Long-Term Demand Forecasting in a Scenario of Energy Transition

Abstract

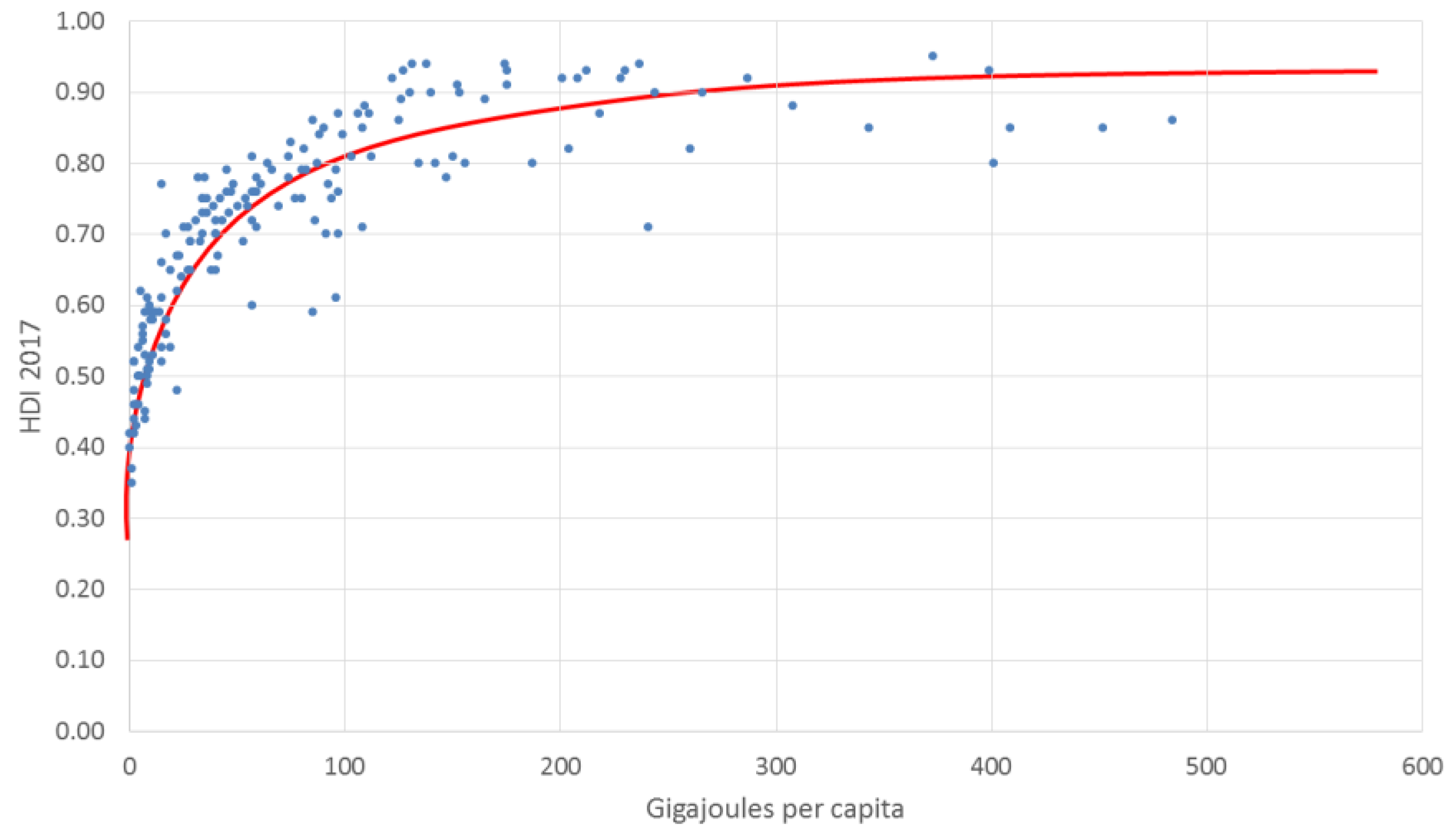

1. Introduction

2. Materials and Methods

2.1. Data Sources

2.2. The Kaya Identity

2.3. Laspeyres Decomposition

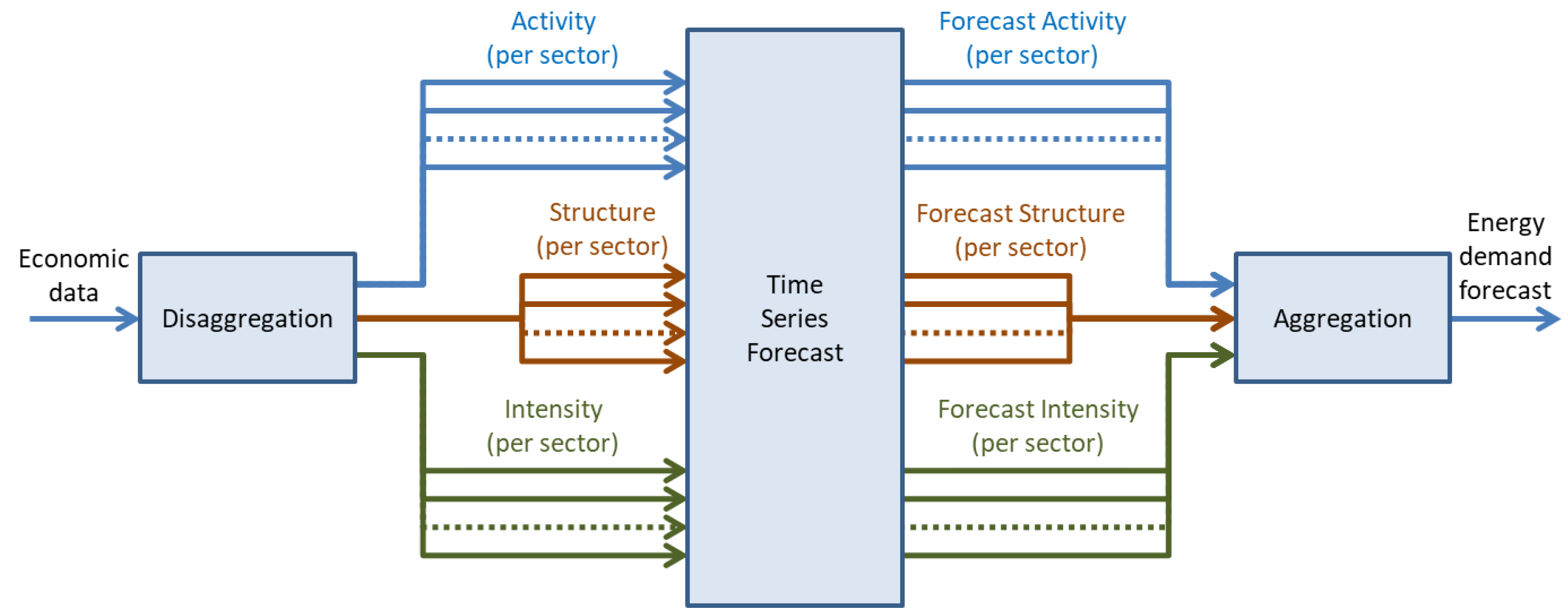

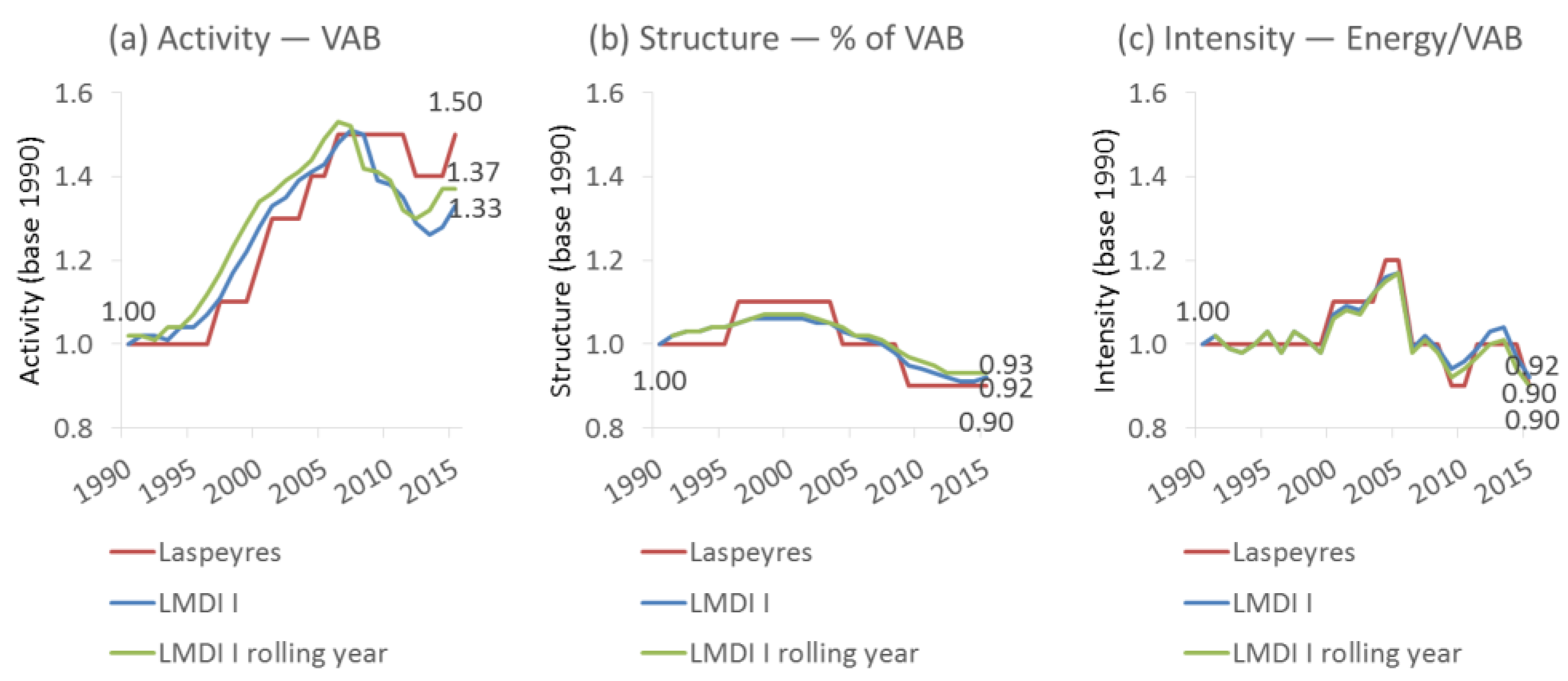

- Using a decomposition method, the raw economic data (1990–2015) were disaggregated into several economic sectors and, for every sector, into three factors (activity, structure, and intensity), which will be defined below.

