Abstract

The integration of shiftable/curtailment distribution generators (DGs) along with quick-response storage has not only increased the transaction’s flexibility but also puzzled the bidding willingness of transmission-connected market players (TMPs). In this paper, the method of heterogeneous decomposition and coordination (HGDC) is applied to decompose the integrated transmission-distribution market framework into a bi-level problem with a transmission wholesale market master problem and several distribution retail market subproblems in a decentralized organization structure. The price-based bidding willingness of demand-side resources’ (DSRs’) aggregator is simulated considering the relation between distribution system operator’s (DSO’s) operation modes and its equivalent market transactive price. Besides the traditional mixed-integer linear programming (MILP) model, the active reconfiguration model of DSOs based on mixed-integer second-order conic programming (MI-SOCP) is proposed to rearrange its operation switch status and elaborate its operation cost according to the market transaction. Multi-period optimal operation modes could be obtained through an HGDC-based iteration process by coordinating the transmission system operator (TSO) with DSOs and considering the market energy equilibrium and reserve requirements for security considerations. Karush-Kuhn-Tucker (KKT) conditions are used to testify the optimality and convergence of the bi-level model in theory. The T5-3D33 case is employed to illustrate the efficiency of the proposed model and method.

1. Introduction

1.1. Background and Motivation

Distribution system operators (DSOs) have traditionally been responsible for the reliable and economic operation of power distribution systems which has been independent from the transmission system operator (TSO) [1]. From the traditional monopolized power industry to the gradually decentralized developed context of the competitive electricity market with advanced ICT facilities, the integrated ISO/RTO market could be decomposed into the wholesale market in the transmission system and retail markets in the distribution systems [2,3]. Accordingly, a more volatile and unpredictable operation pattern is imposed to DSO, acting as an intermediary [4] and coping with transaction issues between TSO and demand-side resources (DSRs) aggregators. However, events such as the cooperation failure [1] of TSO and DSOs which led to low physical and economic performances as a lack of reserve sharing, the recurrence of price spikes due to congestion which gave rise to market malfunction, and even major area blackouts arising from the switch equipment’s shifted breakdown in a distribution system reveal that a number of unresolved issues remain a challenging concern about the decomposition and coordination [2,3] of TSO and DSOs in the decentralized market environment.

The integration of the intermittent generation in TSO has created critical uncertainties on the market equilibrium, while shiftable/curtailment distribution generators (DGs) with fast-response storage in the distribution system add to the flexibility of the integrated system. The research and application are focused in fields of T-D bidirectional market liquidity of energy transaction [4] and DSO’s flexibility resources sharing [5]. Both the market flexibility of energy transaction and reserve sharing puzzles the price-based bidding willingness of all market players (MPs). Therefore, this is especially hard to coordinate TSO and DSOs in a security-constrained market clearing (SCMC) environment. What is more, it is also inconceivable for TSO with designated DSO(s) to make a multi-period optimal operation mode in the wholesale market, satisfying the maximization of integrated social welfare including the DSOs’ payoff without deviating from its security-based constraints. Furthermore, besides the economic-based bidding strategy to make, it is even harder for DSO to model its physical operation decision-makings, such as network reconfiguration, according to market equilibrium and security considerations.

1.2. Literature Review and Contributions

Many pieces of literature already existed in the fields of Transmission-Distribution market operation, focusing on aspects of decomposition and coordination. Reference [4] proposes a general framework for the energy transactive market with TSO and DSOs coordinating through an iterative solving process. Reference [6] solves a bilevel problem of the energy acquisition strategy for a Disco with DGs and interruptible load (IL) by a nonlinear complementarity method which, however, is hard to implement into larger-scale systems. In general, there are two types of decentralized optimization mathematical methods: the dual decomposition family (DD-F) and optimality condition decomposition family (OCD-F). The DD-F is to relax the coupling constraints into a Lagrangian and its derivative. In References [7,8], a multiarea AC-OPF is decomposed and solved using the Lagrangian Relaxation (LR) method and Duality theory. Tie-lines are modeled as generators (or demands) which sell (or buy) energy at the spot price set by the regional coordinator. OPF subproblems are solved for each area and coordinated through an iterative update of Lagrange multipliers associated with the coupling constraints. Reference [9] applies the LR method to get the optimal ED solution in the multi-area problem. However, the LR method relies on the initial guess of the Lagrange multipliers, which needs a complex parameter modulation process and has a low convergent ratio, although it could be applied in large-dimension systems. The OCD-F includes homogeneous decomposition methods and heterogeneous decomposition methods. Reference [10] proposes a homogeneous decomposition method to tackle the multi-area dispatch problem through a price exchange mechanism between adjacent areas, which need a coordinator. References [11,12,13,14,15] propose a generalized master-slave-splitting (G-MSS) method based on the heterogeneous decomposition (HGD) method which is applied in the fields of transmission-distribution OPF, economic dispatch, voltage rise problems, etc. It has been testified that the technical problems of power mismatch existed at the boundary buses of transmission-distribution systems could be eliminated. It does not need a coordinator and it is with a lower computation burden and reduced iterations.

Most of these works could be summarized in application as the equivalent agent-based loads/generators with a demand response (DR) in the power system, emphasizing the importance and benefit of the existence of cooperation. References [16,17] use the agent-based method to tackle with multi-microgrids’ cooperation which, however, does not include the network constraints in the distribution systems. In References [18,19], the two-stage coordinated approach for microgrid energy management is proposed in both the grid-connected mode and islanded mode. The operation objective of grid-connected microgrids is to maximize revenues according to DG bids and the market price as the load demand can be met all the time; while that of islanded microgrids is to keep a reliable power supply to customers.

