar] [CrossRef]

- Du, J.Y.; Meng, X.F.; Li, J.Q.; Wu, X.G.; Song, Z.Y.; Ouyang, M.G. Insights into the characteristics of technologies and industrialization for plug-in electric cars in China. Energy 2018, 164, 910–924. [Google Scholar] [CrossRef]

- Irle, R. Global EV Sales for 2018—Final Results. Available online: http://www.ev-volumes.com/country/total-world-plug-in-vehicle-volumes/ (accessed on 19 August 2019).

- Ouyang, M.; Du, J.; Peng, H.; Wang, H.; Feng, X.; Song, Z. Progress review of US-China joint research on advanced technologies for plug-in electric vehicles. Sci. China-Technol. Sci. 2018, 61, 1431–1445. [Google Scholar] [CrossRef]

- Yan, Z.; Wang, M.; Han, H.; Johnson, L.; Wang, H.; Han, H. Plug-in electric vehicle market penetration and incentives: A global review. Mitig. Adapt. Strateg. Glob. Chang. 2015, 20, 777–795. [Google Scholar]

- Zhang, X.; Bai, X. Incentive policies from 2006 to 2016 and new energy vehicle adoption in 2010–2020 in China. Renew. Sust. Energ. Rev. 2017, 70, 24–43. [Google Scholar] [CrossRef]

- Diao, Q.; Sun, W.; Yuan, X.; Li, L.; Zheng, Z. Life-cycle private-cost-based competitiveness analysis of electric vehicles in China considering the intangible cost of traffic policies. Appl. Energy 2016, 178, 567–578. [Google Scholar] [CrossRef]

- Xie, X.; Zhang, T.; Huang, Z. Life cycle assessment of energy use and GHG emissions of plug-in hybrid electric vehicles in China. In Proceedings of the SAE World Congress & Exhibition, Detroit, USA, 16–18 April 2013; pp. 1–8. [Google Scholar]

- Xiong, S.; Ji, J.; Ma, X. Comparative life cycle energy and GHG emission analysis for BEVs and PHEVs: A case study in China. Energies 2019, 12, 834. [Google Scholar] [CrossRef]

- Hutchinson, T.; Burgess, S.; Herrmann, G. Current hybrid-electric powertrain architectures: Applying empirical design data to life cycle assessment and whole-life cost analysis. Appl. Energy 2014, 119, 314–329. [Google Scholar] [CrossRef] [Green Version]

- Gnann, T.; Stephens, T.S.; Lin, Z.; Plotz, P.; Liu, C.; Brokate, J. What drives the market for plug-in electric vehicles? - a review of international pev market diffusion models. Renew. Sust. Energ. Rev. 2018, 93, 158–164. [Google Scholar] [CrossRef]

- Rietmann, N.; Lieven, T. How policy measures succeeded to promote electric mobility—worldwide review and outlook. J. Cleaner Prod. 2019, 206, 66–75. [Google Scholar] [CrossRef]

- Andress, D.; Das, S.; Joseck, F.; Dean Nguyen, T. Status of advanced light-duty transportation technologies in the US. Energ. Policy 2012, 41, 348–364. [Google Scholar] [CrossRef]

- Zhang, X.; Liang, Y.; Yu, E.; Rao, R.; Xie, J. Review of electric vehicle policies in China: Content summary and effect analysis. Renew. Sust. Energ. Rev. 2017, 70, 698–714. [Google Scholar] [CrossRef]

- Saxena, S.; Phadke, A.; Gopal, A. Understanding the fuel savings potential from deploying hybrid cars in China. Appl. Energy 2014, 113, 1127–1133. [Google Scholar] [CrossRef]

- Palmer, K.; Tate, J.E.; Wadud, Z.; Nellthorp, J. Total cost of ownership and market share for hybrid and electric vehicles in the UK, US and Japan. Appl. Energy 2018, 209, 108–119. [Google Scholar] [CrossRef]

- Du, J.; Ouyang, M.; Wu, X.; Meng, X.; Li, J.; Li, F.; Song, Z. Technological direction prediction for battery electric bus under influence of China’s new subsidy scheme. J. Cleaner Prod. 2019, 222, 267–279. [Google Scholar] [CrossRef]