- The time-series obtained for every sector and factor was used to forecast its values (2030). The forecasted values were then aggregated to obtain a prediction of the energy demand.

- : level of activity of the -th sector, which is measured by the gross value added for the industry and services sectors, by population for residential consumption, and by passenger-kilometers and ton-kilometers for the sectors of passenger and freight transport, respectively;

- : energy consumption of the -th sector;

- : total level of activity, considering all the sectors;

- : weight of the -th sector in the structure of the economy;

- : energy intensity of the -th sector;

2.4. LMDI Decomposition

2.5. Time-Series Forecasting

3. Results

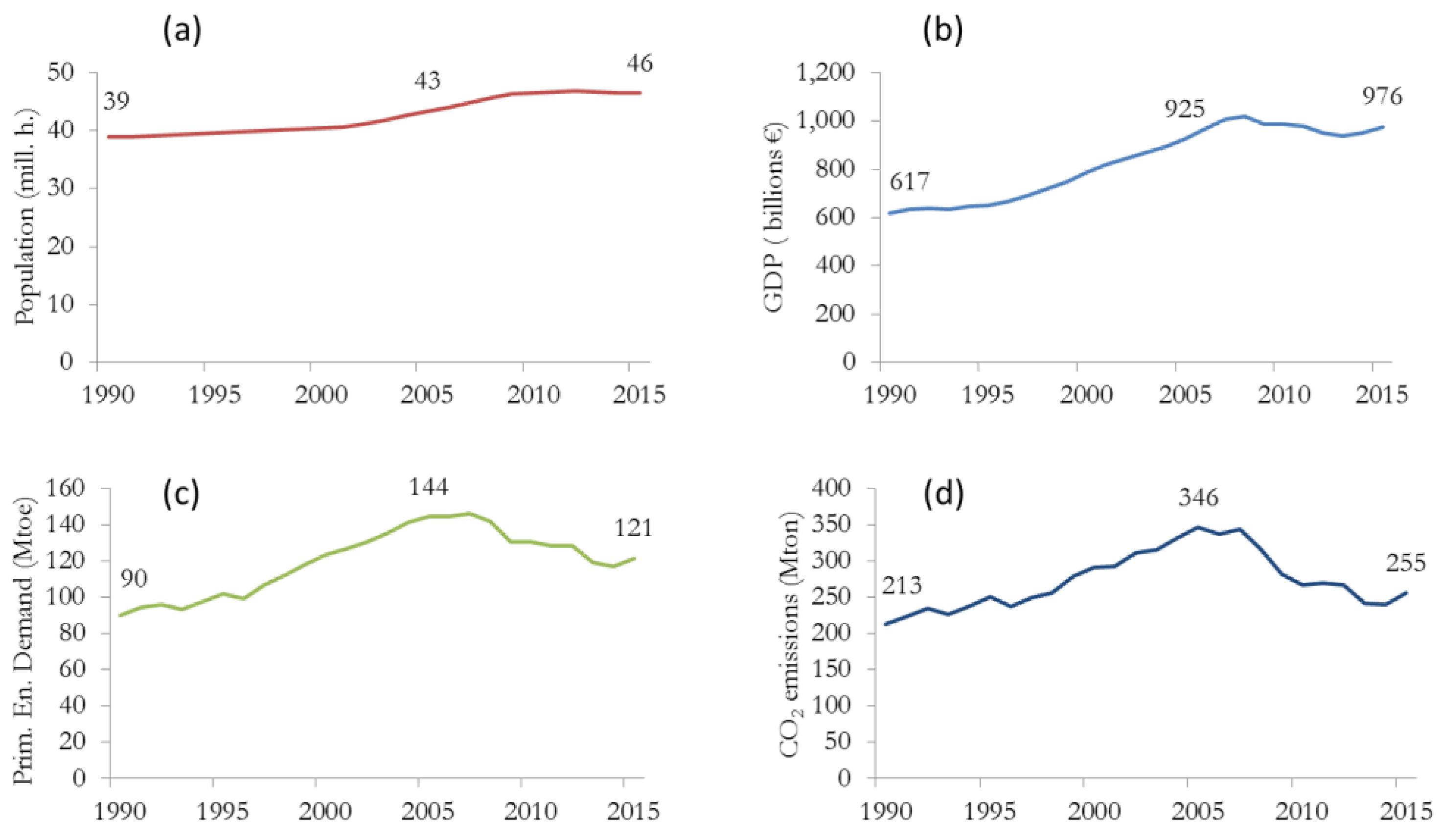

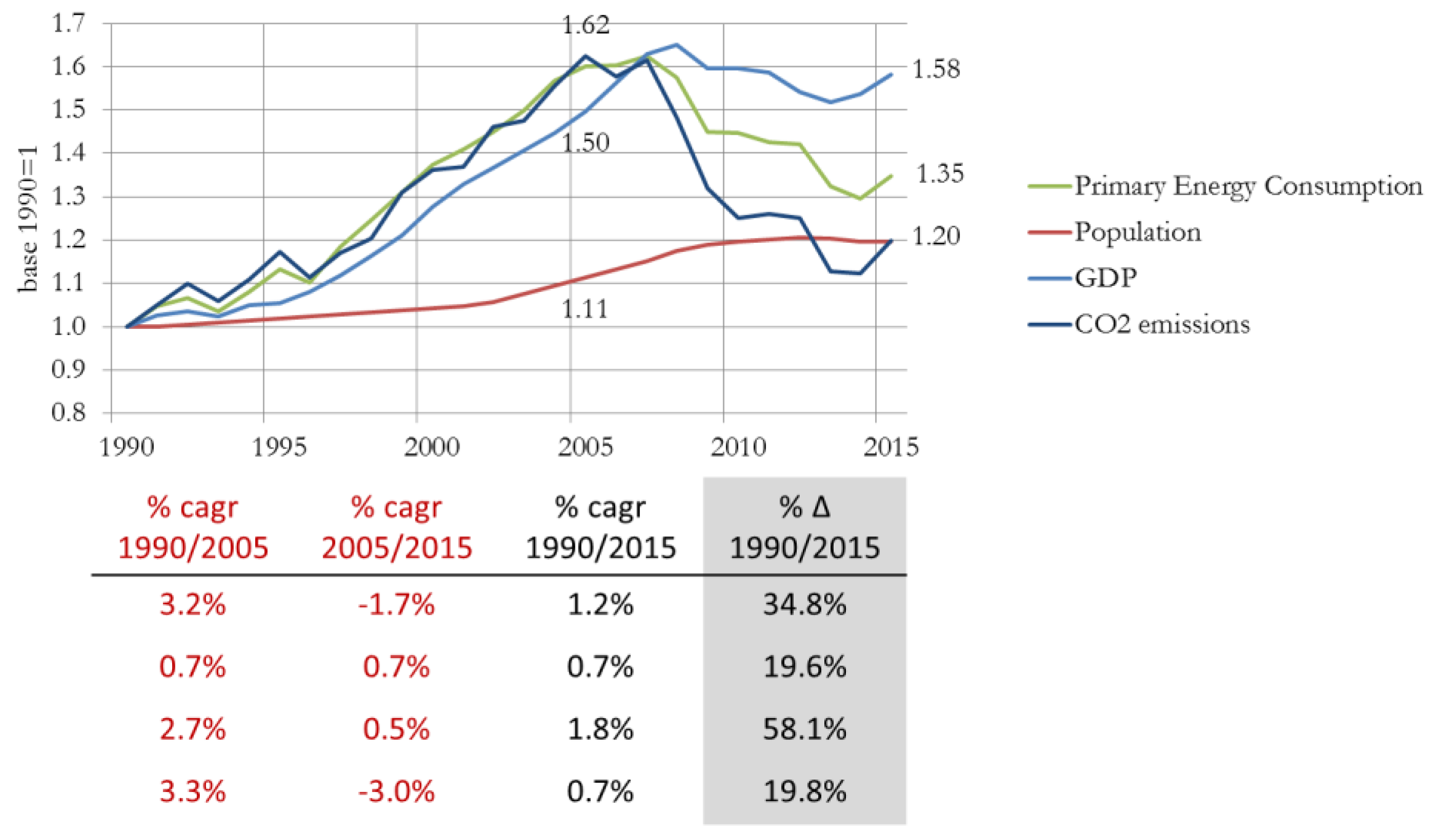

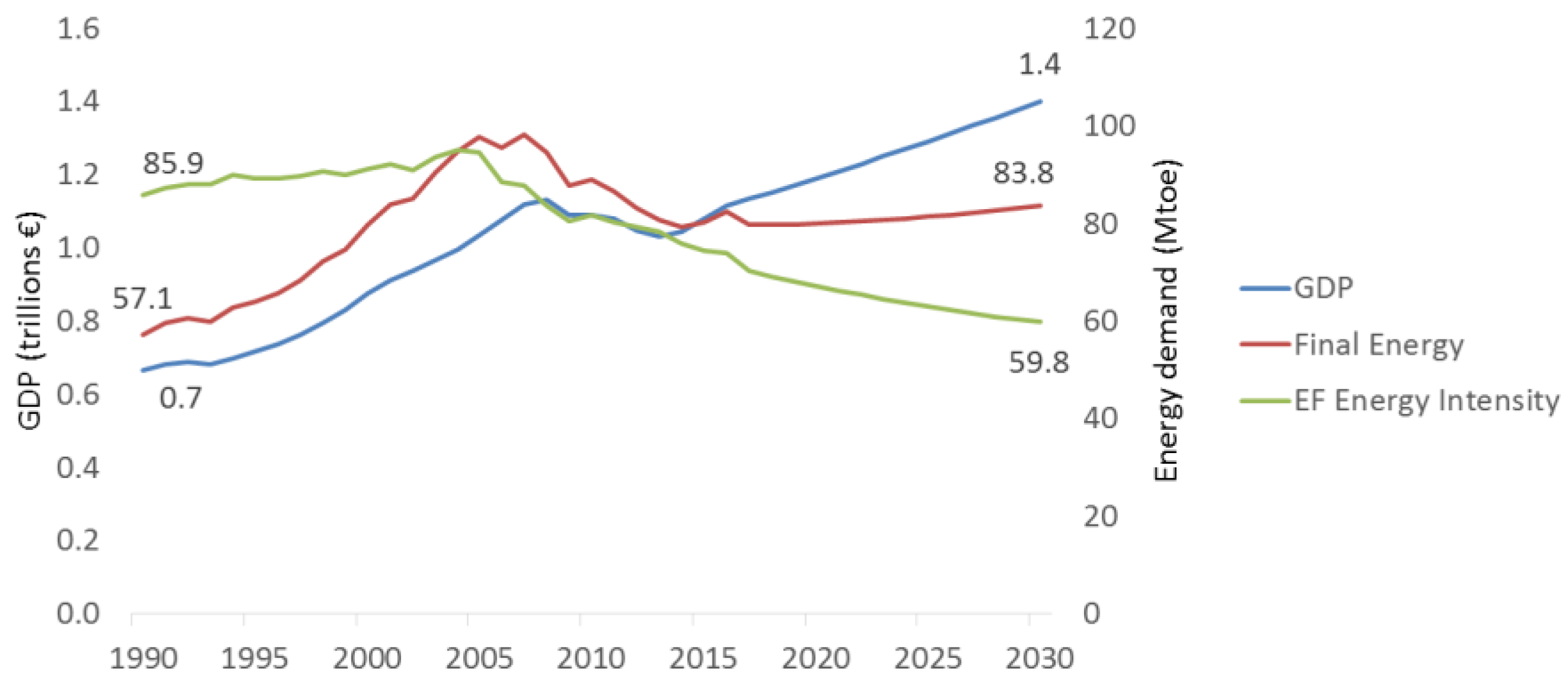