In the wholesale market, the DSOs’ participation behavior in a different extent is mentioned in Reference [20]. As in Reference [3], DSOs could participate in different markets like the capacity market, ancillary market and energy market. Reference [21] illustrates the benefit of shiftable/curtailment DR in fields of shaving peak load, the elimination of large price spikes, reducing transmission congestion, leaving sufficient generation resources in particular at peak hours, lowering the exercise of market power and reducing the system operation cost by reshaping the load profile. Traditionally, power transmission and distribution systems physically coordinate to some extent but seldom financially. In the distribution system, the bidding willingness coefficient as a decision-making reference for market players and its physical network reconfiguration to simulate remote switches as DR, are seldom mentioned in one research paper. Generally, the DSO’s bidding strategy [22,23,24] is modeled as a price-based unit commitment (PBUC) problem [25] in which the market player can maximize its payoff by estimating its opponents’ bidding strategies and utilizing the equilibrium/game theory to simulate local marginal prices (LMPs). In Reference [26], the MILP-based bidding model is proposed to maximize the expected revenues from the day-ahead energy, reserve and FRP markets. In Reference [27], the spatial correlation of wind power (WP) generation is considered in developing a robust DSR bidding strategy which takes into account individual and cooperative aggregators. The Aumann-Shapley procedure is applied in this paper to allocate the payoff among cooperative DSR aggregators considering potential uncertainties. Reference [28] proposes a new strategic bidding model for a load-serving entity (LSE) with a coupon-based DR mechanism to enhance the net revenue of LSEs and minimize the generation cost of ISO. In the most recent literature, the flexibility resources in DSO as DR are not just about shiftable/curtailable bidding loads but also referred to the controllable distributed generations (DGs) which could adjust offers. DGs could be able to leave the ramping margin by coordinating with storage capacity (e.g., charging a Na/S battery or a pumped-storage power station) without deviating from its maximum power. The flexibility also means the distribution network could be reconfigurable actively according to its energy transaction to minimize the DSO’s purchasing cost. For the DSO’s physical network reconfiguration as DR, Reference [29] proposes an algorithm to optimally control the active elements of the network, DGs and responsive loads by the deployment of remotely controlled switches (RCSs). Reference [30] proposes a mixed-integer second-order conic programming (MI-SOCP) model of DSO to reduce its power loss and simulate its open-loop network reconfiguration with controllable switches. Reference [31] proposes a decentralized transmission switching to manage congestion by considering credible contingencies.

It is difficult to coordinate transmission and distribution systems in a centralized manner due to privacy issues, large diversity and high computational complexity. In this paper, the integrated market framework is decomposed into the wholesale market in the transmission system and retail markets in distribution systems with a decentralized organization structure. The contributions of this paper could be summarized below.

- First, a G-MSS method based on heterogeneous decomposition and coordination (HGDC) is for its first time put into application in the field of the decentralized transmission-distribution market operation (TDMO). A bi-level model of TDMO based on the HGDC algorithm is proposed to implement energy transaction and reserve sharing through all available flexibility resources accessible in the integrated system, which is different from the classic LR method. The HGDC algorithm does not have a parameter tuning issue and does not require a central coordinator which is compatible with the current EMS software. It has been proven optimality and the convergence properties are not limited to only convex problems. It is computationally efficient with a lower communication burden and reduced iterations. Different from Reference [13] is that the method used in the market operation needs a coordinator to set bids/offers and its decision making of the market players both in TSO and DSOs. As the network and generator parameters of the TSO and DSOs are currently always non-observable to each other for scale calculation consideration, the HGDC algorithm is ideal for TDMO which is testified for its local optimization and fast convergence characteristics in theory, regardless of what the network model transmission or distribution system would use.

- Second, the strategic behavior of DSOs, including the DSRs aggregators’ bidding willingness and DSOs’ physical network reconfiguration, is implemented and simulated in detail. Under the assumption that only the energy market is implemented, the strategic bidding willingness of DSRs’ aggregators is constructed as constraints and simulated in the TSO wholesale market based on the optimization method, which differs from game theory in many of the research articles about microgrid’s bidding. By contrast with the mixed-integer linear programming (MILP) model, an extra MI-SOCP model [30] of DSO is applied to elaborate its power loss and its open-loop network reconfiguration according to the specific transaction.

- Lastly, the benefit of HGDC-based TDMO is demonstrated in cases from different aspects to testify its effects, which broadens the application of this method. To tackle with the influence of market equilibrium uncertainties, flexibility in distribution systems, including DGs’ shiftable/curtailment offers and DSO’s open-loop network reconfiguration, could be fully implemented and simulated to thereby replace high-cost centralized units with less costly generation and defend (N-1) contingencies from congestion in the transmission system. It indicates that the TDMO mode based on the HGDC algorithm is more economic and reasonable than the independent transmission operation mode which, for system operators, means an improved cost-effectiveness of the integrated market, the elimination of huge price spikes arising from unnecessary congestion through relatively reasonable LMPs, a more feasible redistribution of power flow after the (N-1) contingence and a more market-wise decision-making strategy to follow for market players.

1.3. Paper Organization

The rest of the paper is organized as follows. The proposed framework and its formulation for the multi-period integrated transactive market of the transmission-distribution system are illustrated in Section 2. The MILP formulation of the network model applied in TSO and DSOs along with the optimal market-wise strategic bidding willingness of DSRs’ aggregators are presented in Section 2 including the extra MISOCP-based reconfiguration model of DSOs. The price-based iteration convergence and its HGDC-based solution are also illustrated in Section 2. Case simulation results and analysis are presented in Section 3 and a brief conclusion is provided in Section 4.

2. Joint Transactive Formulation of TSO and DSOs

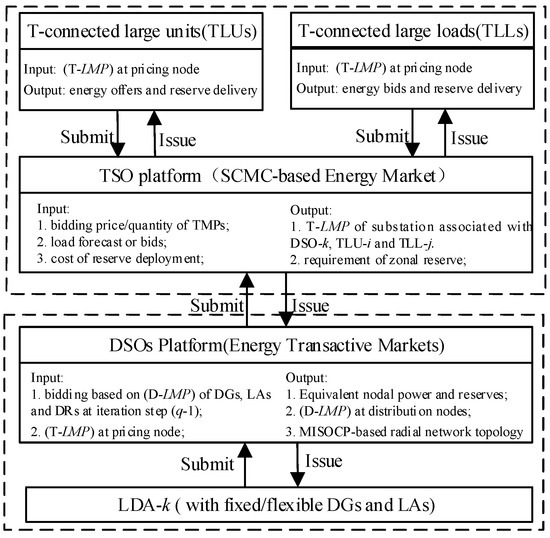

The proposed model for the joint operation of energy and reserves considering the interaction between TSO and DSOs is shown in Figure 1. In this framework, the transmission-connected market players (TMPs) in the transmission grid level include DSRs’ aggregators operated by DSOs, transmission-connected large units (TLUs, including traditional units and large-scale renewable energy resources, like wind power) and large loads (TLLs, like direct power purchaser). DSOs interact flexibly with both TSO and DSRs within local distribution areas (LDAs). LDAs includes fixed/flexible DR resources like DGs and load aggregators (LAs).

