1. Introduction

The transition of the German energy system, known as

Energiewende, is a complex and challenging process. It refers to the switch in energy supply from fossil and nuclear power generation to cleaner and sustainable energy generation from renewable energy technologies, such as wind and hydro power, solar and geothermal energy. According to [

1] (p. 11), it is “

An ability of organizations and society to efficiently impact their bottom line and provide positive social change through reduction in energy consumption, production of renewable energy, and efficient management of energy”. This long-term process was initiated in the 1970s and was connected to the oil crisis at the time. It was the starting point for adopting a new energy policy which should promote energy efficiency and the diversification of the energy mix, including more renewable energy sources (RES). Furthermore, the

Energiewende was reinforced in the 1990s when Germany begun promoting renewable electricity using feed-in tariff (FIT) schemes by means of the Electricity Feed-in Act (StrEG), the predecessor of the Renewable Energies Act of 2000. The German Renewable Energies Law (

EEG–Erneuerbare-Energien-Gesetz) with its guaranteed FITs for 20 years was and still is the key factor for the rapid growth of renewable power production. During this process, the German power system changed dramatically from centralized power production with only a few fossil and nuclear power plants to a more decentralized one with a high share of fluctuating power output from wind and solar energy power plants. The share of the electricity consumption in Germany covered by RES increased between 2000 and 2015 from 6.5% to 31.6% [

2] and in 2018 reached 38.2% [

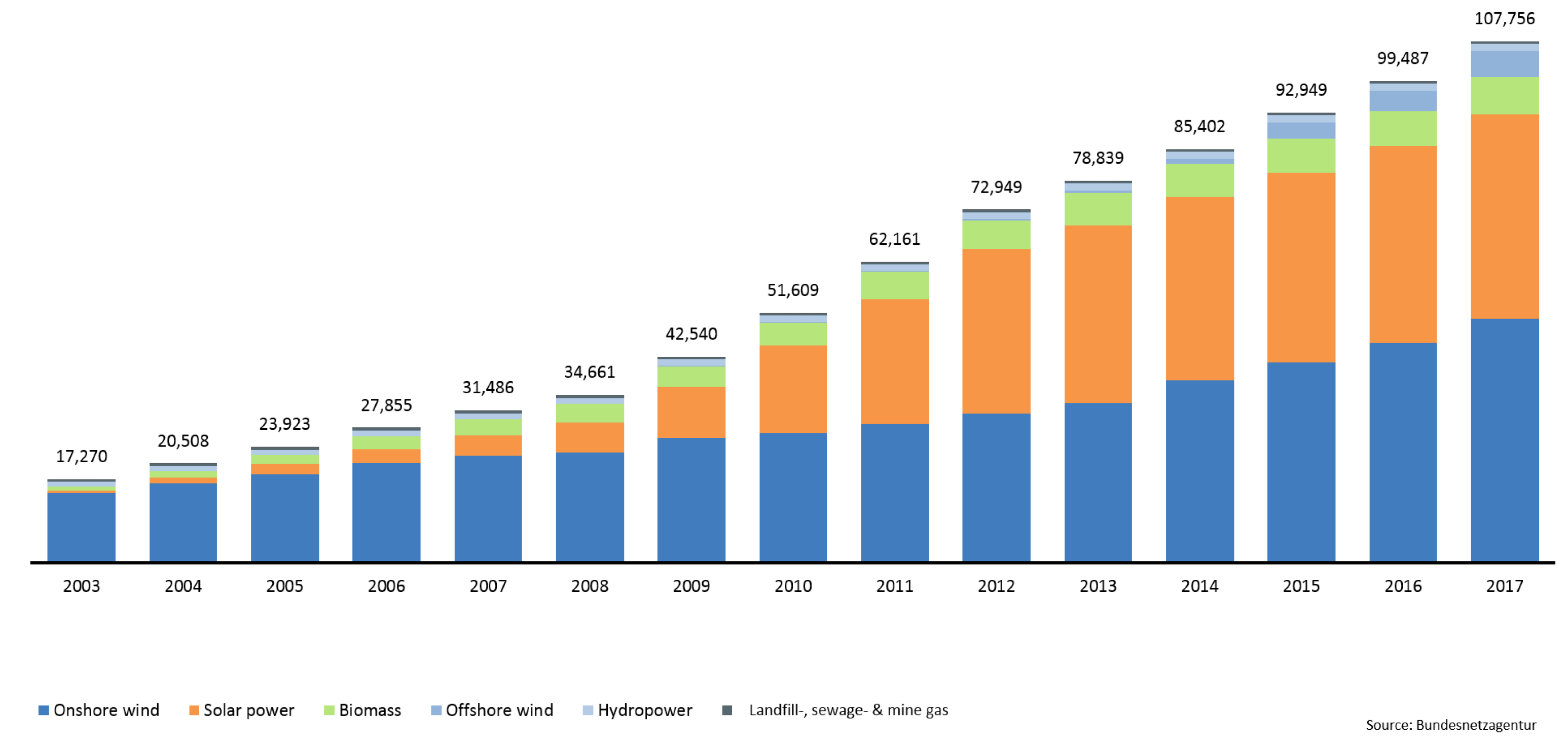

3]. Mainly, there are on- and offshore wind, solar photovoltaics (PV), biomass and hydro power plants, whereas wind energy continued to be the largest source of renewables power generation with 112 TWh in 2018 [

4]. This significant progress over the years was possible thanks to the promotion policy and EEG regulation, which enabled the impressive increase in the installed capacity shown in

Figure 1.

Moreover, since the end of the last century, German energy policy has been strongly influenced by decarbonization policy, which implies a significant reduction of energy demand by higher energy efficiency and a high share of renewables. Officially, the new German energy policy is dated to 2011, after the Fukushima disaster, and called

Energiewende (for more information regarding the development of the German energy policy, also in the institutional and regulatory context, see Dickel [