3.1. Evolution of Main Carbon-Related Magnitudes

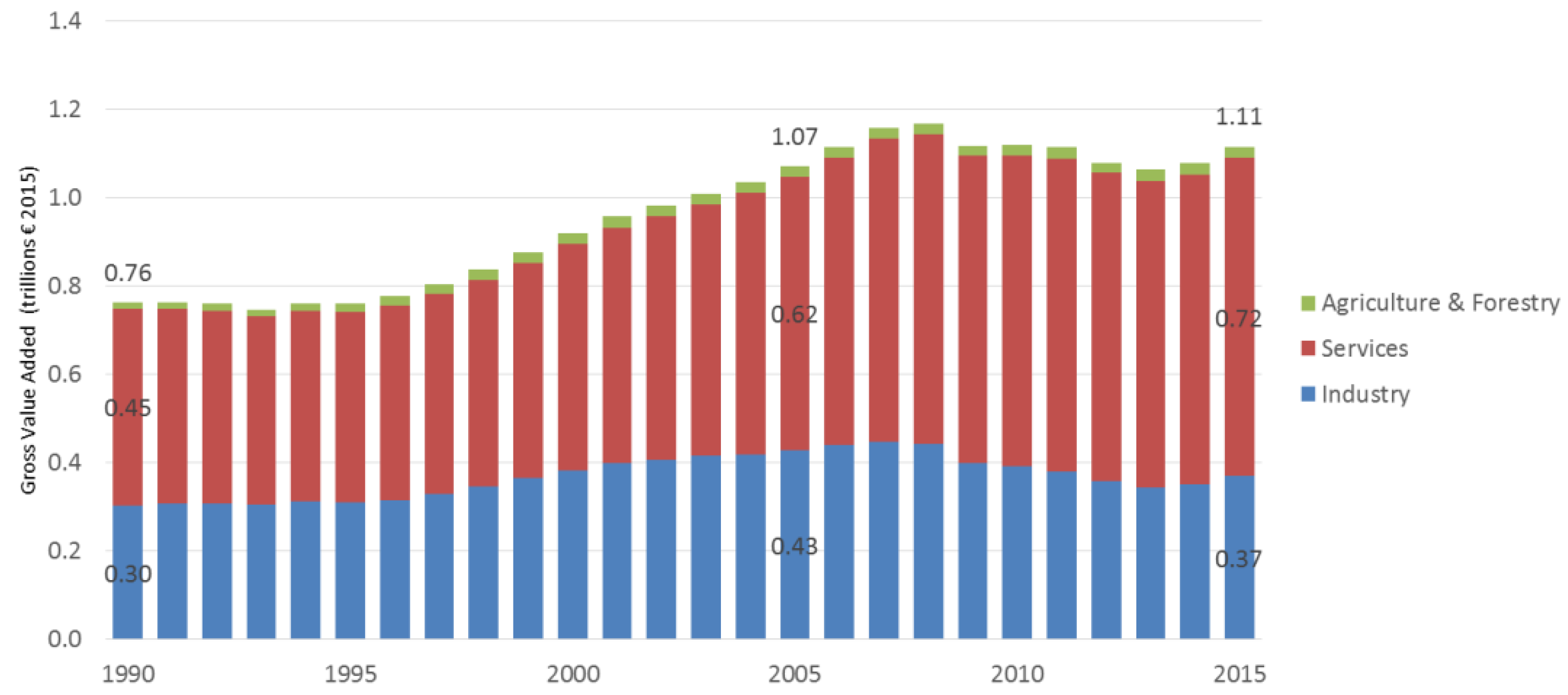

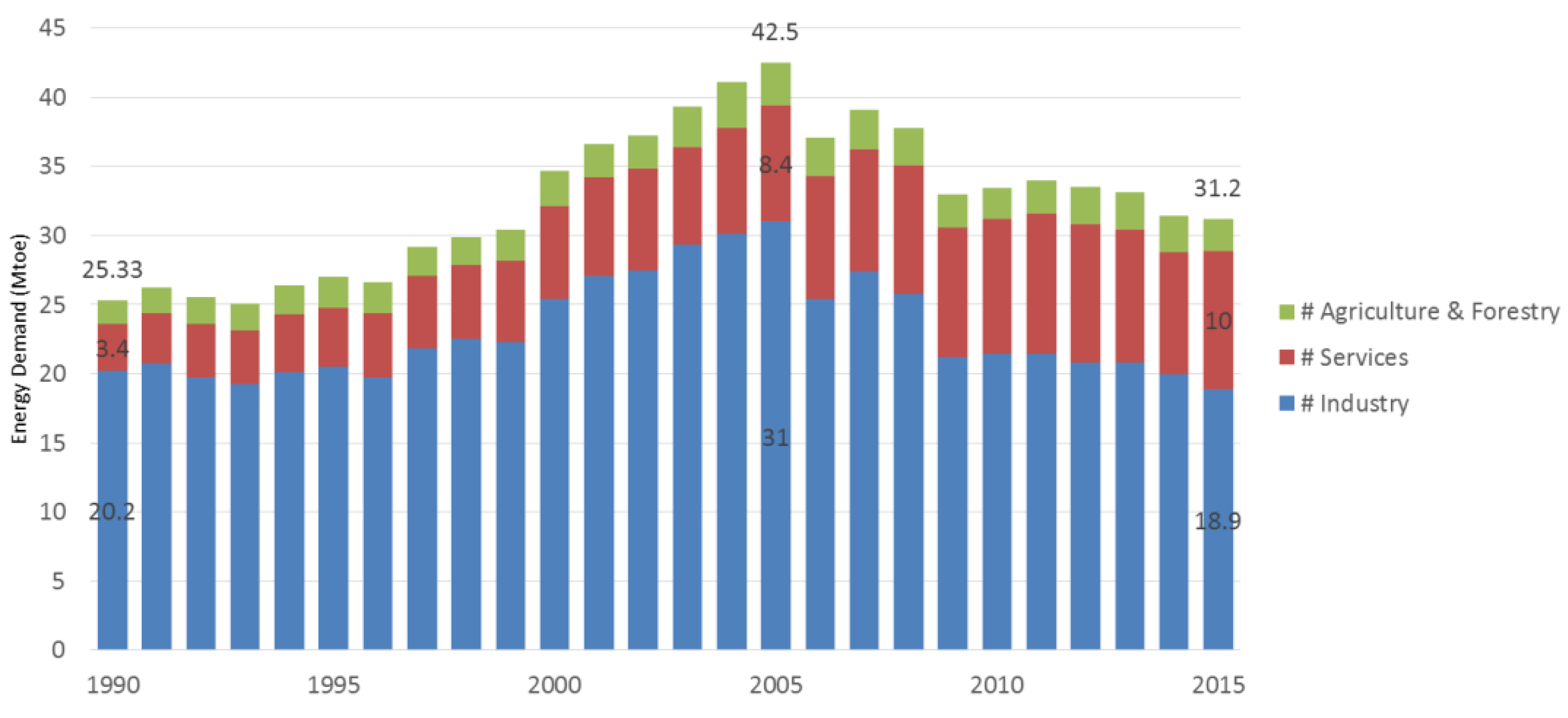

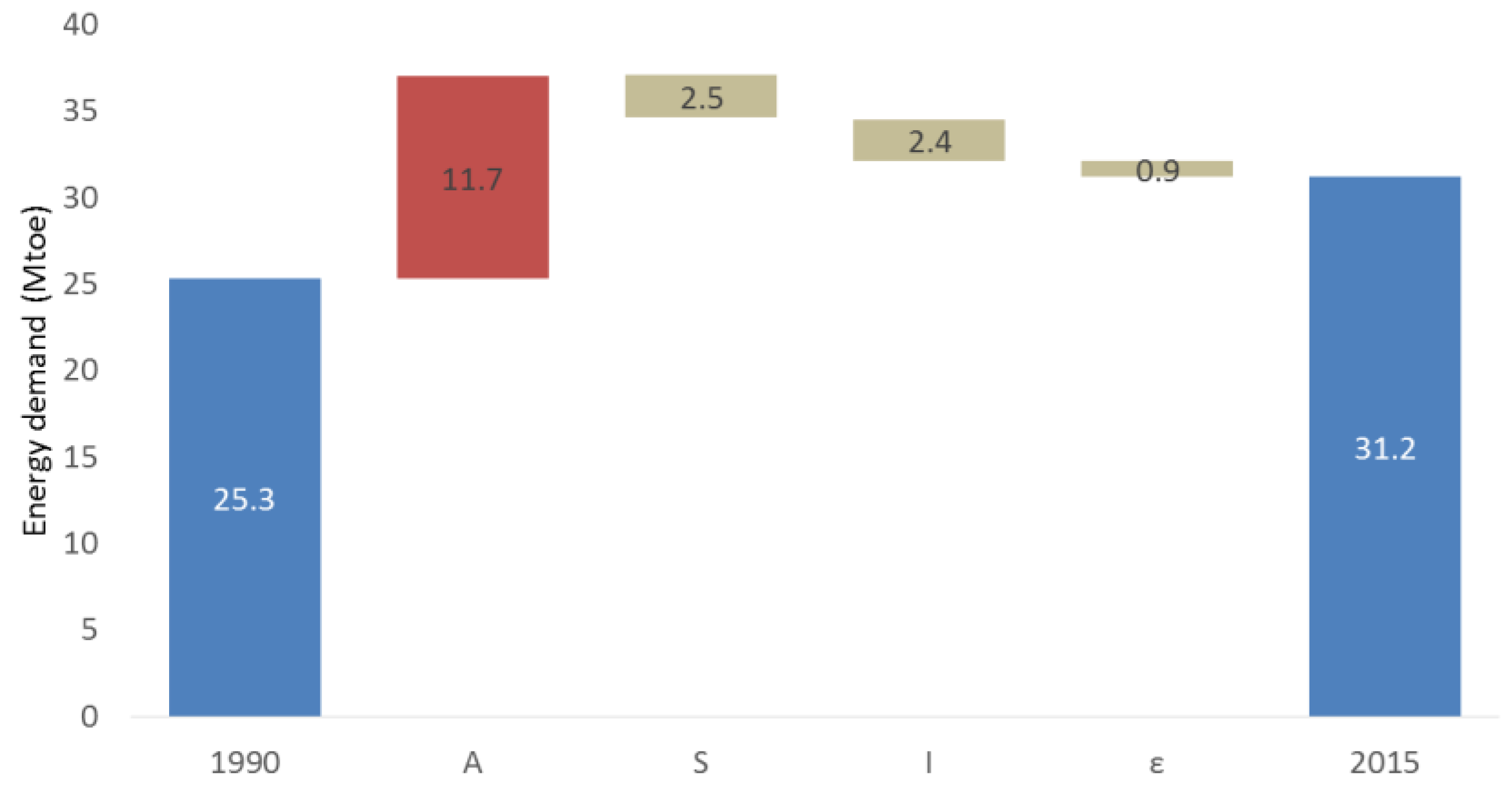

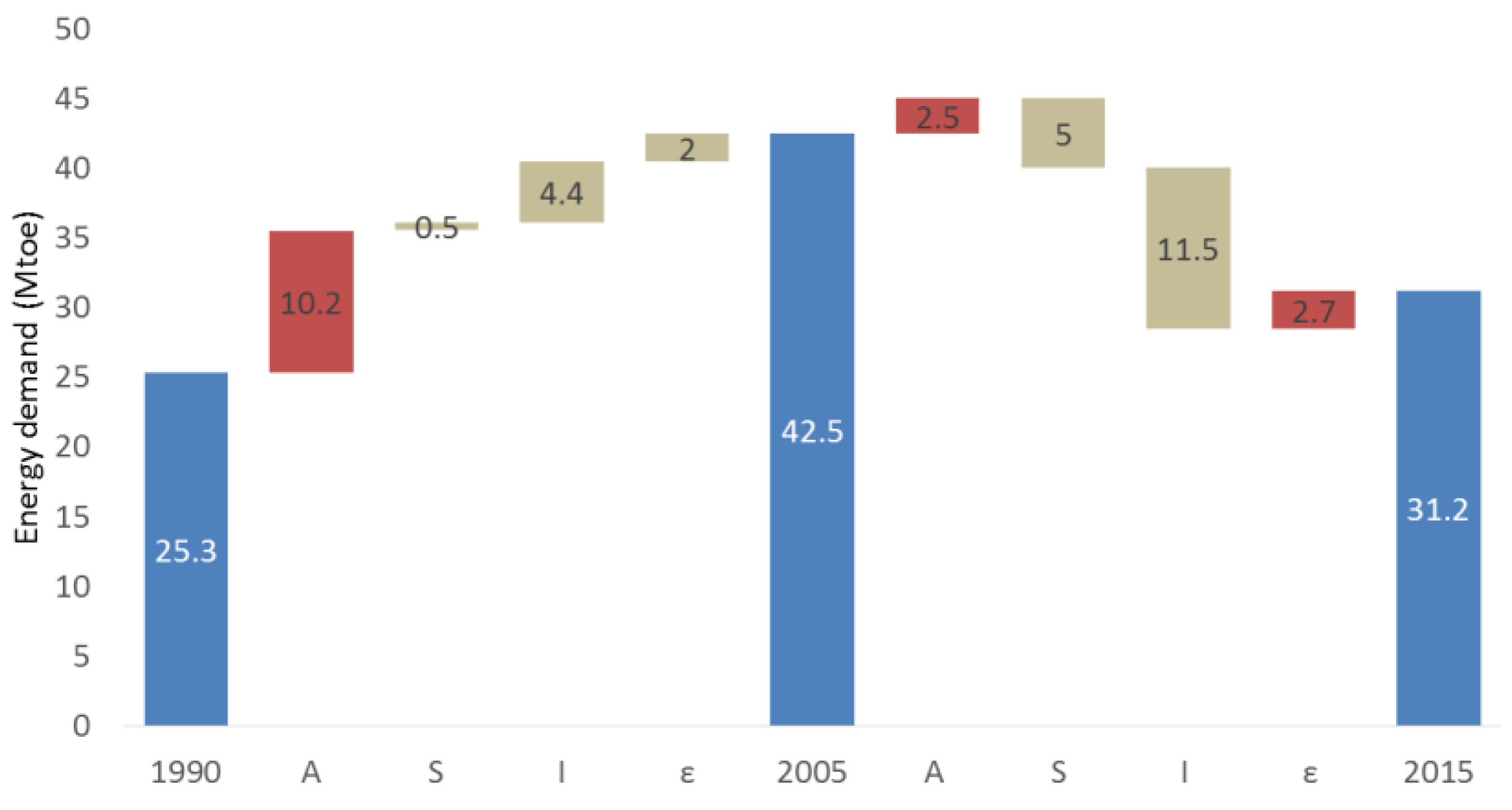

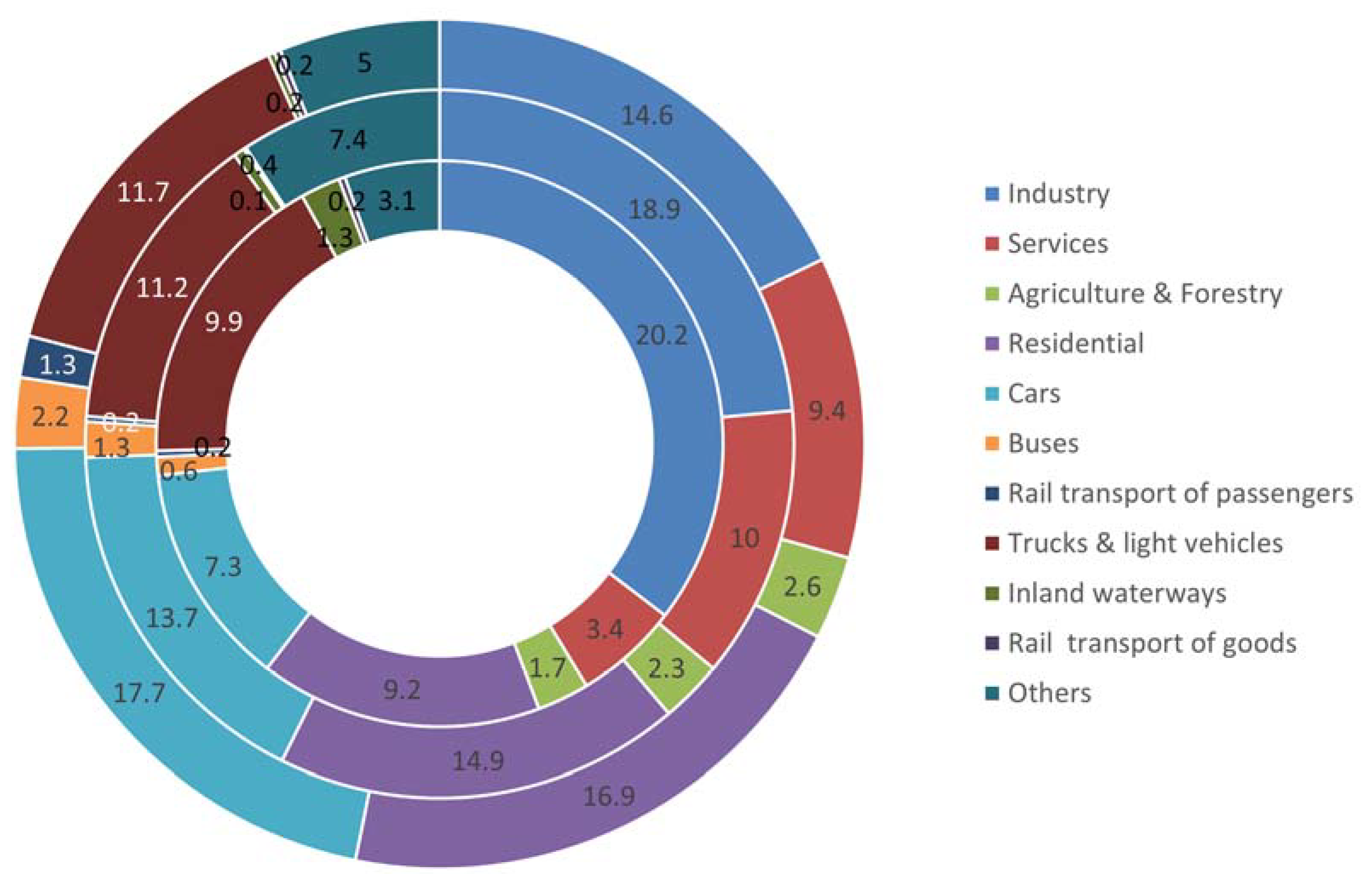

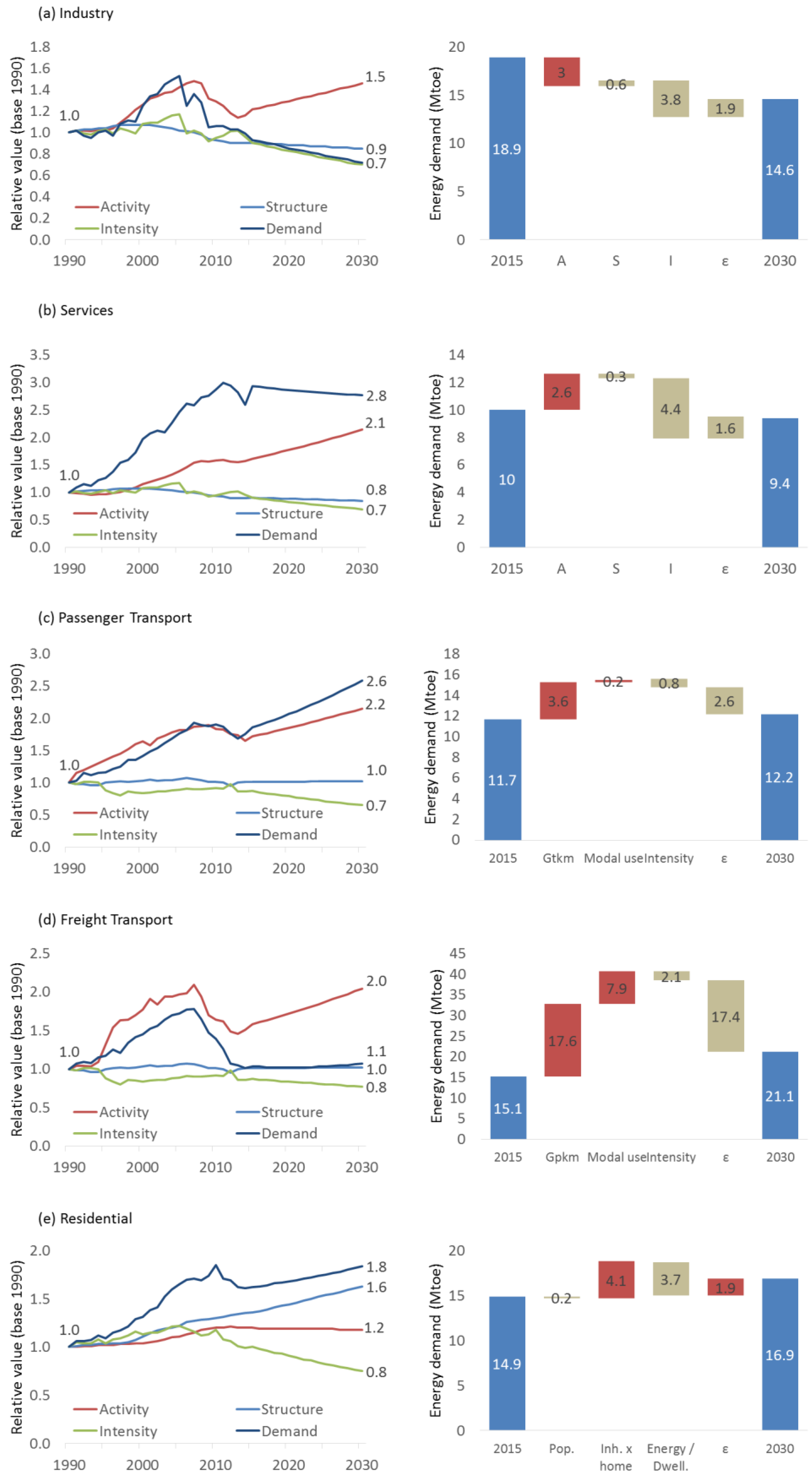

3.2. Energy Demand Decomposition

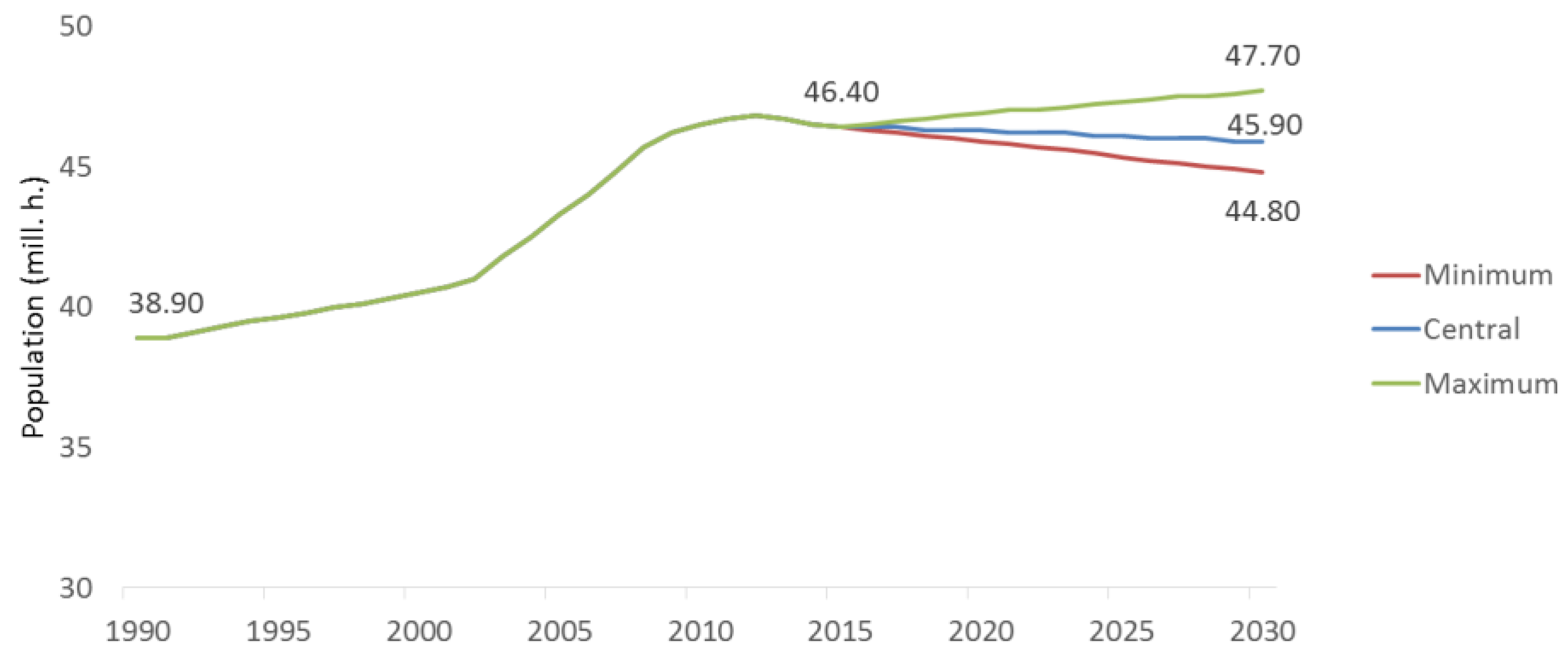

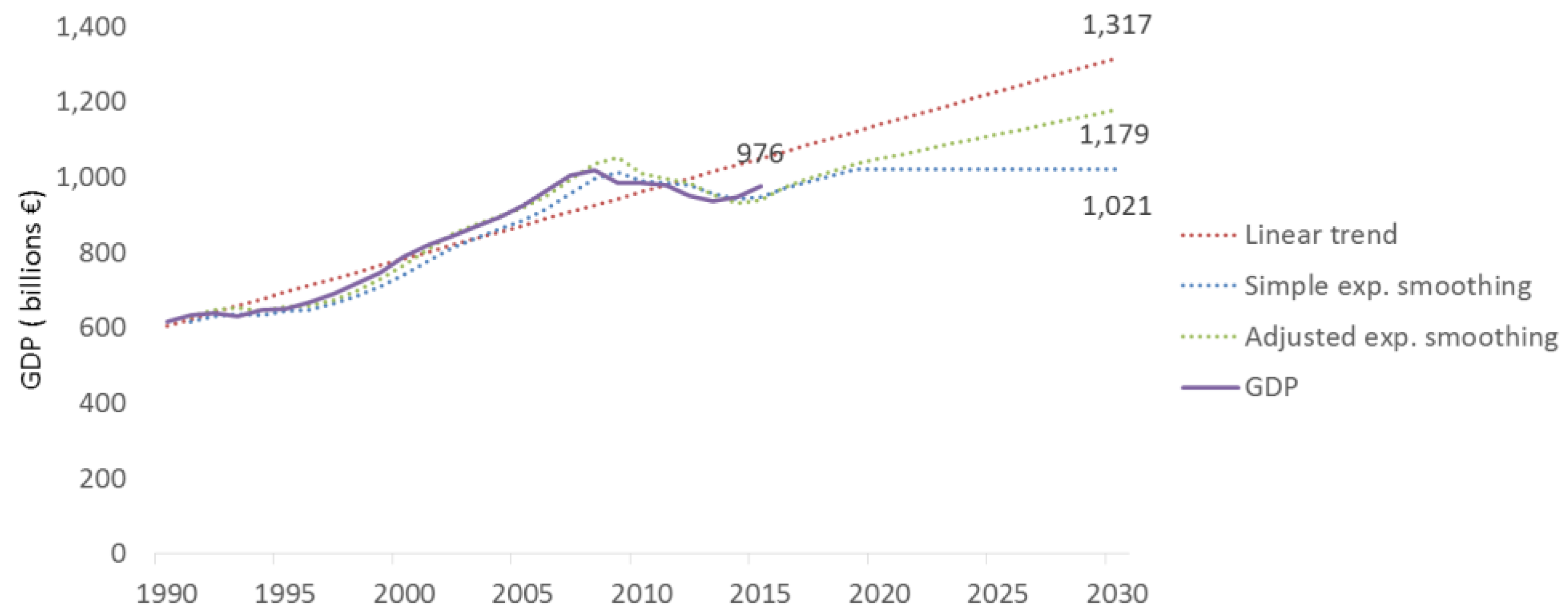

3.3. Population and Aggregated GDP Forecasting