Figure 1.

Transmission system operator-distribution system operators (TSO-DSOs) coordinated the multi-period market with joint optimization of energy and reserves.

By contrast with the centralized ISO, in this paper, the maximum function of DSO is considered. Each flexible load area is represented by one DSO as an equivalent prosumer (producer/consumer). DSO aggregates and coordinates all DSRs within each LDA. DSO submits a single bid to TSO through the equivalent individual T-D interface (substation) which is named the pricing-node [3]. The wholesale transactive market is operated by the TSO at the transmission level. TSO receives bids/offers from all TMPs and set the transaction prices of energy (LMPs) and reserves (MCPs) at pricing nodes. DSOs operates retail transactive markets which feed back the bids of the total demand dispatch to TSO. The iterative and flexible interactions between the TSO and DSOs are modeled as a bi-level formulation which focuses on both minimizing the system operators’ integrated purchasing cost and satisfying the integrated reserve requirement based on HGDC.

In the TSO level, the DSRs aggregator within each LDA operated by DSO are modeled as equivalent load-shifting and load-shedding DG entities with a flexible bidding willingness to engage in the energy market. To account its maximum of payoff, DSOs are under a market option whether to decrease PT-D to transact energy with LDAs or increase PT-D to transact energy with TSO. In the DSO level, TSO is modeled as a power injection source at the pricing node from the DSO’s point of view.

To simulate the optimal transaction of TSO and DSOs, the formulation of network models is proposed, and it is assumed that every market player (TMP or DMP) is bidding close to their marginal clearing price with a price-taking strategy regulated in each iteration. Bidding is assumed to both reflect the market participants’ true costs and represent its willingness of market behavior within its flexibility.

2.1. TSO Wholesale Market Simulation Model

The master problem is for TSO to be responsible for deciding energy T-LMPs and reserves T-MCPs for each TMP. The TSO wholesale market allows bidding for multiple products, namely, energy and regulation up/down reserve including DSOs’ DR-based bids. The wholesale market model could be composed of the classical TSO SCMC model and DSOs’ market-wise behavior constraints which is a MILP and non-convex problem.

2.1.1. Formulation of SCMC-Based TSO Wholesale Market

In the TSO wholesale market, the objective in Equation (1) is to minimize the purchasing costs of both energy and reserve services in the transmission system. The power dispatch at boundary buses is sent from DSOs at each iteration. It is subject to transmission operational constraints, such as the system power balance constraint (Equation (2)), the generator minimum ON/OFF time and its ON/OFF status constraints (Equations (3)–(6)), the generator startup and shutdown cost constraints (Equations (7) and (8)), the generator ramp-rate limit constraint (Equation (9)), the line capacity constraints (Equation (10)), the generator reserve power constraints (Equation (11)), the system reserve power balance constraints (Equation (12)) and the feasibility-check constraint of anti-peak regulation with wind power (Equation (13)). ZÎ{RU, RD}, X = {T}, t = {1,…, Th}, Th is the time horizon, I = {1,…, }, m = {1,…, }, k = {1,…,}, = {1,…,}.

2.1.2. Formulation of DSRs Aggregator’s Market-Wise Bidding Willingness

The DSRs aggregator participates in the energy transaction with TSO as a DR-based prosumer while meeting the regulation reserve requirement. In the energy-only market, it is assumed that all MPs are bidding their prices according to cost characteristics or bidding their quantities according to operation modes. Thus, the DSRs aggregator’s DR-based bidding willingness could be simulated.

In Equation (14), by contrast with the last iteration (q – 1)-th results, the decreased value of the T-Dk boundary power in q-th iteration is (the positive value means decreased). In Equation (15), is the known LMP at the pricing node of the DSO’s side in the last (q – 1)-th iteration, is the known LMP at pricing node of the TSO’s side in the last (q – 1)-th iteration. DSRs aggregator’s bidding willingness behavior coefficient in the q-th iteration has its limits, as shown in Equation (16). The bidding willingness coefficient is decided by the coordination of the coupling relationship between the variation value of the T-Dk boundary power and the energy LMP gap on the pricing node of the TSO and k-th DSO side. In Equation (15), if energy willing bidding price of the DSRs aggregator in the next iteration exceeds T-LMP when the DSRs aggregator is treated as a price-taker in the last iteration (the bidding coefficient equals to 1), then the TSO would decrease its T-Dk boundary power which means because of the DSRs aggregator’s increased bidding willingness, and vice versa.

2.2. DSO Retail Market Model

The slave problem is to minimize the purchasing cost of DSOs based on T-LMPs on the pricing nodes and D-LMPs of DSOs in the last iteration, as shown in Equation (17). Iteratively, each DSO provides a flexible demand response which is a dynamic priced-based coordination with the TSO for energy transaction and reserve sharing considering the game of benefit between the wholesale market and retail markets. Different modeling methods could be used in DSOs only if the clearing price in TSO is properly evaluated.

2.2.1. MILP-Based DSO Model

Besides the normal start-up/shut-down constraints of DGs which is the same formulation (Equations (3)–(9) and (11)) with X = {D}, the model is also subject to the nodal power balance equation constraint at the boundary nodes (Equation (18)), the nodal power balance equation constraint at inner nodes (Equation (19)), the T-Dk power limitation constraints (Equation (20)), the line power equation with its limits constraint (Equations (21) and (22)), the DGs’ dispatch variation at iteration q (Equation (23)), the maximum DGs’ load curtailment constraint in iteration q within the permitted time periods with the help of storage installed as DR (Equation (24)), the maximum demand time interval ramping constraint of DSO (Equation (25)), the zonal regulation-up/regulation-down reserve constraints of the k-th DSO (Equations (26) and (27)), the DGs’ generation and their regulation reserve limitation constraints (Equations (28) and (29)). dg = {1,…, }, k = {1,…, }, = {1,…, }.

2.2.2. MISOCP-Based DSO Open-Loop Reconfiguration Model

To simulate the characteristics of open-loop operation topology and its active reconfiguration with remotely controllable switches as DR, the MI-SOCP model of DSO is proposed to elaborately rearrange its operation modes according to the transaction levels and contingency circumstances, if any. The MI-SOCP model in Reference [30] is simplified and applied in the distribution systems with enhancing advantages of reducing purchasing cost, eliminating transmission congestion and elaborating its power loss. The reactive power is simplified according to a fixed power factor.