- Fotouhi, A.; Auger, D.J.; Propp, K.; Longo, S.; Wild, M. A review on electric vehicle battery modelling: From lithium-ion toward lithium-sulphur. Renew. Sust. Energ. Rev. 2016, 56, 1008–1021. [Google Scholar] [CrossRef]

- Jochem, P.; Doll, C.; Fichtner, W. External costs of electric vehicles. Transport. Res. Part D-Transport. Environ. 2016, 42, 60–76. [Google Scholar] [CrossRef] [Green Version]

- Sabri, M.F.M.; Danapalasingam, K.A.; Rahmat, M.F. A review on hybrid electric vehicles architecture and energy management strategies. Renew. Sust. Energ. Rev. 2016, 53, 1433–1442. [Google Scholar] [CrossRef]

- Roy, F.; Gazo, C.; Ossart, F.; Marchand, C. Triz methodology adapted to hybrid powertrains performances evaluation. Procedia Eng. 2015, 131, 861–870. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, H.; Khajepour, A.; Li, B.; Ji, J.; Zhao, K.; Hu, C. A review of power management strategies and component sizing methods for hybrid vehicles. Renew. Sust. Energ. Rev. 2018, 96, 132–144. [Google Scholar] [CrossRef]

- Martínez, C.M.; Hu, X.; Cao, D.; Velenis, E.; Wellers, M. Energy management in plug-in hybrid electric vehicles: Recent progress and a connected vehicles perspective. IEEE Trans. Veh. Technol. 2016, 66, 1–16. [Google Scholar] [CrossRef]

- Cagatay Bayindir, K.; Gozukucuk, M.A.; Teke, A. A comprehensive overview of hybrid electric vehicle: Powertrain configurations, powertrain control techniques and electronic control units. Energy Convers. Manag. 2011, 52, 1305–1313. [Google Scholar] [CrossRef]

- Freyermuth, V.; Fallas, E.; Rousseau, A. Comparison of powertrain configuration for plug-in hevs from a fuel economy perspective. SAE Int. J. Engines 2008, 1, 392–398. [Google Scholar] [CrossRef]

- Wu, G.; Zhang, X.; Dong, Z. Powertrain architectures of electrified vehicles: Review, classification and comparison. J. Franklin Inst. 2015, 352, 425–448. [Google Scholar] [CrossRef]

- Wang, W.; Song, R.; Guo, M.; Liu, S. Analysis on compound-split configuration of power-split hybrid electric vehicle. Mech. Mach. Theory 2014, 78, 272–288. [Google Scholar] [CrossRef]

- Ngo, H.T.; Yan, H.S. Configuration synthesis of parallel hybrid transmissions. Mech. Mach. Theory 2016, 97, 51–71. [Google Scholar] [CrossRef]

- Hegazy, O.; Barrero, R.; Van den Bossche, P.; El Baghdadi, M.; Smekens, J.; Van Mierlo, J.; Vriens, W.; Bogaerts, B. Modeling, analysis and feasibility study of new drivetrain architectures for off-highway vehicles. Energy 2016, 109, 1056–1074. [Google Scholar] [CrossRef]

- Walker, P.D.; Roser, H.M. Energy consumption and cost analysis of hybrid electric powertrain configurations for two wheelers. Appl. Energy 2015, 146, 279–287. [Google Scholar] [CrossRef]

- Rashid, M.I.M.; Danial, H. Advisor simulation and performance test of split plug-in hybrid electric vehicle conversion. Energy Procedia 2017, 105, 1408–1413. [Google Scholar] [CrossRef]

- Anderson, P.; Tushman, M.L. Technological discontinuities and dominant designs: A cyclical model of technological change. Adm. Sci. Q. 1990, 35, 604–633. [Google Scholar] [CrossRef]

- Shi, T.; Zhao, F.; Hao, H.; Chen, K.; Liu, Z. Structure analysis and cost estimation of hybrid electric passenger vehicle and the application in china case. In Proceedings of the Wcx World Congress Experience, Detroit, MI, USA, 3–6 April 2018; pp. 1–10. [Google Scholar]