6]; furthermore, the background and history of the

Energiewende in more detail can be found in Woodrow [

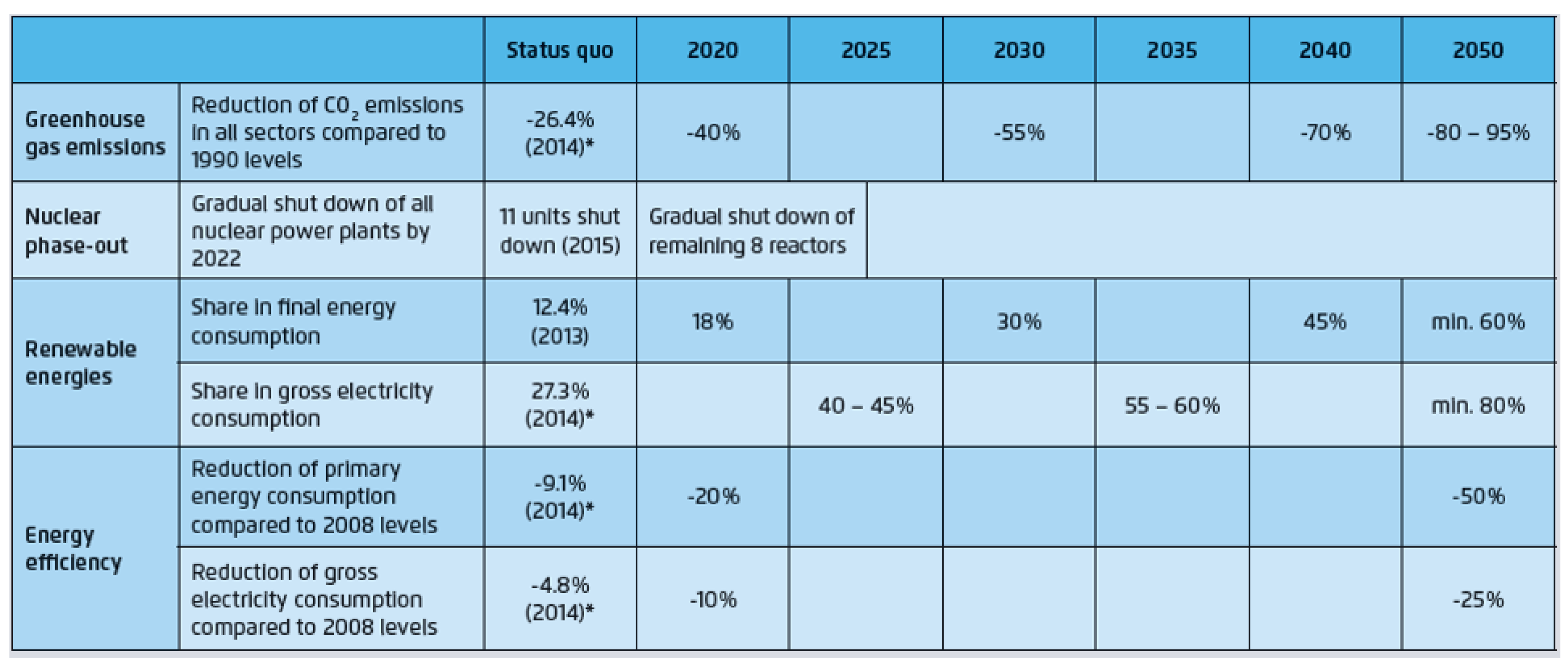

7]). It should be noticed that, next to the nuclear phase-out by 2022, the reduction of greenhouse gas emissions (GHG) and of primary energy consumption, the further development and increase of the share of RES in final energy consumption is one of the four main aims of the

Energiewende (see

Figure 2). Nevertheless, changes in the legislative landscape of the renewable energy market currently being undertaken by the German government can significantly affect the achieving of these aims.

In 2017, the remuneration system for the most important renewable energy technologies in Germany (wind, solar, biomass) and larger systems switched from feed-in tariffs to auctions. The decisive criterion for winning an auction is the bid for the market premium (i.e., the subsidy to be received) in Euros per Megawatt-hour. Notice that with the reform of the EEG in 2014 market premium has become the main support scheme for electricity from RES. The amount of funding is determined by the pay-as-bid procedure (for more information, see [

9,

10]). The Federal Network Agency (

Bundesnetzagentur, BNetzA) is responsible for the competitive bidding procedure. The new regulations cover all offshore wind farms, solar power installations, and onshore wind farms with an installed capacity of over 750 kW, as well as biomass plants with an installed capacity of more than 150 kW. EEG 2017 allows only in the biomass sector the further public policy support of existing facilities after the original 20-years subsidy period and participation in auctions (for an additional 10 years only, and provided the subsidization received so far expires after less than eight years; see EEG 2017 [

11] Art. 39f,g). Previously, according to EEG 2009, the base tariff for onshore wind power plants was 5.02 €-ct/kWh, whereas in the first five years after putting the plant into operation an increased rate of 9.2 €-ct/kWh (so-called initial remuneration) applies (according to the EEG, this duration is prolonged by two months for every 0.75% of the reference yield by which the plant yield undercuts 150% of the reference yield, i.e., if the plant is situated at a location with less favorable wind conditions; see EEG 2009 [

12], Art. 29). Over the years, the EEG was repeatedly amended, and the base tariff for onshore wind power plants decreased to 4.11 €-ct/kWh, and the initial remuneration to 7.39 €-ct/kWh in the year 2017 (according to EEG 2016). Regarding PV power plants, the tariff depended on the installed capacity and varied from 50.62 €-ct/kWh in the year 2000 to 10.65 €-ct/kWh in 2017. The remuneration tariff for biomass power plants also changed over the years and, depending on the installed capacity, varied from 11.50 €-ct/kWh in the year 2004 to 13.06 €-ct/kWh in 2018 for power plants with up to 15 kW of installed capacity, from 9.90 €-ct/kWh in 2004 to 11.26 €-ct/kWh in 2018 for power plants with up to 500 kW of installed capacity, from 8.90 €-ct/kWh in 2004 to 10.09 €-ct/kWh in the year 2018 for power plants with up to 5 MW of installed capacity, and from 8.40 €-ct/kWh in 2004 to 5.60 €-ct/kWh in 2018 for power plants with up to 200 MW of installed capacity (for more information about the development of the EEG remuneration tariffs, see

Appendix A).

Renewable energy technologies in Germany still enjoy a privileged position regarding their diffusion and marketing, and take advantage of EEG support. Nevertheless, today many of the existing renewable energy power plants, mainly onshore wind, have reached their operational lifetime and thus also the end of their support via the EEG feed-in tariff. Regarding onshore wind power, around 4 GW of plant capacity will be affected in the year 2020. In the following years, it is expected that an average of 2.4 GW of wind power capacity per year will fall short of EEG support. In other words, in the period from 2021 till 2025, between 32 and 47 percent of wind power output will reach the end of its funding period [

13]. Because only early adopters installed PV systems before the year 2000, the subsidy’s expiration for an ever higher number of installed PV systems is expected in 2025 and thereafter. The lower installed capacity of biomass power plants compared to wind power plants and PV systems implies a lower number of biomass units leaving the subsidy scheme overall. Moreover, the changes in the policy regarding this technology are not so critical in comparison to wind and PV power plants (see

Section 2.1).

The

Energiewende, a sustainable energy transition process, is going to substantially alter the way the German society is organized in terms of its energy use. The economic, environmental, social, and to a certain extent the governance aspects of the firm (e.g., energy provider) and the society overall are affected in this transition process. On the one hand, this transition process can be seen as a part of sustainability planning where rational management of resources in the present does not need to compromise the needs of future generations. On the other hand, this process is a part of resilience planning where the various economic, environmental, social, governance, and emergency preparedness strategies are incorparated to prepare organizations and communities for threats from climate change, identification of inherent risks, and planning of their risk mitigation strategies [

1].