The optimal DSO topology in the market environment is the transaction-oriented equivalent spanning tree. The necessary condition for network radiality is shown in Equation (30), which could be derived directly from below; Equations (31)–(35).

To reformulate the power flow constraints in terms of its continuous variables as a convex SOCP, auxiliary variables are introduced in Equations (36)–(38) with their upper bound and lower bound constraints in Equations (39)–(41), which are rewritten from the voltage limits constraints. When the power flow in line (i,j) inverses, Tij could be in its opposite direction. Tij = −Tji.

The original line power constraints (Equation (21)) is replaced by its SOCP-based reformulation (Equation (42)). The original line ampacity limits (Equation (22)) is replaced by the squared line current ampacity expression (Equation (43)). The rotated conic quadratic constraint is given by the constraint constituted of auxiliary variables (Equation (44)). .

By contrast with the MILP model, the MI-SOCP model gives a more vivid and active illustration of the DSO network with controllable line switches as DR.

2.3. Convergence and Solution Based on HGDC

2.3.1. HGDC-Based T-D Iteration Convergence and its Optimality Testification

There is an intricate coupling relationship among the iteration-oriented T-D boundary variables. The slave problem of the DSO in the q-th iteration could be summarized as shown in Equation (45). The master problem of TSO in the (q + 1)-th iteration could be illustrated in Equation (46). The iteration-oriented LMP relationship between TSO and DSOs could be given in Equation (47).

Through the iteration calculation method, the results of market operation could be coordinated to its optimization when the T-LMPs(q) and T-LMPs(q + 1) are almost the same at convergence. More specifically, by solving the KKT conditions about and in the centralized and decentralized model, we can conclude that if at convergence, the HGDC solution must satisfy the optimization condition according to Reference [13]. This optimal solution is testified in theory to meet the KKT condition of the centralized TDMO problem. If any security-based re-dispatch circumstances caused by contingencies occur, its optimal solution could be changed.

2.3.2. Decentralized Solution Based on HGDC Algorithm

For practical applications, estimating a reasonable value of boundary power is usually simpler than estimating T-LMPs. Thus, the iterative algorithm beginning from the TSO master problem may be more suitable for most cases. The initial guess of the boundary power could be represented as the total loads of the DSO if DGs are at the small scale or the difference between the DSO’s total loads and generation forecast of the DGs if DGs are in the large scale. The decentralized solution is as follows.

- Initialize for , t = {1,…, Th}, q = 1.

- Solve the TSO master problem and send the obtained LMPs and MCPs to all TMPs, including DSOs.

- With the updated and with price-takers’ bidding strategies, solve the slave problem of k-th DSO to obtain , which is sent to TSO.

- Make a convergence judgment. If for , t = {1,…, Th}, then exit the iteration. Otherwise, q = q + 1, if q is no bigger than the maximum iteration number, go to step 1 to continue the iteration. If q exceeds the maximum iteration number, exit the iteration.

- End the iteration with the obtained optimal transaction results and DSRs aggregator’s strategic bidding willingness coefficient.

3. Case Studies

3.1. Basic Idea for Transaction Cases

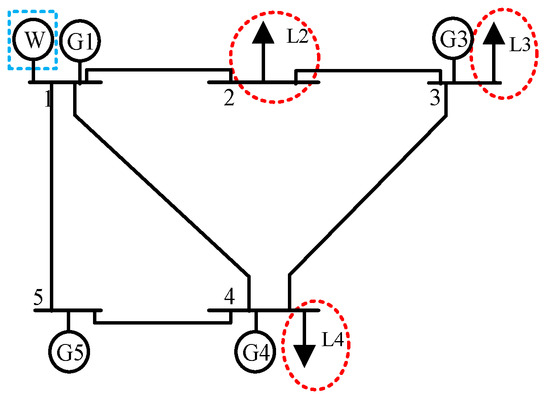

The basic data case is T5-3D33, which means the modified PJM 5-bus system (T5) [32] is used as the transmission system data, which are displayed in Figure 2 and three of same IEEE 33-bus systems (D33) in Reference [33] are used as the distribution system data. The controllable DGs with storage units installed as the DR in DSO are listed in the bus set: {3 7 8 12 18 20 25 31}. The maximum capacity of the storage is the same as that of DGs. All the loads of DGs in DSOs have shiftable/curtailment characteristics.

Figure 2.

The PJM 5-bus system of the transmission system.

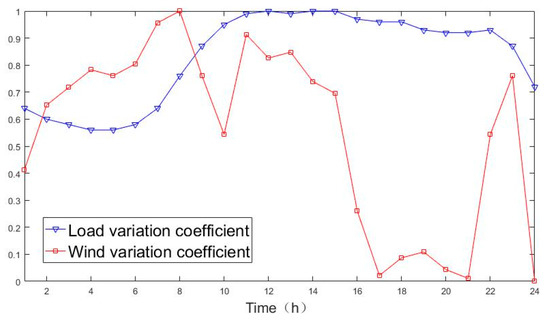

The wind power and load profiles are simulated in TSO as shown in Figure 3, while the DSOs are coordinating with transmission-connected GenCos to cope with the power variation from both the load and wind in the wholesale market. The flexible transaction in DSOs’ retail markets should satisfy the integrated regulation reserve requirement.

Figure 3.

The system peak regulation characteristic with wind generation.

There are five cases which could be used to validate the proposed method and model as efficient to obtain the day-ahead 24 h optimal TDMO mode.

- Case 1: The TSO is independently operated from DSOs. The wholesale market is based on cost-based energy bidding while considering the integrated reserve requirement. This is nominated as the independent transmission operation mode (IT-OM).

- Case 2: Based on Case 1, the TSO and DSOs are iteratively coordinated with a node power forecast of (PD-Pdg) as the first-iteration estimation of the T-D boundary power where Pdg is the forecasted value of the DGs’ total output in the distribution system. The estimation of the T-D power mismatch in the following iteration is zero. This is nominated as the transmission-distribution operation mode (TD-OM).

- Case 3: Based on Case 1 and 2, reserve cost has been generally changed from below the energy price LMP (20$/MWh) to above (25$/MWh).