- Liu, J.; Peng, H. Modeling and control of a power-split hybrid vehicle. IEEE Trans. Control Syst. Technol. 2008, 16, 1242–1251. [Google Scholar]

- Chen, Y.-S.; Chang, J.; Chen, I.-M.; Chen, M.-Y.; Liu, T. Conceptual design and evaluation of a hybrid transmission with power-split, series, and two parallel configurations. SAE Int. J. Altern. Powertrains 2017, 6, 122–135. [Google Scholar] [CrossRef]

- Ahn, K.; Cho, S.; Lim, W.; Park, Y.I.; Lee, J.M. Performance analysis and parametric design of the dual-mode planetary gear hybrid powertrain. Proc. Inst. Mech. Eng. Part D-J. Automob. Eng. 2006, 220, 1601–1614. [Google Scholar] [CrossRef]

- Yang, Y.; Hu, X.; Pei, H.; Peng, Z. Comparison of power-split and parallel hybrid powertrain architectures with a single electric machine: Dynamic programming approach. Appl. Energy 2016, 168, 683–690. [Google Scholar] [CrossRef]

- Knackstedt, C.; Jambor, E.; Bradley, T. Ecocar 3: Architecture selection validation through vehicle modeling and simulation for the colorado state university vehicle innovation team. IFAC-PapersOnLine 2015, 48, 147–152. [Google Scholar] [CrossRef]

- Lanzarotto, D.; Marchesoni, M.; Passalacqua, M.; Prato, A.P.; Repetto, M. Overview of different hybrid vehicle architectures. IFAC-PapersOnLine 2018, 51, 218–222. [Google Scholar] [CrossRef]

- Karbowski, D.; Pagerit, S.; Kwon, J.; Rousseau, A.; Karl-Felix Freiherr, V.P. “Fair” Comparison of Powertrain Configurations for Plug-in Hybrid Operation Using Global Optimization; SAE Technical Paper, 2009-01-1334; SAE: Warrendale, PA, USA, 2009. [Google Scholar]

- Zhou, X.; Qin, D.; Hu, J. Multi-objective optimization design and performance evaluation for plug-in hybrid electric vehicle powertrains. Appl. Energy 2017, 208, 1608–1625. [Google Scholar] [CrossRef]

- Chung, C.-T.; Hung, Y.-H. Performance and energy management of a novel full hybrid electric powertrain system. Energy 2015, 89, 626–636. [Google Scholar] [CrossRef]

- MEP. China Vehicle Environment Management Annual Report; Ministry of Environmental Protection of People Republic of China: Beijing, China, 2016; pp. 1–47.

- Clairand, J.-M.; Guerra-Teran, P.; Serrano-Guerrero, X.; Gonzalez-Rodriguez, M.; Escriva-Escriva, G. Electric vehicles for public transportation in power systems: A review of methodologies. Energies 2019, 12, 3114. [Google Scholar] [CrossRef]

- Demandt, B. Global Car Sales Analysis 2018. Available online: http://carsalesbase.com/global-car-sales-2018/ (accessed on 20 August 2019).

- Chen, K.; Zhao, F.; Hao, H.; Liu, Z. Synergistic impacts of China’s subsidy policy and new energy vehicle credit regulation on the technological development of battery electric vehicles. Energies 2018, 11, 3193. [Google Scholar] [CrossRef]

- Xu, C.; Guo, K.; Yang, F. A comparative study of different hybrid electric powertrain architectures for heavy-duty truck. IFAC-PapersOnLine 2018, 51, 746–753. [Google Scholar] [CrossRef]

- Vora, A.P.; Jin, X.; Hoshing, V.; Saha, T.; Shaver, G.; Varigonda, S.; Wasynczuk, O.; Tyner, W.E. Design-space exploration of series plug-in hybrid electric vehicles for medium-duty truck applications in a total cost-of-ownership framework. Appl. Energy 2017, 202, 662–672. [Google Scholar] [CrossRef]

- Brooke, L. Positioning for hybrid growth. SAE Int. Automot. Eng. 2017, 9, 32–34. [Google Scholar]