Keeping in mind the aims of the Energiewende, its connection to the sustainability and resilience planning as well as the changes in the EEG, we raise the following questions: (1) What happens with the renewable energy power plants after expiry of public policy support at the end of their lifetime? (2) Is it reasonable and economically feasible to operate these power plants any further? (3) Which decision options do owners or operators of those power plants have? (4) What is the impact of those decisions on the aims of the Energiewende? (5) Is the Energiewende at Risk? (6) Should the public policy support schemes be adapted, taking repowering more into consideration, in order to achieve the aims of the Energiewende?

In our paper, we propose the application of real options theory in order to evaluate and analyze the possible options for existing RES power plants after the expiration of the subsidization. Using real options analysis (ROA), we consider three possible options: (i) further operation of the existing power plants under new framework conditions, (ii) repowering of the existing power plant, and (iii) decommissioning. The proposed approach is based on the models developed by [

14,

15] for conventional power generation technologies based on lignite and natural gas, respectively. In contrast to these models, it is not necessary to define the operational strategy for RES power plants based on intermittent sources such as wind and solar power (the power generation for these technologies depends on weather conditions). This becomes an issue only when the RES power plants are combined with storage systems, enabling to shift supply and to self-consume self-generated electricity when it is economically most opportune. On the one hand, it makes the calculation procedure easier; on the other hand, the possible electricity generation over time from RES power plants should be estimated and, in the proposed procedure, is given as a probability distribution. The contribution of our paper is to capture the stochastic and dynamic character of the parameters needed to support the decision-making process regarding the future operation of RES power plants, which is in contrast to the existing studies (reviewed further below), where only deterministic static analysis was conducted.

The remainder of this paper is organized as follows.

Section 2 provides a short literature review regarding the situation of existing RES after the end of public policy support and the application of ROA as a valuation method for RES power plants. In

Section 3, we present our procedure for analyzing the mentioned early decision options.

Section 4 introduces selected RES power plants for the case study and all necessary input information needed for the calculations. Results and a sensitivity analysis of the proposed model application for the case study are presented in

Section 5.

Section 6 provides conclusions and some policy implications.

3. Methodology

On the one hand, real options theory is still to be seen as an innovative tool in capital budgeting. On the other hand, it is already well established and finding increasing application also in the energy sector. Over the last 40 years the evaluation methods developed for financial options have been successfully applied to evaluate real assets, too (with some caveats). As mentioned in

Section 2.2, the valuation methods such as partial differential equation modeling, binomial option valuation, Monte Carlo simulation and dynamic programming can be distinguished. These evaluation methods can be categorized as analytical approximation techniques, comprising dynamic programming and contingent claims, and numerical methods such as tree-building methods or simulations needed to approximate the solution to the partial differential equation. Regardless of the kind of option (i.e., European or American), the binominal tree approach developed by Cox et al. [

22] is a simple and efficient method that allows the holder of an option to decide whether it is most beneficial to exercise the option or to wait until its maturity date. Regardless of some losses in terms of precision compared to the Black–Scholes model in practice (asymptotically—for infinite resolutions—they yield equivalent results), the results obtained with the binomial approach are often found sufficiently accurate, easy to illustrate, and the option of graphical representation improves model transparency and accessibility [

43].

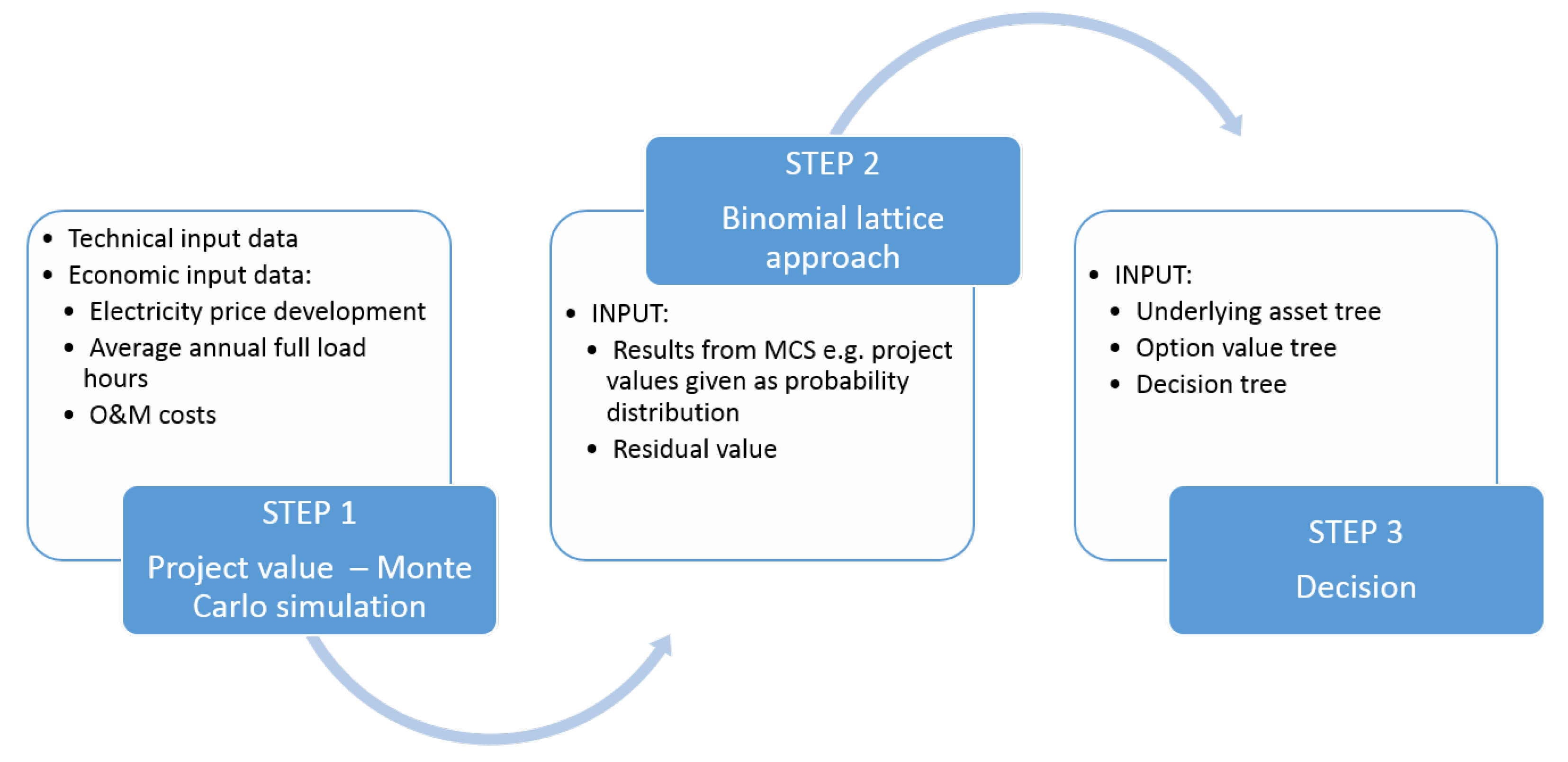

In the proposed model, we combine the binomial lattice approach for real options analysis with Monte Carlo simulation (see

Figure 5).