- Case 4: It is further supposed that one disturbance occurs, e.g., the designated branch of TSO has been in an outage. The static goal of TSO is to economically re-distribute the power flow after an outage. Based on the IT-OM in Case 1, it is named Case 4a. Based on the TD-OM in Case 2, it is named Case 4b. Both two cases are named as (N-1) based operation modes ((N-1)-OM).

- Case 5: By contrast with the MILP model in Case 1–4, a MI-SOCP model of DSO is applied to elaborate the power loss and simulate its network reconfiguration according to the operation mode. Two sets of the retail bidding price in Case 5a,b are listed to test the effectiveness of this model.

3.2. Comparison of the HGDC-Based TD-OM with IT-OM

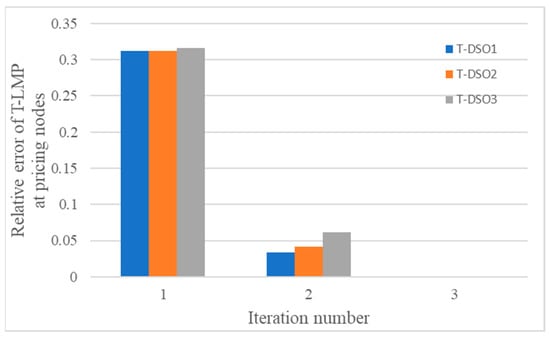

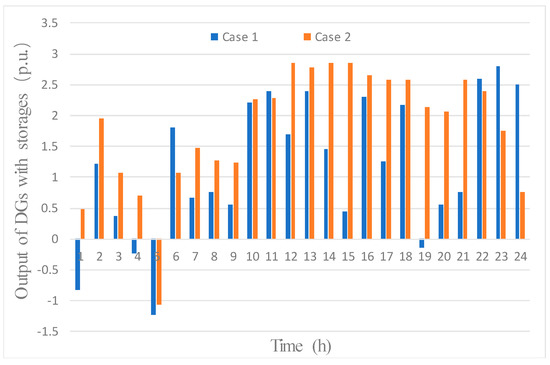

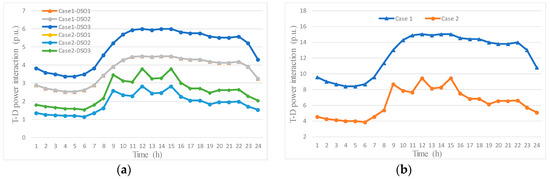

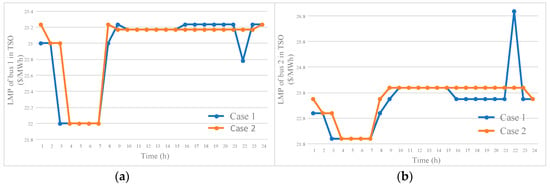

The convergence situation of relative T-LMP errors at pricing nodes in Case 2 could be seen in Figure 4. By comparison of Case 1 with Case 2, it is testified that the economic operation welfare of TSO could be improved in an HGDC-based mode by $1359.95 (4857.67–3497.72) as shown in Table 1. By contrast with IT-OM, the HGDC-based operation mode could utilize the DSOs as a demand response to reduce the generation bidding-based cost OE and the expensive TSO generation units are preferentially less used or shut down along with a more economic set of unit commitment, inducing a lower OU. The more expensive G3 and G4 units are shut down or kept at a low generation level as is manifested in Table 2 Meanwhile, the inexpensive DGs with storages increase their output as shown in Figure 5 and Figure 6. If we run Case 1, the IT-OM, in an iteratively way like Case 2, then the LMP price spike phenomenon could be eliminated, as seen in Figure 7. Therefore, the demand prices could be reasonably reflected by the HGDC-based algorithm.

Figure 4.

Convergence of the relative transmission local marginal prices (T-LMP) errors at the pricing nodes in Case 2.

Table 1.

Purchasing cost in Case 1 and Case 2 ($).

Table 2.

Power generation of GenCos in the transmission system operator (TSO) in Case 1 and 2 (p.u.).

Figure 5.

Output of distribution generators (DGs) with storages in Case 1 and 2.

Figure 6.

TSO-DSOs total power interaction in Case 1 and 2. (a) each DSO’s interaction with TSO; (b) total DSOs’ interaction with TSO.

Figure 7.

Elimination of the LMP price spikes in Case 1 by heterogeneous decomposition and coordination (HGDC) in Case 2. (a) LMP of bus 1 in TSO; (b) LMP of bus 2 in TSO.

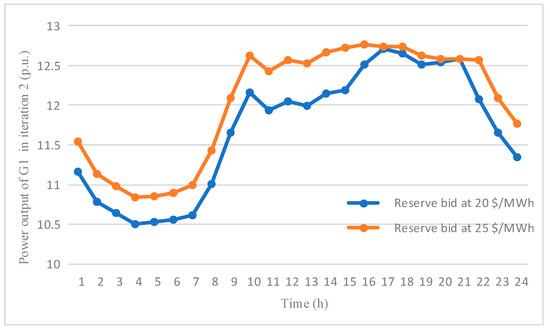

3.3. Impact of Cost-Based Bidding Reserve on Energy Market

In an analysis of Case 1 and 2, the reserve cost is set as around 20$/MWh. While in Case 3, the units bid their basic reserve cost at 25$/MWh, which is generally above the nodal energy prices in Case 2. As illustrated in Table 3 and Figure 8, the purchasing cost of TSO increases in Case 3 by increasing the output of the relatively lower pricing units of GenCos (like G1) in TSO. Meanwhile, the regulation-down reserve of the units is decreased, and all units bid their downward reserve at relatively high pricing intervals. In total, with a higher reserve cost-based bidding price, the purchasing cost of the energy generation increases and that of the units’ reserve decreases, leading to a higher total cost of the system.

Table 3.

Purchasing cost in Case 2 and 3 ($).

Figure 8.

Low pricing unit G1 in TSO increases the output in Case 3.

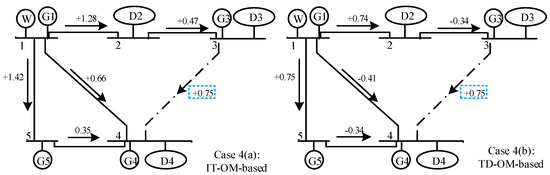

3.4. Impact of Branch Outage on IT-OM and TD-OM

This part compares the differences between the (N-1)-OM based on the IT-OM/TD-OM power flows after the disturbance and the base TD-OM power flow before disturbance. Suppose that the disturbance in Case 4a,b is an outage in line 3-4 whose original power flow is −0.75 (p.u.). The new steady system state after the disturbance occurs is a redistribution of the original power flow. The IT-OM only uses the transmission controls, while the TDZO-OM could use all available transmission and distribution controls.