- Cheng, C.; McGordon, A.; Jones, R.P.; Jennings, P.A. Comprehensive forward dynamic HEV powertrain modelling using dymola and Matlab/Simulink. IFAC Proc. Vol. 2010, 43, 536–541. [Google Scholar] [CrossRef]

- Emadi, A.; Rajashekara, K.; Williamson, S.S.; Lukic, S.M. Topological overview of hybrid electric and fuel cell vehicular power system architectures and configurations. IEEE Trans. Veh. Technol. 2005, 54, 763–770. [Google Scholar] [CrossRef]

- Enang, W.; Bannister, C. Modelling and control of hybrid electric vehicles (a comprehensive review). Renew. Sust. Energ. Rev. 2017, 74, 1210–1239. [Google Scholar] [CrossRef]

- MEE; GAQSIQ. Limits and Measurement Methods for Emissions from Light-Duty Vehicles (China 5), GB 18352.5-2013; Ministry of Eology and Environment of People Republic of China: Beijing, China, 2013; pp. 1–164.

- SAC; GAQSIQ. Test Methods for Energy Consumption of Light-Duty Hybrid Electric Vehicles, GB/T 19753-2013; Standardization Administration of People Republic of China: Beijing, China, 2013; pp. 1–20.

- SAE. Recommended Practice for Measuring the Exhaust Emissions and Fuel Economy of Hybrid-Electric Vehicles, Including Plug-in Hybrid Vehicles. J1711; SAE: Warrendale, PA, USA, 2010; pp. 1–63.

| Category | Focus | Method | Comment |

|---|---|---|---|

| Market | Market conditions [9]; Market-related policies [10]; Costs [11,12,13]; Choices of market subjects [14] | Market penetration [1]; Market share [16]; Market model [15]; Cost model [20,21,22,23]; Policy review [10,16,17,18,19]; Policy and market model [16] | (1) Few analyses combined market and technology; (2) Lack of test performance comparison of detailed architectures of models in the market; (3) Lack of a unified classification method to characterize models in market |

| Technology | Architecture design [24,25]; Component sizing [26]; Control strategy [27] | Architecture classification and selection [28,29,30,31,42,43]; Architecture design [32,33,34]; Performance simulation [35,37]; Optimization and comparison [2,41,44,45] | |

| Combined market and technology | Parameter and market comparison | Parameter data comparison [1,6] | Lack of analysis on architectures and market data. |

| Basic Category | Mixed Mode | Motor Position | Common Name | Applied Model | |

|---|---|---|---|---|---|

| Series | Electric coupling | “P1 + P3” | Series | Nissan Note e-Power, BMW i3, GAC GA5 | |

| Parallel | Mechanical coupling | P0 | BSG/BSA | GM Saturn VUE, Mazda CX-5 | |

| P1 | ISG/Single clutch parallel | Honda Insight 2001, Honda Civic 2003, Honda Accord 2005, Mercedes Benz S400 | |||

| P2 | Parallel P2/Dual clutch parallel | Audi A3 e-Tron, BMW 330e, BMW 530e, BMW X5, VW Golf GTE, SVW Passat, Mercedes Benz E00, Mercedes Benz S550, Infiniti Q50, Hyundai Sonata 9, Hyundai Ioniq, Honda Fit, Kia Niro, Kia Optima, CHANA EADO, Chery Exeed TX | |||

| P2.5 | Parallel P2.5 | Lynk 01 Jin Lite, Geely Bo Rui GE | |||

| P3 | Parallel P3/Rear parallel | BYD Qin | |||

| P4 | - | - | |||

| Compound | Electric and mechanical coupling | P0 + P4 | Series-Parallel/Combined hybrid | 4WD Bridge/“P4+” | BMW X1, BMW i8, GWM WEY P8, MINI Cooper |

| P1 + P4 | Volvo S60L, Volvo XC90 T8 | ||||

| P3 + P4 | BYD Song 1st DM, BYD Tang DM 1st Gen, BYD Yuan DM 1st Gen | ||||

| P0 + P3 + P4 | BYD Tang DM 2nd Gen, BYD Qin Pro DM, Mitsubishi Outlander | ||||