Initially, the project-specific quantities (e.g., project values) are calculated using Monte Carlo simulation (step 1). The binomial tree approach (step 2) uses as a starting point an underlying asset (present value of the expected future cash flows), which undergoes a specific development given as a probability distribution. From the obtained tree for the underlying asset, the tree for the option value and decision can then be calculated and used to make the decision, i.e., to exercise the option or not (step 3).

Considering different types of projects and decision situations, ROA offers different types of options (e.g., to invest, abandon, expand, contract, shut down, switch, etc.) with respect to the project specification and managerial actions which have to be undertaken. In the following analysis, we propose to combine the option to choose between the continuation, abandonment or expansion of the project (here: RES power plant).

3.1. Project Value for RES Power Plants

The project value (

) for each year of operation is simply given as:

where

denotes the revenues obtained from electricity generation from RES at time

t,

are the fixed operation and maintenance costs at time

t, and the WACC (weighted average cost of capital) is used as the discount rate. The expected lifetime of the project is

T years.

By calculating project values for RES, the determination of the revenues is connected with the uncertain development of the electricity price and power generation.

The price of electricity as a special commodity underlying reveals properties such as: high persistence to its long-term average level (mean-reversion), high volatility, seasonal patterns, price jumps and regional differences. To capture all these characteristics, different models for the electricity price development are proposed, e.g., the widely used geometric Brownian motion (GBM) model, the arithmetic Brownian motion (ABM) model, the mean-reverting proportional volatility model, the Ornstein–Uhlenbeck or the geometric Ornstein–Uhlenbeck model (for more information, see e.g., He [

44]). Moreover, the choice of the appropriate modeling method depends on different factors, e.g., the complexity and nature of the research problem, availability of the data set, or prediction accuracy. A comprehensive and useful overview of different methods and the direction of future research in the field of electricity price forecasting can be found in Weron [