As shown in Figure 9, after the line goes through an outage, the incremental MW-flow resulting in Case 4 could be obtained by reflecting the different redistributions of the original line power flow. Different from Case 4a, the incremental MW-flow on line 1-5 in Case 4b is much smaller, which may alleviate the transmission congestion of line 1-5 and 1-2. Additionally, Case 4b also has more an equally distributed power transfer among the network. It is concluded that power flow is more reasonably redistributed, avoiding huge power transfers in critical power lines.

Figure 9.

Incremental MW-flow results in Case 4 (p.u.).

As illustrated in Table 4, by contrast with IT-OM-based (N-1)-OM, the TD-OM-based (N-1)-OM has more economic controls on unit commitment and generation schedule based on the HGDC algorithm.

Table 4.

Purchasing cost in Case 4a,b ($).

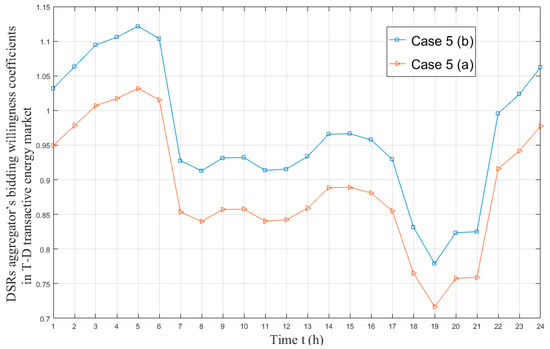

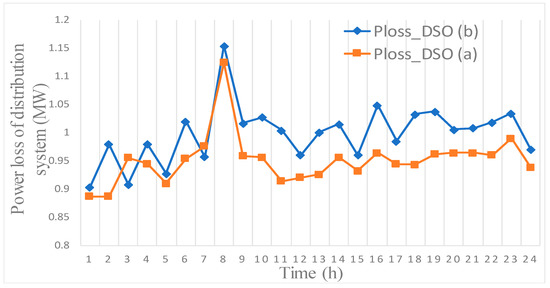

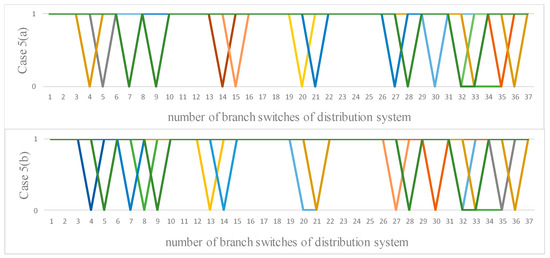

3.5. MI-SOCP Model of DSO

The MI-SOCP model of DSO could be illustrated in three parts: power loss, the detailed simulation of the designated DSRs aggregator’s bidding willingness in the wholesale market and network reconfiguration. To be simplified in Table 5, two cases are illustrated to show the impact of retailers’ price bidding on the market performance of DSO and its strategic behavior of DSRs aggregator.

Table 5.

Convergent ratio of local marginal prices (LMP).

The strategic bidding willingness coefficient for the DSRs aggregator in Case 5 is given in Figure 10, which varies as wind power varies. DSO’s bidding-based payoff has a positive correlation with the retailers’ price bidding. The lower the supply-demand ratio is, the higher the retail price bidding is, so the more willingness DSO would gain through a price-based drive to pursue its maximum payoff in the wholesale energy market. When the retail bidding price (25$/MWh) distinctly exceeds T-LMPs (average value is like 23$/MWh), DSO will buy more energy from TSO. Thus, the higher retailers’ price bidding could expand the T-D market liquidity between the wholesale and retail market.

Figure 10.

Demand-side resources (DSRs) aggregator’s bidding willingness coefficient in the wholesale energy market.

Furthermore, as seen in Figure 11, the lower the supply-demand ratio is and the higher the price bidding of retailers (e.g., DGs), the bigger the power loss the DSO would have. Thus, the power loss could be decreased by improving the system’s supply-demand ratio and imposing restrictions on the maximum retail prices. As the distribution network is always close-looped while in construction and open-looped while in operation, Figure 12 shows the branch switch reconfiguration status in the market operation environment under different retail bidding prices in which the 24 different colors mean the day-ahead 24 h. As the retail price decreases, the day-ahead switching frequency changes from 126 to 106 with a 15.9% ratio drop. Thus, by imposing restrictions on the maximum retail price, the remote switching frequency and the network loss could be decreased and the market liquidity between the wholesale and retail market could be enhanced. Meanwhile, the switch reconfiguration in the distribution system, together with the SCUC/SCED in the demand side, could be an efficient means of DR to reduce the purchasing cost of system operators.

Figure 11.

Power loss of DSO in different levels of retail LMP bidding.

Figure 12.

Day-ahead branch switch status in different levels of retail LMP bidding.

4. Conclusions

In this paper, a G-MSS method based on HGDC is applied as a decentral solution to multi-period integrated TDMO for its first time. With the idea of HGDC, the demand side retail markets in distribution systems are decomposed from the wholesale market in the transmission system, which means the TSO coordinates with several DSOs. The local optimization and convergence properties for this application are proven, which indicate that HGDC is an efficient algorithm with limited communication burdens to solve the decentralized TDMO problem. Besides the optimal transactive dispatch, the DSRs aggregator’s strategic bidding willingness coefficient and its market-wise decision-making for reserve sharing responsibility are simulated in the wholesale market. What is more, by contrast with the MILP model, the MI-SOCP model of DSO is applied to elaborate its power loss and simulate its active open-loop reconfiguration as a means of DR. The enhancing advantages of the method and model to reduce the purchasing cost and eliminate transmission congestion are also testified in the cases.

To tackle the uncertainties rising from the forecast of bidding prices and power transaction, in future work, a stochastic/robust method is needed to cope with these dynamic characteristics to keep its fast convergence in both theory and field work.