| P1 + P3 + P4 | CHANA CS75 | ||||

| P1 + P4 + P4 | Honda Acura NSX | ||||

| P1 + P3 | Non-“P4+” | Honda Clarity, Honda Accord, GAC Trumpchi GS4, BYD F3DM | |||

| P1 + P2 | SAIC Roewe e550, SAIC Roewe e950, SAIC Roewe eRX5 | ||||

| PS | Power split | Toyota Prius Prime, Ford Fusion Energi, Chrysler Pacifica, GM Cadillac CT6, GM Velite5, Subaru Crosstek, Chevrolet Volt, Changan Ford Mondeo, Geely Emgrand | |||

| Typical Architecture | Economy | Dynamic | Cost | Technical Difficulty | |||||

|---|---|---|---|---|---|---|---|---|---|

| Control | Assembly | ||||||||

| Series | █ | ▄ | ▁ | ▄ | █ | ▄ | ▄ | ▁ | ▁ |

| Parallel P2 | ▄ | ▄ | ▄ | ▄ | ▄ | ▄ | ▁ | ▄ | ▄ |

| Parallel P2.5 | ▄ | █ | ▄ | ▄ | ▄ | ▄ | ▄ | ▄ | ▄ |

| Parallel P3 | ▄ | ▄ | ▄ | ▄ | ▄ | ▄ | ▁ | ▄ | ▁ |

| 4WD Bridge | █ | █ | █ | █ | █ | █ | █ | █ | █ |

| Non-“P4+” | █ | █ | █ | ▄ | █ | ▄ | █ | ▄ | ▄ |

| PS | █ | █ | █ | ▄ | █ | ▄ | █ | ▄ | ▄ |

| Attributes | NEDC | 4UDC | EUDC | FTP-75 | HWFET |

|---|---|---|---|---|---|

| Time (s) | 1180 | 780 | 400 | 1874 | 765 |

| Top speed (km/h) | 120 | 50 | 120 | 91.25 | 96.4 |

| Average speed (km/h) | 33.35 | 18.35 | 62.59 | 34.13 | 77.67 |

| Distance (km) | 10.93 | 3.98 | 6.95 | 17.77 | 16.51 |

| Maximum acceleration (m/s2) | 1.06 | 1.06 | 0.83 | 1.48 | 1.43 |

| Minimum deceleration (m/s2) | −1.39 | −0.83 | −1.39 | −1.48 | −1.48 |

| Idling time percent (%) | 23.81 | 30.90 | 10.00 | 17.93 | 0.65 |

| Standard deviation of speed (km/h) | 31.06 | 17.01 | 31.41 | 25.65 | 16.47 |

| Standard deviation of acceleration (m/s2) | 0.42 | 0.45 | 0.38 | 0.63 | 0.30 |

| Coefficient of variation of speed (%) | 93.12 | 92.69 | 50.19 | 75.16 | 21.21 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, B.; Yang, F.; Teng, L.; Ouyang, M.; Guo, K.; Li, W.; Du, J. Comparative Analysis of Technical Route and Market Development for Light-Duty PHEV in China and the US. Energies 2019, 12, 3753. https://doi.org/10.3390/en12193753

Zhang B, Yang F, Teng L, Ouyang M, Guo K, Li W, Du J. Comparative Analysis of Technical Route and Market Development for Light-Duty PHEV in China and the US. Energies. 2019; 12(19):3753. https://doi.org/10.3390/en12193753

Chicago/Turabian StyleZhang, Baodi, Fuyuan Yang, Lan Teng, Minggao Ouyang, Kunfang Guo, Weifeng Li, and Jiuyu Du. 2019. "Comparative Analysis of Technical Route and Market Development for Light-Duty PHEV in China and the US" Energies 12, no. 19: 3753. https://doi.org/10.3390/en12193753

APA StyleZhang, B., Yang, F., Teng, L., Ouyang, M., Guo, K., Li, W., & Du, J. (2019). Comparative Analysis of Technical Route and Market Development for Light-Duty PHEV in China and the US. Energies, 12(19), 3753. https://doi.org/10.3390/en12193753