45]. Debnath and Mourshed [

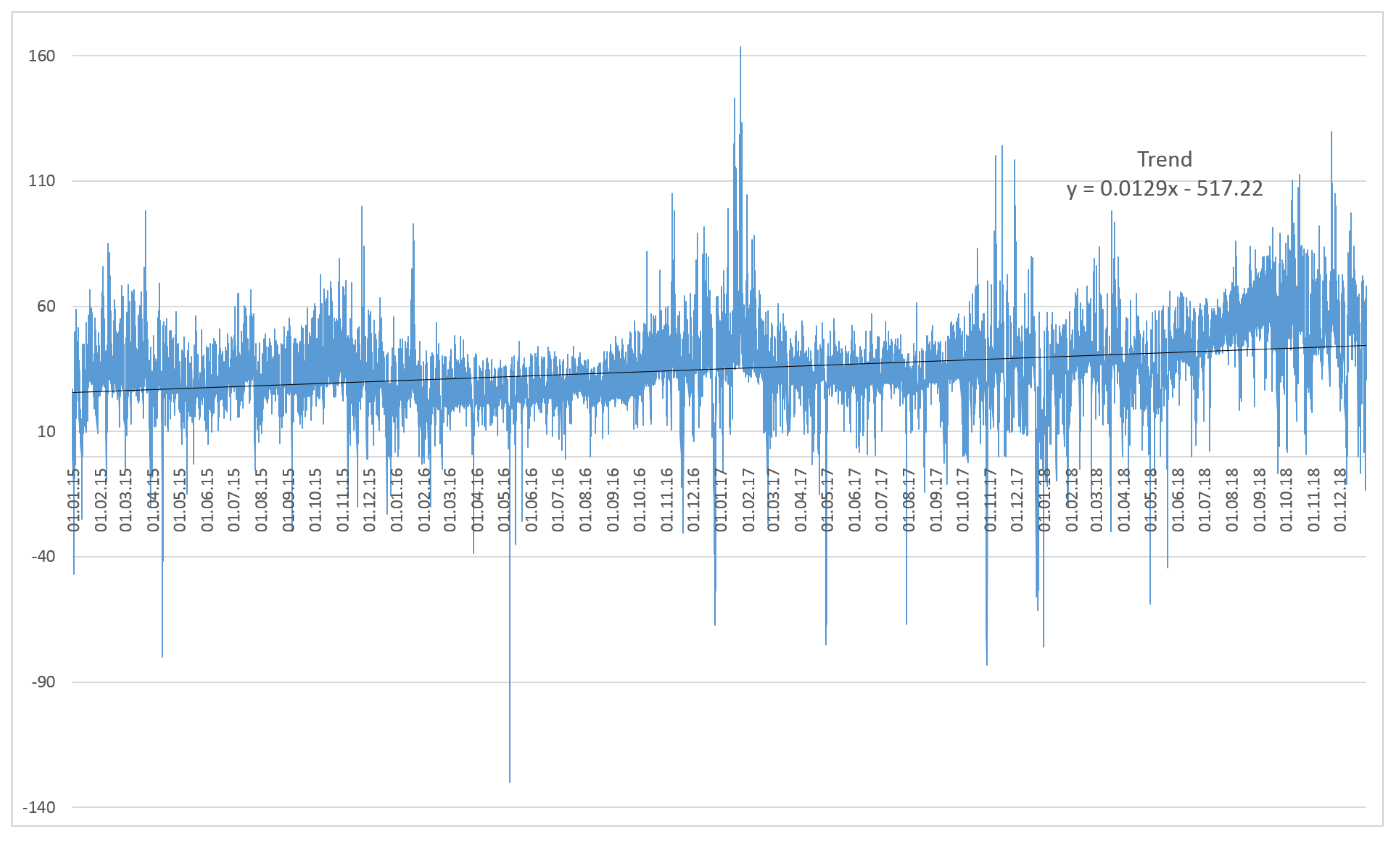

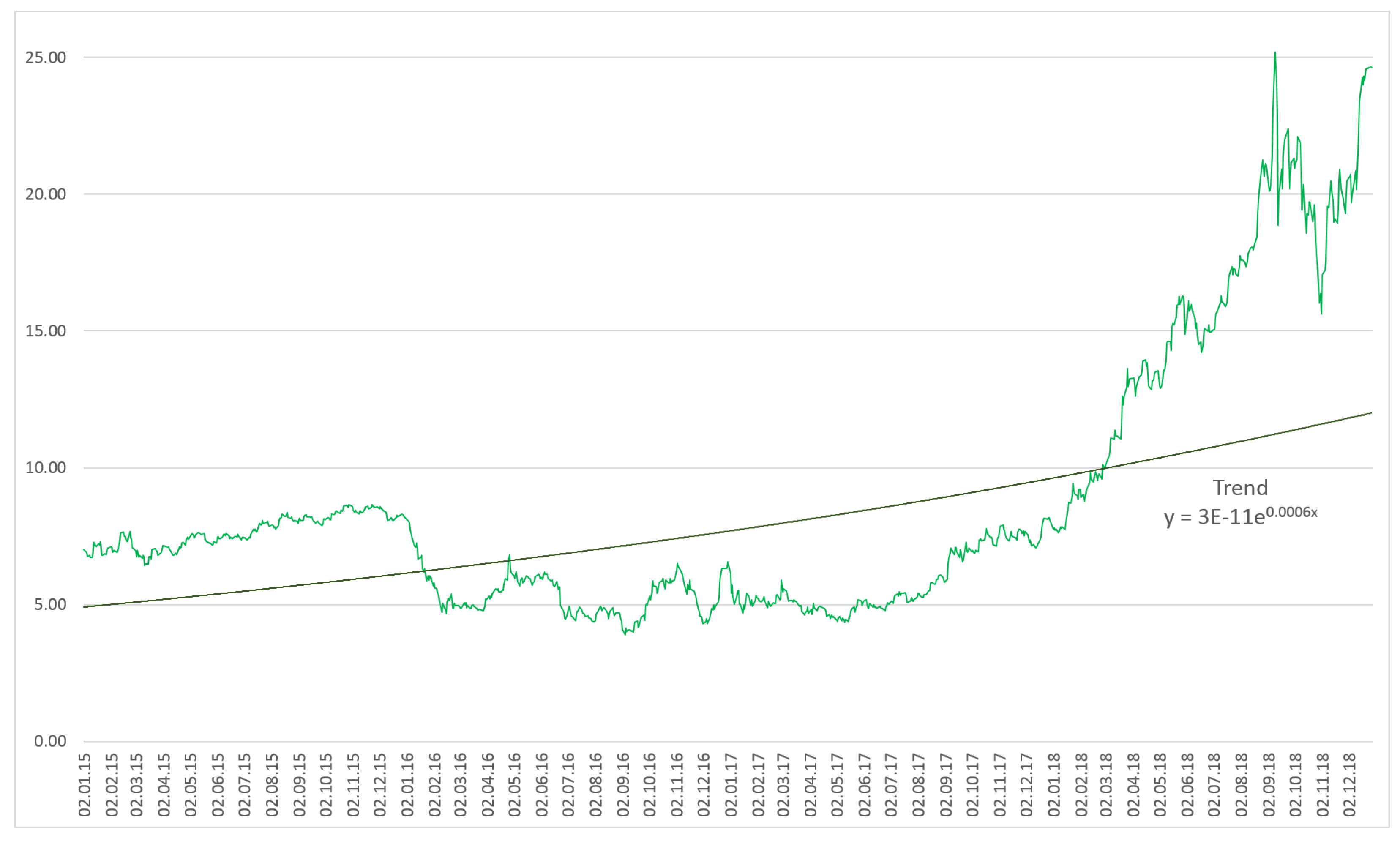

46] point out that, besides the statistical methods, the machine learning approaches have recently become increasingly popular. The ABM model represents the simple one-factor model, which captures very well the randomness of the electricity prices. Moreover, the ABM model offers an alternative to the standard GBM (often used in ROA), especially when the values of the electricity prices become negative [

47]. Negative electricity prices have emerged on the European Energy Exchange (EEX) since 2010, see [

48].

Using the ABM model for modeling the electricity price, it is assumed that the electricity spot price follows a Brownian motion process, i.e., a continuous-time random walk. For the long-term evolution of the electricity price [

49], an ABM process at time

t (

) is defined as:

where

(drift) and

(volatility) are constants,

represents a standard Brownian motion process at time

t,

is the time increment and

is a Wiener process.

The second uncertain parameter in the revenue calculation from an RES project is the annual energy production from wind and PV power plants. Regarding renewable energy technologies, this depends on the location of the power plant as well as the wind speed and solar irradiation, respectively, and has to be determined separately for each individual location and plant. The energy yields for wind parks and PV power plants correspond to a maximum and minimum value of the average annual full-load hours for these two technologies combined in different regions.