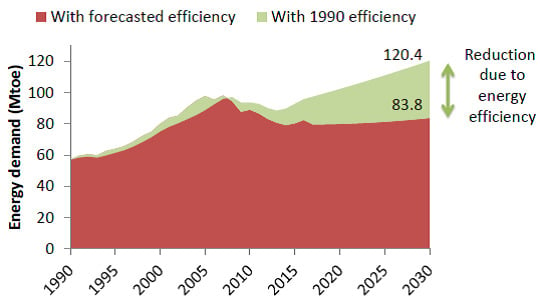

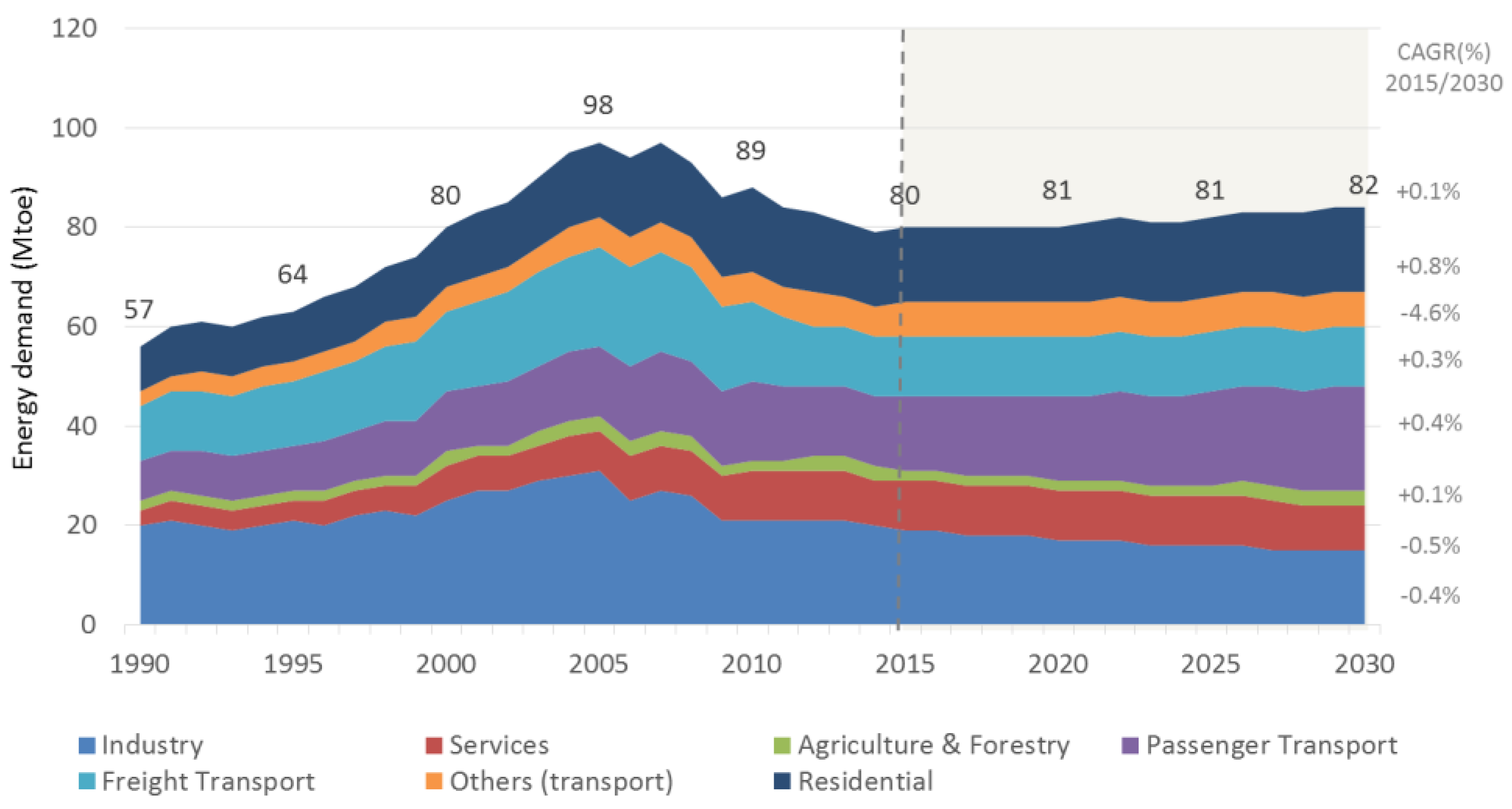

3.4. Energy Demand Forecasting

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix B

References

- World Energy Council. World Energy Trilemma Index 2018; World Energy Council: London, UK, 2018; Available online: https://www.worldenergy.org/publications/2018/trilemma-report-2018/ (accessed on 2 May 2019).

- European Commission. Energy Roadmap 2050; European Commission: Luxembourg, European Union, 2011; Available online: https://ec.europa.eu/energy/sites/ener/files/documents/2012_energy_roadmap_2050_en_0.pdf (accessed on 2 May 2019).

- World Energy Council. World Energy Scenarios 2016; World Energy Council: London, UK, 2016; Available online: https://www.worldenergy.org/publications/2016/world-energy-scenarios-2016-the-grand-transition/ (accessed on 2 May 2019).