Author Contributions

Conceptualization, C.L. and M.S.; methodology, C.L.; writing—original draft preparation, C.L.; writing—review and editing, J.Z., Z.L., Y.W. and M.S.; supervision, J.Z. and Y.P.; project administration, J.Z., Y.P., D.X., Q.D.; funding acquisition, Z.L. and M.S.

Funding

This paper is supported by the scientific and technology program of “Key technology research and application of spot market with abundant renewable energy at inter-regional and inter-provincial areas” from State Grid Corporation of China and the program “Smart grid applications to the design and operation of electricity grids” from Illinois Institute of Technology in U.S.A.

Conflicts of Interest

The authors declare no conflict of interest.

Nomenclature

| Sets and indices: | |

| Index for multi-period hours from t = 1 to t = Th. | |

| Index for line with from bus i and to bus j. | |

| q | Index for iteration number of HGDC. |

| X | Index X∈{T, Dk, T-Dk, Dk-T}, where T is for transmission system operator (TSO), Dk for the k-th distribution system operator (DSO), T-Dk for boundary variables with direction from TSO to Dk and Dk-T for boundary variables with direction from Dk to TSO. |

| Y | Index YT∈{g, w, D, td} for market players of TSO, e.g., GenCos(g), wind generators(w), DSOs(D). and transmission load(td). Index YD∈{dg, dd} for market players of DSOs, e.g., distribution generators(dg), distribution demand(dd). |

| Z | Index Z∈{E, RU, RD} for services like energy (E), regulation-up (RU) and regulation-down (RD) reserves provided by market players. |

| CA | Index for control area with same marginal clearing prices (MCP) for reserve ancillary services. |

| BB/BI | Bus set for T-D boundary(B)/inner DSOs(I). |

| Maximum power which could be curtailed timely in the k-th DSO if necessary. | |

| Set of permitted time at which interruptible entity may be curtailed/shifted if necessary. | |

| Parameters: | |

| Number of market players Y in X. | |

| Number of buses/lines in X. | |

| N(i) | Set of nodes connected to node i by a line. |

| KG/KL/KDk | Incidence matrix of buses and generators/lines/the k-th DSO. |

| Shift factor from bus * to branch . | |

| Min and max line flow in X. | |

| Max power limit (MW) of Y in X. | |

| Min power limit (MW) of Y in X. | |

| Max power variation limit (MW) of Y in X. | |

| / | Number of time that unit g has been on/off. |

| / | Minimum consecutive time for units to be on/off. |

| Requirement of reserve Z∈{RU, RD} in CA of X | |

| Series susceptance in the -model of line ij. | |

| Series conductance in the -model of line ij. | |

| Variables or functions: | |

| OE | Objective of energy generation’s transaction cost. |

| OR | Objective of reserve deployment’s transaction cost. |

| OU | Objective of units’ commitment cost. |

| Locational marginal price of energy at bus i in X. | |

| Locational marginal price of energy at substation k of boundary T-Dk. | |

| Market clearing price of reserve service Z in X. | |

| Market clearing price of reserve service Z at substation k of boundary T-Dk. | |

| f | Purchasing cost of services for system operators. |

| Decision variables for service Z transaction dispatch (MW) of market player Y in X. | |

| Bidding-based cost of market player Y in X for service Z which is the multiply of bidding price and its service deployment quantity. | |

| Bidding willingness coefficient of market player Y for service Z which equals to 1 for price takers. | |

| DSRs aggregator’s bidding willingness coefficient operated by Dk for Z which is used only for reference. | |

| Cost of market player Y for service Z in X. | |

| Binary variable denoting commitment status of a Genco i in TSO or DG i in DSO. | |

| Shut-down cost of thermal unit i. | |

| Start-up cost of thermal unit i. | |

| Binary start-up decision variable for unit i. | |

| Binary shut-down decision variable for unit i. | |

| Power variation of DG in the q-th iteration. | |

| Maximum power ramping of generator units. | |

| Maximum power ramping of the k-th DSO. | |

| Power load curtailment ratio in the k-the DSO. | |

| Maximum deployment ratio of DGs reserve. | |

| Maximum nodal load corresponding to DG. | |

| Variable set according to the connection status of line in the MI-SOCP model of DSO, 1 if connected and 0 if disconnected. | |

| Variable set to 1 if node j is the parent of node i and to 0 otherwise in MI-SOCP model of DSO. | |

| Current magnitude in line . | |

| Variables associated with line in the MI-SOCP model of DSO. | |

| Variable associated with node i in the MI-SOCP model of DSO. | |

| Variable associated with node i and line in the MI-SOCP model of DSO. | |

| Voltage magnitude and voltage angle in DSO. | |

References

- Zegers, A.; Brunner, H. TSO-DSO Interaction: An Overview of Current Interaction between Transmission and Distribution System Operators and an Assessment of Their Cooperation in Smart Grids. 2014. Available online: http://smartgrids.no/wp-content/uploads/sites/4/2016/01/ISGAN-TSO-DSO-interaction.pdf (accessed on 31 December 2017).

- Sbordone, D.A.; Carlini, E.M.; Pietra, B.D.; Devetsikiotis, M. The future interaction between virtual aggregator-TSO-DSO to increase DG penetration. In Proceedings of the 2015 International Conference on Smart Grid and Clean Energy Technologies (ICSGCE), Offenburg, Germany, 20–23 October 2015; pp. 201–205. [Google Scholar]

- Gerard, H.; Rivero Puente, E.I.; Six, D. Coordination between transmission and distribution system operators in the electricity sector: A conceptual framework. Util. Policy 2018, 50, 40–48. [Google Scholar] [CrossRef]

- Renani, Y.K.; Ehsan, M.; Shahidehpour, M. Optimal transactive market operations with distribution system operators. IEEE Trans. Smart Grid 2017, 9, 6692–6701. [Google Scholar] [CrossRef]

- Zipf, M.; Möst, D. Cooperation of TSO and DSO to provide ancillary services. In Proceedings of the 2016 13th International Conference on the European Energy Market (EEM), Porto, Portugal, 6–9 June 2016; pp. 1–6. [Google Scholar]

- Li, H.; Li, Y.; Li, Z. A multiperiod energy acquisition model for a distribution company with distributed generation and interruptible load. IEEE Trans. Power Syst. 2007, 22, 588–596. [Google Scholar] [CrossRef]

- Aguado, J.A.; Quintana, V.H.; Conejo, A.J. Optimal power flows of interconnected power systems. IEEE Power Eng. Soc. Summer Meet. 1999, 2, 814–819. [Google Scholar]