3.2. Binomial Lattice Approach

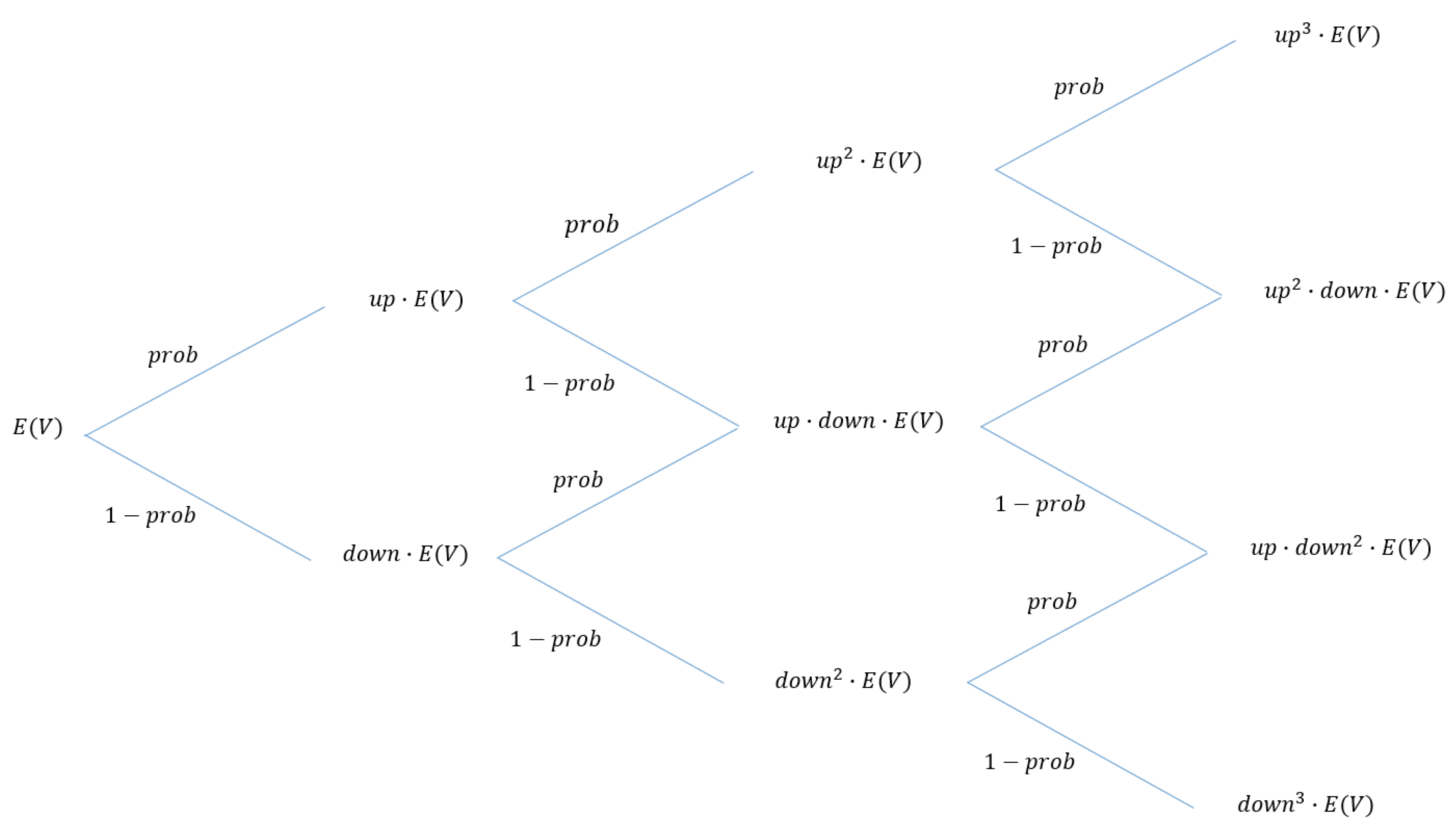

The binomial tree approach, i.e., a valuation method of real options in which the decisions are binary, can be seen as a special case of dynamic programming. This model uses a discrete time framework where the underlying variable varies (goes up and down by a specific multiplicative factor) via a binomial lattice (tree), for a given number of time steps between valuation date and option expiration. Nevertheless, some assumptions regarding the expected project value (underlying asset), whose distribution parameters are obtained from a Monte Carlo simulation (step 1), are necessary.

First, following the method of Cox et al. [

22], we assumed a normal distribution of the expected project value; the “up” and “down” movement parameters are defined as:

where

denotes the associated volatility and

the incremental time.

Figure 6 illustrates the binomial lattice valuation method.

Second, it is assumed that the investors are risk-neutral and that the “up” and “down” movements occur with probabilities

and (

), respectively, which take the value between 〈0,1〉 and sum up to unity. Because in ROA the values of the underlying asset are very often non-traded, the adequate formula for the

value calculation in such a situation is given as:

where

K is the risk-adjusted growth factor of the non-traded underlying asset (cf. [

50], pp. 33–38).

Furthermore, using the binomial lattice of the underlying asset and backward calculation, the option value tree (binomial lattice with option value) can be defined. The calculation begins at the last period (

), and the option value for each time is equal to the maximum between the continuation value, abandonment (disinvestment) value, or expansion (repowering) value, i.e.,

where

and

denote the project’s present values after an “up” or “down” movement in the subsequent time period

, respectively, and

the risk-free interest rate. The

in Equation (

7) is related to the technology and the

in Equation (

8) is the difference between the expected power plant value after repowering. A similar procedure using ROA was developed and used for conventional gas- and coal-fired power generation technologies and their flexibility (for more information, see [

14]).

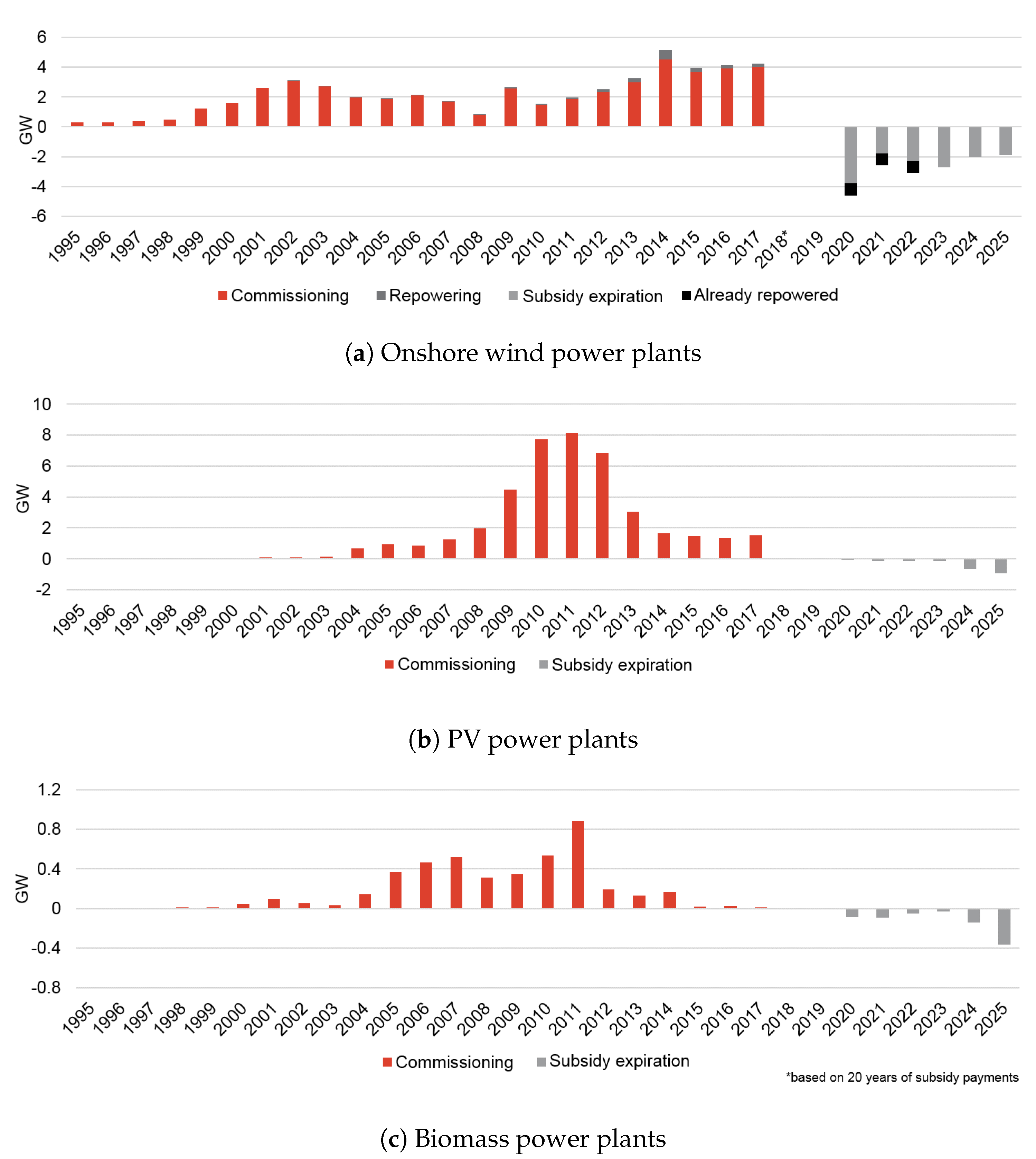

4. Case Study

In our case study, we analyze existing RES power plants in Germany for which public policy support will expire in the next years. The wind power generation technology will be mainly affected in the coming years. Based on the analysis by the Institute of Power Systems and Power Economics (IAEW) at RWTH Aachen University, in the year 2020, almost 4 GW of wind power plants will leave the subsidy scheme, and, in the following years 2021 to 2025, between 1.8 and 2.3 GW per annum (see

Figure 7a). Regarding PV systems, the share of subsidy expiration rises until 2025 and beyond (see

Figure 7b). Lower overall installed capacity of biomass power plants in comparison to onshore wind and PV leads to less biomass units leaving the subsidy scheme (see

Figure 7c). Moreover, the new policy regulation [

11] still accords existing biomass power plants a dominant position (see

Section 2.1).