- Hong, T.; Pinson, P.; Fan, S.; Zareipour, H.; Troccoli, A.; Hyndman, R.J. Probabilistic energy forecasting: Global energy forecasting competition 2014 and beyond. Int. J. 2016, 32, 896–913. [Google Scholar] [CrossRef]

- Ciulla, G.; Brano, V.L.; D’Amico, A. Modelling relationship among energy demand, climate and office building features: A cluster analysis at European level. Appl. Energy 2016, 183, 1021–1034. [Google Scholar] [CrossRef]

- Liang, Y.; Niu, D.; Cao, Y.; Hong, W.C. Analysis and modeling for China’s electricity demand forecasting using a hybrid method based on multiple regression and extreme learning machine: A view from carbon emission. Energies 2016, 9, 941. [Google Scholar] [CrossRef]

- Rehman, S.; Cai, Y.; Fazal, R.; Das Walasai, G.; Mirjat, N. An integrated modeling approach for forecasting long-term energy demand in Pakistan. Energies 2017, 10, 1868. [Google Scholar] [CrossRef]

- Hayes, B.; Gruber, J.; Prodanovic, M. Short-term load forecasting at the local level using smart meter data. In Proceedings of the 2015 IEEE Eindhoven PowerTech, Eindhoven, The Netherlands, 29 June–2 July 2015. [Google Scholar]

- Nagbe, K.; Cugliari, J.; Jacques, J. Short-term electricity demand forecasting using a functional state space model. Energies 2018, 11, 1120. [Google Scholar] [CrossRef]

- Ryu, S.; Noh, J.; Kim, H. Deep neural network based demand side short term load forecasting. Energies 2016, 10, 3. [Google Scholar] [CrossRef]

- Akpinar, M.; Yumusak, N. Year ahead demand forecast of city natural gas using seasonal time series methods. Energies 2016, 9, 727. [Google Scholar] [CrossRef]

- De Oliveira, E.M.; Oliveira, F.L.C. Forecasting mid-long term electric energy consumption through bagging ARIMA and exponential smoothing methods. Energy 2018, 144, 776–788. [Google Scholar] [CrossRef]

- Bourdeau, M.; Zhai, X.Q.; Nefzaoui, E.; Guo, X.; Chatellier, P. Modelling and forecasting building energy consumption: A review of data-driven techniques. Sustain. Cities Soc. 2019, 48, 101533. [Google Scholar] [CrossRef]

- Suganthi, L.; Samuel, A.A. Energy models for demand forecasting—A review. Renew. Sustain. Energy Rev. 2012, 16, 1223–1240. [Google Scholar] [CrossRef]

- Çevik, H.H.; Çunkaş, M. Short-term load forecasting using fuzzy logic and ANFIS. Neural Comput. Appl. 2015, 26, 1355–1367. [Google Scholar] [CrossRef]

- Singh, S.; Yassine, A. Big data mining of energy time series for behavioral analytics and energy consumption forecasting. Energies 2018, 11, 452. [Google Scholar] [CrossRef]

- Chen, Y.; Hong, W.C.; Shen, W.; Huang, N. Electric load forecasting based on a least squares support vector machine with fuzzy time series and global harmony search algorithm. Energies 2016, 9, 70. [Google Scholar] [CrossRef]

- Bouktif, S.; Fiaz, A.; Ouni, A.; Serhani, M. Optimal deep learning lstm model for electric load forecasting using feature selection and genetic algorithm: Comparison with machine learning approaches. Energies 2018, 11, 1636. [Google Scholar] [CrossRef]

- Akhwanzada, S.A.; Tahar, R.M. Strategic forecasting of electricity demand using system dynamics approach. Int. J. Environ. Sci. Dev. 2012, 3, 328. [Google Scholar]

- Roming, N.; Leimbach, M. Econometric Forecasting of Final Energy Demand Using in-Sample and Out-of-Sample Model Selection Criteria; Potsdam Institute for Climate Impact Research: Potsdam, Germany, 2015. [Google Scholar]

- Halvorsen, R. Econometric Models of U.S Energy Demand; United States Department of Energy Office of Scientific and Technical Information: Washington, WA, USA, 1978.

- Ghods, L.; Kalantar, M. Different methods of long-term electric load demand forecasting: A comprehensive review. Iran. J. Electr. Electron. Eng. 2011, 7, 249–259. [Google Scholar]

- Ghalehkhondabi, I.; Ardjmand, E.; Weckman, G.R.; Young, W.A. An overview of energy demand forecasting methods published in 2005–2015. Energy Syst. 2017, 8, 411–447. [Google Scholar] [CrossRef]

- Lin, J.; Zhu, K.; Liu, Z.; Lieu, J.; Tan, X. Study on A Simple Model to Forecast the Electricity Demand under China’s New Normal Situation. Energies 2019, 12, 2220. [Google Scholar] [CrossRef]

- Ha, S.; Tae, S.; Kim, R. Energy Demand Forecast Models for Commercial Buildings in South Korea. Energies 2019, 12, 2313. [Google Scholar] [CrossRef]

- Gómez, M.; Ciarreta, A.; Zarraga, A. Linear and nonlinear causality between energy consumption and economic growth: The case of Mexico 1965–2014. Energies 2018, 11, 784. [Google Scholar] [CrossRef]

- Hall, L.M.; Buckley, A.R. A review of energy systems models in the UK: Prevalent usage and categorisation. Appl. Energy 2016, 169, 607–628. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R.; Pouris, A. On the causality and determinants of energy and electricity demand in South Africa: A review. Energy Sources Part B Econ. Plan. Policy 2016, 11, 626–636. [Google Scholar] [CrossRef]

- Verleger, P.K. An econometric analysis of the relationships between macroeconomic activity and US energy consumption. In Energy Modeling: Art Science Practice; Routledge: London, UK, 2016; pp. 62–102. [Google Scholar]

- Duscha, V.; Fougeyrollas, A.; Nathani, C.; Pfaff, M.; Ragwitz, M.; Resch, G.; Walz, R. Renewable energy deployment in Europe up to 2030 and the aim of a triple dividend. Energy Policy 2016, 95, 314–323. [Google Scholar] [CrossRef]

- Kabir, E.; Kumar, P.; Kumar, S.; Adelodun, A.A.; Kim, K.H. Solar energy: Potential and future prospects. Renew. Sustain. Energy Rev. 2018, 82, 894–900. [Google Scholar] [CrossRef]

- Quintana-Rojo, C.; Callejas-Albiñana, F.E.; Tarancón, M.A.; del Río, P. Identifying the Drivers of Wind Capacity Additions: The Case of Spain. A Multiequational Approach. Energies 2019, 12, 1944. [Google Scholar] [CrossRef]

- Navamuel, E.L.; Morollón, F.R.; Cuartas, B.M. Energy consumption and urban sprawl: Evidence for the Spanish case. J. Clean. Prod. 2018, 172, 3479–3486. [Google Scholar] [CrossRef]

- Abdelradi, F.; Serra, T. Asymmetric price volatility transmission between food and energy markets: The case of Spain. Agric. Econ. 2015, 46, 503–513. [Google Scholar] [CrossRef]

- Gokmenoglu, K.; Kaakeh, M. Causal relationship between nuclear energy consumption and economic growth: case of Spain. Strateg. Plan. Energy Environ. 2018, 37, 58–76. [Google Scholar] [CrossRef]

- Cansino, J.M.; Sánchez-Braza, A.; Rodríguez-Arévalo, M.L. Driving forces of Spain׳ s CO2 emissions: A LMDI decomposition approach. Renew. Sustain. Energy Rev. 2015, 48, 749–759. [Google Scholar] [CrossRef]

- Mbarek, M.B.; Boukarraa, B.; Saidi, K. Role of energy consumption and economic growth in the spread of greenhouse emissions: empirical evidence from Spain. Environ. Earth Sci. 2016, 75, 1161. [Google Scholar] [CrossRef]

- Pérez-García, J.; Moral-Carcedo, J. Analysis and long term forecasting of electricity demand trough a decomposition model: A case study for Spain. Energy 2016, 97, 127–143. [Google Scholar] [CrossRef]

- García-Gusano, D.; Suárez-Botero, J.; Dufour, J. Long-term modelling and assessment of the energy-economy decoupling in Spain. Energy 2018, 151, 455–466. [Google Scholar] [CrossRef]

- Eurostat. Available online: https://ec.europa.eu/eurostat (accessed on 2 May 2019).

- Eurostat. Population (Demography, Migration and Projections). Available online: https://ec.europa.eu/eurostat/web/population-demography-migration-projections/data/main-tables (accessed on 2 May 2019).

- Eurostat. Structural Business Statistics Global Business Activities. Available online: https://ec.europa.eu/eurostat/web/structural-business-statistics/data/main-tables (accessed on 2 May 2019).

- Eurostat. Energy. Available online: https://ec.europa.eu/eurostat/web/energy/data/database (accessed on 2 May 2019).

- Eurostat. Climate Change. Available online: https://ec.europa.eu/eurostat/web/climate-change/data/database (accessed on 2 May 2019).