- Aguado, J.A.; Quintana, V.H. Inter-utilities power-exchange coordination: A market-oriented approach. IEEE Trans. Power Syst. 2001, 16, 513–519. [Google Scholar] [CrossRef]

- Yingvivatanapong, C.; Lee, W.; Liu, E. Multi-area power generation dispatch in competitive markets. IEEE Trans. Power Syst. 2008, 23, 196–203. [Google Scholar] [CrossRef]

- Bakirtzis, A.G.; Biskas, P.N. A decentralized solution to the DC-OPF of interconnected power systems. IEEE Trans. Power Syst. 2003, 18, 1007–1013. [Google Scholar] [CrossRef]

- Kargarian, A.; Fu, Y. System of systems based security-constrained unit commitment incorporating active distribution grids. IEEE Trans Power Syst. 2014, 29, 2489–2498. [Google Scholar] [CrossRef]

- Li, Z.; Guo, Q.; Sun, H.; Wang, J. Coordinated transmission and distribution AC optimal power flow. IEEE Trans. Smart Grid 2018, 9, 1228–1240. [Google Scholar] [CrossRef]

- Li, Z.; Guo, Q.; Sun, H.; Wang, J. Coordinated economic dispatch of coupled transmission and distribution systems using heterogeneous decomposition. IEEE Trans. Power Syst. 2016, 31, 4817–4830. [Google Scholar] [CrossRef]

- Li, Z. Distributed Transmission-Distribution Coordinated Energy Management Based on Generalized. Master-Slave Splitting Theory. Ph.D. Thesis, Tsinghua University, Beijing, China, 2016. [Google Scholar]

- Li, Z.; Sun, H.; Guo, Q.; Wang, J.; Liu, G. Generalized master-slave-splitting method and application to transmission-distribution coordinated energy management. IEEE Trans. Power Syst. 2018. [Google Scholar] [CrossRef]

- Nunna, H.S.; Doolla, S. energy management in microgrids using demand response and distributed storage—A multiagent approach. IEEE Trans. Power Deliv. 2013, 28, 939–947. [Google Scholar] [CrossRef]

- Bui, V.; Hussain, A.; Kim, H. A multiagent-based hierarchical energy management strategy for multi-microgrids considering adjustable power and demand response. IEEE Trans. Smart Grid 2018, 9, 1323–1333. [Google Scholar] [CrossRef]

- Jiang, Q.; Xue, M.; Geng, G. Energy management of microgrid in grid-connected and stand-alone modes. IEEE Trans. Power Syst. 2013, 28, 3380–3389. [Google Scholar] [CrossRef]

- Wang, Z.; Chen, B.; Wang, J.; Kim, J. Decentralized energy management system for networked microgrids in grid-connected and islanded modes. IEEE Trans. Smart Grid 2016, 7, 1097–1105. [Google Scholar] [CrossRef]

- Martini, P. Making the Distribution Grid More Open, Efficient and Resilient. 2015. Available online: https://www.energy.gov/sites/prod/files/2015/04/f21/05-Mar2015EAC-GridMod-DeMartini.pdf (accessed on 31 December 2017).

- Khodaei, A.; Shahidehpour, M.; Bahramirad, S. SCUC with hourly demand response considering intertemporal load characteristics. IEEE Trans Smart Grid 2011, 2, 564–571. [Google Scholar] [CrossRef]

- Li, T.; Shahidehpour, M. Strategic bidding of transmission-constrained GENCOs with incomplete information. IEEE Trans. Power Syst. 2005, 20, 437–447. [Google Scholar] [CrossRef]

- Li, T.; Shahidehpour, M.; Li, Z. Risk-constrained bidding strategy with stochastic unit commitment. IEEE Trans. Power Syst. 2007, 22, 449–458. [Google Scholar] [CrossRef]

- Liu, G.; Xu, Y.; Tomsovic, K. Bidding strategy for microgrid in day-ahead market based on hybrid stochastic/robust optimization. IEEE Trans. Smart Grid 2016, 7, 227–237. [Google Scholar] [CrossRef]

- Shahidehpour, M.; Yamin, H.; Li, Z. Market Operations in Electric Power Systems: Forecasting, Scheduling, and Risk Management; Wiley-IEEE Press: New York, NY, USA, 2002; Volume 9. [Google Scholar]

- Wang, J.; Zhong, H.; Tang, W.; Rajagopal, R.; Xia, Q.; Kang, Q.; Wang, Y. Optimal bidding strategy for microgrids in joint energy and ancillary service markets considering flexible ramping products. Appl. Energy 2017, 2015, 294–303. [Google Scholar] [CrossRef]

- Li, B.; Wang, X.; Shahidehpour, M.; Jiang, C.; Li, Z. Robust bidding strategy and profit allocation for cooperative DSR aggregators with correlated wind power generation. IEEE Trans. Sustain. Energy 2018. [Google Scholar] [CrossRef]

- Fang, X.; Hu, Q.; Li, F.; Wang, B.; Li, Y. Coupon-based demand response considering wind power uncertainty: A strategic bidding model for load serving entities. IEEE Trans. Power Syst. 2016, 31, 1025–1037. [Google Scholar] [CrossRef]

- Golshannavaz, S.; Afsharnia, S.; Aminifar, F. Smart distribution grid: Optimal day-ahead scheduling with reconfigurable topology. IEEE Trans. Smart Grid 2014, 5, 2402–2411. [Google Scholar] [CrossRef]

- Jabr, R.A.; Singh, R.; Pal, B.C. Minimum loss network reconfiguration using mixed-integer convex programming. IEEE Trans. Power Syst. 2012, 27, 1106–1115. [Google Scholar] [CrossRef]

- Khanabadi, M.; Fu, Y.; Liu, C. Decentralized transmission line switching for congestion management of interconnected power systems. IEEE Trans. Power Syst. 2018, 33, 5902–5912. [Google Scholar] [CrossRef]

- Li, F.; Bo, R. Small test systems for power system economic studies. In Proceedings of the IEEE PES General Meeting, Providence, RI, USA, 25–29 July 2010; pp. 1–4. [Google Scholar]

- Baran, M.E.; Wu, F.F. Network reconfiguration in distribution systems for loss reduction and load balancing. IEEE Trans. Power Deliv. 1989, 4, 1401–1407. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).