When analyzing onshore wind power technology in our case study, we consider five different wind parks which will leave the subsidy scheme by 2021. The power plants are located in different federal states and have different installed capacities. Two of them are located in Saxony-Anhalt and were commissioned in 1999 with installed capacities of 10 and 94.5 MW, respectively. The other two wind parks were commissioned in 2000; one is located in Brandenburg with 4 MW of installed capacity, another one in Lower Saxony with 34.2 MW of capacity. Moreover, we have chosen one older wind park located in Lower Saxony and commissioned in 1993 with 44.5 MW of installed capacity and which is still in operation. Although the first PV systems will leave the subsidy scheme only in 2025 and later, we also analyze three PV power plants in our case study. Analogously to the onshore wind technology, the analyzed PV power plants are located in different federal states, i.e., two of them are based in Saxony and one in Saxony-Anhalt; they were commissioned in different years and have different installed capacities (see

Table 1).

The economic parameters for onshore wind and PV power plants needed for the analysis can be found in

Table 2. Note that O&M costs of wind power technology (presented in

Table 2) consist not only of maintenance and repair costs, but also of lease payment, insurance policies, reserves and other operating costs. The cost levels are caused by the operation year of the power plant, which means that some of the costs are higher when the power plant is operated beyond its technical lifetime of 20 years, whereas other costs, such as reserves, are no longer necessary. Additional costs for the operation period after 20 years are direct marketing costs and costs for technical expertise [

20].

The potential further operation of existing onshore wind and PV power plants is set to a duration of five years after public policy support expiration (this assumption follows the study of Quentin et al. [

13]). Without the policy support scheme, the generated electricity will be sold directly on the energy exchange. We evaluate the electricity price using an ABM process (as introduced in

Section 3.1). The time series applied for the evaluation are hourly electricity spot prices from 1 January 2015 until 31 December 2018 (from EEX). Furthermore, the electricity output by onshore wind and PV power plants is given as a probability distribution of the average annual full-load hours for wind energy and solar power for the last few years for each analyzed state [

57].

Regarding terminology, note that “repowering” in Germany refers to the complete replacement of older wind power plants with modern, more efficient ones. In contrast, in other countries, repowering often refers to the fundamental renewal and modernization of existing wind turbines with the replacement of essential components. Thus, in our model, repowering is considered as a new investment. This enables, based on the constant further development of technologies in recent decades, to triple the estimated wind power yield at repowered sites and a doubling of the rated output [

58]. We assume that by the repowering the installed capacity of the power plants increased by 75%, which also means that the

ExpansionFactor in Equation (

8) is equal to 1.75. The generated electricity, in this case, is assumed to be sold directly on the power exchange, just like for the case of a further operation of the existing plant.

5. Results and Discussion

Using the proposed methodology and analyzing the RES power plants introduced in

Section 4, the project values for five onshore wind and three PV power plants were simulated by applying the Crystal Ball software (version 11.1, ORACLE

®, Redwood City, CA, USA). The simulation results were used further to determine the binomial lattice for the underlying asset (project value) and option value. In the last step of the proposed procedure, the decision about further electricity generation, abandonment of the operation, or repowering, was undertaken according to Equation (

5).

Regarding onshore wind power plants and assuming a 5-year period for the further operation after the expiration of the public policy promotion, the decision about the continuation of electricity generation can be undertaken for all analyzed onshore wind power plants when the O&M costs are at the lower (1.81 €-ct/kWh) and mid (2.74 €-ct/kWh) level despite the level of the abandonment value (see

Table 3). In the case where the O&M costs are at the higher level (3.67 €-ct/kWh), the further operation of these power plants should be stopped for both considered levels of the abandonment value. These decisions (to continue or abandon electricity generation) should be undertaken immediately, i.e., in the first year after the EEG levy expiration. The option to re-power these existing power plants for further operation with the option to sell the generated electricity at the spot market is found to be non-profitable (negative project values).

From

Table 3, it can be noticed that the size of the possible market potentials of onshore wind power plants without EEG policy support depends on the level of the O&M costs.

As soon as permission for the further operation is granted, and all individual technical tests for structural stability of the power plant are positive, the subsequent continued operation can be longer than the typical expected five years proposed, such as in the study of Quentin et al. [

13]. For the power plant owners, it can mean more profit at small costs.

Table 4 presents the results obtained when the prolonged operation is 10 years instead of 5. In the first five years, the clear decision to continue the generation is reflected in the results presented in

Table 3 (for lower and mid-level O&M costs). Considering the operation year number six after the EEG levy expiration and beyond, the situation changes. Here, the decision to continue can be taken with decreasing probability with every year of further operation. The results presented in

Table 4 are the same for all analyzed onshore wind power plants, both residual values taken into consideration, and 1.81 €-ct/kWh and 2.74 €-ct/kWh values for the O&M costs. This is connected with the probability value for the “up” and “down” movements given with Equation (

4) and the obtained decision (continue or stop) in each year of the possible further operation considered in the analysis. For O&M costs of 3.67 €-ct/kWh, the decision is always to stop generating electricity.

Regarding the PV technology, three PV power plants with two different levels of O&M costs and one level for the abandonment value (see

Table 2) are analyzed. For the O&M cost level of 33 €/kW per annum and an abandonment value of 5% of the new investment costs, the simulation results are presented in

Table 5. In contrast to the results obtained for onshore wind power plants, only in the first year after the EEG levy expiration is the decision definitely to continue electricity generation. For the next four out of the assumed five years of possible further operation after the EEG levy expiration and additional five years (i.e., assuming 10 years of possible further operation), the decision regarding the continuation of the operation is supported by a probability which decreases with the increasing number of years. For O&M costs of 2.5% of new investment costs, the decision is always to stop electricity generation for both the five and ten years after the EEG levy expiration.

Thus far, the analyzed parameters which definitely bias the decision about the operation of RES after expiry of the policy support schemes are the level of the O&M costs and the length of the further operation time. Nevertheless, the most important profitability indicator and source of uncertainty is the electricity price. In the methodology applied, the ABM process was proposed in order to reflect the stochastic character of the electricity spot prices. With the presented results in

Table 3,

Table 4 and

Table 5, the electricity prices were simulated using an ABM process where the historical time series of the hourly electricity spot price from 1 January 2015 until 31 December 2018 from the electricity exchange (EEX) in Leipzig was applied. The simulated electricity prices were parametrized by a logistic probability distribution with a mean value of 34.53 €/MWh and a scale factor of 8.64 €/MWh.