- Kaya, Y.; Yokobori, K. Environment, Energy, and Economy: Strategies for Sustainability; United Nations University Press: Tokyo, Japan, 1997. [Google Scholar]

- Ang, B.W.; Zhang, F.Q. A survey of index decomposition analysis in energy and environmental studies. Energy 2000, 25, 1149–1176. [Google Scholar] [CrossRef]

- Quan, L. Factors Analysis and Empirical Study on Energy Consumption in China: Based on Laspeyres Index Decomposition. Technol. Econ. 2011, 30, 83–86. [Google Scholar]

- Sun, W.; Cai, H.; Wang, Y. Refined Laspeyres Decomposition-Based Analysis of Relationship between Economy and Electric Carbon Productivity from the Provincial Perspective—Development Mode and Policy. Energies 2018, 11, 3426. [Google Scholar] [CrossRef]

- Jenne, J.; Cattell, R. Structural change and energy efficiency in industry. Energy Econ. 1983, 5, 114–123. [Google Scholar] [CrossRef]

- Ang, B.W.; Zhang, F.Q.; Choi, K.H. Factorizing changes in energy and environmental indicators through decomposition. Energy 1998, 23, 489–495. [Google Scholar] [CrossRef]

- Ang, B.W.; Liu, F.L. A new energy decomposition method: perfect in decomposition and consistent in aggregation. Energy 2001, 26, 537–548. [Google Scholar] [CrossRef]

- Ang, B.W.; Liu, F.L.; Chung, H.S. A generalized Fisher index approach to energy decomposition analysis. Energy Econ. 2004, 26, 757–763. [Google Scholar] [CrossRef]

- Diewert, W.E. Index Numbers; Department of Economics, University of British Columbia: Vancouver, Canada, 2007. [Google Scholar]

- Xue, B.; Geng, J. Dynamic transverse correction method of middle and long term energy forecasting based on statistic of forecasting errors. In Proceedings of the 2012 10th International Power Energy Conference (IPEC), Ho Chi Minh City, Vietnam, 12–14 December 2012. [Google Scholar]

- James, G.; Witten, D.; Hastie, T.; Tibshirani, R. An Introduction to Statistical Learning; Springer: New York, NY, USA, 2013; pp. 61–63. [Google Scholar]

- Montgomery, D.C.; Jennings, C.L.; Kulahci, M. Exponential Smoothing Methods. In Introduction to time Series Analysis and Forecasting; John Wiley & Sons: Hoboken, NJ, USA, 2015. [Google Scholar]

- Gelper, S.; Fried, R.; Croux, C. Robust forecasting with exponential and Holt–Winters smoothing. J. Forecast. 2010, 29, 285–300. [Google Scholar]

- Directive 2012/27/EU of the European Parliament and of the Council of 25 October 2012 on energy efficiency. Available online: https://eur-lex.europa.eu/eli/dir/2012/27/oj (accessed on 2 May 2019).

- United Nations Population Division. The 2015 Revision of the UN’s World Population Projections. Popul. Dev. Rev. 2015, 41, 557–561. [Google Scholar] [CrossRef]

- Key Findings and Advance Tables. In World Population Prospects; The 2015 Revision; United Nations Population Division: New York, NY, USA, 2015.

- INE. Proyecciones de Población 2016–2066. 2016. Available online: https://www.ine.es/prensa/np994.pdf (accessed on 2 May 2019).

- Capros, P.; De Vita, A.; Tasios, N.; Siskos, P.; Kannavou, M.; Petropoulos, A.; Paroussos, L. EU Reference Scenario 2016-Energy, Transport and GHG Emissions Trends to 2050; European Commission Directorate: Luxembourg, European Union, 2016; Available online: https://doi.org/10.2833/9127 (accessed on 2 May 2019).

- OECD. GDP Long-Term Forecast (Indicator). 2018. Available online: https://doi.org/10.1787/d927bc18-en (accessed on 2 May 2019).

- Sanz-Oliva, J. (Coord.) Análisis Y Propuestas Para La Descarbonización. Gobierno de España. Available online: https://drive.google.com/file/d/1ECtDV6Nhg5qzvLj9pwQ5d-Gx7KzuiFFn/view (accessed on 2 May 2019).

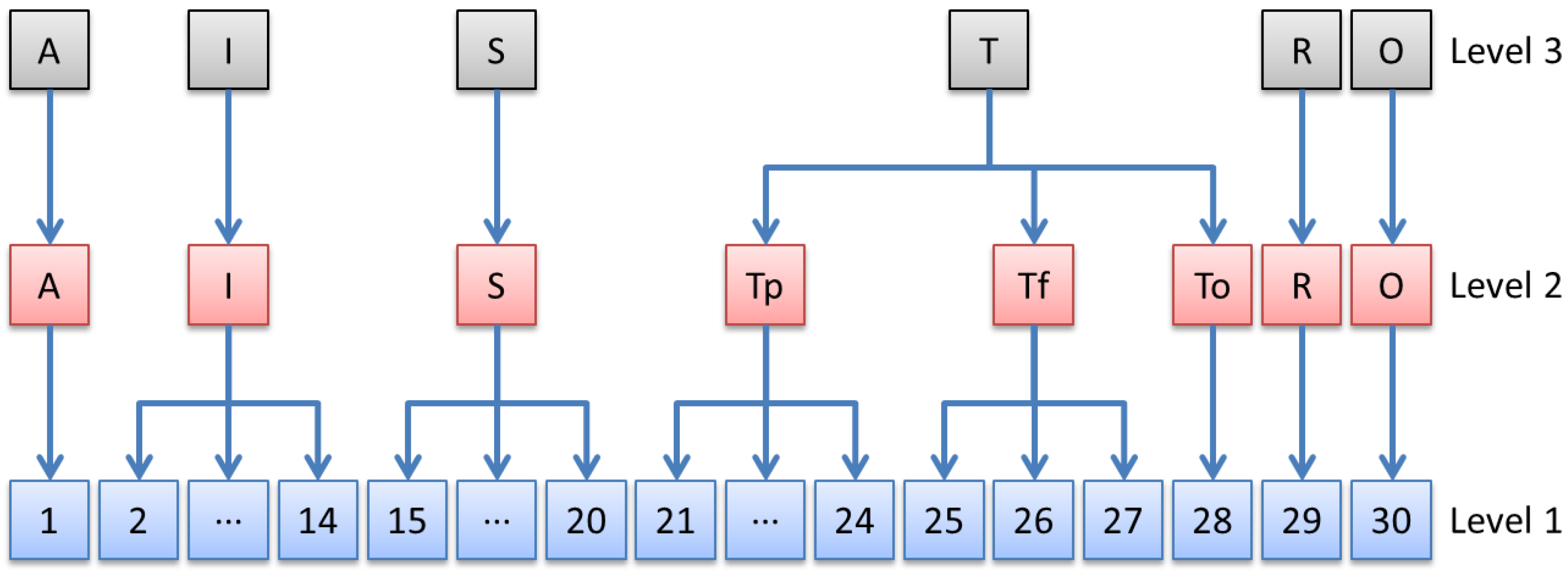

| Sector | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| 1 | Agriculture and Forestry | A: Agriculture and Forestry | A: Agriculture and Forestry |

| 2 | Chemical and Petrochemical | I: Industry | I: Industry |

| 3 | Iron and Steel | ||

| 4 | Non-Metallic Minerals | ||

| 5 | Wood and Wood Products | ||

| 6 | Construction | ||

| 7 | Paper, Pulp and Print | ||

| 8 | Food and Tobacco | ||

| 9 | Textile and Leather | ||

| 10 | Machinery | ||

| 11 | Transport Equipment | ||

| 12 | Non-Specified (Industry) | ||

| 13 | Mining and Quarrying | ||

| 14 | Others (Industry) | ||

| 15 | Hotels, Restaurants | S: Services | S: Services |

| 16 | Health and Social Action Sector | ||

| 17 | Education, Research | ||

| 18 | Trade (Wholesale and Retail) | ||

| 19 | Public and Private Offices | ||

| 20 | Others (Services) | ||

| 21 | Cars | Tp: Passenger Transport | T: Transport |

| 22 | Buses | ||

| 23 | Rail Transport of Passengers | ||

| 24 | Others in Passenger Transport | ||

| 25 | Trucks and Light Vehicles | Tf: Freight Transport | |

| 26 | Inland Waterways | ||

| 27 | Rail Transport of Goods | ||

| 28 | Others (Transport) | To: Others (Transport) | |

| 29 | Occupied Dwellings | R: Residential | R: Residential |

| 30 | Others | O: Others | O: Others |

| Component | Symbol | Laspeyres | LMDI |

|---|---|---|---|

| Activity | |||

| Structure | |||

| Intensity |

| Factor | Symbol | 1990 | 1995 | 2000 | 2005 | 2010 | 2015 |

|---|---|---|---|---|---|---|---|

| Population | 1.00 | 1.02 | 1.04 | 1.11 | 1.20 | 1.20 | |

| GDP per person | 1.00 | 1.03 | 1.23 | 1.34 | 1.33 | 1.32 | |

| Energy Intensity | 1.00 | 1.08 | 1.07 | 1.07 | 0.91 | 0.85 | |

| Carbon footprint of energy | 1.00 | 1.00 | 0.99 | 1.01 | 0.87 | 0.89 | |

| CO2 emissions | 1.00 | 1.17 | 1.36 | 1.62 | 1.25 | 1.20 |

| Time Series Predictor | % CAGR 1990/2005 | % CAGR 2005/2015 | % CAGR 1990/2015 | % CAGR 2015/2030 | % Δ 1990/2015 | % Δ 2015/2030 |

|---|---|---|---|---|---|---|

| Linear regression | 2.7% | 0.5% | 1.8% | 2.0% | 58.1% | 34.9% |

| Exponential smoothing | 2.7% | 0.5% | 1.8% | 0.2% | 58.1% | 2.9% |

| Holt-Winters | 2.7% | 0.5% | 1.8% | 1.1% | 58.1% | 17.9% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sánchez-Durán, R.; Luque, J.; Barbancho, J. Long-Term Demand Forecasting in a Scenario of Energy Transition. Energies 2019, 12, 3095. https://doi.org/10.3390/en12163095

Sánchez-Durán R, Luque J, Barbancho J. Long-Term Demand Forecasting in a Scenario of Energy Transition. Energies. 2019; 12(16):3095. https://doi.org/10.3390/en12163095

Chicago/Turabian StyleSánchez-Durán, Rafael, Joaquín Luque, and Julio Barbancho. 2019. "Long-Term Demand Forecasting in a Scenario of Energy Transition" Energies 12, no. 16: 3095. https://doi.org/10.3390/en12163095

APA StyleSánchez-Durán, R., Luque, J., & Barbancho, J. (2019). Long-Term Demand Forecasting in a Scenario of Energy Transition. Energies, 12(16), 3095. https://doi.org/10.3390/en12163095