Trying to analyze the impact of different electricity price scenarios on the possible decision and profitability of RES after EEG levy expiration, the spot market electricity price simulation conducted by the Institute of Power Systems and Power Economics (IAEW) at RWTH Aachen University was also applied to the presented case study. In this scenario, the simulated electricity prices were parametrized by a logistic probability distribution with a mean value of 47.23 €/MWh and a scale factor of 4.06 €/MWh. The results of this analysis for the onshore wind power plants are presented in

Table 6. Here, despite the O&M costs level and abandonment value in the assumed five years’ operation period after the EEG levy expiration, the decision to continue should be made for all five onshore wind power plants (the probability to continue is equal to 1—see the first row in

Table 6). This already shows some differences from the results obtained in the first analysis and presented in

Table 3 and

Table 4. Moreover, also in operation year number 6, the decision to continue is valid for all analyzed wind power plants with a low level of O&M costs and both abandonment values (

Table 6, second row and second column) as well as for mid-level O&M costs and a lower abandonment value—AV2 (

Table 6, second row and fourth column). In the next years of prolonged operation (7 until 10), the probability value for the decision to continue decreases with increasing operation years (similarly to the results presented in

Table 4). The significant difference from the previous analysis can be observed for the O&M cost level of 3.67 €-ct/kWh. In the first analysis, the decision for this O&M cost level was to stop operation despite the abandonment value (see

Table 3 and

Table 4); in the second analysis, the decision was to continue for the first five years of extended operation and, with decreasing probability, for the years 6 until 10 (

Table 6, column five).

Regarding the PV technology, the results obtained for the electricity price simulated by IAEW are the same as those obtained in the first analysis (

Table 5). It means that, to make the further operation of PV power plants more profitable, the electricity price at the spot market should definitely be higher than the values for the time period studied.

Another source of uncertainty implemented in the project value simulation is the electricity output of onshore wind and PV power plants. This output depends on wind speed and solar irradiation, which both vary by region and power plant location. Although the analyzed onshore wind and PV power plants are located in different federal states of Germany, the electricity output determined by the average annual full-load hours for wind energy and solar is similar.

A short sensitivity analysis regarding this stochastic parameter reveals that, if the probability distribution of the average annual full-load hours for wind energy and solar irradiation is comparable, the installed capacity and the location of the power plant do not matter (i.e., the mean value and standard deviation of the project value after the simulation are almost the same). Comparing the power plants from the same federal state, it can be noticed that the mean value and standard deviation of the project value after the simulation are also almost identical, regardless of the installed capacity.

Table 7 summerizes the results obtained in the case study regarding the impact of different parameters on the decision to continue or stop the further operation of the existing power plants.

6. Conclusions and Policy Implications

The feed-in tariff policy in Germany was widely used to promote the development of renewable energy. Nevertheless, regime changes in the RES support schemes (from feed-in tariffs to market premium and direct marketing to capacity auctioning and pay-as-bid-based premia for larger-scale assets), including siting restrictions, also change the rate of (net) increase in RES capacities installed. Moreover, the public policy support schemes have often been limited to the expected lifetime of the power plant. With the reached lifetime and expiration of the support scheme, continued operation of many RES power plants (especially onshore wind) is questionable. From a technical point of view, the further operation is possible, but the profitability of the power plants whose generation output should be sold on the electricity exchange is not clear. Moreover, regarding the turning-off of many RES power plants, the achieving of the aims of the Energiewende could be a problem if suddenly more RES power plants (in terms of installed capacity) are switched off than new ones commissioned. This can put the Energiewende at Risk.

Different studies, mentioned in

Section 2.1, have tried to discuss this topic and to analyze which options of further operation are possible and which requirements (especially regarding the comparison between the future costs and revenues) have to be fulfilled. They mentioned, for example, the combined use of RES with storage systems (see e.g., Franzen and Madlener [

34]), or with other conventional technologies (e.g., Pless et al. [

59], observe synergies between natural gas and renewable energy technologies in the US energy system, the results of which show that the hybrid system of natural gas and renewable energy technologies is more favorable in comparison to the single one).

In contrast to these studies, we propose the use of ROA in order to support the decision-making process regarding the following three possibilities: (1) to continue the operation without public policy financial support (here: feed-in tariffs), (2) to stop operation, and (3) to repower the existing power plant with the sale of electricity also at the spot market. Here, it is possible to analyze all economic parameters, also with their stochastic character, which impact the revenues and profitability of the existing RES power plants. In the analysis conducted, we consider different levels of O&M costs as well as different abandonment values. As our results show, the level of the O&M costs is one of the more significant factors impacting the decision to repower the power plant, to continue or to stop the electricity generation. An important profitability factor and source of uncertainty is also the electricity price at the spot market. Its development in different scenarios (given by the probability distribution) affects the decision about the possible options. For higher levels of the future electricity price, higher revenues are expected and thus an increase also of the profitability of the RES power plant. Regarding these two parameters, it should be noted that the sufficient spread between the level of the specific O&M costs and the electricity price development makes the operation of a RES power plant profitable and enables continued generation. Furthermore, the profitability of RES power plants such as wind and PV depends on the weather conditions (i.e., wind speed and solar irradiation), which brings more uncertainty into the model. In our model, this is simplified. We apply the average annual full-load hours for wind energy and solar PV for different locations and use the probability distribution of the annual full-load hours to evaluate their development.

The proposed approach (1) extends the knowledge from previous studies (which have favored a more static analysis) regarding possible options for RES which, in the next few years, will lose public policy support; and (2) offers a simple decision support tool but still considers different stochastic parameters. Nevertheless, the model parts connected with repowering and abandonment still need some improvements. In addition, an improved estimation of power generation output in different locations can enhance the model results.

With regard to the conducted analysis, the stabilization of the spot market electricity prices above the current level, but also innovative marketing models, could be used to contribute to the further use of climate-friendly technologies such as wind and solar beyond their originally envisaged lifetime. This can help also to achieve the main aims of the German sustainable energy transition (

Energiewende), which has been seen as an important model and testbed by many other countries worldwide. For example, in the European Union (EU) alone, 18 Member States use FIT schemes (similar to the German system) which guarantee the premium for a period of 10–20 years (for more information, see [

60]). Those policy support instruments should help to achieve not only national goals regarding the electricity generation from renewable energy sources, but also the EU renewable energy targets2030 (32% overall share of energy from renewable sources, 14% energy from renewable sources in transport, cf. [

61]). Nevertheless, in many EU countries, the revisions of single policy instruments over the last few years have been mostly related to the FIT scheme, aimed at ensuring that the financial support complies with the changing economic and market conditions. This need has been triggered by the significant cost reductions in renewable energy technologies (e.g., requiring reductions of FIT rates for PV for the new installations) and the decrease of subsidies through more competitive support schemes (e.g., the introduction of competitive capacity bidding processes e.g., for wind power plants) in a number of European countries [

62]. From this perspective, the proposed model can support the decision-making process of firms and policy-makers alike in countries facing the problem of further operation of RES power plants after expiration of the support scheme.